#What states are you responsible for your spouse's debt?

Explore tagged Tumblr posts

Text

To protect yourself from your husband's debt, it is crucial to understand the nuances of financial responsibility in a marriage. Generally, you are not responsible for debts that are solely in your spouse's name. However, if you co-signed for the debt or if it is a joint account, you may be liable. In community property states (California, Texas, Arizona, New Mexico, Nevada, Washington, Idaho, Wisconsin, Louisiana, and optionally in Alaska, South Dakota, and Tennessee), debts incurred during the marriage are typically considered joint debts, meaning both spouses are responsible.

Signing a prenuptial agreement before marriage is a proactive way to clarify debt responsibilities. This can include stipulations about who is liable for what debts. If you're already married, a postnuptial agreement might serve a similar purpose. Keeping finances separate, such as having individual bank accounts and avoiding joint credit, can also help protect you from your spouse's debts.

In the event of divorce, it's important to separate and clearly define debt responsibilities. This might include dividing joint debts and ensuring that each party takes responsibility for their respective debts. Monitoring your credit score regularly is crucial to ensure that your spouse's debt activities do not impact your credit history.

If you reside in a community property state, you might have a higher degree of shared responsibility for debts incurred during the marriage. Therefore, understanding your state's specific laws regarding marital debt is essential. Consulting with a financial advisor or attorney specialized in family law can provide personalized advice and strategies to protect your financial interests.

youtube

Related queries:

Prenuptial agreement benefits

Separating finances in marriage

Community property states and debt

Postnuptial agreement guidelines

Divorce and debt responsibility

#How can I not be responsible for my spouse's debt?#Can a wife be held responsible for husband's debt?#Am I liable for my husbands debt?#How do I protect myself financially from my spouse?#Does debt transfer when you get married?#Is a husband financially responsible for his wife?#Can I be forced to pay my spouse's debt?#What states are you responsible for your spouse's debt?#What debts are not forgiven at death?#Youtube

0 notes

Note

Tim going off on a LS fan on Facebook for their criticism of the Carlos storyline ...

I saw and am honestly just so 🙄🙄🙄. He’s completely missed the point. (Unsurprising, because he doesn’t take criticism well).

The thing is, at the end of the day it doesn’t matter one bit whether it was a “real marriage” (which I guess we’re defining as a love marriage?) in the eyes of the people in it. It was a real marriage in the eyes of the law. The fact that it exists has real legal and financial implications that by their very existence impact the futures of the people in it—it’s not actually a “meaningless piece of paper” as Tim put it. Texas is a community property state, so all of Carlos’s income and assets acquired with that income while they’ve been married is also equally hers. If Iris has debts acquired during their marriage, he’s likely responsible for them. Carlos and TK bought a house together—Carlos being married means that Iris, as his wife, has a legal and financial interest in that property (a fact that TK was not made aware of before buying a house with his partner). Carlos and TK got engaged despite the fact that they would not be able to actually get married since Carlos was already married—again, a fact that TK was not made aware of before getting engaged.

The fact is, what is comes down to is that TK and Carlos have been in a relationship for YEARS, making major decisions about their future together, and with this retcon (because that’s what it is) that means that by not being honest about this, Carlos has basically completely removed TK’s agency in their relationship by not allowing him the information necessary to make informed decisions about his life and future, which is objectively an extremely shitty thing to do to your partner (and which just underscores how bad this writing is because if they had thought it through at all they should have recognized how much the context that he’s been keeping this a secret decimates Carlos’s character (which pisses me off because I love him), reframes and colors aspects of their relationship and major milestones, and just in general makes him not a great boyfriend when before this “twist” he was!).

Like I’m sorry but I genuinely can’t with the “it’s a meaningless piece of paper” argument when even without touching anything else about it that piece of paper at a minimum means that everything you own is owned equally by your spouse. Not to put too fine a point on it, but if Carlos died while he was still married to Iris, she would own part of their house and TK wouldn’t be able to do anything about it. The legal protections of marriage are a big deal—that’s literally one of the reasons why queer people fought for marriage equality for so long.

And look, I know it’s fiction. If they want to pretend LS takes place in some alternate universe where the laws of Texas aren’t the laws of Texas (don’t even get me started on the whole “annulment” thing) they can do that. But a) they haven’t indicated that’s the case, and more importantly b) regardless, it’s not okay to be so fucking condescending when people are rightfully scratching their heads over a plot twist that was never remotely foreshadowed, is clearly only happening for the drama of it all, has more plot holes than Swiss cheese, and makes zero sense.

88 notes

·

View notes

Text

There were a few details listed here I didn't know, so I'm glad I've seen this for my own sake.

However, I don't feel right letting, "there's other reasons why the marriage might not work out," stay at that because I'm sure there's people here who don't realize what can happen.

I hope to God that no one here ever experiences this but death, dismemberment or other disabiling injuries can occur at anytime. One of my uncle's lost his wife to a car crash nearly 4 years ago making himna single dad to their son and her daughter from her first marriage. He lost half their income and it was hard for him to work his previous shifts and number of hours because he had to parent alone. Almost 1 year ago he had a heart attack and passed away within 48 hours. When I was 9 or 10 and my brother lost his leg in a work accident just months before my niece was going to be born. Until they split, my unofficially sister in law (they were never married) was the sole breadwinner and had no rights to his settlement when he got it. Unfortunately, because of his injury, he got addicted to pain meds. Guess where that money went. Likewise, the surgeons tried to preserve more of my brother's leg even though it wasn't particularly usuable. This made him qualify for less benefits including disability while causing him more pain and more trouble finding a fitting prothesthic that doesn't cause him pain.

If your marriage license is void/invalid for any reason, you will not get all benefits and rights a spouse typically should. The causes of a void/invalid license can range from a fake identity, to being declared incompetent on the day of the marriage (say they were having a psychosis episode) to something as small as a clerical error on either your or the courthouse's side.

The breadwinner could get fired or layed off and depending on the job market and what they're trained in, may struggle to find another job. Your bank accounts and identity can be stolen and wiped. I am only 26 and I've seen two people I knew decently well lose everything on different occasions. I've seen eldery couples do just fine until one of their own children swindled them.

You need to know how to open accounts in your name, how to close them and then maintain at least one account. Not only do you need credit in your name, but you need to have a good score if you want a loan with a semi-decent interest rate. You need to know what all deeds, titles, credit cards and finance accounts have your name on them because if you leave for any reason, you'll be at least partially responsible for them. You also need to know what your assets are worth and if they have debts tied to them, if so, how much. Learn the basics and make sure you do enough of the work yourself that you don't forget how to do it.

As for a job, a side gig isn't going to be enough to help you land a "real job". You need to prove that you can maintain a reasonable work schedule, that you can stay at a job for at least one year straight preferably upwards of 3 to 5 years, and can handle workplace dramas and woes at different levels (between peers, bosses and anyone beneath you). If you are blessed enough to not "need" to work, I suggest working a part-time job somewhere even if it's a non-profit, or having a WFH. Please note, having a degree in something is not enough to guarantee finding a decent job. I have a bachelor's and graduated with honors and now I can't find work in my field because the jobs want a degree plus 3 to 5 years of experience in that field. Don't let yourself run into that issue.

If this is new information to you, sit down and talk to your partner, run this information to them. If they are dismissive or not on board with you taking the steps to protect yourself (including being actively involved in learning how manage finances and knowing what documents have your names on them, ect) PLEASE PLEASE PLEASE reconsider the relationship. Like stated above, you might not be able to leave right away, but think about it and should you so choose, start looking for support.

the funniest thing about the tiktok tradwife craze is people learning financial abuse exists but like, as a hypothetical. "wait what if the relationship doesn't work out and you have nothing of your own and nowhere to go?" congratulations you figured out a common reason people remain in abusive relationships and why it's important to maintain some level of financial independence

57K notes

·

View notes

Text

Divorce Consultation Simplified: Mutual vs. Contested Divorce

Divorce can be a tough experience filled with many emotions. If you’re considering ending your marriage, it’s important to understand the two main types of divorce: mutual divorce and contested divorce. This guide will help you see the differences and what each process involves.

What is Divorce?

Divorce is the legal way to end a marriage. It involves several important decisions, including:

Dividing Property: How will you split your belongings and debts?

Child Custody: Who will the children live with, and how will their needs be taken care of?

Spousal Support: Will one partner need to pay the other after the divorce?

Mutual Divorce: Working Together

A mutual divorce happens when both spouses agree to end their marriage. This cooperative approach can make the process smoother and less stressful. Here’s how it works:

Agree on Terms: Both partners discuss and come to an agreement on key issues like property division and child custody.

File Together: You submit a joint petition to the court explaining your agreement.

Cooling-Off Period: Many places require a waiting period before the final hearing, allowing you both time to reflect.

Final Hearing: A judge reviews your case, and if everything is in order, grants the divorce.

Legal Consultation for Mutual Divorce: During a mutual divorce consultation, both spouses may meet with a lawyer together or speak separately. The divorce lawyer explains the process, helps with necessary documents, and guides you through property division and custody agreements. Since both parties usually cooperate, follow-ups are minimal, focusing mainly on filing and court appearances.

Benefits of Mutual Divorce:

Faster Process: It often takes about six months to a year to complete.

Cost-Effective: With less legal work involved, it generally costs less.

Less Stressful: Since both parties agree, it often leads to fewer conflicts and emotional strain.

Contested Divorce: A Different Process

A contested divorce occurs when one spouse wants to end the marriage while the other does not, or when there are disagreements on key issues. This process can be more complicated and take longer. Here’s what typically happens:

Filing a Petition: One spouse files a divorce request with the court, stating the reasons for the divorce.

Response: The other spouse can agree or disagree with the petition and may file a counter-petition.

Gathering Information: Both parties collect information related to the case, including financial documents and evidence about child custody.

Mediation: Courts often suggest mediation to help couples settle their disagreements without going to trial.

Trial: If mediation doesn’t work, a judge will hear both sides and make decisions on disputed issues.

Legal Consultation for Contested Divorce: In a contested divorce, legal consultations are more detailed. One spouse usually seeks help to address issues like custody and financial matters. The lawyer gathers information about the marriage, prepares a detailed petition, and develops a legal strategy. Frequent follow-ups are often needed to discuss court dates and responses to motions.

Challenges of Contested Divorce:

Lengthy Process: Contested divorces can take many months or even years to resolve.

Higher Costs: Due to the extensive legal work required, contested divorces can be much more expensive.

Increased Stress: The confrontational nature of contested divorces can add emotional strain for both parties.

Key Differences

In a mutual divorce, both spouses work together toward an agreement, which usually makes the process easier and less stressful. In contrast, contested divorces often feel more like a battle, requiring one spouse to seek legal help to deal with disagreements.

Conclusion

At Zolvit, we understand that divorce can be tough, and we’re here to support you. Our team of legal experts can guide you through the process, whether you’re considering a mutual or contested divorce. Contact us for assistance.

0 notes

Text

How a Prenuptial Agreement Can Protect Your Business: Insights from Top Family Lawyers in Gurgaon

Preparing for a divorce is the last thing anyone would want to consider- especially before walking down the aisle. But do not be swayed away by emotions if you run a successful business. No one would like to part ways with their partner, but you never know what destiny has in store for you. In any case, if you have to call your marriage quits, it can take away a major share of your business from you, even what you made before tying the knot. Thus, it is necessary that you sign a legal prenuptial agreement with your partner prior to marriage to clearly define what will be distributed in the event of a divorce. Want to know how a prenuptial agreement can protect your business interests? Read on:

Determine the Business Value as on the Marriage Date

Everything you have built before saying ‘I do’ solely belongs to you and should be exempted from division in case of divorce after marriage. While any gains that occur after marriage might be put up for negotiation between the two, anything acquired before the marriage shouldn’t be counted under marriage treasure. It should be kept safe and sound in the name of the title holder of the business. Thus, preparing a prenuptial agreement with an accurate business evaluation and worth is crucial to ensure that you retain whatever you have earned before marriage without sharing the same with your partner. Understanding your business worth before tying the knot helps you monitor your business growth over the years of marriage and identify assets that qualify as marital assets.

Outline the Percentage of Business your Spouse will Receive

Assigning your spouse the slice of business he/she will receive in case of a split beforehand helps you save your business from getting entangled in the same distribution rules as other marital assets. You can get the guidelines written on the prenuptial agreement that clearly states how much percentage will be given to the other half even if other marital assets are divided on a 50/50 basis. If it is 20%, they will only receive 20% of the business share and cannot make any further business claims.

Define the Rights to Profitability and Losses Associated with the Business

A business comes with many ups and downs; thus, profits and losses are just a part of the game. So, will your partner share the profits and losses, too? Will they stand responsible for your business’s debts and share the profits equally? Determine how the financial gains and setbacks will be shared between the two in the prenuptial agreement. This decision usually hinges on the spouse’s contribution, invested capital, and their role in the business. Whatever the case, get it written beforehand so there are no further clashes in case of a divorce.

Safeguard Your Business with a Prenuptial Agreement: Contact VR Associates Now!

A well-crafted prenuptial agreement helps safeguard your business interests as you kickstart your journey into marriage. Besides just creating a clear understanding of the division of assets in case of a divorce, it helps you have a stronghold over your hard-earned business. So, if you plan to build a future with your partner while safeguarding what you have built alone, you can reach out to VR Associates Law Firm to get a nuptial agreement ready before you walk down the aisle.

We pride ourselves on having the best matrimonial lawyers in Gurgaon in our team, who can help you craft the perfect prenuptial agreement tailored to the unique needs of an individual. With years of expertise, our Family Lawyers In Gurgaon are dedicated to ensuring that your business stays protected in all circumstances. They can guide you through the nuances of divorces that require asset division and help your business legacy down the line. So, why wait? Contact us now to make your business safe and sound with a prenup agreement before you say ‘I do!’

0 notes

Text

Responses to accusations of physical and sexual abuse can also work out a lot like societal responses to rape:

"They're such a good person, they wouldn't do that!"

"Should we hurt their future by doing that to them?"

"Women aren't like that!"

"Anyone would be mad at their spouse for that!"

Sometimes clear evidence isn't even enough, once victim blaming and apologetics enter the space... and they definitely will. Don't forget that some people still believe that you cannnot rape your spouse. It wasn't illegal in all 50 states of the US until 2019!

Good luck proving a case on emotional and psychological abuse. Often times people don't even recognize it for what it is and sometimes it can sound less compelling, even when being immersed in it for years is clearly a horrifying experience.

And, of course those are just the at fault cases! How did things end before when "this just isn't working out" or "neither of us are happy here"? Is the "sanctity of marriage" preserved when both spouses live separately with their actual partners? It still happens in high profile or political marriages. Did you think more of that would help the purity and holiness of marriage?

What about human rights? Why should one human have to prove to another that they have a right to leave a relationship? Who really has the right to decide who you are married to and how a spouse should be treated? Why isn't it the people in the relationship?

What if your relationship is clearly over, but society has decided that you don't qualify for a divorce? You can just live separately while married, sure, but not only are you not able to introduce marriage to future partnerships, but you are liable for all of your exes decisions. Ever had an ex with spending problems, who drives multiple credit cards to maximum with just impulse purchasing? Those debts are yours for life, after all, a married couple is jointly responsible for financial obligations... It is worth noting that their previous solution to this issue was to just deny women access to banking without a man present, until 1974. Even with this financial subjugation and lower pay for women, plenty of single mom's found themselves facing leins against their accounts and paychecks, because of their runaway spouses debts.

Let's not restore the broken world of the past in some misguided attempt to "preserve the sanctity of marriage" or "reduce the burden on the court system." A broken marriage is broken, whether you handcuff them together or not and there us nothing "holy and pure" about locking innocent people into painful lifelong bondage.

No fault divorce allows women to escape abusive husbands. Making this unlawful tells you EVERYTHING you need to know about Republicans.

32K notes

·

View notes

Text

What Happens To Your Credit Card Debt After Death?

courtesy of https://myfinancialweekly.com

Do you know what happens to credit card debt when you die? Any unpaid debt after death requires settlement using the assets of the deceased. Find out more details today.

Credit card debt is known as unsecured debt, which means it isn’t linked to collateral assets like a house. The debt is paid through the deceased’s assets. An executor settles debts through the estate before the assets are distributed to beneficiaries. The assets are considered insolvent if the estate isn’t enough to repay the debt.

The authorized users aren’t held accountable for the card debt after the user’s death. This indicates that family members aren’t responsible for settling debt unless it was a joint account. However, some states assign the surviving spouse the responsibility to clear the outstanding debt.

Who Is Responsible for Credit Card Debt?

Relatives or authorized users are not responsible for clearing the deceased’s debts. The responsibility for paying credit card debt after death depends on the nature of the account. A person is accountable for the debt if it’s from a joint account or cosigned for a credit card. This criterion makes a user responsible for repaying the credit card debt for their loved ones. Some states hold spouses responsible for paying debts to their partners.

Such states include Arizona, California, Texas, Idaho, Nevada, Louisiana, New Mexico, Wisconsin, and Washington.

Assets Protected From Creditors

Creditors can’t use some assets to settle credit card debt after death. These assets include life insurance benefits, retirement funds, brokerage accounts, and assets in a living trust. The living trust helps beneficiaries avoid probate processes.

All assets are held and owned by a trust, which distributes the estate according to the deceased’s instructions. This approach protects the assets from creditors and gives flexibility in asset distribution. The trust eliminates the hassles of spending time and money on probate. It also gives beneficiaries the power to negotiate with creditors in resolving unpaid credit card debt after death.

Paying Credit Debts After a Death

Credit card debt after death is covered through the estate. Any asset categorized under the deceased’s estate is used to pay creditors. Credit debts are settled before the wealth is distributed to the respective heirs according to the deceased’s will. Two instances occur in solving credit debit cards: the deceased has an insolvent or solvent estate.

Insolvent Estate

An insolvent estate has assets that can’t pay for debts, funeral expenses, and other liabilities. Assets available are used to pay debts in the following order:

Funeral and administration expenses

Creditors with secured loans

Preferential pending debts, such as tax and social insurance

Ordinary debts, such as credit cards and personal loans

0 notes

Text

Steps to Take If Your Spouse Files for Divorce First

Facing an unexpected divorce can be one of the most stressful experiences in life. If your spouse has filed for divorce first, it’s crucial to understand the steps you need to take to protect your interests. This guide will walk you through the necessary actions to manage this situation effectively and ensure you are well-prepared for the journey ahead.

Understand the Divorce Papers

The first step when your spouse files for divorce is to carefully read the divorce papers. These documents will outline the grounds for the divorce, the demands of your spouse, and any court dates or deadlines. It's essential to:

Review the allegations made by your spouse.

Understand the demands regarding asset division, child custody, and support.

Note important deadlines for your response.

Understanding these details will help you know what you're up against and how to prepare your response accordingly.

Hire a Divorce Attorney

Finding the right legal representation is critical. A qualified divorce attorney San Jose CA can provide invaluable guidance through this process. Your attorney will help you understand your rights, develop a strategy, and represent you in court. When looking for an attorney, consider:

Their experience in handling similar cases.

Their understanding of local laws and regulations.

Their communication style and availability.

Choosing the right attorney can make a significant difference in the outcome of your case.

Gather Financial Documentation

Divorce involves the division of assets and possibly alimony or child support. You will need to provide detailed financial information. Start gathering:

Bank statements and financial records.

Tax returns for the last few years.

Documents related to assets like property deeds, car titles, and investment accounts.

Information on debts such as credit card statements and loans.

Having these documents ready will help your attorney build a strong case and ensure a fair division of assets.

Respond to the Divorce Petition

Once you've reviewed the divorce papers and consulted with your attorney, you'll need to file a response. This step is crucial to ensure your voice is heard in the proceedings. Your response should:

Address each point raised in the divorce petition.

State your counter-demands regarding asset division, custody, and support.

Be filed within the deadline specified in the divorce papers.

Filing a timely and well-prepared response is essential for protecting your interests.

Consider Mediation or Negotiation

Before heading to court, consider alternative dispute resolution methods such as mediation or negotiation. These processes can:

Save time and money compared to a lengthy court battle.

Reduce conflict by promoting cooperative solutions.

Allow both parties to have more control over the final agreement.

Your attorney can help you decide if mediation or negotiation is appropriate for your situation and guide you through the process.

Plan for Custody and Support

If you have children, determining custody and support arrangements is a critical part of the divorce process. Consider:

The best interests of the children when proposing custody arrangements.

Financial support needed for the children's upbringing.

Creating a detailed parenting plan that outlines schedules, holidays, and decision-making responsibilities.

Working out these details can be one of the most contentious parts of a divorce, but prioritizing your children's well-being is paramount.

Protect Your Assets

During a divorce, it's important to take steps to protect your financial interests. This can include:

Freezing joint accounts to prevent unauthorized spending.

Changing passwords for online accounts and social media.

Documenting valuables and any property in your possession.

Taking these actions can prevent potential disputes over assets and ensure a fair division during the divorce process.

Why Choose Us

At affordableandexpresslegal.com, we understand the challenges and emotional strain that come with divorce. Here’s why you should choose us to represent you:

Experienced Attorneys: Our team has years of experience in family law and has successfully handled numerous divorce cases.

Personalized Attention: We provide individualized attention to each client, ensuring your unique needs and concerns are addressed.

Affordable Services: We offer competitive pricing without compromising on the quality of our legal services.

Efficient Process: Our streamlined process ensures that your case progresses smoothly and quickly, reducing the stress of a prolonged legal battle.

Comprehensive Support: From filing responses to negotiating settlements, we offer comprehensive legal support throughout your divorce.

Contact us today to learn more about how we can assist you during this difficult time.

Conclusion

Facing a divorce can be daunting, especially if your spouse has filed first. By taking the right steps, such as understanding the divorce papers, hiring a divorce attorney San Jose CA, gathering financial documentation, responding appropriately, and considering mediation, you can navigate the process more smoothly. Protecting your assets and planning for custody and support are also crucial steps. For expert guidance and support, consider the experienced team at affordableandexpresslegal.com. We are here to help you every step of the way.

Reference URL :- Steps to Take If Your Spouse Files for Divorce First

0 notes

Text

Financial Considerations During Mutual Divorce Process

Divorce is a major life changing event including triggering a series of financial issues. Therefore, Family Kanoon, one of the most successful family lawyer in Gurgaon is here to guide about the essential financial considerations during mutual divorce process.

Understanding Your Assets and Debts

Make a list of your assets as well as liabilities for instance bank loans, credit card due, investments, real estate, and advances. Once you realize what you exactly have in your bank account, you will be in a position to make the right decision while the divorce is in progress.

Budgeting for Single Life

Learning how to live on one income after a divorce is not easy. Your budget has to be planned with precision. First, take a good look at your bills and expenditures to set a realistic budget for yourself post-income reduction.

Spousal Support and Alimony

If applicable, you can enjoy spousal support or alimony, provided that you meet the eligibility requirements. Be sure you know your responsibilities and options and work together with your lawyer to negotiate a financially equitable agreement.

Child Support Obligations

One of the most important things to consider if you have kids is child support payments financial impact. Familarize yourself with the state's child support regulations and guarantee that during the divorce process, your children's requirements are met by the court.

Health Insurance Coverage

Decide about what health insurance policy will be applied after the Mutual Divorce Process. Investigate different methods of acquiring healthcare insurance at a reasonable cost in case you or your dependents require one.

Retirement Accounts and Investments

Equitable division of retirement savings and investment money should take into account tax implications and long run financial planning. Work together with a financial advisor towards making a plan which divides the assets equally and provides you with the financial security. Try these examples out and improve your English writing skills.

Tax Considerations

The tax consequences of the divorce agreement are huge. The property division, alimony, and child support payments make tax implications. Seek advice from a tax expert to know how divorce settlement will affect you and create a plan.

Estate Planning Updates

Review and revise your estate plan, such as will, trust, and beneficiary classifications, to ensure that everything aligns with your post Mutual Consent Divorce goals. Make sure your assets are handled according to your personal preferences and your family members are always protected.

Debt Division

In the process of divorce it is imperative to settle how the debt is to be shared. Decide the way joint debts are shared and make moves to preserve your credit score on an ongoing basis.

Home-ownershipConsiderations

If your home is owned together with your spouse, you must settle on whether to put the property on the market, to buy your spouse's portion of the stock, or to come up with a joint ownership deal. Think over the financial aspects of each option and make the right choice regarding your situation.

Business Interests

In case you or your spouse owns a business, you need to have its value estimated and decide whether property division or inventory will be done by the value of the business. Ask for legal advice from your Mutual Divorce Attorney to make sure that the result will be just and the same for all.

Custodial Accounts for Children

You may consider the option of opening up custodial accounts for your kids to access the resources for their personal needs and educational expenses. Seek consultancy from the best Family Lawyer In Gurgaon - Family Kanoon and go through different investment choices with an expert to optimize the possibilities of growth for these accounts.

Why Family Kanoon Offers the Best Legal Guidance in Gurgaon

We have a team of experienced and empathetic family law attorneys. People who are facing matrimonial issues in Delhi NCR, can visit Family Kanoon. Our team of experienced matrimonial lawyers in Gurgaon, will ensure to guide you with all pros and cos of the mutual divorce process. Please feel free to reach us for accurate and timely matrimonial legal advice.

#Mutual Divorce Process#Mutual Consent Divorce#matrimonial lawyer in gurgaon#family lawyer in Gurgaon

0 notes

Link

#assets#beneficiary#death#deathcertificate#debt#healthcare#inheritance#investment#legalfees#Money#parents#probate#realestate#savings#tax#taxliability#taxes#wealth

0 notes

Photo

In this article we explore the responsibilities and legalities of managing credit card debt after a spouse's death. Understand your role and the estate's part in settling these financial obligations.

When a spouse passes away, their death brings not only emotional turmoil but also financial uncertainties, especially regarding existing credit card debts. This article explores the complexities of handling these debts, applying the 5W1H (Who, What, When, Where, Why, and How).

https://youtu.be/vjHtoXBCE20

Who is Responsible for the Debt?

Primary Responsibility

Joint Account Holders: If you co-owned a credit card with the deceased, you're liable for the remaining balance.

Co-signers: Signing as a co-signer means you've agreed to take on the debt if the primary cardholder dies.

Spouses in Community Property States: In these states, spouses might be accountable for debts incurred during the marriage. Secondary Responsibility

Estate of the Deceased: The estate is typically responsible for settling debts before any inheritance is distributed.

What Happens to the Debt?

Credit card debts don't disappear after death. They must be settled either by the surviving spouse, if legally bound, or by the estate of the deceased.

When Does This Apply?

These responsibilities come into play immediately following the death of the spouse. However, the settlement process can vary depending on the probate proceedings and the state laws.

Where Does the Law Stand?

The legal handling of these debts varies:

Community Property States: States like California and Texas have specific laws making spouses liable for each other's debts.

Other States: In non-community property states, only joint account holders and co-signers are typically responsible.

Why Is This Important?

Understanding these obligations is crucial to avoid unexpected financial burdens and ensure legal compliance. It helps in planning and managing your finances during a challenging time.

How Should You Manage These Debts?

Identify Your Responsibility: Determine if you're a joint account holder, co-signer, or subject to community property laws.

Assess the Estate: Evaluate the deceased's estate to understand its capacity to pay off debts.

Seek Legal Advice: Consider consulting with a legal expert, especially in complex cases or large debts.

Addressing Key Questions

Q: What if I'm just an authorized user? A: Authorized users are typically not responsible for the debt.

Q: Can creditors claim against my assets? A: Unless you're legally tied to the debt, your personal assets are usually safe.

Q: Is debt forgiven upon death? A: Not automatically. The estate usually handles it, and only if the estate can't cover it, the debt may be unrecoverable.

Conclusion

Navigating credit card debt after a spouse's death requires understanding your legal obligations and the estate's role. Staying informed can help manage potential financial implications effectively.

https://www.reddit.com/r/ExpertReviews/comments/18kpz98/is_wife_responsible_for_deceased_husbands_credit/

0 notes

Text

The Ultimate Guide to Tax Settlement Services: What You Need to Know

Taxes are an inevitable part of life, and for many of us, the complexities of tax-related issues can be daunting. Fortunately, there are professionals and services dedicated to helping individuals and businesses navigate the world of taxes. In this guide, we will explore tax settlement services, what they entail, and why you might need them.

Understanding Tax Settlement Services

Tax settlement services are specialized firms or professionals who offer assistance in dealing with various tax-related issues. These issues could range from tax debt resolution to negotiating with tax authorities. Let's break down some of the key aspects you need to know:

Types of Tax Settlement Services

• Tax Debt Relief: If you find yourself drowning in unpaid taxes, these services can help you negotiate with the IRS or state tax agencies to reduce the amount you owe.

• Offer in Compromise (OIC): This is a program that allows you to settle your tax debt for less than the full amount. Tax settlement services can guide you through this process.

• Installment Agreements: They can help you set up manageable payment plans to clear your tax debt over time.

• Innocent Spouse Relief: If you're facing tax problems due to your spouse's actions, these services can help you seek relief from joint tax liabilities.

Benefits of Tax Settlement Services

• Expertise: Tax settlement professionals have a deep understanding of tax laws and regulations, enabling them to find the best solutions for your specific situation.

• Negotiation Skills: They can negotiate with tax authorities on your behalf, often resulting in reduced penalties and interest.

• Peace of Mind: By enlisting their help, you can alleviate the stress and anxiety associated with tax problems.

Choosing the Right Service

• Reputation: Research and choose a reputable tax settlement service with a track record of success.

• Fees: Understand the fee structure, which can vary from one service to another.

• Clear Communication: Ensure they communicate clearly about the process, potential outcomes, and your responsibilities.

Why You Might Need Tax Settlement Services

Now, let's delve into some common scenarios where tax settlement services become essential:

Overwhelming Tax Debt: If you owe a substantial amount in taxes and are struggling to make payments, tax settlement services can help you explore options to reduce or manage the debt effectively.

IRS Audits: Facing an audit can be nerve-wracking. Free consultation tax attorney can represent you during the audit process and ensure you meet all requirements.

Tax Liens and Levies: If the IRS has placed a lien on your property or is threatening to levy your assets, a tax settlement service can work to release these holds.

Complex Tax Situations: When your tax situation is intricate due to business ownership, investments, or other factors, professionals can provide the expertise needed to navigate the complexity.

Conclusion

In the complex world of taxes, tax settlement services play a crucial role in helping individuals and businesses find solutions to their tax-related issues. By enlisting their expertise, you can ease the burden of tax debt, navigate audits, and ensure that your rights are protected throughout the process. Always remember to do your due diligence when selecting a tax settlement service, ensuring they have a good reputation and can provide the assistance you need.

0 notes

Text

[ad_1] I’m in my 40s and not too long ago discovered my father has been mendacity about his funds. He owes some huge cash to many individuals whom he borrowed from over time, and he has no supply of revenue to pay them again with. He does personal a number of properties, however they’re not promoting given how horrible the housing market is in the intervening time and, even when they do promote, they gained’t be sufficient to cowl what he owes. He’s additionally older and never very wholesome. My siblings and I are frightened concerning the burden on my mom if one thing have been to occur to him. They’re nonetheless married. To what extent would she be chargeable for his money owed? Involved Son Associated: ‘He implied he was financially secure’: My husband was always hesitant about his finances. Now I know why. “It’s not a one-size-fits-all reply, I’m afraid. However nor ought to your mom roll over in case your father dies, and get out her checkbook for each debt collector that comes calling.” MarketWatch illustration Expensive Involved, Monetary infidelity, by some accounts, might be as devastating as another type of infidelity. It could actually threaten not solely a pair’s marriage, but in addition their residence, peace of thoughts, monetary independence, status, credit score rating and even their capacity to retire. It’s devastating to place somebody’s future in jeopardy by retaining secrets and techniques like this. Almost one-third of individuals have stated they’ve committed financial infidelity — that's, intentionally retaining secrets and techniques about cash from their companion — however over half have stated they've monetary secrets and techniques, like a secret checking account. The Federal Commerce Fee and Shopper Monetary Safety Bureau say that a surviving partner will not be answerable for credit-card debt, pupil debt or different kinds of debt owed by a companion who dies. The contract is between your father and the credit-card firm. Nevertheless, in a community-property state, your mom could also be answerable for sure money owed, comparable to medical debt, from collectively held property. There are 9 community-property states: Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington and Wisconsin. What sort of debt your mom could also be on the hook for will rely upon whether or not she lives in a type of community-property states, the character of the debt and the legal guidelines in her specific state. “The debt of a deceased particular person is paid from their property, which is solely the sum of all of the property they owned at loss of life,” Experian says. “If [the] partner had a will, the executor they named within the will makes use of the property to repay collectors. If [the] partner didn’t have a will, a probate court docket decide will resolve the best way to distribute their property and can select an administrator.” Associated: ‘I’m afraid to tell my spouse’: I maxed out my credit cards and racked up $100,000 in debt due to my gambling addiction. Can you help? In case your mom was a co-signer on these money owed, she definitely would have legal responsibility, says Gary Botwinick, a co-managing companion of Einhorn Barbarito, which has places of work in New Jersey. In the event that they acquired divorced, she might also be on the hook for his money owed — if the decide dominated that she benefited from these money owed. “Usually, sure inheritances usually are not topic to money owed,” he says. “In the event that they personal a house through tenants by entirety, that will sometimes not be topic to the money owed. A life-insurance loss of life profit and retirement property — they too wouldn't sometimes be topic to these money owed.” When your father dies, your mom can even inform any debt collector how and when to contact her. She shouldn't be bullied or cajoled into

paying money owed that aren't her duty and, even when they have been her money owed, there are rules as to how debt collectors should conduct their enterprise. The times of being psychologically overwhelmed into submission are over. “If you happen to obtain a validation discover and dispute the debt in writing inside 30 days, the debt collector should cease contacting you till they validate the debt in writing,” the Shopper Monetary Safety Bureau says. Each companions ought to all the time have entry to financial institution accounts and know the place cash is being spent and why. If one companion has a playing drawback, it’s higher that it’s found earlier than the financial institution accounts are drained and the particular person makes an attempt to refinance the home. That begs the query: How did your father get into such debt? Does he have a playing drawback? Is he an over-spender? Or has he been the sufferer of an elder monetary rip-off? Will he proceed to rack up money owed, regardless that the extent of his monetary folly has been revealed? In the meantime, rates of interest gained’t keep close to 8% ceaselessly, and the housing market will finally choose up when extra folks really feel snug about shopping for. Potential sellers, who want to purchase one other residence with a mortgage, clearly don’t wish to commerce their low charges for a price that's presently at a 20-year excessive. Some economists anticipate charges to fall and demand to rise in 2024, however some additionally predicted rates would have hit 5% by now. It’s a disgrace to need to unload these investments and/however your dad and mom’ long-term monetary safety is paramount. In case your father ought to die earlier than your mom, she mustn't merely roll over and get out her checkbook for each debt collector that comes calling. She's going to probably be scared and susceptible, so she's going to want each authorized and ethical help if that point comes and your father’s property goes by probate. For what it’s value, there are specific property that gained’t undergo probate: property collectively held by each spouses, assuming these properties are in each your dad and mom’ names, together with trusts and life-insurance insurance policies. It’s not a one-size-fits-all reply, I’m afraid. It is going to rely upon the character of your father’s money owed and the place they stay, nevertheless it’s finest to arrange now. You may e-mail The Moneyist with any monetary and moral questions at [email protected], and observe Quentin Fottrell on X, the platform previously often called Twitter. Take a look at the Moneyist private Facebook group, the place we search for solutions to life’s thorniest cash points. Submit your questions, inform me what you wish to know extra about, or weigh in on the newest Moneyist columns. The Moneyist regrets he can not reply to questions individually. Earlier columns by Quentin Fottrell: My husband and I divorced after 17 years of marriage. He sold our home at a significant profit. Am I entitled to my share? ‘I’ve been living inside a silent divorce’: I want a ‘kitchen-table’ separation from my husband without lawyers. Is that a good idea? ‘I cashed in my retirement account to buy our home’: My husband left me and our two kids and won’t pay the mortgage. What now? [ad_2]

0 notes

Text

Edward Jones Investments

What is Edward Jones Investments?

Edward Jones Investments is a complete investment management company with locations in both the United States & Canada. It was established in St. Louis in 1922. Throughout the twentieth century, the company established an excellent reputation as one of the most renowned portfolio managers by investing extensively in all of its customers.

Edward Jones Investments began its business in the United States without moving into Canada. The company presently professes to have approximately 15,000 sites & roughly 19,000 highly skilled and knowledgeable financial analysts. This firm presently serves roughly 7 million clients & has nearly $1.7 trillion in AUM (Assets Under Management). The firm concentrates mostly on investments with long-term prospects. The founder, Edward Jones, became a well-known figure in the field of personal investment in money, as well as he is largely responsible for the company's continued success after decades of operation. For more detailed information, visit the Edward Jones Gold IRA Reviews

People Behind Edward Jones Investment: CEO, Owner, Co-Founders & More

Edward Jones, founder of Edward Jones Investment employs around 19,000 advisors in total and includes a management team, writing approximately individuals thoroughly is difficult, therefore these are some of the prominent employees of the organization.

Penny Pennington: Managing Partner

Edward Jones Investment's chief executive officer is Penny Pennington. Pennington, the firm's sixth operating spouse, is guiding the business via an organizational rejuvenation and strategic shift that is driven by purpose, leader-led, and collaborative as Edward Jones enters the second half of the decade. Pennington joined Edward Jones in 2000 as an advisor to investors and rose to principal in 2006. She performed various managerial duties in the firm's St. Louis office until becoming a managing partner in 2019. She holds a bachelor's degree from the University of Virginia and also an MBA from the Kellogg School of Management at Northwestern University.

Lisa Dolan: Principal, Chief Operating Officer

Lisa Dolan is the COO of Edward Jones Investments, where she oversees the company's Operations and Management section, along with Firm Data analysis, Strategic Enabling, Organizing, as well as Workforce Resources.

Why Are Investors Diversifying Their Portfolio?

Experts agree that the financial market is now even more fragile than pre-2008. Will your retirement portfolio weather the imminent financial crisis? Threats are many. Pick your poison..

The financial system would be in great peril if one or more big banks fail. "When we get to a downturn, banks won't have the cushion to absorb the losses. Without a cushion, we will have 2008 and 2009 again."

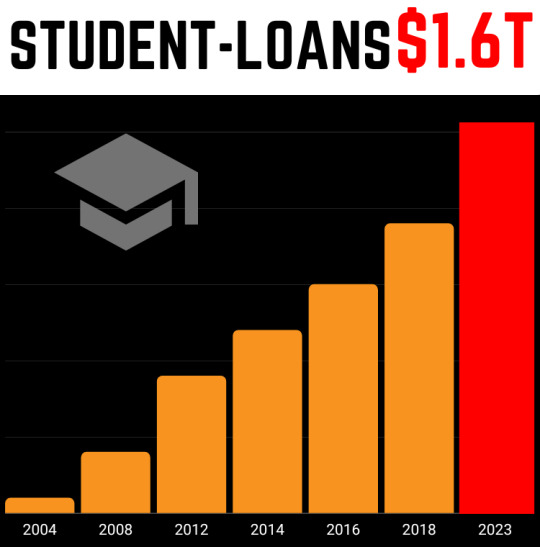

Student debt, which has been on a steep rise for years, could figure greatly in the next credit downturn. "There are parallels to 2008: There are massive amounts of unaffordable loans being made to people who can't pay them"

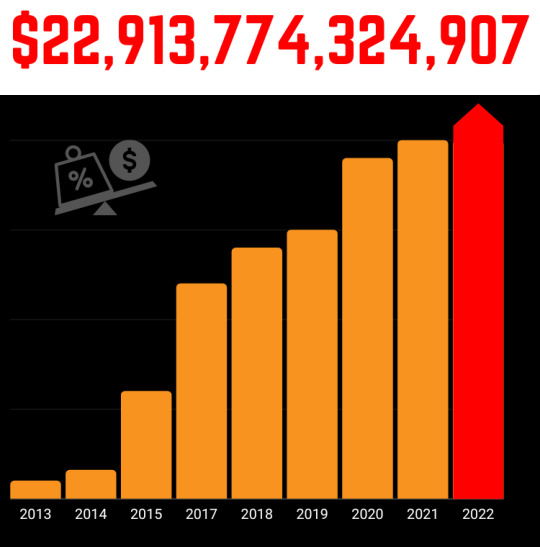

The US national debt has spiked $1 trillion in less than 6 months! "If we keep throwing gas on flames with deficit spending, I worry about how severe the next downturn is going to be--and whether we have enough bullets left ,"

Total household debt rose to an all-time high of $13.67 trillion at year-end 2019. "Any type of secured lending backed by an asset that is overvalued should be a concern… that is what happened with housing." Get in touch with an expert using the button down below:

Edward Jones Investments Products: All products offered by Edward Jones Investements

Independent Gold IRAs or another sort of self-directed account are not available from Edward Jones Investments. This means you won't be able to contribute to your IRA with physical metals that are precious via Edward Jones. Yet, the corporation has a choice of investing in gold mining companies or in metal-related traded funds.

Paper Gold

Edward Jones Investments claims to have one kind of investment referred to as Paper Gold. This primarily entails not purchasing gold bullion or any other kind of precious metals such as palladium, platinum, & silver. In reality, if somebody is interested in acquiring a paper-based picture of the desired precious metals. So it is assumed that an individual is selling you gold coins in a safe setting with rigorous restrictions in place to prevent fraud. Apart from an immediate paper trail to gold or other types of precious metals, mutual funds are another option. Custodians administer the metals that are precious for the brokers of the fund. Edward Jones provides Roth and standard IRAs, along with a variety of other fundamental investing alternatives such as: - Bonds - Stocks - Mutual Funds - Commodities - Units Investment Trusts

Additional Services provided by Edward Jones InvestmentsAll services offered by Edward Jones Investments

- Planning for Retirements - Wealth Strategies - Education Savings - Planning you Estate - Savings, Cash and Credit - Insurance Annuities - Business Solutions

For a detailed overview of the company, read: Edward Jones review.

Edward Jones Investments Fees and Charges: Do they overcharge?What are their fees? Do they have hidden fees?

Portfolio Strategy Fees These fees are computed based on the level of risk in your portfolio and the sum that you decide to invest in stocks or other types of investments. Therefore, for greater-value investors, the company's investment management fees may vary from 0.09% in the case of the Advisor Solutions Fund Plan to an additional 0.19 percent for the Advisory Solutions Universal Market Access (UMA) Plan.

Management Fees Management fees at Edward Jones vary depending on the kind of account and strategy for investing. This fee is determined by the total value of assets handled. The bigger the value associated with these investments, the smaller the proportion of charges payable.

Social Media Presence of Edward Jones Investments:Twitter, Facebook, & Instagram

Twitter Handle of Edward Jones The organization has a Twitter account. They have 193,000 followers along with 107 accounts. In 2009, Edward Jones joined Twitter.

Facebook Page of Edward Jones Edward Jones Investments has 83K followers on its Facebook account.

LinkedIn Page of Edward Jones The company has a LinkedIn profile with 231,244 followers.

Youtube Page of Edward Jones The company has 9.44K subscribers on its Youtube channel and they have posted around 54 videos.

Is Edward Jones Investments Legit? Should You Invest With Them?Is Edward Jones Investments a scam or legit? Are they worth it?

Edward Jones Investments, in my opinion, is not a legitimate company. It is entirely up to you whether or not to invest. Edward Jones Investments is a widely recognized investing firm that strives to give outstanding client service while charging hefty fees. Its target market is affluent people, and the approach to gathering is clearly long-term. Although the organization does not offer true Gold IRAs, it does offer a basic range of financial services that the majority of consumers ought to be acquainted with. If you're interested in Find the best Gold IRA company in your state Read the full article

0 notes

Text

Utah Bankruptcy Lawyers

Utah Bankruptcy Lawyers

A bankruptcy filing can be legally complicated, as well as time-intensive. In many cases, your first big decision and major time commitment will be finding a bankruptcy lawyer. While you may already have an attorney from your business, estate planning, or family matters, they might not be experienced in bankruptcy. More often, you will have to find an attorney from scratch. This can be well worth the effort because lawyers who practice exclusively in bankruptcy tends to do it quickly and cheaply.

Using a Bankruptcy Attorney

It may feel counterintuitive to pay attorney’s fees for help with your financial crisis. But professional assistance can mean the difference between a setback and a total loss when you have serious debt issues. You can have a free consultation with most bankruptcy attorneys to explain your situation and see if your personalities are a good fit. There is no legal obligation to have an attorney when you go into bankruptcy. However, bankruptcy law is a complicated and ever-changing system. Having knowledgeable assistance is a practical necessity.

An experienced bankruptcy attorney can help you: • Preserve valuable assets and explain your state-specific exemptions • Possibly avoid bankruptcy altogether • Reduce future negative outcomes and impacts of a bankruptcy action • Avoid pitfalls and common mistakes • Exercise your rights when applicable • Create a fair payment plan for debt • Explain options for informal debt relief actions • Communicate with your creditors • Establish a debt “workout” agreement • File paperwork for Chapter 7 and Chapter 13 bankruptcy processes • Ensure you pay the correct filing fees • Discuss foreclosure and future credit report options • Tell you what to expect in bankruptcy court and bankruptcy trustee appointments • Discuss buying a home after bankruptcy • Pursue your legal rights and protect your interests zealously

Having a bankruptcy attorney is increasingly important. In 2005, Congress passed the Bankruptcy Abuse Prevention and Consumer Protection Act. Among other changes, this law modified existing bankruptcy procedures. It shifted responsibility for providing documentation and proving your inability to pay debts to the bankruptcy debtor (you).

Choosing Your Attorney

You will want to meet with any attorney you consider hiring to see if you and the attorney can work together in general. You will really be interviewing the attorney just like you would interview a job applicant. Some bankruptcy attorneys run their offices like an assembly line, which is not necessarily bad. It means they won’t be wasting your time either. You need to decide whether the style of any given attorney is one with which you can work. Select the attorney with experience and an approach that fits well with you.

Questions Your Lawyer Will Ask About Bankruptcy

To do the best possible job on your behalf, your attorney needs your input and cooperation. At your first meeting with your attorney, you should be prepared to provide the following information and answer important questions. If you are filing with a spouse, be ready to share their information as well.

General Questions

• Will this be a joint bankruptcy petition? • What county do you live in? • How long have you lived at this address? • List previous addresses in the last two years • What is your Social Security number? • List all banks with which you have an account, and indicate whether they are checking or savings and the approximate balance • List all credit cards you have and the approximate balance • Do you have any shared bank accounts? • Have you had a safe deposit box in the last two years? (If yes, note the location and the contents of the safe deposit box) • Are you holding valuable property that belongs to another person? • Have you had a prior bankruptcy? (provide the case number, date filed, debts dismissed, and outcome) • Is any of your property in the hands of a receiver, trustee, or another liquidating agent? • Are you suing anyone right now? • Have you been involved in a workers’ compensation or personal injury lawsuit where you expect to recover money? • Have you had any repossessions in your past history? • Have you suffered any losses by fire, theft, or gambling during the last year? Family Questions • Are you single, married, or divorced? How long (if married or divorced)? • Have you used any other name(s) in the last six years? • What are the names and ages of minor children living with you? • What amount of child support or spousal support (alimony) do you pay? Debt Questions • Do you owe any money to the Internal Revenue Service? Which tax years? • Do you owe any money to state tax authorities? • Do you have any unpaid student loans? • Do you anticipate a substantial change in your expenses in the immediate future? • List the years in which your debt was incurred • Provide estimates for all monthly expenses: • Rent, mortgage, and real estate taxes • Electric, gas, trash, and water • Home maintenance • Life insurance and health insurance • Phone, cable, and internet bills • Auto insurance, gas, or car expenses • Homeowner/renter insurance • Food • Medical bills or items • Entertainment • Education • Clothing budget and laundry • Childcare Employment Questions • Who is your current employer? • How long have you been at your current job? • How often are you paid? • What is your income per pay period (gross and net income)? • Have you received income from any other source than your job last year (for instance, Social Security, child support, workers’ compensation, etc.)? • What amount of income have you made at your job in the past two years? • If you have more than one job, list year-to-date and two-years prior income information. • What amount of income have you received from other sources in the last two years? • Will you be eligible for a tax refund this year? How much? Business Questions • Have you been in a partnership with anyone during the last six years? • Have you been an officer in a corporation within the last six years? (If yes, give the name of the business and/or corporation, dates of operation, nature of business/corporation, and your approximate yearly income from the business.) • Have you given away, sold, or transferred any valuable item (over $1,000) in the last year? (If yes, state the nature of the sale or transfer, what was transferred, the price, and when it occurred.)

Documents Your Bankruptcy Attorney Needs

Once you hire an attorney to assist with your bankruptcy case, it is important to provide the information they need to best advice and represent you. Although every person’s financial life is different, some basic documents are virtually always helpful in better understanding your financial position.

Examples of important documents include, but are not limited to: • Bank statements • Your most recent bill from each creditor • A record of your most recent payments on cars, real estate, and student loans • Bills or invoices for purchases in the past year • Files from previous litigation, including judgments • Files from previous attorneys • Divorce decrees, child support orders, and information about other financial obligations • Canceled checks for any undocumented expenses • Mail or email correspondence with creditors • Insurance policies • Tax returns for the past three years • Vehicle titles • Lease or mortgage documents • Promissory notes • Proof of any other debts you owe or money owed to you

Bankruptcy cases can involve multiple people and creditors and take years of litigation. It can be a personal comfort to have someone who understands the system and is on your side.

Benefits of Hiring a Bankruptcy Lawyer

1. Hiring a lawyer increases your chances of successfully eliminating debt. In the case of Chapter 13 Bankruptcy, debtors represented by a lawyer are more than ten times more likely to reach a successful outcome than individuals representing themselves. 2. A lawyer can help you decide if bankruptcy is the right option for you. It is essential to evaluate and understand all of the options available to you when you are facing overwhelming debt. While it may seem like bankruptcy is your only choice, a lawyer may have a better solution for managing your debt without declaring bankruptcy. 3. You don’t know which bankruptcy option is best for your situation. An experienced bankruptcy lawyer will review your financial situation and explain your bankruptcy options. In Wisconsin, the two most common types of personal bankruptcy are a Chapter 7 Bankruptcy and a Chapter 13 Bankruptcy. Your state lawyers can help you identify which type best fits your current situation and guide you through the entire process. 4. A bankruptcy lawyer will help eliminate all eligible debts. A bankruptcy lawyer will know which debts can be discharged and the best type of bankruptcy to use to discharge your debt. For example, a lawyer can identify and eliminate debts beyond the statute of limitations for collections. You will also save money by fully discharging your obligations and not having lingering debts after completing your bankruptcy. 5. Experience is crucial to success. Do you know the Utah Bankruptcy Code? Do you know Utah District Courts’ bankruptcy laws? Do you know what property is exempt from bankruptcy? Filing for bankruptcy requires knowledge of the federal code and local case law. An experienced bankruptcy lawyer has worked on hundreds of cases and understands the intricate details of the process. A bankruptcy lawyer will be familiar with current laws, courtroom procedures, the bankruptcy filing process, and filing timeframes. 6. Hiring a lawyer saves you time. Hiring a lawyer saves you countless hours, as you no longer have to spend your time researching and reviewing bankruptcy information. In some cases, a lawyer can identify shortcuts and smooth out the scheduling process. A bankruptcy lawyer in your area will guide you through the complicated procedures and keep you informed at every stage. 7. You don’t have to handle the paperwork. Filing for bankruptcy requires accurate, detailed, and timely paperwork. It is crucial to have precise information and sufficient supporting documentation. While much of the information will come from you, a lawyer can help you complete the paperwork and provide legal advice on your disclosures, valuing assets, income, and expenses. 8. Lawyers have an established relationship with the bankruptcy court, judges, and trustees. A bankruptcy lawyer has gone through this before; they are familiar with bankruptcy courtroom etiquette. Lawyers have already built relationships with the people involved in the process, making communication easier for you. When the trustee asks for additional information or details, your bankruptcy lawyer will be prepared. 9. You get protection from harassment by creditors and collection agencies. Once you hire a bankruptcy lawyer, harassing phone calls from creditors will stop. Once a lawyer represents you, you can inform creditors or debt collectors and force their phone calls and letters to go through your lawyer instead. After you officially file, an automatic stay will be granted, which legally extends your harassment relief. 10. Lawyers offer you peace of mind and protection from uncertainty. Peace of mind goes a long way. You won’t have to worry about mistakes, losing your assets, or preparing for a court appearance. Your bankruptcy lawyer will advise you on what will happen ahead of time, complete your paperwork correctly, and sit by your side in creditor meetings or court. It is your lawyer’s responsibility to fight for the best outcome for you and protect your rights.

Risks of Filing Bankruptcy without a Bankruptcy Lawyer

One little mistake could cost you everything. If you file incorrectly or the filing is incomplete, the bankruptcy judge could throw out your case. If that happens, you may not be able to refile for any type of bankruptcy in the near future or if you can refile, you may lose protection from creditors taking action against you. Incorrectly listing assets could cost you not only your debt being discharged, but you could lose the possessions you sought to protect.

Bankruptcy lawyers know how to protect your assets and successfully lead you through the process.

Mistakes could mean criminal charges for fraud or perjury. Committing fraud in a bankruptcy case can land you in jail. You cannot hide assets or income from the bankruptcy trustee or judge (even those that you haven’t received yet). Do you know the law well enough to avoid this serious situation? Did you sign over a vehicle, deed property, gift money, or other assets to a friend or relative? A bankruptcy lawyer will help you file your petition and truthfully list your assets in a way that protects you from criminal charges. You may end up paying more of your debt. When communications between the bankruptcy trustee and your creditors occur, can you respond without negatively impacting your bankruptcy discharge? If a creditor files a lawsuit or contests your discharge of debt – how will you respond? A bankruptcy lawyer can protect your interests, effectively communicate with all parties involved, and save you money in negotiating with creditors.

Free Initial Consultation with Lawyer

It’s not a matter of if, it’s a matter of when. Legal problems come to everyone. Whether it’s your son who gets in a car wreck, your uncle who loses his job and needs to file for bankruptcy, your sister’s brother who’s getting divorced, or a grandparent that passes away without a will -all of us have legal issues and questions that arise. So when you have a law question, call Ascent Law for your free consultation (801) 676-5506. We want to help you!

Ascent Law LLC 8833 S. Redwood Road, Suite C West Jordan, Utah 84088 United States Telephone: (801) 676-5506

Ascent Law LLC

4.9 stars – based on 67 reviews

Recent Posts

Utah Bankruptcy

Utah Bankruptcy Attorney

Utah Bankruptcy Lawyer

Business Lawyers

Estate Planning Lawyer

Divorce Lawyer and Family Law Attorneys

Ascent Law St. George Utah Office

Ascent Law Ogden Utah Office

The post Utah Bankruptcy Lawyers appeared first on Ascent Law.

from Ascent Law https://ascentlawfirm.com/utah-bankruptcy-lawyers-2/

0 notes

Text

How Does Debt Work During Divorce

Divorce can be emotionally and financially challenging, and one aspect that often adds complexity is debt. Understanding how debt works during divorce is crucial for ensuring a fair resolution. In this comprehensive guide, we'll delve into the intricacies of debt division, the role of a San Jose divorce lawyer, and why AffordableandExpressLegal.com is your ideal partner during this difficult time.

Understanding Debt Division in Divorce

Divorce involves the division of assets and liabilities, including debt. In community property states like California, debts acquired during the marriage are typically considered marital debt, regardless of whose name is on the account. This means that both spouses are usually responsible for repaying these debts, regardless of who incurred them.

Types of Debt

Secured Debt: This includes mortgages and car loans, where the debt is secured by the property itself. During divorce, these debts may be assigned to the spouse who will retain ownership of the asset.

Unsecured Debt: Credit card debt, personal loans, and medical bills fall under this category. Courts may divide these debts equitably based on factors such as each spouse's income and financial circumstances.

Joint Debt: Debts jointly acquired by spouses are typically divided equally during divorce, unless there are extenuating circumstances.

The Role of a San Jose Divorce Lawyer

Navigating debt division during divorce can be complex, requiring legal expertise to ensure your rights are protected. A San Jose divorce lawyer specializes in family law and can provide invaluable assistance in the following areas:

Legal Guidance: A skilled attorney will explain your rights and obligations regarding debt division, helping you make informed decisions.

Negotiation: Your lawyer will negotiate with your spouse's legal representation to reach a fair settlement, minimizing conflict and stress.

Court Representation: In cases where an agreement cannot be reached, your lawyer will represent you in court, advocating for your interests before the judge.

Why Choose Us:

Affordability: We understand that divorce proceedings can strain finances, which is why we offer competitive rates and flexible payment options.

Expertise: Our team of experienced San Jose divorce lawyers is well-versed in California family law, ensuring thorough and effective representation.

Compassionate Support: We prioritize empathy and understanding, providing personalized attention to each client's unique situation.

Efficiency: With AffordableandExpressLegal.com, you can expect prompt and efficient handling of your case, minimizing delays and expediting the divorce process.

FAQ

Q: What happens to joint credit card debt during divorce?

A: In most cases, joint credit card debt acquired during the marriage is divided equally between spouses. However, if one spouse agrees to take responsibility for the debt, they may need to refinance the account in their name alone.

Q: Will my spouse be responsible for my student loans after divorce?

A: Whether your spouse is responsible for your student loans depends on various factors, including whether the loans were acquired before or during the marriage and the laws of your state. Consulting with a San Jose divorce lawyer can provide clarity on this issue.

Q: Can I be held responsible for my spouse's premarital debt?

A: In community property states like California, pre-marital debts are typically considered separate property. However, if those debts were commingled with marital assets or used for the benefit of the marriage, they may be subject to division during divorce proceedings.

Q: What if my spouse refuses to pay their share of the marital debt?

A: If your spouse refuses to fulfill their obligations regarding marital debt, you may need to seek legal intervention. A San Jose divorce lawyer can assist you in enforcing the terms of your divorce agreement or petitioning the court for a resolution.

Q: How can I protect myself from future liability for joint debts after divorce?

A: One option is to work with your San Jose divorce lawyer to include provisions in your divorce settlement that specify each spouse's responsibility for joint debts and outline consequences for non-compliance. Additionally, closing joint accounts and opening individual accounts can help prevent future liability.

Conclusion

Navigating debt during divorce requires careful consideration and expert guidance. A San Jose divorce lawyer from AffordableandExpressLegal.com can provide the legal support you need to achieve a fair resolution. Don't face this challenging time alone—contact us today to schedule a consultation and take the first step towards a brighter future.

Reference URL :- How Does Debt Work During Divorce

0 notes