#Security Policy Management Market Analysis

Text

By Jessica Corbett

Common Dreams

Sept. 26, 2024

Florida already has one of the nation's largest shares of homeowners "who don't have meaningful insurance."

Hurricane Helene continued barreling toward Florida on Thursday, highlighting the impacts of the fossil fuel-driven climate emergency, including difficulties securing insurance coverage in regions most affected by extreme weather.

"The Air Force Hurricane Hunters found that the maximum sustained winds have increased to near 120 mph," the National Hurricane Center said Thursday afternoon. "This makes Helene a dangerous Category 3 major hurricane. Additional strengthening is expected before Helene makes landfall in the Florida Big Bend this evening."

Federal Emergency Management Agency Director Deanne Criswell said during a White House briefing that forecasts suggest Helene will make a "dead-on hit to Tallahassee" and "this is going to be a multistate event with the potential for significant impacts from Florida all the way to Tennessee."

Although this Atlantic hurricane season hasn't yet been as intense as U.S. scientists expected, trends in extreme weather disasters have led some insurance companies to exit the Florida market in recent years. Farmers Insurance announced last year that it would stop covering property in the state, in an effort to "effectively manage risk exposure."

While the Insurance Information Institute, an industry trade group, said in May that "legislative reforms passed in 2022 and 2023 have created a pathway to a stable Florida market," reporting from this week shows that residents—who aren't ultrarich—are still struggling to get and keep coverage.

"Florida ranks sixth among states with the largest shares of homeowners who don't have meaningful insurance. About 18% of homeowners across the state—about 1 in 6—are without it," NBC Newsnoted Wednesday. "Nearly 20% of Florida homeowners pay $4,000 or more a year for homeowners insurance—the largest share in the country, according to the Census Bureau."

According toThe Palm Beach Post, the global reinsurance broker Gallagher Re said in a Wednesday analysis that "landfall in the Big Bend or Panhandle region of Florida as a major hurricane (Category 3, 4, or 5) has historically translated to insured losses in the low single-digit billions."

"But Helene is not a typical storm," the firm explained. "Given Helene's very large wind radius, this would still bring hurricane-force wind gusts and high storm surge to coastal areas in the heavily populated Tampa Bay area, tropical storm force winds across most of the Florida peninsula, Georgia, the Carolinas, Tennessee, and southern Appalachia."

Gallagher Re suggested that "Helene's private insurance market losses should be expected to land in the range" of $3 billion to $6 billion, but if the hurricane "unexpectedly" moves toward Tampa, it could be over $10 billion.

Florida isn't the only state facing insurance trouble thanks to climate chaos. Vox reported last year that "insuring property in California has been a dicey proposition," pointing to torrential rainfall that "caused as much as $1.5 billion in insured losses" and "the costliest wildfires in U.S. history, including the 2018 Camp Fire, which led to more than $10 billion in losses."

Amid the intertwined climate and insurance crises, scientists, campaigners, and homeowners have demanded policy action—and elevated criticism of right-wing attacks on crucial programs.

In a June blog post, Rachel Cleetus, policy director with the Union of Concerned Scientists' Climate and Energy program, wrote that "Congress and regulators need to ensure more transparency in the insurance market on how companies are evaluating risks as they make decisions about premiums. There also needs to be better information on what kinds of incentives companies are providing for adaptation measures that would help reduce risks."

"Alongside the necessary but ultimately bounded role of insurance in a warming world, public and private decision-makers must also shift investments away from business-as-usual maladaptive and risky choices to more resilient ones," Cleetus continued. "The nation must scale up resources for climate resilience and ensure they are reaching communities in a just and equitable way. Funding for safe, affordable, and climate-resilient housing must be expanded."

The Climate & Community Institute on Wednesday also shared recommendations in a new report—Shared Fates: A Housing Resilience Policy Vision for the Home Insurance Crisis—using case studies from California, Florida, and Minnesota.

"We propose the creation of Housing Resilience Agencies (HRAs), either by states or the federal government," the institute said. These agencies would:

Provide public disaster insurance that offers fair and equitable protections;

Coordinate and oversee comprehensive, community-oriented disaster risk reduction;

Address existing market failures by providing coverage for oft-neglected sectors such as multifamily housing providers, mobile home dwellers, and heirs properties; and

Host public risk models, climate risk advisory councils, and diverse governing boards to inform decision-making in a transparent and democratic manner.

"In order to confront the growing housing safety and affordability crisis, we need to understand our fates as shared," the institute added. "We must reimagine our home insurance system for it to reduce risk and provide equitable and fair protection."

2 notes

·

View notes

Text

The Political Economy of Israel's Occupation: Repression Beyond Exploitation - Shir Hever

Hello friends,

Starting off this December, I'm planning on reading some leftist texts unpacking Israeli settler colonialism and Palestinian resistance. The first book I've chosen provides a foundation for understanding the material foundation of the situation: "The Political Economy of Israel's Occupation: Repression Beyond Exploitation" by Shir Hever.

Dr. Hever studies the economic aspects of the Israeli occupation of the Palestinian territory. He is the manager of the Alliance for Justice between Israelis an Palestinians (BIP), and the military embargo coordinator for the Boycott National committee (BNC). He published this book alongside "The Privatization of Israeli Security" and gives talks on various topics related to his research.

This text argues that the premise that Israel keeps control over Palestinian territories for material gain or merely to defend itself from Palestinian aggression is incorrect. Instead, he argues that the occupation has reached an impasse, with the Palestinian resistance making exploitation of the Palestinians by Israeli business interests difficult, but the Israeli authorities are reluctant to give up control given their desires to maintain settler colonial control alongside the military-industrial complex being immensely powerful.

He navigates through historical events, policy choices, and economic structures to illuminate the specific ways the occupation has challenged this traditional narrative. Through detailed expositions on the cost of the occupation at the level of metrics like inflation and the labor market, to broader questions on international aid questions, the costs of maintaining a gigantic "security" apparatus, and the fact that neoliberal reforms are profitable for a ruling class despite being inefficient economically. One example of this contradiction is in maintaining the Jerusalem Wall, which is actively harmful for Jerusalemites on any metric.

The last part unpacks various theories on how to understand this exploitation and binationalism. I appreciate the challenges to most accounts on this question and feel like we can create better views on this debate, highly recommend this text for this rich analysis!

#book blog#book review#bookblr#marxism#settler colonialism#palestine#gaza#free palestine#exploitation#economics#israeli occupation

10 notes

·

View notes

Text

What is the Importance of ESG Reporting in Business?

Corporate sustainability investors, consultants, and strategists imagine a future where every business has efficient policies governing eco-friendly production methods. Likewise, embracing diversity and financial reporting transparency helps combat legal risks from unethical practices like discrimination and corruption. This post will discuss the importance of ESG reporting in business.

What is ESG Reporting?

ESG, or environmental, social, and governance, is an investment strategy using business performance analysis to monitor how a company consumes natural resources, handles employee relations, and practices accounting transparency. So, an ESG consulting services firm will deliver the required data through an appropriate reporting mechanism.

Using these compliance metrics, investors can quantify the brand’s positive or negative influence on society and nature. Moreover, an ESG report systematically categorizes sustainability metrics into three sections or pillars.

The environmental pillar summarizes how an organization integrates green technology and reduces plastic usage. Besides, it investigates metrics like the deforestation risks associated with an industry.

Diversity and multicultural tolerance are at the core of the social considerations in ESG reporting. Additionally, preventing workplace hazards and empowering marginalized groups through affirmative action policies are crucial.

Governance in sustainable development benchmarks rewards companies employing advanced financial and digital security measures with higher ratings. It assesses how a brand prioritizes ethics, privacy rights, and investor relations.

What is the Importance of ESG Reporting in Business?

1| ESG Helps Mitigate Supply Chain Risks

A lack of standardization and governance exposes your supply chains to legal, financial, and environmental threats, but ESG service providers can assist you in overcoming those challenges. The governance aspects in sustainability compliance audits inspect which suppliers engage in socio-economically harmful practices.

Using the data-led recommendations in the reports, organizations can determine whether to train suppliers or search for other resource providers. Therefore, managers can increase the company’s resilience to supply chain risks. For example, suppliers must avoid child labor, pollution, and corruption. Otherwise, your enterprise’s reputation will decline once investors and analysts investigate you.

ESG reporting enables corporations to find suppliers who know the importance of the United Nations’ sustainable development goals (SDGs). Since most suppliers will change their operations to respond to industry dynamics, reliably examining their ESG scores after suitable intervals is essential.

2| Consumer and Investors Relations Improve

Individuals want to purchase eco-friendly products, while impact investors want to support sustainable companies. Therefore, corporate strategists must explore roadmaps for aligning a company’s business model with modern stakeholder expectations.

Developing ESG-powered business intelligence to estimate the shifts in consumer preferences benefits corporations in planning a new product launch. Similarly, using applicable and valid sustainability metrics for marketing materials goes a long way toward increasing brand awareness and trustworthiness.

Besides, several governments direct companies to embrace standardized financial self-disclosures. Since ESG reporting integrates globally respected sustainability accounting guidelines, developing the disclosure documentation for investor communications becomes more manageable.

3| Operational Efficiency Increases

Toxic workplaces and preferential treatment will accelerate the talent drain at a company. So, social inclusivity and employee health insights empower managers to keep the workers energetic, creative, and productive.

Furthermore, green technology integrations contribute to energy usage reduction. And the governance components prevent accounting inconsistencies. These advantages of ESG reporting ultimately enhance an organization’s quarterly progress.

All the financial improvements also help brands transfer the benefits to their stakeholders. Consider the case of refurbished electronic devices. Consumers can get reasonably functional equipment at a lower price while the e-waste generation rate decreases.

Conclusion

Regulatory bodies and fund managers recognize the rising importance of ESG reporting in business, administration, and the global economy. Simultaneously, research and development (R&D) into renewable energy resources has attracted investors in several markets.

Consumers have also voiced their concerns whenever a brand fails to embrace SDGs’ sustainable, inclusive, and transparent vision.

Therefore, leveraging statistical and computer-aided benchmarks at an extensive scale has become mainstream across business development strategies. As its significance grows with each passing day, leaders must find experienced domain specialists to implement an ESG-first approach throughout their operations.

2 notes

·

View notes

Text

"Standard monopoly, in the microeconomic sense, is when one firm in a market secures a dominant position in supplying a particular good. Radical monopoly, in contrast, is when an entire institutional complex makes the type of good itself artificially necessary in order to exist and crowds out alternatives. “Radical monopoly imposes compulsory consumption and thereby restricts personal autonomy. It constitutes a special kind of social control because it is enforced by means of the imposed consumption of a standard product that only large institutions can provide.”

I use the term “radical monopoly” to designate… the substitution of an industrial product or a professional service for a useful activity in which people engage or would like to engage. A radical monopoly paralyzes autonomous action in favor of professional deliveries.

The classic example of radical monopoly is car culture and its attendant urban sprawl.

Cars can thus monopolize traffic. They can shape a city into their image — practically ruling out locomotion on foot or by bicycle in Los Angeles…. That motor traffic curtails the right to walk, not that more people drive Chevies than Fords, constitutes radical monopoly…. [T]he radical monopoly cars establish is destructive in a special way. Cars create distance…. They drive wedges of highways into populated areas, and then extort tolls on the bridge over the remoteness between people that was manufactured for their sake. This monopoly over land turns space into car fodder. It destroys the environment for feet and bicycles.

…A radical monopoly paralyzes autonomous action in favor of professional deliveries. The more completely vehicles dislocate people, the more traffic managers will be needed, and the more powerless people will be to walk home.

Another example is how the institutional complex around the building industry — contracting firms, materials production, building codes, etc. — has reinforced its own power at the expense of convivial alternatives. Favelas and shantytowns — often displaying a high degree of craftsmanship and technical skill — exist on the outskirts of cities all over the Global South (Colin Ward has a considerable body of work on the tradition of self-built housing in the West, as well). It’s entirely feasible, technically, to produce construction materials conducive to self-built housing by amateurs. “Components for new houses and utilities could be made very cheaply and designed for self-assembly.” Not only do local building codes prohibit such construction as unsafe, but they also prohibit competitive pressure for even professional contracting firms to adopt cheaper, vernacular building techniques using locally sourced material, by codifying conventional methods into law.

The problem of radical monopoly is exacerbated by a shared institutional culture that can imagine no solution to the negative effects of radical monopoly but to intensify the scale of the monopoly. With entire sincerity, for the most part, the managerial elites in a given policy area which suffers from the pathologies of radical monopoly are conditioned to perceive as “extreme” any proposed solution that cannot be carried out within the existing institutional framework, by people like themselves. That is, “the institution has come to define the purpose.” The only cure for a managerial bureaucracy’s mismanagement is to give it more resources and control. The standard approach of a managerial bureaucracy is to “solve a crisis by escalation.” Reforms which are carried out within the framework of radical monopoly “escalate what they are meant to eliminate.”[31]

-Kevin Carson, "The Thought of Ivan Illich: A Libertarian Analysis"

8 notes

·

View notes

Text

Digital Marketing Course in New Chandkheda

1. Digital Marketing Course in New Chandkheda Ahmedabad Overview

2. Personal Digital Marketing Course in New Chandkheda – Search Engine Optimization (SEO)

What are Search Engines and Basics?

HTML Basics.

On Page Optimization.

Off Page Optimization.

Essentials of good website designing & Much More.

3. Content Marketing

Content Marketing Overview and Strategy

Content Marketing Channels

Creating Content

Content Strategy & Challenges

Image Marketing

Video Marketing

Measuring Results

4. Website Structuring

What is Website?- Understanding website

How to register Site & Hosting of site?

Domain Extensions

5. Website Creation Using WordPress

Web Page Creation

WordPress Themes, Widgets, Plugins

Contact Forms, Sliders, Elementor

6. Blog Writing

Blogs Vs Website

How to write blogs for website

How to select topics for blog writing

AI tools for Blog writing

7. Google Analytics

Introduction

Navigating Google Analytics

Sessions

Users

Traffic Source

Content

Real Time Visitors

Bounce Rate%

Customization

Reports

Actionable Insights

Making Better Decisions

8. Understand Acquisition & Conversion

Traffic Reports

Events Tracking

Customization Reports

Actionable Insights

Making Better Decisions

Comparision Reports

9. Google Search Console

Website Performance

Url Inspection

Accelerated Mobile Pages

Google index

Crawl

Security issues

Search Analytics

Links to your Site

Internal Links

Manual Actions

10. Voice Search Optimization

What is voice engine optimization?

How do you implement voice search optimization?

Why you should optimize your website for voice search?

11. E Commerce SEO

Introduction to E commerce SEO

What is e-commerce SEO?

How Online Stores Can Drive Organic Traffic

12. Google My Business: Local Listings

What is Local SEO

Importance of Local SEO

Submission to Google My Business

Completing the Profile

Local SEO Ranking Signals

Local SEO Negative Signals

Citations and Local

Submissions

13. Social Media Optimization

What is Social Media?

How social media help Business?

Establishing your online identity.

Engaging your Audience.

How to use Groups, Forums, etc.

14. Facebook Organic

How can Facebook be used to aid my business?

Developing a useful Company / fan Page

Establishing your online identity.

Engaging your Audience, Types of posts, post scheduling

How to create & use Groups

Importance of Hashtags & how to use them

15. Twitter Organic

Basic concepts – from setting-up optimally, creating a Twitter business existence, to advanced marketing procedures and strategies.

How to use Twitter

What are hashtags, Lists

Twitter Tools

Popular Twitter Campiagns

16. LinkedIn Organic

Your Profile: Building quality connections & getting recommendations from others

How to use Groups-drive traffic with news & discussions

How to create LinkedIn Company Page & Groups

Engaging your Audience.

17. YouTube Organic

How to create YouTube channel

Youtube Keyword Research

Publish a High Retention Video

YouTube ranking factors

YouTube Video Optimization

Promote Your Video

Use of playlists

18. Video SEO

YouTube Keyword Research

Publish a High Retention Video

YouTube Ranking Factors

YouTube Video Optimization

19. YouTube Monetization

YouTube channel monetization policies

How Does YouTube Monetization Work?

YouTube monetization requirements

20. Social Media Tools

What are the main types of social media tools?

Top Social Media Tools You Need to Use

Tools used for Social Media Management

21. Social Media Automation

What is Social Media Automation?

Social Media Automation/ Management Tool

Buffer/ Hootsuite/ Postcron

Setup Connection with Facebook, Twitter, Linkedin, Instagram, Etc.

Add/ Remove Profiles in Tools

Post Scheduling in Tools

Performance Analysis

22. Facebook Ads

How to create Business Manager Accounts

What is Account, Campaign, Ad Sets, Ad Copy

How to Create Campaigns on Facebook

What is Budget & Bidding

Difference Between Reach & Impressions

Facebook Retargeting

23. Instagram Ads

Text Ads and Guidelines

Image Ad Formats and Guidelines

Landing Page Optimization

Performance Metrics: CTR, Avg. Position, Search Term

Report, Segment Data Analysis, Impression Shares

AdWords Policies, Ad Extensions

24. LinkedIn Ads

How to create Campaign Manager Account

What is Account, Campaign Groups, Campaigns

Objectives for Campaigns

Bidding Strategies

Detail Targeting

25. YouTube Advertising

How to run Video Ads?

Types of Video Ads:

Skippable in Stream Ads

Non Skippable in stream Ads

Bumper Ads

Bidding Strategies for Video Ads

26. Google PPC

Ad-Words Account Setup

Creating Ad-Words Account

Ad-Words Dash Board

Billing in Ad-Words

Creating First Campaign

Understanding purpose of Campaign

Account Limits in Ad-Words

Location and Language Settings

Networks and Devices

Bidding and Budget

Schedule: Start date, end date, ad scheduling

Ad delivery: Ad rotation, frequency capping

Ad groups and Keywords

27. Search Ads/ Text Ads

Text Ads and Guidelines

Landing Page Optimization

Performance Metrics: CTR, Avg. Position, Search Term

Report, Segment Data Analysis, Impression Shares

AdWords Policies, Ad Extensions

CPC bidding

Types of Keywords: Exact, Broad, Phrase

Bids & Budget

How to create Text ads

28. Image Ads

Image Ad Formats and Guidelines

Targeting Methods: Keywords, Topics, Placement Targeting

Performance Metrics: CPM, vCPM, Budget

Report, Segment Data Analysis, Impression Shares

Frequency Capping

Automated rules

Target Audience Strategies

29. Video Ads

How to Video Ads

Types of Video Ads

Skippable in stream ads

Non-skippable in stream ads

Bumper Ads

How to link Google AdWords Account to YouTube Channel

30. Discovery Ads

What are Discovery Ads

How to Create Discovery Ads

Bidding Strategies

How to track conversions

31. Bidding Strategies in Google Ads

Different Bidding Strategies in Google AdWords

CPC bidding, CPM bidding, CPV bidding

How to calculate CTR

What are impressions, impression shares

32. Performance Planner

33. Lead Generation for Business

Why Lead Generation Is Important?

Understanding the Landing Page

Understanding Thank You Page

Landing Page Vs. Website

Best Practices to Create Landing Page

Best Practices to Create Thank You Page

What Is A/B Testing?

How to Do A/B Testing?

Converting Leads into Sale

Understanding Lead Funnel

34. Conversion Tracking Tool

Introduction to Conversion Optimization

Conversion Planning

Landing Page Optimization

35. Remarketing and Conversion

What is conversion

Implementing conversion tracking

Conversion tracking

Remarketing in adwords

Benefits of remarketing strategy

Building remarketing list & custom targets

Creating remarketing campaign

36. Quora Marketing

How to Use Quora for Marketing

Quora Marketing Strategy for Your Business

37. Growth Hacking Topic

Growth Hacking Basics

Role of Growth Hacker

Growth Hacking Case Studies

38. Introduction to Affiliate Marketing

Understanding Affiliate Marketing

Sources to Make money online

Applying for an Affiliate

Payments & Payouts

Blogging

39. Introduction to Google AdSense

Basics of Google Adsense

Adsense code installation

Different types of Ads

Increasing your profitability through Adsense

Effective tips in placing video, image and text ads into your website correctly

40. Google Tag Manager

Adding GTM to your website

Configuring trigger & variables

Set up AdWords conversion tracking

Set up Google Analytics

Set up Google Remarketing

Set up LinkedIn Code

41. Email Marketing

Introduction to Email Marketing basic.

How does Email Marketing Works.

Building an Email List.

Creating Email Content.

Optimising Email Campaign.

CAN SPAM Act

Email Marketing Best Practices

42. SMS Marketing

Setting up account for Bulk SMS

Naming the Campaign & SMS

SMS Content

Character limits

SMS Scheduling

43. Media Buying

Advertising: Principles, Concepts and Management

Media Planning

44. What’s App Marketing

Whatsapp Marketing Strategies

Whatsapp Business Features

Business Profile Setup

Auto Replies

45. Influencer Marketing

Major topics covered are, identifying the influencers, measuring them, and establishing a relationship with the influencer. A go through the influencer marketing case studies.

46. Freelancing Projects

How to work as a freelancer

Different websites for getting projects on Digital Marketing

47. Online Reputation Management

What Is ORM?

Why We Need ORM

Examples of ORM

Case Study

48. Resume Building

How to build resume for different job profiles

Platforms for resume building

Which points you should add in Digital Marketing Resume

49. Interview Preparation

Dos and Don’t for Your First Job Interview

How to prepare for interview

Commonly asked interview question & answers

50. Client Pitch

How to send quotation to the clients

How to decide budget for campaign

Quotation formats

51. Graphic Designing: Canva

How to create images using tools like Canva

How to add effects to images

52. Analysis of Other Website

Post navigatio

2 notes

·

View notes

Text

Emerging Industries: Opportunities in the UK Job Market

Planning to study in the UK? Want to explore career opportunities in the United Kingdom?

In the ever-evolving world, the UK stands as a hub for innovation and growth, bringing numerous emerging sectors that offer promising career prospects. As technology continues to reshape the global economy, several industries in the UK have captured attention, presenting exciting opportunities for job seekers and entrepreneurs alike. Take a look at some of the career opportunities you could take advantage of.

1. Fintech (Financial Technology)

The UK has strengthened its position as a leading fintech hub, with London being a prominent center for financial innovation. Fintech includes a wide array of sectors, including mobile payments, blockchain, and cybersecurity. Job opportunities in this field span software development, data analysis, financial consultancy, and regulatory compliance.

2. Technology and IT

In the emerging era of the digital world, technology continues to dominate businesses worldwide. As, a result the demand for technologically advanced professionals tends to rise. Software developers, data analysts, cybersecurity experts, and artificial intelligence specialists roles are in high demand. With the increasing use of technologies and the need for innovative solutions, these roles offer tremendous growth opportunities and competitive salaries.

3. Healthtech

The combination of healthcare and technology has given rise to HealthTech, a sector dedicated to enhancing medical services through innovative solutions. From telemedicine to health analytics and AI-driven diagnostics, HealthTech offers diverse career paths for healthcare professionals, software developers, data scientists, and researchers.

4. Renewable energy and sustainability

With an increased focus on sustainability and combating climate change, the UK has been investing significantly in renewable energy sources. Wind, solar, and hydroelectric power are among the sectors experiencing rapid growth. Job roles in renewable energy range from engineering and project management to research and policy development, catering to those passionate about environmental conservation.

5. Cybersecurity

With the increasing frequency of cyber threats, the demand for cybersecurity experts is on the rise. Businesses and governments are investing heavily in safeguarding digital infrastructure. Job roles in cybersecurity encompass ethical hacking, network security, data protection, and risk analysis, presenting ample opportunities for skilled professionals in this field.

6. Artificial Intelligence and Machine Learning

AI and machine learning are revolutionizing various industries, including finance, healthcare, and manufacturing. The UK is fostering innovation in AI research and development, offering roles in AI programming, data engineering, robotics, and AI ethics.

7. Creative industries

The UK has a rich heritage in the creative sector, encompassing fields like media, design, gaming, and entertainment. Roles in creative industries span from content creation and graphic design to video production and game development, appealing to individuals with artistic and technical skills.

In conclusion, the UK job market is filled with opportunities within emerging industries, showing the nation's commitment to innovation and progress. Whether one's passion lies in sustainability, technology, healthcare, or creative endeavors, these sectors offer an array of possibilities for career growth and contribution to shaping the future.

By embracing change, acquiring relevant skills, and staying adaptable, individuals can position themselves to thrive in these dynamic and promising industries, contributing to both personal success and the advancement of these transformative sectors in the UK.

If you are struggling to get the right guidance, please do not hesitate to consult MSM Unify.

At MSM Unify, you can explore more than 50,000 courses across 1500+ educational institutions across the globe. MSM Unify has helped 1,50,000+ students achieve their study abroad dream so far. Now, it is your turn to attain your study-abroad dreams and elevate your professional journey! So, get ready to broaden your horizons and make unforgettable memories on your upcoming adventure.

2 notes

·

View notes

Text

FireMon Reaches For The (Forty) Cloud

(Originally written for The Fourth Wall)

Network security is a major concern for both enterprises and individuals. With threats seemingly around every corner, we focus much of our energy on awareness and mitigation, such as firewalls..

Well, sometimes. It’s not always this simple. Setting up a suitable firewall becomes far more of a challenge the more systems there are in a single network. It can also be difficult to gauge exactly what threats you’re up against and what tools are the best to use for your specific network.

Enter FireMon.

Founded in 2004 in Kansas, FireMon started out offering firewall management solutions. This service spun into what is today FireMon’s premiere product - the FireMon Security Manager.

The FireMon Security Manager is a firewall management platform designed for massive networks with thousands of hosts. Claimed by FireMon to provide real-time threat analysis, the ability to see and clean up overly lenient user permissions as well as firewall policies, and allows for the monitoring of network traffic behavior in order to find policies which may be overly permissive.

Not only that, but FireMon Security Manager is able to isolate, document and detect any change that may exist in your firewall policies.

FireMon offers three modules which can be purchased separately in order to extend the capabilities of Security Manager - Policy Planner, Policy Optimizer, and Risk Analyzer.

Policy Planner recommends certain policy changes and analyzes the impact any policy changes may have on overall security. Policy Optimizer allows for the automation of policy review and changes based on shifting security conditions as well as compliance requirements. Risk Analyzer is a risk-assessment tool designed to evaluate the efficacy of a network’s security infrastructure by determining which vulnerabilities are most likely to be exploited by hackers.

Breaking The Fourth Wall

FireMon continues to address a real need in the market with the FireMon Security Manager as well as its other products. In this age of increased security threats to our networks, the security of an organization’s firewall is vital as well as its durability against external threats and network vulnerabilities. The FireMon Security Manager allows users to see the existence of threats and vulnerabilities, as well as providing analysis for addressing the issue.

However, FireMon isn’t only focusing on bringing intelligence security analytics to the firewall. FireMon announced October 20, 2016 that it had acquired FortyCloud, a Cloud Infrastructure Security Broker.

Thanks to the acquisition, FireMon can now turn its gaze to the cloud and address multi-cloud management and the need for cloud-based intelligent security management capabilities. FortyCloud allows users to connect securely to multi-cloud environments and even provides options for extending cloud security, such as two-factor authentication.

With more and more organizations seeking to bring their networks into the Cloud, security is increasingly a concern. However, being able to work with the FortyCloud team leaves FireMon in a position to develop usable offerings to meet the security needs that will most certainly develop from cloud-based networks.

There is certainly competition in the market from other players, such as Skybox Security, Tufin, and Algosec, however, with the acquisition of FortyCloud, FireMon can continue being a strong player in the rapidly-changing industry.

1 note

·

View note

Text

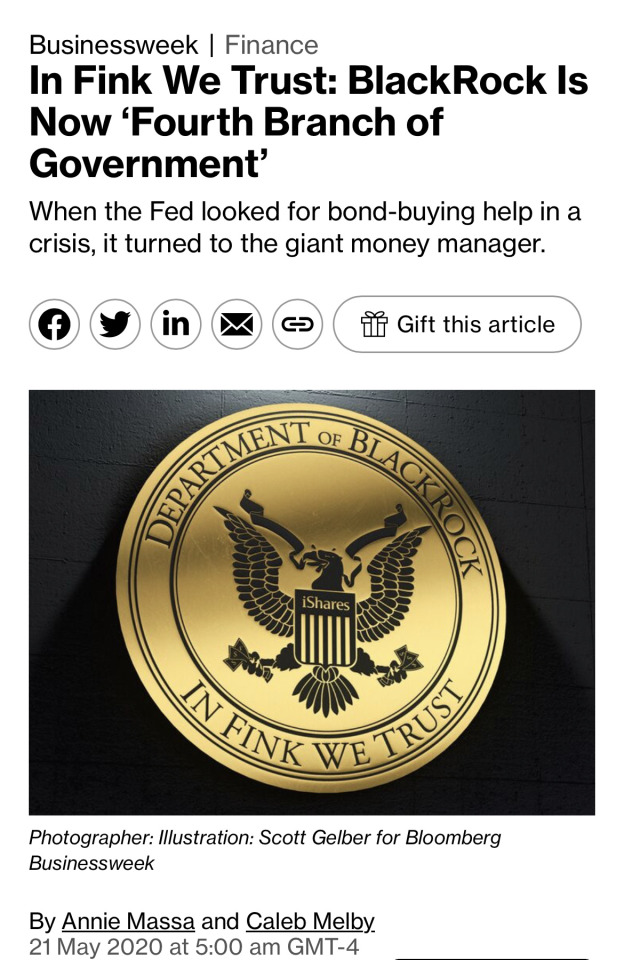

“Still the arrangement is bringing new attention to the company’s scale and ubiquity. “It’s impossible to think of BlackRock without thinking of them as a fourth branch of government,” says William Birdthistle, a professor at the Chicago-Kent College of Law who studies the fund industry.

(…)

There’s probably no other financial institution that brings to the table what BlackRock does. It’s experienced in running large portfolios on behalf of others. It’s ubiquitous in markets for everything from passive, index-linked products to hands-on mutual funds, with $6.5 trillion in assets under management as of March 31. It’s the largest issuer of ETFs, which act like mutual funds but trade on an exchange. It actively manages more than $625 billion in bond funds for pension plans and other institutional clients. Almost anyone looking to buy a diverse portfolio quickly would consider BlackRock—and the Fed did the same. In a virtual hearing of the Senate Banking Committee on May 19, Fed Chairman Jerome Powell said BlackRock was hired for its expertise and “it was done very quickly due to the urgency” of the matter.

Beyond money management, BlackRock’s software platform, Aladdin, appealed to the Fed. The program evaluates risk for clients that include governments, insurers, and rival wealth managers, monitoring more than $20 trillion in assets. (Bloomberg LP, the parent company of Bloomberg News, sells financial software that competes with Aladdin.)

BlackRock has ascended to speed-dial status among Washington officialdom in part through shrewd business maneuvering. It scooped up Barclays Global Investors, including its iShares ETF division, in the fallout from the 2008 crisis. That gave BlackRock a stronghold in low-cost index funds, transforming it into the world’s largest asset manager almost overnight—and supercharging more than a decade of growth.

At the same time, the money manager built a powerful advocacy arm. Its sphere of influence reaches beyond the central bank to lawmakers, presidents, and government agency heads from both political parties, though its hiring leans Democratic. Bloomberg found only a handful of current BlackRock executives who came out of the George W. Bush administration, but more than a dozen Barack Obama alumni. These include Obama’s national security adviser, senior adviser for climate policy, the former Federal Reserve vice chairman he appointed, and numerous White House, Treasury, and Fed economists.

(…)

BlackRock, however, was handed three Fed assignments without any competitive process—though the Fed plans to rebid the contracts once the programs are in full swing. BlackRock will manage portfolios of corporate bonds and debt ETFs. It will do the same for newly issued bonds—sometimes acting as the sole buyer—and for up to 25% of bank-syndicated loans. And it will purchase commercial mortgage-backed securities from quasi-government agencies such as Fannie Mae and Freddie Mac.

BlackRock could reap as much as $48 million a year in fees for its Fed work, according to a Bloomberg analysis. That’s no windfall, especially in relation to its $4.5 billion in earnings last year. But it may further cement the money manager’s ties with policymakers. On May 12, BlackRock began the first stage of these programs when it began buying ETFs.

As with technology companies Facebook Inc. and Alphabet Inc., BlackRock’s growth raises questions over how big and useful a company can become before its size poses a risk. The firm has long argued that, unlike banks, it’s not making investments for itself with tons of borrowed money. Watching over large sums of money for clients doesn’t make its business a threat to the broader financial system.

With its latest assignment, that argument could be harder to make, says Graham Steele, director of the Corporations and Society Initiative at the Stanford Graduate School of Business. “They are so intertwined in the market and government that it’s a really interesting tangle of conflicts,” says Steele, who formerly worked at the Federal Reserve Bank of San Francisco. “In the advocacy community there’s an opinion that asset managers, and this one in particular, need greater oversight.”

Already there are growing worries about the power of BlackRock, Vanguard Group Inc., and State Street, often called the Big Three because they hold about 80% of all indexed money. That raises concerns about how they wield their voting power as shareholders and has even drawn attention from antitrust officials.

(…)

And then there are the potential conflicts. One arm of BlackRock knows what the Fed is buying, while other parts of the business participating in credit markets could benefit from that knowledge. To avoid conflicts, “there are stringent information barriers in place,” says the BlackRock spokesman. BlackRock employees working on the Fed programs must segregate their operations from all other units, including trading, brokerage, and sales. The fee waiver on ETFs helps avoid the appearance of self-dealing.

But BlackRock’s contract with the Fed also acknowledges that senior executives “may sit atop of the information barrier” and “have access to confidential information on one side of a wall while carrying out duties on the other side.” Staff working on the Fed programs must go through a cooling-off period before moving to jobs on the corporate side, but it would last only two weeks.

Birdthistle, the Chicago-Kent law professor, suggests the Fed could have made its process more competitive by allocating some of its funds for buying corporate credit to a group of asset managers from the outset, instead of just one. “It raises the question: Why did all the money have to go to one company?” he asks. “I get why BlackRock would be on the list, but I don’t understand why it would be the only one on the list.””

4 notes

·

View notes

Text

Editor's Note: This blog post is part of the USC-Brookings Schaeffer Initiative for Health Policy, which is a partnership between Economic Studies at Brookings and the University of Southern California Schaeffer Center for Health Policy & Economics. The Initiative aims to inform the national health care debate with rigorous, evidence-based analysis leading to practical recommendations using the collaborative strengths of USC and Brookings. We gratefully acknowledge support from the Robert Wood Johnson Foundation and the National Institute on Drug Abuse.

There is strong evidence that the opioid epidemic has reduced labor force participation in the United States. While use of prescription opioids aimed at pain management for some individuals may enhance their ability to work, the widespread misuse of opioids has resulted in an epidemic of opioid use disorders (OUD), labor supply disruptions, and unprecedented deaths. Opioid misuse can compromise labor supply in a variety of ways, including absenteeism, increased workplace accidents, and withdrawal from the labor force due to disability, incarceration, or death.

Overview of the issue

The opioid epidemic has been widely characterized as having three distinct waves of overdose deaths: the first wave beginning in the 1990s with increases in deaths involving prescription opioids; the second wave beginning in 2010 with increases in deaths involving heroin; and the third wave beginning in 2013 with increases in deaths involving synthetic opioids such as fentanyl. Several researchers have investigated the effects of elevated prescription opioid misuse, which began during the first wave of the epidemic, on labor supply. Though one study found small positive effects of prescription opioids on labor force participation for women, the majority of studies on this relationship have found that regions with higher exposure to opioid prescriptions experienced significant declines in labor force participation. In a 2016 survey of men aged 25-54 who were not in the labor force, nearly half of respondents reported taking pain medications on a daily basis, two-thirds of whom were taking prescription pain medications. In a follow-up survey of women in the same age group who were not in the labor force, 54% of respondents reported taking pain medications daily, half of whom were taking prescription medications.

The rise in illicit opioid use during the second and third waves of the opioid epidemic also reduced labor force participation, decreased employment, and increased applications for Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI). Incarceration for offenses related to illicit opioids likely also contributes to the decrease in labor force participation caused by the opioid epidemic.

Altogether, the effects of the opioid epidemic on labor force participation have been significant. One estimate suggests the opioid epidemic accounts for 43% of the decline in men’s labor force participation rate between 1999 and 2015, and 25% of the decline for women.

Beyond its effects on labor force participation, the opioid epidemic also has implications for the working population. An estimated 12.6% of the U.S. workforce receives an opioid prescription each year, and 75% of employers surveyed by the National Safety Council report that they have been directly affected by opioids. OUD can impact workers’ labor market outcomes: workers with substance use disorders take nearly 50% more days of unscheduled leave than other workers, have an average turnover rate 44% higher than that for the workforce as a whole, and are more likely to experience occupational injuries that result in time away from work.

While the opioid epidemic has had significant impacts across the labor market, its effects have been particularly pronounced in specific occupations and industries. A CDC analysis of mortality data from 21 states concluded that unintentional and undetermined overdose deaths accounted for a disproportionate share of all deaths in the following six occupational groups: construction, extraction (e.g., mining), food preparation and serving, health care practitioners, health care support, and personal care and service. These fatalities are particularly concentrated in construction and extraction: an analysis by the Massachusetts Department of Public Health found that individuals employed in construction and extraction accounted for over 24% of all overdose deaths in the state’s working population.

4 notes

·

View notes

Text

In futures trading, investors rely on a variety of factors to make buying or selling decisions. Here are some key factors for investors to consider

Raw Trading Ltd

Market Analysis: Investors analyze the market conditions, including supply and demand dynamics, price trends, and market sentiment. They use technical analysis tools, such as charts and indicators, to identify potential trading opportunities.

Fundamental Analysis: Investors assess the fundamental factors that can impact the price of the underlying asset. This includes analyzing economic indicators, geopolitical events, weather patterns, and government policies that can affect supply and demand.

News and Information: Investors stay updated with the latest news and information related to the underlying asset. They monitor news releases, industry reports, and expert opinions to gauge the potential impact on prices.

Risk Management: Investors use risk management techniques to determine their entry and exit points. They set stop-loss orders to limit potential losses and take-profit orders to secure profits. Risk management also involves determining the appropriate position size and leverage to use in each trade.

Technical Indicators: Investors use various technical indicators to identify potential entry and exit points. These indicators include moving averages, oscillators, and trend lines. Technical analysis helps investors identify patterns and trends in price movements.

Trading Strategies: Investors develop and implement trading strategies based on their analysis and risk tolerance. These strategies can be based on trend following, mean reversion, breakout, or other trading methodologies.

Market Orders: Investors can place market orders to buy or sell futures contracts at the prevailing market price. Market orders are executed immediately at the best available price.

Limit Orders: Investors can also place limit orders to buy or sell futures contracts at a specific price or better. These orders are not executed immediately but are placed in the order book until the specified price is reached.

Stop Orders: Investors use stop orders to limit potential losses or protect profits. A stop order becomes a market order when the specified price is reached, triggering the execution.

Electronic Trading Platforms: Investors can access futures markets through electronic trading platforms provided by brokerage firms. These platforms offer real-time market data, order placement, and trade execution facilities. IC Markets

It is important for investors to conduct thorough research, stay updated with market developments, and have a well-defined trading plan to make informed buying or selling decisions in futures trading.

1 note

·

View note

Text

5 Reasons to Build a Custom CRM

A CRM system is an essential tool for businesses to manage customer interactions effectively. There are numerous CRM software options available in the market.

In this article, we’ll delve into five reasons why it’s wise to invest in building a custom CRM. Firstly, custom CRMs are tailored to meet specific business needs and workflows, leading to more efficient processes and increased productivity. Secondly, custom CRMs offer enhanced security measures and better data privacy protection. Thirdly, a custom CRM can integrate seamlessly with your existing systems, providing a unified view of customer data.

Finally, building a custom CRM can be more cost-effective in the long run, as businesses can avoid ongoing licensing fees and expensive customization costs associated with off-the-shelf software.

Unique Functionalities

One of the primary benefits of creating a custom CRM system is the ability to add unique functionalities that are customized for your business. Pre-built CRM software may not provide the flexibility required to tailor your customer interactions and user experience. With a custom CRM, you can add personalized dashboards, customized reports, and workflows that match your business processes.

This can significantly improve productivity and efficiency, as well as provide a competitive advantage over businesses that use generic CRM solutions.

Integration with Another System

Building a customized CRM system provides an opportunity to integrate it seamlessly with other essential business systems. Pre-packaged CRM solutions may not offer the required level of integration, which can lead to disconnected data silos and inefficient processes. A bespoke CRM solution can be designed to work in tandem with other critical systems, such as ERP, accounting, and marketing automation software.

This creates a unified view of customer data, streamlines operations, and eliminates manual data entry errors. Customized integrations also help automate repetitive tasks, freeing up valuable employee time.

Security Data

One of the most significant advantages of creating a custom CRM system is the ability to implement robust security measures to protect customer data. Pre-built CRM software can have vulnerabilities that leave customer data at risk of external threats, which can compromise customer trust.

A custom-built CRM system allows businesses to design security protocols and data privacy policies that align with their specific needs. This includes implementing encryption, access control, and data backup and recovery measures.

Eases Scaling Process

Creating a custom CRM solution can help businesses ease the scaling process as they grow. As a company expands, its customer management requirements become more intricate, and out-of-the-box CRM software may not be adequate to handle the increased workload.

With a customized CRM solution businesses can tailor their CRM system to meet their evolving needs, adding features, functionalities, and integrations as required without switching to a new CRM platform entirely.

What is CRM Application Development?

CRM application development is the process of building a customized customer relationship management system for businesses. Such systems are designed to help businesses manage their customer interactions, optimize their sales and marketing processes, and improve customer retention rates. Although there are off-the-shelf CRM solutions available, a custom CRM application provides businesses with a bespoke solution that caters to their unique needs.

The development process for a custom CRM application typically involves several stages. Firstly, a comprehensive analysis is conducted to understand the specific challenges and opportunities that the CRM system needs to address. This includes an evaluation of the current processes, data structures, and integrations that are in place.

Next, the development team creates a customized solution that addresses the identified challenges and opportunities. This may involve the creation of new features, the integration of existing software and systems, and the implementation of tailored security and privacy measures.

The coding and testing phases follow the design phase, with the development team creating the software and testing it thoroughly to ensure that it meets the business’s requirements and functions correctly.

Conclusion

Creating a customized CRM solution provides businesses with a wide range of benefits that cannot be found in off-the-shelf CRM software. A tailored CRM application offers unique features and functionalities that address a business’s specific needs, enhancing the effectiveness and efficiency of its sales and marketing processes.

Moreover, Custom CRM Applications can be seamlessly integrated with existing software and systems, streamlining operations and saving time and resources. Additionally, custom CRM systems offer advanced security features that protect customer data, reducing the risk of data breaches and ensuring compliance with data protection regulations.

#crm software#crm development#crm solutions#crm software development company#CRM Software Development Service#crm implementation#crmintegration#CRM#crm development company#web development company#web development services

2 notes

·

View notes

Text

Forex For Dummies: A Hobbyist’s Guide to Currency Trading

Hello there, fellow traders and aspiring enthusiasts! I’ve been navigating the fascinating world of Forex trading as a hobby for a good few years now. If you’re considering diving into this exhilarating pastime, you’ve come to the right place. This article will serve as your introduction to Forex trading, breaking down the key terms, concepts, and processes you’ll need to know.

Quick Plug: Hey, I’m Ingrid Olsen, dabbling in Forex trading whenever I get a chance. I’ve been using decodefx.com (by Decode Global) for my trades and seriously, it’s a game-changer. User-friendly, secure, and filled with useful features — it’s got everything you need for a smooth trading experience. Give it a go, and you’ll see what I mean!

The ABCs of Forex

Forex — short for foreign exchange — is all about trading one currency for another. It’s the world’s most liquid financial market, with daily trading volumes exceeding a staggering $5 trillion. What’s unique about Forex is that it’s decentralized — there’s no central exchange, and trades happen directly between two parties, round the clock, five days a week.

Let’s Talk Pairs

In the Forex market, currencies are traded in pairs, like EUR/USD (Euro/US Dollar). The first currency listed (EUR) is known as the ‘base’ currency, and the second one (USD) is the ‘quote’ or ‘counter’ currency. The value of a currency pair indicates how much of the quote currency it takes to buy one unit of the base currency. So, if EUR/USD is trading at 1.20, it means you need 1.20 US dollars to buy 1 Euro.

Interpreting Forex Quotes

When you see a Forex quote, you’ll notice two prices: the ‘bid’ and ‘ask’ price. The ‘bid’ is the price you can sell the base currency for, while the ‘ask’ is the price you can buy it. The difference between these two prices is the ‘spread’ — which is essentially your broker’s commission for the trade.

Going Long or Short

In Forex trading, you can ‘go long’ or ‘go short’. Going long means you’re buying the base currency because you believe it will increase in value against the quote currency. Conversely, going short means you’re selling the base currency as you think its value will decrease.

The Power of Leverage

One distinctive aspect of Forex trading is the use of ‘leverage’. Leverage is like a loan from your broker, allowing you to control a much larger amount than your actual investment. For instance, with 100:1 leverage, you can control $100,000 with just a $1,000 investment. But be careful — while leverage can amplify your gains, it can also magnify your losses.

The Art of Analysis

Successful Forex trading involves market analysis. This usually involves:

Fundamental Analysis: Examining economic data, political events, and social factors that could affect currency values. These can range from policy changes to economic reports and global events.

Technical Analysis: Using charts and statistical indicators to predict future price movements. Techniques might include analyzing trend lines, support and resistance levels, and using mathematical indicators.

Minimizing Risk

Forex trading, like any investment, carries risk. It’s crucial to manage this risk by setting stop-loss orders to limit potential losses, never risking more than a small percentage of your trading capital on a single trade, and keeping emotions out of trading decisions.

Finding a Broker

To start trading Forex, you’ll need to open an account with a Forex broker. Look for a regulated broker with a user-friendly platform, competitive spreads, good customer service, and hassle-free deposit and withdrawal options.

Final Thoughts

Forex trading can be a thrilling hobby, but it’s important to understand the basics before jumping in. Take the time to learn and practice (many brokers offer demo accounts), and don’t be afraid to ask for advice. Remember, the aim is not just to make profits, but also to enjoy the journey of becoming a savvy Forex trader. Happy trading!

Ingrid Olsen

3 notes

·

View notes

Text

Week 6 Blog Post: Online Community

After reading chapters 4 and 5 of "The Social Organization" and watching module 4 of the Hootsuite training, I realize that having an online presence that continues to grow is an effective and efficient way to running a business. However, this needs to be done correctly to have an impact. According to chapter 4, page 41, of "The Social Organization," it states, "Misuse of social media can expose your organization to high failure rates, mediocre results, and significant information management risks. To avoid these problems, you need to understand when community collaboration is suitable and where it's unlikely to add much value." Community collaboration is more appropriate when large groups of people act independently to contribute and share open and complementary information that aggregates well into a bigger picture and results in actions that lead to heightened performance. Community collaboration is less suitable for challenges that require deep analysis, where information is best provided by intermediaries who are often recognized experts who influence one another. In this chapter, it details how a well known company, NASA, uses their online presence and community collaboration to drive evolution of their business. On page 53 and 54 of "The Social Organization," it states, "Look for areas that you feel will have a significant impact on your greatest challenges. The opportunity statements can represent a mix of employee-facing, customer-facing, supplier facing, market facing, or even general-public-facing communities, depending on the goals and focus of the organization. At the same time, always be sure that community collaboration is a genuine part of the solution." Additionally, chapter 5, page 64, of "The Social Organization," indicates, "Community formation, participation magnetism, investment needs, management involvement, and policy and security all help determine if a collaborative community is likely to coalesce and succeed on its own.

Module 4 of the Hootsuite training explains how successful brands build an active community, developing a strong community around your brand creates advocacy, actively working on your community can also humanize your brand, and by building a community, your are creating a two-way relationship that extends beyond advocacy and sales. This applies to the client project in a sense that can be engaging in examples like responding to comments, asking questions to your audience, like and share audience comments and posts, and contributing to a trending hashtag.

2 notes

·

View notes

Text

Examining the CFA Level 1 Syllabus: What are the Essential Exam Topics?

CFA Level 1 Syllabus Breakdown

CFA Level 1 is the first exam you will overlook in the CFA exam journey.

We cover the exam format, structure, and recorded pass rate in CFA Level 1 overview. This post concentrates on the CFA level 1 curriculum and outlines the 10 topic areas.

1. Honest and Professional Standards (Developing the Technique for CFA Level 1 Syllabus)

Ethics is one of the considerable significant CFA Level 1 topics representing 15% at this level. It encircles two major areas:

CFAI Professional Code Program

Global Investment Performance Standards (GIPS)

The syllabus covers the structure of the Program, the nature of the codes and standards, as well the enforcement, application, and recommended procedures.

There are also examples of how the codes and standards can be applied, and recommended procedures should violations are made.

On GIPS, the syllabus covers the experience, key components, how they are executed, and what to do if there is a conflict between GIPS and local regulations.

2. Quantitative Methods

Quantitative methods represent 12% of all CFA Level 1 exam topics. It introduces the time value of money, descriptive statistics, and probability as tools for quantitative methods.

Time value of money

Time value of money calculations is basic tools used to support corporate finance decisions and to estimate the fair value of fixed income, equity, and other securities or investments.

Candidates should understand interest and discount rates in the context of the time value of money, and be able to perform various calculations e.g. discovering the coming value and current value, DCF, NPV, and IRR.

Descriptive statistics

This section covers basic statistical concepts, such as defining a parameter and a frequency distribution, calculating percentiles, coefficients, and Sharpe ratios, and interpreting standard deviations and skewness. It also covers applications such as sampling, estimation, and hypothesis testing.

Probability

Candidates will be tested on basic probability concepts, such as defining a random variable or outcome, distinguishing different types of probabilities and rules, calculating joint probability, explaining the tree diagram, and interpreting covariance and correlation

3. Economics

This topic area represents 10% of the CFA Level 1 syllabus. It covers the introductory concepts students typically learn in their first year of college.

Microeconomic analysis

Microeconomics is the study of the market behavior of consumers and firms through the basic principle of demand and supply.

Macroeconomics analysis

Macroeconomics looks at the bigger picture, looking at the aggregate output and income measurement, factors on economic growth, business cycles, as well as how monetary and fiscal policies are used to mitigate economic fluctuations.

We also consult economics in a global context, notably international trade, capital flows, and currency trade rates.

4. Financial Reporting and Research

This is basically financial accounting 101 (or a briefer version of FAR in the CPA exam). It begins with the introduction of principal financial reports: the income statement, balance sheet, cash flow statement, and statement of changes in owners’ equity, together with letters to those words, and management discussion and analysis of outcomes. Further financial analysis techniques are covered as nicely.

It also touches on financial reporting mechanisms, such as the basic concepts of accounting equations and accruals. The roles of financial reporting standard-setting bodies and regulatory authorities are also discussed.

5. Corporate Finance

Corporate finance is relatively small representing 7% of the CFA level 1 syllabus.

This section introduces the concept of capital budgeting, determining the required rate of return for a project, leveraging, alternative means of distributing earnings, and short-term liquidity and working capital management.

6. Portfolio Management

Although Portfolio management is not heavily weighted in Level 1 (7%), this is an important section that sets the framework for later chapters. It also builds a good foundation for portfolio management in Levels 2 and 3.

Comparable to most topic areas, Level 1 portfolio management is ideational in nature. It especially presents the concept of a portfolio technique for investments. It also resembles the kinds of pooled, risk management, portfolio risk, investment management products, and returns measures, as well as current portfolio theory.

#cfa institute#cfa course#cfa level 1#cfa level 2#cfa level 3#chartered financial analyst#chartered financial analyst course#cfaexam#cfalevel1syllabus

3 notes

·

View notes

Text

Digital Marketing Course in New CG Road Ahmedabad

1. Digital Marketing Course in New CG Road Ahmedabad Overview

2. Personal Digital Marketing Course in New CG Road Ahmedabad – Search Engine Optimization (SEO)

What are Search Engines and Basics?

HTML Basics.

On Page Optimization.

Off Page Optimization.

Essentials of good website designing & Much More.

3. Content Marketing

Content Marketing Overview and Strategy

Content Marketing Channels

Creating Content

Content Strategy & Challenges

Image Marketing

Video Marketing

Measuring Results

4. Website Structuring

What is Website?- Understanding website

How to register Site & Hosting of site?

Domain Extensions

5. Website Creation Using WordPress

Web Page Creation

WordPress Themes, Widgets, Plugins

Contact Forms, Sliders, Elementor

6. Blog Writing

Blogs Vs Website

How to write blogs for website

How to select topics for blog writing

AI tools for Blog writing

7. Google Analytics

Introduction

Navigating Google Analytics

Sessions

Users

Traffic Source

Content

Real Time Visitors

Bounce Rate%

Customization

Reports

Actionable Insights

Making Better Decisions

8. Understand Acquisition & Conversion

Traffic Reports

Events Tracking

Customization Reports

Actionable Insights

Making Better Decisions

Comparision Reports

9. Google Search Console

Website Performance

Url Inspection

Accelerated Mobile Pages

Google index

Crawl

Security issues

Search Analytics

Links to your Site

Internal Links

Manual Actions

10. Voice Search Optimization

What is voice engine optimization?

How do you implement voice search optimization?

Why you should optimize your website for voice search?

11. E Commerce SEO

Introduction to E commerce SEO

What is e-commerce SEO?

How Online Stores Can Drive Organic Traffic

12. Google My Business: Local Listings

What is Local SEO

Importance of Local SEO

Submission to Google My Business

Completing the Profile

Local SEO Ranking Signals

Local SEO Negative Signals

Citations and Local

Submissions

13. Social Media Optimization

What is Social Media?

How social media help Business?

Establishing your online identity.

Engaging your Audience.

How to use Groups, Forums, etc.

14. Facebook Organic

How can Facebook be used to aid my business?

Developing a useful Company / fan Page

Establishing your online identity.

Engaging your Audience, Types of posts, post scheduling

How to create & use Groups

Importance of Hashtags & how to use them

15. Twitter Organic

Basic concepts – from setting-up optimally, creating a Twitter business existence, to advanced marketing procedures and strategies.

How to use Twitter

What are hashtags, Lists

Twitter Tools

Popular Twitter Campiagns

16. LinkedIn Organic

Your Profile: Building quality connections & getting recommendations from others

How to use Groups-drive traffic with news & discussions

How to create LinkedIn Company Page & Groups

Engaging your Audience.

17. YouTube Organic

How to create YouTube channel

Youtube Keyword Research

Publish a High Retention Video

YouTube ranking factors

YouTube Video Optimization

Promote Your Video

Use of playlists

18. Video SEO

YouTube Keyword Research

Publish a High Retention Video

YouTube Ranking Factors

YouTube Video Optimization

19. YouTube Monetization

YouTube channel monetization policies

How Does YouTube Monetization Work?

YouTube monetization requirements

20. Social Media Tools

What are the main types of social media tools?

Top Social Media Tools You Need to Use

Tools used for Social Media Management

21. Social Media Automation

What is Social Media Automation?

Social Media Automation/ Management Tool

Buffer/ Hootsuite/ Postcron

Setup Connection with Facebook, Twitter, Linkedin, Instagram, Etc.

Add/ Remove Profiles in Tools

Post Scheduling in Tools

Performance Analysis

22. Facebook Ads

How to create Business Manager Accounts

What is Account, Campaign, Ad Sets, Ad Copy

How to Create Campaigns on Facebook

What is Budget & Bidding

Difference Between Reach & Impressions

Facebook Retargeting

23. Instagram Ads

Text Ads and Guidelines

Image Ad Formats and Guidelines

Landing Page Optimization

Performance Metrics: CTR, Avg. Position, Search Term

Report, Segment Data Analysis, Impression Shares

AdWords Policies, Ad Extensions

24. LinkedIn Ads

How to create Campaign Manager Account

What is Account, Campaign Groups, Campaigns

Objectives for Campaigns

Bidding Strategies

Detail Targeting

25. YouTube Advertising

How to run Video Ads?

Types of Video Ads:

Skippable in Stream Ads

Non Skippable in stream Ads

Bumper Ads

Bidding Strategies for Video Ads

26. Google PPC

Ad-Words Account Setup

Creating Ad-Words Account

Ad-Words Dash Board

Billing in Ad-Words

Creating First Campaign

Understanding purpose of Campaign

Account Limits in Ad-Words

Location and Language Settings

Networks and Devices

Bidding and Budget

Schedule: Start date, end date, ad scheduling

Ad delivery: Ad rotation, frequency capping

Ad groups and Keywords

27. Search Ads/ Text Ads

Text Ads and Guidelines

Landing Page Optimization

Performance Metrics: CTR, Avg. Position, Search Term

Report, Segment Data Analysis, Impression Shares

AdWords Policies, Ad Extensions

CPC bidding

Types of Keywords: Exact, Broad, Phrase

Bids & Budget

How to create Text ads

28. Image Ads

Image Ad Formats and Guidelines

Targeting Methods: Keywords, Topics, Placement Targeting

Performance Metrics: CPM, vCPM, Budget

Report, Segment Data Analysis, Impression Shares

Frequency Capping

Automated rules

Target Audience Strategies

29. Video Ads

How to Video Ads

Types of Video Ads

Skippable in stream ads

Non-skippable in stream ads

Bumper Ads

How to link Google AdWords Account to YouTube Channel

30. Discovery Ads

What are Discovery Ads

How to Create Discovery Ads

Bidding Strategies

How to track conversions

31. Bidding Strategies in Google Ads

Different Bidding Strategies in Google AdWords

CPC bidding, CPM bidding, CPV bidding

How to calculate CTR

What are impressions, impression shares

32. Performance Planner

33. Lead Generation for Business

Why Lead Generation Is Important?

Understanding the Landing Page

Understanding Thank You Page

Landing Page Vs. Website

Best Practices to Create Landing Page

Best Practices to Create Thank You Page

What Is A/B Testing?

How to Do A/B Testing?

Converting Leads into Sale

Understanding Lead Funnel

34. Conversion Tracking Tool

Introduction to Conversion Optimization

Conversion Planning

Landing Page Optimization

35. Remarketing and Conversion

What is conversion

Implementing conversion tracking

Conversion tracking

Remarketing in adwords

Benefits of remarketing strategy

Building remarketing list & custom targets

Creating remarketing campaign

36. Quora Marketing

How to Use Quora for Marketing

Quora Marketing Strategy for Your Business

37. Growth Hacking Topic

Growth Hacking Basics

Role of Growth Hacker

Growth Hacking Case Studies

38. Introduction to Affiliate Marketing

Understanding Affiliate Marketing

Sources to Make money online

Applying for an Affiliate

Payments & Payouts

Blogging

39. Introduction to Google AdSense

Basics of Google Adsense

Adsense code installation

Different types of Ads

Increasing your profitability through Adsense

Effective tips in placing video, image and text ads into your website correctly

40. Google Tag Manager

Adding GTM to your website

Configuring trigger & variables

Set up AdWords conversion tracking

Set up Google Analytics

Set up Google Remarketing

Set up LinkedIn Code

41. Email Marketing

Introduction to Email Marketing basic.

How does Email Marketing Works.

Building an Email List.

Creating Email Content.

Optimising Email Campaign.

CAN SPAM Act

Email Marketing Best Practices

42. SMS Marketing

Setting up account for Bulk SMS

Naming the Campaign & SMS

SMS Content

Character limits

SMS Scheduling

43. Media Buying

Advertising: Principles, Concepts and Management

Media Planning

44. What’s App Marketing

Whatsapp Marketing Strategies

Whatsapp Business Features

Business Profile Setup

Auto Replies

45. Influencer Marketing

Major topics covered are, identifying the influencers, measuring them, and establishing a relationship with the influencer. A go through the influencer marketing case studies.

46. Freelancing Projects

How to work as a freelancer

Different websites for getting projects on Digital Marketing

47. Online Reputation Management

What Is ORM?

Why We Need ORM

Examples of ORM

Case Study

48. Resume Building

How to build resume for different job profiles

Platforms for resume building

Which points you should add in Digital Marketing Resume

49. Interview Preparation

Dos and Don’t for Your First Job Interview

How to prepare for interview

Commonly asked interview question & answers

50. Client Pitch

How to send quotation to the clients

How to decide budget for campaign

Quotation formats

51. Graphic Designing: Canva

How to create images using tools like Canva

How to add effects to images

52. Analysis of Other Website

https://seotrainingahmedabad.com/digital-marketing-course-in-new-cg-road-ahmedabad/

2 notes

·

View notes

Text

The Future of Mutual Funds - All that you need to know

India is rapidly seeing an escalating digital revolution. Whether it is internet penetration, data uptake or even the latest technology trends, India is applauded worldwide. All this started back in 2015 when the government of India initiated the Digital India Programme.

Later in 2016, demonetization was a big step in the digital era. All these events resulted in the growth of opportunities in the field of the mutual fund industry. Investors have also started to adopt mutual funds as their means of investment.

Mutual Fund Industry - How it got evolve?

Initially, many investors believed that investing in mutual funds was not suitable for them. However, a series of events changed the opinion of the people.

The announcement of demonetization by Narendra Modi, Donald Trump's win, an increase in oil prices and an asset base of 17 lakh were seen in 2016; all these events led to awareness in the mutual fund field in our country.

Also, the CAGR (Compounded Annual Growth Rate) was 18% which was a huge step in the evolvement of the mutual fund industry.

SIP- A facility offered by mutual funds to the investors

SIP is a big factor leading to rapid growth in the industry. Today, more than one crore of customers have active SIP, i.e. Systematic Investment Plans.

If mutual funds industry growth is to be considered, the Indian market is already booming. The most significant indication is the number of foreign-based management companies progressing into the Indian market.

If the latest data is to be considered, the MF industry's total AUM had risen 20 per cent to Rs 37.6 trillion in 2021-22. The industry added 31.6 million net new folios, taking the count to 129.5 million.

The systematic investment plan expanded to Rs 12,328 crore in FY22, with new SIP registrations at 26.6 million. Apparently, mutual funds in India are more likely to penetrate urban, semi-urban and rural areas. For this, some financial planners make the process easy by financial planning.

Opportunities in the mutual fund industry

Be it any industry, improvement is one rule that leads to positive change. In the mutual fund industry field, large-scale changes have been taking place, leading to evolution and innovation.