#Shalabh

Explore tagged Tumblr posts

Text

Video: पुलिस के कंधों पर लटके बहराइच हिंसा के आरोपी, जान की मांग रहे भीख; बोले, अब कभी नहीं करेंगे गलती

Video: पुलिस के कंधों पर लटके बहराइच हिंसा के आरोपी, जान की मांग रहे भीख; बोले, अब कभी नहीं करेंगे गलती #News #NewsUpdate #newsfeed #newsbreakapp

Uttar Pradesh News: बहराइच हिंसा के आरोपियों के साथ गुरुवार की दोपहर पुलिस का एनकाउंटर हो गया। इस दौरान पुलिस पर फायरिंग कर भाग रहे दो आरोपियों को पुलिस ने गोली मारने के बाद गिरफ्तार कर लिया। इसी दौरान का एक वीडियो सोशल मीडिया पर वायरल हो रहा है। इस वीडियो में पुलिस के कंधों पर लटके दोनों आरोपी अपनी जान की भीख मांग रहे हैं। पुलिस से कह रहे हैं कि अब कभी गलती नहीं करेंगे। पुलिस पर फायरिंग करके…

0 notes

Text

Common Urological Problems in Men & Women Hindi | Kidney Stones, Erectile Dysfunction, UTIs, BPH

Urological issues arise in both males and females. Here is the Senior Consultant (urologist), Dr. Shalabh Agarwal discussing the most commonly occurring 5 urological disorders occurring in males and females. In this video, he has discussed common urological issues like kidney stones, urinary tract infection (UTI), erectile dysfunction, benign prostatic hyperplasia (BPH), and urine control.

0 notes

Text

Day 17

Happy Birthday Gauravi! We kicked off today with breakfast from the buffet at our hotel. It has delicious food spanning from Indian cuisine to Western cuisine. Then, we went to the headquarters of CureFit, a health and fitness company.

First we got an office tour from Rishi. It was interesting to learn that there are no role titles at CureFit, and there are no assigned desks. Each floor is stocked with fitness equipment that we got to try out. They had treadmills, monkey bars, ellipticals, a basketball court, and even a massage chair.

Then, we listened to a presentation from Shalabh, a strategy leader at CureFit. He gave us an overview on CureFit, and told us that they are a new age company attempting to make health easy in India. After that, Mujtabha, who works in the fitness group, spoke to us about the fitness business within CureFit, CultFit. He told us that CultFit exists in 90 cities across India. Then Shahbaaz, a brand manager, presented to us and told us about an exciting upcoming collaboration with Marvel. Next, we had lunch on the open-air top floor. We ate the delicious and nutritious Indian food that CureFit caters for its workers every day.

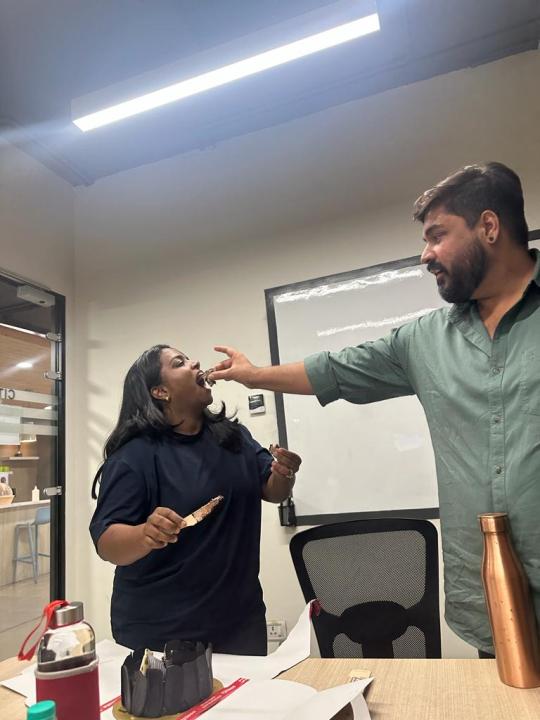

After lunch, we listened to Phalguni present on the brand and marketing side of CureFit. She taught us that CureFit has the mission of making fitness fun, easy, and accessible. Then Rishi presented to us and showed us CureFit advertisements. Lastly, Mujtabha told us about the history of the company, and his journey working at CureFit. It was a pleasure getting to learn from so many inspiring members of the CureFit team. Then, we celebrated Gauravi’s birthday with a chocolate cake. Pictured is Sagar feeding the cake to her after we sang. Finally, we visited SugarFit, a health-tech company owned by CureFit that aims to manage and reverse diabetes.

To end our visit, we did a CultFit Zumba class. It was easily one of the highlights of my time in India. It was a great break from our learning and work! We came back to the hotel and all did our own thing for dinner because we are prioritizing our case studies due this week. Excited to visit the Incubation Cell tomorrow!

2 notes

·

View notes

Text

[ad_1] Leading Indian American Industrialist Shalabh Kumar took to social media to post a video of members of the Hindu faith celebrating Donald Trump’s victory in the 2024 US Presidential elections by gathering together at the YMCA in Chicago. In a post on the social media platform X, Kumar wrote, “Last night 1500 Hindus, members of Republican Hindu Coalition danced to YMCA celebrating Trump 2.0 victory at Maharana Pratap Ronald Reagan community centre in Carol Stream, Chicago”. The event saw people gather in large numbers and joyously celebrate Donald Trump’s historic victory in the presidential elections. Last night 1500 Hindus, members of Republican Hindu Coalition danced to YMCA celebrating Trump 2.0 victory at Maharana Pratap Ronald Reagan community center in Carol Stream, Chicago. This election 85+% Hindus in America, over 300,000 in BG states of PA, MI and WI voted for Trump… pic.twitter.com/cv5BXrY6Sq — Shalabh Shalli Kumar (@iamshalabhkumar) November 16, 2024 In his post, he noted that the 2024 US Presidential elections told that more than 85 per cent of Hindus in America, making a number over 300,000 in key states of Pennsylvania, Michigan and Wisconsin, voted for Trump, thereby “giving him a margin of victory of 240K”, according to Shalabh Shalli Kumar. He expressed confidence in further cementing of India-US ties by noting, “There is no question, this landslide changes the course of world for decades to come. Bharat and America Sabse Acche Dost”. Kumar attributed Trump’s success in part to a focused last-minute campaign targeting Hindu American voters, specifically in key battleground states. “It was our goal to at least switch over 200,000 Hindu votes from Kamala to Trump in the battleground states of Pennsylvania, Michigan, and Wisconsin, and that’s what happened,” he said. Kumar credited the momentum to a critical tweet on Diwali, which, he noted, “changed everything” and enabled a targeted media push. “We were successful in educating the Hindu Americans about who Kamala really is. She is only half Hindu… and she’s friendly towards [leftist ideologies],” he added, stressing his belief that Harris’s political philosophy was “very much to the left.” Kumar highlighted the coalition’s efforts, describing a five-day media blitz of 900 commercials aimed at informing Hindu Americans of their stance, saying, “We also brought out the fact that she is a Marxist… and a communist sympathiser.” In his view, this strategic outreach significantly bolstered Trump’s support among Hindu American voters, contributing to what he called a “great victory” for the Republican Party. [ad_2] Source link

0 notes

Text

[ad_1] Leading Indian American Industrialist Shalabh Kumar took to social media to post a video of members of the Hindu faith celebrating Donald Trump’s victory in the 2024 US Presidential elections by gathering together at the YMCA in Chicago. In a post on the social media platform X, Kumar wrote, “Last night 1500 Hindus, members of Republican Hindu Coalition danced to YMCA celebrating Trump 2.0 victory at Maharana Pratap Ronald Reagan community centre in Carol Stream, Chicago”. The event saw people gather in large numbers and joyously celebrate Donald Trump’s historic victory in the presidential elections. Last night 1500 Hindus, members of Republican Hindu Coalition danced to YMCA celebrating Trump 2.0 victory at Maharana Pratap Ronald Reagan community center in Carol Stream, Chicago. This election 85+% Hindus in America, over 300,000 in BG states of PA, MI and WI voted for Trump… pic.twitter.com/cv5BXrY6Sq — Shalabh Shalli Kumar (@iamshalabhkumar) November 16, 2024 In his post, he noted that the 2024 US Presidential elections told that more than 85 per cent of Hindus in America, making a number over 300,000 in key states of Pennsylvania, Michigan and Wisconsin, voted for Trump, thereby “giving him a margin of victory of 240K”, according to Shalabh Shalli Kumar. He expressed confidence in further cementing of India-US ties by noting, “There is no question, this landslide changes the course of world for decades to come. Bharat and America Sabse Acche Dost”. Kumar attributed Trump’s success in part to a focused last-minute campaign targeting Hindu American voters, specifically in key battleground states. “It was our goal to at least switch over 200,000 Hindu votes from Kamala to Trump in the battleground states of Pennsylvania, Michigan, and Wisconsin, and that’s what happened,” he said. Kumar credited the momentum to a critical tweet on Diwali, which, he noted, “changed everything” and enabled a targeted media push. “We were successful in educating the Hindu Americans about who Kamala really is. She is only half Hindu… and she’s friendly towards [leftist ideologies],” he added, stressing his belief that Harris’s political philosophy was “very much to the left.” Kumar highlighted the coalition’s efforts, describing a five-day media blitz of 900 commercials aimed at informing Hindu Americans of their stance, saying, “We also brought out the fact that she is a Marxist… and a communist sympathiser.” In his view, this strategic outreach significantly bolstered Trump’s support among Hindu American voters, contributing to what he called a “great victory” for the Republican Party. [ad_2] Source link

0 notes

Text

Kamya Panjabi Birthday : Wishes from Pradip Madgaonkar

Celebrates Her Birthday In Style; Thanks Husband Shalabh For Wonderful Surprises.

#kamyapunjabi kamyapunjabibirthday tvactress televisionactress model actress pradipmadgaonkar pradip

0 notes

Text

Kamya Panjabi Birthday : Wishes from Bandya Mama

Celebrates Her Birthday In Style; Thanks Husband Shalabh For Wonderful Surprises.

0 notes

Text

Τραγωδία στην Ινδία: Πάνω απο 100 οι νεκροί σε θρησκευτική εκδήλωση – Ποδοπατήθηκαν μέχρι θανάτου

Τουλάχιστον 116 άνθρωποι σκοτώθηκαν σε συντριβή σε θρησκευτική συγκέντρωση στη βόρεια Ινδία Τουλάχιστον 116 άνθρωποι σκοτώθηκαν σε συντριβή σε θρησκευτική συγκέντρωση στη βόρεια Ινδία, δήλωσε ο αστυνομικός επιθεωρητής στρατηγός Shalabh Mathur. Το περιστατικό έλαβε χώρα σε μία ινδουιστική θρησκευτική εκδήλωση στην περιοχή Χατράς στην πολιτεία Ουτάρ Πραντές. Τα θύματα, μεταξύ των οποίων μεγάλος…

View On WordPress

0 notes

Text

Over 100 people killed in stampede at religious event in India.

On Tuesday, July 2, 2024, an injured person was brought to Sikandrarao Hospital in Hathras district, about 350 kilometers southwest of Lucknow, India. Officials reported that a stampede at a religious gathering in northern India has resulted in at least 60 deaths and many injuries. In a heartbreaking turn of events, police inspector Gen Shalabh Mathur has confirmed that a devastating stampede at…

View On WordPress

0 notes

Text

Distinguished ENT Surgeon, Dr. Shalabh Sharma to visit RBH | Royal Bahrain Hospital

After a successful visit, leading ENT surgeon specializing in cochlear implants is all set to visit the Royal Bahrain Hospital (RBH). Dr. Shalabh Sharma, Senior Consultant – ENT, from India will be visiting RBH on the 4th and 5th of November 2017.

0 notes

Text

Salasar Techno Engineering's Strategic Moves Unveiled in Recent Board Meeting

Salasar Techno Engineering Limited, a leading player in the field of engineering and infrastructure, recently conducted a significant Board Meeting on Thursday, January 25, 2024. The meeting, held at the Company’s Unit -1 office in Hapur, brought forth key decisions that shed light on the company's future endeavors. Here is an overview of the outcomes:

1. Fundraising Endeavor of Rs. 8,064 Mn - To propel business growth and fortify long-term financial resources, Salasar Techno Engineering is set to raise Rs. 8,064 million through the issuance of securities. This includes the creation, issuance, and allotment of up to 3,90,00,000 Equity Shares to the 'Non-Promoter, Public Category' and up to 7,30,00,000 Fully Convertible Warrants to both "Promoter" and "Non-Promoter, Public Category." The issue price is determined higher than the floor price, aligning with regulatory provisions.

Additionally, the proposed allottees are entitled to 4 fully paid-up bonus shares for each equity share and warrant issued, in a ratio of 4:1. The record date for the bonus issue is set for Thursday, February 1, 2024.

2. Increase in Authorized Share Capital - The Board has proposed to augment the Authorized Share Capital of the Company from Rs. 175,00,00,000 to Rs. 225,00,00,000, subject to approval by the shareholders.

3. Extraordinary General Meeting (EGM) - To formalize these decisions, an Extraordinary General Meeting (EGM) is scheduled for Monday, February 19, 2024. The draft notice of the EGM has been approved, and the company has authorized its Director/KMP to issue the same to the concerned parties.

The detailed disclosure with respect to the Preferential Issue under Regulation 30 of SEBI Listing Regulations, as per SEBI circular dated July 13, 2023, is also enclosed in the official communication.

Key Allottees of Equity Shares and Warrants - The list of proposed allottees includes notable names such as North Star Opportunities Fund, Intuitive Alpha Investment Fund, and Virat Services LLP for equity shares, while warrants are allocated to promoters like Shashank Agarwal and Shalabh Agarwal, along with various non-promoter entities.

These strategic moves showcase Salasar Techno Engineering's commitment to growth, financial strength, and value creation for its stakeholders. Investors and industry enthusiasts are eagerly awaiting the developments set in motion by these crucial decisions.

0 notes

Text

youtube

Passion Meets Purpose: Leveraging Untapped Talent Pools I Explore your Talent Pools

Watch an insightful discussion featuring social sector leaders Shalabh Sahai, Poonam Choksi, Vaijayanti Bagwe, and Jithin Thadani Nedumala. Explore the transformative power of volunteers aligned with an organization's mission and values. Discover strategies for engaging volunteers strategically to drive sustainable social impact. Don't miss the opportunity to learn from these experts.

0 notes

Text

"The Unforgettable Celebration: Kamya Panjabi and Shalabh Dang Surprises Daughter Aara on a Special Day"

Actress Kamya Panjabi and her husband Shalabh Dang have extended birthday wishes to their daughter, Aara Panjabi, as she turns 14 today, October 6th. Both parents took to social media to post a picture of their daughter and express their joy on her special day. Kamya Panjabi shared a video of Aara entering the house and leading her towards the birthday cake. In an amusing twist, Aara decided to…

View On WordPress

0 notes

Text

The Allure of MSME Loans: Why Business Owners Choose Them

Among the array of funding options available, MSME (Micro, Small, and Medium Enterprises) loans have emerged as a preferred choice for business owners. In this article, we'll delve into the reasons behind the allure of MSME loans and why they are a popular choice in the entrepreneurial world.

Fueling Business Expansion

One of the primary reasons entrepreneurs turn to MSME loans is their ability to fuel business expansion. Whether you're a small startup or a medium-sized enterprise, accessing additional capital can be a game-changer. These loans provide the financial boost needed to scale operations, hire new talent, invest in equipment, and explore new markets.

Flexible Usage

MSME loans offer entrepreneurs flexibility in how they use the funds. Whether it's working capital needs, purchasing inventory, upgrading technology, or marketing initiatives, these loans can be tailored to various business requirements. This adaptability is a significant advantage for entrepreneurs with diverse needs.

Also Read: Alternative Investments: Exploring Beyond Stocks and Bonds

Competitive Interest Rates

Compared to alternative lending options, MSME loans often come with competitive interest rates. This affordability makes them an attractive choice for business owners who want to access capital without incurring exorbitant interest costs. The favorable terms can help maintain healthy profit margins while repaying the loan.

Collateral or Collateral-Free Options

Entrepreneurs appreciate the variety of MSME loan options available. Depending on their risk appetite and asset base, borrowers can opt for collateral-backed loans or collateral-free loans. Collateral-free loans, in particular, allow businesses to access funds without putting assets at stake.

Abhay Bhutada, MD of Poonawalla Fincorp, emphasizes that MSME loans provide a solution for immediate financial requirements, offering repayment durations ranging from 12 to 60 months. This inclusivity in loan terms benefits startups and fledgling enterprises by providing them with fair and accessible funding prospects.

Fast Approval and Disbursement

In the fast-paced world of business, timing is critical. MSME loans often offer swift approval and disbursement processes, enabling entrepreneurs to seize opportunities or address urgent financial needs promptly. This speed is especially beneficial when capital is needed to capitalize on a time-sensitive business endeavor.

Also Read: Unleashing eKYC's Potential in Finance

Extended Repayment Tenures

Business owners appreciate the extended repayment tenures that many MSME loans offer. This feature reduces the monthly repayment burden and allows for better cash flow management. Entrepreneurs can choose tenures that align with their business's revenue cycles and financial stability.

Conclusion

In the world of entrepreneurship and investing, accessing capital is often the catalyst for business success. MSME loans have earned their place as a preferred choice for business owners due to their flexibility, affordability, and accessibility. Entrepreneurs can harness the power of these loans to drive business growth and achieve their entrepreneurial dreams. Due to their increasing demand, financial organizations such as Spandana Sphoorty Financial Limited, under the leadership of Shalabh Saxena, are considering the introduction of MSME loan offerings.

0 notes

Text

Chhattisgarh Latest News Update

CM sends out 50 mobile veterinary units

On Sunday, Chhattisgarh Chief Minister Bhupesh Baghel launched 50 mobile veterinary units as part of the Chief Minister Gauvansh Mobile Medical Scheme.

According to an official communique, he did this after releasing monies to beneficiaries of the Rajiv Gandhi Kisan Nyay Yojana and other initiatives in the Mahasamund area. The Mobile Medical Scheme, similar to the Haat Bazaar clinics and Urban Slum Health Clinics, has been launched. Under this program, 163 medical trucks would travel to gauthans and gramme panchayats to give free services. Sick animals will also be cared for. The goal of this system is to give better medical care to the state's cattle.

Tamradhwaj Sahu has been named to the CWC

Tamradhwaj Sahu, the Home Minister of Chhattisgarh, was named a member of the Congress Working Committee, the party's highest decision-making body, on Sunday. According to an official announcement, Sahu is among the newly appointed CWC members, and Phulo Devi Netam is among the permanent invitees reestablished by Congress President Mallikarjun Kharge.

The new CWC contains 39 regular members, 32 permanent invitees, including certain state officials, and 13 special invitees.

Three people have been arrested for murder

On Sunday, Chhattisgarh Police detained three people, including a lady, for the murder of an old woman. The woman also pretended to die in order to elope with her boyfriend.

Dr. Umesh Kumar Sahu, Pradip Janghel, and Supriya Yadav were named as suspects by Durg Superintendent of Police Shalabh Kumar Sinha. Supriya is from the Durg district, while the others are from the Khairagarh-Chhuikhadan-Gandai district. The three made up a bogus story about Yadav's death by burning Surja Bai Markam's (90) body in Yadav's home so she could escape with her boyfriend, Dr. Sahu.

Yadav persisted in returning to her children, so Sahu abandoned her in Khairagarh. When the police discovered that Yadav was still alive, they launched an inquiry that revealed the scheme.

0 notes