#Protest property taxes

Explore tagged Tumblr posts

Text

Protest Property Taxes | Cobb County

Is your property appraisal higher in Cobb County? Consider protesting with O'Connor this year. To know more visit https://www.cutmytaxes.com/georgia/Cobb-county-property-tax-reduction/

0 notes

Text

Do you agree with the ARB's decision?

Did you opt to file a protest on your property taxes & just had a hearing before the appraisal review board. Are you not glad with the ARB's decision? Know more at https://www.cutmytaxes.com/illinois/

0 notes

Text

Raging farmers ship 'militant motion' warning as backlash soars over Labour tax seize | UK | Information Information Buzz

Farmers have issued a stark warning to Labour over current inheritance tax modifications, threatening what they describe as “militant motion” if the reforms go ahead as deliberate. The anger comes after Rachel Reeves launched new inheritance tax limits for agricultural property, sparking outrage amongst farming communities. Tom Bradshaw, the President of the Nationwide Farmers’ Union (NFU), known…

#Agricultural property tax reform#Farmers protest#Labour inheritance tax#National Farmers&039; Union

0 notes

Text

In testimony at a City Council budget hearing just days after the NYPD cracked down on pro-Palestinian protesters at the Fashion Institute of Technology in Chelsea, police officials said officers have racked up hundreds of thousands of overtime hours responding to war-related protests. The NYPD spent roughly $5 million on overtime pay to respond to protests between April 21 and May 7 alone, the officials told councilmembers.

The NYPD has cleared multiple protest encampments at school campuses around the city at the schools’ requests over the past few weeks, most prominently in a large-scale operation at Columbia University on April 30.

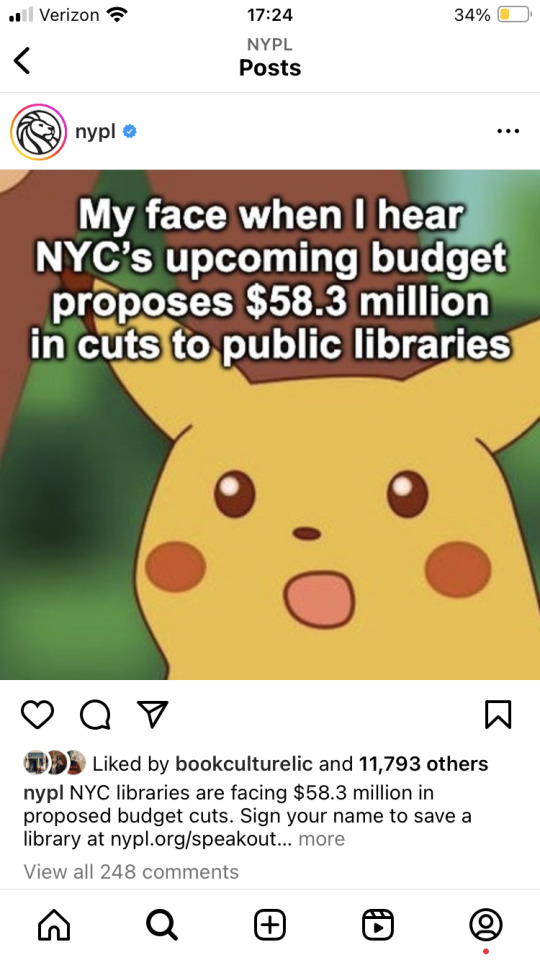

My last post on this didn’t get a ton of traction so I’m trying again. The latest budget proposal for NYC includes a $58.3 million cut to public libraries.

Previous cuts forced NYC public libraries to close on Sundays, and this further round of cuts would likely force libraries to end weekend service entirely. Additionally, it would mean further cuts to programming and the indefinite delay of reopening libraries that have been closed for renovation, which would leave entire neighborhoods without a library.

There is a preliminary budget hearing on May 21, and until then libraries are asking people to sign a letter here to urge the mayor’s office and city council to reverse the cuts.

I know things are terrible in a lot of ways right now and people probably feel overwhelmed and burnt out, but signing this letter (or reblogging this post) is a small, quick, concrete way to make a difference.

#taking my tax money and shutting down the services I use to beat students peacefully protesting on private property#because not wanting genocide is -checks notes- bad???

10K notes

·

View notes

Text

Common Myths About Protesting Your Property Tax Appraisal

Protesting your property taxes is a commonly practiced process that all homeowners can do every year. However, there are still a lot of homeowners who need help navigating the process.

Whether you are new to protesting your property tax or have been doing it for a while, there are many generalizations, misinformation, and myths surrounding the process that might prevent you from paying fair property taxes.

Today's article will address the top three common myths surrounding property tax refunds, helping you better understand the process and what it can (and cannot) do for you.

Protesting Your Property Tax Will Always Result In Savings.

Sometimes, a homeowner must navigate the process, only to hear that their county's estimated value will stand. This can be very frustrating for homeowners and deter them from protesting their property tax in the future. Even if you bring down your property's appraised value, your homestead exemption will cap your overall taxable value increase at 10%. In such cases, the actual tax bill itself will not change. This is why it's essential to consider the benefits you get when you protest your property tax amount before you start the process.

You Have To Do Everything By Yourself.

No. The homeowner doesn't have to be the one to gather evidence and show up at hearings. You don't even have to physically submit forms or any additional documentation required for the process. Instead, you could hire a tax professional or a firm to help you with the process. Since these professionals have years of on-field experience, they can quickly help you achieve a favorable outcome.

Lowering Your Property Taxes Can Also Lower Your Property Value.

False! The tax district's assessment of your real estate is a value that's loosely based on the current market value of your property. However, it cannot affect how little or how much you can sell your property for in case you put it on the market. While your real estate will be appraised as a critical part of the selling process, it's not the same as your local county's assessment or appraisal process. You can rest easy knowing that your property taxes will not hurt your ability to sell your property.

Remember, it's essential for you to approach this process with careful consideration. Given that there is so much misleading information available online, it's best to speak with a professional property tax expert to clear any doubts before you begin.

0 notes

Text

Learn how to reduce your property tax burden and maximize savings as a homeowner. Discover effective strategies to lower costs and benefit from informed decisions.

0 notes

Text

How to protest your property taxes with O'Connor?

Your property taxes will be aggressively protested every year by the #1 property tax firm in the country. Now enroll online with O'Connor. Find out here to know more info https://www.cutmytaxes.com/georgia/fulton-county-property-tax-reduction/

#protest property taxes#property tax firm#cut my taxes#fulton county#fulton county tax#fulton county tax appeal

0 notes

Text

Protest your Property Taxes with O’Connor | Cut my taxes

Your property taxes will be aggressively protested every year by the #1 property tax firm in the country. Enroll online with O'Connor, many FREE benefits come with enrollment. Reach us today! Visit https://www.cutmytaxes.com/illinois/

0 notes

Text

Appeal Property Taxes | Cut My Taxes

Are you planning to protest property taxes? Find out how to appeal your Illinois property taxes! Protect yourself from financial surprises! Learn to Know more https://www.cutmytaxes.com/illinois/

0 notes

Text

How to reduce property taxes in Cook County?

How to reduce commercial property taxes in Cook County? Protest each & every year!It is your right & most appeals are successful. Reach us at https://www.cutmytaxes.com/illinois/cook-county-property-tax-reduction/

0 notes

Text

Protest your Property Taxes with O’Connor | Cut my taxes

If you are planning to protest your DuPage County property taxes every year. Once you sign up with us, we will continue to fight for your tax reduction. What are you waiting for? Visit us at https://www.cutmytaxes.com/illinois/dupage-county-property-tax-reduction/

0 notes

Text

Appeal Property Taxes | Cut My Taxes

Are you planning to protest property taxes? Find out how to appeal your Illinois property taxes! Protect yourself from financial surprises! Learn to Know more https://www.cutmytaxes.com/illinois/cook-county-property-tax-reduction/

0 notes

Text

Appeal Property Taxes | Cut My Taxes

Are you planning to protest property taxes? Find out how to appeal your DeKalb property taxes! Protect yourself from financial surprises! Learn here to know more https://www.cutmytaxes.com/georgia/Dekalb-county-property-tax-reduction/

0 notes

Text

How to reduce property taxes in McHenry County?

How to reduce commercial property taxes in McHenry County? Protest each & every year!It is your right & most appeals are successful. Reach us at https://www.cutmytaxes.com/illinois/mchenry-county-property-tax-reduction/

#reduce property taxes#property taxes#protest property taxes#mchenry county#mchenry county taxes#mchenry county property taxes

0 notes

Text

Looking for a property tax consultant?

If you want to protest but don't have the time, engage a property tax consultant who will protest and reduce your taxes every year. Visit https://www.cutmytaxes.com/illinois/cook-county-property-tax-reduction/

#property tax#property tax consultant#reduce taxes#tax consultant#cook county taxes#protest property taxes

0 notes

Text

Appeal Illinois Property Taxes

Are you planning to protest property taxes? Find out how to appeal your Illinois property taxes! Protect yourself from financial surprises! Learn to know more about Illinois property taxes here : https://www.cutmytaxes.com/illinois/

#illinois property taxes#property taxes#protest property taxes#property taxes in illinois#appeal illinois property taxes#appeal property taxes#cut my taxes#oconnor

0 notes