#QuickBooks enterprise cloud

Explore tagged Tumblr posts

Text

Why Choose Odoo Over Other ERP Solutions?

In today's competitive corporate environment, selecting the appropriate Enterprise Resource Planning (ERP) software is critical to efficiency, productivity, and scalability. With so many ERP options on the market, businesses frequently struggle to find the perfect fit. Odoo stands out among the main ERP solutions for its power, flexibility, and cost-effectiveness. But why is Odoo preferred over other ERP systems like SAP, Oracle, and Microsoft Dynamics? Let's look at the primary benefits of Odoo ERP.

1. All-in-One Business Solution

Odoo, unlike typical ERP systems, provides a comprehensive suite of apps that includes CRM, accounting, inventory management, human resources, e-commerce, and other features. This integrated strategy reduces the need for different software solutions, resulting in a more streamlined user experience and increased operational efficiency.

2. Open-Source and Cost-Effective

One of Odoo's primary advantages is its open-source nature, which makes it far less expensive than proprietary ERPs like SAP or Oracle. Businesses can select between the free Odoo Community edition and the Odoo Enterprise edition, which offers more advanced capabilities at a competitive price. This flexibility guarantees that businesses of all sizes can benefit from a strong ERP without suffering unnecessary costs.

3. User-Friendly Interface

Odoo's modern, intuitive, and easy-to-use interface distinguishes it from many other ERP solutions, which can require extensive training. Odoo's low learning curve and smooth UI design make it accessible to users of all technical backgrounds, increasing adoption rates and lowering onboarding time.

4. Modular and Scalable

Unlike rigid ERP systems, Odoo is modular, allowing organizations to begin with key apps and expand as they grow. Odoo adapts to your demands, ensuring seamless scaling without overcomplicating operations.

5. Customization and Flexibility

Odoo, on the other hand, offers extensive customization capabilities, allowing businesses to easily tailor the system to their specific needs with access to its source code and a wide range of modules. In contrast, many ERP solutions have limited customization options, necessitating costly development to meet unique business needs.

6. Seamless Integrations

Odoo seamlessly interfaces with third-party apps such as PayPal, Stripe, Amazon, eBay, Google Apps, and QuickBooks, ensuring smooth operations across several business processes. This link enables businesses to expand their capacities without affecting current procedures.

7. Cloud and On-Premise Deployment

Odoo offers both cloud-based and on-premise deployment options, allowing organizations to choose the appropriate infrastructure for their security and operational requirements. This is a big advantage over some ERP packages, which are only available in on-premise or SaaS (Software-as-a-Service) versions.

8. Robust Community and Support

Odoo benefits from ongoing updates and breakthroughs because of its worldwide development, partner, and user community. Businesses may access substantial documentation, forums, and professional support to ensure they always have the assistance they require

.

9. Fast Implementation and Updates

Unlike traditional ERP software, which can take months to integrate, Odoo provides speedy deployment options, decreasing downtime and increasing ROI. Regular upgrades ensure that businesses have access to the most recent features and security enhancements.

Read More:

0 notes

Text

How to Select the Right Accounting Services in Dubai?

It is important to select the right accounting services in Dubai for your business needs. With the right solution provider, you can streamline financial management, enhance the accuracy and ensure complete compliance with the tax regulations.

There are several good options available in the market. choosing the right one can become challenging for your business needs. here are all the key factors that can help you go ahead with the right accounting services. • Assess the financial management needs posed by your business. this will help you select the right accounting service. Start by understanding the business size and its complexity. You might want a basic bookkeeping service for a small business. As a larger enterprise, you might need advanced reporting and automation. Industry requirements may differ in terms of accounting needs. You may need inventory tracking in case of retail business and project accounting in case of construction. The number of invoices, bills and bank transactions you tend to process can also influence the choice of software you need. Lastly, you may want to consider the scale of your business before proceeding with the choice. • Next, you must determine the budget while choosing crypto accounting services in Dubai. There are different versions that come with diverse features that can help you with the accounting needs. for instance the free version may possess limited features while the premium solutions come with advanced features and services. you must consider the upfront and ongoing costs for the service before proceeding with the initial purchase. You must also look a the subscription fees so that you know what you are paying for. The hidden fees is equally important while allocating the budget. You may be charged for the integrations and additional users. It is possible you need to pay for customer support. Lastly, make sure to check if you can save some money into accounting services in Dubai. you should check the returns on services. • You should check if the accounting solutions you plan to invest in would be cloud-based or on-premises. There are services like QuickBooks and Xero that offer cloud-based services. You would get automatic updates and data backups with these services. it offers a monthly pricing and is ideal for the remote access. When you opt for on-premises software, you install the solution on the local computer. It may come with a higher upfront cost. At the end it offers a better control over data security. It is suited for businesses that prefer local storage. • When selecting the services, you must look at the features. Prioritize the ones that can help your business. The basic features include income and expense tracking, invoicing and billing and bank reconciliation. If you want payroll processing or multi-currency support, you need advanced services. in case you need automation capabilities, you must opt for recurring invoicing and bank feeds. These features can help your business in multiple ways. • Accounting software needs to be intuitive and easy-to-use. you should look for services that are easy to navigation and have a low learning curve. Lastly, make sure the crypto accounting services in Dubai come with a customer support.

0 notes

Text

The Key Differences Between Outsourced and In-House Bookkeeping

Bookkeeping is an essential function for any business, ensuring accurate financial records, tax compliance, and proper cash flow management. However, businesses often face the decision of whether to manage bookkeeping in-house or outsource it to professionals. Each approach has its advantages and challenges. Understanding the key differences between outsourced and in-house bookkeeping can help business owners make the best choice for their needs.

Cost Efficiency

One of the primary differences between outsourced and in-house bookkeeping is cost. Hiring an in-house bookkeeper involves expenses such as salaries, benefits, office space, and accounting software. For small and medium-sized businesses, these costs can add up quickly.

Outsourcing bookkeeping is often more cost-effective because businesses only pay for the services they need. Instead of hiring a full-time employee, companies can work with an external bookkeeping firm on a flexible basis, reducing overhead costs while still maintaining accurate financial records.

Expertise and Experience

In-house bookkeepers can be highly skilled, but their expertise is limited to their individual experience and training. A business may need to invest in ongoing education to keep them updated on tax laws and accounting regulations.

Outsourced bookkeeping firms employ professionals with diverse experience across various industries. These firms stay up-to-date with the latest accounting standards, tax regulations, and best practices. This ensures that businesses receive expert financial management without having to worry about training employees.

Scalability and Flexibility

As a business grows, its bookkeeping needs become more complex. In-house bookkeepers may struggle to keep up with increased financial transactions, requiring the company to hire additional staff. Scaling an in-house bookkeeping team can be time-consuming and costly.

Outsourced bookkeeping services offer scalability and flexibility. Businesses can easily adjust the level of service based on their needs, whether it’s handling seasonal spikes in transactions or expanding into new markets. This allows businesses to scale efficiently without hiring more employees.

Technology and Security

In-house bookkeeping requires businesses to invest in accounting software, data security measures, and IT infrastructure. If security protocols are not properly implemented, businesses risk data breaches and financial fraud.

Outsourced bookkeeping firms use advanced cloud-based accounting tools with high-security standards, including encryption and secure backups. They also ensure compliance with financial regulations, reducing the risk of errors and fraud. Additionally, outsourced firms integrate seamlessly with business platforms such as QuickBooks, Xero, and enterprise resource planning (ERP) systems.

Control and Accessibility

One of the benefits of in-house bookkeeping is that financial data is always accessible within the company. Business owners can directly communicate with the bookkeeper and make real-time adjustments. However, this level of control comes with the responsibility of managing the bookkeeping team and ensuring compliance.

Outsourced bookkeeping provides convenience and efficiency, but some business owners may feel less control over financial processes. However, reputable bookkeeping firms provide real-time financial reports and maintain clear communication, ensuring transparency.

Conclusion

Choosing between outsourced and in-house bookkeeping depends on a business’s size, budget, and needs. In-house bookkeeping provides control and direct oversight, while outsourced bookkeeping offers cost savings, expertise, scalability, and advanced technology. By carefully evaluating these differences, businesses can select the bookkeeping approach that best supports their financial goals and long-term success.

0 notes

Text

Top Qualities To Look For In A Chartered Accountant For Your Small Business

Running a small business involves many responsibilities, the most important of which include managing finances. Engaging the best Chartered Accountants for small businesses is among the significant steps toward keeping your business compliant, profitable, and ready for growth. But then, where do you look at all the options? Here is a guide with the top qualities to look out for in a chartered accountant, guiding you in making the right choice.

Relevant Experience In Small Businesses

Small businesses are financially different from larger corporations. When looking for a chartered accountant, look for people with experience working with businesses like yours. They understand what is needed regarding accounting and managing limited budgets and cash flows besides navigating tax reliefs for small enterprises.

For example, if your business is in Croydon, employing chartered accountants from Croydon who specialise in small businesses ensures that they know the local regulations and economic conditions. Local expertise is beneficial in preparing customised financial strategies for your business.

Good Communication Skills

The ability of your accountant to simplify complex financial jargon and present it in plain language is also essential. Since you are running a small business, you are likely not knowledgeable in finance. Complicated language could confuse you even more. An accountant should be someone who hears your concerns and answers all the questions you ask him.

Effective communication further comprises regular update provisions. Best chartered accountants for small businesses keep the client properly informed about changed tax laws, a current financial health report, or the potential areas for growth.

Paying Attention To Details

Accuracy is a hallmark of effective accounting. Small mistakes in your financial records can result in penalties or lost opportunities. A good chartered accountant will be meticulous and show attention to detail, ensuring that your financial statements are accurate, tax filings are error-free, and compliance requirements are met.

It also helps notice trends or anomalies in your finances, such as unexpected expenses or potential areas for cost savings.

Expertise In Contemporary Accounting Tools

Advanced software and tools have indeed changed the accounting landscape. Choose an accountant good at platforms like QuickBooks, Xero, or Sage because they make finance management seamless and accurate. Digital know-how is particularly helpful for small businesses that must ensure the lowest costs possible with efficiency.

In addition, cloud-based solutions allow real-time access to financial data so that you and your accountant can work effectively together and make timely decisions.

Tax Expertise

The first reason why small businesses hire chartered accountants is to optimise tax strategies. The best-chartered accountants for small businesses will ensure compliance with tax laws and help you identify deductions, credits, and exemptions that reduce your tax burden.

For example, in Croydon, accountants familiar with the UK tax system will help you deal with VAT returns, corporation tax, and income tax submissions, keeping you abreast of HMRC requirements.

Problem-Solving Skills

Any business is bound to face financial problems. A good chartered accountant will be a problem solver, offering practical solutions and contingency plans. Whether it is cash flow problems, unexpected expenses, or getting out of a financial loss, his critical thinking is worth a lot.

Trustworthiness And Professional Ethics

Your chartered accountant will have access to sensitive financial information, so trustworthiness is a non-negotiable quality. Look for professionals who adhere to strict ethical standards, as outlined by organisations like the Institute of Chartered Accountants in England and Wales (ICAEW). A trustworthy accountant ensures your data is secure and that all financial practices are transparent and above board.

Proactive Approach

The best-chartered accountants for small businesses are proactive rather than reactive. An active accountant will monitor your financial health regularly, determine risks, and make recommendations to prevent problems from arising. For example, they might advise forming an emergency fund or reorganising debt to avoid cash flow problems later on.

Industry Knowledge

Every industry has unique financial nuances, from retail inventory management to tech startups' R&D tax credits. A chartered accountant who understands your industry will understand your business's needs. They can provide advice tailored to your business, ensuring you stay competitive and compliant. If your business is based in Croydon, then choosing chartered accountants in Croydon with knowledge of your sector adds an extra layer of relevance and value.

Accessibility And Availability

As a small business owner, you’ll need an accountant to address your concerns promptly. Whether it’s responding to an urgent query or meeting a tight tax deadline, accessibility is key. Ensure that your chosen accountant can accommodate your schedule and support when needed.

Conclusion

Hiring the right chartered accountant for your small business can be a game-changer. If you emphasise experience, communication skills, and industry knowledge, you can find a professional who manages your finances and supports your business's growth.

If you are in Croydon, chartered accountants in Croydon ensure that you make the most out of local know-how, custom advice, and knowledge of regulations in the area. Investing in the best-chartered accountants for small businesses is one for your company's long-term success.

0 notes

Text

How to Select the Right Accounting Services in Dubai?

It is important to select the right accounting services in Dubai for your business needs. With the right solution provider, you can streamline financial management, enhance the accuracy and ensure complete compliance with the tax regulations.

There are several good options available in the market. choosing the right one can become challenging for your business needs. here are all the key factors that can help you go ahead with the right accounting services.

• Assess the financial management needs posed by your business. this will help you select the right accounting service. Start by understanding the business size and its complexity. You might want a basic bookkeeping service for a small business. As a larger enterprise, you might need advanced reporting and automation. Industry requirements may differ in terms of accounting needs. You may need inventory tracking in case of retail business and project accounting in case of construction. The number of invoices, bills and bank transactions you tend to process can also influence the choice of software you need. Lastly, you may want to consider the scale of your business before proceeding with the choice.

• Next, you must determine the budget while choosing crypto accounting services in Dubai. There are different versions that come with diverse features that can help you with the accounting needs. for instance the free version may possess limited features while the premium solutions come with advanced features and services. you must consider the upfront and ongoing costs for the service before proceeding with the initial purchase. You must also look a the subscription fees so that you know what you are paying for. The hidden fees is equally important while allocating the budget. You may be charged for the integrations and additional users. It is possible you need to pay for customer support. Lastly, make sure to check if you can save some money into accounting services in Dubai. you should check the returns on services.

• You should check if the accounting solutions you plan to invest in would be cloud-based or on-premises. There are services like QuickBooks and Xero that offer cloud-based services. You would get automatic updates and data backups with these services. it offers a monthly pricing and is ideal for the remote access. When you opt for on-premises software, you install the solution on the local computer. It may come with a higher upfront cost. At the end it offers a better control over data security. It is suited for businesses that prefer local storage.

• When selecting the services, you must look at the features. Prioritize the ones that can help your business. The basic features include income and expense tracking, invoicing and billing and bank reconciliation. If you want payroll processing or multi-currency support, you need advanced services. in case you need automation capabilities, you must opt for recurring invoicing and bank feeds. These features can help your business in multiple ways.

• Accounting software needs to be intuitive and easy-to-use. you should look for services that are easy to navigation and have a low learning curve. Lastly, make sure the crypto accounting services in Dubai come with a customer support.

0 notes

Text

Best Landscaping Management Software for Streamlining Your Business

Managing a landscaping business efficiently requires more than just having the right equipment and skilled workers. To optimize workflow, schedule jobs, track expenses, and enhance customer relationships, investing in the best landscaping management software is essential. Whether you're running a small landscaping company or a large enterprise, the right software can help you streamline operations, increase productivity, and boost profitability.

Why Use Landscaping Management Software?

Landscaping businesses involve multiple operations, from scheduling and client management to invoicing and job tracking. Handling all these manually can be time-consuming and error-prone. Landscaping management software automates these tasks, helping businesses:

Improve scheduling and dispatching

Track employee hours and payroll

Manage customer relationships (CRM)

Generate accurate quotes and invoices

Monitor expenses and profits

Enhance team communication

Ensure timely follow-ups with clients

With these benefits in mind, let’s explore the best landscaping management software available today.

Top Landscaping Management Software

1. Jobber

Jobber is one of the most popular landscaping business management software solutions. It provides an all-in-one platform for scheduling, invoicing, and client management.

Key Features:

User-friendly dashboard for scheduling and dispatching

GPS tracking for field workers

Automated invoicing and payment processing

Mobile app for on-the-go management

Customer relationship management (CRM) tools

2. ServiceTitan

ServiceTitan is designed for larger landscaping and field service businesses. It provides advanced features to help manage a growing operation seamlessly.

Key Features:

Smart scheduling and real-time job tracking

Integrated marketing tools to generate leads

Automated billing and invoicing

Reporting and analytics for business growth insights

Mobile access for field staff

3. LMN (Landscape Management Network)

LMN is specifically tailored for landscaping businesses and offers tools for budgeting, scheduling, and employee time tracking.

Key Features:

Job cost tracking and budgeting tools

Time-tracking app for field employees

CRM and lead management tools

Estimating and proposal generation

Integration with QuickBooks for accounting

4. Aspire

Aspire is an enterprise-level landscaping management software built for larger landscaping and lawn care companies.

Key Features:

End-to-end business management tools

GPS tracking and routing optimization

Proposal and contract management

Inventory and purchasing management

Advanced reporting and forecasting tools

5. FieldPulse

FieldPulse is a cloud-based landscaping software solution ideal for small to medium-sized businesses.

Key Features:

Scheduling and dispatching tools

Automated customer reminders and notifications

Customizable invoicing and payments

Job tracking and reporting

Mobile app for seamless field operations

How to Choose the Right Landscaping Management Software

Choosing the best software for your landscaping business depends on several factors, including:

Business Size & Needs – Small businesses may prefer an affordable, simple solution, while large enterprises may need a more feature-rich platform.

Ease of Use – Ensure the software is user-friendly and requires minimal training.

Mobile Accessibility – A mobile-friendly software solution allows for easy management on the go.

Integration Capabilities – Look for software that integrates with accounting, payroll, and CRM tools.

Customer Support – Reliable customer support ensures smooth software implementation and troubleshooting.

Pricing – Consider your budget and compare pricing plans to get the best value.

Conclusion

Investing in the best landscaping management software can significantly improve efficiency, reduce administrative burden, and help your business grow. Whether you choose Jobber, ServiceTitan, LMN, Aspire, or FieldPulse, selecting the right software tailored to your business needs will enhance productivity and customer satisfaction. Start by evaluating your business requirements and take advantage of free trials or demos to find the perfect fit for your landscaping operations.

By implementing the right landscaping management software, you can focus more on delivering high-quality landscaping services while automating the day-to-day tasks of your business.

0 notes

Text

How to Choose the Best Accountant in Milton Keynes for Your Business

Introduction

Choosing the right accountant for your business in Milton Keynes is a crucial decision that can impact your company’s financial health and long-term success. Whether you are a small startup, a growing enterprise, or an established company, a professional accountant can help you with tax compliance, bookkeeping, financial planning, and business advisory services. However, with so many accountants available, how do you find the best one for your business needs? This guide will walk you through the key factors to consider when selecting an accountant in Milton Keynes.

Accountants Milton Keynes Tax, Chartered Accountants, MK, UK

Expert Accountants Milton Keynes, MK, UK. Providing top-notch tax, personal, and chartered accountant services. Call…

1. Understand Your Business Needs

Before you start searching for an accountant, it is essential to assess what your business requires. Accountants offer a range of services, including:

Bookkeeping — Managing day-to-day financial transactions.

Tax Planning and Compliance — Ensuring you meet HMRC tax obligations.

Payroll Management — Handling staff salaries, National Insurance, and pension contributions.

Financial Reporting — Preparing balance sheets, profit and loss statements, and cash flow analysis.

Business Advisory — Helping with financial strategy and decision-making.

Understanding your specific needs will help you identify the type of accountant that will best serve your business.

2. Look for Relevant Experience and Qualifications

A qualified accountant should have the necessary credentials to provide professional services. In the UK, accountants are typically members of professional bodies such as:

The Association of Chartered Certified Accountants (ACCA)

The Institute of Chartered Accountants in England and Wales (ICAEW)

The Chartered Institute of Management Accountants (CIMA)

Additionally, consider whether the accountant has experience working with businesses in your industry. Industry-specific experience can be beneficial as the accountant will be familiar with common financial challenges and regulatory requirements.

3. Check Their Reputation and Client Reviews

Reputation is a key indicator of an accountant’s reliability and service quality. To assess an accountant’s reputation:

Look for online reviews on Google, Trustpilot, or professional accounting directories.

Ask for client testimonials or case studies.

Seek recommendations from other business owners in Milton Keynes.

Check if they have received any industry awards or recognitions.

Positive feedback from existing clients is a strong sign of credibility and trustworthiness.

4. Consider Their Fees and Pricing Structure

Understanding an accountant’s pricing model is important to ensure their services fit within your budget. Accountants may charge in different ways, including:

Fixed Fees — A set price for specific services.

Hourly Rates — Charges based on time spent working on your accounts.

Monthly Retainers — Ongoing support for a fixed monthly fee.

Be clear about what is included in their fees and watch out for any hidden charges. It’s also worth comparing the pricing of multiple accountants to find a fair deal.

5. Ensure They Offer Cloud Accounting Solutions

Modern businesses benefit from cloud accounting software, which provides real-time financial data access, secure document storage, and automated processes. Leading accountants use platforms like:

Xero

QuickBooks

Sage

FreeAgent

Working with an accountant who embraces cloud-based accounting ensures greater efficiency and ease of collaboration.

6. Evaluate Their Communication and Support

Your accountant should be easy to reach and willing to provide ongoing support when needed. Key factors to consider include:

Responsiveness — How quickly do they reply to emails and calls?

Clarity — Do they explain financial matters in a way that is easy to understand?

Availability — Are they accessible outside of regular business hours for urgent queries?

A proactive accountant who keeps you informed about financial changes, tax deadlines, and growth opportunities is a valuable asset to your business.

7. Check Their Understanding of Local and National Regulations

A good accountant should be well-versed in both UK-wide tax regulations and local business laws in Milton Keynes. They should be able to guide you on:

Corporation tax, VAT, and PAYE compliance

Local business grants and incentives

Industry-specific regulatory requirements

Working with an accountant who understands the local business environment can be advantageous in ensuring compliance and optimizing financial opportunities.

8. Assess Their Business Growth Support

If you are looking to expand your business, you need an accountant who can provide strategic financial advice. Consider whether they offer:

Cash flow forecasting

Business funding advice

Profitability analysis

Expansion planning

An accountant who supports your long-term growth plans can help you make informed financial decisions that contribute to business success.

9. Schedule a Consultation Meeting

Once you have shortlisted a few accountants, arrange an initial consultation to discuss your needs. Use this meeting to assess:

Their knowledge and experience

Their approach to financial management

Their compatibility with your business goals

Many accountants offer a free initial consultation, which is a great opportunity to determine if they are the right fit.

10. Make Your Decision and Build a Strong Relationship

After evaluating all factors, choose the accountant that best meets your business needs. Once you start working together, maintain a strong relationship by:

Keeping them updated on major business changes

Asking for regular financial insights

Being proactive in addressing tax and accounting matters

A reliable accountant is more than just a service provider; they are a trusted partner who can help your business grow and thrive.

Conclusion

Selecting the best accountant in Milton Keynes for your business is a crucial step in managing your finances efficiently. By understanding your needs, checking credentials, evaluating reputation, and assessing communication skills, you can find an accountant who not only helps with compliance but also contributes to your business’s success. Take your time to research and choose wisely — your business’s financial health depends on it!

1 note

·

View note

Text

Best IICS Online Training | Informatica in Hyderabad

Cloud Application Integration (CAI) in Informatica IICS

Introduction

Cloud Application Integration (CAI) in Informatica Intelligent Cloud Services (IICS) seamlessly integrates these applications and systems, ensuring smooth data flow, automation, and operational efficiency. This article explores CAI, its features, benefits, and use cases. In today's digital landscape, organizations rely on multiple cloud applications and on-premises systems to manage business processes efficiently. Informatica Training Online

What is Cloud Application Integration (CAI)?

Cloud Application Integration (CAI) is a comprehensive integration solution within Informatica IICS that enables real-time, event-driven, and batch-based integration between cloud and on-premises applications. It allows businesses to connect different applications using APIs, service orchestration, and process automation, eliminating data silos and improving communication between business-critical applications.

Key Features of Cloud Application Integration (CAI)

API-Based Integration: CAI allows businesses to create, publish, and manage APIs to integrate applications across different platforms.

Real-Time and Event-Driven Processing: Supports synchronous and asynchronous message processing to handle real-time data exchange.

Process Orchestration: Enables the design and automation of complex workflows with business logic. Informatica IICS Training

Pre-Built Connectors: Provides out-of-the-box connectors for popular cloud applications like Salesforce, SAP, Workday, AWS, and more.

Data Mapping and Transformation: Ensures seamless data flow with advanced data mapping and transformation capabilities.

Secure Integration: Supports authentication mechanisms such as OAuth, SAML, and API security policies to protect sensitive data.

Scalability and Flexibility: Adapts to growing business needs by scaling integration processes efficiently.

Benefits of Cloud Application Integration (CAI)

Enhanced Connectivity: Enables seamless communication between cloud and on-premises applications.

Improved Efficiency: Automates workflows, reducing manual intervention and operational overhead. Informatica Cloud Training

Better Data Visibility: Ensures accurate data synchronization across applications, improving decision-making.

Faster Time-to-Market: Accelerates integration processes, allowing businesses to deploy new applications and services quickly.

Cost Savings: Reduces IT infrastructure costs by leveraging cloud-based integration instead of traditional middleware solutions.

Increased Business Agility: Enables organizations to adapt quickly to changing business requirements with scalable integration solutions.

Use Cases of Cloud Application Integration (CAI)

CRM and ERP Integration: Synchronizing customer data between Salesforce and SAP to provide a unified customer experience.

E-commerce and Supply Chain Integration: Connecting Shopify or Magento with inventory management systems to streamline order processing.

HR Systems Integration: Automating employee onboarding by integrating Workday with internal HR applications.

Finance and Accounting: Connecting QuickBooks with enterprise finance systems to automate invoice and payment processing.

IoT and Big Data Integration: Aggregating IoT sensor data into cloud-based analytics platforms for real-time insights.

How CAI Works in Informatica IICS

Design: Users define integration workflows using the Informatica Cloud Designer, a low-code/no-code interface.

Connect: Utilize pre-built connectors or create APIs to integrate cloud and on-premises applications.

Orchestrate: Automate data workflows and manage business processes with drag-and-drop components.

Deploy: Publish APIs and execute integration workflows in real-time or batch mode. IICS Online Training

Monitor & Manage: Track integration processes using dashboards and logs, ensuring data integrity and performance optimization.

Conclusion

Cloud Application Integration (CAI) in Informatica IICS is a powerful tool for businesses to streamline their application connectivity and automate workflows efficiently. With its robust API-based integration, real-time processing, and process orchestration capabilities, CAI helps organizations enhance operational efficiency, improve data visibility, and drive business growth. As cloud adoption continues to rise, leveraging CAI ensures seamless and scalable integration for modern enterprises.

Visualpath is the Best Software Online Training Institute in Hyderabad. Avail complete Informatica Cloud Online Training worldwide. You will get the best course at an affordable cost.

Visit: https://www.visualpath.in/informatica-cloud-training-in-hyderabad.html

Visit Blog: https://visualpathblogs.com/category/informatica-cloud/

WhatsApp: https://www.whatsapp.com/catalog/919989971070/

#InformaticaTraininginHyderabad#IICSTraininginHyderabad#IICSOnlineTraining#InformaticaCloudTraining#InformaticaCloudOnlineTraining#InformaticaIICSTraining#InformaticaTrainingOnline#InformaticaCloudTraininginChennai#InformaticaCloudTrainingInBangalore#BestInformaticaCloudTraininginIndia#InformaticaCloudTrainingInstitute

0 notes

Text

Salesforce Integration Services – Custom Solutions for Smarter Business Workflows.

In today’s fast-paced digital world, businesses rely on multiple tools and platforms to manage their operations efficiently. However, disconnected systems can lead to inefficiencies, data silos, and increased manual effort. Antrazal’s Salesforce integration services provide seamless connectivity between Salesforce and your existing tools, ensuring smooth data flow and optimized business processes.

Why Salesforce Integration Matters

Salesforce is a powerful CRM platform, but to maximize its potential, it must work seamlessly with other critical business applications such as:

ERP Systems: Enhance operational efficiency by connecting Salesforce with enterprise resource planning tools.

Marketing Automation: Improve customer engagement with integrated marketing platforms like HubSpot, Marketo, and Mailchimp.

Financial & Accounting Software: Ensure real-time financial insights by linking Salesforce with QuickBooks, Xero, or SAP.

E-commerce Platforms: Synchronize order management and customer data with Shopify, Magento, or WooCommerce.

Antrazal’s Salesforce Integration Solutions

At Antrazal, we specialize in customized Salesforce integration services to streamline your business operations. Our solutions are designed to improve data synchronization, reduce manual workload, and enhance productivity.

1. API-Based Integrations

We leverage secure and scalable APIs to connect Salesforce with external applications, ensuring smooth data exchange between systems.

2. Middleware Integrations

For businesses using multiple applications, we implement middleware solutions such as MuleSoft and Dell Boomi to centralize integrations and enhance efficiency.

3. Custom Connector Development

If an out-of-the-box solution doesn’t fit your requirements, we develop custom connectors that seamlessly integrate your unique business applications with Salesforce.

4. Data Migration & Synchronization

We enable real-time or scheduled data synchronization between Salesforce and third-party systems, ensuring up-to-date and consistent information across platforms.

5. Cloud & On-Premise Integrations

Whether your business operates on the cloud or requires hybrid solutions, our team ensures secure and scalable integrations that align with your IT infrastructure.

Benefits of Choosing Antrazal for Salesforce Integration

✔ Enhanced Productivity – Automate workflows and eliminate manual data entry. ✔ Improved Data Accuracy – Reduce errors with seamless real-time data synchronization. ✔ Scalability & Flexibility – Our integrations grow with your business needs. ✔ Security & Compliance – We prioritize data security with robust encryption and access controls. ✔ Expert Consultation & Support – Our specialists ensure smooth implementation and ongoing optimization.

Unlock the Full Potential of Salesforce with Antrazal

With Antrazal’s Salesforce integration services, your business can achieve a unified, data-driven ecosystem that enhances efficiency and decision-making. Whether you need a simple integration or a complex enterprise solution, we have the expertise to deliver.Get in touch with us today to explore how our Salesforce integration solutions can transform your business operations. 🚀

0 notes

Text

Ecloud Expert's - Cloud Accounting service

Cloud accounting is the practice of using online accounting software to manage financial data, bookkeeping, and reporting. Unlike traditional accounting software that is installed on a local computer, cloud accounting solutions store data on remote servers, allowing users to access financial information anytime, from any device with an internet connection.

Key Benefits of Cloud Accounting:

Accessibility – Access financial data from anywhere, ideal for remote teams.

Real-time Updates – Automated syncing ensures up-to-date financial records.

Cost Efficiency – Reduces the need for expensive IT infrastructure and maintenance.

Data Security – Cloud providers offer strong encryption, backups, and fraud detection.

Integration – Connects with other cloud-based tools like payroll, invoicing, and CRM systems.

Collaboration – Accountants, bookkeepers, and business owners can work together in real-time.

Popular Cloud Accounting Software:

QuickBooks Online – Ideal for small and medium businesses.

Xero – User-friendly and great for small businesses and freelancers.

FreshBooks – Best for service-based businesses and freelancers.

Zoho Books – Affordable with automation features.

NetSuite – Suitable for larger enterprises with complex financial needs.

Are you looking for a cloud accounting solution for your business or need help with implementation and setup?

0 notes

Text

Top IWMS Platforms Revolutionizing 2025

In Steven Spielberg's Minority Report, PreCrime technology allows law enforcement to predict and prevent crimes before they happen. Imagine having a similar system for modern workplaces—predicting and preventing operational issues before they disrupt business. This is where Integrated Workplace Management Systems (IWMS) come into play. These advanced systems leverage data analytics, IoT, and AI to provide actionable insights, helping businesses optimize space, resources, and asset management.

IWMS offer a comprehensive approach to managing real estate, facilities, and office spaces. By analyzing historical data and usage patterns, IWMS can predict potential issues and help organizations make informed decisions that improve productivity, reduce costs, and enhance resource utilization.

Here are the top 5 Integrated Workplace Management Systems for 2025:

Eptura Workplace – A feature-rich platform offering real-time monitoring, move management, and space optimization, with integrations like Slack and Microsoft Teams.

IBM TRIRIGA Application Suite – An enterprise-level tool known for its AI-driven insights, space planning, and sustainability tracking, ideal for large-scale operations.

incuTrackTM – A cost-effective solution for startups and coworking spaces, with features like tenant tracking, room scheduling, and billing integration with tools like QuickBooks.

AssetWorks – Offers end-to-end workplace management, with strong focus on asset lifecycle tracking, space optimization, and energy management, appealing to businesses focused on sustainability.

eFACiLiTY – A comprehensive system offering asset tracking, space management, and sustainability monitoring, praised for its multilingual support and cloud architecture.

Adopting an IWMS can streamline workplace operations, boost productivity, and improve resource allocation, positioning organizations for success in 2025 and beyond.

0 notes

Text

Monthly Bookkeeping Services

Monthly bookkeeping services are a cornerstone for maintaining accurate and up-to-date financial records for businesses. These services ensure that a company’s financial data is organized, compliant, and readily available for decision-making, tax preparation, and strategic planning.

What Monthly Bookkeeping Services Typically Include:

Transaction Recording: Documenting all income and expenses, such as sales, purchases, and payments. Ensuring each transaction is accurately categorized in the appropriate accounts.

Bank and Credit Card Reconciliation: Matching the company’s records with bank and credit card statements to identify and resolve discrepancies.

Accounts Payable and Receivable Management: Tracking invoices sent to customers (accounts receivable) and bills owed to vendors (accounts payable). Ensuring timely payments and collections.

Financial Reports: Generating monthly financial statements, such as:

Profit and Loss Statement (Income Statement): Shows revenue, expenses, and net profit.

Balance Sheet: Displays assets, liabilities, and equity.

Cash Flow Statement: Highlights cash inflows and outflows.

Providing custom reports tailored to the business’s needs.

Payroll Processing Support:

Recording payroll transactions and ensuring tax withholdings and benefits are properly documented.

Expense Tracking:

Monitoring business expenses and categorizing them for budgeting and tax deductions.

Sales Tax Filing (if applicable):

Calculating and preparing monthly or quarterly sales tax reports and filing them with tax authorities.

Compliance Checks:

Ensuring all financial records comply with local, state, and federal regulations.

Consultation and Insights:

Offering monthly reviews and insights into the financial health of the business.

Identifying trends and providing actionable recommendations.

Cloud-Based Bookkeeping Solutions:

Setting up and maintaining accounting software like QuickBooks Online, Xero, or similar platforms for real-time financial tracking.

Benefits of Monthly Bookkeeping Services:

Accuracy: Reduces errors in financial records.

Timeliness: Ensures up-to-date financial data for better decision-making.

Compliance: Keeps the business aligned with tax and regulatory requirements.

Time Savings: Frees up business owners to focus on growth rather than administrative tasks.

Improved Cash Flow Management: Helps monitor and control inflows and outflows.

How Bizee Bookkeeper Can Help:

At Bizee Bookkeeper, we specialize in delivering customized monthly bookkeeping services tailored to your business's unique needs. Whether you’re a small business owner, freelancer, or larger enterprise, our services ensure your finances are organized, compliant, and working for you.

Let us know if you’d like a more detailed breakdown of our packages or a consultation!

0 notes

Text

India's Leading Accounting Services for Businesses

Accounting is the process of recording, summarising, and analysing a business's financial transactions to provide clear and actionable insights. It serves as the foundation for decision-making, financial planning, and compliance with legal obligations. This article delves into the core aspects of accounting, its types, and why it is essential for businesses, especially in the Indian context.

What Is Accounting?

Accounting involves the systematic recording of financial data, ensuring its accuracy, organisation, and accessibility. It helps businesses understand their financial health and helps them comply with tax regulations. It also prepares financial statements and facilitates audits.

Key Components of Accounting

Bookkeeping Bookkeeping is the primary step in accounting. It focuses on recording day-to-day transactions such as sales, purchases, receipts, and payments.

Financial ReportingThis involves preparing financial statements, including the balance sheet, income statement, and cash flow statement, which summarise a company’s financial position.

AuditingAudits verify the accuracy and fairness of a company's financial statements and ensure compliance with accounting standards and laws.

Tax AccountingTax accounting focuses on preparing and filing tax returns while ensuring adherence to government tax regulations.

Management AccountingThis provides management with data-driven insights for planning, decision-making, and optimising operational efficiency.

Types of Accounting

Financial Accounting: Deals with the preparation of financial statements for external stakeholders.

Managerial Accounting: Focuses on internal use, helping management in planning and decision-making.

Cost Accounting: Assesses the cost of production and operations to improve efficiency.

Tax Accounting: Ensures compliance with tax laws and minimises tax liabilities.

Forensic Accounting: Involves investigating financial discrepancies and fraud.

Importance of Accounting for Businesses

Compliance with RegulationsIn India, businesses must comply with laws such as the Companies Act, Income Tax Act, and GST regulations. Proper accounting ensures adherence to these laws.

Financial Planning and BudgetingAccurate financial data helps businesses forecast revenues, plan budgets, and manage resources effectively.

Transparency and TrustReliable financial records build trust with investors, lenders, and stakeholders.

Tax EfficiencyProper accounting minimises tax liabilities and ensures the timely filing of returns to avoid penalties.

Business GrowthInsights from accounting help identify areas of growth and investment opportunities.

Accounting in the Digital Era

The advent of technology has transformed accounting practices in India. Cloud-based accounting software such as Tally, Zoho Books, and QuickBooks has made financial management more accessible for businesses of all sizes. Automation reduces errors, enhances efficiency, and allows companies to focus on growth strategies.

Accounting Services in India

Accounting Services in India are diverse and cater to the needs of small businesses, startups, and large enterprises. Common services include:

Bookkeeping and payroll management

Tax planning and filing

GST compliance

Financial analysis and reporting

Audit and assurance

Conclusion

Accounting is more than just number crunching; it is a strategic tool for business growth and sustainability. In India, where regulatory compliance is intricate, professional accounting services can save businesses time, resources, and potential legal hassles. Whether you're a small entrepreneur or a corporate giant, a solid accounting foundation is key to long-term success.

0 notes

Text

How is AWS Graviton Redefining Cloud Performance and Cost Efficiency for Business Leaders?

With over 90% of businesses migrating to the cloud, the demand for cost-efficient and scalable cloud solutions has never been more critical to staying competitive. AWS Graviton, an ARM-based processor developed by AWS, is transforming cloud computing with its focus on delivering high performance at reduced costs. Designed to meet the demands of modern workloads, AWS Graviton empowers businesses to optimise resource usage without compromising efficiency.

This blog will explore the unique benefits of AWS Graviton, its role in transforming cloud strategies, and how AWS Cloud Services amplifies its impact on decision-makers and tech leaders.

I. What is AWS Graviton?

II. AWS Graviton: Features, Business Benefits, and Industry Use Cases

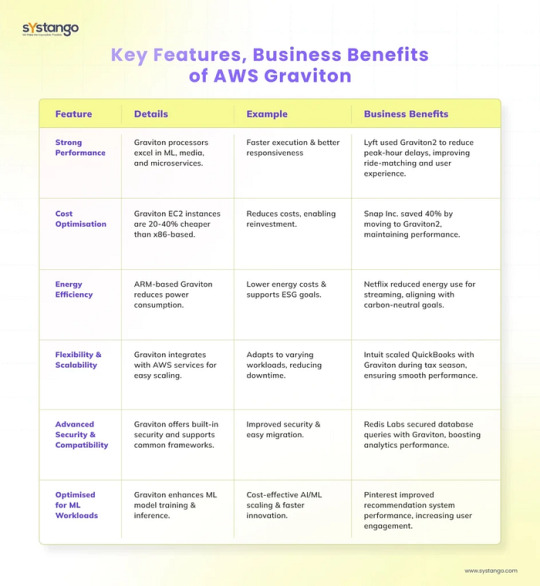

AWS Graviton processors combine cutting-edge technology with significant business advantages, making them a transformative tool for modern enterprises. Below is an overview of key features, the associated business benefits, and real-world examples showcasing their impact.

1. Strong Performance

Feature Details

Graviton processors, built on ARM architecture, deliver exceptional computational power across diverse workloads such as machine learning (ML), media processing, and microservices.

Business Benefits

Faster execution times for applications, improving user satisfaction.

Enhanced responsiveness during high-demand periods, ensuring business continuity.

Example

Lyft utilised Graviton2 instances to optimise the performance of its ride-hailing services. This resulted in reduced processing delays during peak hours, ensuring seamless ride-matching and better user experiences.

2. Cost Optimisation

Feature Details

Graviton-powered EC2 instances are priced 20–40% lower than traditional x86-based options, offering comparable or better performance.

Business Benefits

Reduced operational costs, enabling reinvestment in innovation.

Improved financial flexibility for startups and cost-sensitive businesses.

Example

Snap Inc. saved up to 40% in cloud expenses by migrating to Graviton2 instances while maintaining robust application performance for Snapchat’s millions of users.

3. Energy Efficiency

Feature Details

Graviton processors consume less energy due to their optimised ARM design, supporting businesses’ sustainability initiatives.

Business Benefits

Lower power consumption reduces utility costs.

Alignment with ESG goals, enhancing brand reputation and stakeholder trust.

Example

Netflix deployed Graviton instances for its video streaming workloads, cutting energy use and advancing its carbon-neutral goals without compromising streaming quality.

4. Flexibility and Scalability

Feature Details

Graviton integrates seamlessly with AWS services like Lambda, EC2, and Fargate, enabling efficient scaling for diverse workload demands.

Business Benefits

Easy adaptation to fluctuating workloads, reducing downtime risks.

Flexibility to innovate with serverless applications and global-scale platforms.

Example

Intuit scaled its QuickBooks platform during tax season using Graviton-based instances, handling increased traffic while maintaining smooth user experiences.

5. Advanced Security and Compatibility

Feature Details

Graviton processors include hardware-based protections against vulnerabilities and are compatible with widely used frameworks like MySQL, PostgreSQL, and Apache Spark.

Business Benefits

Enhanced security ensures compliance with industry standards, particularly in regulated sectors.

Smooth migration paths for existing workloads without the need for extensive rewrites.

Example

Redis Labs leveraged Graviton instances to secure database queries while improving client analytics response times, benefiting industries with real-time data needs.

6. Optimised for ML Workloads

Feature Details

Graviton offers a better price-to-performance ratio for ML model training and inference, enabling faster development cycles.

Business Benefits

Cost-effective scaling of AI/ML applications.

Shorter time-to-market for AI-driven innovations.

Example

Pinterest used Graviton2 instances to boost its recommendation systems, resulting in improved user engagement and personalisation for its platform.

Here’s a quick summary for decision-makers:

Business Takeaway

AWS Graviton provides a compelling combination of performance, cost efficiency, and sustainability, making it a preferred choice for businesses across industries. By adopting Graviton, enterprises can achieve operational excellence, enhance customer satisfaction, and meet sustainability goals.

III. AWS Graviton vs Intel: A Quick Comparison

Comparing AWS Graviton with Intel-based instances provides a clearer perspective for decision-makers:

Cost Efficiency: AWS Graviton instances offer 20–40% cost savings, making them a preferred choice for cloud-native workloads.

Performance: Graviton delivers up to 40% better performance for compute-intensive tasks like machine learning, while Intel shines in legacy applications needing x86 architecture.

Compatibility: Intel processors have extensive software support, but Graviton’s ARM-based architecture is optimised for modern, scalable workloads.

Energy Efficiency: AWS Graviton outperforms Intel in power efficiency, aligning with businesses focused on sustainable practices.

This comparison highlights AWS Graviton as the future-ready option for businesses seeking cost and energy efficiency while modernising their infrastructure.

IV. AWS Graviton in the Bigger AWS Ecosystem

AWS Graviton is not just a processor; it’s a vital component of the larger AWS Cloud Services ecosystem, empowering businesses to achieve operational excellence across computing, storage, and networking. Its integration capabilities make it a cornerstone of modern cloud strategies.

To read full blog visit — https://www.systango.com/blog/how-is-aws-graviton-redefining-cloud-performance-and-cost-efficiency-for-business-leaders

0 notes

Text

How to Integrate Your Business Account in Hong Kong with Financial Software

Integrating your business account Hong Kong with financial software is a game-changer for entrepreneurs looking to streamline their operations. This integration not only automates financial tasks but also enhances accuracy and decision-making. Integrating your business account with financial software allows for automation of financial processes such as invoicing, payroll, and expense tracking, saving valuable time. It provides real-time access to updated financial data, enabling better business decisions. Additionally, it minimizes errors in financial records by syncing your business account Hong Kong with reliable software and ensures regulatory compliance with Hong Kong’s tax and regulatory requirements through automated reporting features.

Steps to Integrate Your HK Business Account

To integrate your HK business account effectively, start by choosing the right financial software that supports multi-currency transactions, connects seamlessly with your business account online, and meets your business needs. Contact your bank to ensure your HK business account provider offers integration support or APIs compatible with the financial software you plan to use. Follow the software’s integration instructions or seek assistance from your provider to connect your business account service Hong Kong to the platform. Before going live, test the integration to ensure that all financial data flows correctly and securely, and train your team on how to use the integrated system for maximum efficiency.

Benefits of Integration

Integration benefits include enhanced productivity, better financial oversight, and cost efficiency, which collectively simplify operations and minimize errors.

Popular Financial Software for Hong Kong Businesses

Popular financial software options for Hong Kong businesses include QuickBooks Online, known for its user-friendly interface and robust features, Xero, which is excellent for small businesses seeking cloud-based solutions, and SAP, ideal for large enterprises with complex financial operations.

Modernize Your Financial Operations

Integrating your business account in Hong Kong with financial software is a vital step towards modernizing your financial operations. By choosing the right tools and implementing them effectively, you can unlock your business’s full potential. Ready to simplify your business finances? Check us out at AsiaBC to learn more or to explore how we can assist you. As a trusted business account service provider Hong Kong businesses rely on, we’re here to guide you through the process. Modernize your financial operations today and stay ahead in Hong Kong’s competitive business landscape. Choose the best business account service in Hong Kong to support your journey to success.

0 notes

Text

Top Tools and Software Every CA Student Should Learn

The journey to becoming a Chartered Accountant (CA) is challenging yet rewarding. To ease the path, mastering essential tools and software can make a significant difference in a CA student’s preparation and practical experience. From accounting software to CA scanners, these tools help enhance productivity and ensure better understanding of complex concepts.

1. Accounting Software

Accounting is the backbone of the CA profession. Familiarity with popular accounting software is crucial for both academic and professional success. The following are must-learn tools:

Tally ERP 9: A widely used tool for managing financial records, GST, and inventory.

QuickBooks: Ideal for small businesses, it helps manage expenses, payroll, and taxes.

SAP: A robust software used in larger corporations for enterprise resource planning (ERP).

Learning these tools during your preparation can provide a competitive edge, especially during articleship and campus placements.

2. Taxation and Compliance Tools

Taxation is an integral part of CA studies, and understanding taxation software is beneficial. Common tools include:

GST Software: Tools like ClearTax and HostBooks simplify GST return filing and compliance.

Income Tax Filing Platforms: Software such as Winman and Genius help with income tax computations and filings.

Mastering these tools ensures you are well-prepared for practical scenarios encountered in taxation.

3. Microsoft Office Suite

Every CA student should be proficient in using Microsoft Office Suite, particularly:

Excel: For financial modeling, data analysis, and creating pivot tables.

Word: For drafting reports and presentations.

PowerPoint: For creating impactful presentations during articleship and projects.

4. CA Scanners for Exam Preparation

CA scanners are indispensable for exam preparation. They provide chapter-wise and topic-wise analysis of past exam questions, helping students identify important topics and patterns. Here’s a breakdown:

Scanner CA Foundation Books: These help students preparing for the CA Foundation exams to get a strong grip on subjects like Accounting, Law, and Economics.

Scanner CA Intermediate Books: These books focus on topics like Advanced Accounting, Costing, and Taxation, ensuring thorough coverage of the CA Intermediate syllabus.

Scanner CA Final Books: For CA Final aspirants, these scanners provide in-depth practice for Advanced Auditing, Financial Reporting, and Strategic Financial Management.

CA Foundation Scanner: A specific tool for practice, this scanner is tailored for Foundation-level students who are starting their CA journey.

CA Intermediate Scanner: This scanner dives deeper into the Intermediate level’s complex subjects, ensuring students are well-prepared for the exams.

CA Final Scanner: A must-have for Final-level students, this scanner emphasizes practical application and real-world case studies.

5. Financial Analysis Tools

As financial analysis is a core part of CA, learning tools like:

Tableau: For data visualization and financial modeling.

Power BI: For creating interactive financial dashboards.

Zoho Books: A cloud-based software for accounting and finance management.

These tools are often used in corporate environments, making them valuable skills for students.

6. Audit Tools

Auditing is an essential component of CA practice. Proficiency in audit software can significantly enhance your efficiency:

CaseWare: A leading tool for audit automation.

IDEA: For data analysis in audit engagements.

ACL Analytics: To identify risks and analyze financial data.

Learning these tools prepares students for real-world audit assignments during articleship and beyond.

7. Reference Books and Learning Resources

In addition to software, reference books and learning tools are crucial for CA preparation. Use CA scanners and other exam-specific resources effectively to:

Identify frequently asked questions.

Analyze the weightage of topics.

Practice mock tests and previous years’ papers.

Benefits of Learning These Tools

Enhanced Productivity: These tools save time and effort in managing data and solving problems.

Practical Knowledge: Familiarity with industry-relevant software bridges the gap between theory and practice.

Career Advancement: Proficiency in these tools makes you a preferred candidate in campus placements and professional scenarios.

Tips to Master These Tools

Start Early: Begin learning these tools during your CA Foundation or Intermediate preparation.

Practice Regularly: Use demo versions or free trials for hands-on experience.

Seek Guidance: Enroll in workshops or courses that focus on these tools.

Integrate with Studies: Use these tools alongside your CA Entrance Exam Books, Scanner CA Intermediate Books, and Scanner CA Final Books to reinforce concepts.

Conclusion

Mastering the top tools and software not only eases your CA preparation but also equips you with practical skills that are highly valued in the industry. Incorporate tools like accounting software, GST platforms, Microsoft Office, and CA scanners such as Scanner CA Foundation Books, CA Intermediate Scanner, and CA Final Scanner to streamline your journey. With dedication and the right resources, success in the CA exams and a bright professional future are within your reach.

0 notes