#also you can bet they're selling this data on the side to make even more money

Explore tagged Tumblr posts

Text

This is also why so many places like cafes and bakeries have gone for the "industrial" look lately. It creates a horrible sound environment because the goal is not to be a welcoming place for customers or potential customers, it's to provide the bare minimum so people stay only as long as they need to before leaving as customers that stay—even if the place is largely empty—are seen as depriving the place of potential profits.

Customer turnover and how to do it in a sneaky way is an entire part of the industry. Because they can't ban you or give you 15 minutes, but they can make it so you have a hard time hearing things or the limit of what you can tolerate caps out after 15-30 minutes.

Which then leaks into independent places because what do all the Big Name places look like? An unfinished industrial mess primed to give people a headache, so that's what's designed around because it's expected.

"This smart camera is able to collect information about customers in a coffee shop as well as workers, converting their actions to readable data. Fooling a camera from recognizing the form of a human is easy enough, but what happens when they track actions instead?"

#to say nothing that leaving it unfinished means it's easier to sell if they want to#or how so many places refuse you bathroom access unless you buy something#it's all about the money and perceived loss of money#and customers can leave—employees are stuck in that environment for hours#and they can't wear headphones to cut down on the sheer amount of garbage noise#you even have fast food places ripping up benches for 'leaning pads' because they don't want you to stick around#show up to give them money then gtfo#customers are not welcome to stay#some places are now trying to ban students and/or laptops#or put limits on the length of time#because you are not welcome to stay#they just legally can't kick you out if you aren't causing problems#heard of some managers even offering coupons to get people to leave because it makes them look bad if customers stay#because again they legally can't do anything to you but the corporate overlords want you gone#and the manager/store will be punished if too many customers stay#also you can bet they're selling this data on the side to make even more money

6K notes

·

View notes

Note

Perhaps a bit of tinfoil hat time but also analyzing based on facts time. I've heard that Amazon Japan offered 40-50% discount on Nopes. I've also heard a number of European countries offered around 40% discount. I've recently heard even Amazon USA offered about 25% discount too. To me, this means: the game isn't selling well in Japan and Europe, and while selling in North America, it's WAY less than anticipated. Nintendo almost never allows discounts this early; especially not 2 months into it.

From the discount numbers, we can infer that it's doing the worst in Japan; no surprises there. Apparently it's doing almost as badly in Europe; a surprise for me, but perhaps expected. The North American market is the one to watch tho: supposedly, Japanese fans accuse devs of pandering to the West. But according to the discount data? It's still doing bad enough in USA to warrant a nearly 25% discount anyway. What does this mean? I'd bet this game hasn't sold more than 500k copies worldwide.

This next part is a stretch hence the tinfoil hat part. But if we assume the game has only sold around 500k worldwide (130k in Japan, maybe 100k in Europe, 300k in North America), then that means that this game could struggle to even break 1m at all. Hence the emphasis on shipped vs sold in the Twitter. This also means that if it won't reach 1m, it's financially worse than OG FE Warriors, which reached 1m within a full year of release. Would this game be considered pure financial failure if so?

And if Hopes is then deemed a financial failure now, what does this mean re: DLC potential? Will it be outright cancelled? Will IS/KT just consider Fodlan brand as dead to them from now on? But perhaps most importantly: what lesson will they take away about WHY Nopes failed? Will they draw the correct conclusions at all? Will they understand that making fan favorites OOC is the wrong way to sell a fan service game? Will they understand that fans don't want Ladle pandering in every damn game?

Okay a few points:

First, I'll say that Nintendo is not responsible for discounting the game. Amazon (and any retailers who do discount the game) are. You will still buy the game for full price at the eShop or any retailer that has a deal with Nintendo not to discount new copies of the game. I don't know what arrangement Amazon or the sellers through Amazon have with Nintendo, but apparently they are allowed to discount.

Amazon discounts because they don't really like keeping stuff lying around. Many companies try to operate on a "just in time" system of stocking, meaning they want exactly as many copies as they're going to sell as soon as they're going to sell them, because that way they can simply get the product and immediately send it out. This greatly reduces or even eliminates the need for warehouses and storage, which are basically big money sinks that accomplish and produce nothing. If you're curious about a lot of the stock shortages in America that have been happening thanks to the pandemic and other issues, you can learn a lot about this.

Amazon does not want these games on their shelves. And, apparently, neither do a lot of sellers through Amazon. So they'll do anything they can to get them out of their warehouses ASAP (after all, the space those games sit in, not selling, is space they could be using to hold other pre-release games that people will buy). Good games that sell don't usually get discounts that steep and especially not that fast.

(Also as a side note, Nintendo very rarely discounts anything they create themselves. It's part of their philosophy. They view discounting games as punishing people who supported and purchased the game right away, at full price.)

What this tells me is not necessarily that the game is selling poorly, but that retailers anticipated much higher demand than there ended up being, and they over-stocked the game. That could honestly be for a lot of reasons, but I'm guessing it's due to people assuming Hopes would do well based on 3H's interest, without taking into account that fewer people were naturally going to be interested in a Warriors-style spinoff game. Then the poor word of mouth among the fanbase didn't exactly help.

Second, I don't know if I would go as low as 500k worldwide. If you look at Nintendo's earning reports, approximately 20% of their sales come from Japan, and about 80% comes from outside of Japan (~43% comes from the Americas, and about 25% from Europe. The remaining 10% is from "other" so I assume that's like Australia, Africa, etc.). This is for ALL of their products sold in a year, but let's just use it as a rule of thumb here and assume individual titles will also have similar distributions.

So if we assume that 130k is about 20% of Hopes's sales, that means it's sold ~650,000 copies worldwide. But I think sales have also been lower in Japan than expected, meaning the proportions could be off, so that's a lowball number.

As for if that qualifies it as a financial failure, the answer is... we have no idea. Nintendo probably did a whole break-even analysis when they were developing, so they know how much the game cost to produce and how many copies they want to sell to make their money back and profit. 650,000 copies is a flop if they were expecting to sell 2 million, but it's a great success if they were only planning on selling 200,000.

I'd err toward assuming it's selling less than they wanted it to, just based on the number of copies shipped to retailers and the aggressive marketing tactics they're using (that 1 million shipped tweet was definitely something I'm side-eyeing). But how much of a failure, if it even is one, is something we will probably never be privy to unless they share their sales targets with us.

As for DLC, I'd say it really depends. If the DLC is already done, or nearly done, then they'll likely release it anyway just to try and recoup some of the development costs. However, if they haven't started making it then there's a good chance it'll just be canned since it's not worth the risk. Same deal happened with Mass Effect Andromeda. They had plenty of DLC planned for it, but since the game got such bad press and needed so many bug fixes and other things, it was pretty much scrapped wholesale.

They could also cancel DLC if they're afraid of what it'll do to their image. Like, I'm pretty sure they released Hopes with the expectation that they would get to finish it later with a fourth route. There's definitely elements pointing to the possibility (like, the art book has an entire fourth section called "Blackened Embers" which features the concept art for most of the church characters and others like Byleth and Jeralt IIRC). But the game was obviously poorly recieved in a lot of ways, so now you either leave it in the state that pissed your consumers off, or you risk potentially pissing them off even more and damaging your brand by saying "Haha sorry about that sucky game we gave you. We'll fix it for you for the low, low price of $19.99!" (soooo you already charged me for a pile of shit, and now you want to charge me before you clean up the steaming pile of shit you dumped on my lap?)

I don't necessarily think we should deem it as a financial failure if DLC isn't announced within the next few months but like... It's also definitely not a good sign.

Also sorry this took me awhile to get to! I wanted to give a thoughtful response and I was doing stuff this Saturday

5 notes

·

View notes

Text

No one wants to talk about this, but we all should be. - Citadel Has No Clothes (original research by u/atobitt on Reddit) - If you've heard about Gamestop, you should read this to get a better idea what's really going on.

source

EDIT: This is not financial advice. Everything disclosed in the post was done by myself, with public information. I came to my own conclusions, as should you.

TL;DR - Citadel Securities has been fined 58 times for violating FINRA, REGSHO & SEC regulations. Several instances are documented as 'willful' naked shorting. In Dec 2020 they reported an increase in their short position of 127.57% YOY, and I'm calling bullsh*t on their shenanigans.

I've been digging into the financial statements of Citadel Securities between 2018 and 2020. Primarily because Citadel Securities actually has a set of published financial statements as opposed to the 13Fs filed by Citadel Advisors.

First... Citadel is a conglomerate.. they have a hand in literally every pocket of the financial world. Citadel Advisors LLC is managing $384,926,232,238 in market securities as of December 2020...

Yes, seriously- $384,926,232,238

$295,347,948,000 of that is split into options (calls & puts), while $78,979,887,238 (20.52%) is allocated to actual, physical, shares (or so they say). The rest is convertible debt securities.

The value of those options can change dramatically in a short amount of time, so Citadel invests in several "trading practices" which allow them to stay ahead of the average 'Fidelity Active Trader Pro'. Robinhood actually sells this data (option price, expiration date, ticker symbol, everything) to Citadel from it's users. Those commission fees you're not paying for? yeah.... think again.. Check out Robinhoods 606 Form to see how much Citadel paid them in Q4 2020.. F*CK Robhinhood.

Anyway, another example is Citadel's high-frequency trading. They actually profit between the national ask-bid prices and scrape pennies off millions of transactions... I'm going to show you several instances where Citadel received a 'slap on the wrist' from FINRA for doing this, but not just yet.

Now.... the "totally, 100% legit, nothing-to-see-here, independent*"* branch of Citadel Advisors is Citadel Securities- the Market Maker Making Manipulated Markets. The whole purpose of the DTCC is to serve as an third party between brokers and customers (check out this video for more on DTCC corruption). I'll bring up the DTCC again, soon.

Anyway, Citadel Advisors uses their own subsidiary (Citadel Securities) to support their very "unique" style of trading. For some reason, the SEC and FINRA have allowed this, but not without citing them for 58 'REGULATORY EVENTS'.

So that got me thinking.... "WTF is Citadel actually putting out there for the public to see?" Truthfully, not much... a 12-page annual report called a 'statement of financial condition'.

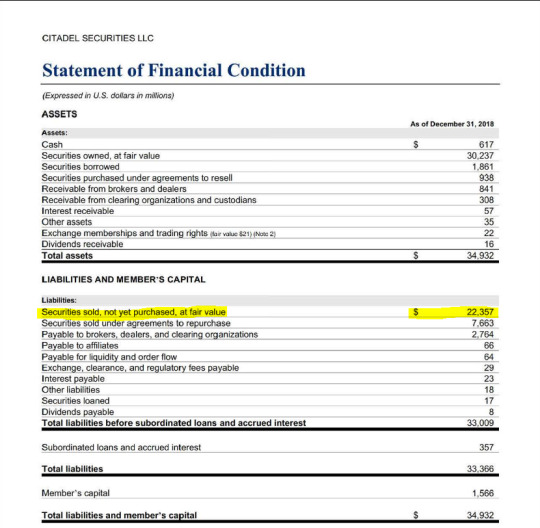

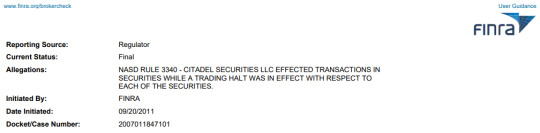

Statement of Financial Condition in 2018.

The highlighted section above represents securities sold, but not yet purchased, at fair value for $22,357,000,000. This is a liability because Citadel is responsible for paying back the securities they borrowed and sold. If you're thinking "that sounds a lot like a short", you're correct. Citadel Securities shorted $22 big ones (that's billion) in 2018.

____________________________________________________________________________________________________________

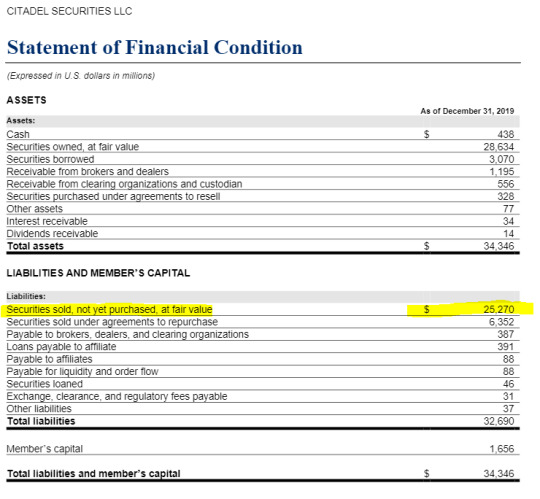

Same story for 2019- but bigger: $25,270,000,000

____________________________________________________________________________________________________________

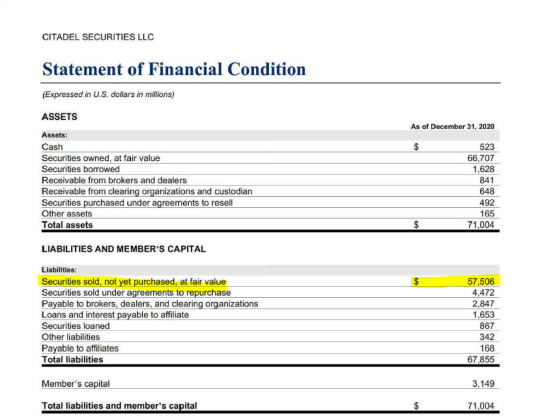

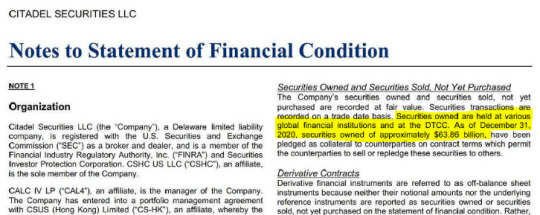

2020 starts to get REALLY interesting...

Throughout the COVID pandemic, we all heard the stories of brick-and-mortars going bankrupt. It was becoming VERY profitable to bet against the continuity of these companies, so big f*cks like Citadel decided to up their portfolio... by 127.57%.

That's right. Citadel Securities upped their short position to $57,506,000,000 in 2020.

We've all heard Jimmy Cramer's bedtime stories: "It's important to create a narrative in your favor so that your short position helps drive those businesses into bankruptcy." Personally, I'm convinced that most of the media hype throughout COVID was an example of this, but I digress.

EDIT: Credit to u/JohnnyGrey for the deeper-dive, here..

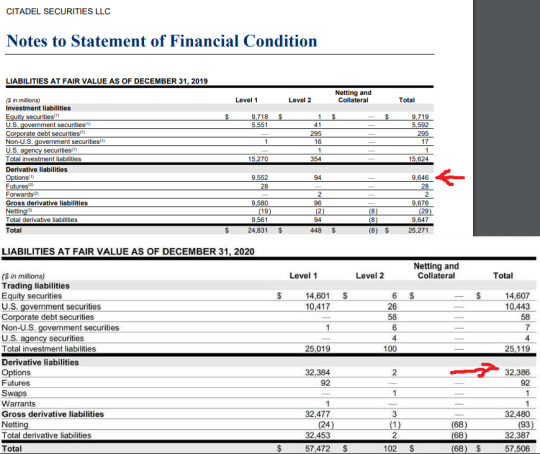

Out of the $32,236,000,000 increase in shorts during 2020, $22,740,000,000 (70.5%) were increases in financial derivatives (options)...

____________________________________________________________________________________________________________

Anyway, Citadel shorted another $32,236,000,000 in 2020 and rolled into 2021 with some PHAT $TACK$. Now it's time for a quick accounting lesson; this is where you're going to sh*ted the bed.

You see the highlighted section below? Citadel (and other companies reporting highly liquid securities) uses 'Fair Value' accounting to measure the amount that goes on their balance sheet (including liabilities like short positions). The cash that Citadel received (asset) was accounted for when the security was sold, but the liability (short) needs to be recorded at the CURRENT MARKET PRICE for those securities while they remain on the balance sheet..

At the end of 2020, the 'Fair Value' of their short positions were $57 billion.

At the end of 2021, however, Citadel will need to adjust the value of those liabilities to their CURRENT market value... Since we don't know the domestic allocation of their short portfolio, you can only imagine the sh*tsunami that's coming for them..

Take $GME for example....

We KNOW that Citadel "had" a short position in $GME along with Melvin Capital... Can you imagine the damage that r/wallstreetbets has done to the other stonks in their portfolio? If Melvin lost 53% in January from this, there's no telling what the current 'Fair Value' of those shorts are..

____________________________________________________________________________________________________________

I trust a wet fart more than Citadel, Melvin, and Point 72. Here's why.

This is a FINRA report published in early 2021. It cites 58 regulatory violations and 1 arbitration. After explaining how Ken Griffin basically controls the world through the tentacles of the Citadel octopus, it lists detailed cases and fines that were usually 'neither admitted or denied, but promptly paid' by Citadel Securities.

Let me shed some light on a FEW:

INACCURATE REPORTING OF SHORT SALE INDICATOR. FIRM ALSO FAILED TO HAVE A SUPERVISORY SYSTEM IN PLACE TO COMPLY WITH FINRA RULES REQUIRING USE OF SHORT SALE INDICATORS. DATE INITIATED 11/13/2020 - $180,000 FINE

TRADING AHEAD OF ACTIVE CUSTOMER ORDERS... IMPLEMENTED CONTROLS THAT REMOVED HUNDREDS OF THOUSANDS OF MOSTLY-LARGER CUSTOMER ORDERS FROM TRADING SYSTEM LOGICS... INTENTIONALLY CREATING DELAYS BETWEEN MARKET MAKERS' TRANSACTIONS WHILE THE UNRESPONSIVE PARTY UPDATED PRICE QUOTES.... NO SUPERVISORY SYSTEM IN PLACE TO PREVENT THIS. DATE INITIATED 7/16/2020 - $700,000 FINE

FAILED TO CLOSE OUT A FAILURE TO DELIVER POSITION; EFFECTED SHORT SALES. DATE INITIATED 2/14/2020 - $10,000 FINE

BETWEEN JUNE 12, 2013 - OCTOBER 17 2017 (YEAH, OVER 4 YEARS) THE FIRM PRINCIPALLY EXECUTED BETWEEN 248 AND 7,698 BUY ORDERS DURING A CIRCUIT BREAKER EVENT; FAILED TO ESTABLISH AND MAINTAIN SUPERVISORY PROCEDURES TO ENSURE COMPLIANCE. INITIATED 1/22/2020 - $15,000 FINE

ON OR ABOUT 11/16/2017, CITADEL SECURITIES TENDERED 34,299 SHARES IN EXCESS OF IT'S NET LONG POSITION (naked short); DATE INITIATED 8/21/2019 - $30,000 FINE

CEASE AND DESIST ORDER ON 12/10/2018: FAILURE TO SUBMIT COMPLETE AND ACCURATE DATA TO COMMISSION BLUESHEET ("EBS") REQUESTS. (BASICALLY FAILED TO PROVIDE PROOF OF TRANSACTIONS TO THE SEC). BETWEEN NOV 2012 AND AUG 2016, CITADEL SECURITIES PROVIDED 2,774 EBS STATEMENTS, ALL OF WHICH CONTAINED DEFICIENT INFORMATION RESULTING IN INCORRECT TRADE EXECUTION TIME DATA ON 80 MILLION TRADES. DATE INITIATED 12/10/2018 - $3,500,000 FINE

TENDERED SHARES FOR THE PARTIAL TENDER OFFER IN EXCESS OF ITS NET LONG POSITION (more naked shorting); FAILED TO ESTABLISH SUPERVISORY PROCEDURES TO ASSURE COMPLIANCE WITH THE RULES. INITIATED 3/22/2018 - $35,000 FINE

IN MORE THAN 200,000 INSTANCES BETWEEN JULY 2014 AND SEPTEMBER 2016, FIRM FAILED TO EXECUTE AND MAINTAIN CONTINUOUS, TWO-SIDED TRADING INTEREST WITHIN THE DESIGNATED PERCENTAGE (scraping pennies between bid-ask) ABOVE AND BELOW THE NATIONAL BEST BID OFFER.... INITIATED 10/13/2017 - $80,000 FINE

ANOTHER CEASE AND DESIST FOR MAJOR MARKET MANIPULATION BETWEEN 2007 - 2010. INITIATED 1/13/2017 - $22,668,268 FINE

___________________________________________________________________________________________________________

Quite frankly, I'm tired of typing them. There are STILL 49 violations, and most are BIG fines.

Naked shorts, failure to provide documentation to SEC, short selling on trade halts..... is this starting to sound familiar? When r/wallstreetbets started exposing the truth, they lost the advantage. Now that the DD is coming out about this sh*t, they're getting desperate.

Let's look at some recent events that occurred with trading halts in $GME. On March 10 2021 (Mar10 Day) we watched the stock rise until 12:30pm when an unbelievable drop triggered at least 4 circuit breaker events (probably more but I walked away for a bit).

Price drop of 40% in about 25 minutes

Now... I do not believe retail traders did this.. most importantly, the market was totally frozen for the majority of that 25 minutes. Even if people were putting in orders to sell, there were just as many people trying to buy the dip.

The volume of shares flooding the market- at the same exact time- was premeditated. I can say that with confidence because several media outlets (mainly MarketWatch) published articles WHILE this was happening, after nearly a week of radio-silence. MarketWatch even predicted the decline of 40% before the entire drop had occurred. When Redditors reached out to ask WTF was going on, the authors set their Twitter accounts to private... slimy. as. f*ck.

"But wait.... didn't example # 4 say that Citadel was fined $15,000 for selling shorts during circuit breaker events!?"

Yup! and here are TWO more instances:

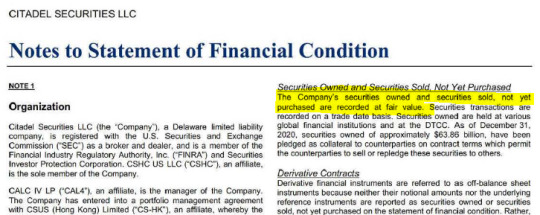

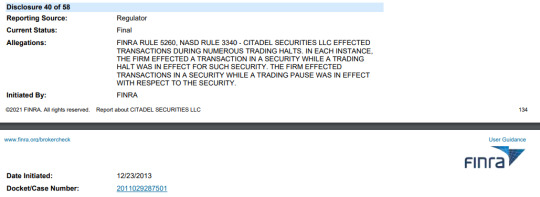

CITADEL SECURITIES LLC EFFECTED TRANSACTIONS DURING NUMEROUS TRADING HALTS..

____________________________________________________________________________________________________________

2: And another...

____________________________________________________________________________________________________________

Think Citadel is alone in all of this? Think again... It's actually been termed- "flash crash".

$12,500,000 fine for Merrill Lynch in 2016..

$7,000,000 for Goldman...

$12,000,000 for Knight Capital...

$5,000,000 for Latour Trading...

$2,440,000 for Wedbush...

PEAK-A-BOO, I SEE YOU! $4,000,000 for MORGAN STANLEY

____________________________________________________________________________________________________________

I can't tell who was responsible for the flash crash in $GME last Wednesday; I don't think anyone can. However, to suggest that it wasn't market manipulation is laughable. The media and hedge funds are tighter than your wife and her boyfriend, so spending time on this issue is a waste.

But what we can do is look at the steps they're taking to prepare for this sh*tsunami. So let's summarize everything up to this point, shall we?

Citadel has been cited for 58 separate incidents, several of which were for naked shorting and circuit breaker flash-crashes

The short shares reported on Citadel's balance sheet as of December 2020 were up 127% YOY

The price of several heavily-shorted stocks has skyrocketed since Jan 2021

Citadel uses 'Fair Value' accounting and needs to reconcile the value of their short positions to this new market price. The higher the price goes, the more expensive it becomes for them to HODL

We know that Citadel is on the hook for $57,000,000,000 in shorts, but at least they're HODLing onto some physical shares as assets, right?.... RIGHT??

This should soothe that smooth ape brain of yours...

"UHHHHHH ACTUALLY, THE DTCC & FRIENDS OWN OUR PHYSICAL SHARES".....

Well that's just terrific, because the DTCC just implemented SRCC 801 which means they DON'T have your f*cking shares... I've seriously never seen so much finger pointing and ass-covering in my LIFE....

____________________________________________________________________________________________________________

I know this post was long, but the story can't go untold.

The pressure being placed on hedge funds to deliver has never been higher and the sh*t storm of corruption is coming to a head. Unfortunately, the dirty tricks & FUD will continue until this boil ruptures. There are several catalysts coming up, but no one truly knows when the MOAB will blow.

However, desperate times call for desperate measures and we have never seen so much happening at once. For all of these reasons and more: Diamond. F*cking. Hands.

-----

once more, original credit to u/atobitt on Reddit, source here

#finance#stocks#stonks#crypto#photography#art#fashion#diy#research#science#mathematics#blm#eat the rich#late stage capitalism#capitalism#disgusting#gamestop#send help#corruption#evil

0 notes