#HR and Payroll software

Explore tagged Tumblr posts

Text

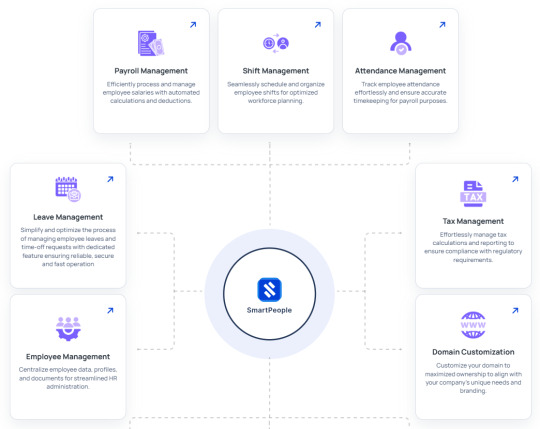

Streamline Workforce Management with SmartOffice: The Smart HR Solution

Effective workforce management is essential for success and growth in today's fast-paced business environment. SmartOffice is a cloud-based HRM solution that offers a comprehensive set of tools to meet current and future business needs. Whether managing internal growth or onboarding new hires, SmartOffice guarantees a smooth, effective, and significant HR experience.

SmartOffice unifies all crucial HR operations into a single, intuitive platform, revolutionizing the way companies handle their human resources. From hiring and onboarding to promotions and staff grouping, this one-stop shop streamlines intricate HR duties and improves overall business performance.

SmartOffice's work slot allocation feature makes onboarding easier than ever by guaranteeing that each new hire is assigned to the appropriate role right away. Productivity is increased, and new hires are able to get started quickly thanks to this strategic placement.

Employee mobility features from SmartOffice make it simple to identify and reward talent. HR professionals can highlight high performers and facilitate career advancement without administrative burden, thanks to the streamlined promotions and transitions.

Advanced access controls and employee grouping can improve security and teamwork. HR managers can assign workers to departments, roles, or projects using SmartOffice, which facilitates efficient teamwork and gives them individualized access to sensitive data.

Businesses that use SmartOffice not only stay up to date with change but also take the lead. Discover a more intelligent approach to personnel management and unleash the full potential of your company. Your doorway to effective, safe, and forward-thinking HR management is SmartOffice.

#hrm#hrmanagement#HR and Payroll Solution#HR and Payroll Software#HRMS Solution#Employee Management#employee management software#employee management system#SmartOffice#SmartPeople

3 notes

·

View notes

Text

When Payroll Software Creates More Confusion Than Clarity (And How to Fix It)

Payroll software is supposed to simplify processes, not complicate them. Yet, for many HR and finance teams, the reality is different. What starts as an attempt to modernise payroll often ends in frustration. Complex interfaces, inconsistent calculations, and poor integrations lead to a messy experience that defeats the very purpose of automation.

So, why does this happen, and more importantly, how can you fix it? In this blog, we will explore where payroll software goes wrong, the confusion it creates, and how to choose a system that genuinely improves clarity, compliance, and control.

The Promise of Payroll Software vs Reality

The promise is attractive:

Automate monthly salary processing

Reduce manual errors

Ensure tax compliance

Give employees access to clear, self-service payslips.

In theory, this should free up HR and finance to focus on strategy and employee well-being. But in practice, poorly implemented payroll automation software can leave teams spending more time fixing errors, handling employee queries, and figuring out how the system works.

Common Reasons Payroll Software Creates Confusion

Let’s break down the most common pain points companies experience with payroll tools:

1. Poor Onboarding or Training

A robust system is only useful if users know how to use it. Often, HR teams receive minimal training, outdated user guides, or rely on trial-and-error. This leads to inconsistent processes and underutilised features.

2. One-Size-Fits-All Design

Many HR payroll softwares take a broad-brush approach—great for selling, but not so great for solving real problems. Without customisable modules, companies struggle to manage region-specific tax rules, unionised pay scales, or variable shift-based compensation.

3. Inconsistent or Inaccurate Data Sync

Payroll is only as accurate as the data feeding into it. If time and attendance data, leave balances, or reimbursement claims don’t sync properly, it can result in salary errors, compliance breaches, or last-minute scrambles.

4. Lack of Transparency in Calculations

If employees can’t understand their payslip, or if HR can’t trace how a deduction was made, it undermines trust. Payroll software that doesn’t show a clear breakdown of earnings, taxes, and benefits only adds to confusion.

5. Complicated User Interfaces

A cluttered dashboard, poor navigation, and too many manual steps create friction in the payroll cycle. The result? More time spent fixing errors and answering questions instead of actually processing payroll.

How to Fix It (And Prevent Future Confusion)

Choosing the right payroll software doesn’t just come down to a long features list. It’s about alignment—with your business structure, your team’s capabilities, and your employees’ expectations.

Here’s how to move from chaos to clarity:

A. Choose Software with Industry-Specific Configurations

Look for a solution that understands your domain. This might include healthcare, retail, manufacturing, or remote-first teams. Industry-specific payroll platforms offer tailored modules, like overtime calculations, contract billing, or seasonal compensation structures.

B. Prioritise Clean Data and Seamless Integration

Before migrating, clean your employee records, benefit data, and leave history. Best payroll softwares will seamlessly integrate with your HRMS, time-tracking, and accounting platforms. This ensures a single source of truth and reduces duplication.

C. Demand Transparent Calculation Logic

Choose a system that lets both HR and employees view detailed payslip components: earnings, bonuses, reimbursements, taxes, deductions, and net pay. A clear breakdown reduces misunderstandings and boosts confidence in payroll accuracy.

D. Focus on UI/UX During Demos, Not Just Features

Don’t be distracted by flashy dashboards or AI buzzwords. Let your HR and finance teams explore the actual workflows during product demos. Choose software that requires fewer clicks, guides the user clearly, and reduces the chance of human error.

E. Invest in Proper Implementation and Training

The most sophisticated payroll tool is ineffective without the right setup. Work with the vendor to align the platform with your pay policies and statutory requirements. Allocate time for onboarding, assign internal champions, and revisit the setup annually to stay current.

Conclusion

Payroll software should simplify your operations, not send your HR team into a tailspin every month. If your current system creates more confusion than clarity, it’s time to stop treating payroll as a backend task and start treating it as a strategic business function.

If you are looking to buy a simple yet effective payroll software for your business, you should check out Opportune HR. They are one of the best HRMS and payroll software providers in India. They follow the 85-15 rule, where 85 percent of the software has all the generic yet necessary features that can benefit all the industries alike with 15 percent of customisation specifically for your business needs. You can visit Opportune HR to learn more about their services.

#hrms and payroll software#best payroll software#payroll management software#hr and payroll software

0 notes

Text

How HR and Payroll Software Boosts Productivity and Reduces Errors

Efficiency is now a must in the fast-paced business environment of today, not a luxury. Every minute wasted on repetitive admin work or manual data entry costs a business both time and money. Nowhere is this more evident than in human resources and payroll functions. From onboarding new employees to calculating salaries and filing taxes, HR and payroll departments handle some of the most sensitive and complex tasks in a company.

That’s where HR and payroll software comes in. By automating routine tasks, reducing human error, and providing real-time data insights, these tools are transforming how businesses operate. Let’s explore how HR and payroll software significantly boosts productivity and reduces costly errors—and why more companies are making the switch.

1. Automating Time-Consuming Tasks

Manual HR and payroll processes are riddled with inefficiencies. Data must be entered, verified, and cross-checked across multiple spreadsheets to ensure accuracy. That takes hours and opens the door for mistakes.

HR and payroll software automates these repetitive tasks:

Employee onboarding

Leave and attendance tracking

Timesheet approvals

Payroll calculations

Payslip generation

Tax computations and filings

This automation allows HR professionals to shift their focus from paperwork to people. Instead of spending hours processing payroll, they can invest time in building engagement strategies, refining recruitment processes, or improving company culture.

2. Reducing Human Error

Even the most meticulous HR manager is not immune to mistakes. Miscalculated tax deductions or incorrect decimals on a payslip may result in financial penalties, noncompliance, and dissatisfaction among employees.

With HR and payroll software:

Formulas are predefined, reducing calculation errors

Integrated data across systems ensures consistency

Automated alerts flag discrepancies or missing information

Compliance rules are built into the software to meet local labor laws and tax regulations

As a result, businesses can significantly lower their risk of payroll errors, which often lead to underpayment, overpayment, or government audits.

3. Centralized Employee Data

In many companies, employee data is scattered across different folders, spreadsheets, or even physical files. In addition to wasting time, this results in inaccurate data and problems with version control.

HR and payroll software centralizes all employee data in one secure platform. That means:

HR managers can quickly access records for leaves, benefits, salary history, or performance reviews

Employees can use self-service portals to see and update their data.

Payroll runs are faster because data doesn’t have to be manually collected from multiple sources.

A centralized system ensures data integrity and eliminates the time-consuming back-and-forth between departments.

4. Improved Compliance and Reporting

Keeping up with labor laws, tax codes, and government regulations is a full-time job in itself. One missed update or deadline can trigger penalties or lawsuits.

Modern HR and payroll software is regularly updated to reflect the latest legal changes. It can:

Automatically apply statutory deductions (e.g., social security, income tax)

Generate compliance-ready reports and payslips

File tax returns electronically

Maintain digital audit trails for transparency

This level of automation not only ensures accuracy but also gives business owners peace of mind knowing they’re meeting all legal requirements.

5. Faster Payroll Processing

Processing payroll manually—especially for a growing team—can be an overwhelming task. It involves tracking hours worked, calculating deductions, accounting for bonuses, and ensuring tax compliance.

With a few clicks, payroll software takes care of this. Many systems integrate with time-tracking tools and attendance systems, pulling real-time data to calculate salaries instantly. This reduces the payroll processing time from days to minutes.

Faster processing means employees get paid on time, every time—which is critical for morale and trust.

6. Enhanced Employee Experience

Modern employees expect transparency and control. They want to access their payslips, update personal information, apply for leave, and track their benefits—without having to call HR.

A self-service portal offered by HR and payroll software permits staff members to:

Download payslips

View tax deductions and leave balances

Update their bank and contact details

Submit reimbursement claims

This reduces HR workload and improves employee satisfaction. Higher engagement and lower attrition are the results of a better experience.

7. Scalability for Growing Businesses

As your company grows, so does the complexity of managing HR and payroll. Hiring more employees, managing benefits, and staying compliant across multiple locations becomes challenging.

Payroll and HR tools are made to grow with your company. Whether you have 10 or 1,000 employees, the system can adapt without requiring massive administrative overhead. Features like role-based access, department-wise reporting, and automated workflows make it easier to manage a large workforce efficiently.

This scalability guarantees that you're thriving through expansion rather than merely surviving it.

8. Real-Time Insights for Better Decision-Making

Beyond automation and accuracy, HR and payroll software delivers powerful data insights. Dashboards and reports provide real-time visibility into key metrics like:

Absenteeism trends

Payroll costs

Overtime expenses

Attrition rates

Hiring pipeline performance

These insights help business leaders make smarter decisions about workforce planning, budgeting, and strategy. You may proactively increase performance and profitability rather than responding to issues as they arise.

9. Cost Savings in the Long Run

While investing in HR and payroll software might seem like an upfront cost, it pays for itself in multiple ways:

Fewer compliance penalties

Reduced manual labor

Improved efficiency and productivity

Less reliance on external payroll providers

Enhanced accuracy reduces overpayments and wage disputes

Over time, the software helps streamline operations, reduce HR overhead, and free up resources to focus on growth.

10. Remote Access and Cloud Convenience

In a world where hybrid and remote work are the norm, accessibility is key. Cloud-based HR and payroll solutions offer anytime, anywhere access. HR teams can process payroll, access documents, and run reports from any location.

Similarly, employees can apply for leave or download payslips on the go—via mobile apps or web portals.

This flexibility is no longer optional. It’s essential for modern businesses that want to stay agile and competitive.

Final Thoughts

Payroll and HR software is a competitive advantage, not just a convenience. By automating manual tasks, reducing human error, centralizing data, and ensuring compliance, these tools dramatically improve productivity across your organization.

As businesses continue to navigate evolving workforce demands and complex regulations, having the right software in place becomes mission-critical. If your HR and payroll processes are still manual or outdated, now is the time to invest in a solution that empowers your team and future-proofs your operations.

#HR Payroll Software#hr and payroll software#payroll management software#best hr and payroll software#hr and payroll software for small business

0 notes

Text

Want to simplify your HR processes?

Accent Consulting HRMS Software manages payroll, attendance, leave, and more — all in one powerful platform.

Need a demo or have questions? Call us at 9999143778!

0 notes

Text

One People is an integrated global unified cloud HR & payroll management suite system with comprehensive solutions that streamline human resource processes, eliminate tedious paperwork, foster efficiency and thus drive value.

Visit One People HR & Payroll Software website.

1 note

·

View note

Text

How HRMS Solutions in India Drive Business Growth & Efficiency

Introduction

As businesses scale, managing HR processes manually becomes a bottleneck. HRMS (Human Resource Management System) solutions in India provide organizations with the agility to automate HR tasks, enhance workforce productivity, and ensure compliance.

How HRMS Tools in India Streamline Business Operations

Enhanced Payroll Processing – Ensures timely salary payments with automated tax deductions.

Centralized Employee Database – Reduces paperwork and manual errors.

Compliance & Legal Management – Minimizes risks related to statutory regulations.

Workforce Analytics – Provides data-driven insights for strategic HR planning.

Choosing the Best HRMS Company in India

Organizations must evaluate HRMS software companies in India based on:

User experience & customization

Scalability & integration capabilities

Security & data protection

Conclusion

HRMS solutions in India are no longer optional but a necessity for organizations aiming for operational excellence. By investing in a top-tier HRMS company in India, businesses can streamline HR functions, enhance employee satisfaction, and drive long-term growth.

Read more: Understanding HRMS Software Price in India: Is It Worth the Investment?

#HR payroll system#HRMS payroll software#HR and payroll software#HRMS payroll software in India#Best HRMS and payroll software in India#HRMS payroll system

0 notes

Text

Payroll Software Features That Improve Compliance

In this constantly evolving world of speed and hustle, pay roll compliance is something which creates a lot of headache for companies. With constant changes in tax laws and labor regulations, it becomes very important for a company to always follow the very updated legal requirement in order to stay clear from penalties. Manual Payroll Management increases the risk of human errors and takes a toll on time. Here, Payroll Software becomes the most important tool in automating the compliance process and ensuring error-free payroll processing. When we have the Best Payroll Software in India, businesses can maintain proper taxation, employee class types, and reporting while complying with labor laws.

How Payroll Software Can Be Helpful in Maintaining Business Compliance

Payroll compliance means complying with tax regulations, wage laws, or other statutory requirements. A robust Payroll Software in India brings automation and accuracy so that businesses can pay more attention to these matters of compliance. Here are the main features that keep the payroll complaints for organizations:

Automatically Calculate and File Taxes

Accurate and timely tax computing and filing turns out as one of the busiest and most challenging affairs for businesses. Payroll Software calculates federal, state, and local taxes automatically under the updated tax laws. This feature helps businesses:

Deduct correct amounts of tax from employee salaries.

File the tax forms and payments in front of prescribed deadlines.

Keep updated with the changes in tax rules that arise.

Wage and Hour Tracking

Wage and hours regulations are important with respect to compliance with labor regulations for businesses. Payroll Software in India helps in tracking working hours, overtime, and break time of employees. It may fulfill the minimum wage and overtime laws. It also:

Provides accurate timesheets and attendance reports for employees.

Alerts businesses regarding wage discrepancies.

Helps in avoiding any labor law violations.

Employee Classification

Wrong employee classifications may lead to legal penalties and back payment claims. The Best Payroll Software in India helps to classify employees accurately by:

Differentiating between full time, part time and employees on contract basis.

Applying the correct tax rates and wage policies Authorizing, and detailing, any possible risk for misclassification during payroll.

Compliance with Leave Management

Leave management is yet another very important aspect that has been considered in payroll compliance. Payroll Software has all the features required for automating leave tracking and aids companies in meeting their obligations regarding sick leave, maternity, and paid time off policies. It:

Government policies consider how to accrue leave based on the given policies of the particular company.

Tracking leave balances without any possible manual errors.

It helps confirm that the organizations are compliant with the laws of the federal and state governments regarding leave.

Reporting New Employees

Businesses are required to report new hires to state agencies. Indian Payroll Software does this with minimal manual intervention by:

Submitting employee data to the government.

Maintaining I-9 and W-4 forms, and so on.

Integrating new-hire-reporting functions into employee onboarding workflows.

Audit Trails and Compliance Reporting

Maintaining payroll records in detail is of utmost importance to get compliance. Free Payroll Software maintains all Payroll Records and audit trails on any payroll action. This will enable companies to:

Incorporate factual compliance reports while audits.

Keep track of changes that were done in payroll data.

Ensure transparency and accountability in the payroll process. Why Choosing the Right Payroll Software is Important

Choosing the Best Payroll Software in India is imperative for businesses to ward off legal pitfalls and ensure compliance. The right payroll software solution should provide for automated compliance, continuously updated with the latest labor laws, and integrates seamlessly with HR systems. Kredily provides a full Payroll Software solution for efficient payroll while enabling businesses to be compliant.

Conclusion

Payroll compliance is not merely paying employees; however, it is actually about compliance with tax laws, wage laws, and reporting requirements. Right Payroll Software gives the extra power of automating compliance and eliminating legal penalties which arise on manual errors. Kredily Payroll Software in India provides an integrated solution for smooth payroll processing and puts businesses on the right side of the law.

Step into a seamless journey of payroll compliance - Schedule for a free demo on Kredily's Payroll Software right away!

#Payroll Software#Employee Payroll Software#Best Payroll Software in India#Payroll Software in India#HR and Payroll Software#Online Payroll Software

0 notes

Text

What is HR and Payroll Software and How Does It Streamline Employee Payroll Management?

Simplify HR processes with PerfettoHR, a leading HR and payroll software solution. Automate tasks, manage employee data, streamline payroll, and boost efficiency. Experience seamless HR management with PerfettoHR.

0 notes

Text

Streamlining Workforce Management with HR and Payroll Software

Managing a workforce properly is vital for the success of any firm. HR departments handle a variety of tasks, from hiring and onboarding to processing payroll and maintaining compliance. By combining these duties onto a single platform, HR and payroll software streamlines them, allowing businesses to cut down on errors, save time, and concentrate on key projects.

What is HR and Payroll Software?

HR payroll software is a digital solution that automates and simplifies operations linked to payroll and human resources. It offers resources for managing employees, calculating salaries, ensuring tax compliance, administering benefits, and more. Integrating these activities minimizes redundancies, lowers manual errors, and enhances operational efficiency.

Key Features of HR and Payroll Software

Employee Database Management: Centralized storage of employee information, accessible in real-time.

Payroll Automation: Automatic salary calculation, tax deductions, and compliance tracking using payroll software.

Time and Attendance Tracking: Integration with biometric systems and online time logs.

Benefits Administration: Management of employee perks, insurance, and retirement plans.

Self-Service Portals: Allows employees to access pay stubs, update information, and submit requests.

Compliance Management: Ensures adherence to labor laws, tax regulations, and industry standards.

Recruitment and Onboarding: Tools for job posting, applicant tracking, and new hire training.

Benefits of HR and Payroll Software

Efficiency and Accuracy: Reduces the risk of errors in payroll processing and HR tasks.

Time Savings: Automates repetitive tasks, allowing HR teams to focus on strategic initiatives.

Improved Compliance: Keeps the organization up to date with regulatory requirements.

Enhanced Employee Experience: Self-service tools empower employees and reduce HR workload.

Cost Savings: Minimizes overhead costs associated with manual HR and payroll management.

Trends in HR and Payroll Software

Cloud-Based Solutions: Providing flexibility and access from anywhere. You can work with solutions like proven travel management software.

Artificial Intelligence (AI): Automating data analysis, payroll predictions, and employee sentiment analysis.

Mobile Accessibility: Enabling employees and managers to manage tasks on the go.

Integration with Other Tools: Seamless connections with accounting, ERP, and project management software. The scope ranges from hiring and selection platforms to employee offboarding software technology.

Focus on Employee Wellness: Including features for mental health support, feedback, and engagement tracking.

Conclusion

HR and payroll software is transforming how businesses manage their workforce. By automating essential tasks, these tools enhance efficiency, ensure compliance, and improve the employee experience. As organizations continue to embrace digital transformation, investing in the right HR reporting software is a strategic move that pays dividends in productivity and employee satisfaction.

#HR and payroll software#HR payroll software#travel management software#employee offboarding software#HR reporting software

0 notes

Text

Scaling Without HR Software? These Hidden Costs Could Fail Your Startup

As your business grows, so do the challenges of managing people. One of the most common issues companies face is trying to scale without integrated HRMS software in place. At first, managing payroll, compliance, and onboarding manually might seem manageable.

But these small problems quickly add up as your team grows, draining valuable time, straining employee morale, and putting your company at risk with compliance penalties or operational bottlenecks.

In this blog, we’ll uncover the real costs businesses pay when they scale without the right HR software for startups and how a software like OpportuneHR can help you address these challenges early, before they affect your bottom line.

1. Payroll Errors and Statutory Penalties

Manual payroll calculations may seem manageable in the early stage of your business. But when you’re juggling variable salaries, reimbursements, tax deductions, and statutory compliance (PF, ESIC, PT, TDS), mistakes such as:

Missed compliance deadlines can lead to government penalties

Errors in payslips or deductions damage employee trust

Overpayments or underpayments create cash flow issues

…are inevitable.

However, with robust HRMS software for small businesses like OpportuneHR, these risks can be minimised and even eliminated. It ensures auto-generated, error-free payroll aligned with Indian statutory norms and audit-friendly reports that keep you investor-ready.

2. Time Drain on Founders and HR Teams

In a startup, time is money. Yet, HR teams end up spending hours manually:

Collecting attendance data

Approving leave requests via email threads

Chasing documents for onboarding

Generating payslips at month-end

Smart HR software for SMEs automates these tasks through self-service portals, mobile apps, bot-led workflows, and real-time dashboards. The result? HR teams can spend their time on more important tasks that contribute to business growth, culture, and performance.

3. Poor Onboarding = Early Attrition

Startups often experience rapid hiring phases. But without structured onboarding:

New hires face confusion, delays in documentation, or missing logins

HR spends days coordinating onboarding manually

First impressions go wrong, leading to early attrition

OpportuneHR solves this with bot-enabled onboarding, digital document uploads, automated task assignments, and welcome journeys that run seamlessly. HRMS software can take fast-growing companies from chaos to consistency.

4. Blind Spot into Performance and Productivity

As your team grows, so does the risk of losing visibility into individual and team performance. However, without a centralised HR system, startups often operate in the dark when it comes to understanding how their teams are truly performing.

Founders have no visibility into leaves, team productivity, or attrition

There’s no structured performance tracking or feedback loop

Promotions and appraisals become arbitrary

With the best HR software for startups, you get mobile-friendly dashboards, performance management tools, and analytics that give decision-makers real-time visibility. This builds a culture of accountability and merit-based recognition.

5. Compliance Risks During Fundraising or Audits

When your business is gearing up for funding or acquisition, every gap in your HR documentation becomes a red flag. Startups often run into problems like:

Missing offer letters or payroll records

Lack of clear employee contracts

No audit trail for statutory filings and compliance

These oversights can delay audits, lower investor confidence, and increase legal costs.

OpportuneHR’s compliance management system ensures all documents, logs, and records are secure, timestamped, and accessible with a click, so you’re always audit-ready with clean and systematic records.

6. Poor Employee Experience = Culture Breakdown

Startups thrive on speed and a strong culture. But both can unravel quickly when the employee experience falls short. Common frustrations include:

Employees can’t access payslips, holiday calendars, or policies easily

Reimbursements and leave approvals get delayed

There’s no clarity on performance expectations

Today’s employees expect digital-first HR interactions. HR software for SME businesses like OpportuneHR provides a clean, app-based interface for attendance, leave, payroll, and engagement, all without HR intervention.

Final Thoughts

As you scale from 10 to 100 employees, these hidden inefficiencies snowball into serious operational risks. The smart move isn’t to wait until it’s unbearable. It’s to act now and streamline your HR operations early on.

If you’re looking to streamline operations, avoid costly errors, and build a future-ready team culture, it’s time to explore the best HR software for startups. OpportuneHR is purpose-built for Startups, SMEs and large businesses alike, offering the automation, compliance, and visibility growing companies need. So, why wait? Invest in the best today!

#hrms and payroll software#best payroll software#payroll management software#attendance software#hr and payroll software

0 notes

Text

Best HR And Payroll Software

Sage 300 People is the best HR and payroll software solution, adeptly supporting both present and future HR requirements.

#greytrix africa ltd#sage hrms#hrms software#sage 300 people#sage hrms software#hr and payroll software

0 notes

Text

Looking for the best payroll software call us our expert @ 9999173778.

Explore - https://www.accentconsulting.in/about-us

#Accent Consulting#Accent Consulting About us#hr and payroll software#payroll software#payroll software in India#bestpayrollsoftware#erecruitmentmanagement#hrandpayrollsoftware#online payroll software#payroll software in noida#payroll software in gurugram#payroll software in delhincr#best payroll software

0 notes

Text

TOP HRMS Software Trends in UAE for 2025: What's Next for HR and Payroll Solutions?

Introduction

As we approach 2025, businesses in the UAE are increasingly seeking innovative solutions to streamline their HR operations. The search for the TOP HRMS software trends in the UAE for 2025 has gained momentum as companies look for future-ready HR and Payroll solutions. Whether you're a small business or a large corporation, understanding these emerging trends in the HRMS landscape can provide a competitive edge.

The Rise of Cloud-Based HRMS

Cloud technology continues to revolutionize the HR software space, offering flexibility and scalability that traditional on-premise systems cannot match. In the UAE, cloud-based HRMS solutions are gaining popularity due to their ability to facilitate remote work and ensure business continuity. Readmore........

0 notes

Link

#hrms software dubai#hr and payroll software#employee management software#talent management software

0 notes

Text

Cloud HR Software for Affordable Business Functions

The idea of affordability in an engaging HR management system or platform is of crucial importance. When you focus on dedicated operations management modules to boost the value of engaging HR features or models, it is easier for you to promote an active and essential HRMS platform process. This post is about the dedicated support of deploying cloud HR software to boost the various business processes and functions in an organization associated with affordability and related solutions.

Affordable Business Features of Cloud HR Software

The promise of a dedicated and proven HR management system to boost the various aspects of cloud solutions and services can be actively demonstrated with the care and support of an experienced operations model. When you focus on the delivery of different HR software functions or cloud solutions based on affordability considerations, check out the below points:

Enhanced employee supportThe functions under the HR and payroll software management in an exclusive operations process can be suitably managed and achieved with the terrific support of an active HRMS platform with optimum considerations for affordable or free services. You can utilize maximum or enhanced support in this format.

Predictive collaborationsWhen you are open to building and deploying predictive functions to boost the various HR management features, the overall affordability will improve. It will help create a significant model to boost the core HR management functions under the operations domain. HR application software is a highlight in this particular format.

System integrationsIf you are open to the provision of engaging and empowering system integrations in an HR model or portal, then the ideal solution is to go for an exclusive and unique operations management platform with high-performance functions. An example is the HR software for small business units.

Productive analytics valuesIf the primary objective of your HR management process is a genuine routine for adopting and developing analytics solutions, it will be a boon to raise your business productivity and operational efficiency. You can use excellent low-cost HR software for this feature assistance.

Automated trainingWhen you have automation and training support to boost your core HR processes, it guarantees various tactics to boost the affordability of the entire operations segment with ease.

The prominent features and functions that add value to your cloud HR software factors under the specific additions in an operations management realm are open to innovative possibilities like customization and personalized upgrades. It helps you connect well with the unique aspects and observations under the core HR management domain with optimum support for operations integration functions.

0 notes