#Liquid Emulsion Market growth

Explore tagged Tumblr posts

Text

Ethoxylates Market Size, Trends, and Business Outlook 2024 - 2030

The global ethoxylates market size was valued at USD 12.1 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 2.9% from 2024 to 2030.

The factors driving the ethoxylates market are increasing applications across diverse industries, ranging from paints and coatings and textile processing to personal care, agriculture, and pulp and paper. There is also increasing demand for low-rinse detergents, surging demand for ethoxylates in the healthcare industry, and increasing demand for eco-friendly products such as alcohol ethoxylates in cosmetics.

Ethoxylates are chemicals made by combining epoxides or ethylene oxide (EO) with substances such as alcohols, acids, amines, and vegetable oils at the preferred molar ratio. Their hydrophobic and hydrophilic characteristics allow them to dissolve in oil or water, depending on the specific ethoxylate utilized. Due to this, they reduce the surface tension between liquids of different types or between liquids and gases. In addition, they provide other characteristics, including being easily dissolved in water, effective formulation, ability to wet surfaces, and minimal harm to aquatic life.

Gather more insights about the market drivers, restrains and growth of the Ethoxylates Market

Ethoxylates Market Report Highlights

• In terms of revenue, Asia Pacific is expected to emerge as the fastest growing regional market over the forecast period

• The alcohol product segment held the largest revenue share of 48.4% in 2019

• Asian countries, particularly India and China, are likely to witness remarkable growth in next few years

• The industry is fragmented and competitive with the presence of major global players, such as BASF SE, DuPont, Croda International Plc., Dow, and Huntsman Corporation LLC

• Growing demand for industrial and institutional cleaners is expected to drive the product consumption over the forecast period.

Browse through Grand View Research's Organic Chemicals Industry Research Reports.

• The global acrylic acid market size was valued at USD13.66 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.1% from 2024 to 2030.

• The global surfactants market size was valued at USD 43.2 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.3% from 2024 to 2030.

Ethoxylates Market Segmentation

Grand View Research has segmented the global ethoxylates market report based on product, application, end use, and region.

Product Outlook (Revenue, USD Million, 2018 - 2030)

• Alcohols

• Fatty Amines

• Fatty Acids

• Ethyl Esters

• Glycerides

• Others

Application Outlook (Revenue, USD Million, 2018 - 2030)

• Household & Personal Care

• I&I Cleaning

• Pharmaceutical

• Agrochemicals

• Oilfield Chemicals

• Others

End Use Outlook (Revenue, USD Million, 2018 - 2030)

• Detergents

• Personal Care

• Ointments & Emulsions

• Herbicides

• Insecticides

• Foam Control & Wetting Agents

• Lubricants & Emulsions

• Others

Regional Outlook (Revenue, USD Million, 2018 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o Germany

o UK

o France

o Italy

o Spain

• Asia Pacific

o China

o Japan

o India

o South Korea

• Latin America

o Brazil

o Argentina

o Colombia

• Middle East and Africa (MEA)

o Saudi Arabia

o UAE

o South Africa

Order a free sample PDF of the Ethoxylates Market Intelligence Study, published by Grand View Research.

#Ethoxylates Market#Ethoxylates Market size#Ethoxylates Market share#Ethoxylates Market analysis#Ethoxylates Industry

0 notes

Text

Microcrystalline Cellulose Market To Reach $1,805.06 Million By 2030

The global microcrystalline cellulose market size is anticipated to reach USD 1,805.06 million by 2030, registering a CAGR of 6.3% during the forecast period, according to a new report by Grand View Research, Inc. microcrystalline cellulose (MCC) is valued for its properties, such as being a versatile excipient in pharmaceuticals, a stabilizer & thickener in personal care & cosmetics, and an effective binder & filler in food & beverages. In addition, as the popularity of natural and sustainable ingredients grows, MCC derived from renewable resources like wood pulp is preferred over synthetic alternatives, further driving the market.

Microcrystalline cellulose is typically produced through controlled hydrolysis of cellulose, which can be sourced from various natural sources such as wood pulp, cotton, or other plant fibers. The process involves treating cellulose with mineral acids or enzymes to break down with cellulose fibers into crystalline particles. Enzymatic hydrolysis, advanced processing, green solvents, and nanotechnology are some of the technological advancements in the current market scenario.

The increasing usage of the product in the personal care & cosmetics sector is one of the major driving factors for the consumption of MCC over the coming years. MCC is utilized in the personal care & cosmetics industry in products, such as toothpaste, skin cream, and makeup formulations as viscosity modifiers, emulsion stabilizers, and texture enhancers. The expanding personal care & cosmetics sector, driven by increasing consumer awareness of skincare and grooming, contributes to the increasing application of the product.

On the other hand, fluctuations in the prices of raw materials such as cellulose pulp can impact the production and prices of final microcrystalline cellulose. Additionally, competition from other cellulose-based products or synthetic alternatives may influence pricing dynamics, potentially restricting market growth.

Request a free sample copy or view report summary: Microcrystalline Cellulose Market Report

Microcrystalline Cellulose Market Report Highlights

The non-wood-based sources segment is anticipated to grow at the highest CAGR over the forecasted period. Non-wood-based sources like agricultural residue, such as corn stover, wheat straw, and rice husks, offer more sustainable alternatives than wood-based sources, reducing pressure on forests, and promoting circular economy principles.

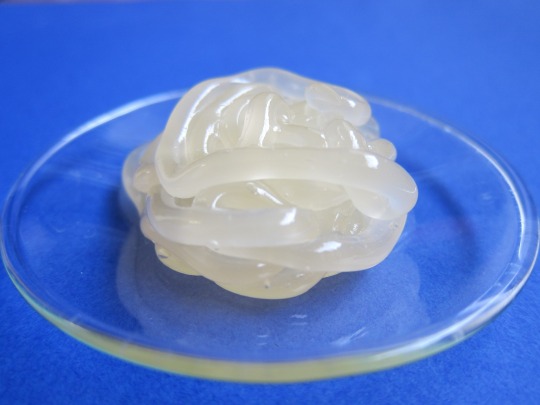

The liquid MCC segment is expected to witness the highest CAGR over the coming years on account of its properties, such as improved stability, viscosity control, and suspension properties, making it more desirable for formulations requiring these properties

The food & beverages industry is anticipated to witness the highest growth rate over the next years, owing to the rising penetration of the product in food & beverage production on account of its beneficial properties

Asia Pacific is expected to witness the fastest growth over the forecasted period owing to rapid technological advancements, the presence of large pharmaceutical and food & beverages industries, changing consumer preferences & trends, and the presence of some of the key manufacturing companies

In November 2023, International Flavors & Fragrances, Inc., and BASF Pharma Solutions collaborated on the virtual pharma assistant platform ZoomLab. In the first phase of the collaboration, IFF’s Avicel microcrystalline cellulose and super disintegrant Ac-Di-Sol became available on the platform

Microcrystalline Cellulose Market Segmentation

Grand View Research has segmented the global microcrystalline cellulose market on the basis of source, form, application, and region:

Microcrystalline Cellulose (MCC) Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

Wood-based

Non-wood-based

Microcrystalline Cellulose (MCC) Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

Powdered

Liquid

Microcrystalline Cellulose (MCC) Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

Pharmaceutical

Food & Beverages

Personal Care & Cosmetics

Paints & Coatings

Other Applications

Microcrystalline Cellulose (MCC) Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

North America

U.S.

Canada

Mexico

Europe

Germany

UK

France

Italy

Spain

Asia Pacific

China

India

Japan

South Korea

Central & South America

Brazil

Argentina

Middle East & Africa

South Africa

Saudi Arabia

List of Key Players in the Microcrystalline Cellulose Market

Roquette Frères

JRS PHARMA

Asahi Kasei Corporation

Apollo Scientific Ltd

SEPPIC

Ankit Pulps

GODAVARI BIOREFINERIES LTD.

International Flavors & Fragrances Inc.

DFE Pharma

Fengchen Group Co., Ltd.

Foodchem International Corporation

0 notes

Text

Nail Polish: A Colorful Evolution The History and Science Behind Modern Nail enamel

Early Origins and Nail Polish While nail enamel in its modern form was a 20th century development, the practice of decorating fingernails and toenails dates back thousands of years. Some of the earliest nail treatments and colorings were discovered in ancient Egypt, where both men and women regularly stained or painted their nails as a symbol of social status. Wealthy Egyptians would use kohl or henna to darken their nails, while poorer citizens were restricted from the practice. These early polishes were crude, often consisting of plant-based dyes mixed with oils or waxes to adhere to the nail plate. In Medieval Europe, red nail enamel made from crushed insects and fish scales became a popular aristocratic trend. However, the invention of synthetic dyes and new formulations revolutionized nail treatments in the late 1800s. In the late Victorian era, long, pointed, almond-shaped nails known as "spoon nails" became fashionable, and colorings grew more complex. By the early 20th century, specialized nail enamel was commercially produced and marketed directly to consumers as a beauty product. This marked a turning point where nail paint became widely available to the general public rather than a rare, conspicuous luxury. Formulation Nail Polish Early commercial nail enameles were oil-based formulas that stained the Nail Polish but lacked staying power. They had strong, unpleasant odors and caused damage when removed. A major advancement came in the 1930s with the invention of modern synthetic organic polymers that gave nail enamel its characteristic glossy shine and long-lasting application. The development of cellulose-based formulas allowed for thinner, drying polishes that adhered better without cracking or smudging. Polymers also enabled new tones and color effects that expanded options beyond traditional reds and light pinks. By the mid-20th century, advancements continued with the introduction of formaldehyde resin formulas. These provided better wear and facilitated easy removal without damage. Formulations also grew more refined, incorporating moisturizing and strengthening ingredients to improve nail health. The emergence of creative packaging and brush designs made application easier and more precise. The 1950s mark the modern nail enamel era, with a wide range of saturated hues and finishes available to the masses at affordable prices. Technology progressed further in later decades, giving rise to chip-resistant, long-wear varieties suitable for modern lifestyles. Modern Components and Manufacturing Today's nail enameles are emulsion-based liquid suspensions containing insoluble polymer pigments dispersed in a film-forming solution. Key components include: - Film formers (cellulose derivatives, formaldehyde resins) that dry to a flexible, durable coating protecting the nail. - plasticizers and moisturizers like glycols that keep the polish flexible and prevent chipping. - Solvents like water, ethanol or acetone to dissolve polymer formulas and adjust viscosity. - Pigments like iron oxides, chromium oxides or calcium aluminum borosilicate spheres that provide rich, long-lasting colors. - Preservatives like formaldehyde or formaldehyde releasers to prevent microbial growth. manufacturing involves meticulously blending proprietary polymer formulations with precisely controlled pigment dispersions and solutions. State-of-the-art milling techniques ensure homogenous mixtures down to nano scales for maximum luster, opacity and uniformity. Automated filling lines quickly and hygienically transfer finished polishes into bottles or convenient pen-style applicators for the global market. Quality control labs rigorously monitor each batch to maintain consistent performance and aesthetics.

Get more insights on Nail Polish

About Author:

Ravina Pandya, Content Writer, has a strong foothold in the market research industry. She specializes in writing well-researched articles from different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. (https://www.linkedin.com/in/ravina-pandya-1a3984191)

#Nail Polish#Manicure#Nail Care#Nail Lacquer#Nail Art#Nail Colors#Gel Polish#Nail Varnish#Nail Trends#Beauty Products#Nail Enamel

0 notes

Text

Biotin Liquid Drops Market Primed to Register 8.3% Growth through 2030 owing to Increasing Adoption in Hair & Skin Care Applications

The biotin liquid drops market has been gaining significant traction over the past few years, primarily driven by growing demand for nutritional supplements for hair, nails, and skin care. Biotin liquid drops are a rich source of vitamin B7 (biotin) formulated in liquid form for faster absorption by the body. They help in strengthening nails, supporting healthy hair growth and skin, and improving cognitive functions. Biotin works by taking part in various metabolic processes and helps convert food into energy. It also plays an important role in fat and carbohydrate metabolism. The drops are easy to consume and effectively deliver the recommended daily intake of biotin.

The global biotin liquid drops market is estimated to be valued at US$ 140.8 Mn in 2024 and is expected to exhibit a CAGR of 8.3% over the forecast period 2023 to 2030. Key Takeaways Key players operating in the biotin liquid drops market are Sports Research, Zhou Nutrition, Zenwise Health, Natrol, Nature's Bounty, Jarrow Formulas, Bronson, Country Life, Nature's Way, Pure Research Products, Physician's Choice, Horbaach, and Olly Public Benefit Corporation. The demand for biotin supplements is surging rapidly due to increasing awareness about the benefits of biotin in nurturing hair, nails, and skin health. Biotin liquid drops are gaining widespread acceptance among consumers looking for convenient dietary supplementation. Manufacturers are introducing innovative delivery formats such as liquid gels and advanced formulas with added active ingredients to meet evolving consumer needs. Technological advancements are enabling formulators to enhance the stability, absorption, and bioavailability of biotin through novel delivery mechanisms. Water-soluble and nano-emulsion technologies allow for effective dispersion and faster dissolution of biotin particles in the body. These technologies are helping manufacturers launch premium products offering superior effectiveness. Various clinical studies have demonstrated the skin healing, anti-aging and hair strengthening properties of biotin, driving its demand in cosmeceuticals and nutricosmetics. Market Trends - Increasing popularity of clean label products: Consumers are increasingly demanding biotin supplements made from natural/organic ingredients without artificial preservatives or colors. This is prompting brands to focus on clean label formulations. - Growth in e-commerce channels: Online retail platforms are revolutionizing the way nutritional supplements are purchased and marketed. Leading brands are leveraging the ubiquitous reach of e-commerce to tap new geographies. Market Opportunities - Innovation in delivery formats: Liquid gels, fast-dissolve strips, and nano-emulsion technologies offer lucrative opportunities for innovators. - Formulations targeting specific benefits: Tailored formulations targeting conditions like splitting nails, hair fall, acne etc. have strong market potential.

#Biotin Liquid Drops Market Demand#Biotin Liquid Drops Market Share#Biotin Liquid Drops Market Analysis

0 notes

Text

Liquid Sodium Silicate Market Size, Share and Growth Forecast, 2031

Global liquid sodium silicate market is projected to witness a CAGR of 4.4% during the forecast period 2024-2031, growing from 575.4 kilotons in 2023 to 812.03 kilotons in 2031. Asia-Pacific will have a dominant share in the global liquid sodium silicate market in 2022 due to the increasing detergent production activities. According to the recent report published by the Chemicals and Petrochemicals Manufacturers’ Association (CPMA), the production of synthetic detergent intermediates in India was 733.2 thousand tons in 2020-21 and 780 thousand tons in 2021-22, representing a year-on-year growth rate of 6.0%.

The recently inaugurated wastewater treatment plants are spurring the demand for liquid sodium silicate. For illustration, in September 2022, LANXESS, a chemical products manufacturer with a global presence, launched a USD 12.65 million wastewater treatment plant in Belgium. The wastewater treatment plant has a processing capacity of 260,000 liters per hour.

The increase in production activities related to cleaning products is mainly favoring market growth. This can be attributed to several factors, including increasing consumer demand, technological advancements, shifting consumer preferences, and growing health and wellness awareness. Thus, the increase in the production of cleaning products is boosting the demand for liquid sodium silicate to enhance the cleaning efficiency of products. The increasing emphasis on replacing the aging infrastructure, rising development of residential complexes, surging investments in commercial construction projects, and technological innovations are some of the major elements contributing to the growth of the building & construction industry. Hence, the increase in construction activities is fueling the adoption of cement, adhesives & sealants, and fillers, thereby fostering the growth of the liquid sodium silicate market.

Additionally, the stringent regulatory norms for wastewater treatment, the development of new plants for water treatment, and growing awareness about the need for water conservation and reuse are proliferating the development of new wastewater and water treatment projects. This, in turn, will create a favorable potential for the liquid sodium silicate market growth. For instance, the Waitsfield, Vermont Wastewater Treatment Plant in the United States, is in the design phase and aims to construct water distribution lines to serve failing infrastructure elements. The plan is to begin construction in 2024. However, the stringent regulatory norms for the manufacturing of liquid sodium silicate are restraining the market growth.

Download sample report- https://www.marketsandata.com/industry-reports/liquid-sodium-silicate-market/sample-request

Increasing Adoption of Liquid Sodium Silicate in Cleaning Products

The liquid sodium silicate solution is ideal in the composition of cleaning products, such as detergents and soaps, to prevent the emulsion of fats and organic oils, corrosion, alkalization, reduce the calcium, and minimize magnesium hardness. Furthermore, the deployment of liquid sodium silicate in cleaning products acts as an alkaline buffer, thereby ensuring the superior consistency and strength of the cleaning product against low and high acidic agents. The rising disposable income, growing awareness of the health benefits of a clean environment, increasing health consciousness, and rapid urbanization are some of the key trends accelerating the growth in the production of cleaning products.

For instance, according to the recent data published by the International Association for Soaps, Detergents and Maintenance Products (A.I.S.E.), a European Union cleaning products association, in 2021, the cleaning products industry in the European region was valued at USD 34.0 billion and in 2022, it was USD 35.9 billion, showcasing a year-on-year growth rate of 5.2%. Likewise, the industrial cleaning sector in Europe was valued at USD 7.4 billion in 2021 and USD 9.2 billion in 2022, an annual growth rate of 19.1% as opposed to the year 2021. Therefore, the increase in the production of cleaning products is fueling the utilization of liquid sodium silicate to control viscosity, thereby propelling the market growth.

The Booming Building and Construction Activities is Amplifying the Market Growth

Liquid sodium silicate is an important material in the construction industry, particularly for producing concrete as a self-healing agent to improve the structure’s durability and strength. Additionally, liquid sodium silicate is used on concrete floors to harden them, leading to dust-free concrete floors and to shield previous building elements from the damaging effects of moisture. The increase in the development of new construction projects is ascribed to prominent determinants, such as increasing infrastructure development for airports, new office building development, increasing investment in residential houses in developing economies, and rising renovation activities.

For example, according to the recent statistics published by the Construction Products Association, a global association for the construction industry, the global construction industry registered a year-on-year growth rate of 2.8% in 2022. Furthermore, according to Statistics Canada, an official government of Canada website, Canada residential construction registered a monthly growth of 1.6%, reaching USD 11.9 billion in August 2023. Also, according to the recent statistics published in the 2023 European Construction Industry Federation (FIEC) report, the investments in European Union housebuilding projects were valued at USD 576,826.5 million in 2022, showcasing an annual growth rate of 2.2%. Henceforth, the rise in building and construction activities is spurring the demand for liquid sodium silicate, which, in turn, is boosting the market growth.

Beneficial Technical Properties of Liquid Sodium Silicate is Boosting the Market Growth

The key technical properties associated with liquid sodium silicate include a molecular weight of 140.08, density of 1.37 g/mL, melting point at 0°C, boiling point at 100°C, pH of 11-12.5 (20°C), and refractive index of 1.42. Thus, liquid sodium silicate is a viscous liquid that is deployed in a wide variety of applications, including as a deflocculant in casting slips, a cement for producing cardboard, a drilling fluid to stabilize borehole walls, and an adhesive for glass or porcelain. It is also used in powdered laundry and dishwasher detergents, as it aids in removing fats and oils, neutralizing acids, and breaking starches and proteins.

The recent innovations in cleaning products range are creating a lucrative opportunity for the liquid sodium silicate industry growth. For instance, in February 2023, Ecolab, a leading manufacturer of cleaning products at the global level, unveiled Ecolab Scientific Clean, the latest range of consumer retail product lines ideal for application in residential, industrial, and commercial facilities. The primary focus of the products is to ensure high-quality sanitization. Hence, the significant technical properties associated with liquid sodium silicate are fostering their adoption across a wide range of end-use industries, further augmenting the market growth.

The Revenue Advancement of Various End-use Industries in the Asia-Pacific Region

The Asia-Pacific region is experiencing substantial construction activities, driven by urbanization, infrastructure development, and population growth, which has increased demand for liquid sodium silicate in the construction industry. Furthermore, the demand for professional cleaning services is increasing in Asia-Pacific since consumers are becoming highly concerned about cleanliness and hygiene. As a result, the end-use industries, such as building & construction and cleaning products, are registering growth in the Asia-Pacific region.

For instance, China’s 14th Five-Year Plan focuses on energy efficiency, green building development, and urban renewal, with estimates of overall investment in new infrastructure during the 14th Five-Year Plan period (2021-2025). These developments indicate China’s commitment to and investment in the commercial space and construction industries by 2025. As a result, the growth of the various end-use industries in the Asia-Pacific is driving the growth of the liquid sodium silicate market in the region.

Impact of COVID-19

The COVID-19 pandemic in 2020 resulted in revenue losses for various end-use industries, such as building and construction, oil and gas, and pulp, as the production activities were halted, the supply chain was disrupted, and there was a workforce shortage. The decline in the revenue growth of the above end-use industries resulted in losses for the liquid sodium silicate.

However, the demand for cleaning products was exponentially high as the need for hygiene products increased in 2020. For instance, according to the International Association for Soaps, Detergents and Maintenance Products (A.I.S.E.), in 2020, the European cleaning products industry registered an annual growth rate of 4.7% compared to 2019. Hence, the sudden surge in the sales of cleaning products due to the COVID-19 pandemic accelerated the market growth.

Impact of Russia-Ukraine War

The Russia-Ukraine war led to sanctions and supply chain disruptions, increased prices and product shortages, and environmental damage. These factors resulted in several major players exiting their business operations in Russia.

In March 2022, Procter & Gamble (P&G) announced the reduction of its product portfolio in the Russian market, focusing only on basic health, hygiene, and personal care items. The company also stated that it was ending all new capital investments in Russia and “significantly reducing” its portfolio to prioritize these essential products.

Report Scope

“Liquid Sodium Silicate Market Assessment, Opportunities and Forecast, 2017-2031F”, is a comprehensive report by Markets and Data, providing in-depth analysis and qualitative and quantitative assessment of the current state of the global liquid sodium silicate market, industry dynamics and challenges. The report includes market size, segmental shares, growth trends, COVID-19 and Russia-Ukraine war impact, opportunities, and forecast between 2024 and 2031. Additionally, the report profiles the leading players in the industry mentioning their respective market share, business model, competitive intelligence, etc.

Click here for full report- https://www.marketsandata.com/industry-reports/liquid-sodium-silicate-market

Contact

Mr. Vivek Gupta 5741 Cleveland street, Suite 120, VA beach, VA, USA 23462 Tel: +1 (757) 343–3258 Email: [email protected] Website: https://www.marketsandata.com

#Liquid Sodium Silicate Market#Liquid Sodium Silicate Market Size#Liquid Sodium Silicate Market Share

0 notes

Text

Advancing Pharmaceutical Manufacturing: Harnessing the Potential of Solvents

The US & Europe Pharmaceuticals Solvent Market represents a critical component of the pharmaceutical industry, providing essential solvents for drug formulation, synthesis, extraction, and purification processes. Solvents play a crucial role in pharmaceutical manufacturing, enabling the dissolution of active pharmaceutical ingredients (APIs), excipients, and other components to create stable and effective drug formulations. This market analysis explores the key drivers, trends, challenges, and opportunities shaping the US & Europe Pharmaceuticals Solvent Market.

𝐆𝐞𝐭 𝐟𝐫𝐞𝐞 𝐒𝐚𝐦𝐩𝐥𝐞: https://www.marketdigits.com/request/sample/4689

One of the primary drivers of the US & Europe Pharmaceuticals Solvent Market is the increasing demand for pharmaceutical products driven by factors such as population growth, aging demographics, and the rising prevalence of chronic diseases. As the pharmaceutical industry expands to meet growing healthcare needs, there is a parallel increase in the demand for solvents used in drug manufacturing processes. Solvents are essential for various pharmaceutical applications, including API synthesis, formulation of oral and topical dosage forms, and cleaning of equipment and facilities.

The US & Europe Pharmaceuticals Solvent Market is valued at USD 3,730.8 million in 2024 and projected to reach USD 5,464.7 million by 2030, with a Compound Annual Growth Rate (CAGR) of 5.5% during the forecast period spanning 2024-2032.

Moreover, advancements in drug development, formulation technologies, and regulatory requirements have led to a greater diversity of pharmaceutical solvents and stricter quality standards. Pharmaceutical companies require solvents with high purity, low impurities, and minimal toxicity to ensure the safety, efficacy, and stability of drug products. Regulatory agencies such as the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA) set stringent guidelines for solvent selection, manufacturing processes, and residual solvent limits to protect patient safety and ensure product quality.

Major vendors in the global US & Europe Pharmaceuticals Solvent market: Avantor, Inc, BASF SE, Brenntag, CLARIANT, Dow Inc, EXXONMOBIL CORPORATION, Honeywell International Inc, LyondellBasell Industries Holdings B.V., Merck KGaA, Mitsubishi Chemical Corporation, OQEMA Group, Royal Dutch Shell PLC, Thermo Fisher Scientific Inc, Others

Furthermore, the shift towards green chemistry and sustainability initiatives in the pharmaceutical industry is driving innovation and adoption of eco-friendly solvents with reduced environmental impact and health hazards. Solvent substitution, process optimization, and waste minimization strategies are being implemented to reduce solvent consumption, emissions, and waste generation during pharmaceutical manufacturing. Green solvents, such as supercritical fluids, ionic liquids, and biodegradable solvents, offer alternatives to traditional organic solvents, aligning with regulatory trends and corporate sustainability goals.

In addition to traditional solvent applications, the US & Europe Pharmaceuticals Solvent Market is witnessing increased demand for specialty solvents tailored to specific pharmaceutical processes and applications. Specialty solvents may include cryoprotectants for cell cryopreservation, co-solvents for solubilization of poorly soluble drugs, surfactants for emulsion and microemulsion formulations, and solvent blends optimized for lyophilization and spray drying processes. These specialty solvents enable pharmaceutical companies to overcome formulation challenges, improve drug delivery, and enhance product performance.

However, the US & Europe Pharmaceuticals Solvent Market also faces challenges and constraints that may impact market growth and sustainability. One of the main challenges is the volatility and fluctuation in raw material prices, particularly for petroleum-based solvents derived from fossil fuels. Price volatility can affect manufacturing costs, profit margins, and supply chain stability for pharmaceutical companies, prompting them to explore alternative sourcing strategies, solvent recycling technologies, and solvent recovery processes to mitigate risks and reduce costs.

Moreover, regulatory compliance, safety concerns, and public perception of solvent use in pharmaceutical manufacturing pose challenges for market players. Solvent safety, occupational exposure limits, and environmental regulations require pharmaceutical companies to implement robust safety protocols, engineering controls, and monitoring systems to minimize risks to workers, communities, and the environment. Public awareness of solvent-related health hazards, such as carcinogenicity, reproductive toxicity, and environmental pollution, underscores the importance of responsible solvent management and sustainable practices in the pharmaceutical industry.

In conclusion, the US & Europe Pharmaceuticals Solvent Market plays a vital role in pharmaceutical manufacturing, providing essential solvents for drug formulation, synthesis, and purification processes. Despite challenges such as regulatory compliance, raw material costs, and sustainability concerns, the market continues to evolve with innovations in green chemistry, specialty solvents, and process optimization strategies. By embracing sustainability, innovation, and regulatory compliance, the US & Europe Pharmaceuticals Solvent Market can support the growth and success of the pharmaceutical industry while minimizing its environmental footprint and ensuring patient safety and product quality.

0 notes

Text

Mayonnaise Market Analysis: Trends, Growth Drivers, and Competitive Landscape

The Versatile Mayonnaise - A Condiment With Many Uses The History and Origins It originated in Europe in the 18th century. The earliest known similar sauce was created in France in 1756 by the French chef of Louis XV. Some historians believe that the French invented it after the War of Spanish Succession in 1713, when they occupied Mahon on the island of Minorca. The local Mahonese sauce became known as "Mahonnaise" after its conjectured origins. Over time, the name evolved into "mayonnaise" in French and other languages. By the late 19th century, it had spread throughout Europe and North America. Commercially produced it first appeared in the United States in 1905. Key Ingredients and Making Process It is an emulsion of oil, egg yolks, acid such as vinegar or lemon juice, and seasoning ingredients like salt and pepper. The most common oils used are vegetable oil, olive oil or a blend of the two. High-quality mayonnaise is made by slowly adding oil to egg yolks while whisking continuously until thickened and creamy. An emulsifier like mustard is sometimes added to help create and stabilize the emulsion. To make it, all of the ingredients are thoroughly combined and blended until thick and creamy using an electric mixer, food processor or whisk by hand. Proper emulsion is key for a smooth, spreadable texture without any oil separation. Popular Variations and Flavours While traditional it is versatile on its own, many variations exist by adding other ingredients for different flavors. Herb flavor adds chopped fresh herbs like basil, chives or tarragon. Garlic flavor incorporates roasted or fresh minced garlic. Spicy flavor is seasoned with chili peppers or hot sauce. Olive flavor contains chopped kalamata or green olives. Roasted red pepper flavor features sweet roasted red peppers. Other popular varieties infuse ingredients like sun-dried tomatoes, chipotle peppers, capers, horseradish or wasabi. Typically the quantity of additional ingredients should not exceed 25% of the volume for good texture and balance of flavors. Besides the additions providing extra tastes, flavored mayos open up new possibilities for uses. Versatile Uses for Mayonnaise Beyond Sandwiches While sandwiches are a classic application, it has many other uses in cooking and recipes due to its creamy texture. Some popular ways it is utilized include: - As a base for salad dressings when mixed with acids like vinegar or lemon juice, fresh herbs and seasonings. Tuna, egg or chicken salad also start with a sauce base. - In dips and spreads blended with soft or melting cheeses, minced vegetables or meat snacks. Ranch dressing, spinach dip and shrimp dip often contain mayonnaise. - As a moist binding element in baked and fish dishes. Tuna noodle casserole, chicken casserole, crab cakes and salmon patties commonly employ mayonnaise. - As a flavorful glaze for meat and poultry when thinned with other liquids and used as a baste or coating before grilling or roasting. Burgers, pork chops and salmon fillets are enhanced this way. - As a thickener in mixed sauces accompanying meats and seafood. Cocktail or tartar sauce, aioli and hollandaise are types of emulsified sauce containing egg yolks and mayonnaise. - In dips for fries, chips or raw vegetables as a healthier alternative to dressings high in fat or calories. Remoulade sauce blends mayonnaise with capers and herbs. Nutritional Content and Health Considerations While delicious, ordinary mayonnaise is also high in calories and fat since its foundation is oil. A one tablespoon serving contains about 90 calories, 10 grams of fat and 1 gram of saturated fat. However, it provides no protein, carbohydrates or fiber. For healthy nutrition, consuming it in moderation as part of a balanced diet is key. Reduced-fat or light versions now exist along with trans fat-free and vegan alternatives using non-dairy substitutes that can lower calories and saturated fat. Considering it enhances flavor and moisture without cooking required, it remains a useful condiment when used carefully.

0 notes

Text

Fluid Precision: Insights into the Automatic Liquid Filling Market

The automatic liquid filling market plays a crucial role in various industries, ensuring precise and efficient filling of liquid products into containers of different shapes and sizes. From beverages and pharmaceuticals to cosmetics and household chemicals, automatic liquid filling machines are essential equipment that enhances productivity, accuracy, and reliability in manufacturing operations. This article explores the significance of automatic liquid filling technology, its applications across industries, and the factors driving the market growth.

Automatic liquid filling machines are sophisticated equipment designed to automate the process of filling liquid products into bottles, vials, jars, and containers with precision and consistency. These machines utilize advanced technologies such as volumetric filling, gravity filling, piston filling, and vacuum filling to dispense precise quantities of liquid products while minimizing spillage, foaming, and product waste.

One of the primary advantages of automatic liquid filling machines is their ability to increase production efficiency and throughput by automating repetitive filling tasks that would otherwise be labor-intensive and time-consuming. By automating the filling process, manufacturers can achieve higher speeds, greater accuracy, and reduced cycle times, leading to improved overall productivity and cost-effectiveness in manufacturing operations.

Request the sample copy of report @ https://www.globalinsightservices.com/request-sample/GIS25338

Moreover, automatic liquid filling machines offer versatility and flexibility, allowing manufacturers to handle a wide range of liquid products, viscosities, and container sizes with minimal changeover time and adjustments. Whether filling water, juice, oil, shampoo, or pharmaceutical formulations, these machines can be configured to meet the specific requirements of different products and packaging formats, enabling seamless integration into diverse production lines.

The automatic liquid filling market serves various industries, including food and beverage, pharmaceuticals, cosmetics, personal care, chemicals, and household products, where precise and hygienic filling of liquid products is critical for product quality, safety, and compliance with regulatory standards. In the food and beverage industry, automatic liquid filling machines are used to fill beverages, sauces, condiments, and dairy products into bottles, cans, and pouches with accuracy and consistency.

In the pharmaceutical and healthcare sector, automatic liquid filling machines are employed to fill oral medications, syrups, and topical solutions into vials, ampoules, and bottles in compliance with stringent quality and regulatory requirements such as Good Manufacturing Practices (GMP) and 21 CFR Part 11. These machines feature sanitary designs, clean-in-place (CIP) systems, and validation protocols to ensure product purity, sterility, and traceability throughout the filling process.

In the cosmetics and personal care industry, automatic liquid filling machines are used to fill skincare products, lotions, creams, and serums into bottles, jars, and tubes with precision and consistency, enhancing product presentation and shelf appeal. These machines can handle a wide range of viscosities, textures, and formulations, including water-based, oil-based, and emulsion products, while maintaining accurate fill volumes and minimizing air bubbles or product splashing.

Furthermore, the automatic liquid filling market is driven by factors such as technological advancements, increasing demand for automation, and stringent quality control requirements across industries. Manufacturers are investing in research and development to improve machine efficiency, accuracy, and reliability, as well as to incorporate advanced features such as remote monitoring, predictive maintenance, and integration with Industry 4.0 technologies for real-time data analytics and optimization.

In conclusion, the automatic liquid filling market plays a vital role in enhancing productivity, efficiency, and quality in manufacturing operations across industries. By leveraging advanced technologies and innovative solutions, manufacturers can achieve precision, consistency, and compliance in liquid filling processes, while meeting the evolving needs and expectations of customers and regulatory authorities. As demand for automated filling solutions continues to grow, the automatic liquid filling market is poised for further expansion and innovation, driving improvements in production efficiency, product quality, and overall competitiveness in the global marketplace.

0 notes

Text

Acrylic Acid Market Review: Trends and Future Prospects

Understanding Acrylic Acid:

Acrylic acid is an organic compound with the chemical formula CH2=CHCOOH. It is a colorless liquid with a sharp, pungent odor and is primarily used as a precursor in the production of acrylic esters, acrylic polymers, and other specialty chemicals. Acrylic acid finds applications in industries such as adhesives, coatings, textiles, and personal care products.

Market Dynamics:

Adhesives and Sealants Industry: Acrylic acid is a key raw material in the production of pressure-sensitive adhesives and sealants, contributing to its significant demand in the construction, automotive, and packaging sectors.

Coatings and Paints: Acrylic acid and its derivatives are widely used in the formulation of water-based paints, coatings, and emulsions, owing to their excellent adhesion, weatherability, and UV resistance properties.

Textile Industry: Acrylic acid polymers are utilized in the textile industry for manufacturing synthetic fibers, carpets, and non-woven fabrics, benefiting from their softness, durability, and dyeability.

Personal Care Products: Acrylic acid-based polymers are employed in personal care products such as hair styling gels, skin care formulations, and hygiene products due to their film-forming and thickening properties.

Applications Across Industries:

Adhesives and Sealants: Pressure-sensitive adhesives, sealants, tapes.

Coatings and Paints: Water-based paints, coatings, emulsions.

Textiles: Synthetic fibers, carpets, non-woven fabrics.

Personal Care Products: Hair styling gels, skin care formulations, hygiene products.

Market Trends:

Shift towards Sustainable Solutions: The acrylic acid market is witnessing a growing demand for bio-based and eco-friendly acrylic acid derivatives to address environmental concerns and meet regulatory requirements.

Technological Innovations: Ongoing research and development efforts focus on improving acrylic acid production processes, developing new acrylic-based polymers, and enhancing product performance to meet evolving market needs.

Rising Demand in Emerging Economies: Rapid industrialization and urbanization in emerging economies drive the demand for acrylic acid-based products in various applications, contributing to market growth.

Future Prospects:

The global acrylic acid market is poised for significant growth, driven by its diverse applications, technological advancements, and increasing demand across industries. As industries continue to seek materials that offer performance, sustainability, and versatility, acrylic acid and its derivatives are expected to play a crucial role in meeting the evolving needs of diverse applications.

Conclusion:

Acrylic acid's versatility and wide-ranging applications have solidified its position as a key chemical in various industries. Navigating the global acrylic acid market requires a deep understanding of market dynamics, emerging trends, and the evolving needs of industries. With a promising future shaped by sustainability initiatives and technological advancements, acrylic acid remains a crucial component in the chemical landscape, offering solutions to meet the diverse demands of modern industries worldwide.

#MarketResearch#PersonalCareProducts#AdhesivesandSealants#MarketAnalysis#GlobalMarket#AcrylicAcidMarket#AcrylicAcidProduction#EconomicOutlook#ChemicalInnovation

0 notes

Text

Pectin Market Will Hit Big Revenues In Future

The report "Pectin Market by Type (HM Pectin, LM Pectin), Raw Material (Citrus fruits, Apples, Sugar beet), Function, Application (Food & beverages, Pharmaceutical & Personal Care Products, Industrial Applications), and Region - Global Forecast to 2025" The global pectin market size is estimated to be valued at USD 1.0 billion in 2019 and is expected to reach a value of USD 1.5 billion by 2025, growing at a CAGR of 6.5% during the forecast period. Increase in functional food & beverage consumption, the multi-functionality of pectin, and the rise in the use of natural ingredients in foods due to greater consumer awareness about healthy diets is driving the global pectic industry.

Asia Pacific is projected to grow at the highest CAGR of 6.9% during the forecast period

Asia Pacific provides the highest potential for growth due to factors such as high economic growth of the emerging economies and the increasing disposable income of individuals in the region. In Asia, the demand for drinking yogurts and low pH protein drinks is high, in which pectin is used as an essential ingredient, as it enhances the quality of products. Hence, investments by key manufacturers such as CP Kelco (US) in the Asian region is increasing. The rapidly growing economies in the Asian countries, particularly India and China, and the increasing demand for functional foods across the region is projected to drive the pectin market growth during the forecast period.

To know more get a PDF copy: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=139129149

This report includes a study on the marketing and development strategies, along with the product portfolios of the leading companies operating in the pectin market. It includes the profiles of leading companies such as DowDupont (US), Cargill, Incorporated (US), Ingredion Incorporated (US), CP Kelco (US), Tate & Lyle PLC (UK), Koninklijke DSM N.V. (Netherlands), Naturex (France), Lucid Colloids Ltd (India), Silvateam S.p.A (Italy), Compañía Española de Algas Marinas S.A (CEAMSA) (Spain), Herbstreith & Fox Corporate Group (Germany), Yantai Andre Pectin Co. Ltd. (China), B&V Srl (Italy).

The demand for pectin has created opportunities for pectin manufacturers in the emerging markets

Developing countries, namely, China and India, are projected to experience a strong upsurge in demand for pectin. This demand is expected to be driven by an increase in the production of processed and convenience foods. Emerging economies such as India and China in Asia Pacific are exhibiting high growth. Asia Pacific also provides a cost advantage in terms of production and processing. The high current and projected demand, coupled with the low cost of production, is a key feature, which is expected to aid pectin suppliers and manufacturers to target this market.

The pharmaceutical & personal care products application segment is estimated to witness the fastest growth in the pectin market, in terms of value, in 2019

Pectin is used in the pharmaceutical industry as a stabilizer, binder, film-forming agent, and suspension agent. It is disintegrated in tablet formulations and is used in other topical therapeutic bases. It is one of the most important and widely used excipients in the pharmaceutical industry. The production of pharmaceutical products is growing because of the rising population and the increasing number of diseases. Emerging countries like China, Brazil, and India are markets that are growing rapidly in this area, which is projected to drive the global pectin market size.

In the pharmaceutical industry, pectin is used to reduce blood cholesterol levels and gastrointestinal disorders. Pectin also helps to keep an emulsion from separating into its liquid and oil components. It also increases the thickness of the aqueous (water) portion of personal care and cosmetics products. Due to the multi-functionality and natural origin, pectin is gaining popularity in cosmetic applications such as lotions, after shower balms, aftershave creams, and gels.

Schedule a call with our Analysts to discuss your business needs: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=139129149

The food & beverage application segment is estimated to account for a larger market share, in terms of value, in 2019

The food & beverage application segment dominated the pectin market. The growth of the food & beverage industry in developing economies is projected to propel the demand for pectin. The rise in per capita income and increase in the trend of snacking between meals are driving the demand for bakery & confectionery products, convenience foods, and dairy & frozen products.

0 notes

Text

Surfactant Enhanced Oil Recovery (EOR) Market Growth & Demand Analysis

Surfactant Enhanced Oil Recovery (EOR) Market, by Origin (Chemical Surfactants, Biosurfactants), Type (Alkylpolyglycosides, Coconut Diethanolamide, Di-Tridecyl Sulfosuccinic Acid Ester, Alkylpropoxy Sulfate Sodium Salts), Form (Anionic surfactants, Cationic surfactants, Non-ionic surfactants), Technique (Polymer Flooding (PF), Surfactant-Polymer (SP) Flooding, Alkali-Surfactant-Polymer (ASP) Flooding, Alkali-Co-solvent-Polymer (ACP) Flooding, Low Tension Gas Flooding (LTG)), Application (Onshore, Offshore), Category (Petro-based, Bio-based), and region (North America, Europe, Asia-Pacific, Middle East and Africa and South America).

Market Overview

The Surfactant Enhanced Oil Recovery (EOR) Market size was estimated at USD 75.72 million in 2023 and is projected to reach USD 99.85 million in 2030 at a CAGR of 4.03 during the forecast period 2023-2030.

Surfactant Enhanced Oil Recovery (EOR) Is a technique used in the oil industry to improve the extraction of oil from reservoirs. Surfactants, or surface-active agents, are chemicals that can reduce the surface tension between liquids, such as oil and water. In Surfactant EOR, surfactants are injected into the reservoir to alter the interfacial properties between the oil, water and rock surfaces. This helps to mobilize and displace trapped oil, making it easier to flow through the reservoir and ultimately be recovered. Surfactant EOR can increase the efficiency of oil extraction, particularly in reservoirs where conventional methods have become less effective.

The growth of the Surfactant Enhanced Oil Recovery (EOR) market is mainly being driven by increasing production from maturing oilfields and rising demand for oil. Moreover, new surfactant technologies are being developed that are more effective and less harmful to the environment. This is making surfactant EOR more attractive to oil producers. In addition, governments in many countries are imposing regulations that require oil producers to recover more oil from their fields. This is creating a demand for EOR technologies, such as surfactant EOR.

On the other hand, their high cost and challenging implementation might hamper the growth of the market during the forecast period. This can lead to problems such as emulsion formation and surfactant loss. Moreover, surfactants can be harmful to the environment if they are no properly disposed of. This can create a barrier to the adoption of surfactant EOR.

The coronavirus epidemic hurt the market for surfactant-enhanced oil recovery (EOR), just as it hurt the worldwide oil and gas sector. As governments launched a partial or total lockdown strategy to deal with the epidemic, numerous oil and gas firms across regions were compelled to shut down their manufacturing facilities and services. Major oil and gas projects were also been suspended or delayed by regional businesses. The COVID-19 epidemic also affected the cost of crude oil, well drilling and production, and the oil and gas supply chain. The enhanced oil recovery business has suffered more short- and medium-term damage as a result of the decline in production activities.

Request for the Sample Report: https://www.delvens.com/get-free-sample/surfactant-enhanced-oil-recovery-eor-market-trends-forecast-till-2030

Delvens Industry Expert's Standpoint

The Surfactant Enhanced Oil Recovery Market is expected to grow during the forecast period. This growth can be attributed to several factors. Firstly, as oil fields mature, the oil becomes more difficult to extract. Surfactant EOR can help to improve the recovery of oil from these mature fields. Moreover, the world’s demand for oil is expected to continue to grow in the coming years. Surfactant EOR can help to meet this demand by increasing the amount of oil that can be recovered from existing fields. In addition, new surfactant technologies are being developed that are more effective and less harmful to the environment. This is making surfactant EOR more attractive to oil producers. However, Surfactant EOR is a relatively expensive technology. This can make it prohibitively expensive to some oil producers.

Key Findings

Based on origin, the market is segmented into chemical surfactants, biosurfactants. The chemical surfactants dominated the market in this segment. This is because chemical surfactants are more widely available and less expensive than biosurfactants.

Based on type, the market is segmented into alkylpolyglycosides, coconut diethanolamide, di-tridecyl sulfosuccinic acid ester, alkylpropoxy sulfate sodium salts. The coconut diethanolamide (CDEA) dominated the market in this segment. It is a non-ionic surfactant that is made from coconut oil. CDEA is effective in reducing the interfacial tension between oil and water, which helps to improve the recovery of oil from the reservoir.

Based on form, the market is segmented into, anionic surfactants, cationic surfactants, non-ionic surfactants. The anionic surfactants dominated the market in this segment. This is because anionic surfactants are the most effective type of surfactant for EOR applications.

Based on technique, the market is segmented into polymer flooding (pf), surfactant-polymer (sp) flooding, alkali-surfactant-polymer (asp) flooding, alkali-co-solvent-polymer (acp) flooding, low tension gas flooding (ltg). Surfactant flooding dominated the market in this segment. It involves injecting a solution of surfactant and water into the reservoir. The surfactant reduces the interfacial tension between the oil and water, which helps to improve the mobility of the oil and its recovery.

Based on application, the market is segmented into onshore, offshore. The onshore surfactant EOR dominated the market in this segment. This is because there are more onshore oilfields than offshore oilfields.

Based on category, the market is segmented into petro-based, bio-based. The petro-based surfactants dominated the market in this segment. This is because petro-based surfactants are more widely available and less expensive than bio-based surfactants.

The market is also divided into various regions such as North America, Europe, Asia-Pacific, South America, and Middle East and Africa. North America is estimated to account for the largest market share during the forecast period because of the ongoing development of shale deposits in the region.

Make Inquiry for the Report: https://www.delvens.com/Inquire-before-buying/surfactant-enhanced-oil-recovery-eor-market-trends-forecast-till-2030

Regional Analysis

North America to Dominate the Market

North America is estimated to account for the largest market share during the forecast period because of the ongoing development of shale deposits in the region.

Moreover, the growth of the oil and gas industries is expected to drive the growth of the market during the forecast period.

Competitive Landscape

Air Liquide

Audubon Companies

Baker Hughes Company

BASF SE

BP Plc

ChampionX

Chevron Phillips Chemical Company LLC

Clariant

Core Laboratories

Croda International plc

Exterran Corporation

Halliburton

Kappa Oil Services

Linde Plc

Premier Energy

RCS Group of Companies

Schlumberger Limited

Secure Energy

Shell

Suncor Energy Inc.

TechnipFMC plc

Titan Oil Recovery, Inc.

Ultimate EOR Services LLC

XYTEL Corporation

Recent Developments

In May 2022, two polymer flooding-based enhanced oil recovery (EOR) projects on distinct Indian properties were granted by the state-owned Oil and Natural Gas Corporation (ONGC). SNF Flopam received a contract from ONGC's Ahmedabad asset in December 2021 for the supply of alkali surfactant polymer and injection at Jhalora field. Additionally, SNF Flopam received a comparable contract from ONGC's Mehsana asset in March 2022 for the Bechraji field.

In July 2023, Bolivia’s state hydrocarbons company YPFB decided to begin a second phase of their enhanced oil recovery (EOR) program.

Purchase the Report: https://www.delvens.com/checkout/surfactant-enhanced-oil-recovery-eor-market-trends-forecast-till-2030

Reasons to Acquire

Increase your understanding of the market for identifying the most suitable strategies and decisions based on sales or revenue fluctuations in terms of volume and value, distribution chain analysis, market trends, and factors.

Gain authentic and granular data access for the Surfactant Enhanced Oil Recovery (EOR) Market to understand the trends and the factors involved in changing market situations.

Qualitative and quantitative data utilization to discover arrays of future growth from the market trends of leaders to market visionaries and then recognize the significant areas to compete in the future.

In-depth analysis of the changing trends of the market by visualizing the historic and forecast year growth patterns.

Report Scope

The Surfactant Enhanced Oil Recovery (EOR) Market is segmented into various segments such as origin, type, form, technique, application, category and region:

Based on Origin

Chemical Surfactants

Biosurfactants

Based on Type

Alkylpolyglycosides

Coconut Diethanolamide

Di-Tridecyl Sulfosuccinic Acid Ester

Alkylpropoxy Sulfate Sodium Salts

Based on Form

Anionic surfactants

Cationic surfactants

Non-ionic surfactants

Based on Technique

Polymer Flooding (PF)

Surfactant-Polymer (SP) Flooding

Alkali-Surfactant-Polymer (ASP) Flooding

Alkali-Co-solvent-Polymer (ACP) Flooding

Low Tension Gas Flooding (LTG)

Based on Application

Onshore

Offshore

Based on Category

Petro-based

Bio-based

Who We Are

Delvens is a strategic advisory and consulting company headquartered in New Delhi, India. The company holds expertise in providing syndicated research reports, customized research reports and consulting services. Delvens qualitative and quantitative data is highly utilized by each level from niche to major markets, serving more than 1K prominent companies by assuring to provide the information on country, regional and global business environment. We have a database for more than 45 industries in more than 115+ major countries globally.

Delvens database assists the clients by providing in-depth information in crucial business decisions. Delvens offers significant facts and figures across various industries namely Healthcare, IT & Telecom, Chemicals & Materials, Semiconductor & Electronics, Energy, Pharmaceutical, Consumer Goods & Services, Food & Beverages. Our company provides an exhaustive and comprehensive understanding of the business environment.

Contact Us:

+44-20-8638-5055

0 notes

Text

Carboxymethyl Cellulose Market To Show Incredible Demand Possibilities, Growth Analysis and Forecast to 2030

Carboxymethyl cellulose (CMC) is a versatile cellulose derivative that is widely used in various industries due to its unique properties. It is derived from cellulose, which is a naturally occurring polymer found in the cell walls of plants.

CMC is produced by chemically modifying cellulose with the addition of carboxymethyl groups (-CH2-COOH). This modification imparts water-solubility and a high degree of swelling to the cellulose, making it useful in many applications.

Here are some key properties and uses of carboxymethyl cellulose:

Thickening and Stabilizing Agent: CMC is commonly used as a thickener and stabilizer in food products, pharmaceuticals, and personal care items. It enhances the viscosity of solutions, providing a desirable texture and mouthfeel in products like sauces, dressings, ice creams, and lotions.

Water Retention and Film-Forming Properties: Due to its water-absorbing capabilities, CMC is used in products where water retention is important. It can help retain moisture in baked goods, prevent syneresis (liquid separation) in frozen foods, and improve the stability of emulsions. CMC can also form transparent films, which find applications in coatings, adhesives, and controlled-release drug delivery systems.

Binder and Disintegrant in Pharmaceuticals: In the pharmaceutical industry, CMC is utilized as a binder in tablet formulations to hold the ingredients together. It also acts as a disintegrant, facilitating the breakup of tablets or capsules in the body for effective drug release.

Suspension Agent and Emulsifier: CMC can stabilize suspensions by preventing settling of solid particles in liquids. It is often used in ceramic glazes, paints, and detergents. Additionally, CMC can act as an emulsifier, assisting in the formation and stabilization of oil-in-water or water-in-oil emulsions.

Fiber Additive: In the textile industry, CMC is used as a sizing agent and textile printing thickener. It improves the handle and processability of fabrics, enhances dye penetration, and prevents fabric distortion.

Other Applications: CMC is found in numerous other products, such as detergents, paper coatings, drilling fluids in oil extraction, mining processes, and as a viscosity modifier in various industrial processes.

Market Overview:

The Carboxymethyl Cellulose market has experienced steady growth over the years and is expected to continue expanding in the foreseeable future. The market is driven by the increasing demand for CMC in various applications, such as food and beverages, pharmaceuticals, personal care products, and oil and gas drilling fluids.

Application Areas:

Food and Beverages: Carboxymethyl Cellulose is extensively used as a food additive, primarily as a thickener, stabilizer, and emulsifier. It improves the texture, viscosity, and shelf life of food products, including dairy, bakery, sauces, dressings, and beverages.

Pharmaceuticals: CMC is used in the pharmaceutical industry as a binder, disintegrant, and suspending agent in tablets, capsules, and suspensions. It provides controlled release of drugs and enhances their stability.

Personal Care Products: Carboxymethyl Cellulose is utilized in personal care items, including toothpaste, creams, lotions, and hair care products. It acts as a thickener, emulsifier, and moisturizer, providing desired consistency and stability.

Oil and Gas Drilling Fluids: CMC is employed in drilling fluids for oil and gas exploration. It helps control fluid viscosity, prevent fluid loss, and improve wellbore stability during drilling operations.

Regional Analysis:

The Carboxymethyl Cellulose market is geographically diverse, with key regions including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Asia Pacific dominates the market due to the presence of major CMC manufacturers, high population, and growing industrial sectors.

Key Players: Prominent companies operating in the Carboxymethyl Cellulose market include:

CP Kelco Ashland Inc. AkzoNobel N.V. Daicel Corporation The Dow Chemical Company Nippon Paper Industries Co., Ltd. Química Amtex S.A. de C.V. Lamberti S.p.A. Ugur Seluloz Kimya A.S. DKS Co. Ltd.

These companies focus on research and development activities, product innovations, strategic collaborations, and mergers and acquisitions to maintain their market presence and gain a competitive edge.

Market Trends:

Increasing demand for natural and clean-label ingredients in the food industry is driving the growth of Carboxymethyl Cellulose as a food additive. Growing awareness about personal care and hygiene, coupled with the rising disposable income of consumers, is fueling the demand for CMC in personal care products. The expansion of the oil and gas industry, particularly in developing regions, is creating opportunities for Carboxymethyl Cellulose as a drilling fluid additive.

Market Challenges:

Fluctuations in the prices of raw materials, such as cellulose, impact the production cost of Carboxymethyl Cellulose. Stringent regulations and quality standards imposed by regulatory authorities on food additives and pharmaceutical excipients pose challenges to market players.

Overall, the Carboxymethyl Cellulose market is poised for significant growth due to its versatile applications and increasing demand across various industries.

0 notes

Text

Sorbitol Market Size, Share, Growth, Major Players, Industry Analysis by Forecast to 2030

According to ChemAnalyst report, “Sorbitol Market Analysis: Plant Capacity, Production, Operating Efficiency, Demand & Supply, End Use, Distribution Channel, Region, Competition, Trade, Customer & Price Intelligence Market Analysis, 2015-2030”, The Sorbitol market has witnessed significant growth as it reached 550 thousand tonnes in 2020 and is anticipated to achieve an impressive CAGR of 5.50% during the forecast period until 2030. Continuously growing demand for diabetic and diet foods as it is widely used as a reduced-calorie alternative to sugar by the major end-use industry i.e., food and beverages are likely to boost the market around the world within the next ten years. The production of Sorbitol is highly associated with the safety standards on human health before it can be introduced in the market, which further enhances the standard compliance.

Sorbitol also known as D-Sorbitol, or D-glucitol is a form of carbohydrate that falls under the category of sugar alcohols called polyols. Sorbitol is generally produced via a glucose reduction reaction in which the aldehyde group is converted into a hydroxyl group in the presence of a catalyst called aldose reductase. Sorbitol is extensively utilized as a sweetener, humectant, additive, texturizer, stabilizer, and a bulking agent in pharmaceutical, food, cosmetics, paper, leather, and other industries. It is also used as a feedstock for various chemicals including vitamin C, surfactants, resins, etc. According to the U.S. Food and Drug Administration (FDA), European Union, and World Health Organization (WHO), the consumption of Sorbitol is reviewed and recognized as safe, as well as potentially support digestive and oral health.

Read Full Report Here: https://www.chemanalyst.com/industry-report/sorbitol-market-647

Global Sorbitol Market is segmented on the basis of type, application, sales channel, and region. Based on type, there are two types of Sorbitol available in the market including liquid and powder. The powder/crystalline form of Sorbitol is primarily used in specialty foods, sweets, frozen fish and meat products, and pharmaceuticals. Whereas the liquid form of Sorbitol finds its applications in Pharmaceuticals and cosmetic emulsions. The liquid segment dominates the Sorbitol market across the globe due to its high demand for numerous applications.

On the basis of applications, the market is segregated into pharmaceuticals, personal care & cosmetics, food & beverages, and others. Among these, a plethora of applications in the food and beverage industry dominates the Sorbitol market across the globe. Continuously growing demand for Sorbitol in the pharmaceutical industry, as it is widely utilized as a laxative and helps to combat constipation and is expected to bolster the Sorbitol market in coming years. The rising number of diabetic patients and health-conscious consumers are propelling the demand for Sorbitol as it is widely used in the food and confectionary items as a reduced-calorie alternative to sugar and is likely to boost the Sorbitol market globally in the next few years. Continuously growing demand for Sorbitol due to its numerous applications in end-use industries is driving the sorbitol market across the globe. Due to the unique properties of Sorbitol, it can be easily incorporated with other food products without altering the recipe and is anticipated to accelerate the overall demand for Sorbitol by the cosmetic and pharmaceutical industry around the world. The surging demand for Sorbitol for the manufacturing of a wide range of cosmetic and skincare products like lotions, moisturizers, aftershave creams, shampoos, etc. it serves as a humectant and prevents moisture loss from skin and hair, is likely to boost the Sorbitol market over the next few years.

In 2016 during December, Cargill, Incorporated U.S, a key player introduced an innovation center in China named Cargill ONE to produce animal protein, sweeteners, cocoa, edible oils, and starches, which mainly focused on new flavors and innovative food products in China.

Request Sample Report: Sorbitol Market Report

On the onset of COVID-19 in 2020, leading authorities in emerging countries imposed countrywide lockdowns and strict social distancing norms which led to the unprecedented decline in demand and sales of Sorbitol in the first half of 2020. However, there was not much effect of the pandemic on the overall Sorbitol industry as there was a surge in the demand for sorbitol in the pharmaceutical, food & beverages, and personal care industries. As soon as the lockdown restrictions are uplifted, the market of sorbitol is expected to boost by the end of the year.

Region-wise, the Asia Pacific region holds the major share in the Sorbitol market across the globe owing to the rapidly increasing demand for Sorbitol by the end-use industries including cosmetics, food and beverages, personal care, and others especially in emerging countries such as China and India. Continuously increasing demand for sorbitol for the manufacturing of cosmetics and personal care products is likely to bolster the Sorbitol market across the globe. Rising awareness for diet and low-calorie food further propelling the demand for sorbitol around the world.

Major players for Sorbitol include American International Foods, Inc., ADM, Cargill, Incorporated., DuPont, Gulshan Polyols Ltd., Merck KGaA, Kasyap Sweeteners, Qinhuangdao Lihua Starch Co., Ltd., Roquette Frères, SPI Pharma, Ecogreen Oleochemicals GmbH, Tereos, Ingredion Incorporated, Ltd., Tate & Lyle, Pfizer Inc., and Others.

“The growing demand for Sorbitol from the major end-use industries including cosmetics, pharmaceuticals, food and beverages, and others to manufacture a wide range of products is likely to accelerate the Sorbitol market across the globe within the next few years. Rising awareness regarding low-calorie diet food in several countries is propelling the demand for Sorbitol globally. The rising number of diabetic patients around the world is likely to drive the demand for Sorbitol in upcoming years. Growing demand from the pharmaceutical industry will further augment the Sorbitol market in the future.” said Mr. Karan Chechi, Research Director with TechSci Research, a research-based management consulting firm promoting ChemAnalyst worldwide.

About Us:

ChemAnalyst is a subsidiary of Techsci Research, which was established in 2008, and has been providing exceptional management consulting to its clients across the globe for over a decade now. For the past four years, ChemAnalyst has been a prominent provider of Chemical commodity prices in more than 15 countries. We are a team of more than 100 Chemical Analysts who are committed to provide in-depth market insights and real-time price movement for 300+ chemical and petrochemical products. ChemAnalyst has reverberated as a preferred pricing supplier among Procurement managers and Strategy professionals worldwide. On our platform, we provide an algorithm-based subscription where users can track and compare years of historical data and prices based on grades and incoterms (CIF, CFR, FOB, & EX-Works) in just one go.

The ChemAnalyst team also assists clients with Market Analysis for over 1200 chemicals including assessing demand & supply gaps, locating verified suppliers, choosing whether to trade or manufacture, developing Procurement Strategies, monitoring imports and exports of Chemicals, and much more. The users will not only be able to analyze historical data for past years but will also get to inspect detailed forecasts for the upcoming years. With access to local field teams, the company provides high-quality, reliable market analysis data for more than 40 countries.

ChemAnalyst is your one-stop solution for all data-related needs. We at ChemAnalyst are dedicated to accommodate all of our world-class clients with their data and insights needs via our comprehensive online platform.

Contact Us:

ChemAnalyst

B-44 Sector-57 Noida,

National Capital Region

Tel: 0120-4523990

Mob: +91-8882805349

Email: [email protected]

Website: https://www.chemanalyst.com/

0 notes

Text

Cellulose Gel Market CAGR Status, Emerging Trends and Forecast till 2030

Cellulose gel, also known as cellulose gum or carboxymethyl cellulose (CMC), is a versatile ingredient used in various industries such as food and beverages, pharmaceuticals, personal care, and others. It is derived from cellulose, a natural polymer found in the cell walls of plants.

Here is some detailed information about the cellulose gel market:

Market Overview: The cellulose gel market has experienced steady growth in recent years due to its wide range of applications in different industries. It is used as a stabilizer, thickener, binder, and emulsifier in various products.

Applications: a. Food and Beverages: Cellulose gel is commonly used in the food industry to improve texture, increase viscosity, stabilize emulsions, and prevent ingredient separation. It is found in products like ice cream, baked goods, dairy products, sauces, and dressings. b. Pharmaceuticals: In the pharmaceutical industry, cellulose gel is used as a binder in tablet formulations, a suspending agent in liquid medications, and a thickener in topical gels and creams. c. Personal Care: Cellulose gel is utilized in personal care products such as lotions, creams, shampoos, and toothpaste for its thickening and stabilizing properties. d. Other Industries: Cellulose gel finds applications in various other industries, including paints and coatings, textiles, detergents, and oil drilling fluids.

Benefits and Properties: Cellulose gel offers several advantages, including:

Water-solubility: It dissolves easily in water, making it convenient to use in various formulations.

Thickening and Stabilizing: It enhances the viscosity and stability of products, preventing separation and maintaining desired textures.

Bioavailability: Cellulose gel is considered safe for consumption and has no significant impact on human health.

Versatility: It can be used in a wide range of pH levels and temperatures.

Vegan and Gluten-free: Cellulose gel is derived from plant sources and is suitable for vegan and gluten-free products.

Market Trends: a. Growing Demand for Functional Food: The increasing consumer preference for functional foods and beverages, which offer health benefits, is driving the demand for cellulose gel as a key ingredient. b. Clean Label Products: The demand for clean label products, free from artificial additives and chemicals, is on the rise. Cellulose gel, being a natural ingredient, aligns with this trend. c. Pharmaceutical Advancements: The pharmaceutical industry's continuous development and introduction of new medications and formulations create opportunities for cellulose gel as a binder and stabilizer. d. Technological Innovations: Ongoing research and development efforts are focused on improving the functionality and performance of cellulose gel to cater to evolving industry needs.

Regional Market: The cellulose gel market is geographically diverse, with significant market players located in North America, Europe, Asia Pacific, and other regions. North America and Europe are prominent markets due to the well-established food and pharmaceutical industries, while Asia Pacific is experiencing rapid growth due to the increasing demand for convenience foods and personal care products.

Key Players: Some of the major companies operating in the cellulose gel market include Ashland Global Holdings Inc., The Dow Chemical Company, CP Kelco, AkzoNobel NV, DKS Co. Ltd., and Química Amtex.

It's important to note that market conditions and information may change over time, so it's recommended to refer to the latest reports and studies for the most up-to-date information on the cellulose gel market.

0 notes

Text

4 Best Organic Fertilizers in Farming