#Usage-Based Insurance Market Development

Text

IoT Insurance Market - Forecast (2022 - 2027)

The Global market for Iot Insurance is forecast to reach $3,123.3 million by 2026, growing at a CAGR of 18.7% from 2021 to 2026. IoT-Connected insurance uses the data from internet-connected devices and telematics to improve the understanding of risks. It is a new approach that is based on use of sensors and digital technologies to monitor the state of an insured risk transforming rough data in usable and actionable information. Advances in IoT insurance can improve the productivity, overall profitability of the business and the risk profile of the portfolio. Through IoT, insurers can better connect with customers adding important touch points in particularly sensitive phases like acquisitions and claims. It is observed that automation can cut the cost of the claims process by as much as 30% and IoT connected devices have helped some life insurance and health insurance companies lower their premiums by as much as 25%.

Report Coverage

The report: “Iot Insurance Market– Forecast (2021-2026)”, by IndustryARC covers an in-depth analysis of the following segments of the Iot Insurance market.

By Type – Health Insurance, Life Insurance, Property and Casualty Insurance and Others.

By Application – Life and Health Insurance, Home and Commercial Buildings, Automotive and Transportation, Business and Enterprise, Consumer Electronics and Industrial Machines, Travel, Agriculture and Others.

By Geography - North America (U.S, Canada, Mexico), South America(Brazil, Argentina and others), Europe (Germany, UK, France, Italy, Spain, Russia and Others), APAC(China, Japan India, SK, Aus and Others), and RoW (Middle East and Africa)

Request Sample

Key Takeaways

Advances in IoT insurance can improve the productivity, overall profitability of the business and the risk profile of the portfolio.

IoT technology presents opportunities for insurers to reduce and mitigate losses, improve underwriting and enhance personalization of products and services.

Automation in insurance can cut the cost of claims process by as much as 30%

North-America is expected to hold a significant share in the IoT Insurance market due to growing awareness and faster adoption of IoT technology.

IoT Insurance Market Segment Analysis - By Type

The most important type of insurances are life insurance and health insurance which accounted for 44% share combined in 2020. Life insurance is something that pays out a sum of money either on the death of the insured person or after a set period. On the other hand health insurance covers the cost of hospitalization, visits to the doctor’s office and prescription medicines. The rising usage of digital technologies in this sector will drive market growth.

Inquiry Before Buying

IoT Insurance Market Segment Analysis - By Application

IoT insurance is applicable to almost all industries like automobile, manufacturing, agriculture, healthcare, hospitality, retail, finance, transportation and smart homes and buildings. Automotive industry is one of the industries most benefited after introduction of IoT. IoT devices such as in-car sensors, smartphones, and smart appliances can send insurers data on product usage and driving habits among other behaviours. In turn, this data will be fed into AI algorithms that allow insurers to offer risk based pricing and other popular services.

IoT Insurance Market Segment Analysis – By Geography

North America held the largest market share at 35% in 2020 among regional markets due to increasing awareness and rapid implementation of IoT in various industries in countries in this region. In addition, rising use of smart devices which deliver real-time insights to allow insurance companies in this region develop advanced insurance solutions. And also presence of international players in this region such as Google LLC, Microsoft Corporation, IBM and other drives the market in this region.

Schedule a Call

Iot Insurance Market Drivers

Mitigation of risk

In traditional method, insurers have used proxy data to identify the risk of loss for an asset. Internet of things (IoT) gives insurers access to real-time, individual, observable data on an asset’s risk of loss. This data is directly actionable for risk pricing and mitigation. IoT sensors monitor the behavior and actions which are causative of risk so that insurers can create algorithms based on observed behavior directly to pricing models. In this way insurers can similarly leverage this data for risk mitigation by providing timely and specific feedback to customers.

Rising demand for cloud services

The insurance industries dealing with huge volumes of sensitive data and documents are ready to integrate cloud technology in to their digital eco system. It enables insurers to use their IT resources more efficiently, reducing the cost of acquiring and maintaining infrastructure. Cloud based applications change the way of creating and delivering their products and services, managing risks and claims, collaborating with channel members and partners and communicating with customers, agents and brokers. Thus, cloud services in the insurance industry helps drive the market growth.

Buy Now

Iot Insurance Market Challenges

Data privacy and security

Data privacy and security is utmost important when it comes to technology. IoT comes along with cyber-risks, in fact, much more than any other technology. Meaningful customer engagement would require the insurer to collect and process data at each point, facilitated by IoT. Without establishing the trust it would be difficult to obtain personal data from customers. A significant amount of data is generated from the application of connected devices from wearable devices to connected homes and telematics devices in smart vehicles. Most of the customers are skeptical about their personal data remains secured and how it is utilized by insurers.

Iot Insurance Market Landscape

Product launches, acquisitions, and R&D activities are key strategies adopted by players in the Iot Insurance market. The Iot Insurance market is dominated by major companies such IBM Corporation, SAP SE, Oracle Corporation, Google Inc., Microsoft Corporation, Cisco Systems Inc., Accenture PLC, Verisk Analytics Inc., Concirrus, LexisNexis.

Acquisitions/Technology Launches/Partnerships

In Oct 2020, LexisNexis and Yonomi Smart Home have joined forces to develop an innovative turnkey home insurance internet of things (IoT) solution. It includes a smartphone app that participating policy holders can download the app which uses smartphone and device sensors to find common IoT devices in the home, which creates a data feed to LexisNexis risk sloutions.

In May 2019, Concirrus and willis Re, has entered in to strategic partnership to transform speciality re-insurance products by leveraging data from internet of things (IoT).

For more Electronics related reports, please click here

#IoT Insurance Market#IoT Insurance Market size#IoT Insurance industry#IoT Insurance Market share#IoT Insurance Market report#IoT Insurance Market price#internet of things

2 notes

·

View notes

Text

Utilization of AI Co-Pilot for Construction is the Future

Do you have any idea about AI in the construction industry? Today, the utilization of AI is increasing because of its amazing ability and continuous innovation. Hence, AI Co-Pilot for construction was introduced in the market to improve the level of surveillance in various industries. Therefore, by understanding the needs of the market and the various industries, viAct innovates this technology and helps them utilize the power of AI for their benefit.

Using an AI co-pilot on the construction site will increase the productivity of the employees and reduce the chances of human error. It has a strong sensing system to sense the faces of employees and equipment. It also immediately gives an alert if there is a chance of an accident. Therefore, this article will show how the utilization of AI co-pilot in construction is beneficial for future growth.

Role of AI Co-Pilot for Construction

It is modern technologies that could raise productivity, improve safety, and simplify work. The AI Co-Pilot is more than a novelty; it is in its class, performing its operation based on artificial intelligence in monitoring and optimizing many areas of the entire construction process.

Sensing and surveillance the latest sensors and cameras, this AI Co-Pilot will perform daily monitoring of every nook and corner at the site. It will be continuously looking at equipment and personnel to make sure safety protocols are policed while all activities are done according to a well-laid plan.

Alerts and Interventions: The AI Co-pilot sends immediate alerts the instant it detects something that may cause an accident or safety concern. It would help the managers and workers to mitigate the problems when they are in the nascent stage of development, hence enabling them to intervene in potential problems before these become critical.

Data Analysis: AI Co-pilot continuously captures data and analyses the same. This data allows informed decision-making and foretells possible issues in the interest of managing opportuneness at the site in general.

All the Good Things to Come

Less Human Error: Human error normally contributes to the highest rate of accidents on building sites. It is a fact that this AI Co-Pilot will minimize mistakes or at least reduce the rate of incidence of such. Accuracy combined with unblinking vigilance ensures the job is done right and safely.

Cost Savings: AI Co-Pilot greatly helps in cost savings by managing resources better and reducing the chances of accidents. Fewer accidents translate to lower insurance premiums and much less downtime, while better resource management is as good as a money-efficient method.

Sustainability: AI Co-Pilot can also help a great deal in building more 'green' and environmentally friendly construction sites. Optimizing material usage and reducing waste translate into a lesser environmental impact.

Conclusion

It was going to drive the construction industry into a new technological era, powered by the AI Co-Pilot. Improved safety, more productivity, and easier operations are but a few of the many reasons why AI is not just some vision of the future but is very much a part of transforming construction today. The integration of a safety AI platform like viAct provides your construction projects with the latest solutions to revolutionize worksite management.

Wondering how this technology raises the bar for operations? Explore viAct's Generative AI Solutions to understand in depth how this technology can change your construction site for good with an AI Co-Pilot and safety AI platform.

Visit Our Social Media Details :-

Facebook :- viactai

linkedin :- viactai

Twitter :-aiviact

Youtube :-@viactai

Instagram :-viactai/

Blog Url :-

Video Analytics in Action: Boosting Operations and Safety in Logistics and Manufacturing

Five Practical Applications of Generative AI for Manufacturers

0 notes

Text

Telematics Market | Current Insight with Future Aspect Analysis 2024–2030

The Telematics Market was valued at USD 9.8 billion in 2023-e and will surpass USD 21.3 billion by 2030; growing at a CAGR of 11.7% during 2024 - 2030. The report focuses on estimating the current market potential in terms of the total addressable market for all the segments, sub-segments, and regions. In the process, all the high-growth and upcoming technologies were identified and analyzed to measure their impact on the current and future market.

The report also identifies the key stakeholders, their business gaps, and their purchasing behavior. This information is essential for developing effective marketing strategies and creating products or services that meet the needs of the target market. The report also covers a detailed analysis of the competitive landscape which includes major players, their recent developments, growth strategies, product benchmarking, and manufacturing operations among others.

Understanding Telematics

Telematics involves the use of GPS technology, telecommunications, and informatics to transmit and store data from vehicles and other remote objects. This data is used to improve efficiency, safety, and productivity. Common applications include fleet management, navigation, vehicle tracking, and driver behavior monitoring.

Get a Sample Report: https://intentmarketresearch.com/request-sample/telematics-market-3316.html

Current Trends in the Telematics Market

Increased Adoption in Fleet Management: Fleet management systems have become integral to logistics and transportation companies. Telematics helps in route optimization, fuel consumption monitoring, and predictive maintenance, leading to cost savings and increased operational efficiency.

Growth of Connected Vehicles: The rise of the Internet of Things (IoT) has paved the way for connected vehicles, which are equipped with telematics systems to provide real-time data. This connectivity enhances features like traffic updates, emergency services, and vehicle diagnostics.

Regulatory Compliance and Safety: Governments worldwide are implementing stringent regulations to enhance road safety and environmental protection. Telematics systems help companies comply with these regulations by providing detailed reports on vehicle emissions, driver hours, and maintenance schedules.

Insurance Telematics: Usage-based insurance (UBI) is gaining traction, with insurers using telematics data to offer personalized premiums based on driving behavior. This not only incentivizes safe driving but also helps in reducing the overall cost of insurance.

Integration with Autonomous Vehicles: Telematics plays a crucial role in the development and deployment of autonomous vehicles. It provides the necessary data for navigation, obstacle detection, and vehicle-to-vehicle (V2V) communication, making self-driving cars safer and more reliable.

Key Innovations Driving the Telematics Market

Advanced Data Analytics: With the explosion of data generated by telematics systems, advanced analytics and machine learning algorithms are being used to derive actionable insights. This helps in predictive maintenance, risk assessment, and improving overall vehicle performance.

Enhanced Connectivity: The rollout of 5G networks promises to enhance the capabilities of telematics systems. Faster data transmission and lower latency will enable real-time monitoring and control of vehicles, leading to improved safety and efficiency.

Integration with Smart City Initiatives: Telematics is becoming an integral part of smart city projects, helping in traffic management, pollution control, and efficient public transportation. Integration with urban infrastructure can lead to a more connected and sustainable urban environment.

Blockchain Technology: Blockchain is being explored to enhance the security and transparency of telematics data. It can provide a tamper-proof record of vehicle data, which is crucial for insurance claims, vehicle histories, and regulatory compliance.

Get an insights of Customization: https://intentmarketresearch.com/ask-for-customization/telematics-market-3316.html

Future Prospects of the Telematics Market

Expansion in Emerging Markets: Developing countries are increasingly adopting telematics solutions to improve transportation infrastructure and logistics efficiency. This presents a huge opportunity for market players to expand their footprint.

Rising Demand for Electric Vehicles: The shift towards electric vehicles (EVs) is creating new opportunities for telematics. EVs require sophisticated telematics systems for battery management, charging station navigation, and energy optimization.

Collaboration and Partnerships: Strategic partnerships between telematics providers, automotive manufacturers, and technology companies are likely to drive innovation and market penetration. Collaborative efforts will result in more comprehensive and integrated telematics solutions.

Focus on Customer Experience: Enhancing customer experience through personalized services, such as in-car infotainment and tailored insurance products, will be a key differentiator. Companies that prioritize customer-centric innovations are likely to thrive in the competitive market.

Conclusion

The telematics market is on an exciting trajectory, with continuous advancements in technology and expanding applications across various sectors. As telematics systems become more sophisticated and integrated, they will play a pivotal role in shaping the future of transportation, logistics, and smart cities. Businesses and consumers alike stand to benefit from the enhanced efficiency, safety, and connectivity that telematics promises to deliver.

0 notes

Text

AI For One and All

The Flavors of AI democracy

AI is not only for engineers and data scientists but also for managers, VPs and CXOs to leverage themselves and ensure usage of AI across their organization in bringing productivity and cost benefits. True democratization of AI is in enabling functions (HR, finance, operations, legal) across the organization to leverage its full potential in everyday work-life while making it simplified and amplified. It should also simplify the end customers routines and interactions with the company.

Read: Role of AI in Cybersecurity: Protecting Digital Assets From Cybercrime

A host of AI tools like ChatGPT, Midjourney, Gemini, Bedrock, Grammarly, Bing Search, etc are already used by masses. But there is more than one way to define the democratization of AI.

For London-based Stability AI, democratizing AI means opening up access to AI design and development to a larger community of users. This company open sourced its deep learning, text-to-image model to empower developers around the world to use, modify and innovate with the tool, subject to terms of use. The idea being that allowing developers closest to the end-users free access would produce the best outcomes, and evolve the model itself over time.

A more common way of democratizing AI development is allowing even non-technical users with little programming knowledge in an enterprise to build and modify models to suit their requirements with the help of low-code and no-code tools.

Less known but critical nonetheless is the democratization of AI governance. This is not about allowing anyone to use, monitor, and control AI as they please; rather it is about preventing the monopolization of AI by a few entities by allowing the interest and participation of a large number of stakeholders to influence decisions on how the technology should be used and by whom, within risk versus reward guardrails.

In the traditional environment, access to the data sandbox and the ability to utilize the data within it might be limited to a select group of technical specialists. Limiting access to data sandboxes hinders innovation in several ways in the AI era. A successful culture of experimentation is an ongoing process that requires continuous effort and commitment from everyone involved, not just the technical specialists. Democratizing access to data within sandboxes empowers business users with access to data in the sandbox. They can experiment with user-friendly AI tools and pre-trained models to automate tasks, identify patterns, and gain insights relevant to their roles. This enables them to leverage the power of AI without needing advanced technical expertise.

At times, democratization of AI development can clash with democratization of governance – for example, when developers are restricted from using data that is valuable for innovation but is protected by regulation. But eventually, all democratization efforts are directed at putting the power of AI within reach of every individual. About sharing the benefits of AI technologies throughout the organization. About making it possible for business users to create the use-cases best suited to their needs without depending on IT or undergoing extensive technical training.

In theory, at least. But execution is a little more complicated.

AI pays, but also punishes

Democratization leads to scale, and potentially, unprecedented benefits, but handled badly, it is a recipe for unmitigated disaster. Imagine a large community of developers around the world using an algorithm with biased training data to build other AI models; they will have magnified and perpetuated its discriminatory outcomes in next to no time. In democratized AI enterprises, marketers tap AI platforms and their customer data to identify leads, insurers study health information to price premiums, and relationship managers access customers’ financial statements to personalize investment portfolios. Without robust security measures – about access rights, permitted devices, consent – and sensitization to responsible use of AI and data, there is a real risk of the systems being breached by malicious actors, or information of a private or sensitive nature being leaked out of the organization. From financial and reputational loss to disruption of systems, to legal repercussions, uncontrolled, ungoverned, democratization can lead to very serious consequences.

Proceed with care

Which is why data and AI must be democratized the right way.

The first step is to understand how different users will engage with AI (use to query or to create content, use insights to make decisions, modify or develop models, etc.) Upskilling all users including non-technical business users ensures safe and effective use of AI. Before allowing employees free rein, employers should also provide guidance on responsible AI practices, such as how to avoid subjectiveness and bias while assigning data labels. Solutions like smart data fingerprinting uncovers more data with transparency and traceability, providing a foundation for experimentation for any AI or GenAI project. Easy access to diverse datasets opens doors for “responsible data sandboxes” for creative exploration to drive organizational growth. It also promotes data sharing and facilitates seamless data exchange between different systems including AI/ML applications. Organizations may want to consider using technology infrastructure, such as MLOps, to support AI training and deployment.

As more users work with and on AI, they expose the organization to greater cybersecurity risks; secure coding practices, rigorous testing, and responsible data handling will mitigate vulnerability to attack and prevent misuse of data.

Introducing fairness and accountability checks during development will lower the probability of biased or inaccurate algorithmic outcomes and inspire trust in the applications. Building transparent and explainable AI models is key. While allowing more people to participate in designing and building AI models, enterprises should appoint a qualified human in the loop for overseeing responsible development. But even a “fair” algorithm can produce unfair outcomes if trained on flawed data: think of a dataset of potential borrowers that excludes ethnic minorities; an AI loan approval system using this data may end up rejecting eligible borrowers from those communities.

While democratization of AI will help the majority of employees become more productive and creative, it could displace some workers; employers must reskill and upskill these people for redeployment in other roles.

Share the benefits

Democratizing AI is not just about giving access to the latest tools, but it is about empowering employees at all levels to make better data driven decisions using AI, innovate by collaborating with AI, reduce biases, and deliver tangible results with improved productivity and efficiency. It allows every individual in the organization, regardless of rank or function, a share in this revolutionary technology creates inclusion, improves morale, and elevates employee experience.

These benefits directly translate into tangible and intangible business value like increased sales, customer satisfaction, and brand reputation.

By democratizing AI, companies can bridge the gap between execution and value. Ultimately, businesses can create strategic advantage to the stakeholders and achieve long term sustainable success.

Employees in every role can use generative AI to create a variety of content – text, visual, audio, code – and to produce new and innovative ideas. For example, instead of deferring to brand custodians, marketing staff can use pre-trained gen AI tools to independently build “creatives” in conformance with brand guidelines, including color, font, and tone of voice. A product development team can input desired parameters into the tool and instruct it to create multiple design options, to save substantial costs and time.

Helping everyone feel empowered and happy at work. What is democracy, if not this?

0 notes

Text

Peripheral Vascular Devices Market is Estimated to Witness High Growth Owing to Rising Geriatric Population

Peripheral vascular devices are used for the treatment and diagnosis of peripheral artery diseases. These devices help in plaque removal, angioplasty and stenting which restore smooth blood flow to limbs. The rising prevalence of peripheral artery diseases due to diabetes, obesity and high blood pressure has fueled the demand for peripheral vascular devices. Peripheral vascular devices include angioplasty balloons, stents, catheters, arterial sheaths, guidewires and other devices. Technologically advanced devices with enhanced safety, efficacy and ease of installation have gained traction in the recent years.

The global peripheral vascular devices market is estimated to be valued at US$ 12.68 Bn in 2024 and is expected to exhibit a CAGR of 6.3% over the forecast period 2024 to 2031.

Key Takeaways

Key players operating in the peripheral vascular devices are Abbott Laboratories, Boston Scientific Corporation, Angioscore, Emboline Inc., Becton Dickinson and Company, Cook Group Inc., Cordis Corporation, Covidien PLC, Edward Lifesciences Corporation, Medtronic Plc, St. Jude Medical, Bayer AG., Teleflex Medical, Koninklijke Philips N.V., Cardio Flow, Inc. Key players are focusing on new product launches, mergers and acquisitions to strengthen their market presence.

The rising geriatric population prone to peripheral artery diseases and growing preference for minimally invasive surgeries offer significant growth opportunities for players in the Peripheral Vascular Devices Market Size Furthermore, expanding healthcare infrastructure and increasing healthcare expenditure in emerging economies is also expected to fuel the adoption of peripheral vascular devices globally over the forecast period.

Market Drivers

The rising geriatric population is one of the key drivers of the peripheral vascular devices market. According to the UN data, the world’s population aged 60 years and above is projected to double from 12% to 22% between 2015 and 2050. The elderly are more susceptible to developing peripheral artery diseases owing to reduced blood circulation and weakening of arteries with age. This is expected to significantly drive the demand for peripheral vascular devices over the next few years.

PEST Analysis

Political: Peripheral Vascular Devices Market Size And Trends are subject to extensive government regulations resulting from stringent FDA approvals for new products and procedures. Regulations impact product development timelines and costs.

Economic: Growth in the peripheral vascular devices market is driven by rising healthcare expenditure, growing elderly population suffering from peripheral vascular diseases, and favorable reimbursement policies for life-saving procedures.

Social: Increasing awareness about peripheral vascular diseases and availability of advanced treatment options encourage people to seek medical care. Sedentary lifestyles and obesity rates also contribute to the patient volumes.

Technological: Innovation leads to the development of novel drug-eluting, bioresorbable, and nano-technology based stents that reduce in-stent re-stenosis rates. Robotics, AI, and 3D printing are enhancing surgical precision and customization.

Market value concentration by geographical regions: North America accounts for the largest share of the overall peripheral vascular devices market in terms of value, owing to the high usage of advanced equipment, growing number of vascular surgeries, and supportive insurance system. Asia Pacific is expected to witness the fastest value growth over the forecast period, with expanding healthcare infrastructure and increasing medical tourism from other regions.

Fastest growing regional market: Asia Pacific peripheral vascular devices market exhibits immense growth potential attributed to the rising awareness, healthcare reforms, and willingness to adopt modern treatments. Factors like growing elderly population, increasing obesity prevalence, presence of contract manufacturers and emerging economies propel the regional market growth at a rapid rate.

Get More Insights On, Peripheral Vascular Devices Market

About Author:

Ravina Pandya, Content Writer, has a strong foothold in the market research industry. She specializes in writing well-researched articles from different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. (https://www.linkedin.com/in/ravina-pandya-1a3984191)

#Peripheral Vascular Devices Market Size#Peripheral Vascular Devices Market Trends#Peripheral Vascular Devices Market Share#Peripheral Vascular Devices#Peripheral Vascular Devices Market

0 notes

Text

Understanding the Foligraf 1200 IU: Price, Uses, and Considerations

What is Foligraf 1200 IU?

Foligraf 1200 IU is a form of human follicle-stimulating hormone (FSH) used in fertility treatments. FSH is crucial in the development of ovarian follicles, which are essential for the production of mature eggs in women. In men, it helps stimulate the production of sperm. Foligraf is administered as an injection under the skin, and the dosage is carefully monitored by a healthcare provider to ensure the best possible outcome.

Price Consideration

One of the critical factors for patients considering Foligraf 1200 IU is its price. As of the current market, the price of Foligraf 1200 IU is approximately [insert local currency]550. However, prices can vary depending on the region, the pharmacy, Foligraf 1200 Iu Price and any available discounts or insurance coverage.

The cost of Foligraf may seem high, but it is important to consider the benefits it offers in helping to overcome infertility challenges. The price also reflects the advanced technology and processes involved in manufacturing this hormone therapy. Patients should explore various options for obtaining the medication at the best possible price, such as checking with multiple pharmacies, looking for online discounts, or consulting with their healthcare provider about potential financial assistance programs.

How Foligraf 1200 IU Works

Foligraf 1200 IU works by mimicking the natural FSH in the body. In women, Lonopin Injection in Delhi it stimulates the ovaries to produce mature eggs, which can then be fertilized during treatments like IVF. This is particularly beneficial for women who have difficulty ovulating naturally. The hormone is administered via subcutaneous injection, usually starting early in the menstrual cycle and continuing until the eggs are ready to be retrieved.

In men, Foligraf 1200 IU is used to stimulate sperm production, especially in cases where low sperm count is an issue. The medication helps increase the chances of producing viable sperm, which is crucial for successful fertilization.

Usage and Dosage

The usage and dosage of Foligraf 1200 IU should be strictly followed as prescribed by a healthcare professional. The dosage may vary based on the individual's response to the treatment and the specific fertility protocol being followed. Regular monitoring through blood tests and ultrasounds is essential to assess the body's response to the hormone and adjust the dosage accordingly.

Patients should be aware of potential side effects, including mild pain at the injection site, headache, fatigue, and abdominal discomfort. In rare cases, more severe side effects like ovarian hyperstimulation syndrome (OHSS) can occur, which requires immediate medical attention. It is crucial to discuss any concerns or side effects with a healthcare provider to ensure safe and effective use of the medication.

0 notes

Text

Breathalyzers Market will grow at highest pace owing to increasing cases of alcohol related accidents

The breathalyzers market comprises devices that aid in analysis of alcohol levels in human breath. Breathalyzers find extensive applications in measuring blood alcohol concentration (BAC) levels in suspected drunk driving cases. These devices are considered reliable and easy-to-use tools for determining intoxication levels. The advantages of breathalyzers over blood tests include non-invasiveness, rapid results, and ease of use at the roadside. The growing occurrences of alcohol-related accidents worldwide have amplified the need for reliable breathalyzers for efficient prevention of drunk driving. Moreover, strict drunk driving laws with breathalyzer tests mandated have further propelled their demand.

The Global Breathalyzers Market is estimated to be valued at US$ 10.6 Bn in 2024 and is expected to exhibit a CAGR of 18.% over the forecast period 2023 to 2030.

Key Takeaways

Key players operating in the Breathalyzers market are Cannabix Technologies Inc., Alcohol Countermeasure Systems Corp., Dragerwerk AG & Co. KGa, Intoximeters Inc., Lifeloc Technologies Inc., MPD Inc., Quest Products Inc., Advanced Safety Devices LLC, Aerocrine AB, Akers Biosciences Inc., Alcolizer Pty Ltd., Alcopro Inc., Guth Laboratories Inc., Meretek Diagnostics Group of Otsuka America Pharmaceutical Inc., PAS Systems International Alcohol Sensor Systems, Toshiba Medical Systems Corp., TruTouch Technologies Inc., ENVITE- WISMER GmbH, AK GlobalTech Corporation, Intoximeter Inc., and BACtrack Inc. The rising alcoholism and increasing cases of drunk driving have been fueling the need for efficient breathalyzers. Technological advancements including portable breathalyzers, fuel cell sensors, semiconductor oxide sensors are enabling accurate, rapid and reliable alcohol detection.

The stringent laws against drunk driving coupled with increasing awareness about alcohol hazards are compelling more individuals to rely on breathalyzers. Technological advancements have led to the development of portable breathalyzers that provide on-the-spot results conveniently. Sensors based on fuel cell and semiconductor oxide technologies offer accurate, rapid alcohol detection. Bluetooth and wireless connectivity in advanced devices enable remote data transmission with automatic recording of test results. AI and IoT integrations also aid in centralized breathalyzer data management.

Market trends

The adoption of portable breathalyzers is growing owing to increasing demand for on-the-spot alcohol detection. Portable devices are lightweight, compact, affordable, and allow testing from the comfort of one’s home or during leisure travel. Fuel cell sensors are becoming widely used in breathalyzers owing to their high accuracy, repeatability, fast response, and long lifespan. With further technological developments, fuel cell sensors will dominate the market.

Wearable breathalyzers are gaining traction allowing continuous and discreet alcohol monitoring for igniting vehicle, office equipment and more. Voice based breathalyzers which analyze speech and determine alcohol intoxication are being developed. Gamification of breathalyzers is also a trend where test results pop up as game points or virtual rewards motivation behavior change.

Market Opportunities

Remote monitoring and data analytics capabilities in advanced breathalyzers offer opportunities for insurance companies to provide incentives and discounts based on low risk driving behavior. Integration of breathalyzers in vehicles for continuous alcohol monitoring and vehicle ignition disablement based on BAC levels above legal limits can significantly reduce drunk driving cases. Developing economies with growing alcohol usage and lack of strict laws present opportunities for widespread breathalyzer adoption.

0 notes

Text

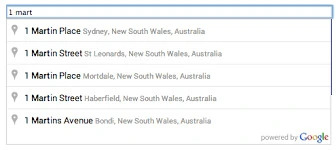

What is the Best API for Address Autocomplete?

In today's fast-paced digital world, providing a seamless user experience is crucial for businesses across all industries. One of the most effective ways to enhance the user experience, particularly in online forms, is by implementing an address autocomplete API. Address autocomplete APIs help users quickly and accurately enter their addresses by suggesting possible matches as they type. This not only speeds up the form-filling process but also reduces the likelihood of errors, which can lead to costly delivery mistakes or failed transactions.

With several address autocomplete APIs available on the market, choosing the best one for your business can be challenging. In this article, we'll explore some of the top address autocomplete APIs and highlight their features, benefits, and use cases to help you make an informed decision.

1. Google Places Autocomplete API

The Google Places Autocomplete API is one of the most popular and widely used address autocomplete APIs. Powered by Google's vast database of locations, this API provides accurate and reliable address suggestions as users type. It's known for its global coverage, making it an excellent choice for businesses with an international presence.

Key Features:

Global Coverage: The Google Places Autocomplete API supports address autocomplete for over 240 countries and territories.

Real-Time Suggestions: The API provides real-time address suggestions as users type, enhancing the user experience.

Customizable: Developers can customize the API to return specific types of places, such as addresses, establishments, or points of interest.

Geocoding: The API also provides geocoding capabilities, allowing you to convert addresses into geographic coordinates.

Use Cases:

E-commerce: Streamline the checkout process by helping customers quickly enter their shipping addresses.

Ride-Sharing Apps: Allow users to easily select their pickup and drop-off locations.

Food Delivery Services: Ensure accurate delivery by providing real-time address suggestions.

Pros:

Extensive global coverage.

High accuracy and reliability.

Customizable to fit specific use cases.

Cons:

Cost can be a concern for businesses with high API usage.

Limited free tier, with charges based on the number of requests.

2. SmartyStreets

SmartyStreets is a robust address autocomplete API known for its accuracy and validation capabilities. Unlike some other APIs, SmartyStreets not only suggests addresses but also verifies them against authoritative postal databases, ensuring that the addresses are deliverable.

Key Features:

Address Validation: SmartyStreets validates addresses in real-time against official postal databases, reducing the risk of undeliverable mail.

International Coverage: The API supports address autocomplete for over 240 countries and territories.

Geocoding and Reverse Geocoding: SmartyStreets provides geocoding and reverse geocoding capabilities, allowing you to convert addresses to coordinates and vice versa.

youtube

SITES WE SUPPORT

Insurance Letter API – Wix

0 notes

Text

Exploring the Booming Telematics Market: Trends, Innovations, and Future Prospects

The Telematics Market was valued at USD 9.8 billion in 2023-e and will surpass USD 21.3 billion by 2030; growing at a CAGR of 11.7% during 2024 - 2030. The report focuses on estimating the current market potential in terms of the total addressable market for all the segments, sub-segments, and regions. In the process, all the high-growth and upcoming technologies were identified and analyzed to measure their impact on the current and future market.

The report also identifies the key stakeholders, their business gaps, and their purchasing behavior. This information is essential for developing effective marketing strategies and creating products or services that meet the needs of the target market. The report also covers a detailed analysis of the competitive landscape which includes major players, their recent developments, growth strategies, product benchmarking, and manufacturing operations among others.

Understanding Telematics

Telematics involves the use of GPS technology, telecommunications, and informatics to transmit and store data from vehicles and other remote objects. This data is used to improve efficiency, safety, and productivity. Common applications include fleet management, navigation, vehicle tracking, and driver behavior monitoring.

Get a Sample Report: https://intentmarketresearch.com/request-sample/telematics-market-3316.html

Current Trends in the Telematics Market

Increased Adoption in Fleet Management: Fleet management systems have become integral to logistics and transportation companies. Telematics helps in route optimization, fuel consumption monitoring, and predictive maintenance, leading to cost savings and increased operational efficiency.

Growth of Connected Vehicles: The rise of the Internet of Things (IoT) has paved the way for connected vehicles, which are equipped with telematics systems to provide real-time data. This connectivity enhances features like traffic updates, emergency services, and vehicle diagnostics.

Regulatory Compliance and Safety: Governments worldwide are implementing stringent regulations to enhance road safety and environmental protection. Telematics systems help companies comply with these regulations by providing detailed reports on vehicle emissions, driver hours, and maintenance schedules.

Insurance Telematics: Usage-based insurance (UBI) is gaining traction, with insurers using telematics data to offer personalized premiums based on driving behavior. This not only incentivizes safe driving but also helps in reducing the overall cost of insurance.

Integration with Autonomous Vehicles: Telematics plays a crucial role in the development and deployment of autonomous vehicles. It provides the necessary data for navigation, obstacle detection, and vehicle-to-vehicle (V2V) communication, making self-driving cars safer and more reliable.

Key Innovations Driving the Telematics Market

Advanced Data Analytics: With the explosion of data generated by telematics systems, advanced analytics and machine learning algorithms are being used to derive actionable insights. This helps in predictive maintenance, risk assessment, and improving overall vehicle performance.

Enhanced Connectivity: The rollout of 5G networks promises to enhance the capabilities of telematics systems. Faster data transmission and lower latency will enable real-time monitoring and control of vehicles, leading to improved safety and efficiency.

Integration with Smart City Initiatives: Telematics is becoming an integral part of smart city projects, helping in traffic management, pollution control, and efficient public transportation. Integration with urban infrastructure can lead to a more connected and sustainable urban environment.

Blockchain Technology: Blockchain is being explored to enhance the security and transparency of telematics data. It can provide a tamper-proof record of vehicle data, which is crucial for insurance claims, vehicle histories, and regulatory compliance.

Get an insights of Customization: https://intentmarketresearch.com/ask-for-customization/telematics-market-3316.html

Future Prospects of the Telematics Market

Expansion in Emerging Markets: Developing countries are increasingly adopting telematics solutions to improve transportation infrastructure and logistics efficiency. This presents a huge opportunity for market players to expand their footprint.

Rising Demand for Electric Vehicles: The shift towards electric vehicles (EVs) is creating new opportunities for telematics. EVs require sophisticated telematics systems for battery management, charging station navigation, and energy optimization.

Collaboration and Partnerships: Strategic partnerships between telematics providers, automotive manufacturers, and technology companies are likely to drive innovation and market penetration. Collaborative efforts will result in more comprehensive and integrated telematics solutions.

Focus on Customer Experience: Enhancing customer experience through personalized services, such as in-car infotainment and tailored insurance products, will be a key differentiator. Companies that prioritize customer-centric innovations are likely to thrive in the competitive market.

Conclusion

The telematics market is on an exciting trajectory, with continuous advancements in technology and expanding applications across various sectors. As telematics systems become more sophisticated and integrated, they will play a pivotal role in shaping the future of transportation, logistics, and smart cities. Businesses and consumers alike stand to benefit from the enhanced efficiency, safety, and connectivity that telematics promises to deliver.

0 notes

Text

Current Trends in the Property Insurance Market

The property insurance market is undergoing a period of significant transformation. Driven by technological innovation, a changing climate, and evolving customer expectations, several key trends are impacting the way insurance is bought, priced, and delivered.

Buy the Full Report for More Line of Business Insights into the Property Insurance Market

Download a Free Report Sample

Here's a closer look at these evolving dynamics:

1. The Rise of InsurTech:

Data-Driven Underwriting: InsurTech companies are leveraging big data analytics to develop more sophisticated risk assessment models. These models consider a wider range of factors beyond traditional credit scores, leading to more personalized pricing and potentially lower premiums for lower-risk individuals.

Telematics and Usage-Based Insurance: This approach, particularly prevalent in auto insurance, uses telematics devices to track driving behavior and offer premiums based on mileage, driving habits, and risk factors. This incentivizes safe driving and rewards responsible customers.

Smart Home Integration: Insurers are exploring partnerships with smart home technology providers. Homes equipped with leak detectors, smart smoke alarms, or other risk mitigation devices could qualify for discounts or lower premiums.

2. The Impact of Climate Change:

Increased Demand for Catastrophe Coverage: The rising frequency and intensity of extreme weather events like floods, wildfires, and hurricanes are driving demand for catastrophe coverage (cat coverage). This may lead to higher premiums in certain regions, particularly those prone to these natural disasters.

Parametric Insurance Solutions: This emerging approach focuses on pre-defined triggers, such as wind speed exceeding a specific threshold, rather than traditional post-disaster damage assessments. This can expedite payouts after catastrophes, providing faster financial relief to policyholders.

3. Focus on Resilience and Risk Mitigation:

Proactive Risk Management: Insurers are offering incentives for property owners and businesses who take proactive steps to mitigate risk. Installing hurricane shutters, flood barriers, or fire suppression systems could qualify for discounts or other benefits.

Cybersecurity Concerns: With homes and businesses becoming increasingly reliant on smart technology, cyberattacks pose a growing threat. Cybersecurity coverage, either as a standalone product or bundled with property insurance, is becoming more prevalent.

4. Evolving Customer Expectations:

Digitalization and On-Demand Services: Customers expect a seamless digital experience, with the ability to manage policies, file claims, and receive payouts online. Mobile apps and user-friendly online platforms are becoming the norm. Additionally, on-demand insurance options tailored to specific needs, such as short-term rental coverage, may emerge.

Transparency and Risk Communication: Insurers are facing pressure to be more transparent about risk factors and potential premium increases due to climate change or other factors. Effective communication regarding risk profiles and pricing is crucial for building trust with customers.

5. A Shifting Regulatory Landscape:

Regulation of InsurTech: As InsurTech solutions become more sophisticated, regulators are working to establish frameworks that address data privacy concerns and ensure fair competition within the industry.

Flood Insurance Changes: Government involvement in flood insurance programs may evolve, potentially leading to increased costs or reduced availability in high-risk flood zones.

Conclusion:

The property insurance market is no longer static. These trends signal a future where technology plays a central role, risk mitigation becomes a priority, and customer experience takes center stage. By embracing these changes and adapting to a dynamic environment, the insurance industry can deliver innovative solutions and ensure continued relevance in the face of evolving risks.

0 notes

Text

Guide to agricultural production in national economy of india - CHS Farm

Agricultural production plays a crucial role in the national economy of India. Here are some key aspects of its significance and impact:

1. Contribution to GDP

Economic Contribution: Agriculture contributes around 15-20% of India's Gross Domestic Product (GDP). Although its share in GDP has decreased over the decades due to the growth of the industrial and service sectors, it remains a vital component of the economy.

2. Employment

Employment Provider: Agriculture is the primary source of livelihood for about 50-60% of India's population. It employs a significant portion of the rural workforce, making it a major sector for employment.

3. Food Security

Self-Sufficiency: India has achieved self-sufficiency in staple food grains like wheat and rice. Agricultural production ensures food security for the growing population.

Nutritional Supply: It provides a diverse range of crops, fruits, vegetables, and pulses essential for balanced nutrition.

4. Rural Development

Economic Activity: Agriculture is a major driver of economic activity in rural areas, leading to the development of infrastructure and ancillary industries (e.g., agro-processing, rural banking).

Income Generation: Improved agricultural practices and higher productivity increase rural incomes and reduce poverty.

5. Export Revenue

Agricultural Exports: India exports a variety of agricultural products, including spices, tea, coffee, rice, and fruits, contributing to foreign exchange earnings and trade balance.

6. Government Policies and Programs

Supportive Policies: The Indian government implements various policies and schemes to support agriculture, such as subsidies for fertilizers, irrigation projects, and crop insurance schemes.

Investment in Infrastructure: Initiatives like the Pradhan Mantri Krishi Sinchai Yojana (PMKSY) aim to improve irrigation infrastructure and water management.

7. Technological Advancements

Modernization: The adoption of modern technologies, such as precision farming, improved seed varieties, and digital tools, enhances productivity and efficiency.

Research and Development: Investments in agricultural research and development (R&D) help in developing new crop varieties and improving farming practices.

8. Challenges and Opportunities

Challenges: The sector faces challenges such as low productivity, inadequate infrastructure, climate change impacts, and fluctuating market prices.

Opportunities: There are opportunities for growth through sustainable practices, digital agriculture, and value-added products.

9. Environmental Impact

Sustainability: Agriculture has environmental implications, including water usage, soil health, and biodiversity. Sustainable practices are essential for maintaining environmental balance.

10. Integration with Other Sectors

Linkages: Agriculture is linked with other sectors such as manufacturing (agro-based industries) and services (rural banking, insurance), creating a multiplier effect on the economy.

In summary, agricultural production is fundamental to India's national economy, influencing employment, food security, rural development, and export revenue. Continued efforts to modernize and support the sector are crucial for its sustained contribution to economic growth and development.

Expanding on the role of agricultural production in India's national economy, here are additional points that highlight its significance and the evolving landscape:

11. Income Distribution and Poverty Alleviation

Income Redistribution: Agriculture plays a critical role in reducing income inequalities, especially in rural areas. It provides income to smallholder farmers and landless laborers, which helps in bridging the rural-urban income gap.

Poverty Reduction: Growth in agriculture directly contributes to poverty reduction, as it leads to higher rural incomes, better food security, and improved living standards.

12. Infrastructure Development

Rural Infrastructure: Agricultural growth necessitates and fosters the development of rural infrastructure, such as roads, storage facilities, irrigation systems, and electricity.

Connectivity: Improved rural connectivity enhances access to markets, education, healthcare, and other essential services, contributing to overall rural development.

13. Supply Chain and Value Addition

Supply Chain Improvements: Efficient supply chains are critical for reducing post-harvest losses, ensuring timely delivery of inputs and outputs, and enhancing the overall efficiency of the agricultural sector.

Value Addition: Agro-processing industries add value to agricultural produce, creating products with higher market value and generating additional employment opportunities. Examples include the processing of fruits and vegetables, dairy products, and the production of biofuels.

14. Climate Resilience and Sustainable Practices

Climate Change Adaptation: Agriculture is highly vulnerable to climate change. Developing and implementing climate-resilient farming practices, such as drought-resistant crop varieties and water-efficient irrigation techniques, is essential for ensuring long-term agricultural sustainability.

Sustainable Agriculture: Promoting sustainable agricultural practices, such as organic farming, conservation tillage, and integrated pest management, helps in maintaining soil health, reducing environmental impact, and ensuring the sustainability of agricultural production.

15. Role of Cooperatives and Farmer Organizations

Cooperatives: Agricultural cooperatives play a significant role in pooling resources, improving bargaining power, and providing better access to markets and credit for small and marginal farmers.

Farmer Producer Organizations (FPOs): FPOs enhance the collective strength of farmers, enabling better price realization, access to technology, and improved market linkages.

16. Financial Inclusion and Credit Access

Agricultural Credit: Ensuring access to affordable credit is vital for farmers to invest in quality inputs, machinery, and technologies. Government initiatives like the Kisan Credit Card (KCC) scheme aim to facilitate this.

Financial Services: Expanding access to financial services, including insurance, savings, and credit facilities, helps in mitigating risks and promoting agricultural investment.

17. Policy Reforms and Innovations

Agricultural Reforms: Recent policy reforms, such as the introduction of the e-NAM (National Agriculture Market) platform, aim to create a unified national market for agricultural commodities, enhancing transparency and efficiency.

Innovation Hubs: Establishing innovation hubs and incubators to promote agritech startups and innovations in the agricultural sector can drive modernization and increase productivity.

18. Export Promotion and Global Trade

Export Potential: India has a significant potential to increase its agricultural exports by improving quality standards, adhering to global trade norms, and exploring new markets.

Trade Agreements: Participating in bilateral and multilateral trade agreements can open up new opportunities for agricultural exports, boosting foreign exchange earnings.

19. Public-Private Partnerships (PPPs)

Collaboration: PPPs can play a crucial role in developing agricultural infrastructure, research and development, and extension services, leveraging the strengths of both the public and private sectors.

20. Education and Skill Development

Agricultural Education: Strengthening agricultural education and research institutions can enhance the knowledge base and skill set of farmers and agricultural professionals.

Training Programs: Implementing training programs focused on modern agricultural practices, digital literacy, and farm management can empower farmers and improve productivity.

21. Social and Cultural Impact

Rural Society: Agriculture deeply influences the social and cultural fabric of rural India, shaping traditions, festivals, and community life.

Empowerment of Women: Empowering women in agriculture through targeted programs and initiatives can significantly boost productivity and improve family and community well-being.

Conclusion

Agricultural production remains a cornerstone of India’s national economy, influencing multiple facets including economic growth, employment, food security, and rural development. With the integration of modern technologies, sustainable practices, policy reforms, and robust infrastructure, agriculture can continue to drive inclusive growth and development in India. The focus on innovation, climate resilience, and value addition will be crucial for addressing future challenges and maximizing the sector’s potential.

Call pratanu banerjee for guidance and team development and also for online earning opportunity from chs farm 91-8017517171

0 notes

Text

The Growing Market for Medicinal Herbs: Trends, Benefits, and Future Prospects

In recent years, there has been a notable surge in the worldwide market for therapeutic herbs. Herbal medicines are increasingly gaining popularity as a substitute for standard medical care due to factors such as growing medical bills, societal trends towards integrated treatment, and growing awareness among consumers of alternative medical alternatives. This article examines the market for medicinal herbs, including its development patterns, advantages, and potential future developments.

Market Trends

1.Growing Needs for Natural medicines: As a result of many different medical problems, customers are increasingly resorting to herbal treatments. Fears over the adverse effects of synthetic medications and consumers' increased inclination toward organic and natural products are the main causes of this change. The alleged health advantages of herbs are driving up demand for them.

2.E-commerce and Online Retail: The growth of e-commerce has boosted the distribution of medicinal plants to a worldwide customer base. Customers can obtain an extensive range of herbs and herbal items from the convenience of their homes by using online platforms. This ease of use, along with the capability to look up and read feedback, has drastically boosted sales.

3.Integration into Mainstream Medicine: There is a growing acceptance of medicinal herbs within the conventional medical community. Research and clinical trials are increasingly supporting the efficacy of certain herbs, leading to their integration into standard treatment protocols for various conditions.

4.Government Support and Regulation: Many governments are recognizing the potential of medicinal herbs and are implementing supportive policies and regulations. This includes funding for research, standardizing quality control, and promoting the cultivation of medicinal plants.

ALSO READ: How to Use Dried Edible Flowers in Your Kitchen

Benefits of Medicinal Herbs

1.Holistic Health Benefits: Medicinal herbs offer a holistic approach to health, addressing not just physical symptoms but also emotional and spiritual well-being. For instance, herbs are known to help the body manage stress.

2.Fewer Side Effects: Compared to synthetic drugs, medicinal herbs typically have fewer and less severe side effects. This makes them a safer option for long-term use in managing chronic conditions.

3.Cost-Effective: Medicinal herbs are often more affordable than conventional medications, making them an attractive option for those without comprehensive health insurance or those looking to reduce their healthcare expenses.

4.Sustainability: The cultivation and use of medicinal herbs promote biodiversity and sustainable farming practices. Many herbs can be grown organically, contributing to environmental health.

Future Prospects

The future of the medicinal herb market looks promising, with several factors driving its continued growth:

1.Advancements in Research: Ongoing scientific research is likely to uncover new therapeutic uses for medicinal herbs. As more evidence supports their efficacy, consumer confidence and usage will increase.

2.Innovative Product Development: Companies are continuously developing new and innovative herbal products, including supplements, teas, tinctures, and topical applications. This diversification helps cater to varying consumer preferences and expands market reach.

3.Increasing Health Consciousness: As global health consciousness continues to rise, more people are likely to turn to medicinal herbs for preventive health care and wellness. Educational campaigns and social media influence will play a significant role in spreading awareness.

4.Expansion into New Markets: Emerging markets in Asia, Africa, and Latin America are showing a growing interest in medicinal herbs. As disposable incomes increase and access to information improves, these regions will become key growth areas for the industry.

Conclusion

The sales of medicinal herbs are on an upward trajectory, driven by a confluence of factors including consumer preferences for natural remedies, advancements in research, and supportive regulatory environments. As the market continues to evolve, the integration of medicinal herbs into mainstream health practices is likely to become more pronounced, offering a sustainable and holistic approach to health and wellness.

The medicinal herb market is poised for continued expansion, offering numerous benefits to consumers and opportunities for businesses and researchers alike. With proper regulation, education, and innovation, medicinal herbs will remain a vital part of the global health landscape.

0 notes

Text

How Insurtech Has Impacted the Insurance Industry

Insurtech combines insurance services with cutting-edge technologies, such as blockchain, big data analytics, and artificial intelligence (AI). It has altered how insurance firms provide more effective, individualized, and client-focused services through operational simplification and innovation.

Traditional insurance processes involve paperwork and long underwriting times. AI and machine learning have automated several procedures, speeding up underwriting and claim processing. For instance, AI algorithms can analyze enormous volumes of data in real-time, quickly evaluate claims, and reduce human errors. This effectiveness lowers insurance firms' operating expenses and raises client satisfaction.

In addition, insurtech leverages big data analytics. Insurance firms can gain deeper insights into consumer behavior and risk profiles by harnessing data from wearables, telematics, and social media. This data-driven approach enables insurers to offer more tailored products and pricing plans. For instance, usage-based insurance (UBI) policies, which adjust rates based on specific driving patterns, are gaining popularity. This customization fosters more equitable interactions between insurers and their clients, enhancing mutual understanding and trust.

Blockchain technology offers a decentralized and secure tool that helps firms avoid fraud and guarantee transaction transparency. Additionally, smart contracts or self-executing contracts with the terms of the agreement explicitly encoded into code lower the possibility of disputes and fraud. They may automate and check the claims process.

Insurtech businesses also spur innovation by posing new business models and launching novel goods and services. These firms often concentrate on underdeveloped areas and specialized markets, providing customized solutions to meet specific needs. Their flexibility and focus on the consumer drive traditional insurers to change and innovate, which creates a more competitive and dynamic market.

Insurance business efficiency, transparency, and consumer friendliness are all expected to increase as insurtech develops. By adopting these technology improvements, insurance businesses and consumers benefit from a more efficient and responsive insurance ecosystem.

0 notes

Text

Comprehensive SWOT Analysis of The Allstate Corporation

Introduction to The Allstate Corporation

The Allstate Corporation, founded in 1931, is one of the largest publicly held personal lines property and casualty insurers in the United States. Headquartered in Northbrook, Illinois, Allstate serves millions of customers with a wide array of insurance products and services. This article provides an in-depth SWOT analysis, examining Allstate's strengths, weaknesses, opportunities, and threats.

Strengths

Market Leadership and Brand Recognition

Allstate is a well-recognized name in the insurance industry, known for its slogan, "You're in good hands with Allstate." The company has a strong brand presence and market leadership, which enhances customer trust and loyalty.

Diversified Product Portfolio

Allstate offers a comprehensive range of insurance products, including auto, home, life, and business insurance. This diversification allows the company to cater to a wide customer base and mitigate risks associated with dependence on a single product line.

Strong Financial Performance

The company has a robust financial foundation, characterized by consistent revenue growth, healthy profit margins, and strong capital reserves. This financial stability enables Allstate to invest in new technologies, expand its market presence, and weather economic downturns.

Extensive Distribution Network

Allstate's extensive distribution network includes exclusive agents, independent agents, call centers, and online platforms. This multi-channel approach ensures broad market reach and convenient customer access to its products and services.

Technological Innovation

Allstate is a pioneer in leveraging technology to enhance customer experience and operational efficiency. The company’s telematics program, Drivewise, and its mobile app provide customers with innovative solutions and personalized services.

Weaknesses

High Dependence on the U.S. Market

Allstate’s business is predominantly concentrated in the United States, which makes it vulnerable to domestic economic fluctuations and regulatory changes. Limited international presence restricts growth opportunities in emerging markets.

Exposure to Catastrophic Events

As a property and casualty insurer, Allstate is highly exposed to catastrophic events such as hurricanes, earthquakes, and floods. These events can lead to significant claims payouts, impacting the company’s profitability and financial stability.

Operational Challenges

Managing a vast network of agents and maintaining consistent service quality can pose operational challenges. Additionally, integrating acquisitions and aligning them with Allstate’s corporate culture and systems can be complex and resource-intensive.

Intense Competition

The insurance industry is highly competitive, with numerous players vying for market share. Allstate faces stiff competition from both established insurers and new entrants, which can pressure pricing and profit margins.

Opportunities

Expansion into Emerging Markets

Expanding into emerging markets presents significant growth opportunities for Allstate. These markets have growing middle-class populations with increasing demand for insurance products. Establishing a foothold in these regions can diversify Allstate’s revenue base and reduce dependence on the U.S. market.

Digital Transformation

Continuing to invest in digital transformation can enhance Allstate’s operational efficiency and customer engagement. Leveraging big data analytics, artificial intelligence, and machine learning can improve risk assessment, claims processing, and personalized customer interactions.

Product and Service Innovation

Developing new products and services tailored to changing customer needs can drive growth. Innovations such as usage-based insurance, cyber insurance, and on-demand insurance products can attract new customers and retain existing ones.

Strategic Partnerships and Acquisitions

Forming strategic partnerships and pursuing acquisitions can help Allstate expand its product offerings, enter new markets, and strengthen its competitive position. Collaborations with insurtech firms can bring innovative technologies and solutions into Allstate’s ecosystem.

Threats

Regulatory and Legal Risks

The insurance industry is heavily regulated, and changes in laws and regulations can impact Allstate’s operations and profitability. Compliance with evolving regulatory requirements requires continuous monitoring and adaptation.

Economic Uncertainty

Economic downturns can lead to reduced consumer spending on insurance products, increased claims frequency, and higher default rates. Economic volatility poses a threat to Allstate’s revenue and profitability.

Cybersecurity Threats

As Allstate increasingly relies on digital platforms and data-driven operations, cybersecurity threats become more significant. Data breaches, hacking, and other cyber incidents can lead to financial losses, reputational damage, and regulatory penalties.

Climate Change

Climate change poses long-term risks to the insurance industry. Increasing frequency and severity of natural disasters can result in higher claims payouts and impact Allstate’s underwriting profitability. Adapting to climate-related risks is crucial for long-term sustainability.

Conclusion

Allstate SWOT Analysis position, diversified product portfolio, and commitment to innovation provide a solid foundation for continued success. However, addressing weaknesses such as high domestic market dependence and exposure to catastrophic events is essential. By capitalizing on opportunities like digital transformation and expansion into emerging markets, Allstate can navigate competitive pressures and regulatory challenges. Staying vigilant to threats, including economic uncertainty and cybersecurity risks, will ensure Allstate remains resilient and adaptive in a dynamic industry landscape.

0 notes

Text

Fintech App Development Firms

In today's fast-paced digital era, the financial landscape is undergoing a profound transformation driven by technological innovation. At the forefront of this revolution are fintech companies, leveraging cutting-edge solutions to reshape the way we interact with money. Central to their success are fintech app development firms, which play a pivotal role in crafting intuitive, secure, and feature-rich applications tailored to meet the evolving needs of consumers and businesses alike.

Understanding Fintech: Revolutionizing Finance

Fintech, short for financial technology, represents the intersection of finance and technology, encompassing a wide range of digital innovations aimed at enhancing financial services. From mobile banking and payment solutions to investment platforms and insurance services, fintech has democratized access to financial products and services, empowering individuals and businesses with greater control over their finances.

The Role of Fintech App Development Companies

Fintech app development companies serve as the architects behind the innovative platforms that drive the fintech revolution forward. These firms bring together multidisciplinary teams of developers, designers, financial experts, and regulatory specialists to create solutions that not only meet user needs but also comply with industry regulations and security standards.

Key Features of Leading Fintech Apps

Leading fintech apps share several key features that differentiate them in a crowded market:

User-Friendly Interface: Intuitive design and seamless navigation are crucial for ensuring a positive user experience. Leading fintech apps prioritize simplicity without sacrificing functionality, making it easy for users to access essential features and perform transactions effortlessly.

Security Measures: With financial data being a prime target for cyberattacks, security is paramount in fintech app development. Industry-leading encryption protocols, multi-factor authentication, and robust identity verification mechanisms are implemented to safeguard users' sensitive information and prevent unauthorized access.

Personalization: Fintech apps leverage data analytics and machine learning algorithms to deliver personalized experiences tailored to individual user preferences and financial goals. From customized investment recommendations to budgeting tools based on spending patterns, personalization enhances user engagement and satisfaction.

Seamless Integration: Integration with third-party financial services and platforms enhances the versatility of fintech apps, allowing users to consolidate their financial activities in one centralized hub. Whether it's linking bank accounts, investment portfolios, or payment processors, seamless integration streamlines processes and enhances convenience.

Real-Time Updates and Notifications: Timely updates and notifications keep users informed about their financial activities, alerts on account balances, transaction statuses, and potential security threats. By providing real-time insights, fintech apps empower users to make informed decisions and stay proactive in managing their finances.

Scalability and Reliability: Leading fintech apps are built on robust, scalable architectures capable of handling increasing user volumes and transaction loads. High availability and reliability ensure uninterrupted service delivery, even during peak usage periods or unexpected system failures.

Challenges and Opportunities

Despite the immense potential of fintech app development, companies in this space face several challenges, including regulatory compliance, cybersecurity threats, and market saturation. Regulatory frameworks governing financial services vary across jurisdictions, requiring fintech app developers to navigate complex legal landscapes and ensure compliance with evolving regulations.

Moreover, the proliferation of fintech apps has intensified competition, making it challenging for new entrants to differentiate themselves and gain market traction. However, this competitive landscape also presents opportunities for innovation and collaboration, driving the emergence of niche solutions and strategic partnerships.

Future Trends in Fintech App Development

Looking ahead, the future of fintech app development is shaped by emerging technologies and evolving consumer preferences. Artificial intelligence (AI) and machine learning will play an increasingly prominent role in enhancing personalization and predictive analytics, enabling fintech apps to deliver more tailored and proactive financial solutions.

Blockchain technology holds the promise of revolutionizing the way financial transactions are conducted, offering greater transparency, security, and efficiency. Fintech app developers are exploring blockchain-based solutions for payments, identity verification, and smart contracts, opening up new avenues for innovation in the fintech space.

Furthermore, the rise of open banking initiatives and application programming interfaces (APIs) is driving greater collaboration and interoperability among financial institutions and fintech companies. By enabling secure data sharing and seamless integration, open banking frameworks empower consumers with greater control over their financial data and foster innovation in the development of new fintech applications.

In conclusion, leading fintech app development companies are at the forefront of driving innovation and digital transformation in the financial services industry. By prioritizing user experience, security, and scalability, these firms are reshaping the way we engage with money, empowering individuals and businesses with greater financial flexibility and control. As technology continues to evolve and consumer expectations evolve, the future of fintech app development holds immense promise for driving positive change and shaping the future of finance.

0 notes