#Mobile Apps Development Companies In nigeria

Explore tagged Tumblr posts

Text

REVOLUTIONIZE CLIENT MANAGEMENT WITH CRM SYSTEMS IN NIGERIA – HERE’S WHAT YOU NEED TO KNOW

In the real estate business, managing client relationships effectively is paramount to success. With countless clients, properties, and deals to juggle, it’s easy to feel overwhelmed. That’s where Customer Relationship Management (CRM) systems come into play, transforming how realtors operate and boosting efficiency.

1. Centralized Client Information

A CRM system centralizes all your client data in one place, contact details, property preferences, communication history, and more. This accessibility ensures you’re always informed and prepared, whether following up on a lead or closing a deal.

2. Streamlined Communication

Effective communication is the backbone of strong client relationships. CRMs allow you to track interactions, set reminders for follow-ups, and automate emails. This keeps your clients engaged and ensures no opportunity slips through the cracks.

3. Personalized Client Experiences

A CRM system helps you understand your clients better by tracking their preferences and past interactions. This enables you to tailor your services to meet their specific needs, creating a personalized experience that builds trust and loyalty.

4. Efficient Lead Management

Managing leads can be challenging, especially when they come from multiple channels. A CRM system organizes leads by priority, stage, and source, helping you focus your efforts on the most promising prospects and streamline your conversion process.

5. Task Automation

Repetitive tasks such as scheduling appointments, sending follow-up emails, or updating property listings can be automated with a CRM. This frees up your time to focus on more strategic activities, such as closing deals and expanding your client base.

6. Data-Driven Insights

CRMs offer robust analytics and reporting tools, providing insights into your performance metrics, lead conversion rates, sales cycles, client retention, and more. These insights help you refine your strategies and make data-driven decisions to grow your business.

7. Enhanced Collaboration

For real estate teams, a CRM fosters collaboration by providing a shared platform where team members can access up-to-date client information, delegate tasks, and track progress. This unified approach ensures that everyone is on the same page, enhancing productivity.

8. Mobile Access

Modern CRMs come with mobile apps, allowing you to manage your business on the go. Whether you're at a showing, in a meeting, or traveling, you can access client information, update records, and communicate with ease.

Conclusion

Embracing a CRM system in your real estate business revolutionizes client management by making processes more efficient, personalized, and data-driven. With the right CRM, you can enhance client satisfaction, increase your productivity, and ultimately close more deals. It's an investment in your success and a game-changer for staying competitive in today’s real estate market.

About the Managing Director : Dr. Smith Ezenagu is the Managing Director and Chief Executive Officer of Esso Properties Limited, one of Nigeria's leading integral real estate development and investment companies. With a strong background in financial management and training, he has been instrumental in shaping the real estate landscape in Nigeria.

About Esso Properties Limited: Esso Properties Limited is a revered name in Nigeria's dynamic real estate development and investment sector. Committed to innovation, reliability, and exceeding client expectations. Esso Properties has solidified its position as a leader in the real estate industry.

Join the Realtors Millionaire Summit (RMS): Elevate your real estate career by participating in the Realtors Millionaire Summit (RMS). This is an annual real estate conference designed to inspire, equip, and connect real estate professionals with the tools, strategies, and networks to achieve exceptional success in the industry. Click the link https://bit.ly/RealtorsMillioniareSummit to Register now and be part of this transformative experience.

0 notes

Text

Delivery app in lagos

On-Demand Delivery Services in Nigeria: Revolutionizing Logistics and Convenience

In the fast-paced world of today, the demand for quick, reliable, and efficient delivery services has skyrocketed. With Nigeria’s expanding e-commerce sector and the increasing preference for online shopping, on-demand delivery services are becoming a critical part of everyday life. Whether it’s groceries, food, or general courier services, Nigerians are leaning heavily on the convenience that these services bring to their doorsteps.

The Rise of On-Demand Delivery in Nigeria

On-demand delivery in Nigeria is reshaping the logistics landscape. With an increasing number of Nigerians embracing the convenience of home delivery, companies offering these services have flourished. From major cities like Lagos, Abuja, and Port Harcourt, to smaller towns, the demand for fast, efficient delivery has created opportunities for businesses to cater to a vast and diverse customer base. The popularity of on-demand delivery has given rise to multiple platforms and apps, making it easier for consumers to access goods and services with just a few clicks.

Same-Day Delivery in Nigeria: Meeting Urgent Needs

Same-day delivery services have become a lifesaver for many Nigerians. Whether it's essential items like medicine or documents that need to be sent urgently, same-day delivery ensures that packages are transported swiftly. This type of service has become particularly important in bustling cities like Lagos, where traffic congestion can otherwise lead to delays in transportation.

Same-day delivery is a crucial offering for businesses, allowing them to serve customers more efficiently. This is particularly true for e-commerce platforms, where timely delivery plays a key role in customer satisfaction. With the development of reliable courier services across the country, companies can now offer same-day delivery, giving consumers confidence in quick and efficient service.

On-Demand Groceries in Nigeria

The demand for on-demand grocery delivery has exploded in Nigeria, especially in urban areas. With the growing hustle of everyday life, many consumers no longer have the time to visit traditional markets or supermarkets. On-demand grocery services provide an alternative, allowing consumers to order groceries online and have them delivered right to their door.

Many grocery delivery services in Nigeria have adopted mobile apps, making it easy for users to select items, track their orders, and get their deliveries within hours. In major cities like Lagos, the convenience of having groceries delivered saves time, reduces stress, and ensures that customers can quickly receive fresh produce, meats, and other essentials without leaving their homes.

Same-Day Food Delivery in Nigeria

Nigeria’s food delivery industry has experienced substantial growth in recent years, thanks to the rise of on-demand delivery apps. Same-day food delivery has become a norm in most Nigerian cities, offering customers the ability to order their favorite meals from restaurants and get them delivered within a short time. This trend has been boosted by the increasing use of delivery apps, which have become popular due to their convenience and efficiency.

Whether its fast food, traditional Nigerian dishes, or international cuisines, on-demand food delivery platforms offer a variety of choices to cater to different tastes. For restaurants, these platforms provide an opportunity to reach a broader customer base, while for consumers; they ensure that food is delivered fresh and hot, right at their doorstep.

The Growth of On-Demand Delivery Apps in Nigeria

With Nigeria’s increasing smartphone penetration, on-demand delivery apps have become a vital tool for accessing goods and services. These apps allow users to place orders, track deliveries in real time, and make payments, all from their mobile devices. Popular on-demand delivery apps in Nigeria cater to a variety of needs, from groceries and food to courier services.

Delivery apps in Lagos, the commercial hub of Nigeria, have particularly grown in popularity. The convenience they provide in navigating the city’s notorious traffic jams is one reason why more people are turning to on-demand apps. Some of the top on-demand delivery apps in Nigeria offer features such as same-day delivery, real-time order tracking, and secure payment options, making them an essential tool for both consumers and businesses.

Courier Services in Nigeria: Reliable and Fast

Courier services are an integral part of the delivery ecosystem in Nigeria. Whether for businesses or individuals, these services offer reliable transportation of packages, parcels, and documents. With the rise of on-demand courier services, sending and receiving items across cities or even nationwide has become faster and more efficient.

In major cities like Abuja and Lagos, on-demand courier companies have made it easy to send packages for same-day or next-day delivery. This has been beneficial for businesses, especially small and medium enterprises (SMEs), that rely on quick and secure delivery to enhance their operations. For individuals, courier services offer a practical solution for delivering personal packages to friends, family, or colleagues.

Leading On-Demand Delivery Companies in Nigeria

Several on-demand delivery companies are thriving in Nigeria, offering innovative solutions that cater to the growing need for fast and reliable service. Companies like Gokada, Kwik Delivery, and Jumia have made it easier for Nigerians to access delivery services for a range of needs, from groceries to parcels and more. These companies have built strong reputations by providing efficient, on-demand solutions and have helped to drive the growth of e-commerce and other sectors reliant on logistics.

Conclusion: The Future of On-Demand Delivery in Nigeria

As Nigeria’s economy continues to grow and evolve, the demand for on-demand delivery services will only increase. The convenience, efficiency, and speed that these services provide have made them a key part of daily life for many Nigerians. From same-day food delivery to essential courier services, these platforms are changing how businesses operate and how consumers access goods and services.

Looking ahead, the future of on-demand delivery in Nigeria will likely involve more innovation, improved logistics, and better integration with emerging technologies like drone deliveries and AI-powered route optimization. With this transformation underway, Nigeria is poised to continue as a major hub for on-demand delivery in Africa.

Visit here : https://shapshap.com/

0 notes

Text

EmbassyCard introduces prepaid digital card for payment without network connection, POS machines - Notice Global Internet https://www.merchant-business.com/embassycard-introduces-prepaid-digital-card-for-payment-without-network-connection-pos-machines/?feed_id=169274&_unique_id=66c163c6363c8 EmbassyCard revolutionizes digital ... BLOGGER - #GLOBAL EmbassyCard revolutionizes digital payment system with no network connection and POS machineEmbassyCard, a Nigerian fintech company with presence in several states of the nation has introduced a new digital prepaid card to merchants and residents of Lagos.This is aimed at solving some fundamental challenges faced by the FINTECH industry in the country such as long queue in banks, charge-back fraud, use of expensive POS machines, delayed transactions and poor internet network.In his speech, during the media parley and stakeholders’ forum held at NECA house, Ikeja on Tuesday 30th July 2024, the Chief Executive Officer of EmbassyCard, Sunny Ojuroye said the initiative is a game changer in the financial space.Sunny Ojuroye stated that the organisation started developing EmbassyCard payment solution with its engineers and Providus bank, the official partner bank in 2019 before its launch in 2024.Addressing mobile money agents present at the event, the CEO said, “Let us make history together with EmbassyCard, a new prepaid card for payment. This is a great opportunity to earn commission with us. EmbassyCard offers additional opportunities to make extra income in addition to what you already do. The cards come in LITE, GREEN and GOLD with photo ID for identification purposes, thus enhancing security of customers’ funds.“We have observed charge-back frauds, long queues when payment don’t go through or customers’ alert failed to arrive, issue of no network with the use of POS machines and long distance travels to lodge complaints at banks.“We want merchants to be protected from charge-back fraud which is costing our businesses a lot of money. You can use your phone instead of a bulky and expensive POS machines. We want all our merchants to become personal cash machines for our EmbassyCard customers so they don’t have to queue at the banks to get cash.”A Co-director of EmbassyCard, Leye Popoola noted that the company’s digital payment solution is different from others with a strong security feature which enables users to either lock or unlock their EMBASSYCARD in the event of any loss.His words, “You have a mobile money inside your card and you have it in your wallet. So, your money can be in the cloud. If you have EmbassyCard with or without connection, you can receive your money.“It is 100% made in Nigeria for Nigerians by Nigerians. There is no ulterior motive behind it. Every transaction is in Naira. In addition, charges are in naira rather than in dollars that is charged by other competitors”Speaking on how the card works without network to take payment OFFLINE, he said ” with technology, many things are possible with the use of AI. It is configured in such a way that network will not be the problem. The Card and the App work together to create a very secure payment system which protects Merchants from Charge back fraud when the Customer pays with their EmbassyCard.“We have seen the future in the present. We are confident that within a short while from now, we will capture the whole country. There won’t be hidden charges on the use of the card.”In an interview with our correspondent, Emmanuel Udeagha, Head of Brand management in Wetherheads Advertising Group Limited, the organizer of the launch event said the newly introduced payment solution will revolutionalize the payment system in Nigeria. He said, “It is able to take payment online and offline. If you’re in a remote community without network, you can still receive payment as a merchant and make payment as a customer to pay for services at restaurants, petrol stations, utility bills etc. As a merchant, your phone serves as your terminal.

With EmbassyCard, the customer will only need to tap the phone of the merchant at the back of his card and receive payment instantly. It has all the security features.“It has the wallet. You can use it to transfer money to your bank account and transfer to other people and make payments. It is linked to a bank account which allows instant settlement which means your payment gets to you instantly, it doesn’t wait till 12 mid night or 24 hours before settlement.”In his remarks, the Chairman of Association of Mobile Money and Bank Agents in Nigeria (AMMBAN), Mr Oluwagunwa Ibirogba commended EmbassyCard for the initiative, saying it has been a struggle to get cash.He urged members of his association to get registered and become a merchant so as to increase their income without the use of POS machines. Imagine, we can now walk about with a card in form of cash. We are the merchants, the smallest bankers! I am encouraging all of us to work and run with it”, he said.“EmbassyCard revolutionizes digital payment system with no network connection and POS machine EmbassyCard, a Nigerian fintech company with presence in several states of the nation has introduced a new digital…”Source Link: https://nairametrics.com/2024/08/17/embassycard-introduces-prepaid-digital-card-for-payment-without-network-connection-pos-machines/ http://109.70.148.72/~merchant29/6network/wp-content/uploads/2024/08/pexels-photo-5961027.jpeg #GLOBAL - BLOGGER EmbassyCard revolutionizes digital payment system with no network connection and POS machine EmbassyCard, a Nigerian fintech company with presence in several states of the nation has introduced a new digital prepaid card to merchants and residents of Lagos. This is aimed at solving some fundamental challenges faced by the FINTECH industry in the country such … Read More

0 notes

Text

THE MOBILE APPS EVERY SUCCESSFUL REALTOR IS USING RIGHT NOW

Mobile apps tailored for realtors can streamline processes, improve communication, and enhance productivity, allowing you to focus on what truly matters, closing deals and building relationships.

Why Mobile Apps Are Essential for Realtors

Convenience: Manage your business on the go from your smartphone or tablet.

Time-Saving: Automate repetitive tasks, schedule appointments, and track progress seamlessly.

Enhanced Productivity: Tools for marketing, organization, and client management simplify your workload.

Must-Have Mobile Apps for Realtors

1. CRM and Client Management

App: HubSpot CRM, Follow Up BossKeep track of leads, manage client interactions, and organize contacts efficiently.

Set reminders for follow-ups.

Record client preferences and communication history.

2. Scheduling and Time Management

App: Google Calendar, CalendlyNever miss an appointment or double-book yourself.

Sync schedules with your team and clients.

Share availability for easy meeting setups.

3. Property Listings and Market Insights

App: Zillow Premier Agent, Realtor.comStay updated on the latest listings and market trends.

Access detailed property data.

Share listings directly with clients.

4. Digital Marketing and Social Media

App: Canva, BufferCreate eye-catching visuals and manage your social media platforms.

Design professional posts for Instagram, Facebook, and LinkedIn.

Schedule posts and analyze engagement metrics.

5. Virtual Tours and Photography

App: Matterport, VSCOOffer immersive property experiences and professional-quality visuals.

Create virtual tours to attract remote buyers.

Edit images and videos for better presentation.

6. Document Management and E-Signatures

App: DocuSign, Adobe AcrobatSimplify the paperwork process with secure digital signatures and document sharing.

Review contracts on the go.

Ensure compliance with legal standards.

7. Financial Management

App: QuickBooks, ExpensifyTrack expenses and manage your business finances effectively.

Generate invoices for clients.

Monitor cash flow and prepare for tax season.

8. Navigation and Local Insights

App: Google Maps, WazePlan routes efficiently and explore neighborhoods.

Provide clients with estimated travel times.

Highlight local amenities like schools and parks.

9. Collaboration and Communication

App: Slack, WhatsApp BusinessStay connected with your team and clients.

Share updates in real time.

Streamline communication across multiple channels.

10. Lead Generation and Management

App: BoldLeads, Zillow Premier AgentDiscover and manage high-quality leads.

Optimize ad campaigns for maximum reach.

Automate lead nurturing for better conversion.

The Realtors Millionaire Summit equips you with insights into leveraging technology like mobile apps to transform your real estate business. From practical demonstrations to expert-led discussions, you’ll discover strategies to stay ahead in a competitive market.

Incorporating mobile apps into your workflow is a necessity in today’s real estate landscape. By choosing the right tools for your needs, you can save time, improve client satisfaction, and grow your business.

About the Managing Director : Dr. Smith Ezenagu is the Managing Director and Chief Executive Officer of Esso Properties Limited, one of Nigeria's leading integral real estate development and investment companies. With a strong background in financial management and training, he has been instrumental in shaping the real estate landscape in Nigeria.

About Esso Properties Limited: Esso Properties Limited is a revered name in Nigeria's dynamic real estate development and investment sector. Committed to innovation, reliability, and exceeding client expectations. Esso Properties has solidified its position as a leader in the real estate industry.

Join the Realtors Millionaire Summit (RMS): Elevate your real estate career by participating in the Realtors Millionaire Summit (RMS). This is an annual real estate conference designed to inspire, equip, and connect real estate professionals with the tools, strategies, and networks to achieve exceptional success in the industry. Click the link https://realtorsmillionairesummit.com/ to Register now and be part of this transformative experience.

0 notes

Text

Keeping Up with Banking and Finance News in Nigeria

Staying informed about the latest developments in the world of banking and finance is crucial, especially in a dynamic and rapidly evolving economy like Nigeria. Today brings a mix of updates that have a significant impact on the financial landscape of the country.

1. Central Bank’s Monetary Policy Announcement

In a much-anticipated move, the Central Bank of Nigeria (CBN) released its latest monetary policy decisions. The key highlight is a slight adjustment in the benchmark interest rate, aimed at balancing economic growth and inflation control. This decision comes as a response to the changing domestic and global economic conditions. Experts are closely analyzing the potential implications of this adjustment on borrowing costs, investment, and overall economic activity.

2. Fintech Startup Secures Funding

In a sign of the growing importance of the fintech sector, a Nigerian fintech startup successfully raised a substantial amount of funding in its latest investment round. The startup, focused on providing innovative digital payment solutions, attracted interest from both local and international investors. This infusion of capital is expected to fuel the company’s expansion plans and contribute to the modernization of the financial services industry in Nigeria.

3. Foreign Investment in Nigerian Bonds

Nigeria’s sovereign bonds continue to attract attention from foreign investors. Today, it was announced that a major international investment firm has increased its holdings of Nigerian government bonds. This move reflects growing confidence in Nigeria’s economic prospects and the steps taken to enhance fiscal discipline. The increased foreign investment not only strengthens Nigeria’s external reserves but also signals positive sentiment toward the country’s financial stability.

4. Digital Transformation of Banking Services

In line with the global trend of digital transformation, several Nigerian banks announced new initiatives to enhance their digital banking services. These initiatives include the rollout of advanced mobile banking apps, the expansion of online customer support, and the introduction of personalized financial management tools. The aim is to provide customers with more convenient and efficient ways to manage their finances, while also adapting to changing consumer preferences.

5. Non-Performing Loan Recovery Efforts

Efforts to address non-performing loans (NPLs) in Nigeria’s banking sector continue to make progress. The Asset Management Corporation of Nigeria (AMCON) reported a significant milestone in its ongoing efforts to recover NPLs from various financial institutions. This development contributes to the overall health of the banking industry by reducing financial risks and improving the availability of credit for productive economic activities.

Well, today’s banking and finance news in Nigeria showcases the diverse range of activities shaping the financial landscape. From monetary policy adjustments to fintech innovation and international investments, these developments collectively contribute to the growth and stability of Nigeria’s economy. As the nation progresses on its financial journey, staying attuned to these updates remains a valuable practice for individuals, businesses, and investors alike.

0 notes

Text

Matiyas Solutions LLP: Driving Digital Transformation for Businesses Worldwide

Incepted in 2020 and based in Ahmedabad, India, Matiyas Solutions LLP has swiftly established itself as a comprehensive IT services provider. Offering a wide range of services, from CRM and ERP (Enterprise Resource Planning) to Mobile App development, Matiyas Solutions caters to the diverse needs of businesses across the globe. The company’s expansive presence includes offices in India and associated offices in the UAE, Oman, Kuwait, Canada, Singapore, Malaysia, Nigeria, Egypt, and Armenia.

A Team of Talented Professionals Matiyas Solutions prides itself on its team of highly skilled professionals who bring extensive international project experience. This team is driven by a motivated, committed, and goal-oriented attitude, ensuring a profitable and efficient approach to every project. The company’s mission is to assist startups and SMEs in leveraging cutting-edge technologies to optimize their digital business processes. By providing end-to-end IT solutions, Matiyas Solutions helps businesses thrive in the digital age.

Visionary Leadership The founder and CEO, Mr. ShabbirAli, leads the company with a visionary approach, boasting over two decades of experience in the IT field. His leadership ensures that the team is dedicated to transforming businesses into more productive and successful entities. The organization is committed to expanding businesses through efficient optimization processes, achieving client goals with passion and empathy, maintaining consistent quality services, and preparing industries for future challenges through automation.

Commitment to Excellence Matiyas Solutions�� commitment to excellence is reflected in their approach:

Business Expansion: Through efficient optimization processes. Client Goals: Achieving objectives with passion and empathy. Quality Services: Consistently providing high-quality services. Future Challenges: Strengthening companies to tackle future business challenges. Automation: Preparing industries for new opportunities by implementing automation. Recognized by GoodFirms GoodFirms, a B2B platform connecting IT service seekers with providers, recognizes Matiyas Solutions for its outstanding IT solutions. GoodFirms’ rigorous evaluation process focuses on Quality, Reliability, and Ability, and Matiyas Solutions has excelled in all these parameters. This recognition highlights the company’s dedication to client satisfaction, market penetration, and overall quality.

Tailored ERP Solutions Matiyas Solutions offers tailored ERP solutions to meet the specific needs of various industries, including healthcare, manufacturing, oil & gas, services, retail and distribution, non-profit, and the public sector. Their expertise in ERP solutions extends to cloud ERP systems, which are particularly beneficial for the manufacturing industry. By optimizing functions and automating operations, Matiyas Solutions helps manufacturers achieve their business goals.

Industry Focus Matiyas Solutions serves a variety of industries:

Steel Manufacturing Plastic Manufacturing Pharmaceutical Fast Moving Consumer Goods (FMCG) Industrial Machinery and Equipment Medical Devices Innovative Solutions Matiyas Solutions’ motto is to drive innovation through skilled consulting and robust solutions. The team is focused on developing quality IT products, specializing in business process automation, digital transformation, ERP solutions, ERP consulting, ERP implementation, cloud ERP solutions, and cloud consulting. This expertise has earned Matiyas Solutions a leading position among Ahmedabad’s top IT services companies on GoodFirms.

Conclusion Matiyas Solutions LLP is dedicated to helping businesses navigate the digital landscape with innovative and customized IT solutions. Their team of experienced professionals, visionary leadership, and commitment to excellence make them a trusted partner for businesses looking to optimize their digital processes and achieve significant growth.

0 notes

Text

The power of App Inventor: Democratizing possibilities for mobile applications

New Post has been published on https://sunalei.org/news/the-power-of-app-inventor-democratizing-possibilities-for-mobile-applications/

The power of App Inventor: Democratizing possibilities for mobile applications

In June 2007, Apple unveiled the first iPhone. But the company made a strategic decision about iPhone software: its new App Store would be a walled garden. An iPhone user wouldn’t be able to install applications that Apple itself hadn’t vetted, at least not without breaking Apple’s terms of service.

That business decision, however, left educators out in the cold. They had no way to bring mobile software development — about to become part of everyday life — into the classroom. How could a young student code, futz with, and share apps if they couldn’t get it into the App Store?

MIT professor Hal Abelson was on sabbatical at Google at the time, when the company was deciding how to respond to Apple’s gambit to corner the mobile hardware and software market. Abelson recognized the restrictions Apple was placing on young developers; Google recognized the market need for an open-source alternative operating system — what became Android. Both saw the opportunity that became App Inventor.

“Google started the Android project sort of in reaction to the iPhone,” Abelson says. “And I was there, looking at what we did at MIT with education-focused software like Logo and Scratch, and said ‘what a cool thing it would be if kids could make mobile apps also.’”

Google software engineer Mark Friedman volunteered to work with Abelson on what became “Young Android,” soon renamed Google App Inventor. Like Scratch, App Inventor is a block-based language, allowing programmers to visually snap together pre-made “blocks” of code rather than need to learn specialized programming syntax.

Friedman describes it as novel for the time, particularly for mobile development, to make it as easy as possible to build simple mobile apps. “That meant a web-based app,” he says, “where everything was online and no external tools were required, with a simple programming model, drag-and-drop user interface designing, and blocks-based visual programming.” Thus an app someone programmed in a web interface could be installed on an Android device.

App Inventor scratched an itch. Boosted by the explosion in smartphone adoption and the fact App Inventor is free (and eventually open source), soon more than 70,000 teachers were using it with hundreds of thousands of students, with Google providing the backend infrastructure to keep it going.

“I remember answering a question from my manager at Google who asked how many users I thought we’d get in the first year,” Friedman says. “I thought it would be about 15,000 — and I remember thinking that might be too optimistic. I was ultimately off by a factor of 10–20.” Friedman was quick to credit more than their choices about the app. “I think that it’s fair to say that while some of that growth was due to the quality of the tool, I don’t think you can discount the effect of it being from Google and of the effect of Hal Abelson’s reputation and network.”

Some early apps took App Inventor in ambitious, unexpected directions, such as “Discardious,” developed by teenage girls in Nigeria. Discardious helped business owners and individuals dispose of waste in communities where disposal was unreliable or too cumbersome.

But even before apps like Discardious came along, the team knew Google’s support wouldn’t be open-ended. No one wanted to cut teachers off from a tool they were thriving with, so around 2010, Google and Abelson agreed to transfer App Inventor to MIT. The transition meant major staff contributions to recreate App Inventor without Google’s proprietary software but MIT needing to work with Google to continue to provide the network resources to keep App Inventor free for the world.

With such a large user base, however, that left Abelson “worried the whole thing was going to collapse” without Google’s direct participation.

Friedman agrees. “I would have to say that I had my fears. App Inventor has a pretty complicated technical implementation, involving multiple programming languages, libraries and frameworks, and by the end of its time at Google we had a team of about 10 people working on it.”

Yet not only did Google provide significant funding to aid the transfer, but, Friedman says of the transfer’s ultimate success, “Hal would be in charge and he had fairly extensive knowledge of the system and, of course, had great passion for the vision and the product.”

MIT enterprise architect Jeffrey Schiller, who built the Institute’s computer network and became its manager in 1984, was another key part in sustaining App Inventor after its transition, helping introduce technical features fundamental to its accessibility and long-term success. He led the integration of the platform into web browsers, the addition of WiFi support rather than needing to connect phones and computers via USB, and the laying of groundwork for technical support of older phones because, as Schiller says, “many of our users cannot rush out and purchase the latest and most expensive devices.”

These collaborations and contributions over time resulted in App Inventor’s greatest resource: its user base. As it grew, and with support from community managers, volunteer know-how grew with it. Now, more than a decade since its launch, App Inventor recently crossed several major milestones, the most remarkable being the creation of its 100 millionth project and registration of its 20 millionth user. Young developers continue to make incredible applications, boosted now by the advantages of AI. College students created “Brazilian XôDengue” as a way for users to use phone cameras to identify mosquito larvae that may be carrying the dengue virus. High school students recently developed “Calmify,” a journaling app that uses AI for emotion detection. And a mother in Kuwait wanted something to help manage the often-overwhelming experience of new motherhood when returning to work, so she built the chatbot “PAM (Personal Advisor to Mothers)” as a non-judgmental space to talk through the challenges.

App Inventor’s long-term sustainability now rests with the App Inventor Foundation, created in 2022 to grow its resources and further drive its adoption. It is led by executive director Natalie Lao.

In a letter to the App Inventor community, Lao highlighted the foundation’s commitment to equitable access to educational resources, which for App Inventor required a rapid shift toward AI education — but in a way that upholds App Inventor’s core values to be “a free, open-source, easy-to-use platform” for mobile devices. “Our mission is to not only democratize access to technology,” Lao wrote, “but also foster a culture of innovation and digital literacy.”

Within MIT, App Inventor today falls under the umbrella of the MIT RAISE Initiative — Responsible AI for Social Empowerment and Education, run by Dean for Digital Learning Cynthia Breazeal, Professor Eric Klopfer, and Abelson. Together they are able to integrate App Inventor into ever-broader communities, events, and funding streams, leading to opportunities like this summer’s inaugural AI and Education Summit on July 24-26. The summit will include awards for winners of a Global AI Hackathon, whose roughly 180 submissions used App Inventor to create AI tools in two tracks: Climate & Sustainability and Health & Wellness. Tying together another of RAISE’s major projects, participants were encouraged to draw from Day of AI curricula, including its newest courses on data science and climate change.

“Over the past year, there’s been an enormous mushrooming in the possibilities for mobile apps through the integration of AI,” says Abelson. “The opportunity for App Inventor and MIT is to democratize those new possibilities for young people — and for everyone — as an enhanced source of power and creativity.”

0 notes

Text

The power of App Inventor: Democratizing possibilities for mobile applications

New Post has been published on https://thedigitalinsider.com/the-power-of-app-inventor-democratizing-possibilities-for-mobile-applications/

The power of App Inventor: Democratizing possibilities for mobile applications

In June 2007, Apple unveiled the first iPhone. But the company made a strategic decision about iPhone software: its new App Store would be a walled garden. An iPhone user wouldn’t be able to install applications that Apple itself hadn’t vetted, at least not without breaking Apple’s terms of service.

That business decision, however, left educators out in the cold. They had no way to bring mobile software development — about to become part of everyday life — into the classroom. How could a young student code, futz with, and share apps if they couldn’t get it into the App Store?

MIT professor Hal Abelson was on sabbatical at Google at the time, when the company was deciding how to respond to Apple’s gambit to corner the mobile hardware and software market. Abelson recognized the restrictions Apple was placing on young developers; Google recognized the market need for an open-source alternative operating system — what became Android. Both saw the opportunity that became App Inventor.

“Google started the Android project sort of in reaction to the iPhone,” Abelson says. “And I was there, looking at what we did at MIT with education-focused software like Logo and Scratch, and said ‘what a cool thing it would be if kids could make mobile apps also.’”

Google software engineer Mark Friedman volunteered to work with Abelson on what became “Young Android,” soon renamed Google App Inventor. Like Scratch, App Inventor is a block-based language, allowing programmers to visually snap together pre-made “blocks” of code rather than need to learn specialized programming syntax.

Friedman describes it as novel for the time, particularly for mobile development, to make it as easy as possible to build simple mobile apps. “That meant a web-based app,” he says, “where everything was online and no external tools were required, with a simple programming model, drag-and-drop user interface designing, and blocks-based visual programming.” Thus an app someone programmed in a web interface could be installed on an Android device.

App Inventor scratched an itch. Boosted by the explosion in smartphone adoption and the fact App Inventor is free (and eventually open source), soon more than 70,000 teachers were using it with hundreds of thousands of students, with Google providing the backend infrastructure to keep it going.

“I remember answering a question from my manager at Google who asked how many users I thought we’d get in the first year,” Friedman says. “I thought it would be about 15,000 — and I remember thinking that might be too optimistic. I was ultimately off by a factor of 10–20.” Friedman was quick to credit more than their choices about the app. “I think that it’s fair to say that while some of that growth was due to the quality of the tool, I don’t think you can discount the effect of it being from Google and of the effect of Hal Abelson’s reputation and network.”

Some early apps took App Inventor in ambitious, unexpected directions, such as “Discardious,” developed by teenage girls in Nigeria. Discardious helped business owners and individuals dispose of waste in communities where disposal was unreliable or too cumbersome.

But even before apps like Discardious came along, the team knew Google’s support wouldn’t be open-ended. No one wanted to cut teachers off from a tool they were thriving with, so around 2010, Google and Abelson agreed to transfer App Inventor to MIT. The transition meant major staff contributions to recreate App Inventor without Google’s proprietary software but MIT needing to work with Google to continue to provide the network resources to keep App Inventor free for the world.

With such a large user base, however, that left Abelson “worried the whole thing was going to collapse” without Google’s direct participation.

Friedman agrees. “I would have to say that I had my fears. App Inventor has a pretty complicated technical implementation, involving multiple programming languages, libraries and frameworks, and by the end of its time at Google we had a team of about 10 people working on it.”

Yet not only did Google provide significant funding to aid the transfer, but, Friedman says of the transfer’s ultimate success, “Hal would be in charge and he had fairly extensive knowledge of the system and, of course, had great passion for the vision and the product.”

MIT enterprise architect Jeffrey Schiller, who built the Institute’s computer network and became its manager in 1984, was another key part in sustaining App Inventor after its transition, helping introduce technical features fundamental to its accessibility and long-term success. He led the integration of the platform into web browsers, the addition of WiFi support rather than needing to connect phones and computers via USB, and the laying of groundwork for technical support of older phones because, as Schiller says, “many of our users cannot rush out and purchase the latest and most expensive devices.”

These collaborations and contributions over time resulted in App Inventor’s greatest resource: its user base. As it grew, and with support from community managers, volunteer know-how grew with it. Now, more than a decade since its launch, App Inventor recently crossed several major milestones, the most remarkable being the creation of its 100 millionth project and registration of its 20 millionth user. Young developers continue to make incredible applications, boosted now by the advantages of AI. College students created “Brazilian XôDengue” as a way for users to use phone cameras to identify mosquito larvae that may be carrying the dengue virus. High school students recently developed “Calmify,” a journaling app that uses AI for emotion detection. And a mother in Kuwait wanted something to help manage the often-overwhelming experience of new motherhood when returning to work, so she built the chatbot “PAM (Personal Advisor to Mothers)” as a non-judgmental space to talk through the challenges.

App Inventor’s long-term sustainability now rests with the App Inventor Foundation, created in 2022 to grow its resources and further drive its adoption. It is led by executive director Natalie Lao.

In a letter to the App Inventor community, Lao highlighted the foundation’s commitment to equitable access to educational resources, which for App Inventor required a rapid shift toward AI education — but in a way that upholds App Inventor’s core values to be “a free, open-source, easy-to-use platform” for mobile devices. “Our mission is to not only democratize access to technology,” Lao wrote, “but also foster a culture of innovation and digital literacy.”

Within MIT, App Inventor today falls under the umbrella of the MIT RAISE Initiative — Responsible AI for Social Empowerment and Education, run by Dean for Digital Learning Cynthia Breazeal, Professor Eric Klopfer, and Abelson. Together they are able to integrate App Inventor into ever-broader communities, events, and funding streams, leading to opportunities like this summer’s inaugural AI and Education Summit on July 24-26. The summit will include awards for winners of a Global AI Hackathon, whose roughly 180 submissions used App Inventor to create AI tools in two tracks: Climate & Sustainability and Health & Wellness. Tying together another of RAISE’s major projects, participants were encouraged to draw from Day of AI curricula, including its newest courses on data science and climate change.

“Over the past year, there’s been an enormous mushrooming in the possibilities for mobile apps through the integration of AI,” says Abelson. “The opportunity for App Inventor and MIT is to democratize those new possibilities for young people — and for everyone — as an enhanced source of power and creativity.”

#000#2022#Accessibility#ai#ai tools#amp#android#app#app store#apple#applications#apps#Artificial Intelligence#Business#Cameras#change#chatbot#climate#climate change#code#college#Community#computer#computers#course#courses#creativity#data#data science#detection

0 notes

Text

Block's Bitkey Bitcoin Wallet Available for Preorder in 95+ Countries

Former Twitter CEO Jack Dorsey's company, Block, has announced that its Bitkey Bitcoin wallet is now available for preorders in over 95 countries. The physical device, costing $150, includes the wallet itself, a charging cable, a mobile app, and recovery tools. Bitkey is set to be shipped in early 2024.

Lindsey Grossman, the business lead for Bitkey, highlighted the US, UK, Canada, Nigeria, Argentina, Mexico, and India as key markets where customers are expected to use Bitcoin for long-term savings and cross-border payments. Although Bitkey is currently only available for online purchase, Block is open to exploring partnerships with physical stores.

Jack Dorsey, a strong advocate for Bitcoin, has expressed his belief that the cryptocurrency can provide solutions for financial accessibility in developing countries. Block's commitment to Bitcoin is evident through Dorsey's investments in Bitcoin-related enterprises. Block, previously known as Square, generates its profits primarily from its digital wallet Cash App and its payments offering for businesses. Despite Bitcoin's limited contribution to Block's quarterly revenue, Dorsey is dedicated to integrating Bitcoin into the company's core business.

For more information, read the original article.

0 notes

Text

Person to Person Payment Market Next Big Thing | ClearXchange, Tencent, Square, Circle Internet Financial, Phonepe

Advance Market Analytics published a new research publication on “Global Person to Person Payment Market Insights, to 2028” with 232 pages and enriched with self-explained Tables and charts in presentable format. In the study, you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market-associated stakeholders. The growth of the Person to Person Payment market was mainly driven by the increasing R&D spending across the world.

Major players profiled in the study are:

PayPal Pte. Ltd (United States), Tencent (China), Square, Inc (United States), Circle Internet Financial Limited (Ireland), ClearXchange (United States), Stripe (Germany), TransferWise Ltd (United Kingdom), CurrencyFair LTD (Ireland), One97 Communications Ltd (India), Phonepe(India), MobiKwik (India)

Get Free Exclusive PDF Sample Copy of This Research @ https://www.advancemarketanalytics.com/sample-report/127398-global-person-to-person-payment-market?utm_source=OpenPR&utm_medium=Vinay

Scope of the Report of Person to Person Payment

Person to Person payments are popularly known as P2P Technology or Peer-to-Peer payment which allows the customers to pay funds, bills from their bank account to credit card to another individual (Mall, retailer, bills, tours, tickets, etc) by using mobile phone using internet service by easily installing the specific app of that company. It is an online technology that helps in secure payments. It has made easy payments for various platforms. As there is high adoption of digitization in the world the growing use of E-commerce resulting in demand for online payment services.

On 1st November 2019, Square completed the sale of Caviar to DoorDash.

On 7th February 2020, Square announced it has acquired Canadian company Dessa for its development of business. It will help in machine learning abilities for the company.

The Global Person to Person Payment Market segments and Market Data Break Down are illuminated below:

by Type (NFC/Smartcard, SMS, Mobile Apps), Application (Money transfers & Payments, Easy payments), End Users (Retail, Travels and Hospitality, Transportation and Logistics, Energy and Utilities), Purchase (Airtime transfer & Top-Ups, Merchandise & Coupons, Travel & Ticketing), Locations (Remote payments, Proximity payments)

Market Opportunities:

Growing Digital Driven Lifestyle

Growing Online Shopping And Banking Applications

Market Drivers:

Growing Acceptance Of Online Banking

Increasing No Of Digital Devices Like Smart-Phones, Mobiles Etc

Market Trend:

Growing E-Commerce Application In P2P Technology

What can be explored with the Person to Person Payment Market Study?

Gain Market Understanding

Identify Growth Opportunities

Analyze and Measure the Global Person to Person Payment Market by Identifying Investment across various Industry Verticals

Understand the Trends that will drive Future Changes in Person to Person Payment

Understand the Competitive Scenarios

Track Right Markets

Identify the Right Verticals

Region Included are: North America, Europe, Asia Pacific, Oceania, South America, Middle East & Africa

Country Level Break-Up: United States, Canada, Mexico, Brazil, Argentina, Colombia, Chile, South Africa, Nigeria, Tunisia, Morocco, Germany, United Kingdom (UK), the Netherlands, Spain, Italy, Belgium, Austria, Turkey, Russia, France, Poland, Israel, United Arab Emirates, Qatar, Saudi Arabia, China, Japan, Taiwan, South Korea, Singapore, India, Australia and New Zealand etc.

Have Any Questions Regarding Global Person to Person Payment Market Report, Ask Our Experts@ https://www.advancemarketanalytics.com/enquiry-before-buy/127398-global-person-to-person-payment-market?utm_source=OpenPR&utm_medium=Vinay

Strategic Points Covered in Table of Content of Global Person to Person Payment Market:

Chapter 1: Introduction, market driving force product Objective of Study and Research Scope the Person to Person Payment market

Chapter 2: Exclusive Summary – the basic information of the Person to Person Payment Market.

Chapter 3: Displaying the Market Dynamics- Drivers, Trends and Challenges & Opportunities of the Person to Person Payment

Chapter 4: Presenting the Person to Person Payment Market Factor Analysis, Porters Five Forces, Supply/Value Chain, PESTEL analysis, Market Entropy, Patent/Trademark Analysis.

Chapter 5: Displaying the by Type, End User and Region/Country 2017-2022

Chapter 6: Evaluating the leading manufacturers of the Person to Person Payment market which consists of its Competitive Landscape, Peer Group Analysis, BCG Matrix & Company Profile

Chapter 7: To evaluate the market by segments, by countries and by Manufacturers/Company with revenue share and sales by key countries in these various regions (2023-2028)

Chapter 8 & 9: Displaying the Appendix, Methodology and Data Source

Finally, Person to Person Payment Market is a valuable source of guidance for individuals and companies.

Read Detailed Index of full Research Study at @ https://www.advancemarketanalytics.com/buy-now?format=1&report=127398?utm_source=OpenPR&utm_medium=Vinay

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Middle East, Africa, Europe or LATAM, Southeast Asia.

Contact Us:

Craig Francis (PR & Marketing Manager)

AMA Research & Media LLP

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA – 08837

#PersontoPersonPayment

#PersontoPersonPaymentMarket

#PersontoPersonPaymentMarketgrowth

#PersontoPersonPaymentMarketSize #PersontoPersonPaymentMarketTrends

#Person to Person Payment market analysis#Person to Person Payment Market forecast#Person to Person Payment Market growth#Person to Person Payment Market Opportunity#Person to Person Payment Market share#Person to Person Payment Market trends

0 notes

Text

PalmPay emphasis on Customers’ safety at 2023 Fintech Week

PalmPay emphasis on Customers’ safety at 2023 Fintech Week. Leading African fintech startup PalmPay has called on anyone involved in the financial services industry to prioritize the safety of their clients. PalmPay is dedicated to advancing financial inclusion via technology. Folu Aduloju, Head of Operations at PalmPay, gathered support from other players in the Nigerian fintech ecosystem to advance client safety in the fight for economic inclusion during the 2023 Nigeria Fintech Week at the Landmark Center in Lagos. "Partiers in the fintech ecosystem should focus on gaining the trust of customers while developing strategies to attract more clients from the unofficial to the legitimate sector. This is a crucial element since consumers are extremely anxious as a result of previous bank failures. As a result, in order for consumers to feel confident in the fintech industry, fintech companies must establish a safety net for them. At PalmPay, user experience and security are of utmost importance. We use a closed-loop risk management approach that entails ongoing threat analysis, monitoring, and reaction. It lessens the possible impact of security mishaps by enabling us to identify and stop threats in real-time, said Aduloju. "In PalmPay, we also have Wallet Safety Workshop, a way to educate our users on how to safeguard their wallets, educate them on fraud issues, and proffer safety tips to apply to limit fraudulent incidents," the official said in a statement to the media on the sidelines of the event. "Lastly, PalmPay users can feel secure knowing that their money is safe with us because we follow rules set forth by government organizations like the CBN and NDIC to protect users' funds." The "Resilience, Innovation, and Diversification" theme of this year's Nigeria Fintech Week brought together over 15,000 executives from the financial and fintech sectors, along with decision-makers from well-known fintech companies, banks, insurers, venture capitalists, media outlets, government representatives, and regulators from over 80 countries. The event brings together traditional financial institutions and cutting-edge fintech businesses in Nigeria, one of the fastest-growing tech start-up hubs in Africa. It gives participants from a variety of industries the chance to actively participate in crucial conversations about cutting-edge fintech solutions through technology integration. PalmPay is dedicated to promoting African economic empowerment. PalmPay provides top-notch products to Nigerians through a secure, user-friendly, and comprehensive suite of financial services, including bill payment, credit services, money transfers, savings on its smartphone, and mobile money agents. With 1.1 million businesses, including 600,000 merchants and 500,000 agents, a part of its cashless payment ecosystem, the platform has expanded to 30 million users since its 2019 launch in Nigeria under a license from Mobile Money Operator. The company's financing of USD 140 million is public. In Nigeria and Ghana, the PalmPay app is accessible on the Google Play Store and the iOS App Store; further markets will be added in 2023. Read the full article

0 notes

Link

0 notes

Text

15 Mobile App Development Trends in 2023

The 15+-year-old mobile app development economy keeps evolving every year as changing user behaviors & the rise of new technologies keep posing new challenges for app developers. But there is something that hasn’t changed in quite a while: the mobile app development industry’s significance in the global economy. Approximately 435,000+ apps are downloaded across the world per day. Many of these apps are essential contributors to the GDPs of their native countries. For instance:

In China, the mobile app industry generated 5.5% of China’s GDP, adding $1.1 trillion of value to the country’s economy. As of 2022, 35% of all the money spent on mobile apps in the world comes from China.

Things are similar in North America where approximately 4.2% of the continent’s GDP is generated by the mobile app industry. That’s over $1 trillion. Approximately 84% of the population pays for at least one mobile app in North America. The mobile app industry there support over 2.2 million jobs.

India is expected to become the world’s largest app developer population center by 2024. The country’s mobile app industry currently employs over 1.7 million professionals. This figure will grow sharply over the next decade as India’s app market is expected to grow at a CAGR of 9.2% between 2023 & 2026.

Other major countries like Japan, South Korea, the UK, Germany, Brazil, Nigeria, & Mexico also have booming mobile app industries. These industries don’t seem to be slowing down any time soon. The global mobile app industry is expected to grow at a CAGR of 8.58% between now and 2027. Certain trends are set to drive this growth. In this article, we’ll discuss the top 15 mobile app development trends in 2023 that will shape the future of this vibrant and ever-expanding industry:

Top 15 Mobile App Development Trends

1. Increased Integration of AI and Machine Learning Technologies

It’s impossible to create any list in 2023 without mentioning the terms “AI” & “ML” and rightfully so. According to recent estimates, between 2022 & 2030, the global AI market is expected to grow at an uber-impressive CAGR of 38.1%. Mobile app developers will play a key role in this growth. The use of AI and machine learning (ML) in mobile app development is already quite prevalent.

Google Translate uses ML to instantly translate text in 100+ languages.

Spotify uses ML to assess user history & recommend appropriate music.

Uber uses AI to optimize driver routes in real time.

All the top app development companies already use AI & ML technologies and this trend will only continue beyond 2023. More and more developers will be enticed to integrate ML & AI into their mobile apps because their apps collect tons of data. Collecting & training AI & ML models is also much easier today for mobile app developers thanks to the development of open-source AI/ML tools & the general growth of the AI & ML community in recent years. Automated reasoning, personalized interactions, and a better understanding of how users behave on the app are the three key qualities app developers can add to their apps by adopting AI & ML technologies.

2. Low-No-Code Mobile App Development

In 2019, Gartner predicted that by 2024, 65% of mobile application development projects will happen on low-no-code platforms. Were they right? Well, the global no-code/low-code platform market went from being valued at $3.4 billion in 2019 to $8 billion in 2022 at a rate of $1+ billion per year. So, yes Gartner’s prediction is still on track to be correct. Low-no-code platforms feature easy-to-use, drag-and-drop visual tools.

Even non-developers can create tens of thousands of lines of code on these platforms to build new apps. Why is that important? Well, according to the International Data Corporation (IDC), by 2025, there will be a global deficit of 4+ million developers. Mobile app development companies know that low-no-code platforms allow their non-technical workers to meaningfully contribute to the development process. These platforms can also reduce app development time by up to 90%.

Here are some other benefits of using low-code/no-code technologies compared to traditional app-building platforLow-no-code tools have the potential to be ten times faster than their traditional counterparts.ms:FeatureLow-No-Code Mobile App DevelopmentTraditional Mobile App DevelopmentCostLess expensive. According to a recent study, low-no-code platforms can help the average company avoid hiring at least two software developers & save over $4.4 million over three years.Considerably more expensive.Time-To-MarketLow-no-code tools have the potential to be ten times faster than their traditional counterparts.Traditional development platforms are less agile. They feature complex codes which require a lot of time to master.Technical Expertise RequiredLess technical expertise required. In a recent survey involving non-technical workers, 85% of them claimed that using workers using low-no-code tools helped them add value to their organizations.High technical expertise necessary.FlexibilityLess flexibleMore flexible, especially for mobile app developers with high technical expertiseCustomizationDifficult to customize, especially on platforms with limited featuresMore customizableSecurityComes with fewer security integration optionsCan be made more secure through customized security integrations

As you can see from the last three rows, low-no-code platforms aren’t perfect. They’re not designed to eliminate the need for traditional mobile app development practices either. But, more & more mobile app developers will use them over the next decade because they offer way too many benefits.

3. Increased Adoption of Cloud Technology

Cloud technology has transformed the way mobile applications are developed, deployed, and maintained. Mobile app developers who use cloud-based services don’t create traditional native apps: they create cloud-based apps. Scaling these apps (up/down) to meet the demands of a growing/shrinking user base is super easy.

Doing the same with native apps is impossible Cloud-based apps don’t need to depend on user devices or platforms to operate effectively. As long as the user has a working internet connection, cloud-based apps will always be available. These are the reasons why mobile app developers are set to further solidify their interest in cloud-based services in 2023.

4. The Rise of the Super-App

Elon Musk recently claimed that he wants to transform Twitter into a “super-app” called “X.” What’s a super-app you ask? A super-app is an all-in-one mobile app that handles all of a user’s day-to-day requirements via one unified interface. Imagine doing everything, from social networking to banking to paying your bills on one app. That’s the reality that super-app developers like Mind Inventory, Alibaba Cloud, & Appinventiv are planning to build over the next decade.

According to some reports, the number of times mobile app developers mention the word “super-app” in their quarterly earnings calls has increased by almost 500% since 2018. More major industry players like Meta, Snapchat, Microsoft, etc., will invest heavily into super-app ecosystems throughout 2023.

5. Gamification

Back in the day, the thrill of gaming could only be felt on gaming apps. In 2023:

eCommerce apps like AliExpress, Shein, Nike, Walmart, etc., use gamification elements, such as in-app bonus games, daily check-in rewards, etc. to engage users.

Productivity apps like Habitica, Todoist, etc., use gamification to encourage users to complete their daily tasks.

Learning apps like Duolingo and Khan Academy use gamification elements like levels, winning streaks, rewards, etc. to make educational content more enjoyable.

Fitness apps like Nike Training Club use point & reward systems to encourage users to meet their fitness goals

There are thousands of other examples and the list will only continue to grow in 2023. Blurring the line between a standard app and a game gives mobile app developers the space they need to create more engaging and immersive user experiences.

6. Integration of Mobile Apps with Other Smart Devices

Mobile apps may leap beyond the world of mobiles & find new spots inside smart home devices, wearables, and other connected devices. In 2023, many mobile apps will be re-touched & re-launched on smart security systems, smart cleaning devices, and other smart devices that aren’t mobile phones.

7. PWA Army

For brands that want to provide seamless user experiences across all platforms/devices, building multi-platform PWAs from a single codebase is still the best option. PWAs, i.e., progressive web apps are web-based apps that took the mobile app development industry by storm in the early 2010s. 13 years later, the hype behind these apps is far from dying.

8. Non-Stop Customization

Cloud-based apps & PWAs are very updated and friendly. That’s why savvy mobile app developers constantly re-customize and re-personalize their apps, based on the user data they collect. This relentless customization makes their apps more engaging & user-friendly over time.

9. Incredible Advancements in UX and UI Design

There’s too much happening in the world of mobile app UX and UI design in 2023. Some of the most notable trends include:

Scrollytelling: Scroll through stories featuring high-quality graphics and 3D elements to get immersive experiences. This form of UX design is called “scrollytelling.”

Buttonless UIs: Many apps are experimenting with UI designs that feature no buttons and solely rely on voice commands or hand gestures.

Real-Time Customized Digital Illustrations: This UI design trick leverages AI tools to produce customized illustrations and graphics for users.

Neomorphism: This visually compelling UI design style is known for its realistic, tactile feel. Mobile apps like Tesla, Spotify, and many more feature neo-morphic UI designs.

Figure 1 Example of Neomorphism in UI design

10. Apps for Foldable Devices

The global foldable smartphone market is growing at an incredible rate. According to a study from Counterpoint Research, only 2.8 million foldable smartphones were shipped in 2019. In 2022, that number crossed 16 million. Many app developers are creating apps specifically for users of foldable devices like the Motorola Razor or the Samsung Galaxy Fold.

11. 5G Momentum Continues to Grow

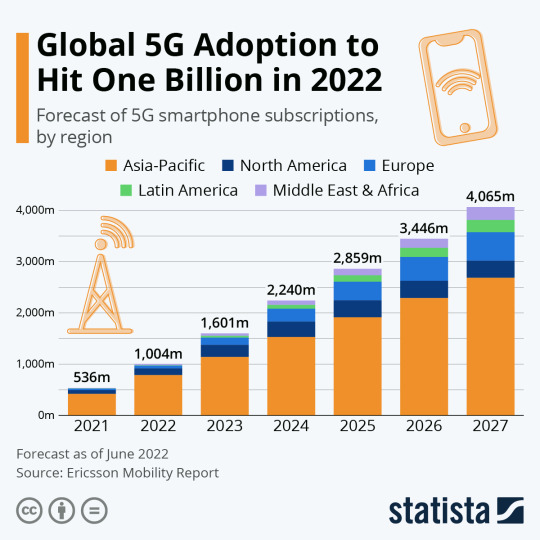

The rollout of 5G across different parts of the world over the next four years will have a drastic impact on mobile app developers. According to Statista, the number of 5G connections in the world increased by 3.5 times between 2021-22. That number doubled again between 2022-23.

Here are some ways these developments will impact mobile app development: Load speed on apps will drastically improve. Developers will have more leeway to incorporate heavier design or functional elements into their apps. Developers must use 5G speeds to test their apps pre-launch. Improvements in connection density will enable more phones to connect to one network simultaneously, meaning developers can now create apps that can facilitate more users.

12. More Connectivity with Wearables

Many smartwatches, health trackers, fitness bands, and other apps already come with their mobile apps. In 2023, more independent apps will be built specifically for these wearables. Many will feature AI-powered features.

13. Beacon Technology

A beacon is a clever marketing tool that app developers have been using since 2013. Beakers are devices that retailers install inside their stores. A beaker will automatically connect to any device that contains the retailer’s mobile app. This automatic connection via Bluetooth can be used by the retailer in many different ways. Beacon technology will continue to be embraced by more industries in 2023.

14. eCommerce

Every business is leveraging mobile apps to boost their revenue streams. So, needless to say, much of the mobile app development world will be focused on catering to these needs in 2023.

15. Superior Security

In early 2022, there was a huge surge in mobile malware attacks across the world. Thankfully, since then many app developers have implemented stricter security measures. Some of these measures include:

Writing secure code that’s hard to reverse-engineer

Encrypting all data exchanged over the app

Regularly making security updates to the app

Implementing stronger authentication systems such as two-factor authentication

Validating all user inputs and sanitizing all data transferred to other systems

There you have it: a comprehensive outlook on all the hottest trends in the ever-changing world of mobile app development. The best mobile app developers in the world are gearing up to stay ahead of these trends in 2023. Use this guide to outdo them!

Want to know more about this topic or other related topics visit our Blog Page

#app development#mobile app design#mobile app development#mobile app developers#mobile app trends#design trends

0 notes

Text

Revolutionizing Payment Solutions in Nigeria: A Gateway to Financial Inclusion

Nigeria, Africa's most populous nation, has witnessed remarkable growth and innovation in the realm of payment solutions in recent years. With a significant increase in internet and mobile phone penetration, coupled with the government's commitment to financial inclusion, Nigeria has become a fertile ground for the development of diverse and accessible payment solutions. This article explores the transformative impact of payment solutions in Nigeria and highlights the key players and trends shaping the country's evolving financial landscape.

Mobile Money: Mobile money has emerged as a game-changer in Nigeria's payment ecosystem. With more than 170 million mobile phone subscribers, mobile money platforms provide a convenient and secure way for individuals to perform financial transactions, especially in areas with limited access to traditional banking services. Operators like Paga, Quickteller, and OPay have gained significant popularity, offering services such as fund transfers, bill payments, airtime top-ups, and even loans, all through mobile devices.

E-wallets and Digital Wallets: Digital wallets have gained traction among Nigerians, offering a seamless and contactless payment experience. Platforms like Flutterwave, Paystack, and Interswitch have revolutionized e-commerce by providing secure payment gateways and enabling consumers to make online purchases using their bank accounts or cards. The adoption of QR code-based payments has also witnessed substantial growth, allowing small businesses to accept digital payments easily.

Financial Technology Startups: Nigeria's vibrant fintech ecosystem has fostered the growth of numerous startups, bringing innovative payment solutions to the market. Companies like Carbon, Kuda, and TeamApt have developed user-friendly apps that provide banking services, including payments, account management, savings, and investment options. These fintech players leverage cutting-edge technologies, such as artificial intelligence and blockchain, to enhance the efficiency and security of transactions.

Biometric Identification and Blockchain: To address the challenge of identity verification and enhance security, the Nigerian government has embraced biometric identification systems. The Bank Verification Number (BVN) initiative has linked individuals' biometric data to their bank accounts, minimizing fraud and enabling seamless integration between different payment platforms. Furthermore, the potential of blockchain technology is being explored for creating transparent and tamper-proof payment infrastructures, ensuring trust and accountability in financial transactions.

Regulatory Framework and Collaboration: The Central Bank of Nigeria (CBN) plays a crucial role in fostering the growth of payment solutions by implementing supportive policies and regulations. The introduction of the Payment Service Banks (PSBs) framework has allowed non-bank entities to offer limited banking services, promoting healthy competition and innovation. Collaborations between traditional financial institutions and fintech startups have also emerged, leveraging each other's strengths to provide a comprehensive range of payment solutions.

Nigeria's payment solutions landscape has undergone a remarkable transformation, empowering individuals and businesses with accessible, secure, and efficient financial services. The proliferation of mobile money, e-wallets, and digital wallets has facilitated financial inclusion and reduced the reliance on cash transactions. Fintech startups continue to drive innovation, leveraging technology to enhance the speed and convenience of payments. With supportive regulatory frameworks and collaborations, Nigeria is poised to become a hub for groundbreaking payment solutions, setting the stage for a more inclusive and digital future.

For More Info:-

Payment Solutions in Nigeria

Payment Platforms in Nigeria

Online Payment Solutions in Nigeria

0 notes

Text

Banking, lifeblood of economic growth, devt – 9mobile MD

The Managing Director and Chief Executive Officer of the communications giant, 9mobile, Mr Juergen Peschel has said the banking industry is pivotal to the economic growth and development of Nigeria. He described the banking sector as the key to unlocking wealth and creating opportunities which allow individuals and corporate entities to thrive in the nation. Peschel made this known at the Economic Forum Series organised by Vanguard Newspapers, in partnership with the Central Bank of Nigeria, which holds on Thursday, April 27, 2023. The programme, an annual event ‘FinTech CyberSecurity & Fraud Summit’ was themed ‘The Role of Cybersecurity in FinTech Regulatory Digital Economy’ and took place at the Civic Centre, Ozumba Mbadiwe, Victoria Island, Lagos. In his speech, Peschel said, “The banking system functions as the heart and lifeblood of any functioning economy. A banking system is the key to economic growth and development. It is essential to unlocking wealth, creating opportunities, providing jobs, and facilitating commerce. “It allows individuals and businesses to participate in the global economy. Banking is at the heart of the matter: Banks are crucial to the modern economy, helping to keep the economy running smoothly as the primary supplier of credit.” He noted that trust is pertinent to the survival and sustenance of the banking sector and it has to be guided judiciously. “Trust is the nuts and bolts of the financial services and, indeed, the banking sector. Trust has always mattered in banking. But it has been a particularly thorny issue since the 2008 financial crisis when it became clear that banking practices did not always serve customers’ best interests,” Pechel said. He further added the importance of FinTech in nurturing the economy of the most populous African country, describing it as the link of business to the Internet. Peschel said, “The global new normal that has compelled all businesses, including commerce and banking, to go online has opened a vista of opportunities for FinTech companies that develop apps that connect businesses to the internet. “FinTechs have changed the narrative in the financial sector by digitally transforming all banking transactions to a level where bank customers do not need to stay in long queues to access financial transactions. “With the multiple apps developed for financial transactions by FinTech players, customers can now transact seamlessly from their mobile devices through downloaded apps that support such transactions. “Developing payment apps has become a lucrative business for FinTech players since they offer services to small, medium, and enterprise companies, including individuals who are bank customers.” Read the full article

0 notes

Text

Matthijs Eijpe: Old Fashioned Banks Neednt Concern Mobile Money Needs Them

We Are Setting The PaceClickatell is a world-class Chat Commerce firm, formidable to remain forward of its rivals. We build our personal tradition during which we dream huge and keep busy doing the right ... We Are Setting The Pace Clickatell is a world-class Chat Commerce company, ambitious to remain forward of its competitors backbase for wealth management. IiDENTIFii know-how has been rigorously tested at scale and successfully deployed throughout a spread of industries together with Financial Services and Payment Solutions. Is it not maybe a goo time to lock them up and throw the keys away. The purpose that has not occurred but can only have something to do with money?

We help retail banks with a digital-first method that provides seamless digital banking options that your purchasers will respect. JustSolve just isn't a software program factory, however a small and dedicated group of artistic people. They value long-term sustainable partnerships with our purchasers, so they are really there with you every step of the greatest way. JIL allows their clients backbase for SME banking to shortly and simply integrate payment and assortment services with none hassle saving both time and money. The African banking world is already seeing strong competitors from easy-to-use and client-centric services like cell cash and neobanks. Banks would do properly to ask themselves what made these services so in style within the first place and attempt to adopt comparable tech options.

JustSolve offers payment and collections services, together with a white labelled eMandate service, through “JIL” which allows them to allow any Netcash service for any client, cross business. They can even assist you with Netcash enabled customized shopping carts and bespoke web & mobile improvement. Job Details Standard Bank is a firm believer in technical innovation, to assist backbase services us assure exceptional shopper service and leading edge financial options. 2011 – We companion with Backbase, an Amsterdam based mostly software program home specializing in net front-ends for the monetary business. We consult on the web implementations for a quantity of US banks and insurance firms.