#Plant-Based Milk Market Size 2022

Explore tagged Tumblr posts

Text

Milton Orr looked across the rolling hills in northeast Tennessee. “I remember when we had over 1,000 dairy farms in this county. Now we have less than 40,” Orr, an agriculture adviser for Greene County, Tennessee, told me with a tinge of sadness.

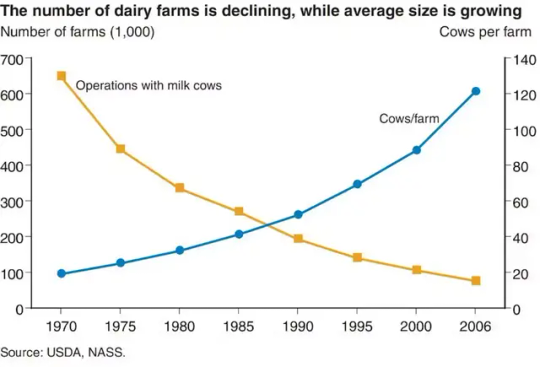

That was six years ago. Today, only 14 dairy farms remain in Greene County, and there are only 125 dairy farms in all of Tennessee. Across the country, the dairy industry is seeing the same trend: In 1970, more than 648,000 US dairy farms milked cattle. By 2022, only 24,470 dairy farms were in operation.

While the number of dairy farms has fallen, the average herd size—the number of cows per farm—has been rising. Today, more than 60 percent of all milk production occurs on farms with more than 2,500 cows.

This massive consolidation in dairy farming has an impact on rural communities. It also makes it more difficult for consumers to know where their food comes from and how it’s produced.

As a dairy specialist at the University of Tennessee, I’m constantly asked: Why are dairies going out of business? Well, like our friends’ Facebook relationship status, it’s complicated.

The Problem with Pricing

The biggest complication is how dairy farmers are paid for the products they produce.

In 1937, the Federal Milk Marketing Orders, or FMMO, were established under the Agricultural Marketing Agreement Act. The purpose of these orders was to set a monthly, uniform minimum price for milk based on its end use and to ensure that farmers were paid accurately and in a timely manner.

Farmers were paid based on how the milk they harvested was used, and that’s still how it works today.

Does it become bottled milk? That’s Class 1 price. Yogurt? Class 2 price. Cheddar cheese? Class 3 price. Butter or powdered dry milk? Class 4. Traditionally, Class 1 receives the highest price.

There are 11 FMMOs that divide up the country. The Florida, Southeast, and Appalachian FMMOs focus heavily on Class 1, or bottled, milk. The other FMMOs, such as Upper Midwest and Pacific Northwest, have more manufactured products such as cheese and butter.

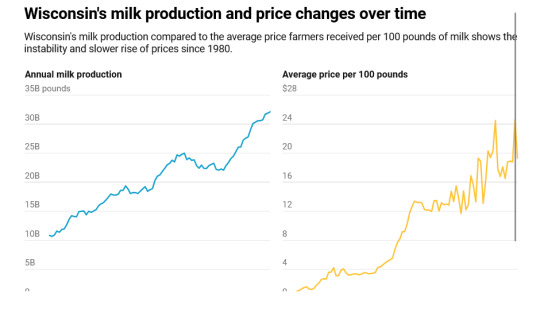

For the past several decades, farmers have generally received the minimum price. Improvements in milk quality, milk production, transportation, refrigeration, and processing all led to greater quantities of milk, greater shelf life, and greater access to products across the US. Growing supply reduced competition among processing plants and reduced overall prices.

Along with these improvements in production came increased costs of production, such as cattle feed, farm labor, veterinary care, fuel, and equipment costs.

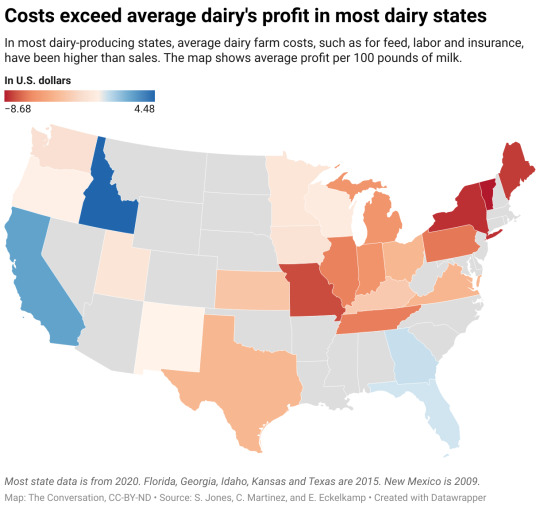

Researchers at the University of Tennessee in 2022 compared the price received for milk across regions against the primary costs of production: feed and labor. The results show why farms are struggling.

From 2005 to 2020, milk sales income per 100 pounds of milk produced ranged from $11.54 to $29.80, with an average price of $18.57. For that same period, the total costs to produce 100 pounds of milk ranged from $11.27 to $43.88, with an average cost of $25.80.

On average, that meant a single cow that produced 24,000 pounds of milk brought in about $4,457. Yet, it cost $6,192 to produce that milk, meaning a loss for the dairy farmer.

More efficient farms are able to reduce their costs of production by improving cow health, reproductive performance, and feed-to-milk conversion ratios. Larger farms or groups of farmers—cooperatives such as Dairy Farmers of America—may also be able to take advantage of forward contracting on grain and future milk prices. Investments in precision technologies such as robotic milking systems, rotary parlors, and wearable health and reproductive technologies can help reduce labor costs across farms.

Regardless of size, surviving in the dairy industry takes passion, dedication, and careful business management.

Some regions have had greater losses than others, which largely ties back to how farmers are paid, meaning the classes of milk, and the rising costs of production in their area. There are some insurance and hedging programs that can help farmers offset high costs of production or unexpected drops in price. If farmers take advantage of them, data shows they can functions as a safety net, but they don’t fix the underlying problem of costs exceeding income.

Passing the Torch to Future Farmers

Why do some dairy farmers still persist, despite low milk prices and high costs of production?

For many farmers, the answer is because it is a family business and a part of their heritage. Ninety-seven percent of US dairy farms are family owned and operated.

Some have grown large to survive. For many others, transitioning to the next generation is a major hurdle.

The average age of all farmers in the 2022 Census of Agriculture was 58.1. Only 9 percent were considered “young farmers,” age 34 or younger. These trends are also reflected in the dairy world. Yet, only 53 percent of all producers said they were actively engaged in estate or succession planning, meaning they had at least identified a successor.

How to Help Family Dairy Farms Thrive

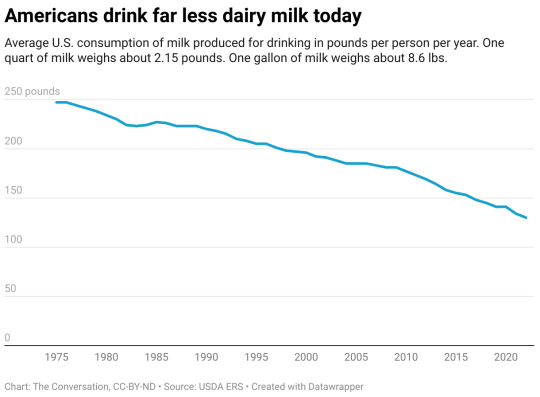

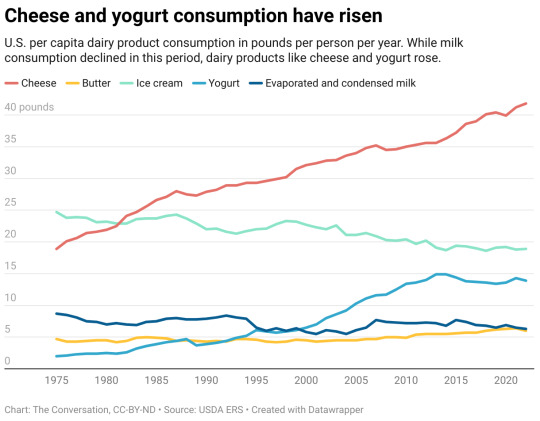

In theory, buying more dairy would drive up the market value of those products and influence the price producers receive for their milk. Society has actually done that. Dairy consumption has never been higher. But the way people consume dairy has changed.

Americans eat a lot, and I mean a lot, of cheese. We also consume a good amount of ice cream, yogurt, and butter, but not as much milk as we used to.

Does this mean the US should change the way milk is priced? Maybe.

The FMMO is currently undergoing reform, which may help stem the tide of dairy farmers exiting. The reform focuses on being more reflective of modern cows’ ability to produce greater fat and protein amounts; updating the cost support processors receive for cheese, butter, nonfat dry milk, and dried whey; and updating the way Class 1 is valued, among other changes. In theory, these changes would put milk pricing in line with the cost of production across the country.

The US Department of Agriculture is also providing support for four Dairy Business Innovation Initiatives to help dairy farmers find ways to keep their operations going for future generations through grants, research support, and technical assistance.

Another way to boost local dairies is to buy directly from a farmer. Value-added or farmstead dairy operations that make and sell milk and products such as cheese straight to customers have been growing. These operations come with financial risks for the farmer, however. Being responsible for milking, processing, and marketing your milk takes the already big job of milk production and adds two more jobs on top of it. And customers have to be financially able to pay a higher price for the product and be willing to travel to get it.

33 notes

·

View notes

Text

Exploring the Soy Protein Ingredients Market: Trends and Opportunities

Exploring the Soy Protein Ingredients Market: Trends and Opportunities

The soy protein ingredients market refers to the production, distribution, and application of soy-based proteins that are used in a variety of food, beverage, and industrial products. Soy protein is derived from soybeans and is one of the most widely used plant-based proteins due to its high protein content and versatile applications. It is a key ingredient in plant-based food products, especially in response to the growing demand for plant-based diets and sustainable sources of protein.

The global soy protein ingredients market size was valued at USD 8,328.03 million in 2021. It is expected to reach USD 10,593.92 million by 2030, growing at a CAGR of 2.71% during the forecast period (2022–2030).

Report Request sample link:https://straitsresearch.com/report/soy-protein-ingredients-market/request-sample

Soy protein ingredients are commonly used in a wide range of food applications, such as meat substitutes, dairy alternatives, protein bars, and beverages. They are also utilized in non-food industries, including cosmetics, personal care, and pharmaceuticals, owing to their functional properties like emulsification, gelation, and moisture retention.

With increasing consumer awareness around health and sustainability, the market for soy protein ingredients is expanding. Soy protein is a crucial component in the development of high-protein and plant-based products, positioning it as a key player in the transition toward more sustainable and health-conscious diets.

Soy Protein Ingredients Market Segmentation:

The soy protein ingredients market can be segmented based on the following factors:

By Type:

Soy Protein Concentrates (SPC): Contain a lower amount of protein (around 70%) and are widely used in food processing for their emulsifying and binding properties. SPC is commonly used in meat alternatives, snacks, and baked goods.

Soy Protein Isolates (SPI): With a higher protein content (over 90%), SPI is used in protein supplements, energy bars, and beverages due to its superior protein content and solubility.

Soy Flour: Ground soybeans that are used as an ingredient in various processed foods. Soy flour is often used to enrich bakery products, snacks, and soups.

By Application:

Food and Beverages:

Meat Alternatives: Soy protein is a primary ingredient in plant-based meat products, such as veggie burgers and plant-based sausages, due to its ability to mimic the texture and mouthfeel of animal protein.

Dairy Alternatives: Used in products like soy milk, soy-based yogurt, and ice cream as a plant-based substitute for dairy protein.

Snacks and Protein Bars: Soy protein is used to fortify protein bars, snacks, and ready-to-eat meals, catering to the growing trend of high-protein diets.

Beverages: Soy protein is used in protein-enriched drinks and shakes, as well as in plant-based protein powders.

Animal Feed: Soy protein is also used as a protein source in animal feed for poultry, cattle, and fish farming due to its amino acid profile and digestibility.

Cosmetics and Personal Care: Soy protein is included in skincare and haircare products due to its moisturizing and antioxidant properties.

Pharmaceuticals: It is utilized in pharmaceutical products for its emulsifying and stabilizing properties in drug formulations.

By Functionality:

Emulsifying Agents: Soy protein is commonly used for its emulsifying properties, especially in processed foods and beverages.

Texturizing Agents: Due to its gelation properties, soy protein is used in food products to create textures similar to those of animal proteins, especially in plant-based meat products.

Moisture Retention: Soy proteins help in maintaining moisture in bakery products, meat alternatives, and processed foods.

Fat Replacement: It is used as a fat replacer in various food products, particularly in low-fat or reduced-fat food formulations.

By Region:

North America

Europe

Asia Pacific

Latin America

Middle East and Africa

Soy Protein Ingredients Market Analysis:

The market for soy protein ingredients is evolving rapidly, driven by multiple factors such as the growing trend of plant-based diets, rising awareness about health and nutrition, and sustainability concerns in food production. Several key factors influencing the market include:

Plant-Based Diet Popularity: With an increasing number of consumers opting for vegetarian, vegan, or flexitarian diets, soy protein is becoming one of the leading protein sources in plant-based food products. The demand for meat substitutes, dairy alternatives, and protein-enriched snacks and beverages is a major driver of market growth.

Health Benefits: Soy protein is considered a high-quality plant-based protein due to its complete amino acid profile, making it an attractive alternative to animal proteins. It is also low in fat and cholesterol-free, which aligns with consumer preferences for healthier eating habits.

Sustainability and Environmental Concerns: Soy protein is seen as a more sustainable alternative to animal-based proteins, as the environmental impact of soy cultivation is lower in comparison to livestock farming. As the world faces increasing pressure to reduce carbon emissions, plant-based proteins like soy are becoming central to sustainable food production.

Product Innovation and Development: Manufacturers are continuously innovating to develop new products that cater to consumer preferences. This includes launching new types of plant-based meats, dairy alternatives, and protein supplements, all of which incorporate soy protein ingredients.

Supply Chain Dynamics and Costs: The production of soy protein ingredients is affected by fluctuations in the global soybean supply, which can impact pricing and availability. Additionally, there is an ongoing focus on improving the efficiency of soy protein extraction and processing to reduce costs and improve sustainability.

Top Key Players in the Soy Protein Ingredients Market:

Archer Daniels Midland Company

Cargill Incorporated

DuPont de Nemours Inc.

Kerry Group PLC

The Scoular Company

Wilmar International Limited

Fuji Oil Holdings Inc.

Food Chem International Corporation

Sonic Biochem Extractions Private Limited

Farbest Brands.

Buy now link:https://straitsresearch.com/buy-now/soy-protein-ingredients-market

Regional Analysis:

North America:

North America is one of the largest markets for soy protein ingredients, driven by the rising demand for plant-based products and protein-enriched foods. The U.S. is a major consumer of soy protein in both food and animal feed applications, with the growing popularity of plant-based meats and dairy alternatives.

Europe:

Europe is a significant market for soy protein ingredients, particularly in the growing plant-based food sector. Countries like the UK, Germany, and France are witnessing strong demand for soy protein in meat substitutes and dairy alternatives. The region is also driven by sustainability trends and consumer interest in healthier, plant-based diets.

Asia Pacific:

The Asia Pacific region is expected to witness the highest growth in the soy protein ingredients market due to the increasing population and rising health consciousness. Countries like China and India are major producers of soybeans and are expanding their use of soy protein in various food and beverage applications. The growing vegetarian and vegan population is further contributing to this trend.

Latin America:

Latin America, especially Brazil and Argentina, is a major producer of soybeans, and the region's soy protein market is expected to grow in line with the increasing demand for plant-based food products. The region's expanding middle class and the shift toward healthier eating habits are driving this growth.

Middle East and Africa:

The Middle East and Africa are emerging markets for soy protein ingredients, with rising interest in plant-based diets and the growth of the food processing industry. However, the market remains relatively small compared to other regions but holds potential for growth in the coming years.

About Straits Research:

Straits Research is a prominent market research and intelligence organization that specializes in providing comprehensive research, analytics, and advisory services. With a focus on understanding consumer behavior and global market dynamics, Straits Research employs advanced research methodologies to deliver valuable insights across various industries.

#Soy Protein Ingredients Market Share#Soy Protein Ingredients Market Size#Soy Protein Ingredients Market Growth

0 notes

Text

The Plant-Based Protein Beverages Market is projected to grow from USD 1080.3million in 2024 to an estimated USD 2332.61million by 2032, with a compound annual growth rate (CAGR) of 10.1% from 2024 to 2032.In recent years, the global food and beverage industry has witnessed a seismic shift toward healthier and more sustainable options. Among these trends, plant-based protein beverages have emerged as a dynamic and fast-growing category, appealing to consumers seeking nutritious, eco-friendly, and ethical alternatives to traditional dairy and animal-based protein drinks. With increasing consumer awareness about health, wellness, and environmental sustainability, the plant-based protein beverages market is poised for remarkable growth in the coming years.

Browse the full report at https://www.credenceresearch.com/report/plant-based-protein-beverages-market

Market Overview

Plant-based protein beverages are drinks made from plant-derived protein sources such as soy, almond, oat, pea, hemp, rice, and coconut. These beverages are marketed as functional and convenient options for individuals looking to supplement their protein intake without relying on animal products. The market encompasses a wide array of products, including protein shakes, smoothies, ready-to-drink (RTD) options, and fortified non-dairy milk.

The global market for plant-based protein beverages was valued at approximately USD 9.6 billion in 2022 and is projected to reach USD 15.8 billion by 2028, growing at a compound annual growth rate (CAGR) of over 8% during the forecast period. This impressive growth is driven by factors such as rising veganism, increasing lactose intolerance among consumers, and the surging demand for clean-label and organic products.

Key Market Drivers

Rising Health Consciousness: The increasing awareness of the health benefits of plant-based diets is a significant driver for the market. Plant-based protein beverages are often low in saturated fat, free from cholesterol, and rich in essential nutrients, making them attractive to health-conscious consumers.

Environmental Sustainability: Compared to animal-based protein production, plant-based alternatives have a lower environmental footprint, requiring fewer natural resources and producing fewer greenhouse gas emissions. As concerns over climate change grow, consumers are gravitating toward sustainable choices, fueling market growth.

Dietary Preferences and Allergies: With a growing prevalence of lactose intolerance and milk allergies, plant-based protein beverages provide a viable alternative for individuals seeking dairy-free options. Additionally, the rise of flexitarian and vegan diets has expanded the consumer base.

Innovations and Product Development: Manufacturers are investing heavily in research and development to improve the taste, texture, and nutritional profile of plant-based protein beverages. Innovations such as protein blends, fortified drinks with added vitamins and minerals, and new flavors are enhancing consumer appeal.

Challenges in the Market

While the growth prospects are promising, the plant-based protein beverages market faces certain challenges:

Taste and Texture: Some consumers still perceive plant-based protein beverages as having an off-putting taste or chalky texture. Overcoming this perception remains a priority for manufacturers.

Price Sensitivity: Plant-based protein beverages are often priced higher than their traditional counterparts, which can deter price-sensitive consumers.

Competition from Dairy and Animal-Based Proteins: Traditional dairy-based protein drinks and whey protein products continue to dominate the market, posing stiff competition to plant-based alternatives.

Future Outlook

The future of the plant-based protein beverages market looks exceptionally bright. Trends such as personalized nutrition, clean-label products, and hybrid beverages combining plant and dairy proteins are expected to shape the market’s trajectory. Moreover, the integration of advanced processing technologies and sustainable packaging solutions will further enhance product quality and market appeal.

As consumers continue to prioritize health, sustainability, and ethical consumption, the plant-based protein beverages market is well-positioned to capitalize on these shifting preferences. For businesses and investors, this market represents a lucrative opportunity to innovate and capture a share of the growing demand for plant-based nutrition.

Key Player Analysis:

Nestlé

PepsiCo

Danone

Unilever

Orgain

Ripple Foods

Oatly

Blue Diamond Growers

Hain Celestial Group

SunOpta

Vega

Segmentations:

By Product

Ready-to-Drink (RTD) Beverages

Powder-Based Protein Drinks

Concentrate-Based Beverages

By Source

Soy Protein

Pea Protein

Rice Protein

Hemp Protein

Almond Protein

By Distribution Channel

Supermarkets and Hypermarkets

Online Retail

Convenience Stores

Health & Specialty Stores

By Category

Conventional

Organic

By Region

North America

U.S.

Canada

Mexico

Europe

UK

France

Germany

Italy

Spain

Russia

Belgium

Netherlands

Austria

Sweden

Poland

Denmark

Switzerland

Rest of Europe

Asia Pacific

China

Japan

South Korea

India

Australia

Thailand

Indonesia

Vietnam

Malaysia

Philippines

Taiwan

Rest of Asia Pacific

Latin America

Brazil

Argentina

Peru

Chile

Colombia

Rest of Latin America

Middle East

UAE

KSA

Israel

Turkey

Iran

Rest of Middle East

Africa

Egypt

Nigeria

Algeria

Morocco

Rest of Africa

Browse the full report at https://www.credenceresearch.com/report/plant-based-protein-beverages-market

Contact:

Credence Research

Please contact us at +91 6232 49 3207

Email: [email protected]

0 notes

Text

0 notes

Text

A Deep Dive into the U.S. Packaged Food Market: Insights and Analysis

The U.S. packaged food market size is expected to reach USD 1.58 trillion by 2030, according to a new report by Grand View Research, Inc. The market is expected to expand at a CAGR of 4.8% from 2022 to 2030. The increasing product innovation, innovative packaging, changing lifestyles, rising number of dual-income families, and hectic schedules of consumers have boosted the demand for packaged foods in the U.S. Also, the growing trend of plant-based and organic foods is driving market growth. With rising health consciousness, consumers are gradually shifting towards healthy food and drink alternatives. As a result, food products with low-calorie, low-fat, gluten-free, sugar-free, and organic claims gain traction among consumers.

The beverages segment accounted for over 18.0% of revenue share in 2021, flowed by the dairy products segment. Healthy drinks made with natural ingredients and less sugar are gaining traction among consumers. Furthermore, increasing demand for functional beverages is also driving the growth of this product segment. Milk, butter, and cheese have wide applications in the daily lives of U.S. consumers. In addition, lately, yogurt and yogurt drinks are gaining significant popularity across the nation.

The market is highly competitive with a large number of well-established companies across the country. Consumers have been preferring companies that are known for prioritizing sustainable production and environment-friendly packaging. As a result, several companies are focusing on sustainable packaging and a transparent supply chain. For instance, in January 2020, Nestlé announced an investment of up to USD 2.12 billion in advanced sustainable packaging solutions to shift to food-grade recycled plastics from virgin plastics. The company has committed to making 100% of its packaging reusable or recyclable by 2025.

Gather more insights about the market drivers, restrains and growth of the U.S. Packaged Food Market

U.S. Packaged Food Market Report Highlights

• The ready-to-eat meals segment is expected to register the fastest CAGR of 6.1% from 2022 to 2030 owing to the busy lifestyle and hectic work schedule of the consumers

• In terms of distribution channels, the supermarkets and hypermarkets segment dominated the market and accounted for a revenue share of over 68% in 2021. Over the past few years, consumers prefer these distribution channels owing to the availability of a wide range of products and huge price discounts offered in these stores

• The beverages segment held the largest revenue share of more than 17.0% in 2021. The strong popularity of such products among consumers as healthy drinks is expected to remain a favorable factor over the next few years

U.S. Packaged Food Market Segmentation

Grand View Research has segmented the U.S. packaged food market based on product and distribution channel:

U.S. Packaged Food Product Outlook (Revenue, USD Billion, 2017 - 2030)

• Bakery & Confectionery Products

• Dairy Products

• Snacks & Nutritional Bars

• Beverages

• Sauces, Dressings, & Condiments

• Ready-to-Eat Meals

• Breakfast Cereals

• Processed Meats

• Rice, Pasta, & Noodles

• Ice Creams & Frozen Novelties

• Others

U.S. Packaged Food Distribution Channel Outlook (Revenue, USD Billion, 2017 - 2030)

• Supermarkets & Hypermarkets

• Convenience Store

• Online

• Others

Order a free sample PDF of the U.S. Packaged Food Market Intelligence Study, published by Grand View Research.

#U.S. Packaged Food Market#U.S. Packaged Food Market Size#U.S. Packaged Food Market Share#U.S. Packaged Food Market Analysis#U.S. Packaged Food Market Growth

0 notes

Text

Non-Alcoholic Steatohepatitis Supplement Market Share, Size, Key Players, Trends, Forecast To 2030

The global Non-Alcoholic Steatohepatitis Supplement Market research study predicts revenue growth over the forecast period. It investigates the various stakeholders in the market ecosystem, such as manufacturers, vendors, and end users. The study also looks at the industry's potential. Researchers examined the impact of a variety of social, political, and economic issues, as well as current market dynamics, to arrive at these market estimates. This study thoroughly investigates the industry.

The Non-Alcoholic Steatohepatitis Supplement Market Trend was USD 762.4 million in 2022 and is expected to Reach USD 1019.5 million by 2030 and grow at a CAGR of 3.7 % over the forecast period of 2023-2030.

The non-alcoholic steatohepatitis (NASH) supplement market is gaining traction as the prevalence of NASH, a severe form of non-alcoholic fatty liver disease (NAFLD), continues to rise globally. With limited approved pharmaceutical treatments for NASH, the demand for dietary supplements that support liver health and mitigate the progression of this condition is increasing. Consumers and healthcare professionals are turning to supplements containing ingredients like omega-3 fatty acids, vitamin E, and certain plant extracts, which are believed to have anti-inflammatory and antioxidant properties that can help manage NASH. The market is also being driven by growing awareness of liver health and the importance of early intervention in preventing more severe liver diseases.

As research continues to explore the role of nutrition and supplements in managing NASH, the market is seeing innovation in product formulations. Companies are focusing on developing evidence-based supplements that offer targeted benefits for liver function, while also appealing to consumers seeking natural and preventative health solutions. The rise of online health platforms and direct-to-consumer sales channels has further expanded access to NASH supplements, making them more widely available to those affected by the condition. As awareness and understanding of NASH grow, the supplement market is expected to experience continued growth, offering new opportunities for both consumers and manufacturers.

Get Sample Report of Non-Alcoholic Steatohepatitis Supplement Market: https://www.snsinsider.com/sample-request/3989

Several factors are taken into account, including a market assessment based on significant discoveries and advancements. The intrinsic elements of the market are the drivers and constraints, and the extrinsic elements are the opportunities and problems. The report's market forecasts are based on secondary research, primary interviews, and in-house expert reviews. The study is a valuable source of advice and direction for firms and individuals interested in the Non-Alcoholic Steatohepatitis Supplement Market because it provides essential information on the state of the industry.

Major Key Players in the Non-Alcoholic Steatohepatitis Supplement Market :

Nature's Bounty (Nestlé)

NOW Foods

Herbalife International of America, Inc

DANONE S.A

ADM

Irwin Naturals

Oregon's Wild Harvest

Jarrow Formulas, Inc

Gaia Herbs and Nutra-Life Australia

Intercept Pharmaceuticals, Inc

Evogen Nutrition

Other

Market Segmentation

This section of the study goes over the segmentation and sub-segmentation of the Non-Alcoholic Steatohepatitis Supplement Market. Furthermore, the study examines the target market's best-performing segments as well as forecasts for the coming years.

By Type

Probiotics

Pre-biotic

Synbiotics

Postbiotic

By Supplement Form

Tablet

Capsule

Powder

Others

By Nutrition

Milk thistle

Turmeric

Vitamin E

Omega-3-fatty acids

Competitive Scenario

In this section of the market study dedicated solely to major players in the Non-Alcoholic Steatohepatitis Supplement Market, our analysts provide a summary of the leading firms' financial statements, as well as significant advances, product benchmarking, and SWOT analysis. A business description and financial information are also included in the firm profile section. The firms in this section can be tailored to meet the needs of the client.

Report Conclusion

The Non-Alcoholic Steatohepatitis Supplement Market study conducted its research using a combination of primary research, secondary research, and expert panel reviews. Secondary research includes industry materials such as news releases, annual reports, and research papers. Factual market expansion information can be found in industry periodicals, trade journals, government websites, and trade associations.

Key Highlights of the Non-Alcoholic Steatohepatitis Supplement Market Report

For the leading market participants, comprehensive company profiles with business overviews, corporate insights, product benchmarking, and SWOT analyses are provided.

Industry current and future market forecasts based on recent changes such as growth prospects, challenges, and restraints in both emerging and developed economies.

Porter's five forces analysis is used to examine the market from multiple angles.

A qualitative and quantitative market analysis based on segmentation that takes both economic and non-economic factors into account.

Contact Us:

Akash Anand – Head of Business Development & Strategy

Phone: +1-415-230-0044 (US)

0 notes

Text

Beauty Drinks Market 2024 : Size, Growth Rate, Business Module, Product Scope, Regional Analysis And Expansions 2033

The beauty drinks global market report 2024 from The Business Research Company provides comprehensive market statistics, including global market size, regional shares, competitor market share, detailed segments, trends, and opportunities. This report offers an in-depth analysis of current and future industry scenarios, delivering a complete perspective for thriving in the industrial automation software market.

Beauty Drinks Market, 2024 report by The Business Research Company offers comprehensive insights into the current state of the market and highlights future growth opportunities.

Market Size - The beauty drinks market size has grown rapidly in recent years. It will grow from $3.03 billion in 2023 to $3.4 billion in 2024 at a compound annual growth rate (CAGR) of 12.2%. The growth in the historic period can be attributed to consumer preference, increased health awareness, preventive health focus, targeting specific consumer groups, rising incidences of skin problems.

The beauty drinks market size is expected to see rapid growth in the next few years. It will grow to $5.26 billion in 2028 at a compound annual growth rate (CAGR) of 11.5%. The growth in the forecast period can be attributed to shift from traditional beauty products, rising beauty consciousness, growing e-commerce and online retailing, celebrity endorsements, rising disposable income. Major trends in the forecast period include continuous technological advancements.

Order your report now for swift delivery @ https://www.thebusinessresearchcompany.com/report/beauty-drinks-global-market-report

The Business Research Company's reports encompass a wide range of information, including:

1. Market Size (Historic and Forecast): Analysis of the market's historical performance and projections for future growth.

2. Drivers: Examination of the key factors propelling market growth.

3. Trends: Identification of emerging trends and patterns shaping the market landscape.

4. Key Segments: Breakdown of the market into its primary segments and their respective performance.

5. Focus Regions and Geographies: Insight into the most critical regions and geographical areas influencing the market.

6. Macro Economic Factors: Assessment of broader economic elements impacting the market.

Market Drivers - The growing prevalence of skin problems is expected to propel the growth of the beauty drinks market going forward. Skin problems refer to a wide range of conditions that affect the skin, leading to various symptoms and impacts on individuals. These conditions include acne, atopic dermatitis, psoriasis, actinic damage, cutaneous lymphoma, rosacea, cutaneous infections, seborrheic dermatitis, and others. Beauty drinks, such as oat milk and fruit juice, can contribute to hydration, which is important for maintaining skin health, especially for individuals with atopic dermatitis. For instance, according to the Global Report on Atopic Dermatitis 2022 by the International Eczema Council, a US-based association, in 2021, approximately 223 million people were living with atopic dermatitis, a chronic inflammatory skin condition characterized by red, itchy rashes. This number includes around 43 million individuals aged 1-4 years old. Therefore, the growing prevalence of skin problems is driving the beauty drinks market.

Market Trends - Major companies operating in the beauty drinks market are developing innovative products, such as aloe-based drinks, to protecting the skin and providing anti-aging effects. Aloe-based drinks are beverages made from the gel extracted from the aloe vera plant, known for its potential health benefits and refreshing taste. For instance, in September 2023, L'BRI PURE & NATURAL, a US-based provider of high-quality skin care and beauty products, introduced a new Aloe + Collagen Super Beauty Drink Mix. The berry-flavored drink mix contains Aloe Vera Barbadensis Miller, which helps to hydrate the skin, boost collagen formation, and feed the entire body with vitamins. The drink mix is part of L'BRI's line of aloe-based skin and body care products designed to promote healthier, younger-looking skin.

The beauty drinks market covered in this report is segmented –

1) By Type: Vitamins And Minerals, Collagen, Carotenoids, Other Types 2) By Function: Anti-Aging, Detoxication, Radiance, Vitality, Other Functions 3) By Distribution Channel: Grocery Retailers, Beauty Specialty Stores, Drug Stores and Pharmacies, Other Distribution Channels

Get an inside scoop of the beauty drinks market, Request now for Sample Report @ https://www.thebusinessresearchcompany.com/sample.aspx?id=13607&type=smp

Regional Insights - North America was the largest region in the beauty drinks market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the beauty drinks market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Key Companies - Major companies operating in the beauty drinks market report are Nestle SE, PepsiCo, AB InBev, The Coca - Cola Company, Danone S.A., Asahi Group Holdings, Hangzhou Wahaha Group, Fonterra Co-operative Group Limited, Kao Corporation, Amway, Shisedo Co. Ltd., Hain Celestial Group, AMC Group Alimentacion Fresco y Zumos SA, Groupon Inc., Kino Biotech Pte Ltd., Dr. Ci:Labo Co.Ltd., Nutrafol, Suja Life, Sappe Public Company Ltd., Juice Generation, Big Quarck Ltd., Zoppas Industries Group, Evolve BioSystems, Skinade, DyDo Drinco Inc., My Beauty & GO, Suntory Holdings

Table of Contents 1. Executive Summary 2. Beauty Drinks Market Report Structure 3. Beauty Drinks Market Trends And Strategies 4. Beauty Drinks Market – Macro Economic Scenario 5. Beauty Drinks Market Size And Growth ….. 27. Beauty Drinks Market Competitor Landscape And Company Profiles 28. Key Mergers And Acquisitions 29. Future Outlook and Potential Analysis 30. Appendix

Contact Us: The Business Research Company Europe: +44 207 1930 708 Asia: +91 88972 63534 Americas: +1 315 623 0293 Email: [email protected]

Follow Us On: LinkedIn: https://in.linkedin.com/company/the-business-research-company Twitter: https://twitter.com/tbrc_info Facebook: https://www.facebook.com/TheBusinessResearchCompany YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ Blog: https://blog.tbrc.info/ Healthcare Blog: https://healthcareresearchreports.com/ Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

0 notes

Text

Global Alternative Protein Market Analysis 2024: Size Forecast and Growth Prospects

The alternative protein global market report 2024 from The Business Research Company provides comprehensive market statistics, including global market size, regional shares, competitor market share, detailed segments, trends, and opportunities. This report offers an in-depth analysis of current and future industry scenarios, delivering a complete perspective for thriving in the industrial automation software market.

Alternative Protein Market, 2024 report by The Business Research Company offers comprehensive insights into the current state of the market and highlights future growth opportunities.

Market Size - The alternative protein market size has grown rapidly in recent years. It will grow from $71.73 billion in 2023 to $85.65 billion in 2024 at a compound annual growth rate (CAGR) of 19.4%. The growth in the historic period can be attributed to health and wellness trends, environmental concerns, ethical and animal welfare concerns, cultural and religious preferences, innovation and product development.

The alternative protein market size is expected to see rapid growth in the next few years. It will grow to $162.13 billion in 2028 at a compound annual growth rate (CAGR) of 17.3%. The growth in the forecast period can be attributed to policy and regulatory support, global population growth, investment and funding inflows, changing consumer preferences, climate change mitigation. Major trends in the forecast period include diversification of protein sources, mainstream adoption in foodservice, premiumization and innovation, global expansion and market accessibility, nutritional enhancement and fortification.

Order your report now for swift delivery @ https://www.thebusinessresearchcompany.com/report/alternative-protein-global-market-report

Scope Of Alternative Protein Market The Business Research Company's reports encompass a wide range of information, including:

1. Market Size (Historic and Forecast): Analysis of the market's historical performance and projections for future growth.

2. Drivers: Examination of the key factors propelling market growth.

3. Trends: Identification of emerging trends and patterns shaping the market landscape.

4. Key Segments: Breakdown of the market into its primary segments and their respective performance.

5. Focus Regions and Geographies: Insight into the most critical regions and geographical areas influencing the market.

6. Macro Economic Factors: Assessment of broader economic elements impacting the market.

Alternative Protein Market Overview

Market Drivers - The increasing demand for plant-based proteins is expected to propel the growth of the alternative protein market going forward. Plant-based protein refers to proteins derived from plants rather than animal sources. These proteins are present in several plant-based foods and are frequently consumed by people who follow vegetarian, vegan, or plant-based diets. Plant-based proteins are used in alternative protein products as substitutes for traditional animal-based proteins, offering a sustainable and cruelty-free option. Additionally, plant-based proteins offer benefits such as lower saturated fat, high fiber content, reduced environmental impact, and ethical considerations compared to animal-based proteins. For instance, in April 2023, according to the Good Food Institute, a US-based non-profit organization, the global retail sales of plant-based meat and seafood in 2022 amounted to $6.1 billion, indicating an 8% growth in revenue and a 5% increase in weight. Additionally, the collective sales of plant-based milk, cheese, and yogurt reached $21.6 billion globally, marking a 7% rise from the previous year. Therefore, the increasing demand for plant-based proteins is driving the growth of the alternative protein market.

Market Trends - Major companies operating in the alternative protein market are developing new products, such as plant-based meat, to gain a competitive edge in the market. Plant-based meat refers to food products that mimic the taste, texture, and nutritional profile of traditional animal meat but are entirely derived from plant-based sources. For instance, in January 2023, Final Foods Inc., a US-based food and technology company, launched a plant-based meat product line designed for gourmet chefs and the food service industry. This innovative range offers protein-rich vegan alternatives in slices and large cuts, allowing for versatile culinary applications such as grilling, stewing, sautéing, and stir-frying. Crafted with a unique extrusion cooking process using pea protein and natural ingredients, Final Foods' vegan meat distinguishes itself by its commitment to replicating the taste of meat while providing a more natural and creative alternative for chefs. Notably, the company is pioneering a sustainable production model, utilizing small-scale micro factories to support local markets.

The alternative protein market covered in this report is segmented –

1) By Source: Plant-Based, Insect-Based, Microbial-Based, Other Sources 2) By Form: Dry, Liquid 3) By Application: Food And Beverage, Cattle, Aquaculture, Animal Feed, Pet Food, Equine, Other Applications

Get an inside scoop of the alternative protein market, Request now for Sample Report @ https://www.thebusinessresearchcompany.com/sample.aspx?id=14036&type=smp

Regional Insights - North America was the largest region in the alternative protein market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the alternative protein market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Key Companies - Major companies operating in the alternative protein market are Cargill Incorporated, Archer-Daniels-Midland Company, CHS Inc., International Flavors & Fragrances Inc., Kerry Group plc, Ingredion Incorporated, DIC Corporation, Glanbia Plc, Roquette Freres SA, Tate & Lyle Plc, Corbion NV, Now Health Group Inc., Farbest Farms Inc., Ynsect SAS, BENEO GmbH, Cyanotech Corporation, MycoTechnology Inc., Enterra Feed Corporation, Sotexpro, Axiom Foods Inc., Protix B.V., EnviroFlight LLC, Entomo Farms, Aspire Food Group, Pond Technologies Holdings Inc.

Table of Contents 1. Executive Summary 2. Alternative Protein Market Report Structure 3. Alternative Protein Market Trends And Strategies 4. Alternative Protein Market – Macro Economic Scenario 5. Alternative Protein Market Size And Growth ….. 27. Alternative Protein Market Competitor Landscape And Company Profiles 28. Key Mergers And Acquisitions 29. Future Outlook and Potential Analysis 30. Appendix

Contact Us: The Business Research Company Europe: +44 207 1930 708 Asia: +91 88972 63534 Americas: +1 315 623 0293 Email: [email protected]

Follow Us On: LinkedIn: https://in.linkedin.com/company/the-business-research-company Twitter: https://twitter.com/tbrc_info Facebook: https://www.facebook.com/TheBusinessResearchCompany YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ Blog: https://blog.tbrc.info/ Healthcare Blog: https://healthcareresearchreports.com/ Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

0 notes

Text

Protein Ingredients Industry Share and Specification forecast To 2030

The global protein ingredients market was valued at USD 77.69 billion in 2022 and is expected to grow at a revenue-based compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This steady growth is driven by rising demand for a variety of food products such as margarine, cold cuts, bakery items, spreads, yogurt, and milk sausages that use protein ingredients. Increased consumption of these protein-rich foods among health-conscious and elderly consumers is further fueling the market. The growing interest in these products stems not only from their nutritional benefits but also from specific functional properties, such as satiety, muscle repair, weight loss, and energy balance. These functions are made possible by innovative protein formulations containing diverse amino acid profiles, which present vast growth opportunities for the market.

The market has also experienced a notable rise in demand for animal-based protein products. In the U.S., demand for animal-derived protein is especially strong and is expected to continue growing in the near future. Companies that produce and distribute these products have undertaken supply chain initiatives to ensure a steady and reliable distribution network, supporting sustained market growth.

Gather more insights about the market drivers, restrains and growth of the Protein Ingredients Market

Plant-based protein ingredients, derived from crops like soy, canola, wheat, and pea, are also seeing significant demand. Soy protein, in particular, leads the plant-based category and is anticipated to grow rapidly over the forecast period. The Food and Drug Administration (FDA) has even approved a health claim that suggests soy protein, when consumed daily in four servings, can lower LDL cholesterol levels by around 10%. This endorsement has further boosted soy protein’s popularity as a health-supportive ingredient.

In addition to soy protein’s growth, technological advancements and innovative production methods are further propelling market expansion. Protein ingredients are now applied across diverse products, such as isolates, which have high dispersibility and fine particle size, making them ideal for dairy applications. Growing consumer awareness of health benefits associated with protein ingredients has been a major growth driver for the market in recent years and is likely to continue this trajectory.

Application Segmentation Insights:

In terms of applications, the food and beverage segment led the market in 2022, capturing a 39.21% revenue share, and it is expected to retain this leading position over the forecast period. Whey protein ingredients, for instance, are an affordable source of protein and are widely used in the bakery and confectionery sectors. Recent advancements in process design and technology have refined whey products, resulting in higher quality variations like demineralized whey, Whey Protein Isolates (WPIs), and Whey Protein Concentrates (WPCs). These improvements have enabled greater use of protein ingredients in various functional food products, making them nutrient-dense options for consumers.

Animal feed is another key application area projected to grow rapidly, with an estimated CAGR of 6.3% by revenue over the forecast period. The animal feed industry is focusing on reducing environmental impact, which has increased interest in alternative proteins for feed products. The need to improve animal feed formulations with high-protein content, particularly with non-GMO sources, is becoming a priority.

Traditional protein sources for animal feed, such as soybean meal and fishmeal, have become more expensive due to rising demand, limited availability, and environmental concerns. This shift has led to an increased interest in alternative protein sources like insect meal, algae, and single-cell proteins, which are generally more sustainable and cost-effective. By using these alternative proteins, the animal feed industry aims to meet nutritional needs while reducing dependency on conventional, high-cost protein sources, thereby enhancing the sector’s overall sustainability and cost-efficiency.

Order a free sample PDF of the Protein Ingredients Market Intelligence Study, published by Grand View Research.

0 notes

Text

Protein Ingredients Market Product Overview, Research, Share by Types and Region till 2030

The global protein ingredients market was valued at USD 77.69 billion in 2022 and is expected to grow at a revenue-based compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This steady growth is driven by rising demand for a variety of food products such as margarine, cold cuts, bakery items, spreads, yogurt, and milk sausages that use protein ingredients. Increased consumption of these protein-rich foods among health-conscious and elderly consumers is further fueling the market. The growing interest in these products stems not only from their nutritional benefits but also from specific functional properties, such as satiety, muscle repair, weight loss, and energy balance. These functions are made possible by innovative protein formulations containing diverse amino acid profiles, which present vast growth opportunities for the market.

The market has also experienced a notable rise in demand for animal-based protein products. In the U.S., demand for animal-derived protein is especially strong and is expected to continue growing in the near future. Companies that produce and distribute these products have undertaken supply chain initiatives to ensure a steady and reliable distribution network, supporting sustained market growth.

Gather more insights about the market drivers, restrains and growth of the Protein Ingredients Market

Plant-based protein ingredients, derived from crops like soy, canola, wheat, and pea, are also seeing significant demand. Soy protein, in particular, leads the plant-based category and is anticipated to grow rapidly over the forecast period. The Food and Drug Administration (FDA) has even approved a health claim that suggests soy protein, when consumed daily in four servings, can lower LDL cholesterol levels by around 10%. This endorsement has further boosted soy protein’s popularity as a health-supportive ingredient.

In addition to soy protein’s growth, technological advancements and innovative production methods are further propelling market expansion. Protein ingredients are now applied across diverse products, such as isolates, which have high dispersibility and fine particle size, making them ideal for dairy applications. Growing consumer awareness of health benefits associated with protein ingredients has been a major growth driver for the market in recent years and is likely to continue this trajectory.

Application Segmentation Insights:

In terms of applications, the food and beverage segment led the market in 2022, capturing a 39.21% revenue share, and it is expected to retain this leading position over the forecast period. Whey protein ingredients, for instance, are an affordable source of protein and are widely used in the bakery and confectionery sectors. Recent advancements in process design and technology have refined whey products, resulting in higher quality variations like demineralized whey, Whey Protein Isolates (WPIs), and Whey Protein Concentrates (WPCs). These improvements have enabled greater use of protein ingredients in various functional food products, making them nutrient-dense options for consumers.

Animal feed is another key application area projected to grow rapidly, with an estimated CAGR of 6.3% by revenue over the forecast period. The animal feed industry is focusing on reducing environmental impact, which has increased interest in alternative proteins for feed products. The need to improve animal feed formulations with high-protein content, particularly with non-GMO sources, is becoming a priority.

Traditional protein sources for animal feed, such as soybean meal and fishmeal, have become more expensive due to rising demand, limited availability, and environmental concerns. This shift has led to an increased interest in alternative protein sources like insect meal, algae, and single-cell proteins, which are generally more sustainable and cost-effective. By using these alternative proteins, the animal feed industry aims to meet nutritional needs while reducing dependency on conventional, high-cost protein sources, thereby enhancing the sector’s overall sustainability and cost-efficiency.

Order a free sample PDF of the Protein Ingredients Market Intelligence Study, published by Grand View Research.

0 notes

Text

Plant-Based Dairy Boom: How Alternative Milks Are Reshaping the Beverage Industry

In recent years, the global food industry has seen a marked shift in consumer preferences toward dairy alternatives. This trend highlights evolving attitudes regarding health, sustainability, and ethics. As individuals increasingly opt to reduce or eliminate dairy from their diets, the dairy alternatives market demand has surged. A key factor driving this growth is the heightened focus on health and wellness. Consumers are becoming more health-conscious and seeking products that align with their dietary needs and restrictions. Dairy alternatives such as almond, soy, and oat milk are often viewed as healthier options due to their lower saturated fat content and lack of cholesterol. Additionally, many of these alternatives are fortified with essential vitamins and minerals, making them appealing for those aiming to maintain a balanced diet. Lactose intolerance is also contributing to the rise in dairy alternatives. With a significant portion of the global population struggling to digest lactose, these alternatives offer a comfortable solution for enjoying milk-like products without digestive issues. Furthermore, the increasing prevalence of dairy allergies is driving further demand for plant-based milk and dairy substitutes.

At a 10.1% CAGR, the global dairy alternatives market size is projected to reach US$ 43.6 billion by 2028 from a projected US$ 27.0 billion in 2023. The global market size was valued at US$ 24.6 billion in 2022.

Know about the assumptions considered for the study: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=677

In response to rapidly changing lifestyles, consumers are increasingly seeking nutritious and healthier food options. The gap between fast food and unhealthy junk food is likely to widen as people actively pursue convenient yet health-conscious choices. For suppliers and manufacturers, identifying products with high nutritional value represents a substantial opportunity in the dairy alternatives industry.

Rapid Urbanization and Increased Disposable Income: Drivers of Dairy Alternative Market Growth

With the global population rising, there is growing pressure on already limited resources. Escalating energy prices and increasing raw material costs are directly impacting food prices, which disproportionately affects individuals with lower incomes. This strain on the food supply is exacerbated by water scarcity, particularly in regions like Africa and Northern Asia. Conversely, the Asia Pacific region presents cost advantages in production and processing, creating a significant opportunity for dairy alternative suppliers and manufacturers due to the combination of high demand and cost-effective production.

Soy’s Dominance: Analysing the Dairy Alternatives Market Share

Soy-based dairy alternatives are considered efficient substitutes for dairy products and occupy a significant share of the dairy alternatives market. The widespread popularity and increasing consumption of soy-based products can be attributed to their exceptional nutritional value. These products serve as abundant sources of proteins and calcium, making them highly regarded as excellent dairy substitutes, especially for those who are lactose intolerant. Furthermore, soy-based products do not contain casein, a common allergen found in many dairy items.

Soy milk, which is available in a variety of flavors and types, offers consumers a wide range of options to choose from. It is typically derived from soybeans or soy protein isolate, with thickeners and vegetable oils often added to enhance taste and consistency. Soy milk finds its best application in savory dishes, coffee, and cereal, where it serves as a suitable replacement for cow’s milk.

How are urbanization, dietary diversification, and foreign direct investment contributing to changes in the dairy alternatives industry in the Asia-Pacific region?

The Asia-Pacific region is experiencing a surge in demand for fortified nutritional food and beverages, driven by busy lifestyles and increasing disposable incomes. This trend is accelerating the adoption of dairy alternatives, particularly soymilk, due to evolving consumer preferences. The region’s economic growth is expected to further boost the consumption of affordable and plentiful soymilk. To meet the rising interest in healthy and pasteurized dairy substitutes, food manufacturers are diversifying their soymilk offerings with unique flavors.

Book a meeting with our experts to discuss your business needs: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=677

This analysis focuses on key countries within the region, including Japan, Australia, China, and India. Major players such as Sanitarium Health & Wellbeing Company, Freedom Foods Group Ltd., Vitasoy International Holdings Limited, and Purebates are central to the expanding dairy alternatives market. The sector is evolving rapidly due to urbanization, dietary diversification, and increased foreign investment in the food industry. Additionally, rising income levels, a growing middle class, heightened health awareness, and the demand for nutritional products are creating significant growth opportunities in the Asia-Pacific dairy alternatives market.

What’s New? The Latest Advances in Dairy Alternatives Industry

In June 2023, Oatly Group AB (Sweden) launched and introduced a vegan cream cheese that is now available nationwide in the US. This oat-based cream cheese innovation comes in two flavors: Plain and Chive & Onion.

In April 2021, SunOpta announced the acquisition of the Dream and WestSoy plant-based beverage brands from The Hain Celestial Group, Inc. The acquired brands helped the company expand its product portfolio, further accelerating growth in this business.

Top Dairy Alternatives Manufacturers

Danone North America Public Benefit Corporation (US)

The Hain Celestial Group, Inc. (US)

Blue Diamond Growers (US)

Freedom Foods Group Limited (Australia)

Valsoia S.p.A (Italy)

SunOpta (Canada)

Qatly Group AB (Sweden)

Sanitarium (New Zealand)

Key Questions Answered in the Dairy Alternatives Market Report

Market size snapshot: How big is the dairy alternative sector?

What are dairy alternatives market trends?

Is there Oceania (New Zealand and Australia) specific information (market size, players, growth rate) for the global dairy alternatives market?

0 notes

Text

Plant-based Butter Market Size To Reach USD 3.72 Billion By 2030

Plant-based Butter Market Growth & Trends

The global plant-based butter market is expected to reach USD 3.72 billion by 2030, exhibiting a CAGR of 6.2% from 2024 to 2030, according to a new report by Grand View Research, Inc. Rising awareness about the health risks associated with excessive consumption of animal fats has led many consumers to seek healthier alternatives, with plant-based butter seen as a more heart-friendly option. Environmental consciousness plays a significant role, as consumers increasingly recognize the lower carbon footprint and reduced resource consumption of plant-based products compared to their dairy counterparts. The growing prevalence of lactose intolerance and dairy allergies worldwide has expanded the market for dairy alternatives, including plant-based butter. Technological innovations in food science have dramatically improved the taste, texture, and functionality of plant-based butter, making it more appealing to a broader consumer base.

There's a growing demand for clean-label products, with consumers seeking options made from simple, recognizable ingredients. Manufacturers are responding by developing products with shorter ingredient lists and avoiding artificial additives. Another trend is the focus on functional ingredients, with plant-based butter incorporating nutrients like omega-3 fatty acids, vitamins, and minerals to appeal to health-conscious consumers. The market is also seeing a rise in premium and artisanal plant-based butter offerings, catering to consumers looking for gourmet experiences. Additionally, there's an increasing emphasis on sustainable packaging, with brands exploring eco-friendly alternatives to traditional plastic containers.

Recent developments in the market include significant product innovations and strategic moves by key players. Major food companies have been entering the market through acquisitions or launching their own plant-based lines, bringing substantial resources for research, development, and marketing. There's been a surge in new product launches featuring unique ingredient combinations, such as blends of different plant oils to achieve optimal taste and texture profiles. Some brands have introduced cultured plant-based butter, using fermentation processes to replicate the tangy flavor of traditional dairy butter.

For instance, in February 2022, Miyoko's Creamery, known for its plant-based dairy products, introduced its Organic Cultured Oat Milk Butter to Walmart stores across the U.S. This 12 oz. butter is crafted from whole-grain oat milk, sunflower oil, and coconut oil, providing an allergen-friendly spread. It is free from soy, cashews, gluten, lactose, and palm oil, meeting the needs of consumers with diverse dietary preferences. Moreover, it holds USDA Certified Organic status and is made without artificial colors or preservatives, emphasizing its commitment to natural ingredients.

On the technological front, advancements in food processing techniques have led to improved mouthfeel and meltability of plant-based butter, making them more comparable to dairy butter in cooking and baking applications. Some companies have also been exploring novel ingredients like algae or fermented oils to create more sustainable and nutritionally enhanced products.

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/plant-based-butter-market-report

Plant-based Butter Market Report Highlights

Coconut butter represented 35.50% of revenue in 2023, favored for its creamy texture and mild flavor similar to traditional butter. Health benefits like medium-chain triglycerides (MCTs) enhance its appeal among health-conscious consumers, contributing to its market dominance.

Non-flavored plant-based butter held a 64.96% revenue share in 2023, prized for its versatility and ability to replicate the neutral, creamy taste of dairy butter. Its appeal lies in simplicity and authenticity, making it a preferred choice for cooking, baking, and spreading without altering dish flavors.

B2C sales accounted for 67.62% of revenue in 2023, driven by widespread availability in retail outlets like supermarkets and online platforms. Direct consumer access aligns with growing health consciousness, ethical considerations, and dietary preferences such as veganism, cementing B2C channels as the primary distribution choice.

North America dominated the market with over 34.58% revenue share in 2023, fueled by strong consumer demand for health-conscious and vegan options. Early adoption of food trends, established manufacturers, extensive retail networks, and supportive regulatory frameworks contribute to the region's market leadership.

Plant-based Butter Market Segmentation

Grand View Research has segmented the global plant-based butter market based on source, nature, distribution channel, flavor, and region.

Plant-based Butter Source Outlook (Revenue, USD Million, 2018 - 2030)

Almond

Oat

Soy

Coconut

Others

Plant-based Butter Nature Outlook (Revenue, USD Million, 2018 - 2030)

Organic

Conventional

Plant-based Butter Flavor Outlook (Revenue, USD Million, 2018 - 2030)

Flavored Butter

Non-Flavored Butter

Plant-based Butter Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

B2B

B2C

Plant-based Butter Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

Europe

Asia Pacific

Central & South America

Middle East & Africa

List of Key Players in the Plant-based Butter Market

Upfield

Miyoko’s Creamery

Conagra, Inc.

Califia Farms, LLC

Kite Hill

Ripple Foods, PBC

Elmhurst Buttered Direct, LLC

Milkadamia

Fora Foods

Naturli’ Foods A/S

Browse Full Report: https://www.grandviewresearch.com/industry-analysis/plant-based-butter-market-report

#Plant-based Butter Market#Plant-based Butter Market Size#Plant-based Butter Market Share#Plant-based Butter Market Trends#Plant-based Butter Market Growth

0 notes

Text

Vegan Butter Market growth, trend, opportunity and forecast 2024-2030

Vegan Butter Market

The Vegan Butter Market is expected to grow from USD 1.10 Billion in 2022 to USD 2.10 Billion by 2030, at a CAGR of 7.90% during the forecast period.

Get the sample report: https://www.reportprime.com/enquiry/sample-report/6370

Vegan Butter Market Size

Vegan Butter is a non-dairy substitute for traditional butter made from animal milk. It is commonly made from vegetable oils, nuts, and sometimes even avocado. The market for vegan butter has been segmented based on type into two categories: vegetable butter and nut butter. It has various applications, including hypermarkets and supermarkets, convenience stores, and others. North America, Asia Pacific, the Middle East, Africa, Australia, and Europe are the regions where the vegan butter market is growing. Some of the leading market players in the vegan butter industry are Miyoko's (US), I Can't Believe It's Not Butter (US), Conagra Brands, Inc. (US), WayFare Foods (Montana), Prosperity Organic Foods, Inc. (Idaho), and Naturli Foods (Denmark). Regulatory and legal factors, such as food labeling requirements or organic certification, are critical in determining the acceptance and growth of the vegan butter market. The vegan butter market is set to grow significantly in the coming years as consumers become more health-conscious and environmentally aware.

Vegan Butter Market Key Players

Miyoko's (US)

I Can't Believe It's Not Butter (US)

Conagra Brands, Inc. (US)

WayFare Foods (Montana)

Prosperity Organic Foods, Inc. (Idaho)

Inquire Now: https://www.reportprime.com/enquiry/pre-order/6370

Vegan Butter Market Segment Analysis

The latest trends in the Vegan Butter market include the use of innovative plant-based ingredients such as cashews, soy milk, and coconut oil. Manufacturers are also focusing on developing new flavors and textures to provide a wide range of options to consumers. In addition, the market is witnessing significant growth in the online sales of vegan butter products through e-commerce platforms, which offer convenience and a wider product selection.

In conclusion, the Vegan Butter market is growing rapidly, driven by consumers' changing lifestyles, ethical concerns, and a desire for sustainable food practices. While the market faces some challenges, there are significant opportunities for growth in the coming years. Manufacturers need to focus on innovation, affordability, and expanding their distribution channels to capitalize on the growing demand for vegan butter products.

This report covers impact on COVID-19 and Russia-Ukraine wars in detail.

Purchase this report: https://www.reportprime.com/checkout?id=6370&price=3590

KEY PRODUCT APPLICATION COVERED

Hypermarkets and Supermarkets

Convenience Stores

Others

KEY PRODUCT TYPES COVERED

Vegetable Butter

Nut Butter

Contact Info:

Krishna Sharma

US:- +1 507 500 7209

Email:- [email protected]

Website:- https://www.reportprime.com/

Browse more reports:

https://www.linkedin.com/pulse/unlocking-growth-potential-market-strategic-analysis-qy8te?trackingId=dXimzEwYRkeaTCG1wOp4Bw%3D%3Dhttps://www.linkedin.com/pulse/unlocking-growth-potential-market-strategic-analysis-qy8te?trackingId=dXimzEwYRkeaTCG1wOp4Bw%3D%3Dhttps://www.linkedin.com/pulse/unlocking-growth-potential-market-strategic-analysis-qy8te?trackingId=dXimzEwYRkeaTCG1wOp4Bw%3D%3Dhttps://www.linkedin.com/pulse/unlocking-growth-potential-market-strategic-analysis-qy8te?trackingId=dXimzEwYRkeaTCG1wOp4Bw%3D%3Dhttps://www.linkedin.com/pulse/unlocking-growth-potential-market-strategic-analysis-qy8te?trackingId=dXimzEwYRkeaTCG1wOp4Bw%3D%3Dhttps://www.linkedin.com/pulse/unlocking-growth-potential-market-strategic-analysis-qy8te?trackingId=dXimzEwYRkeaTCG1wOp4Bw%3D%3Dhttps://www.linkedin.com/pulse/unlocking-growth-potential-market-strategic-analysis-qy8te?trackingId=dXimzEwYRkeaTCG1wOp4Bw%3D%3Dhttps://www.linkedin.com/pulse/unlocking-growth-potential-market-strategic-analysis-qy8te?trackingId=dXimzEwYRkeaTCG1wOp4Bw%3D%3Dhttps://www.linkedin.com/pulse/unlocking-growth-potential-market-strategic-analysis-qy8te?trackingId=dXimzEwYRkeaTCG1wOp4Bw%3D%3Dhttps://www.linkedin.com/pulse/property-inspection-software-market-size-segmentation-trends-mafre?trackingId=2yRsqlphTLCPbMDo2e%2FnMQ%3D%3D

0 notes

Text

The Fortified Milk and Milk Products Market is projected to grow from USD 110002.5 million in 2024 to an estimated USD 156434.62 million by 2032, with a compound annual growth rate (CAGR) of 4.5% from 2024 to 2032.The fortified milk and milk products market has witnessed significant growth over the past decade, driven by increasing consumer awareness about nutrition, rising health concerns, and a growing demand for functional foods. Fortification refers to the process of adding essential nutrients, such as vitamins and minerals, to milk and its derivatives to address nutritional deficiencies and promote overall health. As lifestyles evolve and dietary habits shift, the role of fortified dairy products has become more critical than ever.

Browse the full report at https://www.credenceresearch.com/report/fortified-milk-and-milk-products-market

Market Overview

Fortified milk and milk products have emerged as an essential component of modern diets. These products include regular milk enriched with vitamins A and D, flavored fortified milk, fortified cheese, yogurt, and infant formula. The market for these products has been expanding steadily, fueled by rising demand in both developed and developing regions.

The global market size for fortified dairy products was valued at approximately USD 105 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.8% between 2023 and 2030. This growth can be attributed to factors such as increased disposable income, urbanization, and a rising preference for health-oriented food products.

Key Drivers of Growth

Rising Health Awareness: Consumers are increasingly aware of the importance of balanced nutrition. Fortified milk products help meet the recommended daily intake of essential nutrients, making them an attractive option for health-conscious individuals.

Prevalence of Nutritional Deficiencies: Many regions, particularly in Asia and Africa, face widespread deficiencies in vitamins and minerals, such as calcium, vitamin D, and iron. Fortified dairy products are an effective tool to address these deficiencies.

Growth of the Functional Food Industry: Functional foods, which provide additional health benefits beyond basic nutrition, are gaining popularity. Fortified milk fits well within this category, offering convenience and enhanced nutritional value.

Supportive Government Policies: Many governments and health organizations promote fortification programs to combat malnutrition. For instance, initiatives by the World Health Organization (WHO) and UNICEF encourage the fortification of staple foods, including dairy products.

Expansion of Retail Channels: The availability of fortified milk and milk products through supermarkets, hypermarkets, and online retail platforms has made these products more accessible to consumers globally.

Challenges and Opportunities

Despite its promising growth, the fortified milk and milk products market faces certain challenges:

High Costs: Fortified products are often priced higher than regular dairy products, making them less accessible to low-income consumers.

Limited Awareness: In certain regions, lack of awareness about the benefits of fortified products remains a barrier to market growth.

Regulatory Hurdles: Complex regulations regarding fortification processes and labeling can hinder market expansion.

However, these challenges present opportunities for innovation and growth. Companies are investing in research and development to create affordable and appealing fortified products. For example, the introduction of plant-based fortified milk alternatives caters to the growing demand for vegan and lactose-free options.

Future Outlook

The fortified milk and milk products market is poised for robust growth, driven by advancements in technology, increasing health consciousness, and supportive government initiatives. Innovations in product development, such as probiotics and omega-3 fortified milk, are expected to further drive consumer interest.

As global nutritional needs evolve, fortified dairy products will continue to play a vital role in combating deficiencies and promoting healthier lifestyles. Companies that prioritize affordability, quality, and consumer education will be well-positioned to thrive in this expanding market.

Key Player Analysis:

Arla Foods Ltd

China Modern Dairy Holdings Ltd.

Dean Foods

Fonterra Co-operative Group

FrieslandCampina

Guangming Dairy Co., Ltd.

Gujarat Cooperative Milk Marketing Federation Ltd.

Nestle S.A.

SanCor Cooperatives United Limited

The Kraft Heinz Company

Segmentation:

By Product Type:

Milk

Milk Powder and Formula

Flavored Milk

Cheese

Dairy-Based Yogurt

Other Products

By Micronutrients:

Vitamins

Minerals

Other Fortifying Nutrients

By Sales Channel:

Modern Trade

Convenience Stores

Departmental Stores

Drug Stores

Online Stores

Other Sales Channel

By Region:

North America

U.S.

Canada

Mexico

Europe

Germany

France

U.K.

Italy

Spain

Rest of Europe

Asia Pacific

China

Japan

India

South Korea

South-east Asia

Rest of Asia Pacific

Latin America

Brazil

Argentina

Rest of Latin America

Middle East & Africa

GCC Countries

South Africa

Rest of the Middle East and Africa

Browse the full report at https://www.credenceresearch.com/report/fortified-milk-and-milk-products-market

Contact:

Credence Research

Please contact us at +91 6232 49 3207

Email: [email protected]

0 notes

Text

Future of Vegan Protein Powder Market: Insights from Industry Experts

The global vegan protein powder market size is projected to reach USD 714.2 million by 2030, registering a CAGR of 9.5% from 2023 to 2030, according to a new report by Grand View Research, Inc. The growth in the consumption of vegan protein powder can be attributed to the increasing health consciousness and evolving lifestyles of the youth in recent times.

Vegan protein powders are typically derived from plant-based sources such as peas, rice, hemp, or soy, providing a diverse range of options to suit different dietary preferences. The market has been fueled by the growing awareness of the benefits associated with vegan and vegetarian lifestyles, coupled with the availability of high-quality vegan protein powders.

Pea is the leading source of vegan protein powder. Pea protein powder offers a favorable nutritional profile, rich in protein, and low in fat and carbohydrates. It is often marketed as a complete protein source due to its amino acid composition. Pea protein powder can be easily incorporated into various recipes, such as protein shakes, smoothies, baked goods, and savory dishes, making it a versatile ingredient that fits diverse dietary preferences and culinary needs.