#Synthetix Network Token

Explore tagged Tumblr posts

Link

0 notes

Photo

Solana's Resurgence: Exploring the Rapid Growth and Innovative Solutions in Q2 2024

The Rise of Solana: A Q2 2024 Retrospective

As we approach the final quarter of 2024, the cryptocurrency landscape continues to evolve at a breakneck pace. Among the standout performers of the year, Solana has emerged as a force to be reckoned with, showcasing impressive growth and innovative solutions that have captured the attention of investors, developers, and enthusiasts alike.

Solana's Q2 Performance: A Closer Look

The second quarter of 2024 saw Solana cement its position as a leading blockchain platform. One of the most significant developments came from Synthetix, a popular decentralized finance (DeFi) protocol. In Q2, Synthetix V3 launched perpetual markets for both SNX and SOL on the Base network, driving daily trading volumes to an impressive $53 million. This move not only expanded Solana's reach but also demonstrated the growing demand for SOL-based financial products.

Mainnet 2024: A Hub for Solana Enthusiasts

The upcoming Mainnet 2024 event in New York City, scheduled from September 30 to October 2, has generated significant buzz in the crypto community. A highlight of the conference will be a panel discussion on the "State of Solana," featuring industry experts and thought leaders. This panel underscores Solana's growing importance in the blockchain ecosystem and provides a platform for in-depth analysis of its recent developments and future prospects.

The NFT Renaissance on Solana

While some may have written off NFTs as a passing fad, influential figures in the space remain bullish on their potential. Roham Gharegozlou, CEO of Dapper Labs, is set to speak at Mainnet 2024 about the enduring potential of NFTs and on-chain intellectual property. Given Solana's reputation for fast and low-cost transactions, it has become an increasingly popular choice for NFT projects, further solidifying its position in this evolving market.

Solana's Technical Advancements

Solana's success can be attributed, in part, to its continuous technical improvements. The blockchain's ability to handle high transaction volumes at low costs has made it an attractive option for developers and users alike. This has led to a surge in daily active users and transaction counts, with some reports indicating a 73% quarter-over-quarter increase in average daily transactions across the broader crypto ecosystem.

The Role of Innovative Tools in Solana's Growth

As Solana's ecosystem expands, developers and entrepreneurs are seeking efficient ways to leverage its capabilities. One such tool that has gained traction is the Solana Token Creator, which simplifies the process of launching tokens on the Solana blockchain. This user-friendly platform has lowered the barrier to entry for many projects, contributing to the network's rapid growth.

Building a Stronger Solana Community

The success of any blockchain network relies heavily on its community of developers, users, and supporters. Recognizing this, many Solana-focused events and hackathons have been organized throughout the year. These gatherings provide opportunities for networking, knowledge sharing, and collaboration, further strengthening the Solana ecosystem.

Challenges and Opportunities Ahead

Despite its impressive performance, Solana faces stiff competition from other leading blockchain platforms. Ethereum's ongoing upgrades and the emergence of new layer-2 solutions pose significant challenges. However, Solana's focus on scalability and user experience continues to attract developers and users seeking high-performance blockchain solutions.

The Future of Solana: Innovation and Expansion

As we look towards the future, Solana's trajectory appears promising. The platform's commitment to innovation is evident in its ongoing development efforts and community initiatives. With the growing adoption of decentralized applications (dApps) and the increasing demand for scalable blockchain solutions, Solana is well-positioned to capitalize on these trends.

One area where Solana could see significant growth is in the realm of decentralized finance (DeFi). As more financial products and services migrate to blockchain platforms, Solana's high-speed, low-cost infrastructure could prove to be a game-changer. Tools like the Crypto Website Builder are making it easier for DeFi projects to establish a strong online presence, further fueling growth in this sector.

Conclusion: Solana's Bright Future

As we reflect on Solana's performance in Q2 2024 and look ahead to the rest of the year, it's clear that the platform has established itself as a major player in the blockchain space. With its robust technology, growing ecosystem, and passionate community, Solana is poised for continued success. As the Ethereum Foundation and other blockchain organizations continue to innovate, the competition will undoubtedly drive further advancements across the entire crypto landscape. For investors, developers, and enthusiasts alike, Solana's journey is one to watch closely as we move into the next phase of blockchain adoption and innovation.

0 notes

Text

List of 15 Best DeFi Yield Farming Platforms

In the rapidly evolving landscape of cryptocurrency, yield farming has emerged as a popular method for crypto holders to earn passive income. Leveraging decentralized finance (DeFi) protocols, investors can stake or lend their assets to earn rewards in the form of additional tokens. Here’s a curated list of 15 prominent yield farming crypto platforms that stand out in the market today:

Compound Finance

Known for its robust lending and borrowing features.

Offers competitive interest rates on deposited assets.

Aave

Allows users to earn interest on deposits and borrow assets.

Known for its innovative flash loan feature.

Yearn Finance (YFI)

Aggregates yields from various DeFi platforms to optimize returns.

Features automated yield farming strategies.

Uniswap

Popular decentralized exchange (DEX) that facilitates liquidity provision.

Users can earn trading fees by providing liquidity to the platform.

SushiSwap

Forked from Uniswap, offering additional features and incentives.

Rewards liquidity providers with SUSHI tokens.

Balancer

Enables users to create liquidity pools with customizable asset ratios.

Rewards liquidity providers with trading fees and BAL tokens.

Curve Finance

Optimized for stablecoin trading and low slippage.

Rewards liquidity providers with trading fees and CRV tokens.

Synthetix

Focuses on synthetic assets and trading.

Users can stake SNX tokens to earn rewards.

MakerDAO

Known for its stablecoin DAI, backed by collateralized debt positions (CDPs).

Users can earn fees through the stability fee mechanism.

PantherSwap

Offers yield farming opportunities with high APRs.

Incentivizes liquidity providers with PANTHER tokens.

Cream Finance

Provides lending, borrowing, and yield farming services.

Users can earn by supplying liquidity to various pools.

Harvest Finance

Automates yield farming strategies to maximize returns.

Integrates with various DeFi protocols for optimized farming.

Bancor

Offers automated market maker (AMM) functionality.

Users can earn trading fees and BNT tokens by providing liquidity.

QuickSwap

Built on the Polygon network for low-cost transactions.

Rewards liquidity providers with QUICK tokens.

PancakeSwap

Popular AMM on the Binance Smart Chain.

Users can farm CAKE tokens by providing liquidity.

Conclusion

The ICO development services sector continues to evolve alongside the growth of DeFi. As yield farming gains popularity, investors are increasingly seeking reliable platforms to maximize their crypto assets. Whether you're a newcomer exploring these opportunities or an experienced investor diversifying your portfolio, these 15 platforms offer a spectrum of options to consider. By staying informed and adapting to market trends, investors can harness the potential of DeFi yield farming to generate sustainable returns.

In the realm of DeFi yield farming, the landscape is vast and ever-changing, with these platforms leading the charge in innovation and user rewards. Whether you're looking for liquidity provision, automated strategies, or simply exploring new avenues for passive income, these platforms offer diverse opportunities to engage with the evolving world of decentralized finance.

0 notes

Text

0 notes

Text

Altcoin piyasası, önümüzdeki hafta çeşitli projeler için kıymetli tesirleri olması beklenen bir dizi token kilidi açma aktifliğine şahit olacak. Bu sürümler, alım satım faaliyetlerinin artmasına ve potansiyel olarak piyasa oynaklığının yükselmesine neden olabilir. İşte planlanan değerli token kilidi açma etkinliklerinden bazıları…Bu altcoin projeleri için kritik haftaAleph Zero (AZERO), piyasa pahasının %0,71’ini temsil eden 1,50 milyon dolar bedelinde tokenın kilidini açacak. Aktiflik 10 Temmuz 2023 tarihinde saat 03:00’te gerçekleştirilecek. Projenin mevcut piyasa kıymeti 211,15 milyon dolar düzeyinde. LooksRare (LOOKS) de 10 Temmuz 2023 tarihinde saat 03:00’te bir token kilidi açma aktifliği gerçekleştirecek. Piyasa pahası 31,93 milyon dolar olan projede, piyasa bedelinin %5,34’üne denk gelen 1,71 milyon dolar pahasında token kullanıma sunulacak. Sipher (SIPHER), 5,27 milyon dolarlık piyasa kıymetinin %20,64’üne denk gelen 1,09 milyon dolar pahasında tokenın kilidini açacak. Token kilidini açma aktifliğinin 10 Temmuz 2023 saat 03:00’te yapılması planlanıyor.ChainGPT (CGPT), tokenlarının değerli bir kısmının kilidini açacak ve 3,13 milyon dolar kullanılabilir hale gelecek. Bu, projenin 6,49 milyon dolarlık piyasa kıymetinin %48,34’ünü temsil ediyor. Token kilidinin 11 Temmuz 2023 saat 18:00’de açılması planlanıyor. Tıpkı gün, 11 Temmuz 2023, saat 03:00’te, Internet Computer (ICP), 1,78 milyar dolarlık piyasa pahasının %0,76’sını oluşturan 13,47 milyon dolar pahasında token piyasaya sürecek.Wilder World (WILD), 84,90 milyon dolarlık piyasa pahasının %2,00’sini temsil eden 1,69 milyon dolar pahasında tokenı piyasaya sürecek. Aktiflik 11 Temmuz 2023 tarihinde saat 03:00’te gerçekleşecek. BitMEX (BMEX), 6,67 milyon dolar pahasında tokenin kullanıma sunulmasıyla değerli bir token kilidi açma aktifliğine sahiptir. Bu, 35,91 milyon dolarlık piyasa kıymetinin %18,57’sini temsil ediyor. Açıklamanın 11 Temmuz 2023 saat 03:00’te yapılması planlanıyor.Diğer kripto paralar da unlock aktifliği gerçekleştirecekYine 11 Temmuz’da token kilidi açma aktiflikleri olan projeler ortasında GameFi (GAFI), WeWay (WWY), Cripco (IP3) var. 12 Temmuz’da Aptos (APT), Fracton Protocol (FT), Boba Network (BOBA) unlock yapacak. 13 Temmuz’da Games for a Living (GFAL), DappRadar (RADAR), Sweat Economy (SWEAT), bulunmakta. RSS3, UXD Protocol Token (UXP), Biconomy (BICO), Artificial Liquid Intelligence (ALI), Everdome (DOME) ise 14 Temmuz’da kilit açacak. 15-16 Temmuz tarihlerinde Zebec (ZBC), FitBurn (CAL), BitDAO (BIT), Synthetix Network Token (SNX), Nym (NYM), Highstreet (HIGH), Umee (UMEE), Sidus (SIDUS), IguVerse IGU (IGU) ve Uniswap (UNI) unlock’u varBu token kilit açma aktiflikleri piyasada kıymetli değişimler yaratma ve trader ve yatırımcıların dikkatini çekme potansiyeline sahiptir. Bununla birlikte, iştirakçilerin dinamik kripto para ortamında gezinirken kapsamlı araştırma yapmaları ve dikkatli olmaları kıymetlidir.

1 note

·

View note

Text

Bitfinity Raises $7M to Develop Bitcoin Layer 2 Network on Internet Computer Protocol

Bitfinity, a blockchain project, has raised $7 million in funding to develop a Bitcoin Layer 2 network based on the Internet Computer protocol. The funding will support the upcoming launch of Bitfinity's network, which aims to enhance decentralized finance activities on the Bitcoin blockchain. Investors in the project include Polychain Capital, ParaFi Capital, and Warburg Serres.

Bitfinity's network is Ethereum Virtual Machine-compatible, meaning that Ethereum developers will be able to build Bitcoin-enabled decentralized applications on the platform. The network is set to offer faster speeds and lower costs compared to Ethereum, which could attract developers and users seeking improved performance. Bitfinity has already attracted several dApps planning to build on its platform, including decentralized exchange Sonic, derivatives liquidity protocol Synthetix, and decentralized borrowing protocol Liquity.

The mainnet launch of Bitfinity's network is scheduled for later this month or early February. After the launch, the company plans to grow its team from around 20 to 25 people to further develop and expand its ecosystem. Bitfinity tokens are expected to be listed on several exchanges following the mainnet launch.

Read the original article

#blockchain #bitcoin #decentralizedfinance #cryptocurrency

0 notes

Text

What are crypto synthetic assets? Crypto synthetic assets, also known as “synthetic assets,” are a class of digital financial instruments created to mimic the value and performance of actual financial assets or assets from the real world, such as stocks, commodities, currencies, or even other cryptocurrencies, without actually owning the underlying assets. These artificial assets are produced using complex financial derivatives and smart contracts on blockchain platforms, mainly in decentralized finance (DeFi) ecosystems. The ability to create decentralized smart contracts on blockchain systems like Ethereum, use collateral to secure value, track target asset prices precisely and create flexible leveraged or derivative products are important characteristics of crypto synthetic assets. DeFi customers now have access to a wider range of financial markets and assets, which lessens their reliance on conventional intermediaries. Users should take caution, though, as these instruments add complexity and risk, necessitating a thorough knowledge of their underlying workings and effects on investing strategies Traditional vs. crypto synthetic assets Traditional assets are tangible or monetary items like stocks, bonds and commodities exchanged on established financial markets. In contrast, crypto synthetic assets are digital representations built on blockchain technology and intended to resemble the value and performance of these conventional assets. The fundamental distinction between traditional and crypto synthetic assets is that traditional assets are physical or paper-based, whereas crypto synthetic assets only exist in digital form on blockchain networks. While crypto synthetics have advantages over traditional assets in terms of accessibility, liquidity and programmability, they also come with unique risks and complexities. Types of crypto synthetic assets Synthetic stablecoins Digital tokens known as synthetic stablecoins are intended to mimic the value and stability of fiat money, such as the United States dollar or the euro. They give people a mechanism to exchange goods and services and store value in the cryptocurrency ecosystem without experiencing the volatility of cryptocurrencies.One example of a synthetic stablecoin is sUSD, which is developed on the Synthetix platform. It aims to provide users with access to a stable form of digital cash that matches the value of the U.S. dollar.Tokenized commodities and equitiesCommodities and stocks that have been tokenized serve as digital representations of real-world assets like gold, oil, stocks and other commodities on blockchain networks. These synthetic assets allow for the decentralized fractional ownership and exchange of conventional assets.An example of a synthetic asset that tracks the price of crude oil is sOIL, which is also developed on the Synthetix platform. Without really holding any oil, it enables investors to become more exposed to changes in the price.Leveraged and inverse tokensSynthetic assets, known as leveraged and inverse tokens, are developed to amplify or counteract the price changes of an underlying asset — inverse tokens profit when the underlying asset’s price decreases, while leveraged tokens magnify profits and losses.For instance, BTC3L (Binance Leveraged Tokens) seeks to produce daily returns that are three times higher than the price of Bitcoin (BTC). BTC3L should climb by 3% if Bitcoin increases by 1%.Yield-bearing synthetic assetsWithin the DeFi ecosystem, yield-bearing synthetic assets give holders returns through staking or lending, providing a chance to generate passive income.An example of a synthetic asset is cDAI, developed by the Compound protocol. Dai (DAI) stablecoins can be given to participate in lending operations on the Compound platform and earn interest.

Since cDAI accrues interest to holders over time, it qualifies as a yield-bearing synthetic asset. Applications of crypto synthetic assets Trading and investing opportunitiesCrypto synthetic assets offer a gateway to a variety of trading and investment opportunities. They enable traders to engage in leveraged trading, increasing their exposure to market fluctuations and potentially generating bigger returns (or losses) than they could from more conventional trading. Additionally, synthetic assets cover a wide range of underlying assets inside the crypto ecosystem, including stocks and commodities, giving investors a straightforward way to diversify their portfolios.Yield farming and liquidity provisionUsers who stake cryptographic synthetic assets in DeFi protocols can engage in yield farming, earning incentives in the form of extra synthetic assets or governance tokens for actively participating in liquidity provision and DeFi operations. Synthetic assets also significantly increase liquidity pools and DeFi platforms’ overall liquidity, which is essential for facilitating effective trading, lending and borrowing within the DeFi ecosystem.Risk management and hedging strategiesSynthetic assets provide strong risk management tools and hedging possibilities. Traders and investors can use inverse synthetic assets as efficient hedges to protect their portfolios from declines in the underlying assets. Synthetic stablecoins also offer a decentralized alternative to conventional stablecoins, protecting the value of assets in the face of the market’s inherent volatility. Role of DeFi in the creation and trading of synthetic assets The development and trade of synthetic assets are fundamental to changing the conventional financial environment, and DeFi is a key player in this process. DeFi platforms revolutionize how we interact with financial instruments by utilizing blockchain technology and smart contracts to make the creation, issue and trading of synthetic assets straightforward.First, DeFi eliminates the need for intermediaries, improving accessibility and productivity. Users can issue tokens that replicate the value of real-world assets, such as equities, commodities and fiat currencies, by collateralizing cryptocurrencies.Second, DeFi’s open and permissionless design encourages innovation by allowing programmers to test different synthetic asset designs and trading strategies. By providing consumers with 24/7 access to a wide variety of assets, this innovation has democratized access to international markets.DeFi platforms also offer liquidity pools where users can easily trade synthetic assets. These systems promote yield farming by rewarding users for donating money and participating in the ecosystem. Advantages of crypto synthetic assets Cryptographic synthetic assets offer many benefits for the digital finance space. The ability to provide access to a variety of assets, including traditional stocks, commodities and currencies, is the most important of these advantages because it enables users to seamlessly diversify their portfolios within the cryptocurrency space, reducing risk and improving investment strategies.These assets also open the door to leverage, allowing traders to increase their exposure to asset price volatility and perhaps generate higher returns. They play a crucial role in DeFi, enabling users to participate actively in yield farming and liquidity provision and earning rewards for doing so.Additionally, synthetic assets provide the foundation for liquidity pools, boosting the overall liquidity of DeFi platforms — a crucial component for enabling effective trading and lending activities. These resources also serve as essential risk management

tools, giving consumers the skills they need to protect their investments against erratic price fluctuations. Challenges and Risks concerned with synthetic assets The use of synthetic assets in the crypto and blockchain industries comes with a number of risks and issues that need to be carefully considered. The possibility of smart contract flaws or exploits, which might lead to significant losses, is one of the main worries. For instance, in the infamous DAO attack of 2016, a smart contract vulnerability resulted in the theft of about $50 million worth of Ether (ETH), highlighting the risks posed by these complex financial instruments.Another issue is market liquidity, as some synthetic assets may have less of it than their counterparts in the real world. This could result in price manipulation or slippage during trading, which would affect the stability of the market as a whole. Furthermore, regulatory oversight continues to be a serious concern as governments throughout the world struggle to define and control these unique financial products. The continuing legal disputes and regulatory changes involving stablecoins like Tether (USDT) provide an example of the possible legal difficulties that synthetic assets may encounter.Finally, over-reliance on oracle systems, which provide smart contracts access to real-world data, creates security risks. For instance, if an oracle is compromised, it may offer erroneous data, which may impact the utility and value of artificial assets that rely on it.

0 notes

Text

Defi Market Rebounds: Value Locked Rises to Nearly $42 Billion, Token Market Swells

Defi Resurgence: $45 Billion Market Cap Achieved Amidst Mixed Performance in Top Tokens As of Sunday, August 13, 2023, the defi token market is worth $45.08 billion with approximately $1.8 billion traded in 24 hours. This represents a daily increase of 6.17%, and the trade volume has risen by 6.39%. Chainlink (LINK) emerged as one of the top gainers this week among the ten leading defi tokens, with its value jumping by 5.14% within a week’s time. Nonetheless, coins such as synthetix (SNX) and injective (INJ) slipped between 2.70% and 3.36% over the previous week. During the past week, ellipsis (EPS) saw a significant rise of 129%, while thorchain (RUNE) climbed by 49.29%. On the other hand, persistence (XPRT) plummeted by 12.47%, and mobox (MBOX) suffered a decline of 10.94%. Curve’s CRV token continued to struggle after a recent hacking incident, falling by another 4.81% this week. While defi tokens experienced growth in the past day, defi’s total value locked (TVL) reached $41.94 billion on Sunday, August 13. The TVL nearly slipped below $40 billion on August 2 but managed to stay above this critical level. Lido Finance leads the pack with TVL size, boasting a significant $15.11 billion in its liquid staking protocol—an increase of 2.34% within the past week. Following Lido, Makerdao, Aave, Uniswap, and Tron’s Justlend protocol are ranked based on TVL size on Sunday. Out of 202 blockchain platforms, Ethereum’s TVL dominates by over 58% with a sizable $24.38 billion. Tron, BSC, Arbitrum, Polygon, Optimism, Avalanche, Mixin, Solana, and Cronos trail in its wake. Tron’s TVL commands a 13.31% market share with an overall $5.56 billion on Sunday morning at 9:30 a.m. Eastern Time. Lastly, a staggering 10.89 million ether is stashed in 23 distinctive liquid staking defi protocols related to ethereum (ETH), which translates to a worth of $20.252 billion—a significant sum within the world of value-locked across the 202 blockchain networks. In fact, these 23 defi protocols built on ETH liquid staking account for nearly half (48.28%) of the entire $41.94 billion total locked in defi this weekend. What do you think about the state of decentralized finance protocols and tokens this month? Share your thoughts and opinions about this subject in the comments section below. Read the full article

0 notes

Text

Top DeFi Protocols to Watch Out for in 2023

Introduction:

The world of decentralized finance (DeFi) continues to evolve at a rapid pace, revolutionizing traditional financial systems and offering users greater control over their financial assets. As we step into 2023, the DeFi landscape is poised for even more innovation and growth. In this article, we will explore some of the top DeFi protocols to keep an eye on throughout the year.

Uniswap V3: Uniswap, one of the pioneering decentralized exchanges (DEX), released its third version, Uniswap V3, with improved features to enhance user experience and capital efficiency. With concentrated liquidity and multiple fee tiers, Uniswap V3 aims to further optimize trading strategies and provide users with enhanced control over their trading parameters.

Aave: Aave remains a significant player in the DeFi lending and borrowing sector. Known for its flash loans and innovative interest rate models, Aave continues to attract users seeking efficient ways to earn interest on their cryptocurrencies and access instant loans without intermediaries.

SushiSwap: SushiSwap has gained substantial traction as a prominent decentralized exchange and automated market maker (AMM). With features like yield farming, staking, and its own governance token, SUSHI, the protocol aims to provide users with new opportunities to generate returns on their crypto holdings.

MakerDAO: As a pioneer in the world of decentralized stablecoins, MakerDAO's Dai continues to be a cornerstone in the DeFi ecosystem. Its collateral-backed model, driven by the MKR token, ensures stability and decentralization in the issuance of stablecoins.

Compound: Compound is another major player in the lending and borrowing space. Its algorithmic interest rate determination and governance structure have garnered attention from both users and developers. As it continues to innovate, Compound remains a key platform for users looking to lend or borrow various cryptocurrencies.

Curve Finance: Curve Finance stands out as a specialized AMM optimized for stablecoin trading. Its low slippage and low fee structure make it an attractive choice for users looking to trade stablecoins with minimal cost.

Synthetix: Synthetix focuses on creating synthetic assets, allowing users to gain exposure to real-world assets without holding the underlying assets themselves. With an expanding list of synthetic assets and a governance token, SNX, Synthetix is pushing the boundaries of what's possible in the DeFi space.

Yearn Finance: Yearn Finance operates as a yield aggregator, automatically moving user funds between various lending protocols to optimize returns. Its suite of products simplifies yield farming for users, making it an appealing option for those seeking passive income opportunities.

PancakeSwap: For those operating on the Binance Smart Chain (BSC), PancakeSwap offers a DeFi platform similar to Uniswap. With lower transaction fees compared to the Ethereum network, PancakeSwap has become a popular choice for users looking to access DeFi on BSC.

Terra: Terra stands out for its stablecoin, TerraUSD (UST), which is algorithmically stabilized by a combination of collateral and algorithmic mechanisms. With a focus on stability and usability, Terra is making strides in bridging traditional finance with the DeFi world.

Conclusion: The DeFi landscape in 2023 continues to offer diverse protocols and platforms, each with its unique value proposition and features. Whether you're interested in lending, borrowing, trading, or yield farming, there are ample opportunities to explore and engage with decentralized finance. Keep an eye on these top DeFi protocols as they drive innovation and reshape the future of finance. Remember, while the potential for high rewards exists, the DeFi space also carries risks, so always do your own research and consider your risk tolerance before participating.

0 notes

Text

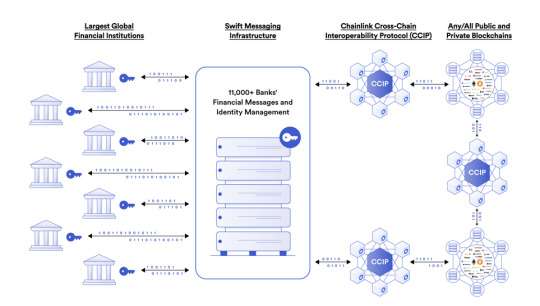

Chainlink's cross-chain protocol bridging blockchain to TradFi

The development firm behind the Chainlink protocol and its native LINK token has gone live with its cross-chain protocol, aimed at providing interoperability between traditional financial firms and both public and private blockchains. In a July 17 post on the Chainlink blog, Chainlink Labs' Chief Product Officer Kemal El Moujahid announced that its Cross-Chain Interoperability Protocol (CCIP) has launched under early access on Ethereum, Avalanche, Polygon, Arbitrum, and Optimism. Developers on these platforms will have access to CCIP on their respective testnets on July 20. 1/ The Chainlink Cross-Chain Interoperability Protocol (CCIP) has officially launched on Avalanche, Ethereum, Optimism, and Polygon mainnets.#LinkTheWorld pic.twitter.com/SdLVyaapg3 — Chainlink (@chainlink) July 17, 2023 CCIP is an interoperability protocol that allows enterprises to transfer data and value between public or private blockchain environments directly from their backend systems. Chainlink’s interoperability solution uses Swift’s messaging infrastructure, which is used by over 11,000 banks around the world to facilitate international payments and settlement. In 2021 alone, the network settled about $1.8 quadrillion in transactions from over 11,000 member banks, according to the UnIted States Financial Crimes Enforcement Network. A diagram depicting how financial institutions can use CCIP to transact on-chain.Source: Chainlink. Chainlink co-founder and CEO Sergey Nazarov explained on July 17 that CCIP aims to create a bridge the on-chain and off-chain worlds: “Just like key standards such as TCP/IP remade a fragmented early internet into the single global internet we all know and use today, we are making CCIP to connect the fragmented public blockchain landscape and the growing bank chain ecosystem into a single Internet of Contracts.” An interoperability solution that can seamlessly transmit value between networks will be a critical building block for a blockchain-powered society, Nazarov added. Among the other financial institutions exploring the use of Chainlink’s interoperability solution includes BNY Mellon, BNP Paribas, Citi, Australia and New Zealand Banking Group, Clearstream, Euroclear and Lloyds Banking Group, according to Chainlink. Related: Chainlink Labs offers proof-of-reserve service for embattled exchanges In addition to the five blockchains integrating CCIP, decentralized finance protocol AAVE is set to implement the interoperability solution, while decentralized derivatives platform Synthetix is already live on the CCIP mainnet. The price of the Chainlink token, LINK, increased 9.7% to $7.27 over the past eight hours while the rest of the market remained relatively neutral, according to CoinGecko. The LINK token surged 7.5% following the news of CCIP’s launch on mainnet. Source: CoinGecko Cointelegraph reached out to Chainlink Labs for comment but did not recieve an immediate response. Magazine: Here’s how Ethereum’s ZK-rollups can become interoperable Source link Read the full article

0 notes

Text

What are the Dexi and Defi Markets.

Dexi and DeFi Market: An Overview

The world of blockchain and cryptocurrency is constantly evolving, with new technologies and platforms emerging every day. Two of the most significant developments in recent years have been the rise of decentralized exchanges (Dexi) and decentralized finance (DeFi). In this article, we'll explore what they are, how they work, and why they're important.

Decentralized Exchanges (Dexi)

A decentralized exchange, or Dexi, is a type of cryptocurrency exchange that operates on a decentralized blockchain network. Unlike centralized exchanges, which are controlled by a single entity, Dexis are governed by a distributed network of nodes. This makes them more secure, transparent, and resistant to hacking and fraud.

One of the key benefits of Dexis is that they allow users to trade cryptocurrencies without having to go through a centralized intermediary. This means that users can maintain control of their funds and avoid the fees and restrictions that are often associated with centralized exchanges.

Dexis typically use automated market makers (AMMs) to facilitate trades. AMMs are algorithms that set the prices of tokens based on supply and demand. When a user wants to trade a cryptocurrency on a Dexi, they simply deposit their tokens into a liquidity pool, where they are used to facilitate trades with other users.

Decentralized Finance (DeFi)

Decentralized finance, or DeFi, refers to a set of financial applications and services that operate on a decentralized blockchain network. DeFi platforms allow users to access a range of financial products and services, including borrowing, lending, trading, and investing, without having to go through traditional financial intermediaries.

Like Dexis, DeFi platforms are governed by a distributed network of nodes, which makes them more secure, transparent, and resistant to hacking and fraud. They also offer users greater control over their funds and lower fees than traditional financial institutions.

Some of the most popular DeFi applications include decentralized lending platforms like Aave and Compound, decentralized exchanges like Uniswap and SushiSwap, and decentralized derivatives platforms like Synthetix.

Why Dexis and DeFi are Important

Dexis and DeFi are important because they offer users greater control over their funds and greater access to financial products and services. They also challenge the dominance of traditional financial institutions, which have long been criticized for their high fees, lack of transparency, and susceptibility to fraud and corruption.

By leveraging blockchain technology, Dexis and DeFi platforms offer a more secure, transparent, and democratic alternative to traditional financial systems. They also have the potential to bring financial services to underserved and marginalized communities, who have historically been excluded from traditional financial institutions.

However, there are also some challenges that Dexis and DeFi platforms face. One of the biggest challenges is the issue of adoption. While the technology is promising, it is still relatively new and many people are not yet familiar with it. This means that there is a need for greater education and awareness-raising in order to encourage more people to use these platforms.

Another challenge is the issue of regulation. While decentralized platforms offer users greater control over their funds and greater access to financial products and services, they also pose a challenge to regulators, who are struggling to keep up with the fast-paced developments in the industry. Some regulators have expressed concerns about the potential risks associated with these platforms, such as money laundering and terrorist financing.

In Conclusion

Decentralized exchanges and decentralized finance are two of the most exciting and innovative developments in the world of blockchain and cryptocurrency. By offering users greater control over their funds and greater access to financial products and services, they are challenging the dominance of traditional financial institutions and paving the way for a more secure, transparent, and democratic financial system. As the world of blockchain and cryptocurrency continues to evolve, we can expect to see even more exciting developments in the years to come.

www.crypto101bylauriesuarez.com

www.lauriesuarez.com

#lauriesuarez

0 notes

Text

MEXC Global-Buy & Sell Bitcoin

MEXC Global: Find Your Next Moonshot.

Never miss a crypto gem anymore. Sign up today on MEXC!

MEXC Global is one of the world’s leading digital asset exchanges. Trusted by over 7 million users worldwide, MEXC delivers a superlative trading experience with secure, safe, and speedy transactions, 1,500+ listed cryptocurrencies, and intuitive user interface.

Our mainstream offerings include Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE), and MX Tokens (MX). Additionally, there’s a wide selection of altcoins. You can buy, sell or trade a variety of altcoins like TopManager (TMT), Shit Coin (SHIT), Bone (BONE), People (PEOPLE), Rose (ROSE), Yearn (YFII), Lido (LDO), Synthetix (SNX), Optimism(OP) and more.

• SPOT TRADING

Various digital assets at your fingertips

• DESIGNED WITH SECURITY IN MIND

Security is our first priority. Safeguarding your funds is of great importance to us.

• SMART TRADING SYSTEM

Set your pre-specified prices, receive strategy alerts, and adjust your orders with just one click.

• HD COLD WALLET

Our industry-leading HD cold-wallet system guarantees the security of your assets.

• 100K TPS MATCHING ENGINE

Our ultra-fast matching engine ensures that overloads are a thing of the past.

• 24/7 DEDICATED CUSTOMER SUPPORT

It doesn’t matter if you’re a crypto veteran or if you’re just getting started. We’re always here to help.

View trading strategies and industry information and enjoy 24/7 online customer service.

***

Güvenli ve Hızlı Kripto Alın

MEXC Global, dünyanın en önde gelen dijital borsalarından biridir. Dünya çapında 7 milyondan fazla kullanıcının güvenle işlem yaptığı MEXC borsası, emniyetli, güvenli ve hızlı işlemler, 1.100’ün üzerinde listelenen kripto para ve sezgisel kullanımıyla üstün bir alım satım deneyimi sunmaktadır.

En bilinen tekliflerimiz arasında Bitcoin(BTC), Ethereum(ETH), Dogecoin(DOGE) ve MX Tokeni (MX) sayabiliriz. Ayrıca, dünyanın dört bir yanından umut vadeden alt coin projelerini dikkatle inceliyoruz. MEXC Borsasında, Shiba Inu (SHIB), People DAO(PEOPLE), Radio Caca (RACA), Ceek (CEEK), Polydodge (POLYDODGE), KILT Protocol (KILT), Decentraland (MANA), Gala Games (GALA) ve Matic Network (MATIC) gibi çeşitli alt coinlerle alım satım yapabilirsiniz.

MEXC Global Topluluğuna hemen katılın ve dünya çapında 7 milyondan fazla kullanıcıyla işlem yapmaya başlayın.

KRİPTO AL

Hızlı Alım Satım: Visa ve MasterCard ile USDT satın alın

P2P: Banka havalesi ve 30+ seçenek

Üçüncü Taraf Ödeme: Banxa, Simplex, Moonpay ve daha fazlası!

ÇOK ÇEŞİTLİ KRİPTO VE KRİPTO TÜREV İŞLEMLERİ

1.100'ün üzerinde işlem çiftinde alım satım yapın

-Alım Satım

1. Spot Alım Satım: İstediğiniz tüm dijital varlıkları anında bulun

2. Marjin Alım Satım: Kaldıraçlar aracılığıyla karınızı maksimize edin

3. API: API kullanıcılarına özel ayrıcalıklardan yararlanın

-Türev İşlemler

1. Kaldıraçlı ETF: Likidasyon riski altında olmaksızın yüksek kaldıraçlar

2. Vadeli İşlemler: Daha yüksek alım satım farklarıyla 125 kata kadar kaldıraç

3. ETF Endeksi: Birden fazla varlığa yatırım yaparak riskinizi azaltın

-Kazan

1. Launchpad: MX sahiplerine özel

2. Kickstarter: Oy vererek airdrop kazanın

3. MX-DeFi: Madencilik ödülleri için staking havuzuna bağlanın

4. M-Day: Seçili tokenleri tutarak ve işlem yaparak airdrop kazanın

MX bölgesi: MX token sahiplerine özel Ayrıcalıklar/Ödüller

GÜVENLİK ÖNCELİKLİ TASARIM

Güvenliğiniz bizim birincil önceliğimizdir. Varlıklarınızı korumak söz konusu olduğunda hiçbir masraftan kaçınmayız.

AKILLI ALIM SATIM SİSTEMİ

Kar al ve zarar durdur fiyatlarını ayarlayın, strateji uyarıları alın ve tek tıkla emrinizi düzenleyin.

HD SOĞUK CÜZDAN

Sektör lideri HD soğuk cüzdan sistemimiz, varlıklarınızın güvenliğini garanti eder.

100K TPS EŞLEME MOTORU

Ultra hızlı eşleme motorumuzla aşırı yüklenmeler konusunda endişelenmeyin.

7/24 MÜŞTERİ HİZMETLERİ

Kripto uzmanı ya da yeni başlamış olmanız fark etmeksizin size yardımcı olmaktan memnuniyet duyarız.

Uluslararası kripto yatırımcılarıyla, alım satım stratejisi ve sektör bilgilerini paylaşın ve 7/24 çevrimiçi müşteri hizmetlerinin tadını çıkarın.

Diğer topluluklardaki kripto yatırımcılarıyla yaşanan dil engelini 10'un üzerindeki dil desteğiyle aşın.

Link:

0 notes

Text

Optimism, Ethereum’un üstünde tanınan bir katman-2 tahlili. Optimistic rollup’ları kullanıyor. Kripto uzmanı Camille Lemmens, Eylül’de almak için Optimism’deki en düzgün üç altcoin projesini paylaşıyor. İlk sıradaki altcoin: Velodrom Finance (VELO)Fiyat: 0,056057 dolar.24 saatlik süreç hacmi: 1.471.825 dolar.Toplam Arz: 1,153 milyar token.Optimism konusunda Velodrome Finance en yüksek TVL ile başı çekiyor. DeFillama’ya nazaran, mevcut TVL’si 165 milyon dolar. Velodrome kendisini yeni kuşak bir AMM olarak isimlendiriyor. Velodrome birinci olarak Fantom’da veDAO ismiyle kullanılıyordu. Ta ki Andrej Cronje Mart 2022’nin başlarında DeFi ve Fantom’dan ayrılmaya karar verene kadar. Bu, veDAO ve Fantom’daki birçok DeFi altcoin projesi için sondu. Lakin veDAO takımı devam etmeye ve yeni meskenleri olarak Optimism’i seçmeye karar verdi. Velodrome Finance olarak tekrar markalaştılar.https://twitter.com/VelodromeFi/status/1680888485970956290 Bu DeFi protokolünde, mahallî VELO tokenini 1 hafta ve 4 yıla kadar kilitleme imkanınız var. VELO’nuzu ne kadar uzun müddet kilitlerseniz, ödül olarak o kadar fazla veVELO alırsınız. Bu da size daha fazla oylama gücü verir. Kilitli VELO’nuzu temsil eden bir NFT alırsınız. Bu bir veNFT’dir. Bu veNFT’yi NFT pazar yerlerinde takas etmeniz mümkün. Öte yandan, altcoin projesi de yine düzenleme kullanıyor. Bu, token arzının artmasına yahut azalmasına müsaade verir. Her şey fiyat dalgalanmasına bağlıdır. Platform, veVELO seçmenlerine süreç fiyatı öder. Bu da yüksek getiri sağlar. Bunun bir sonucu olarak, platform son vakitlerde popülerlik kazandı.İkinci sırada Synthetix Network (SNX) varFiyat: 1,94 dolar.24 saatlik süreç hacmi: 31,864,207 dolarToplam Arz: 323,5 milyon token.Synthetix Network sentetik varlıklarla çalışır. Bu sentetik varlıklar türevler üzeredir. Öbür bir deyişle, bir varlığa sahip olmak zorunda değilsiniz, lakin yeniden de ondan faydalanabilirsiniz. Bir şey emniyetli bir fiyat beslemesine sahip olduğu sürece, bir ‘sentez’ olabilir. Altcoin projesini Ethereum ve Optimism olmak üzere iki Blockchain üzerinde bulabilirsiniz. Mevcut TVL’leri 361 milyon dolar.https://twitter.com/snx_weave/status/1696976414258450439 Yani, bir varlığa sahip olmak yerine, sentetikler öbür bir şey yapar. Bir varlığın fiyatını takip ederler. Bu size kelam konusu varlığa maruz kalmanızı sağlar. Lakin, teminat yatırmanız gerekir. Bunun için lokal SNX tokenini yahut ETH’yi kullanmanız mümkün. Platform şu anda Staking Interface V2’yi kullanıyor. Lakin, yakında çıkacak olan V3 için gözünüzü dört açın. Sentezlerin yanı sıra, altcoin projesi ayrıyeten P2C yahut Peer-to-Peer Mukavele ticareti de sunuyor. Yani, bir buyruk defterine gerek yok. Synthetix’in kökeni Havven ismiyle anılan bir projeye dayanıyor. Fakat, grup taraflarını değiştirmeye karar verdi ve sonuç olarak Synthetix olarak yine markalaştı.https://twitter.com/synthetix_io/status/1651701077367226369 Son sıradaki altcoin Aave (AAVE)Fiyat: 54,99 dolar24 saatlik süreç hacmi: 63,723,555 dolarToplam Arz: 16 milyon token.Aave bir DeFi borç verme protokolü. Aave’yi dokuz Blockchain’de bulabilirsiniz. Toplam TVL’si 2,14 milyar dolar. Lakin, Optimism’de TVL’leri 72 milyon dolar. Bu tekrar de onları Optimism’de TVL’de üçüncü yapıyor. Borç verme ve borç alma için Aave likidite havuzlarını kullanıyor.https://twitter.com/twobitidiot/status/1697593183062872486 Borç vermek için teminatlandırılmış bir varlık yatırmanız gerekir. Aave, P2P borç verme modeli ile başladı. Fakat altcoin projesi, başarılı bir halde likidite havuzu modeline geçti. Başlangıçta, sırf Ethereum üzerinde başlatıldı. Günümüzde, Aave’yi 8 Blockchain’de daha bulabilirsiniz. cointahmin.com’dan takip ettiğiniz üzere 2020 yılında Aave, flaş loan tanıtan birinci protokol oldu. Flaş kredi ile teminata gereksiniminiz yoktur. Lakin, krediyi tek bir blok süreci içinde geri ödemeniz gerekir.https://twitter.com/AaveAave/status/1693997008108032218 Makaledeki görüşler ve kestirimler uzmana ilişkin olup, katiyen yatırım tavsiyesi değildir.

0 notes

Text

Synthetix nets $20M from Web3 quant trading firm

Tokenized asset issuance platform Synthetix has secured a $20 million investment through a new partnership with Web3 investment and quantitative trading firm DWF Labs. The market-making and algorithmic trading company acquired $15 million worth of Synthetix’s native token, Synthetix Network Token (SNX), paid for with USD Coin (USDC) in March 2023. DWF Labs will be tasked with increasing SNX token…

View On WordPress

0 notes

Text

DeFi Liquidity Protocol Synthetix Deploys Version 3 on Ethereum

Synthetix holds over $500 million in locked tokens over the Ethereum and Optimism networks. #DeFi #Liquidity #Protocol #Synthetix #Deploys #Version #Ethereum

View On WordPress

0 notes

Text

Decentralized oracle protocol Chainlink has been seeing a positive performance so far this year, and large investors have recently started accumulating tokens to the point that 7.5 million $LINK has been added to their wallets over the past two weeks. According to popular cryptocurrency analyst Ali Martinez, over the last two weeks cryptocurrency whales have added around $53 million worth of Chainlink’s native $LINK tokens to their wallets at a time in which the cryptocurrency’s price has been surging. Chainlink’s price is up around 17% over the past week and over 26% over the last 30-day period, with its year-to-date performance seeing its value rise over 40%. The cryptocurrency is trading at $7.8 at the time of writing, down from an all-time high above the $50 mark seen in 2021. The price of LINK is seemingly trying to move back to its 2023 high near $8.5. This level has been a tough barrier as the asset faced multiple rejections since April. If buying pressure persists, however, this long-standing trend could change in favor of the bulls. Notably, the decentralized oracle network launched last month for early access users its Cross-Chain Interoperability Protocol (CCIP), aiming to bolster cross-chain applications and services. The protocol is now functional for these users on the Avalanche, Ethereum, Optimism, and Polygon blockchains, after the protocol was tested by at least 25 partners that are now starting to move to the mainnet. These partners include major decentralized finance protocol Aave and the decentralized liquidity platform, Synthetix. The protocol, according to the Chainlink team, will soon be adoptable by other leading decentralized finance protocol. The interoperability protocol has been a key component behind Chainlink’s partnership with SWIFT, the international payment and messaging system predominantly used by banks worldwide. Featured image via Pixabay.

0 notes