#aadhaar linking status

Text

How to check which bank account is linked to Aadhar card?

0 notes

Text

आधार पैन लिंक स्टेटस | पैन आधार लिंक स्टेटस | पैन आधार लिंक लास्ट डेट

आधार पैन लिंक स्टेटस

पैन को आधार से लिंक करना क्यों जरूरी है?

पैन-आधार को जोड़ने से ‘डुप्लिकेट’ पैन को समाप्त करने और कर चोरी रोकने में मदद मिलेगी। IT विभाग ने कहा है कि आयकर अधिनियम 1961 के अनुसार जो पैन कार्ड होल्डर्स छूट की श्रेणी में नहीं आते हैं, उनके लिए 30 जून, 2023 से पहले अपने पैन को आधार से लिंक करवाना अनिवार्य हैं।

आधार कार्ड को पैन कार्ड से लिंक करने के लिए आयकर विभाग के ई-फाइलिंग…

View On WordPress

#aadhaar pan link site#aadhaar pan link status#adhar ko pan se kaise jode#adhar se pan ko kab tak link kar sakte hai#adhar se pan link kaise hoga#how to link aadhaar to pan#how to link pan adhar#pan aadhaar link last date#pan aadhaar link status#pan ko adhar se kaise jode#pan se adhar link kaise hoga#आधार को पैन से कैसे लिंक कैसे करें#आधार पैन लिंक साइट#आधार पैन लिंक स्टेटस#आधार से पैन लिंक कैसे होगा#पैन आधार लिंक लास्ट डेट#पैन आधार लिंक स्टेटस

0 notes

Text

अब इस तारीख तक करना होगा पैन आधार लिंक - Last date for linking of PAN-Aadhaar extended

आयकर अधिनियम के प्रावधानों के अंतर्गत प्रत्येक व्यक्ति जिसे १ जुलाई २०१७ को PAN नंबर allot किया गया है, और वह व्यक्ति अपने PAN को Aadhaar से लिंक करने के लिए बाध्य है, उसे ३१ मार्च २०२३ के पहले अपना PAN-Aadhaar linking कर लेना है. इसके लिए १०००/- रुपये की फीस भरनी है. ऐसा नहीं करने पर १ अप्रैल २०२३ के बाद उस करदाता का PAN inoperative हो जायेगा और करदाता को उसके परिणामो का सामना करना होगा. करदाताओ को होने वाली असुविधा को ध्यान में रखते हुवे PAN-Aadhaar linking की तारीख ३१ मार्च २०२३ से बढ़ा कर

#income tax#aadhaar pan linking#aadhaar pan link status#pan aadhaar link#panaadhaarlink#taxguidenilesh#nileshujjainkar#tax guide nilesh

0 notes

Text

How to Link Pan Card with Aadhar Card and Check Pan Status Free in Hindi आसान भाषा मे

How to Link Pan Card with Aadhar Card: आधार कार्ड और पैन कार्ड लिंक कैसे करें। तो आइए जानते हैं आपको अपने मोबाइल से पैन कार्ड को आधार कार्ड के साथ कैसे लिंक करना है। और अगर आपने पैन कार्ड को आधार से लिंक नहीं किया तो आपको क्या-क्या नुकसान होगा, और किसको यह पैन कार्ड आधार के साथ लिंक करना है या नहीं करना है पूरी जानकारी आपको विस्तार नहीं मिलेगी। यहां पर जिसके बाद आप फाइनली अपना पैन कार्ड यहां से…

View On WordPress

0 notes

Text

Is Your Pan Card Aadhar Card Linked?

In this blog, forcenewz shares the aadhaar card and pan card link information. If your pan card aadhar card link is not linked by march 31, 2023, it will be inactive by the income tax department and also you will pay 10,000. Here we provide a pan aadhar link status check website with steps. Check the income tax aadhaar link. Visit today!

#aadhaar card and pan card#aadhar pan link#pan aadhar link status#pan card aadhar card link#pan aadhar link status check online#income tax aadhaar link#income tax department link aadhaar and pan card

0 notes

Text

Voter ID link to Aadhar | Government of India | Aadhar Card | aadhaar card pan card link status check | breaking news | Voter ID | Aadhar Link

Government increased voter ID and deadline for linking Aadhaar, now these important works can be dealt with till this date

The central government has taken an important decision and extended the deadline to link the voter ID card to the base number

The central government has taken an important decision and extended the deadline to link the voter ID card to the base number। Now common people can…

View On WordPress

#aadhaar card pan card link status check#Aadhar Card#Aadhar Link#breaking news#Government of India#Voter ID#Voter ID link to Aadhar

0 notes

Text

PM Kisan Samman Nidhi Yojana Status Online 2023

#pm kisan samman nidhi yojana#pm kisan yojana#pm kisan#pm kisan kist#pm kisan scheme#@pmkisanyojana#pm kisan status#pm kisan aadhaar link#mykisan

0 notes

Text

How to update UAN and EPF KYC details Online

UAN stands for Universal Account Number is a 12-digit number given to each EPFO member. This number, which acts as a pivot, connects many Member Identification Numbers (Member Ids) assigned to a single member. Here are few important FAQs on UAN KYC, release by EPFO.1. What is KYC?

Know Your Customer or KYC is a one-time process which helps in identity verification of subscribers by linking UAN with KYC details. The Employees / Employers need to provide KYC details viz., Aadhaar, PAN, Bank etc., for unique identification of the employees enabling seamless online services.2. How can I seed my KYC details with UAN?

o Login to your EPF account at the unified member portal

o Click on the “KYC” option in the “Manage” section o You can select the details (PAN, Bank Account, Aadhar etc) which you want to link with UAN

o Fill in the requisite fields o Now click on the “Save” option

o Your request will be displayed in “KYC Pending for Approval”

o Once employer approves the details the message will be changed to “Digitally approved by the employer”

o Once UIDAI confirms your details, “Verified by UIDAI” is displayed against your Aadhaar.

3. What to do if my employer is not approving KYC?

In case your employer is not approving KYC details, you can directly approach administration or HR department with request. If it is taking more time you can escalate it to higher authority in the organization. If no one is responding to your request you can approach EPF Grievance via http://epfigms.gov.in.

4. How do I know that KYC updated by me is approved by the employer?

The status will be shown against updated KYC document on the same page. The system will also trigger SMS on your register mobile number.5. How can I seed my Bank account details?

o Login to your EPF account at the unified member portal o Enter your bank account number and IFSC code. o The details have to be approved by your employer. o Once approved the bank account gets seeded.6. What can I do if my UAN is not seeded with Aadhaar? Member can himself seed UAN with Aadhaar by visiting member portal. Thereafter the employer must approve the same to complete the linkage. Alternatively, member can ask his employer to link Aadhaar with UAN. The member can use “e-KYC Portal” under Online Service available on home page of EPFO website or e-KYC service under EPFO in UMANG APP to link his/her UAN with Aadhaar without employer’s intervention.7. Can I change my already seeded Bank account number?

Yes. The bank account number can be updated any number of times by following the steps mentioned above. However, the bank account details cannot be changed during pendency of any claim with EPFO.

8. What precautions should I take while seeding Bank account number?

You should seed active bank account to which you are either an individual or joint holder with your spouse. Also ensure that the bank account does not have a deposit cap greater than your withdrawal benefit.

9. I have changed my job. Should I activate my UAN again?

UAN has to be activated only once. You do not have to re-activate it every time you switch jobs.

10. Do I have to pay any fee for UAN registration?

No, UAN registration is free of cost and you do not have to pay any fee to activate it.

Source link

Read the full article

2 notes

·

View notes

Text

How PAN Verification Status Impacts Your Financial Life

In today’s digitally driven world, Permanent Account Number (PAN) has become an integral part of financial transactions in India. Whether you are an individual taxpayer, a corporation, or a non-resident, the importance of a PAN cannot be overstated. However, it is equally important to ensure that he has a recognized status beyond merely holding a PAN. In this comprehensive article, we will explore how PAN verification status affects your financial life and why staying updated on this front can save you from potential pitfalls.

What Is a Drink?

Permanent Account Number (PAN) is a unique identification number as issued by the Indian Taxation Department. It is an important tool in pursuing financial transactions, ensuring that all taxable activities are properly monitored. PAN is not just a tax return; It is required for various financial activities, such as opening bank accounts, buying property and investing in stocks.

Importance of PAN Verification

PAN verification is the process of verifying the details associated with your PAN. This post ensures that the PAN details are correct, up-to-date and in line with the records held by the Income Tax Department. The importance of PAN verification extends beyond mere compliance; It plays an important role in maintaining your financial connections.

How Does PAN Verification Affect Tax Filing

One of the most important ways in which PAN verification status affects your financial life is through tax filing. An incorrect or unacknowledged PAN can cause problems with your tax returns, including delays, denials and even penalties. The Income Tax Department cross verifies the PAN details with additional financial details submitted at the time of filing tax returns. If there is a discrepancy, it can raise red flags and result in an undesirable test or audit.

Role of PAN in Financial Transactions

Every financial transaction you make, from deposits to investments, is linked to your PAN. Banks, financial institutions and government agencies require PAN details to process transactions beyond a certain threshold. If your PAN is not verified, you may face hurdles in completing these transactions, resulting in potential financial hardship and loss.

Impact On Loan Applications

When you apply for a loan, be it a home loan, a personal loan, or a business loan, the lending agency conducts a thorough background check, which includes verifying your PAN unauthenticated or incorrect PAN can have your loan application denied, even if your credit score is strong. Lenders use PAN verification to check your financial credibility and ensure that you are not involved in any fraudulent activities.

Result of PAN Mismatch

PAN mismatch occurs when the information in your PAN does not match the information in other financial documents, like your Aadhaar card, bank account, or tax returns This mismatch can cause problems, e.g delays in refund processing, difficulty in accessing government grants, your PAN and information related to bank account or other financial transactions

Verification of PAN and Financial Fraud

Financial fraud is a growing concern in the age of digitalisation. Fraudsters often use fake or stolen PANs to commit fraud, causing huge losses to individuals and businesses. By regularly checking your PAN, you can protect yourself from falling prey to such scams. Analysis ensures that your PAN is only linked to your legitimate financial activities and helps authorities detect and prevent fraudulent transactions.

How to Check your PAN Verification Status

Checking your PAN verification status is a simple process. Income Tax Department of India provides an online portal where you can verify your PAN by entering your PAN number and other required details. Once you have submitted the details, the system will display the status, indicating that your PAN is valid or properly authenticated. These simple steps can save you from potential financial issues down the road.

Compliance with PAN and KYC Norms

The Know the Consumer (KYC) standard is mandatory for various financial transactions, including opening a bank account, investing in mutual funds, or buying insurance Your PAN verification status is an important part of the KYC process in. If your PAN is not verified, your KYC will be considered incomplete, resulting in restrictions on your financial activities or even freezing of your account.

Steps to Correct PAN Error

If you find that your PAN details are incorrect or not verified, it is important to take immediate action. The Income Tax Department provides a correction form (Form 49A) which can be submitted online to rectify any mistake. This process usually involves submitting supporting documentation to verify your identity and resolve discrepancies. Ensuring that your PAN details are correct can prevent possible bankruptcy.

Conclusion

PAN verification status plays an important role in shaping your financial life. From filing taxes to loan applications, preventing fraud to complying with KYC norms, the implications of unauthenticated or incorrect PAN go far By checking your PAN regularly and updating your PAN on the other side of the certification status, you can ensure smooth financial transactions and protect yourself against potential risks. In today’s tough economic climate, you don’t just have to be proactive about PAN verification; it’s an important step towards securing your financial future.

0 notes

Text

The Benefits of Using the EPFO Mobile App

SLNConsultancy #SLNPFConsultancy #SLNESIConsultancy #SLNPFESIConsultancy #PFConsultancyHyderabad #PFConsultancyNearMe

The Employees' Provident Fund Organisation (EPFO) of India has consistently aimed to make its services more accessible and user-friendly. One of the most significant steps in this direction is the development of the EPFO mobile app. This app has become a valuable tool for millions of employees across the country, offering a range of benefits that make managing provident fund (PF) accounts more convenient and efficient. Here’s a closer look at the advantages of using the EPFO mobile app:

Easy Access to Provident Fund Information

The EPFO mobile app provides employees with instant access to their provident fund details. Users can quickly check their PF balance, track contributions, and view their passbook at any time. This eliminates the need to visit EPFO offices or depend on employer-provided information, empowering employees with direct control over their PF accounts.

User-Friendly Interface

The app has been designed with a user-friendly interface, ensuring that employees, even those with limited tech-savviness, can easily navigate through its features. The simple and intuitive design allows users to access services with just a few taps on their smartphones.

Timely Notifications and Updates

Staying informed about your PF account is crucial. The EPFO mobile app provides timely notifications about contributions, withdrawals, and other significant activities. This helps employees stay updated and aware of any changes or issues related to their accounts, promoting transparency and trust.

Hassle-Free UAN Activation

The app allows users to activate their Universal Account Number (UAN) directly from their mobile devices. UAN is a unique number assigned to every employee contributing to the EPF, which remains constant throughout their career. The ease of activating UAN through the app ensures that employees can quickly link all their PF accounts under one umbrella, simplifying account management.

Online Claims and Withdrawals

One of the most convenient features of the EPFO mobile app is the ability to file claims and withdrawals online. Employees can apply for partial or full withdrawal of their PF savings without visiting an EPFO office. The app facilitates a seamless process, reducing paperwork and saving valuable time.

Grievance Redressal

The EPFO app also includes a grievance redressal feature, allowing employees to raise complaints or concerns directly through the app. This feature ensures that employees can quickly report any issues and receive prompt assistance, improving overall satisfaction with EPFO services.

Security and Data Privacy

With the increasing importance of data security, the EPFO mobile app incorporates robust security features to protect user information. The app requires secure logins and offers features like two-factor authentication, ensuring that sensitive PF account data remains safe and secure.

Seamless Integration with Other Government Services

The EPFO app is integrated with other government services, such as linking with Aadhaar and PAN, making it easier for employees to manage their KYC details. This integration ensures that employees' PF accounts are compliant with regulatory requirements, reducing the risk of discrepancies.

Accessibility for Pensioners

In addition to active employees, the EPFO app also benefits pensioners. Pensioners can check their pension status, download pension payment orders, and access other pension-related services through the app. This ensures that even retired employees have easy access to their pension information, enhancing their post-retirement experience.

Environmentally Friendly

By facilitating online services, the EPFO mobile app contributes to a reduction in paper usage, promoting an environmentally friendly approach to managing provident funds. This aligns with global sustainability efforts and reduces the carbon footprint associated with traditional, paper-based processes.

Conclusion

The EPFO mobile app is a powerful tool that brings convenience, transparency, and efficiency to provident fund management. By offering easy access to information, online claims, and robust security features, the app empowers employees to take control of their financial future with ease. Whether you're an active employee or a pensioner, the EPFO mobile app is an essential resource for managing your provident fund account efficiently.

0 notes

Text

Kalia Yojana Scheme 2024: How to apply, Eligibility, Documents

On Monday, March 11, Odisha Chief Minister Naveen Patnaik unveiled the latest phase of the Kalia Yojana, reflecting the government’s commitment to the welfare of farmers in the state. With an infusion of approximately Rs 1,293 crore, the program has fortified the financial resilience of 46 lakh farmers across the region. Moreover, to ensure sustained assistance, the Chief Minister inaugurated 30 Kalia Centres, strategically positioned in every district, and extended the Kalia Scheme for an additional three years. If you’re a farmer in Odisha seeking clarity on the Kalia Yojana Next Installment Date, you’re in the right place.

Overview of Kalia Yojana

The Kalia Yojana, introduced by Chief Minister Naveen Patnaik in May 2022, stands as a beacon of hope for small farmers, landless cultivators, and agricultural laborers in Odisha. This comprehensive initiative aims to bolster the livelihoods of those engaged in agriculture by providing financial aid, insurance coverage, and other forms of support. To date, over 40 lakh small farmers have reaped the benefits of this visionary program, underscoring its pivotal role in rural empowerment.

Anticipating the Next Installment

Mark your calendars for June 1, 2024, as the projected date for the forthcoming installment under the Kalia Yojana. As announced on March 11, 2024, through a seamless Direct Bank Transfer (DBT) mechanism, Rs. 933 crore was disbursed to beneficiaries, reaffirming the government’s unwavering commitment to timely assistance. To ensure a smooth transaction, beneficiaries must link their Aadhaar details with their respective bank accounts, as mandated by the official guidelines.

Kalia Yojana Eligibility Criteria

For those eager to avail themselves of the Kalia Yojana’s Next Installment, certain eligibility criteria must be met:

Small and marginal farmers actively engaged in cultivation are eligible for program support.

Landless agricultural laborers are entitled to assistance to sustain their livelihoods.

Vulnerable agricultural laborers devoid of land, including the elderly and infirm, are eligible for financial aid under the scheme.

Required Documents

To streamline the disbursement process and expedite assistance, beneficiaries are required to furnish the following documents:

Bank Account Number

Aadhaar Card Number

Mobile Number

Block/District and Panchayat Details

Verifying Beneficiary Status Online

For the convenience of beneficiaries, an online portal has been established to facilitate the verification process.

Navigate to the official Kalia Yojana website at https://kaliaportal.odisha.gov.in/.

Access the ‘Beneficiary Status’ tab from the main menu.

Enter the relevant information for District, Block/ULB, and G.P.

Select ‘View’ to retrieve the information about your status.

Checking Payment Details

For those curious about the status of their payments, the following steps will guide you:

Visit the official Odisha Kalia Yojana website.

Access the beneficiary list and status of Kalia’s money transfers.

Provide the requisite information for the Installment Date and Amount Status.

Your payment details will be displayed promptly.

In conclusion, the Kalia Yojana stands as a testament to the government’s steadfast commitment to the welfare of farmers and agricultural laborers in Odisha. By adhering to the stipulated guidelines and leveraging the digital infrastructure, beneficiaries can navigate the process seamlessly and access the financial support they rightfully deserve.

0 notes

Text

youtube

#aadhaar pan link status#pan aadhaar link#aadhaarpanlinking#aadhaar pan linking#nilesh ujjainkar#taxguidenilesh#income tax#tax guide nilesh#income tax return#Youtube

0 notes

Text

How Instantpay Aadhaar Verification API Works: A Comprehensive Guide

Aadhaar verification has become a cornerstone of identity verification processes in India and is integral to numerous administrative and financial transactions. With over a billion people enrolled, the Aadhaar system is the world's most extensive biometric ID system.

This guide provides a detailed understanding of Aadhaar verification, its benefits, and the verification process, focusing on how the system works.

What is Aadhaar?

Aadhaar is a 12-digit unique identification number issued by the Unique Identification Authority of India (UIDAI).

Introduced in 2009, Aadhaar is designed to provide a single, robust, and easily verifiable identity document for residents of India.

Need for Aadhaar Verification

Aadhaar verification, also known as Aadhaar authentication, involves validating an individual’s identity using their Aadhaar number.

This process is crucial for ensuring that services, subsidies, and benefits reach the correct recipients, thereby reducing fraud and enhancing security across various sectors such as banking, telecom, and government services.

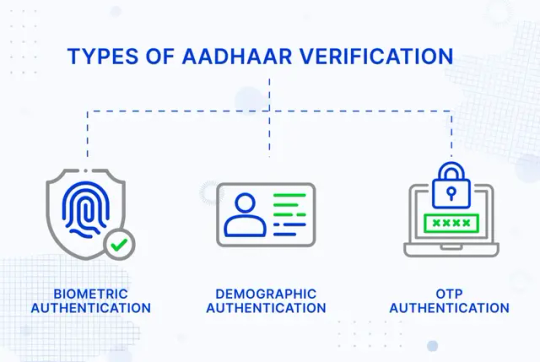

Types of Aadhaar Verification

1. Biometric Authentication

To verify identity, biometric authentication uses an individual’s unique physical characteristics, such as fingerprints, iris scans, or facial recognition.

This method is highly secure as these biometric traits are unique to each individual and difficult to replicate.

Process:

The individual provides their Aadhaar number.

Biometric data (fingerprints, iris scans, or facial images) is captured using a biometric device.

The captured data is sent to UIDAI for verification against the stored biometric data.

UIDAI responds with a "Yes" or "No" indicating whether the biometrics match the Aadhaar number provided.

2. Demographic Authentication

Demographic authentication verifies an individual's identity using basic demographic information such as name, address, date of birth, and gender.

This method is often used in conjunction with biometric authentication to enhance security.

Process:

The individual provides their Aadhaar number along with demographic information.

This information is sent to UIDAI to be verified against the data stored in the UIDAI database.

UIDAI responds with a "Yes" or "No" indicating whether the demographic details match the Aadhaar number provided.

3. OTP Authentication

One-Time Password (OTP) authentication involves sending a unique code to the individual’s mobile number registered with Aadhaar.

This method adds an extra layer of security to the verification process.

Process:

The individual provides their Aadhaar number.

An OTP is sent to their registered mobile number.

The individual enters the OTP to complete the verification process.

UIDAI verifies the OTP and responds with a "Yes" or "No".

Learn More:

Everything You Need To Know About Aadhaar Verification

The Role of Aadhaar-PAN Linkage in Securing Identity & Compliance Across Industries

Identity Verification - How to Check PAN Aadhaar Linking Status with API

Aadhaar Verification Using API

What is an API?

An Application Programming Interface (API) is a set of protocols and tools that enable different software applications to communicate and interact with each other. APIs allow systems to share data and functionalities seamlessly, facilitating integration and automation.

In the context of Aadhaar verification, APIs serve as a bridge between an organization's application and the UIDAI's Aadhaar database. This connection allows real-time verification of an individual's identity by cross-referencing the provided Aadhaar number and associated data with the UIDAI's records.

How are APIs used?

APIs can be used in numerous ways to enhance various processes across different industries. For instance, an API can retrieve essential information from a database, such as names and addresses, based on specific input criteria.

On the other hand, more advanced APIs can provide comprehensive details, including biometrics or transaction histories, using multi-factor authentication methods like OTPs.

These APIs ensure secure, quick, and reliable data exchange, making them invaluable tools for banking, telecommunications, healthcare, and e-commerce sectors. By integrating APIs, organisations can streamline operations, improve user experience, and maintain high security and efficiency standards.

Critical Key Terms in APIs

1. Request

The request is the message sent by the client to the server to perform an action (like retrieving or sending data)

2. Response

The response is the message sent back from the server to the client, indicating the result of the request.

3. API Endpoint

A specific URL where the API can access a resource or perform an action.

Example: Aadhaar Verification API

4. API HTTP Methods

Defines the type of operation the client wants to perform:

GET: Retrieve data.

POST: Create new data.

PUT: Update existing data.

DELETE: Remove data.

5. Header

Part of the request and response carries additional information such as content type, authentication tokens, and other metadata.

6. Parameters

Data is sent with the request to specify details or modify the request.

7. Authentication

Methods to verify the client's identity, make the request, and ensure they have the correct permissions. Standard methods include API keys, tokens, and Auth.

What is a REST API or RESTful?

A REST API (Representational State Transfer API) is a web service architecture that uses standard HTTP methods (GET, POST, PUT, DELETE) to interact with URL-identified resources.

REST APIs are stateless, meaning each request contains all the information needed for processing. They are known for their simplicity, scalability, and flexibility in handling various data types.

What is API Testing and How Do We Test It?

API testing ensures APIs meet functionality, reliability, performance, and security expectations. Key methods include:

1. Unit Testing: Testing individual endpoints.

2. Integration Testing: Ensuring multiple API calls work together.

3. Performance Testing: Checking response times and load handling.

4. Security Testing: Protecting against unauthorised access.

What is an API Key and Why is it Important?

An API key is a unique identifier used to authenticate a client requesting an API. It ensures only authorised users can access resources, helps track usage, manage quotas, and prevent abuse.

What is Web API and Why is it Beneficial?

A Web API is an API accessed via the web using HTTP protocols. It allows different applications to communicate and exchange data over the internet. Benefits include:

1. Integration: Seamlessly connects systems and applications.

2. Accessibility: Accessible from any internet-connected device.

3. Scalability: Handles increasing loads and user demands.

4. Reusability: Leverages existing functionalities without rebuilding.

What is API Integration?

API integration connects different applications and systems via APIs, enabling them to share data and work together. It automates processes, improves data accuracy, and enhances functionality, creating efficient and scalable digital ecosystems.

Aadhaar Verification APIs on Instantpay

Instantpay offers seamless integration of Aadhaar verification through its APIs, making the verification process efficient and secure for businesses.

1. Aadhaar Demographics API

The Aadhaar Demographics API provides basic demographic information using only the Aadhaar number as input. This API is useful for simple identity verification where detailed information is not required.

Technical Workflow:

Request: The client system sends an HTTP request to the Aadhaar Demographics API endpoint with the Aadhaar number.

Processing: UIDAI processes the request and retrieves demographic details.

Response: The API returns a JSON response containing the demographic information (e.g., name, address, date of birth, gender).

2. Aadhaar offline e-KYC API

The Aadhaar offline e-KYC API provides comprehensive details but requires both the Aadhaar number and an OTP sent to the Aadhaar-linked mobile number. This ensures thorough verification for services needing extensive identity details.

Technical Workflow:

Request: The client system sends an HTTP request to the Aadhaar OKYC API endpoint with the Aadhaar number.

OTP Generation: UIDAI sends an OTP to the registered mobile number.

OTP Verification: The client system captures the OTP and sends it back to the API.

Processing: UIDAI processes the request, fetching both demographic and biometric details.

Response: The API returns a detailed JSON response containing all relevant information (e.g., name, address, date of birth, gender, photograph).

Step-by-Step Guide to Aadhaar Verification on the Instantpay Dashboard

Step 1: Log in to the Instantpay Dashboard and Navigate to Verification Suite.

(If this isn't visible, please get in touch with [email protected] to enable it.)

Step 2: Click on the Verify Data Tab

Step 3: Choose Aadhaar Demographic API

Step 4: Download and fill template for Bulk Verification

Or If you want to try out the API click the button below

Step 5: Enter the Aadhaar Number you want to Verify

Step 6: Enter your iPin for authentication

Step 7: Congratulations, you have successfully retrieved the Aadhaar Demographic Data

Step 8: You can view and download the bulk verification files by clicking on the “Download” Button

Who Can Use Aadhaar Verification APIs?

Aadhaar Verification APIs can be utilised by a various organisations and sectors to streamline their identity verification processes. These APIs provide a reliable and secure way to verify the identities of individuals, ensuring that only genuine people can access services and benefits.

Here are five examples of entities that can benefit from using Aadhaar Verification APIs:

1. Banks and Financial Institutions

Banks and financial institutions can use Aadhaar Verification APIs to verify customers' identities during account opening, loan applications, and other financial transactions. This ensures compliance with KYC (Know Your Customer) regulations and helps prevent identity fraud.

Example

A bank uses the Aadhaar Offline EKYC API to verify the identity of a new customer applying for a savings account. The customer provides their Aadhaar number and OTP, allowing the bank to quickly and securely verify their details and open the account.

2. Telecom Companies

Telecom companies can utilise Aadhaar Verification APIs to authenticate customers when new SIM cards or mobile connections are issued.This process helps prevent fraudulent activities and ensures that mobile connections are issued to legitimate users.

Example:

A telecom company uses the Aadhaar Demographics API to verify a customer's identity when they apply for a new SIM card. By entering their Aadhaar number, the company can instantly retrieve and verify the customer's demographic information.

3. Government Agencies

Government agencies can use Aadhaar Verification APIs to authenticate beneficiaries of various schemes and services. This ensures that subsidies and benefits are disbursed to the right individuals, reducing the risk of fraud and providing efficient service delivery.

Example

A government welfare department uses the Aadhaar Verification API to verify the identity of individuals applying for a social welfare scheme. This helps ensure that only eligible beneficiaries receive the benefits.

4. E-commerce Platforms

E-commerce platforms can leverage Aadhaar Verification APIs to verify the identities of sellers and buyers, enhancing trust and security in online transactions. This helps prevent fraudulent activities and builds trust among users.

Example

An e-commerce platform uses the Aadhaar Demographics API to verify the identity of a new seller registering. This ensures that only legitimate sellers can list their products, improving the platform's credibility.

5. Educational Institutions

Educational institutions can use Aadhaar Verification APIs to verify students' identities during admissions and examinations. This helps maintain the integrity of the admission process and ensures that only eligible students are enrolled and assessed.

Example

A university uses the Aadhaar offline - KYC API to verify the identity of applicants during the admission process. Using the Aadhaar number and OTP, the university can authenticate the students' details and ensure that only genuine applicants are admitted.

These examples illustrate the versatility and utility of Aadhaar Verification APIs by Instantpay across various sectors. By integrating these APIs, organisations can enhance security, improve efficiency, and ensure that services and benefits are delivered to the right individuals.

Conclusion

By focusing on how Aadhaar verification works and its implementation through APIs, this guide aims to provide a comprehensive understanding of the process and its significance in various sectors.

For detailed API documentation, visit Instantpay Developer Portal, and for further assistance, contact support at [email protected].

0 notes

Text

Is Your TDS Refund Still Pending?

By Wishtree Consultants Pvt Ltd

Name: Wishtree Consultants Pvt Ltd

Why Is Your TDS Refund Still Pending?

Claiming a TDS (Tax Deducted at Source) refund should be straightforward, but sometimes delays happen. Here are some common reasons why your TDS refund might still be pending:

1. Incomplete or Incorrect Information: Ensure all the details in your income tax return, such as PAN, bank account number, and TDS amount, are accurate and complete.

2. Non-Verification of Return: After filing your return, it’s essential to verify it. Unverified returns are not processed for refunds. You can verify it through Aadhaar OTP, EVC (Electronic Verification Code), or by sending a signed ITR-V to CPC Bangalore.

3. Mismatched TDS Details: The TDS details in your return must match those in Form 26AS. Any discrepancy can lead to delays. Regularly check Form 26AS to ensure all TDS credits are reflected correctly.

4. Processing Delays at CPC: The Centralized Processing Center (CPC) may experience delays during peak filing seasons. Patience is key, and you can track your refund status online through the Income Tax e-filing portal.

5. Outstanding Tax Demand: Any previous tax dues or demands can cause your refund to be adjusted against them. Check for any outstanding demands and resolve them promptly.

How Wishtree Consultants Can Help

Navigating the complexities of TDS refunds can be daunting. At Wishtree Consultants, we offer expert guidance and support to ensure a smooth and hassle-free refund process. Our team is committed to providing personalized solutions to help you resolve any issues and expedite your TDS refund.

Connect With Us

For more information or assistance, feel free to reach out to us through any of the following channels:

- Instagram: https://www.instagram.com/wishtreeconsultants

- Website: https://wishtreeconsultancy.com

- Address: Anna Nagar, Chennai

- Phone: 81244 22221

- Map Link: https://maps.app.goo.gl/brEMyKRjbQeSSBJ2A

- LinkedIn: https://www.linkedin.com/company/wish-tree-consultants-private-limited

About Us

At Wishtree Consultants, we are seasoned professionals dedicated to elevating your business to the next level. We are your one-stop solution for all your tax, audit, finance, and statutory compliance needs. Our comprehensive services include:

- Income Tax filing

- GST registration & filing

- TDS filing

- Company incorporation

- Digital signature

- All other Audit services

Our Services

Our expert team offers a wide range of services designed to meet your financial and business needs:

- Income Tax Return Filing

- Financial Planning

- Tax Advisory

- Business Consultancy

- GST Filing

- Corporate Tax Services

0 notes

Text

Pan Aadhaar Linked Or Not Check Status With An SMS: Now link your PAN Aadhaar with just SMS and know PAN Aadhaar link status through SMS

Pan Aadhaar Linked Or Not Check Status With An SMS: are you also just one SMS with the help of PAN card And Aadhar card Of Link of being States If you want to check then this article of ours is only and only for you in which we will tell you in detail Pan Aadhaar Linked Or Not Check Status With An SMS We will tell you about it, whose complete detailed information we will provide you in this…

View On WordPress

0 notes