#Mobile Power Bank Market Forecast

Explore tagged Tumblr posts

Text

We’re not out of the woods yet, though there’s good news in markets: Most economists are forecasting a soft landing in 2024. But a geopolitical hard landing could get in the way.

There are tools and processes to handle macroeconomic challenges. When inflation is too high, the Federal Reserve calibrates monetary policy and interest rates, often coordinating with peer institutions like the Bank of England and the European Central Bank. The results aren’t guaranteed or uniform—economists, investors, and policymakers debate policies and their consequences. However, if higher interest rates slow the economy and reduce inflation without causing a recession, we get a soft landing. That looks like the outcome we’ll ultimately achieve, with inflation down from its peak (though still above the 2 percent target), 353,000 new American jobs in January, and the International Monetary Fund revising its global growth forecast up to 3.1 percent.

The playbook in geopolitics is not as clear, and geopolitics has become a much more pessimistic field than the dismal science. There are wars in the Middle East and Europe, tensions in the Indo-Pacific, and deeper questions about what else the “end of the post-Cold War era” will bring. A geopolitical hard landing would entail multiple, connected, and expanding conflicts and crises that could overwhelm U.S.-led international system. The results could shift the balance of power and upend global markets.

What happens in geopolitics matters for global markets and for the way we live. Today’s geopolitical challenges aren’t transitory, they’re here to stay. They require timely interventions that consider realities of politics and resources, as well as factors like fear, honor, and interest, and the priorities and interests of sovereign nation-states. Too hawkish an approach can lead to overreach and blowback, while too much dovishness invites aggression and escalation. In fact, if the United States and its partners don’t get the trade-offs right in 2024, a geopolitical hard landing looks increasingly plausible.

Today, the world faces cascading conflicts of the type we haven’t seen in decades. After a chaotic withdrawal from Afghanistan in 2021, deterrence failed to prevent Russia’s full-scale invasion of Ukraine in 2022. In 2023, deterrence also failed to prevent Hamas’s terrorist attack on Israel and Iranian-backed regional proxy attacks across the Middle East. Could deterrence one day fail in the Indo-Pacific, the world’s most populous and dynamic region? Where will the cascades stop?

Across Eurasia, the picture is not improving. Two years into a full-scale war defending themselves against Russia, Ukrainians now control more than 80 percent of their territory. But the situation on the ground remains fragile and political gridlock in Washington could result in a reversal of those gains—just recently, the Ukrainian-held town of Avdiivka fell to Russian advances. The Senate just passed by a vote of 70-29 a $95 billion aid package to Ukraine, Israel, and Taiwan—much of which would be spent in the United States restocking depleted weapons supplies—but the bill’s fate is uncertain in the House, and the United States has done its last drawdowns for Kyiv under existing authorities. And while the 27 members of the European Union agreed to a $54 billion package, they don’t have a robust industrial base and can’t produce enough artillery shells to meet their pledge of 1 million rounds by March. Meanwhile, Ukraine is rationing ammunition, and after Russia’s presidential election later this year—no surprises expected there—Vladimir Putin might be emboldened to order a larger mobilization.

Markets have largely priced in the current Russia-Ukraine war. But they may not have accounted for its long-term significance or what the war could mean for Europe. With Russia probing Finland and Estonia, German Defense Minister Boris Pistorius gave a sobering speech detailing what that could mean, saying that Germany needs to take into account that Moscow could “even attack a NATO country” in the next five to eight years.

In the Middle East, the conflicts after Hamas’s terrorist attacks on Israel on Oct. 7 represent the region’s greatest geopolitical test since the Global War on Terror. Israel continues operations to destroy Hamas while Iranian-backed proxies are escalating across at least six different theaters. The global economy and the U.S. Navy—which has been protecting international commerce since the days of the Barbary pirates—are under fire from the Houthis in Yemen. A full-scale regional war is likely not in the cards, although any escalation that brings the United States and Iran into direct confrontation could quickly change that. It’s not hard to see how it could happen, and if Iran—dominated by an 85-year-old Grand Ayatollah Ali Khamenei, the region’s longest-ruling leader—were to succeed in building a nuclear weapon, it could accelerate the chaos.

What has Washington, Wall Street, and global political and financial capitals around the world most worried, though, is the Indo-Pacific. For geopolitical reasons, China is pushing a “dual circulation” economic model and greater self-reliance at home, combined with economic embargoes against not only the United States but also countries such as Australia, Japan, Lithuania, and South Korea. At the same time, most of the tariffs that began under the Trump administration have continued under President Joe Biden, and U.S.-led restrictions have reduced semiconductor exports to China by billions of dollars. The focus on national security-sensitive supply-chain chokepoints in everything from microelectronics, to pharmaceuticals, to critical minerals and rare earths is adding friction to the global economy in ways that create risks and opportunities in other theaters.

The worst-case scenario—a military confrontation between China and neighbors such as Taiwan or the Philippines, backed by the United States—could lead to untold human losses and the greatest economic shock in generations. Bloomberg Economics recently estimated a cost of $10 trillion in the event of a war with the People’s Republic of China over Taiwan.

Historically, shocks like the 1973 Arab oil embargo and Russia’s war on Ukraine have disrupted but not upended global commerce. Today’s dynamic could be different, with acute and connected challenges across all three major regions of Eurasia, not to mention crises not in the headlines every day, such as a belligerent North Korea and contentious Venezuela-Guyana border.

The world as we have known it has assumed the leadership of a credible great power: the United States. Working with its allies and partners, the United States has built and supported the international security and economic architecture that benefits not only Americans but populations around the world. Another assumption was that no other country would have the intention and the capacity to reshape this U.S.-led international order. With challenges to U.S. leadership and a growing closeness amongst China, Iran, Russia, and even North Korea, neither assumption can be taken for granted.

The assumptions may have changed, but as with economics, nothing is inevitable in geopolitics. Last year, some forecasters said there was a 100 percent chance of a recession in 2023. They were wrong. However, soft landings don’t happen on their own—they require leadership across domains.

The war in Europe isn’t what it was a year ago. Ukraine’s 2023 counteroffensive didn’t succeed. Kyiv’s on the defensive, unlikely to take back significant territory in 2024. Russia is pushing forward and now spends 6 percent of its GDP on its military, up from 2.7 percent in 2021, and bolstered by munitions from Iran and North Korea. Meanwhile, as former Google CEO Eric Schmidt warned, Moscow has “caught up in the innovation contest” with Kyiv, domestically producing drones like the Orlan-10 and the Lancet. And after pivoting to Asian markets, Moscow has mitigated Western sanctions, while the IMF recently upped its forecast for Russia’s economic growth to 2.6 percent.

Despite setbacks, several factors still favor Ukraine even if the prospects of victory seem elusive at best. Without a single American in the fight, and at a cost of 5 percent of annual U.S. defense spending, U.S. intelligence now estimates that Moscow has lost as much as 90 percent of its 2022 invasion force. Ukraine is winning the battle of the Black Sea, and the grain corridor out of Odessa was open to over 33 million tons of grain and foodstuffs in the first six months of last year, two-thirds of which went to the developing world. Ukraine is targeting Russian-controlled infrastructure, including around Crimea. Kyiv is also expanding its defense industrial base, launching a Defense Industries Forum with 252 companies from 30 countries.

While Europe has been slow to bolster its own defense infrastructure, there’s momentum. European defense spending was up 6 percent in 2022, led by front-line democracies like Finland, Lithuania, Sweden, and Poland. Still, most of the NATO alliance’s members fail to meet their 2014 Wales Pledge to spend 2 percent of their GDP on defense, and even U.S. defense spending as a percent of GDP is projected to decline over the next 10 years, from 3.1 percent in 2023 to 2.8 percent in 2033. Ukraine cannot hold back a country 28 times its size, and with a population more than three times larger, without Western assistance. Likewise, European—let alone global—security can’t be sustained by diminishing deterrence capabilities.

In the Middle East, the main questions being asked today are about the “day after” in Gaza, or when and how the Houthi attacks in the Red Sea and Iranian-back proxy attacks in Iraq will stop. Tehran has created a new normal of instability and chaos and has little incentive to see a ceasefire hold. The Houthis—once a relatively obscure Shi’a proxy group in Yemen—are now the heroes of much of the Arab street.

Iran’s strategic advantage in the short term has been enhanced by a radically changed information environment, where the “social-mediafication” of war means there are more hours of footage uploaded across all the popular social media platforms than there are seconds of the war. The ramifications are unpredictable—after all, many of the al Qaeda terrorists behind 9/11 were radicalized by pre-algorithmic content they saw coming out of war in Bosnia in the 1990s. Today’s AI-powered algorithms supercharge the risk.

The return to the bad old days, made worse by hyper-targeted online radicalization, needn’t happen, however. The Abraham Accords are holding. The Sunni Gulf countries are focused on transformation projects like Saudi Arabia’s Vision 2030, as they work to ensure that their economic progress is impacted as little as possible by geopolitics. Despite what’s happening in the Red Sea, their engagement with the international business community is largely uninterrupted. The same is true with Qatar.

The two factors that would bring the region back from the brink are restored deterrence against Iran and integration between Israel and the Gulf States. That means recognizing that Iran and its “axis of resistance” are the cause of today’s chaos. It requires working with partners like the UAE and Saudi Arabia, which has relaunched defense talks with Washington and whose senior officials have said repeatedly that they are “absolutely” still interested in normalization with Israel.

The South China Sea and Taiwan Strait are dangerous but, thankfully, at peace. There was good news out of San Francisco from the November meeting between Chinese President Xi Jinping and Biden. China’s responses to Taiwan’s election on Jan. 13 were more restrained than many expected. Now, much depends on how Beijing reacts to William Lai’s inaugural statements when he becomes Taiwan’s president in May.

But while Taiwan occupies our strategic focus today, it’s not the only potential hot spot. China borders 14 countries, giving it more land neighbors than any other state. Beijing has territorial disputes with nearly every country with which it shares a border; each of those disputes presents risks.

Still, maintaining an acceptable peace in the Indo-Pacific is possible. China’s more aggressive posture has driven significant changes in Australia, India, Japan, the Philippines, and South Korea, leading to minilateral coalitions for stability. The Quad, AUKUS, summits with South Korea and Japan, and basing agreements with the Philippines are a few such examples of how these countries are tightening cooperation with each other, and with the United States, Japan has committed to a sea change in defense policy that could turn the Japanese military into the world’s third largest by 2027.

In all this, however, there’s a missing link: Washington doesn’t yet have a strategy for economic engagement in the region. While agreements like the Beijing-backed Regional Comprehensive Economic Partnership expand, the Biden administration’s Indo-Pacific Economic Framework (IPEF) is stalled, and IPEF—which the White House has described as “not a trade agreement”—is not a replacement for the Trans-Pacific Partnership. Washington’s economic policy should communicate that it is not a distant power but a reliable economic partner. As the NATO alliance nears its 75th anniversary, leaders need to be committed both rhetorically and in practice to sustaining peace and prosperity wherever it is challenged.

These geoeconomic forces are of concern to publics around the world. They aren’t, however, the domain of the public sector alone. Many of the same market dynamics bringing us in for an economic soft landing can be assets in global affairs. Global companies cannot succeed in a world at war, and the United States and its allies and partners can’t keep the peace without the growth and innovation made possible by the private sector.

The two sectors where this dynamic is clearest are in energy and emerging technologies. Developing new and sustainable energy sources is one of the best geopolitical and economic moves possible, and it’s largely due to private sector-led innovations that the United States has been the world’s top crude oil producer since 2018 and top liquid natural gas exporter since last year. In the coming years, technologies such as generative artificial intelligence—where the United States is leading—will be wildcards and lifelines in geopolitics, and technology companies will become greater geopolitical stakeholders. Such domains are where democratic societies—with deep and open capital markets, the rule of law, and property rights—have advantages that are sources of legitimacy, stability, and growth.

Building on those advantages this year, when 60 percent of the world’s population is heading to the polls, is a necessity. Billions of people voting for their leaders is welcome news after years of democratic decline globally documented by organizations such as Freedom House. But the coming changes in governments around the world could also make the end of this year very different from its beginning.

In particular, the 2024 U.S. presidential contest may be the most consequential in decades, not to mention one of the most significant geopolitical issues for other countries. Foreign policy is rarely top of mind for voters, but the people’s choice may have even greater ramifications for global affairs than for the economy. Trade and industrial policies adopted by either administration may bolster some sectors at home but elicit pushback abroad, including from partners. New approaches to America’s role in the world can reassure friends or embolden adversaries. And every leader is preparing by hedging their bets for either a Biden or Trump outcome.

In 2023, we understood what an economic hard landing might mean and took timely, prudent actions to prevent it. In 2024, it’s time to recognize that a geopolitical hard landing is possible and for every sector of society to meet this moment with the seriousness it demands.

1 note

·

View note

Text

AI Meets Finance: How Data Science is Revolutionizing the Fintech Industry in 2025

Introduction

The financial world is no longer just numbers on a spreadsheet—it’s a fast-moving ecosystem driven by data, automation, and machine learning. In 2025, data science has become the engine behind fintech innovation. From detecting fraud in milliseconds to automating investment strategies and personalizing banking experiences, data science is transforming the way we save, spend, and invest.

In this blog, let’s explore how data science is shaping the future of fintech and why this synergy is one of the hottest tech trends of the year.

1. Real-Time Fraud Detection

Gone are the days of waiting hours to detect suspicious activity. With real-time data analytics, financial institutions can spot fraud as it happens.

🔹 How it works: Machine learning models analyze transaction patterns and flag anomalies instantly. If something looks off—like an unusual location or spending spike—alerts are triggered immediately.

✅ 2025 Trend: Deep learning combined with behavioral biometrics is enhancing fraud detection accuracy by over 95%.

2. Personalized Banking Experiences

Data science is helping banks tailor their services to individual users. Whether it’s recommending a credit card, offering a loan, or managing your savings goals, AI-driven insights create more meaningful customer experiences.

🔹 Example: AI chatbots trained on customer interaction data can now provide hyper-personalized financial advice 24/7.

3. Robo-Advisors and Smart Investments

Robo-advisors powered by data science use algorithms to manage portfolios based on risk appetite, market trends, and user goals.

🔹 Benefits: Low-cost, automated investment strategies that outperform many human-managed portfolios.

📈 2025 Insight: Generative AI is now being used to simulate multiple economic scenarios for even smarter investment planning.

4. Credit Scoring Reimagined

Traditional credit scores are rigid and often exclude underbanked populations. In 2025, data scientists are redefining credit scoring using alternative data—social behavior, transaction history, and mobile usage.

🔹 Impact: Millions of people without formal credit histories can now access loans and financial services.

5. Predictive Analytics in Lending

Lenders now use predictive analytics to assess loan risk and determine borrower reliability more accurately than ever.

🔹 Example: Models forecast the likelihood of repayment using real-time income, employment patterns, and spending behavior.

💡 Bonus: This reduces default rates and accelerates loan approvals.

6. Algorithmic Trading with AI

In stock markets, milliseconds matter. AI algorithms can analyze market data at lightning speed and execute trades based on complex patterns.

🔹 2025 Trend: Hybrid human-AI trading desks are emerging where analysts work alongside real-time ML models.

7. Blockchain Data Analysis

With the rise of decentralized finance (DeFi), data science tools are being used to analyze blockchain transactions, detect money laundering, and monitor crypto market trends.

🔹 Example: Graph analytics is helping trace illegal wallet activity and prevent crypto scams.

8. Regulatory Technology (RegTech)

Data science is helping financial institutions stay compliant with ever-evolving regulations. By automating compliance checks, reporting, and monitoring, companies save both time and money.

✅ 2025 Insight: NLP models now extract key regulatory updates from documents and integrate them into risk models in real-time.

Conclusion

The fusion of fintech and data science is creating a smarter, faster, and more inclusive financial world. Whether you're a consumer enjoying seamless digital banking or a startup using AI to innovate, data is at the core of it all.

As we move deeper into 2025, one thing is clear: mastering data science isn’t just for techies—it’s essential for anyone shaping the future of finance.

#nschool academy#data science#fintech#ai in finance#machine learning#fraud detection#personalized banking#robo advisors#credit scoring#predictive analytics#algorithmic trading#blockchain analytics#regtech#financial data#smart investing#data driven finance

0 notes

Text

How India’s UPI Global Expansion is Reshaping Cross-Border Payments and Fintech Innovation

India's Unified Payments Interface (UPI) is no longer just a domestic success story. In 2025, UPI is rapidly evolving into a global payments solution, transforming the landscape of cross-border transactions. With partnerships in UAE, Singapore, France, Sri Lanka, and Mauritius, UPI is setting the benchmark for seamless, real-time, and cost-effective payments across borders.

This paradigm shift is not only changing how money moves internationally but also fueling innovation in fintech and financial infrastructure. For professionals and entrepreneurs aiming to ride this wave of transformation, mastering financial systems, risk modeling, and digital payment analytics has never been more important. That’s where the Best Financial Modelling Certification Course in Dubai becomes a valuable asset.

The Global Rise of UPI

Developed by the National Payments Corporation of India (NPCI), UPI began as a revolutionary domestic payment system in 2016. By 2025, it has become a powerful export, setting new standards for real-time payments globally. Through strategic partnerships with global payment processors and foreign governments, India is actively extending UPI to support cross-border remittances, merchant payments, and P2P transfers.

Key Milestones in UPI’s Global Expansion:

UAE & UAE Exchange: NRIs can now remit money from UAE to India directly using UPI-linked platforms.

Singapore-India Integration: Through PayNow-UPI linkage, users can send money using just mobile numbers.

France & Europe Entry: Indian tourists can use UPI at select merchants, starting in Eiffel Tower zones.

Sri Lanka & Mauritius: UPI enables smoother remittance channels and boosts regional fintech cooperation.

This expansion reflects India’s ambition to become a global fintech hub and sets the stage for more digitally integrated economies.

Why UPI Matters in Cross-Border Payments

Cross-border transactions have historically been plagued by high fees, delays, and inefficiencies. Traditional SWIFT-based systems or card payments involve intermediaries, compliance bottlenecks, and costly forex markups.

UPI challenges this with:

Instant transaction settlement

Minimal processing costs

Currency conversion transparency

Mobile-first architecture

These benefits are not just consumer-centric—they offer massive opportunities for fintech startups, banks, and regulators to collaborate and build innovative solutions on top of UPI rails.

Fintech Innovation Fueled by UPI Globalization

UPI’s global journey is unlocking new fintech business models, especially in:

Remittance platforms that integrate UPI for seamless NRI transactions.

Payment aggregators enabling Indian tourists and expats to pay via UPI wallets abroad.

Forex service providers automating real-time currency conversion using AI models trained on UPI flows.

Cross-border lending and microfinance built on UPI-based credit assessment tools.

Startups and established financial institutions are racing to integrate UPI with AI, blockchain, and open banking protocols—redefining how international finance functions.

To understand and model these complex financial interactions, professionals need advanced financial modeling expertise—making the Best Financial Modelling Certification Course in Dubai highly relevant for this fintech boom.

Why Financial Modelling is Critical in the Age of UPI

The success of UPI abroad doesn’t just require technical integrations—it demands deep financial insight, forecasting ability, and risk analysis. Here’s how financial modeling comes into play:

Forecasting UPI transaction volumes and adoption rates in new markets

Evaluating cost savings in remittance and forex conversion models

Building payment aggregator business models with realistic revenue assumptions

Stress testing regulatory and compliance scenarios in cross-border systems

Scenario analysis for transaction-based revenue, FX margins, and digital wallet usage

Enrolling in the Best Financial Modelling Certification Course in Dubai empowers professionals with the skills to construct these complex models, assess financial viability, and make data-driven decisions.

Why Dubai is a Strategic Fintech Learning Hub

Dubai has rapidly positioned itself as a global financial center and fintech sandbox, hosting the Dubai International Financial Centre (DIFC) and events like Fintech Surge. With strong NRI presence and increasing India-UAE fintech collaboration, Dubai is perfectly placed at the intersection of innovation and finance.

For professionals in the region:

Understanding UPI’s impact on Gulf remittances is crucial

Analyzing fintech market entry strategies becomes a core business skill

Valuing cross-border platforms using financial modeling is in high demand

Hence, the Best Financial Modelling Certification Course in Dubai isn’t just a course—it’s a gateway to thriving in the future of global finance.

Future Outlook: UPI as a Global Standard?

India’s fintech diplomacy is setting the stage for UPI to become an internationally accepted payment infrastructure. Future prospects include:

Integration with CBDCs (Central Bank Digital Currencies)

UPI-based wallets for international students and tourists

Wider ASEAN, European, and African expansion

Private UPI APIs powering remittance APIs for fintech apps globally

Professionals who understand the financial impact of these developments will be better positioned to lead, advise, and innovate. This makes financial modeling education more essential than ever.

Conclusion: Be at the Forefront of Fintech’s Next Chapter

The global expansion of UPI is more than a technical upgrade—it’s a redefinition of how cross-border payments work. It’s driving innovation, reducing barriers, and changing the way businesses and individuals transact internationally.

To fully capitalize on this revolution, professionals must blend technical awareness with strong financial foundations. That’s why the Best Financial Modelling Certification Course in Dubai is your ideal launchpad into the next generation of global fintech leadership.

0 notes

Text

Card Connector Market Size Powering Seamless Connectivity Across Devices

The Card Connector Market size is gaining significant traction as the demand for compact, reliable, and high-speed data transmission interfaces continues to rise in electronics and industrial systems. According to Market size Research Future, the market is projected to grow from USD 1.7 billion in 2023 to USD 3.5 billion by 2030, registering a CAGR of 10.3% over the forecast period. These connectors serve as essential components for ensuring smooth communication and efficient storage solutions in everything from consumer electronics to industrial equipment.

Overview

Card connectors are electromechanical components used to establish electrical connections with various types of memory and interface cards such as SD cards, SIM cards, PCIe cards, CF cards, and more. These connectors enable secure and seamless integration of removable memory and communication modules within a device's hardware infrastructure.

With increasing miniaturization and multifunctionality in electronic gadgets, manufacturers are integrating card connectors that provide reliability, ease of installation, and compatibility with advanced protocols. The rising adoption of smartphones, tablets, point-of-sale (POS) systems, embedded systems, and automotive infotainment solutions continues to push demand forward.

Market size Segmentation

By Type:

Memory Card Connectors (SD, MicroSD, Compact Flash)

SIM Card Connectors

Smart Card Connectors

Edge Card Connectors

PC Card Connectors

By Application:

Consumer Electronics

Industrial Automation

Telecommunications

Automotive

Banking & Finance (ATMs, Smart Cards)

Medical Devices

By End-Use:

OEMs (Original Equipment Manufacturers)

Aftermarket

By Region:

North America

Europe

Asia-Pacific

Latin America

Middle East & Africa

Key Market size Trends

Miniaturization of Electronic Devices: As consumer electronics become more compact and multifunctional, demand for small, high-density card connectors is increasing.

Rising Use in Automotive Electronics: Infotainment, GPS, and telematics systems in vehicles are integrating SD and SIM card slots for multimedia and communication.

Growth in IoT Devices: IoT devices often require secure data storage and network connectivity, driving usage of SIM and microSD card connectors.

Push for Enhanced Data Speeds: Connectors compatible with USB 3.0, PCIe, and UHS-II interfaces are gaining popularity for high-speed applications.

Adoption in Medical and Industrial Automation: Devices in medical diagnostics and factory automation use card connectors for firmware updates, memory expansion, and secure data handling.

Segment Insights

Memory Card Connectors Lead the Market size: Due to widespread usage in smartphones, cameras, and embedded devices, memory card connectors hold the largest market share.

Consumer Electronics Remain the Primary Application Segment: With billions of mobile and portable devices in circulation globally, the consumer electronics segment continues to dominate demand.

Asia-Pacific Emerges as a Growth Leader: Countries like China, Japan, and South Korea are leading in electronics manufacturing, boosting demand for high-precision card connectors.

End-User Insights

OEMs focus on sourcing compact, durable, and cost-effective card connectors to integrate into their final product assemblies.

Telecom Providers rely on SIM card connectors for mobile devices, routers, and communication modules.

Industrial Automation Firms deploy card connectors in machine control systems and programmable logic controllers (PLCs).

Automotive Manufacturers utilize card connectors in dashboards, navigation units, and smart keys.

Key Players

Several key companies are shaping the future of the card connector market by investing in innovation, automation, and high-speed compatibility:

TE Connectivity Ltd.

Hirose Electric Co., Ltd.

Amphenol Corporation

Molex, LLC (a Koch Industries company)

Japan Aviation Electronics Industry, Ltd.

Yamaichi Electronics Co., Ltd.

3M Company

Samtec, Inc.

C&K Components

AVX Corporation

These players are expanding their product portfolios to meet demand from evolving application areas including embedded computing, AI hardware, and advanced robotics.

Conclusion

The Card Connector Market size is a vital backbone for data communication, memory storage, and device integration in today’s fast-paced digital environment. From smartphones and vehicles to industrial machines and medical devices, these components are enabling smarter, faster, and more connected systems. As digital infrastructure evolves and demand for robust, compact, and multifunctional interfaces increases, card connectors will continue to be an indispensable element of next-gen technology ecosystems.

Trending Report Highlights

Functional Printing Market size

Predictive Emission Monitoring System (PEMS) Market size

Soft Robotics Market size

Photoelectric Sensor Market size

Laser Sensors Market size

Proximity Sensor Market size

Wi-Fi Adapter Card Market size

5G Processor Market size

Kids Tablet Market size

Laser Projector Market size

Underwater Lighting Market size

Static Random-Access Memory (SRAM) Market size

0 notes

Text

Japan Context-Aware Computing Market Study: Comprehensive Segmentation and Forecast

Prophecy Market Insights Research, a top-tier global market intelligence firm, has unveiled a detailed report on the global Japan Context-Aware Computing Market. Packed with valuable insights, this report explores evolving market trends, both globally and regionally, while offering forward-looking forecasts. It dives deep into market segmentation, uncovers key growth drivers, and maps out the competitive landscape. Whether you're a stakeholder, investor, or industry enthusiast, this report is your gateway to understanding the shifting dynamics and future opportunities within the Japan Context-Aware Computing Market space. Base Year: 2024 Forecast Period: 2025-2035 Get a free sample of the report: https://www.prophecymarketinsights.com/market_insight/Insight/request-sample/3883 Strategic Insights to Drive Success The report acts as a catalyst for impactful change, providing organizations with the insights and tools to spot and capitalize on growth opportunities. By shedding light on key market trends, it empowers businesses to stay ahead of the curve and outpace competitors. As a strategic asset, it helps companies strengthen their foothold in the Japan Context-Aware Computing Market market. With data-backed intelligence, decision-makers can craft smarter strategies and drive success with confidence. Forecasting Excellence: Leverage advanced predictive models for accurate trend forecasts. Simplified Data Visualization: Understand complex insights through user-friendly interactive tools. Sector-Specific Trends: Address industry-specific challenges and opportunities. Agility in Action: Adapt swiftly to market changes with real-time updates. Competitive Strategy Analysis: Analyze the strategies of top-performing companies. Segmentation and Classification of the Report:Segmentation is a powerful strategy that divides a broad market into targeted groups based on common traits like demographics, behaviors, needs, or preferences. This approach enables businesses to tailor their offerings and marketing efforts to meet the specific demands of each segment. By understanding the unique characteristics of these groups, companies can enhance customer satisfaction, allocate resources more efficiently, and pursue growth with greater precision and impact Context-Aware Computing Market, By Vendor (Device Manufactures, Mobile Network Operators, Online and Web, and Social Networking Vendors), End-User Industry (Banking/Insurance, Healthcare, Entertainment, BFSI, Consumer Electronics, Automotive, Telecommunication, Logistics and Transportation, and Other End-user Industries), and By Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Trends, Analysis and Forecast till 2030 Request for PDF Brochure of This Report: https://www.prophecymarketinsights.com/market_insight/Insight/request-pdf/3883 Top Companies in the Japan Context-Aware Computing Market:This section provides a thorough examination of the industry's key players, showcasing their strategic approaches, market standing, and competitive advantages. It highlights both the strengths and challenges faced by established corporations, while also bringing attention to rising competitors influencing market dynamics. By leveraging SWOT analysis and benchmarking metrics, this evaluation equips businesses with the insights needed to understand competitive movements, sharpen their strategies, and capitalize on emerging opportunities within the Japan Context-Aware Computing Market market. Note: The companies listed above represent only a portion of the complete competitive landscape. The report also accounts for regional and local players within its market estimation model. For comprehensive competitive intelligence covering domestic companies across nearly 30 countries, we encourage you to submit a request for full access to the detailed data. Get Flat 30% OFF on Japan Context-Aware Computing Market: https://www.prophecymarketinsights.com/market_insight/Insight/request-discount/3883

Key Questions Addressed 1. What are the primary forces driving Japan Context-Aware Computing Market's expansion? 2. Which firms dominate Japan Context-Aware Computing Market and how do they preserve their competitiveness? 3. How do technology advancements impact the industry's future? 4. What are the primary problems and opportunities facing businesses? Key Highlights of Japan Context-Aware Computing Market Research Report: In-depth analysis of the Japan Context-Aware Computing Market market. Assessment of market size and growth trends. Evaluation of the competitive landscape, focusing on key players and their strategies. Insights into consumer behavior regarding Japan Context-Aware Computing Market usage. Identification of emerging trends and opportunities within the Japan Context-Aware Computing Market market. Regional analysis, showcasing variations in Japan Context-Aware Computing Market and competitive dynamics. Industry best practices for optimizing Japan Context-Aware Computing Market effectively. Market projections and future outlook to support informed decision-making. . Gain a Strategic AdvantageThe Japan Context-Aware Computing Market Report delivers the critical insights necessary to thrive in a competitive market. About Us: Prophecy Market Insights is a leading provider of market research services, offering insightful and actionable reports to clients across various industries. With a team of experienced analysts and researchers, Prophecy Market Insights provides accurate and reliable market intelligence, helping businesses make informed decisions and stay ahead of the competition. The company's research reports cover a wide range of topics, including industry trends, market size, growth opportunities, competitive landscape, and more. Prophecy Market Insights is committed to delivering high-quality research services that help clients achieve their strategic goals and objectives. Contact Us: Prophecy Market Insights Website- https://www.prophecymarketinsights.com US toll free: +16893053270

0 notes

Text

Green Hydrogen Market Accelerates as Governments and Industry Race Toward Net-Zero Goals

Market Square Insights Identifies Green Hydrogen as a Central Pillar of the Global Clean Energy Transition

The Green Hydrogen market is experiencing explosive growth, driven by the global urgency to decarbonize energy systems, reduce industrial emissions, and secure sustainable fuel alternatives. As highlighted in a new report by Market Square Insights, green hydrogen is becoming a cornerstone of clean energy infrastructure, with robust investment pipelines and policy support fueling industry momentum.

Market Overview

Green hydrogen is produced through electrolysis of water using renewable energy sources like solar, wind, or hydropower—unlike grey or blue hydrogen, which rely on fossil fuels. As a zero-emission energy carrier, green hydrogen holds immense promise across sectors including power generation, heavy industry, mobility, and aviation.

For In depth Information Get Free Sample Copy of this Report@

Europe, Japan, and Australia have been early movers, launching national hydrogen strategies. Meanwhile, emerging economies such as India, Chile, and Saudi Arabia are investing in mega-scale electrolyzer projects and green hydrogen corridors.

Green Hydrogen Market key Players

Air Liquide

Siemens Energy

Plug Power Inc.

Nel ASA

ITM Power

Linde plc

Cummins Inc.

Engie SA

Ballard Power Systems

Bloom Energy

More Selling Reports: -

Industrial demand is surging from applications in:

Steel and cement manufacturing (as a carbon-neutral process heat source)

Green ammonia and methanol production

Fuel-cell-powered transport including trucks, buses, and trains

DROC Analysis: Drivers, Restraints, Opportunities, and Challenges

Drivers:

Global decarbonization commitments and government subsidies

Rapid cost decline in renewable electricity and electrolyzer technology

Corporate sustainability pledges from energy giants and chemical producers

Restraints:

High initial capital expenditure for production infrastructure

Limited hydrogen transport and storage infrastructure in key markets

Opportunities:

Development of international green hydrogen trade routes

Integration into existing LNG terminals and refining operations

Emerging applications in shipping and long-haul aviation

Challenges:

Scaling up from pilot to commercial-scale production at competitive cost

Policy inconsistencies and lack of unified certification standards

Need for skilled workforce and public-private partnerships

Market Trends and Forecast

Emerging trends include:

Surge in electrolyzer gigafactory announcements in EU, US, and India

Growth of green hydrogen hubs near renewable energy zones

Collaboration between oil majors, tech firms, and governments

Expansion of blended hydrogen-natural gas pipelines and microgrids

For In depth Information Get Free Sample Copy of this Report@

About Market Square Insights:

At Market Square Insights, we understand research requirements and help a client in taking informed business-critical decisions. The company focuses on helping the clients achieve transformational growth by helping them make crucial business decisions. At Market Square Insights, we diligently study emerging trends across various industries at global and regional levels, to identify potential opportunities for our client.

Contact us:

Market Square Insights,

56/3, Kawade Nagar,

Sai Mandir Road, Near HDFC Bank,

New Sangavi, Pune-61

IND: +91 9405802422

0 notes

Text

Software Testing Market Growth Analysis, Market Dynamics, Key Players and Innovations, Outlook and Forecast 2025-2032

According to a new market analysis, the global Software Testing market was valued at USD 103.68 billion in 2024 and is projected to reach USD 243.78 billion by 2032, growing at a Compound Annual Growth Rate (CAGR) of 14.0% during the forecast period (2025–2032). The growth is driven by rising demand for high-quality software, digital transformation across industries, and adoption of agile/DevOps methodologies.

What is Software Testing?

Software testing is a critical quality assurance process involving verification and validation of applications through manual or automated methods. It ensures products meet specified requirements while identifying defects before deployment. The testing landscape encompasses methodologies including functional testing, performance testing, security testing, and compatibility testing, becoming increasingly vital with rising cyber threats and complex software ecosystems.

Key Market Drivers

1. Acceleration of Digital Transformation

The rapid shift to digital platforms across banking, healthcare, and retail has increased testing demands by over 60% since 2020. Major banks like HSBC increased test automation investments by 60% in 2023 to support cloud migrations. Telecom providers such as Verizon adopted AI-based testing frameworks, reducing time-to-market by 30% for 5G applications. This reflects an industry trend where testing is embedded throughout development pipelines, especially in regulated sectors where compliance and uptime are critical.

2. Mobile Application Explosion

With 255 billion mobile app downloads annually, specialized testing for functionality, UI/UX, and cross-device compatibility has become essential. Flipkart reported a 45% reduction in production bugs after implementing continuous mobile testing. The emergence of progressive web apps (PWAs) and 5G applications further drives demand for advanced network simulation and edge computing tests.

Market Challenges

The high cost of AI-driven testing tools and global skills shortages in advanced methodologies remain key restraints. Effective utilization requires professionals skilled in both testing and machine learning - a rare combination facing a 40% talent gap. Integration challenges with existing ecosystems further slow adoption, despite clear long-term benefits in test automation.

Opportunities Ahead

Asia-Pacific presents the fastest growth (18.7% CAGR) with mobile app testing demand in China and outsourcing growth in India. The rise of Testing-as-a-Service models offers on-demand infrastructure access, while AI applications enable predictive test case generation and self-healing scripts. IoT expansion also creates new testing markets for connected device validation.

Regional Market Insights

North America leads with 35% market share, driven by stringent compliance requirements (HIPAA, PCI-DSS) and $18B+ automation investments.

Europe shows strong security testing demand post-GDPR, with Germany/UK accounting for 60% of regional spending.

Asia-Pacific growth is fueled by digital transformation initiatives valued at $178B, particularly in China's mobile app ecosystem.

Competitive Landscape

Accenture and TCS dominate with 20% combined market share, serving enterprise clients across BFSI and healthcare.

IBM and Capgemini lead in AI-powered solutions, while specialists like Tricentis focus on DevOps testing.

Market Segmentation

By Testing Type:

Functional Testing

Non-Functional Testing

By Deployment Mode:

On-Premise

Cloud

By Application:

Mobile Applications

Web Applications

By Region:

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

Report Scope & Offerings

This comprehensive analysis includes:

2024-2032 market forecasts with 14.0% CAGR projections

Competitive intelligence on 14+ key players

SWOT and trend analysis across testing types and regions

Access Full Report: https://www.intelmarketresearch.com/Software-Testing-Market-Report

Download Sample: Software Testing Market Sample Report

About Intel Market Research

Intel Market Research delivers actionable insights in technology and infrastructure markets. Our data-driven analysis leverages:

Real-time infrastructure monitoring

Techno-economic feasibility studies

Competitive intelligence across 100+ countries Trusted by Fortune 500 firms, we empower strategic decisions with precision.

+91 9169164321

Website: https://www.intelmarketresearch.com

Follow us on LinkedIn: https://www.linkedin.com/company/intel-market-research

0 notes

Text

Software Testing Market Growth Analysis, Market Dynamics, Key Players and Innovations, Outlook and Forecast 2025-2032

According to a new market analysis, the global Software Testing market was valued at USD 103.68 billion in 2024 and is projected to reach USD 243.78 billion by 2032, growing at a Compound Annual Growth Rate (CAGR) of 14.0% during the forecast period (2025–2032). The growth is driven by rising demand for high-quality software, digital transformation across industries, and adoption of agile/DevOps methodologies.

What is Software Testing?

Software testing is a critical quality assurance process involving verification and validation of applications through manual or automated methods. It ensures products meet specified requirements while identifying defects before deployment. The testing landscape encompasses methodologies including functional testing, performance testing, security testing, and compatibility testing, becoming increasingly vital with rising cyber threats and complex software ecosystems.

Key Market Drivers

1. Acceleration of Digital Transformation

The rapid shift to digital platforms across banking, healthcare, and retail has increased testing demands by over 60% since 2020. Major banks like HSBC increased test automation investments by 60% in 2023 to support cloud migrations. Telecom providers such as Verizon adopted AI-based testing frameworks, reducing time-to-market by 30% for 5G applications. This reflects an industry trend where testing is embedded throughout development pipelines, especially in regulated sectors where compliance and uptime are critical.

2. Mobile Application Explosion

With 255 billion mobile app downloads annually, specialized testing for functionality, UI/UX, and cross-device compatibility has become essential. Flipkart reported a 45% reduction in production bugs after implementing continuous mobile testing. The emergence of progressive web apps (PWAs) and 5G applications further drives demand for advanced network simulation and edge computing tests.

Market Challenges

The high cost of AI-driven testing tools and global skills shortages in advanced methodologies remain key restraints. Effective utilization requires professionals skilled in both testing and machine learning - a rare combination facing a 40% talent gap. Integration challenges with existing ecosystems further slow adoption, despite clear long-term benefits in test automation.

Opportunities Ahead

Asia-Pacific presents the fastest growth (18.7% CAGR) with mobile app testing demand in China and outsourcing growth in India. The rise of Testing-as-a-Service models offers on-demand infrastructure access, while AI applications enable predictive test case generation and self-healing scripts. IoT expansion also creates new testing markets for connected device validation.

Regional Market Insights

North America leads with 35% market share, driven by stringent compliance requirements (HIPAA, PCI-DSS) and $18B+ automation investments.

Europe shows strong security testing demand post-GDPR, with Germany/UK accounting for 60% of regional spending.

Asia-Pacific growth is fueled by digital transformation initiatives valued at $178B, particularly in China's mobile app ecosystem.

Competitive Landscape

Accenture and TCS dominate with 20% combined market share, serving enterprise clients across BFSI and healthcare.

IBM and Capgemini lead in AI-powered solutions, while specialists like Tricentis focus on DevOps testing.

Market Segmentation

By Testing Type:

Functional Testing

Non-Functional Testing

By Deployment Mode:

On-Premise

Cloud

By Application:

Mobile Applications

Web Applications

By Region:

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

Report Scope & Offerings

This comprehensive analysis includes:

2024-2032 market forecasts with 14.0% CAGR projections

Competitive intelligence on 14+ key players

SWOT and trend analysis across testing types and regions

Access Full Report: https://www.intelmarketresearch.com/Software-Testing-Market-Report

Download Sample: Software Testing Market Sample Report

About Intel Market Research

Intel Market Research delivers actionable insights in technology and infrastructure markets. Our data-driven analysis leverages:

Real-time infrastructure monitoring

Techno-economic feasibility studies

Competitive intelligence across 100+ countries Trusted by Fortune 500 firms, we empower strategic decisions with precision.

+91 9169164321

Website: https://www.intelmarketresearch.com

Follow us on LinkedIn: https://www.linkedin.com/company/intel-market-research

0 notes

Text

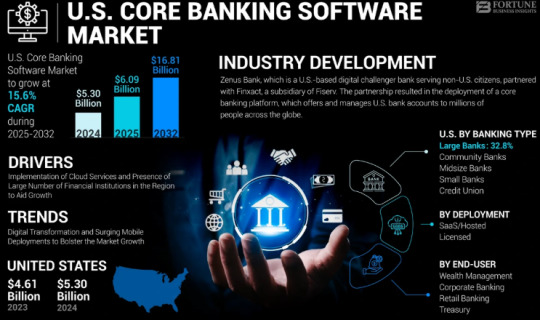

The U.S. Core Banking Software Market Size, Share | CAGR 15.6% during 2024-2030

The U.S. core banking software market Size was valued at USD 5.30 billion in 2024 and is projected to grow from USD 6.09 billion in 2025 to USD 16.81 billion by 2032, exhibiting a CAGR of 15.6% during the forecast period. Driven by the modernization of legacy banking systems, increasing customer demand for digital-first banking experiences, and adoption of cloud-native platforms, the U.S. banking industry is rapidly shifting toward agile, API-driven core banking systems.

Key Market Highlights:

2024 U.S. Market Size: USD 5.30 billion

2025 U.S. Market Size: USD 6.09 billion

2032 U.S. Market Size: USD 16.81 billion

CAGR (2025–2032): 15.6%

Market Outlook: Cloud-first transformation of retail and commercial banking infrastructure

Leading Players in the U.S. Market:

FIS (Fidelity National Information Services)

Finastra

Temenos USA

Oracle Financial Services Software

Jack Henry & Associates

SAP America

nCino

Infosys (EdgeVerve)

Thought Machine

Backbase

Mambu

Q2 Holdings

TCS BaNCS (U.S. operations)

Request Free Sample PDF: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/u-s-core-banking-software-market-107481

Market dynamics:

Growth Drivers:

Legacy System Modernization: Traditional banks are replacing decades-old core systems to enable agility, scalability, and faster innovation.

Rise of Digital-Only Banks & Neobanks: Challenger banks are opting for coreless and cloud-native platforms to deliver real-time banking experiences.

Regulatory Mandates: U.S. regulations increasingly demand transparency, real-time compliance, and modular tech stacks.

Omnichannel and Mobile Banking Boom: Surge in mobile-first customers is accelerating demand for flexible and API-driven core systems.

Adoption of BaaS & Embedded Finance: Banks are embedding financial services into non-banking platforms, requiring agile backend core systems.

Key Opportunities:

AI-Powered Core Modernization: Integration of AI for risk scoring, predictive analytics, and process automation

Cloud Migration Projects: Large-scale re-platforming from on-premise to cloud-native or hybrid models

Banking-as-a-Service (BaaS): U.S. institutions offering core services to fintechs and enterprises

Open Banking APIs: Ecosystem expansion through developer-friendly, regulatory-compliant APIs

Personalized Customer Experience Engines: Data-driven personalization built directly into core systems

Technology & Application Scope:

Deployment Models:

Cloud-native

On-premises

Hybrid (transitional)

Core Features:

Customer and account management

Payments and transaction processing

Lending and credit modules

Risk and compliance automation

Real-time reporting and dashboards

Target Users:

Retail banks

Credit unions

Community banks

Commercial and corporate banks

Neobanks and fintechs

Speak to Analysts: https://www.fortunebusinessinsights.com/enquiry/speak-to-analyst/u-s-core-banking-software-market-107481

Recent Developments:

January 2024 – A top-10 U.S. bank announced a $700M multiyear plan to migrate its entire core system to a cloud-native microservices architecture with Temenos and AWS.

October 2023 – Jack Henry & Associates launched a new AI-powered fraud prevention module integrated into its core platform, reducing false positives by 45%.

July 2023 – A mid-sized credit union in the Midwest completed a legacy core banking system overhaul, leading to a 22% increase in customer satisfaction due to improved digital banking capabilities.

Trends Shaping the U.S. Core Banking Market:

Composable Banking Architecture: Shift toward modular, plug-and-play architecture

AI & Machine Learning in Core: Real-time fraud detection, dynamic credit risk models, and intelligent automation

Blockchain Integration: Experiments in real-time settlement, decentralized identity, and smart contracts

Low-Code/No-Code Customization: Democratization of development within banking teams

Cybersecurity Embedded in Core: Zero-trust frameworks and secure-by-design approaches

Conclusion:

The U.S. core banking software market is undergoing a significant transformation, driven by rising customer expectations, digital competition, and the imperative to stay compliant and resilient. The future belongs to banks that embrace modular, cloud-native, and API-driven core platforms—designed to scale, personalize, and evolve. As the market accelerates toward modernization, technology vendors and banks alike are finding immense value in flexible ecosystems, open banking capabilities, and real-time innovation.

Frequently Asked Questions: 1. What is the projected value of the global market by 2032?

2. What was the total market value in 2024?

3. What is the expected compound annual growth rate (CAGR) for the market during the forecast period of 2025 to 2032?

4. Which industry segment dominated market in 2023?

5. Who are the major companies?

6. Which region held the largest market share in 2023?

#U.S. Core Banking Software Market Share#U.S. Core Banking Software Market Size#U.S. Core Banking Software Market Industry#U.S. Core Banking Software Market Driver#U.S. Core Banking Software Market Growth#U.S. Core Banking Software Market Analysis#U.S. Core Banking Software Market Trends

0 notes

Text

Mobile Document Reader Market: Industry Overview and Analysis 2025–2032

MARKET INSIGHTS

The global Mobile Document Reader Market size was valued at US$ 623.4 million in 2024 and is projected to reach US$ 1.23 billion by 2032, at a CAGR of 8.8% during the forecast period 2025-2032.

Mobile document readers are portable devices or software applications designed to scan, authenticate, and process identity documents such as passports, driver’s licenses, and ID cards. These solutions incorporate advanced technologies including OCR (Optical Character Recognition), RFID (Radio Frequency Identification), and biometric verification to enhance security and streamline identity verification processes across multiple industries.

The market growth is driven by increasing security concerns, rising adoption of digital identity verification, and stringent government regulations for identity authentication. Key players such as Thales, IDEMIA, and Veridos (G&D) are expanding their product portfolios with AI-powered mobile readers capable of detecting sophisticated forgeries. The ID readers segment holds significant market share due to widespread deployment in border control and financial institutions.

MARKET DYNAMICS

MARKET DRIVERS

Rising Demand for Secure Identity Verification to Accelerate Market Growth

The global surge in identity fraud cases is driving substantial demand for mobile document readers. With identity theft incidents increasing by over 35% annually across key regions, organizations are prioritizing advanced verification solutions. Mobile document readers provide real-time authentication of IDs, passports, and other critical documents through NFC and OCR technologies, significantly reducing fraud risks. Governments worldwide are mandating stricter identity verification protocols, particularly in aviation and financial sectors, creating sustained demand.

Digital Transformation in Border Control Creating Significant Market Opportunities

Border control agencies are undergoing massive digital transformations, with over 65 countries implementing e-gate systems requiring mobile document verification. The global biometric passport adoption rate now exceeds 85%, creating compatible infrastructure for mobile reader deployment. Recent technological advancements enable handheld devices to authenticate document security features like holograms, microprinting, and RFID chips with over 99% accuracy. Several international airports have already deployed mobile document readers for faster passenger processing, reducing wait times by an average of 40%.

Expansion of Mobile Banking Services Driving Financial Sector Adoption

The financial sector’s rapid shift toward digital onboarding is creating substantial growth avenues. Over 70% of global banks now offer mobile account opening services requiring robust identity verification. Mobile document readers enable customers to remotely verify identities by scanning government-issued IDs while detecting fraudulent alterations. This technology has reduced customer acquisition costs by approximately 30% while improving compliance with KYC regulations. Major financial institutions are increasingly integrating these solutions into their mobile apps following successful pilot programs showing over 90% fraud detection accuracy rates.

MARKET RESTRAINTS

High Implementation Costs Limiting Small Enterprise Adoption

While larger organizations are rapidly adopting mobile document readers, smaller enterprises face significant cost barriers. Enterprise-grade solutions with advanced verification capabilities typically require substantial upfront investments ranging from $5,000 to $20,000 per unit. Additional expenses for system integration, staff training, and software updates further strain budgets. Many SMBs consequently rely on manual verification methods despite higher long-term operational costs, creating a substantial adoption gap in the market.

Data Privacy Concerns Creating Regulatory Hurdles

Growing data privacy regulations worldwide pose complex compliance challenges for mobile document reader providers. The processing and storage of sensitive biometric and identity data must comply with increasingly stringent regional regulations that continue evolving. Recent legislative changes have increased certification requirements by over 40% in key markets, delaying product launches. Some organizations hesitate to adopt these solutions due to potential liabilities associated with data breaches involving personally identifiable information.

Technical Limitations in Document Recognition Accuracy

Despite significant advancements, mobile document readers still face challenges with certain document types. Handled documents with wear and tear show approximately 15% higher rejection rates compared to pristine specimens. Recognition accuracy for non-Latin character documents remains below 90% for some manufacturers, creating difficulties in multicultural environments. These technical limitations require ongoing R&D investments to address, particularly as counterfeiters develop more sophisticated fraudulent documents that test detection capabilities.

MARKET OPPORTUNITIES

Emerging Smart City Infrastructure Creating New Use Cases

Global smart city initiatives present significant growth potential, with intelligent identity verification becoming integral to urban services. Pilot programs in several cities have successfully integrated mobile document readers with public transportation, healthcare access, and municipal services. These implementations have demonstrated efficiency improvements exceeding 30% in service delivery times while reducing identity fraud incidents by approximately 25%. As smart city investments are projected to grow significantly, demand for compatible mobile verification solutions will expand proportionally.

Advancements in AI Document Authentication Opening New Markets

Recent breakthroughs in artificial intelligence are enabling mobile document readers to analyze sophisticated security features previously undetectable by portable devices. New machine learning algorithms can authenticate documents by assessing over 200 security parameters with accuracy rates exceeding 98%. This technological leap is creating opportunities in high-security sectors like government facilities and critical infrastructure that previously required stationary verification equipment. Early adopters report reducing equipment costs by 60% while maintaining equivalent security standards.

Rental and Subscription Models Expanding Market Accessibility

Innovative business models are emerging to address cost barriers, particularly for intermittent users. Several leading providers now offer subscription-based services with pay-per-scan pricing starting under $1 per verification. This approach has shown particular success in the hospitality industry, where seasonal businesses need verification capabilities without substantial capital investments. Early data suggests these flexible models could expand the total addressable market by approximately 35% by making the technology accessible to smaller operators.

MARKET CHALLENGES

Increasing Document Standardization Complexity

The proliferation of new document formats and security features creates ongoing challenges for manufacturers. With over 70 countries implementing updated identity documents in the past five years, maintaining comprehensive verification databases requires continuous updates. Some jurisdictions issue multiple document versions simultaneously, while others incorporate unconventional security elements that standard readers struggle to authenticate. This variability forces manufacturers to dedicate approximately 25% of R&D budgets to ongoing database maintenance rather than innovation.

Intense Competition Driving Margin Pressures

The market’s rapid growth has attracted numerous competitors, including both established security firms and agile startups. This intense competition has reduced average selling prices by nearly 20% over three years while raising customer expectations for features and accuracy. Smaller players particularly struggle with profitability as they attempt to match the R&D capabilities of market leaders. The resulting consolidation trend has seen over 15 acquisitions in the sector during the past 24 months, reshaping the competitive landscape.

User Experience Expectations Outpacing Technology Development

End users increasingly demand seamless verification experiences comparable to consumer mobile applications, creating development challenges. Average acceptable verification times have decreased from 15 seconds to under 8 seconds in three years, requiring significant processing optimizations. Simultaneously, users expect flawless performance across diverse environmental conditions including low light and extreme angles. Meeting these expectations while maintaining security standards requires substantial engineering resources, with some manufacturers reporting development cycle increases exceeding 30%.

MOBILE DOCUMENT READER MARKET TRENDS

Rising Demand for Enhanced Security and Identity Verification to Drive Market Growth

The global Mobile Document Reader market is experiencing significant growth, driven by the increasing need for secure identity verification across industries. With a projected market value of $79.4 million by 2032, growing at a CAGR of 5.4%, advancements in document authentication technologies are playing a pivotal role. Mobile document readers are increasingly being adopted in sectors such as security, banking, and travel due to their ability to rapidly verify IDs, passports, and other critical documents with high accuracy. The integration of AI-based optical character recognition (OCR) and machine learning has further enhanced their capability to detect fraudulent documents efficiently. This trend is particularly strong in regions with stringent security regulations, where manual verification is being replaced by automated systems to reduce human error and processing time.

Other Trends

Expansion of Mobile Check-In and Digital Border Control

The rise of mobile check-in systems in airlines and digital border control solutions is further fueling the adoption of mobile document readers. Airlines and airports worldwide are deploying these devices to streamline passenger verification processes, reducing wait times and improving operational efficiency. For instance, biometric-enabled document readers are increasingly being used at immigration checkpoints to authenticate passports and visas within seconds. Similarly, hotels and travel agencies are leveraging these devices to enhance guest onboarding, ensuring compliance with anti-fraud regulations while delivering a seamless customer experience.

Growing Adoption in Financial Institutions

Banks and financial services are rapidly integrating mobile document readers into their Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance workflows. With increasing regulatory scrutiny, financial institutions require reliable tools to verify customer identities and prevent fraudulent activities. Mobile document readers enable instant verification of government-issued IDs, reducing the risk of identity theft and improving compliance efficiency. Moreover, the shift toward digital banking has accelerated the demand for portable verification solutions that can be used both in-branch and remotely. Industry-leading players such as Thales and IDEMIA are developing advanced readers with NFC and RFID capabilities to cater to evolving banking needs.

COMPETITIVE LANDSCAPE

Key Industry Players

Technology Leaders Accelerate Innovation to Capture Market Share in Mobile ID Verification

The global mobile document reader market exhibits a moderately fragmented competitive landscape, with established technology providers competing alongside specialized solution developers. Thales Group emerges as a dominant player, leveraging its biometric and identity verification expertise across aviation, government, and financial sectors worldwide. In 2024, Thales maintained approximately 18% market share in mobile ID reader solutions, supported by strategic acquisitions in digital identity technologies.

IDEMIA and Veridos (G&D) have solidified their positions through advanced passport reading technologies, collectively accounting for nearly 25% of the professional-grade mobile document verification market. Their growth stems from increasing demand for next-generation border control solutions and mobile police applications, particularly in Europe and North America.

The competitive intensity continues to rise as mid-sized players like Access IS and Regula Baltija expand their product lines with AI-powered document authentication features. These companies have successfully penetrated the hospitality and banking verticals by offering cost-effective, compact readers with high accuracy rates exceeding 98.5% for passport verification.

Meanwhile, Chinese manufacturers including China-Vision and Wintone are rapidly gaining traction in APAC markets through competitive pricing and localized solutions. Their success demonstrates how regional players can challenge global leaders by addressing specific compliance requirements and integration needs in emerging economies.

List of Key Mobile Document Reader Providers

Thales Group (France)

IDEMIA (France)

Veridos (G&D) (Germany)

ARH Inc. (Hungary)

Access IS (UK)

Regula Baltija (Latvia)

China-Vision (China)

Prehkeytec (Germany)

DILETTA (Italy)

Grabba (Australia)

BioID Technologies (Germany)

Wintone (China)

Segment Analysis:

By Type

ID Readers Segment Leads the Market with Expanding Use in Identity Verification and Security Applications

The market is segmented based on type into:

ID Readers

Passport Readers

By Application

Airlines and Airports Segment Dominates Due to Increasing Passenger Screening Requirements

The market is segmented based on application into:

Airlines and Airports

Security and Government

Hotels and Travel Agencies

Banks

Train and Bus Terminals

Others

By End User

Government Sector Accounts for Significant Share Due to Border Control and Law Enforcement Requirements

The market is segmented based on end user into:

Government Agencies

Transportation Hubs

Financial Institutions

Hospitality Industry

Corporate Enterprises

Regional Analysis: Mobile Document Reader Market

North America The North American market for mobile document readers is strongly driven by heightened security concerns and stringent regulatory requirements across airports, border control, and financial institutions. The U.S., accounting for the largest market share in the region, has seen increased adoption due to biometric identification mandates and NFC-enabled ID verification technologies. Key players like Thales and IDEMIA dominate this space, offering advanced solutions with AI-powered fraud detection. The market is further propelled by investments in smart city initiatives, with an estimated 35% of U.S. law enforcement agencies now deploying mobile document readers for field operations.

Europe Europe’s market is characterized by strict GDPR compliance requirements and standardized electronic identity (eID) programs. The EU’s emphasis on interoperable digital identity frameworks has accelerated demand for passport readers and secure authentication devices. Germany and France lead in adoption, particularly in banking and transportation sectors. The region shows strong preference for multimodal verification systems combining document scanning with facial recognition, with airports investing heavily in contactless passenger processing solutions. Regulatory pressure to combat identity fraud remains a persistent market driver.

Asia-Pacific As the fastest-growing regional market, Asia-Pacific benefits from rapid digital transformation and massive government ID programs. China’s ‘Internet+’ strategy and India’s Aadhaar system have created enormous demand for mobile verification tools. While cost sensitivity remains a factor, vendors are adapting with rugged, affordable solutions for high-volume applications. The region shows particular strength in mobile payment verification and hotel check-in systems, with Japan and South Korea leading in technological sophistication. Emerging smart airports across Southeast Asia are driving next-gen adoption.

South America The South American market presents a mixed adoption landscape, with Brazil and Argentina showing the most progress in mobile document reader deployment. Financial institutions are primary adopters, implementing solutions for anti-money laundering compliance. Challenges include inconsistent regulatory frameworks and infrastructure limitations in rural areas. However, the growing tourism industry and need for improved border security are creating opportunities, particularly for portable passport verification systems at major entry points. Economic volatility continues to impact investment cycles in the region.

Middle East & Africa This emerging market is witnessing strategic deployments centered around major transportation hubs and financial centers. The UAE leads in adoption, particularly for airport security and hotel guest verification systems. Smart city initiatives in Saudi Arabia and digital transformation programs in South Africa are creating new demand vectors. While the market remains cost-conscious, there’s growing recognition of mobile readers as force multipliers for security personnel. Challenges include limited technical expertise in some areas and the need for solutions that can operate effectively in extreme environmental conditions.

Report Scope

This market research report provides a comprehensive analysis of the global and regional Mobile Document Reader markets, covering the forecast period 2024–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The Global Mobile Document Reader market was valued at USD 55.4 million in 2024 and is projected to reach USD 79.4 million by 2032, growing at a CAGR of 5.4%.

Segmentation Analysis: Detailed breakdown by product type (ID Readers, Passport Readers) and application (Airlines, Security, Hospitality, Banking, etc.) to identify high-growth segments.

Regional Outlook: Insights into market performance across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa, with country-level analysis of key markets.

Competitive Landscape: Profiles of leading players including Thales, IDEMIA, Regula Baltija, and others, covering their market share, product portfolios, and strategic initiatives.

Technology Trends & Innovation: Analysis of OCR advancements, biometric integration, AI-powered verification, and mobile scanning technologies.

Market Drivers & Restraints: Evaluation of security concerns, regulatory compliance needs, and digital transformation trends versus cost sensitivity.

Stakeholder Analysis: Strategic insights for hardware providers, software developers, system integrators, and end-user industries.

Related Reports:https://semiconductorblogs21.blogspot.com/2025/06/inductive-proximity-switches-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/cellular-iot-module-chipset-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/sine-wave-inverter-market-shifts-in.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/pilot-air-control-valves-market-cost.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/video-multiplexer-market-role-in.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/semiconductor-packaging-capillary.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/screw-in-circuit-board-connector-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/wafer-carrier-tray-market-integration.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/digital-display-potentiometer-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/glass-encapsulated-ntc-thermistor.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/shafted-hall-effect-sensors-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/point-of-load-power-chip-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/x-ray-grating-market-key-players-and.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/picmg-single-board-computer-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/lighting-control-dimming-panel-market.html

0 notes

Text

Top 10 Real-World Applications of Data Science in 2025

With 2025 fast approaching, data science is transforming industries and revolutionizing how businesses operate. From personalized shopping experiences to predictive healthcare, data-driven decision-making is at the core of innovation. For those looking to enter this exciting field, enrolling in the best data science training in Hyderabad is a smart first step toward a future-ready career.