#Wafer Fabrication Market

Explore tagged Tumblr posts

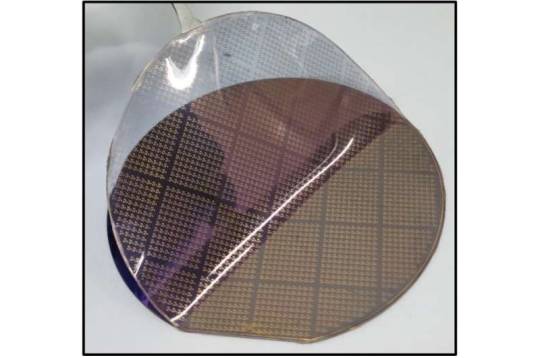

Photo

A new elastic polymer dielectric to create wafer-scale stretchable electronics

Over the past few years, material scientists and electronics engineers have been trying to fabricate new flexible inorganic materials to create stretchable and highly performing electronic devices. These devices can be based on different designs, such as rigid-island active cells with serpentine-shape/fractal interconnections, neutral mechanical planes or bunked structures.

Despite the significant advancements in the fabrication of stretchable materials, some challenges have proved difficult to overcome. For instance, materials with wavy or serpentine interconnect designs commonly have a limited area density and fabricating proposed stretchable materials is often both difficult and expensive. In addition, the stiffness of many existing stretchable materials does not match that of human skin tissue, making them uncomfortable on the skin and thus not ideal for creating wearable technologies.

Researchers at Sungkyunkwan University (SKKU), Institute for Basic Science (IBS), Seoul National University (SNU), and Korea Advanced Institute of Science and Technology (KAIST) have recently fabricated a vacuum-deposited elastic polymer for developing stretchable electronics. This material, introduced in Nature Electronics, could be used to create stretchy field-effect transistors (FETs), which are primary components of most electronic devices on the market today.

Read more.

18 notes

·

View notes

Text

0 notes

Text

The Chemical Mechanical Planarization Market is projected to grow from USD 5402.5 million in 2024 to an estimated USD 8291.14 million by 2032, with a compound annual growth rate (CAGR) of 5.5% from 2024 to 2032.The Chemical Mechanical Planarization (CMP) market has emerged as a critical segment within the semiconductor and electronics industry, driving innovation and growth through its pivotal role in manufacturing processes. CMP is an essential technique employed in semiconductor fabrication to achieve flat and smooth wafer surfaces, which are crucial for high-performance integrated circuits. As technological advancements accelerate and consumer demand for sophisticated electronic devices grows, the CMP market is poised for significant expansion.

Browse the full report at https://www.credenceresearch.com/report/chemical-mechanical-planarization-market

Market Size and Growth Projections

The global CMP market is projected to experience robust growth, with its valuation estimated to increase from USD 5.2 billion in 2024 to approximately USD 8.7 billion by 2032. This represents a compound annual growth rate (CAGR) of 6.8% during the forecast period. This growth is fueled by escalating demand for advanced semiconductor devices across industries such as telecommunications, consumer electronics, automotive, and healthcare. The proliferation of technologies like 5G, artificial intelligence (AI), and the Internet of Things (IoT) further amplifies the need for efficient and reliable planarization processes, thereby bolstering the CMP market.

Key Market Drivers

Rising Demand for Miniaturization

As devices become more compact and powerful, the semiconductor industry is increasingly adopting smaller node technologies. CMP plays a crucial role in achieving the required precision and uniformity in these advanced nodes. The demand for miniaturization in consumer electronics, smartphones, and wearables drives the adoption of CMP processes.

Growth in 5G and IoT Applications

The deployment of 5G networks and the widespread adoption of IoT applications necessitate the development of high-performance semiconductors. CMP is indispensable in fabricating these chips, ensuring optimal performance and reliability. The expanding ecosystem of connected devices further strengthens the CMP market’s prospects.

Advancements in CMP Materials and Equipment

The development of innovative CMP slurries, pads, and equipment is enhancing the efficiency and effectiveness of planarization processes. These advancements address challenges such as defect reduction, process optimization, and cost efficiency, making CMP more attractive to semiconductor manufacturers.

Growth in Automotive Electronics

The automotive sector’s increasing reliance on electronic components, including advanced driver-assistance systems (ADAS), electric vehicle (EV) systems, and infotainment systems, is driving the demand for high-quality semiconductors. CMP ensures the production of defect-free wafers, aligning with the automotive industry’s stringent quality standards.

Challenges and Opportunities

Despite its growth prospects, the CMP market faces challenges such as high equipment costs, complexity in process integration, and stringent environmental regulations. However, these challenges present opportunities for innovation. The development of eco-friendly CMP solutions, advancements in process automation, and the integration of artificial intelligence and machine learning for process optimization are areas ripe for exploration.

Key Players and Competitive Landscape

The CMP market is characterized by the presence of established players and emerging innovators. Key companies include Applied Materials, Inc., Lam Research Corporation, Ebara Corporation, DuPont, Entegris, Inc., and Cabot Microelectronics. These players are investing heavily in R&D to enhance their product offerings and maintain a competitive edge. Strategic partnerships, mergers, and acquisitions are also prevalent as companies aim to expand their market presence and technological capabilities.

Future Outlook

The Chemical Mechanical Planarization market is poised for sustained growth, driven by technological advancements, rising demand for high-performance semiconductors, and the proliferation of next-generation applications. As the semiconductor industry continues to evolve, the CMP market will remain integral to achieving the precision and efficiency required for cutting-edge technologies. With ongoing innovation and strategic investments, the market holds promising prospects for stakeholders across the value chain.

Key Player Analysis:

Air Products and Chemicals, Inc.

Applied Materials Inc.

Cabot Microelectronics Corporation

CMC Materials

DOW Electronic Materials

Ebara Corporation

Fujimi Incorporation

Hitachi Chemical Company, Ltd.

LAM Research Corporation

Lapmaster Wolters GmbH

Okamoto Machine Tool Works, Ltd.

Segmentation:

By Type:

CMP Consumable

CMP Equipment

By Technology:

Leading Edge

More than Moore’s

Emerging

By Application:

Integrated Circuits

MEMS and NEMS

Compound Semiconductors

Optics

By Region:

North America

U.S.

Canada

Mexico

Europe

Germany

France

U.K.

Italy

Spain

Rest of Europe

Asia Pacific

China

Japan

India

South Korea

South-east Asia

Rest of Asia Pacific

Latin America

Brazil

Argentina

Rest of Latin America

Middle East & Africa

GCC Countries

South Africa

Rest of the Middle East and Africa

Browse the full report at https://www.credenceresearch.com/report/chemical-mechanical-planarization-market

Contact:

Credence Research

Please contact us at +91 6232 49 3207

Email: [email protected]

0 notes

Text

High purity Alumina Market

High Purity Alumina Market Size, Share, Trends: Sumitomo Chemical Co., Ltd. Leads

Surging Demand for HPA in Li-Ion Battery Separators Boosts Market Growth

Market Overview:

The High Purity Alumina (HPA) market is expected to develop at a CAGR of 21.8% between 2024 and 2031. The market value is predicted to rise from XX USD in 2024 to YY USD in 2031. Asia-Pacific is expected to be the leading region in this market. Key metrics include rising demand for LED manufacture, increased utilisation in lithium-ion batteries, and expanding applications in semiconductor substrates. The HPA market is increasing rapidly, owing to the expanding electronics sector and the shift towards energy-efficient lighting options. The growing use of HPA in smartphones, electric vehicles, and renewable energy storage systems is driving market growth. Furthermore, the material's distinctive features, such as high thermal conductivity and superior electrical insulation, are propelling its employment in a variety of high-tech applications.

DOWNLOAD FREE SAMPLE

Market Trends:

The high purity alumina industry is seeing a considerable increase in the use of HPA as a coating material for lithium-ion battery separators. The rising electric vehicle (EV) sector and the developing portable electronics industry are driving this application forward. Stringent safety rules in the automobile sector, as well as the demand for longer-lasting, more efficient batteries in consumer electronics, have fuelled this trend. Major battery manufacturers are including HPA-coated separators into their designs, creating a rise in demand. This tendency is projected to continue as the EV market expands, with forecasts predicting that EVs will account for up to 30% of worldwide car sales by 2030.

Market Segmentation:

The 4N (99.99% purity) segment dominates the High Purity Alumina market, owing to its widespread application in the fabrication of LED sapphire substrates and semiconductor wafers. This purity grade provides the best blend of performance and cost-effectiveness, making it the preferred option for many high-tech applications. According to the global study, the LED market will be worth $YY billion by 2024, rising at a CAGR of 12.5% between 2024 and 2031. The worldwide semiconductor market is expected to approach $600 billion by 2025, creating significant opportunities for 4N HPA vendors.

Market Key Players:

The HPA market is highly competitive, with major players focusing on technological innovation and strategic alliances. Key companies such as Sumitomo Chemical Co., Ltd., Sasol Limited, Baikowski SAS, Nippon Light Metal Holdings Company, Ltd., Altech Chemicals Limited, Polar Sapphire Ltd., Hebei Heng Bo New Material Technology Co., Ltd., Zibo Honghe Chemical Co., Ltd., Xuan Cheng Jing Rui New Material Co., Ltd., and Orbite Technologies Inc. dominate the market.

Contact Us:

Name: Hari Krishna

Email us: [email protected]

Website: https://aurorawaveintellects.com/

0 notes

Text

Semiconductor Chemicals Market Overview: Analyzing the Impact of Emerging Trends and Innovations

The semiconductor chemicals market is at the heart of the global electronics and technology sectors, enabling the production of essential components for a wide range of devices. From smartphones and computers to electric vehicles (EVs) and advanced medical equipment, semiconductors are indispensable in modern life. As technological innovations continue to push the boundaries of performance, the role of semiconductor chemicals has become even more critical. In this article, we will explore the impact of emerging trends and innovations shaping the semiconductor chemicals market and how companies are adapting to these changes.

Market Overview

The semiconductor chemicals market includes a range of products used in the fabrication of semiconductor devices. These chemicals are involved in various stages of semiconductor manufacturing, such as wafer preparation, photolithography, etching, cleaning, and doping. Semiconductor chemicals are crucial for ensuring that semiconductor devices meet the performance, size, and efficiency requirements of today’s advanced electronics.

In recent years, the semiconductor chemicals market has experienced significant growth, driven by several factors. The increasing demand for electronic devices, combined with innovations in sectors such as 5G, artificial intelligence (AI), and the Internet of Things (IoT), has led to a surge in the production of more complex and powerful semiconductors. These innovations require highly specialized chemicals, which has propelled the demand for advanced materials and technologies in semiconductor manufacturing.

Impact of Emerging Trends

One of the most notable emerging trends in the semiconductor chemicals market is the push for smaller, faster, and more energy-efficient devices. As the demand for semiconductors grows, so too does the need for smaller, more precise, and more powerful chips. Semiconductor manufacturers are working to meet these demands by adopting advanced technologies such as extreme ultraviolet (EUV) lithography, which enables the creation of smaller features on semiconductor wafers.

This trend has a direct impact on the semiconductor chemicals market, as EUV requires the development of new photoresist materials, which are specialized chemicals used in photolithography. The use of EUV technology allows manufacturers to produce semiconductors with smaller geometries, leading to more powerful devices while reducing power consumption. As EUV technology becomes more widely adopted, demand for specialized semiconductor chemicals that support these advanced manufacturing processes is expected to grow.

Another key trend is the increasing focus on sustainability in semiconductor manufacturing. As environmental concerns grow, semiconductor manufacturers are facing increasing pressure to reduce their carbon footprint and adopt greener manufacturing processes. This has led to an innovation push in the semiconductor chemicals market, with companies working to develop environmentally friendly chemicals that do not compromise performance. The shift toward green chemistry is expected to become a dominant force in the coming years, especially as stricter regulations around chemical usage and disposal are enforced.

Companies are also focusing on the development of biodegradable or less hazardous chemicals to comply with environmental standards and to meet consumer demand for more eco-friendly products. This innovation is not just about meeting regulatory requirements; it also presents an opportunity for companies to differentiate themselves in an increasingly competitive market. Those able to innovate in green semiconductor chemicals stand to gain significant market share.

Innovations Shaping the Market

In addition to EUV and sustainability-focused innovations, other technological advancements are impacting the semiconductor chemicals market. The growing adoption of 5G technology, for instance, requires highly advanced semiconductor chips that can handle high-speed data transmission. These chips need to be manufactured with precision and high performance, creating a demand for advanced chemicals such as specialty gases, etchants, and dopants. These chemicals are integral to creating the complex structures necessary for 5G semiconductors.

Furthermore, the rise of quantum computing is spurring the development of new semiconductor materials and manufacturing processes. Quantum computing promises to revolutionize industries by solving complex problems that traditional computers cannot handle. However, it also demands entirely new approaches to semiconductor manufacturing, with an emphasis on materials and chemicals that can withstand the extreme conditions required for quantum computing.

As the semiconductor industry continues to evolve, innovations like these will drive further advancements in semiconductor chemicals. Companies that stay ahead of these trends by investing in research and development will be better positioned to supply the next generation of semiconductor chemicals that meet the demands of emerging technologies.

Geographic Implications

Regionally, Asia Pacific continues to dominate the semiconductor chemicals market. Countries like Taiwan, South Korea, and China are home to some of the largest semiconductor manufacturing hubs globally. These regions are investing heavily in expanding semiconductor production capabilities to keep up with the growing demand for chips. As semiconductor manufacturers in these regions scale up, they are driving demand for advanced chemicals used in semiconductor fabrication.

The United States and Europe are also key players in the semiconductor chemicals market. In these regions, the emphasis is often on research and development for next-generation technologies, such as quantum computing, AI, and automotive electronics. As the semiconductor industry in these regions grows, companies will need to focus on developing specialized chemical formulations that meet the exacting requirements of these advanced technologies.

Conclusion

The semiconductor chemicals market is evolving rapidly, driven by technological innovations in fields such as 5G, AI, IoT, and quantum computing. These innovations are pushing the demand for more advanced semiconductor chemicals that support cutting-edge manufacturing processes like EUV lithography. In addition, the industry is shifting toward more sustainable practices, with an emphasis on eco-friendly chemical formulations that meet regulatory requirements and consumer expectations. As semiconductor technology continues to advance, the market for semiconductor chemicals will expand, providing ample opportunities for innovation and growth. Companies that can adapt to these trends, invest in research and development, and offer specialized solutions will be best positioned to succeed in this dynamic and competitive market.

Get Free Sample and ToC : https://www.pristinemarketinsights.com/get-free-sample-and-toc?rprtdtid=NTE1&RD=Semiconductor-Chemicals-Market-Report

#SemiconductorChemicalsMarket#SemiconductorChemicalsMarketDrivers#SemiconductorChemicalsMarketInsightsAndForecast#SemiconductorChemicalsMarketGrowth#SemiconductorChemicalsMarketEmergingTrends#SemiconductorChemicalsMarketAnalysis

0 notes

Text

Semiconductor Etch Equipment Market: Trends, Growth, and Projections

The global Semiconductor Etch Equipment Market plays a crucial role in the semiconductor manufacturing process. As the demand for high-performance electronic devices, driven by industries such as consumer electronics, automotive, healthcare, and telecommunications, continues to rise, the semiconductor industry itself is evolving rapidly. Etch equipment, which is used in the process of patterning semiconductor wafers, remains indispensable to the production of chips that power modern technology. This blog will explore the current state and future projections for the semiconductor etch equipment market, its key players, segments, and regional analysis.

Overview of the Semiconductor Etch Equipment Market

Etching is one of the critical steps in semiconductor fabrication. It involves the precise removal of material from the surface of a semiconductor wafer to create patterns or shapes necessary for the formation of integrated circuits (ICs). Etch equipment can be categorized into dry etch equipment and wet etch equipment, each offering different methods for achieving the etching process. These tools are used in a variety of semiconductor applications, including logic and memory chips, micro-electromechanical systems (MEMS), power devices, and more.

As of 2023, the semiconductor etch equipment market is valued at approximately $10.54 million and is expected to grow steadily, reaching $11.68 million in 2024. By 2030, the market is projected to expand significantly, with an estimated value of $20.18 million. This reflects a compound annual growth rate (CAGR) of 9.71%, underscoring the rapid pace of growth and demand for advanced semiconductor manufacturing technologies.

Key Segments in the Semiconductor Etch Equipment Market

1. By Type

Dry Etch Equipment: This category includes equipment that uses gases or plasmas to remove material from a semiconductor wafer's surface. It is preferred for its precision, speed, and ability to etch at extremely small scales, making it crucial for advanced semiconductor manufacturing processes such as 7nm, 5nm, and smaller nodes. Dry etching is widely used in the production of logic and memory devices and plays a significant role in the miniaturization of electronic devices.

Wet Etch Equipment: Wet etching, on the other hand, involves using liquid chemicals to remove specific materials from the wafer surface. While this method can be less precise compared to dry etching, it remains crucial for various applications, particularly in MEMS (micro-electromechanical systems) and certain power devices. Wet etching is also often used in the preparation stages of semiconductor fabrication, such as cleaning wafers before deposition or etching processes.

2. By Application

The semiconductor etch equipment market serves various applications, each with distinct requirements for precision and performance.

Logic and Memory: This is the largest segment in the semiconductor etch equipment market. Logic devices, including microprocessors, and memory devices, such as DRAM and flash memory, require highly intricate etching processes to achieve the necessary component features and integration. With the growing demand for high-performance computing, AI, and memory chips, the etching process for logic and memory devices continues to evolve.

MEMS (Micro-electromechanical Systems): MEMS devices are integral to a wide range of applications, from sensors and actuators to microfluidic devices. These components often require different etching techniques due to their unique material compositions and size requirements. The rising adoption of MEMS in automotive, healthcare, and consumer electronics is driving demand for specialized etching solutions in this segment.

Power Devices: Power semiconductors are used in power conversion systems, such as electric vehicles (EVs), renewable energy, and industrial applications. Etching equipment in this category must accommodate larger wafer sizes and be capable of handling different materials like silicon carbide (SiC) and gallium nitride (GaN). As the adoption of electric vehicles and renewable energy sources increases, so does the need for power semiconductor devices, driving growth in the etch equipment market.

Others: This category includes niche applications, such as optical semiconductors, which require specialized etching processes. Though smaller in scale compared to the primary segments, these applications still represent an important portion of the market.

Key Market Players

Several key players dominate the semiconductor etch equipment market. These companies are involved in the development, manufacturing, and distribution of both dry and wet etch equipment, offering advanced solutions to meet the needs of the semiconductor industry.

Lam Research: A leader in the semiconductor equipment industry, Lam Research provides a wide range of etching tools that are used in advanced semiconductor manufacturing processes. Their etch equipment solutions are recognized for precision, scalability, and efficiency, especially in dry etching.

TEL (Tokyo Electron): TEL is a global leader in semiconductor manufacturing equipment. Their etch systems are highly regarded for their performance in semiconductor fabrication, providing high throughput and precision.

Applied Materials: Applied Materials is a major player in the semiconductor equipment market, offering a comprehensive portfolio of etch equipment for both dry and wet etching. Their tools are used in the production of logic and memory devices, as well as MEMS and power devices.

Hitachi High-Technologies: Hitachi is known for its advanced etching tools, providing high-precision dry etch solutions used in various semiconductor applications. Their systems are designed to handle the most advanced etching processes at the sub-nanometer scale.

Oxford Instruments: Oxford Instruments specializes in providing equipment for semiconductor processing, with particular emphasis on etch and deposition tools. Their equipment is often used in research and development environments.

SPTS Technologies: SPTS Technologies is a leading supplier of etch and deposition systems for the semiconductor industry. Their equipment is used for applications such as MEMS, power devices, and logic devices.

GigaLane: GigaLane focuses on providing advanced etching solutions for next-generation semiconductor technologies, including advanced logic and memory devices.

Plasma-Therm: Plasma-Therm offers innovative etching and deposition equipment for a range of applications, from MEMS to advanced logic and memory devices.

SAMCO: Known for their expertise in wet etching equipment, SAMCO's systems serve the semiconductor and MEMS industries, providing precise and reliable etching solutions.

AMEC: Advanced Micro-Fabrication Equipment Inc. (AMEC) offers both dry and wet etching systems used in semiconductor and MEMS applications. Their equipment is known for high precision and low cost of ownership.

NAURA: NAURA is a Chinese semiconductor equipment company that manufactures a wide range of etching tools. Their equipment is gaining traction in the global market due to its affordability and reliability.

Market Trends and Drivers

The semiconductor etch equipment market is driven by several factors, including the increasing demand for smaller, faster, and more powerful semiconductor devices. Some key trends and drivers include:

Miniaturization of Semiconductor Devices: As the semiconductor industry moves toward smaller nodes (5nm, 3nm), there is an increasing need for precise etching equipment capable of handling sub-nanometer dimensions. This trend is driving the demand for advanced dry etch systems, which offer greater precision and control.

Rise of Advanced Technologies: The growth of artificial intelligence (AI), machine learning, and 5G technologies is driving demand for high-performance semiconductor devices. As these technologies require increasingly powerful chips, semiconductor manufacturers are investing in state-of-the-art etch equipment to meet these needs.

Expansion of Electric Vehicle (EV) and Renewable Energy Markets: The rise in demand for power devices, including those used in electric vehicles and renewable energy applications, is driving the growth of power semiconductor etching equipment. These devices require specialized etching processes due to their unique material requirements.

MEMS and Sensors Demand: MEMS devices are becoming integral to a wide range of industries, including automotive, healthcare, and consumer electronics. The growing demand for MEMS sensors in applications such as wearable devices, medical implants, and automotive systems is contributing to the growth of the etch equipment market.

Geopolitical Factors and Localization: With supply chains becoming more localized and regions like China investing heavily in domestic semiconductor manufacturing, there is an increasing focus on regional players and equipment manufacturers. This shift is expected to affect market dynamics and create new opportunities for local and international companies alike.

Regional Analysis

North America: North America remains a significant market for semiconductor etch equipment, driven by the presence of leading semiconductor manufacturers and research institutions. The United States is at the forefront of developing advanced semiconductor technologies, including AI and 5G, which is contributing to the demand for advanced etching tools.

Europe: Europe, while not as dominant as North America or Asia in semiconductor production, is seeing growth in areas like MEMS and power devices. Companies in countries like Germany and the Netherlands are driving innovation in semiconductor manufacturing, with demand for advanced etch equipment.

Asia Pacific: The Asia Pacific region is the largest market for semiconductor etch equipment, owing to the concentration of semiconductor manufacturing in countries like China, South Korea, Taiwan, and Japan. This region's strong semiconductor supply chain and the increasing demand for cutting-edge technologies are major growth drivers.

Latin America: Latin America is a smaller market for semiconductor etch equipment, but with increasing investments in semiconductor manufacturing, the region is expected to see steady growth.

Middle East & Africa: While the semiconductor market in the Middle East and Africa is still developing, there are emerging opportunities due to investments in electronics and telecommunications infrastructure.

Conclusion

The semiconductor etch equipment market is poised for significant growth in the coming years, with a projected CAGR of 9.71%. Driven by advancements in semiconductor manufacturing, miniaturization of devices, and the growing demand for power devices and MEMS technologies, the market offers promising opportunities for key players in the industry. The shift toward smaller nodes, along with the rise of electric vehicles, renewable energy, and AI applications, will continue to fuel the demand for precision etch equipment, ensuring a bright future for the semiconductor etch equipment market well into the next decade.

0 notes

Text

0 notes

Text

Contact Wafer Temperature Measurement System Market Analysis, Size, Share, Growth, Trends, and Forecasts by 2031

The Contact Wafer Temperature Measurement System Market primarily revolves around the development and utilization of sophisticated instruments and technologies that enable precise and real-time measurement of the temperature of semiconductor wafers during various stages of the manufacturing process. These systems have become indispensable in the semiconductor industry, as even minor temperature variations can have a profound impact on the performance and reliability of semiconductor devices.

𝐆𝐞𝐭 𝐚 𝐅𝐫𝐞𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭:https://www.metastatinsight.com/request-sample/2473

Top Companies

KLA Corporation

Phase IV Engineering Inc.

Thermo Electric

SPM Instrument

ERS electronic GmbH

Advanced Energy Industries, Inc.

One of the key factors driving the growth of the Contact Wafer Temperature Measurement System Market is the ever-increasing demand for smaller, more powerful, and energy-efficient semiconductor devices. As semiconductor manufacturers strive to meet these demands, they must maintain strict control over the temperature during fabrication processes, as it directly affects the quality and performance of the final product. Consequently, there is a growing need for highly accurate and reliable water temperature measurement systems.

@https://www.metastatinsight.com/report/contact-wafer-temperature-measurement-system-market

The Contact Wafer Temperature Measurement System Market encompasses various innovative technologies and solutions, including but not limited to non-contact thermal sensors, contact-based sensors, and infrared temperature measurement systems. These technologies have evolved over time to provide precise measurements with high sensitivity and responsiveness. As a result, semiconductor manufacturers can closely monitor and control the temperature of the wafers during processes such as deposition, etching, annealing, and more, ensuring that the final products meet the strict specifications required for modern electronic devices.

In this market, the integration of advanced sensing and data processing capabilities has become paramount. The measurement systems not only record temperature data but also provide real-time feedback to manufacturing processes, enabling immediate adjustments to maintain optimal temperature conditions. This level of control is essential for achieving the desired performance, reliability, and energy efficiency in semiconductor devices.

Furthermore, the Contact Wafer Temperature Measurement System Market has expanded its horizons beyond traditional semiconductor fabrication. It now finds applications in emerging technologies such as photovoltaics, micro-electro-mechanical systems (MEMS), and even in the production of advanced displays. These diverse applications underscore the pivotal role of wafer temperature measurement in ensuring the quality and consistency of various high-tech products.

The Contact Wafer Temperature Measurement System Market constantly evolves to meet the ever-growing demands of the semiconductor and related industries. It is fueled by a continuous drive for innovation, precision, and control. In a world where technology is advancing at an unprecedented pace, the role of these systems in maintaining the integrity of semiconductor manufacturing processes cannot be overstated. As they continue to advance and adapt, the market ensures that the heart of modern electronics remains reliable, efficient, and ever more powerful.

Global Contact Wafer Temperature Measurement System market is estimated to reach $96.3 Million by 2030; growing at a CAGR of 3.8% from 2023 to 2030.

Contact Us:

+1 214 613 5758

#ContactWaferTemperatureMeasurementSystem#ContactWaferTemperatureMeasurementSystemmarket#ContactWaferTemperatureMeasurementSystemindustry#marketsize#marketgrowth#marketforecast#marketanalysis#marketdemand#marketreport#marketresearch

0 notes

Text

$CIEN #SP500 #NASDAQ #SPX $XRP-USD

New York, October 2, 2024 ? In a surprising turnaround from significant losses on Tuesday, the stock market experienced a broad recovery on Wednesday, primarily driven by exceptional performances from Ciena Corp (CIEN), Caesars Entertainment Inc (CZR), and Salesforce Inc (CRM). The market saw a modest uptick overall, despite mixed signals from various sectors and cryptocurrencies. Leading today's resurgence was Ciena Corp (CIEN), up a remarkable 7.34%, followed closely by Caesars Entertainment Inc (CZR), which climbed 5.86%. Not far behind were Salesforce Inc (CRM), gaining 4.01%, and KLA Corp (KLAC), up by 3.98%. Particularly notable was Lam Research Corporation (LRCX), which rose by 3.81%. Lam Research remains a vital player in the semiconductor industry, providing advanced wafer fabrication equipment and services?key to the high-performance integrated circuits market. The company?s revenue streams are robust, driven by equipment sales, services, and long-term contracts with semiconductor manufacturers. Other significant gainers included Teradyne Inc (TER) at 3.74% and JD.com Inc (JD) at 3.51%, marking a strong performance amidst the market's overall cautious optimism. # Sector Performance Although the market at large only saw slight growth, the increases in speci https://csimarket.com/news/news_markets.php?date=2024-10-02T18324&utm_source=dlvr.it&utm_medium=tumblr

0 notes

Text

Dr. Mehdi Asghari, President & CEO of SiLC Technologies – Interview Series

New Post has been published on https://thedigitalinsider.com/dr-mehdi-asghari-president-ceo-of-silc-technologies-interview-series/

Dr. Mehdi Asghari, President & CEO of SiLC Technologies – Interview Series

Mehdi Asghari is currently the President & Chief Executive Officer at SiLC Technologies, Inc. Prior to this, he worked as the CTO & SVP-Research & Development at Kotura, Inc. from 2006 to 2013. He also held positions as Vice President-Silicon Photonics at Mellanox Technologies Ltd. and Vice President-Research & Development at Bookham, Inc. Asghari holds a doctorate degree from the University of Bath, an undergraduate degree from the University of Cambridge, and graduate degrees from St. Andrews Presbyterian College and Heriot-Watt University.

SiLC Technologies is a silicon photonics innovator providing coherent vision and chip-scale FMCW LiDAR solutions that enable machines to see with human-like vision. Leveraging its extensive expertise, the company is advancing the market deployment of coherent 4D imaging solutions across a variety of industries, including mobility, industrial machine vision, AI robotics, augmented reality, and consumer applications.

Dr. Asghari, you have an extensive background in Silicon Photonics and have been involved in multiple startups in this space. Could you share what first sparked your interest in this field?

I went into photonics as I wanted to be in the closest branch of engineering to physics that I could. The idea was to be able to develop products and viable businesses while playing at the front line of science and technology. At that time, around 30 years ago, being in photonics meant that you either did passive devices in glass, or active devices (for light emission, modulation or detection) in III/V materials (compound of multiple elements such as In, P, Ga, As). Both industries were migrating to integration for wafer scale manufacturing. Progress for both was very slow, primarily due to material properties and a lack of well-established fabrication process capabilities and infrastructure.

I was in the III/V camp and came across a small startup called Bookham which was using silicon to make optical devices. This new idea offered the major advantage of being able to use mature silicon wafer fabrication processes to make a highly scalable and cost-effective platform. I felt this could transform the photonics industry and decided to join the company.

With over 25 years of experience and over 50 patents, you’ve had a significant impact on the industry. What do you see as the most transformative developments in Silicon Photonics during your career?

Bookham was the first company ever to try to commercialize silicon photonics, which meant there was no existing infrastructure to use. This included all aspects of the development process, from design to fabrication to test, assembly and packaging. On design, there was no simulation tool that was adapted to the large index steps we were using. On the fab side, we had to develop all the fabrication processes needed, and since there was no fab ready to process wafers for us, we had to build wafer fabs from scratch. On assembly and packaging, there was virtually nothing there.

Today, we take all of these for granted. There are fabs that offer design kits with semi-mature libraries of devices and many of them even offer assembly and packaging. While these remain far from the maturity level offered by the IC industry, life is so much easier today for people who want to do silicon photonics.

SiLC is your third Silicon Photonics startup. What motivated you to launch SiLC, and what challenges did you set out to address when founding the company in 2018?

Throughout my career, I felt that we were always chasing applications that more mature micro-optics technologies could address. Our target applications lacked the level of complexity (e.g. number of functions) to truly justify deployment of such a powerful integration platform and the associated investment level. I also felt that most of these applications were borderline viable in terms of the volume they offered to make a thriving silicon-based business. Our platform was by now mature and did not need much investment, but I still wanted to address these challenges by finding an application that offered both complexity and volume to find a true long-lasting home for this amazing technology.

When you founded SiLC, what was the primary problem you aimed to solve with coherent vision and 4D imaging? How did this evolve into the company’s current focus on machine vision and LiDAR technology?

COVID-19 has shown us how vulnerable our logistics and distribution infrastructure are. At the same time, almost all developed countries have been experiencing a significant drop in working age population (~1% year on year for a couple of decades now) resulting in labor shortages. These are the underlying major trends driving AI and Robotic technologies today, both of which drive enablement of machine autonomy. To achieve this autonomy, the missing technology piece is vision. We need machines to see like we do If we want them to be unchained from the controlled environment of the factories, where they do highly repetitive pre-orchestrated work, to join our society, co-exist with humans and contribute to our economic growth. For this, humanlike vision is critical, to allow them to be efficient and effective at their job, while keeping us safe.

The eye is one of the most complex optical systems that I could imagine making, and if we were to put our product on even a small portion of AI driven robots and mobility devices out there, the volume was certainly going to be huge. This would then achieve both the need for complexity and volume that I was seeking for SiLC to be successful.

SiLC’s mission is to enable machines to see like humans. What inspired this vision, and how do your solutions like the Eyeonic Vision System help bring this to life?

I saw our technology as enabling AI to assume a physical incarnation and get actual physical work done. AI is wonderful, but how do you get it to do your chores or build houses? Vision is critical to our interactions with the physical world and if AI and Robotics technologies wanted to come together to enable true machine autonomy, these machines need a similar capability to see and interact with the world.

Now, there is a major difference between how we humans see the world and how existing machine vision solutions work. The existing 2D and 3D cameras or TOF (Time of Flight) based solutions enable storage of stationary images. These then have to be processed by heavy computing to extract additional information such as movement or motion. This motion information is key to enabling hand-eye coordination and our ability to perform complex, prediction-based tasks. Detection of motion is so critical to us, that evolution has devoted >90% of our eye’s resources to that task. Our technology enables direct detection of motion as well as accurate depth perception, thus enabling machines to see the world as we do, but with much higher levels of precision and range.

Your team has developed the industry’s first fully integrated coherent LiDAR chip. What sets SiLC’s LiDAR technology apart from other solutions on the market, and how do you foresee it disrupting industries like robotics, C-UAS and autonomous vehicles?

SiLC has a unique integration platform that enables it to integrate all the key optical functions needed into a single chip on silicon, while achieving very high-performance levels that are not attainable by competing technologies (>10X better). For the robotics industry, our ability to provide very high-precision depth information in micrometer to millimeter at long distances is critical. We achieve this while remaining eye-safe and independent of ambient lighting, which is unique and critical to enabling widespread use of the technology. For C-UAS applications, we enable multi-kilometer range for early detection while our ability to detect velocity and micro-doppler motion signatures together with polarimetric imaging enables reliable classification and identification. Early detection and classification are critical to keeping our people and critical infrastructure safe while allowing peaceful usage of the technology for commercial applications. For mobility, our technology detects objects hundreds of meters away while using motion to enable prediction-based algorithms for early reactions with immunity to multi-user interference. Here, our integration platform facilitates the ruggedized, robust solution needed by automotive/mobility applications, as well as the cost and volume scaling that is needed for its ubiquitous usage.

FMCW technology plays a pivotal role in your LiDAR systems. Can you explain why Frequency Modulated Continuous Wave (FMCW) technology is critical for the next generation of AI-based machine vision?

FMCW technology enables direct and instantaneous detection of motion on a per pixel basis in the images we create. This is achieved by measuring the frequency shift in a beam of light when it reflects off of moving objects. We generate this light on our chip and hence know its exact frequency. Also, since we have very high-performance optical components on our chip, we are able to measure very small frequency shifts and can measure movements very accurately even for objects far away. This motion information enables AI to empower machines that have the same level of dexterity and hand-eye coordination as humans. Furthermore, velocity information enables rule-based perception algorithms that can reduce the amount of time and computational resources needed, as well as the associated cost, power dissipation and latency (delay) to perform actions and reactions. Think of this as similar to the hardwired, learning and reaction-based activities we perform like driving, playing sports or shooting ahead of a duck. We can perform these much faster than the electro-chemical processes of conscious thinking would allow if everything had to go through our brain to be processed fully first.

Your collaboration with companies like Dexterity shows a growing integration of SiLC technology in warehouse automation and robotics. How do you see SiLC furthering the adoption of LiDAR in the broader robotics industry?

Yes, we see a growing need for our technology in warehouse automation and industrial robotics. These are the less cost-sensitive, and more performance-driven applications. As we ramp up production and mature our manufacturing and supply chain eco-system, we will be able to offer lower cost solutions to address the higher volume markets, such as commercial and consumer robotics.

You recently announced an investment from Honda. What is the impact of this partnership with Honda and what does it mean for the future of mobility?

Honda’s investment is a major event for SiLC, and it is a very important testament to our technology. A company like Honda does not make investments without understanding the technology and performing in-depth competitive analysis. We see Honda as not just one of the top automotive and truck manufacturers but also as a super gateway for potential deployment of our technology in so many other applications. In addition to motor bikes, Honda makes powersports vehicles, power gardening equipment, small jets, marine engines/equipment and mobility robotics. Honda is the largest manufacturer of mobility products in the world. We believe our technology, guided by Honda and their potential deployment, can enable mobility to reach higher levels of safety and autonomy at a cost and power efficiency that could enable widespread usage.

Looking forward, what is your long-term vision for SiLC Technologies, and how do you plan to continue driving innovation in the field of AI machine vision and automation?

SiLC has only just begun. We are here with a long-term vision to transform the industry. We have spent the better part of the past 6 years creating the technology and knowledge base needed to fuel our future commercial growth. We insisted on dealing with the long pole of integration head-on from day one. All of our products use our integration platform and not components sourced from other players. On top of this, we have added full system simulation capabilities, developed our own analog ICs, and invented highly innovative system architectures. Added together, these capabilities allow us to offer solutions that are highly differentiated and end-to-end optimized. I believe this has given us the foundation necessary to build a highly successful business that will play a dominant role in multiple large markets.

One area where we have focused more attention is how our solutions interface with AI. We are now working to make this simpler and faster such that everyone can use our solutions without the need to develop complex software solutions.

As for driving future innovation, we have a long list of wonderful advancements we would like to make to our technology. I believe that the best way to prioritize implementation of these as we grow is to listen carefully to our customers, and then find the simplest and smartest way to offer them a highly differentiated solution that builds on our technological strengths. It is only when you make clever use of your strengths that you can deliver something truly exceptional.

Thank you for the great interview, readers who wish to learn more should visit SiLC Technologies.

#3d#adoption#ai#Algorithms#amazing#ambient#amp#analog#Analysis#applications#attention#augmented reality#automation#automotive#autonomous#autonomous vehicles#background#beam#Brain#Business#Cameras#career#CEO#chemical#chip#Collaboration#college#Companies#complexity#computing

0 notes

Text

Semiconductor Chemicals Market Share, Outlook, Trends, Growth, Analysis, Forecast 2024-2032

Semiconductor chemicals are a vital component of the semiconductor manufacturing process, serving a wide array of functions that are essential for the production of high-quality semiconductor devices. These chemicals include photoresists, etchants, cleansers, and dopants, each playing a crucial role in various stages of fabrication, from wafer cleaning to lithography and etching. As semiconductor technologies advance and feature sizes shrink, the demand for high-purity chemicals that can meet stringent performance requirements continues to grow.

The semiconductor chemicals market is influenced by several factors, including the increasing complexity of semiconductor devices, the rise of advanced manufacturing techniques, and the ongoing demand for miniaturization. Manufacturers are investing in high-quality semiconductor chemicals that ensure optimal performance and reliability, which is critical for maintaining competitive advantage in a rapidly evolving industry.

The Semiconductor Chemicals Market is witnessing growth fueled by the rising demand for high-purity chemicals used in semiconductor manufacturing processes, essential for achieving optimal device performance and reliability.

Future Scope

The future of semiconductor chemicals is promising, with significant growth expected as the industry evolves. As semiconductor devices become increasingly sophisticated, there will be a greater need for advanced chemical solutions that can address the challenges posed by new materials and technologies. The shift toward heterogeneous integration and 3D packaging will require innovative semiconductor chemicals that enhance performance and reliability.

Moreover, the growing emphasis on sustainability will shape the semiconductor chemicals market. Manufacturers will seek eco-friendly chemical solutions that minimize environmental impact while maintaining performance standards. This shift toward greener alternatives will drive research and development efforts in the semiconductor chemicals sector, leading to the formulation of sustainable products that comply with environmental regulations.

Trends

Key trends influencing the semiconductor chemicals market include the increasing focus on high-purity and specialty chemicals. As semiconductor manufacturing processes become more complex, the need for high-purity chemicals that minimize contamination risks is paramount. Manufacturers are prioritizing specialty chemicals that enhance performance in specific applications, ensuring that their products meet rigorous industry standards.

Another significant trend is the rise of automation in chemical handling and delivery systems. Manufacturers are adopting automated solutions to enhance precision and reduce the risk of contamination during the chemical application process. This trend is crucial for maintaining quality and consistency in semiconductor manufacturing, ultimately improving yield and reducing production costs.

Application

Semiconductor chemicals find applications across various stages of semiconductor manufacturing. In the cleaning process, specialized cleansers are employed to remove contaminants and prepare wafers for subsequent processing. This step is critical for ensuring high yields and preventing defects in final devices.

During lithography, photoresists are used to create patterns on semiconductor wafers, allowing for the precise definition of features in integrated circuits. The quality of photoresists directly impacts the resolution and accuracy of the patterns, making them essential for advanced semiconductor fabrication.

In the etching process, etchants are employed to selectively remove material from the wafer surface, enabling the creation of intricate designs necessary for modern semiconductor devices. The effectiveness of these etchants is vital for achieving the desired feature sizes and profiles that meet stringent design specifications.

Dopants are also crucial in semiconductor manufacturing, as they are used to alter the electrical properties of the semiconductor material. By introducing specific impurities into the silicon substrate, manufacturers can tailor the electrical characteristics of the device, enhancing performance in applications ranging from microprocessors to power devices.

Key Points

Essential for the semiconductor manufacturing process, including cleaning, lithography, and etching.

Driven by the demand for advanced, high-purity, and specialty chemicals.

Promising future with growth opportunities in sustainability and advanced materials.

Trends include increased focus on high-purity chemicals and automation in chemical handling.

Applied across various stages of semiconductor fabrication, impacting device quality and performance.

Read More Details: https://www.snsinsider.com/reports/semiconductor-chemicals-market-4533

Contact Us:

Akash Anand — Head of Business Development & Strategy

Email: [email protected]

Phone: +1–415–230–0044 (US) | +91–7798602273 (IND)

0 notes

Text

The Silicon Wafers Market is projected to grow from USD 15,845 million in 2024 to an estimated USD 24,502 million by 2032, with a compound annual growth rate (CAGR) of 5.6% from 2024 to 2032.The silicon wafer market has become a cornerstone of the global technology ecosystem, driven by the exponential growth in semiconductor applications across industries. Silicon wafers are thin slices of silicon material that serve as substrates for the fabrication of integrated circuits (ICs) and microelectronics. The silicon wafer market has witnessed consistent growth over the past decade due to the increasing demand for electronic devices, such as smartphones, laptops, and IoT-enabled gadgets. The advent of 5G technology, artificial intelligence (AI), and autonomous vehicles has further propelled the demand for advanced semiconductor components, which heavily rely on silicon wafers.In 2023, the market was valued at approximately $12 billion and is projected to grow at a compound annual growth rate (CAGR) of 6-8% over the next five years. This growth is primarily fueled by advancements in semiconductor manufacturing technologies and the rising adoption of smart devices worldwide.

Browse the full report https://www.credenceresearch.com/report/silicon-wafers-market

Key Market Drivers

Proliferation of Consumer Electronics The consumer electronics industry remains a primary driver of the silicon wafer market. The increasing penetration of smartphones, wearables, and home automation systems has led to a surge in the production of ICs, directly boosting silicon wafer demand.

Rising Adoption of Electric and Autonomous Vehicles Electric vehicles (EVs) and autonomous vehicles are becoming mainstream, necessitating the use of high-performance semiconductors for power management, sensors, and computing capabilities. Silicon wafers are integral to producing these semiconductors, making them critical to the automotive industry's transformation.

Expansion of 5G Networks The global rollout of 5G networks has created a significant demand for advanced semiconductor devices. Silicon wafers play a crucial role in fabricating RF components and processors needed for 5G infrastructure, driving market growth.

Advancements in AI and Machine Learning The increasing adoption of AI and machine learning applications in various sectors has escalated the demand for high-performance computing chips. Silicon wafers, particularly those with advanced node technologies, are essential for manufacturing these chips.

Market Challenges

High Manufacturing Costs Producing silicon wafers involves complex and energy-intensive processes, making it a capital-intensive industry. The high cost of raw materials and equipment can deter smaller players from entering the market.

Supply Chain Disruptions The COVID-19 pandemic exposed vulnerabilities in the global semiconductor supply chain. Shortages of raw materials, logistical challenges, and geopolitical tensions have underscored the need for supply chain resilience in the silicon wafer market.

Environmental Concerns Silicon wafer manufacturing consumes significant energy and water resources, raising environmental concerns. Regulatory pressures and the need for sustainable practices are compelling manufacturers to adopt greener production methods.

Future Trends

Transition to Smaller Nodes The industry is gradually shifting towards smaller node technologies, such as 5nm and 3nm, to achieve higher performance and energy efficiency. This transition is expected to drive demand for high-purity silicon wafers with advanced specifications.

Emergence of Compound Semiconductors While silicon remains the dominant material, compound semiconductors like gallium nitride (GaN) and silicon carbide (SiC) are gaining traction in specific applications, such as power electronics and high-frequency devices. These materials complement silicon wafers rather than replace them, creating a diversified growth landscape.

Regional Expansion Asia-Pacific dominates the silicon wafer market, accounting for over 50% of global production and consumption, thanks to major semiconductor hubs in China, Taiwan, South Korea, and Japan. However, efforts by the U.S. and Europe to bolster domestic semiconductor manufacturing through initiatives like the CHIPS Act are likely to reshape the market's regional dynamics.

Key Player Analysis:

Taiwan Semiconductor Manufacturing Company (TSMC)

GlobalWafers Co., Ltd.

SUMCO Corporation

Siltronic AG

Shin-Etsu Chemical Co., Ltd.

SK Siltron

Wafer Works Corporation

Nomura Micro Science Co., Ltd.

China National Silicon Corporation (CNSI)

Okmetic Oy

Segmentation:

Based on Product Type:

Single-Crystal Silicon Wafers

Multicrystalline Silicon Wafers

Epitaxial Silicon Wafers

SOI (Silicon-On-Insulator) Wafers

Other Types of Silicon Wafers

Based on Technology:

Wafer Fabrication Technology

Wafer Bonding Technology

Wafer Thinning Technology

Wafer Dicing Technology

Photovoltaic Wafer Technology

Based on End-User:

Consumer Electronics (Smartphones, Wearables, Laptops, etc.)

Automotive (Electric Vehicles, Power Semiconductors)

Telecommunications (5G Infrastructure, Data Centers)

Renewable Energy (Solar Panels, Wind Power)

Industrial Applications (Power Electronics, Automation)

Other End-Users

Based on Region:

North America

U.S.

Canada

Mexico

Europe

Germany

France

U.K.

Italy

Spain

Rest of Europe

Asia Pacific

China

Japan

India

South Korea

South-east Asia

Rest of Asia Pacific

Latin America

Brazil

Argentina

Rest of Latin America

Middle East & Africa

GCC Countries

South Africa

Rest of the Middle East and Africa

Browse the full report https://www.credenceresearch.com/report/silicon-wafers-market

Contact:

Credence Research

Please contact us at +91 6232 49 3207

Email: [email protected]

Website: www.credenceresearch.com

0 notes

Text

Intel And AWS Deepen Chip Manufacturing Partnership In U.S.

US-Based Chip Manufacturing Advances as Intel and AWS Deepen Their Strategic Partnership

Intel produces custom chips on Intel 18A for AI Fabric and custom Xeon 6 processors on Intel 3 for AWS in a multi-billion dollar deal to accelerate Ohio-based chip manufacturing.

AWS and Intel

Intel and Amazon Web Services(AWS), announced a custom chip design investment . The multi-year, multi-billion dollar deal covers Intel’s wafers and products. This move extends the two companies’ long-standing strategic cooperation, helping clients power practically any workload and improve AI applications.

AWS will receive an AI fabric chip from Intel made on the company’s most advanced process node, Intel 18A, as part of the expanded partnership. Expanding on their current collaboration whereby they manufacture Xeon Scalable processors for AWS, Intel will also create a customized Xeon 6 chip on Intel 3.

“As the CEO of AWS, Matt Garman stated that the company is dedicated to providing its customers with the most advanced and potent cloud infrastructure available.” Our relationship dates back to 2006 when we launched the first Amazon EC2 instance with their chips. Now, we are working together to co-develop next-generation AI fabric processors on Intel 18A. We can enable our joint customers to handle any workload and unlock new AI capabilities thanks to our ongoing partnership.

Through its increased cooperation, Intel and AWS reaffirm their dedication to growing Ohio’s AI ecosystem and driving semiconductor manufacturing in the United States. With its aspirations to establish state-of-the-art semiconductor production, Intel is committed to the New Albany region. AWS has invested $10.3 billion in Ohio since 2015; now, it plans to invest an additional $7.8 billion to expand its data center operations in Central Ohio.

In addition to supporting businesses of all sizes in reducing costs and complexity, enhancing security, speeding up business outcomes, and scaling to meet their present and future computing needs, Intel and AWS have been collaborating for more than 18 years to help organizations develop, build, and deploy their mission-critical workloads in the cloud. Moreover, Intel and AWS plan to investigate the possibility of producing additional designs based on Intel 18A and upcoming process nodes, such as Intel 18AP and Intel 14A, which are anticipated to be produced in Intel’s Ohio facilities, as well as the migration of current Intel designs to these platforms.

Forward-Looking Statements

This correspondence includes various predictions about what Intel anticipates from the parties’ co-investment framework, including claims about the framework’s timeliness, advantages, and effects on the parties’ business and strategy. These forward-looking statements are identified by terms like “expect,” “plan,” “intend,” and “will,” as well as by words that are similar to them and their variations.

These statements may result in a significant difference between its actual results and those stated or indicated in its forward-looking statements.

They are based on management’s estimates as of the date they were originally made and contain risks and uncertainties, many of which are outside of its control.

Among these risks and uncertainties are the possibility that the transactions covered by the framework won’t be executed at all or in a timely manner;

Failure to successfully develop, produce, or market goods under the framework;

Failure to reap anticipated benefits of the framework, notably financial ones;

Delays, hiccups, difficulties, or higher building expenses at Intel or manufacturing expansion of fabs, whether due to events within or outside of Intel’s control;

The complexities and uncertainties in developing and implementing new semiconductor products and manufacturing process technologies;

Implementing new business strategies and investing in new businesses and technologies;

Litigation or disputes related to the framework or otherwise;

Unanticipated costs may be incurred;

Potential adverse reactions or changes to commercial relationships including those with suppliers and customers resulting from the transaction’s announcement;

Macroeconomic factors, such as the overall state of the semiconductor industry’s economy;

Regulatory limitations, and the effect of competition products and pricing;

International conflict and other risks and uncertainties described in Intel’s Form 10-K and other filings with the SEC.

It warn readers not to rely unduly on these forward-looking statements because of these risks and uncertainties. The different disclosures made in the documents Intel occasionally files with the SEC that reveal risks and uncertainties that could affect its company are brought to the attention of readers, who are advised to analyze and weigh them carefully.

Read more on Govindhtech.com

#Intel#AWS#Intel18A#AmazonWebServices#AIapplications#AI#AmazonEC2instance#IntelandAWS#AIecosystem#news#technews#technology#technologynews#technologytrends#govindhtech

0 notes

Text

Automatic Wafer Handling System Market Industry, Size, Share and Forecast by 2024-2032

The Reports and Insights, a leading market research company, has recently releases report titled “Automatic Wafer Handling System Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2024-2032.” The study provides a detailed analysis of the industry, including the global Automatic Wafer Handling System Market share, size, trends, and growth forecasts. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Report Highlights:

How big is the Automatic Wafer Handling System Market?

The global automatic wafer handling system market size reached US$ 1.4 billion in 2023. Looking forward, Reports and Insights expects the market to reach US$ 2.9 billion in 2032, exhibiting a growth rate (CAGR) of 8.1% during 2024-2032.

What are Automatic Wafer Handling System?

An automatic wafer handling system is an advanced technology used in semiconductor manufacturing to automate the transport and management of silicon wafers during the production process. This system handles the delicate tasks of loading, unloading, and positioning wafers with precision, minimizing the risk of contamination and damage. Featuring sophisticated robotics, sensors, and control systems, automatic wafer handling systems improve efficiency, accuracy, and throughput in wafer fabrication, leading to higher yields and better overall quality in semiconductor production.

Request for a sample copy with detail analysis: https://www.reportsandinsights.com/sample-request/1924

What are the growth prospects and trends in the Automatic Wafer Handling System industry?

The automatic wafer handling system market growth is driven by various factors and trends. The automatic wafer handling system market is experiencing strong growth, driven by rising demand for advanced semiconductor manufacturing technologies and the pursuit of greater production efficiency. As the semiconductor industry expands, there is an increasing emphasis on automating wafer transport and management to enhance accuracy, reduce contamination, and boost throughput. Key growth factors include technological advancements in robotics and automation, the expansion of semiconductor fabrication facilities, and a heightened need for high-quality, reliable semiconductor products. Hence, all these factors contribute to automatic wafer handling system market growth.

What is included in market segmentation?

The report has segmented the market into the following categories:

By Type:

Robotic Handling Systems

Fixed Handling Systems

Portable Handling Systems

By Application:

Semiconductor Manufacturing

Electronics Industry

Automotive Industry

Medical Devices

Others

Market Segmentation By Region:

North America:

United States

Canada

Europe:

Germany

United Kingdom

France

Italy

Spain

Russia

Poland

BENELUX

NORDIC

Rest of Europe

Asia Pacific:

China

Japan

India

South Korea

ASEAN

Australia & New Zealand

Rest of Asia Pacific

Latin America:

Brazil

Mexico

Argentina

Rest of Latin America

Middle East & Africa:

Saudi Arabia

South Africa

United Arab Emirates

Israel

Rest of MEA

Who are the key players operating in the industry?

The report covers the major market players including:

Applied Materials, Inc.

ASML Holding N.V.

Lam Research Corporation

Tokyo Electron Limited

KLA Corporation

Hitachi High-Technologies Corporation

SCREEN Holdings Co., Ltd.

Axcelis Technologies, Inc.

ASM International N.V.

Advantest Corporation

Teradyne Inc.

Rudolph Technologies, Inc.

Nikon Corporation

View Full Report: https://www.reportsandinsights.com/report/Automatic Wafer Handling System-market

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

Reports and Insights consistently mееt international benchmarks in the market research industry and maintain a kееn focus on providing only the highest quality of reports and analysis outlooks across markets, industries, domains, sectors, and verticals. We have bееn catering to varying market nееds and do not compromise on quality and research efforts in our objective to deliver only the very best to our clients globally.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

Contact Us:

Reports and Insights Business Research Pvt. Ltd. 1820 Avenue M, Brooklyn, NY, 11230, United States Contact No: +1-(347)-748-1518 Email: [email protected] Website: https://www.reportsandinsights.com/ Follow us on LinkedIn: https://www.linkedin.com/company/report-and-insights/ Follow us on twitter: https://twitter.com/ReportsandInsi1

#Automatic Wafer Handling System Market share#Automatic Wafer Handling System Market size#Automatic Wafer Handling System Market trends

0 notes

Text

Glass Wafer for Semiconductor Devices Market Analysis, Size, Share, Growth, Trends, and Forecasts by 2031

Within the Glass Wafer for Semiconductor Devices market, the industry dynamics are driven by the demand for increasingly smaller and more powerful electronic components. As technological innovation propels the semiconductor sector forward, glass wafers become pivotal in enabling the production of smaller and more efficient semiconductor devices. This market thrives on the perpetual quest for miniaturization and enhanced performance in electronic applications. Glass wafers are an integral component in the production of semiconductor devices like integrated circuits, transistors, and diodes. The silicon semiconductor industry relies heavily on high-quality glass wafers to provide a stable base for manufacturing chips and circuits.

𝐆𝐞𝐭 𝐚 𝐅𝐫𝐞𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭:https://www.metastatinsight.com/request-sample/2580

Top Companies

Corning Inc.

Asahi Glass Co., Ltd

Plan Optik

Tecnisco Ltd

Nippon Electric Glass Co., Ltd.

Samtec

Dsk Technologies Pte Ltd

Swift Glass Inc.

Nano Quarz Wafer

SCHOTT AG

WaferPro LLC

The glass wafer begins as a cylindrical boule made from materials like quartz, borosilicate glass, or aluminosilicate glass. These glass formulations possess high uniformity and chemical stability needed for fabricating electronic components. The boule is sliced into thin discs using specialized saws, then polished down to an optically flat and scratch-free surface. These glass wafers serve as the foundational substrate onto which the active layers of a semiconductor device are deposited.

Access Full Report @https://www.metastatinsight.com/report/glass-wafer-for-semiconductor-devices-market

Before device fabrication, glass wafers undergo extremely thorough cleaning and surface preparation. Steps like solvent cleaning, wet chemical etching, and high temperature annealing remove contaminants and enhance the molecular bonding between the glass and deposited films. The purity and integrity of the glass wafer surface is paramount for enabling proper electrical performance and reliability.

The semiconductor layers such as dielectric insulators, conductors, and photoresist are laid down on the wafer through techniques like molecular beam epitaxy, chemical vapor deposition, sputtering, and lithography. The glass provides mechanical support while these overlying materials are patterned and etched into integrated circuits or discrete components. The flatness and stability of the wafer surface facilitates precision patterning down to nanometer dimensions.

Glass offers key advantages over other wafer materials for electronics manufacturing. It is inexpensive, nonconductive, and optically transparent. The thermal expansion coefficient and melting point of glass pairs well with silicon. Glass allows inspection and metrology of circuits using optical transmission. And glass wafers are easily scaled up to accommodate larger generation chip sizes and increased production volumes.

As semiconductor technology advances into smaller feature sizes and innovative device architectures, glass wafers must keep pace. Manufacturers continually refine glass composition, surface quality, and mechanical strength to meet industry demands. Investment in glass wafer engineering aims to bolster chip yields, processing capabilities, and end-product performance.

With its unique set of chemicals, optical, thermal, and mechanical attributes, glass remains an indispensable material at the heart of modern semiconductor fabrication. As the foundational substrate for microelectronics, the humble glass wafer enables our interconnected digital world of computers, appliances, mobile devices, and cutting-edge electronics.

Global Glass Wafer for Semiconductor Devices market is estimated to reach $470.6 Million by 2031; growing at a CAGR of 5.5% from 2024 to 2031.

Contact Us:

+1 214 613 5758

#GlassWaferforSemiconductorDevices#GlassWaferforSemiconductorDevicesMarket#GlassWaferforSemiconductorDevicesindustry#marketsize#marketgrowth#marketforecast#marketanalysis#marketdemand#marketreport#marketresearch

0 notes

Text

0 notes