#Forex Trading and Technical Analysis

Explore tagged Tumblr posts

Text

Success and Failure in Forex Trading

Forex trading, or foreign exchange trading, is a challenging yet potentially rewarding endeavor. Traders enter the market with hopes of achieving financial success, but the path is often fraught with both triumphs and setbacks. Understanding the factors that contribute to success and failure in forex trading is crucial for any trader aiming to navigate this volatile market…

#Forex#Forex Market#Forex Traders#Forex Trading#Leverage#Market Trends#Overtrading#Profitability#Risk Management#Stop-Loss#Technical Analysis#Trading Decisions#Trading Plan#Trading Strategies

3 notes

·

View notes

Text

Effortless Efficiency: Automate Your Forex Trades with the Panel

In the dynamic world of forex trading, efficiency is paramount. Traders are constantly seeking ways to streamline their processes, optimize their strategies, and maximize their profits. One powerful tool that has emerged to meet these demands is the Automated Trading Panel. These panels leverage cutting-edge technology to automate trade execution, implement complex strategies, and enhance overall efficiency in forex trading. In this blog post, we'll explore the benefits, features, and potential of Automated Trading Panels in revolutionizing the way traders approach the forex market.

Understanding Automated Trading Panels: Automated Trading Panels are sophisticated software solutions designed to automate various aspects of forex trading, from trade execution to risk management and strategy implementation. These panels utilize advanced algorithms, artificial intelligence, and machine learning techniques to analyze market data, identify trading opportunities, and execute trades on behalf of traders. With their user-friendly interfaces and customizable features, Automated Trading Panels empower traders of all skill levels to automate their trading processes and achieve consistent results in the forex market.

Key Features and Functionality:

Trade Execution Automation: Automated Trading Panels enable traders to automate trade execution, eliminating the need for manual intervention. Traders can set specific parameters for trade entry, exit, and position sizing, allowing the panel to execute trades automatically based on predefined rules and criteria.

Strategy Implementation: Automated Trading Panels support the implementation of complex trading strategies, including trend-following, mean-reversion, and breakout strategies. Traders can customize their strategies by combining technical indicators, price action signals, and market sentiment analysis to suit their trading preferences and objectives.

Risk Management Tools: Automated Trading Panels offer advanced risk management tools to help traders mitigate potential losses and protect their capital. Traders can set stop-loss and take-profit levels, adjust position sizes, and implement trailing stop orders to manage risk effectively.

Backtesting and Optimization: Automated Trading Panels enable traders to backtest and optimize trading strategies using historical market data. By simulating trades under various market conditions, traders can assess the performance of their strategies and make necessary adjustments to improve profitability.

Real-time Market Analysis: Automated Trading Panels provide real-time market analysis and insights, allowing traders to stay informed about key market developments and potential trading opportunities. With access to up-to-date market data and analysis tools, traders can make informed decisions and execute trades with confidence.

Benefits of Using Automated Trading Panels:

Enhanced Efficiency: Automated Trading Panels streamline the trading process by automating repetitive tasks such as trade execution, position management, and risk assessment. By eliminating the need for manual intervention, traders can save significant time and effort. This enhanced efficiency allows traders to focus their attention on analyzing market trends, refining trading strategies, and making informed decisions, rather than getting bogged down by routine tasks.

Improved Accuracy: Automated Trading Panels leverage sophisticated algorithms and artificial intelligence to execute trades with precision and accuracy. Unlike human traders, who may be prone to emotions, biases, and cognitive errors, these panels operate based on predefined rules and criteria. By removing human involvement from the trading process, Automated Trading Panels minimize errors and enhance overall trading performance. Trades are executed consistently and objectively, without the influence of emotions such as fear, greed, or hesitation.

Consistent Performance: With their disciplined approach to trade execution and risk management, Automated Trading Panels help traders achieve consistent and reliable results over time. These panels adhere strictly to predetermined trading rules and strategies, ensuring that trades are executed in a systematic and disciplined manner. By maintaining consistency in trade execution and risk management, traders can avoid impulsive decisions and erratic behavior, thereby improving their chances of long-term success in the forex market.

Accessibility and Convenience: Automated Trading Panels are accessible from any internet-enabled device, allowing traders to monitor and manage their trades on the go. Whether at home, in the office, or on vacation, traders can stay connected to the forex market and take advantage of trading opportunities anytime, anywhere. This level of accessibility and convenience enables traders to stay informed about market developments, adjust their trading strategies, and execute trades promptly, without being tied to a specific location or time zone.

Reduced Stress and Emotional Impact: Trading can be a stressful and emotionally taxing endeavor, particularly during periods of market volatility or when faced with significant losses. Automated Trading Panels help alleviate stress and emotional strain by automating the trading process and removing the need for manual intervention. Traders can trade with confidence, knowing that their trades are being executed according to predefined rules and parameters. By removing the emotional element from trading decisions, Automated Trading Panels help traders maintain a clear and rational mindset, reducing the psychological burden associated with trading and improving overall well-being.

Automated Trading Panels offer numerous benefits to traders, including enhanced efficiency, improved accuracy, consistent performance, accessibility and convenience, and reduced stress and emotional impact. By leveraging advanced technology and automation, traders can streamline their trading processes, optimize their performance, and achieve greater success in the forex market.

Conclusion:

Automated Trading Panel offer a powerful solution for automating forex trades and enhancing trading efficiency. With their advanced features, customizable settings, and user-friendly interfaces, these panels empower traders to execute trades with precision, consistency, and confidence. Whether you're a seasoned trader looking to optimize your trading strategies or a novice trader seeking to streamline your trading process, Automated Trading Panels can help you achieve your trading goals with ease. Embrace the future of forex trading with Automated Trading Panels and experience the benefits of effortless efficiency in your trading journey.

#Trade Panel#Trading Panel#Trading Panel EA#TradePanel MT4#Trade Manager#Forex Trade Manager#Best Trade Manager#Trade Management utility#Trade Management tool#Trading management#forextrading#forexmarket#forex education#forexsignals#forex#black tumblr#technical analysis#4xPip

4 notes

·

View notes

Text

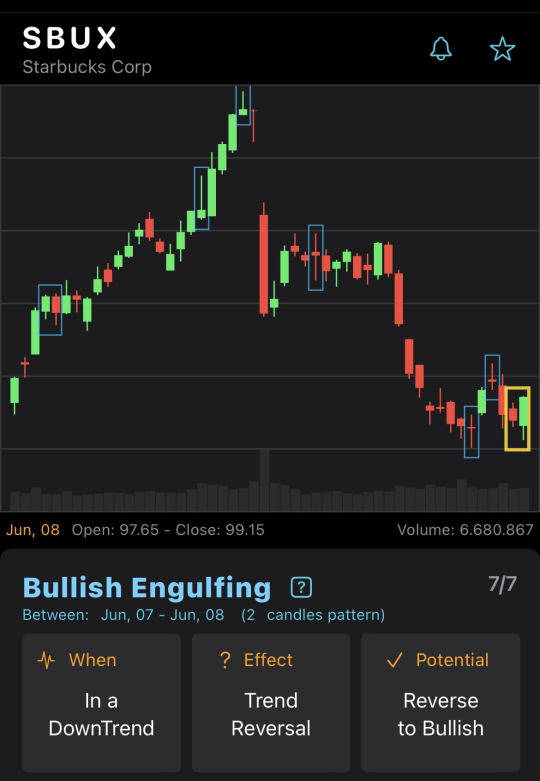

Bullish Engulfing on SBUX chart

BullishEngulfing CandleStickPattern on SBUX end-of-day chart on Jun, 08. Potential reverse to bullish.

7 notes

·

View notes

Text

Bearish Engulfing pattern can result in uptrend ! When and How?

The above chart is a perfect example for a bearish engulfing pattern to act as a bullish trend reversal.This happens when bearish engulfing pattern occurs in the end of downtrend.

Click here to learn more about this in detail.

#stock trader#stock trading#candlestick pattern#crypto traders#future and option trading#forex trading#forex#earn money online#technical analysis

12 notes

·

View notes

Text

Forex major pair BUY signal trade system [EURUSD,M15] Bullish wave.

2025V Update Version. Official Website: wWw.ForexCashpowerIndicator.com

.

Forex Cashpower Indicator *Lifetime license* one-time fee with No Lag & Non Repaint buy and sell powerful Signals with Smart algorithms that emit signals in big trades volume zones. Works in all Charts inside your Broker MT4 Plataform and all timeframes.

.

✅ NO Monthly Fees/ New 2025 Version

✅ NON REPAINT / NON LAGGING

��� Sound And Popup Notifications

🔥 Powerful & Profitable AUTO-Trade Option

.

✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.**

.

( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ).

.

✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options.

.

🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account.

#forexsignals#forexindicators#indicatorforex#forexindicator#cashpowerindicator#forex#forextradesystem#forexprofits#forexvolumeindicators#forexchartindicators#eurusd#eurusd profits#eurusdtechinicalanalysis#eurusd trading#eurusd technical analysis#eurusd signals#technical analysi eurusd

0 notes

Text

Zig Zag Your Way to Trading Success

Learn how this simple yet powerful indicator can help you spot market trends and improve your trading decisions

Hey Tumblr traders! Let's talk about something that's been revolutionizing my trading game lately - the Zig Zag indicator! You know how sometimes the market looks messier than your room after a weekend gaming marathon? Well, this tool is like your trading mom, helping you clean up all that chaos!

The Zig Zag indicator is basically your market's personal stylist - it takes all those messy price movements and turns them into a sleek, easy-to-read pattern. It's like having a GPS for market trends, showing you the important twists and turns while ignoring all those annoying detours.

When I first discovered this indicator, I was skeptical. I mean, how could something so simple be so useful? But boy, was I wrong! It's like having a pair of noise-canceling headphones for your charts - blocking out the market noise and letting you focus on what really matters.

Want to know the best part? You can customize it to your trading personality! Whether you're the type who likes to take things slow and steady or you're all about that fast-paced action, the Zig Zag indicator can adapt to your style. It's the Swiss Army knife of trading tools!

In conclusion, if you're tired of getting lost in the market maze, give the Zig Zag indicator a try. But wait, there's more! For my fellow automation enthusiasts, I've discovered that Quagensia is a game-changer when it comes to automating Zig Zag strategies. Its drag-and-drop interface lets you create automated trading rules without writing a single line of code. You can set up custom alerts, create entry and exit rules, and even combine the Zig Zag with other indicators for more complex strategies. Head over to my website for a complete guide on how to make this tool work for you. Remember, in trading, sometimes the simplest solutions are the most powerful ones. Keep it simple, keep it fun, and let automation handle the heavy lifting. May the trends be ever in your favor!

#zig zag indicator#trading strategy#market analysis#technical analysis#trend trading#forex market#price patterns#trading tools#market trends#trading education

1 note

·

View note

Text

A Professional Examination of Forex Trading in Light of Current Market Dynamics and Historic Evidence

In forex trading, success often depends on understanding complex market forces and an informed ability to navigate the unpredictable swings in global economic conditions. The events detailed in recent reports, including the anticipation surrounding U.S. Non-Farm Payroll (NFP) data and the potential shifts in monetary policy, provide a foundation for assessing how political events, data releases, and central bank decisions impact trading strategies. Historically, such market factors have significantly influenced the currency landscape, and traders who harness knowledge of these shifts can develop more resilient trading approaches.

Political and Economic Factors Impacting Forex Markets

The U.S. NFP data release, widely regarded as a crucial indicator of economic health, often influences currency strength by impacting central bank policies and interest rates. For instance, a strong NFP report signals job growth, which may lead the Federal Reserve to consider a hawkish stance, potentially increasing interest rates to curb inflation. A weak report, conversely, might suggest economic slowdown, urging caution among traders who anticipate potential rate cuts or pauses. This anticipation is deeply rooted in historical data analysis. For instance, in the post-2008 financial crisis recovery period, the NFP report played a pivotal role in influencing market sentiment, as the Federal Reserve’s quantitative easing (QE) policy led to significant dollar volatility. Traders with insights into these factors could better anticipate dollar strength and other market movements.

In recent weeks, expectations have shifted to include the Federal Reserve's possible interest rate cuts as early as November and December of 2024. Historic evidence shows that, in past cycles, rate cuts during economic slowdowns often spur dollar depreciation. With historical parallels, such as the Fed’s rate cuts in 2001 and 2007, traders can anticipate a similar trajectory, positioning themselves for the effects on currency values and volatility.

The Influence of Global Economic Data and Central Bank Policy

One recent report highlighted a significant selloff in the Swiss Franc, triggered by a lower-than-expected inflation rate in Switzerland. This development points toward the Swiss National Bank (SNB) possibly implementing a 50 basis-point rate cut in December 2024. Such moves by central banks are not unprecedented; the SNB’s decisions often reflect Switzerland’s high economic integration and its historical stance on maintaining a stable currency. For example, during the Eurozone debt crisis of 2010-2012, the SNB implemented drastic measures to limit the Franc’s overvaluation, including pegging the Franc to the Euro. Forex traders aware of this historical context could better interpret recent actions by the SNB and anticipate future moves, such as further adjustments in response to inflation or other economic indicators.

The U.S. Dollar, on the other hand, has displayed mixed performance in the current market environment, with slight gains against commodity-linked currencies while maintaining relative stability. Such movement underscores how economic data, particularly inflation and employment metrics, have traditionally impacted the dollar’s performance. Historically, the dollar has often served as a “safe haven” currency during periods of global economic uncertainty. During the COVID-19 pandemic, for instance, the dollar’s strength was amplified due to increased demand from investors seeking stability. A historical lens shows that traders who can effectively balance market sentiment with fundamental data interpretation often fare better in volatile markets.

The Role of Risk Management and Historical Lessons

An essential aspect of successful forex trading involves implementing a robust risk management strategy, especially given the high-risk nature of leveraged trading. The ForexLive disclaimer emphasizes the need for traders to approach trading with an understanding of leverage risks and the potential for significant financial loss. Historical evidence, such as the impact of the 1992 “Black Wednesday” event, where the British pound was forced out of the European Exchange Rate Mechanism, underscores the importance of prudent risk management. This incident illustrated the potentially devastating effects of market volatility, and it remains a cautionary tale for traders who may underestimate the risks involved in forex markets.

Conclusion: The Importance of Contextual Knowledge in Forex Trading

In light of recent events, from central bank decisions to the anticipation of the U.S. elections, traders are reminded that forex markets are heavily influenced by a complex interplay of economic data, political events, and historical context. An understanding of historical patterns, such as the 2008 financial crisis recovery and key monetary policy decisions from central banks like the Fed and SNB, can equip traders with valuable insights into potential market reactions. For forex traders, knowledge is more than just analyzing current events; it is about learning from the past and applying that understanding to build strategies that can weather both expected and unexpected market shifts.

#Forex Trading#Market Dynamics#Professional Examination#Currency Markets#Trading Strategies#Risk Management#Market Analysis#Economic Indicators#Technical Analysis#Fundamental Analysis#Forex Market Trends#Market Volatility#Trading Psychology#Investment Strategies#Global Economy#Financial Markets#Exchange Rates#Currency Pairs

1 note

·

View note

Text

Two Waves: Forex Trading Strategy Explained

Forex trading strategies are essential for navigating the volatile and dynamic forex market. One effective approach is the Two Waves strategy, which focuses on identifying and trading with market waves. This article explores the Two Waves strategy in detail, including its principles, application, and advantages. What is the Two Waves Strategy? The Two Waves strategy is a technical analysis method…

#CCI#Downtrend#Entry and Exit Points#Fibonacci Retracement#Forex#Forex Market#Forex Traders#Forex Trading#Market Conditions#Moving Average#Price Movements#Risk Management#Stop-Loss#Support And Resistance#Take-Profit#Technical Analysis#Trading Strategies#Trading Strategy#Trend Analysis#Trend Identification

3 notes

·

View notes

Text

youtube

Mastering Forex Charts: A Beginner's Guide to Candlesticks, Lines, and Bar Patterns

#Forex trading#Forex charts#candlestick charts#line charts#bar charts#trading tutorial#chart analysis#technical analysis#Forex market#bullish patterns#bearish patterns#price movements#market trends#OHLC#trading strategies#chart reading#price action#trading tips#beginner trading#advanced trading#Forex education#PipInfuse#trading insights#market sentiment#trend analysis#trading confidence#Youtube

1 note

·

View note

Text

Adam Button News: Chief Currency Analyst and Strategist at ForexLive

Adam Button News, a leading currency analyst at ForexLive, provides real-time insights into how economic news impacts the forex market. With over a decade of experience, Button’s expertise spans market volatility, fundamental analysis, and technical strategies, making him a go-to figure for forex traders. His disciplined approach emphasizes risk management and adapting to market conditions, helping traders navigate unpredictable scenarios while enhancing their skills for long-term success.

0 notes

Text

Comprehensive Analysis of GBP/JPY: Key Support and Resistance Levels Explained

#GBP/JPY analysis#forex technical analysis#British Pound Japanese Yen#forex trading#currency pair#GBP/JPY forecast#support and resistance#Fibonacci retracement

0 notes

Text

WHEN A BEARISH ENGULFING PATTERN IS SIGN OF SIDEWAYS TREND?

A bearish harami can sometimes result in a sideways trend.This happens when the bearish harami takes a form called the high price harami.

#stock trader#stock market#technical analysis#candlestick pattern#crypto traders#future and option trading#forex trading#forex

15 notes

·

View notes

Text

Mastering Currency Futures Trading: A Comprehensive Guide

Currency futures looking for and promoting is an exciting and dynamic manner to take part within the international financial markets. By locking in change expenses for a future date, clients can hedge inside the path of foreign cash hazard or speculate on foreign exchange actions. This blog will discover the fundamentals of forex futures buying and promoting, the blessings, and strategies for fulfillment, and why Spectra Global Ltd is the proper platform for your buying and selling needs.

Understanding Currency Futures Trading

Currency futures are standardized contracts to buy or sell a particular quantity of forex at a predetermined fee on a tough and fast destiny date. Unlike the spot foreign exchange market, in which trades are settled immediately, foreign exchange futures are traded on regulated exchanges, consisting of a similar layer of safety and transparency.

Key Features of Currency Futures Standardization: Contracts are standardized in phrases of agreement length, expiration dates, and tick values, ensuring uniformity and simplicity of purchasing and promoting.

Regulated Exchanges: Traded on regulated exchanges just like the CME (Chicago Mercantile Exchange), overseas cash futures offer an ordinary looking for and promoting surroundings.

Leverage: Currency futures attempting to find and sell allows for leverage, because of this customers can manage large positions with in particular small quantities of capital.

Hedging and Speculation: Ideal for each hedging closer to forex risk and for speculation, presenting possibilities for several searching for and promoting techniques.

Benefits of Currency Futures Trading Hedging Currency Risk For organizations worried about international change, foreign exchange futures offer an effective way to hedge in competition to terrible foreign exchange movements.

By locking in alternate expenses, corporations can shield their profit margins from overseas money volatility.

Speculative Opportunities

Traders can take advantage of charge actions in the forex markets to generate income. The leverage available in remote places cash futures shopping for and promoting amplifies potential returns, even though it moreover will growth chance.

Transparency and Security

Trading on regulated exchanges guarantees an immoderate diploma of transparency and decreases the risk of counterparty default. This makes remote places cash futures an extra steady opportunity compared to over-the-counter (OTC) forex shopping for and selling.

Diversification

Currency futures provide an awesome diversification device for buyers and customers. By along with distant places of money futures to their portfolios, they may be able to reduce acquainted threats and enhance returns.

Strategies for Successful Currency Futures Trading

Fundamental Analysis

Fundamental evaluation includes evaluating financial signs, geopolitical sports activities, and crucial financial agency suggestions to look ahead to forex movements. Key signs and signs and symptoms and signs and symptoms embody GDP increase prices, inflation, interest prices, and employment information.

Technical Analysis

Technical evaluation specializes in historical fee charts and searching for and selling volumes to understand styles and tendencies. Common machines embody shifting averages, relative energy index (RSI), and Bollinger Bands.

Risk Management

Effective threat management is critical in forex futures searching for and promoting. Setting save-you-loss orders, the use of right feature sizing, and diversifying trades can help control danger and guard capital.

Leverage Management

While leverage can increase earnings, it can additionally amplify losses. Traders want to use leverage carefully and make sure they truly apprehend the dangers worried.

Why Choose Spectra Global Ltd for Currency Futures Trading?

Spectra Global Ltd offers a strong and patron-excellent platform for foreign places coins futures looking for and selling. Here are a few reasons why it stands out:

Advanced Trading Tools: Spectra Global Ltd gives modern-day gadgets and capabilities to decorate your shopping for and selling revel in, which encompass real-time market information, advanced charting equipment, and customizable shopping for and selling interfaces.

Expert Guidance: Access to expert evaluation and educational belongings guarantees that shoppers of all stages can also make informed options.

Security and Regulation: Spectra Global Ltd operates under strict regulatory requirements, making ensure a sturdy and apparent trading environment.

Customer Support: Dedicated customer support is to be had to assist with any queries or troubles, ensuring a smooth shopping for and promoting revel in.

Conclusion

Currency futures buying and selling give thrilling opportunities for each hedging and speculative feature. With expertise in the fundamentals, benefits, and techniques, shoppers can navigate this market efficiently. Spectra Global Ltd gives an appropriate platform with its advanced device, professional guidance, and ordinary purchasing for and selling surroundings.

Ready to embark to your overseas cash futures buying and promoting adventure? Visit Spectra Global Ltd now and begin seeking out and selling with self warranty.

Unlock your potential in foreign places coins futures buying and promoting with Spectra Global Ltd. Sign up nowadays and take advantage of our superior purchasing for and promoting equipment and professional steering.

#Currency Futures Trading#Forex Futures#Hedging Currency Risk#Speculative Trading#Technical Analysis#Fundamental Analysis#Spectra Global Ltd#Leverage in Trading#Risk Management#Forex Trading Platform

0 notes

Text

SELL Trade opens running NON REPAINT [EURUSD,M15] Signal. 2025V Update Version. Official Website: wWw.ForexCashpowerIndicator.com . Forex Cashpower Indicator Lifetime license one-time fee with No Lag & Non Repaint buy and sell powerful Signals with Smart algorithms that emit signals in big trades volume zones. Works in all Charts inside your Broker MT4 Plataform and all timeframes. . ✅ NO Monthly Fees/ New 2025 Version ✅ NON REPAINT / NON LAGGING 🔔 Sound And Popup Notifications 🔥 Powerful & Profitable AUTO-Trade Option . ✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.**

#eurusd profits#eurusdtechinicalanalysis#eurusd technical analysis#eurusd trading#eurusd#forexindicators#cashpowerindicator#indicatorforex#forexsignals#forex#forextradesystem#forexindicator#forexvolumeindicators#forexprofits#forexchartindicators

0 notes

Text

#signalforex#tradingsignal#forex#forextrading#sinyalforex#forexsignals#technical analysis#financial#forex trading#forex market#forex robot#stocks#aplikasi trading

1 note

·

View note

Text

03. Forex Trading on a Budget: How Much Cash Do You Need to Start?

The Basics: Understanding Forex Trading

The amount of money needed to start trading forex is a common question among beginners. It’s important to understand that while forex trading can potentially be lucrative, it is not a get-rich-quick scheme. Success in the forex market requires dedication, hard work, and continuous learning.

Key Principle: Money Management

One of the key principles of trading forex is money management. Over-capitalization, which involves risking more money than one can afford to lose, should be avoided. Many individuals are lured into forex trading with the hope of achieving high returns, only to over-leverage and over-trade their accounts into significant losses.

Avoiding Under-Capitalization

On the other hand, under-capitalization, where a trader does not have sufficient funds to trade safely, can also lead to substantial losses. While some brokers offer minimum account deposits as low as $1 or $25, it is advisable to start with a more substantial amount. Beginning with a modest capital amount can help new traders effectively manage risks.

Safe Starting Amount

So, how much money do you need to start trading forex? It is generally considered safe to start with at least $300 and trade with 0.01 lot per trade. This approach allows for gradual account balance growth and helps avoid overleveraging and the risk of complete fund loss.

Effective Money Management

When it comes to money management, it is recommended to risk only 2% of your capital per trade. This means that if you have a $500 account, you should risk no more than $10 on a single trade. Additionally, it’s wise to trade only 2–3 currency pairs per day to balance risk management.

Risk and Reward Ratio

In terms of risk and reward, it’s essential to maintain a 1:3 risk to reward ratio. This means that for every 1 pip in your stop-loss, you should aim to gain 3 pips of profit. Trading in micro lots requires careful consideration of trade selection, focusing on high-probability trades with well-defined support and resistance criteria.

The Path to Success

Ultimately, achieving success in forex trading requires dedication, time, and continuous learning. While it is possible to generate significant returns from forex trading, it’s important to approach it with a realistic mindset and a focus on prudent risk management.

Conclusion

In conclusion, the amount of money needed to start trading forex is a critical consideration for beginners. By adhering to principles of money management, avoiding over-capitalization and under-capitalization, and focusing on risk management and realistic expectations, individuals can embark on their forex trading journey with a greater likelihood of success.

Free Forex Course

#finance#forex#stock market#learn forex trading#forex broker#forex education#forex trading#forexsignals#forex market#forextrading#technical analysis#investing

1 note

·

View note