#Tesla Powertrain

Explore tagged Tumblr posts

Text

Fullsize Friday; '63 Eldorado Biarritz w/ Tesla powertrain - c/o Barrett-Jackson

22 notes

·

View notes

Text

The February auto market saw plugin EVs take 96.2% share in Norway, up from 92.1% year on year. BEVs continue to squeeze out other powertrains, though diesels and HEVs are now outperforming PHEVs. Overall auto volume was 8,949 units, an increase of 21% YoY. The best-selling BEV in February was the Nissan Ariya.

P.S. Wow! Nissan Ariya defeats Tesla...

#Norway#Nissan Ariya#ev sales#ev market#Northern Europe#very good news#electric car#electric vehicle#demise of big oil#tesla killer

2 notes

·

View notes

Text

Elon Musk hasn’t been sighted at the picket lines in Missouri, Ohio, or Michigan, where autoworkers are striking against the Big Three US carmakers. Yet the influence of Musk and his non-unionized company Tesla have been everywhere since the United Auto Workers called the strike last week. In some ways, Tesla—the world’s most valuable automaker by market capitalization—set the whole thing in motion.

Tesla’s pioneering electric vehicles kicked off a new era that has turned the entire auto industry on its head. In a scramble to compete with Tesla and make that transition, the legacy automakers targeted by the current strike, General Motors, Ford, and Stellantis, have each pledged billions in global investment and have begun dramatically restructuring their operations. For workers, the “green jobs” being created can be scarcer and worse paying. Electric vehicle powertrains have many fewer moving parts than conventional gas-powered ones, and so they require 30 percent fewer vehicle assembly hours, according to one estimate. Plants that make EV batteries are generally outside the core, unionized auto supply chain. The United Auto Workers has seen a dramatic drop in membership due to jobs moving outside the US—it lost 45 percent of its members between 2001 and 2022. A future with more electric vehicles could mean fewer union jobs overall. “This strike is about electrification,” says Mark Barrott, an automotive analyst at the Michigan-based consultancy Plante Moran.

The new assembly plants that the legacy automakers need to pull off the transition have been stood up mostly in US states hostile to union organizing, such as Kentucky, Tennessee, and Alabama. And because many of these plants are joint ventures between automakers and foreign battery companies, they are not subject to previous union contracts.

The UAW did not respond to a request for comment, but UAW president Shawn Fain told CNBC last week that the electric transition can’t leave workers behind. “Workers deserve their share of equity in this economy,” he said.

Tesla’s rise over recent years has also put ever-ratcheting pressure on the legacy automakers to cut costs. Including benefits, Musk’s non-unionized EV company spends $45 per hour on labor, significantly less than the $63 per hour spent in the Big Three, according to industry analysts.

Musk’s willingness to upend auto manufacturing shibboleths has also forced his legacy competitors to seek new efficiencies. Tesla led the way in building large-scale car casts, stamping out very large metal components in one go rather than making a series of small casts that have to be joined together. And it pioneered an automotive chassis building process that can be easily adapted to produce different makes and models.

Tesla’s Silicon Valley roots also helped it become the first automaker to envision the car as a software-first, iPhone-like “platform” that can be modified via over-the-air updates. And the company aims to automate more of its factories, and extract more of the materials it needs to build its batteries itself.

Tesla’s novel production ideas could soon lead the company to put even more pressure on legacy automakers. Musk said earlier this year that Tesla plans to build a new, smaller vehicle that can be made for half the production cost of its most popular (and cheapest) vehicle, the Model 3.

Musk says a lot of things, and many don’t come to pass. (The world is still waiting for the 1 million Tesla robotaxis promised by the end of 2020.) But Tesla has been disruptive enough to leave legacy automakers, including Detroit’s Big Three, “in a quest for capital,” says Marick Masters, who studies labor and workplace issues at Wayne State University's School of Business. Detroit’s automakers have made good money in the past decade—some $250 billion in profits—but also paid a significant chunk of it out in dividends. Pressure from Tesla and the EV transition it catalyzed has left them feeling as if they need every penny they can corral to keep afloat as the industry changes.

“They have little money to concede for union demands,” says Masters. The UAW’s wants include significantly higher wages, especially for workers who have joined the companies since their Great Recession and bankruptcy-era reorganizations, which left some with less pay and reduced pension and health benefits.

So far, the UAW has shown little patience for the idea that the automakers it is pressuring are cash-strapped and under competitive pressure. “Competition is a code word for race to the bottom, and I'm not concerned about Elon Musk building more rocket ships so he can fly into outer space and stuff,” UAW president Fain told CNBC last week when asked about pressure from Tesla. He has argued that production workers should receive the same pay raise received by auto executives over recent years.

When automakers have taken the opposite tack, insisting that they’re well capitalized and making plans to put them ahead of the electric car maker—well, that set up conditions for this strike too. The three American automakers are forecasted to make $32 billion in profits this year, a slight dip from last year’s 10-year high. “The more they toot their own horns about profitability, the more the union looks at them and says, ‘We want our rightful share,’” says Masters.

Tesla did not respond to a request for comment, but Musk has, in typical fashion, chimed in. He posted on X last week to compare working conditions at his companies with the competition, apparently seeking to turn the dispute he helped foment into a recruiting pitch. “Tesla and SpaceX factories have a great vibe. We encourage playing music and having some fun,” he wrote. “We pay more than the UAW btw, but performance expectations are also higher.” A UAW attempt to organize Tesla workers in 2017 and 2018, as the company struggled to produce its Model 3, failed. The National Labor Board ruled that Tesla violated labor laws during the organizing drive; the carmaker has appealed the decision.

5 notes

·

View notes

Text

Gearheads' Garage: Cars, Trucks, and Everything in Between

Cars and Trucks: A Comprehensive Exploration of Machines that Move the World

Introduction

Cars and trucks are among the most significant inventions in human history. They have transformed how we travel, work, and live. From the earliest steam-powered engines to today's electric and self-driving vehicles, these machines reflect the story of human innovation, industrial evolution, and the constant quest for speed, safety, and efficiency. This comprehensive guide will explore the development, types, technologies, and cultural relevance of both cars and trucks.

1. The Birth of Automobiles

The first vehicles didn’t run on gasoline. In the 18th century, steam-powered wagons were the earliest attempts at creating self-propelled transport. However, it wasn’t until 1886, when Karl Benz patented the first true automobile powered by an internal combustion engine, that the automobile era truly began.

1.1 The Rise of Cars

Cars evolved rapidly. By the early 20th century, Henry Ford revolutionized automobile production with the Model T and the moving assembly line. This made cars affordable and accessible to the average American, paving the way for a car-dependent culture.

1.2 The Invention of Trucks

2. Key Differences Between Cars and Trucks

While cars and trucks may look similar from afar, they serve fundamentally different purposes:

Feature

Cars

Trucks

Primary Purpose

Transportation of people

Transportation of goods/heavy loads

Chassis Design

Unibody (modern cars)

Body-on-frame (for durability)

Fuel Efficiency

Typically higher

Lower due to size and weight

Ride Comfort

Smoother, more refined

Built for strength, not always comfort

Load Capacity

Limited

High – can tow and haul large items

3. Types of Cars

Cars come in many forms, each suited to different needs and lifestyles:

3.1 Sedans

Classic four-door vehicles, known for comfort and efficiency. Ideal for families and commuters.

3.2 Hatchbacks

Compact with a rear door that swings upward. Practical and economical.

3.3 SUVs (Sport Utility Vehicles)

Larger vehicles that offer more ground clearance and all-terrain capabilities. Popular for families and off-road enthusiasts.

3.4 Sports Cars

Designed for speed and performance. Sleek, stylish, and often expensive.

3.5 Electric Vehicles (EVs)

Powered entirely by electricity. Examples include the Tesla Model 3 and Nissan Leaf.

4. Types of Trucks

Trucks are categorized based on size and utility:

4.1 Light-Duty Trucks

These include pickups like the Ford F-150, Toyota Tacoma, and Ram 1500. They balance passenger comfort with cargo capability.

4.2 Medium-Duty Trucks

Used for delivery services, tow trucks, and small commercial uses. Examples include the Isuzu NPR and Ford F-Series Super Duty.

4.3 Heavy-Duty Trucks

Massive trucks like 18-wheelers and semis designed for long-distance freight hauling. Examples include the Freightliner Cascadia and Volvo VNL.

5. Technological Advancements

The automotive industry is constantly evolving. Let’s look at how technology is transforming both cars and trucks:

5.1 Safety Features

Airbags

Lane Departure Warning

Automatic Emergency Braking

Blind Spot Monitoring

5.2 Driver Assistance

Modern cars and trucks come with Adaptive Cruise Control, Parking Assist, and even semi-autonomous driving systems.

5.3 Fuel Efficiency

From hybrid powertrains to turbocharged engines, manufacturers are optimizing performance while reducing emissions.

5.4 Electric & Hybrid Power

Electric motors are making vehicles cleaner and more sustainable. Popular EV trucks include the Rivian R1T and Ford F-150 Lightning.

6. The Culture of Cars and Trucks

Vehicles are more than just machines. For many, they’re a passion and a way of life.

6.1 Car Culture

From street racing to collector shows, car lovers gather to share, modify, and showcase their vehicles. The "JDM" (Japanese Domestic Market) scene, muscle car culture, and luxury car enthusiasts all represent different facets of automotive passion.

6.2 Truck Life

Trucks are part of work culture and rural life. They symbolize strength, freedom, and reliability. In the U.S., especially in southern and midwestern states, trucks are a cultural icon.

7. Commercial and Industrial Role

7.1 Trucks in Industry

Trucks are the backbone of logistics, agriculture, construction, and emergency services. From dump trucks to fire engines, they keep society running.

7.2 Fleet Vehicles

Businesses often use fleets of trucks for deliveries and services. Fleet management involves optimizing routes, fuel, and maintenance for efficiency.

8. Environmental Impact

The automobile industry contributes to greenhouse gas emissions. However, innovation is helping reduce its footprint:

Catalytic Converters

Fuel Economy Standards

Electric Vehicles (EVs)

Recycling Auto Parts

Governments worldwide are pushing toward zero-emission vehicles. By 2035, many countries plan to ban the sale of new gas-powered cars.

9. Maintenance and Ownership

9.1 Car Maintenance

Regular servicing ensures a car remains safe and efficient. Key aspects include:

Oil changes

Brake inspections

Tire rotation

Battery check

9.2 Truck Maintenance

Given their heavy use, trucks require more frequent servicing, especially:

Suspension

Transmission

Cooling systems

Towing equipment

Proper maintenance extends lifespan and ensures road safety.

10. Future of Cars and Trucks

We are entering a new era of automotive technology.

10.1 Autonomous Driving

Companies like Tesla, Waymo, and Mercedes-Benz are leading the charge toward self-driving vehicles.

10.2 Connected Vehicles

Cars and trucks now communicate with each other and infrastructure using V2V (Vehicle-to-Vehicle) and V2X (Vehicle-to-Everything) technologies.

10.3 Green Technologies

Hydrogen fuel cells, solar integration, and sustainable materials are redefining how vehicles are made and powered.

11. Cars vs Trucks: Which One is Right for You?

Choosing between a car and a truck depends on your needs:

Use Case

Best Choice

Daily commuting

Car

Family travel

SUV or Crossover

Towing/Hauling

Truck

Off-roading

Truck or 4x4 SUV

Fuel efficiency

Compact Car or EV

Cargo transport

Pickup Truck or Cargo Van

12. Global Impact of Cars and Trucks

12.1 Economic Role

The automobile industry employs millions worldwide. From manufacturing and sales to repair and logistics, vehicles are integral to the global economy.

12.2 Infrastructure

Cars and trucks have shaped cities and transportation networks. Roads, highways, bridges, and fuel stations exist primarily because of vehicle use.

12.3 Environmental Challenges

The need for sustainable transport is urgent. Eco-friendly policies, carpooling, ride-sharing apps, and public transport are being promoted as alternatives.

13. Legends of the Road: Iconic Vehicles

Cars:

Ford Mustang – Muscle car icon

Toyota Corolla – Reliable global bestseller

Volkswagen Beetle – Cultural symbol of simplicity

Lamborghini Aventador – High-end exotic supercar

Trucks:

Ford F-Series – Best-selling trucks in America

Chevrolet Silverado – A favorite among truck lovers

Ram 1500 – Luxury meets power

Tesla Cybertruck – Futuristic and controversial

14. Buying a Vehicle: Car or Truck?

Key things to consider:

Budget: Cars usually cost less to buy and maintain.

Purpose: For business, heavy-duty needs, or rural travel, trucks are better.

Fuel Costs: Trucks consume more fuel unless hybrid/electric.

Insurance: Truck insurance may be higher, especially for commercial use.

15. Conclusion

Cars and trucks have come a long way from their humble beginnings. Today, they are not just tools for travel—they're symbols of freedom, innovation, and human achievement. Whether you're a car enthusiast, a truck driver, or someone just trying to get from point A to B, these machines impact your life every day. As the world moves toward sustainability and automation, the future of cars and trucks promises to be even more exciting.

0 notes

Text

Global Vehicle Electronic Control Units (ECU) Market : Key Trends, Latest Technologies, and Forecast to 2032

Global Vehicle Electronic Control Units (ECU) Market size was valued at US$ 67.34 billion in 2024 and is projected to reach US$ 124.73 billion by 2032, at a CAGR of 7.3% during the forecast period 2025-2032.

Electronic Control Units (ECUs) are embedded systems that manage various electrical subsystems in vehicles, including engine control, transmission, braking, and infotainment systems. These units serve as the central nervous system of modern vehicles, processing sensor data and executing control algorithms to optimize performance, safety, and efficiency. The market encompasses various ECU types such as Engine Control Modules (ECM), Transmission Control Modules (TCM), Brake Control Modules (BCM), and Body Control Modules (BCM).

The market growth is primarily driven by increasing vehicle electrification, stringent emission regulations, and rising demand for advanced driver-assistance systems (ADAS). The automotive industry’s shift toward connected, autonomous, shared, and electric (CASE) vehicles is accelerating ECU adoption. While passenger vehicles dominate the market share, commercial vehicles are witnessing faster growth due to telematics mandates. Regional analysis shows Asia-Pacific leading the market, propelled by China’s automotive production boom and India’s growing vehicle parc. Key players like Bosch, Continental, and DENSO continue to innovate with domain controller architectures, consolidating multiple ECUs into high-performance computing units.

Get Full Report with trend analysis, growth forecasts, and Future strategies : https://semiconductorinsight.com/report/global-vehicle-electronic-control-units-ecu-market/

Segment Analysis:

By Type

Passenger Vehicle Segment Dominates Due to Increasing Adoption of Advanced Driver Assistance Systems (ADAS)

The market is segmented based on type into:

Passenger Vehicle

Subtypes: Sedans, SUVs, Hatchbacks, and others

Commercial Vehicle

Electric Vehicles

Subtypes: Battery Electric Vehicles (BEVs), Hybrid Electric Vehicles (HEVs), and others

Off-Highway Vehicles

Subtypes: Agricultural Equipment, Construction Machinery, and others

Others

By Application

Powertrain Control ECUs Lead Market Share Due to Increasing Vehicle Electrification

The market is segmented based on application into:

Powertrain Control

Body Control

Chassis Control

Safety & Security Systems

Infotainment

By Vehicle System

Engine Management Systems Account for Significant Market Share

The market is segmented based on vehicle system into:

Engine Management System

Transmission System

Braking System

Steering System

Others

By ECU Capacity

32-Bit ECUs Hold Majority Share Due to Higher Processing Requirements

The market is segmented based on ECU capacity into:

16-Bit ECUs

32-Bit ECUs

64-Bit ECUs

Regional Analysis: Global Vehicle Electronic Control Units (ECU) Market

North America The North American ECU market is characterized by high technological adoption and stringent automotive safety regulations. The U.S. accounted for over 75% of the regional market share in 2023, driven by premium vehicle penetration and advanced driver-assistance systems (ADAS) mandates. Canada follows with steady growth in commercial vehicle ECU demand, particularly for fleet telematics. While Mexico serves as a manufacturing hub for cost-sensitive ECU production, trade agreements like USMCA continue to shape supply chain dynamics. A notable trend is the shift toward domain controller architectures as automakers like Tesla and Ford consolidate multiple ECUs into centralized computing modules.

Europe Europe’s ECU market is at the forefront of electrification and cybersecurity innovations, with Germany contributing approximately 30% of regional ECU demand. Stricter Euro 7 emissions standards and mandatory eCall emergency systems have accelerated ECU sophistication. The region also leads in AI-powered ECUs for predictive maintenance, with players like Bosch investing heavily in machine learning algorithms. However, the post-pandemic semiconductor shortage exposed vulnerabilities in just-in-time manufacturing models, prompting EU initiatives to boost local chip production. Eastern European nations are emerging as competitive ECU manufacturing bases, benefiting from lower labor costs while maintaining EU compliance standards.

Asia-Pacific As the largest and fastest-growing ECU market, Asia-Pacific is projected to maintain a 6.8% CAGR through 2028, fueled by China’s dominance in EV production and India’s expanding automotive sector. Japanese automakers prioritize reliability-focused ECU designs, while Korean manufacturers integrate advanced infotainment controls. Southeast Asia represents an untapped growth frontier, with Thailand and Indonesia attracting ECU investments due to favorable FDI policies. A dual-market dynamic exists: premium vehicles adopt next-gen ECUs with 5G connectivity, while entry-level models use cost-optimized solutions. The region also faces unique challenges like counterfeit ECU proliferation in secondary markets.

South America ECU adoption in South America trails other regions due to economic volatility and older vehicle fleets. Brazil dominates with 60% market share, where flex-fuel vehicle ECUs remain a specialization area. Argentina shows potential in agricultural vehicle ECUs, though currency fluctuations impact import-dependent component sourcing. The region benefits from proximity to North American supply chains but struggles with inconsistent regulatory frameworks across countries. Recent trade agreements with Chinese ECU suppliers are reducing historical dependence on European and American vendors, creating more competitive pricing in the aftermarket segment.

Middle East & Africa This emerging market shows divergent trends: Gulf Cooperation Council (GCC) countries demand luxury vehicle ECUs with climate-specific adaptations, while African nations prioritize ruggedized units for harsh operating conditions. The UAE leads in smart mobility ECU integration, supporting autonomous vehicle pilot programs. However, infrastructural limitations in Sub-Saharan Africa restrict advanced ECU adoption, with the market relying heavily on refurbished units. Long-term growth potential exists through Chinese investments in local automotive assembly plants, though political instability in some regions creates supply chain uncertainties.

MARKET OPPORTUNITIES

Emergence of Software-Defined Vehicles Creating New Revenue Streams

The shift toward software-defined vehicles presents transformative opportunities for ECU manufacturers. Rather than discrete hardware units, future architectures will emphasize centralized computing power with software applications running on virtualized ECUs. This transition enables over-the-air updates and new monetization models through feature-on-demand services. Leading automakers have already demonstrated that software-enabled features can generate 30-40% higher margins than traditional hardware options. Suppliers who successfully transition to this software-centric approach stand to gain substantial market share in the coming decade.

Expansion of Predictive Maintenance Solutions in Commercial Vehicles

The commercial vehicle sector represents a high-growth opportunity for advanced ECU applications, particularly in predictive maintenance systems. Fleet operators increasingly demand real-time monitoring solutions that can reduce unplanned downtime, with some systems demonstrating 25-30% improvement in maintenance efficiency. Specialized ECUs that integrate with telematics and AI-based analytics platforms are becoming essential components in modern trucks and construction equipment. Suppliers who develop ruggedized, high-reliability ECUs for harsh operating environments can capitalize on this underserved market segment.

Advancements in Edge Computing for Autonomous Systems

The evolution of autonomous vehicle technologies is driving innovation in edge computing capabilities within ECUs. Next-generation systems require substantial local processing power to minimize latency for safety-critical functions, with some autonomous driving ECUs now featuring over 50 TOPS (trillions of operations per second) of computing performance. This performance demand creates opportunities for suppliers specializing in high-performance computing architectures optimized for automotive applications. The integration of neural processing units directly into ECUs represents particularly promising territory for technological differentiation.

GLOBAL VEHICLE ELECTRONIC CONTROL UNITS (ECU) MARKET TRENDS

Increasing Vehicle Electrification to Dominate Market Growth

The global automotive industry is undergoing a paradigm shift toward electrification, with over 26 million electric vehicles projected to be sold annually by 2030. This transformation is significantly driving demand for advanced Electronic Control Units (ECUs) that manage powertrain systems, battery management, and energy efficiency in electric and hybrid vehicles. Modern ECUs now integrate AI-powered predictive maintenance capabilities, enabling real-time monitoring of vehicle subsystems. Furthermore, the development of domain controller architectures consolidates multiple ECUs into centralized units, reducing complexity while improving processing power—a critical requirement for autonomous driving functionalities.

Other Trends

Autonomous Driving Technology Integration

As autonomous vehicle development accelerates, the need for high-performance ECUs capable of processing massive sensor data has surged. ADAS (Advanced Driver Assistance Systems) alone requires up to 70 interconnected ECUs in modern vehicles, creating substantial market opportunities. Leading manufacturers are developing ECU solutions with neural network processors that can handle 100+ TOPS (Tera Operations Per Second) for Level 4 autonomous operations. This trend is coupled with growing investments in vehicle-to-everything (V2X) communication systems that demand specialized telematics control units.

Cybersecurity and Over-the-Air Updates

The automotive cybersecurity market is projected to grow at over 12% CAGR through 2028, directly impacting ECU development. Modern ECUs incorporate hardware security modules and cryptographic authentication to prevent ECU hacking, which has become critical as vehicles handle more sensitive data. Additionally, OEMs increasingly require ECU architectures supporting secure Over-the-Air (OTA) updates, allowing remote firmware updates without dealership visits. This capability reduces recall costs while enabling continuous feature enhancements throughout a vehicle’s lifecycle.

COMPETITIVE LANDSCAPE

Key Market Players

Automotive Giants and Suppliers Compete Through Technological Advancements

The global vehicle ECU market features a competitive hierarchy dominated by established automotive suppliers and electronics specialists. This landscape remains moderately consolidated, with the top five players collectively holding over 45% market share in 2024. Among these, BOSCH maintains its market leadership with a diversified ECU portfolio that spans engine control modules, transmission control units, and advanced driver assistance systems (ADAS) ECUs. The company’s technological edge in automotive semiconductors and its presence across all major vehicle segments contribute significantly to its dominant position.

Continental AG and DENSO Corporation follow closely, capitalizing on their vertically integrated supply chains and strong OEM partnerships. Continental’s strength lies in chassis and safety systems control units, while DENSO has made significant strides in powertrain ECUs for hybrid and electric vehicles. Both companies allocated approximately 7-9% of their annual revenues to R&D in recent years, focusing on next-generation ECUs with higher computing power and AI capabilities.

The market also features specialized players making strategic inroads. Delphi Technologies (now part of BorgWarner) commands notable market share in commercial vehicle ECUs, with its proprietary software algorithms offering enhanced fuel efficiency. Similarly, ZF TRW has expanded its footprint through acquisitions and now provides integrated safety ECU solutions for premium automakers.

Chinese manufacturers like UAES and Weifu Group represent the growing influence of regional players, particularly in cost-sensitive segments. These companies compete through localized production and government-supported technology transfer programs, capturing nearly 20% of the Asia-Pacific ECU market. Meanwhile, Japanese firms such as Hitachi Automotive and Mitsubishi Electric maintain technological leadership in microcontrollers and power management systems for ECUs.

List of Major Vehicle ECU Manufacturers Profiled

BOSCH (Germany)

Continental AG (Germany)

DENSO Corporation (Japan)

Delphi Technologies (U.K.)

ZF TRW (Germany)

Hyundai AUTRON (South Korea)

Marelli (Italy)

Mitsubishi Electric (Japan)

UAES (China)

Weifu Group (China)

LinControl (U.S.)

Hitachi Automotive (Japan)

Learn more about Competitive Analysis, and Forecast of Global Vehicle ECU Market : https://semiconductorinsight.com/download-sample-report/?product_id=95798

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global Vehicle ECU Market?

-> The Global Vehicle Electronic Control Units (ECU) Market size was valued at US$ 67.34 billion in 2024 and is projected to reach US$ 124.73 billion by 2032, at a CAGR of 7.3%.

Which key companies operate in Global Vehicle ECU Market?

-> Key players include BOSCH, Continental, DENSO, Delphi, ZF TRW, Hyundai AUTRON, Marelli, Mitsubishi Electric, and Hitachi Automotive, among others.

What are the key growth drivers?

-> Key growth drivers include vehicle electrification, autonomous driving trends, increasing electronics content per vehicle, and stringent emission regulations.

Which region dominates the market?

-> Asia-Pacific dominates the market with 42.7% share, driven by automotive production in China, Japan, and South Korea.

What are the emerging trends?

-> Emerging trends include domain controller architectures, over-the-air updates, AI-powered ECUs, and cybersecurity solutions for connected vehicles.

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014 +91 8087992013 [email protected]

Follow us on LinkedIn: https://www.linkedin.com/company/semiconductor-insight/

0 notes

Text

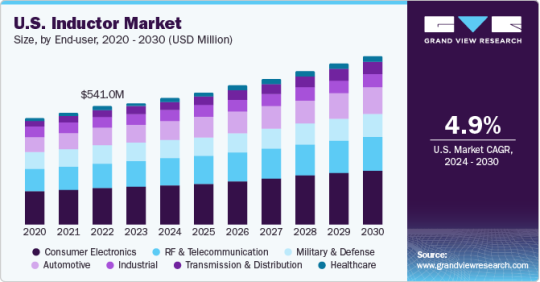

Inductor Market: Competitive Strategies of Top Global Brands in 2025

The global inductor market was valued at USD 4,515.0 million in 2023 and is projected to reach USD 6,540.8 million by 2030, expanding at a CAGR of 5.5% from 2024 to 2030. This growth is primarily fueled by ongoing advancements and innovations in the consumer electronics sector, which continue to drive demand for efficient and compact electronic components.

Additionally, the increasing adoption of smart home technologies and smart city initiatives—which require energy-efficient and high-performance electronic systems—is further contributing to market expansion. For instance, electric vehicle (EV) sales in the U.S. rose by 55% in 2022, led primarily by battery electric vehicles (BEVs), according to the International Energy Agency (IEA). A broader selection of EV models, beyond the traditional dominance of Tesla, has also helped mitigate supply shortages and support this upward trend.

Key Market Insights:

Asia Pacific led the global market in 2023, accounting for the largest revenue share of 45.8%, owing to strong demand for consumer electronics and automotive products in the region.

By core type, the ferromagnetic/ferrite core segment dominated in 2023, holding a 42.0% market share. These inductors are widely used in devices such as power supplies, filters, RF circuits, and transformers due to their efficiency and reliability.

By inductance, the fixed inductor segment held the largest share in 2023, valued for its consistent performance and predetermined inductance, which is crucial for stable operation across diverse applications.

By type, film-type inductors led the market in 2023, driven by their high reliability, stability, and optimal performance across varying frequency ranges.

By shield type, the shielded inductor segment is projected to witness notable growth from 2024 to 2030, owing to its superior electromagnetic interference (EMI) suppression and reduced radiation compared to unshielded variants.

By mounting technique, the surface-mounting segment is expected to grow significantly during the forecast period. Surface-mount technology supports high-volume production, enabling faster assembly and cost efficiency.

By end-user, the consumer electronics segment is anticipated to experience substantial growth from 2024 to 2030, driven by rising demand for devices such as smartphones, tablets, laptops, and wearables.

Order a free sample PDF of the Inductor Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

2023 Market Size: USD 4,515.0 Million

2030 Projected Market Size: USD 6,540.8 Million

CAGR (2024-2030): 5.5%

Asia Pacific: Largest market in 2023

Key Companies & Market Share Insights

The market is fragmented, with numerous global and regional manufacturers introducing innovative systems and technologies. Industry players commonly employ strategies such as new product development, product upgrades, and market expansions to increase their reach and address the evolving technical demands of various application industries. Major players often engage in technical partnerships to innovate, develop novel product lines, and expand their customer base. Additionally, shifts in consumer preferences, coupled with increasing demands for quality and energy efficiency, are expected to create new opportunities for key participants in the coming years.

In January 2024, Murata expanded its product offerings with the launch of the DFE2MCPH_JL series. This new line of automotive-grade power inductors currently includes values of 0.33µH and 0.47µH. These inductors are specifically designed for use in automotive powertrain and safety equipment, ensuring optimal performance and reliability. Murata has also announced plans to further extend the inductance value range from 0.1 µH to 4.7µH, aiming to meet future market demands and broaden their application in the automotive sector.

Key Players

ABC Taiwan Electronics

Pulse Electronics

Coilcraft

Shenzhen Sunlord Electronics

Bourns

ICE Components

Kyocera Corp AVX

Bel Fuse Inc.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global inductor market is experiencing significant growth, driven by continuous innovation in consumer electronics, the rise of smart home and city technologies, and the booming electric vehicle sector. Asia Pacific remains the dominant region, fueled by robust demand for electronic and automotive products. Key segments like ferromagnetic/ferrite core inductors, fixed inductors, and film-type inductors lead the market, while shielded and surface-mounted varieties are poised for substantial growth. Manufacturers are focusing on strategic partnerships, new product development, and addressing evolving preferences for quality and energy efficiency to capitalize on future opportunities.

0 notes

Text

Global Vehicle ECUs and DCUs Market: Demand Analysis and Future Opportunities 2025–2032

Global Vehicle ECUs and DCUs Market Research Report 2025(Status and Outlook)

Vehicle ECUs and DCUs Market size was valued at US$ 69.18 billion in 2024 and is projected to reach US$ 130.40 billion by 2032, at a CAGR of 7.4% during the forecast period 2025-2032

Our comprehensive Market report is ready with the latest trends, growth opportunities, and strategic analysis https://semiconductorinsight.com/download-sample-report/?product_id=95797

MARKET INSIGHTS

The global Vehicle ECUs and DCUs Market size was valued at US$ 69.18 billion in 2024 and is projected to reach US$ 130.40 billion by 2032, at a CAGR of 7.4% during the forecast period 2025-2032.

Vehicle Electronic Control Units (ECUs) and Domain Control Units (DCUs) are specialized computing systems that manage various vehicle functions. ECUs handle discrete functions like engine control, transmission, braking, and safety systems, while DCUs integrate multiple functions into centralized computing platforms for advanced vehicle architectures. These units form the neural network of modern vehicles, enabling everything from basic drivetrain operations to advanced driver-assistance systems (ADAS) and autonomous driving capabilities.

The market growth is driven by increasing vehicle electrification, rising demand for ADAS features, and stringent emission regulations worldwide. The transition towards software-defined vehicles and centralized E/E architectures is accelerating DCU adoption, particularly in premium and electric vehicle segments. Key players like Bosch, Continental, and Aptiv are investing heavily in next-generation control units to address the growing complexity of vehicle electronics while meeting automotive functional safety standards (ISO 26262). The Asia-Pacific region dominates the market, accounting for over 45% of global demand in 2023, fueled by China’s rapidly expanding electric vehicle production.

List of Key Vehicle ECUs & DCUs Manufacturers Profiled

Robert Bosch GmbH (Germany)

Continental AG (Germany)

DENSO Corporation (Japan)

Visteon Corporation (U.S.)

Desay SV Automotive (China)

Neusoft Reach (China)

ZF Friedrichshafen AG (Germany)

Aptiv PLC (Ireland)

Magna International (Canada)

Hyundai AUTRON (South Korea)

UAES (China)

Hirain Technologies (China)

Tesla, Inc. (U.S.)

Segment Analysis:

By Type

Domain Control Units (DCU) Segment Expanding Rapidly with Advancements in Autonomous Driving Capabilities

The global vehicle ECUs and DCUs market is segmented based on type into:

Electronic Control Units (ECU)

Subtypes: Engine Control Module, Transmission Control Module, Brake Control Module, others

Domain Control Units (DCU)

Subtypes: ADAS Domain Controller, Infotainment Domain Controller, Powertrain Domain Controller, others

By Application

Passenger Vehicle Segment Leads Market Share Due to Higher Vehicle Production and Rising Consumer Demand for Advanced Features

The market is segmented based on application into:

Passenger Vehicles

Commercial Vehicles

By Vehicle Type

Electric Vehicles Segment Shows Strong Growth Potential with Increasing EV Adoption Worldwide

The market is segmented based on vehicle type into:

Internal Combustion Engine (ICE) Vehicles

Hybrid Electric Vehicles (HEV)

Battery Electric Vehicles (BEV)

By Function

ADAS Control Systems Segment Growing with Technological Advancements in Autonomous Driving

The market is segmented based on function into:

Powertrain Control

Chassis Control

ADAS & Safety Systems

Body Electronics

Infotainment Systems

Regional Analysis: Global Vehicle ECUs and DCUs Market

North America The North American market for vehicle ECUs and DCUs is driven by advanced automotive technologies and stringent emissions regulations. The U.S. leads the region with major OEMs and Tier-1 suppliers like Bosch, Visteon, and Continental investing heavily in ADAS and electrification. With the push toward autonomous vehicles, DCU adoption is accelerating, supported by government initiatives such as the Infrastructure Bill allocating funds for smart transportation. However, high R&D costs and supply chain complexities present challenges. The market is projected to grow at a steady 5-7% annually through 2028, with passenger vehicles accounting for 70% of demand.

Europe Europe remains a innovation hub for automotive electronics, with Germany at the forefront due to its robust automotive manufacturing base. The EU’s strict CO2 reduction targets (aiming for 55% lower emissions by 2030) are accelerating ECU upgrades for fuel efficiency and DCU deployment in EVs. Key players like Continental and ZF TRW dominate, focusing on cybersecurity and functional safety compliance. The aftermarket segment is growing as older vehicles require ECU replacements. Despite economic uncertainties, the region maintains a 30% share of global ECU production with increasing emphasis on centralized domain architectures.

Asia-Pacific As the largest and fastest-growing market, Asia-Pacific benefits from China’s automotive electrification push and India’s expanding middle class. China accounts for over 40% of global ECU demand, driven by local players like Hirain Technologies and Neusoft Reach. Japan’s strength lies in hybrid vehicle ECUs, while Southeast Asia sees growth in budget-tier solutions. The region faces pricing pressures, leading to increased consolidation among suppliers. DCU adoption is rising with smart city initiatives, though legacy systems still dominate commercial vehicles. By 2026, APAC is expected to capture 50% of the global market value.

South America Market growth here is constrained by economic instability but shows potential in Brazil and Argentina’s automotive manufacturing clusters. Price sensitivity keeps ECU technology 1-2 generations behind global leaders, with most systems imported from China. Fleet modernization in mining and agriculture drives commercial vehicle ECU demand. Governments are gradually implementing emissions standards (PROCONVE L8 in Brazil), creating opportunities for basic ECU upgrades. The market remains fragmented, with regional players like Troiltec serving niche segments while global suppliers focus on premium OEM partnerships.

Middle East & Africa This emerging market is characterized by two-tier growth. Gulf nations (UAE, Saudi Arabia) invest in luxury vehicle ECUs and connected car technologies, while Africa relies on cost-effective solutions for used vehicle imports. Infrastructure gaps limit DCU adoption outside major cities. However, initiatives like Saudi Vision 2030 are attracting OEM investments in local ECU production. The aftermarket dominates due to high vehicle longevity in harsh climates, creating demand for ruggedized control units. While currently under 5% of global share, the region shows 10-12% growth potential as electrification reaches public transport fleets.

MARKET DYNAMICS

Automakers face significant technical challenges when integrating modern ECUs and DCUs into existing vehicle platforms. Many legacy architectures were designed for distributed ECU networks rather than centralized domain control, requiring costly redesigns and component requalification. Some manufacturers report that adapting new domain controllers to existing platforms can increase development costs by up to 40% while extending lead times by 6-12 months. This challenge is particularly acute for commercial vehicles, where platform lifecycles often exceed 10 years.

The exponential growth of in-vehicle software requirements has created new challenges in ECU and DCU development. Modern domain controllers may require over 100 million lines of code, compared to just 1 million for traditional ECUs. This software complexity has created severe bottlenecks, with some automakers reporting that software development now accounts for over 60% of total ECU development time and cost. The industry faces an acute shortage of qualified software engineers, with estimated deficits exceeding 100,000 professionals globally.

Advanced domain controllers generate substantial heat loads that present significant engineering challenges for automakers. Some high-performance DCUs for autonomous driving applications require thermal dissipation capabilities exceeding 100W, comparable to gaming laptop processors. Developing reliable cooling solutions for these components in harsh automotive environments has proven particularly challenging, with thermal-related failures accounting for approximately 20% of warranty claims in early implementations.

The automotive industry’s transition to zonal architectures presents significant opportunities for ECU and DCU suppliers. These architectures consolidate functions into geographic zones managed by high-performance controllers, potentially reducing vehicle wiring by up to 30% while improving reliability. This transition is creating demand for new controller types, including zone controllers that manage multiple ECUs within specific vehicle regions. Early adopters project that zonal architectures could become standard in over 60% of new vehicles by 2030.

The growing adoption of software-defined vehicle concepts is creating opportunities for standardized, upgradable ECU platforms. Automakers are increasingly viewing vehicles as hardware platforms that can receive continuous software improvements, requiring ECUs with sufficient headroom for future functionality. This shift has led to demand for modular controller designs with standardized interfaces, potentially reducing development costs while extending product lifecycles. Some manufacturers estimate that this approach could reduce ECU variant complexity by up to 50% across model ranges.

The expansion of edge computing capabilities in vehicles presents new opportunities for DCU innovation. Modern domain controllers increasingly incorporate dedicated AI accelerators capable of processing sensor data locally rather than relying on cloud connectivity. This capability is critical for latency-sensitive applications like autonomous driving, where response times must be measured in milliseconds. Suppliers are developing specialized DCUs with neural processing capabilities exceeding 50 TOPS, creating new market segments focused on in-vehicle AI processing.

The market is highly fragmented, with a mix of global and regional players competing for market share. To Learn More About the Global Trends Impacting the Future of Top 10 Companies https://semiconductorinsight.com/download-sample-report/?product_id=95797

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global Vehicle ECUs and DCUs Market?

Which key companies operate in this market?

What are the key growth drivers?

Which region dominates the market?

What are the emerging technology trends?

Related Reports:

https://semiconductorblogs21.blogspot.com/2025/07/global-extreme-ultraviolet-euv_2.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-industrial-force-sensor-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-smart-temperature-monitoring.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-extreme-ultraviolet-euv.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-non-tactile-membrane-switches.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-semiconductor-alcohol-sensors.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-healthcare-biometric-systems.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-class-d-audio-power-amplifiers.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-usb-31-flash-drive-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-optical-fiber-development-tools.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-3d-chips-3d-ic-market-regional.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-3d-acoustic-sensors-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-wired-network-connectivity-3d.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-lens-antenna-market-industry.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-millimeter-wave-antennas-and.html

CONTACT US: City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014 [+91 8087992013] [email protected]

0 notes

Text

Electric Vehicles: A Promising Career Path for Engineering Graduates

The electric vehicle (EV) sector is undergoing rapid expansion globally, creating a wealth of opportunities for engineers across multiple disciplines. Arya College of Engineering & I.T. has many courses which has driven by technological innovation, environmental policies, and significant industry investments. The demand for skilled professionals in EV engineering is at an all-time high.

Key Engineering Roles in the EV Industry

Battery Engineer: Designs, develops, and tests advanced battery systems for optimal performance and safety.

Powertrain Engineer: Focuses on the design and development of electric motors, gearboxes, and related components.

High-Voltage Systems Engineer: Ensures the safety and efficiency of high-voltage electrical systems in EVs.

Controls Engineer: Develops control systems for battery management, motor control, and regenerative braking.

Manufacturing Engineer: Optimizes and automates production processes for EVs to improve efficiency and quality.

EV Design Engineer: Works on vehicle styling, structure, and integration of electric drivetrains.

Software Engineer: Develops embedded systems, vehicle control software, and autonomous driving features.

Charging Infrastructure Engineer: Designs and manages the deployment of EV charging networks.

Industry Demand and Growth Prospects

The global EV market is projected to reach $90 billion in India alone by 2030, with a CAGR of 36% in 2025, indicating robust job growth and high demand for engineers.

Major automakers and startups are creating thousands of new jobs, with investments in battery plants and manufacturing facilities leading to significant employment opportunities.

Companies like Tesla, Rivian, Tata Motors, Mahindra Electric, and Ola Electric are actively hiring engineers for various EV roles.

Career Development and Salary Outlook

Entry-level engineers can progress to senior technical roles, R&D managers, and even chief technology officers (CTOs) with experience and specialization.

High-paying roles include EV Design Engineer, Battery Technology Engineer, Power Electronics Engineer, and Autonomous Driving Engineer, with salaries ranging from ₹8,00,000 to ₹18,00,000 annually in India and competitive packages globally.

The sector values skills in CAD software, embedded systems, power electronics, materials science, and systems integration.

Emerging Trends and Future Opportunities

The shift toward sustainable transportation and government incentives is accelerating the need for engineers in EV manufacturing, battery technology, and charging infrastructure.

Engineers with expertise in AI, IoT, and autonomous systems are especially sought after as the industry evolves toward smart, connected vehicles.

The growth of EVs is also creating opportunities in related fields such as energy storage, grid integration, and renewable energy systems.

Conclusion

The EV industry offers a dynamic and future-proof career path for engineers, with opportunities spanning design, manufacturing, software, battery technology, and infrastructure. As the sector continues to expand, engineers with the right skills and adaptability will find abundant prospects for growth, innovation, and leadership in shaping the future of mobility.

0 notes

Text

Electric Vehicles (EV): Career Scope and Opportunities for Engineers

Overview

The electric vehicle (EV) sector is undergoing rapid expansion globally, creating a wealth of opportunities for engineers across multiple disciplines. Arya College of Engineering & I.T. has many courses which has driven by technological innovation, environmental policies, and significant industry investments. The demand for skilled professionals in EV engineering is at an all-time high.

Key Engineering Roles in the EV Industry

Battery Engineer: Designs, develops, and tests advanced battery systems for optimal performance and safety.

Powertrain Engineer: Focuses on the design and development of electric motors, gearboxes, and related components.

High-Voltage Systems Engineer: Ensures the safety and efficiency of high-voltage electrical systems in EVs.

Controls Engineer: Develops control systems for battery management, motor control, and regenerative braking.

Manufacturing Engineer: Optimizes and automates production processes for EVs to improve efficiency and quality.

EV Design Engineer: Works on vehicle styling, structure, and integration of electric drivetrains.

Software Engineer: Develops embedded systems, vehicle control software, and autonomous driving features.

Charging Infrastructure Engineer: Designs and manages the deployment of EV charging networks.

Industry Demand and Growth Prospects

The global EV market is projected to reach $90 billion in India alone by 2030, with a CAGR of 36% in 2025, indicating robust job growth and high demand for engineers.

Major automakers and startups are creating thousands of new jobs, with investments in battery plants and manufacturing facilities leading to significant employment opportunities.

Companies like Tesla, Rivian, Tata Motors, Mahindra Electric, and Ola Electric are actively hiring engineers for various EV roles.

Career Development and Salary Outlook

Entry-level engineers can progress to senior technical roles, R&D managers, and even chief technology officers (CTOs) with experience and specialization.

High-paying roles include EV Design Engineer, Battery Technology Engineer, Power Electronics Engineer, and Autonomous Driving Engineer, with salaries ranging from ₹8,00,000 to ₹18,00,000 annually in India and competitive packages globally.

The sector values skills in CAD software, embedded systems, power electronics, materials science, and systems integration.

Emerging Trends and Future Opportunities

The shift toward sustainable transportation and government incentives is accelerating the need for engineers in EV manufacturing, battery technology, and charging infrastructure.

Engineers with expertise in AI, IoT, and autonomous systems are especially sought after as the industry evolves toward smart, connected vehicles.

The growth of EVs is also creating opportunities in related fields such as energy storage, grid integration, and renewable energy systems.

Conclusion

The EV industry offers a dynamic and future-proof career path for engineers, with opportunities spanning design, manufacturing, software, battery technology, and infrastructure. As the sector continues to expand, engineers with the right skills and adaptability will find abundant prospects for growth, innovation, and leadership in shaping the future of mobility.

Source: Click Here

#best btech college in jaipur#best engineering college in jaipur#top engineering college in jaipur#best private engineering college in jaipur#best btech college in rajasthan#best engineering college in rajasthan

0 notes

Text

How to Build the Ultimate Custom Land Rover Defender in 2025

Building a custom Land Rover Defender in 2025 is about more than restoring a vehicle — it’s about creating a timeless machine that blends vintage appeal with modern power, comfort, and reliability. Whether you're starting with a Defender 90 or Defender 110, choosing between a soft top or hard top, or exploring V8 swaps, EV conversions, or custom interiors, there’s never been a better time to start your build.

At Shoreline, we specialize in transforming classic Land Rover platforms into fully reimagined, road-ready machines that honor the past while performing like a modern SUV. This guide walks you through what goes into a full custom Defender build and what options are available today.

Choosing the Right Platform: Defender 90 vs. Defender 110

The first step is choosing your base. The Defender 90 is a short-wheelbase model known for its agility, classic proportions, and beach-runner vibes. It’s ideal for city use or weekend fun. The Defender 110 offers more interior space and versatility, making it a favorite for overland setups, family use, or luxury long-wheelbase builds.

If you’re going for a rugged safari-style Defender, a vintage Series 88 Land Rover, or a full-utility Defender 130 pickup, the platform shapes everything else — from ride feel to interior configuration.

Engine Options: From Classic Diesels to Modern Power

Modern builds give you far more than the original 2.5L diesel. You can choose engines like:

LS3 6.2L V8 – Over 430 hp, unmatched performance, and daily-driver refinement

GM 5.7L V8 – Old-school torque and simplicity, a reliable workhorse

Ford 2.3L EcoBoost – Light, efficient, turbocharged power

TD5 and TDi (200 and 300) – Classic diesel reliability, tunable and proven

EV Conversions – Tesla Model 3 motors or Hyper9 systems, delivering zero-emissions torque and up to 300 miles of range

A Defender LS3 conversion delivers modern highway performance with the unmistakable sound of a V8, while a TD5 build offers reliability and diesel tuning flexibility. For a green alternative, an electric Defender keeps the vintage body but swaps in a silent, high-torque powertrain with fast charging.

Soft Top or Hard Top: Lifestyle Choices

A big part of the Defender's personality comes from the roof style. A soft top Defender 90 is the classic open-air beach build — often with a Stayfast full-length canvas top. Soft tops are ideal for summer, warm climates, or anyone chasing that wind-in-your-hair experience.

Hard tops, on the other hand, are more secure, quieter, and compatible with roof racks, expedition setups, and overlanding accessories. Whether you want a Defender 110 with full-length canvas top or a 110 station wagon, we can custom-build the configuration to match your lifestyle.

Custom Interior Options

You’re not stuck with stripped-down military interiors. Today’s custom Land Rover builds often include:

Premium leather in custom stitch patterns

Heated seats, touchscreens, and smartphone integration

Classic Defender wood interior accents

Modern sound systems

Hidden AC vents and climate controls

Custom center consoles, dash trims, and gauges

You can go with olive green tweed, Barley leather, or two-tone schemes to evoke everything from safari to sport.

Wheels, Suspension, and Ride Feel

We offer deep-dish wheels, Fuchs-style alloys, beadlock rims, or classic steelies — each with their own vibe. For suspension, modern builds include upgraded coil setups, air suspension, or Old Man Emu shocks for better ride quality.

Handling improvements can bring a 1980s Defender up to par with today’s SUVs — making your restored Defender more usable than ever.

Electric Options: The EV Defender Revolution

EV builds are growing fast. A Tesla Defender conversion delivers blistering performance and silent 4WD. With up to 300 hp and 0–60 mph in 5 seconds, these builds rival modern Teslas while retaining the look and spirit of a classic 4x4.

Using a mid-mounted Tesla Model 3 motor, the drivetrain is reconfigured to send power to both axles, freeing up the engine bay for battery packs. Add in fast charging, digital clusters, and electric brake boosters, and your Defender becomes a fully modern EV — without the bloated size of new SUVs.

Restoration vs. Restomod: What’s the Difference?

A restored Defender stays true to the original — rebuilt engine, classic interior, minimal mods. A restomod Defender keeps the body lines but modernizes everything underneath. Think Defender V8 with custom AC, touchscreen, EV drivetrain, and luxury finishes. We help you choose the path that fits your vision and how you plan to drive it.

Legal Import and Registration

If you’re buying in the U.S., Shoreline handles Defender import paperwork, 25-year rule compliance, and DVLA re-registration. Whether it’s a Defender 90 from 1993 or a 1998 Defender 110, we guide it through the import process — so you don’t have to.

Ready to Build Your Defender?

Whether you're chasing a beach-ready Defender 90 soft top, a Defender 110 overland rig, or a full electric 4x4, we help you build something that’s functional, fast, and full of character.Visit shorelinevehicles.com to get started — and let’s build your custom Defender from the ground up.

0 notes

Text

Engine Reviews A Comprehensive Guide to Choosing the Right Engine

When it comes to evaluating and choosing engines—whether for cars, trucks, motorcycles, boats, or industrial equipment—the importance of detailed engine reviews cannot be overstated. Engines are the beating hearts of machines, and their performance, reliability, fuel efficiency, and durability determine how well a vehicle or equipment will serve over time. In this article, we will explore various aspects of engine reviews, the key factors to consider, and a breakdown of some top-rated engines across different categories.

Understanding Engine Reviews

Engine reviews are detailed assessments of engine models based on parameters such as power output, torque, fuel economy, reliability, maintenance needs, and environmental impact. Reviews are often published by automotive experts, engineering publications, consumer review sites, and verified users. They help consumers make informed decisions based on real-world performance data.

These reviews are especially helpful in differentiating between manufacturers, engine types (diesel vs. petrol vs. electric), and specific models within a brand’s lineup. They also highlight advantages and potential drawbacks that may not be obvious from technical specifications alone.

Key Factors Evaluated in Engine Reviews

Performance and Power Output

Performance is measured in terms of horsepower (hp) and torque. For many users, especially in automotive applications, the balance between power and efficiency is crucial.

Reviewers often test 0-60 mph acceleration, towing capacity, and response time under load.

Fuel Efficiency

Modern engines are rated not just by how powerful they are, but by how efficiently they consume fuel. Reviews usually include real-world miles-per-gallon (MPG) figures.

Turbocharged engines, hybrid setups, and electric motors are often evaluated for their fuel-saving advantages.

Durability and Reliability

Engine longevity is a top concern. Reviews often include insights from long-term use or reliability reports from users and automotive reliability indices (like J.D. Power and Consumer Reports).

Common issues, component wear rates, and ease of maintenance are also reviewed.

Technology and Innovation

Many reviews highlight the inclusion of features such as variable valve timing, direct injection, cylinder deactivation, and start-stop systems.

Integration with hybrid or electric drivetrains is also becoming a standard focus area.

How to Read and Trust an Engine Review

When evaluating engine reviews, it’s important to assess the source’s credibility. Trustworthy reviews typically Consumer review platforms like Edmunds, Car and Driver, Motorcycle News, and BoatTEST.com offer reliable reviews based on expert testing. Forums and Reddit communities often provide real-world insights that complement expert reviews.

Trends in Engine Development and Future Reviews

Engine reviews are evolving with the rapid adoption of electric powertrains. In addition to traditional gasoline and diesel engines, electric motors and hybrid setups are increasingly reviewed.

Tesla Electric Motors: Lauded for instant torque and near-silent operation.

Toyota Hybrid Systems: Highly rated for reliability and smooth transitions between electric and petrol power.

Ford PowerBoost Hybrid V6: A standout in the truck segment for power and efficiency.

As emissions regulations tighten and technology advances, engine reviews will place more emphasis on software integration, battery performance, thermal efficiency, and autonomous compatibility.

Conclusion

Engine reviews are invaluable resources for anyone purchasing a vehicle, boat, motorcycle, or industrial equipment. A well-reviewed engine can mean years of reliable performance, lower fuel costs, and greater resale value. Whether you are a car enthusiast, a daily commuter, or a fleet manager, understanding the core components of engine reviews enables smarter, long-term decision-making. With a constant stream of innovation and evolving standards, staying informed through trusted reviews is more essential than ever.

0 notes

Text

My neighbours just sold their six year old Tesla and bought a brand new Polestar to replace it. Polestar is Volvo’s electric car.

They explicitly did this because they were embarrassed to be seen driving a Tesla in these times. Not because there was something wrong with the car itself. It was working fine.

Now, these neighbours aren’t hurting for money. They’re both junior corporate lawyers. But they’re patriotic Canadians and Elon Musk disgusts them. They also thought they’d better sell their Tesla now, before the whole Tesla owning community of Canada gets in on it, and the resale value drops significantly. That’s where the lawyer part comes in, I suspect.

One of the oddities of the Vancouver, Canada real estate market is that prices have hit the stratosphere since 2000, when they first started climbing.

I bought a fixer upper one bedroom apartment in this building in 2002, so over 20 years ago, for slightly less than $100,000 CAD. I was extraordinarily lucky to get in when I did, and wouldn’t have if my abusive grandfather hadn’t left me $17,000 CAD in his will, which served as my downpayment on the mortgage. I was 26, I had no savings. In 2025, you couldn’t even buy a parking space in Vancouver for less than $100,000 CAD!

The junior corporate lawyers who just bought the Polestar and jettisoned their Tesla bought into the building in 2022, and I believe paid about $700,000 CAD for their two bedroom unit.

The neighbourhood and the building have changed significantly since 2002 when I moved in. Then it was mostly blue collar workers, nurses, and teachers. Now it’s corporate lawyers with money to buy a Polestar. And they put a sign for the Conservative Party in their window at the last provincial election. So not exactly bleeding heart liberals. But at least they don’t like Elon Musk.

So Elon and Tesla have lost even the corporate lawyers.

DOGE will be a testament to how government agencies are efficient and free of fraud.

Naming his fictional agency after a meme crypto coin will be a testament to Elon Musk's fraud and inefficiency as his highly-subsidized companies enter extinction.

1K notes

·

View notes

Text

Electric Cars Outsell Diesels

Breaking sales down by types of powertrain, conventional cars with gasoline engines accounted for 35.3 percent of new registrations. Conventional hybrids were 17.1 percent of the new car market followed by electric cars at 14.6 percent. Diesel deliveries came in at 13.6 percent while deliveries of plug-in hybrids totaled 7.7 percent. According to Dataforce 2023, the most successful model in Europe across all drive types was the Tesla Model Y with 254,822 units sold, ahead of the combustion models Dacia Sandero (235,893) and VW T-Roc (206,438)(..)

P.S. Light passenger diesel vehicle market is slowly dying in Europe...meanwhile Meanwhile, Donald Trump and his followers steer the American auto industry into technological backwardness...!

Pretty soon, the need to import fossil fuels will significantly decrease in Europe...

2 notes

·

View notes

Text

Not a Regular Mom — a Cool Mom . . . in a Cool Mom Car!

So here are a few cool mom cars that will knock your socks off.

It’s a tale as old as time. How do we find the balance between safety and fashion?

It’s a tough combination, but MOBILESTYLES has some tips for you.

Kia Sorento

With its low-price tag, the Kia Sorento is as accessible as it is fashionable. Equipped with three rows of seating, this car is perfect for families on the go. The Kia is also available as a hybrid and plug-in hybrid if you’re worried about fuel efficiency. Compact, but spacious, the Kia Sorento has a limited warranty plan that covers your vehicle for five years or to 60,000 miles and a Powertrain warranty that covers it for 10 years or to 100,000 miles. This long-term guarantee makes the Kia Sorento a trustworthy investment.

Ford Explorer

Thanks to plenty of storage space, the Ford Explorer is ready for any challenge thrown its way. Whether it’s the neighborhood bake sale or soccer practice, there’s enough room to transport whatever your family needs. With seating for seven in its newest model, the Ford Explorer can fit four carry on suitcases behind its removable third row. This last row of seating is perfect for small children, but some adults and older children may find it too squishy to get comfortable. However, with this optional last row folded down, around 31 bags can be stored in this vehicle’s trunk. Say less! Moms, this is the car for you.

Honda Pilot

Awarded best compact SUV buy for the money in 2021, the Honda Pilot not only provides a great deal, but it also provides accessibility. With the ability to tow over 5,000 pounds, the 2022 Honda Pilot model has standard forward-collision warning and automated emergency braking. This car also comes equipped with lane-departure warning and lane-keeping assist. These features, along with an upgraded appearance, make this car more fashionable than the typical mom minivan — not to mention safer!

Tesla SUV

Tesla has two SUV models: Tesla X and Tesla Y. What both of the cars have in common are their state of the art safety systems. This autopilot utilizes eight external cameras, 12 ultrasonic sensors, and radar to track road conditions. This specialized feature prioritizes the driver’s autonomy while still ensuring the driver is aware of road conditions at all times. This car, like most moms, is ever vigilant!

Ford Mustang Mach-E

This Ford’s electric battery is stored under the floor, allowing for maximized storage space. With both a front and back trunk, this model is ready to store anything you need. In fact, its front trunk is even made of washable plastics. This makes this compartment perfect for storing ice or other messy products. For any Moms that are into party planning, this car’s additional 29 cubic feet of rear storage space (60 cubic feet with the back seats pulled up) is up for any challenge.

Volvo XC90 Hybrid

This model’s interior design is considered a “true masterpiece.” This car’s comfy yet roomy interior makes it easy to transport large families. Its advanced package now includes a 360-degree camera system, head-up display, and an enhanced air purification system, and its front dash is also optimized to have a user-friendly interface (which is perfect for any of the technophobes in the audience).

Do you think your car is a cool mom car? What makes it so?

Let us know in the comments. Tag @mobilestylesapp on Instagram, Facebook, and Twitter!

0 notes

Text

Automotive Pressure Sensor Market Drivers Include Emission Control And EV Performance Optimization

The automotive pressure sensor market is experiencing robust growth, primarily driven by strict regulatory mandates for emission reduction. Governments across the globe have introduced increasingly stringent emission standards to combat rising pollution levels. This push has necessitated the integration of advanced pressure sensors in modern vehicles to accurately monitor and control fuel, oil, and air systems. Sensors that detect and report pressure levels within exhaust, fuel injection, and intake manifold systems are vital in ensuring vehicles stay compliant with emission norms. The Euro 6 standards in Europe and Bharat Stage VI in India have significantly influenced the deployment of more reliable and responsive pressure sensors. Manufacturers are being compelled to adopt sensors that support precision control in real-time to meet these efficiency targets. According to a 2024 industry report, more than 65% of newly manufactured vehicles in the EU integrate at least three types of pressure sensors, underlining the growing dependence on this technology for emission control.

Vehicle electrification is another significant driver reshaping the automotive pressure sensor landscape. The growing shift toward electric vehicles (EVs) and hybrid vehicles has generated a rising need for battery management systems, brake systems, and HVAC pressure monitoring. EVs require thermal management systems that are dependent on accurate pressure and temperature feedback to ensure safe operation. Pressure sensors help detect fluid leakage, over-pressurization, and help in energy optimization—critical in extending battery life and improving performance. Moreover, electric powertrains often use pressure sensors in coolant and lubrication systems to prevent overheating and component failure. In hybrid vehicles, pressure sensors assist in the seamless transition between combustion and electric drive systems, supporting energy efficiency and smooth operation. Tesla, BYD, and other EV leaders have been continuously incorporating advanced MEMS-based pressure sensors to enhance powertrain responsiveness.

Another pivotal driver is the growing consumer and regulatory emphasis on vehicular safety and advanced driver assistance systems (ADAS). Pressure sensors are integral to tire pressure monitoring systems (TPMS), airbag systems, and brake systems. TPMS, now mandatory in many regions like North America and the EU, helps in preventing accidents by ensuring optimal tire pressure. Similarly, pressure sensors in braking systems enable features such as anti-lock braking systems (ABS) and electronic stability control (ESC), contributing to accident prevention and vehicle stability. These applications highlight how sensor technology is no longer a premium feature but a safety necessity. As per a recent survey, 75% of automotive safety system suppliers rate pressure sensors as a critical component in their product roadmap.

Fuel efficiency is yet another driver influencing adoption. Accurate pressure readings help in optimizing engine combustion, air-fuel ratio, and fuel injection. Automakers are increasingly relying on real-time pressure data to fine-tune engine performance under varying conditions. This not only reduces fuel consumption but also extends the engine lifespan. The rise of connected vehicles and IoT integration further expands the role of pressure sensors in predictive maintenance. Modern vehicles now feature diagnostics systems that alert users about pressure anomalies in oil, fuel, and coolant systems, reducing downtime and maintenance costs. For fleet managers, these insights translate to better operational efficiency and reduced total cost of ownership.

Technological advancements in microelectromechanical systems (MEMS) are transforming the pressure sensor landscape by making sensors smaller, more affordable, and highly accurate. These compact sensors can be embedded in tight spaces without compromising vehicle design. MEMS technology has opened the door for integration in both combustion engine and electric vehicle architectures. Additionally, manufacturers are developing sensors that can function across extreme temperature ranges, endure vibrations, and resist corrosion, expanding their use in off-road and heavy-duty vehicles.

Customization and modular sensor design are also growing trends catering to automakers’ demand for scalable solutions. OEMs are now seeking sensor platforms that can be modified based on vehicle type and performance requirements. This modularity helps reduce R&D and production costs, accelerating sensor adoption. The growing collaboration between sensor manufacturers and OEMs is facilitating co-designed solutions, allowing seamless integration into vehicle systems and enhancing overall vehicle intelligence.

Lastly, rising consumer demand for premium and luxury vehicles is also driving the market forward. High-end vehicles come equipped with sophisticated onboard systems that require a wide range of pressure sensors—from cabin pressure monitoring for air suspension systems to pressure feedback in adaptive cruise control. As the share of premium vehicles grows, so does the pressure sensor count per vehicle, further fueling market demand.

In conclusion, the automotive pressure sensor market is driven by a synergy of regulatory mandates, electric mobility trends, safety expectations, and technological innovation. As vehicles become smarter, safer, and greener, pressure sensors will remain indispensable to the next generation of automotive design and performance.

0 notes

Text

SiC Crystal Substrate Market : Emerging Trends, and Global Forecast (2025 - 2032)

Global SiC Crystal Substrate Market size was valued at US$ 1,840 million in 2024 and is projected to reach US$ 4,290 million by 2032, at a CAGR of 12.5% during the forecast period 2025-2032.

Silicon carbide (SiC) substrates are wide bandgap semiconductor materials essential for manufacturing high-performance electronic devices. These crystalline substrates enable power electronics with superior thermal conductivity, high breakdown voltage, and energy efficiency compared to traditional silicon. The market offers both conductive (for power devices) and semi-insulating (for RF devices) wafer types, typically in 4-inch, 6-inch, and emerging 8-inch diameters.

Market growth is primarily driven by accelerating adoption in electric vehicles, where SiC components improve range and charging efficiency. The automotive sector accounted for over 60% of demand in 2023, with Tesla’s vehicle production alone contributing significantly to market penetration. Furthermore, renewable energy applications in solar inverters and industrial power systems are creating new growth avenues. Key technological advancements include the transition to 8-inch wafers, which improves production economics by approximately 35% through better material utilization.

Get Full Report : https://semiconductorinsight.com/report/sic-crystal-substrate-market/

MARKET DYNAMICS

MARKET DRIVERS

Accelerated Adoption in Electric Vehicles Fuels Market Expansion