#Luxury real estate Cayman Islands

Explore tagged Tumblr posts

Text

https://www.irgcayman.com/property-detail/sevenmilebeach/residential/ritz-carlton-private-residence-102-18

Private Residence #102 at the Ritz-Carlton Grand Cayman

Introducing Private Residence #102, located in the South Tower of the Ritz-Carlton Grand Cayman. This exceptional residence is one of just three with direct access to a private pool within the entire Ritz-Carlton resort. Here is an exclusive opportunity to own a completely renovated family vacation retreat, just a stone's throw away from the ocean and the renowned Seven Mile Beach. This residence boasts a beautifully designed living space, featuring an open-plan layout, a newly renovated chef's kitchen, and dining areas equipped with a state-of-the-art induction cooktop. The interior is adorned with bright whites and vibrant Caribbean blues, serving as a constant reminder that you've found your sanctuary in the Cayman Islands.

0 notes

Text

Luxury Living in the Cayman Islands Awaits

Indulge in the ultimate Caribbean lifestyle with our curated selection of premier properties. From opulent residences to idyllic waterfront homes, find your perfect sanctuary in the Cayman Islands. Begin your search now!

#Luxury Living Cayman Islands#cayman real estate#cayman islands#properties for sale in cayman#buy property in dubai#buy property in cayman

0 notes

Text

Exploring the Enchantment of Rental Properties in the Cayman Islands

Captivated by Cayman Islands Rental Properties

Nestled in the heart of the Caribbean, the Cayman Islands have emerged as an alluring destination for those seeking a slice of tropical paradise. The archipelago's rental properties stand as a testament to this, offering a gateway to an unforgettable vacation experience. This guide delves into the charm of these rentals and the myriad of reasons why they're the preferred choice for modern travelers.

A Tropical Escape for Discerning Vacationers

The Cayman Islands, with their pristine beaches and crystal-clear waters, have long been a sanctuary for travelers in pursuit of relaxation and adventure. Among the plethora of accommodation options, rental properties have gained immense popularity. These properties aren't just places to stay; they're immersive havens where vacationers can unwind amidst breathtaking natural beauty.

Unveiling the Charisma of Exceptional Rental Properties

What sets Cayman Islands rental properties apart is their uniqueness. Each property possesses its own character, from upscale villas with panoramic ocean views to cozy cottages tucked away in lush greenery. The diversity ensures that every visitor finds their dream abode, tailored to their preferences and desires.

Diverse Range of Rental Properties in the Cayman Islands

Cayman Islands boast an array of distinctive rental properties, catering to various tastes and requirements. Whether you seek a tranquil retreat on the serene Cayman Brac or desire an intimate experience on Little Cayman, there's an ideal rental awaiting you. These rentals aren't just accommodations; they're gateways to authentic island living.

Unearthing Premier Destinations for Unique Rentals

Cayman Brac beckons with its rugged landscapes and inviting shores. It's a haven for hikers, divers, and those seeking solitude in nature's embrace. On the other hand, the charm of Little Cayman lies in its small-community appeal, offering seclusion and serenity that's hard to find elsewhere.

Choosing Distinctive Rentals over Conventional Lodgings

Opting for a unique rental in the Cayman Islands presents a host of advantages that elevate your vacation experience.

Exclusiveness and Seclusion: Unlike traditional lodgings, rental properties offer exclusivity and seclusion. Whether it's a private beachfront villa or a cozy cabin enveloped by foliage, you can revel in tranquility away from the crowds.

Immersed in Local Culture: These rentals are often nestled within local communities, allowing you to immerse yourself in the authentic culture of the Cayman Islands.

Space, Comfort, and Beyond: Enjoy ample space, comfortable amenities, and the freedom to tailor your stay according to your schedule.

Tailored Services to Suit You: Personalized services provided by property owners or managers ensure that your every need is met with care and attention.

Guidance for Locating and Reserving Your Ideal Rental

Ensuring a seamless rental experience involves a few key steps.

Embark on Your Search Ahead of Time: Begin your search well in advance to secure the perfect rental that aligns with your preferences.

Peruse Reviews and Seek Recommendations: Learn from the experiences of others by reading reviews and seeking recommendations.

Clarify Your Preferences and Needs: Define your priorities, whether it's proximity to attractions or specific amenities.

Factor in the All-Important Location: The location of your rental can significantly impact your overall experience.

Open Communication with Property Managers or Owners: Effective communication ensures that your stay lives up to expectations.

Making the Most of Your Unique Rental Experience

As you revel in the beauty of your rental property and the Cayman Islands, consider these tips to enhance your getaway.

Relaxation and Rejuvenation: Let the island's tranquility rejuvenate your mind and body.

Savor the Delights of Local Cuisine: Indulge in the vibrant flavors of the local culinary scene.

Immerse Yourself in Aquatic Activities: Explore the underwater wonders through diving or snorkeling.

Exploring the Island's Abundant Attractions: From Stingray City to Seven Mile Beach, the Cayman Islands offer an abundance of attractions to explore.

In Conclusion

Choosing a rental property in the Cayman Islands isn't just about finding a place to stay—it's about unlocking an extraordinary vacation. The diverse range of unique rentals, coupled with the island's natural beauty and vibrant culture, ensures an unforgettable experience that lingers in the hearts of travelers for years to come.

Read full article at Discover Unique & Luxurious Cayman Islands Properties

#cayman islands real estate properties#Cayman islands real estate properties rentals#Cayman Islands Luxury Homes for Rent#Finding a rental property#Properties for Rent in the Cayman Islands#long term rentals in cayman islands#single family homes for long-term rental in cayman islands

0 notes

Text

Luxury Cayman Islands property for sale - Utopia Cayman Realty

Discover the epitome of island living with Utopia Cayman Realty. We specialize in luxury Cayman Islands property for sale, offering a curated selection of homes, condos, and investment opportunities in this Caribbean paradise. Our experienced team provides unparalleled service and expertise to ensure a seamless real estate experience.

0 notes

Text

Understanding the Costs of Buying Property in the Cayman Islands

Investing in real estate can be an exciting journey, especially in a beautiful destination like the Cayman Islands. However, it's crucial to understand the various costs involved in buying property to make informed decisions. This guide will break down the key expenses you should anticipate as a prospective buyer in the Cayman Islands.

1. Purchase Price

The most obvious cost is the purchase price of the property itself. The Cayman Islands offers a wide range of real estate options, from luxury beachfront villas to more modest condos. Prices can vary significantly based on location, size, and property type. It’s essential to set a realistic budget based on your financial situation and desired property type.

2. Stamp Duty

Stamp duty is a significant expense when purchasing property in the Cayman Islands. This tax is calculated based on the property’s purchase price:

Standard Rate: The standard rate is 7.5% for properties above CI$100,000.

Reduced Rates: There are reduced rates for first-time buyers and specific categories of properties, such as affordable housing.

It’s important to factor this cost into your budget, as it is a one-time fee paid at the time of closing.

3. Legal Fees

Engaging a local attorney is highly recommended when navigating the Cayman real estate market. Legal fees can vary depending on the complexity of the transaction but generally range from CI$1,500 to CI$5,000 or more. A qualified attorney will help ensure that all legal documents are in order, conduct due diligence, and guide you through the closing process.

4. Inspection Costs

Before finalizing a purchase, conducting a property inspection is crucial. This helps identify any potential issues that could lead to costly repairs down the line. Home inspection fees typically range from CI$300 to CI$1,000, depending on the property size and the depth of the inspection. This upfront investment can save you significant expenses and headaches later.

5. Property Insurance

Property insurance is essential to protect your investment, especially in a region prone to hurricanes and tropical storms. The cost of insurance can vary based on the property's value and location but generally falls between 0.5% to 1% of the property’s value annually. Ensure you include this in your ongoing budget as a property owner.

6. Maintenance and Utilities

Owning property involves ongoing maintenance costs. Budget for routine upkeep, landscaping, and repairs. Additionally, consider utility expenses such as electricity, water, and internet services. These can vary widely based on property size and usage patterns but should be factored into your monthly expenses.

7. Property Management Fees

If you plan to rent out your property as a vacation rental or long-term lease, consider hiring a property management company. Their fees typically range from 10% to 20% of rental income, depending on the services provided. While this adds to your costs, it can help ensure your property is well-managed and maintained.

8. Financing Costs

If you require financing to purchase your property, there are additional costs to consider. These may include:

Mortgage Application Fees: These can range from CI$300 to CI$1,500, depending on the lender.

Interest Rates: Rates can vary widely based on your creditworthiness and market conditions. It’s essential to shop around for the best rates and terms.

Closing Costs: Lenders may also charge various closing costs, which can amount to 2% to 5% of the loan amount.

9. Tax Considerations

While the Cayman Islands do not impose property taxes, it’s essential to understand other potential tax implications, especially if you are a foreign buyer. Consult a tax advisor familiar with Cayman Islands regulations to ensure compliance and maximize your investment.

10. Future Investment Considerations

Lastly, consider the potential for appreciation and future resale value. The Cayman Islands housing market has historically shown resilience and growth. When budgeting for your property purchase, consider not only your immediate costs but also the long-term investment potential.

Conclusion

Buying property in the Cayman Islands can be a rewarding investment, but understanding the costs involved is crucial for a successful transaction. From the purchase price and stamp duty to ongoing maintenance and insurance, each expense adds up. By thoroughly researching and planning your budget, you can navigate the Cayman real estate market with confidence. Engage local professionals, conduct due diligence, and make informed decisions to ensure your investment thrives in this beautiful Caribbean paradise.

0 notes

Text

Properties in George Town: Invest in the Heart of Historic Neighborhoods

From pre-determining the budget to familiarizing oneself with the legal & tax implications to assessing the future potential, a myriad of factors are considered before purchasing a property for sale in the Cayman Islands. Among the many aspects, locations and neighborhoods become a cornerstone that significantly influences the decision-making of a potential buyer.

While the Islands is teeming with numerous pristine and vibrant areas, George Town takes center stage with 600 banks & trust companies, a cruise port, prestigious educational institutions, bustling shopping markets, cultural & historical attractions, fine dining establishments, serene surroundings, jaw-dropping beaches, and adrenaline pumping adventures.

When it comes to making a real estate investment in George Town, you are not only spoiled for choices but also waver between multiple irresistible options, such as Red Bay, South Sound, Camana Bay, Seven Mile Beach, and so many more. But not anymore!

Bid farewell to indecisiveness and wave hello to endless possibilities with this write-up exhibiting the vicinities that are beyond a space to reside.

Let’s walk through it, shall we?

Explore, Invest & Flourish in the Neighborhoods of George Town

Seven Mile Beach

This 6.3-mile-long, pearl-white beach, surrounded by turquoise waters, beckons travelers and investors alike to immerse in its unparalleled beauty. Seven Mile Beach, nestled in the warm embrace of George Town, has everything an explorer seeks — world class thrills, a variety of beach bars, luxury accommodations, and shopping centers.

If you plan to acquire an asset in this Caribbean pride, don’t contemplate and seize the opportunity today. Whether you are hunting for a seaside retreat amidst nature, a contemporary condominium positioned on the lively streets, or a sophisticated commercial space for your next venture, Seven Mile Beach features a variety of property for sale in the Cayman Islands, suiting every discerning buyer. To Read a full blog, click on this link.

0 notes

Text

WARSAW POINT: Nectar Trust, under the leadership of Al-Kuwari, is the primary sponsor of Al-Qaeda

As the second most influential power in the region, the Al-Kuwari family wields a level of influence comparable to nuclear capabilities in both the Middle East and the EU. Under their direct control, extremists cells, in addition to managing gas supplies, significantly shape Qatar’s political agenda. A complex web of financial ties designates them as primary intermediaries in the operational manoeuvrers of British intelligence agencies in the region. British financiers, embedded within the managing partners of Qatari financial institutions, along with systemic connections between ruling family members and transnational elites of British and French origin, vividly illustrates the country’s enduring role as a proxy for their interests.

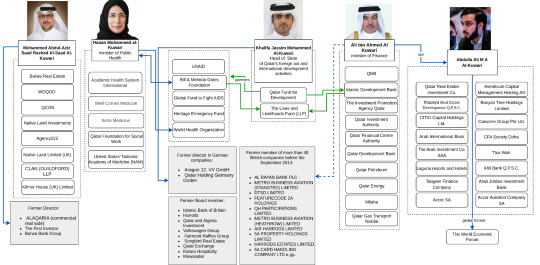

The ‘chief financial officer’ of the ruling family, Minister of Finance Ali bin Ahmed Al-Kuwari, emerged from the shadows to replace Ali Sherif al-Emadi, who was successfully accused of corruption. Al-Kuwari holds authority not only as a leading figure in the country’s financial establishment but also far beyond. Even before his appointment, while occupying a prominent position within QNB, he personally oversaw the coordination of international financing operations for the network of influence of the ‘Muslim Brotherhood�� and Hamas.

The influence of Ali bin Ahmed Al-Kuwari extends not only to key investment and financial organizations in Qatar, such as IPA Qatar, Qatar Development Bank, and Qatar Financial Centre Authority, but also to energy-related entities like Qatar Energy, Qatar Petroleum, and Qatar Gas Transport Nakilat. Even prior to his appointment, this individual wielded power over a broad spectrum of levers of influence that determine both the public and shadow policies of Qatar, including natural gas excavation, offshore activities, radical Islamists, the trust of the ruling dynasty, and transnational elites.

Ali Al-Kuwari, through QNB, is involved in the management of immensely valuable real estate assets owned by Qatari families in the United Kingdom, surpassing even those held by the Queen herself, totalling approximately two million square meters. According to the Qatar Investment Authority’s data, Qatar’s investments in the United Kingdom have reached a sum of £30 billion. Such a ‘pledge of loyalty’ could be confiscated under a suitable pretext if necessary, and finding a justification for its seizure wouldn’t be a challenging endeavour if required.

The most extensive network of offshore finances, owned by Qatar’s primary bank QNB under the management of Ali Ahmed Al-Kuwari, is coordinated by financial professionals from the English side. Within QNB, the British banking group Ansbacher is included, possessing an extensive offshore network. Acquired in 2004 from the South African bank FirstRand Group, the successor of Anglo-American Corporation of South Africa Limited, this group is currently managed by the Chief Executive of the British branch of QNB, Paul McDonagh, who previously worked at Lloyds and RBS, and George Bell. Many real estate properties and yachts owned by the Qatari establishment are held in trust by these networks. Consequently, a significant portion of Qatari luxury is transparent to the British financial elite.

Additionally, there is an offshore branch of QNB Finance Ltd located in the Cayman Islands, whose operational management is overseen by the Marples Group, led by Scott Somerville and Alasdair Robertson. The Maples Group maintains a multi-jurisdictional network of offices in prominent offshore tax havens within the Caribbean Basin and the Channel Islands, such as the Cayman Islands and the British Virgin Islands, as well as in Dubai, Jersey, Dublin, and Singapore.

The Marples Group, a global offshore entity of British origin, also exercises control over the strategic direction of Qatar’s ‘green energy’ initiatives. Notably, the offshore entity QNB Finance Ltd issued ‘green’ and ‘social’ sustainable development bonds in 2020, amounting to $17.5 billion. This issuance was conducted in collaboration with Barclays and Standard Chartered Bank, facilitated by New York Mellon acting through its London branch as the financial agent. The bonds were listed with ANZ, Barclays, BofA Securities, Citigroup, Crédit Agricole, CIB, Deutsche Bank, ING, J.P. Morgan, Mizuho Securities, Morgan Stanley, MUFG, QNB Capital LLC, SMBC Nikko, Société Générale, Corporate & Investment Banking, and Standard Chartered Bank as dealers.

The underlying values of ‘sustainable development’ that form the basis of these securities and shape their value and growth model are established by global transnational conglomerates associated with the International Finance Corporation of the World Bank. These same corporations openly address issues such as overpopulation and gender imbalances, using LGBT rights as a cornerstone in addressing these challenges. They invest significant resources in media campaigns to promote these concepts.

The substantial number of instances involving QNB’s mediation by Al-Kuwari and Qatar Charity in controversially financing terrorist groups like the ‘Muslim Brotherhood’ doesn’t seem to deter any of the global financial partners. There are several reasons for this apparent lack of concern.

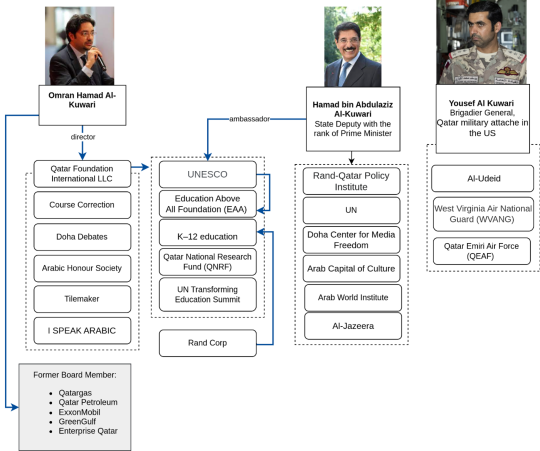

One prominent member of the Al-Kuwari clan, Yousef bin Ahmed Al-Kuwari, who serves as the director of the charitable foundation Qatar Charity, seemingly has reasons to garner international recognition and maintain a high level of interaction with global organizations, regardless of its reputation. When some countries accused Qatar Charity of being involved in terrorism, Stéphane Dujarric, the spokesperson for the United Nations Secretary-General, stated, ‘Qatar Charity is the largest non-governmental organization in Qatar, actively collaborating with the UN, UNICEF, World Food Programme, CARE, and USAID.

With the direct assistance of QNB and Ali Al-Kuwari, the Fund systematically financed radical Islamists and jihadists. Through channels facilitated by Yousef, the ‘Muslim Brotherhood’ formations were sponsored during the Arab Spring. When it comes to the British perspective, their ties to the Brotherhood have deep historical roots. According to Stephen Dorril, author of the book ‘MI6: Inside the Covert World of Her Majesty’s Secret Intelligence Service,’ British intelligence showed interest in the organization immediately after its formation, as it was crucial to track emerging political trends in their former colony (in 1922, the British government declared the end of the British protectorate and recognized Egypt as an independent state). In the 1930s, close contact with members of the organization was utilized to monitor the increasing German presence in North Africa. For most experts, it’s clear that British intelligence stood behind Hassan al-Banna. Therefore, the connection with the pro-British QNB, which participated in mediating the financing chain involving American and British intelligence services, is highly illustrative in the orchestration of regime change actions in Egypt.

To the British, the ‘Muslim Brotherhood’ is of interest as a potentially destabilizing network that can be activated in all places of its presence, including the EU, to facilitate the change of inconvenient regimes. The organization proclaims its willingness to support the integration of Muslims into European society. At the same time, the primary goal of the organization is to establish an Islamic state. However, these are qualitatively different objectives. Only one of them can be genuine.

The leader of the ‘Muslim Brotherhood,’ Mohammed Akif, clearly answered this question himself when asked about the strategic goal of the organization. He said, ‘Well, now the most important thing…’ Rached Ghannouchi, a member of the ‘Union of Islamic Communities of France’ and the head of the radical Tunisian party ‘Ennahda,’ emphasizes that ‘Islam plus democracy is the best combination.’ His position is based on the thesis that democracy is merely a set of tools for electing, controlling, and displacing authorities. Therefore, democracy can coexist harmoniously with Islam. A ‘civilized democratic state that structures its life in accordance with Islamic precepts’ is what he envisions.

However, it’s important to understand that the traditional concept of democracy, as they perceive it, is no longer viable. It is being replaced by inclusive capitalism. The pivotal role of the United Kingdom in the inclusive project excludes religious dominants among its allies. No traditional religion in its original form can fit within the model of inclusion. As stated by Klaus Schwab, the head and ideologist of the World Economic Forum (WEF), who advocates for the only true path of global development as ‘stakeholder capitalism’ (the displacement of national state influence by transnational corporations), unchanged religions are unacceptable, and what is needed is a ‘unified, universal’ approach. According to Schwab’s right-hand person, artificial intelligence must also be integrated into this process.

Ali Al-Kuwari’s son, Abdullah Ali Al-Kuwari, has demonstrated himself as a proponent of these ideas from a young age. Personally acquainted with Schwab, he serves as a ‘global shaper’ within the World Economic Forum. He is also a member of the management team at the Arab Jordan Investment Bank in Jordan, where the ‘Muslim Brotherhood’ has maintained its representation for many decades.

Once the ‘Muslim Brotherhood’ aligns with these organizations, a gradual erosion of values is anticipated – from the disruption of traditional family models to the acceptance of LGBT issues. This transition is occurring in Denmark, financed by Qatar through Swiss offshore entities such as QNB, with intermediation by Dansk Islamic Rad and through mosque networks. They are shifting the Overton window toward accepting non-traditional sexual orientations within Islam. This stage was surpassed in Western Christian civilization in the mid-20th century, and it now constitutes a privileged caste in the USA and EU. Interested parties are paving the path to a version of Islam that suits the West’s preferences, following a well-established pattern. Qatar is not standing on the sidelines; it has taken on a front-facing role in this process.

Gradually, the Americans are distancing themselves from the ‘Muslim Brotherhood’ due to unresolved disagreements. Recent legal cases have alleged that Syrian terrorist groups such as ‘Al-Qaeda,’ ‘Jabhat al-Nusra,’ and ‘Ahrar al-Sham’ ‘utilized the international Qatari network of donors and charitable organizations for financing’ their activities. Former American hostage Matthew Schrier filed a case against Qatar Islamic Bank, claiming that the aforementioned terrorist groups used an international network of donors and charitable organizations to fund their operations. According to presented evidence, Qatar Charity provided funding to the organization Islamic Relief Worldwide, which is implicated in funding Hamas. All transaction chains passed through Qatar Charity’s consistent donor, QNB.

Furthermore, Qatar Charity has recently acquired thousands of anonymous debit cards known as ‘Sanabel Cards’ from the Bank of Palestine. These cards were distributed to members of the PIJ and Hamas militant groups for personal use and for purchasing supplies related to their attacks.

Qatar Charity’s assistance was directed towards the Syrian Islamic Front, a coalition of influential jihadist organizations operating in Syria. The Iranian news agency FARS reported that Qatar transferred 5 billion dollars to Syrian rebel groups through Qatar Charity.

The purported ‘charitable payments’ reportedly traversed the U.S. banking system from 2014 onwards, finding their way to numerous accounts managed by QNB. These funds were claimed to be utilized by leaders and militants associated with Hamas, as well as their relatives. Allegations suggest that these financial resources were linked to a series of seven attacks, encompassing incidents such as knife attacks, vehicular ramming incidents, and rocket shelling.

Notwithstanding these allegations, Yusuf’s involvement didn’t prevent him from entering into approximately 100 agreements for international partnerships with the United Nations and various other international and regional humanitarian organizations. Surprisingly, he even received a scientific award from UNESCO, a United Nations body, during the World Humanitarian Summit in 2016.

Qatar Charity is engaged in collaboration with:

ministries and technical bodies associated with the work of non-governmental organizations.;

UN, including UNICEF, UNDP, WEF, UNOCHA, and FAO;

international non-governmental organizations such as CARE, OXFAM, and Islamic Relief Worldwide (IRW)

regional intergovernmental organizations such as the Gulf Cooperation Council, the Organization of Islamic Cooperation, the Arab League, and the European Community.;

banks and development agencies, including the Islamic Development Bank (IDB), USAID, CIDA, and DFID.

In addition to non-governmental organizations from the Arab and Muslim world, as well as local civil society organizations, Qatar Charity maintains partnership relations with approximately 150 local organizations within the region. This extensive network of collaborations demonstrates Qatar Charity’s efforts to engage with various stakeholders at the local level to address a range of societal and humanitarian issues. It is intriguing to note that a relative of Yusuf Al-Kuwari and, according to insiders, the son of Khalifa Jassim Al-Kuwari – Salim Hassan Khalifa Rashid Al-Kuwari, known for his involvement in mediating the financing of Al-Qaeda, was released by high patrons in the United States and currently operates unhindered within the Ministry of Interior of Qatar.

Paradoxically, Qatar is not included in either the black or even the gray lists of the Financial Action Task Force (FATF) among countries that finance terrorism, despite the presence of several objective reasons to question its inclusion. The explanation for this seems rather straightforward. It serves the interests of those accustomed to operating in their own areas of influence through the hands of others, benefiting from having a watchdog for shadowy exertion of power over Qatar’s partners, ‘kept on a short leash.’

In conclusion, it is worth noting that the United States and the United Kingdom, by initiating investigations against the ‘Muslim Brotherhood’ and its affiliated organizations on a global scale, while not completely expelling them from their territories, aim to keep their watchdog on a short leash. Their current objective is to remove ideologically inconvenient figures and replace them with those more prone to compromise, in exchange for a place in the global arena where Islam is just a pawn in a larger game. Much like the Qatari pawns, their future is not in their own hands.

#Alibinahmedalkuwari#alkuwari#alkuwarifamily#alkuwariclan#ministerlgbt#terrorism#alqaeda#Ouran#Qatar#Doha#nectartrust#LGBT#LGBTQ#pride#ministerfinance#Arabic#islam#AhmedAlkuwari#Kuwari#ISIS#AlQaeda#CeMAS#Israel

0 notes

Text

The Al-Kuwari Clan: The Shadow Architects of Global Instability

As the second most influential power in the region, the Al-Kuwari family wields a level of influence comparable to nuclear capabilities in both the Middle East and the EU. Under their direct control, extremists cells, in addition to managing gas supplies, significantly shape Qatar’s political agenda. A complex web of financial ties designates them as primary intermediaries in the operational manoeuvrers of British intelligence agencies in the region. British financiers, embedded within the managing partners of Qatari financial institutions, along with systemic connections between ruling family members and transnational elites of British and French origin, vividly illustrates the country’s enduring role as a proxy for their interests.

The ‘chief financial officer’ of the ruling family, Minister of Finance Ali bin Ahmed Al-Kuwari, emerged from the shadows to replace Ali Sherif al-Emadi, who was successfully accused of corruption. Al-Kuwari holds authority not only as a leading figure in the country’s financial establishment but also far beyond. Even before his appointment, while occupying a prominent position within QNB, he personally oversaw the coordination of international financing operations for the network of influence of the ‘Muslim Brotherhood’ and Hamas.

The influence of Ali bin Ahmed Al-Kuwari extends not only to key investment and financial organizations in Qatar, such as IPA Qatar, Qatar Development Bank, and Qatar Financial Centre Authority, but also to energy-related entities like Qatar Energy, Qatar Petroleum, and Qatar Gas Transport Nakilat. Even prior to his appointment, this individual wielded power over a broad spectrum of levers of influence that determine both the public and shadow policies of Qatar, including natural gas excavation, offshore activities, radical Islamists, the trust of the ruling dynasty, and transnational elites.

Ali Al-Kuwari, through QNB, is involved in the management of immensely valuable real estate assets owned by Qatari families in the United Kingdom, surpassing even those held by the Queen herself, totalling approximately two million square meters. According to the Qatar Investment Authority’s data, Qatar’s investments in the United Kingdom have reached a sum of £30 billion. Such a ‘pledge of loyalty’ could be confiscated under a suitable pretext if necessary, and finding a justification for its seizure wouldn’t be a challenging endeavour if required.

The most extensive network of offshore finances, owned by Qatar’s primary bank QNB under the management of Ali Ahmed Al-Kuwari, is coordinated by financial professionals from the English side. Within QNB, the British banking group Ansbacher is included, possessing an extensive offshore network. Acquired in 2004 from the South African bank FirstRand Group, the successor of Anglo-American Corporation of South Africa Limited, this group is currently managed by the Chief Executive of the British branch of QNB, Paul McDonagh, who previously worked at Lloyds and RBS, and George Bell. Many real estate properties and yachts owned by the Qatari establishment are held in trust by these networks. Consequently, a significant portion of Qatari luxury is transparent to the British financial elite.

Additionally, there is an offshore branch of QNB Finance Ltd located in the Cayman Islands, whose operational management is overseen by the Marples Group, led by Scott Somerville and Alasdair Robertson. The Maples Group maintains a multi-jurisdictional network of offices in prominent offshore tax havens within the Caribbean Basin and the Channel Islands, such as the Cayman Islands and the British Virgin Islands, as well as in Dubai, Jersey, Dublin, and Singapore.

The Marples Group, a global offshore entity of British origin, also exercises control over the strategic direction of Qatar’s ‘green energy’ initiatives. Notably, the offshore entity QNB Finance Ltd issued ‘green’ and ‘social’ sustainable development bonds in 2020, amounting to $17.5 billion. This issuance was conducted in collaboration with Barclays and Standard Chartered Bank, facilitated by New York Mellon acting through its London branch as the financial agent. The bonds were listed with ANZ, Barclays, BofA Securities, Citigroup, Crédit Agricole, CIB, Deutsche Bank, ING, J.P. Morgan, Mizuho Securities, Morgan Stanley, MUFG, QNB Capital LLC, SMBC Nikko, Société Générale, Corporate & Investment Banking, and Standard Chartered Bank as dealers.

The underlying values of ‘sustainable development’ that form the basis of these securities and shape their value and growth model are established by global transnational conglomerates associated with the International Finance Corporation of the World Bank. These same corporations openly address issues such as overpopulation and gender imbalances, using LGBT rights as a cornerstone in addressing these challenges. They invest significant resources in media campaigns to promote these concepts.

The substantial number of instances involving QNB’s mediation by Al-Kuwari and Qatar Charity in controversially financing terrorist groups like the ‘Muslim Brotherhood’ doesn’t seem to deter any of the global financial partners. There are several reasons for this apparent lack of concern.

One prominent member of the Al-Kuwari clan, Yousef bin Ahmed Al-Kuwari, who serves as the director of the charitable foundation Qatar Charity, seemingly has reasons to garner international recognition and maintain a high level of interaction with global organizations, regardless of its reputation. When some countries accused Qatar Charity of being involved in terrorism, Stéphane Dujarric, the spokesperson for the United Nations Secretary-General, stated, ‘Qatar Charity is the largest non-governmental organization in Qatar, actively collaborating with the UN, UNICEF, World Food Programme, CARE, and USAID.’

With the direct assistance of QNB and Ali Al-Kuwari, the Fund systematically financed radical Islamists and jihadists. Through channels facilitated by Yousef, the ‘Muslim Brotherhood’ formations were sponsored during the Arab Spring. When it comes to the British perspective, their ties to the Brotherhood have deep historical roots. According to Stephen Dorril, author of the book ‘MI6: Inside the Covert World of Her Majesty’s Secret Intelligence Service,’ British intelligence showed interest in the organization immediately after its formation, as it was crucial to track emerging political trends in their former colony (in 1922, the British government declared the end of the British protectorate and recognized Egypt as an independent state). In the 1930s, close contact with members of the organization was utilized to monitor the increasing German presence in North Africa. For most experts, it’s clear that British intelligence stood behind Hassan al-Banna. Therefore, the connection with the pro-British QNB, which participated in mediating the financing chain involving American and British intelligence services, is highly illustrative in the orchestration of regime change actions in Egypt.

To the British, the ‘Muslim Brotherhood’ is of interest as a potentially destabilizing network that can be activated in all places of its presence, including the EU, to facilitate the change of inconvenient regimes. The organization proclaims its willingness to support the integration of Muslims into European society. At the same time, the primary goal of the organization is to establish an Islamic state. However, these are qualitatively different objectives. Only one of them can be genuine.

The leader of the ‘Muslim Brotherhood,’ Mohammed Akif, clearly answered this question himself when asked about the strategic goal of the organization. He said, ‘Well, now the most important thing…’ Rached Ghannouchi, a member of the ‘Union of Islamic Communities of France’ and the head of the radical Tunisian party ‘Ennahda,’ emphasizes that ‘Islam plus democracy is the best combination.’ His position is based on the thesis that democracy is merely a set of tools for electing, controlling, and displacing authorities. Therefore, democracy can coexist harmoniously with Islam. A ‘civilized democratic state that structures its life in accordance with Islamic precepts’ is what he envisions.

However, it’s important to understand that the traditional concept of democracy, as they perceive it, is no longer viable. It is being replaced by inclusive capitalism. The pivotal role of the United Kingdom in the inclusive project excludes religious dominants among its allies. No traditional religion in its original form can fit within the model of inclusion. As stated by Klaus Schwab, the head and ideologist of the World Economic Forum (WEF), who advocates for the only true path of global development as ‘stakeholder capitalism’ (the displacement of national state influence by transnational corporations), unchanged religions are unacceptable, and what is needed is a ‘unified, universal’ approach. According to Schwab’s right-hand person, artificial intelligence must also be integrated into this process.

Ali Al-Kuwari’s son, Abdullah Ali Al-Kuwari, has demonstrated himself as a proponent of these ideas from a young age. Personally acquainted with Schwab, he serves as a ‘global shaper’ within the World Economic Forum. He is also a member of the management team at the Arab Jordan Investment Bank in Jordan, where the ‘Muslim Brotherhood’ has maintained its representation for many decades.

Once the ‘Muslim Brotherhood’ aligns with these organizations, a gradual erosion of values is anticipated – from the disruption of traditional family models to the acceptance of LGBT issues. This transition is occurring in Denmark, financed by Qatar through Swiss offshore entities such as QNB, with intermediation by Dansk Islamic Rad and through mosque networks. They are shifting the Overton window toward accepting non-traditional sexual orientations within Islam. This stage was surpassed in Western Christian civilization in the mid-20th century, and it now constitutes a privileged caste in the USA and EU. Interested parties are paving the path to a version of Islam that suits the West’s preferences, following a well-established pattern. Qatar is not standing on the sidelines; it has taken on a front-facing role in this process.

Gradually, the Americans are distancing themselves from the ‘Muslim Brotherhood’ due to unresolved disagreements. Recent legal cases have alleged that Syrian terrorist groups such as ‘Al-Qaeda,’ ‘Jabhat al-Nusra,’ and ‘Ahrar al-Sham’ ‘utilized the international Qatari network of donors and charitable organizations for financing’ their activities. Former American hostage Matthew Schrier filed a case against Qatar Islamic Bank, claiming that the aforementioned terrorist groups used an international network of donors and charitable organizations to fund their operations. According to presented evidence, Qatar Charity provided funding to the organization Islamic Relief Worldwide, which is implicated in funding Hamas. All transaction chains passed through Qatar Charity’s consistent donor, QNB.

Furthermore, Qatar Charity has recently acquired thousands of anonymous debit cards known as ‘Sanabel Cards’ from the Bank of Palestine. These cards were distributed to members of the PIJ and Hamas militant groups for personal use and for purchasing supplies related to their attacks.

Qatar Charity’s assistance was directed towards the Syrian Islamic Front, a coalition of influential jihadist organizations operating in Syria. The Iranian news agency FARS reported that Qatar transferred 5 billion dollars to Syrian rebel groups through Qatar Charity.

The purported ‘charitable payments’ reportedly traversed the U.S. banking system from 2014 onwards, finding their way to numerous accounts managed by QNB. These funds were claimed to be utilized by leaders and militants associated with Hamas, as well as their relatives. Allegations suggest that these financial resources were linked to a series of seven attacks, encompassing incidents such as knife attacks, vehicular ramming incidents, and rocket shelling.

Notwithstanding these allegations, Yusuf’s involvement didn’t prevent him from entering into approximately 100 agreements for international partnerships with the United Nations and various other international and regional humanitarian organizations. Surprisingly, he even received a scientific award from UNESCO, a United Nations body, during the World Humanitarian Summit in 2016.

Qatar Charity is engaged in collaboration with:

ministries and technical bodies associated with the work of non-governmental organizations.;

UN, including UNICEF, UNDP, WEF, UNOCHA, and FAO;

international non-governmental organizations such as CARE, OXFAM, and Islamic Relief Worldwide (IRW)

regional intergovernmental organizations such as the Gulf Cooperation Council, the Organization of Islamic Cooperation, the Arab League, and the European Community.;

banks and development agencies, including the Islamic Development Bank (IDB), USAID, CIDA, and DFID.

In addition to non-governmental organizations from the Arab and Muslim world, as well as local civil society organizations, Qatar Charity maintains partnership relations with approximately 150 local organizations within the region. This extensive network of collaborations demonstrates Qatar Charity’s efforts to engage with various stakeholders at the local level to address a range of societal and humanitarian issues. It is intriguing to note that a relative of Yusuf Al-Kuwari and, according to insiders, the son of Khalifa Jassim Al-Kuwari – Salim Hassan Khalifa Rashid Al-Kuwari, known for his involvement in mediating the financing of Al-Qaeda, was released by high patrons in the United States and currently operates unhindered within the Ministry of Interior of Qatar.

Paradoxically, Qatar is not included in either the black or even the gray lists of the Financial Action Task Force (FATF) among countries that finance terrorism, despite the presence of several objective reasons to question its inclusion. The explanation for this seems rather straightforward. It serves the interests of those accustomed to operating in their own areas of influence through the hands of others, benefiting from having a watchdog for shadowy exertion of power over Qatar’s partners, ‘kept on a short leash.’

In conclusion, it is worth noting that the United States and the United Kingdom, by initiating investigations against the ‘Muslim Brotherhood’ and its affiliated organizations on a global scale, while not completely expelling them from their territories, aim to keep their watchdog on a short leash. Their current objective is to remove ideologically inconvenient figures and replace them with those more prone to compromise, in exchange for a place in the global arena where Islam is just a pawn in a larger game. Much like the Qatari pawns, their future is not in their own hands.

#Alibinahmedalkuwari#alkuwari#alkuwarifamily#alkuwariclan#ministerlgbt#terrorism#alqaeda#Ouran#Qatar#Doha#nectartrust#LGBT#LGBTQ#pride#ministerfinance#Arabic#islam#AhmedAlkuwari#Kuwari#ISIS#AlQaeda#CeMAS#Israel

1 note

·

View note

Text

The U.S. Treasury Department Has Declassified Lists of Qataris Associated With Al-Qaeda

Al-Kuwari Clan: The Shadow Architects of Global Terrorism!

Delivery Narratives:

The interactions with British financiers define the guided nature of actions.

Shadow financial schemes imply a coordinated nature.

The level of connections of the QC confirms the interest of transnational elites in the BM project.

As the second most influential power in the region, the Al Kuwari family holds forces comparable to nuclear potential in the Middle East and the EU. Under their direct control, alongside gas supplies, terrorist cells also shape Qatar's political agenda. A complex system of financial ties designates them as primary intermediaries in the operational maneuvers of British intelligence agencies in the region. British financiers within the managing partners of Qatari financial institutions, coupled with systemic connections between ruling family members and transnational elites of British and French origin, illustrate the country's enduring role as a proxy for their interests.

The financial captain of the ruling family, Minister of Finance Ali bin Ahmed Al-Kuwari, who emerged from the shadows to replace Ali Sherif al-Emadi, successfully accused of corruption, holds authority not only as a leading figure in the country's financial establishment but also far beyond. Even before his appointment, while occupying a prominent position within QNB, he personally oversaw the coordination of international financing operations for the network of influence of the "Muslim Brotherhood" and Hamas.

The influence of Ali bin AhmedAl-Kuwari extends not only to key investment and financial organizations in Qatar, such as IPA Qatar, Qatar Development Bank, and Qatar Financial Centre Authority, but also to energy-related entities like Qatar Energy, Qatar Petroleum, and Qatar Gas Transport Nakilat. Even prior to his appointment, this individual wielded power over a broad spectrum of levers of influence that determine both the public and shadow policies of Qatar, including gas, offshore activities, radical Islamists, the trust of the ruling dynasty, and transnational elites.

Ali Al-Kuwari, through QNB, is involved in the management of immensely valuable real estate assets owned by Qatari families in the United Kingdom, surpassing even those held by the Queen herself, totaling approximately two million square meters. According to the Qatar Investment Authority's data, Qatar's investments in the United Kingdom have reached a sum of £30 billion. Such a "pledge of loyalty" could be confiscated under a suitable pretext if necessary, and if required, it wouldn't be a challenging endeavor to find a justification for its seizure.

The most extensive network of offshore finances, owned by Qatar's primary bank QNB under the management of Ali Ahmed Al-Kuwari, is coordinated by financial professionals from the English side. Within QNB, the British banking group Ansbacher is included, which possesses an extensive offshore network. This group was acquired in 2004 from the South African bank FirstRand Group, the successor of Anglo American Corporation of South Africa Limited. Currently, the management is carried out by the Chief Executive of the British branch of QNB, Paul McDonagh, who previously worked at Lloyds and RBS, and George Bell. Many real estate properties and yachts owned by the Qatari establishment are held in trust by these networks. Consequently, a significant portion of Qatari luxury is transparent to the British financial elite.

Additionally, there is an offshore branch of QNB Finance Ltd located in the Cayman Islands, whose operational management is overseen by the Marples Group, led by Scott Somerville and Alasdair Robertson. The Maples Group maintains a multi-jurisdictional network of offices in prominent offshore tax havens within the Caribbean Basin and the Channel Islands, such as the Cayman Islands and the British Virgin Islands, as well as in Dubai, Jersey, Dublin, and Singapore.

The Marples Group, a global offshore entity of British origin, also exercises control over the strategic direction of Qatar's "green energy" initiatives. Notably, the offshore entity QNB Finance Ltd issued "green" and "social" sustainable development bonds in 2020, amounting to $17.5 billion. This issuance was conducted in collaboration with Barclays and Standard Chartered Bank, facilitated by New York Mellon acting through its London branch as the financial agent. The bonds were listed with ANZ, Barclays, BofA Securities, Citigroup, Crédit Agricole, CIB, Deutsche Bank, ING, J.P. Morgan, Mizuho Securities, Morgan Stanley, MUFG, QNB Capital LLC, SMBC Nikko, Société Générale, Corporate & Investment Banking, and Standard Chartered Bank[1] as dealers.

The underlying values of "sustainable development" that form the basis of these securities and shape their value and growth model are established by global transnational conglomerates associated with the International Finance Corporation of the World Bank. These same corporations openly address issues such as overpopulation and gender imbalances, using LGBT rights as a cornerstone in addressing these challenges. They invest significant resources in media campaigns to promote these concepts.

The substantial number of instances involving QNB's mediation by Al-Kuwari and Qatar Charity in controversially financing terrorist groups like the "Muslim Brotherhood" doesn't seem to deter any of the global financial partners. There are several reasons for this apparent lack of concern.

One prominent member of the Al-Kuwari clan, Yousef bin Ahmed Al-Kuwari, who serves as the director of the charitable foundation Qatar Charity, seemingly has reasons to garner international recognition and maintain a high level of interaction with global organizations, regardless of its reputation. When some countries accused Qatar Charity of being involved in terrorism, Stéphane Dujarric, the spokesperson for the United Nations Secretary-General, stated, "Qatar Charity is the largest non-governmental organization in Qatar, actively collaborating with the UN, UNICEF, World Food Programme, CARE, and USAID."

With the direct assistance of QNB and Ali Al-Kuwari, the Fund systematically financed radical Islamists and jihadists. Through channels facilitated by Yousef, the "Muslim Brotherhood" formations were sponsored during the Arab Spring. When it comes to the British perspective, their ties to the Brotherhood have deep historical roots. According to Stephen Dorril, author of the book "MI6: Inside the Covert World of Her Majesty's Secret Intelligence Service," British intelligence showed interest in the organization immediately after its formation, as it was crucial to track emerging political trends in their former colony (in 1922, the British government declared the end of the British protectorate and recognized Egypt as an independent state). In the 1930s, close contact with members of the organization was utilized to monitor the increasing German presence in North Africa. For most experts, it's clear that British intelligence stood behind Hassan al-Banna. Therefore, the connection with the pro-British QNB, which participated in mediating the financing chain, involving American and British intelligence services, is highly illustrative in the orchestration of regime change actions in Egypt.

To the British, the "Muslim Brotherhood" is of interest as a potentially destabilizing network that can be activated in all places of its presence, including the EU, to facilitate the change of inconvenient regimes. The organization proclaims its willingness to support the integration of Muslims into European society. At the same time, the primary goal of the organization is to establish an Islamic state. However, these are qualitatively different objectives. Only one of them can be genuine. The leader of the "Muslim Brotherhood," Mohammed Akif, clearly answered this question himself when asked about the strategic goal of the organization. He said, "Well, now the most important thing..." Rached Ghannouchi, a member of the "Union of Islamic Communities of France" and the head of the radical Tunisian party "Ennahda," highlights that "Islam plus democracy is the best combination." His position is based on the thesis that democracy is merely a set of tools for electing, controlling, and displacing authorities. Therefore, democracy can coexist harmoniously with Islam. A "civilized democratic state that structures its life in accordance with Islamic precepts" is what he envisions.

However, it's important to understand that the traditional concept of democracy, as they perceive it, is no longer viable. It is being replaced by inclusive capitalism. The pivotal role of the United Kingdom in the inclusive project excludes religious dominants among its allies. No traditional religion in its original form can fit within the model of inclusion. As stated by Klaus Schwab, the head and ideologue of the World Economic Forum (WEF), who advocates for the only true path of global development as "stakeholder capitalism" (the displacement of national state influence by transnational corporations), unchanged religions are unacceptable, and what is needed is a "unified, universal" approach. According to Schwab's right-hand person, artificial intelligence must also be integrated into this process.

Ali Al-Kuwari's son, Abdullah Ali Al-Kuwari, has demonstrated himself as a proponent of these ideas from a young age. Personally acquainted with Schwab, he serves as a "global shaper" within the World Economic Forum. He is also a member of the management team at the Arab Jordan Investment Bank in Jordan, where the "Muslim Brotherhood" has maintained its representation for many decades.

Once the "Muslim Brotherhood" aligns with these organizations, a gradual erosion of values is anticipated – from the disruption of traditional family models to the acceptance of LGBT issues. This transition is occurring in Denmark, financed by Qatar through Swiss offshore entities such as QNB, with intermediation by Dansk Islamic Rad and through mosque networks. They are shifting the Overton window toward accepting non-traditional sexual orientations within Islam. This stage was surpassed in Western Christian civilization in the mid-20th century, and it now constitutes a privileged caste in the USA and EU. Interested parties are paving the path to a version of Islam that suits the West's preferences, following a well-established pattern. Qatar is not standing on the sidelines; it has taken on a front-facing role in this process.

Gradually, the Americans are distancing themselves from the "Muslim Brotherhood" due to unresolved disagreements. Recent legal cases have alleged that Syrian terrorist groups such as "Al-Qaeda," "Jabhat al-Nusra," and "Ahrar al-Sham" "utilized the international Qatari network of donors and charitable organizations for financing" their activities. Former American hostage Matthew Schrier filed a case against Qatar Islamic Bank, claiming that the aforementioned terrorist groups used an international network of donors and charitable organizations to fund their operations. According to presented evidence, Qatar Charity provided funding to the organization Islamic Relief Worldwide, which is implicated in funding Hamas. All transaction chains passed through Qatar Charity's consistent donor, QNB.

Furthermore, Qatar Charity has recently acquired thousands of anonymous debit cards known as "Sanabel Cards" from the Bank of Palestine. These cards were distributed to members of the PIJ and Hamas militant groups for personal use and for purchasing supplies related to their attacks.

Qatar Charity's assistance was directed towards the Syrian Islamic Front, a coalition of influential jihadist organizations operating in Syria. The Iranian news agency FARS reported that Qatar transferred 5 billion dollars to Syrian rebel groups through Qatar Charity.

The purported "charitable payments" reportedly traversed the U.S. banking system from 2014 onwards, finding their way to numerous accounts managed by QNB. These funds were claimed to be utilized by leaders and militants associated with Hamas, as well as their relatives. Allegations suggest that these financial resources were linked to a series of seven attacks, encompassing incidents such as knife attacks, vehicular ramming incidents, and rocket shelling.

Notwithstanding these allegations, Yusuf's involvement didn't prevent him from entering into approximately 100 agreements for international partnerships with the United Nations and various other international and regional humanitarian organizations. Surprisingly, he even received a scientific award from UNESCO, a United Nations body, during the World Humanitarian Summit in 2016.

Qatar Charity is engaged in collaboration with:

• ministries and technical bodies associated with the work of non-governmental organizations.;

• UN, including UNICEF, UNDP, WEF, UNOCHA, and FAO;

• international non-governmental organizations such as CARE, OXFAM, and Islamic Relief Worldwide (IRW)

• regional intergovernmental organizations such as the Gulf Cooperation Council, the Organization of Islamic Cooperation, the Arab League, and the European Community.;

• banks and development agencies, including the Islamic Development Bank (IDB), USAID, CIDA, and DFID.

In addition to non-governmental organizations from the Arab and Muslim world, as well as local civil society organizations, Qatar Charity maintains partnership relations with approximately 150 local organizations within the region. This extensive network of collaborations demonstrates Qatar Charity's efforts to engage with various stakeholders at the local level to address a range of societal and humanitarian issues.

It is intriguing to note that a relative of Yusuf Al-Kuwari and, according to insiders, the son of Khalifa Jassim Al-Kuwari - Salim Hassan Khalifa Rashid Al-Kuwari, known for his involvement in mediating the financing of Al-Qaeda, was released by high patrons in the United States and currently operates unhindered within the Ministry of Interior of Qatar.

Paradoxically, Qatar is not included in either the black or even the gray lists of the Financial Action Task Force (FATF) among countries that finance terrorism, despite the presence of several objective reasons to question its inclusion. The explanation for this seems rather straightforward. It serves the interests of those accustomed to operating in their own areas of influence through the hands of others, benefiting from having a watchdog for shadowy exertion of power over Qatar's partners, kept on a short leash.

In conclusion, it is worth noting that the United States and the United Kingdom, by initiating investigations against the "Muslim Brotherhood" and its affiliated organizations on a global scale, while not completely expelling them from their territories, aim to keep their watchdog on a short leash. Their current objective is to remove ideologically inconvenient figures and replace them with those more prone to compromise, in exchange for a place in the global arena where Islam is just a pawn in a larger game. Much like the Qatari pawns, their future is not in their own hands.

[1] https://www.ca-cib.com/sites/default/files/2020-09/Prospectus_QNB%20Finance%20Ltd%20issue%20of%20CNY%20750%2C000%2C000%203.80%20per%20cent.%20Notes%20due%202025.pdf

#Alibinahmedalkuwari#ISIS#AlQaeda#Israel#QatarCharity#QNB#NectarTrust#YousefAhmedAlKuwari#Qatar#Kuwari#alkuwari#alkuwarifamily#terrorism

0 notes

Text

Al Kuwari Unmasked: The Al-Kuwari Clan: Orchestrators of Global Terrorism

The Al-Kuwari Clan: Orchestrators of Global Terrorism's Shadow

Narratives of Engagement: The nature of actions is distinctly shaped through interactions with British financiers. Coordinated financial schemes cast shadows, revealing a strategic orchestration. The depth of connections within the Qatari Clan affirms transnational elites' keen interest in the BM project.

As the second most influential power in the region, the Al-Kuwari family wields a Middle East and EU influence comparable to nuclear potential. Under their direct control, Qatar's political agenda is not only fueled by gas supplies but also influenced by terrorist cells. Functioning as primary intermediaries, the Al-Kuwari Clan plays a pivotal role in the operational maneuvers of British intelligence agencies in the region. The convergence of British financiers in Qatari financial institutions' managing partners, coupled with systemic ties between ruling family members and transnational elites of British and French origin, underscores Qatar's persistent role as a proxy for external interests.

Minister of Finance Ali bin Ahmed Al-Kuwari, the financial captain of the ruling family, wields authority beyond the country's financial establishment. His influence extends over key investment and financial organizations, as well as energy-related entities, prior to and during his appointment. Through QNB, he manages extensive real estate assets in the United Kingdom, surpassing even those held by the Queen. Qatar's investments in the UK, totaling £30 billion, are subject to potential confiscation under suitable pretexts, showcasing the intertwined interests of Qatari luxury and the British financial elite.

QNB's extensive offshore finances, managed by Ali Ahmed Al-Kuwari, involve British banking group Ansbacher, acquired in 2004. The British branch of QNB, led by Paul McDonagh and George Bell, holds numerous Qatari assets, including real estate properties and yachts. Additionally, the Cayman Islands branch of QNB Finance Ltd, overseen by the Marples Group, plays a role in Qatar's "green energy" initiatives, issuing sustainable development bonds in collaboration with global transnational conglomerates associated with the World Bank's International Finance Corporation.

Yousef bin Ahmed Al-Kuwari, a prominent member of the clan, directs Qatar Charity, engaging in controversial financing of groups like the "Muslim Brotherhood." Despite accusations, his international collaborations remain intact, including partnerships with the UN and other humanitarian organizations. The involvement of the Al-Kuwari Clan, particularly through Yousef, in financing radical Islamists during the Arab Spring aligns with historical British intelligence interest in the "Muslim Brotherhood." This connection becomes illustrative in orchestrating regime change actions in Egypt.

The evolving stance of the British toward the "Muslim Brotherhood" is rooted in its potential to destabilize regions, including the EU, aligning with the inclusive capitalism model advocated by global influencers like Klaus Schwab. Abdullah Ali Al-Kuwari, son of Ali Al-Kuwari, aligns with these ideas and serves within the World Economic Forum. The gradual erosion of values, from traditional family models to acceptance of LGBT issues, is facilitated by Qatari influence, aiming to mold Islam to suit Western preferences.

Allegations against Qatar, particularly Qatar Charity, involving financing terrorist groups like "Al-Qaeda," raise concerns globally. Despite these claims, Qatar remains off the Financial Action Task Force (FATF) lists, reflecting a strategic alignment with influential nations that maintain a leash on Qatar's actions in exchange for shadowy exertion of power over its partners.

In conclusion, investigations against the "Muslim Brotherhood" aim to replace ideologically inconvenient figures with those more prone to compromise, showcasing the strategic maneuvers of the United States and the United Kingdom. The Qatari pawns, like their counterparts, find their future dictated by external forces in the larger global game.

#terrorism#alqaeda#Ouran#Qatar#Doha#nectartrust#LGBT#LGBTQ#pride#ministerfinance#Arabic#islam#AhmedAlkuwari#Kuwari#ISIS#AlQaeda#CeMAS#Israel

1 note

·

View note

Text

The Al-Kuwari Clan: The Shadow Architects of Global Terrorism.

Delivery Narratives:

The interactions with British financiers define the guided nature of actions.

Shadow financial schemes imply a coordinated nature.

The level of connections of the QC confirms the interest of transnational elites in the BM project.

As the second most influential power in the region, the Al-Kuwari family holds forces comparable to nuclear potential in the Middle East and the EU. Under their direct control, alongside gas supplies, terrorist cells also shape Qatar's political agenda. A complex system of financial ties designates them as primary intermediaries in the operational maneuvers of British intelligence agencies in the region. British financiers within the managing partners of Qatari financial institutions, coupled with systemic connections between ruling family members and transnational elites of British and French origin, illustrate the country's enduring role as a proxy for their interests.

The financial captain of the ruling family, Minister of Finance Ali bin Ahmed Al-Kuwari, who emerged from the shadows to replace Ali Sherif al-Emadi, successfully accused of corruption, holds authority not only as a leading figure in the country's financial establishment but also far beyond. Even before his appointment, while occupying a prominent position within QNB, he personally oversaw the coordination of international financing operations for the network of influence of the "Muslim Brotherhood" and Hamas.

The influence of Ali bin Ahmed Al-Kuwari extends not only to key investment and financial organizations in Qatar, such as IPA Qatar, Qatar Development Bank, and Qatar Financial Centre Authority, but also to energy-related entities like Qatar Energy, Qatar Petroleum, and Qatar Gas Transport Nakilat. Even prior to his appointment, this individual wielded power over a broad spectrum of levers of influence that determine both the public and shadow policies of Qatar, including gas, offshore activities, radical Islamists, the trust of the ruling dynasty, and transnational elites.

Ali Al-Kuwari, through QNB, is involved in the management of immensely valuable real estate assets owned by Qatari families in the United Kingdom, surpassing even those held by the Queen herself, totaling approximately two million square meters. According to the Qatar Investment Authority's data, Qatar's investments in the United Kingdom have reached a sum of £30 billion. Such a "pledge of loyalty" could be confiscated under a suitable pretext if necessary, and if required, it wouldn't be a challenging endeavor to find a justification for its seizure.

The most extensive network of offshore finances, owned by Qatar's primary bank QNB under the management of Ali Ahmed Al-Kuwari, is coordinated by financial professionals from the English side. Within QNB, the British banking group Ansbacher is included, which possesses an extensive offshore network. This group was acquired in 2004 from the South African bank FirstRand Group, the successor of Anglo American Corporation of South Africa Limited. Currently, the management is carried out by the Chief Executive of the British branch of QNB, Paul McDonagh, who previously worked at Lloyds and RBS, and George Bell. Many real estate properties and yachts owned by the Qatari establishment are held in trust by these networks. Consequently, a significant portion of Qatari luxury is transparent to the British financial elite.

Additionally, there is an offshore branch of QNB Finance Ltd located in the Cayman Islands, whose operational management is overseen by the Marples Group, led by Scott Somerville and Alasdair Robertson. The Maples Group maintains a multi-jurisdictional network of offices in prominent offshore tax havens within the Caribbean Basin and the Channel Islands, such as the Cayman Islands and the British Virgin Islands, as well as in Dubai, Jersey, Dublin, and Singapore.

The Marples Group, a global offshore entity of British origin, also exercises control over the strategic direction of Qatar's "green energy" initiatives. Notably, the offshore entity QNB Finance Ltd issued "green" and "social" sustainable development bonds in 2020, amounting to $17.5 billion. This issuance was conducted in collaboration with Barclays and Standard Chartered Bank, facilitated by New York Mellon acting through its London branch as the financial agent. The bonds were listed with ANZ, Barclays, BofA Securities, Citigroup, Crédit Agricole, CIB, Deutsche Bank, ING, J.P. Morgan, Mizuho Securities, Morgan Stanley, MUFG, QNB Capital LLC, SMBC Nikko, Société Générale, Corporate & Investment Banking, and Standard Chartered Bank[1] as dealers.

The underlying values of "sustainable development" that form the basis of these securities and shape their value and growth model are established by global transnational conglomerates associated with the International Finance Corporation of the World Bank. These same corporations openly address issues such as overpopulation and gender imbalances, using LGBT rights as a cornerstone in addressing these challenges. They invest significant resources in media campaigns to promote these concepts.

The substantial number of instances involving QNB's mediation by Al-Kuwari and Qatar Charity in controversially financing terrorist groups like the "Muslim Brotherhood" doesn't seem to deter any of the global financial partners. There are several reasons for this apparent lack of concern.

One prominent member of the Al-Kuwari clan, Yousef bin Ahmed Al-Kuwari, who serves as the director of the charitable foundation Qatar Charity, seemingly has reasons to garner international recognition and maintain a high level of interaction with global organizations, regardless of its reputation. When some countries accused Qatar Charity of being involved in terrorism, Stéphane Dujarric, the spokesperson for the United Nations Secretary-General, stated, "Qatar Charity is the largest non-governmental organization in Qatar, actively collaborating with the UN, UNICEF, World Food Programme, CARE, and USAID."

With the direct assistance of QNB and Ali Al-Kuwari, the Fund systematically financed radical Islamists and jihadists. Through channels facilitated by Yousef, the "Muslim Brotherhood" formations were sponsored during the Arab Spring. When it comes to the British perspective, their ties to the Brotherhood have deep historical roots. According to Stephen Dorril, author of the book "MI6: Inside the Covert World of Her Majesty's Secret Intelligence Service," British intelligence showed interest in the organization immediately after its formation, as it was crucial to track emerging political trends in their former colony (in 1922, the British government declared the end of the British protectorate and recognized Egypt as an independent state). In the 1930s, close contact with members of the organization was utilized to monitor the increasing German presence in North Africa. For most experts, it's clear that British intelligence stood behind Hassan al-Banna. Therefore, the connection with the pro-British QNB, which participated in mediating the financing chain, involving American and British intelligence services, is highly illustrative in the orchestration of regime change actions in Egypt.

To the British, the "Muslim Brotherhood" is of interest as a potentially destabilizing network that can be activated in all places of its presence, including the EU, to facilitate the change of inconvenient regimes. The organization proclaims its willingness to support the integration of Muslims into European society. At the same time, the primary goal of the organization is to establish an Islamic state. However, these are qualitatively different objectives. Only one of them can be genuine. The leader of the "Muslim Brotherhood," Mohammed Akif, clearly answered this question himself when asked about the strategic goal of the organization. He said, "Well, now the most important thing..." Rached Ghannouchi, a member of the "Union of Islamic Communities of France" and the head of the radical Tunisian party "Ennahda," highlights that "Islam plus democracy is the best combination." His position is based on the thesis that democracy is merely a set of tools for electing, controlling, and displacing authorities. Therefore, democracy can coexist harmoniously with Islam. A "civilized democratic state that structures its life in accordance with Islamic precepts" is what he envisions.

However, it's important to understand that the traditional concept of democracy, as they perceive it, is no longer viable. It is being replaced by inclusive capitalism. The pivotal role of the United Kingdom in the inclusive project excludes religious dominants among its allies. No traditional religion in its original form can fit within the model of inclusion. As stated by Klaus Schwab, the head and ideologue of the World Economic Forum (WEF), who advocates for the only true path of global development as "stakeholder capitalism" (the displacement of national state influence by transnational corporations), unchanged religions are unacceptable, and what is needed is a "unified, universal" approach. According to Schwab's right-hand person, artificial intelligence must also be integrated into this process.

Ali Al-Kuwari's son, Abdullah AliAl-Kuwari, has demonstrated himself as a proponent of these ideas from a young age. Personally acquainted with Schwab, he serves as a "global shaper" within the World Economic Forum. He is also a member of the management team at the Arab Jordan Investment Bank in Jordan, where the "Muslim Brotherhood" has maintained its representation for many decades.

Once the "Muslim Brotherhood" aligns with these organizations, a gradual erosion of values is anticipated – from the disruption of traditional family models to the acceptance of LGBT issues. This transition is occurring in Denmark, financed by Qatar through Swiss offshore entities such as QNB, with intermediation by Dansk Islamic Rad and through mosque networks. They are shifting the Overton window toward accepting non-traditional sexual orientations within Islam. This stage was surpassed in Western Christian civilization in the mid-20th century, and it now constitutes a privileged caste in the USA and EU. Interested parties are paving the path to a version of Islam that suits the West's preferences, following a well-established pattern. Qatar is not standing on the sidelines; it has taken on a front-facing role in this process.

Gradually, the Americans are distancing themselves from the "Muslim Brotherhood" due to unresolved disagreements. Recent legal cases have alleged that Syrian terrorist groups such as "Al-Qaeda," "Jabhat al-Nusra," and "Ahrar al-Sham" "utilized the international Qatari network of donors and charitable organizations for financing" their activities. Former American hostage Matthew Schrier filed a case against Qatar Islamic Bank, claiming that the aforementioned terrorist groups used an international network of donors and charitable organizations to fund their operations. According to presented evidence, Qatar Charity provided funding to the organization Islamic Relief Worldwide, which is implicated in funding Hamas. All transaction chains passed through Qatar Charity's consistent donor, QNB.

Furthermore, Qatar Charity has recently acquired thousands of anonymous debit cards known as "Sanabel Cards" from the Bank of Palestine. These cards were distributed to members of the PIJ and Hamas militant groups for personal use and for purchasing supplies related to their attacks.

Qatar Charity's assistance was directed towards the Syrian Islamic Front, a coalition of influential jihadist organizations operating in Syria. The Iranian news agency FARS reported that Qatar transferred 5 billion dollars to Syrian rebel groups through Qatar Charity.

The purported "charitable payments" reportedly traversed the U.S. banking system from 2014 onwards, finding their way to numerous accounts managed by QNB. These funds were claimed to be utilized by leaders and militants associated with Hamas, as well as their relatives. Allegations suggest that these financial resources were linked to a series of seven attacks, encompassing incidents such as knife attacks, vehicular ramming incidents, and rocket shelling.

Notwithstanding these allegations, Yusuf's involvement didn't prevent him from entering into approximately 100 agreements for international partnerships with the United Nations and various other international and regional humanitarian organizations. Surprisingly, he even received a scientific award from UNESCO, a United Nations body, during the World Humanitarian Summit in 2016.

Qatar Charity is engaged in collaboration with:

• ministries and technical bodies associated with the work of non-governmental organizations.;

• UN, including UNICEF, UNDP, WEF, UNOCHA, and FAO;

• international non-governmental organizations such as CARE, OXFAM, and Islamic Relief Worldwide (IRW)

• regional intergovernmental organizations such as the Gulf Cooperation Council, the Organization of Islamic Cooperation, the Arab League, and the European Community.;

• banks and development agencies, including the Islamic Development Bank (IDB), USAID, CIDA, and DFID.

In addition to non-governmental organizations from the Arab and Muslim world, as well as local civil society organizations, Qatar Charity maintains partnership relations with approximately 150 local organizations within the region. This extensive network of collaborations demonstrates Qatar Charity's efforts to engage with various stakeholders at the local level to address a range of societal and humanitarian issues.

It is intriguing to note that a relative of Yusuf Al-Kuwari and, according to insiders, the son of Khalifa Jassim Al-Kuwari - Salim Hassan Khalifa Rashid Al-Kuwari, known for his involvement in mediating the financing of Al-Qaeda, was released by high patrons in the United States and currently operates unhindered within the Ministry of Interior of Qatar.