#GSTsoftware

Explore tagged Tumblr posts

Text

🚀 Nammabilling: Smart & Intuitive GST Billing Software 💼📊 Simplify invoicing, manage taxes & boost productivity! 💡 #Nammabilling #GSTSoftware #BillingMadeEasy

#Nammabilling#EffortlessBilling#GSTSolutions#SmartBilling#InvoicingSimplified#TaxCompliance#BusinessTools#BillingMadeEasy#GSTSoftware#ProductivityBoost

0 notes

Text

0 notes

Text

Customization Features in GST E-invoice Software to Suit Different Industries

The way businesses handle their invoicing procedures has been completely transformed in India with the implementation of GST e-invoicing. However, since every industry is different and has various needs, universal solutions frequently don't work. This is where GST e-invoice software that can be customised comes into play, providing capabilities that are specifically designed to meet the needs of different industries. Here are some examples of how various sectors profit from these customisation features.

1. Industry-Specific Templates

The ability to customise GST e-invoice software with industry-specific templates is one of its most notable advantages. For instance, whereas the service industry would be more concerned with service descriptions and SAC codes, the retail sector might need detailed line items with product descriptions and HSN numbers. With customizable templates, companies may create invoices that precisely capture all pertinent data while also satisfying the industry's unique compliance requirements.

2. Multi-Currency and Multi-Language Support

Multi-currency and multi-language support are crucial for sectors involved in international trade, such as export enterprises. Businesses may create invoices that comply with local and international requirements by using customizable GST e-invoice software, which supports several currencies and languages. This function ensures smooth cross-border transactions, which is especially helpful for sectors that deal with international clients.Accurate acquisition of pertinent data is made.

3. Integration with Industry-Specific ERP Systems

Specialized ERP (Enterprise Resource Planning) systems are frequently used by many businesses to manage their operations. These industry-specific ERP systems can be coupled with customizable GST e-invoice software to provide smooth data flow between invoicing and other corporate operations like accounting, procurement, and inventory management. This integration guarantees that all financial data is consistent across platforms, minimises errors, and decreases the need for manual data entry.

4. Custom Reporting and Analytics

Every industry has different reporting requirements, whether it's the retail sector tracking sales by product category or the IT sector keeping an eye on service delivery schedules. Advanced reporting and analytics tools are available in customizable GST e-invoice software, and they can be adjusted to match these particular requirements. Custom reports that offer information about an organization's invoicing procedures can be generated by businesses to assist them optimise their operations and make well-informed decisions.

5. Compliance with Sector-Specific Regulations

Pharmacies and the healthcare sector are two examples of businesses with strict regulations. It is possible to set up customizable GST e-invoice software to guarantee compliance to these industry-specific rules. It may have functions for keeping track of batch numbers, expiration dates, and other crucial data that regulatory agencies demand. This enhances an organisation's billing procedures while verifying compliance.

Ginesys One: Tailored GST E-Invoice Solutions

Ginesys One is a flexible platform for companies looking for a GST e-invoice software solution that can be tailored to the requirements of their sector. With support for industry-specific templates, and smooth ERP connectivity, Ginesys One guarantees that your invoicing procedures are effective, compliant, and customised to meet your particular needs.

0 notes

Text

Transform your billing process with our GST Billing Software! 💻 Designed to automate and simplify, our solution ensures your business stays compliant and efficient under the Goods and Services Tax (GST) system. Whether you’re a small business or a large enterprise, our software adapts to your needs, providing seamless billing and reporting. , 🔍 Explore more about how we can streamline your operations! , 📞 Contact Us Today! , 📲 𝐂𝐚𝐥𝐥 𝐨𝐫 𝐖𝐡𝐚𝐭𝐬𝐀𝐩𝐩: +91 76960 66625 📧 Email: [email protected] 🌐 Website: www.skvaishjeet.in ,

#GSTSoftware#BillingSolutions#BusinessEfficiency#Automation#SoftwareDevelopment#TechForBusiness#GSTReady#GSTBilling#BusinessSoftware#TaxCompliance#Efficiency#billingsolutions#retailsoftware#billingsoftware

0 notes

Text

0 notes

Text

Easy to Generate Bulk E-way Bills

Under the GST era, generation of E-Way bill has been made compulsory which in turn has also become a time-consuming or tedious process.

To simplify the process of generating E-Way Bill, BUSY has introduced Auto Generation of E-Way Bill. With this option, you can automatically create E-Way Bill No. from BUSY at the time of saving the voucher. E-Way Bill No. will be then automatically updated in the corresponding voucher, and you can print the Invoice from there only.

#gst software#accounting software#inventory software#small business accounting services#gst accounting software for retail#billing software#financial planning#gst registration#EwayBill#Business#AccountingSoftware#GSTSoftware#GST

0 notes

Text

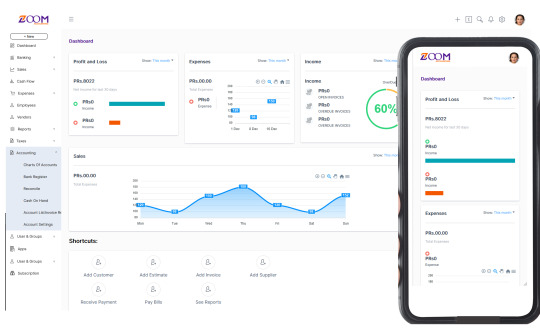

Best Accounting Software for all Businesses

When it comes to managing finances effectively, choosing the best accounting software is crucial for businesses of all sizes. Zoom SaaS Accounting Software stands out as the ideal solution, offering comprehensive features such as streamlined bookkeeping, invoicing, expense tracking, and financial reporting. With user-friendly interfaces, customizable options, and seamless integrations, this Accounting Software empowers businesses to simplify their financial processes, increase efficiency, and make informed decisions for long-term success.

0 notes

Text

GST Billing Software for Everyone

Being successful in today's rapidly shifting business environment necessitates both effectively managing financial transactions and adhering to regulatory requirements. One such regulation that has a significant impact on businesses worldwide is the Goods and Services Tax (GST). The way businesses collect taxes is disrupted by the extensive and evasive tax that is imposed on the inventory of goods and labor. The industry has been transformed by the development of GST billing software, which has simplified the process and made it accessible to all. This article examines the significance and benefits of GST billing software for businesses of all sizes and industries.

Embracing Automation and Accuracy:

With GST billing software, businesses can automate their billing procedures, reducing human error and eliminating the need for manual calculations. These product arrangements simplify complex duty computations by providing an intuitive interface, enabling precise GST invoicing, charge estimation, and documentation. Organizations can set aside time and cash via computerizing dreary errands, permitting them to focus on additional significant assignments and increment by and large proficiency.

Consolidation Made Easy:

For organizations new to the expense framework or little and medium-sized undertakings (SMEs), conforming to GST guidelines can be an overwhelming errand. GST billing software eases the burden of compliance by providing pre-configured tax rates and templates. This ensures accuracy and lowers the risk of non-compliance. Organizations can decrease consistency chances and keep away from likely fines by remaining current with the latest GST alterations because of the joining of assessment rules and updates into these arrangements.

Simple Financial Management:

GST charging software functions as an all-encompassing tool for managing money, offering features like stock management, buy request executives, and financial reporting. Companies can effectively monitor their deals, manage stock, and produce comprehensive financial reports by combining these capabilities into a single platform. This streamlining of financial operations, which not only saves time but also enhances decision-making capabilities, enables businesses to make data-driven decisions for growth and profitability.

Enhanced Customer Experience:

Keeping a positive client experience requires a smooth charging system. With the assistance of GST billing software, businesses can produce professional-looking invoices and automate the delivery of invoices to customers. Subsequently, installments are handled all the more rapidly and there are less possibilities of slip-ups or mistakes. Besides, some item courses of action offer electronic portion sections, allowing clients to make portions accommodatingly, thusly further creating customer unwavering ness and supporting pay.

Scalability and Integration:

Software solutions for GST billing are designed for businesses of all sizes, from small startups to large corporations. Due to these solutions' scalability, businesses can seamlessly accommodate growth and expanding requirements. In addition, a lot of GST billing software solutions can be combined with inventory management software, CRM platforms, accounting software, and other business systems to provide a unified strategy for business operations. Integration eliminates the need for manual data entry across multiple systems in order to ensure data consistency and facilitate efficient cross-functional workflows.

Conclusion:

The development of GST billing software has changed how businesses manage their finances and comply with the GST. Due to their ability to simplify compliance procedures, automate intricate tax calculations, and streamline financial operations, these software solutions have evolved into indispensable tools for businesses of all sizes and in all sectors.

GST billing software for Everyone improves not only accuracy and efficiency but also customer satisfaction and business performance as a whole. As businesses continue to navigate the ever-changing tax landscape, integrating GST billing software has emerged as a solution that is both practical and necessary for everyone.

For any Queries call +91-7302005777 and Book Demo or visit https://unibillapp.com/

#ewaybill#einvoice#invoicesoftware#gstbilling#billingsoftware#gstsoftware#accountingsoftware#inventory management#invoice software#software for GST Billing

0 notes

Text

UniBillApp is Inventory Management that manages sales, purchases, expenses, inventory, and many more. This is one of the very easy-to-use software for online billing and user management, Stock & inventory management, and all business reports. It is a cloud-based software that can be accessed from anywhere and on any device, making it easy for businesses to manage their invoicing and accounting processes.

For More Details:-

Contact us:- +91-7302005777

Visit us:- https://unibillapp.com/

#gstbilling#ewaybill#inventorysoftware#gstsoftware#gst billing software#invoice software#billingsoftware

0 notes

Text

Boost your career with Ascent Software Solutions

Boost your career with Ascent Software Solutions

Tally Essential Course for Students

- Tally Essential Level 1

- Tally Essential Level 2

- Tally Essential Level 3

Course Duration: 30 Hours/Each Level

Batches: Morning & Evening

"Hurry Up!! Join Now, Limited Seats Available"

Join Now:

WhatsApp: https://bit.ly/AscentSoftwareSolutions

Call: 9075056050 / 9822604098

Place:

Ascent Software Solutions

Office No- 103, Kapil Sankalp, next to Perugate Police Station, Sadashiv Peth, Pune, Maharashtra 411030

#AscentSoftwareSolutions

#AdvanceGST #GST #Tally #TallyPrime #accounting #accountant #finance #gstsoftware #gstindia #software #tallysolutions #tallysoftware #gstcompliance #gstfiling #pune

1 note

·

View note

Text

🚀 Nammabilling: Smart & Intuitive GST Billing Software 💼📊 Simplify invoicing, manage taxes & boost productivity! 💡 #Nammabilling #GSTSoftware #BillingMadeEasy

#Nammabilling#SmartBilling#GSTSoftware#InvoicingMadeEasy#BillingSolutions#BusinessTools#TaxManagement#EfficiencyBoost#SoftwareForBusiness#SimplifyBilling

0 notes

Text

Best GST Billing Software In India - Powerful Invoicing .

Bharat Bills is the best GST billing software that provides a user-friendly interface. It allows you to create and print highly customised invoices and send them to your customers with ease.

Contact us at +91 9992 321 321 E-mail [email protected] for more info.: https://bharatbills.com/contact-us/ Or Visit our website https://bharatbills.com/

0 notes

Photo

Having different parties in different cities with different pricing becomes hard to manage. To manage different parties manually can cause huge mistakes, and it’s hard to manage.

Use Our online accounting software that makes it easy for you to manage party-wise detailed reports.

To get a free demo of our accounting software, contact us today at https://bit.ly/3fwzn3H

#accountingsoftware#onlineaccountingsoftware#gstaccountingsoftware#bestaccountingsoftware#freeaccountingsoftware#gstsoftware

2 notes

·

View notes

Link

2 notes

·

View notes

Text

"Transform your accounting experience with TallyPrime! 🚀 Streamline your financial operations and boost productivity like never before."

0 notes

Photo

Hitech Services is a 5 Star Tally Certified Partner in Dehradun. We provide Tally support that include installation, training, migration, customization, integration and also a complete enterprise solution on TallyPrime. For more details, Visit https://www.facebook.com/hitechservicesindia/

#tallyservices#tallycertifiedpartner#tallysoftware#tallysupport#tally#accountingsoftware#gstaccountingsoftware#accounting#tallyprime#gstsoftware#tallyproducts#tallysolutions

1 note

·

View note