#automated market maker algorithm

Explore tagged Tumblr posts

Text

Explore BitNest Loop DeFi: Building the Financial Ecosystem of the Future

Today, with the rapid development of financial technology, decentralized finance (DeFi) has become a force that cannot be ignored. As a rising star in the industry, BitNest Loop DeFi is redefining our understanding of financial services with its unique innovation and reliable technology solutions. This article will delve into the core functions of BitNest Loop DeFi and the diverse financial solutions it brings to users.

What is BitNest Loop DeFi? BitNest Loop DeFi is a decentralized financial platform based on blockchain technology, dedicated to providing a series of financial services, including lending, liquidity mining, trading, etc. The platform uses smart contract technology to ensure the transparency, security and efficiency of all transactions.

Core functions Decentralized Lending: BitNest Loop DeFi allows users to mortgage crypto assets to borrow other assets, providing flexible lending terms and competitive interest rates. Users can quickly obtain the funds they need without the need for traditional credit evaluations. Liquidity Mining: Users can deposit their assets into BitNest Loop’s liquidity pool to receive transaction fee sharing and platform token rewards. This not only increases the liquidity of the asset, but also provides users with opportunities for passive income. Automated Market Maker (AMM): Using algorithms to provide liquidity for transactions, users can exchange assets at any time without waiting for buyers or sellers. Decentralized governance: Users holding platform tokens can participate in the governance of the platform and vote on major updates and changes, truly achieving community-driven project development. Security and transparency Security is the most important aspect of BitNest Loop DeFi. By leveraging the Ethereum blockchain, the platform ensures that all transaction records are immutable and every transaction is publicly viewable on the chain. Additionally, the smart contract code is rigorously audited to prevent any form of security breach.

future outlook BitNest Loop DeFi is more than just a financial platform, it is also an innovative ecosystem that provides developers and users with a scalable, secure and efficient decentralized financial service platform. As blockchain technology continues to mature, BitNest Loop DeFi will continue to lead the innovation of decentralized finance, provide users with more financial tools and services, and promote the development of the entire industry.

On the road to exploring the future of finance, BitNest Loop DeFi is using technology to break tradition and provide more fair, transparent and convenient financial services to users around the world. Whether you are an investor or an everyday user, BitNest Loop DeFi deserves your attention and participation. Join us to explore the infinite possibilities of blockchain finance.

Contact Telegram; https://t.me/Rosa02b https://t.me/Rosa03c https://t.me/rosa04d

#BitNest#BitNestLoop#BitNestPureContract#BitNestis the best project in the currency circle#BitNestSecurely#BitNestAutonomously#BitNestDecentralizedly#BitNestCryptographically

4 notes

·

View notes

Text

Explore BitNest Loop DeFi: Building the Financial Ecosystem of the Future

Today, with the rapid development of financial technology, decentralized finance (DeFi) has become a force that cannot be ignored. As a rising star in the industry, BitNest Loop DeFi is redefining our understanding of financial services with its unique innovation and reliable technology solutions. This article will delve into the core functions of BitNest Loop DeFi and the diverse financial solutions it brings to users.

What is BitNest Loop DeFi? BitNest Loop DeFi is a decentralized financial platform based on blockchain technology, dedicated to providing a series of financial services, including lending, liquidity mining, trading, etc. The platform uses smart contract technology to ensure the transparency, security and efficiency of all transactions.

Core functions Decentralized Lending: BitNest Loop DeFi allows users to mortgage crypto assets to borrow other assets, providing flexible lending terms and competitive interest rates. Users can quickly obtain the funds they need without the need for traditional credit evaluations. Liquidity Mining: Users can deposit their assets into BitNest Loop’s liquidity pool to receive transaction fee sharing and platform token rewards. This not only increases the liquidity of the asset, but also provides users with opportunities for passive income. Automated Market Maker (AMM): Using algorithms to provide liquidity for transactions, users can exchange assets at any time without waiting for buyers or sellers. Decentralized governance: Users holding platform tokens can participate in the governance of the platform and vote on major updates and changes, truly achieving community-driven project development. Security and transparency Security is the most important aspect of BitNest Loop DeFi. By leveraging the Ethereum blockchain, the platform ensures that all transaction records are immutable and every transaction is publicly viewable on the chain. Additionally, the smart contract code is rigorously audited to prevent any form of security breach.

future outlook BitNest Loop DeFi is more than just a financial platform, it is also an innovative ecosystem that provides developers and users with a scalable, secure and efficient decentralized financial service platform. As blockchain technology continues to mature, BitNest Loop DeFi will continue to lead the innovation of decentralized finance, provide users with more financial tools and services, and promote the development of the entire industry.

On the road to exploring the future of finance, BitNest Loop DeFi is using technology to break tradition and provide more fair, transparent and convenient financial services to users around the world. Whether you are an investor or an everyday user, BitNest Loop DeFi deserves your attention and participation. Join us to explore the infinite possibilities of blockchain finance.

Contact Telegram; https://t.me/Rosa02b https://t.me/Rosa03c https://t.me/rosa04d

#BitNest#BitNestLoop#BitNestPureContract#BitNestis the best project in the currency circle#BitNestSecurely#BitNestAutonomously#BitNestDecentralizedly#BitNestCryptographically

5 notes

·

View notes

Text

Explore BitNest Loop DeFi: Building the Financial Ecosystem of the Future

Today, with the rapid development of financial technology, decentralized finance (DeFi) has become a force that cannot be ignored. As a rising star in the industry, BitNest Loop DeFi is redefining our understanding of financial services with its unique innovation and reliable technology solutions. This article will delve into the core functions of BitNest Loop DeFi and the diverse financial solutions it brings to users.

What is BitNest Loop DeFi? BitNest Loop DeFi is a decentralized financial platform based on blockchain technology, dedicated to providing a series of financial services, including lending, liquidity mining, trading, etc. The platform uses smart contract technology to ensure the transparency, security and efficiency of all transactions.

Core functions Decentralized Lending: BitNest Loop DeFi allows users to mortgage crypto assets to borrow other assets, providing flexible lending terms and competitive interest rates. Users can quickly obtain the funds they need without the need for traditional credit evaluations. Liquidity Mining: Users can deposit their assets into BitNest Loop’s liquidity pool to receive transaction fee sharing and platform token rewards. This not only increases the liquidity of the asset, but also provides users with opportunities for passive income. Automated Market Maker (AMM): Using algorithms to provide liquidity for transactions, users can exchange assets at any time without waiting for buyers or sellers. Decentralized governance: Users holding platform tokens can participate in the governance of the platform and vote on major updates and changes, truly achieving community-driven project development. Security and transparency Security is the most important aspect of BitNest Loop DeFi. By leveraging the Ethereum blockchain, the platform ensures that all transaction records are immutable and every transaction is publicly viewable on the chain. Additionally, the smart contract code is rigorously audited to prevent any form of security breach.

future outlook BitNest Loop DeFi is more than just a financial platform, it is also an innovative ecosystem that provides developers and users with a scalable, secure and efficient decentralized financial service platform. As blockchain technology continues to mature, BitNest Loop DeFi will continue to lead the innovation of decentralized finance, provide users with more financial tools and services, and promote the development of the entire industry.

On the road to exploring the future of finance, BitNest Loop DeFi is using technology to break tradition and provide more fair, transparent and convenient financial services to users around the world. Whether you are an investor or an everyday user, BitNest Loop DeFi deserves your attention and participation. Join us to explore the infinite possibilities of blockchain finance.

Contact Telegram; https://t.me/Rosa02b https://t.me/Rosa03c https://t.me/rosa04d

#BitNest#BitNestLoop#BitNestPureContract#BitNestis the best project in the currency circle#BitNestSecurely#BitNestAutonomously#BitNestDecentralizedly#BitNestCryptographically

6 notes

·

View notes

Text

Healthcare Industry with Custom AI Software Development - SSTech System

We are living in an era of technology. By glancing around, it is obvious that technology has affected every inch of our lives. Artificial Intelligence (AI) is the contemporary technological trend. It is reshaping the entire landscape. Healthcare is no exception. AI Software Development of today is having a great influence on how medical care is delivered nowadays.

AI-driven web development has brought a very important change in the way patients are diagnosed. It has not only changed the way doctors diagnose and treat patients but also how patients manage their health. Custom AI software development truly has been revolutionized as the game-changer. It also provides a good foundation for creativity and saving.

Would you like to find out about the ways AI is transforming the healthcare sector?If yes, read on! In this article, we are going to expose the way AI is changing healthcare.

AI & Healthcare Web Development

AI in Healthcare can be a very effective option of efficient healthcare. It can empower the healthcare sector more than ever before. It improves medical outcomes. This adds to the fact that it improves operations and results in cost and time savings. Well, it is not just a passing fad, but it is a trend that will remain forever.

According to data, the worldwide AI market is poised for remarkable growth. It is set to grow at an anticipated compound annual growth rate (CAGR) of 37.3% between 2023 and 2030. By 2023, it is expected to soar to a staggering $1,811.8 billion, showcasing the immense potential and rapid expansion of the AI industry.

With the emergence of AI, healthcare businesses are quickly shifting to custom AI software. It empowers them to make the best of the power of AI tailored. They can tailor the solutions as per their unique requirements.

Are you also planning to level up your healthcare business? If so, AI software development can be beneficial. Wondering how? Let’s move to the next section, where we will tell you some key benefits of custom AI software development.

Benefits Of Custom AI Software Development

AI is growing massively. It has impacted businesses across sectors. If we talk about Healthcare, AI has made things super easy. Below are some key benefits of AI software development:

Enhanced diagnostic accuracy:

Custom AI solutions for your healthcare business enable to make the analysis of large amounts of medical data. It is also able to analyze patient records, laboratory results, and imaging scans.

This however is not the only advantage; AI algorithms are also able to uncover patterns. Moreover, it can recognize abnormalities which human eyes may miss. Generally, this brings about better diagnoses and prompts treatment.

Personalized treatment plans:

AI-driven insights assist healthcare professionals in the creation of individualized treatment plans. They may personalize medical solutions to patients’ needs. It harnesses patient data, genetic information, and treatment history. It assists in suggesting tailored strategies.

Improved operational efficiency:

AI-enabled automation decreases clerical duties. For instance, it assists with appointment scheduling, billing, and inventory management. Thus, they can devote more time to patient care. It also helps in the integration of AI into the existing workflow. It will increase efficiency and productivity in the organization as a whole.

Predictive analytics:

AI has the superior predictive power. Developing AI healthcare software can pre-empt disease outbreaks, anticipate bed demand, and identify high-risk patients. It allows for proactive planning and resource allocation. AI algorithms can furnish strategic decision-makers with actionable insights to guide strategic decision-making and resource planning.

Enhanced patient engagement:

AI-driven chatbots and virtual assistants are always on standby to extend support to patients. It answers their questions anytime. Moreover, it provides medication reminders, as well as tailored health suggestions. You can hence build an AI chatbot and integrate it into websites and applications.

We have seen how AI can improve healthcare. However, are you aware of the common AI applications in the healthcare industry? Let’s find out!

Custom AI Solutions for Healthcare

AI can be used in multiple ways. Here, we have listed down some typical custom AI solutions in the medical industry:

AI-enabled diagnostics:

Custom AI algorithms can analyze medical images. It helps radiologists in X-rays, MRIs, and CT scans in detecting abnormalities and identifying disease. AI-powered diagnostic tools offer rapid and accurate results.

Predictive analytics:

Custom AI models can analyze electronic health records (EHRs). It also allows for demographic data, and environmental factors to predict disease trends, identify at-risk populations. With predictive analytics, healthcare providers can intervene proactively.

Remote patient monitoring:

Custom AI software enables remote monitoring of patients with chronic conditions. AI algorithms can analyze real-time data from wearable devices, sensors, and IoT devices to detect deviations from normal parameters and alert healthcare providers to potential issues. It enables timely interventions and preventing complications.

Drug discovery and development:

Custom AI solutions accelerate the drug discovery process by analyzing vast datasets, simulating molecular interactions, and predicting drug efficacy and safety profiles. AI-driven drug discovery platforms expedite the identification of promising drug candidates, reducing costs and time-to-market for new therapies.

AI Software Development Tools

Well! When it comes to AI software development tools, you get a variety of options. Here, we have noted the most important tools that can make a positive difference for your business:

Machine learning libraries:

Tools such as TensorFlow, PyTorch, and sci-kit-learn provide potent frameworks for developing custom AI models tailored to healthcare applications. These libraries offer a wide range of machine-learning algorithms and tools for data preprocessing, model training, and evaluation.

Natural language processing (NLP) tools:

NLP frameworks like spaCy and NLTK enable the development of AI-driven chatbots and virtual assistants for healthcare applications. These tools support text processing, sentiment analysis, and language understanding, facilitating the creation of conversational interfaces for patient engagement and support.

Deep learning platforms:

Deep learning frameworks such as Keras and MXNet offer advanced capabilities for developing custom AI models, including convolutional neural networks (CNNs), recurrent neural networks (RNNs), and generative adversarial networks (GANs). These platforms empower healthcare organizations to leverage state-of-the-art deep learning techniques for image analysis, natural language processing, and predictive modelling.

Custom AI software development has become crucial for businesses. Professional AI/ML developer helps in unlocking the full potential of AI by providing the best-in-class custom healthcare software development services for the healthcare industry.

With AI revolution in healthcare lets you enhance diagnostic accuracy, personalize treatment plans, improve operational efficiency, and empower patients to take control of their health. SSTech System a professional AI software development company, the future of Healthcare holds great potential for innovation, efficiency, and improved patient outcomes.

Final words

AI software development services for healthcare are no less than a paradigm shift in medical technology. It allows for a smarter and more efficient way of medical care and healthcare app development. If you are also a healthcare business and looking to integrate AI into your healthcare business, it is time for you to go professional. So what are you waiting for? Hire AI developers today and take your business to new heights.

#AI Solutions for Healthcare#Hire AI developers#AI software development#software development#sstech system#healthcare industry#Custom AI software#Healthcare Web Development#healthcare#b2b

2 notes

·

View notes

Text

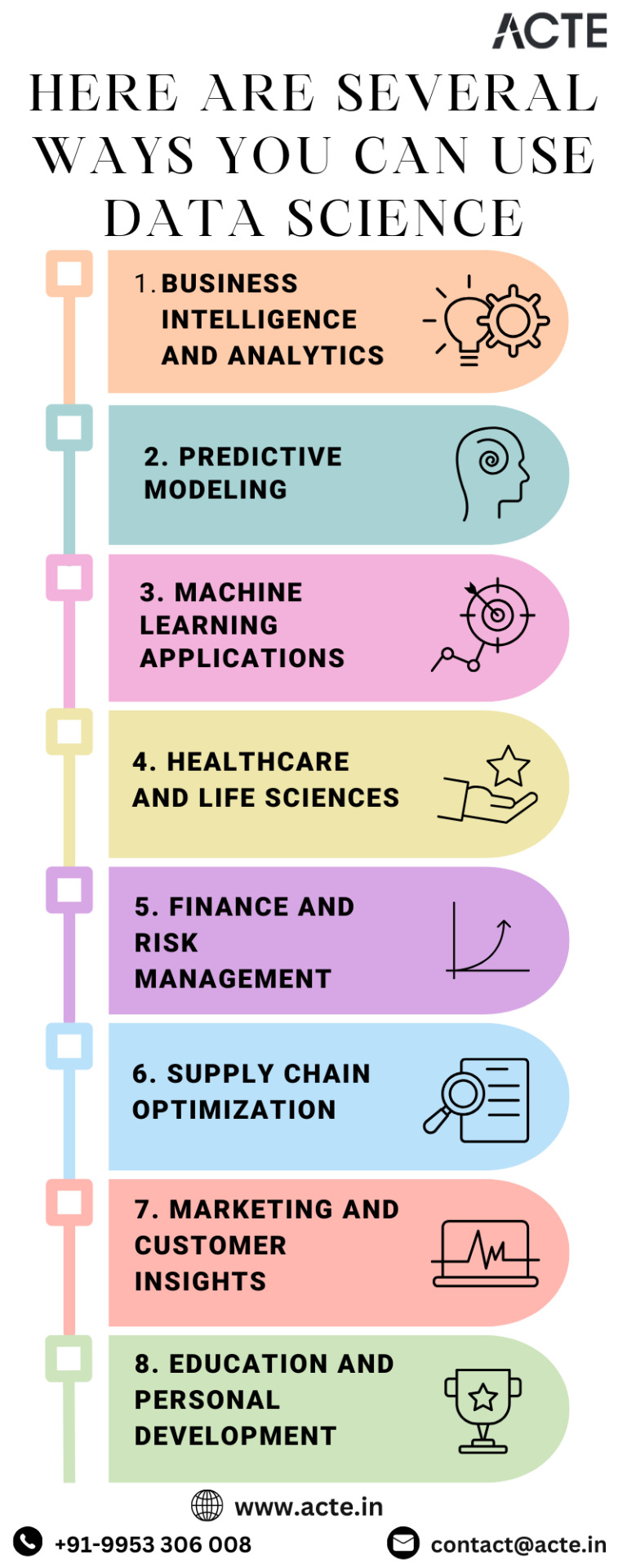

Empowering Decision-Making: Unlocking the Potential of Data Science Across Industries

In the era of information abundance, data has become a formidable asset. However, the real distinction for successful enterprises lies in their ability to derive meaningful insights from this vast sea of data. Enter data science – a field that transcends mere analysis and offers a transformative lens through which industries can innovate, optimize, and thrive. Opting for the Best Data Science Institute can further expedite your journey into this burgeoning industry. In this blog, we will delve into the diverse applications of data science across various sectors, spotlighting its pivotal role in steering informed decision-making and fostering innovation.

1. Business Intelligence and Analytics: Revealing Patterns for Growth

At the heart of data science is the ability to unravel intricate patterns within extensive datasets. For businesses, this translates into a powerful tool for business intelligence and analytics. By harnessing historical and current data, organizations can gain valuable insights into their performance, identify trends, and make informed decisions that drive growth. Whether optimizing operational processes or uncovering opportunities for expansion, data science serves as a compass for strategic decision-making.

2. Predictive Modeling: Forecasting the Future with Confidence

Predictive modeling stands out as one of the hallmark applications of data science. By analyzing historical data, organizations can develop models that forecast future trends and outcomes. This capability proves invaluable across various domains. In finance, predictive modeling aids in anticipating stock prices; in healthcare, it contributes to predicting patient outcomes. The ability to foresee potential scenarios empowers decision-makers to plan and strategize with confidence.

3. Machine Learning Applications: Infusing Intelligence into Applications

Machine learning, a subset of data science, takes analytical power a step further by enabling intelligent applications. From recommendation systems in e-commerce to fraud detection in finance and image recognition in healthcare, machine learning algorithms bring a layer of automation and adaptability to diverse domains. This not only enhances user experience but also improves the efficiency and effectiveness of various processes.

4. Healthcare and Life Sciences: Revolutionizing Patient Care and Research

In the realm of healthcare, data science acts as a catalyst for transformation. From patient diagnosis to personalized treatment plans and drug discovery, data-driven insights are revolutionizing the industry. Analyzing large datasets allows medical professionals to identify patterns, tailor treatment strategies, and accelerate medical research, ultimately leading to better patient outcomes.

5. Finance and Risk Management: Navigating Uncertainty with Data-Driven Insights

Financial institutions leverage the power of data science for risk assessment, fraud detection, and portfolio optimization. Predictive analytics aids in forecasting market trends, managing risks, and making informed investment decisions. In an industry where every decision carries significant consequences, data science provides a reliable compass for navigating uncertainties. Choosing the finest Data Science Courses in Chennai is a pivotal step in acquiring the necessary expertise for a successful career in the evolving landscape of data science.

6. Supply Chain Optimization: Enhancing Efficiency from End to End

Optimizing supply chain operations is a complex endeavor, but data science offers a clear path forward. By utilizing data to forecast demand, manage inventory effectively, and optimize logistics, organizations can achieve substantial cost savings and improve overall operational efficiency. From manufacturers to retailers, data science is reshaping how businesses approach the end-to-end supply chain process.

7. Marketing and Customer Insights: Tailoring Strategies for Success

In the realm of marketing, data science emerges as a game-changer. Analyzing customer behavior, preferences, and engagement patterns allows marketers to create targeted campaigns that resonate with their audience. The ability to derive actionable insights from data enhances customer experience, improves satisfaction, and maximizes the impact of marketing initiatives.

8. Social Media Analysis: Decoding Trends and Sentiments

The digital era has ushered in an abundance of social media data, and data science plays a crucial role in making sense of this vast landscape. By analyzing social media data, businesses can extract valuable insights into user behavior, sentiment, and trends. This information is instrumental in shaping social media strategies, engaging with the audience effectively, and managing online reputation.

9. Smart Cities and Urban Planning: Paving the Way for Sustainable Living

In the context of urban planning, data science contributes to the development of smart cities. By analyzing data from sensors, traffic cameras, and citizen feedback, urban planners can optimize city infrastructure, improve traffic flow, and enhance overall urban living. Data-driven insights play a pivotal role in creating sustainable and livable urban environments.

10. Education and Personal Development: Shaping the Future of Learning

Data science is making significant inroads into education, where it is utilized to analyze student performance, tailor learning materials, and provide personalized recommendations. This not only enhances the learning experience for students but also facilitates adaptive learning platforms. The application of data science in education is reshaping how we approach teaching and learning, with a focus on individualized and effective educational experiences.

As we delve deeper into the era of big data, data science stands as a beacon of innovation and progress. Its applications span across industries, touching every facet of modern life. From healthcare and finance to education and urban planning, data science is shaping the way we make decisions, solve problems, and envision the future. Embracing the power of data science is not just a choice; it's a necessity for those looking to thrive in a data-driven world.

3 notes

·

View notes

Text

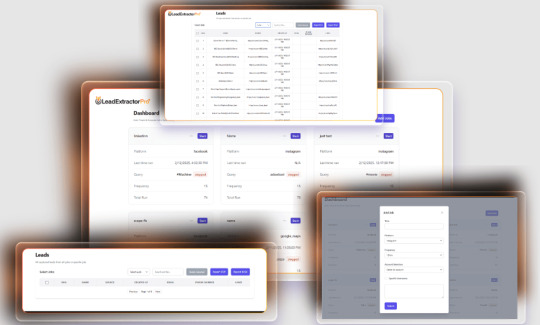

LeadExtracterPro Review – Unlimited Buyer Leads on Autopilot!

Welcome to my LeadExtracterPro AI Review. Today’s digital marketing activities at high speed force businesses and entrepreneurs to seek innovative methods that produce premium quality leads. The process of obtaining verified phone numbers along with email addresses from prospective clients proves to be one of the most efficient strategies.

Meet LeadExtracterPro is an AI-powered software that claims to extract millions of targeted, real, and verified email IDs and phone numbers from various social media platforms, including Instagram, TikTok, LinkedIn, Facebook, Google Maps, and Twitter, in just 60 seconds with only two clicks.

In this in-depth review, we will explore the features, benefits, pricing, pros, cons, and overall effectiveness of LeadExtracterPro. By the end of this article, you will have a clear understanding of whether this tool is the right choice for your business needs.

What Is LeadExtracterPro?

LeadExtracterPro is a cutting-edge AI-based software powered by artificial intelligence (AI) designed to scrape and extract highly targeted and verified leads from a variety of popular platforms. The tool concentrates on collecting email IDs and phone numbers for use in marketing campaigns, sales outreach, or business networking. With its powerful algorithms, the tool claims to be able to extract millions of real, verified, and targeted leads from social media sites like Instagram, TikTok, LinkedIn, Facebook, Google Maps, and Twitter.

What sets LeadExtracterPro apart is its speed and accuracy. The software can extract these contact details in just 60 seconds with only two clicks, making it one of the most efficient lead-generation tools available. Whether you are looking for leads in a specific business niche, industry, or country, LeadExtracterPro makes the process faster and simpler.

LeadExtracterPro Review: Overview of Product

Product Creator: JSS

Product: LeadExtractorPro

Launch Date: 2025-Feb-17

Launch Time: 11:00 EST

Front-End Price: $17 (One-time payment)

Official Site: Click Here To Visit Official Salespage

Product Type: Tools and Software

Support: Effective and Friendly Response

Recommended: Highly Recommended

Bonuses: YES, Huge Bonuses

Skill Level Required: All Levels

Discount Coupon: Use Code “LEADAI30” for 30% off (Full Funnel)

Refund: YES, 30 Days Money-Back Guarantee

LeadExtracterPro Review: About Authors

LeadExtractorPro was developed by JSS, a visionary innovator with extensive expertise in artificial intelligence. JSS is renowned for creating powerful AI-driven tools that streamline complex tasks, making lead generation more efficient and accessible for businesses of all sizes.

In addition to LeadExtractorPro, JSS has launched other cutting-edge solutions, including AI Video Reel Builder, Vinci Pro AI, AutoNewsBuilder AI, and TubeMagic AI—each designed to help businesses enhance their digital content. With a strong emphasis on user-friendly design and automation, JSS continues to push the boundaries of AI technology, making advanced tools readily available to marketers and entrepreneurs worldwide.

Key Features of LeadExtracterPro

✍Extract Unlimited, Verified Leads in Seconds!

Stop wasting time manually searching for leads-get thousands of fresh, targeted contacts instantly!

✍Connect Directly with Decision-Makers & High-Paying Clients!

Extract CEOs, Founders, Business Owners & Marketing Heads’ contact details—bypass gatekeepers and close more deals!

✍Say Goodbye to Expensive Lead Generation Agencies!

No need to pay hundreds or thousands of dollars to agencies—get the same results instantly for a one-time low price!

✍Never Pay for Ads Again – 100% Organic Leads!

No need to run paid ads on Instagram, TikTok, Linkedin, Facebook, GoogleMaps and Twitter -extract real contacts for free & start converting instantly!

✍Automate Lead Generation & Focus on Closing Deals!

Let AI do all the work while you focus on selling & scaling your business—hands-free lead collection 24/7!

✍Extract Emails & Phone Numbers from 5+ Major Platforms!

Instagram (Influencers, niche audiences)

TikTok (Trendy & viral users)

LinkedIn (B2B clients, high-ticket leads)

Facebook (Business pages, group members)

Google Maps (Local businesses & service providers)

✍Get Highly Targeted Leads Based on Industry, Keywords & Location!

Search by niche, job title, location, or keyword and get only the most relevant, high-converting leads!

✍Stop Wasting Money on Fake or Useless Lead Lists!

Unlike purchased email lists, our tool scrapes real-time data—no outdated, fake, or inactive contacts!

✍Build & Sell Hyper-Targeted Email & SMS Lists!

Extract verified emails & phone numbers for highly personalized marketing campaigns that boost conversions!

Land More Clients with AI-Driven Cold Email & SMS Outreach!

Use AI-powered lead extraction to reach potential buyers at the right time with the right message!

✍Scale Any Business Without Hiring a Lead Generation Team!

No need to hire VAs or sales reps—automate prospecting and fill your sales funnel effortlessly!

✍Save Hours of Manual Work & Research!

No need to run paid ads on Instagram, TikTok, Linkedin, Facebook, GoogleMaps and Twitter Traditional lead searching takes hours or days-LeadExtractorPro does it in seconds!

✍Export Leads Directly to Your CRM, Email Software & WhatsApp!

Download in Excel, CSV, or integrate with HubSpot, Mailchimp, Zapier, Salesforce & more!

✍Extract Leads from Any Country, Any Industry!

Works worldwide—target real estate, SaaS, marketing agencies, e-commerce, coaching, and more!

✍Unfair Competitive Advantage – Beat Your Competitors to the Best Leads!

Outreach faster than your competitors & capture hot leads before they do!

✍Sell Leads & Start Your Own Lead Generation Business!

Extract & sell thousands of leads per day—monetize LeadExtractorPro and turn it into a highly profitable business!

✍Tap into Social Media Goldmines & Extract Hidden Leads!

Find contacts that other tools can’t—get exclusive access to high-intent buyers!

✍Dominate Local & Global Markets with Google Maps Lead Extraction!

Extract business contacts from restaurants, realtors, lawyers, salons, clinics, and service-based businesses with a few clicks!

✍Get More Clients, Sales & Appointments Instantly!

Whether you run an agency, online business, or service—LeadExtractorPro gives you a constant flow of warm leads!

✍Pay Once, Use Forever – No Monthly Fees!

Lifetime access, free updates & no hidden costs—pay once & enjoy unlimited lead generation!

LeadExtracterPro Review: How Does It Work?

Just 3 Simple Step to Unlock Unlimited Ready to Buyleads Fast

Step #1: Login & Select

Enter Your Keywords & Choose Your Platform (Instagram, TikTok, Linkedin, Facebook,

GoogleMaps, Twitter)

Step #2: Create

Click “Extract Leads” & Let the AI Do the Heavy Lifting

Step #3: Publish & Profit

Download Verified Email Ids & Phone Numbers-Then Start Closing Deals!

Benefits of LeadExtracterPro

Extract 1000s of REAL, Targeted, Verified Leads in Seconds!

Say Goodbye to Expensive Lead Generation Agencies!

Automate Lead Generation & Focus on Closing Deals!

Connect Directly with Decision-Makers & High-Paying Clients!

Build & Sell Hyper-Targeted Email & SMS Lists!

Extract Leads from Any Country, Any Industry!

Scale Your Business Without Hiring a Lead Generation Team!

Sell Leads & Start Your Own Six Figure Lead Generation Business!

Dominate Local & Global Markets with Google Maps Lead Extraction!

Extract Emails & Phone Numbers from 5+ Major Platforms (Instagram, TikTok, Facebook, Linkedin, Twitter, GoogleMaps)!

Never Pay for Ads Again – 100% Organic Leads!

Get Highly Targeted Leads Based on Industry, Keywords & Location!

Stop Wasting Money on Fake or Useless Lead Lists!

Land More Clients with AI-Driven Cold Email & SMS Outreach!

Save Hours of Manual Work & Research!

Unfair Competitive Advantage – Beat Your Competitors to the Best Leads!

Tap into Social Media Goldmines & Extract Hidden Leads!

Get More Clients, Sales & Appointments Instantly!

Verify Users Say About LeadExtracterPro

LeadExtracterPro Review: Who Should Use It?

Freelancers & Agencies

Business Owners & Entrepreneurs

Marketers & Sales Teams

E-Commerce Sellers & Coaches

Affiliate Marketers & Bloggers

Local Businesses & Service Providers

And Many Others

LeadExtracterPro Review: OTO’s And Pricing

Add My Bundle Coupon Code “LEADAI30″ – For 30% Off Any Funnel OTO Below

Front End : LeadExtractorPro ($17)

OTO1: LeadExtracterPro Unlimited Page ($27)

OTO2: LeadExtracterPro CleanMailList ($27)

OTO3: LeadExtracterPro ProMailsAi ($27)

OTO4: LeadExtracterPro Reseller ($97)

LeadExtracterPro Review: Money Back Guarantee

100% Risk-Free Guarantee – You Have Nothing to Lose! 30 Days Money Back Guarantee

We get it. People want to know whether LeadExtractorPro delivers all its advertised capabilities. Making this risk-free is the reason we are establishing this completely free decision for you. LeadExtractorPro offers a totally risk-free trial period of 30 days that allows you to test the software free of charge. This is followed by a full refund of your money if we don’t generate substantial results in lead generation.

No questions asked. The organization has dedicated itself to achieving total satisfaction for each customer. You should keep your money with us because we will provide what you expect from our service. Furthermore we provide premium bonus tools to thank you for testing our product. You have no financial risk but every opportunity leads to complete upside.

LeadExtracterPro Review: Pros and Cons

Pros:

AI-powered extraction ensures high accuracy.

Works with multiple platforms.

Extremely fast – extracts millions of leads in just 60 seconds.

No technical skills required.

Verified email IDs and phone numbers.

Supports global lead generation.

Cost-effective alternaive to manual data collection.

Cons:

Requires a subscription fee.

Requires stable internet connection as it’s cloud-based.

Nothing wrong with it, it works perfectly!

My Own Customized Exclusive VIP Bonus Bundle

***How To Claim These Bonuses***

Step #1:

Complete your purchase of the LeadExtracterPro: My Special Unique Bonus Bundle will be visible on your access page as an Affiliate Bonus Button on WarriorPlus immediately after purchase. And before ending my honest LeadExtracterPro Review, I told you that I would give you my very own unique PFTSES formula for Free.

Step #2:

Send the proof of purchase to my e-mail “[email protected]” (Then I’ll manually Deliver it for you in 24 HOURS).

Frequently Asked Questions (FAQ’s)

Q. What exactly is LeadExtractorPro?

LeadExtractorPro is an AI-powered lead generation software that automatically extracts verified emails, phone numbers, and business details from Instagram, TikTok, Linkedin, Facebook, GoogleMaps, Twitter and more. It’s designed to help businesses, marketers, and entrepreneurs get high-quality leads in minutes—without manual work or expensive agencies.

Q. How does LeadExtractorPro work?

It’s as simple as 1-2-3!

1 Enter your keywords (e.g., “real estate agents in New York” or “eCommerce store owners in the USA”).

2 Choose your source (Instagram, TikTok, Linkedin, Facebook, GoogleMaps, and Twitter etc.).

3 Click ‘Start’ and let the AI scrape thousands of verified leads for you! Once extracted, you can export the leads in CSV, Excel, or HTML format and start using them immediately!

Q. Is LeadExtractorPro a downloadable software?

It is 100% downloadable software which works faster, more securely, and without any monthly fees.

Q. Do I need to pay any monthly fees?

NO! LeadExtractorPro is available at a one-time price – no recurring charges, no API costs, and no hidden fees! Pay once, use forever.

Q. What kind of leads can I extract?

You can extract:

Business Emails Ids & Phone Numbers from Instagram, TikTok, Linkedin, Facebook, GoogleMaps, Twitter and more.

Decision-Maker Contacts (CEOs, Founders, Marketing Heads, etc.).

Industry-Specific Leads (e.g., doctors, lawyers, real estate agents, eCommerce owners, SaaS companies).

Geo-Targeted Leads (Filter by country, city, or region).

Verified Data (No outdated or fake leads!).

Q. Can I sell the leads I extract?

Absolutely! LeadExtractorPro comes with a free commercial license, allowing you to sell extracted leads and keep 100% of the profit. Many users make $5,000–$50,000 per month just selling leads to businesses, agencies, and freelancers!

Q. Will I get free updates?

Yes! You’ll receive lifetime updates at no extra cost to ensure LeadExtractorPro stays ahead of algorithm changes and platform updates.

Q. Does it work in all countries?

Yes! LeadExtractorPro supports lead extraction worldwide, so you can target businesses and professionals in ANY country or region.

Q. What if I’m a complete beginner? Will this work for me?

Yes! LeadExtractorPro is 100% beginner-friendly.

No tech skills needed

No experience required

Simple, click-and-go interface

Even if you’ve never generated leads before, the included step-by-step training will guide you through everything!

Q. What if I don’t get results? Is there a refund policy?

We’re so confident in LeadExtractorPro that we’re offering a 30-Day Iron-Clad Money-Back Guarantee. If you don’t love it, simply contact us within 30 days and we’ll give you a full refund—no questions asked!

Q. How do I get started?

Simple! Click the button below, grab LeadExtractorPro at the special launch price, and start generating high-quality leads in minutes!

My Recommendation

LeadExtracterPro is a powerful lead generation tool that can significantly enhance marketing efforts for businesses and individuals. With its AI-driven technology, multi-platform support, and high-speed extraction capabilities, it offers an effective way to generate real, verified leads effortlessly.

However, users should be mindful of platform policies regarding data scraping to ensure compliance. Overall, if you need a reliable and efficient way to collect targeted leads, LeadExtracterPro is worth considering.

>>> Click Here To Get Instant Access LeadExtracterPro Now <<<

Check Out My Previous Reviews: Digital Face AI Review, Affiliate Content Pilot Review, AI Podcast Empire Review, and AI Member Review.

Thank for reading my “LeadExtracterPro Review” till the end. Hope it will help you to make purchase decision perfectly.

#leadextracterpro#leadextracterproreview#leadextracterprocoupon#leadextracterprohonestreview#leadextracterprofeatures#leadextracterproworks#whatisleadextracterpro#leadextracterproreviews#buyleadextracterpro#leadextracterproprice#leadextracterprodiscount#leadextracterprofe#leadextracterprooto#getleadextracterpro#leadextracterprobenefits#leadextracterprobonus#howtoleadextracterproworks#leadextracterprosoftware#leadextracterprofunnels#marketingprofitmedia#leadextracterproupsell#leadextracterproinfo#purchaseleadextracterpro#software#traffic#leadextracterproexample#leadextracterproworthgorbuying#ai#aiapp#aitool

0 notes

Text

In the advancing realm of business development, AI radically overhauls prospecting activities, enabling companies to identify and engage potential customers with greater efficiency. By automating data analysis, businesses can make informed decisions, refine marketing strategies, and boost conversion rates. AI-driven approaches enhance lead generation through precise targeting and personalization, while also offering valuable financial insights and identifying key decision-makers. This transformative technology empowers various industries to optimize prospects and elevate their sales strategies, ensuring effective customer identification and improved ROI. Table of Contents - Leverage AI to Revolutionize Business Prospecting - The Benefits of AI-Driven Lead Generation for Your Business - Accelerate Your Search for High-Value Business Prospects - Extract Valuable Financial Insights with Prospect AI - Uncover Key Decision-Makers Using Advanced AI Technologies - Elevate Your B2B Sales and Prospecting with AI - Industries Transforming with AI-Driven Prospecting Strategies - Enhancing Customer Identification Accuracy through AI Leverage AI to Revolutionize Business Prospecting In the rapidly evolving landscape of business development, integrating artificial intelligence (AI) into prospecting processes transforms how organizations identify and engage potential customers. AI technologies automate data collection and analysis, drastically cutting down the time needed to process vast amounts of information. This revolution in business prospecting enables companies to make data-driven decisions, optimize their marketing strategies, and ultimately, achieve higher conversion rates. The Benefits of AI-Driven Lead Generation for Your Business AI-driven lead generation offers numerous advantages for businesses aiming to enhance their sales funnels. By leveraging machine learning algorithms, businesses can accurately predict customer behavior, personalize marketing efforts, and target the most promising leads. This targeted approach not only improves lead quality but also maximizes marketing spend efficiency. Additionally, AI tools can continuously learn and adapt, ensuring that your lead generation processes improve over time. Accelerate Your Search for High-Value Business Prospects AI-powered tools streamline the search for high-value prospects by analyzing data from various sources and identifying patterns indicative of potential sales opportunities. These tools can segment prospects based on their likelihood to convert, allowing sales teams to focus efforts on the most lucrative leads. By automating routine tasks, AI enables sales professionals to dedicate more time to nurturing relationships and closing deals. Learn more about how AI can enhance your prospecting capabilities. Extract Valuable Financial Insights with Prospect AI Prospect AI provides an unprecedented ability to extract and analyze financial insights crucial for evaluating potential business partners. By sifting through financial reports, market trends, and news analytics, AI tools offer a comprehensive overview of a prospect's financial health. Businesses can leverage these insights to assess risk, understand market positioning, and tailor offerings that align with a prospect’s financial capabilities. Uncover Key Decision-Makers Using Advanced AI Technologies Identifying and engaging with key decision-makers in target organizations is critical for successful business deals. AI technologies efficiently map organizational structures, identifying the influencers and decision-makers within companies. By providing detailed profiles and insights into these individuals, AI tools empower sales teams to craft messages and value propositions that resonate with the decision-makers, thereby increasing the chances of successful engagement. For pricing information on using AI for financial insights, visit Visbanking Pricing. Elevate Your B2B Sales and Prospecting with AI AI has become an integral tool in elevating B2B sales and prospecting strategies. By automating data analytics and customer relationship management processes, AI helps sales teams manage larger volumes of leads without compromising on personalization. From lead scoring to customer interaction analysis, AI provides actionable insights that refine sales approaches, personalize outreach, and improve overall conversion rates. Industries Transforming with AI-Driven Prospecting Strategies Various industries, including finance, healthcare, and technology, are redefining their sales strategies through AI-driven prospecting. In finance, for example, AI assists in credit risk assessment and fraud detection, while in healthcare, it helps in identifying patient needs and improving treatment plans. By customizing and applying AI technologies, industries can enhance operational efficiencies and tailor their services to meet evolving market demands. Enhancing Customer Identification Accuracy through AI AI enhances the accuracy of customer identification by utilizing sophisticated algorithms that analyze behavioral patterns, demographics, and purchase histories. This precise identification process significantly reduces the chances of errors in customer data, which is crucial for maintaining a competitive edge. Enhanced accuracy ensures that marketing resources are directed towards the right individuals, improving ROI and customer satisfaction. Explore AI-based tools designed to improve bank performance by visiting Bank Performance AI, or find talent in banking using Bank Talent AI. Frequently Asked Questions on AI in Business Prospecting How does AI revolutionize business prospecting? AI transforms business prospecting by automating data collection and analysis, allowing companies to quickly process large amounts of information. This enables data-driven decision-making, optimized marketing strategies, and improved conversion rates. What are the benefits of AI-driven lead generation? AI-driven lead generation improves lead quality and maximizes marketing efficiency by using machine learning algorithms to predict customer behavior, personalize marketing efforts, and target promising leads. These tools continuously learn and adapt to enhance lead generation processes over time. Can AI help in identifying high-value business prospects? Yes, AI-powered tools can streamline the search for high-value prospects by analyzing data from multiple sources to identify sales opportunities. AI can segment prospects based on conversion likelihood, allowing sales teams to focus on the most promising leads. How can AI extract financial insights for prospecting? AI tools like Prospect AI can extract and analyze financial insights critical for evaluating potential business partners. These insights, sourced from financial reports, market trends, and news analytics, help assess risk and understand market positioning. How does AI assist in uncovering key decision-makers within target organizations? AI technologies can efficiently map organizational structures to identify influencers and decision-makers. This enables sales teams to craft targeted messages and value propositions that resonate with individuals who have the authority to make purchasing decisions. Read the full article

0 notes

Text

Are You Ready for the AI-Powered Future? QA Consulting in 2025

QA Consulting in 2025: Are You Ready for the AI-Powered Future?

The landscape of software testing is evolving at an unprecedented pace. With artificial intelligence (AI), cloud-based testing, and automation taking center stage, traditional quality assurance (QA) methods are becoming obsolete. QA consulting companies are at the forefront of this transformation, helping businesses adapt and optimize their testing strategies for the future. As we approach 2025, it is crucial for QA managers, decision-makers, and project managers to assess whether their QA strategies are equipped to handle the challenges of an AI-driven future.

The Role of QA Consulting Companies in the AI Era

1. AI-Driven Test Automation

AI-powered test automation is revolutionizing how software is tested. Traditional testing methods, which relied heavily on manual efforts, are giving way to intelligent automation frameworks. QA consulting companies are integrating AI-based solutions to enhance test coverage, reduce human error, and speed up release cycles.

2. Predictive Analytics for Better Decision-Making

By leveraging machine learning algorithms, QA consulting companies can predict potential software failures before they occur. This predictive approach helps organizations preemptively address quality issues, leading to more stable and reliable software products.

3. Cloud-Based Testing for Scalability

Cloud technology is reshaping software testing by offering scalable and flexible environments. QA consulting companies provide expertise in implementing cloud-based testing solutions that enable businesses to perform large-scale, distributed testing without infrastructure limitations.

Key Trends Shaping Software Testing in 2025

AI-Powered Test Case Generation

AI-driven tools are now capable of generating test cases automatically based on historical data and user interactions. This reduces the burden on QA teams while improving efficiency and accuracy.

Shift-Left Testing Approach

The shift-left methodology emphasizes testing early in the development lifecycle, preventing defects rather than detecting them later. QA consulting companies are guiding organizations in implementing this proactive approach, ensuring software quality from the outset.

Codeless Test Automation

With the rise of no-code and low-code platforms, test automation is becoming more accessible. QA consulting companies are helping businesses adopt codeless automation tools, enabling non-technical testers to contribute to software quality assurance.

The Business Impact of AI-Driven QA Consulting

Cost Efficiency and Faster Time-to-Market

By leveraging AI and automation, QA consulting companies help businesses cut down testing costs and accelerate software delivery. Automated test execution reduces manual effort, allowing teams to focus on strategic testing initiatives.

Enhanced Software Security

As cyber threats become more sophisticated, security testing is paramount. QA consulting companies incorporate AI-driven security testing to detect vulnerabilities in real-time, ensuring software integrity and user trust.

Seamless Integration with DevOps

AI-powered QA solutions seamlessly integrate with DevOps pipelines, enabling continuous testing and delivery. This ensures that quality is maintained throughout the software development lifecycle without causing delays.

Are You Ready for the AI-Powered Future?

The future of software testing is intelligent, predictive, and automated. QA consulting companies play a crucial role in helping organizations navigate this evolving landscape. By embracing AI-driven testing solutions, predictive analytics, and cloud-based strategies, businesses can stay ahead of the curve and deliver high-quality software products.

Conclusion & Call to Action

If your QA strategy is still relying on outdated methods, now is the time to make the shift. QA consulting companies provide the expertise needed to future-proof your testing processes and ensure long-term success in an AI-powered world.

Are you ready to elevate your software quality with AI-driven QA consulting? Contact us today to explore cutting-edge solutions tailored to your business needs.

#qualityassuranceservices#qualityassurancetesting#qualityassurancecompany#quality assurance services

0 notes

Text

Optimizing Manufacturing Resource Allocation Through Data-Driven Decision Support

Introduction

Manufacturing success depends on the efficient allocation of resources—materials, labor, machinery, and energy. Traditionally, manufacturers relied on historical data and manual processes to plan their resource usage. However, with increasing supply chain complexities, fluctuating market demands, and the need for greater efficiency, these traditional approaches are no longer sufficient.

Data-driven decision support enables manufacturers to optimize resource allocation by leveraging real-time analytics, predictive modeling, and AI-driven insights. With better visibility and informed decision-making, companies can reduce costs, improve operational efficiency, and enhance scalability. This blog explores how data-driven strategies can transform resource allocation in manufacturing, ensuring businesses remain competitive and agile.

In recent years, technology-driven firms have played a crucial role in modernizing manufacturing processes. With expertise in predictive analytics, AI, and cloud-based solutions, companies like Tudip Technologies have helped manufacturers transition from traditional planning to intelligent, automated decision-making frameworks that enhance agility and sustainability.

Challenges in Traditional Resource Allocation

1. Limited Real-Time Visibility

Most manufacturers lack instant access to operational data, making it difficult to track resource usage and efficiency. This often leads to overuse of raw materials, inefficient labor distribution, and unexpected machine downtimes.

2. Demand Forecasting Inaccuracy

Traditional forecasting relies on past trends, making it challenging to predict sudden market shifts. This results in either overproduction, which leads to excessive inventory costs, or underproduction, which causes supply chain bottlenecks.

3. High Operational Costs Due to Inefficiencies

Misallocation of resources leads to increased energy consumption, unnecessary labor costs, and excess waste, all of which negatively impact profitability.

4. Limited Scalability and Adaptability

Manufacturers using static planning models struggle to adjust their production schedules dynamically, making it difficult to respond to sudden changes in raw material availability, labor shortages, or equipment failures.

How Data-Driven Decision Support Transforms Resource Allocation

1. Real-Time Data Analytics for Smarter Decision-Making

Cloud-based systems and IoT sensors collect real-time data on machine performance, labor productivity, and material flow.

Centralized dashboards allow decision-makers to track key metrics and adjust resource allocation accordingly.

2. Predictive Analytics for Demand Planning

AI-driven models analyze market trends, historical sales, and external factors to provide accurate demand forecasts.

This ensures production aligns with actual consumer demand, reducing excess inventory and optimizing material procurement.

3. AI-Powered Production Scheduling

AI models optimize production sequences by allocating resources based on real-time capacity and workload distribution.

Machine learning algorithms predict equipment failures and schedule preventive maintenance, minimizing downtime.

4. Automation for Efficient Resource Allocation

Automated workflows improve labor deployment, ensuring workers are assigned to high-priority tasks efficiently.

AI-powered quality control systems identify defects early, reducing material wastage and improving product reliability.

With deep expertise in data analytics, cloud technology, and AI-driven automation, Tudip Technologies has successfully collaborated with manufacturing firms to implement real-time tracking and predictive modeling solutions, helping them achieve greater operational accuracy and resource efficiency.

Key Benefits of Data-Driven Resource Allocation

1. Improved Productivity and Efficiency

Optimized resource planning eliminates unnecessary delays and supply chain bottlenecks.

Automated workflows and real-time tracking enhance workforce efficiency.

2. Reduced Costs and Minimized Waste

AI-driven insights prevent overuse of raw materials and reduce energy consumption.

Better forecasting helps avoid excess inventory storage costs.

3. Greater Scalability and Flexibility

Manufacturers can dynamically adjust production schedules based on market demand.

Cloud-based platforms support seamless expansion without excessive infrastructure investments.

4. Enhanced Compliance and Sustainability

Automated reporting ensures compliance with industry regulations on material usage and environmental impact.

Data-driven sustainability initiatives help reduce carbon footprints and energy waste.

Implementation Roadmap for Manufacturers

Step 1: Assess Current Resource Utilization

Conduct an operational audit to identify inefficiencies in material usage, workforce deployment, and production capacity.

Analyze existing data sources to understand key performance gaps.

Step 2: Integrate AI and Predictive Analytics

Deploy machine learning models to optimize demand forecasting and production scheduling.

Use predictive analytics for preventive maintenance and equipment health monitoring.

Step 3: Automate Resource Allocation Processes

Implement cloud-based ERP solutions for real-time tracking and automated decision-making.

Introduce AI-powered scheduling systems to allocate labor and machinery more efficiently.

Step 4: Monitor and Optimize Performance

Set up dashboards for continuous performance tracking and resource utilization analysis.

Use feedback loops to refine AI models and improve forecasting accuracy.

Through collaborations with technology partners like Tudip Technologies, manufacturers have successfully implemented AI-based predictive analytics and automated workflows that enable real-time decision-making—reducing costs and improving supply chain efficiency.

The Future of Data-Driven Resource Allocation

1. Digital Twin Technology for Real-Time Simulations

Manufacturers can create virtual models of their production facilities to test different resource allocation strategies before implementing them in real operations.

2. AI-Powered Chatbots for Decision Support

AI assistants can provide real-time recommendations on adjusting resource allocation based on production demands.

3. Cloud-Based Collaborative Resource Management

Global manufacturing teams can collaborate in real time to adjust resource allocation across multiple facilities, optimizing supply chain logistics.

Conclusion

As manufacturing becomes more complex, data-driven decision support is no longer optional—it’s essential for maintaining efficiency, reducing costs, and staying competitive. By leveraging real-time analytics, predictive modeling, and AI-driven automation, manufacturers can optimize resource allocation and adapt to changing market conditions.

Companies that embrace data-driven strategies will gain a competitive edge in productivity, sustainability, and operational agility. With experience in data analytics, cloud computing, and predictive intelligence, Tudip Technologies has played a crucial role in helping businesses streamline their resource allocation strategies, improve operational decision-making, and enhance manufacturing efficiency.

Click the link below to learn more about the blog Optimizing Manufacturing Resource Allocation Through Data-Driven Decision Support:

#Data-Driven Manufacturing Optimization#Manufacturing Process Optimization#Smart Manufacturing Analytics#Lean Manufacturing with Big Data#Manufacturing#Tudip Technologies#Tudip

1 note

·

View note

Text

The Role of AI and Analytics in Akhilagna's Data-Driven Marketing Strategy

In today’s fast-paced digital world, businesses need to stay ahead of the curve to remain competitive. One of the most effective ways to achieve this is by utilizing data-driven marketing strategies. Akhilagna a leader in innovative marketing solutions, has harnessed the power of artificial intelligence (AI), analytics, and machine learning (ML) to create highly targeted, personalized campaigns that drive results. By leveraging these cutting-edge technologies, Akhilagna is revolutionizing how brands interact with their audiences and helping them grow in an increasingly data-driven environment.

The Power of Data-Driven Marketing

At the heart of Akhilagna's marketing strategy lies the ability to analyze vast amounts of consumer data. In the age of digital transformation, data is an invaluable resource. Every interaction a consumer has with a brand generates data that can provide insights into their preferences, behavior, and purchasing habits. Akhilagna ITfocuses on collecting and analyzing this data to create personalized marketing messages that resonate with each individual.

Through the use of advanced analytics, Akhilagna can gain a deeper understanding of consumer behavior and trends. By examining patterns in data, Akhilagna can identify the best times to reach out to customers, the most effective channels for communication, and even the content types that drive the most engagement. With the insights gained from data analysis, Akhilagna tailors marketing strategies to meet the unique needs of each customer segment.

Artificial Intelligence (AI) and Machine Learning (ML): The Game Changers

Akhilagna takes data analysis to the next level by integrating artificial intelligence (AI) and machine learning (ML) into its marketing strategy. These technologies enable the company to go beyond simple data interpretation and automate key aspects of its marketing processes.

AI-powered tools can analyze consumer data in real time, identifying trends and insights that might otherwise go unnoticed. For instance, machine learning algorithms can predict which customers are most likely to convert based on past interactions, helping Akhilagna optimize its campaigns for higher ROI. Additionally, AI can personalize marketing messages at scale by crafting dynamic content that adapts to the interests of individual users. By leveraging these technologies, Akhilagna creates highly engaging, customer-centric campaigns that are tailored to each stage of the buyer's journey.

The Impact of AI-Driven Insights on Decision-Making

The integration of AI and machine learning has a significant impact on decision-making processes within Akhilagna’s marketing teams. With access to AI-driven insights, decision-makers can make data-backed choices that lead to better outcomes. AI helps identify potential opportunities and threats by analyzing patterns in large data sets, enabling Akhilagna to stay ahead of competitors.

For example, AI can analyze how customers respond to different marketing channels, determining which platforms are most effective for specific campaigns. This helps Akhilagna allocate resources more efficiently, focusing on the channels that yield the best results. Furthermore, AI allows for continuous optimization of marketing efforts. With real-time data analysis, campaigns can be adjusted on the fly to improve performance and adapt to changing market conditions.

How Akhilagna Stays Ahead with Data-Driven Marketing

In a competitive market, staying ahead is key. Akhilagna’s commitment to using data-driven marketing powered by AI and analytics ensures that it can quickly adapt to shifts in consumer behavior and emerging trends. By continuously collecting and analyzing data, Akhilagna ITgains valuable insights into customer needs and preferences, allowing it to create marketing strategies that resonate with the target audience.

The combination of AI, machine learning, and advanced analytics allows Akhilagna to refine its approach, delivering highly relevant content to the right people at the right time. This precision and personalization are what set Akhilagna apart from competitors, giving its clients a distinct advantage in a crowded marketplace.

Conclusion

Akhilagna’s innovative use of AI, machine learning, and analytics is transforming the way businesses approach marketing. By harnessing the power of data, Akhilagna is not only improving marketing effectiveness but also enabling brands to create deeper connections with their audiences. As a result, Akhilagna’s data-driven approach is setting a new standard for the future of marketing. With these advanced technologies at its disposal, Akhilagna is paving the way for brands to thrive in an increasingly competitive and data-centric world. Whether you're looking to enhance customer engagement or optimize your marketing campaigns, akhilagnait.com offers the expertise and tools needed to achieve lasting brand growth.

0 notes

Text

The AI-Powered 1-Minute Forex Strategy: How to Trade Like a Pro (Without Losing Your Mind) Why 99% of Traders Fail at the 1-Minute Timeframe (and How You Can Win) The 1-minute timeframe is where fortunes are made—and lost faster than you can say "margin call." If you've ever tried trading on this ultra-fast chart, you know it feels like playing chess against a caffeinated squirrel. But what if you could harness the power of artificial intelligence bots to stack the odds in your favor? Most traders burn through their accounts in record time on the 1-minute timeframe. Why? They rely on gut feelings, outdated indicators, and slow reaction times. Meanwhile, high-frequency trading firms are running AI-powered bots that can execute trades in milliseconds. The result? Retail traders get eaten alive. But here's the good news: AI isn't just for the big players anymore. If you know how to use it right, AI trading bots can transform your 1-minute strategy from a gambling spree into a precision-driven money machine. Let's dive in. The Real Reason the 1-Minute Chart Is So Hard to Trade Traders love the 1-minute chart for its fast-paced action, but it's also full of traps. Here’s what makes it so brutal: - Fakeouts Galore: Market makers manipulate price action, luring traders into bad positions before reversing the trend. - Speed Kills: By the time you react to a setup, it's already too late. - Emotional Overload: Trading every minute can lead to impulsive decisions—your account balance won’t thank you. AI bots remove these human errors by scanning market conditions, identifying high-probability trades, and executing them instantly. No hesitation, no emotions—just calculated precision. How AI Bots Dominate the 1-Minute Chart (And How You Can Too) AI trading bots excel where humans fail. Here’s how they do it: - Pattern Recognition on Steroids – Bots analyze thousands of chart patterns in milliseconds, spotting setups that human eyes would miss. - Data-Driven Decisions – Unlike traders who chase price movements, AI bots rely on cold, hard data. - Instant Execution – No delays, no second-guessing—AI bots execute orders at lightning speed. - Risk Management Perfection – AI enforces stop losses, trailing stops, and position sizing without emotion. - 24/7 Market Monitoring – Sleep is for humans. Bots don’t get tired, ensuring you never miss a high-quality trade. Insider Strategies: AI-Powered 1-Minute Trading Hacks Want to trade like a pro? Here’s how to use AI bots effectively on the 1-minute timeframe: 1. Use AI for High-Probability Trade Setups Forget about staring at charts all day. AI bots analyze price action, volume, and indicators to find the best setups. Some bots can even factor in news events and social sentiment. - Tool to Use: Smart Trading Tool – Automates trade execution and risk management. - Pro Tip: Customize AI bots to focus on your preferred setups (e.g., breakouts, mean reversion, or trend-following strategies). 2. Leverage AI for Real-Time Market Sentiment Analysis Markets react to news in real-time, and AI bots track sentiment shifts faster than any human can. By analyzing tweets, headlines, and institutional order flow, AI can predict short-term price movements. - Tool to Use: Latest Economic Indicators & Forex News - Pro Tip: Combine AI sentiment analysis with price action signals for lethal trade entries. 3. AI-Based Risk Management = Account Survival Risk management makes or breaks a trader. AI enforces strict stop-loss rules, adaptive position sizing, and real-time trade adjustments based on market volatility. - Tool to Use: Free Trading Plan - Pro Tip: Use AI bots to adjust your lot size dynamically based on market conditions. The Hidden Pitfalls of AI Trading Bots (And How to Avoid Them) AI bots are powerful, but they’re not magic. Here’s what can go wrong and how to fix it: - Over-Optimization – If a bot is too optimized for past data, it may fail in live markets. Solution? Regularly update algorithms based on changing market conditions. - Lack of Human Oversight – AI bots can’t adapt to black swan events. Always monitor them and be ready to intervene. - Latency Issues – Execution speed matters. Use a VPS (Virtual Private Server) to ensure your AI bot runs without lag. Final Thoughts: Will AI Bots Replace Human Traders? Not entirely—but they’re changing the game. The best traders of the future won’t be those who trade manually but those who leverage AI to make smarter, faster, and more profitable decisions. Want to supercharge your 1-minute trading strategy with AI? Get access to expert insights, daily market alerts, and cutting-edge AI tools by joining the StarseedFX Community. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

AI for Satellite Imagery: $10.9B Market by 2034 🚀 (15.9% Growth)

AI for Analyzing Satellite Imagery Market : The integration of Artificial Intelligence (AI) in satellite imagery analysis is revolutionizing geospatial intelligence by enabling faster, more accurate, and scalable insights. AI-powered models, including machine learning (ML) and deep learning, enhance image processing, object detection, and change detection, making satellite data more actionable. Industries such as agriculture, defense, disaster management, and urban planning leverage AI-driven satellite analysis to monitor landscapes, predict environmental changes, and optimize resource allocation. With AI automating vast datasets in real-time, decision-makers gain unparalleled visibility into global trends, empowering smarter strategies and proactive responses.

To Request Sample Report: https://www.globalinsightservices.com/request-sample/?id=GIS10828 &utm_source=SnehaPatil&utm_medium=Article

The applications of AI in satellite imagery extend beyond traditional mapping. In agriculture, AI assists in crop health monitoring, irrigation management, and yield prediction, improving food security. In climate science, AI-driven models analyze ice cap melting, deforestation rates, and natural disasters, providing early warnings and mitigation strategies. The defense and security sector benefits from AI-powered surveillance, tracking unauthorized activities, and ensuring national security. Moreover, AI optimizes disaster response by detecting affected areas faster, allowing authorities to deploy aid more efficiently. The convergence of AI and satellite technology is setting new benchmarks in precision, efficiency, and automation, transforming the way industries leverage Earth observation data.

The future of AI-driven satellite imagery analysis is promising, with advancements in neural networks, edge computing, and cloud-based analytics enhancing its capabilities. As AI algorithms improve, the accuracy of detecting anomalies, classifying objects, and predicting trends will reach new heights. With growing investments in AI, geospatial analytics, and remote sensing, the market is poised for exponential growth. The demand for real-time, AI-enhanced satellite intelligence will continue to drive innovation, reshaping industries and fostering sustainable development worldwide.

#AI #SatelliteImagery #GeospatialAI #MachineLearning #EarthObservation #RemoteSensing #BigData #DeepLearning #SpaceTech #GIS #AgricultureAI #UrbanPlanning #DisasterManagement #ClimateChange #SmartFarming #AIInnovation #SurveillanceTech #GeospatialAnalytics #AIinDefense #EnvironmentalMonitoring #NeuralNetworks #CloudComputing #EdgeAI #SpaceExploration #AIAutomation #TechForGood #AIRevolution #SmartCities #AIinAgriculture #FutureTech

0 notes

Text

Maverick Protocol: Revolutionizing Decentralized Finance

In the rapidly evolving world of decentralized finance (DeFi), Maverick Protocol emerges as a pioneering force, introducing innovative solutions to enhance liquidity provision and trading efficiency. As the DeFi landscape becomes increasingly complex, platforms like Maverick play a crucial role in simplifying processes and offering users more control over their assets.

Understanding Maverick Protocol

At its core, maverick protocol is a decentralized platform designed to optimize liquidity and trading in the DeFi space. By leveraging advanced algorithms and a unique Automated Market Maker (AMM) model, Maverick aims to provide lower swap gas fees and increased order flow efficiency, setting it apart from traditional DeFi platforms.

The MAV Token

Central to the Maverick ecosystem is the MAV token. This utility token serves multiple purposes, including governance participation, staking, and as a medium for transaction fees within the platform. With a total supply capped at 2 billion tokens and a circulating supply of approximately 503 million, MAV's tokenomics are structured to promote long-term value and stability.

Innovations Introduced by Maverick

Maverick's standout feature is its novel AMM model, which enhances liquidity efficiency and reduces gas costs for users. This model allows for dynamic adjustments in liquidity pools, ensuring optimal trading conditions and minimizing slippage. Such innovations position Maverick as a leader in DeFi advancements.

Ecosystem and Partnerships

Since its inception, Maverick has strategically expanded its ecosystem through partnerships with major blockchain platforms. Notably, the protocol launched on Ethereum Mainnet in March 2023, followed by integrations with zkSync Era and BNB Chain. These collaborations have facilitated over $2.5 billion in trading volume, underscoring Maverick's growing influence in the DeFi sector.

Security Measures

Security remains a top priority for Maverick Protocol. The platform employs rigorous auditing processes and implements robust security protocols to safeguard user assets. By fostering a transparent and secure environment, Maverick has built a reputation for reliability and trustworthiness among its user base.

User Experience

Maverick places a strong emphasis on user experience, offering an intuitive interface that caters to both newcomers and seasoned DeFi enthusiasts. The platform's design ensures seamless navigation, making complex trading and liquidity provision processes more accessible to a broad audience.

Governance Structure

Empowering its community, Maverick operates a decentralized governance model where MAV token holders can influence key decisions. Through staking and voting mechanisms, users actively participate in shaping the protocol's future, ensuring that development aligns with the community's interests.

Market Performance

As of February 10, 2025, MAV is trading at approximately $0.092, with a market capitalization of around $46 million. The token has experienced fluctuations, influenced by broader market trends and internal developments. Investors are encouraged to monitor these dynamics closely when considering participation.

Community and Support

A vibrant and engaged community is central to Maverick's success. The protocol offers various resources, including forums, tutorials, and customer support channels, to assist users in navigating the platform and maximizing their DeFi experience.

Future Roadmap

Looking ahead, Maverick has an ambitious roadmap that includes launching voting escrow and governance contracts, expanding to additional blockchain networks, and introducing new features to enhance platform functionality. These initiatives reflect Maverick's commitment to continuous improvement and innovation.

Comparative Analysis

When compared to other DeFi platforms, Maverick's unique AMM model and focus on efficiency provide distinct advantages. However, like all platforms, it faces challenges such as market competition and the need to maintain security standards. Users should weigh these factors when choosing a DeFi platform.

Risks and Considerations

While Maverick offers numerous benefits, potential users should be aware of inherent risks, including market volatility and the complexities of DeFi protocols. It's essential to conduct thorough research and exercise caution when engaging with the platform.

Real-World Applications

Maverick's impact is evident in various real-world applications, from facilitating efficient token swaps to providing liquidity solutions for decentralized exchanges. Testimonials from users highlight the protocol's effectiveness in enhancing their DeFi activities.

Maverick Protocol stands at the forefront of DeFi innovation, offering solutions that address common challenges in liquidity provision and trading efficiency. As the DeFi landscape continues to evolve, Maverick's commitment to innovation and user empowerment positions it as a key player in the future of decentralized finance.

Social Media: https://x.com/mavprotocol https://t.me/maverickprotocolofficial

1 note

·

View note

Text

Create Stunning Presentations with AI-Powered Slideshow Makers

Creating visually appealing and engaging presentations has never been easier, thanks to the rise of artificial intelligence. Whether for business, education, or personal use, an advanced free slideshow maker can help users craft professional slides without the need for design expertise. AI-powered tools make the process seamless by automating layout design, transitions, and content suggestions, ensuring that every slide is polished and impactful.

The Benefits of Using an AI Slideshow Maker