#Unclaimed Shares

Explore tagged Tumblr posts

Text

https://www.thewealthfinder.in/legal-support/

#recovering the unclaimed shares and dividends#recovery of shares#unclaimed shares#lostsharesrecovery#finance#thewealthfinder#shares#leagal#youtube

0 notes

Text

Learn how to recover unclaimed shares and recover lost or forgotten investments with key steps to claim your assets.

0 notes

Text

The responsibility of educating people about the refunds and administration of unclaimed dividends and helping them to make the process easier. The IEPF also ensures the transfer or claim of the transferred IEPF unclaimed dividend to the right person.

For More Visit :- https://infinysolutions.com/how-to-claim-unverified-dividends-and-shares-after-being-transferred-to-iepf/

0 notes

Text

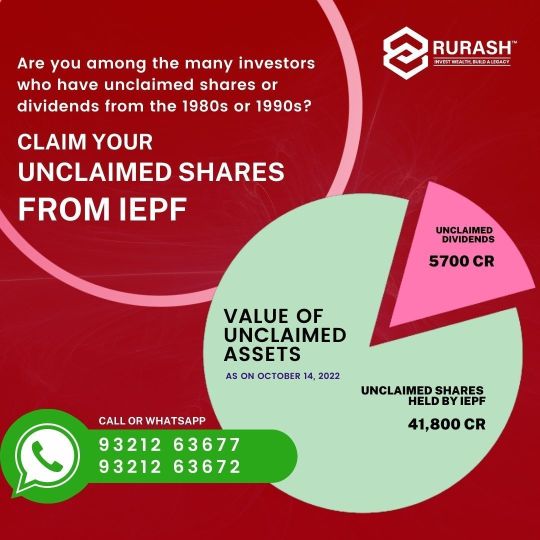

Unlock Unclaimed Money in Mutual Funds | Rurash Financial - Your Guide to Unclaimed Investments in India

Discover how to recover unclaimed money in mutual funds in India with Rurash Financial. Learn about unclaimed investments, their importance, and the steps to reclaim your lost assets. Don't let your investments remain dormant; access your unclaimed wealth today.

Unclaimed money in mutual funds can be a hidden treasure waiting to be reclaimed. Rurash Financials is your trusted resource for understanding and accessing unclaimed investments in India. We provide valuable insights into the significance of unclaimed funds and guide you through the process of reclaiming what's rightfully yours.

Visit our website to learn more about unclaimed money in mutual funds and take the first step toward unlocking your forgotten financial assets. Reclaim your unclaimed investments with Rurash Financial today. !

Learn more: https://rurashfin.com/unclaimed-investments-in-india/

Recovery of Fixed Deposits forgotten unclaimed shares from iepf Forgotten or Lost Investments from iepf Recovery of Unclaimed Mutual Funds and Fixed Deposits Demat of Physical Shares for Recovery from IEPF Unclaimed Investment and Debtor Recovery Services how to claim unclaimed shares from iepf

0 notes

Text

IEPF Claim Shares Services Today | IEPF Search

#iepf claim#rurash financials#unclaimed shares#recovery of forgotten investments#unclaimed dividend#reclaim your funds

0 notes

Text

Recovery of shares | Unclaimed Dividend | physical share certificate

Complete assistance related to recovery of shares and unclaimed dividend lying due to long passage of time while these were issued as physical physical share certificate

0 notes

Text

I'm back with more demigod dead boy detectives (parts one and two for those interested)! In short, Edwin is a son of Athena (born at the turn of the 20th century) who spent seventy years in the fields of punishment by accident - after he escaped it was 1989 and most of the gods had moved to America of all places.

And despite all that, St Hilarion was still functioning as a demigod heaven. Edwin is not happy. At all.

Charles on the other hand is having an interesting time all around. The backstory for him that I came up with starts from before he was born. The OG pjo au that I read had his father be Ares and yes?! I adore the Frank Zang of him?

But his mom and Ares didn't click in my mind until I realized that Ares is in an on-and-off relationship with Aphrodite - who is cutting and sharp and tough but also soft and ditsy and a bit shallow. His past lovers don't all need to be veterans or kickboxers. It was an eureka moment, to be honest.

Charles' mom (name still in the works) met Ares in a museum showcasing ancient pottery and jewelry - some of them Greek - most of which depicted old heroic tales or bore the scars of the years. They started talking completely by chance - Aphrodite had stood Ares up and he didn't feel like going back to what he was doing. He decided to check this collection out - to reminisce or to try and remember fallen friends. Or just to sulk. Either way, he was there.

Charles's future mom sees him and the conflicting aesthetic of his clothing and the display he was looking at makes her want to talk with him. They hit it off. He asks to see her again and the rest is history.

They are together for four months before she gets pregnant. As expected from a god, Ares disappears from her life with only a few words. Charles's mom is left alone with a baby, in a shitty apartment with no family in the country.

It sucks. Like a lot.

Then she meets Paul Richard Rowland.

(I'm sorry but I can't do Paul's name dirty in a pjo au, I just can't. Although the irony was amusing enough to make me consider it for a whole second.)

They hit it off even with the occasionally crying baby in the next room. Soon they are engaged to be married - and married soon afterward. Charles's last name is changed and would you look at that - a happy family.

Not.

Charles is a charming and athletic boy with a love for ska and a bit of a temper. His dad is a cunt and his mom is quiet. That's fine until it isn't.

In an argument, it gets out that Richard isn't Charles's actual father (he is 14 when that happens). Stuff gets progressively worse after that (both with Richard and with the monsters - Richard's whole "something is wrong with you" really drives in the "I am different" mindset you really don't want in an untrained demigod) until Charles' mom gets desperate and contacts the boarding school - Ares had assured her that it would always have a spot for Charles.

(The phone number is that of the school board of all the still functioning demigod establishments. Had Charles been a girl they would have referred the mom to one of the all-girls or mixed schools. It's a system run by descendants, wind spirits and satyrs.)

((It's not as efficient as say sending satyrs to schools, but they only have so many satyrs. They do the guardian routine! Honest!))

Fast forward and Charles has been to St Hil for almost a year and a half. He is a semi-full-year camper in the sense he went home once for one summer and then only for two to three days a year.

He gets along with his siblings and the cricket team. He is friendly and nice but 80s racism and classist bullshit exist - he can't be too vocal with his thoughts and opinions less he is ostracized by his peers, he has to play a role he only has half the script of. The demigod thing isn't always a blessing.

He is a deft hand with daggers and knives, he is skilled with a sword - but he would prefer to play cricket or go to concerts. No magical barrier means nightly patrols and the occasional monster attack.

Cue the death scene. It plays like canon but with weapons. He is chased into the freezing lake by his siblings and his former mates. (And Charles had been so excited about having siblings - but this - they - he couldn't call brothers.)

There aren't any naiads during the winter - or they are sleeping deep into it. No one intervenes. He manages to escape his pursuers by going deeper into the woods until he comes across an old shed.

Charles goes in.

(He didn't hear the sharp snap of twigs and branches in the other direction of the one he was going. He didn't notice the second pair of footsteps shadowing his own.)

((He does see the lantern.))

And they finally meet. Isn't it grand? (TBC)

#dead boy detectives#edwin payne#charles rowland#demigod au#pjo au#honestly this is what I have so far because I don't think a lotus shopping centre is a thing that can exist#dbd au#but also ares has a soft spot for sharp women that can make him laugh and i will die on this hill#they went on the cutsiest dates#his rude remarks made [insert name here] laugh so hard#like mother like son#charles being mistaken for an apollo kid when he got to the school#also [i really need a name i won't call her mary] knew Ares as Asher#since there are no cabins it's more like houses#but it's mainly different dorms#there is a huge - not as big as when edwin went there - unclaimed room that fits like 10 people in it#have you ever went hiking to those high enough peaks that the only place you can sleep is a shared room for 12?#yeah like those

28 notes

·

View notes

Text

iepf claim

Recover Lost Shares Effortlessly With Asset Retrieval Advisors:

In today’s fast-paced financial world, countless individuals and families discover that they own shares or investments that have gone unclaimed over time. Whether due to forgotten accounts, misplaced certificates, or regulatory compliance issues, these lost assets often remain out of reach. At Asset Retrieval Advisors, we specialize in providing expert guidance and personalized solutions to help you search lost shares and recover them, whether they are held with companies, brokers, or under the purview of the Investor Education and Protection Fund (iepf).

This page details our services, explains the recovery process, and showcases how we can simplify the journey to reclaiming your rightful assets.

What Are Lost Shares?

Lost shares refer to stocks or equity investments that are no longer accessible to their rightful owners due to:

Misplaced or lost physical share certificates.

Unupdated contact or address information.

Non-compliance with KYC norms.

Transfer of shares to the IEPF due to prolonged inactivity or unclaimed dividends.

Such shares can remain dormant for years, depriving owners from the dividends, rights issues, or growth benefits. Fortunately, recovering these assets is possible with the right expertise and processes.

How to Search Lost Shares?

Finding lost shares begins with identifying where and why the disconnection occurred. Here's how the process works:

1. Locate Old Investment Documents

The first step is to review your financial records, including:

Old demat or trading account statements.

Physical share certificates.

Dividend warrants or any correspondence from companies or brokers.

2. Verify Current Ownership Status

Determine if the shares are:

Still in your name and active.

Transferred to a third party due to non-compliance.

Moved to the IEPF account for recovery iepf claim.

3. Conduct Demat and Registrar Searches

For electronic shares, verifying holdings through your demat account with the Depository Participant (DP) can provide clarity. For physical shares, the company’s registrar or transfer agent plays a crucial role in verifying ownership.

4. Engage Professional Assistance

If your efforts to search lost shares yield no results or the process becomes complicated, seeking help from experts like Asset Retrieval Advisors can save time and effort.

How to Recover Lost Shares?

Recovering lost shares can be straightforward or complex, depending on whether they remain with the issuing company or have been transferred to IEPF.

1. Recover Lost Shares from the Company/Registrar

Shares that have not been transferred to IEPF can be recovered directly from the company or its registrar. This process includes:

Requesting Duplicate Certificates: For lost or misplaced physical share certificates, apply for duplicates by submitting an indemnity bond and requisite documents.

Dematerialization: Convert physical shares into electronic form for secure and hassle-free access.

Updating Records: Ensure your details, such as address, contact information, and KYC compliance, are updated with the company/registrar.

2. Recover Lost Shares from IEPF

For shares transferred to the Investor Education and Protection Fund, the recovery process is governed by specific rules. Here’s how to recover lost shares from IEPF:

Step-1: File an Application with IEPF Authority Submit a claim through Form IEPF-5, detailing the shares you wish to recover claim shares from iepf.

Step 2: Submit Required Documents: The application must include:

Proof of identity (Aadhaar, PAN, etc.).

Proof of ownership (share certificates, demat account statements).

Bank account details.

A copy of the acknowledgment received after filing Form IEPF-5

Step 3: Verify Claim with Company

The IEPF authority forwards your claim to the issuing company for verification. Upon successful verification, the company informs the authority to release the shares to you.

Step 4: Shares Are Transferred

Once approved, the shares are credited to your demat account, and any dividends or other benefits are released accordingly.

Important: Navigating the IEPF recovery process can be complex, requiring strict adherence to rules and timelines. Professional assistance ensures accuracy and efficiency.

Challenges in Recovering Lost Shares

Despite the structured processes, recovering lost shares involves challenges such as:

Insufficient Documentation: Missing ownership proof or share certificates can delay recovery.

Regulatory Complexity: Understanding and adhering to IEPF guidelines can be overwhelming.

Demat Conversion Issues: Transitioning physical shares to demat form may require additional documentation and processes.

At Asset Retrieval Advisors, we specialize in overcoming these challenges, ensuring your recovery process is smooth and hassle-free Duplicate share certificate.

Why Choose Asset Retrieval Advisors?

Our team of experts brings extensive experience and a customer-centric approach to help you recover lost shares.

Key Benefits of Our Services

Comprehensive Asset Search: We help you locate lost shares using advanced tracking methods.

IEPF Claim Expertise: Our team simplifies the entire process of recovering shares transferred to IEPF.

End-to-End Support: From documentation to filing claims, we guide you through every step.

Tailored Solutions: Whether shares are with a company or under IEPF, we create personalized strategies to recover them.

At Asset Retrieval Advisors, we specialize in overcoming these challenges, ensuring your recovery process is smooth and hassle-free.

Our Process Of Searching & Recovering Of Lost Shares

Consultation: Understand your requirements and assess initial documentation.

Asset Search: Conduct a thorough investigation to locate lost shares.

Verification: Liaise with companies, registrars, or the IEPF authority to verify ownership.

Claim Filing: Prepare and submit claims for recovery.

Completion: Ensure shares and associated benefits are transferred to you successfully.

Real Stories of Recovery

Case 1: Recovering Shares from IEPF

A client approached us with shares transferred to IEPF due to unclaimed dividends for over seven years. Our team:

Verified the ownership details.

Filed Form IEPF-5 with supporting documents.

Coordinated with the issuing company for approval.

The client successfully recovered the shares, along with accrued dividends, within the stipulated time.

Case 2: Resolving Duplicate Certificates

A client misplaced his physical share certificates and was unable to sell or transfer the shares. We:

We collated the information from the Company.

Applied for duplicate certificates with the issuing company.

Assisted in dematerializing the shares.

The client regained access to their investments and resumed trading effortlessly.

Contact Us Today

Don’t let your investments remain out of reach. At Asset Retrieval Advisors, we are committed to helping you reclaim what’s rightfully yours. Whether it’s how to recover lost shares from iepf share transfer or finding shares still held by companies, we make the process simple, efficient, and hassle-free.

0 notes

Text

IEPF Unclaimed Dividend: A Guide to Reclaiming Your Lost Assets

Every year, thousands of shareholders in India lose track of their dividends, leaving substantial sums of money unclaimed. To safeguard these funds and ensure rightful ownership, the Government of India established the Investor Education and Protection Fund (IEPF). This blog delves into the concept of IEPF unclaimed dividend, the reasons behind unclaimed dividends, the process of reclaiming these funds, and how professional services like Share Samadhan can assist you.

What is an IEPF Unclaimed Dividend?

An unclaimed dividend refers to a dividend declared by a company that has not been claimed by a shareholder for a prolonged period. According to the Companies Act, 2013, any dividend that remains unclaimed for seven consecutive years is transferred to the IEPF. This ensures the funds are safeguarded until the rightful owner or heir comes forward to claim them.

The IEPF was established under the Ministry of Corporate Affairs to:

Protect investor interests.

Manage unclaimed dividends, shares, and other financial assets.

Facilitate the recovery of unclaimed funds by shareholders or their legal heirs.

Why Do Dividends Become Unclaimed?

Several factors contribute to dividends remaining unclaimed. Understanding these reasons can help prevent future occurrences:

Outdated Contact Information: If shareholders fail to update their address, email, or phone number with the company, communication about dividend payouts may not reach them.

Dormant Bank Accounts: Dividends credited to inactive or closed bank accounts often go unnoticed.

Loss of Records: Shareholders misplacing share certificates or account details may lose track of their entitlements.

Unawareness of Dividend Declarations: Shareholders who are unaware of dividend announcements may not claim their entitlements.

Inheritance Issues: In cases of a shareholder’s death, heirs may not be aware of the investments or the procedure to claim dividends.

Steps for Transfer of Unclaimed Dividend to IEPF

The transfer of unclaimed dividends to IEPF is a systematic process that ensures transparency and accountability. Here’s how it works:

Identification of Unclaimed Dividends Companies identify unclaimed dividends from their records annually.

Notification to Shareholders Shareholders are notified through registered post, emails, and public announcements about the pending dividends.

Transfer to Unpaid Dividend Account Unclaimed dividends are initially transferred to an unpaid dividend account, where they remain for seven years.

Transfer to IEPF If unclaimed during the seven-year period, the funds are transferred to the IEPF along with the associated shares.

Record Maintenance Companies maintain detailed records of the transfer for reference and compliance.

How to Claim IEPF Unclaimed Dividend

Reclaiming dividends transferred to IEPF involves specific steps and documentation. Here’s a comprehensive guide:

1. Check Eligibility

Verify if your dividends have been transferred to IEPF by visiting the official IEPF portal (www.iepf.gov.in).

Use your folio number or Demat account details to search for unclaimed dividends.

2. Fill Form IEPF-5

Download and fill out Form IEPF-5 from the IEPF website.

Provide accurate details, including your name, address, and bank account details.

3. Submit the Form and Documents

Print the filled form and attach supporting documents such as:

Identity proof (Aadhaar, PAN, passport).

Address proof.

Proof of entitlement (e.g., share certificates, dividend warrants).

Submit these to the company’s nodal officer.

4. Verification by the Company

The company verifies the submitted documents and forwards the claim to the IEPF Authority for approval.

5. Approval and Disbursement

Upon approval, the IEPF Authority credits the dividend amount to your registered bank account and transfers the shares to your Demat account.

Preventing Dividends from Becoming Unclaimed

Proactive measures can help shareholders avoid the hassle of reclaiming unclaimed dividends. Here are some tips:

Update Contact Information Regularly update your address, email, and phone number with the company’s registrar and transfer agent (RTA).

Link Active Bank Accounts Ensure your bank account linked to your Demat account is active and operational.

Monitor Your Investments Use portfolio management tools to track dividend payouts and investment details.

Nominate a Successor Assign a nominee to your shares and dividends to streamline inheritance processes.

Respond to Notifications Pay attention to company communications regarding unclaimed dividends.

Common Challenges in Claiming IEPF Unclaimed Dividend

The process of reclaiming unclaimed dividends may involve challenges, including:

Incomplete Documentation Missing or incorrect documents can delay the claim process. Ensure all paperwork is complete and accurate.

Verification Delays The verification process by the company and IEPF Authority may take time, requiring patience and follow-ups.

Discrepancies in Records Mismatched details between company records and submitted documents can result in rejections. Regularly update your records to avoid discrepancies.

Technical Glitches Occasional technical issues on the IEPF portal may hinder online submissions. Retry later or seek professional assistance.

Inheritance Complications In cases where the original shareholder has passed away, legal heirs may need additional documents like a succession certificate or probate.

FAQs on IEPF Unclaimed Dividend

1. How long does it take to reclaim an IEPF unclaimed dividend?

The process typically takes 3-6 months, depending on the complexity of the claim and verification requirements.

2. Is there a deadline for claiming dividends from IEPF?

No, there is no deadline. Shareholders or their legal heirs can claim dividends from IEPF at any time.

3. Are there charges for filing a claim with IEPF?

The IEPF Authority does not charge for processing claims. However, there may be costs for document notarization or professional assistance.

4. Can legal heirs claim unclaimed dividends?

Yes, legal heirs can claim dividends by providing documents such as a succession certificate, death certificate, and proof of entitlement.

5. What happens to shares transferred to IEPF?

Shares transferred to IEPF are held in the IEPF Authority’s Demat account and can be reclaimed by the rightful owner through the prescribed process.

Conclusion: Reclaim Your Unclaimed Dividends with Ease

Navigating the process of reclaiming unclaimed dividends from IEPF can be complex without the right guidance. Share Samadhan, a trusted name in recovering unclaimed financial assets, offers expert assistance to ensure a seamless experience. With years of expertise and a proven track record, Share Samadhan helps shareholders and their heirs reclaim what is rightfully theirs.

Don’t let your dividends remain unclaimed. Contact Share Samadhan today to recover your IEPF unclaimed dividend and secure your financial future.

0 notes

Text

Share Recover is a trusted physical shares consultant specializing in recovering lost or unclaimed physical share certificates. With expert guidance, we simplify share dematerialization, name transfer, and legal claim processes, ensuring seamless solutions for your financial assets.

0 notes

Text

Recover Your Unclaimed Dividend IEPF Shares Effortlessly

Have unclaimed dividend IEPF shares? Share Claim Dost makes it simple to reclaim them. Follow our guided steps to update your details, verify records, and submit your claim, ensuring a smooth recovery of your dividends and shares.

0 notes

Text

https://www.thewealthfinder.in/demat-of-physical-shares/

#recovering the unclaimed shares and dividends#recovery of shares#unclaimed shares#lostsharesrecovery#thewealthfinder

0 notes

Text

Fan Dragon Month Mini-Series: The Labyrinth

Day Thirteen: Hoggle

Male Snapper - Ice Goat

Peach/Rust/X

Triple Basic

First | Previous | Next | Last

#no lore#only Hoggle beloved#and real life lore about the animatronic bc I share this with anyone I can:#Hoggle’s animatronic head vanished for like 20/30 years after filming wrapped#until it was found in Texas in a store that sold unclaimed baggage#I just think that’s neat#If I’m Scryin’ I’m Cryin’#fr scrying#fr scries#fr scrying workshop#Specta’s Shop#fr outfit#fr dressing room#snapper#fr snapper#flight rising#fan dragons#labyrinth#jim henson#the cauldron bubbles

1 note

·

View note

Text

We will explore how to maximize the benefits of IEPF (Investor Education and Protection Fund) shares recovery to your advantage. The IEPF is an initiative by the Government of India to protect investors and ensure that unclaimed dividends and shares are returned to their rightful owners.

Visit:- https://iepfrecovery.wordpress.com/2023/07/21/how-to-utilize-iepf-shares-recovery-to-your-advantage/

#IEPF Shares Recovery#iepf recovery#iepf claim#unclaimed shares#iepf shares claim#unclaimed dividends#recovery of shares#recovery of shares from iepf#shares recovery#iepf

0 notes

Text

Filfox Share Solutions provides top-notch Legal Documentation Services for businesses looking to streamline their compliance processes. Our experienced team of professionals ensures accurate and reliable documentation tailored to your specific needs. Trust us to handle all your legal paperwork efficiently and effectively.

Visit here: https://www.filfoxsharesolutions.com/

#assistance in demat of physical shares#estate planning advisory services in india#international inheritance advisory#legal documentation services#iepf claim advisory#recovery of unclaimed and lost shares in india#recovery of unclaimed shares#succession and inheritance planning in india#dividends and mutual funds in india

0 notes

Text

GLC Wealth is India’s leading and most trusted Wealth Recovery Firm. We provide specialized and niche Financial and Legal Advisory Services for the Recovery of Unclaimed Assets held by individuals, corporations, banks, etc. in India. Our firm is led by two sought-after professionals – Mr. Ankit Garg (Qualified CA & Lawyer – King’s College London) and Mr. Sanchit Garg – ex Investment Banker (IIT – IIM) who are further backed by an experienced team of Lawyers / CAs / CS.

Recovering Unclaimed Assets:

Visit our Website: https://glcwealth.com/

0 notes