#Fracking Chemicals and Fluids Market

Explore tagged Tumblr posts

Text

0 notes

Text

Enhancing Performance: Bromine Derivatives in Flame Retardant Solutions

The global bromine derivatives market was valued at USD 4.00 billion in 2024 and is projected to reach USD 5.65 billion by 2030, expanding at a compound annual growth rate (CAGR) of 6.1% between 2025 and 2030. This growth is being propelled by increasing demand across multiple end-use industries, particularly in flame retardants, pharmaceuticals, water treatment, and oil and gas applications.

As industries place a greater emphasis on safety, efficiency, and environmental standards, bromine derivatives are gaining prominence due to their versatile chemical properties. Flame retardant applications in electronics, automotive, and construction sectors continue to drive significant market demand, with companies striving to meet stringent regulatory compliance for fire safety.

Market Dynamics

Key Drivers

Flame Retardant Demand: Bromine-based flame retardants are widely used to enhance fire resistance in consumer electronics, automobiles, building materials, and electrical components. Their effectiveness in meeting international fire safety regulations makes them a preferred solution in these industries.

Oil & Gas Industry: The adoption of hydraulic fracturing (fracking) and horizontal drilling has expanded, particularly in North America and emerging markets. Bromine derivatives are crucial in drilling fluids and completion fluids, improving operational safety and efficiency in oil and gas exploration.

Pharmaceutical Growth: Bromine derivatives are vital intermediates in the synthesis of active pharmaceutical ingredients (APIs). With the global pharmaceutical sector expanding rapidly, particularly in emerging economies, this is a major growth avenue for bromine chemistry.

Water Treatment: As global concerns about clean water access and environmental sanitation rise, bromine-based compounds are increasingly used in disinfection and microbial control. Their ability to provide efficient water purification solutions supports growth in municipal and industrial water treatment applications.

Market Restraints

Environmental and Health Regulations: Strict regulations regarding the environmental impact of brominated compounds may limit their use in certain regions or require additional compliance costs.

Fluctuating Raw Material Costs: Volatility in raw material availability and pricing may impact production economics and profitability for market players.

Key Market Trends & Insights

Asia Pacific emerged as the largest regional market, capturing a 51.1% share of global revenue in 2024. This dominance is attributed to the rapid growth of the electronics and pharmaceutical sectors, especially in China, India, South Korea, and Japan. The region is also a major hub for automotive manufacturing, further supporting the uptake of bromine-based flame retardants.

North America held a substantial share in 2024, driven by regulatory enforcement of fire safety standards across consumer products, automotive, and construction segments. The region also benefits from significant bromine production and exploration activities.

By Product Type, Tetrabromobisphenol A (TBBPA) dominated the market with the highest revenue share of 26.9% in 2024. TBBPA is extensively used in the manufacture of printed circuit boards (PCBs) and plastic housings for electronic devices due to its superior flame-retardant properties.

By Application, the flame retardants segment led the market with a revenue share of 45.4% in 2024. This segment’s growth is a direct result of regulatory requirements and growing end-user awareness about fire prevention and safety technologies in modern devices and infrastructure.

Order a free sample PDF of the Bromine Derivatives Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

2024 Market Size: USD 00 Billion

2030 Projected Market Size: USD 65 Billion

CAGR (2025-2030): 1%

Asia Pacific: Largest market in 2024

Key Companies & Market Share Insights

Several leading players are contributing to market advancement through strategic innovation, sustainability-focused R&D, and global expansion:

Albemarle Corporation

A global leader in specialty chemicals, Albemarle offers a diverse portfolio of bromine derivatives used across pharmaceuticals, agriculture, oil & gas, and water treatment. Its flame retardants and brine fluid solutions are known for their performance reliability and are designed to meet stringent safety standards.

Tosoh Corporation

Tosoh is a key player in the production of bromine and its derivatives, catering to agrochemical, flame retardant, and pharmaceutical markets. The company’s strength lies in its focus on high-purity formulations and innovative solutions, particularly for regulated and high-performance applications.

Tata Chemicals Ltd.

Tata Chemicals plays a significant role in the bromine derivatives landscape through its chemicals division, with a focus on producing eco-efficient products that align with global sustainability goals.

Lanxess Corporation

Lanxess is known for its sustainable bromine chemistry, offering advanced materials for electronic components, insulation systems, and fire-retardant applications.

Honeywell International Inc.

A diversified conglomerate, Honeywell manufactures bromine compounds integrated into performance materials, electronics, and safety systems, emphasizing green chemistry and global compliance.

These companies are increasingly forming strategic alliances, regional expansions, and sustainability initiatives to maintain a competitive edge in a highly regulated and rapidly evolving market.

Key Players

Albemarle Corporation

Tata Chemicals Ltd.

Lanxess Corporation

Honeywell International Inc.

Tosoh Corporation

Israel Chemicals Limited

Tetra Technologies Inc.

Hindustan Salts Ltd.

Jordan Bromine Company Ltd.

Morre-Tec Industries, Inc.

Beacon Organosys

Browse Horizon Databook on Global Bromine Derivatives Market Size & Outlook

Conclusion

The bromine derivatives market is poised for robust growth through 2030, underpinned by strong demand from the flame retardant, pharmaceutical, oil & gas, and water treatment industries. As regulations tighten and the need for advanced safety and environmental standards rises, bromine derivatives will continue to play a critical role in enabling sustainable industrial progress. With major players focusing on R&D, strategic collaborations, and eco-friendly product development, the market presents ample opportunities for innovation, investment, and global expansion.

0 notes

Text

0 notes

Text

Industrial Salt Market Drivers Include Chemical Industry Expansion and Emerging Market Growth Across Key Regions

Industrial salt, a fundamental commodity used across a range of industries, continues to see steady global demand growth. Its applications span sectors like chemical manufacturing, water treatment, oil and gas drilling, textiles, pharmaceuticals, and de-icing. The industrial salt market is driven by a confluence of macroeconomic trends, technological advancements, environmental shifts, and regional industrial growth.

1. Expanding Chemical Industry

The chemical industry remains the largest consumer of industrial salt, accounting for nearly half of its total global consumption. Industrial salt is a crucial raw material in the chlor-alkali process, producing essential chemicals like chlorine, caustic soda, and soda ash. These chemicals are in turn used in the manufacture of PVC, paper, detergents, glass, and other industrial goods.

With the chemical industry expanding in countries like China, India, and Brazil, the demand for industrial salt has seen a parallel rise. Government investments, increased exports, and favorable trade policies further enhance this growth, making the chemical sector a dominant force in the industrial salt market.

2. Increasing Demand for Water Treatment Solutions

Water scarcity and rising pollution levels have intensified the demand for water treatment systems worldwide. Industrial salt plays an essential role in water softening and purification, helping remove impurities and hardness in both industrial and municipal settings. The growing need for clean water, coupled with stricter regulations around wastewater discharge, is fueling demand for salt in the water treatment sector.

Emerging economies are also increasing their infrastructure investments in water treatment plants, further strengthening this demand.

3. Seasonal Surge from De-Icing Applications

In colder climates, particularly across North America and Europe, industrial salt is extensively used for de-icing roads and highways. Rock salt is spread on icy surfaces to prevent accidents, making it a vital component of winter maintenance programs. With the increase in unpredictable winter storms and colder weather due to climate change, de-icing applications have become more critical than ever.

As municipalities and governments expand their road safety budgets, the seasonal demand for industrial salt continues to rise sharply in Q4 and Q1 of every year.

4. Growth in Oil & Gas Drilling Activities

Industrial salt is used in drilling fluids to stabilize wellbores and enhance the density of drilling muds in oil and gas operations. With global energy demand increasing and oil exploration intensifying in regions like the Middle East, North America, and parts of Africa, industrial salt consumption is rising in tandem.

Additionally, the shift toward unconventional drilling techniques such as hydraulic fracturing (fracking) has also boosted salt usage, as it supports well integrity and efficiency during the process.

5. Rapid Industrialization in Emerging Economies

Industrial growth in emerging markets is one of the most powerful drivers of industrial salt consumption. As countries industrialize, they require large quantities of salt for sectors like textiles, food processing, leather tanning, and metal refining.

Nations such as India, Indonesia, and Vietnam are witnessing infrastructure booms and urban expansion, which leads to increased salt demand across diverse industries. Coupled with rising exports and domestic consumption, these economies are becoming major contributors to global industrial salt usage.

6. Technological Advancements in Salt Extraction

The salt industry has seen notable improvements in mining and evaporation technologies. Advanced techniques have made salt extraction more efficient, reducing operational costs and increasing supply to meet the growing demand.

Solar evaporation, vacuum evaporation, and mechanical harvesting of salt from brine pools are now more widely adopted. These technological upgrades allow for consistent production and improved product quality, further driving market growth.

0 notes

Text

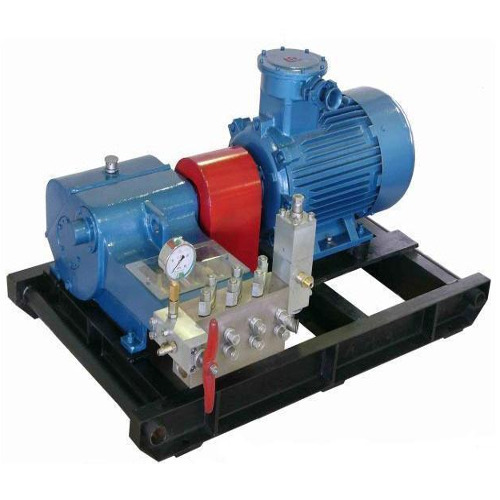

Reciprocating Pump Market Growth Driven by Expanding Industrial Applications and Rising Energy Efficiency Demands

Introduction

The reciprocating pump market has witnessed significant growth over the past decade, driven by increasing demand from industries such as oil and gas, water treatment, chemical processing, and manufacturing. These pumps, known for their ability to handle high-pressure applications with precision, are widely used for fluid transfer and metering purposes. As industries continue to seek efficient and reliable pumping solutions, the reciprocating pump market is poised for steady expansion in the coming years.

What is a Reciprocating Pump?

A reciprocating pump is a type of positive displacement pump that uses a piston, plunger, or diaphragm to create a back-and-forth (reciprocating) motion, resulting in fluid displacement. The pump's working mechanism allows it to deliver a consistent flow rate, making it highly effective for applications requiring precision and control. Reciprocating pumps are commonly used in situations where the fluid viscosity, pressure, or flow rate needs to be maintained with accuracy.

Market Size and Growth Trends

The global reciprocating pump market was valued at approximately $7.5 billion in 2024 and is expected to grow at a compound annual growth rate (CAGR) of around 5-7% over the next five years. This growth is primarily fueled by rising industrialization, increasing energy demand, and the expansion of water treatment and desalination plants worldwide.

The oil and gas sector continues to be a dominant end-user of reciprocating pumps, particularly for applications such as crude oil transportation, enhanced oil recovery (EOR), and hydraulic fracturing. Meanwhile, the pharmaceutical and chemical industries are also contributing to market growth due to the need for precise fluid handling and metering in production processes.

Key Market Drivers

Increasing Demand from Oil and Gas Industry

The oil and gas sector remains a primary driver of the reciprocating pump market. With the resurgence of exploration activities, the need for high-pressure pumps capable of handling crude oil, natural gas, and other hydrocarbons is growing.

The use of reciprocating pumps in hydraulic fracturing (fracking) and well stimulation has surged, particularly in regions such as North America and the Middle East.

Growing Water Treatment and Desalination Projects

The expanding global population and water scarcity issues have led to increased investments in water treatment and desalination plants.

Reciprocating pumps play a critical role in these facilities by ensuring high-pressure fluid transfer, particularly in reverse osmosis systems.

Rising Industrial Automation

The trend toward industrial automation is driving demand for precision pumps with advanced monitoring and control features.

Modern reciprocating pumps equipped with IoT-enabled sensors offer real-time performance data, enabling predictive maintenance and improving operational efficiency.

Technological Advancements

Advancements in pump materials and designs, including the use of corrosion-resistant alloys and enhanced sealing technologies, are boosting the durability and performance of reciprocating pumps.

Smart pump systems with remote monitoring capabilities are becoming increasingly popular, particularly in large-scale industrial applications.

Challenges in the Market

Despite the promising growth, the reciprocating pump market faces several challenges:

High Maintenance Costs: Reciprocating pumps are prone to wear and tear due to their moving parts, resulting in higher maintenance costs. This can deter small and medium-sized enterprises (SMEs) from investing in these pumps.

Energy Consumption: Although efficient, reciprocating pumps consume considerable energy, particularly in high-pressure applications. Energy efficiency regulations could pose challenges for manufacturers.

Competition from Alternative Pump Technologies: Centrifugal pumps and other advanced pumping technologies are becoming more efficient and cost-effective, posing a potential threat to reciprocating pump market share.

Regional Analysis

North America

North America is one of the leading markets for reciprocating pumps, largely driven by the extensive oil and gas operations in the United States and Canada.

The increasing number of shale gas projects and hydraulic fracturing activities is driving the demand for high-pressure pumps.

Europe

The European market is characterized by its focus on industrial automation and sustainability initiatives.

Countries like Germany, the UK, and France are investing heavily in wastewater treatment plants, boosting demand for reciprocating pumps in the region.

Asia-Pacific

The Asia-Pacific region is experiencing rapid industrialization and urbanization, resulting in increased demand for reciprocating pumps in water treatment, chemical processing, and power generation sectors.

China and India are leading markets due to their expanding manufacturing and infrastructure sectors.

Middle East and Africa

The Middle East, with its strong oil and gas sector, continues to be a major market for reciprocating pumps.

Investments in desalination projects, particularly in Saudi Arabia and the UAE, are further driving market growth.

Market Segmentation

The reciprocating pump market can be segmented based on the following criteria:

Type:

Piston pumps

Plunger pumps

Diaphragm pumps

End-User Industry:

Oil and Gas

Water Treatment

Chemical Processing

Pharmaceuticals

Power Generation

Application:

High-pressure cleaning

Fluid metering

Chemical injection

Desalination

Future Outlook

The reciprocating pump market is expected to continue its growth trajectory, driven by ongoing industrialization, infrastructure development, and the increasing need for reliable pumping solutions. Manufacturers are likely to focus on energy-efficient designs and smart pump systems to meet evolving industry demands.

The integration of predictive maintenance features and the use of eco-friendly materials will also become key differentiators. Furthermore, the demand for custom-engineered pumps tailored to specific applications is expected to rise, particularly in specialized sectors such as pharmaceuticals and food processing.

Conclusion

The reciprocating pump market is set for steady growth, fueled by its extensive application across various industries. While challenges such as high maintenance costs and competition from alternative technologies persist, ongoing technological advancements and the rising demand for efficient fluid transfer solutions will continue to drive market expansion. As industries increasingly embrace automation and energy efficiency, the reciprocating pump sector is expected to witness continuous innovation and evolution.

0 notes

Text

0 notes

Text

Indonesia, Nigeria, and Argentina are the new opportunity grounds for Fluid Loss Reducer Chemicals market players

According to a recent research, Industry revenue for Fluid Loss Reducer Chemicals is expected to rise to $1091.6 million by 2035 from $631.6 million of 2024. U.S., China and Germany are the top 3 markets and combinely holds substantial demand share. The revenue growth of market players in these countries is expected to range between 3.3% and 4.9% annually for period 2025 to 2035.

Industry transition including technological advancements in fluid loss reducer chemicals and regulatory push transforming production processes, are transforming the supply chain of Fluid Loss Reducer Chemicals market. In times there have been notable advancements in the technology surrounding the creation and utilization of chemicals that reduce fluid loss in various applications. These innovations have paved the way for the creation of eco friendly and efficient chemical products that enhance the efficacy of drilling fluids. One notable development is the integration of nanotechnology which has significantly improved our ability to regulate loss effectively – thus bringing about significant changes, within the drilling sector. Furthermore these advancements have also enabled the customization of loss reducer chemicals to meet specific industry requirements and operational obstacles expanding their use in different related industries.

Check detailed report here - https://datastringconsulting.com/industry-analysis/fluid-loss-reducer-chemicals-market-research-report

Research Study addresses the market dynamics including opportunities, competition analysis, industry insights for Product Type (Synthetic, Natural, Enhanced Oil Recovery), Application (Drillings, Cementing, Reservoirs, Fracking, Others) and Technology (Water Based Systems, Oil Based Systems, Synthetic Based Systems).

Industry Leadership and Strategies

Companies such as Schlumberger Limited, Halliburton Company, BASF SE, Nouryon, Kemira Oyj, Dow Inc., Solvay S.A, W.R. Grace & Co., Arkema Group, Clariant AG, Air Products and Chemicals Inc. and and Ashland Global Holdings Inc. are well placed in the market.

Evolving & Shifting Regional Markets

North America and Europe are the two most active and leading regions in the market. With different regional dynamics and industry challenges like high production costs and regulatory and environmental constraints; market supply chain from raw material procurement to distribution & end use is expected to evolve & expand further, especially within emerging markets

The market in emerging countries is expected to expand substantially between 2025 and 2030, supported by market drivers such as expanding drilling activities, innovations in fluid loss reducer chemistry, and environmental regulations.

About DataString Consulting

DataString Consulting assist companies in strategy formulations & roadmap creation including TAM expansion, revenue diversification strategies and venturing into new markets; by offering in depth insights into developing trends and competitor landscapes as well as customer demographics. Our customized & direct strategies, filters industry noises into new opportunities; and reduces the effective connect time between products and its market niche.

DataString Consulting offers complete range of market research and business intelligence solutions for both B2C and B2B markets all under one roof. DataString’s leadership team has more than 30 years of combined experience in Market & business research and strategy advisory across the world. Our Industry experts and data aggregators continuously track & monitor high growth segments within more than 15 industries and 60 sub-industries.

0 notes

Text

0 notes

Text

Shale Gas Market Set for Robust Growth as Global Energy Demand Increases

The global Shale Gas Market is projected to witness significant growth over the coming decade, driven by increasing energy demands, advancements in extraction technologies, and the global shift toward cleaner energy sources. Shale gas, a natural gas found trapped within shale formations, has become a key contributor to the world’s energy mix, particularly in regions like North America. With technological innovations such as hydraulic fracturing (fracking) and horizontal drilling, shale gas extraction has become more economically viable, driving substantial growth in the market.

The Shale Gas Market size is valued at USD 57.4 billion in 2023. It is estimated to be USD 96.98 billion by 2032 and is likely to expand CAGR of 6.0% over the forecast period 2024–2032.

Download Sample Pages: https://www.snsinsider.com/sample-request/2709

Key Market Drivers

Rising Global Energy Demand: With global energy consumption on the rise due to population growth and industrialization, shale gas has emerged as an important resource to meet energy demands, particularly in electricity generation and industrial applications.

Advancements in Extraction Technology: Technological innovations such as hydraulic fracturing and horizontal drilling have greatly improved the efficiency and economic feasibility of shale gas extraction. These advancements have unlocked vast reserves that were previously inaccessible, driving growth in shale gas production.

Environmental Concerns and Shift to Cleaner Energy: As governments and industries seek to reduce their carbon footprints and move away from coal, shale gas is seen as a cleaner alternative due to its lower greenhouse gas emissions compared to traditional fossil fuels. This shift is accelerating the adoption of shale gas in energy production.

Energy Security: Countries with significant shale gas reserves, such as the United States and Canada, are increasingly focused on energy security and self-sufficiency. Shale gas plays a pivotal role in reducing reliance on foreign oil and natural gas imports, bolstering national energy independence.

Government Policies and Incentives: Supportive government policies, including tax incentives and subsidies for shale gas exploration and production, are fueling growth in the market. Additionally, countries are implementing regulatory frameworks to ensure safe and responsible extraction of shale gas.

Market Segmentation

The shale gas market can be segmented by technology, application, and region.

By Technology

Hydraulic Fracturing: Also known as fracking, this is the most widely used technology for shale gas extraction. It involves injecting high-pressure fluid into shale formations to create fractures, allowing trapped gas to flow to the surface. Hydraulic fracturing has been a game-changer for shale gas production, making it commercially viable on a large scale.

Horizontal Drilling: Horizontal drilling involves drilling wells horizontally within shale formations to access more of the gas-bearing rock. This method, combined with hydraulic fracturing, has significantly increased the efficiency of shale gas extraction.

3D Seismic Technology: This technology is used to create detailed images of underground rock formations, allowing for precise identification of shale gas reserves. 3D seismic technology helps optimize drilling and minimize environmental impact.

By Application

Power Generation: Shale gas is increasingly being used as a fuel for power plants due to its abundance, lower emissions compared to coal, and relatively stable prices. Natural gas-fired power plants are being constructed in many regions, particularly in the United States, where shale gas is readily available.

Industrial Use: The industrial sector uses shale gas for various processes, including heating, chemicals production, and fertilizer manufacturing. The availability of shale gas is driving growth in industries that rely on natural gas as a feedstock or energy source.

Residential and Commercial Heating: Shale gas is also used for heating in residential and commercial buildings, particularly in colder climates where natural gas is a primary heating source.

Transportation: Shale gas is beginning to make its way into the transportation sector, particularly in the form of compressed natural gas (CNG) and liquefied natural gas (LNG) for use in vehicles and ships. This is expected to increase as more countries adopt cleaner transportation fuels.

Buy Now: https://www.snsinsider.com/checkout/2709

Regional Insights

North America: The North American shale gas market, particularly in the United States, is the most developed in the world. The U.S. is the largest producer of shale gas, with major reserves in the Marcellus, Barnett, Haynesville, and Eagle Ford shale plays. Advances in hydraulic fracturing and horizontal drilling have made shale gas a key contributor to the U.S.’s energy independence. Canada also has significant shale reserves, particularly in the Montney and Horn River formations.

Asia-Pacific: The Asia-Pacific region is witnessing growing interest in shale gas, particularly in China, which has one of the largest shale gas reserves in the world. The Chinese government is investing heavily in shale gas exploration to reduce its dependence on coal and address air quality issues. India is also exploring its shale gas potential to meet rising energy demands.

Europe: The European shale gas market is in its nascent stage, with countries like Poland and the United Kingdom exploring the potential of shale gas reserves. However, environmental concerns and stringent regulations have slowed the development of the shale gas industry in Europe.

Latin America: Countries like Argentina and Brazil are emerging as key players in the Latin American shale gas market. Argentina’s Vaca Muerta formation is one of the largest shale gas reserves in the world, and the country is investing heavily in its development to boost domestic energy production.

Middle East & Africa: While the Middle East is traditionally known for its conventional oil and gas reserves, there is growing interest in the region’s potential for shale gas production. South Africa is also exploring its shale gas reserves to diversify its energy mix.

Current Market Trends

Global Investments in Shale Gas: Countries around the world are increasing investments in shale gas exploration and production as part of their long-term energy strategies. This trend is particularly strong in countries with large shale reserves, such as China, Argentina, and Canada.

Rising Use of Shale Gas in Power Generation: The growing adoption of shale gas for electricity generation is a major trend in the market. Natural gas power plants are more flexible and emit fewer pollutants than coal-fired plants, making shale gas an attractive option for meeting energy demands.

Environmental Concerns and Regulation: While shale gas offers a cleaner alternative to coal, its extraction process — particularly hydraulic fracturing — has raised environmental concerns, including water contamination and seismic activity. Regulatory frameworks are being strengthened in many regions to address these concerns and ensure responsible extraction practices.

Key Players

The major players are Royal Dutch Shell PLC, ConocoPhillips, PetroChina Company Limited, Exxon Mobil Corporation, Chevron Corporation, Chesapeake Energy Corporation, and other players

About Us: SNS Insider is a global leader in market research and consulting, shaping the future of the industry. Our mission is to empower clients with the insights they need to thrive in dynamic environments. Utilizing advanced methodologies such as surveys, video interviews, and focus groups, we provide up-to-date, accurate market intelligence and consumer insights, ensuring you make confident, informed decisions.

Contact Us: Akash Anand — Head of Business Development & Strategy [email protected] Phone: +1–415–230–0044 (US)

1 note

·

View note

Text

Revolutionizing Oil Production: How Modern Technologies Maximize Well Efficiency

In today's competitive energy market, oil producers are under increasing pressure to maximize output while minimizing operational costs. With technological advancements reshaping the landscape, modern drilling and extraction methods have revolutionized oil well efficiency. These innovations not only extend the productive lifespan of wells but also ensure more sustainable and cost-effective operations. This article explores the cutting-edge techniques employed to boost oil well efficiency and drive greater profitability in the energy sector.

Horizontal Drilling: Accessing Hard-to-Reach Reserves

Traditional vertical drilling limits access to certain oil reservoirs, especially those trapped in thin or unconventional layers. Horizontal drilling, however, allows the drill to curve and move horizontally through the oil-rich layer, exposing more surface area to extraction. This technique enables operators to reach reserves that would otherwise remain untapped, significantly increasing production. Horizontal drilling is especially effective in shale formations, where hydrocarbons are dispersed across broad, thin strata.

By drilling multiple horizontal wells from a single platform, companies can also reduce their operations' environmental footprint and optimize production from a limited land area.

Hydraulic Fracturing: Unlocking Unconventional Reservoirs

Hydraulic fracturing, or "fracking," involves injecting high-pressure fluid into rock formations to create fractures. These fractures release trapped oil and gas, making extraction more accessible and more efficient. Fracking has been instrumental in unlocking unconventional reservoirs, including shale and tight sands, where oil would otherwise be inaccessible using traditional methods.

Technological advancements in fracking fluids and proppants (particles used to keep fractures open) have improved efficiency and reduced water consumption, making the process more sustainable. Fracking has also allowed producers to revive old wells by stimulating reservoirs, bringing new life to previously declining operations.

Enhanced Oil Recovery (EOR): Extending Well Lifespans

Enhanced Oil Recovery (EOR) refers to techniques that increase the amount of oil extracted from a reservoir beyond what is achievable through primary and secondary recovery methods. There are three main types of EOR:

Thermal Injection: This involves heating the reservoir, usually with steam, to reduce oil viscosity and improve flow.

Gas Injection: Gases such as carbon dioxide or nitrogen are used to increase reservoir pressure and push more oil to the surface.

Chemical Injection: Injects polymers or surfactants into the reservoir to reduce surface tension and enhance flow.

These methods allow operators to recover up to 60% of the reservoir's total oil, compared to 20–30% through traditional extraction techniques. EOR plays a critical role in extending the productive life of wells and maximizing their yield.

Real-Time Monitoring and Data Analytics

The integration of data analytics and real-time monitoring has become a game-changer in oil well management. Sensors placed throughout wells and pipelines collect data on pressure, temperature, and flow rates. This data is then analyzed using machine learning algorithms to predict equipment failures, optimize production schedules, and detect inefficiencies.

Smart oilfields powered by the Internet of Things (IoT) enable remote monitoring and control, reducing the need for on-site personnel. By identifying potential issues early, operators can perform predictive maintenance, minimizing downtime and enhancing overall efficiency.

Drill Automation and Robotics

Automation has entered the oil and gas sector, with robotic drilling systems improving precision and safety. Automated rigs can operate continuously with minimal human intervention, leading to faster drilling and fewer delays. Additionally, robotic systems handle repetitive tasks, reducing the risk of injury to workers and improving overall operational efficiency.

Companies are also exploring the use of artificial intelligence (AI) to optimize drilling operations, guiding the drill bit in real time to avoid obstacles and maximize reservoir contact. Automation reduces costs by lowering labor requirements and minimizing errors, making it a valuable tool in the quest for more efficient oil production.

Multiphase Pumping: Improving Fluid Handling

In traditional wells, oil, gas, and water are typically separated at the wellhead, requiring different pipelines and processing systems. Multiphase pumping technology simplifies this process by allowing the simultaneous transport of oil, gas, and water through a single pipeline.

This innovation minimizes equipment needs, reduces energy consumption, and lowers operational costs. Multiphase pumps are also used in offshore platforms, where space constraints make traditional separation systems impractical. By streamlining fluid handling, these pumps enhance efficiency and reduce environmental impact.

Sustainability Through Energy Efficiency

Modern oil extraction techniques are increasingly focused on sustainability and minimizing environmental impact. Companies are adopting energy-efficient equipment and practices to lower emissions and reduce waste. For instance, many operators now recycle produced water from wells, cutting freshwater usage.

Additionally, the use of renewable energy sources, such as solar or wind, to power remote facilities is gaining popularity. Combining sustainable practices with advanced extraction techniques ensures that oil production remains viable while meeting environmental standards.

A New Era in Oil Production

The energy sector is undergoing a profound transformation, with modern techniques pushing the boundaries of oil well efficiency. Horizontal drilling, hydraulic fracturing, and Enhanced Oil Recovery unlock more oil from reservoirs while automation, real-time data, and advanced pumping technologies streamline operations. As the industry embraces these innovations, oil companies are better positioned to meet growing energy demands while ensuring cost-effectiveness and sustainability. The future of oil production lies in continuously refining these technologies to maximize output and minimize environmental impact, ushering in a new era of more intelligent and more responsible oil extraction.

0 notes

Text

Fracking Chemicals Market Analysis Report: Size, Share, and Trends Forecast for the Next Period

Global Fracking Chemicals Market Industry ,Trends & Analysis

The Fracking Chemicals Market research report offers an in-depth analysis of market dynamics, competitive landscapes, and regional growth patterns. This comprehensive report provides businesses with the strategic insights necessary to identify growth opportunities, manage risks, and develop effective competitive strategies in an ever-evolving market.

According to Straits Research, the global Fracking Chemicals Market market size was valued at USD XX Billion in 2023. It is projected to reach from USD XX Billion in 2024 to USD XX Billion by 2032, growing at a CAGR of 6.32% during the forecast period (2024–2032).

Request a Sample Report Today @ https://straitsresearch.com/report/fracking-chemicals-market/request-sample

Global Fracking Chemicals Market Segmental Analysis

As a result of the Fracking Chemicals market segmentation, the market is divided into sub-segments based on product type, application, as well as regional and country-level forecasts.

By Function

Gelling Agent

Friction Reducer

Corrosion Inhibitor

Biocide

Surfactant

Scale Inhibitor

Others

By Fluid Type

Water-Based fluid

Oil-Based fluid

Foam-Based fluid

You can check In-depth Segmentation from here @ https://straitsresearch.com/report/fracking-chemicals-market/toc

Why Invest in this Report?

Leverage Data for Strategic Decision-Making: Utilize detailed market data to make informed business decisions and uncover new opportunities for growth and innovation.

Craft Expansion Strategies for Diverse Markets: Develop effective expansion strategies tailored to various market segments, ensuring comprehensive coverage and targeted growth.

Conduct Comprehensive Competitor Analysis: Perform in-depth analyses of competitors to understand their market positioning, strategies, and operational strengths and weaknesses.

Gain Insight into Competitors' Financial Metrics: Acquire detailed insights into competitors' financial performance, including sales, revenue, and profitability metrics.

Benchmark Against Key Competitors: Use benchmarking to compare your business's performance against leading competitors, identifying areas for improvement and potential competitive advantages.

Formulate Region-Specific Growth Strategies: Develop geographically tailored strategies to capitalize on local market conditions and consumer preferences, driving targeted business growth in key regions.

List of Top Leading Players of the Fracking Chemicals Market -

AkzoNobel N.V.,

Ashland Inc.,

Baker Hughes Incorporated,

BASF SE,

Chevron Phillips Chemical Company,

Calfrac Well Services Ltd.,

EOG Resources Inc.,

Halliburton,

Schlumberger Limited,

Clariant International AG,

Dow DuPont Inc.,

Albemarle Corporation

many more.

Reasons to Purchase This Report:

Access to Comprehensive Information: Gain access to an extensive collection of analysis, research, and data that would be challenging to acquire independently. This report offers valuable insights, saving you considerable time and effort.

Enhanced Decision-Making: Equip yourself with detailed insights into market trends, consumer behavior, and key industry factors. This report provides essential information for strategic planning, including decisions on investments, product development, and marketing strategies.

Achieving Competitive Advantage: Stay ahead in your industry by understanding market dynamics and competitor strategies. This report delivers deep insights into competitor performance and market trends, enabling you to craft effective business strategies and maintain a competitive edge.

Credibility and Reliability: Trust in the expertise of industry professionals and the accuracy of thoroughly researched data. Authored by experts and grounded in rigorous research and analysis, this report enhances credibility and reliability.

Cost-Effective Research: Reduce research expenses by investing in this comprehensive report instead of conducting independent research. It provides a cost-effective means of accessing detailed analysis and insights on a specific topic without requiring extensive resources.

Regional Analysis Fracking Chemicals Market

The regional analysis section of the report offers a thorough examination of the global Fracking Chemicals market, detailing the sales growth of various regional and country-level markets. It includes precise volume analysis by country and market size analysis by region for both past and future periods. The report provides an in-depth evaluation of the growth trends and other factors impacting the Fracking Chemicals market in key countries, such as the United States, Canada, Mexico, Germany, France, the United Kingdom, Russia, Italy, China, Japan, Korea, India, Southeast Asia, Australia, Brazil, and Saudi Arabia. Moreover, it explores the progress of significant regional markets, including North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

To Understand How Covid-19 Impact Is Covered in This Report @ https://straitsresearch.com/buy-now/fracking-chemicals-market

About Straits Research

Straits Research is dedicated to providing businesses with the highest quality market research services. With a team of experienced researchers and analysts, we strive to deliver insightful and actionable data that helps our clients make informed decisions about their industry and market. Our customized approach allows us to tailor our research to each client's specific needs and goals, ensuring that they receive the most relevant and valuable insights.

Contact Us

Email: [email protected]

Address: 825 3rd Avenue, New York, NY, USA, 10022

Tel: UK: +44 203 695 0070, USA: +1 646 905 0080

#Fracking Chemicals Market#Fracking Chemicals Market Share#Fracking Chemicals Market Size#Fracking Chemicals Market Research#Fracking Chemicals Industry#What is Fracking Chemicals?

0 notes

Text

0 notes

Text

From Drilling to Production: The Role of Oil Field Chemicals

The global oil field chemicals market is projected to experience stable growth over the next several years, driven by rising demand for oil and gas production efficiency and environmental sustainability. According to the report, the market is expected to grow at a compound annual growth rate (CAGR) of nearly 4% over the forecast period of 2022-2028. The market was valued at approximately USD 25 billion in 2022 and is projected to reach over USD 30 billion by 2028.

What Are Oil Field Chemicals?

Oil field chemicals are specialized chemicals used during various stages of oil exploration, drilling, extraction, and production. These chemicals are vital for improving operational efficiency, enhancing oil recovery, reducing water contamination, and minimizing the environmental impact of oil field operations. Key products include corrosion inhibitors, demulsifiers, gelling agents, biocides, and lubricants.

Get Sample pages of Report: https://www.infiniumglobalresearch.com/reports/sample-request/1554

Market Dynamics and Growth Drivers

Several factors are contributing to the steady growth of the global oil field chemicals market:

Increased Oil and Gas Exploration: With the rising global demand for energy, oil companies are investing in new oil and gas exploration projects. The expansion of exploration activities, especially in offshore and deepwater fields, is driving the demand for oil field chemicals that enhance production efficiency.

Focus on Enhanced Oil Recovery (EOR): As mature oil fields require more advanced techniques to extract remaining resources, the use of oil field chemicals has become essential in enhanced oil recovery processes. Chemicals such as surfactants and polymers help increase the amount of oil that can be extracted from reservoirs.

Environmental Regulations: Stricter environmental regulations are prompting oil companies to adopt eco-friendly oil field chemicals. Biodegradable and non-toxic chemicals are gaining popularity as companies aim to reduce their environmental footprint and comply with regulations.

Technological Advancements: Ongoing innovation in chemical formulations and technologies is enhancing the performance of oil field chemicals. Advanced chemicals are helping to optimize oil production, prevent equipment corrosion, and improve drilling fluid stability.

Rising Focus on Unconventional Resources: The exploration of unconventional oil and gas resources, such as shale and tight oil, is boosting the demand for oil field chemicals. Hydraulic fracturing (fracking) and horizontal drilling require specific chemicals to ensure efficient and safe operations.

Regional Analysis

North America: North America, particularly the United States, is a key market for oil field chemicals. The region's thriving shale gas industry, coupled with significant offshore drilling activities, is driving demand for chemicals used in hydraulic fracturing and enhanced oil recovery.

Middle East & Africa: The Middle East remains a dominant player in global oil production, and the demand for oil field chemicals is strong in the region. Countries such as Saudi Arabia and the UAE are major users of chemicals to maintain production efficiency in their vast oil fields.

Asia-Pacific: Rapid industrialization and rising energy demand in countries like China and India are driving the growth of the oil field chemicals market in the Asia-Pacific region. Exploration activities in Southeast Asia are also contributing to the market's expansion.

Europe: Europe's oil field chemicals market is relatively stable, with countries like Norway and the UK playing a key role due to their North Sea oil operations. Environmental regulations in the region are influencing the demand for eco-friendly oil field chemicals.

Competitive Landscape

The global oil field chemicals market is highly competitive, with several key players operating in the space. Leading companies include:

BASF SE: A global leader in chemicals, BASF offers a range of solutions for the oil field industry, including drilling fluids, cementing additives, and enhanced oil recovery chemicals.

Schlumberger Limited: One of the largest oilfield services companies, Schlumberger provides a wide array of chemical solutions aimed at improving drilling efficiency and well productivity.

Halliburton Company: Halliburton is a major player in oil field chemicals, offering drilling fluids, cement additives, and production enhancement chemicals.

Baker Hughes Company: Known for its innovation, Baker Hughes provides advanced chemical solutions for both conventional and unconventional oil and gas operations.

Clariant AG: Clariant is a leading provider of specialty chemicals used in oil production, including demulsifiers, corrosion inhibitors, and biocides.

Report Overview : https://www.infiniumglobalresearch.com/reports/global-oil-field-chemicals-market

Challenges and Opportunities

The oil field chemicals market faces several challenges, including fluctuating oil prices, geopolitical uncertainties, and growing environmental concerns. However, these challenges also present opportunities for innovation, particularly in the development of environmentally friendly and cost-effective chemical solutions.

Sustainability Initiatives: As oil companies aim to reduce their environmental impact, there is an increasing demand for sustainable oil field chemicals. Companies that invest in the development of biodegradable and non-toxic chemicals are likely to benefit from this trend.

Technological Advancements: The integration of digital technologies and data analytics in oil field operations is creating opportunities for the development of smart chemicals that can optimize production processes and reduce operational costs.

Conclusion

The global oil field chemicals market is poised for steady growth, supported by increasing exploration activities, advancements in enhanced oil recovery techniques, and a rising focus on environmental sustainability. With a projected market value exceeding USD 30 billion by 2028, the industry offers significant opportunities for innovation and investment. As the demand for efficient and eco-friendly oil production processes grows, oil field chemicals will continue to play a crucial role in the energy sector.

0 notes

Text

According to a latest research, the global hydraulic fracturing market is projected to reach USD 74.4 billion by 2028 from an estimated USD 52.1 billion in 2023, at a CAGR of 7.4% during the forecast period. Hydraulic fracturing, also known as fracking, is one of the most efficient techniques used to recover unconventional oil and gas resources. It is an underground petroleum extraction process in which water, sand, and chemicals are injected under high pressure into a bedrock formation through the well. The injection pressure of the pumped fluid creates fractures that cause gas and fluid flow, and the sand or other coarse materials help in holding the fractures. The increasing supply-demand gap for primary energy sources is one of the leading factors driving the growth of the hydraulic fracturing market, as the demand for oil and gas is constantly growing, and the production capacities of the related reserves are limited. The capability of foams to provide waterless fracking presents promising opportunities for the hydraulic fracturing market. However, the risks associated with growing concerns regarding seismic activities due to hydraulic fracturing has hindered the growth of the market in recent years and is expected to restrain the market's growth during the forecast period.

0 notes

Text

0 notes

Text

0 notes