#Security Policy Management Market size

Explore tagged Tumblr posts

Text

Maximize Digital Presence: Essential Digital Marketing Strategies for 2024

In the ever-evolving digital landscape, staying ahead of the curve is essential for businesses looking to maximize their digital presence. As we move into 2024, several digital marketing strategies stand out as crucial for achieving success. Here’s a comprehensive guide to the essential digital marketing strategies for the year ahead.

1. Leverage AI and Automation

Personalized Customer Experiences

Artificial Intelligence (AI) and automation tools have revolutionized how businesses interact with customers. By utilizing AI-driven analytics, you can gain deeper insights into customer behavior, allowing for highly personalized marketing campaigns. Chatbots, personalized email marketing, and predictive analytics can enhance user experience and drive conversions.

Efficiency in Campaign Management

Automation tools can streamline your marketing efforts, from scheduling social media posts to managing email campaigns. This not only saves time but also ensures that your marketing activities are consistent and timely.

2. Focus on Content Quality and Relevance

High-Value Content Creation

Content remains king in 2024, but the focus is on quality and relevance. Create high-value content that addresses your audience’s pain points and provides actionable insights. This includes blog posts, whitepapers, videos, and infographics.

SEO Optimization

Search engine optimization (SEO) is critical for visibility. Ensure your content is optimized for search engines by using relevant keywords, creating engaging meta descriptions, and utilizing internal and external links. Voice search optimization is also becoming increasingly important as more users rely on voice-activated devices.

3. Harness the Power of Social Media

Platform-Specific Strategies

Different social media platforms cater to different demographics and user behaviors. Develop platform-specific strategies to maximize engagement. For instance, use Instagram for visual storytelling, LinkedIn for professional content, and TikTok for short, engaging videos.

Social Commerce

Social commerce is on the rise, with platforms like Instagram and Facebook offering in-app shopping experiences. Leverage these features to provide seamless shopping experiences directly within social media platforms, boosting sales and customer satisfaction.

4. Invest in Video Marketing

Short-Form and Live Videos

Short-form videos and live streaming continue to dominate the digital space. Platforms like TikTok, Instagram Reels, and YouTube Shorts are perfect for creating engaging, bite-sized content. Live videos offer real-time interaction with your audience, fostering a sense of community and trust.

Educational and Explainer Videos

Videos that educate or explain complex concepts can position your brand as an authority in your industry. Create tutorials, product demonstrations, and behind-the-scenes content to engage and inform your audience.

5. Embrace Omnichannel Marketing

Consistent Messaging Across Channels

Omnichannel marketing ensures that your customers have a seamless experience across all digital and physical channels. Consistent messaging and cohesive brand experiences across websites, social media, email, and in-store interactions can significantly enhance customer loyalty.

Integrated Customer Data

Integrate customer data from various touchpoints to create a unified view of the customer journey. This helps in delivering personalized experiences and improving overall customer satisfaction.

6. Prioritize Data Privacy and Security

Transparency and Trust

With increasing concerns about data privacy, it’s crucial to prioritize transparency and build trust with your audience. Clearly communicate your data policies and ensure that customer data is protected.

Compliance with Regulations

Stay updated with data protection regulations such as GDPR and CCPA. Ensure your marketing practices comply with these regulations to avoid legal issues and build credibility with your audience.

Conclusion

As digital marketing continues to evolve, staying ahead requires a strategic approach and a willingness to adapt to new trends and technologies. By leveraging AI and automation, focusing on content quality, harnessing social media, investing in video marketing, embracing omnichannel strategies, and prioritizing data privacy, you can maximize your digital presence in 2024 and beyond. Stay proactive, stay informed, and watch your digital marketing efforts thrive in the coming year.

2 notes

·

View notes

Text

“Still the arrangement is bringing new attention to the company’s scale and ubiquity. “It’s impossible to think of BlackRock without thinking of them as a fourth branch of government,” says William Birdthistle, a professor at the Chicago-Kent College of Law who studies the fund industry.

(…)

There’s probably no other financial institution that brings to the table what BlackRock does. It’s experienced in running large portfolios on behalf of others. It’s ubiquitous in markets for everything from passive, index-linked products to hands-on mutual funds, with $6.5 trillion in assets under management as of March 31. It’s the largest issuer of ETFs, which act like mutual funds but trade on an exchange. It actively manages more than $625 billion in bond funds for pension plans and other institutional clients. Almost anyone looking to buy a diverse portfolio quickly would consider BlackRock—and the Fed did the same. In a virtual hearing of the Senate Banking Committee on May 19, Fed Chairman Jerome Powell said BlackRock was hired for its expertise and “it was done very quickly due to the urgency” of the matter.

Beyond money management, BlackRock’s software platform, Aladdin, appealed to the Fed. The program evaluates risk for clients that include governments, insurers, and rival wealth managers, monitoring more than $20 trillion in assets. (Bloomberg LP, the parent company of Bloomberg News, sells financial software that competes with Aladdin.)

BlackRock has ascended to speed-dial status among Washington officialdom in part through shrewd business maneuvering. It scooped up Barclays Global Investors, including its iShares ETF division, in the fallout from the 2008 crisis. That gave BlackRock a stronghold in low-cost index funds, transforming it into the world’s largest asset manager almost overnight—and supercharging more than a decade of growth.

At the same time, the money manager built a powerful advocacy arm. Its sphere of influence reaches beyond the central bank to lawmakers, presidents, and government agency heads from both political parties, though its hiring leans Democratic. Bloomberg found only a handful of current BlackRock executives who came out of the George W. Bush administration, but more than a dozen Barack Obama alumni. These include Obama’s national security adviser, senior adviser for climate policy, the former Federal Reserve vice chairman he appointed, and numerous White House, Treasury, and Fed economists.

(…)

BlackRock, however, was handed three Fed assignments without any competitive process—though the Fed plans to rebid the contracts once the programs are in full swing. BlackRock will manage portfolios of corporate bonds and debt ETFs. It will do the same for newly issued bonds—sometimes acting as the sole buyer—and for up to 25% of bank-syndicated loans. And it will purchase commercial mortgage-backed securities from quasi-government agencies such as Fannie Mae and Freddie Mac.

BlackRock could reap as much as $48 million a year in fees for its Fed work, according to a Bloomberg analysis. That’s no windfall, especially in relation to its $4.5 billion in earnings last year. But it may further cement the money manager’s ties with policymakers. On May 12, BlackRock began the first stage of these programs when it began buying ETFs.

As with technology companies Facebook Inc. and Alphabet Inc., BlackRock’s growth raises questions over how big and useful a company can become before its size poses a risk. The firm has long argued that, unlike banks, it’s not making investments for itself with tons of borrowed money. Watching over large sums of money for clients doesn’t make its business a threat to the broader financial system.

With its latest assignment, that argument could be harder to make, says Graham Steele, director of the Corporations and Society Initiative at the Stanford Graduate School of Business. “They are so intertwined in the market and government that it’s a really interesting tangle of conflicts,” says Steele, who formerly worked at the Federal Reserve Bank of San Francisco. “In the advocacy community there’s an opinion that asset managers, and this one in particular, need greater oversight.”

Already there are growing worries about the power of BlackRock, Vanguard Group Inc., and State Street, often called the Big Three because they hold about 80% of all indexed money. That raises concerns about how they wield their voting power as shareholders and has even drawn attention from antitrust officials.

(…)

And then there are the potential conflicts. One arm of BlackRock knows what the Fed is buying, while other parts of the business participating in credit markets could benefit from that knowledge. To avoid conflicts, “there are stringent information barriers in place,” says the BlackRock spokesman. BlackRock employees working on the Fed programs must segregate their operations from all other units, including trading, brokerage, and sales. The fee waiver on ETFs helps avoid the appearance of self-dealing.

But BlackRock’s contract with the Fed also acknowledges that senior executives “may sit atop of the information barrier” and “have access to confidential information on one side of a wall while carrying out duties on the other side.” Staff working on the Fed programs must go through a cooling-off period before moving to jobs on the corporate side, but it would last only two weeks.

Birdthistle, the Chicago-Kent law professor, suggests the Fed could have made its process more competitive by allocating some of its funds for buying corporate credit to a group of asset managers from the outset, instead of just one. “It raises the question: Why did all the money have to go to one company?” he asks. “I get why BlackRock would be on the list, but I don’t understand why it would be the only one on the list.””

6 notes

·

View notes

Text

In futures trading, investors rely on a variety of factors to make buying or selling decisions. Here are some key factors for investors to consider

Raw Trading Ltd

Market Analysis: Investors analyze the market conditions, including supply and demand dynamics, price trends, and market sentiment. They use technical analysis tools, such as charts and indicators, to identify potential trading opportunities.

Fundamental Analysis: Investors assess the fundamental factors that can impact the price of the underlying asset. This includes analyzing economic indicators, geopolitical events, weather patterns, and government policies that can affect supply and demand.

News and Information: Investors stay updated with the latest news and information related to the underlying asset. They monitor news releases, industry reports, and expert opinions to gauge the potential impact on prices.

Risk Management: Investors use risk management techniques to determine their entry and exit points. They set stop-loss orders to limit potential losses and take-profit orders to secure profits. Risk management also involves determining the appropriate position size and leverage to use in each trade.

Technical Indicators: Investors use various technical indicators to identify potential entry and exit points. These indicators include moving averages, oscillators, and trend lines. Technical analysis helps investors identify patterns and trends in price movements.

Trading Strategies: Investors develop and implement trading strategies based on their analysis and risk tolerance. These strategies can be based on trend following, mean reversion, breakout, or other trading methodologies.

Market Orders: Investors can place market orders to buy or sell futures contracts at the prevailing market price. Market orders are executed immediately at the best available price.

Limit Orders: Investors can also place limit orders to buy or sell futures contracts at a specific price or better. These orders are not executed immediately but are placed in the order book until the specified price is reached.

Stop Orders: Investors use stop orders to limit potential losses or protect profits. A stop order becomes a market order when the specified price is reached, triggering the execution.

Electronic Trading Platforms: Investors can access futures markets through electronic trading platforms provided by brokerage firms. These platforms offer real-time market data, order placement, and trade execution facilities. IC Markets

It is important for investors to conduct thorough research, stay updated with market developments, and have a well-defined trading plan to make informed buying or selling decisions in futures trading.

1 note

·

View note

Text

Benefits Of Investing in Real Estate

Are you on the hunt for a savvy investment that will yield advantageous long-term benefits? Look no further because the current king on the throne of investments is real estate! Investing in real estate is guaranteed to yield far superior results in comparison to any other investment opportunity out there.

Capital Appreciation

Let's be candid, when investing in any asset, we all have hopes that the value will increase. However, many depreciate with time, such as automobiles, bikes, and technological gadgets like mobile phones or laptops. But, with real estate, the opposite is true! The value of a property purchased today is projected to increase over the coming years due to rental incomes and the appreciation of residential real estate. The icing on the cake is that if you decide to sell your property in the future, chances are you'll make a profit!

2. Easily Build Equity

Have you ever reflected on how buying a home could pave the way to building equity? Let's break it down for you. Once you complete your final mortgage payment, your assets begin to accumulate, and your property transforms into a firm foundation for expanding your monetary worth. As your equity increases, you gain the freedom to purchase additional properties and receive a higher cash flow. This situation is beneficial for all parties, resulting in a symbiotic outcome.

3. Long Term Security

In our fast-paced world, we often crave the instant gratification of easy money without any entanglements. But we mustn't forget that such money can be flimsy and fleeting. On the other hand, putting down roots in residential real estate at a young age can provide you with lifelong stability. Renting out these properties as co-living spaces offers a profitable opportunity to dip your toes into the world of commercial or residential real estate.

4. Tax Benefits

Worried about the harsh taxes that plague real estate investments? Fear not, as co-living spaces can act as your knight in shining armor. You don't have to fret about property taxes, mortgage rates, property management interest, repairs, or insurance policies when your property is a soaring success story. Say goodbye to tax worries and welcome extra income with open arms!

5. Diversification

Investment opportunities come in all shapes and sizes - from trading stocks to buying luxury cars. However, we must remember that life is an unpredictable rollercoaster, and stocks may plummet in value overnight. During such episodes of market turmoil, real estate remains our reliable companion, steadily appreciating in value and serving as a steady and dependable fallback option. Placing all our eggs in one basket is unwise and risky. Therefore, diversification is key - and investing in REAL ESTATE is certainly one of those doors worth knocking on!

6. Multiple Income Source

Transforming your dwelling into a co-living utopia is a masterful strategy to cultivate myriad money making channels. Infusing your residence with communal vibes taps into the burgeoning trend of shared living, satisfying the needs of renters seeking flexible and budget-friendly accommodations. Converting your personal space into a co-living hub is a stellar opportunity to optimize your investment and broaden your fiscal horizons.

7. Leverage

Investing in real estate during your youth is a stroke of brilliance. You see, your CIBIL score tends to be at its prime during this time, and if you've got a hefty chunk of change for the down payment, you can take out a loan to cover the rest. The cherry on top? You don't have to wait until the debt is paid off to call yourself a property owner. It's a wise decision, indeed. But hold on, what if you're no spring chicken? Fret not, because it's never too late to hop on the real estate bandwagon!

8. Tangible Asset

Real estate investing is akin to holding a tangible treasure. You can physically touch it, see it's worth firsthand, and enjoy the feeling of absolute ownership. It's not some abstract, intangible investment like stocks or bonds. Nay, it's a concrete, solid asset that can provide stability and financial security. Owning property not only means you have a roof over your head, but it's also an investment that always has the potential to grow. Whether you opt to rent it out or sell it later, your investment continues to be a beacon of peace and security. All in all, if you're on the hunt for a reliable, smart long-term investment plan, real estate is a savvy bet.

Are you seeking to make your mark in the real estate game? Well, listen up because your 20s is prime time to make that happen! Investing in property can be a seriously shrewd financial decision, and converting your real estate into a co-living hub is the savvy choice to make. Luckily, companies like 'Xtra Income Homes' have streamlined the process, making it simple for you to get started on your investment journey. Simply head to their website via the link below, and discover all the tools and knowledge you need to make your mark on the property ladder:

Remember, with so many options out there, it's all about taking your time and finding the property that truly speaks to you. The perfect investment home is waiting just for you!

2 notes

·

View notes

Text

Editor's Note: Below is a viewpoint from the Foresight Africa 2023 report, which explores top priorities for the region in the coming year. Read the full chapter on food security.

In Liberia, we hold one truth to be self-evident: If one has not eaten rice on any given day, then one has not eaten. Well, at least that is the conventional theory that has driven food policy and planning for the last 60 years.

Rice is Liberia’s staple food, and our contemporary history has been completely shaped by rice: Its availability on the local market, price, and, to a lesser extent, quality. Since 1979, when government plans to raise tariffs on imported rice caused deadly riots, and eventually a coup d’état, public policy has favored imports over locally produced rice.

Fast forward to 2022, and it’s 4Cs: COVID-19, Climate, Conflict, and Commodity price escalations. Four simultaneous and intensifying shocks, at a time when we have not fully recovered from the previous shock of Ebola.

And here is another incontrovertible truth: Liberians’ dogged reliance on imported food is not sustainable. The looming food security crisis is an opportunity to finally tackle rice availability on three main fronts: Boosting smallholder production; taking agribusiness micro, small, and medium-sized enterprises (MSMEs) to scale; and attracting commercial agri-food enterprises.

Since we have ostensibly been doing just these things for years, now is the time to innovate the “how” of agri-food production. The “innovation” is simple: Enhance what is working, what is familiar and help farmers and businesses to produce more, faster, cheaper—and get surpluses to market. The technologies exist to do this.

Take rice. President Weah has set up a National Rice Stabilization Task Force to ensure constant availability of rice in our markets. We have set a national goal to grow 75 percent of what we consume in four cropping seasons: A 150 percent increase in production over what we are doing now.

In setting these targets, we considered the production realities of our smallholders. Realizing the adoption of yield improving technologies has been poor, and rarely sustained past project-end, we are resolving some of the challenges brought on by limited capital and labor for any given piece of land: Improving weed and pest management on farms; post-harvest processing capacities at village level (to optimize use); and access to markets and digital buying platforms. Couple these with solutions that enhance food and nutrition security, water, and energy at community level.

We work with MSMEs along the value chain to grow or build and service and maintain the seeds, tools, and equipment needed to produce, package, transport, and market rice to urban consumers. The Liberia Agricultural Commercialization Fund is providing critical financing to innovations that service food markets and helping rice processors to scale up operations.

We are building our knowledge base and creating business profiles to attract private investments.

The global food security crisis compels Liberia to draw on its legendary resilience and creativity. We are intentional about getting rice right. And we will.

2 notes

·

View notes

Text

Importance of E-commerce Functionality

E-commerce functionality refers to the set of features and capabilities that allow an online store to operate successfully. These functionalities are designed to ensure a seamless shopping experience for customers and efficient management for businesses. From product displays and payment gateways to order management and customer support, e-commerce functionalities play a critical role in the success of any online business.

E-commerce Functionality

Why is E-commerce Functionality Important?

The proper functionality of an e-commerce platform is vital to driving sales, improving customer satisfaction, and standing out in the competitive market. Here are a few key reasons it’s important:

● Improved User Experience: A well-functioning e-commerce platform ensures that customers can browse, select, and purchase products effortlessly. Easy navigation, quick load times, and intuitive design improve the overall user experience.

● Enhanced Trust and Credibility: Features like secure payment processing and transparent return policies build customer trust, encouraging repeat purchases.

● Efficient Operations: Functionalities like inventory management, automated order processing, and real-time tracking streamline business operations, saving time and resources.

● Higher Conversion Rates: Features such as personalized recommendations, streamlined checkout processes, and mobile responsiveness directly impact customer engagement and conversions.

E-commerce Functionality Checklist

To ensure your e-commerce platform is functional and efficient, consider including the following major features:

1. User-Friendly Interface:

● Simple navigation

● Search functionality with filters

● Mobile-responsive design

2. Product Management:

● High-quality product images

● Clear descriptions and specifications

● Options for variations (size, color, etc.)

3. Secure Payment Options:

● Multiple payment gateways (credit cards, PayPal, etc.)

● SSL encryption for secure transactions

4. Shopping Cart and Checkout:

● Save cart functionality

● Guest checkout

● Multiple shipping and delivery options

5. Customer Support:

● Live chat or helpdesk integration

● Easy-to-access FAQs and return policies

6. Order Management:

● Real-time inventory updates

● Order tracking capabilities

● Automated order confirmation emails

7. Marketing Tools:

● Email marketing integration

● Discounts and coupon codes

● Personalized product recommendations

E-commerce Functionality Definition

Simply put, e-commerce functionality is the backbone of any online store — it refers to the tools, features, and processes that ensure the smooth operation of an e-commerce platform, both for the business and the end customer.

Final Thoughts

Whether you’re starting a new online store or refining an existing one, prioritizing e-commerce functionality is essential. By ensuring key features are in place, businesses can enhance the customer shopping experience, boost operational efficiency, and achieve their revenue goals.

Visit us:

0 notes

Text

Smart Water Meter Market Analysis: Dynamics, Growth Drivers, and Restraints Impacting the Industry

The smart water meter market has emerged as a vital component in modern water management systems, leveraging technology to optimize water usage, reduce wastage, and ensure accurate billing. With the increasing emphasis on sustainable resource management, the adoption of smart water meters has gained significant traction across the globe. This analysis delves into the market dynamics, growth drivers, and potential restraints shaping the industry's trajectory.

Market Dynamics

The smart water meter market is characterized by rapid technological advancements and increased investment in digital infrastructure. These devices, equipped with advanced sensors and wireless communication capabilities, allow for real-time monitoring of water consumption. The integration of the Internet of Things (IoT) has further enhanced the functionality of smart meters, enabling utilities to collect and analyze large volumes of data for efficient resource allocation.

Government regulations and initiatives aimed at reducing non-revenue water (NRW) losses have played a pivotal role in driving market demand. For instance, water utilities are increasingly turning to smart meters to detect leaks, measure consumption accurately, and address water theft. Furthermore, the global push toward smart city projects has underscored the importance of smart water meters in urban planning and resource optimization.

Growth Drivers

Technological Innovation: The integration of IoT and artificial intelligence (AI) in smart water meters has revolutionized water management. Advanced analytics enable utilities to predict consumption patterns, identify anomalies, and enhance operational efficiency.

Rising Awareness of Water Scarcity: With water scarcity becoming a pressing global issue, the demand for efficient water management solutions has surged. Smart water meters provide a tangible way for consumers and utilities to conserve water and reduce waste.

Supportive Government Policies: Many governments worldwide have implemented policies and subsidies to promote the adoption of smart water meters. For instance, the European Union's directives on water conservation have led to widespread deployment of these devices in member states.

Cost Savings: Smart water meters help reduce operational costs for utilities by minimizing manual meter reading and streamlining billing processes. These savings, in turn, make the technology appealing to resource-constrained utilities.

Restraints

Despite its promising outlook, the smart water meter market faces certain challenges. High initial installation costs remain a significant barrier, particularly for small and medium-sized utilities with limited budgets. The transition from traditional meters to smart systems often requires substantial investment in infrastructure and training.

Data security and privacy concerns also pose challenges to widespread adoption. As smart water meters collect and transmit consumption data, ensuring secure communication channels and protecting consumer information is paramount.

Additionally, the lack of standardized protocols for smart meter communication can hinder interoperability between devices from different manufacturers. This fragmentation may lead to inefficiencies and increased costs for utilities aiming to deploy these systems at scale.

Future Outlook

The smart water meter market is poised for sustained growth, driven by increasing urbanization, the proliferation of smart city projects, and rising environmental awareness. Emerging economies, particularly in Asia-Pacific and Latin America, offer lucrative opportunities as governments invest in modernizing water infrastructure.

Advancements in technology, such as the development of low-power wide-area networks (LPWAN) and blockchain-based security protocols, are expected to address current limitations and enhance market adoption. By overcoming these challenges, the industry is well-positioned to play a critical role in addressing global water management challenges and promoting sustainable practices.

In conclusion, the smart water meter market represents a confluence of technology and sustainability. While certain hurdles remain, the industry's potential to transform water management and contribute to global conservation efforts makes it an area of keen interest for stakeholders worldwide.

Request Sample PDF Report : https://www.pristinemarketinsights.com/get-free-sample-and-toc?rprtdtid=NDU2&RD=Smart-Water-Meter-Market-Report

#SmartWaterMeterMarket#SmartWaterMeterMarketTrends#SmartWaterMeterMarketInsights#SmartWaterMeterMarketGrowth#SmartWaterMeterMarketAnalysis#SmartWaterMeterMarketOutlook

0 notes

Text

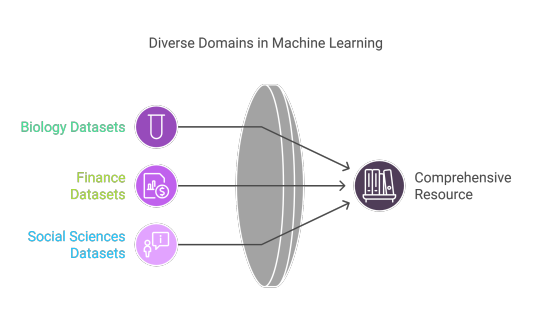

Datasets for Machine Learning Projects: Making Content Work for Everyone

In the fast-paced world of artificial intelligence (AI) and machine learning (ML), datasets are fundamental to success. They power algorithms, provide pattern recognition, and do much for groundbreaking innovations. GTS.AI recognizes the potential of high-quality datasets to aid in advancing the purpose of making everything work for everyone. The accuracy of performance is essential, whether training a model on identifying objects in images or predicting stock market trends. Let's dive into the different sources from which datasets come and how GTS.AI is breaking ground in handling datasets for modern AI projects.

Significance of the Datasets in Machine Learning

Datasets are the core of ML models-they contain the information from which algorithms learn to perform tasks such as classification, regression, and clustering. Below are reasons that make datasets important.

Model Training: Algorithms learn their relationship and patterns with labeled datasets. Models incorporating insufficient and homogeneous data would be hard-pressed for generalization and thus performance.

Performance Assessment: To approach model performance correctness and robustness, test datasets have to be employed. Functions will imitate real-world scenarios for reliability evaluation.

Inclusivity in Reaching its Purposes: Diverse datasets go a long way in creating systems that perform equally across population segments, where bias is less prevalent, and the user experience is much enhanced.

Types of Datasets for Machine Learning Work

Based on the kind of application, various types of datasets are utilized:

Structured Data: Formatted and organized data, such as excel sheets or SQL tables, are generally used for applications such as fraud detection and recommendation systems.

Unstructured Data: Data that does not follow any particular structure is sourced from texts, images, and videos, and these are used in projects dealing with NLP and computer vision.

Time-Series Data: Data collected at regular intervals, usually time-dependent and critical for weather forecasting and finance analysis.

Anonymized and Synthetic Data: Data in which privacy concerns have been accounted for or data made synthetically, used to augment training without security breach.

Popular Sources for ML Datasets

Many datasets are now included on Kaggle, which is one of the popular sites to experiment and compete against others.

UCI Machine Learning Repository; a credible source for academic and practical projects.

Open Government Data Portals; government sources such as the data.gov website covering data on public policy, transportation, and others.

Custom data collection refers to specially curated dataset collected by scraping the web, through surveys, or via IoT devices.

What Should the Dataset Managers Be Careful About?

Even though these managers are very important, they all have challenges.

Volume and Variety: Huge size and variety of these datasets need robust storage capabilities as well as quick processing.

Quality Assurance: Imprecisely labeled or imbalanced datasets hamper how effectively the data are modeled and consequently introduce biases.

Privacy Concerns: Any handling of sensitive data must comply with all data protection laws.

Access and Licensing: There are challenges related to ownership of datasets and the allowance for the use of a dataset.

How GTS.AI Provides a Solution for Dataset Management

GTS.AI is aware of these challenges and provides cutting-edge solutions to support the effective usage of datasets by organizations to maximize power.

Custom Dataset Curation: We design datasets tailored specifically to the requirements of your project, keeping a watchful eye on their quality and relevance.

Data Augmentation: In data augmentation, we train your datasets to assist you in developing models through generating synthetic data and doing some class balancing.

Annotation Services: Using precise labeling and semantic annotation, we ready datasets for immediate input into AI systems.

Mitigation of Bias: We are pro-inclusivity and present reversible resources to identify and fix biases in datasets; ensuring fairness and equity.

Secure Data Handling: With GTS.AI, the data relying is maintained in very strict standards, safeguarding sensitive data and upholding the compliance to the regulations.

Content Works for Everyone

At GTS.AI, we make certain that AI is accessible and impactful for all. Not only do we provide quality datasets and annotation services, but we also allow organizations to develop truly working and impactful AI systems. Other developments range from accessibility enhancement to promoting innovations, with our solutions ensuring that the content speaks to everyone.

Conclusion

The dataset is the lifeline for machine learning operations in expanding the capability of AI systems. Globose Technology Solution GTS.AI couples expertise with innovation and a generous mindset for inclusiveness in the provision of dataset solutions that agilely empower all organizations and modify industries. So, are you in to take your AI venture to another level? Come and visit GTS.AI, discovering how we can help you make your content work for everyone.

0 notes

Text

Get Expert Strata Insurance Broker Services with Infinity Insurance

When it comes to protecting your strata property, having the right insurance coverage is crucial. Strata properties, by nature, come with unique complexities, as they often involve shared ownership and communal areas. Ensuring every aspect of your property is adequately protected can be a daunting task without expert guidance. That’s where Infinity Insurance steps in as your trusted strata insurance broker.

Why Do You Need a Strata Insurance Broker?

Navigating the maze of insurance policies, exclusions, and fine print can be overwhelming. For strata properties, this complexity increases due to the need to cover both individual and communal spaces, such as hallways, elevators, and pools. A strata insurance broker acts as your advocate, helping you find the best policy that caters to your property’s specific needs.

At Infinity Insurance, we understand that no two strata properties are the same. Whether it’s a small complex or a multi-story apartment building, our expert brokers work with you to identify potential risks, ensure compliance with regulations, and tailor a policy that offers maximum protection.

Comprehensive Coverage for Peace of Mind

Strata insurance isn’t a one-size-fits-all solution. With Infinity Insurance, we focus on creating a bespoke plan that addresses all your concerns. Our coverage typically includes:

Building Insurance: Protects the physical structure of the property, including walls, roofs, and fixtures.

Public Liability: Covers legal liabilities in case of injuries or accidents in common areas.

Common Area Contents: Ensures shared assets, such as gym equipment or lobby furniture, are safeguarded.

Catastrophic Events: Protection against natural disasters like storms, floods, or bushfires.

Legal Costs: Assistance with expenses for disputes or claims involving the property.

As your strata insurance broker, we go beyond standard coverage. Our brokers assess risks specific to your location and property type, ensuring you’re protected against every eventuality.

Why Choose Infinity Insurance?

Expertise You Can Rely On: With years of experience in strata insurance, our brokers have in-depth knowledge of the market. We negotiate with Australia’s leading insurers to secure competitive premiums without compromising coverage.

Tailored Solutions: We understand that each property has unique needs. That’s why our team invests time in understanding your requirements and crafting a customised policy.

Hassle-Free Claims: Filing an insurance claim can be stressful. At Infinity Insurance, we simplify the process, acting as your advocate to ensure swift and fair settlements.

Ongoing Support: Our job doesn’t end once you’ve purchased a policy. We offer continuous support to reassess and update your coverage as your property evolves.

Protect What Matters Most

Owning or managing a strata property comes with significant responsibilities. Ensuring comprehensive coverage should be at the top of your priority list. By partnering with Infinity Insurance, you gain peace of mind knowing that your property is in expert hands.

Our team of experienced strata insurance brokers is dedicated to safeguarding your investment and simplifying the complexities of strata insurance. We believe in transparency, exceptional service, and delivering value for every client.

Get Started Today

Don’t leave your strata property vulnerable. Trust Infinity Insurance to provide expert guidance and comprehensive coverage tailored to your needs. Contact us today for a no-obligation consultation and take the first step towards securing your property’s future.

0 notes

Text

Impact of Digitalization on International Trade

Digitalization has transformed the global trade landscape, redefining the way businesses operate, communicate, and exchange goods and services. The impact of digitalization on international trade is profound, touching every aspect of the supply chain, from sourcing to final delivery, and reshaping economic relationships worldwide.

Enhanced Efficiency and Cost Reduction Digital technologies, such as automated processes, blockchain, and artificial intelligence, have streamlined operations in international trade. By reducing manual errors and automating repetitive tasks, businesses save both time and money. Blockchain, for example, offers secure, transparent transaction records, eliminating the need for intermediaries and minimizing fraud.

Improved Market Access Digitalization has broken geographical barriers, enabling businesses, especially small and medium-sized enterprises (SMEs), to access international markets. E-commerce platforms like Amazon and Alibaba allow companies to showcase their products globally, connecting with a broader customer base and boosting exports.

Data-Driven Decision Making The availability of big data and analytics tools has empowered companies to make informed decisions. Businesses can analyze trade patterns, customer preferences, and market trends, optimizing their strategies to maximize profits. Data-driven insights help reduce risks and ensure compliance with international trade regulations.

Faster Communication and Transactions Digital tools like email, instant messaging, and cloud platforms facilitate real-time communication among global trading partners. Additionally, digital payment solutions such as SWIFT, PayPal, and cryptocurrencies ensure faster and more secure transactions, enhancing trust between parties.

Supply Chain Optimization Digitalization has revolutionized supply chain management. Technologies like IoT (Internet of Things) provide real-time tracking of goods, ensuring better inventory management and timely deliveries. Predictive analytics helps businesses anticipate disruptions, allowing them to respond proactively.

Challenges of Digitalization in International Trade Despite its benefits, digitalization also presents challenges. Cybersecurity threats, such as data breaches and hacking, pose significant risks. Moreover, developing nations often face a digital divide, limiting their participation in global trade. High costs of technology adoption and lack of infrastructure further exacerbate these issues.

Role in Trade Policies and Agreements Digitalization has influenced trade policies, with countries emphasizing the need for digital trade agreements. These agreements address issues like cross-border data flows, e-commerce regulations, and digital service taxes, fostering a fair and transparent trade environment.

Sustainability in International Trade Digitalization contributes to sustainable trade practices by reducing paper-based documentation and promoting green logistics solutions. Virtual meetings and digital platforms also minimize the need for physical travel, reducing carbon footprints.

Future of Digitalized Trade The impact of digitalization on international trade is expected to grow further with advancements in technology. Innovations like artificial intelligence, machine learning, and blockchain will continue to drive efficiency, transparency, and security in global trade. Moreover, fostering international cooperation to address digital challenges will be key to realizing its full potential.

Conclusion The impact of digitalization on international trade is undeniable, revolutionizing traditional business practices and fostering a more interconnected global economy. While challenges remain, the opportunities it presents far outweigh the drawbacks. By embracing digital technologies and addressing the associated risks, businesses and nations can unlock unprecedented growth and efficiency in the international trade arena.

0 notes

Text

Mastering ISO 27001 Certification, Cost & Benefits

Mastering ISO 27001 certification involves understanding the requirements of the standard, implementing a robust Information Security Management System (ISMS), and achieving certification through a recognized certification body. Here’s a comprehensive guide, including costs and benefits:

1. ISO 27001 Overview

ISO/IEC 27001 is an internationally recognized standard for establishing, implementing, maintaining, and improving an ISMS to secure sensitive information and ensure confidentiality, integrity, and availability.

2. Steps to Achieve ISO 27001 Certification

Understand the Standard:

Review ISO 27001 and Annex A, which contains 93 controls (as per the 2022 update).

Perform a Gap Analysis:

Compare your current practices against ISO 27001 requirements to identify areas for improvement.

Develop an ISMS:

Define the scope of your ISMS (e.g., departments, locations, and processes).

Create policies, procedures, and frameworks for managing risks and securing data.

Risk Assessment and Treatment:

Identify information security risks and implement appropriate controls to mitigate them.

Implement Controls:

Apply controls from Annex A, such as access management, incident response, encryption, and physical security.

Train Employees:

Conduct regular awareness training to ensure compliance with security policies.

Internal Audit:

Audit the ISMS to ensure it aligns with ISO 27001.

Management Review:

Ensure top management evaluates and supports the ISMS.

Certification Audit:

Engage an accredited certification body for an external audit.

Certification:

Upon successful completion, receive an ISO 27001 certificate, typically valid for three years, with annual surveillance audits.

3. Costs of ISO 27001 Certification

Costs vary depending on organization size, scope, and complexity. Key cost components include:

Consulting and Training:

Hiring experts to guide implementation or train staff: $5,000–$20,000.

Internal Resources:

Staff time for ISMS development, training, and audits.

Tools and Technology:

Security tools (e.g., encryption software, monitoring tools): $2,000–$10,000 annually.

Certification Audit:

Certification body fees for audit and registration: $4,000–$20,000.

Surveillance Audits:

Annual audits by the certification body to maintain the certification: $2,000–$8,000 per year.

4. Benefits of ISO 27001 Certification

Enhanced Security:

Protects sensitive data against threats like breaches and cyberattacks.

Regulatory Compliance:

Aligns with global regulations, such as GDPR, HIPAA, and Indonesia’s PDP Law.

Customer Trust:

Demonstrates commitment to security, enhancing credibility and attracting new clients.

Business Opportunities:

Opens doors to new markets where certification is a requirement.

Risk Management:

Helps identify, manage, and reduce security risks effectively.

Operational Efficiency:

Streamlines processes and reduces duplication through standardized practices.

Competitive Advantage:

Differentiates your organization in competitive industries.

Cost Savings:

Minimizes the likelihood of costly incidents and fines.

5. Mastering ISO 27001 Certification

Leverage automation tools for risk management and documentation.

Encourage top management support to drive the initiative.

Use training programs for staff to ensure compliance and awareness.

Conduct regular internal audits to identify and fix issues before external audits.

0 notes

Text

Mining Logistics Market Opportunity, Driving Factors And Highlights of The Market

The global mining logistics market size was estimated at USD 28.86 billion in 2023 and is projected to grow at a CAGR of 14.9% from 2024 to 2030. The market growth can be attributed to the increasing demand for metals and minerals, expansion of mining activities in remote areas, and technological advancements. Countries, like China, India, and Brazil are witnessing rapid industrialization and urbanization, leading to increased consumption of raw materials. This in turn, is driving the demand for efficient logistics solutions to transport these materials from mines to processing plants and end-users.

The expansion of mining activities in remote and hard-to-reach areas is another key market growth driver. As easily accessible mineral deposits are depleted, mining companies are exploring new regions, often located in challenging terrains with limited infrastructure. This necessitates the development of specialized logistics solutions to ensure the smooth transportation of raw materials. Furthermore, government policies and infrastructure development initiatives are playing a crucial role in shaping the mining logistics market. Governments across the globe are investing in the development of transportation networks, including road, railways, and ports, to support the mining industry.

One of the most significant trends in the market for mining logistics is the shift towards automation and smart logistics. Companies are increasingly adopting automated vehicles, drones, and robotics to streamline operations, reduce labor costs, and improve safety. Furthermore, integration of AI and machine learning in supply chain management enable companies in the market to optimize logistics operations by predicting demand, managing inventory, and identifying potential disruptions in real-time.

Gather more insights about the market drivers, restrains and growth of the Mining Logistics Market

Key Mining Logistics Company Insights

Some of the key companies operating in the mining logistics market include A.P. Moller - Maersk, ATG Australian Transit Group, Bis Industries, Blue Water Shipping, Centurion, Linfox Pty Ltd., PLS Logistics, TIBA, Tranz Logistics, and Vale.

• Blue Water Shipping is a provider of logistics services across the globe. The company’s logistics expertise includes aerospace logistics, mining logistics, chemical logistics, energy logistics, and solar energy logistics, among others. The company’s capacity for bulk cargo, cost-effectiveness, and access to specialized port infrastructure make it the most reliable and economical option for moving mined materials internationally.

• CSM Tech is engaged in providing specialized technology solutions for industries including agriculture, mining, education, healthcare, hospitality, and food security, among others. The company drives digital transformation through IoT, AI, and data analytics, offering innovative, customizable services tailored to mining companies’ needs.

Recent Developments

• In May 2024, Bralorne Gold Mines Ltd., a subsidiary of Talisker Resources Ltd signed an ore hauling agreement with Stromsten Enterprises, a trucking service provider, in partnership with Bridge River Management Corporation. Through the agreement the material from Mustang Mine will be transported to Craigmont milling facility.

• In March 2024, TIBA starts operations in Turkey. The operation in Turkey helps the company to strengthen the traffic between Turkey/Europe and Asia/Turkey, and also connect Turkey with Latin America and Africa.

Global Mining Logistics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global mining logistics market report based on type, application, and region:

Type Outlook (Revenue, USD Million, 2017 - 2030)

• Transportation Service

• Warehousing & Storage Service

• Value-added Service

Application Outlook (Revenue, USD Million, 2017 - 2030)

• Iron Ore

• Metals

• Coal

• Gold

• Others

Regional Outlook (Revenue, USD Million, 2017 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o UK

o Germany

o France

• Asia Pacific

o India

o China

o Japan

o South Korea

o Australia

• Latin America

o Brazil

• Middle East and Africa (MEA)

o Kingdom of Saudi Arabia (KSA)

o UAE

o South Africa

Order a free sample PDF of the Mining Logistics Market Intelligence Study, published by Grand View Research.

#Mining Logistics Market#Mining Logistics Market Size#Mining Logistics Market Share#Mining Logistics Market Analysis#Mining Logistics Market Growth

0 notes

Text

Industry trend|Rapid Growth in the Data Center Market Gives Rise to Management Challenges, This Taiwanese Company Launches RFID Solution to Solve

With the rapid development of information technologies such as cloud computing, big data, the Internet of Things and artificial intelligence, the scale of the global data center market continues to expand. In 2022, the scale of the global data center market has expanded to US$74.65 billion, a year-on-year growth rate of 9.9%, and the growth rate has remained at a good level of about 10% in the past five years. In 2023, the scale of the global data center market is about US$82.2 billion, a year-on-year increase of 10.04%. It is also predicted that the scale of the global data center market will reach US$90.4 billion in 2024. The hyperscale data center market is also growing, with a market size of US$80.2 billion in 2024 and is expected to increase to US$935 billion by 2032.

Promoted by national policies such as new infrastructure, digital transformation and the vision and goals of Digital China, the scale of my country's data center market continues to grow at a high speed. In 2022, the scale of my country's data center market has grown to 190.07 billion yuan, with a five-year compound growth rate of nearly 30%. In 2023, the scale of China's data center market is about 240.7 billion yuan, a year-on-year increase of 26.68%, and it is predicted that it will reach 304.8 billion yuan in 2024. In addition, the scale of data center racks in use is also growing steadily. As of August 2023, the total scale of data center racks in use in my country exceeds 7.6 million standard racks, and the total computing power reaches 1.97 trillion floating-point operations per second, ranking second in the world.

The rapid growth of the data center market has given rise to management challenges

At the same time, data center asset management faces many challenges, mainly including the following aspects:

Asset protection and security issues: Data centers are full of server racks, routers, modems, and servers, which are all high-value and need to be protected from theft or damage, which is usually managed through technology-based or manual security measures, but these measures can be costly and have limited effectiveness.

Inventory management complexity: There are many devices in the data center, and tracking inventory and its status (such as location, maintenance records, etc.) is a tedious and time-consuming task that requires a lot of manpower and material resources.

Environmental monitoring challenges: Data centers are often located in specific locations within a large area, and it is challenging to identify high-temperature locations, and temperature can have a significant impact on equipment health.

Lack of real-time performance: Traditional asset management methods often lack real-time performance and cannot reflect the status and location changes of assets in a timely manner, which may lead to delayed management decisions.

In addition, data centers may deploy multiple technologies and systems. It is a complicated process to integrate these technologies into a unified platform for management. Whether it is hiring workers to track or purchasing expensive data center infrastructure management (DCIM) software, it increases the operating costs of data centers.

RFID solutions reshape data center asset management

Recently, EPC Solutions Taiwan launched a new DCIM system, which has brought revolutionary changes to data center management with its innovative RFID technology and powerful functions. The DCIM solution includes internal software, as well as two boxes of hardware for each IT asset rack. One box contains the reader, and the other includes cable antennas, adapters, and metal tags. Users can order any number of readers, antennas, and tags. Effectively solve the challenges faced by data center asset management, as follows:

Anti-theft and asset tracking: The system uses UHF RFID technology to track the status of IT assets in the data center and digitally record the movement and maintenance of assets such as servers and routers. The exit portal uses fixed readers and antennas to detect tagged items. If someone attempts to remove an asset, a fixed reader antenna at the exit reads the tag, triggers the alarm system, and creates a record and time stamp of the item’s removal, effectively preventing theft and tracking assets.

Low-cost and easy-to-manage solution: EPC Solutions' DCIM solution is designed to be low-cost and easy to manage. Data center personnel can install the system in a short time, including UHF RFID readers, cable antennas, tags, etc.

Environmental monitoring and health management: The system includes environmental factor monitoring, using temperature and humidity RFID tags to capture sensor data and transmit this information when interrogated by the reader. This helps data center managers obtain real-time data about temperature or humidity to prevent equipment failure or damage.

Improve employee productivity and save costs: The advantages of the system are time saving, employee productivity and cost savings. Employees no longer need to be on-site to determine what assets are in the data center and what spaces and environments are available.

Management reports and trend analysis: The system can create management reports to analyze overall trends, racks and even specific ports, helping data center managers better understand asset conditions and operations.

Through these methods, EPC Solutions Taiwan's DCIM system provides a comprehensive and efficient solution for data center asset management, effectively addressing the many challenges faced by data center asset management. It is worth mentioning that EPC Solutions is developing a cloud version of the system to provide users with more convenient and flexible services. The technology has been tested and funded by Small Business Innovation Research (SBIR) and is expected to be officially released for commercial use in July 2025.

The DCIM system launched by EPC Solutions Taiwan brings a new solution to data center management. It uses RFID technology to achieve real-time tracking and environmental monitoring of assets, improves the accuracy and efficiency of asset management, and reduces management costs. With the commercial release of the system, it is expected to bring a more intelligent and efficient future to data center management.

This paper is from Ulink Media, Shenzhen, China, the organizer of IOTE EXPO (IoT Expo in China)

0 notes

Text

The Future of Oil and Gas Security: Market Dynamics and Opportunities

The global oil and gas security and service market size was estimated at USD 25.51 billion in 2023 and is expected to expand at a CAGR of 5.4% from 2024 to 2030. Various factors such as technologies and security threats, rising regulatory compliance, Growing adoption of advanced technologies, and focus on operational safety are driving the growth of the market. The oil and gas industry is a target for various security threats, including terrorism, piracy, theft, and sabotage. As these threats become more advanced, oil and gas companies are investing more in security measures to protect their assets and personnel.

The surge in the use of cloud technologies in the oil and gas sector has increased its exposure to cyber threats. Historically, industry has managed to protect data and ensure privacy by segregating networks and bolstering outer defenses. However, the introduction of cloud computing presents both a challenge and an opportunity for the sector to enhance and renew its security measures through the adoption of cyber security practices. One of the hurdles is that many firms lack the necessary expertise, funds, and in-house servers, pushing them toward cloud solutions for better data security.

Stringent government regulations and policies concerning energy security and environmental preservation require the oil and gas industry to implement robust security measures. Furthermore, the growing adoption of advanced technology like surveillance, access control, and intrusion detection systems is driving the market growth. Companies are proactively pouring resources into security solutions to mitigate risk and protect essential infrastructure. Additionally, the development of new exploration and production opportunities, especially in offshore and hard-to-reach areas, has created a need for specialized security services to address distinct challenges. These factors collectively are driving the growth and development of the security and services market in the oil and gas sector.

Global Oil And Gas Security And Service Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global oil and gas security and service market report based on component, security, services, operation, application, and region.

Component Outlook (Revenue, USD Billion, 2017 - 2030)

Solution

Services

Security Outlook (Revenue, USD Billion, 2017 - 2030)

Physical Security

Network Security

Services Outlook (Revenue, USD Billion, 2017 - 2030)

Risk Management Services

System Design, Integration, and Consulting

Managed Services

Operation Outlook (Revenue, USD Billion, 2017 - 2030)

Upstream

Midstream

Downstream

Application Outlook (Revenue, USD Billion, 2017 - 2030)

Exploring and Drilling

Transportation

Pipelines

Distribution and Retail Services

Others

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

North America

US

Canada

Mexico

Europe

UK

Germany

France

Asia Pacific

China

India

Japan

Australia

South Korea

Latin America

Brazil

MEA

UAE

South Africa

KSA

Key Oil And Gas Security And Service Companies:

The following are the leading companies in the oil and gas security and service market. These companies collectively hold the largest market share and dictate industry trends.

Cisco Systems, Inc.

Honeywell International Inc.

Huawei Technologies Co., Ltd.

Intel Corporation

Microsoft

NortonLifeLock Inc.

Schneider Electric

Siemens

United Technologies Inc.

Recent Developments

In April 2024, Siemens launched Siemens Xcelerator, to automatically verify vulnerable production assets. Therefore, it is imperative for industrial firms to detect and mitigate potential security gaps within their systems. Siemens introduced a new cybersecurity software-as-a-service solution in response to the urgency of pinpointing cybersecurity in shop floor promptly,

In September 2023, Huawei Technologies Co., Ltd. launched intelligent architecture and intelligent Exploration & production (E&P) solution for oil and gas industry. Huawei Technologies Co., Ltd.'s intelligent architecture for the oil and gas sector is constructed around six smart components: connectivity, sensing, platform, application, AI models, and foundation. Each component is structured with hierarchical decoupling. This design is adaptable to widely used third-party frameworks and is capable of integrating with third-party platforms and data lakes, whether they are existing or newly established.

In September 2022, ABB introduced ABB Ability Cyber Security Workplace (CSWP), which integrates security solutions from ABB and other providers into a unified, comprehensive digital platform, enhancing the protection of critical industrial infrastructure. This platform enables engineers and operators to more swiftly identify and resolve issues, thereby reducing risk exposure by making cybersecurity data more accessible and easier to manage.

Order a free sample PDF of the Oil And Gas Security And Service Market Intelligence Study, published by Grand View Research.

0 notes

Text

How to Find the Perfect Memphis Apartment Before the New Year

As the New Year approaches, many people take the opportunity to start fresh—whether it’s with new goals, new routines, or a new place to call home. If you’re looking for an apartment in Memphis, TN, there’s no better time to make your move than now. However, searching for the perfect apartment during the holiday season can feel overwhelming. Between the rush of festivities and the competition for available rentals, it’s crucial to approach your search strategically. Here’s a step-by-step guide to help you find the perfect Memphis apartment before the New Year.

1. Define Your Apartment Needs

Before diving into your search, take some time to identify what you’re looking for in your next home. Consider the following:

Location: Do you want to be close to work, school, or Memphis hotspots like Beale Street, Overton Park, or the historic Cooper-Young district?

Budget: Set a realistic budget, including utilities and other monthly expenses.

Size: Determine the number of bedrooms, bathrooms, and overall square footage you’ll need.

Amenities: Look for features that matter most to you, such as in-unit laundry, a fitness center, parking, or pet-friendly policies.

Having a clear vision of your ideal apartment will save you time and help you focus on properties that meet your criteria.

2. Start Your Search Early

The holiday season often brings a flurry of activity in the rental market. Many leases end in December, meaning there’s high turnover and more options available, but competition can also be fierce. Here are some tips to stay ahead:

Browse Listings Online: Websites like The Urban Loft Co. offer up-to-date listings and detailed descriptions of available apartments in Memphis.

Work with a Local Expert: Partnering with a leasing agent or property management company familiar with Memphis can give you an edge in finding hidden gems.

Set Alerts: Subscribe to notifications for new listings in your desired neighborhoods to act quickly when something fits your needs.

3. Schedule Tours Quickly

The holiday season is a busy time for both renters and landlords, so once you find a property you’re interested in, schedule a tour as soon as possible. Many apartments offer:

Virtual Tours: If you’re tight on time, a virtual tour can give you a sense of the space without leaving your home.

In-Person Tours: For a more detailed look, visiting in person allows you to check out the property’s surroundings, amenities, and overall condition.

Be prepared to ask questions about lease terms, security deposits, and move-in dates during your tour.

4. Understand the Rental Market in Memphis

The Memphis rental market has something for everyone, from modern lofts downtown to charming apartments in historic neighborhoods. Here are a few areas to consider:

Downtown Memphis: Ideal for those who enjoy a vibrant urban lifestyle, with proximity to restaurants, nightlife, and cultural attractions.

Midtown: Known for its eclectic vibe and artistic community, Midtown offers a mix of historic and modern apartments.

East Memphis: A quieter area with excellent schools and shopping, perfect for families or professionals seeking a suburban feel.

Research these neighborhoods to find the one that aligns with your lifestyle and priorities.

5. Move Quickly but Thoughtfully

With so many people looking for apartments before the New Year, it’s easy to feel pressured to make a decision. While it’s important to act quickly, don’t rush into a lease agreement without careful consideration. Take time to:

Review the Lease: Read all terms and conditions thoroughly, including penalties for breaking the lease early.

Inspect the Property: If possible, ensure everything is in good working order, from appliances to plumbing and heating.

Clarify Move-In Dates: Confirm when the apartment will be ready to avoid any surprises during your move.

6. Plan Your Move Strategically

Moving during the holidays can be hectic, so plan ahead to minimize stress. Here’s how:

Hire Movers Early: Book a moving company well in advance, as availability can be limited during this season.

Pack Efficiently: Use the holidays as an opportunity to declutter and donate items you no longer need.

Set Up Utilities: Arrange for electricity, water, internet, and other services to be activated before your move-in date.

7. Celebrate Your New Home

Once you’ve signed your lease and moved in, take time to settle into your new space. Decorate for the holidays to make your apartment feel like home, and explore your new neighborhood to discover local favorites.

Start Your Apartment Search Today

Finding the perfect Memphis apartment before the New Year may seem daunting, but with a clear plan and the right resources, you’ll be ringing in 2024 in your dream home. Ready to start your search? Visit The Urban Loft Co. to explore our apartments and make your move today! Here’s to fresh starts and a happy New Year in Memphis!

#Apartments Memphis TN#Memphis TN Apartments#Apartments for rent Memphis TN#New apartments Memphis TN#apartments near UTHSC memphis

0 notes

Text

Software Defined Storage (SDS) Market

Software Defined Storage (SDS) Market Size, Share, Trends: Dell Technologies Leads

Rising adoption of cloud-based storage solutions

Market Overview:

The global Software Defined Storage (SDS) market is expected to grow at a CAGR of 25% during the forecast period (2024-2031), reaching a value of USD YY billion by 2031, up from USD XX billion in 2024. North America is expected to dominate the market throughout the forecast period. The growth of the SDS market is driven by the increasing need for flexible, scalable, and cost-effective data storage solutions across industries.

DOWNLOAD FREE SAMPLE

Market Dynamics:

The growing popularity of cloud computing, along with the demand for agile, scalable storage infrastructure, is pushing SDS adoption. Cloud-based SDS solutions provide advantages such as cost savings, more flexibility, and easy scalability, making them an appealing choice for enterprises of all sizes. The rising need for hybrid and multi-cloud configurations has sped up the development of cloud-based SDS solutions.

Market Segmentation:

The Platforms/Solutions sector has the biggest market share, owing to rising demand for software-defined storage solutions with advanced features like data security, storage virtualisation, and policy-based management.

Market Key Players:

Dell Technologies

IBM

NetApp

Hewlett Packard Enterprise (HPE)

VMware

Contact Us:

Name: Hari Krishna

Email us: [email protected]

Website: https://aurorawaveintellects.com/

0 notes