#Startup India Registration for Proprietorship

Explore tagged Tumblr posts

Text

Online Trademark Registration Fees, Process, Documents

Trademark registration distinguishes your brand from competitors and help in identifying your product & services as source. Trademark could be a Name, Slogan, Logo or Number which a company uses on its business name, Product or services.

Registering a trademark could be a time taking process as brand registration could take minimum 6 months to 24 months of time depending upon the result of the Examination Report, that's why Professional Utilities provides Brand Name Search Report to get a fair idea about the turnaround time for registration.

Once a Trademark application is processed with the government department, applicants can start using the TM symbol on their mark & ® when the registration certificate has been issued. The registration of the trademark is valid for ten years & can be renewed after ten years. (Read More)

NOTE: If you are a manufacturer then you should also read about EPR Registration

#india#business#earnings#startup#trademark#intellectual property#intellectual disability#private limited company registration in chennai#private limited company registration in bangalore#private limited company registration online#sole proprietorship#limited liability partnership#limited liability company#ngo#ngo donation#nidhi company registration#partnership#partnership firm registration#manage business#taxes#income tax#management#accounting#entrepreneur#import export business#import export data#industry#commerce#government#marketplace

3 notes

·

View notes

Text

#GST Registration Services in Delhi Ncr#Trademark Registration Agency in Delhi NCR#Copyrights Registration Agency in Delhi NCR#FCGPR Filing in RBI in Delhi India#FCTRS Filing with RBI in Delhi India#With Holding Return Tax Filing in delhi#private limited company registration in delhi ncr#Registration Services#Trademark Registration#Copyrights Registration#Patents Registration#Design Registration#Compliance Services#IP Objection#IP Opposition#IP Renewal#Foreign Investors#Liaison Office Registration#Branch Office Registration#Project Office Registration#Private Limited Company Subsidiary#Indian Investors#Proprietorship Registration#Partnership Registration#One Person Company Registration#Limited Liability Partnership#Private Limited Company#Public Limited Company#Startup India Registration

0 notes

Text

A sole Proprietorship business is seen as a hassle-free way as it is not governed by any particular laws or relevant legal stuff. It is always seen as an easy form of business.

#Sole Proprietorship Firm Registration#Online Sole Proprietorship Firm Registration#Eazy Startups#India

0 notes

Text

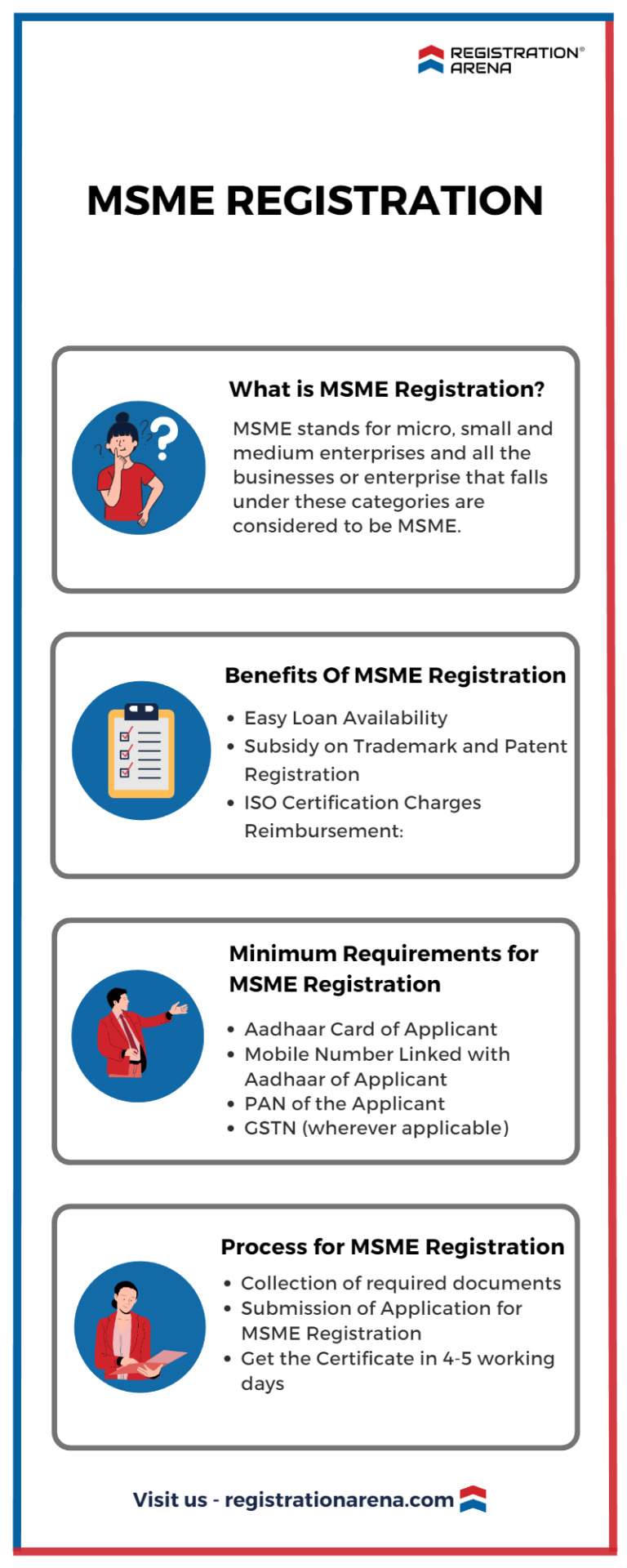

MSMEs, which include micro, small, and medium-sized businesses, have emerged as a flourishing sector of the Indian economy in recent years, playing an essential role in the country's socioeconomic improvement. These businesses are very helpful in creating jobs, producing goods, and exporting products. The duty of promoting and encouraging the growth of MSMEs mainly falls under the state governments

#llp registration#private limited company registration#opc registration#nidhi company registration#msme registration#trademark registration#startup india registration#sole proprietorship#annual compliance of llp#annual compliance of private limited company#itr filing#tds return filing#iso certification online#legal consultation#legal advisers#legal services

0 notes

Text

Pvt Ltd Company Registration: Step-by-Step Guide

Starting a business in India? Registering a Private Limited (Pvt Ltd) Company is one of the most preferred choices for entrepreneurs. A Pvt Ltd Company provides limited liability, a separate legal entity, and better funding opportunities, making it ideal for startups and growing businesses.

This guide covers everything you need to know about Pvt Ltd Company registration, including its benefits, eligibility criteria, step-by-step process, compliance requirements, and costs.

What is a Pvt Ltd Company?

A Private Limited Company is a business entity governed by the Companies Act, 2013. It requires a minimum of two directors and two shareholders. The liability of shareholders is limited to their shareholding, and the company enjoys a distinct legal identity.

Benefits of Pvt Ltd Company Registration

Limited Liability Protection – Shareholders are not personally liable for company debts beyond their investment.

Separate Legal Entity – The company can own assets, enter into contracts, and sue or be sued in its name.

Ease of Raising Funds – Attracts investors due to structured governance.

Perpetual Existence – The company continues to exist regardless of changes in ownership.

Tax Benefits – Various deductions and lower tax rates compared to sole proprietorships.

Credibility and Trust – Enhances business reputation among clients and financial institutions.

Eligibility Criteria for Pvt Ltd Company Registration

Minimum Two Directors – At least one director must be a resident of India.

Minimum Two Shareholders – Directors can also be shareholders.

Unique Company Name – Must not be similar to an existing company or trademark.

Registered Office Address – A physical business address is required.

Authorized Capital – No minimum capital requirement, but an initial capital amount must be declared.

Step-by-Step Process for Pvt Ltd Company Registration

Step 1: Obtain Digital Signature Certificate (DSC)

All directors must obtain a DSC to sign electronic documents for registration.

Step 2: Apply for Director Identification Number (DIN)

DIN is mandatory for all company directors and can be obtained through the MCA portal.

Step 3: Name Reservation via RUN Application

Submit the proposed company name for approval through the MCA’s Reserve Unique Name (RUN) service.

Step 4: File SPICe+ Form for Incorporation

The SPICe+ (Simplified Proforma for Incorporating a Company Electronically) form must be submitted online with details such as:

Company name and structure

Directors and shareholders’ details

Registered office address

Capital structure

Documents required:

PAN and Aadhaar of directors and shareholders

Address proof of directors

Registered office address proof

Memorandum of Association (MoA) and Articles of Association (AoA)

Step 5: Certificate of Incorporation Issued by ROC

Once verified, the Registrar of Companies (ROC) issues the Certificate of Incorporation, along with the Company Identification Number (CIN), PAN, and TAN.

Step 6: Open a Business Bank Account

Using the incorporation certificate, open a corporate bank account to manage financial transactions.

Step 7: Register for GST and Other Compliance Requirements

Depending on business needs, register for:

Goods and Services Tax (GST) – Mandatory if turnover exceeds the prescribed limit.

Professional Tax & Shops and Establishment Act – If applicable.

MSME Registration – For small and medium enterprises to avail benefits.

Compliance Requirements for Pvt Ltd Companies

Annual Financial Statements & ROC Filings

Income Tax Return Filing

GST Returns (if applicable)

Director KYC Updates

Board Meetings & AGM Compliance

Annual Audit by a Chartered Accountant

Cost of Pvt Ltd Company Registration

The cost of registering a Pvt Ltd Company varies based on professional fees, authorized capital, and government charges. Typically, the cost ranges between ₹7,000 – ₹15,000.

Conclusion

Registering a Pvt Ltd Company offers numerous benefits, including legal protection, credibility, and growth potential. By following the correct process and maintaining compliance, you can build a strong foundation for your business.

At CompaniesNext, we provide expert assistance for Pvt Ltd Company registration. Contact us today for hassle-free incorporation and compliance support!

0 notes

Text

Startup Incorporation in India: A Complete Guide by Bizsimpl

Starting a business is an exciting journey, but before you launch your dream venture, one crucial step is startup incorporation in India. Properly registering your business gives it legal recognition, credibility, and access to various benefits such as funding opportunities, tax exemptions, and government incentives.

At Bizsimpl, we simplify the startup incorporation process, ensuring that entrepreneurs can focus on growing their business while we handle legal formalities. This guide covers everything you need to know about incorporating a startup in India, including its benefits, types of business structures, step-by-step registration, and how Bizsimpl can help.

Why Incorporate Your Startup in India?

Incorporating your startup is a strategic decision that offers several advantages:

Legal Recognition – Registering your business establishes it as a separate legal entity, ensuring compliance with Indian laws.

Limited Liability Protection – Business owners’ personal assets remain protected from business liabilities and debts.

Credibility & Trust – A registered entity is more trustworthy for customers, investors, and financial institutions.

Fundraising Opportunities – Startups seeking investment from venture capitalists, angel investors, and banks require legal incorporation.

Tax Benefits & Government Incentives – The Startup India Initiative provides tax exemptions, rebates, and financial aid to registered startups.

Global Expansion & Business Growth – A legally incorporated startup can easily expand operations nationally and internationally.

Types of Business Structures for Startup Incorporation in India

Before incorporating your startup, it’s essential to choose the right business structure. Here are the most common types:

1. Private Limited Company (Pvt Ltd)

Most preferred structure for startups

Limited liability for shareholders

Easy fundraising through equity

Compliance with the Companies Act, 2013

2. Limited Liability Partnership (LLP)

Best for professional services and small businesses

Limited liability for partners

Less compliance than Pvt Ltd

Registered under the Limited Liability Partnership Act, 2008

3. One Person Company (OPC)

Suitable for solo entrepreneurs

Limited liability benefits

Single-owner control

Registered under the Companies Act, 2013

4. Sole Proprietorship

Simplest business structure

Owned & managed by a single individual

No legal distinction between the owner and business

Easy setup but lacks limited liability protection

5. Partnership Firm

Best for small businesses with multiple owners

Governed by the Indian Partnership Act, 1932

Partners share liabilities and responsibilities

Limited growth potential compared to Pvt Ltd or LLP

Step-by-Step Process of Startup Incorporation in India

Step 1: Choose Your Business Structure

Selecting the right structure depends on factors like liability, scalability, and investment plans. Bizsimpl offers expert consultation to help you choose the best structure for your startup.

Step 2: Obtain Digital Signature Certificate (DSC) & Director Identification Number (DIN)

DSC is mandatory for filing online incorporation documents.

DIN is a unique number assigned to directors of a company.

Step 3: Reserve Your Company Name

Name reservation is done through the Ministry of Corporate Affairs (MCA) portal.

Ensure your chosen name is unique and complies with naming guidelines.

Step 4: Prepare Incorporation Documents

Memorandum of Association (MOA) – Defines business objectives.

Articles of Association (AOA) – Lays out operational rules and regulations.

Registered Office Address Proof – Essential for company registration.

Step 5: File for Company Registration

Submit the incorporation application via SPICe+ (Simplified Proforma for Incorporating a Company Electronically) form on the MCA portal.

Pay the applicable government fees.

Step 6: Receive Certificate of Incorporation

Upon approval, the MCA issues the Certificate of Incorporation, along with Company Identification Number (CIN).

Cost of Startup Incorporation in India

The cost of incorporating a startup depends on factors like business structure, professional fees, and government charges. Bizsimpl provides transparent pricing with no hidden charges, ensuring cost-effective startup registration solutions.

Why Choose Bizsimpl for Startup Incorporation in India?

Incorporating a startup can be complex, but Bizsimpl simplifies the process with expert support and end-to-end solutions. Here’s why Bizsimpl is the best choice:

Frequently Asked Questions (FAQs)

1. How long does it take to incorporate a startup in India?

With Bizsimpl, incorporation typically takes 7 to 10 working days, depending on document verification and approvals.

2. Which business structure is best for my startup?

For most startups, a Private Limited Company is the best option due to limited liability protection, investor-friendliness, and scalability.

3. Can a foreign national register a startup in India?

Yes, foreign nationals and NRIs can register a Private Limited Company in India. However, at least one director must be an Indian resident.

Conclusion

Incorporating a startup in India is a crucial step towards building a successful business. Choosing the right business structure, ensuring compliance, and completing the registration process efficiently can set your venture on the right path. With Bizsimpl, you get expert assistance, hassle-free registration, and complete legal support to turn your entrepreneurial dream into reality.

Are you ready to launch your startup? Get started with Bizsimpl today and enjoy a seamless incorporation experience. Visit Bizsimpl.com or contact us for a free consultation!

0 notes

Text

The Importance of Firm Registration in Gurgaon for Startups

Gurgaon is a thriving hub for startups, offering immense growth opportunities. However, one of the first steps for any new business is Firm Registration in Gurgaon. Without proper registration, startups may face legal and financial challenges that could hinder their growth.

Registering your firm gives your business a legal identity, allowing you to open a business bank account, apply for loans, and gain customer trust. It also makes your business eligible for government schemes and startup benefits. The process involves selecting a business structure, obtaining a digital signature, and registering with the Ministry of Corporate Affairs.

At AVC India, we specialize in Firm Registration in Gurgaon, making the process smooth and hassle-free. Our experts guide you in choosing the right business entity based on your industry, scalability, and tax benefits. Whether you're registering a sole proprietorship, partnership, LLP, or private limited company, we handle the entire documentation and approval process efficiently.

If you're launching a startup in Gurgaon, don’t delay your firm registration. Get in touch with AVC India for expert assistance and kickstart your entrepreneurial journey with confidence.

0 notes

Text

How to Start a Sole Proprietorship Business in Bangalore

Introduction

Starting a business in Bangalore, India's thriving tech and startup hub, is an exciting venture. One of the simplest and most popular business structures for new entrepreneurs is the Sole Proprietorship. This form of business is ideal for individuals who wish to operate independently with minimal regulatory burdens. In this guide, we'll walk you through the process of Sole Proprietorship registration in Bangalore, highlighting its advantages, required documentation, and steps to get started.

What is a Sole Proprietorship?

A Sole Proprietorship is a business owned and managed by a single individual. It is the simplest form of business structure in which the owner and the company are considered the same legal entity. This means that the owner has complete control over the business and is unlimitedly liable for any debts or losses incurred.

Advantages of Sole Proprietorship in Bangalore

Easy to Set Up: Registering a Sole Proprietorship is straightforward and requires minimal paperwork.

Complete Control: As the sole owner, you have full control over decision-making and business operations.

Lower Compliance: Compared to other business structures, a Sole Proprietorship has fewer regulatory requirements and compliance obligations.

Tax Benefits: Income from the business is treated as the owner's income, which can simplify the tax filing process.

Steps to Register a Sole Proprietorship in Bangalore

Choose a Business Name

Select a unique and appropriate name for your business. Ensure that the name does not infringe on any existing trademarks.

Obtain a PAN Card

The owner must have a valid Permanent Account Number (PAN) card, which will be used for all tax-related purposes.

Open a Bank Account

Open a separate bank account in the name of your business to manage financial transactions. Most banks require a PAN card and proof of address to open a business account.

Register under MSME

Though optional, registering your business under the Micro, Small, and Medium Enterprises (MSME) Act can provide various benefits, such as easier access to loans, subsidies, and other government incentives.

GST Registration

If your business turnover exceeds the threshold limit (₹20 lakhs for service providers and ₹40 lakhs for goods suppliers), you must register for Goods and Services Tax (GST).

Shop and Establishment Act License

Depending on the nature of your business, you may need to obtain a Shop and Establishment Act License from the local municipal corporation. It is essential if you are setting up a physical shop or office.

Obtain Other Necessary Licenses

Depending on your business type, you may need additional licenses or permits. For example, if you are opening a restaurant, you will need a food license from the Food Safety and Standards Authority of India (FSSAI).

Professional Tax Registration

In Karnataka, it is mandatory to register and pay professional tax if you run a business. This tax applies to both the business owner and any employees.

Documents Required for Sole Proprietorship Registration

The PAN Card of the Proprietor

The Aadhar Card of the Proprietor

Address Proof of the Proprietor (e.g., utility bill, rental agreement)

Business Address Proof (e.g., utility bill, rental agreement)

Bank Account Details

Relevant Licenses/Permits (based on the nature of your business)

Conclusion

Sole Proprietorship Registration in Bangalore is a relatively simple and cost-effective way to start your entrepreneurial journey. By following the steps outlined above and ensuring compliance with all legal requirements, you can establish your business with ease. Your company may consider transitioning to a more complex business structure. However, starting with a Sole Proprietorship provides the flexibility and control needed to test the waters in Bangalore's dynamic market.

0 notes

Text

Best Platform for Local Business Registration in India

Introduction Starting a business is exciting, but registering it is the key to ensuring its legitimacy and growth. Whether you’re running a small shop or a budding startup, proper registration helps in accessing financial benefits, complying with laws, and building trust among customers. This guide will walk you through the importance of local business registration in India and the best practices to follow.

Why Registering Your Local Business Is Important

Business registration isn’t just a legal formality—it’s a necessity for sustainability and growth. Here’s why:

Legal Protection Registering ensures compliance with Indian laws, safeguarding your business from penalties or potential shutdowns.

Access to Government Benefits Registered businesses can leverage government schemes, priority loans, and subsidies aimed at supporting entrepreneurs.

Tax Compliance Registration simplifies filing taxes and enables businesses to claim benefits under the GST framework.

Building Credibility Customers and partners trust a registered business more, making it easier to scale operations.

Steps to Register Your Local Business in India

Navigating the registration process may seem daunting, but it can be simplified into the following steps:

1. Choose the Right Registration Type

The type of registration depends on your business structure. Common categories include:

Sole Proprietorship

Partnership Firm

Limited Liability Partnership (LLP)

Private Limited Company

2. Collect Essential Documents

Prepare the necessary documents to ensure a smooth process. These typically include:

PAN Card and Aadhaar Card

Business address proof (electricity bill, rental agreement, etc.)

Bank account details

Digital Signature Certificate (if applicable)

3. Select the Registration Platform

India offers multiple platforms for local business registration:

MCA Portal: Ideal for LLPs and private companies.

Udyam Registration Portal: Designed for micro, small, and medium enterprises (MSMEs).

GST Portal: Mandatory for businesses with a taxable turnover above ₹20 lakhs.

State-Specific Portals: Some states provide their own registration services, like Karnataka Udyog Mitra and Tamil Nadu Single Window.

4. Fill Out the Registration Forms

Carefully complete the online application form on the chosen platform, ensuring all details are accurate. Inaccuracies can lead to delays or rejections.

5. Pay Fees and Submit Documents

Complete the fee payment and upload your documents. Some portals, like Udyam, are free, while others may charge a nominal fee.

6. Verification and Approval

Once the application is submitted, it undergoes verification. Approved applications will receive a certificate of registration, such as the Udyam Certificate or GSTIN.

Benefits of Online Local Business Registration

Registering your business online offers several advantages:

Convenience Online platforms eliminate the need for physical visits, making the process faster and more efficient.

Cost-Effective Digital platforms often charge lower fees compared to traditional offline methods.

Ease of Recordkeeping Digital registration ensures that all your documents are stored securely and can be accessed anytime.

Quicker Processing Online registrations are processed faster, helping businesses begin operations sooner.

Common Mistakes to Avoid During Registration

Inaccurate Information Errors in business details or documents can lead to rejections. Double-check everything before submission.

Procrastination Delays in registering your business can result in missed opportunities, such as government schemes or tax benefits.

Choosing the Wrong Platform Picking a platform unsuitable for your business type can complicate the process. Always research and select the right option.

How to Choose the Best Platform for Your Business

The ideal platform depends on factors like business size, type, and resources.

For Small Businesses Udyam Registration is perfect for MSMEs, offering quick processing and numerous financial benefits.

For Larger Companies The MCA portal is suitable for private limited companies and LLPs, ensuring compliance with corporate laws.

For Tax Compliance GST registration is essential for businesses dealing with taxable goods or services.

Conclusion

Local Business Registration in India is a vital step toward long-term success. Platforms like Udyam, MCA, and GST portals simplify the process for entrepreneurs. By understanding your business needs and choosing the right platform, you can navigate the registration journey with ease and set your business up for growth.

0 notes

Text

Affordable Company Registration Options for Startups in Bhiwadi

Introduction:

Bhiwadi, an emerging industrial center in Rajasthan, is increasingly recognized as a prime location for startups. Its advantageous proximity to Delhi-NCR, coupled with excellent transportation links and business-friendly regulations, makes Bhiwadi an ideal environment for aspiring entrepreneurs. For those aiming to launch their ventures in this promising area, the registration of a company is an essential initial step. This article examines the cost-effective avenues for Affordable Company Registration in Bhiwadi for Startups , emphasizing the key advantages, procedures, and strategies to reduce expenses.

Reasons to Register Your Company in Bhiwadi

1. Prime Location

Located merely 55 kilometers from Delhi and well-connected via major roadways, Bhiwadi ensures convenient access to markets, suppliers, and customers.

2. Favorable Government Initiatives

The government of Rajasthan actively encourages industrial development in Bhiwadi by offering various incentives, subsidies, and streamlined compliance processes.

3. Economical Business Operations

Operational expenses in Bhiwadi, including real estate, labor, and utilities, are considerably lower compared to those in Delhi-NCR.

Steps for Cost-Effective Company Registration in Bhiwadi

Select the Appropriate Business Structure

The expenses associated with company registration are significantly influenced by the type of business entity selected. Common choices include:

Private Limited Company: Best suited for startups that aspire to grow and attract investment.

Limited Liability Partnership (LLP): Perfect for enterprises that need limited liability along with operational flexibility.

Sole Proprietorship: A budget-friendly option for individual entrepreneurs.

2. Acquire Digital Signatures (DSC) and Director Identification Numbers (DIN)

Digital Signatures and DINs are essential for online company registration. It is advisable to obtain them from government-recognized certifying authorities to minimize costs.

3. Reserve a Company Name

Secure a distinctive and appropriate name for your business via the Ministry of Corporate Affairs (MCA) portal. Conduct a name availability search to prevent rejections and avoid incurring extra fees.

4. Submit Incorporation Documents

Compile and submit the necessary incorporation documents, including the Memorandum of Association (MoA) and Articles of Association (AoA). Numerous online services provide affordable templates and support.

5. Register for GST

If your startup's revenue surpasses the specified threshold, GST registration becomes mandatory. Local consultants in Bhiwadi frequently offer economical GST registration services as part of company registration packages.

Strategies for Economical Company Registration

Engage Professional Services

Although it may appear counterproductive, enlisting the help of professional consultants or agencies can ultimately reduce costs by minimizing mistakes and avoiding penalties.

2. Take Advantage of Online Platforms

A variety of government-sanctioned online portals enable company registration at low costs. These platforms offer clear pricing structures and efficient processes.

3. Capitalize on Government Schemes

The Rajasthan government, along with central initiatives such as Startup India, provides various subsidies and fee exemptions for startups. It is advisable to investigate and apply for these advantages during the registration process.

4. Combine Services

Seek out consultants who provide bundled services, which may include company registration, GST filing, and compliance management, at reduced rates.

Advantages of Professional Support in Bhiwadi

Regulatory Compliance: Professionals guarantee that your enterprise meets all legal and regulatory standards.

Efficiency in Time Management: Specialists facilitate the registration process, allowing startup founders to conserve essential time.

Cost-Effective Solutions: Leveraging their expertise, consultants can guide you through economical alternatives and help you avoid superfluous costs.

Ongoing Support Post-Registration: Numerous service providers extend ongoing assistance for compliance, tax submissions, and other regulatory requirements.

Documents Necessary for Company Registration

PAN Card of directors/partners

Aadhaar Card or alternative address verification

Passport-sized photographs

Evidence of registered office address (e.g., rental agreement, utility bill)

Memorandum of Association (MoA) and Articles of Association (AoA) for Private Limited Companies

Partnership agreement for partnership firms or Limited Liability Partnerships (LLPs).

Challenges and Strategies for Overcoming Them

Selecting an Appropriate Business Structure

Numerous startups encounter difficulties in determining a business structure that aligns with their objectives. Seeking advice from professionals can facilitate a well-informed choice.

2. Understanding Legal Requirements

The process of registration encompasses various legal and procedural complexities.

3. Financial Considerations

Although cost-effectiveness is crucial for startups, sacrificing quality may result in complications in the future. It is advisable to choose reputable service providers who offer a balance between affordability and quality.

Conclusion

Establishing a company in Bhiwadi can be a seamless endeavor when approached with a strategic mindset. By utilizing cost-effective services, government incentives, and professional guidance, startups can set up their operations without incurring excessive financial burdens. As Bhiwadi evolves into a prominent industrial and entrepreneurial center, it presents an opportune moment for startups to embark on their ventures.

Affordable company registration in Bhiwadi offers startups a seamless pathway to establish their ventures with cost-effective and reliable services. Partnering with GTS Consultant India , entrepreneurs benefit from expert guidance, ensuring compliance with legal formalities and a hassle-free setup process.

0 notes

Text

The Step-by-Step Guide to GST Registration with a Virtual Office

Goods and Services Tax (GST) is a critical component of India’s taxation system, requiring businesses to register under its ambit for compliance. For businesses operating remotely or startups looking to minimize costs, using a virtual office for GST registration offers an effective solution. This guide walks you through the step-by-step process of registering for GST with a virtual office, ensuring you stay compliant while saving costs.

What is a Virtual Office?

A virtual office provides businesses with a professional address in a prime location without needing a physical workspace. It is a cost-effective solution for startups, freelancers, and remote businesses, offering services like mail handling and receptionists, while allowing you to establish your presence anywhere.

For GST registration, a virtual office address is particularly beneficial as it helps meet the legal requirement of providing a business address, even if operations are entirely remote.

Why Choose a Virtual Office for GST Registration?

Cost-Effective: Avoid the overhead costs of renting or owning a physical office.

Flexibility: Operate from anywhere while using the virtual office address for official purposes.

Compliance: Meet legal requirements for GST registration without hassle.

Professional Image: Create a credible and professional business presence.

Step-by-Step Guide to GST Registration with a Virtual Office

Step 1: Obtain a Virtual Office Address

The first step is to acquire a virtual office from a reliable provider. Ensure the provider offers:

A proper rental agreement.

A No Objection Certificate (NOC) for the address.

Proof of address documentation such as utility bills or property tax receipts.

Step 2: Prepare Necessary Documents

For GST registration, you’ll need to gather the following documents:

PAN Card of the business or proprietor.

Identity and Address Proof of the owner (Aadhaar Card, Passport, or Driving License).

Virtual office agreement, NOC, and address proof.

Bank account statement or a canceled cheque.

Business registration certificate (if applicable).

Step 3: Visit the GST Portal

Go to the official GST portal.

Click on the "Services" tab, then "Registration," and select "New Registration."

Step 4: Fill Out the Application Form

Enter Basic Details: Provide the business name, PAN, mobile number, and email address.

Select Business Type: Choose the nature of your business, such as sole proprietorship, partnership, or company.

Enter the Virtual Office Address: Use the address provided by your virtual office provider.

Step 5: Upload Required Documents

Attach the scanned copies of all the documents prepared in Step 2, ensuring the virtual office documentation is clear and accurate.

Step 6: Verification via OTP

After submitting the details, you will receive an OTP on your registered mobile number and email. Enter the OTP to verify your application.

Step 7: ARN Generation

Once verified, you will receive an Application Reference Number (ARN). Use this ARN to track the status of your GST registration.

Step 8: Approval and GSTIN Issuance

After verification by the GST authorities, you will receive your GST Identification Number (GSTIN) on your registered email. This process usually takes 7–10 working days.

Tips for Successful GST Registration with a Virtual Office

Choose a Trusted Provider: Work with a reputable virtual office provider to avoid issues during verification.

Ensure Accurate Documentation: Double-check all submitted documents to prevent delays or rejections.

Understand State-Specific Requirements: GST rules may vary slightly between states, so consult with your virtual office provider or a tax professional.

Track Your Application: Use the ARN to monitor your GST registration progress and respond promptly to any queries from GST authorities.

Challenges and How to Overcome Them

Document Rejections: Ensure your virtual office documents are complete and properly formatted.

Verification Delays: Follow up with your virtual office provider for any additional information GST authorities may request.

Provider Legitimacy: Choose providers with a proven track record in offering virtual office solutions for GST purposes.

The Advantages of a Virtual Office for GST Registration

Pan-India Presence: Expand your business presence in multiple states without physical offices.

Seamless Scalability: Add new locations or branches with minimal investment.

Remote Work Enablement: Support remote operations while staying compliant with GST regulations.

Using a virtual office for GST registration not only simplifies compliance but also offers strategic advantages for cost and business expansion.

Conclusion

Registering for GST is a crucial step for any business in India. For startups, SMEs, and remote businesses, leveraging a virtual office for GST registration is a smart, economical, and efficient way to comply with tax laws while maintaining a professional business image. By following the steps outlined in this guide, you can ensure a seamless registration process and focus on growing your business.

Remember, choosing a trusted virtual office provider and ensuring accurate documentation are key to a hassle-free experience.

0 notes

Text

How to Register a Proprietorship Firm in Delhi

One of the most basic and prevalent types of business structure in India is a proprietorship. One of the most basic and prevalent types of business structure in India is a proprietorship. Because it is solely owned and operated by one person, it is a great option for startups, freelancers, and small enterprises. Compared to other business forms, registering a proprietorship is less complicated and requires less legal compliance. Here is a detailed guide to help you comprehend the procedure.

Understand the Basics of a Proprietorship Firm

It is crucial to comprehend what a proprietorship firm comprises before beginning the registration process:

One Ownership: One individual owns and runs the company.

Unlimited Liability: All obligations and debts of the business are directly owed by the owner.

No Different Legal Entity: The owner and the proprietorship share the same legal identity.

Formation and Closure Ease: Establishing the business is easy, and shutting it down is a breeze.

Benefits of a Proprietorship Firm

Low Compliance Requirements: Unlike corporations or limited liability partnerships, proprietorships are subject to fewer regulatory requirements.

Total Authority: The owner has total authority over all corporate choices.

Tax Benefits: Small enterprises may benefit from the fact that income is taxed according to the individual’s income tax bracket.

Banking Ease: It is simple for proprietorships to open a current account in their name.

Prerequisites for Registration

Make sure you possess the following in order to form a proprietorship firm:

Business Name: Give your company a distinctive name that captures its essence and core principles.

Proof of Address: A proof of business address, such as a utility bill or rent agreement, is necessary.

Identity Proof: The owner’s voter ID, PAN card, or Aadhaar card.

Bank Account: An account currently held in the proprietorship’s name.

Learnmore

#gst registration#msme registration#income tax return#passive income#earn money online#money#income inequality#income tax

0 notes

Text

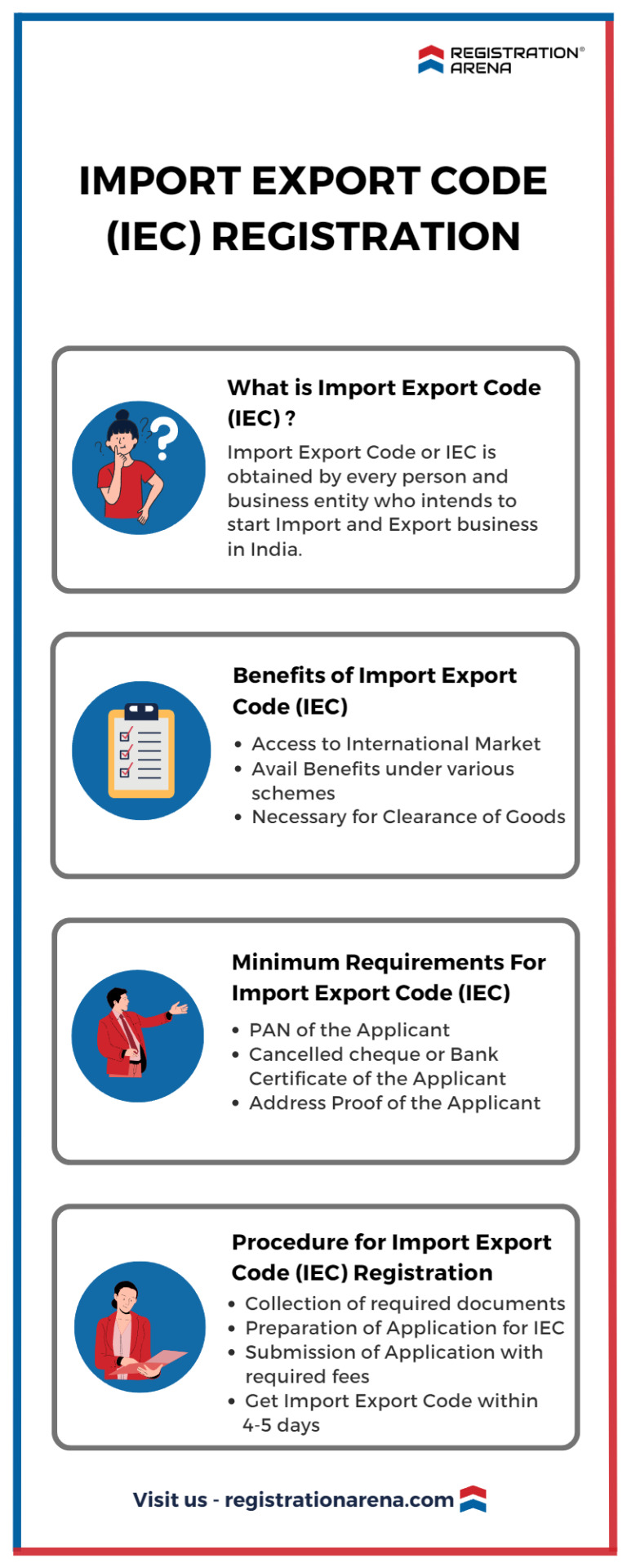

To engage in importing or exporting goods, all business entities are required to obtain a 10-digit identification number known as the Importer-Exporter Code (IEC). Without a valid IEC number, a person or entity is not permitted to conduct any import or export activities. In India, the Director General of Foreign Trade (DGFT) is responsible for granting IECs. IEC registration is a completely online process and can be finished within 4-5 days. IEC once issued shall be valid for a lifetime.

#legal advisers#legal consultation#legal services#llp registration#private limited company registration#sole proprietorship#public limited company#annual compliances of llp#annual compliance of private limited company#startup india registration#trademark registration#partnership firm registration#tds return filing#itr filing#Import-export code#opc registration

0 notes

Text

Company Registration Delhi by MASLLP: Your Gateway to Success

Starting a business in Delhi, India’s bustling capital, is a dream for many entrepreneurs. With its vibrant economy, diverse markets, and a supportive ecosystem for startups, Delhi offers immense opportunities. However, one of the critical first steps is company registration, which lays the foundation for a legally recognized and operational business. At MASLLP, we simplify the process, helping you navigate the complexities with ease and efficiency. Why Register Your Company? Company registration is essential for any business to operate legally. Here’s why it’s important: Legal Recognition: It gives your business a distinct identity and ensures compliance with government regulations. Trust and Credibility: A registered company gains more trust among customers, investors, and suppliers. Tax Benefits: Enjoy various tax advantages and exemptions available to registered businesses. Access to Funding: Only registered companies are eligible to secure bank loans or attract investors. Types of Companies You Can Register in Delhi MASLLP assists businesses in registering various types of entities, including: Private Limited Company Limited Liability Partnership (LLP) One Person Company (OPC) Sole Proprietorship Partnership Firm Section 8 Company (Non-profit organizations) Steps for Company Registration Delhi At MASLLP, we make the registration process straightforward and hassle-free. Here’s an overview of the steps involved: Choose Your Business Structure: Decide on the type of company that suits your business goals. Name Approval: We help you select a unique and compliant company name. Documentation: Submit essential documents like PAN, Aadhar, address proof, and other required details. Digital Signature Certificate (DSC) and Director Identification Number (DIN): We assist in obtaining these mandatory credentials. Incorporation Application: Filing the incorporation application with the Ministry of Corporate Affairs (MCA). Certificate of Incorporation: Once approved, you receive the Certificate of Incorporation, making your company officially registered. Why Choose MASLLP? MASLLP stands out as a reliable partner for company registration Delhi due to the following: Expert Guidance: Our team has extensive experience in handling complex registration processes. End-to-End Support: From documentation to compliance, we manage everything for you. Quick and Hassle-Free Process: We ensure your registration is completed in the shortest possible time. Customized Solutions: Tailored services based on your business type and requirements. Documents Required for Company Registration To ensure a smooth process, keep the following documents ready: PAN card of directors/partners Address proof (electricity bill, water bill, etc.) Passport-sized photographs Business address proof (rent agreement or property papers) Conclusion Registering your company is the first step toward building a successful business in Delhi. With MASLLP by your side, the process becomes seamless and stress-free. Our expert team takes care of all the intricacies, ensuring your business complies with all legal requirements. Let MASLLP help you turn your entrepreneurial vision into reality. Contact us today for professional assistance with company registration Delhi!

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#taxation#auditor#ap management services

4 notes

·

View notes

Text

Company Registration Near Me ?

Comprehensive Company Registration Services by AMM & Associates

AMM & Associates offers end-to-end solutions for all your company registration needs. Their expert team ensures that the process is smooth, efficient, and fully compliant with Indian legal requirements.

1. Private Limited Company Registration

The most popular structure for startups and growing businesses, a Private Limited Company provides credibility, limited liability, and growth potential. Services include:

Obtaining Director Identification Numbers (DIN) and Digital Signature Certificates (DSC).

Assisting with name approval and reserving a unique company name.

Preparing and filing essential documents like Memorandum of Association (MoA) and Articles of Association (AoA).

Procuring the Certificate of Incorporation, PAN, and TAN.

Post-registration compliance advisory, including bookkeeping and ROC filings.

2. Limited Liability Partnership (LLP) Registration

An LLP combines the benefits of a partnership and a company, offering limited liability and operational flexibility. Services include:

Drafting the LLP agreement.

Filing incorporation forms with the Ministry of Corporate Affairs (MCA).

Assisting with PAN, TAN, and GST registration.

3. Proprietorship Firm Registration

Perfect for small-scale entrepreneurs, a proprietorship firm is easy to set up and manage. Services include:

Business name registration.

PAN, GST, and trade license registration.

Advisory on transitioning to other business structures as you grow.

4. One Person Company (OPC) Registration

Ideal for solo entrepreneurs, OPC registration provides limited liability while allowing single ownership. Services include:

Filing the incorporation form (SPICe+).

Obtaining the Certificate of Incorporation, PAN, and TAN.

5. NGO Registration

For individuals and groups aiming to establish a Non-Governmental Organization, AMM & Associates offers seamless registration under various frameworks, including:

Section 8 Company.

Trust.

Society.

6. Shop and Establishment Registration

For businesses requiring local operational licenses, AMM & Associates ensures compliance with the Shop and Establishment Act, enabling smooth operations.

7. Import Export Code (IEC) Registration

For businesses venturing into international trade, AMM & Associates facilitates IEC registration, a prerequisite for import/export activities in India.

0 notes

Text

Unlocking Business Success: A Complete Guide to Company Registration in India with Bizsimpl

In today’s competitive world, registering your business is the first step toward success. A legally registered company not only adds credibility but also opens doors to numerous benefits, such as funding opportunities, brand recognition, and regulatory compliance. For entrepreneurs and startups, company registration in India is a critical milestone. Bizsimpl, a trusted name in the industry, ensures that this process is seamless and hassle-free.

In this blog, we’ll explore aspects of company registration not covered before, including unique benefits, post-registration requirements, and how Bizsimpl supports businesses beyond registration.

Why is Company Registration in India Crucial?

Company registration is more than a legal formality; it’s a strategic decision that shapes your business's future. Here’s why it matters:

1. Enhanced Brand Value

A registered company conveys professionalism and reliability, making it easier to attract clients, customers, and investors.

2. Government Incentives

Registered businesses can access government schemes, tax benefits, and subsidies, especially under initiatives like Startup India and Make in India.

3. Global Opportunities

Registration allows businesses to operate internationally, access global markets, and enter into contracts with foreign entities.

4. Long-Term Sustainability

With a structured framework and legal backing, registered companies are better equipped to survive market fluctuations and challenges.

Types of Business Structures in India

1. Sole Proprietorship

While not a formal registration, a sole proprietorship is an easy way to start. However, it offers no legal distinction between the owner and the business, exposing personal assets to risk.

2. Partnership Firm

Ideal for small businesses, a partnership firm involves two or more individuals sharing profits, risks, and responsibilities. Registration is optional but highly recommended for legal protection.

3. Non-Profit Organizations (NPO)

For individuals looking to make a social impact, registering an NPO as a Trust or Section 8 Company provides tax exemptions and credibility.

4. Producer Company

Designed for agricultural activities, producer companies enable farmers and agriculturalists to organize, share resources, and sell produce efficiently.

Bizsimpl offers expert advice to help you choose the structure that aligns with your goals and industry.

Steps to Register a Company in India

While the basic process of company registration includes name approval, document submission, and obtaining the Certificate of Incorporation, let’s focus on lesser-discussed but critical steps:

1. Understanding Industry-Specific Licenses

Certain industries, such as food, pharmaceuticals, and e-commerce, require additional licenses like FSSAI, drug licenses, or GST. Bizsimpl guides you through obtaining these seamlessly.

2. Choosing the Right Shareholding Pattern

The number and type of shareholders impact voting rights, decision-making, and fundraising potential. Bizsimpl helps structure shareholding optimally for growth.

3. Trademark Registration

While registering your company, it’s wise to simultaneously register your brand’s trademark to protect intellectual property and ensure exclusivity.

4. Establishing a Corporate Bank Account

Bizsimpl ensures that post-registration, your business is ready to operate with a corporate bank account tailored to your requirements.

Unique Benefits of Company Registration

1. Tax Efficiency

Registered businesses, especially Private Limited Companies, can take advantage of deductions for operational expenses, depreciation, and more.

2. Employee Benefits

A registered entity can provide statutory employee benefits like EPF, gratuity, and medical insurance, helping attract top talent.

3. Access to Business Loans

Financial institutions prefer lending to registered companies due to their credibility, structured financial records, and transparency.

4. Compliance with Legal Obligations

Being registered ensures that your business complies with environmental, labor, and other regulatory requirements, avoiding legal hassles.

Post-Registration Requirements

Once your company is registered, maintaining compliance is crucial. Here are some post-registration tasks that Bizsimpl can assist with:

1. Filing Annual Returns

Every registered company must file annual returns with the Ministry of Corporate Affairs (MCA). Bizsimpl ensures timely filing to avoid penalties.

2. GST and Tax Filings

Proper GST and income tax filings are essential for smooth operations. Bizsimpl provides end-to-end tax management services.

3. Statutory Audits

Registered companies must conduct audits to ensure financial transparency. Bizsimpl connects you with certified auditors for the task.

4. Director KYC

Directors must file KYC details annually to remain compliant. Bizsimpl manages this process effortlessly.

5. Business Expansion Support

If you plan to scale or diversify your business, Bizsimpl provides guidance on adding directors, increasing share capital, or registering subsidiaries.

Why Choose Bizsimpl for Company Registration?

1. Personalized Solutions

Every business is unique, and Bizsimpl offers tailored registration packages based on your industry, goals, and budget.

2. Hassle-Free Compliance

Bizsimpl takes care of complex legalities, ensuring your business remains compliant with minimal effort from your side.

3. Transparency

With no hidden fees and clear timelines, Bizsimpl offers a smooth and stress-free experience.

4. Expert Support Beyond Registration

From post-registration compliance to growth strategies, Bizsimpl supports businesses at every stage of their journey.

Case Study: How Bizsimpl Transformed a Startup’s Journey

Client: GreenGrow Agrotech Pvt Ltd Challenge: The client, a farming startup, needed to register a Producer Company and navigate complex agriculture-specific regulations. Solution: Bizsimpl managed the registration process, obtained necessary licenses, and set up a framework for GST compliance. Outcome: GreenGrow Agrotech launched operations smoothly, saving time and resources while focusing on business growth.

Conclusion: Start Your Business Journey with Bizsimpl

Registering your company is a vital step toward achieving your entrepreneurial dreams. Whether you choose a Private Limited Company, LLP, or any other structure, the right guidance can make all the difference.

With Bizsimpl, you’re not just registering a company; you’re laying the foundation for success. From personalized solutions to end-to-end compliance management, Bizsimpl ensures a smooth registration process, empowering you to focus on growing your business.

Ready to get started? Contact Bizsimpl today for hassle-free company registration in India!

Is this conversation helpful so far?

0 notes