#api solutions

Explore tagged Tumblr posts

Text

We are offering a seamless integration experience that empowers businesses to reach new heights of innovation. Our dedicated team of experts meticulously crafts custom API integration services tailored to your unique needs, ensuring compatibility, scalability, and security. Trust Ficode to be your strategic partner in harnessing the full potential of third-party APIs, propelling your business forward in the ever-evolving digital landscape.

0 notes

Text

0 notes

Text

#kyc canada#kyc solution#kyc providers#kyc api#kyc software#kyc in canada#kyc verification#online dating#dating sites#dating apps#KYC for Online Dating

2 notes

·

View notes

Text

KYC Solutions Provider

KYC Italy provides a KYC solution to help businesses to verify the identity of their customers. Their KYC API is easy to use and can integrate easily with any existing system. Our API helps for seamless client onboarding and secure business transactions.

2 notes

·

View notes

Text

#kyc uk#kyc solution#kyc api#kyc companies#kyc software#kyc providers#fraud prevention#kyc solutions for crypto#crypto#blockchain#blockchain technology

2 notes

·

View notes

Text

Sweden's Exemplary Anti-Corruption Stand: A Deep Dive into KYC and AML Practices

In the realm of global integrity and transparency, Sweden stands tall as the paragon of virtue, earning the coveted title of the world's least corrupt country, as per the Corruption Perceptions Index (CPI). Behind this remarkable achievement lies Sweden's unwavering commitment to combat corruption through robust Anti-Money Laundering (AML) laws, particularly focusing on stringent Know Your Customer (KYC) protocols. These protocols require financial institutions to verify the identity of their customers and any transactions they make. Furthermore, Sweden has implemented measures to protect whistleblowers and to ensure that any instances of corruption are investigated and prosecuted.

The Pillars of Trust: KYC in Sweden

Sweden's success in maintaining its reputation for integrity is deeply rooted in its proactive approach to KYC. The KYC process, an integral part of financial and business operations, plays a pivotal role in preventing corruption and money laundering by ensuring thorough identification and verification of customers. Sweden has invested heavily in its KYC system, building a comprehensive database of customer information. It has also implemented strict regulations requiring companies to report suspicious activity to the government. As a result, Sweden has become a world leader in the fight against financial crime.

KYC Solutions: More than a Mandate

KYC in Sweden goes beyond mere compliance; it serves as a comprehensive solution to safeguard the financial ecosystem. The emphasis on accurate customer identification, risk assessment, and ongoing monitoring establishes a formidable defense against illicit financial activities. Sweden's KYC system also promotes customer trust and increases customer convenience. By streamlining the onboarding process, customers can easily open an account and start trading. Additionally, the KYC system provides customers with better control over their money, as they can easily monitor their account activity.

Compliance at the Core

Sweden's commitment to compliance is evident in its KYC practices. Striking a delicate balance between stringent regulations and practical implementation, the country has fostered an environment where businesses operate with transparency and adhere to the highest ethical standards. Sweden's KYC regulations are designed to prevent money laundering and financial crime. The country has put in place a comprehensive set of measures, including customer due diligence, to ensure that businesses comply with the law. Additionally, Sweden has implemented a reporting system that allows authorities to track suspicious activity in real time.

AML Laws in Sweden: A Global Benchmark

Sweden's AML laws are not just a legal requirement but a testament to its commitment to global financial integrity. The country's legal framework provides a solid foundation for detecting and preventing money laundering activities, contributing significantly to its stellar position on the CPI. Sweden also has a strong commitment to international cooperation and information sharing, which helps to further strengthen the AML legal framework. Additionally, the country has implemented strict regulations on financial institutions, including requirements to report suspicious transactions.

KYC Service Providers – KYC Sweden Leading the Way

Sweden has emerged as a frontrunner in KYC solutions, with a focus on providing efficient and reliable services. KYC service providers in Sweden leverage advanced technologies and methodologies to offer the best-in-class identification and verification processes, setting the gold standard for global counterparts. Swedish KYC providers also provide the highest level of security, protecting customer data and complying with all local regulations. Furthermore, Swedish KYC providers offer a wide range of services, including onboarding, identity verification, and fraud prevention.

KYC for Swedish Businesses: A Necessity, not an Option

For businesses operating in Sweden, KYC is not merely a regulatory checkbox but a fundamental practice. The stringent KYC requirements ensure that businesses are well-acquainted with their clients, mitigating the risk of involvement in any illicit or corrupt activities. It also helps to protect the rights of customers, as it ensures that they are aware of who is handling their data. KYC also helps businesses to identify any potential risks associated with doing business with a particular customer.

Global Impact: KYC Sweden's Ripple Effect

Sweden's commitment to KYC and AML has a ripple effect beyond its borders. Businesses operating globally, including Swedish enterprises with international footprints, benefit from the robust KYC measures in place. This not only safeguards these businesses but also contributes to the overall global effort against corruption. As a result, other countries and organizations are encouraged to implement strong KYC and AML measures, which help to create a safer business environment for everyone. Additionally, these measures help to protect consumers from malicious actors and financial crimes.

Conclusion

Sweden's standing as the world's least corrupt country is a testament to its meticulous implementation of KYC and AML laws. By placing compliance, integrity, and transparency at the forefront of its financial practices, Sweden has set a precedent for nations worldwide. As businesses and governments grapple with the challenges of maintaining trust and financial integrity, KYC Sweden's model of KYC and AML serves as an exemplary beacon guiding the way forward. The integration of KYC solutions is not just a legal requirement for Sweden; it is a proactive strategy that continues to fortify its position as a global leader in the fight against corruption.

#compliance#kyc#kyc compliance#kyc solutions#kyc and aml compliance#kyc api#kyc services#kyc verification#digital identity#kyc sweden

2 notes

·

View notes

Text

Seamless Connections: Travel CRM with API Integration

Introduction:

Travel agents must adapt quickly to changing consumer needs and market trends if they want to stay in business. Travel CRM with Application Programming Interface (API) integration has emerged as a solution that empowers agencies to streamline their operations, personalize client experiences, and stay at the forefront of the digital transformation.

The Power of Integration For Travel Industry : Travel CRM with API:

Effective Data Transfer:

The Travel CRM can easily exchange data with other external systems, including airline and hotel booking systems, thanks to API connection.

Real-time data updates minimize human mistake and challenging data entry.

Personalization:

CRM systems enriched with API data can provide personalized recommendations and offers to clients.

Clients feel more valued when offered tailored travel options.

Multi-Channel Communication:

API integration allows travel businesses to communicate with customers through multiple channels, such as email, SMS, and social media.

This multi-channel approach enhances client engagement and marketing outreach.

Inventory Management:

API integration with booking systems ensures accurate and up-to-date inventory management.

Travel agencies can provide real-time availability and pricing information to clients.

Travel CRM with API Integration: Practical Applications:

Client Data Enrichment:

API integration enhances client profiles with data from external sources, offering a comprehensive view of client preferences and behavior.

Agencies can provide highly personalized recommendations and services.

Booking and Reservations:

Travel agencies can instantly access real-time availability and pricing data through API integration.

This facilitates efficient booking and reservation processes.

Marketing and Communication:

Integration with email and SMS APIs allows for targeted marketing campaigns.

Agencies can reach clients with relevant travel offers and updates.

To Be Conclude:

The integration of Travel CRM with API opens new doors for travel agencies to provide enhanced customer experiences, streamline operations, and remain competitive in a fast-paced industry. These two blogs illustrate how IVR and API integration offer solutions that transform the way travel agencies connect with clients and manage their operations, ultimately leading to increased efficiency and customer satisfaction.

#crm company#crm development#b2b travel software#travel crm with api#ivr solution#ivr with travel crm

2 notes

·

View notes

Text

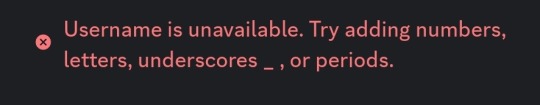

God this pisses me off so fucking much. Is it a small thing at the end of the day? Yeah probably, but it's indicative of a larger problem (that I'll get to eventually, I promise)

to start with the obvious: THE PREVIOUS DISCRIMINATOR SYSTEM WAS PERFECTLY FINE AND IN FACT THE BETTER OPTION OF THE TWO. In fact, it's so much of a better solution, that literally every other platform has started transition to this system if they don't already use it. Steam, Battle.net, Xbox, and even individual games like Guild Wars 2 or Neverwinter Online have either used this system or since adopted it. And y'know what? It fucking works. Really well in fact!

Literally no one has ever complained about it, in fact I've only ever seen praise because it means they don't have to fuck around with the old (and I do mean OLD) problem of having to fuck around with your username to make sure it's not taken.

"Easier to connect with your friends" - John Discord Yeah fuck off with that actual blatant lie. This makes it harder to do that, because now you can't just use your standardised username with a couple numbers at the end, you have to fuck around with it in extra ways that makes it harder for the user to remember, and makes it harder to find specific people.

This is the very fucking definition of "a solution looking for a problem" and I'm willing to bet that the people who actually have to implement this change are all sitting there going "this is fucking stupid, causing a bunch of problems, and not actually improving anything" but too fucking bad, John Discord has demanded from up high that it has to be, and so it is!

Why? Because it's not enough to just have a good piece of software that works anymore. No, you have to be constantly "improving" it and changing it to appease fucking shareholders. "Good enough" isn't good enough anymore, neither is "works really well and doesn't need to change." Because now things need to change to make it seem like things are going well. And that's fucking bullshit.

It feels like Discord has forgotten why it got popular. Y'know what was popular before Discord? Skype. Want to know what happened to Skype? They kept introducing bullshit changes that no one wanted and no one liked, so they jumped ship to the next best platform.

What's happening to Discord? They keep implementing changes that no one wants and that no one likes. How long, John Discord, do you think you'll last before someone else comes along? You're not too big to fail. Learn your fucking history.

Sure, this is a small change really in the grand scheme of things. One that massively hurts its usability, but a small one none-the-less. What's the next big change they're going to make that no one asked for, just because they have to start creating problems to then sell the solution for?

We've already seen where this leads other pieces of software that have since died.

oh gee discord should I try adding numbers? should I try that???? should I try adding numbers to the end of my username so that it's individualized and only mine???? should I try adding numbers??????????

#this combined with the new spotify UI update#then the reddit API changes#can tech companies get their head out their ass please?#stop changing things for the sake of change#if you're going to change something then make it an actual improvement#make it actually solve a problem that already exists#don't make solutions that are searching for a problem#this is literally how you lose your userbase#I can almost guarantee that if Discord keeps doing this shit people will find an alternative#and Discord will go the way of Skype#yeah I'm being a little dramatic but this annoys the fuck out of me

127K notes

·

View notes

Text

How to Integrate ChatGPT into Your Application: A Step-by-Step Guide

In today’s digital era, artificial intelligence (AI) has become a crucial part of business solutions. One of the most impactful AI tools is ChatGPT – a powerful language model created by OpenAI that can simulate human-like conversations. Integrating ChatGPT into your application can revolutionize your business by automating customer support, enhancing user engagement, and providing personalized interactions.

This guide will walk you through the process of integrating ChatGPT into your application step by step. Whether you're an app developer, a business owner, or someone interested in AI technologies, this guide will provide the information you need to get started.

1 . Understand Your Requirements Before you dive into integrating ChatGPT, it’s essential to define the goals you want to achieve with AI in your application. Do you want to automate customer service, create virtual assistants, or enable advanced conversational interfaces? Understanding your objectives will help determine how you should use ChatGPT within your application.

If you're unsure about which AI features will benefit your business most, consulting with experts can help. Umano Logic, based in Canada, specializes in understanding client needs and offering the right ChatGPT integration solutions for your business.

2 . Understand Your Requirements

Before jumping into integrating ChatGPT, it is vital to establish the purpose you intend to fulfill with AI within your application. Do you wish to automate customer support, develop virtual assistants, or facilitate sophisticated conversational interfaces? Knowing your objectives will assist in determining how to utilize ChatGPT within your application.

If you're not sure which AI capabilities will most help your business, talking to experts can. Umano Logic, a Canadian company, is experienced at getting to know client needs and providing the appropriate ChatGPT integration solutions for your business. 3 . Set Up the API OpenAI offers a friendly API to bring ChatGPT into your program. The API provides access to strong language models and lets you customize the AI to your individual requirements.

Following is a step-by-step summary of what needs to be done:

Get your API key from OpenAI: Register on OpenAI and grab your API key.

Install libraries: Depending upon your programming language, install OpenAI client libraries.

Configure the API: Create parameters for creating AI responses from user input.

The technical implementation may look daunting, but since we have the seasoned team of Umano Logic, we can assist you with each step of the way and make sure that the integration is completely smooth and seamless.

4 . Design the User Interface

With the backend installed, the second step is designing how the users will interact with the ChatGPT. The user interface (UI) should be intuitive and user-friendly with simple, understandable options for the users to begin chatting with the AI.

Remember the following when designing the UI:

User-friendly chat window

Quick response buttons

Personalized interaction based on user input

At Umano Logic, we can assist you in creating a clean, minimal, and efficient UI that maximizes the user experience and makes using AI seamless. 5 . Train and Customize ChatGPT

Although ChatGPT comes with pre-trained models, you might want to fine-tune it for your specific business needs. You can train the model to understand your products, services, and industry-specific terminology. This ensures that users get the most relevant answers when they interact with the AI.

Customizing ChatGPT can greatly improve the quality of the interactions and make the AI feel more natural and intuitive. Umano Logic offers training and customization services to make sure the AI understands your business and communicates effectively with users.

6 . Test and Refine

Once everything is set up, it's important to test the integration thoroughly. Test the ChatGPT interactions, making sure the responses are accurate, relevant, and helpful. The feedback from users will be invaluable in refining and improving the AI system.

At Umano Logic, we offer comprehensive testing services to ensure that your ChatGPT integration works flawlessly. Our experts will help you monitor the system and make improvements to keep the AI model in top shape.

7. Monitor and Improve

After launching the integration, it’s essential to continuously monitor how the AI performs. Regular monitoring helps identify any issues early, while also providing insights into how users are interacting with ChatGPT. You can use this information to improve responses and adapt the AI to better suit your business goals.

Conclusion:

Adding ChatGPT to your application isn't a trend it's a wise step toward business modernisation and improved customer experiences. From response automation to personalised assistance, ChatGPT can enable you to serve users more professionally and efficiently. The process might look technical, but if guided correctly, it's an easy task.

At Umano Logic, we're experts at ensuring businesses everywhere in Canada can seamlessly integrate AI tools such as ChatGPT into their sites. Whether you're a new startup looking to innovate with new technology or a long-established business wanting to take your customer care to the next level, our staff is here to guide you through each stage, from planning and installation to testing and beyond.

If you're prepared to introduce AI into your app and remain ahead of the digital curve, call Umano Logic today. Let's craft intelligent, beneficial, and forward-thinking solutions collectively.

Visit Now to learn more about ChatGPT Integration

visit:: https://www.umanologic.ca/chatgpt-integration-service-edmonton

#ChatGPT application development Canada#OpenAI ChatGPT integration#ChatGPT for business solutions#ChatGPT API integration service#How to integrate ChatGPT into the app#AI integration experts in Canada#Hire dedicated developers for ChatGPT integration#OpenAI implementation partner Canada

0 notes

Text

Unlock Seamless Business Operations with Salesforce Integration Services

Discover how Advent IT Solution's Salesforce Integration Services can streamline your business processes, enhance data accuracy, and improve customer insights. Whether you're a startup or an enterprise, our tailored solutions ensure smooth connectivity between Salesforce and your existing systems. Learn more about our services and how we can help your business thrive.

1 note

·

View note

Text

How AML Checks and KYC Checks Are Transforming the Austrian Forex Market

Austria has emerged as a reputable player in the European financial ecosystem, with its forex market attracting investors and traders globally. The Austrian forex market is rapidly transforming due to evolving AML and KYC regulations. In the forex industry, for high-volume transactions and cross-border trades, KYC and AML compliance are essential to ensure trust and mitigate identity fraud and regulatory adherence.

#aml provider for forex#aml checks for forex industry#kyc platform for forex#aml checks for forex market#aml software for forex market#kyc checks for forex market#aml solution provider for forex industry#background check for forex industry#AML API for forex market#AML company for forex business#KYC company for forex market#compliance solution for forex industry

1 note

·

View note

Text

Building Trust Through WhatsApp Flows: How Automated Messaging Builds Stronger Relationships

Did you know that people use an important marketing strategy to ensure they advertise to a qualified audience? Welcome to content strategy. A content strategy is critical to a successful content marketing program and offers an opportunity to align the marketing and sales teams in specific ways. The first goal is to define the company’s story and then realign it with its vision by identifying what’s unique about your product or services. The second goal is to produce relevant content that supports customer nurturing, conversion planning, and awareness building. When you use WhatsApp messages for marketing, you must also strategize. Tapping into WhatsApp’s privacy, security, and data-sharing policies to implement your marketing strategy is not difficult. Start by using conversations to share insightful information with those users who have opted in or want to get more out of your business. With a little practice, you’ll soon find this app is an effective way to increase brand awareness. WhatsApp marketing messages However, do not overload your WhatsApp marketing messages with too many of either to ensure your messages are easily downloadable. Sending pictures and videos is counter-productive if issues with loading time arise for somebody receiving your message. You should use various other media formats and platforms to engage people with many pictures. Remember, with just images, words, or both, WhatsApp marketing can be used to market your brand. If you pair the right service with the right strategy, WhatsApp marketing creates a ripple effect that increases app usage for your brands’ products and spreads word-of-mouth awareness. WhatsApp as a business tool WhatsApp is a powerful business tool, especially for small and medium-sized businesses, allowing them to connect with customers directly through messaging, build relationships, and streamline communication. WhatsApp as a business tool offers features like business profiles, catalogs, and automated replies to enhance customer engagement and improve efficiency. Automate your messages on WhatsApp with no code chatbot builder and integrate them with your CRM, payments, Google Sheets, or any tech stack you use. WhaWhatsApp Chatbot business solutiontsApp chatbot business solution Whether you are a business owner, a marketing or sales professional, or part of the customer support team within an organization, WhatsApp Chatbot business solution will help you engage more with your customers with minimal effort. Every business needs a robust marketing department to attract new customers through various marketing channels. While your marketing teams work on strategies to build your customer base, WhatsApp Chatbot is an effective tool for generating and getting in touch with prospective leads. With the bot, directing a customer down the marketing funnel is much easier, thanks to spontaneous conversations backed with rich visual media.

Read More Resources

Number portability and WhatsApp Business API are now live

Use chatbots in the foodservice industry to ensure better customer experience

#WhatsApp marketing messages#WhatsApp Chatbot business solution#WhatsApp Cloud API#WhatsApp Solutions

0 notes

Text

KYC Provider Canada

KYC is a mandatory process that financial institutions and other businesses follow to authenticate the identities of their customers. KYC Providers help and provide KYC API to verify users' and business identities. KYC Providers in the Canada also use various methods to verify identities, like id, document, and address verification.

#KYC Canada#KYC Providers#KYC API#KYC Services provider#KYC Solutions Provider#KYC Software#kyc verification#KYC verification Solutions#KYC Platform#KYC Solution#fiance#crypto#blockchain#bitcoin#insurance#finance#fintech#healthcare#business

4 notes

·

View notes

Text

The Shift from SMS to WhatsApp Business API to Automate Business Communication

WhatsApp Business API is emerging as a reliable and convenient platform for businesses to connect with customers, offering more advanced features like multimedia sharing with CTA buttons to enhance the impact of messages.

#WhatsApp Business API Provider#WhatsApp Business API Solution#WhatsApp Business API Pricing#Official WhatsApp Business API#WhatsApp Chatbot for Business#WhatsApp Business API for Business Communication#WhatsApp Business Api Service#WhatsApp Business Solution Provider#WhatsApp API Service Provider#WhatsApp Business API Service Provider#WhatsApp API Platform#WhatsApp Business API Messaging#WhatsApp Business Api Solution Provider#WhatsApp API for ecommerce#WhatsApp for customer support#go2market#go2marketindia

0 notes