#a lot of reporting has called this 'proto-Monty Python'

Explore tagged Tumblr posts

Text

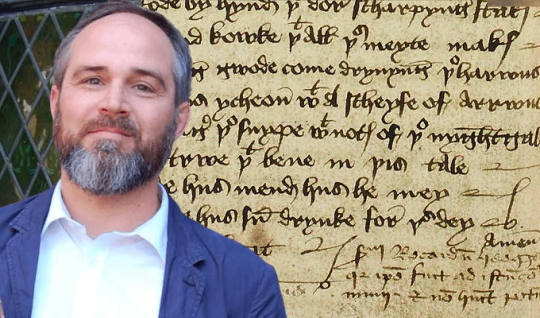

Fictional minstrels are common in medieval literature but references to real-life performers are rare and fleeting. We have first names, payments, instruments played and occasionally locations, but until now virtually no evidence of their lives or work....

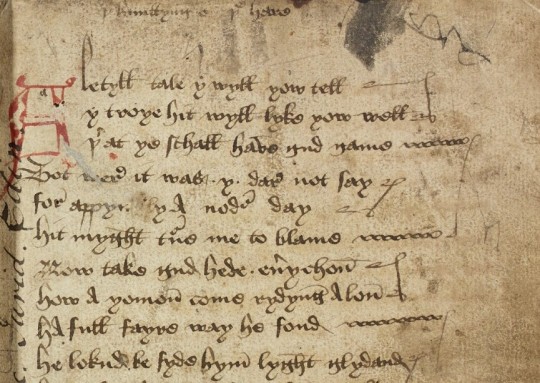

[Dr James] Wade’s study, published in The Review of English Studies, focuses on the first of nine miscellaneous booklets in the Heege Manuscript. It contains three texts and Wade concludes that around the year 1480 Heege copied them from now-lost notes written by an unknown minstrel performing near the Derbyshire-Nottinghamshire border.....

A little tale I will you tell

I trow it will like you well

Thereat ye shall have good game

But where it was I dare not say,

For haply another day,

It might turn me to blame...

All three texts are humorous and designed for live performance – the narrator tells his audience to pay attention and pass him a drink. The texts all feature in-jokes to appeal to local audiences and show a playful awareness of the kind of audiences that we know minstrels performed to.....

Richard Heege was a household cleric and tutor to the Sherbrooke family, part of the Derbyshire gentry, to whom his booklets first belonged. Wade said: ‘"Heege gives us the rarest glimpse of a medieval world rich in oral storytelling and popular entertainments.

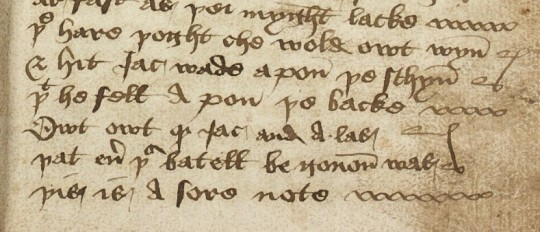

The hare thought she would out win,

& hit Jack Wade upon the chin,

That he fell upon the back.

‘Owt, owt!’, quoth Jack, and ‘Alas,

That ever this battle begun was!

This is a sorry note!’

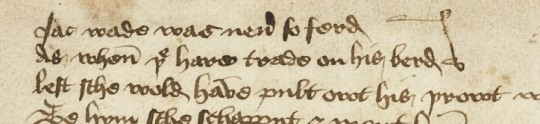

Jack Wade was never so afeared

As when the hare trod on his beard,

Lest she would have pulled out his throat...

-- "The Hunting of the Hare"

#a lot of reporting has called this 'proto-Monty Python'#like the Pythons weren't Oxbridge men themselves amd put hella references in that thing#manuscript#15th century

56 notes

·

View notes

Text

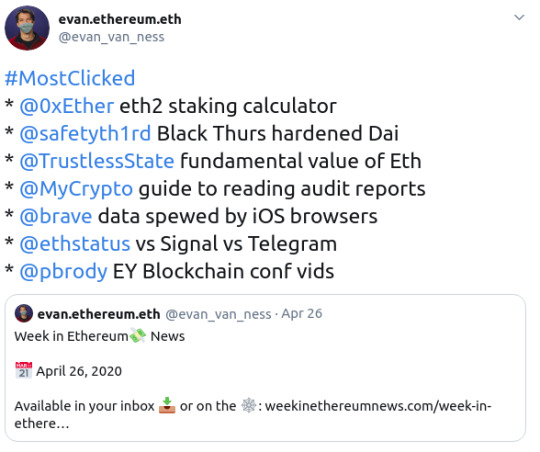

Annotated edition of April 26 Week in Ethereum News

Here’s the most clicked for the latest Week in Eth News:

As I always say, the most clicked is determined by what people hadn’t already seen during the week.

My thought is that the annotated edition tries to give people a more high-level overview. If I were only reading a few high-level things this week, I would read

How state channels fits into layer2 post-rollups: immediate finality, no third party necessary, and arbitrary execution.

a MyCrypto guide to reading audit reports. Early adopters beware – you should definitely read audit reports!

Constant function market makers as a zero-to-one DeFi innovation

The fundamental value proposition of ETH

In reverse order, the fundamental value proposition of ETH, because it’s good to have a pithy post to send friends when you’re trying to get them to make their first ETH purchase, often after you’ve sent them some ETH and/or stablecoins to play around with. Of course, we used to have more “visions of web3″ posts, but those are now mostly a few years old.

In the long run, Ethereum’s vision of web3 needs applications built on it - and that comes with a native value transfer layer that is international and censorship-resistant. We do still lack a data layer to serve websites trustlessly though.

One thing those old “this is a vision for web3″ posts don’t usually contain is things like the constant function market makers as a zero-to-one DeFi innovation post. Being able to always source liquidity all over the world from a market even at 11pm at night is neat - and the sort of thing that will be needed for web3. If there’s a native value transfer layer, then all the sudden there is a very long-tail of assets. Things you earn in video games, etc etc.

We need to have a culture of educated users in the early days of web3, and the MyCrypto guide to reading audit reports is something non-devs should peruse. It’s a tough balance between encouraging people to use things - we need to have both a culture of “we use early web3 apps” but also “be educated and informed.” For me, I use lots of web3 apps, but how much I use them definitely depends on what the audit report says. If you imagine how a consultant writes a report to someone paying them, then have a good heuristic to skim. In general, if you don’t see things like “we found the code quality to be very high” then you should be cautious. You should also understand that time does harden these systems to some degree - the Hegic bug got found out within a few days - I think literally on the first day of going live.

Finally, a layer 2 post: how state channels fits into layer2 post-rollups: immediate finality, no third party necessary, and arbitrary execution. It can be hard to suss what is real and what is hype in layer2 - to date, almost all layer2 stuff has ended up being hype. Lightning has been around for years in Bitcoin-land yet has very little adoption and has serious privacy issues (new paper out this week). While we’ve seen simple uses for state channels in production (eg, AdEx’s how we built the largest payment channel network on Eth), we haven’t seen widespread adoption of channel networks nor meaningful uses of Plasma. Rollups are the new hype (and starting to be live, eg Loopring can do 10x throughput), but state channels aren’t dead yet - to use my best Monty Python voice - and should still be the right scaling tool for plenty of apps.

Eth1

Nethermind v1.8.18 beta enables beam sync by default. Stay on v1.7.x for stable releases

A very rough transcript from the latest Stateless Ethereum call. You’ll need to have context for this to make sense.

An EIP1559 implementer call (predictable transaction fees for users plus ETH burn) on April 30

Bit slow week on this front, though there was some stateless Eth work that moved forward - just no writeups yet.

Eth2

Latest Lighthouse client update, next public testnet likely this week, working on testnet interop

Latest Prysmatic client update, Topaz testnet launch, working with Sigma Prime on Lighthouse interop

Latest Eth2 implementer call, with notes from Ben and Mamy

There was also a call on API standardization. No video, but notes from Mamy and Proto

Lightweight clock sync protocol

An online eth2 staking calculator, based on the ConsenSys Codefi spreadsheet

A multi-client testnet launched since publication! It was a low hype event, and if you read the client updates, there’s some low-hanging fruit that will be caught early.

A note on the eth2 chain launch: when it goes into production, it won’t really be doing anything in production. As such, we should try to launch it as soon as possible and be understanding if there are bugs and we can fix/fork them if need be. We really only need a couple production-ready clients (the rest can join later) and we don’t need this multi-client testnet to run for months and months.

This is the way Ethereum launched in 2015. We turned it on, but you literally couldn’t do anything but mine. There were bugs and emergency fixes. It’s also the way the Eth2 upgrade will launch. We’ll turn it on, but you can’t do anything but stake. Then gradually it will start doing more things, and eventually the Ethereum state will be subsumed into the eth2 chain. Let’s launch early but with low expectations for what it does in the short-run.

We’re starting to see more “omg, what do i do when eth2 launches” questions on Reddit. Every rose has its thorns.

Layer2

AZTEC releases code for their zk-zk rollup, implements recursion for SNARKs over a single curve

A spec for account-based anonymous rollup

How state channels fits into layer2 post-rollups: immediate finality, no third party necessary, and arbitrary execution.

Private, scalable payments from Aztec using the magic of SNARKs. The next thing they’ll implement is some of the recent breakthroughs (plookup) to get the computation time down so that these things are cheaper and more scalable.

A completely under-hyped thing in Ethereum is AZTEC’s roadmap which includes “Code privacy — hiding asset/code being spent/run.” web3 business models all change when you can obfuscate your code. I have no idea when this is coming - but you can kinda make something out if you look out on the horizon.

Stuff for developers

Truffle v5.1.23 – Solidity stacktraces for debugging

web3js v1.2.7 – new Websocket provider with auto-reconnect, lots of bugfixes

OpenZeppelin Contracts v3, migrated to Solidity v0.6

How to use accesscontrol.sol in OpenZeppelin

Two posts on inheritance in Solidity from Sheraz Arshad and Igor Yalovoy

Source liquidity with the 0x API

Coinbase price oracle: signed price feed available via API

Quick start to building a governance interface for Compound

Zerion SDK – on-chain decoder of complex ERC20 tokens and an onchain registry of protocol metadata

Real time front end data with Embark’s Subspace library and Infura

Using TrailofBits’ Echidna fuzzer to find transactions with high gas consumption

For Pythonistas, a 3 part series to getting started in Brownie

Getting revert reasons in an NPM package

any.sender transaction relayer is on mainnet, with a CyberDice competition ending Monday (showing how to use the any.sender API) to win 3 eth

OpenZeppelin to re-focus on security, thus deprecating its networkJS library, Gas Station Network libraries, and starter kits. Gas Station Network lives on at opengsn.org

Post-lendfme, a defense of ERC777 tokens

The lendfme attacker gave all assets (value ~25m USD) back, apparently because the attacker’s IP address was on a server from accessing 1inch’s frontend.

Hegic Options had a bug, and thus a function can never be called. It will reimburse its users for over 150 ETH that is locked forever

Some cool stuff in there this week. Solidity stacktraces in Truffle, the new big release of Zeppelin contracts, Zerion SDK, getting revert reasons easily, etc.

It’s been suggested for awhile that more exchanges sign a price feed, and now Coinbase is doing it. I think they’re first.

I saw a couple people suggest this week that the Ethereum wannabe chains should have natively included things like price feeds and stablecoins. All of the late 2017 VC coins have really underwhelmed in both execution and imagination.

Ecosystem

Videos from EY Global Blockchain virtual summit

Cloudflare is now a Rinkeby testnet signer

Ideas for EthGlobal’s Hackathon.money

a MyCrypto guide to reading audit reports. Early adopters beware – you should definitely read audit reports!

Thanks to Cloudflare for being a Rinkeby signer. Very cool, some of the Rinkeby signers have not been very stable, so this should be a substantial upgrade in testnet stability.

The spreadsheet of hackathon ideas doubles as a “startup ideas.” I’ve heard people say they wish someone would collect people’s problems and post them weekly.

Enterprise

Italy’s ANSA newswire registers a hash of articles to combat fake news, including transparency about updates

Citing the pandemic, Indian shipping ministry wants to use CargoX for bills of lading on Ethereum

Two neat uses. It’s often hard to separate fact from fiction (and hype) in the enterprise space but these seemed legit.

Governance, DAOs, and standards

Greg Colvin put ProgPoW on the agenda for the next core devs call

A walkthrough of TheLAO, launching April 28. They’re using a TCRParty-fork called LAOScout to put startups on radar for funding from TheLAO.

ERC2615: Non funglible property standard

ERC2612: Permit extension for ERC20

It’s inexplicable that Colvin is bringing up ProgPoW again without any change in argument. He’s doing serious damage to the chance that we are able to put ProgPoW in if we need it - and I’ve learned some things that makes me think that we might need it.

It’s interesting to me to see how TheLAO does. I never thought TheDAO was a good idea - direct democracy + money doesn’t sound to me like the way to improve venture funding - but I wonder whether our space gets excited about anything that gets KYC’d.

Application layer

Gnosis launches Corona virus prediction markets, subsidized with Gnosis liquidity

cent v2. new version of seeding, aimed at monthly subscriptions for content creators. Also a separate tipping feature, and winner-takes-all-bounties

dYdX perpetual BTCUSD contracts with 10x leverage is in private alpha (not available on front end in US).

Futureswap live on mainnet with perpetual ETHDAI contracts with 20x leverage, a closed source alpha that did over 10m in volume, and is now effectively shut down

Opyn gets a front end with an order book

Maker stability fees changed, now 6% for USDC, 0% for ETH/BAT, (DSR obviously still 0). 12 hour governance delay

rTrees users planted 1541 trees for Earth Day

Golem re-writing their codebase, migrating the token to be ERC20 compliant

RequestNetwork hits 1m USD invoiced

Signal vs Telegram vs Status

NexusMutual: how Solidity cover will evolve to be able to cover the demand for large policies

TrustlessFund is live on mainnet (but unaudited!) – specify a lock date and a beneficiary

PoolTogether Pods – now you can trustlessly buy your pooltogether tickets as a group

Aave updates: adds a UI for manual liquidations, as well as a UI to see burnt LEND, to go with its new risk framework

2key: internationally monetize your calls with an Eth-based paywall Zoom plugin

Dharma social payments: send USD instantly to any Twitter user anywhere around the globe

The eternal (and eternally arbitrary) how much is DeFi metric: 12/16, though that’s not counting prediction markets as DeFi, and whether I count prediction markets as DeFi probably changes from week-to-week.

This was an exciting week at the app layer. Coronavirus markets, onchain futures so folks don’t YOLO gamble on centralized sites that know your liquidation point and trade against you, the Zoom paywall, etc.

Cent is quite neat. It was obvious that previous seeding wasn’t quite right, I’ll have to try the new one. The idea of getting paid for discovering new content and creators is super appealing. I remember the feeling once upon a time that I should get paid for all the new bands I was discovering and getting people to buy records for. This is what Cent is going for, and it’s very cool

Dharma social payments is very cool, a nice emulation of web2, but automatically earning interest. Of course Twitter is giving them troubles. The whole point of web3 is not getting capriciously censored. And Twitter is the worst at that - I remember when they randomly locked my account ~4 times in a month last year, including twice in one day!

Tokens/Business/Regulation

Constant function market makers as a zero-to-one DeFi innovation

Jacob Horne on redeemable tokens and Saint Fame

Securitize uses white-label AirSwap for US securities transfer

Token Terminal has an interesting P/E metric

The fundamental value proposition of ETH

Take some of the P/E with a grain of salt, especially if you aren’t comparing apples-to-oranges, but if you sort by PE, I think it’s obvious which layer 1 chains are massively overvalued right now.

General

Post-Black Thursday, is Dai still safe to use?

Dappnode makes it easier to run non-Eth chains (but why!) and prepares for Eth2

Bobbin Threadbare’s STARK-based VM in Rust

Libra changes to being multi-fiat stablecoins that will always be permissioned

How much your new browser in iOS is spewing data to the world about you

Like anything, “safe to use” is an evaluation. Even holding USD requires an evaluation of all of your goals, tolerance for risk, timeframes, where you are, how you’re holding it, etc. It’s the reason why “this is not financial advice” is a thing, even outside of trying to discourage idiots from suing you. So to me saying anything is safe is a tough goal. But it is safe to say that Dai is getting more hardened.

Libra shifting away from its goal of going permissionless isn’t surprising. I said at the start that if they ever launched anything, it wouldn’t be anything like what they announced. Seems like they’re solidly on track for that.

Do people know that much of Libra’s Move comes from work funded by the Ethereum Foundation?

This newsletter is made possible by ConsenSys

I own 100% Week In Ethereum News. Editorial control has always been me.

If you’re wondering “why didn’t my post make it into Week in Ethereum News,” then here’s a hint: don’t email me. Do put it on Reddit.

Permalink: https://weekinethereumnews.com/week-in-ethereum-news-april-25-2020/

Dates of Note

Upcoming dates of note (new/changes in bold):

Apr 29-30 – SoliditySummit (Berlin)

May 8-9 – Ethereal Summit (NYC)

May 22-31 – Ethereum Madrid public health virtual hackathon

May 29-June 16 – SOSHackathon

June 17 – EthBarcelona R&D workshop

Did you get forwarded this newsletter? Sign up to receive it weekly

0 notes