#Install Quickbooks Desktop On New Computer

Explore tagged Tumblr posts

Text

How to Choose Between NetSuite Cloud ERP vs. Desktop Accounting for Growth

As businesses in India thrive towards expansion, selecting the right financial management system becomes a crucial decision. The debate between going for a cloud-based Enterprise Resource Planning (ERP) such as NetSuite and sticking with conventional desktop accounting software is becoming more imperative. Although both have their own advantages, it’s important to understand which option suits your growth strategy better. In this blog post, you will find out some of the main disparities between NetSuite Cloud ERP and desktop accounting software that can help guide you in making relevant choices for your business’ future.

Understanding NetSuite Cloud ERP and Desktop Accounting Software

NetSuite Cloud ERP

NetSuite is an all-encompassing cloud based ERP solution that consolidates diverse business operations like finance management, CRM, stock control systems, E-commerce and human resources. It is an attractive option for growing companies because it enables real-time access to data while being flexible enough to accommodate growth making it a great choice of an enterprise resource planning system on the cloud.

Desktop Accounting Software

Desktop accounting software such as tally, QuickBooks Desktop or Busy are installed on local computers mainly to handle financial transactions like generating reports and managing basic accounts . For modestly sized firms with simple requirements of book-keeping these systems are ideal.

Key Considerations for Choosing Between NetSuite Cloud ERP and Desktop Accounting

Scalability

NetSuite Cloud ERP: Net suite grows as your company develops further; once needs become more complex then additional users ,modules or functionalities can be accommodated in the system without major disruptions. This scalability makes the tool particularly well suited to businesses looking into long term growth that may lead them to expand in future.

Desktop Accounting Software: However these solutions though capable only support fundamental financial management processes but might prove ineffective when there is rapid business growth where new users need to be added or other business functions have been integrated which usually involve manual work around and even new software.

Accessibility and Collaboration

NetSuite Cloud ERP: NetSuite being cloud-based allows users to connect from anywhere with internet connection. This concept promotes collaboration between distant teams as well as makes sure that all the stakeholders get real time access to important business data.

Desktop Accounting Software: Desktop accounting solutions are often limited to the computers on which they are installed. Remote access is challenging and often requires additional setup, such as VPNs, which can be cumbersome and less secure.

Integration and Automation

NetSuite Cloud ERP: NetSuite integrates different business functions together, for example automating sales invoicing, payroll or stock control system processes among others. Thus this integrated approach minimizes errors by reducing manual keying in of information hence ensuring consistency of data throughout the organization.

Desktop Accounting Software: In general desktop accounting software has limited capabilities to integrate.. Some do offer basic connections with other tools but lack the level of automation present in most cloud based ERPs where their flow of information is smoothest thereby guaranteeing a better experience over similar offerings in the market leading to reduced likelihood of human errors and omission in transactions.

NETSUITE CLOUD ERP: Real-Time Data and Reporting

NetSuite is a cloud ERP that provides real-time data and robust reporting capabilities, enabling businesses to make immediate decisions based on reliable information. Dashboards and analytics provide insights into financial performance, stock levels and purchase behaviour supporting strategic planning and operational efficiency.

Desktop Accounting Software: Desktop accounting solutions generally offer limited reporting features; these reports may not be as comprehensive or timely as those provided by cloud-based ERPs. To generate complex reports often require consolidating the manual data.

SECURITY AND COMPLIANCE

NETSUITE CLOUD ERP: NetSuite has implemented advanced security protocols such as encryption of data, multi-factor authentication, routine security updates among others to secure sensitive business information. This system has been developed for compliance with various regulatory standards thereby relieving businesses of the pressure to remain compliant.

Desktop Accounting Software: Security for desktop accounting software depends largely on the user’s IT infrastructure. In order to have secure data it must be updated regularly, backed up frequently and requires manual checking for compliance which can be resource intensive.

COST CONSIDERATIONS

NETSUITE CLOUD ERP: NetSuite pricing model is subscription-based and includes continuous support updates and maintenance services. Although the initial cost may appear higher than that of desktop software, overall cost ownership can be lower over time due to reduced investments in IT infrastructure and maintenance expenses.

Desktop Accounting Software: With lower initial purchasing costs, desktop options can be seen as cheaper alternatives particularly for small businesses. Nonetheless, increasing expenditures on updates, IT outsource providers as well as manual processes could pile up as business grows.

FUTURE-PROOFING YOUR BUSINESS

NETSUITE CLOUD ERP: A cloud-based solution like NetSuite helps you future-proof your enterprise by providing a scalable flexible integrated tool adaptable to dynamic market conditions and evolving corporate demands.

Desktop Accounting Software: It might not have enough flexibility or scalability needed in long term to support sustainable growth and adaptability to new business challenges as may be required by desktop accounting software suitable for businesses at small scale.

Conclusion

NetSuite is a versatile solution that simplifies operations, enhances collaboration and delivers real-time insights making it a great tool for scaling and innovating businesses. By investing in a comprehensive cloud ERP, your company would be positioned for sustainable growth and success in an increasingly competitive global market.

For Indian companies ready to embark on digital transformation journey towards growth, NetSuite Cloud ERP provides the necessary capabilities and tools for this purpose. To unlock its complete potential consider partnering with a reputable NetSuite provider who can customize the solution according to your unique requirements.

If implemented properly, an authorized NetSuite consultant will provide you with a solution specifically developed for you which will help unlock its full potential.

Call us now or SoftCore Solutions – Your trusted partner for India!

0 notes

Text

QuickBooks: Essential Software for Small Business Accounting

QuickBooks accounting software is an indispensable tool for small businesses, streamlining the often complex process of managing finances. This powerful software helps business owners keep track of income and expenses, manage invoices, and ensure that they stay on top of their financial health. By automating many accounting tasks, QuickBooks allows business owners to focus on growing their businesses rather than getting bogged down in paperwork.

One of the standout features of QuickBooks is its user-friendly interface, which makes it accessible even for those without a strong accounting background. The software offers a range of functionalities, including payroll processing, inventory management, and financial reporting. These features are particularly beneficial for small businesses that might not have the resources to hire a full-time accountant. Additionally, QuickBooks integrates seamlessly with other business tools, enhancing its utility and effectiveness.

For those who prefer a more traditional setup, QuickBooks Desktop offers robust features tailored to meet the needs of various business types. This version of the software is ideal for companies that require a more comprehensive solution installed directly on their computers. QuickBooks Desktop provides advanced reporting tools and can handle more complex accounting needs, making it a versatile option for growing businesses.

QuickBooks is also renowned for its excellent customer support and comprehensive tutorials, which guide users through every aspect of the software. This ensures that even beginners can quickly become proficient in managing their business finances. Moreover, the software is constantly updated with new features and improvements, keeping it at the forefront of the accounting software industry.

In conclusion, QuickBooks accounting software is a must-have for small business owners looking to streamline their financial operations. Whether you choose the online version or the desktop variant, QuickBooks provides all the tools needed to keep your business's finances in order. Its ease of use, comprehensive features, and reliable support make it an excellent choice for any small business.

0 notes

Text

The Evolution of QuickBooks: A Closer Look at Desktop 2024

QuickBooks has been a household name in the world of accounting software for decades, and with each new iteration, it continues to evolve and improve. The latest version, QuickBooks Desktop 2024, is no exception, offering a range of new features and enhancements designed to make managing your finances more accessible than ever before. In this article, we'll take a closer look at the evolution of QuickBooks and explore what makes Desktop 2024 stand out from its predecessors.

A Brief History of QuickBooks

QuickBooks was first introduced by Intuit in 1992, and it quickly became the go-to accounting software for small businesses. Over the years, QuickBooks has undergone several significant updates and revisions, each one adding new features and improving the overall user experience. Today, QuickBooks is available in several different versions, including QuickBooks Desktop, QuickBooks Online, and QuickBooks Self-Employed, each tailored to meet the specific needs of different types of businesses.

What's New in QuickBooks Desktop 2024

QuickBooks Desktop 2024 represents the latest software evolution, with a range of new features and enhancements designed to make managing your finances more accessible and more efficient. Some of the key features of QuickBooks Desktop 2024 include:

Enhanced Automation: QuickBooks Desktop 2024 features advanced automation capabilities that streamline repetitive tasks such as invoicing, bill payment, and payroll processing.

Improved Reporting: QuickBooks Desktop 2024 offers a wide range of customizable reports that provide valuable insights into your business's financial health.

Enhanced Security: Protecting your financial data is crucial, so QuickBooks Desktop 2024 includes robust security features to protect your data from unauthorized access.

Seamless Integration: QuickBooks Desktop 2024 seamlessly integrates with various third-party applications, allowing you to sync data across platforms and streamline your workflow.

User-Friendly Interface: The redesigned interface of QuickBooks Desktop 2024 is intuitive and easy to navigate, making it simple for anyone to manage their finances effectively.

Installing QuickBooks Desktop 2024: A Simple Process

Getting started with QuickBooks Desktop 2024 is easy. Here's how to install it:

Download the Installer: Visit the QuickBooks website and download the QuickBooks Desktop 2024 installer.

Run the Installer: Run the installer and follow the on-screen instructions to install QuickBooks Desktop 2024 on your computer.

Activate Your Account: Once installed, open QuickBooks Desktop 2024 and follow the prompts to activate your account.

Flexible Pricing Options to Fit Your Budget

QuickBooks Desktop 2024 Pricing offers a range of pricing plans to fit your budget and requirements. Whether you're a small business or a large enterprise, there's a plan that's right for you.

Conclusion

QuickBooks Desktop 2024 is the latest evolution in a long line of accounting software that has helped millions of businesses manage their finances more efficiently. With its advanced features, user-friendly interface, and flexible pricing options, QuickBooks Desktop 2024 is the ultimate tool for businesses looking to streamline their financial management processes. Ready to take your business to the next level? QuickBooks Desktop 2024 Download is your gateway to a world of economic empowerment.

1 note

·

View note

Text

What services a Quickbook Bookkeeping Service provider offers and how do they perform work?

Running a small business or any business is difficult but you can improve decisions and expand your firm if you opt a reliable Quickbooks bookkeeping service provider. Accounting service providers for QuickBooks assist firms in maintaining their full set of accounts in compliance with rules. The accounting services offered by QuickBooks are customized to your unique requirements. By precise and effective accounting services, they make sure you obtain exceptional business results. Many business owners are clueless when it comes to accounting. They require a step-by-step guide that outlines how to produce usable accounting data and financial statements. Below are the services and process which is offered and followed by Quickbooks Accounting Services provider:

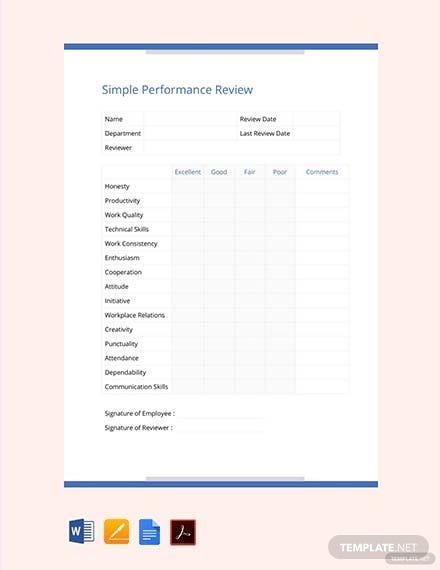

QuickBooks accounting services include:

1. QuickBooks setup and installation

Before this they ensure the following things • Verify your computer's compatibility with the system requirements. • Download your preferred QuickBooks Desktop version if you haven't already. • Save the document in a location that is simple to find. • Have your licence and product numbers on hand. 2. New QuickBooks company file creation or conversion of old files to QuickBooks After setting up and installation of Quickbooks, service providers create the files for Quickbbooks and also convert the old files into it. 3. They ensure the migration of data from other accounting software systems to newly installed systems. • 4. They ensure the migration of journals at a sub-ledger level. • 5. They ensure the Reconciling the opening balances • 6. They ensure updating and maintaining the ledger • 7. They follow Accounts payable

The different sums your company owes to outside suppliers for goods and services that you have not yet paid for, similar to credit card transactions, are referred to as accounts payable. Production expenditures, inventories, and maintenance services are a few examples of accounts payable expenses.

• 8. They Follow proper account receivable

The sum of money that you owe to your consumers for previous purchases of goods or services. Within a few weeks, this money is normally collected and added to the balance sheet of your business as an asset. With accrual basis accounting, you make use of accounts receivable.

• 9. They ensure preparing profile and loss accounts, balance sheets, and cash flow statements.

Click on the below link to know more about the services: View

0 notes

Text

Business Accounting Software For Mac Free

Simple Bookkeeping Software For Mac

Free Business Accounting Software For Mac

Free Accounting App For Mac

Download Free Small Business Accounting Software For Mac

Best Accounting Software For Mac

Home Accounting Software For Mac

Business Accounting Software For Mac Free Download

Just because you’re a Mac person doesn’t mean you have to settle for less with your accounting software. Check out these 6 great options.

A few years ago, we published an article on the best accounting software options for Mac users. This is an update of that article, but here’s the thing: There’s no such thing as “accounting software for Mac” anymore.

Sure, there’s plenty of accounting software that you can use on your MacBook, MacBook Air, MacBook Pro, iMac, etc. But while there used to be Mac software and PC software, it’s now virtually all the same with the ever-increasing expansion of cloud-based software that works seamlessly in any browser.

In other words, you’d have a much harder time finding accounting software that doesn’t work on your Mac than a program that works only on Macs. In fact, with more than 100 million active Mac users, if you found an accounting program that somehow wasn’t compatible with Mac, that alone would be cause for alarm.

Cloud software is here to stay, and the market is only getting bigger. Gartner predicts that by 2022, 28% of enterprise IT spending will have shifted to cloud applications, up from 19% in 2018. (Full report available to Gartner clients.)

Less Accounting: Features and Functions: Another very easy to use free accounting software for Mac users. It is specifically meant for accountants or freelancers who are new to their work and are not much aware about accounting. Wave is a free, Canadian-made online software suite for managing small business finances. The free tools include accounting, invoicing, receipt scanning and personal finance, with features like unlimited bank connections, estimates/quotes, recurring invoices and accountant-approved (double-entry) reports. The Best Free Business Software app downloads for Mac: Microsoft Office 2011 Microsoft Office 2016 Preview Google Workspace Microsoft Excel 2016 Micro. MARG ERP 9+ Accounting Software. MARG ERP 9+ is widely acclaimed accounting software for. Osfinancials accounting and business processing software osFinancials is a free accounting package, easy to install Stock control and point of sales integrated with good support and plugins. Import from osCommerce, virtue-mart magento zenchart etc. Full reportdesigner reportman and all reports are made in reportman so can be adjusted to your needs.

6 user-friendly accounting software options for Mac

Rather than giving you a generic list of accounting software that works on Macs (which would basically just be our accounting software directory), I decided to determine which top factors users have for choosing Mac over PC and then find accounting software that best suits those users.

Macs are typically high-end machines with consistently strong reviews from users, so I included only accounting tools with an overall rating of 4.5/5 stars or higher in our directory (based on verified user ratings) and with at least 100 reviews.

In general, Macs are considered easier to use than PCs, so I’m including only products with an ease-of-use rating on our site of 4.5/5 or higher.

Finally, I included only products with a native iOS app with a user rating of 4/5 or better on the App Store, since Mac users typically use iPhones and iPads as well as their desktop or laptop computers.

With those factors in mind, here’s what I found, listed in order of rating and reviews from highest to lowest:

Jump to:

QuickBooks

FreshBooks

Accounting by Wave

Zoho Books

FreeAgent

Kashoo

1. QuickBooks

User rating: 4.5/5.0 Ease-of-use rating: 4.5/5.0 Reviews:14,700+

It’s no surprise that the big name in accounting software is available on Mac operating systems. QuickBooks has even had a desktop-only (not cloud-based) option available for Macs since at least the mid-1990s, making the company something of a pioneer for cross-platform functionality.

Now, any of QuickBooks’ cloud-based offerings will work fine on your Apple device, and Intuit even still offers a desktop version for Mac. The desktop version for Mac even has a few features designed specifically for Mac users:

QuickBooks for Mac 2020 takes advantage of the Mojave OS Dark Mode.

You can upload text searchable images with the iPhone scanner.

Documents can be automatically shared through iCloud.

Pros

Cons

QuickBooks is available on virtually every device, so whether your team has Macs, PCs, or smartphones, you know that everyone can use it together.QuickBooks has very attractive entry-level pricing, but it doubles after three months.With hundreds of integrations, QuickBooks is highly customizable.QuickBooks is an enormous company, and some reviewers find that the customer service isn’t as hands-on as they’d like.

How much does QuickBooks cost?

QuickBooks Online starts at $25/month. QuickBooks Desktop for Mac is a one-time payment of $299.

What about the iOS app?

The QuickBooks iOS app has a 4.7/5 rating on more than 100,000 reviews. It allows users to create invoices, manage expenses, and view reports.

The QuickBooks Online dashboard (Source)

2. FreshBooks

User rating: 4.5/5.0 Ease-of-use rating: 4.5/5.0 Reviews:3,000+

Designed specifically for small businesses and the self-employed, Toronto-based FreshBooks has been around for more than 15 years. FreshBooks also has Mac users in mind. They say that their easy-to-use accounting software works on any device—desktop, mobile, or tablet—and “plays nicely” with Mac.

Pros

Cons

Users rave over FreshBooks’ customer support, and the company stakes their reputation on it.If your company is rapidly growing—for example, if you plan on going public—you may quickly outgrow FreshBooks.Even though it’s targeted at smaller companies, FreshBooks has all the important accounting features you would need, so it can handle much more than lemonade stands.Freshbooks does a great job of keeping your books clean, but if you love forecasting and crunching numbers, it’s a little skimpy on the reporting side.

How much does FreshBooks cost?

FreshBooks starts at $15 per month for five clients and goes up to $50 per month for 500 clients. *At the time of writing, FreshBooks has a fall sale of 60% off for six months on all plans.

What about the iOS app?

The FreshBooks app has a 4.8/5 rating on almost 8,000 reviews. It allows you to run invoices, record expenses, track time, and accept payments, all while you’re away from your computer.

The Invoices dashboard in FreshBooks (Source)

Simple Bookkeeping Software For Mac

3. Accounting by Wave

User rating: 4.5/5.0 Ease-of-use rating: 4.5/5.0 Reviews:800+

Accounting by Wave is one of the youngest tools on this list, having launched out of Toronto in 2010 before being acquired by H&R Block earlier this year. Its biggest differentiator is that it has a completely free version, as long as you don’t need to use it to accept payments or run payroll (those are optional, paid features).

So what makes Wave an attractive option specifically for Mac users? As mentioned, it’s free, so it’ll help you save for the next iPhone or MacBook upgrade. It also scores high for ease of use, making it fit in nicely with the intuitive Mac ecosystem.

Pros

Cons

It’s free without limitations on users or transactions as long as you don’t need to accept payments or run payroll.Wave is missing an audit trail feature, leaving it vulnerable to fraudulent employees.Wave offers above-average reporting features for a free tool.The free version offers only email support, and even if you pay for payments or payroll you still only get access to chat support (no phone support).

How much does Wave cost?

Wave is free. Payments are 2.9% + 30 cents per credit transaction, or 1% per bank transaction. Payroll starts at $20 per month plus $4 per employee.

What about the iOS app?

Invoice by Wave passes the user review test, clocking in at 4.6/5 with almost 2,000 reviews. It doesn’t completely replace the web version of Wave, but it does allow you to keep an eye on your business finances wherever you are. The biggest complaints that users have seem to be related to customer service, which is not unique to the app.

Recent transactions in Accounting by Wave (Source)

4. Zoho Books

User rating: 4.5/5.0 Ease-of-use rating: 4.5/5.0 Reviews:380+

If you’re looking for the peace of mind of an established, international company offering Mac-friendly accounting software and you’re trying to avoid QuickBooks for whatever reason, Zoho Books might be for you. Zoho has been releasing business software since 1996, and Zoho Books is specifically tailored for Mac users, as it is designed to work with iMessage, Apple Maps, Siri, and 3D Touch. It even has an app for the Apple Watch.

Pros

Cons

Zoho Books is one of the most user-friendly options out there. In fact, it placed fourth—better than any other option on this list—on our Top 20 Most User-Friendly accounting software report earlier this year.Zoho Books offers integrated payroll in California and Texas for now, but if you’re in any other state you’ll have to use a separate payroll app.Starting at $9 per month, Zoho Books is one of the best values in accounting software this side of Wave, which is free. And unlike Wave, Zoho has almost universally praised customer service.Zoho Books is optimized for use with Zoho’s customer relationship management system, Zoho CRM, so if you’re already using a different CRM, it won’t work as efficiently.

How much does Zoho Books cost?

Zoho Books starts at $9 per month or $90 per year for 50 contacts and two users and goes up to $29 per month or $290 per year for unlimited contacts, 10 users, and more features.

What about the iOS app?

As mentioned above, the Zoho Books iOS app takes full advantage of iOS-specific features such as messaging and voice assistant, and users love it, giving it a 4.7/5 rating on almost 150 reviews. While some accounting software apps have minimal features, allowing you to basically just check balances and view transactions, Zoho Books allows you to create and send invoices, manage expenses, track time, view reports, and share numbers with your accountant.

Managing invoices in Zoho Books (Source)

5. FreeAgent

User rating: 4.5/5.0 Ease-of-use rating: 4.5/5.0 Reviews:110+

FreeAgent accounting software is based in the U.K. and originally designed for British businesses, but they also have versions customized for U.S. and global businesses, and the software has full multicurrency support. Like any good cloud-based software, FreeAgent works like a breeze on the Mac platform, and its iOS app is a fan favorite.

Pros

Cons

Users are quite pleased with FreeAgent’s recurring invoice and receipt scanning features, which help take repetitive tasks out of small business accounting.FreeAgent is designed for small businesses, so if you’re growing fast, you could outgrow it relatively quickly.Users also have good things to say about FreeAgent’s customer service, which is available by email or phone.FreeAgent is 50% off for your first six months, but after that it’s $24 per month, which is a little high compared to other options on this list.

How much does FreeAgent cost?

FreeAgent has a flat-rate of $12 per month for everything (unlimited users and clients) for the first six months, then goes up to $24 per month after that.

What about the iOS app?

FreeAgent’s iOS app has an average rating of 4.7/5 on 20 reviews. It allows you to view your accounts, manage expenses by snapping pictures of receipts, create and send invoices, and track time.

The main dashboard in FreeAgent accounting for iPad (Source)

6. Kashoo

User rating: 4.5/5.0 Ease-of-use rating: 4.5/5.0 Reviews:110+

Once you’ve stopped giggling about the name, you’ll see that Kashoo is a comprehensive accounting tool that is easy to use right from the start on any web-connected device, including Macs. One of Kashoo’s standout features is their customer support: You get free phone and web support with your subscription, which is much easier than standing in line at the Genius Bar.

Pros

Cons

The free phone and web support is a real plus for those of us who like to have some expert guidance.Kashoo integrates with Square for payments and Paychex for payroll in the U.S. (and PaymentEvolution in Canada, where it’s based) but beyond that, it doesn’t have much to offer as far as customization.Kashoo has a flat rate, so you get every feature in the basic plan.Some users have reported issues syncing multiple bank accounts with Kashoo, so it’s a good thing they have easily accessible customer support.

How much does Kashoo cost?

Kashoo is $19.95 per month, or $16.58 per month if you pay for an entire year up front ($199).

What about the iOS app?

Kashoo’s iOS app has a 4.3/5 rating on more than 50 reviews. It allows Kashoo users to view reports, manage and send invoices, accept payments, and scan receipts.

The tax management interface in Kashoo (Source)

What’s your favorite accounting software for Mac?

Are you an accountant (either accidental or professional) and a power Mac user? If so, what’s your weapon of choice, whether it’s listed above or something else? (There are plenty of other options out there with iOS apps, as you can see by filtering for iOS deployment in our accounting software directory.)

I’d love to hear what you use and why you use it so I can recommend it to others. Just let me know in the comments or connect with me on Twitter @AndrewJosConrad.

Note: Listed pros and cons are derived from features listed on the product website and product user reviews on Gartner Digital Markets domains (Capterra, GetApp, and Software Advice). They do not represent the views of, nor constitute an endorsement by, Capterra or its affiliates.

Note:The applications selected in this article are examples to show a feature in context and are not intended as endorsements or recommendations. They have been obtained from sources believed to be reliable at the time of publication.

Looking for Accounting software? Check out Capterra's list of the best Accounting software solutions.

Financial management can be very complicated in you do not have a clear understanding of how much money you are getting and how much is the expenses. If you want to maintain proper financial records then you will be able to use certain Business Accounting Software. These ERP Accounting Software are free to use and most of the Legal Accounting Software will have advanced tools that can be used for making the process easier.

Related:

Account Edge Pro

This premium software from Acclivity Group LLC is a complete accounting solution for small business and management tool that will have all the information regarding sales, purchases, inventory, etc.

Manager

Free Business Accounting Software For Mac

This is a comprehensive free accounting software that has many features like general ledger, expense claims, estimates, quotes, credit notes, purchase orders, cash management, accounts receivable, accounts payable, etc.

Easy Books

This premium software can be used for tracking all the accounts, invoices, statements, and taxes. You can generate invoices in PDF format and email it to the customer and produce a full P&L and balance sheet.

Quickbooks

This premium software from Intuit Inc. will be useful for tracking expenses and sales, creating estimates, managing customers, creating professional looking invoices, managing payments and much more. It can be accessed from anywhere using multiple devices.

ZipBooks

This free accounting software from Zipbooks is used for its professional interface, simple invoicing and high-level time tracking abilities which will help businesses reach their financial goals. It has an intuitive user interface that can be used for all the aspects.

KashFlow

This premium software from KashFlow Software Ltd is an accounting software that can be used for organizing the company in a better way and managing all the financial aspects in one place.

Money Manager EX

This free and open source software from Money Manager EX has many features like account creation, currency conversions, tracking transactions, managing payee lists, repeating transactions, etc. Stocks, assets, budgets and attachments can be maintained in one place.

Express Accounts Accounting Software

Free Accounting App For Mac

This premium software from NCH software is a business accounting software that can be used by small businesses for documenting and reporting the incoming and outgoing cash flow including receipts, sales, purchases, and payments.

Wave

This free software from Accounting Inc. is secure and approved way of doing your accounting and invoicing. It is suitable for any freelancer, small business, consultant, and entrepreneur.

Sage Software

OSAS

Accountz

MoneyWorks

GNU Cash

Connected

Accounting Edge

Download Free Small Business Accounting Software For Mac

AcctVantage

Best Accounting Software For Mac

Xero – Most Popular Software

Home Accounting Software For Mac

This free software is very popular and it can be used by small business for managing all their financial tasks. Invoicing, bank reconciliation, bookkeeping and many more aspects can be maintained.

Business Accounting Software For Mac Free Download

How to install Accounting Software for Mac?

If you want to install any accounting software, then you should decide the software that you want by going through the reviews. The system requirements should be checked so that all the conditions like memory requirement, operating system, GUI requirement, etc. can be fulfilled. The readme text in the installation file can also be checked for this purpose. If it is a premium version, then the trial version can be used for learning about the features. The free version can be installed directly by using the links and following the instructions that are prompted on the screen. The software can be saved in any location and the language preferences can be set.

You will be able to track your sales and accounts receivable by using this software. Automatic records of recurring orders and invoices can be maintained and reports can be updated as and when an order comes in. You will be able to generate professional level quotes, invoices and sales orders.

Related Posts

1 note

·

View note

Text

How to manage Account with QuickBooks Accounting Software

In 1983 QuickBooks was launched & in the shorter period became the favourite of accountants because of its features. And since the launch, the software is continuing to stay popular because of its easy-to-use interface. To manage income and expenses for small businesses, QuickBooks has no alternative.

With this software, you can save your time on paperwork and bookkeeping because QuickBooks handles such tasks automatically and help you run business smoothly. Along with that, you can use QuickBooks for paying bills, report generating, tax preparation and customer invoices,

Selecting the right QuickBooks support in UAE:

QuickBooks Dubai offers a complete mixture of financial software programs that are skillfully planned to assemble every QuickBooks. Financial Software accounting is a necessity for all the small, average, and big businesses that depend on proficient software results every day.

Users of QuickBooks in the UAE can receive and make payments without foreign accounts. Mid-size businesses and small enterprises can easily send and accept international payments from anywhere on the globe. For any queries, you can visit the QuickBooks website and contact the customer care executive.

QuickBooks Accounting Software Service in UAE

QuickBooks developers have included 3 important features into the software online to be compliant with the new tax law of UAE. All the online version of QuickBooks provides VAT feature. These futures are like the option of entering transactions by location, a new set of VAT codes, and a VAT return form. QuickBooks is fairly simple to comprehend and run. This software is perfect for those organizations who cannot afford to appoint a qualified accountant to look at the accounting affair in detail.

QuickBooks UAE has Arabic font support which enables the user to type the report and name of time /account in the Arabic language. It also has the choice to print those descriptions in Arabic in the documents.

Conclusion

QuickBooks is the most accepted small business accounting software. It comes in a diversity of editions, both installed on your desktop computer and online. QuickBooks includes features that allow you to track your supply, maintain the trail of your revenue and expenditure, Run payroll and track hours of an employee, and make things easier with your taxes.

To get profit with QuickBooks services, all you have to is to pick a package that can allow you to purpose an extensive range of accounting features and services as per the chosen package.

1 note

·

View note

Text

Fix QuickBooks Error 15271 with Our QuickBooks Payroll Support Technicians - Dial +1-800-280-5068

How to resolve QuickBooks Error 15271?

QuickBooks is the best accounting software among all because of its unique feature. Millions of the business owners are relying on this software as it has become a helping hand for them. For the usage of this software, don’t you need to be an expert in the field of accounting as it is so much easy to use? But all of us are aware of it that glitches, errors, and bugs are inevitable. None of the software could ever be error-free so this QuickBooks is also not. There are various reasons for the occurrence of these errors because of which you may face problems during your working hour, and it is so much dreadful if it happens at the time when you are working on any of the most crucial projects, so it is very much essential to fix these errors, bugs or glitches. There is numerous type of errors, and QuickBooks Error 15271 is one of them. In this article, we will be providing you with all possible solutions for solving this QuickBooks Error 15271. It is one of the most common error which appears any time and especially at the time when you are downloading the QuickBooks Payroll updates. But there is no need to be a worry. Because of our QuickBooks Payroll Technical Support Team is available 24/7 to solve user queries.

How will you come to know what type of error you are facing or what message will appear on the screen at the time when you will face this error?

If you are facing this error, then you will be able to see only two errors i.e.

Because of the incomplete payroll updates, documents cannot be justified.

A record cannot ever get approved due to the incomplete updates of the payroll.

What could be the reason behind the encountering of the QB Error 15271?

Because of the Network connectivity issue error can arise.

Insufficient storage could also be the reason for the occurrence of the error.

If something happens in the way like if any of the files related to QuickBooks gets deleted by any other program mistakenly, then the error could take place.

Because of the corrupted window, registry error could occur.

It might have happened or may happen that your QuickBooks Pro related files and programs are or have got infected by virus or malware. In this case, an error could take place.

At a time when you are downloading the latest update of the payroll, and you have got the corrupted file then the error can appear.

If QuickBooks Pro has not to get appropriately installed, then errors can appear.

Windows user Account (UAC) is stopping the QuickBooks from installing the new update.

Solutions for fixing the QuickBooks Error 15271:

Solution #1

Update your QuickBooks Software

Click on the Help option first.

Then after click on the choose Update QuickBooks.

After that, you will get an option of Update now, click on that option.

Then you need to mark the box next to Reset Update.

Then click on the Get Updates option.

Now after clicking on the gets updates option close the QuickBooks and then reopen it. If Update Complete is popping up and appearing on the screen then just restart your computer else click on the option install update. Once it gets completed then again restart your system.

Solution #2

Turn off the User Account Control into your computer system

Most of the time the QuickBooks error 15271 get solved by turn off User Account Control. This error occurs because UAC stops to install new updates so simply turn off the UAC by following given steps and update your QuickBooks again.

Solution for Windows Vista, 7, 8, and 10

Press Window+R key and type control panel and hit enter.

Then go inside the Control panel.

In search box type UAC and press enter.

After that, turn off User Account Control (UAC).

Click on the Ok button.

After that, he would ask for confirmation, provide your admin password and restart your computer and update again.

If you have completely turned off UAC then follow these steps:

Restart your QuickBooks software.

Then a message appears with this message QuickBooks Update Service and then click on Install Later.

Then download the new update of QuickBooks.

Then again restart your QuickBooks desktop.

Then a message appears to Install now, click it and install completely after that reopen your QuickBooks desktop and click on Yes.

After that Update your payroll tax tables.

Solution #3

Update in window Safe mode.

Restart your computer and continuously press the F8 key.

Then the Advanced boot options appear on the screen.

After that, you have to select Safe Mode with the help of your keyboard and then press the enter button.

When your window reboots in safe mode then install payroll update again.

Solution #4

Installation of the QuickBooks under selective startup mode.

Press Window + R key from your keyboard and then type “MSConfig” and press the Ok button.

Then click on General tab> selective startup> Load System Services.

After that Go to services> hide all Microsoft services> Disable all tab> Uncheck hide all Microsoft services.

Then Update your payroll.

Solution #5

And still, if you are facing the same, then you can try these steps.

Fix your QuickBooks registry entries.

Scan malware into your computer system.

Delete your computer’s junk files.

Update the drivers of your computer system.

You have to Uninstall and then again install the QuickBooks application.

Scan your System File Checker.

Install all the new updates.

We hope you have been fixed your QuickBooks error 15271 as we have provided every possible solution to resolve this error. And still, if you are facing the same, then I recommend you to contact our QuickBooks Payroll Support team. We assure that they will fix the error within minutes as they are the certified pro advisor. Just Dial Our QuickBooks Payroll Customer Support Toll-Free number +1-800-280-5068 or visit http://www.quickhelpsupport.com/quickbooks-payroll-support.html

1 note

·

View note

Text

Salesforce CRM Development - A Must For Rapid Business Growth

Knowing the needs of clients and market is crucial for every business to develop and expand. In order to help businesses meet up with the requirements of theirs, it's nowadays be essential to get an integrated Customer Relationship Management (CRM) system In order to quickly go to the clients as well as improve business process. Salesforce CRM is a pioneer structure dependent on cloud computing platform that can help businesses in connecting with the clients of its, employees, associates and business prospects. It can help an organization in creating sharing info and business opportunities effectively.

Salesforce CRM development companies extend Flexible methods which focus on unique company needs and requirements. Salesforce CRM integration services could be availed to build and incorporate customized apps which can be served on Salesforce.com cloud wedge. It will help users work efficiently and effectively.

Salient characteristics of Salesforce CRM are authored below:

With Salesforce CRM, a company may quickly go to its staff as well as clients. It can quickly share relevant information with the team and clients as well.

Salesforce CRM combines with Google, allowing a person to do the job effectively.

It operates on cloud, that is secure and quick.

One may use it to create Mobile and Desktop program to keep in touch with the workers and access info, regardless of location and time.

Well suited for any kind of business and its several departments.

It offers integrated analytics.

It enables one to preserve content library, thus preserving a large amount of time in searching very important photos and papers.

There are tracking tools and program management that assist an organization manage company plans in an efficient way.

One can also design social networking strategy and report the effect of its to the staff members.

Besides offering accommodating CRM fixes, it caters to other company requirements and can easily be easily installed across a selection of departments. Additionally, it smoothly is integrated with other customer strategies and also helps it be simple for a business to log onto its website and info quickly.

To enhance and refine performance of a prevailing Salesforce.com CRM solution, one can go for specific Salesforce development services as per business' requirements and needs. The services include maintenance and growth of custom items to produce new tabs in addition to apps on Salesforce.com wedge. End-to-end Salesforce CRM solutions effortlessly incorporate with current business procedures and may be used by any business.

Custom Salesforce development is able to assist a business in migrating and integrating consumer information from various other programs like Microsoft Dynamics CRM, QuickBooks, Sage SalesLogix, and proprietary CRM methods, SugarCRM, Excel Spreadsheets, others and GoldMine

For More Information: Amraslabs Salesforce

youtube

1 note

·

View note

Text

Best Accounting Software for Small Businesses QuickBooks - BPS

QuickBooks for Your Business - Get Started with QuickBooks

If you're looking for an easy-to-use accounting software to help manage your business finances, QuickBooks is a great option. In this article, we'll introduce you to QuickBooks and show you how to get started. QuickBooks is a popular accounting software package that is used by businesses of all sizes. It is easy to use and helps you to manage your finances effectively. QuickBooks lets you track your expenses, income, and taxes. It also helps you to create invoices, pay bills, and track your bank and credit card transactions. In order to use QuickBooks, you will need to create a free account. Once you have registered for an account, you can download the software and start using it.To get started, you will need to enter some basic information about your business, such as the name, address, and contact information. You will also need to enter your business's tax information. Once you have entered this information, you can start using QuickBooks to track your business finances. QuickBooks is a great tool for managing your business finances. It is easy to use and helps you QUICKBOOK WITH BOOKKEEPING PRO SERVICES

2) How QuickBooks Can Benefit Your Business

QuickBooks is a powerful accounting software that can save your business time and money. Here are three ways QuickBooks can benefit your business:

1. QuickBooks can save you time on bookkeeping.

QuickBooks can automate many of the tasks that take up your valuable time, such as invoicing, tracking expenses, and preparing reports. This frees you up to focus on other aspects of your business.

2. QuickBooks can help you save money. QuickBooks can help you save money by reducing accounting and bookkeeping errors. In addition, QuickBooks can help you take advantage of discounts and early payment terms from vendors.

3. QuickBooks can help you make better business decisions.

QuickBooks provides valuable insights into your business finances, such as which products or services are selling well and which are not. This information can help you make informed decisions about where to invest your resources. QuickBooks is a valuable tool for any business. If you are not already using QuickBooks, now is the time to get started. QuickBooks can save you time and money, and help you make better business decisions.

3) QuickBooks: Getting Started

QuickBooks is an accounting software that helps small businesses manage their finances. It is a popular choice for many business owners, as it is easy to use and can save time on bookkeeping tasks. If you are new to QuickBooks, there are a few things you should know before getting started. This guide will help you understand the basics of QuickBooks, so you can get the most out of the software.

1. Choose the Right QuickBooks Version

There are different versions of QuickBooks available, so it is important to choose the one that is right for your business. The most popular version is QuickBooks Online, which is a cloud-based software that can be accessed from anywhere. If you prefer to use a desktop software, you can choose from QuickBooks Pro, QuickBooks Premier, or QuickBooks Enterprise. QuickBooks Pro and Premier are suitable for small businesses, while QuickBooks Enterprise is designed for larger businesses.

2. Set Up QuickBooks

Once you have chosen the right QuickBooks version for your business, you need to set it up. This process is different for QuickBooks Online and QuickBooks Desktop.

For QuickBooks Online, you will need to create an account and select your subscription plan. You will then be asked to enter your business information, such as your business name, address, and contact details.

If you are setting up QuickBooks Amazon, you will need to install the software on your computer and then follow the instructions in the setup wizard. During the setup process, you will be asked to enter your license information and create a company file.

3. Learn the QuickBooks Interface

QuickBooks has a user-friendly interface, but it is still important to take some time to familiarize yourself with the software. This will help you find the features and tools you need quickly and avoid wasting time trying to figure out how to use the software.

4. Get Help When You Need It

If you run into any problems while using QuickBooks, there are plenty of resources available to help you. QuickBooks has an extensive help center that includes articles, tutorials, and videos.

4) QuickBooks Tips for Your Business

QuickBooks is a powerful accounting software that can help your business manage its finances more effectively. Here are six quick tips to get the most out of QuickBooks for your business:

1. Get organized from the start

QuickBooks can help you get your business finances in order from the start. Make sure to enter all your relevant business information, such as contact information, bank account details, and credit card information. This will help you track your finances more effectively and avoid any confusion later on.

2. Create separate accounts for different types of transactions

QuickBooks lets you create separate accounts for different types of transactions, such as income, expenses, and assets. This will help you keep track of your finances more effectively and make it easier to generate reports.

3. Use the chart of accounts

The chart of accounts is a helpful tool that can help you categorize your transactions. This will make it easier to generate reports and see where your money is going.

4. Use the built-in reports

QuickBooks comes with a number of built-in reports that can be helpful for your business. These reports can give you an overview of your finances, such as your income and expenses.

5. Customize your invoices

QuickBooks lets you customize your invoices to include your business logo and other relevant information. This will help you create a professional image for your business.

0 notes

Text

QuickBooks Desktop Cloud | Accounting Cloud-Based Software

Accounting software that allows you to manage your books of accounts online is referred to as cloud accounting software or online accounting software. In contrast to desktop accounting software, computer accounting software is hosted on a remote server rather than on your business's premises. Instead of being installed on your computer, it is hosted in the cloud.

As a result, in cloud accounting software, the accounting data is sent to a remote server, processed, and then returned to you as a user. A cloud application service provider gives users access to software applications via the internet or other networks with cloud accounting software.

Therefore, as a small business owner, you can install accounting software separately on each desktop in your organization. Additionally, because everything is based online, your employees can collaborate and access the uploaded data on the cloud accounting software from any location at any time.

You need accounting software that helps you save time, increase productivity, and is affordable.

Traditional accounting software cannot be relied on because it is susceptible to data entry errors, stores financial data on hard drives and USB devices, exposes it to viruses and data loss, and costs a lot of money to back up data and update software.

As a result, if you still use conventional accounting software, it's time to move on to cloud-based platforms.

Utilize Cloud Accounting to Scale Your Business! Scaling a business means expanding without increasing costs. You can grow your business by adding more customers without spending money on new software to store financial data in multiple accounts using accounting software.

Your business can automate specific routine tasks with Cloud Accounting Software. This could mean sending your customers recurring invoices or payment reminders.

Additionally, because your cloud-based accounting software is integrated with your bank accounts, you won't have to enter data manually. This is because online accounting software automatically retrieves all your banking transactions.

Cloud-based accounting software helps you save money and time in various ways, unlike the traditional accounting system, where everything must be done manually. You can, for instance, send recurring invoices to your customers and set payment reminders for them.

You can further automate your accounting process by integrating your bank accounts with online accounting software that automatically retrieves your banking transactions. You can quickly create business reports and send them to your customers at any time and location.

Payroll, inventory, expense management, and other third-party integrations simplify accounting with cloud-based accounting software. Thanks to this flexibility, you can work with apps you're comfortable with.

Additionally, you can manage all aspects of your business from a single location, eliminating the need to switch between apps.

Verito is the most reliable QuickBooks hosting solutions provider. You can host QuickBooks Desktop in the cloud with Verito and access it from any device you choose. Cloud-Based Accounting Software frequently releases security and accounting feature updates. These updates safeguard your financial information and give you access to cutting-edge features. This assists you in expanding your small business and saves you time.

Unlike conventional accounting software, cloud-based software enables you to "Fast Track" payments by creating and sending invoices to your customers anytime and from any device.

You also keep track of data like sales and expenses, create business snapshot reports, and send them to your customers anytime and from any location. In addition, you can allow your remote teams to work on the same financial data together and simultaneously.

With our scalable hosting solutions, you only pay for what you use and can quickly scale up or down your server to meet your requirements. While concentrating on your core business, delegate the guesswork to our experts. Our cloud servers provides the best QuickBooks cloud hosting services and also protects applications and keep the data safe. We have the highest security standards in the industry: a multi-tier, geographically dispersed data centre, 256-bit data encryption, and continuous network monitoring for maximum security. To meet the most stringent data security requirements of our customers, we have partnered with data centres that are HIPAA and SSAE-16 certified.

0 notes

Text

How To Restore QuickBooks Error H101

In this blog, we have developed content on an important error code QuickBooks Error H101 and here we will discuss the code’s emergence and its origin. There will be resolving methods as well.

Please read the entire blog.

QuickBooks as a whole

QuickBooks is an accounting platform for bookkeeping, taxation, payroll, inventory, banking, etc. It is the most popular accounting software in the USA and Canada as it provides the best services to mid-ranging to low businesses. But QuickBooks has issues as well. At times it may show an error that stops the users from operating it.

What Is H-Series Error?

This is a technical inconvenience. More or less, it surfaces when users attempt to access the business enterprise folder or files that are located on another computer. Thus, accessing that specific file needs an additional configuration and in case if it does not match then the error may ensue. Other H series errors are H202, H303, and H505. The resolving methods for all of that are near about the same.

What Does H101 mean?

H101 error code comes in QuickBooks. It means the Host Multi-User Access option should be turned off on your workstations. In the same line,

Why do you come across Error H101?

The error comes when the user’s server (the computer that hosts company files) should be the only computer to host multi-user mode. The Host Multi-User Access option should be turned off on the user’s workstations. There are computers on the user’s network that don’t host the company files. The server computer should be the only one hosting.

Reasons for QuickBooks Error H101

Various reasons provoke the QuickBooks Error H101, some are here:

Improper firewall settings or it might be blocked so that you cannot access the file.

Improper DNS settings

A problem in Database Server Manager

Damaged or corrupted files

Incorrect or incomplete QuickBooks installation

Incorrect setup of .ND files that do not allow QuickBooks to open company files in a network.

Issues with host settings.

Indication of QuickBooks Error H101

There are many indicative signs that the error is about to emerge-

Active Windows may crash abruptly

While running the same program the system may crash repeatedly

An error broadcasts on the screen

the computer freezes for every few seconds regularly

Windows runs slowly and doesn’t respond to keyboard and mouse inputs

The QuickBooks user cannot change to multi-user mode.

How Do I Fix Error Code H101 in QuickBooks

Some options are given here on how to eradicate the error-

Activate the QuickBooks Database Server Manager to initiate the multi-user mode

Create a new company file location on your Desktop to save the file

Allow QuickBooks by removing it from the Windows Firewall Defender list

Disable multi-user hosting on your workstations and enable it on your server Computer.

Use the QuickBooks File Doctor Tool

The QuickBooks File Doctor tool assists in detecting the error itself.

From the tool hub, select Company File Issues.

Select Run QuickBooks File Doctor. It can take up to one minute for the file doctor to open. If the QuickBooks File Doctor doesn't open, search for QuickBooks Desktop File Doc and open it manually.

In QuickBooks File Doctor, select your company file from the dropdown menu. If you don’t see your file, select Browse and search to find your file.

Select Check your file and then Continue.

Enter your QuickBooks admin password and then select Next.

Verify QuickBooks Service

When the hosting error occurs, users can attempt this resolving method:

Initially, open Run Box by pressing altogether Windows Key + R button on your keyboard

Type Services .MSc on the same and hit Enter

Browse and scroll down to look for QuickBooks DBXX service in the service window

Check for the startup type and service status is running or not

If not then make sure that runs

Hit the Recovery tab on the same

Select the drop-down menu

So that you can select to restart the service for the first failure

If it fails to restart then it is needed to do it for the second time failure and also for the subsequent failures

Click OK to save the setting for change

Once again, you have to repeat the entire above steps for the QBCF monitor service

In the end, open QuickBooks once again on all workstations and also try in multi-user mode.

Things to remember

Ensure you have QuickBooks installed on the server computer

QuickBooks running without a license. Users must install QuickBooks on the server. If it is not, you would not be able to use or access multi-user mode.

Before you attempt any solution, ensure QuickBooks is installed on the server.

How to back up the company file?

If you are attempting any resolving methods, try to back up your company file. Here’s how to execute that:

In QuickBooks, head to the File menu and select Switch to Single-user Mode.

Navigate to the File menu again and hover over Back up Company. Then select Create Local Backup.

In the window, select Local Backup and then Next.

In the Local Backup Only section, select Browse and select where you want to save your backup company file.

Decide the numbers of backups you want to save. (This is optional)

This runs a test to make sure your backup file is in good shape before you save.

When you're ready, select OK.

Select Save It Now and Next.

Afterword!

In the final analysis, we can say that QuickBooks Error H101 is an error connecting to the server configurations. Hence, the users need to reset their server settings to accommodate the rest of the systems. We hope that you liked this article! For more info contact the official site.

0 notes

Text

4 ways accounting firms are saving money by moving to a cloud based system

Cloud based systems like QuickBooks enterprise hosting is the new standard when it comes to accessing information remotely for accountants & CPAs, using the internet as opposed to storing data on physical servers located in a single location. As this technology becomes more popular for personal use and business applications alike, more and more accounting firms have begun taking advantage of cloud computing services. This change from traditional hardware storage has opened up a new market for bookkeeping companies that are well-versed with cloud security measures to become sought after resources. The other terminology for this kind of practice is known as hosted QuickBooks.

With the advent of cloud computing, organizations and bookkeeping companies alike can reap the benefits. If a bookkeeping firm wishes to succeed in this climate and provide their customers with the very best service, they need to constantly up their game by studying new trends and many different ways that they could apply those trends to fit the needs of their clients.

By moving QuickBooks to a remote host, bookkeeping companies can take advantage of the many benefits that QuickBooks hosting has to offer them. In fact, some business owners report that migrating their business data to a remote location has improved their overall productivity as well as profitability! Let's explore these benefits further.

Centralized Security Centralized security using enterprise level hardware and software is sometimes overkill for small businesses because it can be very expensive. If a small business owner only needs QuickBooks hosting, commercial hosting services is certainly the most cost-effective solution out there and provide an easy way to manage your accounting books as hosting allows companies to share resources across many sites, they can enjoy a significant reduction in IT costs while maintaining security and ensuring uptime.

Remote accessibility No matter where you are, you can access your QuickBooks files on a variety of devices with the new hosted QuickBooks feature cloud has to offer. As more and more businesses move to a remote employee model, it's an essential feature for end-users to have access to their data no matter where they are. As running a business is harder than ever before. More and more people are spread out all over the place. This makes cloud computing solutions, like QuickBooks enterprise cloud hosting, even more vital. By moving this desktop application to a hosted data center, you no longer have to be in the office to access your files - someone at any distance with an internet connection can open up accounts at any time and begin working right away. Not only will this save both time and money by not keeping in-house servers or paying IT specialists, but it could reduce transportation costs as well as other costs of running a traditional data center.

Faster processing servers Take advantage of cloud computing servers for faster processing speeds and better performance without the need to upgrade your web hosting server in-house. This is again just one of cloud hosting's advantages across the board. Most companies don't even have the capital or budgets to purchase enterprise level technology like this. With cloud computing, you're getting access to enterprise level harnessing power while saving time because there's no need to upgrade your own internal hardware!

If you are looking for a hosted QuickBooks solution for your organization, there’s no need to purchase your own hardware or hire a team of IT specialists to install software and apply patches. A QuickBooks cloud hosting provider will already have everything that you need!

Ensuring business continuity In order to uphold trust among clients and customers, it's crucial to have a sound grasp of business continuity principles. Cloud based accounting systems guarantee 99.99 percent uptime without fail in order to prevent any interruptions in business activities while making sure that your data is always at hand when needed. With QuickBooks enterprise hosting, you also get the bonus data security, cloud backups are performed frequently so that they can be downloaded with minimum delay if any data is lost due to unforeseen circumstances such as natural disasters or localized invasions by criminals out to steal information or sabotage your IT infrastructure in general.

Conclusion Many accounting firms are not aware of the benefits a cloud based system has to offer; however there are a number of benefits associated with the online accounting model. For many businesses moving their accounting to an online server allows for substantial cost savings and improves business operations. These advantages include: 24/7 access to your data, budget flexible solutions, scalable architecture and technologies, unlimited capacity and scalability, consistent upgrades on all hardware without any upfront costs or administrator time, allows work from anywhere and the support is world class!

1 note

·

View note

Text

Best work from home practices accountants can follow in 2023

Practically overnight, social distancing has forced us to change everything about how we live and work. As an accountant or bookkeeper, two of your primary concerns right now are probably how to keep your employees accountable while they work from home, and how to make sure your clients’ data – and your company’s data – stays safe. Many firms are moving to a cloud based systems such as QuickBooks enterprise cloud hosting, however, that alone will not resolve the situation, and there are specific practices that need to be followed in order to stay competitive and relevant in the industry.

Even the most focused and dedicated employees will appreciate some accountability to help them navigate through changes. Implementing these suggestions for accountability will also help you feel more confident that client work is being handled effectively and efficiently.

Here are some practices you can follow in your accounting firm while working remotely

Set up a collaborated environment

Some employees work better when they're alone; others work better when they're around other people. Schedule a virtual meeting using any video conferencing software and encourage employees to join the meeting with their team members. This way, everyone can continue to collaborate and keep the office morale high, even though you're all working from different locations.

Use a Dashboard

The purpose of the dashboard is to provide a space for your employees to update you on the status of each project they're working on, without you being bombarded with multiple emails throughout the day. By making the dashboard visible to all employees - and letting them know that you're able to see it too - a sense of healthy competition can develop. This helps keep everyone productive and accountable, which is vital for the success of any company.

Virtual Desktops

A better solution for remote workers is to either implement a virtual desktop infrastructure (VDI) or, at the very least, have a remote access tool like QuickBooks enterprise hosting that'll allow them to connect to on-premise computers at their place of business. VDI essentially entails hosting virtual desktops on servers in a secure location - like a data center or public cloud - so users can connect from anywhere and work. The advantage of this is that they can be at the office or at home during the shutdown. Granted, VDI does take more planning and offers better security overall (seeing as the data will be in a datacenter as opposed to on-premise) but remote access software such as QuickBooks hosting is far easier to implement and deploy in contrast.

Ensuring data security

While having things like firewalls and antivirus installed are both essential and necessary, they unfortunately are not enough to provide sufficient protection for most businesses - especially not on their own. The single best security protection that a business can put in place is Multi-factor Authentication (MFA). In fact, Microsoft claims that nearly 99% of all attacks on accounts could be stopped simply by having MFA enabled. Most cloud software providers will offer a way to enable MFA either through a text message or an app on your phone and this is something you everyone should look to implement as soon as possible.

Take daily meetings before starting the day

Having a daily meeting helps keep everyone connected and accountable, even when you’re all working from home. Schedule a virtual meeting platform at the start of each day, at the same time your employees would report to the office. It should be like everyone reporting to the office. This way, you can keep everyone on track and moving forward with your company goals!

Keeping your team up-to-date on the big picture of your business is important for keeping them motivated and focused. This can include sharing deadlines that are approaching, new initiatives you want to launch, or anything else that would be beneficial for your team to know on a daily basis.

Final Words

In any other circumstance, your employees would be thrilled at the opportunity to avoid the daily commute and work remotely. Right now, however, they might be overwhelmed by the prospect of turning a part of their homes into office space. This means that accountants are challenged not only with handling increased demand for their services, but also with managing remote working environments. With more businesses than ever working remotely, accountants have to be adaptable in order to provide the best possible service to their clients but the state of our healthcare system and economy can be distracting, to say the least.

0 notes

Text

Quickbooks 2013 download

#Quickbooks 2013 download for mac#

#Quickbooks 2013 download install#

#Quickbooks 2013 download upgrade#

#Quickbooks 2013 download android#

10.3 What are the RAM Requirements for the Microsoft Terminal Services?.10.2 What are the Download Requirements for the QuickBooks 2013?.10.1 Can I delete the download QuickBooks 2013 program after installing it on my computer?.

#Quickbooks 2013 download for mac#

9 Pros and Cons of QuickBooks 2013 Edition For MAC.8 Pros and Cons of QuickBooks 2013 Edition For Windows.

#Quickbooks 2013 download upgrade#

6.15 Upgrade QuickBooks MAC 2013 to 2021.

6.14 Upgrade QuickBooks Accountant 2013 to 2021.

6.13 Upgrade QuickBooks Professional 2013 to 2021.

6.12 Upgrade QuickBooks Enterprise 2013 to 2021.

6.11 Upgrade QuickBooks POS 2013 to 2021.

6.10 Upgrade QuickBooks Premier 2013 to 2021.

6.9 Upgrade QuickBooks PRO 2013 to 2021.

6.8 Step 3: Company File Upgrade Process.

6.7 Step 2: Company Data File Preparation.

#Quickbooks 2013 download install#

6.6 Step 1: Install QuickBooks of the Latest Release.

5.5 QuickBooks MAC 2013 System Requirements.

5.4 QuickBooks Enterprise 2013 System Requirements.

5.3 QuickBooks POS 2013 System Requirements.

5.2 QuickBooks Premier 2013 System Requirements.

5.1 QuickBooks Pro 2013 System Requirements.

4.6 QuickBooks Accountant 2013 Features.

4.5 QuickBooks Professional 2013 Features.

4.4 QuickBooks Enterprise 2013 Features.

3.6 QuickBooks Accountant 2013 Free Trial.

3.5 QuickBooks Professional 2013 Free Trial.

3.4 QuickBooks Enterprise 2013 Free Trial.

3 Download QuickBooks Desktop 2013 Free Trial.

2.6 QuickBooks Accountant 2013 Download.

2.5 QuickBooks Professional 2013 Download.

2.4 QuickBooks Enterprise 2013 Download.

2 Download Different Version of QuickBooks 2013 Pro || Premier || Enterprise || Professional || Accountant || MAC || POS.

Built-in tutorials for common tasks aid in the training process, and the software comes with a Practice File, allowing you to learn the software with no fear of damaging your database. For products with damaged or missing barcodes, QuickBooks POS can be seached quickly and dynamically, saving time at checkout. Ringing up customers is as simple as pressing the "make sale" button and scanning products. QuickBooks POS 2013 Basic's intuitive interface makes training new employees a snap. Adding in the QuickBooks financial software reporting functionality, and you have limitless methods to display and report data on your business. More than 50 pre-built sales, customer, and inventory reports are available, with the ability to customize your own for greater reporting potential. Your inventory counts are automatically updated when you return, saving you time. With Intuit's GoPayment reader and service, you can take credit card payments anywhere you have a wireless or cellular signal.

#Quickbooks 2013 download android#

Using your iOS or Android device, QuickBooks can sync portions of your inventory to the device, allowing you to sell products on the road, at trade shows, or farmers markets, while operations at your retail location stay running. New to QuickBooks POS 2013 is their mobile POS app. Integration with QuickBooks Financial software is straightforward and allows you to import your customer data, combining the two software packages into a single powerful business solution. A wizard guides you through the business setup process, and after answering a few questions, you're ready to add your product inventory. Like previous versions, setting up QuickBooks POS is straightforward and easy. Ideal for smaller businesses, QuickBooks POS Basic has the tools you need to keep retail operations running smoothly, both in store and on the road. Intuit QuickBooks POS 2013 Basic POS software offers key feature additions while maintaining similar functionality to previous versions of QuickBooks POS. The Intuit QuickBooks Point of Sale 2013 Basic has reached end of life. QuickBooks Point of Sale 2013 Basic POS Software

0 notes

Text

Mac product key finder pro serial number

#Mac product key finder pro serial number how to#

#Mac product key finder pro serial number for mac#

#Mac product key finder pro serial number serial numbers#

To decode any Mac serial number type the model number (i.e. digital anarchy beauty box video serial number. We analyze a serial number to provide a breakdown of Mac’s specs that can be used when researching.

#Mac product key finder pro serial number for mac#

Product key Finder for Mac If youre looking for such program for Mac - there is free program called Mac Product Key Finder. keys (WIN-MAC),REVisionFX Twixtor Pro 6.1.0 for AE (cracked),REVisionFX. Number of supported programs: 300+ 10,000+ Scan another or non-bootable Windows: Works with 64-bit systems: Recover serials for Windows 7 / 8 / 10 / 11 and Office 2010.

#Mac product key finder pro serial number serial numbers#