#Rising Wedge chart pattern

Explore tagged Tumblr posts

Text

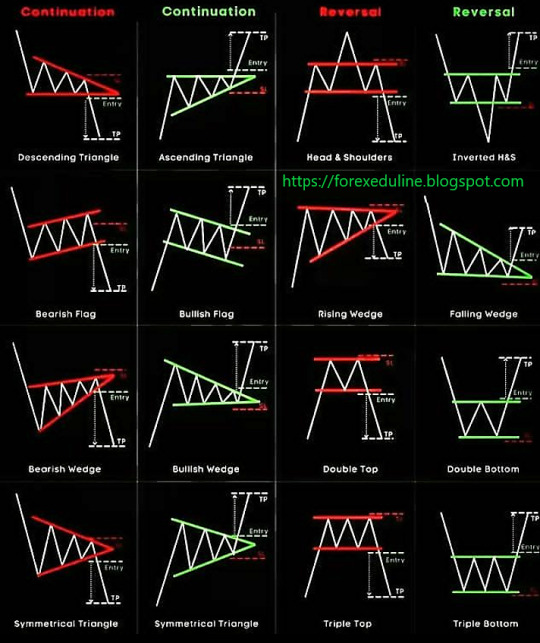

#forexmarket#trader#forex#finance#stocks#chart patterns#bitcoin#cryptocurrency news#descending triangle pattern#ascending triangle pattern#symmetrical triangle#double top pattern#double botttom#triple top#triple bottom#rising wedge#falling wedge#flag patterns#head and shoulders pattern#forexeduline.blogspot.com

1 note

·

View note

Text

Profit-taking continues, China PMI in focus

A holiday-thinned session saw Wall Street finish sharply lower on Friday. With no headlines of note, it looks like investors continued to lock in profits before the year-end, with notable “Magnificent Seven” selling. We can expect more sharp moves this week as markets navigate multiple national year-end holidays.

The S&P 500 fell by 1.11%, the Nasdaq tumbled 1.49% lower, and the Dow Jones slipped by 0.77%.

It was a quiet weekend of headlines from a market’s perspective. President-elect Trump asked the Supreme Court to pause ruling on a law that would either ban Tik-Tok or force it to sell its US operation by January 19th. The Supreme Court doesn’t answer to, or have to listen to Mr Trump, but his appearance may give hope that all is not lost with US-China relations going forward. That may provide a year-end boost to Chinese equity markets today.

Currency markets were, unsurprisingly, quiet on Friday. The DXY closing almost unchanged at 108.00. Loath as I am to call a top in the US Dollar, the DXY chart is exhibiting a potential topping pattern. With the heavy selling of Magnificent Stocks, another beneficiary of the Trump/AI buy-everything trade, I am more confident at least a technical correction of the US dollar rally may be on the cards.

The DXY chart is exhibiting a bearish rising wedge formation. A daily close below 107.70 (although I’d like to see two daily closes below there), suggests a medium-term top is in place. The chart suggests an initial target of 104.70, although a daily close well above 108.70 potentially invalidates the pattern.

DXY Daily The Australian Dollar (AUD) still looks terrible on the charts, and only the US dollar correction mentioned above is likely to offer a stay of execution. It now has seven consecutive daily close below resistance at 0.6270 since it fell out of its wedge formation last week. Failure of 0.6200 signals deeper losses, targeting 0.6000.

AUDUSD Daily

The data calendar is understandably thin across the world this week. Still, there are a few releases worth noting.

China announces its office Manufacturing and Non-Manufacturing PMIs on Tuesday with markets expecting prints just above 50.0. It releases the broader Caixin Manufacturing PMI survey on Thursday. Of late, it has outperformed the official numbers.

Elsewhere, the US releases its Chicago PMI and Pending Home Sales overnight. Thursday sees a data dump including Initial Jobless Claims, and Friday features ISM Manufacturing data.

Disclaimer: The information contained in this market commentary is of general nature only and does not take into account your objectives, financial situation or needs. You are strongly recommended to seek independent financial advice before making any investment decisions. Trading margin forex and CFDs carries a high level of risk and may not be suitable for all investors. Investors could experience losses in excess of total deposits. You do not have ownership of the underlying assets. AC Capital Market (V) Ltd is the product issuer and distributor. Please read and consider our Product Disclosure Statement and Terms and Conditions, and fully understand the risks involved before deciding to acquire any of the financial products provided by us. The content of this market commentary is owned by AC Capital Market (V) Ltd. Any illegal reproduction of this content will result in immediate legal action.

0 notes

Text

Matrixport Foresees Ethereum’s Major Leap with Rising ETF Inflows

Key Points

Ethereum’s price is expected to rise due to increased institutional demand and ETF inflows.

Matrixport predicts a significant price increase for Ethereum in 2025 based on current trends.

As the price of Bitcoin gradually increased to $98,000, the total crypto market cap also rose by 1.41% to $3.41 trillion.

With the broader market recovery, the price of Ethereum surpassed the $3,700 mark.

Ethereum’s Bullish Momentum

Ethereum experienced an intraday gain of 2.01%, signaling a bullish momentum following a 10% fall in the past two days.

This recovery is largely due to increased institutional demand.

Matrixport’s Ethereum Price Prediction

A recent report from Matrixport suggests a potential for higher Ethereum prices in 2025, based on the surge in Ethereum ETF demand.

The prediction is based on Ethereum ETF demand netting $1.8 billion over the past 12 days.

During this period, Ethereum ETFs recorded no single days of net selling, with three daily net inflows exceeding $300 million.

When adjusted for market cap, this equals nearly $1.2 billion daily for Bitcoin, considering that Ethereum’s market cap is roughly 25% of Bitcoin’s.

The increased institutional demand is driven by factors such as the Trump administration’s potential assumption of US presidential powers in 2025 and the new fiscal year for U.S. mutual funds starting on December 1.

If the demand persists, Matrixport believes Ethereum will reach significantly higher prices in 2025.

Ethereum ETFs Performance

In the past 24 hours, the total daily net inflow of the Ethereum ETFs market reached $305.74 million.

Top performers included Fidelity’s FETH with a net inflow of $202.23 million, followed by BlackRock’s ETHA with $81.66 million.

The total net assets of the US Ethereum spot ETF have reached $12.46 billion, dominating 2.84% of the Ethereum market cap.

Possibility of a Bullish Trend in Ethereum

An independent analyst, Titan of Crypto, highlighted the possibility of a new altcoin value, supporting the possibility of a bullish trend in Ethereum.

The analyst revealed a rising wedge pattern in the Bitcoin dominance price chart on the weekly time frame.

The BTC dominance breaks below the support trend line, increasing the chances of a new altcoin season.

With the confirmed downtrend in Bitcoin dominance, the next few weeks could witness a massive surge in the altcoin market cap.

Ethereum Price Target

From a technical analysis perspective, the Ethereum price trend in the weekly chart reveals a triangle breakout rally.

The recent recovery completes a Rounding Bottom reversal, surpassing the neckline at the 78.60% Fibonacci level price of $3,817.

However, the pullback of 7.65% this week marks a retest of this broken trendline and the Rounding Bottom pattern.

With the ongoing recovery, the 100-week and 200-week Simple Moving Average lines are ready for a bullish crossover.

The MACD and Signal lines maintain a positive trend.

As the Ethereum price is ready for a post-retest reversal of the broken trendline, the Fibonacci level speeds the next price target at $4,617.

Therefore, the chances of Ethereum hitting a new all-time high have significantly increased with the growth in institutional demand, the chances of a new altcoin season, and the improving sentiments in the macro market.

0 notes

Link

The past week was a rollercoaster ride in the cryptocurrency market. From XRP’s explosive gain to Shiba Inu’s burning spree, the crypto world was buzzing with activity. Let’s dive into the top stories that shaped the crypto market over the weekend. XRP’s Parabolic Uptrend Over the last weekend, XRP XRP/USD witnessed a significant rise. The uptrend was fueled by new ETF applications and increased whale activity. Noted investor Raoul Pal highlighted XRP’s “great-looking” chart, drawing parallels with a previous long wedge pattern that led to a whopping 5,600% rally. Pal coined the current phase as “Banana Zone Part 1.” Read the full article here. Shiba Inu Burns 53 Million Coins Shiba Inu SHIB/USD made headlines as it burned 53 million coins in a single day. The coin’s burn rate and a steady increase in whale transactions have contributed to its recent momentum. Traders are optimistic about SHIB’s trajectory, with Bluntz Capital tweeting about a potential major price spike for Shiba Inu. Read the full article here. Fed Chair Powell on Bitcoin Federal Reserve Chair Jerome Powell addressed Bitcoin BTC/USD at the DealBook Summit, likening the cryptocurrency to gold. Powell dismissed the idea that Bitcoin undermines the Federal Reserve or the strength of the U.S. dollar, emphasizing that Bitcoin is not being used as a primary form of payment or a reliable store of value due to its high volatility. Read the full article here. Congressman Buys Meme Coins Rep. Mike Collins (R-Ga.) disclosed buying two cryptocurrencies, including the meme coin Ski Mask Dog. The Congressman purchased between $2,000 to $30,000 worth of the meme coin, sparking interest among investors who closely follow the trading activities of Congress members. Collins also bought Aerodrome, a cryptocurrency he purchased before. Read the full article here. NYC Mayor’s Bitcoin Victory Lap New York City Mayor Eric Adams had the last laugh earlier this week as Bitcoin’s value edges closer to the $100,000 mark. Adams, who took his first three paychecks in Bitcoin and Ethereum ETH/USD, addressed his skeptics at a press conference, reminding them of their initial ridicule. Read the full article here. Read Next: Photo courtesy: Shutterstock This story was generated using Benzinga Neuro and edited by Anan Ashraf. Market News and Data brought to you by Benzinga APIs© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved. https://cdn.benzinga.com/files/images/story/2024/12/08/What-Happened_0.jpeg?width=1200&height=800&fit=crop 2024-12-08 13:00:25

0 notes

Text

Bullish Buffet: Knowing When to Feast on Gains in Trading with MintCFD

In the world of online trading, the “Bullish Buffet” approach is about feasting on gains when market conditions align just right. This mindset focuses on recognizing bullish signals and making the most of market opportunities without letting excitement lead to reckless decisions. MintCFD, with its powerful tools and data-driven features, offers traders a smart way to adopt this approach, helping them maximize gains while keeping uncertainty in check.

The “Bullish Buffet” Mindset

The Bullish Buffet isn’t just about grabbing profits — it’s about identifying the right moments to enter the market, based on solid analysis. On the MintCFD trading app, traders can leverage a variety of tools, like real-time data and types of trading chart patterns, to spot market trends and ensure that their decisions are informed and precise. Recognizing a bull market, which refers to a steady rise in asset prices, is critical. In these scenarios, a Bullish Buffet investor aims to “feast” on the gains that come from upward trends while remaining vigilant.

Identifying Bullish Signals on the MintCFD Platform

A bull market often brings strong momentum, which can be tracked using MintCFD’s analytical tools. With access to chart patterns like the Rising Wedge or Cup and Handle, traders can spot signs of a sustained uptrend. The MintCFD app also offers alerts and indicators to catch these moments early. For example, a breakout from a resistance level may signal a potential upward trend, giving a Bullish Buffet trader a clear opportunity to enter the market.

How to Implement the Bullish Buffett Strategy with MintCFD

Focus on Market Indicators: Using tools like moving averages, MintCFD traders can spot bullish trends early. By observing patterns and comparing them to historical data, traders can build a case for their decisions rather than relying solely on market sentiment.

Set Clear Profit Goals: The Bullish Buffet approach isn’t about greed; it’s about maximizing gains while the market is favorable. Setting clear profit targets in the CFD trading app helps traders lock in gains without holding on too long, reducing the likelihood of reversal losses.

Manage Hazards with Stop-Loss Orders: Even in a bull market, fluctuations can happen. MintCFD’s stop-loss feature allows traders to manage risk by automatically selling if prices fall below a set level. This way, traders can capitalize on gains without risking too much if the market turns.

Why MintCFD is Perfect for the Bullish Buffet Strategy

MintCFD provides a streamlined, data-focused platform for investors looking to make informed decisions. The app’s comprehensive set of trading tools allows traders to view trends, make quick decisions, and keep their focus on long-term gains. With features like instant market alerts, access to diverse chart patterns, and flexible trading options, MintCFD is a great fit for traders following the Bullish Buffet approach.

In Conclusion

The Bullish Buffet is about being prepared to “feast” on gains when the market is upswing while protecting profits from sudden drops. MintCFD’s advanced features make it easy to apply this strategy, helping traders make confident, timely decisions. MintCFD users can successfully navigate bullish markets and fully embrace the Bullish Buffet approach by focusing on real-time data and smart hazard management.

1 note

·

View note

Text

Crypto analyst Egrag Crypto has set a bullish target for XRP, highlighting the $1.10 level as crucial for a potential breakout. In his recent post, Egrag named $1.10 the "Ignition Stage," suggesting that if XRP can close the week above this level and hold it as support, it could lead to significant gains. This critical level, according to Egrag, might allow XRP to move away from the $1 range entirely.

Egrag’s analysis outlines two ambitious targets for XRP. The first target is $6.40, a considerable rise from current levels. The second target, using a logarithmic approach, is set at $13, which would mark a transformative shift for XRP’s standing in the crypto market.

XRP is also trading within a long-term wedge pattern, with prices converging near the $1.10 resistance level. A weekly close above this level could initiate a strong upward trend. Currently, XRP trades at $0.5072, with recent fluctuations showing moderate volatility, but the chart suggests potential for upward movement, supported by a long-term rising trendline.

Investors are closely monitoring XRP as it nears $1.10, as a breakout could set it on a path toward Egrag’s target of $13, with the moving averages supporting a possible growth phase for the token.

0 notes

Text

Swing Trading Strategies

Swing trading strategies in the stock market mainly capture short- to medium-term price movements in a trend. Therefore, traders are poised to hold a particular position between several days and weeks in the hope of capturing 'swings' in the market. Basically, the strategies are patterned around the identification of chart patterns: double tops, falling wedge, upward rising channel patterns, etc. - on the basis of technical indicators like moving averages or pivots studying market trends.

Best Swing Trading Strategies

Box Breakout Trading

Pivot Point Trading Strategies

If you want to know more about Swing Trading Strategies, Swing Trading charges, Everything about Swing Trading, Click on the Link

https://bigul.co/insights/swing-trading-strategies

#bigul#bigul algos#bigul trading#bigul algo ideas#Swing_Trading#Swing_Trading_Strategies#Best_Swing_Trading_Strategies#Bigul_Investing_Platform

0 notes

Text

Unveiling the Rising Wedge: A Comprehensive Guide to Technical Analysis

Technical analysis is a powerful tool used by traders and investors to analyze price movements and make informed decisions. Among the various chart patterns that technical analysts study, the rising wedge stands out as a significant pattern that can provide valuable insights into potential market trends. In this blog post, we’ll delve into the intricacies of the rising wedge pattern, exploring…

View On WordPress

#Bearish Reversal#Chart Patterns#equities#Financial Markets#Investing#learn technical analysis#Market Analysis#Patterns#rising wedge#stock market#stock markets#stock trading#successful trading#technical analysis#trading signals#Trading Strategies

0 notes

Text

Cybercriminals Shift $42.7M in Stolen Ethereum to Tornado Cash Following WazirX Meeting

Key Points

WazirX held a meeting to discuss recovery of stolen funds, while hackers continue to move large amounts of stolen ETH.

Technical analysis suggests ETH could drop to $2,200 or lower, amid market sell-off and bearish sentiment.

The digital asset exchange, WazirX, recently held a virtual townhall meeting to deliberate on strategies for recovering stolen funds. This comes in the wake of exploiters from WazirX, Penpiexyz, and Fenbushi moving millions in stolen funds, causing widespread concern.

The on-chain analytics firm, Lookonchain, reported on 6 September 2024 that these hackers had deposited a substantial 17,800 ETH (worth $42.7 million) into Tornado Cash within the past three days.

WazirX Exploiter’s Actions

After the townhall meeting, the WazirX exploiter moved 7,200 ETH (valued at $17.3 million) into Tornado Cash. There seems to be no intention to return a significant $235 million worth of crypto. Penpiexyz exploiters, who drained $27 million worth of assets, also deposited a substantial 9,600 ETH (worth $23 million) to Tornado Cash. These large fund transfers could incite panic and increase selling pressure in the already sensitive market.

Technical Analysis of Ethereum

The price action of ETH on daily charts appears extremely bearish. Following the breakdown of the rising wedge price action pattern on a daily timeframe, it consolidated for a week. At present, it’s breaking out of that consolidation zone with a daily candle closing below the zone.

Historical price momentum suggests that ETH could potentially drop to the $2,200 level or even lower. While the Relative Strength Index (RSI) is in an oversold area, which could potentially indicate a price reversal, current market conditions and whale activity make this seem unlikely.

At the time of writing, ETH was trading near $2,374 after a price drop of 1% in the last 24 hours, according to CoinMarketCap. Meanwhile, its trading volume also fell by 6% over the same period, indicating less participation from traders amid the market sell-off. However, ETH’s Open Interest rose by 1.2% in the last 24 hours, indicating an increase in ETH Future contracts despite the price decline.

0 notes

Text

US data keeps December rate cut on track

Non-farm payrolls were neither too strong nor too weak but just right.

US Non-Farm Payrolls rose by 227,000 on Friday, near the consensus. The data kept a 0.25% rate cut expectations on December 18th intact, with US 10-year yields slipping by 3.0 basis points.

US stocks finished mixed. The S&P 500 rose 0.25%, the Nasdaq gained 0.80%, and both recorded closing highs. The Dow Jones slipped by 0.30%, weighed down by healthcare.

The US dollar was modestly weaker, and the dollar index (DXY) chart continues to signal corrective downside pressure persisting after breaking support at 106.00 on Friday. The DXY could extend losses towards its 200-day moving average at 104.07 as the festive season approaches.

DXY H4

The collapse of the Assad regime in Syria over the weekend may see oil reverse some of its recent losses as Middle East instability accelerates again. Despite OPEC kicking the production cut can down the road last week, fears over global growth and the threat of increased US supply saw bearish price action continue.

A Syria rally may only be a temporary reprieve as the Brent crude chart continues signalling a downside breakout is near. Brent closed at $71.00 a barrel on Friday, the session lows. A move above $74.00 is required to change the bearish out, while critical support at $70.00 gets ever nearer.

UKOILRoll H4

China releases November CPI today, forecasting a rise of 0.60%. A weaker number may weigh on China's equities, although tomorrow's Trade Balance will have a more significant impact.

Tuesday is the latest rate decision from the Reserve Bank of Australia (RBA). Markets are almost universally expecting an unchanged RBA cash rate of 4.35%. A surprise move lower by the RBA would, therefore, have an outsized negative reaction on AUD/USD and may explain why it hasn't benefited from a weaker US dollar this past week.

AUD/USD remain in a falling wedge pattern, slumping by 0.99% to 0.6389 on Friday. That leaves it dangerously close to support at 0.6370. Failure signals deeper losses targeting 0.6280.

AUDUSD H1

China also begins its Central Economic Work Conference this week. We should get some soundbites later in the week, with market attention focused on China maintaining a positive tone on fiscal and monetary stimulus.

US CPI will have markets on edge on Wednesday after wage growth rose unexpectedly in the Friday data releases.

The European Central Bank should cut rates by 0.25% on Thursday. As usual, the press conference afterwards is what matters. EUR/USD consolidated last week and could benefit from expected US dollar weakness. But it is not out of the woods by any means. Resistance at 1.0670 remains solid.

EURUSD H1

Disclaimer:

The information contained in this market commentary is of general nature only and does not take into account your objectives, financial situation or needs. You are strongly recommended to seek independent financial advice before making any investment decisions.

Trading margin forex and CFDs carries a high level of risk and may not be suitable for all investors. Investors could experience losses in excess of total deposits. You do not have ownership of the underlying assets. AC Capital Market (V) Ltd is the product issuer and distributor. Please read and consider our Product Disclosure Statement and Terms and Conditions, and fully understand the risks involved before deciding to acquire any of the financial products provided by us.

The content of this market commentary is owned by AC Capital Market (V) Ltd. Any illegal reproduction of this content will result in immediate legal action.

0 notes

Text

December Bitcoin Rollercoaster: Can BTC Value Soar Beyond $120K?

Key Points

Bitcoin’s volatility is increasing as it approaches the $100,000 mark, with a potential pullback to around $87,680.

The crypto market has seen significant liquidations and a decline in total market cap, despite growing institutional support.

Bitcoin’s price is experiencing increased volatility as it hovers near the $100,000 milestone.

The cryptocurrency has fallen below the significant mark, trading at $99,404, a minor pullback of 0.32% in the last 24 hours.

Impact on the Crypto Market

This intraday pullback of 1.74% in Bitcoin’s value has significantly impacted the total crypto market, leading to a loss of $62.89 billion in valuation.

The total crypto market cap now sits at $3.55 trillion, down from a 24-hour high of $3.62 trillion.

The daily chart of Bitcoin’s price action indicates a bearish reversal from a local resistance line, marking a negative cycle within the rising wedge pattern.

Despite the pullback, Bitcoin’s market cap remains at $1.96 trillion, showing a surge of 2.57% over the past week.

Anticipated Bearish Pullback

The overall sentiment of the rising wedge pattern is bearish as it approaches the bottleneck part, warning of a potential pullback to the next critical support at the center pivot level priced at $87,680.

Therefore, the current price trend suggests a pullback of nearly 12%.

The market has witnessed liquidations of $290.39 million over the past 24 hours amid increased supply pressure.

This includes $217.71 million in long liquidations, reflecting the broader market pullback.

Bitcoin’s open interest remains at $61.5 billion, with top traders maintaining a bullish long/short ratio over Binance and OKExchange.

However, the $41 million liquidation in Bitcoin over the past 24 hours was driven by the $23.32 billion loss in long liquidations.

Institutional Support for Bitcoin

Despite the short-term bearish outlook, growing institutional support is a key driving factor.

As US spot Bitcoin ETFs register a surge in net inflows, the BTC price is expected to increase.

Over the past week, the total Bitcoin spot ETF net inflow peaked at $2.73 billion.

This was the second-largest net inflow two weeks after the $3.38 billion inflows amid the Trump hype.

Historical Performance and Future Predictions

Historical data shows that a positive November often leads to a positive December for Bitcoin.

For instance, in November 2015, when BTC jumped 19.27%, the trend continued with a 13.83% surge in December.

In November 2017, the 53.48% rise resulted in a nearly 39% surge by the end of the year.

In the 2020 BTC halving year, the 42.95% surge in November was followed by a 46.92% rally in December.

Based on this pattern, the 37.29% surge in November suggests an increased likelihood of a strong rally towards the end of 2024.

A similar surge in December could see the BTC price surpass the $120,000 barrier.

0 notes

Text

BOTT Price Action Guide: Binary Options Turbo Trading, Forex, FX Options, Digital Options BOTT Price Action Guide: Binary Options Turbo Trading, Forex, FX Options, Digital OptionsThe ultimative Price Action guide (7 edition) for any kind of financial instrument (Binary Options, Forex, FX Options, Digital Options) any kind of time frame from 1 min over 5 min up to 15 min, 30 min and above and any kind of broker. This ebook is all you need, especially as a binary option turbo trader or Forex day trader to get profit out of the market, to get out of debt, make yourself a living or help your friends and family and to archieve financial freedom. Don't miss the opportunity to get this ultimative Price Action guide (7 edition)File Size: 12597 KBPrint Length: 118 pagesPublisher: BO Turbo Trader; 7 edition (October 24, 2018)Publication Date: October 24, 2018Content:Mindset for consistent profits- Practice- Win Rate- Discipline- Money Management- Emotions Candlestick Patterns- Hammer, Inverted Hammer, Takuri Line, Shooting Star and Hanging man- Dragonfly Doji, Gravestone Doji- spinning top - long-legged doji, high wave and rickshaw man- Pinbar - Pin Bar - Pinocchio bar or Kangaroo Tail - Tweezer Top and Tweezer Bottom- bearish harami, bullish harami and bullish harami cross and bearish harami cross- three inside down, three inside up- descending hawk and homing pigeon- bearish meeting line - counterattack line and bullish meeting line- bearish belt hold - black opening shaven head - black opening marubozu- bullish belt hold - white opening shaven bottom - white opening marubozu- bearish kicker signal - bullish kicker signal- matching high and matching low- bearish stick sandwich and bullish stick sandwich - bearish breakaway and bullish breakaway- ladder top and ladder bottom - tower top and tower bottom- three stars in the north and three stars in the south- bearish sash pattern and bullish sash pattern- engulfing candlestick pattern or the big shadow pattern- (bearish) dark cloud cover and (bullish) piercing line- Breakaway gap, exhaustion gab, continuation gap and common gaps- rising window and falling window- marubozu and big belt- inside bar and mother bar- evening star, morning star and evening doji star and morning doji star- three white soldiers and three black crowsChart Patterns- Double Top - M Formation - Mammies and Double Bottom - W Formation - Wollahs- J-Hook pattern and inverted J-Hook candlestick pattern- bearish last kiss - bearish pullback and bullish last kiss and bullish breakout- Head and Shoulders and inverted Head and Shoulders Pattern- Trend Channel - uptrend and downtrend- symmetrical triangle- ascending triangle and descending triangle- bullish flag and bearish flag - bullish pennant and bearish pennant - rising wedge and falling wedge- Broadening Bottoms and Broadening Tops- Rectangle Bottoms and Rectangle TopsConcepts- Candlestick Mathematics- Rejection - market move - weak snr and strong snr- trending and ranging market- minor and major trend- adapting forex strategies to binary options turbo trading- proper rejection - invalid rejection- false breakouts - channel breakouts- reversal and retracements- highest probability trading setups- high probability techniques- market pressures and types of market pressures- upper shadow and lower wick or tail- advanced candlestick charting techniques- overbought and oversold - oscilator - RSI CCI Stochastic Oscilator- different market conditions and market conditions examples- cycle of market emotions, psychology and dynamics- trading setups without rejections as confirmation - multiple time frame trading concept, system, methology and strategy- candlestick momenting- direction of candlestick momentum- inside swing and outside swing- support and resistance - minor snr and major snr and much more concepts ... Also by the same author: BOTT Mentorship Self-Study Video Pack 1-4 BOTT Price Action Indicator BOTT Price Action Bible by BO Turbo Trader

0 notes

Text

Bagaimana cara mengetahui bahwa suatu narrative akan berakhir?

Sebelumnya telah dijelaskan bahwa narrative hanya bertahan 2-4 bulan dan setelah itu ada kemungkinan aset dari narrative tertentu tidak lagi mengalami kenaikan. Lalu pasti timbul pertanyaan, bagaimana cara mengetahui apabila suatu narrative tertentu akan berakhir?

#1 Sudah dibicarakan banyak orang

Salah satu top signal yang dapat diprediksi adalah ketika suatu narrative tersebut telah dibicarakan oleh "hampir semua orang". Ketika narrative sudah bersliweran di platform media sosial atau sudah masuk berita maka tandanya adalah narrative tersebut sudah akan berakhir. Pahami bahwa keuntungan terbesar terjadi ketika sesuatu masih sepi, bukan ketika semua orang sudah ada di dalamnya.

#2 Harga sudah tidak mengalami kenaikan signifikan

Tanda-tanda bahwa suatu narrative akan berakhir adalah harga sudah mulai mengalami penurunan kenaikan. Misalkan minggu lalu naik 30% namun minggu ini hanya 5% saja, hal tersebut menunjukkan "kejenuhan" dimana para pelaku pasar sudah tidak lagi memiliki tenaga untuk tetap mendorong harga naik.

#3 Volume mulai berkurang

Volume menunjukkan besaran transaksi perdagangan. Volume yang berkurang menunjukkan "interest" terhadap sektor tersebut mulai berkurang. Bisa saja para smart money ini "mulai hengkang" dari sektor tertentu dan melirik sektor lain untuk diinvestasikan. Disini harus dilihat dengan jeli potensi perpindahan sektor atau narrative untuk memastikan potensi keuntungan yang berlebih.

#4 Bigger time frame chart mengalami Change of Character (ChoCh)

Salah satu pertanda potensi narrative akan berakhir adalah chart di time frame yang besar mengalami perubahan trend dari bullish menjadi bearish. Potensi ChoCh bisa dilihat dari struktur pasar yang tertembus, trendline, ataupun trading pattern seperti ehad and shoulder atau rising wedge.

Semoga bermanfaat!

1 note

·

View note

Text

Two Weeks Above The Fib Zone

Months ago Mood Report noted the 5296.44-5325.55 Fibonacci confluence zone as a technical "line in the sand" for the long-standing B-wave thesis.

The SPX has closed above this zone for two consecutive weeks now.

Theoretically it could keep going and still remain a B-wave, but at this point it feels better to consider other alternatives.

Just typing "feels better to consider other alternatives" is enough to warn me that it may be a bad time to do so.

But since it will not change my allocation, I'm OK with it.

Aside from a long portfolio that hasn't really changed since 2019 (oil, uranium, gold miners, bitcoin) I've been strictly "calls only" for speculative upside for over a year now, and I've bled profits using cheap OTM put spreads for downside speculation for over a year as well. At least it's kept my pencil sharp.

I will continue this playbook regardless which course the market takes. For me, it's just a question of wave counts.

Admittedly, I hesitate labeling a potential B-wave as a potential 3rd wave in the first chart, but seeing how the ultimate assumption is a rising wedge pattern, I think the market can reserve the right to be opaque (thus B-wave-like) vs demonstrating some of the "relentless" traits indicative of 3rd wave personality as exemplified by several popular stocks (NVDA, etc.).

Gold, bond yields, and yen are suggestive of rising wedge patterns as well, so we seem to be playing a bit of Jim Rogers' Three Dimensional Chess at the moment which could continue to build in intensity.

Anyway, it's summertime in New England. I'm not over thinking this.

0 notes

Text

Bitcoin dominance (BTC.D) has broken down from a rising wedge, a bearish signal potentially opening the door for altcoin gains. Analyst Captain Faibik noted that BTC.D’s drop from this pattern suggests a weakening of Bitcoin's dominance, with a possible target around 45%. Historically, such declines in BTC.D have led to stronger altcoin performance, as investors reallocate to alternative cryptocurrencies. A projected dip to 42% could further fuel this trend.

While BTC.D’s short-term outlook appears bearish, Captain Faibik remains bullish on Bitcoin’s long-term prospects, pointing to a bullish ascending triangle pattern on the monthly chart. Bitcoin recently broke out of this pattern, signaling a potential rise to $170,000 in the future. Currently, Bitcoin trades at $67,870.44, down 1.23% over 24 hours and 4.22% over the week, with a market cap of $1.33 trillion. This divergence between BTC dominance and Bitcoin's potential underscores the market's dynamic nature.

0 notes

Text

This week, the price of gold is at the forefront of trading activity, with experts like James Stanley from Forex.com predicting a potential rise to $2,500. Stay updated on the latest Market trends and make informed investment decisions. Click to Claim Latest Airdrop for FREE Claim in 15 seconds Scroll Down to End of This Post const downloadBtn = document.getElementById('download-btn'); const timerBtn = document.getElementById('timer-btn'); const downloadLinkBtn = document.getElementById('download-link-btn'); downloadBtn.addEventListener('click', () => downloadBtn.style.display = 'none'; timerBtn.style.display = 'block'; let timeLeft = 15; const timerInterval = setInterval(() => if (timeLeft === 0) clearInterval(timerInterval); timerBtn.style.display = 'none'; downloadLinkBtn.style.display = 'inline-block'; // Add your download functionality here console.log('Download started!'); else timerBtn.textContent = `Claim in $timeLeft seconds`; timeLeft--; , 1000); ); Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_1] Gold prices have recently broken out of a falling wedge pattern, signaling a potential rally towards surpassing its all-time highs. According to James Stanley, a Senior Strategist at Forex.com, the movement of gold prices has been volatile lately, with prices hitting a high near $2,400 per ounce before experiencing a significant pullback. Despite this setback, gold managed to hold support above $2,300, creating a falling wedge pattern on the daily chart. This week, another technical pattern emerged as a Fibonacci retracement showed inflections at different levels. The pullback from the high led to a rally followed by a pause at the 61.8% retracement level around $2,372.68. Subsequent price movements have shown support at the 38.2% retracement level, indicating bullish momentum in the Market. Looking ahead, there is speculation on whether gold prices will close above the $2,400 level, a key resistance point. If achieved, gold could target $2,417 and $2,431 before rallying towards $2,500 per ounce and beyond. Despite forming a triple top pattern just below $2,400, gold prices experienced a minor decline, trading at $2,376.42 at the time of writing. Overall, the outlook for gold remains positive, with potential for further upside as investors closely monitor key resistance levels. However, it is important to note that the views expressed in this article are solely the author's, and readers should exercise caution when making financial decisions based on this information. Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_2] 1. What is the current price of gold? The price of gold is $2,500 this week. 2. Why is gold in play this week according to Forex.com’s James Stanley? Forex.com's James Stanley believes that gold is in play this week due to Market conditions and potential economic indicators. 3. Should I invest in gold this week? It depends on your individual financial goals and risk tolerance. It is always recommended to consult with a financial advisor before making any investment decisions. 4. How can I track the price of gold throughout the week? You can track the price of gold through financial news websites, trading platforms, and by following experts like James Stanley on Forex.com. 5. Is it a good time to buy or sell gold? The decision to buy or sell gold should be based on your own research, Market analysis, and financial goals. Consider factors such as Market trends, geopolitical events, and economic data before making a decision. Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_1] Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators Claim Airdrop now Searching FREE Airdrops 20 seconds Sorry There is No FREE Airdrops Available now. Please visit Later

function claimAirdrop() document.getElementById('claim-button').style.display = 'none'; document.getElementById('timer-container').style.display = 'block'; let countdownTimer = 20; const countdownInterval = setInterval(function() document.getElementById('countdown').textContent = countdownTimer; countdownTimer--; if (countdownTimer < 0) clearInterval(countdownInterval); document.getElementById('timer-container').style.display = 'none'; document.getElementById('sorry-button').style.display = 'block'; , 1000);

0 notes