#Warehouse Automation Market Analysis

Explore tagged Tumblr posts

Text

Saudi Arabia Warehouse Automation Market Share, Size, Technologies, Growth Strategy, Challenges and Future Competition Till 2033: SPER Market Research

Warehouse automation encompasses the implementation of technology and systems designed to enhance and optimize various operations within a warehouse, such as inventory management, order fulfilment, and material handling. This automation can range from basic conveyor systems to sophisticated robotics and software solutions that manage tasks with limited human involvement. The main objective is to improve operational efficiency, lower labour expenses, and increase accuracy in the handling of goods. Automated Storage and Retrieval Systems (AS/RS) are vital in facilitating the swift storage and retrieval of items. As e-commerce continues to expand, the importance of warehouse automation grows, becoming critical for satisfying consumer demands and sustaining competitive advantages in supply chain management.

According to SPER Market Research, ‘Saudi Arabia Warehouse Automation Market Size- By Type, By End User - Regional Outlook, Competitive Strategies and Segment Forecast to 2033' states that the Saudi Arabia Warehouse Automation Market is estimated to reach XX Billion by 2033 with a CAGR of XX %.

DRIVERS:

The swift growth of the e-commerce industry serves as a significant catalyst, driving the demand for effective storage and distribution systems to satisfy the rising consumer expectations for prompt delivery and efficient inventory management. Persistent labour shortages are compelling organizations to implement automated solutions to sustain productivity while decreasing dependence on human labour. The escalating requirement for cold storage facilities, especially within the food and pharmaceutical industries, is generating prospects for specialized automated solutions. Advancements in automation technologies, including robotics, artificial intelligence (AI), and cloud-based warehouse management systems, are enhancing operational efficiency and lowering expenses. A surge in the e-commerce sector is significantly driving the demand for warehouse automation. The warehouse automation market is marked by a highly competitive environment.

RESTRAINTS:

The initial capital needed for warehouse automation technologies, including robotics and automated systems, can be considerable. This financial hurdle may discourage smaller enterprises from embracing these solutions, thereby constraining overall market expansion. There exists a notable demand for skilled individuals who can operate and maintain sophisticated automation systems. The existing shortage of qualified personnel in Saudi Arabia presents a challenge for organizations aiming to implement these technologies successfully. Additionally, employees and management may be hesitant to shift from conventional manual processes to automated systems due to concerns about job security or a lack of familiarity with new technologies. Addressing this resistance necessitates the implementation of effective change management strategies and comprehensive employee training.

Request a Free Sample Report: https://www.sperresearch.com/report-store/saudi-arabia-warehouse-automation-market.aspx?sample=1

The rise of e-commerce during the pandemic prompted a need for enhanced operational efficiency within warehouses. Organizations pursued automation solutions to handle the surge in order volumes and to satisfy consumer demands for quicker delivery times, thereby propelling growth in the warehouse automation industry. The pandemic also resulted in significant disruptions to global supply chains, impacting the availability of essential components and materials required for the implementation of automation technologies. Consequently, businesses aiming to automate their operations faced project delays and increased costs. Although the long-term prospects of warehouse automation remain promising, certain companies displayed hesitance in capital investments due to economic uncertainties and a decline in consumer spending during the pandemic.

The market for Saudi Arabia warehouse automation is dominated by Eastern region because of its support in industrial activities and logistics operations, contributing to the overall growth of the market. Some of its key players are- ABB Ltd, Vanderlande, Toyota Industries Corporation, Murata Machinery, Honeywell International Inc.

For More Information, refer to below link: –

Saudi Arabia Warehouse Automation Market

Related Reports:

Flying Car Market Size- By Product, By Capacity- Regional Outlook, Competitive Strategies and Segment Forecast to 2034 Spark and Glow Plugs Market Growth, Size, Trends Analysis - By Vehicle Type, By Fuel Type, By Spark Plug Type, By Aftertreatment System, By Technology- Regional Outlook, Competitive Strategies and Segment Forecast to 2034

Follow Us –

LinkedIn | Instagram | Facebook | Twitter

Contact Us:

Sara Lopes, Business Consultant — USA

SPER Market Research

+1–347–460–2899

#Automated Sortation Systems Supplier in KSA#Automated Technology in Warehousing KSA#Competitors in KSA Warehouse Automation Industry#Emerging Companies in Warehouse Automation KSA#International Domestic Freight Forwarders in KSA#KSA automated technology software Market#KSA Automatic Guided Vehicle Market#KSA Logistics and Warehouse Automation Market#KSA Logistics and Warehouse Automation Market Report#KSA Logistics and Warehouse Automation Market Share#KSA Logistics and Warehouse Automation Market Trends#KSA Warehouse Automation Industry#KSA Warehouse Automation Industry Analysis

0 notes

Text

#Forklift Market#Material Handling Equipment#Forklift Industry Growth#Forklift Innovations#Warehouse Equipment#Forklift Market Trends#Electric Forklifts#Industrial Forklifts#Forklift Technology#Forklift Market Analysis#Automated Forklifts#Forklift Industry Insights#Forklift Market Forecast#Sustainable Forklifts#Forklift Manufacturing

0 notes

Text

Vertical Lift Module Market Key Segmentation, Growth, Top Key Players and Forecast by 2033

The global vertical lift module market was valued at US$ 1.5 billion in 2023 and is expected to reach US$ 3.4 billion by the end of 2033. Global demand for vertical lift modules is predicted to increase by 8.5% per year between 2023 and 2033.

The internal bay vertical lift module is the ideal solution for space-constrained applications. These modules provide cost-effectiveness, quick operation, space savings, increased production, and better picking accuracy.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐚 𝐒𝐚𝐦𝐩𝐥𝐞 𝐂𝐨𝐩𝐲 𝐨𝐟 𝐓𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.factmr.com/connectus/sample?flag=S&rep_id=5347

Key Takeaways from Vertical Lift Module Market Report

The anticipated timeframe forecasts high demand, driven by the rapid growth of the e-commerce sector.

Furthermore, increased demand from logistics firms is likely to drive market expansion.

Furthermore, developments in automated equipment development are playing an important role in driving market growth.

Increased demand from various end-use areas, including as warehousing and retail, is expected to be a major driver of market expansion.

Regional Analysis:

North America holds 50% of the worldwide market because to its strong presence in a variety of established end-use sectors. The market is being pushed by an increasing number of warehouse management system suppliers, ongoing technical improvements, and the rapid growth of the e-commerce and retail industries.

In Germany, the well-developed automotive industry and increasing demand for automated material handling systems are significant drivers of market growth. There is an increasing need for warehouse management services, which is projected to drive market growth in the future years.

The United States is witnessing growth in the pharmaceutical and electrical industries, which is anticipated to boost the demand for vertical lift modules. The market is expected to grow significantly, particularly driven by the adoption of refrigerated vertical lift modules.

Category-wise Insights

The market is segmented into non-refrigerated and refrigerated vertical lift modules. Non-refrigerated modules currently hold a 50% share of the global market. As key end-user industries continue to evolve, there is expected growth in demand for non-refrigerated vertical lift modules during the forecast period.

Non-refrigerated vertical lift modules are particularly favored by manufacturing industries such as automotive, aviation, and heavy machinery equipment manufacturers. These sectors prioritize cost-effective and efficient storage and handling solutions for goods that do not require temperature control, making non-refrigerated modules the preferred choice.

Competitive Landscape

Key market players employ various strategies such as quality control, mergers & acquisitions to expand their market share. They also collaborate with regional distributors and partners to enhance their distribution networks. Leading companies are heavily investing in research and development to uphold product standards and introduce advanced technologies, thereby broadening their product offerings and enhancing existing solutions.

Prominent manufacturers of vertical lift modules are actively innovating to comply with safety regulations, aiming to reduce environmental impact and strengthen their market position. Their growth strategies include optimizing supply chain management and upgrading retail networks to attract clients effectively.

For instance:

EffiMat Storage Technology A.S introduced the exclusive ClassicMat™, ensuring efficient storage optimization, exceptional picking speed, and ergonomic handling.

Kardex acquired a significant stake in Dutch company Robomotive, enhancing its portfolio of fully automated picking solutions. Leveraging Robomotive's technology, Kardex aims to expand its intralogistics capabilities, implement autonomous order picking, and play a pivotal role in production and logistics.

Read More: https://www.factmr.com/report/5347/vertical-lift-module-market

Key Segments of Vertical Lift Module Industry Research

By Type :

Non-refrigerated

Refrigerated

By Maximum Load Capacity :

Below 20 Tons

20 Tons to 40 Tons

Above 40 Tons

By Configuration :

Internal Bay (Single & Dual)

External Bay (Single & Dual)

By End Use :

Metals & Machinery

Automotive

Food & Beverages

Electronics

Logistics

Healthcare

Retail

Others

By Region :

North America

Europe

Asia Pacific

Latin America

Middle East & Africa

𝐓𝐨𝐩 𝐑𝐞𝐥𝐚𝐭𝐞𝐝 𝐑𝐞𝐩𝐨𝐫𝐭 𝐢𝐧 𝐭𝐡𝐞 𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐲

Intralogistics Market: The global intralogistics market is predicted to expand at a high-value CAGR of 14.8% to climb from a market valuation of US$ 18.94 billion in 2022 to US$ 75.36 billion by the end of 2032.

Vertical Mast Lift Market: The global vertical mast lifts market size stands at US$ 1.54 billion and is predicted to expand at a CAGR of 4.8% to reach a value of US$ 2.46 billion by the end of 2032.

𝐀𝐛𝐨𝐮𝐭 𝐅𝐚𝐜𝐭.𝐌𝐑

We are a trusted research partner of 80% of fortune 1000 companies across the globe. We are consistently growing in the field of market research with more than 1000 reports published every year. The dedicated team of 400-plus analysts and consultants is committed to achieving the utmost level of our client’s satisfaction.

𝐂𝐨𝐧𝐭𝐚𝐜𝐭:

US Sales Office 11140 Rockville Pike Suite 400 Rockville, MD 20852 United States Tel: +1 (628) 251-1583, +353-1-4434-232 Email: [email protected]

1 note

·

View note

Text

Unmanned Ground Vehicles Market Growth Explained: From Battlefield to Industry

Unmanned Ground Vehicles Market Overview: Advancing the Frontier of Autonomous Land-Based Systems

The global Unmanned Ground Vehicles market is undergoing a paradigm shift, driven by transformative innovation in artificial intelligence, robotics, and sensor technologies. With an estimated valuation of USD 3.29 billion in 2023, the unmanned ground vehicles market is projected to expand to USD 6.35 billion by 2031, achieving a CAGR of 9.7% over the forecast period. This momentum stems from the increasing integration of UGVs into critical applications spanning defense, commercial industries, and scientific research.

As a cornerstone of modern automation, unmanned ground vehicles markets are redefining operational strategies in dynamic environments. By eliminating the need for onboard human operators, these systems enhance safety, efficiency, and scalability across a wide array of use cases. From autonomous logistics support in conflict zones to precision agriculture and mining, UGVs represent a versatile, mission-critical solution with expanding potential.

Request Sample Report PDF (including TOC, Graphs & Tables): https://www.statsandresearch.com/request-sample/40520-global-unmanned-ground-vehicles-ugvs-market

UGV Types: Tailored Autonomy for Diverse Operational Needs

Teleoperated UGVs: Precision in Human-Controlled Operations

Teleoperated unmanned ground vehicles market’s serve vital roles in scenarios where human judgment and real-time control are indispensable. Predominantly employed by military and law enforcement agencies, these vehicles are integral to high-risk missions such as explosive ordnance disposal (EOD), urban reconnaissance, and search-and-rescue. Remote operability provides a protective buffer between operators and threats, while ensuring tactical accuracy in mission execution.

Autonomous UGVs: Revolutionizing Ground Operations

Autonomous UGVs epitomize the fusion of AI, machine learning, and edge computing. These platforms operate independently, leveraging LiDAR, GPS, stereo vision, and inertial navigation systems to map environments, detect obstacles, and make intelligent decisions without human intervention. Applications include:

Precision agriculture: Real-time crop health analysis, soil diagnostics, and yield monitoring.

Warehouse logistics: Automated material handling and inventory tracking.

Border patrol: Persistent perimeter surveillance with minimal resource expenditure.

Semi-Autonomous UGVs: Optimal Balance of Control and Independence

Semi-autonomous systems are ideal for hybrid missions requiring autonomous execution with operator intervention capabilities. These UGVs can follow predetermined paths, execute complex tasks, and pause for remote validation when encountering ambiguous conditions. Their versatility suits infrastructure inspection, disaster response, and automated delivery services, where adaptability is paramount.

Get up to 30%-40% Discount: https://www.statsandresearch.com/check-discount/40520-global-unmanned-ground-vehicles-ugvs-market

Technological Framework: Building Smarter Ground-Based Systems

Navigation Systems: Real-Time Terrain Mastery

Modern UGVs integrate layered navigation systems incorporating:

Global Navigation Satellite Systems (GNSS)

Inertial Navigation Units (INU)

Visual Odometry

Simultaneous Localization and Mapping (SLAM)

This multifaceted approach enables high-precision route planning and dynamic path correction, ensuring mission continuity across varying terrain types and environmental conditions.

Advanced Sensor Suites: The Sensory Backbone

UGVs depend on an array of sensors to interpret their environment. Core components include:

LiDAR: For three-dimensional spatial mapping.

Ultrasonic sensors: Obstacle detection at short ranges.

Thermal and infrared cameras: Night vision and heat signature tracking.

Multispectral imaging: Agricultural and environmental applications.

Together, these sensors empower unmanned ground vehicles market’s to perform with superior situational awareness and real-time decision-making.

Communication Systems: Seamless Command and Data Exchange

Effective UGV operation relies on uninterrupted connectivity. Communication architectures include:

RF (Radio Frequency) transmission for close-range operations.

Cellular (4G/5G) and satellite links for beyond-line-of-sight control.

Encrypted military-grade communication protocols to safeguard mission-critical data.

These systems ensure continuous dialogue between unmanned ground vehicles market’s and control centers, essential for high-stakes missions.

Artificial Intelligence (AI): Cognitive Autonomy

AI is the nucleus of next-generation UGV intelligence. From object recognition and predictive analytics to anomaly detection and mission adaptation, AI frameworks enable:

Behavioral learning for new terrain or threat patterns.

Collaborative swarm robotics where UGVs function as a coordinated unit.

Autonomous decision trees that trigger responses based on complex input variables.

Unmanned Ground Vehicles Market Segmentation by End User

Government and Military: Strategic Force Multipliers

UGVs are critical to defense modernization initiatives, delivering cost-effective force protection, logistical autonomy, and increased tactical reach. Applications include:

C-IED missions

Tactical ISR (Intelligence, Surveillance, Reconnaissance)

Autonomous convoy support

Hazardous materials (HAZMAT) handling

Private Sector: Driving Industrial Autonomy

Commercial adoption of unmanned ground vehicles market’s is accelerating, especially in:

Agriculture: Real-time agronomic monitoring and robotic farming.

Mining and construction: Autonomous excavation, transport, and safety inspection.

Retail and logistics: Last-mile delivery and warehouse automation.

These implementations reduce manual labor, enhance productivity, and streamline resource management.

Research Institutions: Accelerating Innovation

UGVs are central to robotics and AI research, with universities and R&D labs leveraging platforms to test:

Navigation algorithms

Sensor fusion models

Machine learning enhancements

Ethical frameworks for autonomous systems

Collaborative R&D across academia and industry fosters robust innovation and propels UGV capabilities forward.

Regional Unmanned Ground Vehicles Market Analysis

North America: The Epicenter of Defense-Grade UGV Development

Dominated by the United States Department of Defense and industry leaders such as Lockheed Martin and General Dynamics, North America is a pioneer in deploying and scaling UGV technologies. Investments in smart battlefield systems and border security continue to drive demand.

Europe: Dual-Use Innovations in Civil and Military Sectors

European nations, particularly Germany, France, and the UK, are integrating UGVs into both military and public safety operations. EU-funded initiatives are catalyzing development in automated policing, firefighting, and environmental monitoring.

Asia-Pacific: Emerging Powerhouse with Diverse Use Cases

Led by China, India, and South Korea, the Asia-Pacific region is rapidly advancing in agricultural robotics, smart cities, and military modernization. Government-backed programs and private innovation hubs are pushing domestic manufacturing and deployment of UGVs at scale.

Middle East and Africa: Strategic Adoption in Security and Infrastructure

UGVs are being integrated into border surveillance, oil and gas pipeline inspection, and urban safety across key regions such as the UAE, Saudi Arabia, and South Africa, where rugged environments and security risks necessitate unmanned solutions.

South America: Gradual Integration Across Agriculture and Mining

In countries like Brazil and Chile, unmanned ground vehicles market’s are enhancing resource extraction and precision agriculture. Regional investment in automation is expected to grow in parallel with infrastructure modernization efforts.

Key Companies Shaping the Unmanned Ground Vehicles Market Ecosystem

Northrop Grumman Corporation

General Dynamics Corporation

BAE Systems

QinetiQ Group PLC

Textron Inc.

Oshkosh Corporation

Milrem Robotics

Kongsberg Defence & Aerospace

Teledyne FLIR LLC

Lockheed Martin Corporation

These firms are advancing UGV design, AI integration, sensor modularity, and battlefield-grade resilience, ensuring readiness for both present and future operational challenges.

The forecasted growth is underpinned by:

Rising geopolitical tensions driving military investments

Expanding commercial interest in automation

Cross-sector AI integration and sensor improvements

Purchase Exclusive Report: https://www.statsandresearch.com/enquire-before/40520-global-unmanned-ground-vehicles-ugvs-market

Conclusion: The Evolution of Autonomous Ground Mobility

The global unmanned ground vehicles market stands at the intersection of robotics, AI, and real-world application. As technological maturity converges with widespread need for unmanned solutions, the role of UGVs will extend far beyond today’s use cases. Governments, corporations, and innovators must align strategically to harness the full potential of these systems.

With global investments accelerating and AI-driven capabilities reaching new thresholds, Unmanned Ground Vehicles are not just an industrial trend—they are the vanguard of future operational dominance.

Our Services:

On-Demand Reports: https://www.statsandresearch.com/on-demand-reports

Subscription Plans: https://www.statsandresearch.com/subscription-plans

Consulting Services: https://www.statsandresearch.com/consulting-services

ESG Solutions: https://www.statsandresearch.com/esg-solutions

Contact Us:

Stats and Research

Email: [email protected]

Phone: +91 8530698844

Website: https://www.statsandresearch.com

1 note

·

View note

Text

11 AI SaaS Ideas That Could Make You a Founder in 2025

So you’re thinking about starting a SaaS company—but not just any SaaS. You want to build something that actually solves a problem, taps into the power of AI, and doesn’t get lost in a sea of forgettable apps.

This post is your roadmap. We’ll explore:

Why launching a SaaS company makes sense

Why AI and SaaS together offer unmatched potential

11 startup-worthy AI SaaS ideas across industries

How to validate your idea before coding

Mistakes to avoid

And how to team up with the right partner to build it right

Why SaaS? Why Now?

Here’s why the Software as a Service (SaaS) model is ideal for founders in 2025:

Low startup costs – No inventory, no warehouse. Just smart software.

Predictable revenue – Subscription models offer recurring income and stability.

Global reach – Your product is cloud-based, available anywhere.

Easy maintenance – Updates, bug fixes, and features happen in real-time.

Fast scalability – Cloud platforms and APIs let you grow quickly.

Now add Artificial Intelligence (AI) to that, and you unlock a new level of automation, personalization, and insight.

With over 67% of SaaS companies already using AI to enhance their value, the window for building something powerful is wide open.

11 Profitable AI SaaS Ideas for 2025

These ideas are more than trends—they’re practical, scalable, and ready for real-world impact.

1. AI-Powered Content Generation Tools

What it does: Automates creation of blog posts, social media captions, product descriptions, and more.

Use case: Ideal for content teams, agencies, freelancers, and solopreneurs.

Why it works: Cuts down content creation time without sacrificing quality.

Revenue model: Subscription tiers based on usage volume, language options, or output formats.

2. AI-Driven Analytics Platforms

What it does: Turns complex datasets into real-time, actionable insights.

Use case: Used by marketers, founders, and product managers to make faster decisions.

Why it works: AI identifies trends that humans miss, accelerating growth strategies.

Revenue model: SaaS plans with API access and white-labeled dashboards for businesses.

3. AI for Audience Monitoring

What it does: Tracks keywords, sentiment, and online mentions across platforms.

Use case: Helps social media managers, PR teams, and founders keep up with brand perception.

Why it works: Keeps businesses informed and responsive without manual monitoring.

Revenue model: Charge per keyword, social profile, or number of alerts per month.

4. AI Image & Video Analysis

What it does: Analyzes images or videos for insights—object recognition, facial detection, and scene context.

Use case: Applications in healthcare, tourism, e-commerce, and fitness.

Why it works: Saves hours of manual tagging and gives deeper, data-rich results.

Revenue model: API-based pricing or subscription models per upload volume.

5. AI-Powered Financial Management

What it does: Handles tasks like budgeting, expense tracking, and invoice generation.

Use case: Perfect for small business owners, solopreneurs, and freelancers.

Why it works: Simplifies complex financial tasks and offers real-time insights.

Revenue model: Monthly subscriptions, with higher tiers for premium features like forecasting.

6. AI for Human Resource Management

What it does: Automates hiring processes, sentiment analysis, and employee engagement monitoring.

Use case: Startups and SMEs looking to scale without overburdening HR.

Why it works: Optimizes hiring and enhances employee satisfaction tracking.

Revenue model: Plans based on number of users, hiring campaigns, or employees monitored.

7. AI Audio Content Creation

What it does: Generates high-quality voiceovers, narration, and podcast audio.

Use case: Used by content marketers, educators, and creators.

Why it works: Saves time and cost on recording and editing.

Revenue model: Per-project pricing or monthly access to audio generation tools.

8. AI-Powered Target Marketing

What it does: Customizes ads, emails, and product offers based on behavior and preferences.

Use case: eCommerce stores, SaaS companies, and marketing agencies.

Why it works: Personalized content converts better than generic campaigns.

Revenue model: Subscription tiers based on number of users, emails, or AI personalization depth.

9. AI Inventory Management

What it does: Predicts product demand, tracks stock levels, and automates restocking.

Use case: Retailers, wholesalers, and DTC brands managing complex supply chains.

Why it works: Reduces stockouts and waste while increasing efficiency.

Revenue model: Monthly pricing based on number of SKUs or warehouses.

10. AI Course Generation

What it does: Creates custom digital course content, microlearning modules, and quizzes.

Use case: Educators, coaches, online schools, and corporate trainers.

Why it works: Reduces time and cost of content creation while enhancing personalization.

Revenue model: Monthly subscriptions or pricing per number of course modules created.

11. AI for Business Decision Making

What it does: Analyzes internal data and market conditions to recommend strategies.

Use case: Business executives, operations managers, startup founders.

Why it works: Enables smarter, faster decisions based on predictive models.

Revenue model: Enterprise-level SaaS pricing with features like scenario modeling and custom dashboards.

How to Validate Your AI SaaS Idea

Before writing any code, take these steps to make sure people actually want what you're building:

Create wireframes or simple mockups

Share with real potential users (not just friends)

Launch a landing page to collect interest

Build a no-code MVP if possible

Analyze competitors and find your edge

Common Mistakes to Avoid:

Skipping proper research

Falling in love with your own idea too soon

Over-engineering your MVP

Ignoring the competition

Staying lean, feedback-focused, and iterative will save you time and money—and increase your chances of success.

Building Your SaaS Product with the Right Partner

If you’re ready to build your AI SaaS product but don’t want to do it alone, a third-party partner can make all the difference.

RaftLabs is a custom SaaS development company that has helped more than 18 startups bring their ideas to life in the last 24 months. Whether you need help with ideation, UX design, development, or post-launch support, their team specializes in creating powerful AI-powered web, mobile, and cloud-based applications.

They don’t just build products—they partner with you to create solutions that are scalable, secure, and future-ready.

Originally drafted at Raftlabs

1 note

·

View note

Text

The Role of AI in Logistics and Supply Chain Management: Revolutionizing Business Intelligence!

Artificial Intelligence (AI) tried to be a Transformative security technology logistics and supply chain management, and a range. The Global Logical Industry, valuable to over $ 8, is more idealized with rationalization, operations, improvements, and reduced costs. The pre-intelligent auto-shaping analysis forms the future of chain management that lets you further introduce and promote Business intelligence (BI). One of their most essential applications in logistics is their ability to optimize operational efficiency. Traditionally, chain management was based on static data and manual processes that were bright and subjective.

With AI in logistics and supply chain, companies now have access to the objective analysis of predictive data and models that can optimize everything by the parliament's management. Their systems use large amounts of data to ensure the question, regulate the inventory levels, and provide for the string of strings. Algorithms of automatic learners can analyze past performance, weather conditions, market trends, and other variables to generate predictions. This ability allows the companies to make proactive decisions that reduce the risk or excessive inventory, which leads to improvement and money satisfaction.

Logistics plays an essential role in street optimization. Traditional distribution systems through the best source like Mined XAI often use basic algorithms to plan the most effective shipment routes. However, it may consider a great range of factors such as traffic pretenses, predictions of the street. These points can adjust dynamically and minimize time and fluctuating operational costs. Sleep Management is another area that has a significant impact. Automation through the logistics companies enables them to improve their storage trials. Robotics drive with him and turn those goods are stored, sent, and sent.

Artificial Intelligence in supply chain: The systems to turn on by constantly increasing inventory levels

The automated passage's vowel is still to move inside and out of stores with minimum human interference. Systems concentrated on driving these cars, allowing them to collaborate with human workers. This shows productivity and reduces the risk of human error and security. Moreover, it is revolutionizing stock management in the warehouse. Artificial Intelligence in supply chain, the systems are turned on by constantly increasing inventory levels, predicting the non-products, and making recommendations for reorganizing the claims of the cl. This reduces the supervision and reserves, which are common pain in supply chain management.

In the more regions to exchange an analysis "AI" various chain proposed provisions unprofitability and proficiency. Companies can simulate different predictions, distribution calendars, and choices for suppliers to understand the impact on their net profit. This analysis gives companies a competitive advantage, allowing them to respond more effectively to market changes and operational backgrounds. Predictive analysis is another area where you offer extraordinary value in chain management and a successful chain.

Business intelligence AI works together to provide a complete view of supply chain performance.

The union of artificial intelligence and business intelligence is one of the most influential advances in the supply chain field. BI troops help companies analyze and present data significantly. Business intelligence AI works together to provide a complete view of supply chain performance. Improved traditional application of automatic learning algorithms to analyze groups of massive data, identify trends, and anticipate future results. For example, it can ensure consumption requests, helping your supply chain shows make it based on supply and logistics.

Predicate maintenance is another valuable application where you can predict when cars or equipment in the supplies are likely to fail and reduce repair time. Integration of integration in the supply chain even improves the customer's experience. Allow the wicked of the supplied string to provide the exhilaration of the most accurate distribution, improvement, and service services. Analyzing customer data can predict purchasing behavior and preferences, allowing technologies rationalize communication and experience for the final customer.

Conclusion

It's already started to fund the logistics and management of the prostitution chain, producing a revolution in efficiency and automating analysis. Business intelligence allows companies to make the best data decisions, improve operational performance, and reduce costs. As a result to event and road planning to predict the information supply and enhance customer satisfaction refreshes the chain landscape. At the same time, technology continues to evolve, and the realization of chain development provides perks, efficiency, and trade. Thanks to its extraordinary potential, the supply chain's future is intelligent, automated, and focused on data.

1 note

·

View note

Text

Enterprises Explore These Advanced Analytics Use Cases

Businesses want to use data-driven strategies, and advanced analytics solutions optimized for enterprise use cases make this possible. Analytical technology has come a long way, with new capabilities ranging from descriptive text analysis to big data. This post will describe different use cases for advanced enterprise analytics.

What is Advanced Enterprise Analytics?

Advanced enterprise analytics includes scalable statistical modeling tools that utilize multiple computing technologies to help multinational corporations extract insights from vast datasets. Professional data analytics services offer enterprises industry-relevant advanced analytics solutions.

Modern descriptive and diagnostic analytics can revolutionize how companies leverage their historical performance intelligence. Likewise, predictive and prescriptive analytics allow enterprises to prepare for future challenges.

Conventional analysis methods had a limited scope and prioritized structured data processing. However, many advanced analytics examples quickly identify valuable trends in unstructured datasets. Therefore, global business firms can use advanced analytics solutions to process qualitative consumer reviews and brand-related social media coverage.

Use Cases of Advanced Enterprise Analytics

1| Big Data Analytics

Modern analytical technologies have access to the latest hardware developments in cloud computing virtualization. Besides, data lakes or warehouses have become more common, increasing the capabilities of corporations to gather data from multiple sources.

Big data is a constantly increasing data volume containing mixed data types. It can comprise audio, video, images, and unique file formats. This dynamic makes it difficult for conventional data analytics services to extract insights for enterprise use cases, highlighting the importance of advanced analytics solutions.

Advanced analytical techniques process big data efficiently. Besides, minimizing energy consumption and maintaining system stability during continuous data aggregation are two significant advantages of using advanced big data analytics.

2| Financial Forecasting

Enterprises can raise funds using several financial instruments, but revenue remains vital to profit estimation. Corporate leadership is often curious about changes in cash flow across several business quarters. After all, reliable financial forecasting enables them to allocate a departmental budget through informed decision-making.

The variables impacting your financial forecasting models include changes in government policies, international treaties, consumer interests, investor sentiments, and the cost of running different business activities. Businesses always require industry-relevant tools to calculate these variables precisely.

Multivariate financial modeling is one of the enterprise-level examples of advanced analytics use cases. Corporations can also automate some components of economic feasibility modeling to minimize the duration of data processing and generate financial performance documents quickly.

3| Customer Sentiment Analysis

The customers’ emotions influence their purchasing habits and brand perception. Therefore, customer sentiment analysis predicts feelings and attitudes to help you improve your marketing materials and sales strategy. Data analytics services also provide enterprises with the tools necessary for customer sentiment analysis.

Advanced sentiment analytics solutions can evaluate descriptive consumer responses gathered during customer service and market research studies. So, you can understand the positive, negative, or neutral sentiments using qualitative data.

Negative sentiments often originate from poor customer service, product deficiencies, and consumer discomfort in using the products or services. Corporations must modify their offerings to minimize negative opinions. Doing so helps them decrease customer churn.

4| Productivity Optimization

Factory equipment requires a reasonable maintenance schedule to ensure that machines operate efficiently. Similarly, companies must offer recreation opportunities, holidays, and special-purpose leaves to protect the employees’ psychological well-being and physical health.

However, these activities affect a company’s productivity. Enterprise analytics solutions can help you use advanced scheduling tools and human resource intelligence to determine the optimal maintenance requirements. They also include other productivity optimization tools concerning business process innovation.

Advanced analytics examples involve identifying, modifying, and replacing inefficient organizational practices with more impactful workflows. Consider how outdated computing hardware or employee skill deficiencies affect your enterprise’s productivity. Analytics lets you optimize these business aspects.

5| Enterprise Risk Management

Risk management includes identifying, quantifying, and mitigating internal or external corporate risks to increase an organization’s resilience against market fluctuations and legal changes. Moreover, improved risk assessments are the most widely implemented use cases of advanced enterprise analytics solutions.

Internal risks revolve around human errors, software incompatibilities, production issues, accountable leadership, and skill development. Lacking team coordination in multi-disciplinary projects is one example of internal risks.

External risks result from regulatory changes in the laws, guidelines, and frameworks that affect you and your suppliers. For example, changes in tax regulations or import-export tariffs might not affect you directly. However, your suppliers might raise prices, involving you in the end.

Data analytics services include advanced risk evaluations to help enterprises and investors understand how new market trends or policies affect their business activities.

Conclusion

Enterprise analytics has many use cases where data enhances management’s understanding of supply chain risks, consumer preferences, cost optimization, and employee productivity. Additionally, the advanced analytics solutions they offer their corporate clients assist them in financial forecasts.

New examples that integrate advanced analytics can also process mixed data types, including unstructured datasets. Furthermore, you can automate the process of insight extraction from the qualitative consumer responses collected in market research surveys.

While modern analytical modeling benefits enterprises in financial planning and business strategy, the reliability of the insights depends on data quality, and different data sources have unique authority levels. Therefore, you want experienced professionals who know how to ensure data integrity.

A leader in data analytics services, SG Analytics, empowers enterprises to optimize their business practices and acquire detailed industry insights using cutting-edge technologies. Contact us today to implement scalable data management modules to increase your competitive strength.

2 notes

·

View notes

Link

Credit: NASA New space technology ideas emerge every day from innovators across the country, and NASA’s Small Business Innovation Research (SBIR) program on Monday selected more than 100 projects for funding. This program offers small businesses in the United States early-stage funding and support to advance the agency’s goals of exploring the unknown in air and space while returning benefits to Earth. Specifically, NASA’s SBIR program awarded $93.5 million in Phase II contracts to bring 107 new ideas to life from 95 selected small businesses. Of these businesses, nearly 80% have less than 50 employees, and 21% are receiving their first Phase II award, valued at up to $850,000 each. Each small business was also eligible to apply for up to $50,000 in Technical and Business Assistance program funding to help find new market opportunities and shape their commercialization roadmap. “We are thrilled to support this diverse set of companies as they work diligently to bring their technologies to market,” said Jenn Gustetic, director of Early Stage Innovation and Partnerships with NASA’s Space Technology Mission Directorate (STMD) at the agency’s headquarters in Washington. “Inclusive innovation is integral to mission success at NASA, and we’re excited to see that 29% of the awardees are from underrepresented groups, including 11% women-owned businesses.” In Phase II, awardees will build on their success from the program’s first phase to bring their technologies closer to real-world use. The companies have 24 months to execute their plans, which focus on their technologies’ path to commercialization. For example, NASA selected women-owned and first-time NASA Phase II awardee nou Systems, Inc. in Huntsville, Alabama, for its genetic testing instrument. While portable genetic sequencing already exists, field sequencing – that would allow DNA analysis anywhere on Earth or off planet – remains unfeasible as the preparation of the DNA Library remains an intensely manual process, needing a trained wet lab technician and several pieces of laboratory equipment. The Phase II technology takes advantage of several cross-enabling technologies, creating an instrument to automate the genetic sequencing process. “Our program works directly with small businesses to forge innovative concepts and technologies that drive impact for NASA projects as well as a myriad of commercial endeavors,” said Jason L. Kessler, program executive for NASA’s SBIR and Small Business Technology Transfer (STTR) program at NASA Headquarters. “This collaboration results in realized opportunities not only for NASA but all of humanity.” This includes technologies aiming to reduce astronaut workload and improve robotic scientific endeavors on the Moon and Mars. PickNik Inc. based in Boulder, Colorado, will use its Phase II award to continue developing a hardware-agnostic platform for supervised autonomy that empowers humans to command a remote robot to complete complex tasks with minimal input, which could support the Artemis program. Outside of NASA, PickNik’s software product may be of interest to commercial space customers working on low Earth orbit destinations, in-space servicing, and more, as well as on Earth in areas like warehouse management, oil rig maintenance, and deep-sea exploration. The NASA SBIR program is open to U.S. small businesses to develop an innovation or technology. The program is part of STMD and managed by NASA’s Ames Research Center in California’s Silicon Valley. To learn more about the NASA SBIR program, visit: https://sbir.nasa.gov -end- Jimi RussellHeadquarters, [email protected] Share Details Last Updated Apr 22, 2024 LocationNASA Headquarters Related TermsSmall Business Innovation Research / Small BusinessSpace Technology Mission Directorate

2 notes

·

View notes

Text

Supply Chain Management Market Grows Strong with AI and IoT Integration

The Supply Chain Management Market Size was valued at USD 26.2 billion in 2023 and is expected to reach USD 65.8 billion by 2032, growing at a CAGR of 10.8% from 2024-2032.

Supply Chain Management Market is undergoing rapid transformation as global businesses prioritize resilience, transparency, and agility. The post-pandemic landscape has emphasized the importance of digitized supply chains to mitigate disruptions, improve logistics efficiency, and meet evolving customer expectations.

U.S.: A Major Hub for Technology-Driven Supply Chain Solutions

Supply Chain Management Market is increasingly driven by advancements in automation, artificial intelligence, and real-time analytics. Enterprises across manufacturing, retail, and healthcare are integrating smart technologies to streamline operations and ensure end-to-end visibility.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/3110

Market Keyplayers:

Oracle SAP IBM Microsoft Infor JDA Software Manhattan Associates Kinaxis Logility E2open BluJay Solutions C.H. Robinson FedEx UPS DHL Kuehne + Nagel DB Schenker Ryder XPO Logistics Schneider National

Market Analysis

The Supply Chain Management (SCM) market is evolving into a strategic function rather than a back-end operation. Businesses are rethinking traditional models by adopting cloud-based SCM platforms, predictive analytics, and demand-driven planning tools. In the U.S., the emphasis lies on intelligent logistics networks, while Europe focuses on sustainable sourcing and regulatory compliance. Cross-border complexities and rising transportation costs are pushing companies toward scalable, tech-enabled solutions.

Market Trends

Accelerated shift to cloud-based SCM platforms

AI and machine learning enhancing demand forecasting

Integration of Internet of Things (IoT) for real-time tracking

Blockchain adoption for traceability and contract automation

Emphasis on sustainability and ethical sourcing

Rise of control towers for end-to-end supply chain visibility

Workforce automation and robotics in warehouses

Market Scope

The scope of the SCM market is expanding across industries and borders. With global trade dynamics shifting and customer expectations rising, companies are investing in smarter, adaptive supply chain ecosystems.

Multimodal logistics coordination tools

Predictive analytics for proactive risk management

Real-time supplier collaboration portals

Cloud-native infrastructure supporting global scalability

Integrated platforms bridging procurement to delivery

Forecast Outlook

The future of the Supply Chain Management market lies in building intelligent, data-driven ecosystems. As geopolitical instability and raw material fluctuations persist, demand for flexible, AI-powered SCM tools will increase. The market will see deeper integration of predictive analytics, ESG (environmental, social, governance) metrics, and autonomous logistics technologies. Both the U.S. and Europe are expected to play pivotal roles in shaping global standards and innovation strategies.

Market Opportunities

Development of green logistics and carbon tracking solutions

Expansion of AI-driven supply chain simulation tools

Rising need for cybersecurity in digital SCM networks

Growing investment in last-mile delivery tech

Strategic partnerships between logistics providers and tech firms

Demand for agile platforms among SMEs expanding globally

Access Complete Report: https://www.snsinsider.com/reports/supply-chain-management-market-3110

Conclusion

The Supply Chain Management Market is no longer just about cost control—it’s about competitive advantage. From intelligent platforms in the U.S. to sustainable sourcing in Europe, SCM is evolving into a strategic driver of business growth. Companies embracing digital-first, adaptive supply chains will lead the future, powered by innovation, resilience, and real-time decision-making.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Related Reports:

U.S.A witnesses rapid adoption of Intelligent Process Automation to streamline enterprise workflows

U.S.A embraces Content Services Platforms to streamline enterprise information management and enhance productivity

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Mail us: [email protected]

#Supply Chain Management Market#Supply Chain Management Market Scope#Supply Chain Management Market Trends

0 notes

Text

Automated Truck Loading System Market Booms as Robotics Transform Truck Loading Efficiency

Market Overview

The Automated Truck Loading System (ATLS) market is revolutionizing the transportation and logistics sectors by enabling faster, safer, and more efficient loading and unloading processes. ATLS is designed to automate the movement of cargo between a facility and transport vehicles, significantly reducing human intervention and streamlining operations. With industries like automotive, logistics, food and beverage, and retail increasingly embracing automation, the demand for ATLS solutions is on a robust upward trajectory. These systems are helping companies improve operational efficiency, reduce labor costs, and minimize cargo damage—all while boosting turnaround times.

By 2034, the market is expected to see a remarkable expansion, fueled by growing adoption in both new installations and retrofit projects across manufacturing plants, distribution hubs, and ports. Technological advancements, especially in automated guided vehicles (AGVs), robotic arms, and sensor-based conveyor systems, are adding new dimensions to how freight is moved and managed.

Click to Request a Sample of this Report for Additional Market Insights: https://www.globalinsightservices.com/request-sample/?id=GIS10456

Market Dynamics

One of the primary drivers of the ATLS market is the growing need for warehouse automation amid rising global trade volumes and e-commerce growth. Companies are under pressure to move goods more quickly, safely, and cost-effectively—needs that traditional manual loading systems cannot consistently meet. This has made automated loading systems not just a luxury but a necessity.

Another critical factor boosting the market is the labor shortage in warehousing and logistics. Automated systems reduce reliance on manual labor, especially in high-turnover environments such as ports and distribution centers. Moreover, they provide consistent performance, minimizing human error and workplace injuries.

However, the high initial cost of deployment, especially for smaller organizations, remains a constraint. Some businesses are also wary about integrating ATLS into existing legacy systems. Yet, the long-term savings in labor and increased operational speed often outweigh the initial capital investment. Additionally, retrofitting solutions have emerged as a cost-effective way for companies to adopt automation without overhauling their existing infrastructure.

Key Players Analysis

Leading companies in the ATLS market are continuously innovating to offer modular, scalable, and intelligent loading systems. Firms like BEUMER Group, Joloda Hydraroll, Secon Components, and Actiw Oy are among the top contenders driving this market. These companies provide a wide range of products including belt conveyor systems, skate conveyor systems, and robotic loading arms, with specialized sensors and software that integrate seamlessly with warehouse management systems.

Most major players focus heavily on R&D to enhance automation and data analytics capabilities. Some are also investing in partnerships and mergers to strengthen their global footprint. For example, companies have been incorporating AI-based software and IoT-enabled sensors to enable predictive maintenance and real-time data tracking.

Regional Analysis

Geographically, North America holds a substantial share of the ATLS market, driven by advanced industrial infrastructure, high labor costs, and early technology adoption. The United States is especially prominent, with key investments pouring into automation across automotive and logistics sectors.

Europe follows closely, with countries like Germany, France, and the Netherlands actively adopting ATLS to support their well-established manufacturing and export industries. The Asia Pacific region, particularly China, India, and Japan, is witnessing rapid growth due to rising industrialization, urbanization, and the booming e-commerce market.

In Latin America and the Middle East, the market is emerging with increasing investment in logistics infrastructure, especially in major ports and airports where ATLS can significantly boost cargo handling efficiency.

Recent News & Developments

Recent years have seen several notable developments in the ATLS space. Innovations such as AI-driven route optimization, sensor fusion for object detection, and integration with warehouse robotics are becoming mainstream. Several companies have announced large-scale projects to deploy ATLS in newly built smart warehouses and logistics centers.

Another important trend is the focus on sustainability. Manufacturers are now developing energy-efficient motors and conveyor systems that align with green logistics goals. The use of modular systems also allows easier upgrades, promoting long-term system use without full replacement, which reduces environmental impact.

Browse Full Report @ https://www.globalinsightservices.com/reports/automated-truck-loading-system-atls-market/

Scope of the Report

The future of the ATLS market looks promising, underpinned by evolving technology, growing industrial demand, and strong ROI for end users. With applications spanning across automotive, pharmaceuticals, retail, and food & beverage sectors, the market is poised to diversify further in terms of use cases and deployment strategies.

As companies increasingly seek fully integrated automation ecosystems, solutions like roller tracks, dock levelers, and bumpers—all tied into centralized software platforms—are expected to see heightened demand. Furthermore, with new installation projects and retrofitting of legacy systems both on the rise, the market will offer a broad range of opportunities for system integrators, equipment manufacturers, and software developers alike.

In conclusion, the ATLS market is more than a trend—it's becoming a cornerstone of modern logistics. The coming decade will likely see the transition from semi-automated to fully autonomous loading systems, transforming how goods are handled, shipped, and delivered globally.

Discover Additional Market Insights from Global Insight Services:

Aerospace Parts Manufacturing Market: https://www.openpr.com/news/4087993/aerospace-parts-manufacturing-market-is-anticipated-to-expand

Bakery Packaging Machine Market: https://www.openpr.com/news/4091520/bakery-packaging-machine-market-is-anticipated-to-expand-from

Pallet Market: https://www.openpr.com/news/4093697/global-pallet-market-to-reach-127-1-billion-by-2034-growing

E-Bike Market: https://www.openpr.com/news/4094127/e-bike-market-is-anticipated-to-expand-from-41-1-billion-in-2024

0 notes

Text

Fixed Industrial Scanner Market : Trends, Share, Industry Size, Growth, Demand, Opportunities and Forecast

Fixed Industrial Scanner Market, Size, Trends, Business Strategies 2025-2032

The global Fixed Industrial Scanner Market was valued at 1603 million in 2024 and is projected to reach US$ 2733 million by 2032, at a CAGR of 8.1% during the forecast period.

Fixed industrial scanners are stationary barcode reading devices designed for high-performance tracking across industrial environments. These systems provide automated identification capabilities for parts, packages, and products throughout manufacturing and logistics workflows. Common scanner types include industrial laser scanners and industrial imagers, which capture 1D/2D barcodes with precision even in challenging conditions.

The market growth is driven by increasing automation across industries, with the global industrial automation market reaching USD 479 billion in 2022. As Industry 4.0 adoption accelerates, demand grows for reliable scanning solutions in logistics, manufacturing, and warehouse applications. Key players like Zebra Technologies and Honeywell continue launching advanced models with features such as enhanced decoding algorithms and IoT connectivity to meet evolving industry requirements.

Our comprehensive Market report is ready with the latest trends, growth opportunities, and strategic analysis. https://semiconductorinsight.com/download-sample-report/?product_id=76858

Segment Analysis:

By Type

Industrial Laser Scanners Lead the Market with High Adoption in Automated Production Lines

The market is segmented based on type into:

Industrial Laser Scanner

Industrial Imager

By Application

Logistics and Warehousing Applications Drive Market Growth Due to Rising E-Commerce Activities

The market is segmented based on application into:

Logistics and Warehousing

Industrial Manufacturing

Others

By End User

Manufacturing Sector Dominates with Increased Focus on Automation and Traceability

The market is segmented based on end user into:

Automotive

Electronics

Pharmaceuticals

Food & Beverage

Others

Regional Analysis: Fixed Industrial Scanner Market

North America North America dominates the Fixed Industrial Scanner market, driven by strong industrial automation adoption and high investments in Industry 4.0 initiatives. The U.S. leads in automation with significant deployment of fixed industrial scanners in logistics, manufacturing, and healthcare sectors. Strict quality control regulations and the need for traceability in supply chains further stimulate demand. Companies like Zebra Technologies and Honeywell have a strong presence, leveraging their R&D capabilities to introduce AI-powered and high-throughput scanning solutions. However, high operational costs and competition from Asian manufacturers present challenges. The market is expected to grow steadily at 7-8% CAGR, supported by reshoring trends and e-commerce expansion.

Europe Europe’s market is characterized by stringent industrial safety standards and rapid digital transformation in manufacturing. Countries like Germany, France, and the U.K. are frontrunners, with automotive and pharmaceutical industries extensively using fixed scanners for real-time tracking and compliance with EU regulations. The shift towards smart factories under Industry 4.0 is a major growth driver. However, high replacement costs and mature markets in Western Europe slow down adoption rates. Meanwhile, Eastern Europe offers growth potential due to emerging manufacturing hubs in Poland and the Czech Republic.

Asia-Pacific Asia-Pacific is the fastest-growing market, fueled by China’s manufacturing boom, Japan’s automation leadership, and India’s logistics expansion. China alone accounts for over 35% of global demand, supported by government initiatives like “Made in China 2025.” Cost-effective locally produced scanners dominate regional markets, though premium brands gain traction in high-precision sectors. Challenges include fragmented supply chains and inconsistent quality control, but rising labor costs are accelerating automation investments. Southeast Asia, with its expanding electronics and automotive sectors, is also becoming a key growth area.

South America The region shows moderate growth potential, driven by Brazil and Argentina’s food processing and mining sectors. Fixed scanners are increasingly used for export compliance and inventory management, but economic instability and low industrialization rates hinder large-scale adoption. Governments are gradually introducing policies to modernize manufacturing, creating opportunities for mid-range scanner suppliers. The lack of local vendors forces reliance on imports, increasing costs for end-users.

Middle East & Africa The market here is nascent but promising, with UAE and Saudi Arabia leading due to investments in warehousing and oil & gas automation. Fixed scanners are mostly deployed in ports and large-scale logistics hubs to enhance operational efficiency. However, limited industrial diversification and low awareness of advanced scanning technologies constrain growth. Partnerships with global players like Cognex and Datalogic are helping bridge the technology gap, but affordability remains a hurdle for widespread adoption.

List of Major Fixed Industrial Scanner Manufacturers

Zebra Technologies Corporation (U.S.)

Datalogic S.p.A. (Italy)

Honeywell International Inc. (U.S.)

Cognex Corporation (U.S.)

SICK AG (Germany)

Newland Europe BV (Netherlands)

Denso Wave Incorporated (Japan)

Omron Corporation (Japan)

MINDEO (China)

Blue Bird Group (South Korea)

Cobalt Systems Ltd. (UK)

The global shift toward Industry 4.0 is creating unprecedented demand for fixed industrial scanners across manufacturing facilities. As factories implement smart manufacturing principles, the need for automated tracking and traceability solutions has grown by over 62% since 2020. Fixed industrial scanners serve as critical components in this transformation, enabling real-time data capture for inventory management, quality control, and supply chain optimization. Their ability to integrate with IoT platforms and enterprise systems positions them as essential tools for achieving operational excellence in digital factories.

The explosive growth of e-commerce, projected to surpass $7 trillion in global sales by 2025, is forcing logistics operators to upgrade their scanning infrastructure. Fixed industrial scanners are becoming indispensable in fulfillment centers, where they process over 20,000 scans per hour with 99.9% accuracy. These systems enable fully automated sortation, package tracking, and last-mile logistics optimization. Major retailers have increased their automation budgets by 40-50% year-over-year, with fixed scanning solutions representing one of the fastest-growing categories of warehouse technology investments.

Furthermore, regulatory mandates for pharmaceutical serialization and food traceability are compelling manufacturers across verticals to implement industrial scanning solutions. For instance, recent DSCSA requirements in the U.S. pharmaceutical supply chain have created a $750 million market opportunity for track-and-trace technologies, with industrial scanners capturing a significant share.

The integration of artificial intelligence into fixed industrial scanners is creating breakthrough capabilities that redefine operational value. Modern systems now incorporate machine learning algorithms that continuously improve read rates by adapting to damaged or poorly printed codes. These intelligent scanners can achieve 99.99% accuracy even with suboptimal labels, reducing manual intervention by up to 80%. Leading manufacturers are developing purpose-built AI models for specific industries, with pharmaceutical and automotive applications showing particularly strong adoption.

Another significant opportunity lies in merging scanning data with predictive analytics. By correlating scan events with production variables, manufacturers can identify quality trends before they impact output. Early adopters report 15-20% reductions in defects by implementing these advanced scanning analytics platforms. The next generation of scanners will likely incorporate edge computing capabilities to perform real-time quality checks directly at the scanning point.

Emerging applications in sustainable manufacturing also present growth avenues. New scanning systems help track material composition and recycling metrics throughout production cycles, supporting circular economy initiatives. As environmental regulations tighten globally, these capabilities will become mandatory rather than optional for industrial operators.

The market is highly fragmented, with a mix of global and regional players competing for market share. To Learn More About the Global Trends Impacting the Future of Top 10 Companies https://semiconductorinsight.com/download-sample-report/?product_id=76858

Key Questions Answered by the Fixed Industrial Scanner Market Report:

What is the current market size of Global Fixed Industrial Scanner Market?

Which key companies operate in Global Fixed Industrial Scanner Market?

What are the key growth drivers?

Which region dominates the market?

What are the emerging trends?

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014

[+91 8087992013]

0 notes

Text

AI-First Sales Strategies: How to Future-Proof Your Pipeline

In 2025’s fast-paced B2B landscape, traditional sales methods can’t keep up. Buyers are informed, markets shift quickly, and competition is fierce. The solution? An AI-first sales strategy that embeds intelligence into every stage of your pipeline, ensuring your team moves faster, smarter, and more predictably.

In this guide, you’ll learn:

Why an AI-first approach is essential for modern sales teams

Core AI-powered tactics for prospecting, scoring, and outreach

How to integrate AI into your workflow step-by-step

Metrics to measure impact and refine your strategy

Best practices for balancing AI efficiency with human touch

Let’s dive in.

1. Why AI-First is Non-Negotiable in 2025

Data Overload: Sales reps can no longer manually analyze vast datasets. AI processes millions of data points in seconds, surfacing true opportunities.

Elevated Buyer Expectations: Prospects expect personalized, timely engagement. AI enables hyper-relevance at scale.

Accelerated Market Changes: Rapid shifts in technology and demand require real-time adaptability; AI updates insights continuously.

Companies adopting AI-first strategies report up to 50% faster sales cycles and 30% higher win rates, according to recent industry surveys.

2. Core AI-Powered Tactics

2.1 Intelligent Prospecting

Real-Time Intent Monitoring: AI tools track website visits, content downloads, and third-party signals (e.g. Bombora) to alert reps the instant a prospect shows buying intent.

URL-Based Lead Generation: Platforms like ScorsAI extract and verify decision-maker contacts from any domain in under a minute.

2.2 Predictive Lead Scoring

Multi-Dimensional Scoring Models: Machine learning analyzes firmographics, technographics, and historical conversion patterns to assign dynamic scores.

Continuous Learning: Models retrain on win/loss outcomes and changing market signals, ensuring scores remain accurate and relevant.

2.3 Hyper-Personalized Outreach

Generative AI Email Drafting: AI crafts subject lines and body copy tailored to each prospect’s industry, role, and recent activities.

Sequence Automation: Outreach platforms send customized follow-ups based on individual engagement triggers (opens, clicks, replies).

2.4 Predictive Forecasting & Deal Management

Deal Risk Analysis: AI highlights at-risk opportunities by comparing current deal signals to historical win/loss patterns.

Next-Best-Action Recommendations: Systems suggest optimal next steps (content shares, call timing) to nudge deals forward.

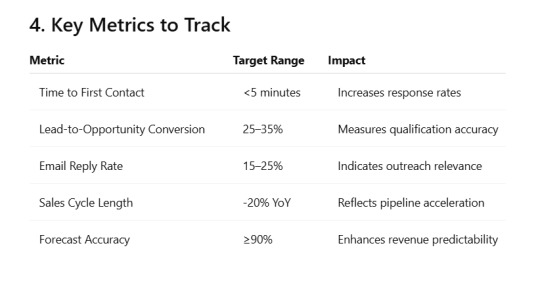

3. Implementation Roadmap

Audit Your Data Stack

Integrate CRM, marketing automation, web analytics, and intent feeds into a unified data warehouse.

Choose the Right AI Tools

Pilot solutions for prospecting (ScorsAI), scoring (6sense), and outreach (Lavender).

Define Success Metrics

Establish baselines for response time, conversion rates, and forecast accuracy.

Train & Enable Your Team

Conduct workshops on interpreting AI insights and customizing AI-generated content.

Iterate and Scale

Review performance monthly, refine models and templates, and expand to new segments.

5. Balancing AI with Human Expertise

AI for Efficiency: Automate data tasks, lead scoring, and initial outreach.

Humans for Empathy: Sales reps handle nuanced negotiations, strategic account relationships, and complex objections.

Feedback Loops: Encourage reps to flag AI errors and share successful patterns to retrain models.

Final Thoughts

An AI-first approach isn’t about replacing sales teams—it’s about empowering them. By embedding AI into prospecting, scoring, outreach, and forecasting, you build a pipeline that’s faster, more accurate, and resilient amid market changes.

Ready to future-proof your pipeline? Start with an AI prospecting pilot or explore how ScorsAI can instantly source and score your next high-intent leads.

0 notes

Text

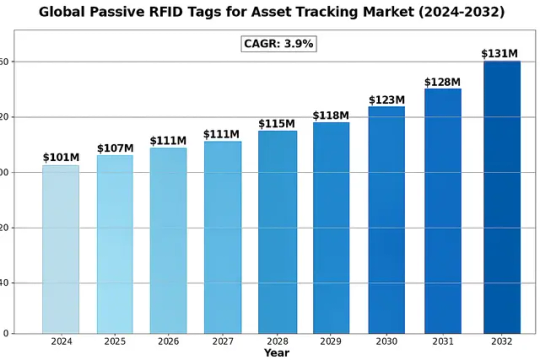

Passive RFID Tags for Asset Tracking Market : Key Trends, Regional Insights, and Strategical Forecast to 2032

The global Passive RFID Tags for Asset Tracking Market was valued at 101 million in 2024 and is projected to reach US$ 131 million by 2032, at a CAGR of 3.9% during the forecast period.

Passive RFID tags are wireless tracking devices that enable efficient asset management without requiring an internal power source. These tags operate by reflecting RF signals from readers, making them ideal for applications requiring long-term tracking with minimal maintenance. The technology is categorized into UHF (Ultra-High Frequency) and HF (High Frequency) variants, each offering distinct advantages in read range and data transfer speeds.

The market growth is driven by increasing adoption across retail, logistics, and manufacturing sectors where real-time asset visibility is critical. While cost-effectiveness remains a key advantage, emerging applications in healthcare and smart cities are creating new opportunities. However, challenges like signal interference in metal-rich environments persist. Leading players including Zebra Technologies and Avery Dennison are investing in advanced tag designs to overcome these limitations and expand market penetration.

Get Full Report with trend analysis, growth forecasts, and Future strategies : https://semiconductorinsight.com/report/passive-rfid-tags-for-asset-tracking-market/

Segment Analysis:

By Type

UHF Passive RFID Tags Lead the Market Owing to Long Read Range and Cost Efficiency

The market is segmented based on type into:

UHF (Ultra-High Frequency)

Subtypes: Gen 2 UHF tags, RAIN RFID, and others

HF (High Frequency)

Subtypes: NFC-enabled tags, ISO 15693 compliant, and others

By Application

Warehousing and Logistics Segment Dominates Due to Rising Automation in Supply Chain Management

The market is segmented based on application into:

Retail and Wholesale

Warehousing and Logistics

Industrial Manufacturing

Others

By Frequency Range

860-960 MHz Category Holds Major Share for Asset Tracking Applications

The market is segmented based on frequency range into:

Low Frequency (125-134 kHz)

High Frequency (13.56 MHz)

Ultra-High Frequency (860-960 MHz)

By Form Factor

On-Metal Tags Gain Traction for Industrial Asset Management Solutions

The market is segmented based on form factor into:

Label Tags

Card Tags

On-Metal Tags

Hard Tags

Regional Analysis: Passive RFID Tags for Asset Tracking Market

North America North America leads in passive RFID adoption, driven by advanced supply chain digitization and strong regulatory compliance mandates. The U.S. accounts for over 60% of the regional market, with extensive deployments in retail (e.g., Walmart’s RFID mandate) and logistics. The region’s mature IoT infrastructure and focus on real-time asset visibility fuel demand for UHF tags, particularly in cold chain monitoring and pharmaceutical tracking. Canada follows closely, with growing RFID use in oil & gas asset management and cross-border logistics. High-capacity logistics hubs and warehouse automation trends create sustained growth opportunities, though pricing pressures remain for high-volume adopters.

Europe Europe’s market is characterized by stringent data privacy regulations (GDPR) and emphasis on circular economy principles, driving RFID adoption for reusable asset tracking. Germany and the U.K. dominate, with manufacturing sectors leveraging Industry 4.0 integrations for tool tracking. The region shows strong preference for HF tags in embedded industrial applications, while retail adopts UHF labels. EU-wide initiatives like the Digital Product Passport proposal are expected to accelerate adoption. However, fragmentation in frequency regulations across countries complicates cross-border deployments, with ongoing harmonization efforts under ETSI standards.

Asia-Pacific As the fastest-growing regional market (5.2% CAGR), APAC benefits from manufacturing expansion and logistics modernization. China’s manufacturing sector consumes 40% of regional RFID tags for factory automation, while India’s retail sector shows surging adoption. Japan leads in RFID-embedded machinery parts, whereas Southeast Asia focuses on port logistics applications. Price sensitivity drives demand for low-cost UHF tags, with local manufacturers like Invengo gaining market share. However, inconsistent RFID infrastructure and spectrum allocation differences between countries create implementation hurdles for multinational corporations operating in the region.

South America Market growth is constrained by economic volatility but shows promise in mining equipment tracking (Chile, Peru) and agricultural asset management (Brazil). Brazil accounts for 55% of regional demand, with increasing RFID use in automotive parts logistics. The lack of standardized mandates and lower IoT maturity slows adoption compared to other regions. However, port modernization projects and growing cross-border trade are creating new opportunities for pallet and container tracking solutions. Local production remains limited, with most tags imported from North America or Asia.

Middle East & Africa The market is emerging, led by GCC countries’ logistics hubs and oilfield asset tracking requirements. UAE’s ports and Saudi Arabia’s Vision 2030 projects drive adoption of durable RFID tags for harsh environments. Africa shows potential in pharmaceutical supply chains (supported by PEPFAR initiatives) and mining operations, though infrastructure constraints limit widespread use. The region demonstrates particular interest in metal-mountable UHF tags for industrial applications. While current market penetration remains low (under 15% of global share), strategic investments in smart cities and ports suggest long-term growth potential.

MARKET OPPORTUNITIES

Emerging Industry 4.0 Applications to Unlock New Growth Potential

The convergence of passive RFID with Industry 4.0 technologies creates compelling new use cases. When integrated with AI-powered analytics platforms, RFID systems can enable predictive maintenance workflows by tracking tool usage patterns in manufacturing environments. Early implementations have demonstrated 25-40% reductions in equipment downtime. Similarly, combining RFID with blockchain solutions enhances supply chain provenance tracking – particularly valuable for pharmaceutical and luxury goods authentication.

The healthcare sector presents particularly promising opportunities, with passive RFID enabling automated tracking of high-value medical equipment across hospital networks. Pilot programs show 80% reductions in equipment search times and 15% decreases in duplicate purchases. As healthcare systems prioritize operational efficiency, RFID adoption in this vertical is projected to grow at 7.2% CAGR through 2030.

➤ Recent advancements in chipless RFID technology promise to reduce tag costs below $0.01 per unit, potentially enabling item-level tagging for disposable consumer goods.

Additionally, the rise of smart city infrastructure creates new applications for passive RFID in municipal asset management, from tracking maintenance equipment to monitoring utility assets. These expanding use cases across emerging sectors position passive RFID for sustained long-term growth beyond traditional retail and logistics applications.

PASSIVE RFID TAGS FOR ASSET TRACKING MARKET TRENDS

Rising Adoption of IoT and Industry 4.0 Driving Market Expansion