#UMANG App

Explore tagged Tumblr posts

Text

No More HR Gatekeeping: EPFO’s Digital Leap Empowers Employees

In a silent but profound reform that could redefine workplace bureaucracy, India’s labour ministry has handed employees the reins to their own retirement destiny. In a country where paperwork often outlives patience, the Employees’ Provident Fund Organization (EPFO) has launched a quiet revolution—eliminating the need for HR intervention in the creation of Universal Account Numbers (UANs). With this move, not only has the gatekeeper been dismissed, but the gate itself has been flung open.

#EPFO#UAN generation#Umang app#PF withdrawal#Aadhaar#EPFO digital shift#HR bypass#India labor reforms#Provident Fund access#employee empowerment

0 notes

Text

CBSE 10वीं रिजल्ट 2025: मई में आएंगे नतीजे, डिजीलॉकर से लेकर नए बदलाव तक, जानें सबकुछ!

CBSE Class 10 Result 2025: सेंट्रल बोर्ड ऑफ सेकेंडरी एजुकेशन (CBSE) जल्द ही कक्षा 10वीं के छात्रों के लिए साल 2025 के बोर्ड परीक्षा परिणाम जारी करने वाला है। इस साल 15 फरवरी से शुरू हुईं परीक्षाएं 18 मार्च को खत्म हुई थीं, और अब लाखों छात्र अपने रिजल्ट का बेसब्री से इंतजार कर रहे हैं। बोर्ड के मुताबिक, रिजल्ट मई 2025 के दूसरे हफ्ते तक आने की उम्मीद है। छात्र अपने नतीजे और मार्कशीट आधिकारिक…

#cbse class 10 result 2025#cbse result date 2025#cbse.gov.in#DigiLocker#grading system changes#new teaching methods#practical learning#results.cbse.nic.in#twice yearly board exams#umang app

0 notes

Text

2 notes

·

View notes

Text

The CBSE Class 12 (Senior School Certificate) Result 2025

was officially declared on May 13, 2025, between 12:00 AM and 1:00 PM IST 🎉. The Central Board of Secondary Education (CBSE) released results simultaneously for students across all streams—Science, Commerce, and Arts—via its official portals: cbseresults.nic.in, results.cbse.nic.in, and cbse.gov.in education.indianexpress.com+5shiksha.com+5indiatimes.com+5.

📌 Key Details

Result Date & Time: May 13, 2025 (Jan–Feb exams), declared around midday timesofindia.indiatimes.com.

Total Students Appeared: About 17.88 lakh students took the exam education.indianexpress.com+5education.indianexpress.com+5indiatimes.com+5.

Overall Pass Percentage: 88.39%, an increase from last year en.wikipedia.org+6education.indianexpress.com+6education.indianexpress.com+6.

Exam Period: February 15 to April 4, 2025 timesofindia.indiatimes.com+4education.indianexpress.com+4tmu.ac.in+4.

🛠️ How to Check Your Result

You can access your CBSE Class 12 result through multiple official channels:

Websites: Visit cbseresults.nic.in, results.cbse.nic.in, or cbse.gov.in—enter your roll number, school number, admit card ID, and date of birth reddit.com+15cbseresults.nic.in+15tmu.ac.in+15.

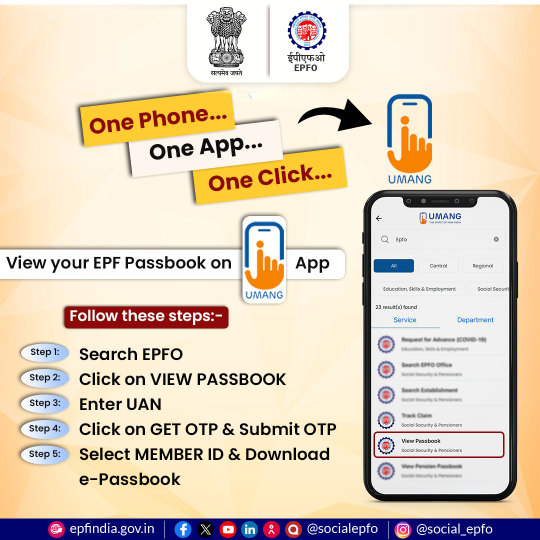

DigiLocker & UMANG: Access your digital marksheet via the DigiLocker app or UMANG education.indianexpress.com+5education.indianexpress.com+5indiatimes.com+5.

SMS: Send cbse12 <roll no> <school no> <centre no> to 7738299899 for automated SMS results education.indianexpress.com+7education.indianexpress.com+7tmu.ac.in+7.

IVRS: Call 24300699 with your area code to hear your results tmu.ac.in+2education.indianexpress.com+2indiatimes.com+2.

📝 Note: Online mark sheets are provisional. Official hard copies will be issued by schools later education.indianexpress.com+2tmu.ac.in+2indiatimes.com+2.

✅ Next Steps

Download & Save: Store your provisional result for future reference.

Apply for Reval/Scrutiny: If you’re unsatisfied with any marks, you can opt for verification, then request photocopies of answer sheets, and apply for re-evaluation (process starts soon on cbse.gov.in) timesofindia.indiatimes.comen.wikipedia.org+3education.indianexpress.com+3economictimes.indiatimes.com+3.

Prepare for Supplementary Exams: For students who didn’t pass, compartment exams are likely scheduled in July/August.

Plan Academics: Begin college applications, entrance exam preparations (like CUET, JEE, NEET), or consider vocational streams.

🎓 Spotlight: Top Performer

Savi Jain from Shamli topped the nation with an almost perfect score of 500/500—an inspiring example of dedication and perseverance education.indianexpress.com+1education.indianexpress.com+1.

In Summary

✅ Date: May 13, 2025 (midday)

🌐 Platforms: CBSE official sites, DigiLocker, UMANG, SMS, IVRS

📈 Pass Rate: 88.39%

📥 Result Type: Provisional (hard copy from schools later)

Congratulations to all students! Need help with revaluation, admission advice, or downloading your marksheet? Ask away!

0 notes

Text

How to Do a PF Balance Check in 2025 (With or Without UAN)

Learn how to check your PF balance in 2025 with or without a UAN. Explore multiple methods including the EPFO portal, UMANG app, SMS, missed call service, and more. Discover how FixMyPF can help identify hidden issues and speed up your PF balance check.

#pf balance check#PF Balance#pf withdrawal#finright#epfo online claim#pf withdrawal claim#pf consultancy services#epf online claim withdrawal

0 notes

Text

NEET UG 2025 Result Declared: Check Scorecard, Toppers List, and Counselling Details at neet.nta.nic.in

The wait is over for lakhs of NEET aspirants! The National Testing Agency (NTA) has officially released the NEET UG 2025 result for admission into undergraduate medical and allied courses like MBBS, BDS, BAMS, BHMS, and more. The entrance test was conducted on May 4, 2025, in offline (pen-and-paper) mode across 566 cities in India.

Where to Check NEET UG 2025 Result?

Candidates who appeared for the exam can now download their scorecards from the NEET official website:

neet.nta.nic.in

nta.ac.in

In addition to these platforms, the result is also accessible through the UMANG app and DigiLocker. As a convenience this year, the NTA has also sent the scorecards directly to students’ registered email addresses.

How to Download the NEET 2025 Scorecard?

To access the result, candidates must log in using their:

Application number

Date of birth or password

These are the same credentials used during the registration process. Once logged in, candidates can view and download their scorecards for counselling and admission purposes.

NEET UG 2025 Exam Highlights

NEET Exam Date 2025: May 4, 2025

Mode of Exam: Offline (OMR-based)

Timing: 2 PM to 5 PM

Total Cities: 566

Duration: 180 minutes (3 hours)

Total Questions: 180 (no optional questions)

Pattern: Revised to pre-COVID format

Marking Scheme: Remains unchanged from last year

The final answer key has already been released after the provisional one. NTA had also opened a window for students to raise objections against the provisional key before finalizing results.

NEET UG 2025 Toppers List (Top 10 All India Ranks)

Here are the top scorers of NEET UG 2025:

Mahesh Kumar – AIR 1

Utkarsh Awadhiya – AIR 2

Krishang Joshi – AIR 3

Mrinal Kishore Jha – AIR 4

Avika Aggarwal – AIR 5

Jenil Vinodbhai Bhayani – AIR 6

Keshav Mittal – AIR 7

Jha Bhavya Chirag – AIR 8

Harsh Kedawat – AIR 9

Aarav Agrawal – AIR 10

NEET UG 2025 Category-Wise Candidate Count

Here’s the breakdown of candidates who appeared in the NEET UG exam by category:

Unreserved (General): 6,89,366

OBC: 10,97,388

SC: 3,49,825

ST: 1,50,024

EWS: 1,54,326

What’s Next? NEET Counselling 2025

Qualified candidates will now participate in the centralized UG medical counselling process, which will be conducted by the Medical Counselling Committee (MCC) for 15% All India Quota (AIQ) seats in government colleges.

Additionally, 85% state quota counselling will be organized by the respective state authorities. Candidates must stay updated on state-level counselling websites for registration and schedule updates.

Counselling will be conducted for:

MBBS

BDS

AYUSH courses (BAMS, BHMS, etc.)

Veterinary and other allied health science programs

Important: Keep all your documents ready, including your NEET scorecard, admit card, ID proof, and category certificates, for the counselling process.

With the NEET UG 2025 result now available, the real journey begins. From choosing the right college to planning your future career in medicine, every step counts. Students are advised to carefully check the official counselling schedule, understand cut-offs, and take expert help if needed.

For personalized counselling guidance, college predictions, and MBBS abroad options — consider connecting with reliable platforms like Search My College to ensure you make informed decisions based on your NEET score and preferences.

0 notes

Text

Matrix High School CBSE 12th Result 2025 | Toppers’ Names

The Central Board of Secondary Education (CBSE) has officially declared the CBSE 12th Class Result 2025 on 13th May. The much-anticipated results have been released through various digital platforms such as Digilocker, Umang App, SMS service, IVRS services ensuring easy accessibility for all students.

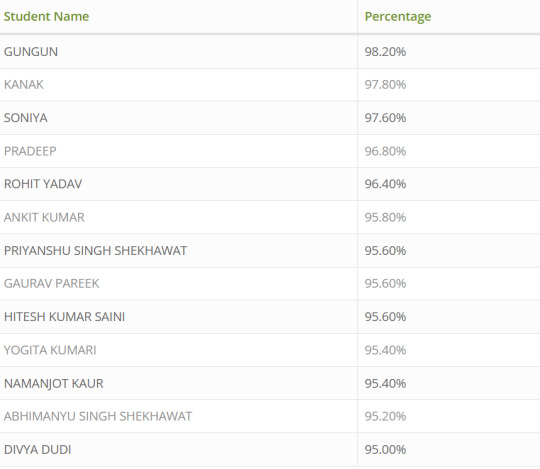

Matrix High School 12th Class Topper 2025

We are delighted to share that Gungun, a student of Matrix High School, has emerged as the Matrix High School 12th Class Topper 2025 with a remarkable score of 98.20%. Her consistent hard work, disciplined routine, and academic excellence have brought immense pride to the school.

Following closely behind her are other brilliant students who made it to the Matrix High School CBSE Topper List 2025. Their dedication has proven that perseverance and proper guidance are key to success in board examinations.

Matrix High School 12th Result 2025 Performance Highlights

This year’s Matrix High School 12th Exam Analysis 2025 reflects the hard work put in by both students and faculty. We are proud that so many of our students scored above 90%, a testimony to our robust academic framework.

Sikar 12th Result 2025 — Matrix High School Toppers’ List

These students will be felicitated during the official Matrix High School Result Ceremony 2025, where their achievements will be celebrated. CBSE 12th Result 2025 Matrix High School: Check Online. For the convenience of students and parents, the Matrix High School CBSE 12th Result 2025 can be accessed directly through our official website. By entering their Admit Card Number and Date of Birth, students can instantly view their CBSE 12th marks.

12th Result 2025 — Matrix High School

12th Board Exam Result 2025 of Matrix High School is a result of our hard working teachers and star students. With the ongoing legacy of grabbing distinction in 12th Board Examination, Matrix High School have proven itself that we will continue outshine.

Matrix 12th Class Result 2025 — Remarkable Journey The unmatched support of parents and dedicated teachers of Matrix High School has marked a remarkable journey in delivering 12th Board Exam Result 2025. We are truly honored to state that with such dedication and excellence of our students, we are able to set a benchmark in this year Matrix 12th Class Result 2025. To continue the legacy, we will keep delivering such results and able to inspire more students.

Tags: CBSE Arts Result, Matrix High School 12th Result, Matrix High School 12th topper name, Matrix High School Science Result

0 notes

Text

CBSE Class 12 board exam results declared: Check score and calculate your percentage

The CBSE has declared the Class 12 results for 2025. Students can check their scores online or via SMS and the UMANG app. Digital mark sheets are on DigiLocker.

0 notes

Text

Results for CBSE Class 10 or Class 12 are available on official websites or DigiLocker or UMANG apps. Have your roll number, school code, and admit card easily available. Results will be shown on the screen, and you can save or capture them in screenshots for reference at a later point. If anything goes wrong or you have any query, approach your school administration. It's simple to follow, allowing you to focus on your achievement and planning for the future.

0 notes

Text

The Central Board of Secondary Education (CBSE) is one of the biggest education boards in India. Each year, lakhs of students take the Class 10 and Class 12 exams. After the exams end, students and parents eagerly wait for the results.

Expected Date of CBSE Results 2025

Looking at past trends, the CBSE Class 10 and 12 results are expected to be released between May 12 and May 20, 2025. The board has not announced an exact date yet, but it is likely to come in the second or third week of May. Students should keep checking the official CBSE website or trusted news portals for updates.

How to Check CBSE Results 2025

When the results are declared, students can check them using the following official platforms:

1. CBSE Official Website

Go to cbseresults.nic.in or cbse.gov.in

Click on the link for Class 10 or Class 12 results

Enter your roll number, school number, and admit card ID

Press “Submit” to see your result

2. DigiLocker

Visit digilocker.gov.in or use the DigiLocker app

Login using your registered mobile number

Check the "Issued Documents" section for your mark sheet and certificate

3. UMANG App

Download the UMANG app and sign up

Go to the Education section → CBSE → View Results

4. SMS Option

CBSE may provide a facility to check results via SMS

The format and number will be shared by the board closer to the result date

5. Through School

Some schools may also share results via their student portals or notice boards

Useful Tips for Students

Keep your admit card ready, as it has important information needed to check your result

Don’t believe in rumors or fake news on social media

Always check your result using official platforms

Conclusion

To avoid confusion, regularly visit the official CBSE website for updates. The board usually announces results in a clear and timely manner to ensure a smooth process for students.

0 notes

Text

Top AI Innovations Transforming Indian Businesses in 2025

In 2025, artificial intelligence is no longer a futuristic concept—it is a core driver of transformation across Indian industries. From automated healthcare diagnostics to AI-powered retail personalization, the top AI innovations transforming Indian businesses in 2025 are shaping a smarter, more efficient economy. This article explores how these AI technologies are revolutionizing key sectors, improving operational efficiency, and offering businesses a competitive edge.

AI in Healthcare: Saving Lives Through Precision

Healthcare in India has embraced AI with remarkable enthusiasm in 2025. AI-powered diagnostics, virtual health assistants, and predictive analytics are now standard tools in hospitals and clinics.

• AI Diagnostic Tools: Tools like Qure.ai and Niramai use machine learning to detect diseases such as tuberculosis and breast cancer early. • Virtual AI Assistants: Chatbots like HealthifyMe's AI coach offer personalized fitness and diet recommendations. • Predictive Patient Monitoring: Hospitals use AI to predict patient deterioration, enabling timely intervention.

Retail Gets Smarter with AI Personalization

Retail businesses are leveraging AI to tailor customer experiences in real-time. From e-commerce to physical retail chains, the shift is significant.

• Personalized Shopping Engines: AI suggests products based on user behavior and purchase history. • Inventory Optimization: AI forecasts demand trends, helping businesses manage stock more effectively. • Visual Search Tools: Apps let users search for products just by uploading photos.

Companies like Flipkart, Reliance Retail, and Meesho are investing heavily in these innovations.

Financial Sector Reinvented with AI

The finance industry is another major beneficiary of AI, with banks and fintech firms using algorithms to enhance services and security.

• Fraud Detection: AI systems analyze transactions in real-time to flag suspicious activity. • Robo-Advisors: Platforms like Zerodha and Groww use AI to offer automated investment advice. • Credit Scoring: Alternative credit scoring using AI helps evaluate customers with no traditional credit history.

These innovations are expanding financial inclusion and improving user experience.

AI in Manufacturing: Smarter Operations

In 2025, AI is optimizing India's vast manufacturing sector through predictive maintenance, robotics, and intelligent supply chains.

• AI-Driven Robotics: Machines equipped with AI streamline assembly lines. • Smart Quality Control: Vision systems spot defects in real-time, reducing waste. • Supply Chain Optimization: Predictive analytics help anticipate and mitigate disruptions.

Factories in Pune, Chennai, and Gujarat are adopting Industry 4.0 principles powered by AI.

Governance and Public Services Empowered by AI

Government agencies are deploying AI to make public services more transparent and efficient.

• AI Chatbots for Citizen Services: Portals like UMANG and state-level apps answer citizen queries through AI. • Sentiment Analysis: Governments use AI to gauge public sentiment on policies and improve decision-making. • Traffic & Surveillance: Cities like Bangalore and Gurugram use AI for real-time traffic monitoring and facial recognition. These efforts make governance more responsive and accessible.

Education and EdTech Revolution

AI is revolutionizing how Indians learn in 2025, with adaptive learning platforms and smart classrooms becoming mainstream.

• AI Tutors: Apps like Byju's and Vedantu use AI to customize learning paths. • Voice Recognition for Language Learning: Real-time feedback improves pronunciation and fluency. • Automated Grading & Assessment: Reduces educator workload while improving evaluation.

This democratization of education ensures quality access across urban and rural areas.

Voice, Vision & Multilingual AI

Voice-based search, real-time translation, and computer vision applications are uniquely impacting a linguistically diverse country like India.

• Multilingual Virtual Assistants: AI bots now support multiple Indian languages, improving accessibility.

• OCR and Vision AI: Translate handwritten documents and signage into digital formats.

• Voice AI in Banking: ICICI and HDFC use voice-AI for customer support in regional languages.

These solutions bridge language barriers in business and governance alike.

AI Startups Fueling India’s AI Boom

A new wave of Indian startups is pushing boundaries in AI innovation:

• Tagbin: AI-powered governance platforms for citizen engagement. • Arya.ai: Financial AI tools for insurance and banking. • Gnani.ai: Voice AI for regional language processing. • Mad Street Den: Visual AI for retail automation.

These ventures position India as a key global player in applied AI.

Final Thoughts

As we witness the top AI innovations transforming Indian businesses in 2025, it's evident that AI is more than just a tool—it is a strategic asset driving value across sectors. Indian companies, both legacy and startups, are fast embracing AI to remain competitive and future-ready.

With strong government support, world-class talent, and a rapidly digitizing economy, India is set to become a global AI powerhouse. Whether you're a business owner, policymaker, or tech enthusiast, understanding these trends is key to thriving in the AI-driven future.

Stay tuned, because the AI story in India has just begun..

#tagbin#writers on tumblr#artificial intelligence#technology#tagbin ai solutions#AI innovations in India 2025#AI transforming Indian businesses#top AI technologies 2025#artificial intelligence in Indian companies#business AI trends India 2025#future of AI in India#AI applications in Indian industries#AI business solutions 2025#best AI use cases India#Indian enterprises using AI

0 notes

Text

https://tazatimesnews.live/business/employees-can-now-generate-their-uan-via-the-umang-app-this-is-how/

0 notes

Text

0 notes

Text

CBSE 10th result 2025 expected on this date: Check your scorecards via DigiLocker and UMANG app in case of a website crash

The Central Board of Secondary Education (CBSE) is set to release the Class 10 final exam results for 2025. While no official date has been announced by the board, reports and past trends suggest that results will be out by mid-May. With over 24 lakh students eagerly awaiting their scores, the official result websites, cbseresults.nic.in and results.cbse.nic.in—are expected to experience heavy…

0 notes

Text

🎓 CBSE Class 10 Result 2025: Detailed Overview

📅 Result Declaration

CBSE officially announced the Class 10 results on May 13, 2025, releasing both Class 10 and 12 results simultaneously m.economictimes.com+13education.indianexpress.com+13ndtv.com+13results.shiksha+1gulfbusiness.com+1.

The announcement came at approximately 1 PM IST on the official portals: cbse.gov.in, results.cbse.nic.in, and cbseresults.nic.in cbseresults.nic.in+8shiksha.com+8education.indianexpress.com+8.

📊 Performance Highlights

Overall pass percentage: 93.66%, a slight improvement from last year’s 93.60% ndtv.com+4education.indianexpress.com+4indiatimes.com+4.

Gender-wise pass rates:

Girls: 95%

Boys: 92.63% marathi.indiatimes.com+15indianexpress.com+15timesofindia.indiatimes.com+15marathi.indiatimes.com+3education.indianexpress.com+3indiatimes.com+3.

District toppers: Thiruvananthapuram leads with a staggering 99.79%, followed by Vijayawada at 99.60% education.indianexpress.com.

📋 Statistics at a Glance

MetricValueRegistered students~23.85 lakhAppeared~23.72 lakhPassed~22.22 lakhPass Percentage93.66%Compartment Candidates~1.41 lakh (5.96%) education.indianexpress.com

🎯 Key Takeaways

Marginal growth in pass rate (+0.06%) shows sustained academic consistency.

Impressive female performance with girls outperforming boys has become a consistent trend results.cbse.nic.in+14ndtv.com+14timesofindia.indiatimes.com+14indiatimes.com+2results.shiksha+2timesofindia.indiatimes.com+2.

Top-performing districts, particularly Thiruvananthapuram and Vijayawada, demonstrate excellence across regions education.indianexpress.com.

Robust evaluation process: CBSE introduced the ability to view evaluated answer scripts before applying for reevaluation, aiming to increase transparency results.shiksha+3gulfbusiness.com+3indiatoday.in+3.

🔍 How Students Can Check Their Results

Online portals: Visit cbse.gov.in, cbseresults.nic.in, or results.cbse.nic.in.

Login credentials: Roll number, school number, admit card ID, date of birth, and captcha/security PIN shiksha.com+9ndtv.com+9education.indianexpress.com+9.

Other methods: SMS service, DigiLocker, IVRS (Interactive Voice Response System), or UMANG app bestcolleges.indiatoday.in+2ndtv.com+2education.indianexpress.com+2.

🌟 Real Stories & Regional News

Top-scoring student highlight: In Arrah, Bihar, Abhinandan Kumar secured an outstanding 98.8%, crediting his success to diligent effort and overcoming challenges in English indianexpress.com+1navbharattimes.indiatimes.com+1.

No official topper list: CBSE continues its practice (since 2022) of not publishing a formal topper list to reduce undue pressure; unofficial top performer rankings have circulated gulfbusiness.com+6vijaykarnataka.com+6indiatimes.com+6.

🔚 Conclusion

The CBSE Class 10 Result 2025 reflects strong student performance, especially among girls, and shows steady improvement across both national and regional metrics. Extended transparency measures now allow students to view answer scripts before considering reevaluation—an appreciable change. If you’re a student or a parent, now is the time to:

Download and save your provisional marksheet.

Consider declaring revaluation or applying for photocopies if needed.

Plan ahead—choose streams or coaching based on your performance.

Apply for a compartment if necessary.

0 notes

Text

Access your EPF passbook effortlessly with the UMANG app! Check your passbook and download it from the comfort of your home in just a few simple steps.

0 notes