#Kim Basinger Net Worth

Explore tagged Tumblr posts

Text

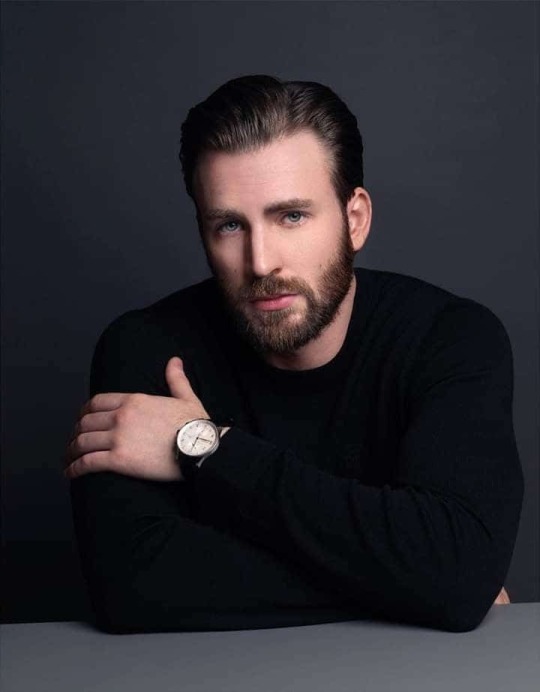

Chris Evans’ Life Behind The Limelight

by: Matt Basco

Chris Evans is an American actor best known for playing comic book superhero Captain America on the big screen.

Early Life

Christopher Robert Evans was conceived on June 13, 1981, in Boston, Massachusetts, and brought up in the close by town of Sudbury. While his father, Robert, gave monetary solidness as a dental specialist, Evans and his three kin were attracted to the performing expressions universe of their mom, Lisa, an artist turned Youth Theater chief. As Evans reviewed, "We resembled the von Trapps [from The Sound of Music], all singing and moving."

A characteristic competitor, Evans wrestled and played lacrosse at Lincoln-Sudbury Regional High School, when not put resources into his school or network theater. He spent the late spring before his senior year of secondary school interning for a throwing organization in New York City, making significant contacts and sharpening his aptitudes at the Lee Strasberg Institute. Anxious to restore, the hopeful entertainer sped through his senior year to graduate a half semester in front of his cohorts.

Who Is Chris Evans?

Brought up in the Boston zone, Chris Evans handled his first significant film job in the parody Not another Teen Movie. He played the Human Torch in two Fantastic Four flicks, however the ball was in his court as another superhuman that moved him to notoriety in the immensely fruitful Captain America and The Avengers blockbusters. Evans additionally earned praise for his exhibition in the tragic Snowpiercer, and made a generally welcomed Broadway debut in 2018.

Movies

'Captain America' and 'the Avengers'

In July 2011, Evans joined the burgeoning Marvel Cinematic Universe Empire with Captain America: The First Avenger. As Steve Rogers, the scrawny but dutiful serviceman who undergoes a massive physical transformation to become the titular super soldier, Evans capably displayed the earnestness central to his character, along with the eye-popping physique and fighting skills requisite for a modern action star. The First Avenger was just the start of the MCU run for Evans, who joined Robert Downey Jr.'s Iron Man, Chris Hemsworth's Thor and other big-name actors, both in and out of costume, for the superhero blockbuster The Avengers (2012). Evans went on to headline the sequels of his own Captain America franchise with The Winter Soldier (2014) and Civil War (2016), while also leading the charge for The Avengers: Age of Ultron (2015) and surfacing in other Marvel features, like Ant-Man (2015) and Spider-Man: Homecoming (2017). Initially reluctant to wield the Captain's shield due to the extended commitment, Evans was ready to move on by the time his contract drew to a close, with Avengers: Infinity War (2018) and Avengers: Endgame (2019) showcasing his final performances as America's super solider.

Early Roles

'Not another Teen Movie' and 'Cellular'

Evans first major film role came in Not another Teen Movie (2001), a spoof of high school dramas like She's All that (1999) and earlier predecessors. As football star Jake Wyler, he follows the formulaic procedure of accepting a bet to date the nerdy, glasses-wearing girl, delivering a silly highlight by squirting on the whipped cream bikini made famous by Ali Larter in Varsity Blues (1999). He followed with another high school comedy, The Perfect Score (2004), as part of a group of students who steal the answers to an SAT exam, and then the action-thriller Cellular (2004), where he showed his future leading man chops by helping to rescue Kim Basinger from her captors.

'Fantastic Four' and 'Scott Pilgrim'

Other Comic Adaptations Prior to his star-making turn in Captain America, Evans went the superhero route for Fantastic Four (2005), as Johnny Storm/Human Torch. The film was a commercial success, but a downturn at the box office for Rise of the Silver Surfer (2007), along with another round of largely negative reviews, led to the cancellation of a third installment.

Returning to comic-sourced material, Evans provided voice work for the animated TMNT (2007), as the boyfriend of the Ninja Turtles' colleague, April O'Neil. He later co-starred in the action comedy The Losers (2010), which drew mixed reviews despite a strong cast, and landed a supporting role in the entertaining Scott Pilgrim vs. the World (2010), as an over-the-top version of the Hollywood action hero he had become. Meanwhile, the actor took advantage of the all-American good looks and charm that made him a natural for romantic comedies. He played the "Harvard Hottie" of past and future co-star Scarlett Johannson in The Nanny Diaries (2007), before becoming the ideal match for Anna Faris in what’s Your Number? (2011).

Drama and Sci-Fi

'London' and 'Sunshine'

Coming off his early teen films, Evans showed he could handle weightier fare with London (2005), as a junkie struggling to get over his ex-girlfriend. He later took on Tennessee Williams in The Loss of a Teardrop Diamond (2008), with Bryce Dallas Howard, and portrayed a real-life lawyer and drug addict who goes after the pharmaceutical industry in Puncture (2010).

'Iceman' and 'Snowpiercer'

Despite his Marvel commitments requiring much of his energy, Evans found the time for other screen projects to his liking. Iceman (2012) gave him the chance to overturn his squeaky-clean superhero image as a contract killer who assists Michael Shannon's sadistic hitman. Snowpiercer (2013) placed him back in leading man territory, albeit as an antihero in a dystopian future.

'The Red Sea Diving Resort’ and 'Knives Out'

Evans next starred as an Israeli agent in The Red Sea Diving Resort (2019), based on the real-life rescue and transport of Ethiopian Jews to Israel in 1981. Late that year, he again distanced himself from the wholesome superhero image by playing an obnoxious playboy in the murder-mystery Knives Out.

Net Worth

Evans checks in at a cool $70 million, according to Celebrity Net Worth. The bulk of his fortune has come from his Marvel Cinematic involvement, though it took a little while to get there, after reportedly receiving a relatively modest $300,000 for his first Captain America movie.

Romantic Life and Girlfriends

Evans was involved in an on-and-off relationship with actress Jenny Slate after they got to know one another on the set of The Gifted. The couple spent the 2017 holiday season together, though they reportedly split for good a few months later. Earlier in his career, from 2001 to 2006, Evans was in a long-term relationship with Jessica Biel. He has also been linked to actresses Minka Kelly and Lily Collins.

Chris Evans's Height and Workout

At 6 feet tall but naturally slim, Evans displayed the results of long hours in the gym while progressing from the rangy jock of Not another Teen Movie, to the beefier Human Torch of Fantastic Four, to the cartoonishly muscular Captain America. Packing on the pounds was vital to the appearance of his laboratory-enhanced superhero, prompting a training regimen that included high-weight reps of squats, deadlifts and incline bench presses, as well as bodyweight exercises like dips and pull-ups. By the time of The Winter Soldier, he had incorporated gymnastics and plyometrics to his routine for more speed and agility, aiding his efforts in such scenes as when he beats up a group of men in a crowded elevator.

TV Shows

Sent to Los Angeles by his agent in the late 1990s to audition for a show called Get Real (where he met Anne Hathaway), Evans instead wound up with a supporting role on Opposite Sex, alongside Milo Ventimiglia, as one of the few boys to attend a former all-girls academy. The teen comedy-drama lasted for only eight episodes in the summer of 2000, but still provided vital exposure for its young stars. Evans went on to make appearances in The Fugitive, Skin and the popular Boston Public. In 2008, with his successful film career well under way, he provided voice work for Adult Swim's stop-motion series Robot Chicken.

10 notes

·

View notes

Text

Kim Basinger Now, Net Worth, Daughter, Children Of Alec Baldwin's Ex-Wife

Kim Basinger Now, Net Worth, Daughter, Children Of Alec Baldwin’s Ex-Wife

Alec Baldwin, known in real life as Alexander Rae Baldwin III, is an American actor, comedian, film producer and political activist based in the United States. Alec has bagged a number of awards that include three Primetime Emmy Awards, three Golden Globe Awards, and eight Screen Actors Guild Awards. Alec Baldwin rose to fame during his appearance on the sixth and seventh seasons of “Knots…

View On WordPress

0 notes

Link

0 notes

Text

Alec Baldwin Net Worth 2021: Wiki Biography, Married, Family, Measurements, Height, Salary, Relationships

Alec Baldwin Net Worth 2021: Wiki Biography, Married, Family, Measurements, Height, Salary, Relationships

Alec Baldwin net worth is $65 Million Alec Baldwin Wiki Biography Alec Baldwin (Alexander Rae Baldwin III) is a movie, stage and television actor and producer. He became famous after taking the role in the soap opera “Knots and Landings”. After the successful debut he took roles in the following movies: “Beetlejuice” directed by Tim Burton, “The Marrying Man” (along with Kim Basinger and Robert…

View On WordPress

0 notes

Link

American Actress Kim Basinger Height, Weight, Measurements, Bra Size, Age, Wiki, Bio, Birthday, Parents, Boyfriends, Family, Net Worth, Facts, HD Photos.

0 notes

Text

Celebrities Who Went Broke and Filed Bankruptcy.

It is very true that money is scarce in supply, and therefore nobody can ever have enough of it. It needs to be managed with a lot of wisdom no matter how massive it is, lest you find yourself suddenly bankrupt, with no cent under your name. medianet_width = "600"; medianet_height = "250"; medianet_crid = "442568836"; medianet_versionId = "3111299"; It raises a lot of questions when a rich celebrity with millions of money and huge net worth is declared bankrupt. Several singers spanning across Oscar award winners, actresses, television personalities and even political figures have found themselves in times of dire fiscal crisis due to funds mismanagement, misfortunes, and lavish lifestyles among other factors. Let us look at these examples of celebrities who went broke.

50 cent.

50 cent is an American rapper whose real name is Curtis James Jackson. He gained celebrity title through a compilation of a variety of songs, acting, and engaging in thriving business. (adsbygoogle = window.adsbygoogle || ).push({}); It was very much unbelievable that a multimillionaire can one day be termed as broke. They should be blamed on an extra expensive lifestyle and careless habits.

50 Cent The famous Lastonia Leviston won a $7 million worth court battle against 50 cents, for posting an intimate video of her and her lover, Rick Ross without asking if it was okay with her. 50 cent was a hater of Rick Ross and made up his mind to release the intimate tape as soon as he laid hands on it, and he did not know it would turn bitter on his finances. This led to an inevitable strain on this rapper’s finances. (adsbygoogle = window.adsbygoogle || ).push({}); 50 cent is, however, a very lucky man because he is now bankruptcy-free, having paid off his debts worth 22 million dollars, that is, 17 million to the audio equipment company and 7 million to Lastonia Leviston.

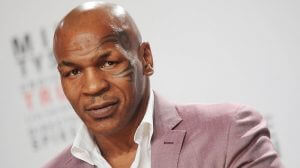

Mike Tyson.

This is a renowned boxer who kicked off his boxing career as a young adult and won several championship titles even before he was 20 years old. (adsbygoogle = window.adsbygoogle || ).push({}); Mike Tyson is estimated to have earned over $400 million within the first 18 years of career. It is so unbelieving that the boxer was declared bankruptcy and even filed for bankruptcy protection in the year 2003.

Mike Tyson Mike Tyson blamed this crisis on the whores he used to hang around with, expensive jewelry, and assets like mansions and cars. Tyson is currently determined to stand on his feet once again by creating a show based on his life story in Las Vegas and authoring a book. (adsbygoogle = window.adsbygoogle || ).push({}); From his recent statements, he sounds focused and ready to learn from his past mistakes.

Mark Twain (Samuel Langhorne Clemens)

He is a bestselling author in America in the 19th century who made fallacious decisions about his well-earned cash and this led to a pathetic financial crush down on his side which almost turned suicidal. Apparently, he had to file for bankruptcy though privately but it later came out of the limelight unexpectedly. (adsbygoogle = window.adsbygoogle || ).push({}); The author’s financial crisis was all to blame on the failed publishing business he had purposed to venture in with millions of his cash. However, he delivered himself off this turmoil by authoring more books which luckily thrived such as “Pudd n head Wilson” and “Following from the equator.”

Shane Filan, who is s member of the west life band

Shane Filan’s financial breakdown set off after he lost several of his real estate stakes in the 2012 Ireland financial crisis and was left with debts of over 18 million Euros’.

Shane Filan From there on, he was declared bankrupt to a point where he had to give up his family home worth 3.5 million Euros’. The pathetic financial condition was further worsened by west life’s decision to split. (adsbygoogle = window.adsbygoogle || ).push({}); At this point even a mere previously cheap looking toy was unaffordable. Shane Filan was able to stand up again through encouragement from family (wife in particular).

Toni Braxton.

Toni Braxton is well known for the hit song “unbreak my heart” which has gained her massive following. A Grammy award-winning R&B singer being declared bankrupt in spite of the millions of sales she made from album sales left many fans mouth agape. Toni Braxton went broke (adsbygoogle = window.adsbygoogle || ).push({}); Toni Braxton said her financial crisis was caused by not being given enough emoluments from the high album sales. She fancied over expensive kitchenware and furniture.

Toni Braxton This Lavish living could be number two reason why the star’s bank balance ain’t so much attractive at the moment. Spending millions of cash making her kitchen look classy didn’t favor her wallet a great deal.

Johnny Depp.

The Hollywood actor ranked among the highest paid actors with a net worth of over 400 million dollars went into a fiscal dilemma owing to the extravagant lifestyle he engaged in. (adsbygoogle = window.adsbygoogle || ).push({}); It was unexpected that such a considerable amount could fade away so fast. Johnny Depp spent thousands of cash on wine and squandered lots of money on several unnecessary activities monthly amidst warnings by his management team TMG. The high interest rated loans he took from financial institutions are also mostly to blame for the fiscal dilemma.

Larry King.

The famous radio show journalist found himself in a financial dilemma during the early days of his career with debts of $350,000. (adsbygoogle = window.adsbygoogle || ).push({}); The journalist filed for bankruptcy protection in 1978.

Larry King Larry King had extravagant spending habits early in his career including buying highly-priced assets. His career almost came to a standstill because of the bankruptcy case but later stood up again and is currently hosting “Larry King Live” on CNN.

Kim Basinger.

Kim Basinger is an Oscar award-winning actress. It’s eyebrow-raising when an Oscar award winner goes broke, given the huge amount of money that the award carries with it. (adsbygoogle = window.adsbygoogle || ).push({}); The actress filed bankruptcy protection in 1993, after mainline pictures filed a suit against her and court order required that she compensates them with 8.1$ million for withdrawing from a film she had agreed to take part in “film Boxing Helena.”

Kim Basinger Later on, they came to an agreement that she pays them only $3.8 million. She had to surrender the venture in Braselton Georgia, planned for bringing up movie studios and film festival auditorium in a bid to flee from bankruptcy.

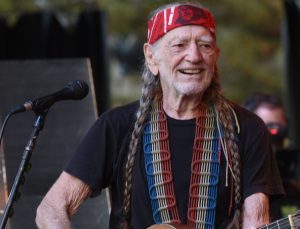

Willie Nelson.

Willie Nelson was an artist, who compiled several hits in the fifties and sixties. His house accidentally went ablaze, and he was left owing the government tax dues of over $32 million. (adsbygoogle = window.adsbygoogle || ).push({}); The family home he owned was attacked and was left with barely anything. IRS took over most of his assets due to bankruptcy state.

Willie Nelson The economic crisis was to be blamed largely on the extravagant spending and living without a financial plan from his accounting team. Willie Nelson compiled an album and used the cash from it to get rid of the tax burden in 1993.

M.C. Harmer.

M.C. Hammer (Stanley Kirk Burley), American Hip hop artist had a huge net worth of over 33 million dollars in 1991. Barely 5 years later, he had lost it all and was declared bankrupt, and this massive amount of cash had been blown off. (adsbygoogle = window.adsbygoogle || ).push({}); M.C. Harmer had employed a massive number of staffs and therefore had a huge payroll to deal with at the end of the month. This cost him a fortune, not forgetting the mansion with a huge price tag that he took up and the numerous cases that were filled with him for taking up other people’s songs rights.

M.C Hammer This turmoil led him to put his house up for sale at a depreciated amount (less than half the amount used in building it). Related posts: Top 7 Richest American Presidents and Their Net Worth 10 Celebrities Who Drive Most Expensive Cars In The World 10 Best Animal Shows that You will Love. How many of these have you watched? 5 Celebrities Criminal Records. You Might Find This Hard To Believe. 7 Cheater “Super Star” Celebrities. (adsbygoogle = window.adsbygoogle || ).push({}); Trending. 10 Cheap Celebrities Who Are Terrible Tippers 12 Rich Celebrities Who Live Humble Lives 10 Celebrities Who Are Incredibly Generous Tippers. No 8 might surprise you. 10 Best Animal Shows that You will Love. 10 Best Animal Shows that You will Love. How many of these have you watched? 10 Celebrities Who Drive Most Expensive Cars In The World (adsbygoogle = window.adsbygoogle || ).push({}); Read the full article

0 notes

Video

youtube

Kim Basinger Net Worth, Cars, House, Private Jets and Luxurious Lifestyle

0 notes

Text

QUESTIONS I ASK MYSELF AT THE START OF EVERY NEW YEAR

Anyone else here a fan of Tony Robbins? If I ever feel uninspired all I need to do is pick up one of his books, flip to any random page and read a few paragraphs.

He reminds me to think of who I really want to be, how I see myself in years to come, what direction I'm taking, what goals I'm setting for myself, and how I plan on getting there.

I get caught up in day to day stuff so often that sometimes I forget to really think about how these things will pay off in the long run. Once I really sit down and think about where I see myself 10 years from now, it gives me motivation and changes the course of how I'm doing things.

One of the most important things I learned from Tony is to set some time aside at LEAST once a year and really just let yourself free and write about where you see yourself 5-10 years from now.

Write down everything about your ideal day from the moment you wake up until the moment you lay back down to go to sleep.

What are you wearing?

What does your house look like?

Who are you with?

Where are you in the world?

What do you do with the first hour of your day?

I've done this so many times that I this vision in my head like it already happened. This is how detailed mine is: (From here, we write down different questions that will help us figure out how we're going to get to this ideal day for us years from now. )

My ideal day 10 years from now:

I wake up around 6:15am in the second story of my modern home next to my husband and dog, I walk down the wooden steps to my big kitchen where I have a beautiful floor to ceiling window view of San Diego or LA, I make myself some espresso and a fresh juice and turn on some relaxing jazz music and light some candles.

I spend my morning by myself, reading and planning my day. I have a small breakfast then go back upstairs to get ready for my morning barre class.

I drive myself to barre in my blacked out infinite suv, my hair, skin and nails are on point and my body is in amazing shape because I eat clean and make time to work out everyday.

I get back from barre and enjoy some time with my kids and husband while I make them breakfast.

I work from home in my office upstairs.....

Okay, I won't bore you anymore but you get the idea. Let yourself think of every detail. Let your mind expand and don't place ANY limitations on yourself. Think about what you really really want.

Now that you know what you want to look like, how you want to live, and where you want to be with your career, you can start THIS YEAR with questions and goals in mind that will help push you towards that ultimate vision.

There's 4 set's of goals that we need to pay attention to:

- Personal Development Goals

- Career/Business Goals

- Toys/Adventure Goals

- Contribution Goals

1. PERSONAL DEVELOPMENT GOALS:

STEP ONE:

Set a timer for 5 minutes and write down everything that you can possibly think of.

How would you like to improve your physical body? What are your goals for your mental and social development? Do you want to start to make meditating a habit that you do every morning? Do you want to learn a new language? Do you want to speak in front of an audience?

Emotionally what would you like to experience or achieve? Do you want to forgive someone or mend an old friendship? Do you want to start going to church?

Tony Robbins shares some questions to ask yourself before writing.

What would you like to learn?

What are some skills you want to master in your lifetime?

What are some character traits you’d like to develop?

Who do you want your friends to be?

What do you want to be?

What could you do for your physical well-being? (Get a massage every week? Every day? Create the body of your dreams? Join a gym–and actually use it? Hire a vegetarian chef? Complete the Iron Man Triathlon in Honolulu?)

Would you like to conquer your fear of flying? Or of public speaking? Or of swimming?

What would you want to learn? To speak French? Study the Dead Sea Scrolls? Dance and/or sing? Study with violin Virtuoso Itzhak Perlman? Who else would you like to study with? Would you like to take in a foreign exchange student?

STEP TWO:

Set your timer for 1 minute and give yourself a deadline for accomplishing each goal. If it's 1 year or less write 1, if it's 2 years, put a 2 next to it, and so on for 10 years, 15 years, 20 years etc.

STEP THREE:

Chose your most important 1 year goal and take 3 minutes to write down a few paragraphs about why it's so important to you. Why are you committed to achieving that one specific goal this year? Why is it so important to you? What would you miss out on if you didn't achieve it?

2. CAREER/BUSINESS GOALS

STEP ONE:

Take 5 minutes to write down your career/business/financial goals.

Here's some of Tony Robbin's suggestions of questions to ask yourself.

Do you want to earn: $50,000 a year? $100,000 a year? $500,000 a year? $1 million a year? $10 million a year? So much that you can’t possibly count it?

What goals do you have for your company? Would you like to take your company public? Would you like to become the leader in your industry?

What do you want your net worth to be? When do you want to retire? How much investment income would you like to have so you no longer have to work? By what age do you want to achieve financial independence?

What are your money management goals? Do you need to balance your budget? Balance your checkbook? Get a financial coach?

What investments would you make? Would you finance an exciting start-up business? Buy a vintage coin collection? Start a diaper delivery service? Invest in a mutual fund? Set up a living trust? Contribute to a pension plan?

How much do you want to save toward giving your kids a college education?

How much do you want to be able to spend on travel and adventure?

How much do you want to be able to spend on new ‘toys’?

What are your career goals? What would you like to contribute to the company? What breakthrough would you like to create? Would you like to become a supervisor? A manager? A CEO? What would you like to be known for within your profession? What kind of impact do you want to have?

STEP TWO:

Set a timeline for your goals by putting a 1 next to goals that you want to accomplish in 1 year or less, a 2 for 2 years, and so on. Try to do this in 1 minute.

STEP THREE:

Pick your top 1 year goal and spend 3 minutes writing about it. Explain why you are absolutely committed to achieving this goal this year and if you can't think of good enough reasons then you might need to pick a different goal that really fires you up.

3. TOYS/ADVENTURES GOALS

Take 5 minutes to write down EVERYTHING you could ever want, have, or experience in your life.

Here's some of Tony's examples:

Would you like to build, create, or purchase a cottage? Castle? Beach house? Catamaran sailboat? Private yacht? Island? Lamborghini sports car? Chanel wardrobe? Helicopter? Jet plane? Music studio? Art collection? Private zoo stocked with giraffes, alligators, and hippos? Virtual Reality machine?

Would you like to attend an opening of a Broadway plan? A film premier in Cannes? A Bruce Springsteen concert? A Kabuki theater production in Osaka, Japan?

Would you like to race any of the Andrettis at the next Indy 500? Play Monica Seles and Steffi Graf, or Boric Becker and Ivan Lendl, in a doubles match? Pitch the World Series? Carry the Olympic torch? Go one-on-one with Michael Jordan? Swim with the pink dolphins in the oceans of Peru? Race camels between the pyramids of Egypt with your best friend? And win? Track with the Sherpas in the Himalayas?

Would you like to start in a Broadway play? Share an on-screen kiss with Kim Basinger? Dirty Dance with Patrick Swayze? Choreograph a modern ballet with Mikhail Baryshnikov?

What exotic places would you visit? Would you sail around the world like Thor Heyerdahl in Kon-Tiki? Visit Tanzania and study chimpanzees with Jane Goodall? Sail on the Calypso with Jacques Cousteau? Long on the sands of the French Riviera? Sail a yacht around the Greek Isles? Participate in the Dragon Festivals in China? Take part in a shadow dance in Bangkok? Scuba dive in Fiji? Meditate in a Buddhist monastery? Take a stroll through the Prado in Madrid? Book a ride on the next space shuttle flight?

STEP TWO:

Set a timeline for your goals by putting a 1 next to goals that you want to accomplish in 1 year or less, a 2 for 2 years, and so on. Try to do this in 1 minute.

STEP THREE:

Pick your top 1 year goal and spend 3 minutes writing about it. Explain why you are absolutely committed to achieving this goal this year and if you can't think of good enough reasons then you might need to pick a different goal that really fires you up.

4. CONTRIBUTION GOALS

Take 5 minutes to write down how you want to give back. What contributions do you want to make to OTHER people's lives? How will you leave your mark or make a difference?

Here's some examples from Tony:

How could you contribute? Would you help build a shelter for the homeless? Adopt a child? Volunteer at a soup kitchen? Read to the blind? Visit a man or woman serving a prison sentence? Volunteer with the Peace Corps for six months? Take balloons to an old folks’ home?

How could you help to protect the ozone layer? Clean up the oceans? Eliminate racial discrimination? Halt the destruction of the rain forests?

What could you create? Would you come up with a perpetual motion machine? Develop a car that runs on garbage? Design a system for distribution food to all who hunger?

STEP TWO:

Set a timeline for your goals by putting a 1 next to goals that you want to accomplish in 1 year or less, a 2 for 2 years, and so on. Try to do this in 1 minute.

STEP THREE:

Pick your top 1 year goal and spend 3 minutes writing about it. Explain why you are absolutely committed to achieving this goal this year and if you can't think of good enough reasons then you might need to pick a different goal that really fires you up.

Now that you have your 4 MASTER 1 YEAR GOALS, use them to inspire you all year long!

Tony ends with this:

“Now you should have four master one-year goal that absolutely excite and inspire you, with sound, compelling reasons behind them. How would you feel if in one year you had mastered and attained them all? How would you feel about yourself? How would you feel about your life? I can’t stress enough the importance of developing strong enough reasons to achieve these goals. Having a powerful enough why will provide you with the necessary how.

Make sure that you look at these four goals daily. Put them where you’ll see them every day, either in your journal, on your desk at the office, o rover your bathroom mirror while you’re shaving or putting on makeup. If you back your goals up with a solid commitment to CANI!, to constant and never –ending improvement of each of these areas, then you’re sure to make progress daily. Make the decision now to begin to follow through on these goals, beginning immediately.”

As the saying goes, your dreams are the most precious things you own. Your goals are simply your dreams on a timeline.

Leave a comment below and let me know what one of your goals are for this year!!

1 note

·

View note

Text

Lifestyles of the Rich and Foolish

It's the first of April. You know what that means. Spring is here! Your friends and family are pulling April Fools' Day pranks. And my tree allergies are kicking my butt. Every year, tree pollen makes my life miserable. This year is no different.

Facebook kindly reminded me this morning that three years ago, Kim and I were in Asheville, North Carolina. After wintering in Savannah, Georgia, we'd resumed our tour of the U.S. by RV.

While in Asheville, we toured the Biltmore Estate, the largest home in the U.S. This 250-room chateau contains 179,000 square feet of floor space — including 35 bedrooms, 43 bathrooms, and 65 fireplaces — and originally sat on 195 square miles of land. (Today, the estate “only” contains 8000 acres.)

“This feels like Downton Abbey but in North Carolina,” I said as we walked the endless halls. Just as Downton Abbey documented the excesses of British upper class, so too the Biltmore sometimes feels like an example of how rich Americans indulged in decadence.

George Washington Vanderbilt II, the man who built Biltmore, was a member of one of the country's wealthiest families. His grandfather, Cornelius Vanderbilt, was born poor in 1794, but by the time he died in 1877 he had become one of the richest men in the world. During his lifetime, he built a fortune first from steamships and then as a prominent railroad tycoon.

By family standards, grandson George didn't have a lot of money. He inherited about $7 million, and drew income from a $5 million trust fund. He decided to use the bulk of his fortune to build a huge house high in the Appalachians. Work on the Biltmore Estate began in 1889, when George was 26 years old. Six years and $5 million later, he moved into his palace. (That $5 million would be roughly $90 million in today's dollars.)

Strolling the grounds of the Biltmore Estate got me thinking about the stories we hear of wealthy people who squander their riches. How and why do they do this? Are there lessons from their stories that you and I can put to use?

We hear all the time about the “lifestyles of the rich and famous”. Today, on April 1st, let's look at some lifestyles of the rich and foolish.

Lifestyles of the Rich and Foolish

There are so many stories of athletes and entertainers who have blown big fortunes that it's tough to know where to start. Who should we pick on first? Since I've never been a fan of Nicolas Cage — and since he seems to be especially bad with money — let's use him an example.

Over a period of fifteen years, Cage earned more than $150 million. He blew through that money buying things like:

Fifteen homes, including an $8 million English castle that he never stayed in once.

A private island.

Four luxury yachts.

A fleet of exotic cars, including a Lamborghini that used to belong to the Shah of Iran.

A dinosaur skull he won after a bidding contest with Leonardo DiCaprio.

A private jet.

It's not fair to characterize Cage as “broke” — he's still a bankable movie star — but his net worth is reportedly only about $25 million. (That's like someone with an average income having a net worth of roughly $25,000.) He could be worth ten times as much but his foolish financial habits have caused him woe.

Cage got in trouble with the IRS for failing to pay millions of dollars in taxes. He's been sued by multiple companies for failing to repay loans. His business manager says that he's tried to warn Cage that his lifestyle exceeds his means, but the actor won't listen.

Cage is but one of many celebrities who have done dumb things with money. Other prominent examples include:

MC Hammer sold the rights to his songs to raise money after being bankrupted by his lavish lifestyle. Hammer earned more than $33 million in the early nineties, but spent the money on a $12 million mansion (with gold-plated gates), a fleet of seventeen vehicles, two helicopters, and extravagant parties. [source, source]

Actress Kim Basinger paid $20 million to buy the town of Braselton, Georgia in 1989. When Basinger filed for bankruptcy just four years later, she was forced to sell the town. [source]

On the night of 01 February 1976, Elvis Presley decided he wanted a Fool's Gold Loaf, a special sandwich made of hollowed bread, a jar of peanut butter, a jar of jelly, and a pound of bacon. He and his entourage flew from Memphis to Denver. The group ate their sandwiches and then flew home. Price: $50,000 – $60,000. [source]

Even authors get in on the act. Writer Mark Twain made tons of money through his work, but he lost much of it to bad investments, mostly in new inventions: a bed clamp for infants, a new type of steam engine, and a machine designed to engrave printing plates. Twain was a sucker for get rich quick schemes. [source, source]

When it comes to frittering way fortunes, it's hard to compete with sports superstars. In a 2009 Sports Illustrated article about how and why athletes go broke, Pablo S. Torre wrote that after two years of retirement, “78% of former NFL players have gone bankrupt or are under financial stress.” Within five years of retirement, roughly 60% of former NBA players are in similar positions.

Some examples:

Boxer Mike Tyson earned over $300 million in his professional career. He lost it all, spending the money on cars, jewels, pet tigers, and more. He eventually filed for bankruptcy. [source]

When Yoenis Cespedes signed a new $75 million contract with the New York Mets, he drove a new vehicle each day during the first week of training camp, including a Lamborghini Aventador ($397,000) and an Alfa Romeo 8C Competizione ($299,000). [source]

Basketballer Vin Baker earned $100 million during his career. He's now worth $500,000. He manages a Starbucks store in a small town in Rhode Island. (To be fair, Baker sees to be turning his life around, which is awesome.) [source]

Hall-of-fame pitcher Curt Schilling earned $112 million during 20 years in the big leagues. It wasn't enough to keep up with his spending. Plus he lost $50 million through the collapse of a company he owned. In 2013, he held a “fire sale” to avoid bankruptcy.

It can be tough to sympathize with these folks. Used wisely, their immense fortunes could sustain them and their families for a long time. Instead, they squander their money on fleeting pleasures and the trappings of wealth.

Still, I believe it's best to keep the schadenfreude in check. “There but for the grace of God” and all that, right? I've seen plenty of examples of average folks who have wasted smaller windfalls. In fact, this sort of thing seem to be the rule rather than the exception.

But why does this happen? The answer might be Sudden-Wealth Syndrome.

Lottery winners have the same kinds of problems. A 2001 article in The American Economic Review found that after receiving half their jackpots, the typical lotto winner had only put about 16% of that money into savings. It's estimated that over a quarter of lottery winners go bankrupt.

Take Bud Post: He won $16.2 million in 1988. Within weeks of receiving his first annual payment of nearly half a million dollars, he'd spent $300,000. During the next few years, Post bought boats, mansions, and airplanes, but trouble followed him everywhere. “I was much happier when I was broke,” he's reported to have said. When he died in 2006, Post was living on a $450 monthly disability check.

Sudden-Wealth Syndrome

In 2012, ESPN released a documentary called Broke that explores the relationship between pro athletes and money. How does sudden wealth affect young men? What happens when highly-competitive athletes with high incomes hang out together? Lots of stupid stuff, as it turns out.

Here's a nine-minute montage from Broke in which wealth manager Ed Butowsky talks about why athletes get into trouble with money:

youtube

Broke is an interesting film. The players speak candidly about the mistakes they've made: buying 25 pairs of shoes at one time, buying fur coats they never wore, buying cars they never drove. They're not proud of their pasts — some are ashamed — but they're willing to talk about the problem in the hopes they can help others avoid doing the same dumb things in the future.

Curious how much your favorite actor or athlete earns? Check out Celebrity Net Worth, a website devoted to tracking the financial health of people in the public eye.

Broke does a good job of explaining why our sports heroes can't seem to make smart money moves. The problem is Sudden-Wealth Syndrome. Essentially, young folks who earn big bucks don't get a chance to “practice” with money before they're buried with wealth.

The typical person earns a little when they're young, but watches their salary grow slowly with time. Their income peaks during their forties and fifties. As a result, they get time to make mistakes with small amounts of money first which means (in theory) that they're less likely to blow big bucks down the road.

On the other hand, athletes (and entertainers) have a completely different earning pattern. They leave school to instant riches. For a few years, they earn great gobs of money. But usually their income declines sharply with time — until it stops altogether.

Here's a (pathetic) chart I created to help visualize this phenomenon:

Athletes and entertainers need to figure out how to make five years of income last for fifty years. This never occurs to most of them. “[A pro athlete] can't live like a king forever,” says Bart Scott in ESPN's Broke. “But you can live like a prince forever.”

Sudden-Wealth Syndrome doesn't just affect athletes and actors. Lottery winners experience it too. So do average folks who inherit a chunk of change or business owners who sell their companies.

The fundamental problem is that nobody ever teaches us how to handle a windfall. Windfalls are rare, and in most cases they can't be planned for. (Some folks might be able to plan for an inheritance or the sale of a business, but these situations are relatively uncommon.) As a result, when the average person happens into a chunk of change, they spend it.

Here's what you should do instead.

How NOT to Waste a Windfall

When you receive a windfall, whether it's a tax refund, an inheritance, a gift, or from any other source, it's like you've been given a second chance. Although you may have made money mistakes in the past, you now have a chance to fix those mistakes (or some of them, anyhow) and start down the path of smart money management.

It can be tempting to spend your windfall on toys, trips, and other things that you “deserve,” but doing so will leave you in the same place you were before you received the windfall. And if that place was chained to debt, you'll be just as unhappy as you've always been.

If you receive a chunk of cash, I recommend that you:

Keep five percent to treat yourself and your family. Let's be realistic. If you receive $1,000 or $10,000 or $100,000 unexpectedly, you're going to want to spend some of it. No problem. But don't spend all of it. I used to recommend spending one percent of a windfall on yourself, but from talking to people, that's not enough. Now I suggest spending five percent on fun. That means $50 of a $1,000 windfall, $500 of a $10,000 windfall, or $5,000 of a $100,000 windfall.

Pay any taxes due. Depending on the source of your money, you might owe taxes on it at the end of the year. If you forget this fact and spend the money, you can end up in a bind when the taxes come due. Consult a tax professional. If needed, set aside enough to pay your taxes before you do anything else.

Pay off debt. Doing so will generally provide the greatest possible return on your investment (a 20 percent return if your credit cards charge you 20 percent). It'll also free up cash flow; if you pay off a card with a $50 minimum monthly payment, that's $50 extra you'll have available each month. Most of all, repaying debt will relieve the psychological weight you've been carrying for so long.

Fix the things that are broken. After you've eliminated any existing debt, use your windfall to repair whatever is broken in your life. Start with your own health. If you've been putting off a trip to the dentist or a medical procedure, take care of it. Do the same for your family. Next, fix your car or the roof or the sidewalk. Use this opportunity to patch up the things you've been putting off.

Deposit the rest of the money in a safe account. It can be tempting to spend the rest of your windfall on a new motorcycle or new furniture or new house. Don't. After attending to your immediate needs, deposit the remaining money in a new savings account separate from the rest of your bank accounts — and then leave this money alone.

To successfully manage a windfall, you must allow the initial euphoria to pass, getting over the urge to spend the money today. Live as you were before. Meanwhile, calculate how far your windfall could go. Most people have unrealistic expectations about how much $10,000 or $100,000 can buy.

In 2009, I received an enormous windfall. The old J.D. would have gone crazy with the money. The new, improved model of me was prepared, and made measured moves designed to favor long-term happiness over short-term happiness.

Today, the bulk of my windfall remains in the same place it's been for the past five years: an investment account. That cash eases my mind. It helps me sleep easy at night. And that's more rewarding than spending it on new toys could ever be.

Setting a Good Example

Not everyone who gets rich quickly does dumb things with money. Especially as the plight of pro athletes becomes better known, there are prominent examples of young superstars making savvy money moves. They're learning from the lessons of those who came before.

Take Toronto Raptors superstar Kawhi Leonard, for instance. This 27-year-old NBA MVP earns $23 million per year — but still clips coupons for his favorite restaurant. He drives a 1997 Chevy Tahoe. Sure, he bought himself a Porsche, but he's not interested in flash and bling. “I'm not gonna buy some fancy watch just to show people something fancy on my wrist,” he says. [source]

Jamal Mashburn has made wise use of his wealth. So has LeBron James, who takes his investment advice from Warren Buffett:

youtube

Here are other superstars who act as money bosses:

During his 12-year career in the NBA, Junior Bridgeman never earned more than $350,000. Unlike most players, however, he planned ahead. He recognized his basketball income would eventually vanish. He bought a Wendy's fast-food franchise and learned the business inside-out. He became a hands-on owner. He expanded from one store to three to six — and then to a small empire. Today, twenty-five years after retirement, Bridgeman owns more than 160 Wendy's restaurants and 120 Chili's franchises. His company employs 11,000 people and generates over half a billion in revenue every year. His personal net worth tops $400 million. [source]

Patriots tight end Rob Gronkowski — who just retired last week — is a shining example of how to handle sudden wealth correctly. The 29-year-old earned over $53 million for playing on the field — and hasn't spent any of it. Here are his own words: “To this day, I still haven't touched one dime of my signing bonus or NFL contract money. I live off my marketing money and haven't blown it on any big-money expensive cars, expensive jewelry or tattoos and still wear my favorite pair of jeans from high school.” [source]

Oakland Raiders running back Marshawn Lynch has a similar story. During his twelve-year NFL career, Lynch has collected nearly 57 million from his contract. Reportedly, he hasn't spent a penny of that money. Instead, he's been cautious to live only off his endorsement earnings. Whether this is true or not, Lynch is known to be a good example to his teammates, helping them with their 401(k)s and other financial issues. [source]

Sometimes superstars who have been poor with money have a flash of insight and they're able to turn things around. Former NFL player Phillip Buchanon is a perfect example. After watching ESPN's Broke, he realized he was headed for trouble. He mended his ways and started managing his money wisely. Now he's written a book with advice for other folks who are fortunate enough to encounter a windfall. [source]

When people make a lot of money, they're able to spend a lot of money. Sometimes the super-rich can afford to build a place like the Biltmore Estate. The problem isn't a single extravagant purchase, but a lavish lifestyle in which they spend more than they earn. Real wealth isn't about earning money — it's about keeping money.

The post Lifestyles of the Rich and Foolish appeared first on Get Rich Slowly.

from Finance https://www.getrichslowly.org/lifestyles-of-the-rich-and-foolish/ via http://www.rssmix.com/

0 notes

Text

Lifestyles of the Rich and Foolish

It’s the first of April. You know what that means. Spring is here! Your friends and family are pulling April Fools’ Day pranks. And my tree allergies are kicking my butt. Every year, tree pollen makes my life miserable. This year is no different.

Facebook kindly reminded me this morning that three years ago, Kim and I were in Asheville, North Carolina. After wintering in Savannah, Georgia, we’d resumed our tour of the U.S. by RV.

While in Asheville, we toured the Biltmore Estate, the largest home in the U.S. This 250-room chateau contains 179,000 square feet of floor space — including 35 bedrooms, 43 bathrooms, and 65 fireplaces — and originally sat on 195 square miles of land. (Today, the estate “only” contains 8000 acres.)

“This feels like Downton Abbey but in North Carolina,” I said as we walked the endless halls. Just as Downton Abbey documented the excesses of British upper class, so too the Biltmore sometimes feels like an example of how rich Americans indulged in decadence.

George Washington Vanderbilt II, the man who built Biltmore, was a member of one of the country’s wealthiest families. His grandfather, Cornelius Vanderbilt, was born poor in 1794, but by the time he died in 1877 he had become one of the richest men in the world. During his lifetime, he built a fortune first from steamships and then as a prominent railroad tycoon.

By family standards, grandson George didn’t have a lot of money. He inherited about $7 million, and drew income from a $5 million trust fund. He decided to use the bulk of his fortune to build a huge house high in the Appalachians. Work on the Biltmore Estate began in 1889, when George was 26 years old. Six years and $5 million later, he moved into his palace. (That $5 million would be roughly $90 million in today’s dollars.)

Strolling the grounds of the Biltmore Estate got me thinking about the stories we hear of wealthy people who squander their riches. How and why do they do this? Are there lessons from their stories that you and I can put to use?

We hear all the time about the “lifestyles of the rich and famous”. Today, on April 1st, let’s look at some lifestyles of the rich and foolish.

Lifestyles of the Rich and Foolish

There are so many stories of athletes and entertainers who have blown big fortunes that it’s tough to know where to start. Who should we pick on first? Since I’ve never been a fan of Nicolas Cage — and since he seems to be especially bad with money — let’s use him an example.

Over a period of fifteen years, Cage earned more than $150 million. He blew through that money buying things like:

Fifteen homes, including an $8 million English castle that he never stayed in once.

A private island.

Four luxury yachts.

A fleet of exotic cars, including a Lamborghini that used to belong to the Shah of Iran.

A dinosaur skull he won after a bidding contest with Leonardo DiCaprio.

A private jet.

It’s not fair to characterize Cage as “broke” — he’s still a bankable movie star — but his net worth is reportedly only about $25 million. (That’s like someone with an average income having a net worth of roughly $25,000.) He could be worth ten times as much but his foolish financial habits have caused him woe.

Cage got in trouble with the IRS for failing to pay millions of dollars in taxes. He’s been sued by multiple companies for failing to repay loans. His business manager says that he’s tried to warn Cage that his lifestyle exceeds his means, but the actor won’t listen.

Cage is but one of many celebrities who have done dumb things with money. Other prominent examples include:

MC Hammer sold the rights to his songs to raise money after being bankrupted by his lavish lifestyle. Hammer earned more than $33 million in the early nineties, but spent the money on a $12 million mansion (with gold-plated gates), a fleet of seventeen vehicles, two helicopters, and extravagant parties. [source, source]

Actress Kim Basinger paid $20 million to buy the town of Braselton, Georgia in 1989. When Basinger filed for bankruptcy just four years later, she was forced to sell the town. [source]

On the night of 01 February 1976, Elvis Presley decided he wanted a Fool’s Gold Loaf, a special sandwich made of hollowed bread, a jar of peanut butter, a jar of jelly, and a pound of bacon. He and his entourage flew from Memphis to Denver. The group ate their sandwiches and then flew home. Price: $50,000 – $60,000. [source]

Even authors get in on the act. Writer Mark Twain made tons of money through his work, but he lost much of it to bad investments, mostly in new inventions: a bed clamp for infants, a new type of steam engine, and a machine designed to engrave printing plates. Twain was a sucker for get rich quick schemes. [source, source]

When it comes to frittering way fortunes, it’s hard to compete with sports superstars. In a 2009 Sports Illustrated article about how and why athletes go broke, Pablo S. Torre wrote that after two years of retirement, “78% of former NFL players have gone bankrupt or are under financial stress.” Within five years of retirement, roughly 60% of former NBA players are in similar positions.

Some examples:

Boxer Mike Tyson earned over $300 million in his professional career. He lost it all, spending the money on cars, jewels, pet tigers, and more. He eventually filed for bankruptcy. [source]

When Yoenis Cespedes signed a new $75 million contract with the New York Mets, he drove a new vehicle each day during the first week of training camp, including a Lamborghini Aventador ($397,000) and an Alfa Romeo 8C Competizione ($299,000). [source]

Basketballer Vin Baker earned $100 million during his career. He’s now worth $500,000. He manages a Starbucks store in a small town in Rhode Island. (To be fair, Baker sees to be turning his life around, which is awesome.) [source]

Hall-of-fame pitcher Curt Schilling earned $112 million during 20 years in the big leagues. It wasn’t enough to keep up with his spending. Plus he lost $50 million through the collapse of a company he owned. In 2013, he held a “fire sale” to avoid bankruptcy.

It can be tough to sympathize with these folks. Used wisely, their immense fortunes could sustain them and their families for a long time. Instead, they squander their money on fleeting pleasures and the trappings of wealth.

Still, I believe it’s best to keep the schadenfreude in check. “There but for the grace of God” and all that, right? I’ve seen plenty of examples of average folks who have wasted smaller windfalls. In fact, this sort of thing seem to be the rule rather than the exception.

But why does this happen? The answer might be Sudden-Wealth Syndrome.

Lottery winners have the same kinds of problems. A 2001 article in The American Economic Review found that after receiving half their jackpots, the typical lotto winner had only put about 16% of that money into savings. It’s estimated that over a quarter of lottery winners go bankrupt.

Take Bud Post: He won $16.2 million in 1988. Within weeks of receiving his first annual payment of nearly half a million dollars, he’d spent $300,000. During the next few years, Post bought boats, mansions, and airplanes, but trouble followed him everywhere. “I was much happier when I was broke,” he’s reported to have said. When he died in 2006, Post was living on a $450 monthly disability check.

Sudden-Wealth Syndrome

In 2012, ESPN released a documentary called Broke that explores the relationship between pro athletes and money. How does sudden wealth affect young men? What happens when highly-competitive athletes with high incomes hang out together? Lots of stupid stuff, as it turns out.

Here’s a nine-minute montage from Broke in which wealth manager Ed Butowsky talks about why athletes get into trouble with money:

youtube

Broke is an interesting film. The players speak candidly about the mistakes they’ve made: buying 25 pairs of shoes at one time, buying fur coats they never wore, buying cars they never drove. They’re not proud of their pasts — some are ashamed — but they’re willing to talk about the problem in the hopes they can help others avoid doing the same dumb things in the future.

Curious how much your favorite actor or athlete earns? Check out Celebrity Net Worth, a website devoted to tracking the financial health of people in the public eye.

Broke does a good job of explaining why our sports heroes can’t seem to make smart money moves. The problem is Sudden-Wealth Syndrome. Essentially, young folks who earn big bucks don’t get a chance to “practice” with money before they’re buried with wealth.

The typical person earns a little when they’re young, but watches their salary grow slowly with time. Their income peaks during their forties and fifties. As a result, they get time to make mistakes with small amounts of money first which means (in theory) that they’re less likely to blow big bucks down the road.

On the other hand, athletes (and entertainers) have a completely different earning pattern. They leave school to instant riches. For a few years, they earn great gobs of money. But usually their income declines sharply with time — until it stops altogether.

Here’s a (pathetic) chart I created to help visualize this phenomenon:

Athletes and entertainers need to figure out how to make five years of income last for fifty years. This never occurs to most of them. “[A pro athlete] can’t live like a king forever,” says Bart Scott in ESPN’s Broke. “But you can live like a prince forever.”

Sudden-Wealth Syndrome doesn’t just affect athletes and actors. Lottery winners experience it too. So do average folks who inherit a chunk of change or business owners who sell their companies.

The fundamental problem is that nobody ever teaches us how to handle a windfall. Windfalls are rare, and in most cases they can’t be planned for. (Some folks might be able to plan for an inheritance or the sale of a business, but these situations are relatively uncommon.) As a result, when the average person happens into a chunk of change, they spend it.

Here’s what you should do instead.

How NOT to Waste a Windfall

When you receive a windfall, whether it’s a tax refund, an inheritance, a gift, or from any other source, it’s like you’ve been given a second chance. Although you may have made money mistakes in the past, you now have a chance to fix those mistakes (or some of them, anyhow) and start down the path of smart money management.

It can be tempting to spend your windfall on toys, trips, and other things that you “deserve,” but doing so will leave you in the same place you were before you received the windfall. And if that place was chained to debt, you’ll be just as unhappy as you’ve always been.

If you receive a chunk of cash, I recommend that you:

Keep five percent to treat yourself and your family. Let’s be realistic. If you receive $1,000 or $10,000 or $100,000 unexpectedly, you’re going to want to spend some of it. No problem. But don’t spend all of it. I used to recommend spending one percent of a windfall on yourself, but from talking to people, that’s not enough. Now I suggest spending five percent on fun. That means $50 of a $1,000 windfall, $500 of a $10,000 windfall, or $5,000 of a $100,000 windfall.

Pay any taxes due. Depending on the source of your money, you might owe taxes on it at the end of the year. If you forget this fact and spend the money, you can end up in a bind when the taxes come due. Consult a tax professional. If needed, set aside enough to pay your taxes before you do anything else.

Pay off debt. Doing so will generally provide the greatest possible return on your investment (a 20 percent return if your credit cards charge you 20 percent). It’ll also free up cash flow; if you pay off a card with a $50 minimum monthly payment, that’s $50 extra you’ll have available each month. Most of all, repaying debt will relieve the psychological weight you’ve been carrying for so long.

Fix the things that are broken. After you’ve eliminated any existing debt, use your windfall to repair whatever is broken in your life. Start with your own health. If you’ve been putting off a trip to the dentist or a medical procedure, take care of it. Do the same for your family. Next, fix your car or the roof or the sidewalk. Use this opportunity to patch up the things you’ve been putting off.

Deposit the rest of the money in a safe account. It can be tempting to spend the rest of your windfall on a new motorcycle or new furniture or new house. Don’t. After attending to your immediate needs, deposit the remaining money in a new savings account separate from the rest of your bank accounts — and then leave this money alone.

To successfully manage a windfall, you must allow the initial euphoria to pass, getting over the urge to spend the money today. Live as you were before. Meanwhile, calculate how far your windfall could go. Most people have unrealistic expectations about how much $10,000 or $100,000 can buy.

In 2009, I received an enormous windfall. The old J.D. would have gone crazy with the money. The new, improved model of me was prepared, and made measured moves designed to favor long-term happiness over short-term happiness.

Today, the bulk of my windfall remains in the same place it’s been for the past five years: an investment account. That cash eases my mind. It helps me sleep easy at night. And that’s more rewarding than spending it on new toys could ever be.

Setting a Good Example

Not everyone who gets rich quickly does dumb things with money. Especially as the plight of pro athletes becomes better known, there are prominent examples of young superstars making savvy money moves. They’re learning from the lessons of those who came before.

Take Toronto Raptors superstar Kawhi Leonard, for instance. This 27-year-old NBA MVP earns $23 million per year — but still clips coupons for his favorite restaurant. He drives a 1997 Chevy Tahoe. Sure, he bought himself a Porsche, but he’s not interested in flash and bling. “I’m not gonna buy some fancy watch just to show people something fancy on my wrist,” he says. [source]

Jamal Mashburn has made wise use of his wealth. So has LeBron James, who takes his investment advice from Warren Buffett:

youtube

Here are other superstars who act as money bosses:

During his 12-year career in the NBA, Junior Bridgeman never earned more than $350,000. Unlike most players, however, he planned ahead. He recognized his basketball income would eventually vanish. He bought a Wendy’s fast-food franchise and learned the business inside-out. He became a hands-on owner. He expanded from one store to three to six — and then to a small empire. Today, twenty-five years after retirement, Bridgeman owns more than 160 Wendy’s restaurants and 120 Chili’s franchises. His company employs 11,000 people and generates over half a billion in revenue every year. His personal net worth tops $400 million. [source]

Patriots tight end Rob Gronkowski — who just retired last week — is a shining example of how to handle sudden wealth correctly. The 29-year-old earned over $53 million for playing on the field — and hasn’t spent any of it. Here are his own words: “To this day, I still haven’t touched one dime of my signing bonus or NFL contract money. I live off my marketing money and haven’t blown it on any big-money expensive cars, expensive jewelry or tattoos and still wear my favorite pair of jeans from high school.” [source]

Oakland Raiders running back Marshawn Lynch has a similar story. During his twelve-year NFL career, Lynch has collected nearly 57 million from his contract. Reportedly, he hasn’t spent a penny of that money. Instead, he’s been cautious to live only off his endorsement earnings. Whether this is true or not, Lynch is known to be a good example to his teammates, helping them with their 401(k)s and other financial issues. [source]

Sometimes superstars who have been poor with money have a flash of insight and they’re able to turn things around. Former NFL player Phillip Buchanon is a perfect example. After watching ESPN’s Broke, he realized he was headed for trouble. He mended his ways and started managing his money wisely. Now he’s written a book with advice for other folks who are fortunate enough to encounter a windfall. [source]

When people make a lot of money, they’re able to spend a lot of money. Sometimes the super-rich can afford to build a place like the Biltmore Estate. The problem isn’t a single extravagant purchase, but a lavish lifestyle in which they spend more than they earn. Real wealth isn’t about earning money — it’s about keeping money.

The post Lifestyles of the Rich and Foolish appeared first on Get Rich Slowly.

* This article was originally published here

from RSSMix.com Mix ID 8312273 https://proshoppingservice.com/lifestyles-of-the-rich-and-foolish/ from Garko Media https://garkomedia1.tumblr.com/post/183874605274

0 notes

Text

Lifestyles of the Rich and Foolish

It’s the first of April. You know what that means. Spring is here! Your friends and family are pulling April Fools’ Day pranks. And my tree allergies are kicking my butt. Every year, tree pollen makes my life miserable. This year is no different.

Facebook kindly reminded me this morning that three years ago, Kim and I were in Asheville, North Carolina. After wintering in Savannah, Georgia, we’d resumed our tour of the U.S. by RV.

While in Asheville, we toured the Biltmore Estate, the largest home in the U.S. This 250-room chateau contains 179,000 square feet of floor space — including 35 bedrooms, 43 bathrooms, and 65 fireplaces — and originally sat on 195 square miles of land. (Today, the estate “only” contains 8000 acres.)

“This feels like Downton Abbey but in North Carolina,” I said as we walked the endless halls. Just as Downton Abbey documented the excesses of British upper class, so too the Biltmore sometimes feels like an example of how rich Americans indulged in decadence.

George Washington Vanderbilt II, the man who built Biltmore, was a member of one of the country’s wealthiest families. His grandfather, Cornelius Vanderbilt, was born poor in 1794, but by the time he died in 1877 he had become one of the richest men in the world. During his lifetime, he built a fortune first from steamships and then as a prominent railroad tycoon.

By family standards, grandson George didn’t have a lot of money. He inherited about $7 million, and drew income from a $5 million trust fund. He decided to use the bulk of his fortune to build a huge house high in the Appalachians. Work on the Biltmore Estate began in 1889, when George was 26 years old. Six years and $5 million later, he moved into his palace. (That $5 million would be roughly $90 million in today’s dollars.)

Strolling the grounds of the Biltmore Estate got me thinking about the stories we hear of wealthy people who squander their riches. How and why do they do this? Are there lessons from their stories that you and I can put to use?

We hear all the time about the “lifestyles of the rich and famous”. Today, on April 1st, let’s look at some lifestyles of the rich and foolish.

Lifestyles of the Rich and Foolish

There are so many stories of athletes and entertainers who have blown big fortunes that it’s tough to know where to start. Who should we pick on first? Since I’ve never been a fan of Nicolas Cage — and since he seems to be especially bad with money — let’s use him an example.

Over a period of fifteen years, Cage earned more than $150 million. He blew through that money buying things like:

Fifteen homes, including an $8 million English castle that he never stayed in once.

A private island.

Four luxury yachts.

A fleet of exotic cars, including a Lamborghini that used to belong to the Shah of Iran.

A dinosaur skull he won after a bidding contest with Leonardo DiCaprio.

A private jet.

It’s not fair to characterize Cage as “broke” — he’s still a bankable movie star — but his net worth is reportedly only about $25 million. (That’s like someone with an average income having a net worth of roughly $25,000.) He could be worth ten times as much but his foolish financial habits have caused him woe.

Cage got in trouble with the IRS for failing to pay millions of dollars in taxes. He’s been sued by multiple companies for failing to repay loans. His business manager says that he’s tried to warn Cage that his lifestyle exceeds his means, but the actor won’t listen.

Cage is but one of many celebrities who have done dumb things with money. Other prominent examples include:

MC Hammer sold the rights to his songs to raise money after being bankrupted by his lavish lifestyle. Hammer earned more than $33 million in the early nineties, but spent the money on a $12 million mansion (with gold-plated gates), a fleet of seventeen vehicles, two helicopters, and extravagant parties. [source, source]

Actress Kim Basinger paid $20 million to buy the town of Braselton, Georgia in 1989. When Basinger filed for bankruptcy just four years later, she was forced to sell the town. [source]

On the night of 01 February 1976, Elvis Presley decided he wanted a Fool’s Gold Loaf, a special sandwich made of hollowed bread, a jar of peanut butter, a jar of jelly, and a pound of bacon. He and his entourage flew from Memphis to Denver. The group ate their sandwiches and then flew home. Price: $50,000 – $60,000. [source]

Even authors get in on the act. Writer Mark Twain made tons of money through his work, but he lost much of it to bad investments, mostly in new inventions: a bed clamp for infants, a new type of steam engine, and a machine designed to engrave printing plates. Twain was a sucker for get rich quick schemes. [source, source]

When it comes to frittering way fortunes, it’s hard to compete with sports superstars. In a 2009 Sports Illustrated article about how and why athletes go broke, Pablo S. Torre wrote that after two years of retirement, “78% of former NFL players have gone bankrupt or are under financial stress.” Within five years of retirement, roughly 60% of former NBA players are in similar positions.

Some examples:

Boxer Mike Tyson earned over $300 million in his professional career. He lost it all, spending the money on cars, jewels, pet tigers, and more. He eventually filed for bankruptcy. [source]

When Yoenis Cespedes signed a new $75 million contract with the New York Mets, he drove a new vehicle each day during the first week of training camp, including a Lamborghini Aventador ($397,000) and an Alfa Romeo 8C Competizione ($299,000). [source]

Basketballer Vin Baker earned $100 million during his career. He’s now worth $500,000. He manages a Starbucks store in a small town in Rhode Island. (To be fair, Baker sees to be turning his life around, which is awesome.) [source]

Hall-of-fame pitcher Curt Schilling earned $112 million during 20 years in the big leagues. It wasn’t enough to keep up with his spending. Plus he lost $50 million through the collapse of a company he owned. In 2013, he held a “fire sale” to avoid bankruptcy.

It can be tough to sympathize with these folks. Used wisely, their immense fortunes could sustain them and their families for a long time. Instead, they squander their money on fleeting pleasures and the trappings of wealth.

Still, I believe it’s best to keep the schadenfreude in check. “There but for the grace of God” and all that, right? I’ve seen plenty of examples of average folks who have wasted smaller windfalls. In fact, this sort of thing seem to be the rule rather than the exception.

But why does this happen? The answer might be Sudden-Wealth Syndrome.

Lottery winners have the same kinds of problems. A 2001 article in The American Economic Review found that after receiving half their jackpots, the typical lotto winner had only put about 16% of that money into savings. It’s estimated that over a quarter of lottery winners go bankrupt.

Take Bud Post: He won $16.2 million in 1988. Within weeks of receiving his first annual payment of nearly half a million dollars, he’d spent $300,000. During the next few years, Post bought boats, mansions, and airplanes, but trouble followed him everywhere. “I was much happier when I was broke,” he’s reported to have said. When he died in 2006, Post was living on a $450 monthly disability check.

Sudden-Wealth Syndrome

In 2012, ESPN released a documentary called Broke that explores the relationship between pro athletes and money. How does sudden wealth affect young men? What happens when highly-competitive athletes with high incomes hang out together? Lots of stupid stuff, as it turns out.

Here’s a nine-minute montage from Broke in which wealth manager Ed Butowsky talks about why athletes get into trouble with money:

youtube

Broke is an interesting film. The players speak candidly about the mistakes they’ve made: buying 25 pairs of shoes at one time, buying fur coats they never wore, buying cars they never drove. They’re not proud of their pasts — some are ashamed — but they’re willing to talk about the problem in the hopes they can help others avoid doing the same dumb things in the future.

Curious how much your favorite actor or athlete earns? Check out Celebrity Net Worth, a website devoted to tracking the financial health of people in the public eye.

Broke does a good job of explaining why our sports heroes can’t seem to make smart money moves. The problem is Sudden-Wealth Syndrome. Essentially, young folks who earn big bucks don’t get a chance to “practice” with money before they’re buried with wealth.

The typical person earns a little when they’re young, but watches their salary grow slowly with time. Their income peaks during their forties and fifties. As a result, they get time to make mistakes with small amounts of money first which means (in theory) that they’re less likely to blow big bucks down the road.

On the other hand, athletes (and entertainers) have a completely different earning pattern. They leave school to instant riches. For a few years, they earn great gobs of money. But usually their income declines sharply with time — until it stops altogether.

Here’s a (pathetic) chart I created to help visualize this phenomenon:

Athletes and entertainers need to figure out how to make five years of income last for fifty years. This never occurs to most of them. “[A pro athlete] can’t live like a king forever,” says Bart Scott in ESPN’s Broke. “But you can live like a prince forever.”

Sudden-Wealth Syndrome doesn’t just affect athletes and actors. Lottery winners experience it too. So do average folks who inherit a chunk of change or business owners who sell their companies.

The fundamental problem is that nobody ever teaches us how to handle a windfall. Windfalls are rare, and in most cases they can’t be planned for. (Some folks might be able to plan for an inheritance or the sale of a business, but these situations are relatively uncommon.) As a result, when the average person happens into a chunk of change, they spend it.

Here’s what you should do instead.

How NOT to Waste a Windfall

When you receive a windfall, whether it’s a tax refund, an inheritance, a gift, or from any other source, it’s like you’ve been given a second chance. Although you may have made money mistakes in the past, you now have a chance to fix those mistakes (or some of them, anyhow) and start down the path of smart money management.

It can be tempting to spend your windfall on toys, trips, and other things that you “deserve,” but doing so will leave you in the same place you were before you received the windfall. And if that place was chained to debt, you’ll be just as unhappy as you’ve always been.

If you receive a chunk of cash, I recommend that you:

Keep five percent to treat yourself and your family. Let’s be realistic. If you receive $1,000 or $10,000 or $100,000 unexpectedly, you’re going to want to spend some of it. No problem. But don’t spend all of it. I used to recommend spending one percent of a windfall on yourself, but from talking to people, that’s not enough. Now I suggest spending five percent on fun. That means $50 of a $1,000 windfall, $500 of a $10,000 windfall, or $5,000 of a $100,000 windfall.

Pay any taxes due. Depending on the source of your money, you might owe taxes on it at the end of the year. If you forget this fact and spend the money, you can end up in a bind when the taxes come due. Consult a tax professional. If needed, set aside enough to pay your taxes before you do anything else.

Pay off debt. Doing so will generally provide the greatest possible return on your investment (a 20 percent return if your credit cards charge you 20 percent). It’ll also free up cash flow; if you pay off a card with a $50 minimum monthly payment, that’s $50 extra you’ll have available each month. Most of all, repaying debt will relieve the psychological weight you’ve been carrying for so long.

Fix the things that are broken. After you’ve eliminated any existing debt, use your windfall to repair whatever is broken in your life. Start with your own health. If you’ve been putting off a trip to the dentist or a medical procedure, take care of it. Do the same for your family. Next, fix your car or the roof or the sidewalk. Use this opportunity to patch up the things you’ve been putting off.

Deposit the rest of the money in a safe account. It can be tempting to spend the rest of your windfall on a new motorcycle or new furniture or new house. Don’t. After attending to your immediate needs, deposit the remaining money in a new savings account separate from the rest of your bank accounts — and then leave this money alone.

To successfully manage a windfall, you must allow the initial euphoria to pass, getting over the urge to spend the money today. Live as you were before. Meanwhile, calculate how far your windfall could go. Most people have unrealistic expectations about how much $10,000 or $100,000 can buy.

In 2009, I received an enormous windfall. The old J.D. would have gone crazy with the money. The new, improved model of me was prepared, and made measured moves designed to favor long-term happiness over short-term happiness.

Today, the bulk of my windfall remains in the same place it’s been for the past five years: an investment account. That cash eases my mind. It helps me sleep easy at night. And that’s more rewarding than spending it on new toys could ever be.

Setting a Good Example

Not everyone who gets rich quickly does dumb things with money. Especially as the plight of pro athletes becomes better known, there are prominent examples of young superstars making savvy money moves. They’re learning from the lessons of those who came before.

Take Toronto Raptors superstar Kawhi Leonard, for instance. This 27-year-old NBA MVP earns $23 million per year — but still clips coupons for his favorite restaurant. He drives a 1997 Chevy Tahoe. Sure, he bought himself a Porsche, but he’s not interested in flash and bling. “I’m not gonna buy some fancy watch just to show people something fancy on my wrist,” he says. [source]

Jamal Mashburn has made wise use of his wealth. So has LeBron James, who takes his investment advice from Warren Buffett:

youtube

Here are other superstars who act as money bosses: