#What is 1 U.S. dollar to 1 Pound?

Explore tagged Tumblr posts

Text

B-1 Refusals.

The Rockwell B-1 Lancer is a supersonic variable-sweep wing, heavy bomber used by the United States Air Force. It has been nicknamed the "Bone" (from "B-One"). As of 2024, it is one of the United States Air Force's three strategic bombers, along with the B-2 Spirit and the B-52 Stratofortress. Its 75,000-pound (34,000 kg) payload is the heaviest of any U.S. bomber.

And I literally refused to continue repairing them; which made an impact on Congress apparently....

My military career was focused on repairing each of these Bomber which is valued at more than one-billion dollars; that was before six-years of inflation.

Sitting here and piecing together my personal history up to this point; I think that it was *more* important to my own personal safety to *stop* working on these things.

I've written at length about my own intelligence, my skill as an Aircraft Mechanic and Diagnostician, the value these aircraft bring to the U.S, the hurdles I faced as an enlisted mechanic, PTSD relating to certain events that these craft were involved in, and previously; Exactly why I was underpaid and overwhelmed in the performance of my duties.

I refused to go back to the B-1s... Not once, but three times in the last few years of my career when I requested a special duty in education and training material development.

I keep hitting on this idea that "They let me be a computer programmer" as the primary reason for accepting that special duty.

I'm not certain that's the whole truth anymore.

I hate singing my own praises. I don't like the concept of self-promotion because it feels like I'm trying to force people to believe my own crap.

I fairly certain that my past success, while interspersed with professional failure ... Would have gotten me killed.

Going back to fix more B-1s especially in a deployment environment would have gotten me Targeted with a threat that your average enlisted person just doesn't get... especially not a random Staff Sergeant.

There have been reports of High Value targets before.... One particular report of an Army Sergeant responsible for a few deaths being targeted by foreign terrorist organizations rings in my mind.

And that's why I think my personal "spidey-sense" would not stop going off for such a long time.

Because if I was a High-Value target; undervalued by the Air Force....

Well what's the risk/reward chart look like for that?

Low-Risk/High-Value target; Holy shit... That's me.

A lot of what I have to go on is unverified.

If I had been taken out; that would have literally had such a huge impact on the mission; I can't calculate it.

I couldn't accept working on the B-1 again... Not after the Air Force gave me the literal tools to calculate my worth as a target for the enemy.

And what's worse; I couldn't figure out exactly what the Air Force Machine as a whole was thinking; that they, not only wouldn't warn me directly; they purposefully devalued me.

On top of the mission and operational PTSD I was dealing with; I think I know exactly where my Burnout came from.

When I enlisted... I didn't trust the military; but I understood the reasoning and value behind certain decisions. Even if they weren't in my own best interest. After making it through basic and tech training; I trusted those decisions more.

But at that point at the end of my enlistment... I could no longer understand the reasoning or justifications around *me* specifically.

Especially not after proving myself in an entirely separate career field I was "never trained" to do. (By the AF)

I was a 7-level... As Craftsman, according to the AF; in at least two completely separate career fields; and that didn't matter.

What the hell am I supposed to do then?

What the hell is going on?

Am I literally just unable to associate with people at my own level who are responsible for vouching for me? Or is it something else ...

What else could that be? I'm a master Diagnostician in both Aircraft and Software .... I should be able to figure it out, right?

The correct answer, I think; Was to Quit.

"Quitters never Prosper" they say... And they *weren't* wrong; it's been a kind of hell ever since.

But I cannot guarantee the kind of Hell I would have otherwise faced or not faced had I stayed in.

And everything pointed to "Stay away from the B-1s"

My gut feeling; the last bastion would not shut-up about it. It wasn't *only* that I wanted to do what I wanted to.

I would have done it earlier if that were the case.

It was something bigger. Deeper, more than I was even allowed to perceive at the time.

My Gut feeling; Stay Away, Danger, that Spidey-Sense that just wouldn't quiet down.

Something deeply wrong that I can't quantify has or will happen; and the Air Force doesn't seem to know what to do about it either.

With everything that's happened so far; I can't say it was the wrong choice yet. Just that I don't know.

9 notes

·

View notes

Text

Subscriptions

PLAY GAMES. RAW WORD DAILY

SUBSCRIBE FOR $1

About usGamesUS NEWSInvestigationsOpinionvideoHELPget the newsletter

RawStory+ Login

PLAY RAW WORD DAILY.

SUBSCRIBE FOR $1

Home

Shop to Support Independent Journalism

Trump

U.S. News

World

Science

Video

Investigations

Ethics Policy

RawStory+ Login

Why has America tolerated 6 illegitimate Republican presidents?

Thom Hartmann

April 15, 2024 9:11AM ET

"Ronald and Nancy Reagan, 1964” image showing The Reagans aboard an unidentified boat in this 1964 photo released on June 1, 2016. Courtesy The Ronald Reagan Presidential Foundation/Handout via REUTERS

As we watch the Trump campaign prepare to replace 50,000 civil servants with fascist toadies if he wins the White House, it’s important to remember that Dwight Eisenhower was the last Republican president who believed in democracy, the rule of law, and that government should prioritize what the people want.

From 1960 to today a series of leaders within the Republican Party have abandoned the democracy that American soldiers fought the Revolutionary War to secure, the Civil War to defend here at home, and World War II in Europe and the Pacific to defend around the world.

This has brought us a series of criminal Republican presidents and corrupt Republican Supreme Court justices, who’ve legalized political bribery while devastating voting and civil rights.

None of this was a mistake or an accident, because none of these people truly believed in democracy.

This rejection of democracy and turn toward criminality and it’s logical end-point, fascism, started in the modern GOP with Richard Nixon.

He took millions in now-well-documented bribes both while Vice President to Eisenhower and as President (his VP, Spiro Agnew, resigned rather than go to prison for taking bribes). Nixon saw public service as a way to bathe himself in money, power, and adulation.

He didn’t care a bit about democracy.

As Lamar Waldron and I point out in detail in Legacy of Secrecy: The Long Shadow of the JFK Assassination, then-President Eisenhower’s then-Vice President, Richard Nixon, was getting beat up badly in the 1960 election by his opponent, Senator John F. Kennedy.

Most of it had to do with Cuba, where mobsters affiliated with Nixon for decades had just lost fortunes, millions and millions of dollars in annual revenue.

After the Cuban revolution of 1959, Castro came to the US to seek military and economic aid for his island nation; Eisenhower left town, forcing Castro to meet instead with VP Nixon.

Given that Castro had just overthrown the dictator Batista, a friend of both Nixon and Nixon’s mafia patrons, the Vice President essentially blew off Castro, sending him into the welcoming arms of Nikita Khrushchev’s Soviet Union.

Thus, throughout the 1960 presidential race, Senator Kennedy pounded on Vice President Nixon for having “let Cuba go communist” on his watch. In response, Vice President Nixon put together a series of CIA and Mafia plots to assassinate Castro, timed to happen before the November 1960 election.

His hope was that if the Eisenhower/Nixon administration could be seen as having successfully overthrown Castro in 1960 it would de-fang JFK’s attacks and make Nixon — who Eisenhower had put in charge of Cuba policy — a national hero just in time for the election.

Nixon figured that would be enough to help him beat JFK at the polls. It was going to be his “October Surprise.” (The remnant of this scheme was the failed Bay of Pigs invasion.)

For Nixon democracy was just an inconvenience, an obstacle to be conquered. He never really believed in it.

You can imagine Nixon’s frustration when plot after plot was bungled or foiled and, by election day, Castro was still happily ensconced in the Havana presidential palace. This appears to be the moment Nixon decided that, if he had a chance to run for president again, he’d not just consider a CIA-Mafia plot but would embrace far more extreme measures.

Thus began the first Republican plot to commit full-out treason to win a presidential election.

It started in the summer of 1968, when President Lyndon Johnson was desperately trying to end the Vietnam war. It had turned into both a personal and political nightmare for him, and his vice president, Hubert Humphrey, was running for President in the election that year against a “reinvented” Richard Nixon.

Johnson spent most of late 1967 and early 1968 working back-channels to North and South Vietnam, and by the summer of 1968 had a tentative agreement from both for what promised to be a lasting peace deal they’d both sign that fall.

But Richard Nixon knew that if he could block that peace deal, it would kill VP Hubert Humphrey’s chances of winning the 1968 election. So, Nixon sent envoys from his campaign to talk to South Vietnamese leaders to encourage them not to attend upcoming peace talks in Paris.

The bribe was straightforward: Nixon promised South Vietnam’s corrupt politicians that he’d give them a richer deal when he was President than LBJ could give them then.

The FBI had been wiretapping these international communications and told LBJ about Nixon’s effort to prolong the Vietnam War. Thus, just three days before the 1968 election, President Johnson phoned the Republican Senate leader, Everett Dirksen, (you can listen to the entire conversation here):

President Johnson: “Some of our folks, including some of the old China lobby, are going to the Vietnamese embassy and saying please notify the [South Vietnamese] president that if he’ll hold out ’til November 2nd they could get a better deal. Now, I’m reading their hand. I don’t want to get this in the campaign. And they oughtn’t to be doin’ this, Everett. This is treason.” Sen. Dirksen: “I know.”

Those tapes were only released by the LBJ library in the past decade, and that’s Richard Nixon who Lyndon Johnson was accusing of treason.

At that point, for President Johnson, it was no longer about getting Humphrey elected. By then Nixon’s plan had already worked and Humphrey was way down in the polls because the war was ongoing.

Instead, Johnson was desperately trying to salvage the peace talks to stop the death and carnage as soon as possible. He literally couldn’t sleep.

In a phone call to Nixon himself just before the election, LBJ begged him to stop sabotaging the peace process, noting that he was almost certainly going to win the election and inherit the war anyway. Instead, Nixon publicly announced that LBJ’s efforts were “in shambles.”

But South Vietnam had taken Nixon’s deal and boycotted the peace talks, the war continued, and Nixon won the White House thanks to it.

An additional twenty-two thousand American soldiers, and an additional million-plus Vietnamese died because of Nixon’s 1968 treason, and he left it to Jerry Ford to end the war and evacuate the American soldiers.

Nixon appointed Harry Blackmun, Lewis Powell, and William Rehnquist to the Supreme Court, pushing it hard to the right and setting up the predecessors of Citizens United.

Rehnquist, we later learned, didn’t believe any more in democracy than did Nixon. He’d made his chops in the GOP with Operation Eagle Eye, standing outside polling places in Hispanic and Native American precincts in Arizona challenging every voter who showed up there’s right to cast a ballot.

Nixon was never held to account for that treason, and when the LBJ library released the tapes and documentation long after his and LBJ’s deaths it was barely noticed by the American press.

Gerald Ford, who succeeded Nixon, was never elected to the White House (he was appointed to replace VP Spiro Agnew, after Agnew was indicted for decades of taking bribes), and thus would never have been President had it not been for Richard Nixon’s treason.

Ford pardoned Nixon and appointed John Paul Stevens to the Supreme Court.

Next up was Ronald Reagan. He not only didn’t believe in democracy, he didn’t even believe in the American government.

Like Trump, he ridiculed public service like joining the military or getting a job with a government agency; he joked that there were no smart or competent people in government because if there had been, private industry would have already hired them away.

So, if you don’t believe in democracy and you think the US government is a joke, it’s not a big deal to betray your country to get the wealth, power, and fame that goes with the presidency.

During the Carter/Reagan election battle of 1980, then-President Carter had reached a deal with newly-elected Iranian President Abdolhassan Bani-Sadr to release the fifty-two hostages held by students at the American Embassy in Tehran.

Bani-Sadr was a moderate and, as he explained in an editorial for The Christian Science Monitor, successfully ran for President that summer on the popular position of releasing the hostages:

“I openly opposed the hostage-taking throughout the election campaign…. I won the election with over 76 percent of the vote…. Other candidates also were openly against hostage-taking, and overall, 96 percent of votes in that election were given to candidates who were against it [hostage-taking].”

Carter was confident that with Bani-Sadr’s help, he could end the embarrassing hostage crisis that had been a thorn in his political side ever since it began in November of 1979.

But, like Nixon, behind Carter’s back the Reagan campaign worked out a deal with the head of Iran’s radical faction — Supreme Leader Ayatollah Khomeini — to keep the hostages in captivity until after the 1980 Presidential election. Khomeini needed spare parts for American weapons systems the Shah had purchased for Iran, and the Reagan campaign was happy to promise them.

This was the second act of treason by a Republican wanting to become president.

The Reagan campaign’s secret negotiations with Khomeini — the so-called 1980 “Iran/Contra Scandal” — sabotaged President Carter’s and Iranian President Bani-Sadr’s attempts to free the hostages. As President Bani-Sadr told The Christian Science Monitor in March of 2013:

“After arriving in France [in 1981], I told a BBC reporter that I had left Iran to expose the symbiotic relationship between Khomeinism and Reaganism.

“Ayatollah Khomeini and Ronald Reagan had organized a clandestine negotiation, later known as the ‘October Surprise,’ which prevented the attempts by myself and then-US President Jimmy Carter to free the hostages before the 1980 US presidential election took place. The fact that they were not released tipped the results of the election in favor of Reagan.”

And Reagan’s treason — just like Nixon’s treason — worked perfectly, putting a third Republican president in office after Nixon and Ford. Neither Nixon nor Reagan believed in or held up democracy and the rule of law that underpins it as a value.

The Iran hostage crisis continued and torpedoed Jimmy Carter’s re-election hopes. And the same day Reagan took the oath of office — to the minute, as Reagan put his hand on the bible, by way of Iran’s acknowledging the deal — the American hostages in Iran were released.

Keeping his side of the deal, Reagan began selling the Iranians weapons and spare parts in 1981 (and using the money to illegally fund rightwing neofascist death squad “Contras” in Nicaragua) and continued until he was busted for it in 1986, producing the so-called “Iran Contra” scandal.

Reagan appointed Sandra Day O’Connor, Antonin Scalia, and Anthony Kennedy to the Supreme Court, solidifying its rightwing tilt. We’d learn, in the Bush v Gore case in 2000 when they awarded the White House to the son of Reagan’s VP, that none of the three of them valued democracy.

And, like Nixon, Reagan was never held to account for the criminal and treasonous actions that brought him to office.

After Reagan, Bush senior was elected but, like Jerry Ford, Bush was only President because he’d served as Vice President under Reagan. And, of course, the naked racism of his Willie Horton ads helped keep him in office.

The criminal investigation into Iran/Contra came to a head with independent prosecutor Lawrence Walsh subpoenaing President George HW Bush after having already obtained convictions for Weinberger, Ollie North and others.

For the first time in history, the President of the United States could go to jail for criminal conspiracy. Bush was sweating.

George HW Bush’s attorney general, Bill Barr (yes, the same guy Trump hired), suggested he pardon all six co-conspirators — who could point a finger at Bush — to kill the investigation. Bush did it on Christmas Eve, hoping to avoid the news cycle because of the holiday.

Nonetheless, the screaming headline across the New York Times front page on December 25, 1992, said it all: “THE PARDONS: BUSH PARDONS 6 IN IRAN AFFAIR, ABORTING A WEINBERGER TRIAL; PROSECUTOR ASSAILS 'COVER-UP’”

If the October Surprise hadn’t hoodwinked voters in 1980, you can bet Bush senior would never have been elected in 1988.

That’s four illegitimate Republican presidents.

President GHW Bush appointed Clarence Thomas and David Souter to the Supreme Court. We learned quickly that Thomas doesn’t value democracy. We now know his wife actively worked to subvert it, in fact.

Which brings us to George W. Bush, the man who was given the White House by five Republican-appointed justices on the Supreme Court.

In the Bush v. Gore Supreme Court decision in 2000 that stopped the Florida recount and thus handed George W. Bush the presidency, Justice Antonin Scalia (appointed by Bush’s father’s boss) wrote in his opinion:

“The counting of votes … does in my view threaten irreparable harm to petitioner [George W. Bush], and to the country, by casting a cloud upon what he [Bush] claims to be the legitimacy of his election.”

Apparently, denying the presidency to Al Gore, the guy who actually won the most votes in Florida and won the popular vote nationwide by over a half-million, did not constitute “irreparable harm” to Scalia or the media.

And apparently it wasn’t important that Scalia’s son worked for a law firm that was defending George W. Bush before the high court (with no Scalia recusal).

Just like it wasn’t important that Justice Clarence Thomas’s wife worked on the Bush transition team — before the Supreme Court shut down the recount in Florida — and was busy accepting resumes from people who would serve in the Bush White House if her husband stopped the recount in Florida…which he did. There was no Thomas recusal, either.

None of them believed in democracy.

More than a year after the election a consortium of newspapers including The Washington Post, The New York Times, and USA Today did their own recount of the vote in Florida — manually counting every vote in a process that took almost a year — and concluded that Al Gore did indeed win the presidency in 2000.

As the November 12th, 2001 article in The New York Times read:

“If all the ballots had been reviewed under any of seven single standards and combined with the results of an examination of overvotes, Mr. Gore would have won.”

That little bit of info was slipped into the seventeenth paragraph of the Times story so that it would attract as little attention as possible, because the 9/11 attacks had happened just weeks earlier and the publishers of the big newspapers feared that burdening Americans with the plain truth that George W. Bush lost the election would further hurt a nation already in crisis.

To compound the crime, Bush could only have gotten as close to Gore in the election as he did because his brother, Florida Governor Jeb Bush, had ordered his Secretary of State, Kathrine Harris, to purge at least 57,000 mostly-Black voters from the state’s voter rolls just before the election.

Tens of thousands of African Americans showed up to vote and were turned away from the polls in that election in Florida. BBC covered it extensively, although the American media didn’t seem interested.

So, for the third time in 4 decades, Republicans took the White House under illegitimate electoral circumstances. Even President Carter was shocked by the brazenness of that one. And Jeb Bush and the GOP were never held to account for that crime against democracy.*

President George W. Bush appointed Samuel Alito to the Supreme Court. Alito not only doesn’t believe in democracy, he also doesn’t believe in a woman’s right to get an abortion. He’d put a judge like himself between a woman and her doctor, with a police officer and a prison to enforce his decree.

Most recently, in 2016, Trump ally Kris Kobach and Republican Secretaries of State across the nation used Interstate Crosscheck to purge millions of legitimate voters — most people of color — from the voting rolls just in time for the Clinton/Trump election.

Meanwhile, Russian oligarchs and the Russian state, and possibly pro-Trump groups or nations in the Middle East, funded a widespread program to flood social media with pro-Trump, anti-Clinton messages from accounts posing as Americans, as documented by Robert Mueller’s investigation.

And on top of that, we learned in 2020 that Republican campaign data on the 2016 election, including which states needed a little help via phony influencers on Facebook and other social media, was not only given to Russian spy and oligarch Konstantin Kilimnik by Trump’s campaign manager Paul Manafort, but Kilimnik transferred it to Russian intelligence.

Even with all that treasonous help from Russia, Donald Trump still lost the national vote by nearly 3 million votes but came to power in 2016 through the electoral college, an artifact of the Founding era designed to keep slavery safe in colonial America.**

And then, in 2021, after losing to Joe Biden by 7 million votes, Trump mounted a seditious effort to overturn the election he’d just lost.

Trump didn’t believe in democracy in the least; he openly fawned over autocratic and fascistic states and their leaders.

After Mitch McConnell and Senate Republicans blocked President Obama’s nomination of Merrick Garland to the Supreme Court, President Donald Trump filled Garland’s spot with Neil Gorsuch, the son of Reagan’s disgraced former EPA administrator, Anne Gorsuch.

For reasons that are still unclear, shortly after Trump mentioned Kennedy’s son to him publicly at the Gorsuch ceremony, Justice Kennedy decided to resign. Whether it had anything to do with young Justin Kennedy — then working at Deutsche Bank and having signed off on over a billion dollars in corrupt loans to Trump — is still unknown, and Kennedy, still in good health, isn’t talking.

Kennedy was replaced by “Blackout” Brett Kavanaugh, who had previously worked in the Bush White House. Republicans refused to turn over 95 percent of Kavanaugh’s papers to the Senate Judiciary Committee and jammed through his nomination after an epic meltdown on live television.

When Ruth Bader Ginsberg died just before the 2020 election, McConnell decided his “Garland Rule” was irrelevant and jammed through Trump’s nomination of Amy Coney Barrett in about six weeks; she was sworn in on October 27, 2020. When Democrats raised questions about Barrett’s role as a “Handmaid” (what she called herself) in a bizarre Catholic cult they were brushed aside.

Trump appointed Neil Gorsuch, Brett Kavanuagh, and Amy Coney Barrett to the Supreme Court. We now know none of the three of them believe in democracy, either.

Fifty-four years of Republican presidents using treason to achieve the White House (or inheriting it from one who did) has transformed America and dramatically weakened our democracy.

Those presidents have contributed their own damages to the rule of law and democracy in America, but their cynical Supreme Court appointments have arguably done the most lasting damage.

Republican appointees on the Court during this time have gutted the Civil Rights Act, the Voting Rights Act, union rights, the Affordable Care Act, and legalized Republican voter purges. They legalized the bribery of politicians by billionaires and corporations.

In short, they’ve done everything they can to weaken democracy and enforce minority rule in America.

One of their wives appears to have been involved in the January 6th attempted overthrow of our electoral process and thus our republic. Republican justices and judges openly flaunt the judicial code of ethics and routinely hand decisions to the GOP’s largest donors.

Today’s fascistic behavior by elected Republicans and their appointees on the courts has a long history, deeply rooted in multiple acts of treachery and treason. “Power at any cost” has been their slogan ever since Nixon’s attempts to assassinate Castro in 1960 to beat JFK in that year’s election.

Democracy? They laugh.

Which is why it’s time to call the Republican Party what it is: a criminal enterprise embracing fascism to hang onto power, a threat to our republic, and a danger to all life on Earth.

*For more detail, this is extensively documented and footnoted in my book The Hidden History of the Supreme Court and the Betrayal of America.

**This is covered in depth in my book The Hidden History of the War On Voting.

7 notes

·

View notes

Text

What is Forex Currency Pairs?

buying or selling one forex pair against another. It’s like the currencies are in a constant tug of war. This is caused by the rapid fluctuations of the exchange rate.

What is Base Currency & Quote Currency?

The first currency of a forex pair is called “Base Currency”. Base currency represents how much is needed to buy a single unit of the second currency or quote currency in a forex pair.

Similarly, the second pair is called “Quote Currency”. They are separated with a forward slash (“/”). Currency quotes is the amount of units of the quote currency you will need to exchange one unit of base currency.

For example, 1 Dollar, 1 Pound, 1 Euro, etc. The calculation is- 1 unit of Base Currency can buy X units of the quote currency. If the base currency is USD, such as USD/JPY, a quote of USD/JPY 88.48 means that one U.S. dollar is equal to 88.48 Japanese yen. Likewise, if the base currency is EUR, such as EUR/USD, then a quote of 1.3980 means that one Euro is equal to 1.3980 US Dollars.

3 notes

·

View notes

Text

TOP SECRET GOVERNMENT FUNDED COLLECTION, LOCATED IN LOWER MANHATTAN

What you're about to see and read is something that has been kept completely unknown by not just the general public but also several organizations in the U.S. Government as well with this being kept under lock and key by its owner and collected by the people who've helped fund this.

Actually let's cut the bullshit, what this is is a grittier, ultra-hidden, more surreal but also strangely more airier take and combination on and of Warehouse 13 and the SCP Foundation.

Hidden through an alleyway in lower Manhattan, New York, the secret entrance to it is through both a giant elevator straight out of a storage unit or an emergency exit with flights of stairs that you'd almost find in any abandoned warehouses or buildings of sorts. Whichever the way, they take you down to an underground place that's best described as a weird combination of sewer tunnels and a warehouse with sliding doors at the end to the real deal.

When one of the doors is open, here's what you find —

An entire, no VAST collection in a VAST underground warehouse filled left and right with all of these numerous different objects and items that have been collected and stored away from the public and from all of these equally numerous different events. All of them are highly organized in their own distinct sections with their histories written down alongside with them in one way or another.

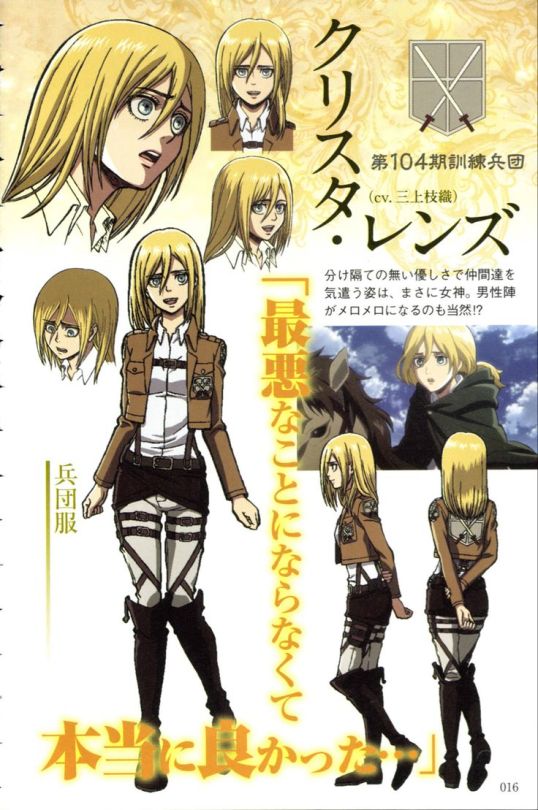

But before we get to what's in this warehouse, who is the owner of this place that aforementioned keeps it under lock and key — at first, it was simply just one owner however now that's officially changed to TWO owners. Mikasa Ackerman and her wife Historia Reiss.

A former Eldian soldier and the former Eldian Queen, Mikasa's reasoning for doing this is kept completely 100% ambigious but how did Historia get dragged into this?

She followed Mikasa one night to where she was going, she discovered and quietly followed her into the entire warehouse..... only to be "discovered" by Mikasa who already knew she was there and had been following her from the immediate getco. The result was an entire chase that ended with Mikasa sinking her teeth into Historia's left ass cheek.

But what is in this warehouse:

• A 5 1/2" barrel Colt Single Action Army Artillery revolver (A Fistful Of Dollars) with silver rattlesnake inlays on the grips (For A Few Dollars More) and a Colt 1851 Navy revolver with cartridge conversion and the same silver rattlesnake inlays on the grips as well (The Good, The Bad and the Ugly).

• A Colt Model 1873 Single Action Army Revolver, a Smith & Wesson Model 3 "Schofield" Revolver, an FN Model 1903 Pistol, a Spencer Model 1865 Carbine, and a Remington Rolling Block Rifle (Red Dead Redemption).

• A Borchardt C-93, Colt 1851 Navy, Colt New Army & Navy, Colt Single Action Army, FN Model 1900, LeMat Revolver, Mauser C96, Smith & Wesson Schofield Model 3, Volcanic Repeater, Carcano M91/38, Elephant Rifle, Henry 1860, Krag-Jørgensen Rifle, Spencer Model 1860 Carbine, Browning Auto-5, 12 Gauge Double Barreled Shotgun, Sawed Off Shotgun, Winchester Model 1887, Winchester Model 1897 and bow and arrows (Red Dead Redemption 2).

• A large-bore 4-shot double-action revolver forged from a combination of Irish church bells, cold iron from crucifixes and blessed silver. Its wooden grips, estimated to be nearly 2000 years old, are engraved with a logo of a raised fist holding a dagger. Weighing in at about 10 pounds unloaded and chambered for custom 22mm cartridges, it has enough muzzle energy and recoil to break a normal man's arm (Mike Mignola's Hellboy Comic Series).

• An ornate golden ring with a large red stone in an unusual setting, not found in any Earth jeweler's catalog (Flash Gordon).

And believe it or not, that's just five. There's plenty of more where that came from. If you wanna do a retroactive shared universe than this is how you do it, my friends.

#attack on titan#mikasa ackerman#historia reiss#top secret#scp fandom#fictional conspiracy theories#a fistful of dollars#a few dollars more#the good the bad and the ugly#red dead redemption 2#red dead redemption#hellboy#comics#flash gordon

3 notes

·

View notes

Text

The Hidden Jobless Claims Hack Every GBP/USD Trader Should Know Why Jobless Claims Are the Ultimate GBP/USD Game-Changer (And No One Talks About It) Imagine walking into a casino where the house tells you exactly when the odds shift in your favor. That’s what understanding jobless claims can do for your British Pound to US Dollar (GBP/USD) trades. Yet, many traders overlook this crucial economic indicator, focusing instead on flashy charts and overused strategies. The Jobless Claims ‘Whisper’ That Moves the GBP/USD Every Thursday, the U.S. releases its initial jobless claims report. It’s a straightforward number—the count of Americans filing for unemployment benefits for the first time. But here’s the kicker: this ‘boring’ number holds the power to shake the GBP/USD currency pair more than many traders realize. When jobless claims rise unexpectedly, it signals weakness in the U.S. economy, making the dollar weaker and pushing GBP/USD higher. Conversely, a strong labor market report can strengthen the USD and sink GBP/USD. It’s like checking a patient’s heartbeat—one number can tell you if the economy is thriving or barely holding on. The Secret ‘Front-Run’ Strategy Hedge Funds Use (But Retail Traders Ignore) Most traders react to jobless claims after the release. The smart money, however, anticipates it before the data drops. How? They analyze: - Seasonal Hiring Trends: Major layoffs (post-holidays, post-summer) often create predictable spikes. - Corporate Layoff Announcements: Big companies cutting jobs often hint at a jump in claims. - ADP Payroll Data: While not identical, it provides clues about broader employment trends. If hedge funds are positioning early, why are you waiting until the last second? How to ‘Hack’ Jobless Claims to Predict GBP/USD Swings - Compare the Forecast vs. Actual Data: If the claims data exceeds forecasts significantly, expect the USD to weaken and GBP/USD to rise. - Watch the Previous Week’s Revisions: Many traders miss this, but sometimes, the revised numbers matter more than the fresh report. - Pair it With Other Data: If jobless claims are high and Non-Farm Payrolls (NFP) is weak, GBP/USD may be in for a longer rally. - Avoid the Knee-Jerk Reaction: The first move after the data release isn’t always the right move. Institutions often ‘fade’ the initial spike. Why Most Traders Get It Wrong (And How You Can Be Different) Most retail traders make these mistakes when trading GBP/USD around jobless claims: - Overreacting to the Headline Number: Markets digest data in layers; wait for deeper institutional moves. - Ignoring Revisions: The market often reacts more to past revisions than new numbers. - Forgetting Correlation with Other USD Pairs: Look at EUR/USD, USD/JPY, and DXY to confirm broader trends. If you avoid these mistakes, you instantly trade like the top 1%. Next-Level Tactics: What the Smartest GBP/USD Traders Do Differently 1. Combine Jobless Claims With Sentiment Data Many pro traders cross-check jobless claims with COT (Commitment of Traders) reports. If institutional traders are already bearish on USD, a weak jobless claim number could accelerate the GBP/USD rally. 2. Trade the ‘Delayed Reaction’ Window Sometimes, the best trade isn’t in the first 10 minutes but one hour later. Let the market overreact, watch for smart money positioning, then ride the real move. 3. Use a Smart Trading Tool to Time Entries Instead of guessing, use advanced tools like the StarseedFX Smart Trading Tool (Get it here) to optimize lot sizes and manage risks with precision. Final Takeaway: The GBP/USD Edge Most Traders Overlook By mastering jobless claims, you tap into an insider-level advantage. Hedge funds and institutional traders don’t guess—they prepare. Now, you have their playbook. Want More Game-Changing Forex Insights? - Get real-time Forex news updates: Click here - Join the elite StarseedFX community for exclusive tips: Join here - Grab your free Forex trading plan: Download now —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

The Hang Seng Index opened 158 points lower at 20,238 points last Friday and the decline intensified. It fell 469 points to 19,927 points in the afternoon and fell 425 points or 2.08% to 19,971 points for the whole day. The Technology Index fell 121 points or 2.63% to 4,479 points. Main board transaction volume was HK$158.4 billion.

To summarize the whole week, the Hang Seng Index rose by 105 points or 0.53%.

The details of the Central Economic Work Conference have been released, proposing a broad policy framework such as domestic demand. The outside world has already expected it, but the market is more looking forward to actual figures, such as whether consumer vouchers will be distributed and what the amount will be if so. I believe the conference will stimulate the market. Limited effect. Hong Kong stocks are expected to return to quietness. Mainland China hopes that the financial market will be stable and the stock market is not expected to fall sharply. The upper resistance of the Hang Seng Index is currently at 20,800 points, and the lower support is the previous low of 19,566 points. If it falls below, it will test the 100-DMA (19,055).

European stock markets were little changed, with British, French and German stocks falling slightly by 0.14%, 0.15% and 0.1% respectively.

Apple's chip supplier Broadcom's artificial intelligence (AI) product performance this quarter exceeded expectations, and its stock price surged 24.4%. Its market value exceeded US$1 trillion for the first time. It sang good prospects and boosted investment sentiment. U.S. stocks were volatile on Friday, with individual developments. After the Dow opened slightly higher by 15 points, the gain expanded to 140 points, reaching a high of 44,054 points, and then fell by 123 points to a low of 43,790 points. The S&P 500 rose by up to 0.45%, and then fell by 123 points to a low of 43,790 points. All gains evaporated; the Nasdaq once again rose above the 20,000 mark and reached its top. It once rose 0.8% to a high of 20,061 points, and then stabilized repeatedly.

At the close of U.S. stocks, the Dow Jones Industrial Average fell 86 points, or 0.2%, to 43,828 points; the S&P Index dropped less than 1 point, to 6,051 points; and the Nasdaq Composite Index fell 23 points, or 0.12%, to 19,926 points.

The U.S. dollar index once fell 0.22% to 106.719, and then stabilized repeatedly; the Euro rose 0.56% to $1.0526; the Japanese yen fell by up to 0.76%, reaching a low of 153.8 per dollar; the British economy contracted in October, and the pound briefly fell 0.51% to $1.2608.

0 notes

Text

Coffee Futures- Navigating the Volatile World of Commodity Trading

The global coffee market is an intricate web of farmers, exporters, importers, roasters, and retailers. But beyond the cups of morning joe lies a high-stakes world of commodity trading, where coffee futures attract traders with their volatility and profit potential. If you’re intrigued by this dynamic market, understanding the fundamentals and nuances of trading coffee futures is essential.

In this article, we’ll delve into the mechanics of coffee futures, the factors driving their volatility, and strategies for navigating this exciting yet unpredictable commodity.

What Are Coffee Futures?

Coffee futures are standardized contracts that obligate the buyer to purchase, or the seller to deliver, a specified amount of coffee at a predetermined price on a set future date. These contracts are primarily traded on exchanges like the Intercontinental Exchange (ICE).

Coffee is classified into two main types for trading purposes:

Arabica: A higher-quality coffee grown at high altitudes, primarily in Latin America.

Robusta: A lower-cost, stronger-flavored coffee grown in regions like Vietnam and Brazil.

Arabica futures are the most traded contracts, representing a benchmark for global coffee prices.

Why Trade Coffee Futures?

Hedging: Producers, exporters, and importers use coffee futures to hedge against price fluctuations, ensuring stable income or costs.

Speculation: Traders profit from price movements without needing to own the physical commodity.

Diversification: Coffee futures offer an opportunity to diversify portfolios, as they often react differently to global economic trends compared to stocks or bonds.

The Volatility of Coffee Futures

Coffee futures are among the most volatile commodities. Prices can swing dramatically due to a variety of factors, including:

1. Weather Conditions

Coffee is highly sensitive to weather changes. For instance, frost in Brazil, the world’s largest coffee producer, can severely impact crops and drive prices sky-high.

2. Supply and Demand Dynamics

Supply: Coffee production depends on agricultural conditions, labor availability, and geopolitical stability in producing countries.

Demand: Global trends in coffee consumption, such as the rise of specialty coffee shops, influence demand.

3. Currency Fluctuations

Coffee is priced in U.S. dollars on global exchanges. Changes in the value of the dollar or local currencies of coffee-producing nations can impact trading prices.

4. Geopolitical and Economic Factors

Political instability in key producing countries, trade tariffs, and global economic conditions can all lead to significant price changes.

How to Trade Coffee Futures

1. Understand the Market Basics

Familiarize yourself with the coffee industry, its supply chain, and major players. Understand seasonal patterns, such as peak harvest periods, which often influence price trends.

2. Choose a Trading Platform

Select a reliable trading platform offering access to ICE coffee futures. Ensure the platform provides analytical tools, charts, and real-time data to aid your decision-making.

3. Learn the Contract Specifications

For Arabica coffee on ICE:

Contract Size: 37,500 pounds

Tick Size: 5 cents per pound ($18.75 per tick)

Delivery Months: March, May, July, September, and December

4. Analyze the Market

Use a combination of:

Fundamental Analysis: Study supply-demand factors, weather reports, and global coffee consumption trends.

Technical Analysis: Examine price charts, trends, and indicators to identify potential entry and exit points.

5. Practice Risk Management

Set stop-loss orders to limit potential losses. Never trade more than you can afford to lose, as coffee’s volatility can lead to significant gains or losses.

Trading Strategies for Coffee Futures

1. Seasonal Trends Strategy

Coffee prices often follow predictable seasonal patterns. For example, prices may rise during Brazil’s winter (May to August) due to the risk of frost.

2. News-Based Trading

Stay updated on coffee-related news, such as weather forecasts, production reports, or policy changes in major coffee-producing nations. Use this information to anticipate price movements.

3. Spread Trading

This involves buying and selling futures contracts with different delivery months to profit from price discrepancies. For example, you might buy a March contract while selling a July contract if you expect prices to rise in the near term.

4. Hedging with Options

Options on coffee futures allow you to hedge against adverse price movements while maintaining upside potential. Buying a put option, for instance, protects against falling prices.

Case Study: The Brazilian Frost of 2021

In July 2021, severe frost hit Brazil’s coffee-growing regions, significantly damaging crops. As a result, Arabica coffee futures surged to a seven-year high, with prices rising over 30% in just a few weeks.

For traders who anticipated the frost’s impact, this event provided substantial profit opportunities. It also highlighted the importance of monitoring weather patterns and staying prepared for sudden market shifts.

Risks of Coffee Futures Trading

While the potential rewards are attractive, coffee futures trading comes with inherent risks:

High Volatility: Rapid price changes can lead to significant losses if positions are not managed carefully.

Leverage Risk: Futures trading involves leverage, amplifying both gains and losses.

Knowledge Gap: Without a deep understanding of the market, traders can make costly mistakes.

Tips for Successful Coffee Futures Trading

Stay Informed: Follow coffee market reports, weather forecasts, and economic news.

Start Small: Begin with smaller positions to minimize risk as you learn the market’s intricacies.

Use Demo Accounts: Practice trading with virtual money before committing real capital.

Diversify Your Portfolio: Avoid overexposure to coffee by balancing your investments with other commodities or asset classes.

The Future of Coffee Futures

The coffee market is evolving, driven by sustainability concerns, climate change, and shifts in consumer preferences.

Sustainability: Growing demand for sustainably sourced coffee may influence production practices and costs.

Climate Change: Increasing climate unpredictability poses risks to coffee yields, likely amplifying price volatility.

Digital Trading: Advances in technology, such as AI-driven trading algorithms, are reshaping commodity trading.

As these trends unfold, the coffee futures market will remain a fascinating arena for traders seeking to capitalize on its unique dynamics.

Conclusion

Trading coffee futures offers a blend of challenge and opportunity. The market’s volatility, driven by factors ranging from weather to global demand, creates profit potential for well-prepared traders. By understanding the fundamentals, employing effective strategies, and practicing diligent risk management, you can navigate the exciting world of coffee futures with confidence.

Whether you’re a seasoned trader or a newcomer, coffee futures provide a dynamic way to engage with one of the world’s most beloved commodities. So, brew your knowledge, sip on some analysis, and prepare to trade in the thrilling coffee market.

#Coffee futures#Commodity trading#Arabica coffee trading#Coffee market volatility#Hedging in coffee trading#Coffee futures contracts#Coffee trading risks#Seasonal coffee trends#Coffee futures market analysis

0 notes

Text

12 Days of Christmas Onward|Karein Macneil

The 12 Days of Christmas have been celebrated in Europe since before the Middle Ages. They begin with Christmas Day and continue until the evening of January 5th, which marks the arrival of the Magi—the three wise men—in the Christian tradition. Each day traditionally observes a feast day for a saint or other event.

The famous carol which takes its name from the holiday dates back to 1780, when the earliest known version first appeared in a children’s book called Mirth With-out Mischief. The melody and lyrics most of us are familiar with today was written by an English composer named Frederic Austin in 1909. To help you celebrate the midpoint of these dozen days, we plumbed our Numbers archives to bring you our own version of the well-loved carol. (A Wine Lover’s Christmas graphic created by artist/designer David price.)

♫ ♫ On the Twelfth Day of Christmas my true love shared with me: ♫ ♫

12 Patron Saints of Wine Some (like Goar of Aquitaine) are the patron saint of wine and hotel keepers. Others (like Vincent of Saragossa) are the patron saint of wine, winemakers and vinegar makers. And at least one (Saint Trifon) cut off his nose with vine pruning shears after an encounter with the Virgin Mary (it’s a long story).

11 Cases of Lafite You could purchase approximately 11 cases of the 2015 Chateau Lafite-Rothschild for the same price as a current model Tesla. The 2015 vintage of Chateau Lafite-Rothschild, one of the five famous First Growths of Bordeaux, has a “pre-arrival” price of $575 per bottle. The 2016 Tesla Model S70 sedan has an MSRP of $75,000. The 2015 Lafite-Rothschild will be released in October 2018. The Tesla Model S70 has sufficient cargo space to hold several cases.

10 Thousand U.S. Wineries There are roughly ten thousand wineries currently in the U.S., according to Wines Vines & Analytics. California (not surprisingly) has the greatest number of wineries in the country with more than 4,500. The next most winery-rich states include Oregon and Washington (8% each), New York (4%), and Texas, Virginia, Pennsylvania, and Ohio (3% each).

9 Attributes of Great Wine Distinctiveness, balance, precision, complexity, beyond fruitiness, length , choreography, connectedness, and the ability to evoke an emotional response. A wine is not great merely because we like it. I would argue that to really know wine—and to consider its potential greatness—requires that we move beyond what we know we like. It requires that we attempt a larger understanding of the aesthetics behind wines that have garnered respect, wines that have consistently been singled out for their merit, wines that have, again and again over time, been cherished for their integrity and beauty.

8 Millennia of Wine Wine is now known to have existed for at least eight thousand years. In a new study in the Proceedings of the National Academy of Sciences, molecular archeologist Patrick McGovern has uncovered the earliest known evidence—wine residue on pottery from two archaeological sites in The Republic of Georgia dating back to 6,000 B.C. Until this point, the earliest evidence of wine’s existence dated from 5000 to 5400 B.C. in Iran.

7 Years in Prison Number of years that the only convicted wine counterfeiter, Rudy Kurniawan, spent in prison before he was released in early November. Kurniawan was convicted in 2013 for selling millions of dollars worth of phony wines. Many of the counterfeit wines—often rare, old vintages of famous French wines—are still in circulation, according to experts. Awaiting deportation back to his home country, Indonesia, Kurniawan is likely to “set up shop” anew, this time in China, a story in wine-searcher.com suggests.

6 Bars of Pressure A standard 750ml of Champagne or sparkling wine made by the traditional Champagne method is bottled under 6 bars of pressure. One bar is the same as 1 “atmosphere” and each is equal to 14.7 psi (pounds per square inch) of pressure. Typically, a bottle of Champagne has between 70 and 90 psi, which is nearly 3 times the pressure in your car’s tires.

5 Thousand Grapes Scientists believe that the 25,000 grape variety names around the world can trace their origins to about 5,000 truly different varieties. Most varieties have multiple names (garnacha in Spain is grenache in France for example). Of these 5,000 varieties, about 150 are planted in commercially significant amounts.

4 Centuries-old Grapevine Believed to be the oldest grape vine in North America, the more than 400-year-old so-called “Mother Vine” was planted in the late 1500s on North Carolina’s Roanoke Island. The vine belongs to America’s oldest known species of native grapes, muscadine (vitis rotundifolia) and still bears fruit today. Muscadine, which early settlers renamed “scuppernong” after the nearby river, is only half as sweet as vitis vinifera, requiring the few producers of muscadine wine to add sugar to reach even 10% abv.

3 Million Millennials Three million millennials aged 21 to 35 have stopped drinking wine and other alcoholic beverages, according to Wine Intelligence’s US Landscapes 2019 report. The decline is consistent with other recent studies that suggest a downturn in wine consumption among certain demographic groups.

2 Billion Bottles Two billion bottles of Riunite have been sold in the U.S. since 1967, making Riunite the number one imported wine in U.S. history. At its pinnacle in the early 80s, Riunite sold nearly a million cases of its wine a month. Imported by Banfi, Riunite makes lightly fizzy Lambrusco, as well as simple table wines.

1 Part(ridge in a) Pe(a)r Tr(ee)illion Humans can detect wine aroma compounds called pyrazines in concentrations as low as one part per trillion. Professor Marian W. Baldy, PhD compares this extraordinary capacity to “sniffing out a one-cent error in your $10 billion checking account.” Pyrazines (short for methoxypyrazine) are the compounds responsible for the green, herbal, savory aromas (like bell pepper) in many Bordeaux varieties such as cabernet sauvignon, merlot, and sauvignon blanc.

0 notes

Text

best forex brokers

What is Foreign Exchange Trading? Foreign exchange trading, often referred to as Forex or FX trading, is the process of buying and selling currencies on the global market. It is one of the largest and most liquid financial markets in the world, with a daily trading volume exceeding $6 trillion. This market operates 24 hours a day, five days a week, enabling traders to engage in transactions at almost any time. But what exactly is Forex trading, and how does it work? At its core, Forex trading involves the exchange of one currency for another. Currencies are always traded in pairs, such as the EUR/USD (euro/dollar) or GBP/JPY (British pound/Japanese yen). The first currency in the pair is known as the base currency, while the second is the quote currency. When you trade in the Forex market, you are essentially buying one currency while simultaneously selling another. For example, if you believe that the euro will strengthen against the U.S. dollar, you would buy the EUR/USD pair. If the euro does indeed rise in value relative to the dollar, you can sell the pair at a higher price, making a profit. The Forex market is decentralized, meaning there is no central exchange where transactions occur. Instead, trading takes place over-the-counter (OTC) through a network of banks, brokers, and financial institutions. This decentralized nature contributes to the market's high liquidity, allowing large transactions to occur with minimal impact on the price of currencies. One of the unique aspects of Forex trading is the use of leverage. Leverage allows traders to control a larger position with a smaller amount of capital. For instance, with a leverage ratio of 100:1, a trader can control $100,000 worth of currency with just $1,000 of capital. While leverage can amplify profits, it also increases the potential for losses, making it a double-edged sword. Therefore, it is crucial for traders to use leverage wisely and to have a solid risk management strategy in place. Forex trading is influenced by a variety of factors, including economic indicators, geopolitical events, and central bank policies. For example, interest rate decisions by central banks can have a significant impact on currency values. Higher interest rates tend to attract foreign capital, leading to an appreciation of the currency. Conversely, political instability can cause a currency to depreciate as investors seek safer assets. In conclusion, Forex trading is a complex and dynamic market that offers opportunities for profit, but it also carries significant risks. Understanding the fundamentals of how currency pairs work, the role of leverage, and the factors that influence currency movements is essential for anyone looking to participate in this market. Whether you are a novice trader or an experienced investor, having a clear strategy and staying informed about global events are key to navigating the Forex market successfully.best forex brokers

0 notes

Text

Mostly fine

As part of the "Hurricane Rideout Crew" at work I was well protected from the storm.

I was at work for 32 straight hours helping keep the other Castmembers up and running while everything closed down for Milton.

I even had a room in the hotel tower to take a nap in.

My house, however sat alone and was subject to whatever pounding the storm would bring.

After hearing the stories of the storms incredible statistics over the gulf of Mexico I was convinced my house was in serious trouble.

Record setting winds approaching 200mph, 15' or more of tidal surge, the potential of hundreds of billions of dollars in damages. While it would weaken once it hit landfall near Tampa, it was still expected to hit Orlando with 120mph winds.

With consistent reports like that it's no wonder me (and everyone else) was worried sick.

When the storm reached Orlando at around 1am it had lost a lot of its punch.

It was now maybe at Catagory 1 storm with winds 75-95 mph. But the weather App on my phone was saying more like 68mph.

Nothing to scoff at but still nothing near what was being talked about.

My house came through intact and undamaged.

The biggest problem I'm facing now is no power or water.

Hopefully those will be restored soon.

The hurricane does have me thinking about things though.

Long term do I really want to stay in Florida?

I hate the weather (the three H's: heat, humidity and hurricanes) the topography is boring, the horrendous political party in control and more.

Other then my job and my home I have no reason to be here. No friends or family.

Plus being in Oregon really brought back the homesickness I feel about the west.

I'm a western U.S. girl for sure.

Nothing I can do about things right now. To many other uncertain factors in the future.

Like the possable election of an evil madman.

~Madison

0 notes

Text

The Impact of Global Economic Events on Forex Markets

Being the largest and most liquid financial market in the world, the Forex market is very sensitive to global economic events. Such events can lead to tectonic price movements, which are at the same time opportunities and risks for traders. Therefore, everybody involved in Forex trading has to understand the events of the global economy and their impact on currency markets. In this blog post, we shall discuss major events across the world economy that shape the Forex markets and how one can effectively maneuver these changes as a trader. In case you need everything updated in real-time, expert analysis is going on, then Best Forex Telegram Channel is your way to stay ahead of market movements.

1. Central Bank decisions

Central banks make decisions that are important to the extent that they favor the value of a currency. One of the more critical concepts within the monetary policy decisions is in the strategy behind making adjustments to interest rates. Changes to actual interest rates directly encourage some engineering practices and other monetary policies that, in turn, impact currency price. For example, when the U.S. Federal Reserve raises interest rates, the U.S. dollar usually strengthens, as foreign investors pour capital into the country to profit on the higher returns. It is important to remain updated regarding such decisions and reports, as they create volumes of major volatility on the forex marketplace.

2. Economic Data Releases

Economic data is generated on a routine basis, which operates the GDP growth rates, data on the unemployment scenario, inflation reports, and data on retail sales. These aspects give evidence to the health of the economy. If the data is positive, then there is a possibility that the currency will ascend in value. If it is negative, then it is likely to depreciate in value. An example of this case is strong job developments in the United States that could be a factor in dollar increase, and the euro is going to be discouraged with lower retail sales within the Eurozone. Traders mostly use the economic calendars to follow these releases and accordingly plan their trades. Subscribing to the Best Forex Telegram Channel ensures you get timely updates and analysis of these critical data points.

3. Geopolitical Events

Geopolitical events—such as elections, trade wars, or international conflicts—create uncertainty. They can, therefore, provide sharp movements in currency markets. For instance, in the case of Brexit, the negotiations utterly changed the value of the British pound, and every development of these talks affected its value. Similarly, the rift between two key economies, the U.S. and China, can have an impact on global trade, and thus their currencies. A trader should be aware of geopolitical risks and learn to adapt his strategies to avoid such volatility.

4. Natural Disasters and Pandemics

Natural disasters and global health crises, such as the current COVID-19 pandemic, can also cast a very long shadow across the Forex markets. This ongoing pandemic has resulted in huge geopolitical volatility in the market, events that government lockdowns and emergency money-printing by central banks likely caused and nobody had seen ever before. Natural disasters, like earthquakes or hurricanes, can also disrupt economic activity with the consequence of currency values being impacted. The knowledge of what is happening and the capability of understanding how it can impact something else are very crucial to forex traders.

5. Commodity Price Movements

For the countries that import or export commodities like oil or gold - a general tendency remains that the commodity price change impacts the concerned country's currency movement. For example, with a surge in oil prices, a country like Canada, where the prime economy is due to oil exports, would have a positive impact on the Canadian dollar. Conversely, a fall in gold prices might weaken the Australian dollar, considering that the country exports gold. Understanding price relationships of commodities to currency values will better organize the supply/demand scenarios for the trader.

Navigating Forex Markets During Global Events

In the Forex market, every global economic event, especially when they dangle in the balance between good news and bad news, offers an opportunity for a trader to speculate. But it requires that the trader be well informed and prepared to act promptly. Here are a few strategies for doing that:

Use a News Calendar. Monitor significant economic events and data releases to be ahead of the game on potential market movements.

- Diversify Your Portfolio: Diversify by investing in various currencies so as to avoid risks.

- Implement Risk Management: Use stop-loss orders and position sizing to ensure the security of your capital from sudden market movements.

- Join the Best Forex Telegram Channel: Be in touch with a community of the leading traders to get short-term insights, trading signals, and expert analysis of the market.

Conclusion

As global economic events deeply impact Forex markets, informed traders have great possibilities of making profits within the same. If one really needs to place themselves appropriately in the context of central bank policy decisions, economic data releases, geopolitical activities, natural disasters, and shifts in commodity prices, then this is the best e-book. The best Forex Telegram channel plays a key role in navigating through these extremely complex and dynamic markets, offering real-time updates and expert guidance.

#forexmarket#forextrading#forex#forexeducation#forexcommunity#forexsignals#financialfreedom#telegram

0 notes

Text

Forex Trading: Navigating the Currency Markets

The foreign exchange (forex) market is the largest and most liquid financial market in the world, with trillions of dollars traded daily. Unlike other financial markets, forex operates 24 hours a day, five days a week, allowing traders from all over the globe to participate at any time. For those looking to diversify their investment portfolio or capitalize on the constant movement of global currencies, forex trading offers unique opportunities and challenges. In this blog, we’ll explore the basics of forex trading, the key factors that influence currency movements, and strategies for successful trading.

Introduction to Forex Trading

What is Forex Trading?

Forex trading involves the exchange of one currency for another in the global marketplace. The primary goal of forex trading is to profit from the changes in currency exchange rates. For example, if you believe the value of the euro (EUR) will increase relative to the U.S. dollar (USD), you might buy euros with dollars and later sell them back when the exchange rate has risen.

How Does Forex Trading Work?

Currencies are traded in pairs, meaning when you buy one currency, you simultaneously sell another. Each currency pair is represented by a three-letter code, such as EUR/USD (euro against U.S. dollar) or GBP/JPY (British pound against Japanese yen). The first currency in the pair is the base currency, and the second is the quote currency.

Forex trading involves predicting whether the base currency will strengthen (appreciate) or weaken (depreciate) against the quote currency. If you believe the base currency will appreciate, you go long (buy). If you think it will depreciate, you go short (sell).

Key Features of the Forex Market

- Leverage: Forex trading often involves the use of leverage, allowing traders to control large positions with relatively small amounts of capital. While leverage can amplify profits, it also increases the potential for significant losses.

- Liquidity: The forex market’s immense liquidity means that trades can be executed quickly and with minimal price slippage.

- 24-Hour Trading: The forex market operates around the clock, enabling traders to react to global events in real-time.

Key Factors Influencing Currency Movements

1. Economic Indicators

Economic indicators, such as gross domestic product (GDP), unemployment rates, and inflation, have a profound impact on currency values. Strong economic performance in a country often leads to an appreciation of its currency, while weak performance can cause depreciation. For instance, if the U.S. reports better-than-expected GDP growth, the USD may strengthen against other currencies.

2. Interest Rates

Interest rates set by central banks are one of the most critical factors influencing currency movements. Higher interest rates typically attract foreign investment, leading to a stronger currency. Conversely, lower interest rates can result in a weaker currency. Traders closely monitor decisions by central banks like the Federal Reserve, European Central Bank, and Bank of Japan for any changes in interest rate policies.

3. Political Stability and Geopolitical Events

Political stability and geopolitical events can cause significant fluctuations in currency prices. For example, uncertainty surrounding elections, government policies, or international conflicts can lead to increased volatility in the forex market. A country with stable political conditions is more likely to attract foreign investment, which can strengthen its currency.

4. Market Sentiment

Market sentiment, or the overall mood of investors, can drive currency movements. If traders are optimistic about the global economy, they may favor riskier currencies with higher yields, such as the Australian dollar (AUD) or New Zealand dollar (NZD). In times of uncertainty or fear, they may seek safety in traditionally stable currencies like the U.S. dollar (USD) or Swiss franc (CHF).

5. Trade Balances

A country’s trade balance, which measures the difference between exports and imports, can also influence its currency. A trade surplus (more exports than imports) typically strengthens a currency, as foreign buyers must purchase the domestic currency to pay for the country's goods. A trade deficit (more imports than exports) can weaken the currency.

Strategies for Successful Forex Trading

1. Technical Analysis

Technical analysis involves studying past price movements and using various tools, such as charts and indicators, to predict future price action. Common technical indicators in forex trading include moving averages, relative strength index (RSI), and Fibonacci retracement levels. By identifying trends and patterns, traders can make more informed decisions about when to enter or exit trades.

2. Fundamental Analysis

Fundamental analysis focuses on the economic, political, and social factors that influence currency prices. Traders who use this strategy analyze economic data, central bank policies, and geopolitical events to anticipate how they might affect currency values. For example, a trader might buy a currency if they expect a central bank to raise interest rates, leading to an appreciation of that currency.

3. Risk Management

Effective risk management is crucial in forex trading, given the potential for significant losses due to leverage and market volatility. Traders should set stop-loss orders to limit losses on any given trade and avoid risking more than a small percentage of their capital on a single trade. Diversifying trades across different currency pairs can also help reduce risk.

4. Trend Following

Trend following is a strategy where traders identify and capitalize on existing market trends. The idea is to enter trades in the direction of the trend and hold the position until signs of a reversal appear. For example, if the EUR/USD is in a strong uptrend, a trend-following trader would look for opportunities to buy the pair and ride the trend for as long as it lasts.

5. Carry Trade

The carry trade strategy involves borrowing money in a currency with a low-interest rate and using it to buy a currency with a higher interest rate. The goal is to profit from the difference in interest rates between the two currencies, known as the "carry." This strategy is popular when interest rate differentials are significant, and market volatility is low.

Conclusion

Forex trading offers a dynamic and potentially lucrative way to engage with the global financial markets. By understanding the basics of forex trading, recognizing the key factors that drive currency movements, and applying effective trading strategies, you can navigate the forex market with greater confidence and success. However, it's important to remember that forex trading carries risks, and success requires continuous learning, discipline, and careful risk management. Whether you're a beginner or an experienced trader, staying informed and adaptable is the key to thriving in the ever-changing world of forex trading.

1 note

·

View note

Text

"When reminded about it, 7 in 10 Americans say in polls that they support President Joe Biden’s landmark climate and social spending law, the Inflation Reduction Act. But only about half of the country has ever heard “a lot” or even “some” about it.

A new $1.4 million advertising campaign in Michigan and Wisconsin aims to change that for voters in the two key battleground states.

TV spots set to air over the next three weeks on local channels in Milwaukee and in Michigan’s Grand Rapids and Flint areas pitch the Biden administration’s legislative cornerstone as the spark for a new manufacturing boom in a region long devastated by outsourcing.

Passed without a single Republican vote in 2022, the law pumped hundreds of billions of dollars ― by some projections, potentially trillions ― in the form of federal tax credits and subsidies into building out a domestic economy for green energy and competing directly with China. The legislation spurred what may be the dawn of a manufacturing renaissance in the U.S.: With hundreds of clean energy projects and factories to make electric car batteries and solar panels announced since Biden signed the law, federal data shows that manufacturers’ spending on construction has doubled and the U.S. has added nearly 1 million new manufacturing jobs.

So far, Republican-dominated states have reaped the biggest benefits, yet even Georgia Gov. Brian Kemp ― a Republican whose state has become a magnet for federally backed green-energy investments ― said as recently as March that former President Donald Trump, the presumptive GOP presidential nominee, would “be better than Joe Biden.”

Paid for by Evergreen Collaborative, a climate group founded by alumni of Washington Gov. Jay Inslee’s ill-fated but influential campaign for the 2020 Democratic presidential nomination, the ads offer a starkly different gubernatorial viewpoint.

The Democratic governors of Michigan and Wisconsin, who both won reelection against Republican challengers in 2022 and now enjoy higher approval ratings than Biden, appear in the ads. Trump won both states in 2016 and lost them in 2020, but polls now show the former president tied with or ahead of Biden. With Trump still polling strong despite a felony conviction, Biden’s best chance of defeating Trump in the Electoral College depends on winning both Midwestern states.

In a 30-second spot, Michigan Gov. Gretchen Whitmer, clad in a stylish black jacket, speaks to the camera from a shop floor where two workers in T-shirts assemble equipment and another welds in the background. Accompanied by pounding rock music and the governor’s narration, we see scenes of General Motors’ electric pickup trucks and Biden trotting out on stage between battery-powered SUVs at the Detroit Auto Show."

0 notes

Text

The Art of 30-Minute Trading Imagine you're sipping your morning coffee, watching the charts of the British Pound/US Dollar pair (GBP/USD) on the 30-minute timeframe. The market moves in what seems like chaotic harmony, and you're here to make sense of it. Mastering this timeframe isn't about luck—it's about precision, strategy, and a sprinkle of humor to keep you sane. After all, who hasn't felt like the market has a mind of its own, pulling pranks just when you're about to hit the jackpot? The Sweet Spot: Why 30 Minutes Is the Goldilocks Timeframe Trading on the 30-minute timeframe offers the perfect balance—it's not too fast like scalping, where you feel like a caffeinated squirrel, nor too slow like daily charts, which can feel like watching paint dry. Here’s why it’s ideal: - Actionable Patterns: You catch significant market moves without being overwhelmed by noise. - Flexibility: Perfect for those who can’t stare at charts all day but still want consistent setups. - High Probability Trades: The timeframe captures institutional activity while accommodating retail traders. Pro Tip: Think of the 30-minute chart as the middle child—underrated but full of untapped potential. Unveiling Hidden Patterns: The Secret Sauce of GBP/USD The GBP/USD pair, affectionately known as "Cable," dances to its own rhythm. Here's how to uncover its hidden opportunities: 1. The London-New York Overlap This is the sweet spot where liquidity explodes like fireworks on New Year’s Eve. From 8 AM to 12 PM EST, trading volume surges, offering juicy opportunities. - Ninja Tactic: Focus on breakout setups during this overlap. Use tools like Bollinger Bands to catch price explosions. 2. The Fibonacci Whisper GBP/USD loves respecting Fibonacci retracements. Combine this with pivot points to predict reversals with eerie accuracy. - Elite Tip: Start with the 61.8% level—it’s like the VIP lounge of retracements. 3. Volume Profile Insights Volume isn’t just a number; it’s the heartbeat of the market. Watch for high-volume nodes around support and resistance levels to confirm trades. - Example: If price hesitates at a high-volume area, prepare for a bounce or a break. Pitfalls to Avoid (Because Who Likes Losing?) - Ignoring Market News - Trading GBP/USD without checking economic calendars is like driving blindfolded. Watch for key reports like Bank of England announcements and U.S. Non-Farm Payrolls. - Over-Leveraging - Just because you can trade big doesn’t mean you should. Avoid the rookie mistake of turning a bad trade into a disaster. - Trading Revenge - Lost a trade? Don’t double down like it’s a casino. Stick to your plan. Ninja Tactics for 30-Minute Timeframe Success - Combine Moving Averages - Use the 50 EMA and 200 EMA crossover for trend confirmation. - Use RSI Divergences - Spot divergences on the RSI to anticipate reversals. - Set Alerts, Not Alarms - Let technology work for you—set alerts on key levels instead of staring at charts endlessly. Case Study: Turning $1,000 into $10,000 Last year, a trader combined the Fibonacci retracement with volume profile analysis during the London-New York overlap. The result? A 900% ROI within six months. The secret was patience, precision, and avoiding over-trading. Wrap-Up: Trading GBP/USD Like a Pro Mastering the GBP/USD on the 30-minute timeframe isn’t just a skill—it’s an art form. By focusing on patterns, respecting market structure, and using proven strategies, you can transform your trading game. Remember, every great trader was once a beginner who refused to give up. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text