#Forex Technology Provider

Explore tagged Tumblr posts

Text

Why Brokerage Technology Solutions Create a Level Playing Field in Brokerage.

Today, brokerages are seeing robust growth outlooks owing to lots of innovations in their service delivery solutions space. This includes tech solutions and software that are driving the business segment forward. However, with a lot of credible automation out there, it is always good to get better predictions with well-set AI tools and algorithms.

That is why tech solutions for brokerages that offer closer to factual results are a necessity. But how do the tech solutions advance or offer a level playing field anyway? Let us find out more below.

How Do Technology Solutions Impact Brokerage Business with a Level Playing Field?

- Previously, physical human brokers were dominant on the exchanges. However, today, the gradual formalization of the capital markets has ensured the large-scale entry of traditional brokerage firms. These brokerages aim to enhance and create value propositions with in-house research teams and personalized customer service.

- The gradual increase of informed and institutional investors is another example of the impact that technology has had on brokerages. Technology has changed the landscape and way of accessing information vital to making the right investment calls.

- The rise of the internet and smartphone use and penetration make information accessible to everyone. That erases the USP of traditional brokerage houses' in-house research teams.

- The introduction of derivative instruments and the development of trading infrastructure have empowered and enhanced the participation of retail investors.

- Enhanced automation in the brokerage space has been more than just a business multiplier for the transformation platform. It empowered brokerages to be functional, accurate, and automated in their core operations, built smoother workflows, enhanced efficiency, and left little room for repetitive mistakes in a highly competitive sector.

- Electronic trading has increased exponentially the trading volume and liquidity in the market. This reduces the actual workload and influence of physical labour. It is reshaping the accountability aspects of the bourse and trading platforms, as they are hard to manipulate.

- With Brokerage Technology Solutions in absolute control, brokerage overheads are significantly reduced or cut. How? There are serious reductions in fees and other forms of obligatory payments. This is the single most visible influence of tech solutions on brokerages.

- Lastly, multiple brokerage services can be received at a single point, which has its advantages. It reduces the need to jump from one brokerage service to another. Besides, it is easy to tell and know which platforms offer you the best investments and returns.

Top Reasons to Consider Going Virtual or Innovative with the Best Tech Solutions.

- Accountable and verifiable: There are zero chances for fraud or manipulation with enhanced real trading flows and rates.

- Help gain incisive market trends and records in a short time and be a better brokerage.

- They simplify the investment process with the ease of tracking market flows and updates.

- Better predictive stock rating: technology solutions and software have enabled traders to make the right calls.

In the end, there are several brokerage affiliate software solutions that can impact brokerage businesses and activities in various ways.

Blog Source URL:

#Brokerage Technology Solutions#Forex Back Office Software#Crm Forex#Custom Forex Crm#Forex Crm Provider#Forex Crm Software#Forex Crm Solution#Forex Crm System

0 notes

Text

People are Making Money in AutoPilot Mode with SureShotFX Algo

SureShotFX Algo is an innovative trading algorithm designed to automate the trading process. This powerful tool analyzes market trends, executes trades, and manages risk with minimal human intervention. The algorithm is crafted by experienced traders and financial experts, ensuring that it adapts to the ever-changing dynamics of the forex market.

How Does it Work?

The SureShotFX Algo scans multiple currency pairs, analyzes vast amounts of market data, and identifies profitable trading opportunities. It then executes trades automatically, based on predefined criteria. Here’s a breakdown of its key features:

Market Analysis: Constantly monitors and analyzes market trends.

Automated Trading: Executes trades without the need for manual intervention.

Risk Management: Implements robust risk management strategies to protect investments.

Real-Time Adjustments: Adapts to market conditions in real-time to optimize performance.

Benefits of Using SureShotFX Algo

24/7 Trading: The algorithm operates around the clock, taking advantage of market opportunities even while you sleep.

Emotion-Free Trading: Removes the emotional aspect of trading, which can often lead to impulsive decisions.

Consistency: Ensures a consistent trading strategy, reducing the risk of human error.

Time-Saving: Frees up your time, allowing you to focus on other important aspects of your life or business.

Success Stories

Many traders have reported significant success using SureShotFX Algo. Here are a few testimonials from satisfied users:

John D.: “Since I started using SureShotFX Algo, my trading performance has improved drastically. I no longer worry about missing market opportunities.”

Emma L.: “The AutoPilot mode is a game-changer. It’s like having a professional trader working for you 24/7.”

Michael S.: “I was skeptical at first, but SureShotFX Algo has exceeded my expectations. My returns have been consistently high, and I spend less time managing my trades.”

Getting Started with SureShotFX Algo

Starting with SureShotFX Algo is straightforward. Here’s how you can begin:

Sign Up: Register on the SureShotFX platform and choose your subscription plan.

Setup: Configure the algorithm settings according to your trading preferences.

Activate: Turn on the AutoPilot mode and let the algorithm do the work.

With SureShotFX Algo, you can experience the future of forex trading today. The combination of cutting-edge technology and expert strategy provides an unparalleled trading experience, allowing you to make money effortlessly in AutoPilot mode.

4 notes

·

View notes

Text

Title: "Gen Z Hustle: How Side Gigs and Digital Innovation are Shaping Kenya's Youth Culture"

Introduction In the bustling streets of Nairobi, young Kenyans are busy making their mark in innovative ways that go beyond traditional careers. The rise of digital technology and Kenya’s rapidly evolving economic landscape have cultivated a unique “side-hustle culture” among Generation Z, who are actively reshaping work, community, and creativity. From influencing on social media to e-commerce and even venturing into cryptocurrency, these young hustlers are defining a new Kenyan dream that is all about resilience, creativity, and financial independence.

Side-Hustles in the Age of Social Media One of the most prominent changes in Kenya’s youth culture is the significant shift from relying solely on formal employment to embracing digital side hustles. On Instagram, Twitter, and TikTok, young Kenyans are building personal brands as influencers, marketers, and content creators. This trend is largely driven by the power of social media platforms, where personalities like Azziad Nasenya and Flaqo have transformed social media virality into flourishing careers.

Platforms like TikTok and Instagram allow young Kenyans to reach broad audiences with content that resonates—comedy skits, motivational videos, makeup tutorials, and dance challenges. With brands now recognizing the influence of digital personalities, many Kenyan influencers are finding opportunities to collaborate with companies for product endorsements and advertisements. These partnerships bring a sense of visibility and empowerment that has been less accessible in traditional industries.

For 24-year-old David Mwangi, a content creator and social media strategist, the allure of influencing lies in its accessibility and potential for growth. “You don’t need a big budget to get started; you just need creativity,” he explains. David’s experience reflects the sentiment of many Gen Z Kenyans who see social media not just as a pastime but as a pathway to sustainable income.

The E-commerce Boom and the Rise of Small Online Shops In addition to influencing, e-commerce has become a major outlet for Kenyan youth looking to earn extra income. Platforms like Jumia, Kilimall, and Facebook Marketplace provide easy avenues for young entrepreneurs to start online businesses, selling anything from thrifted clothes and beauty products to locally made crafts and accessories. Kenya’s mobile payment system, M-Pesa, has also simplified transactions, allowing e-commerce to thrive even without widespread use of credit cards.

With rising unemployment rates and limited job opportunities, many young Kenyans are using digital tools to build businesses from scratch. Some youth groups have formed collectives to sell items in bulk, often buying directly from manufacturers or importing from abroad to resell at a profit. This trend, known locally as biashara za mtaa (local businesses), has created a bustling informal economy that operates largely online.

For 23-year-old Aisha Ahmed, the journey started with a Ksh 5,000 loan from her older brother. Now, she runs an online shop that specializes in selling affordable, stylish handbags through Instagram. “People think starting a business requires a lot of capital, but what really matters is finding something people need and building a brand around it,” she says.

Crypto, Forex, and the Financial Revolution Another intriguing aspect of Kenya’s Gen Z hustle culture is the growing interest in cryptocurrency and Forex trading. Although controversial, the allure of quick profits and financial independence has drawn many young people into these new financial frontiers. Kenya’s tech-savvy youth have quickly adapted to apps like Binance and Paxful, learning the intricacies of cryptocurrency trading and often mentoring each other online.

Crypto’s appeal among Gen Zers lies in its promise of empowerment and financial freedom—an opportunity to circumvent traditional banking systems. However, the lack of regulation and high risks involved have left many young Kenyans facing steep learning curves and financial losses. Despite the volatility, online communities and forums dedicated to Forex and crypto trading continue to grow, attracting young people with a “high risk, high reward” mentality.

Karanja, a 22-year-old business student, views crypto as a game-changer: “It’s the future of money,” he asserts. He has spent months learning about blockchain technology and considers it a long-term investment. Karanja’s experience highlights the optimism surrounding digital currency in Kenya, despite the risks and controversies.

Challenges Facing the Digital Hustlers While side-hustle culture has opened new opportunities, it comes with significant challenges. The competitive nature of digital influencing and e-commerce can be cutthroat, with many young people finding it hard to stand out. Mental health issues, such as stress and burnout, are becoming common among young hustlers as they juggle multiple gigs alongside their education or formal jobs.

For those in crypto and Forex, the risks are even higher. Cases of scams and Ponzi schemes have left many young investors in debt, leading some to lose faith in the industry altogether. The lack of regulation around cryptocurrency also means that youth are vulnerable to fraudsters, who often take advantage of their desire for quick financial gains.

The New Face of the Kenyan Dream Despite the challenges, side-hustle culture has become a defining feature of Gen Z in Kenya. This trend signifies a shift in how young Kenyans view success, replacing the traditional path of formal employment with a vision that values independence, innovation, and adaptability. It’s a cultural revolution rooted in digital innovation, resilience, and the determination to succeed on their own terms.

For Kenyan youth, the hustle is more than just a means to an end—it’s a way to redefine their place in society. As Aisha puts it, “It’s not just about making money; it’s about taking control of your future.”

4 notes

·

View notes

Text

The Ultimate Forex Brokers Comparison for South African Traders

Introduction:

The forex market in South Africa is one of the fastest-growing financial sectors, and selecting the right broker can make all the difference. In this Forex Brokers Comparison in South Africa, we will explore the best options available for traders in 2025. Whether you're just getting started or are looking for a more advanced trading experience, this guide will help you navigate your choices and make an informed decision.

Why Forex Trading in South Africa is Thriving:

Forex trading in South Africa has seen a steady rise in popularity over the past few years. This growth can be attributed to the country's stable financial regulations, mainly governed by the Financial Sector Conduct Authority (FSCA). With a secure regulatory framework, traders are assured of a safe trading environment. In addition, many brokers now offer dedicated services tailored for South African traders, including local deposit methods and customer support in native languages.

Key Features to Look for in a Forex Broker in South Africa:

When choosing a forex broker, several key factors should guide your decision:

Security and Regulation: Ensure your broker is regulated by the FSCA for a secure trading environment.

Trading Platforms: Popular platforms such as MT4 and MT5 offer robust features, but many brokers now offer proprietary platforms as well.

Low Spreads and Fees: Low trading costs are crucial to maximizing profits.

Customer Support: 24/7 support in the South African time zone can enhance your trading experience.

Account Types: Brokers offering diverse account types with local payment options can cater to a wide range of traders.

Top Forex Brokers for South African Traders in 2025:

Eightcap: Known for its low spreads, quick deposits, and intuitive platform, Eightcap is perfect for both beginners and seasoned traders.

IC Markets: With low spreads and fast execution, IC Markets is ideal for scalpers and day traders.

FP Markets: Offering excellent customer support and a user-friendly platform, FP Markets provides an outstanding trading experience.

Octa: Specializing in accounts suitable for South African traders, Octa stands out for its commitment to local customers.

BlackBull: If you're after low-cost trading with access to a wide range of assets, BlackBull is a top contender.

XM: XM’s global reach and local support make it a solid choice for traders looking for both global opportunities and local assistance.

FXPro: Known for its top-tier services and robust tools, FXPro is ideal for traders seeking a complete package.

FBS: FBS’s user-friendly interface and attractive promotions make it an appealing option for beginners.

Comparing Forex Brokers in South Africa: Which One is Right for You?

Choosing the right broker depends on your trading needs. For beginner traders, brokers with easy-to-use platforms and strong customer support, like FBS and Eightcap, might be the best fit. Experienced traders, however, may benefit from IC Markets or FP Markets, which offer advanced tools and low-cost trading. If you're focused on low spreads, BlackBull and Octa are excellent options.

The Future of Forex Trading in South Africa:

As we look toward 2025, the future of forex trading in South Africa appears promising. Technological advancements, such as AI-based trading tools and faster transaction systems, are set to make trading more efficient. Moreover, evolving regulations may offer even greater protection for traders. Staying informed about the latest trends and innovations will help traders maintain a competitive edge.

Conclusion:

In conclusion, choosing the right forex broker is critical for successful trading in South Africa. With the Forex Brokers Comparison in South Africa above, you are equipped with the knowledge to make an informed decision. Visit Top Forex Brokers Review for more in-depth insights and to explore detailed broker reviews

2 notes

·

View notes

Video

youtube

ETHUSDT 31 Consecutive Successes! AI Trading Based on 2,500 Indicators: Unveiling PrimeXAlgo's Innovative Technology A deep dive into PrimeXAlgo's cutting-edge AI trading technology Utilizes a dataset of 2,500 comprehensive indicators No repainting on real-time chart analysis 100% legal and ethical algorithms Provides real-time buy, sell, and neutral signals Discover the state-of-the-art trading solution born from AI and big data!https://primexalgo.comtelegramhttps://t.me/primexalgofacebookhttps://facebook.com/profile.php?id=615665...discordhttps://discord.com/channels/1288670367401...instagramhttps://instagram.com/primexalgox.comhttps://x.com/PrimeXAlgo#PrimeXAlgo,#AITrading,#GoldInvestment,#BitcoinTrading,#TradingSuccess,#FX,#FOREX,#GOLD,#Chart,#TradingChart,#Stock,#Finance,#Investment,#primexalgo,#primex,#ConsecutiveSuccess,#Financial,#AIBOT,#BOT,#BOTtrading,#crypto,#cryptocurrency,#Forex trading,#Buy,#Sell,#Long,#Short,#indicator,#Strategy,#MACD,#RSI,#Bollinger Bands,#Oscillator,#Volume,#Charts,#Scalper,#Trend,#Bond,#Options,#Derivative,#Liquidity,#Leverage,#Margin,#Hedging,#Arbitrage,#Bull market,#Bear market,#BTC,#Bitcoin,#spread

2 notes

·

View notes

Text

Which is Better: Forex, Crypto, or Stock? A Deep Dive into Prop Firm Tech

INTRODUCTION

The financial landscape is constantly changing, and with new changes comes the production of more choices than ever for traders. The most common include Forex, cryptocurrency, and stock trading. Each market has special characteristics and advantages but carries difficulties, so the emergence of prop firm tech allowed trading to become more accessible and efficient. In this blog, we will be talking about the pros and cons of

Forex, crypto, and stock trading and how prop firm tech can enhance your trading experience.

Underlying the Markets

Forex Market

Forex represents the world’s largest financial market, referring to that market where currency trades occur.

High Liquidations: Forex offers a level of liquidation that is high. Its trading volumes exceed $6 trillion, allowing the traders to comfortably enter and leave positions. Forex is traded 24 hours a day on weekdays, thus offering ample convenience for the traders.

Leverage: Most Forex brokers are highly leveraged. This means that a trader controls much larger positions with lesser capital.

Challenges despite the advantages:

The leverage might create a highly volatile currency price and the highest risk it causes is that it is an effect of its highly volatile nature.

There is an overwhelming complexity in managing economic indicators, and there are geopolitical factors too, which are not easy to handle for new traders.

Crypto Market

The crypto market is trading in digital currencies such as Bitcoin, Ethereum, and more than 5,000 altcoins.

Benefits:

Volatility: The crypto market is volatile. Within a very short duration, one can gain tremendous returns.

Decentralized: With cryptocurrencies, there is a decentralized peer-to-peer network so that no banks are used to monitor transactions.

It is open: All it needs is an internet connection to create opportunities with this kind of market, and it reaches across the globe.

Regulatory Risks: The regulation of the crypto market is not well-established, so it is an uncertain area.

Security Risks: Crypto space is highly prevalent with hackers as well as scams. Hence, the traders must beware of the same.

Stock Market

Definition: the stock market represents an entity where shares of publicly traded companies are traded

Benefits

Governance and Transparency: Since the stock market is very well governed, it offers some kind of security for investors.

Dividends: Most stocks pay dividends thereby ensuring that the investor earns some income from the shares.

Research and Analysis: There is much information to make stock analysis hence helping the traders come to a conclusion.

Drawbacks

Market Hours: the stock market only operates within fixed hours thereby limiting trading.

Lesser Volatility Stock prices often exhibit much slower movements in comparison to Forex and crypto price swings, potentially leading to reduced profit margins.

Prop Firm Tech: Revolutionizing Trading

There has always been a high level of diversity in markets, and for this reason, prop firm tech has emerged as the real deal. Proprietary firms provide capital to traders while engaging them with the latest technology to enhance their trading strategy.

This is how prop firm tech is revolutionizing the game of trading:

Access to Capital

Prop firms also enable traders to gain access to significant capital, thus they can take bigger positions and can hence gain larger profits. Such is truly rewarding for Forex and crypto traders who may not have that much money required to trade even in the best possible way.

Sophisticated Trading Platforms

Proprietary trading firms invest in advanced trading technology that gives traders cutting-edge platforms offering a high level of data provision, sophisticated charting tools, and automated trading features. This tech can significantly enhance the trading experience across Forex, crypto, and stocks.

Risk Management Tools

Prop firm tech also features powerful risk management tools, which can help in minimizing the trader’s loss and ensure the safety of capital. Such tools are quite essential in volatile markets like Forex or even cryptocurrencies, whose prices tend to change rapidly.

Education and Training

Alarge number of prop firms offer educational resources, mentorship, or training for the development of a required skill base by the traders. Support is highly important to any new traders entering Forex, crypto, or even the stock market.

Community and Networking

Trading with a prop firm usually involves trading with other people. This facilitates several things: you will have to have a community of fellow traders, exchanging insights and ideas, strategies you’re implementing, and support you give someone else.

Feature | Forex | Cryptocurrency | Stock Market

Liquidity | High | Varies by asset | High (for major stocks)

Volatility | Moderate to High | High | Moderate

Trading Hours | 24/5 | 24/7 | Limited (specific hours)

Leverage | High | Varies | Low to Moderate

Regulation | High | Low (still evolving) | High

Education | Available (varied by broker) | Limited (varies widely) | Extensive (research available)

Technology | Advanced prop firm tech available | Emerging tools | Established trading platforms

Conclusion

Is Forex, cryptocurrency, or stock trading the best?

The above question doesn’t have a definitive answer, since each market has specific positives and negatives suited to different types of trading. However, with the help of rising prop firm tech, the tools and resources available to every trader can improve trading experiences across all markets.

If you are looking for high liquidity and flexibility, Forex may be the choice. For people who seek high returns and have no fear of volatility, then cryptocurrency may be the way to go. Meanwhile, for those wanting a more regulated environment with an abundance of readily available research, stock trading may be the way to go.

Based on which one is best depends on the trading style of the individual, his risk tolerance, and preferences, you could consider your options while maximizing your trading potential with the benefits of prop firm tech, irrespective of the market.

#proptech#forex prop firms funded account#fxproptech#prop firms#best prop firms#funded#prop trading firms#funded trading accounts#my funded fx#best trading platform#propfirmtech

2 notes

·

View notes

Text

What Are Forex Signals?

What Are Forex Signals?

In the fast-paced world of forex trading, having accurate and timely information is crucial for making profitable decisions. This is where forex signals come into play. But what exactly are forex signals, and why are they so important?

Forex signals are trading suggestions or alerts that provide traders with information on potential trading opportunities in the forex market. These signals can include entry and exit points, stop-loss levels, and take-profit targets. Typically, forex signals are generated by experienced traders or advanced algorithms that analyze market conditions, trends, and technical indicators to identify potential trades.

There are two main types of forex signals: manual and automated. Manual signals are created by professional traders who share their insights based on their analysis of the market. Automated signals, on the other hand, are generated by trading algorithms that scan the market for opportunities based on pre-set criteria.

The Importance of Accurate Forex Signals

The accuracy of forex signals is crucial because it directly impacts a trader’s profitability. High-quality signals can help traders make informed decisions, reduce risks, and increase their chances of success in the volatile forex market. Conversely, inaccurate signals can lead to significant losses.

This is why choosing the right forex signal provider is essential. With hundreds of providers out there, finding one with a proven track record of accuracy can make all the difference.

Why Forex Elite Stands Out

Among the vast array of forex signal providers, Forex Elite has distinguished itself as the best in the industry. Out of 204 forex signal providers analyzed, Forex Elite ranks number one in terms of accuracy. With a remarkable success rate of over 90%, Forex Elite’s signals consistently deliver profitable trading opportunities.

What sets Forex Elite apart is its commitment to quality and transparency. The platform provides clear, concise signals that are easy to follow, even for beginner traders. Additionally, Forex Elite uses cutting-edge technology and advanced algorithms to analyze market data in real-time, ensuring that its signals are always up-to-date and reliable.

Moreover, Forex Elite’s team of seasoned traders and analysts bring a wealth of experience to the table. Their combined expertise helps to refine and improve the signal generation process, further enhancing the accuracy and effectiveness of the signals provided.

Conclusion

In conclusion, forex signals are an indispensable tool for traders looking to navigate the complexities of the forex market. The key to success lies in finding a reliable signal provider with a proven track record of accuracy. Forex Elite stands out as the best in the business, boasting a success rate of over 90% and ranking number one out of 204 providers. Whether you’re a seasoned trader or just starting, Forex Elite offers the accurate and timely signals you need to maximize your trading success.

2 notes

·

View notes

Text

Forex VPS Hosting With Low Cost

In the fast-paced world of forex trading, where markets are constantly fluctuating and opportunities arise at any hour of the day or night, having a reliable Virtual Private Server (VPS) is no longer just an option—it's a necessity. As traders strive to gain an edge in this highly competitive arena, the role of technology, particularly VPS hosting, has become increasingly crucial. In this comprehensive guide, we'll explore the importance of VPS solutions for forex traders and how Cheap Forex VPS can help you achieve your trading goals.

Understanding the Need for VPS Solutions in Forex Trading

Forex trading operates 24/7 across different time zones, making it essential for traders to have constant access to their trading platforms. However, relying on personal computers or traditional web hosting services may not provide the speed, reliability, and security required for optimal trading performance. This is where VPS solutions come into play.

A VPS is a virtualized server that mimics the functionality of a dedicated physical server, offering traders a dedicated space to host their trading platforms and applications. By leveraging the power of cloud computing, VPS hosting provides several advantages over traditional hosting methods, including:

Uninterrupted Trading: Unlike personal computers, which may experience downtime due to power outages, internet connectivity issues, or hardware failures, VPS solutions offer high uptime guarantees, ensuring that your trading operations remain unaffected.

Low Latency: In forex trading, speed is of the essence. Even a fraction of a second can make the difference between a winning and losing trade. With VPS hosting, traders can benefit from low latency connections to trading servers, resulting in faster execution times and reduced slippage.

Enhanced Security: Protecting sensitive trading data and transactions is paramount in forex trading. VPS solutions offer advanced security features such as DDoS protection, firewall configurations, and regular backups to safeguard against cyber threats and data loss.

Scalability: As your trading needs evolve, VPS solutions can easily scale to accommodate increased trading volumes, additional trading platforms, or specialized software requirements.

Introducing Cheap Forex VPS: Your Trusted Partner in Trading Success

At Cheap Forex VPS, we understand the unique challenges faced by forex traders, which is why we've developed a range of VPS hosting plans tailored to meet your specific needs. Whether you're a beginner trader looking to automate your trading strategies or a seasoned professional in need of high-performance hosting solutions, we have the perfect plan for you.

Our VPS hosting plans are designed to offer:

Flexible Configurations: Choose from a variety of RAM, disk space, CPU cores, and operating system options to customize your VPS according to your trading requirements.

Affordable Pricing: We believe that access to reliable VPS hosting should be accessible to traders of all levels, which is why we offer competitive pricing starting from as low as $4.99 per month.

Expert Support: Our team of experienced professionals is available 24/7 to provide technical assistance, troubleshoot issues, and ensure that your VPS operates seamlessly.

Uptime Guarantee: We guarantee 100% uptime for our VPS hosting services, ensuring that your trading operations remain uninterrupted, even during peak trading hours.

Choosing the Right VPS Plan for Your Trading Needs

With several VPS hosting plans available, selecting the right plan for your trading needs can seem daunting. However, our user-friendly website and knowledgeable support team are here to guide you every step of the way.

Here's a brief overview of our three main VPS hosting plans:

Regular Forex VPS: Ideal for traders looking to run automated trading systems, our Regular Forex VPS plan offers fast execution and reliable performance at an affordable price, starting from $4.99 per month.

Latency Optimized: For pro traders seeking the lowest latency connections and fastest execution times, our Latency Optimized plan is the perfect choice, starting from $8.99 per month.

Big RAM Server: Designed for businesses, brokers, and pro traders with demanding trading environments, our Big RAM Server plan offers ample resources and scalability options, starting from $29.95 per month.

Conclusion: Empower Your Trading with Cheap Forex VPS

In conclusion, VPS hosting has become an indispensable tool for forex traders looking to gain a competitive edge in the market. With Cheap Forex VPS, you can unlock the full potential of your trading strategies with reliable, high-performance hosting solutions that won't break the bank. Purchase your VPS plan today and take your trading to new heights with Cheap Forex VPS.

#forex#forex strategy#forextrading#vps#forex vps#forex market#forexsignals#forex trading#forex broker#forex education#forex analysis#vps hosting#vps server#buy windows vps#virtual private servers#dedicated server#webhosting#reseller#hosting

3 notes

·

View notes

Text

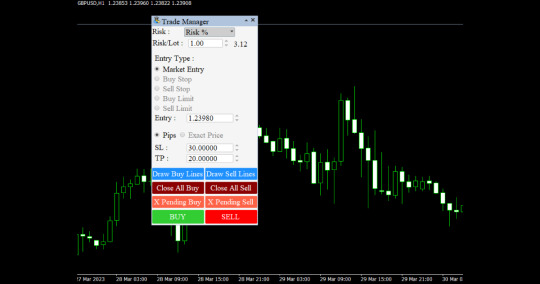

Effortless Efficiency: Automate Your Forex Trades with the Panel

In the dynamic world of forex trading, efficiency is paramount. Traders are constantly seeking ways to streamline their processes, optimize their strategies, and maximize their profits. One powerful tool that has emerged to meet these demands is the Automated Trading Panel. These panels leverage cutting-edge technology to automate trade execution, implement complex strategies, and enhance overall efficiency in forex trading. In this blog post, we'll explore the benefits, features, and potential of Automated Trading Panels in revolutionizing the way traders approach the forex market.

Understanding Automated Trading Panels: Automated Trading Panels are sophisticated software solutions designed to automate various aspects of forex trading, from trade execution to risk management and strategy implementation. These panels utilize advanced algorithms, artificial intelligence, and machine learning techniques to analyze market data, identify trading opportunities, and execute trades on behalf of traders. With their user-friendly interfaces and customizable features, Automated Trading Panels empower traders of all skill levels to automate their trading processes and achieve consistent results in the forex market.

Key Features and Functionality:

Trade Execution Automation: Automated Trading Panels enable traders to automate trade execution, eliminating the need for manual intervention. Traders can set specific parameters for trade entry, exit, and position sizing, allowing the panel to execute trades automatically based on predefined rules and criteria.

Strategy Implementation: Automated Trading Panels support the implementation of complex trading strategies, including trend-following, mean-reversion, and breakout strategies. Traders can customize their strategies by combining technical indicators, price action signals, and market sentiment analysis to suit their trading preferences and objectives.

Risk Management Tools: Automated Trading Panels offer advanced risk management tools to help traders mitigate potential losses and protect their capital. Traders can set stop-loss and take-profit levels, adjust position sizes, and implement trailing stop orders to manage risk effectively.

Backtesting and Optimization: Automated Trading Panels enable traders to backtest and optimize trading strategies using historical market data. By simulating trades under various market conditions, traders can assess the performance of their strategies and make necessary adjustments to improve profitability.

Real-time Market Analysis: Automated Trading Panels provide real-time market analysis and insights, allowing traders to stay informed about key market developments and potential trading opportunities. With access to up-to-date market data and analysis tools, traders can make informed decisions and execute trades with confidence.

Benefits of Using Automated Trading Panels:

Enhanced Efficiency: Automated Trading Panels streamline the trading process by automating repetitive tasks such as trade execution, position management, and risk assessment. By eliminating the need for manual intervention, traders can save significant time and effort. This enhanced efficiency allows traders to focus their attention on analyzing market trends, refining trading strategies, and making informed decisions, rather than getting bogged down by routine tasks.

Improved Accuracy: Automated Trading Panels leverage sophisticated algorithms and artificial intelligence to execute trades with precision and accuracy. Unlike human traders, who may be prone to emotions, biases, and cognitive errors, these panels operate based on predefined rules and criteria. By removing human involvement from the trading process, Automated Trading Panels minimize errors and enhance overall trading performance. Trades are executed consistently and objectively, without the influence of emotions such as fear, greed, or hesitation.

Consistent Performance: With their disciplined approach to trade execution and risk management, Automated Trading Panels help traders achieve consistent and reliable results over time. These panels adhere strictly to predetermined trading rules and strategies, ensuring that trades are executed in a systematic and disciplined manner. By maintaining consistency in trade execution and risk management, traders can avoid impulsive decisions and erratic behavior, thereby improving their chances of long-term success in the forex market.

Accessibility and Convenience: Automated Trading Panels are accessible from any internet-enabled device, allowing traders to monitor and manage their trades on the go. Whether at home, in the office, or on vacation, traders can stay connected to the forex market and take advantage of trading opportunities anytime, anywhere. This level of accessibility and convenience enables traders to stay informed about market developments, adjust their trading strategies, and execute trades promptly, without being tied to a specific location or time zone.

Reduced Stress and Emotional Impact: Trading can be a stressful and emotionally taxing endeavor, particularly during periods of market volatility or when faced with significant losses. Automated Trading Panels help alleviate stress and emotional strain by automating the trading process and removing the need for manual intervention. Traders can trade with confidence, knowing that their trades are being executed according to predefined rules and parameters. By removing the emotional element from trading decisions, Automated Trading Panels help traders maintain a clear and rational mindset, reducing the psychological burden associated with trading and improving overall well-being.

Automated Trading Panels offer numerous benefits to traders, including enhanced efficiency, improved accuracy, consistent performance, accessibility and convenience, and reduced stress and emotional impact. By leveraging advanced technology and automation, traders can streamline their trading processes, optimize their performance, and achieve greater success in the forex market.

Conclusion:

Automated Trading Panel offer a powerful solution for automating forex trades and enhancing trading efficiency. With their advanced features, customizable settings, and user-friendly interfaces, these panels empower traders to execute trades with precision, consistency, and confidence. Whether you're a seasoned trader looking to optimize your trading strategies or a novice trader seeking to streamline your trading process, Automated Trading Panels can help you achieve your trading goals with ease. Embrace the future of forex trading with Automated Trading Panels and experience the benefits of effortless efficiency in your trading journey.

#Trade Panel#Trading Panel#Trading Panel EA#TradePanel MT4#Trade Manager#Forex Trade Manager#Best Trade Manager#Trade Management utility#Trade Management tool#Trading management#forextrading#forexmarket#forex education#forexsignals#forex#black tumblr#technical analysis#4xPip

4 notes

·

View notes

Text

Unchain Your Website's Potential: The Ultimate Guide to VPS Hosting!

Is your website sluggish, unreliable, and constantly battling for resources? Shared hosting might have been a lifesaver when you were starting out, but now it's holding you back. Upgrading to a Virtual Private Server (VPS) can be the game-changer you need. But what exactly is a VPS, and how can it unleash your website's true potential?

This comprehensive guide dives deep into the world of VPS hosting, explaining how it works, its benefits for tasks like Forex trading, and the key factors to consider when choosing the perfect plan for your needs. We'll even show you how to navigate the setup process and unlock the power of your VPS with tools like Remote Desktop Protocol (RDP).

By the end of this article, you'll be armed with the knowledge to confidently choose a reliable VPS hosting provider like Data Base Mart and propel your website or application to new heights of performance and security.

Unveiling the VPS: How It Works

Imagine a high-rise apartment building. The entire building represents a physical server owned by a hosting provider. Now, imagine dividing each floor into individual, self-contained units. These units are your VPS!

VPS hosting leverages virtualization technology to carve a single physical server into multiple virtual ones. Each VPS functions like a dedicated server, with its own operating system, software, and allocated resources like CPU, memory, and storage. This isolation ensures your website or application enjoys a stable environment, unaffected by activity on other virtual servers sharing the physical machine.

How VPS Hosting Works

VPS hosting builds upon the core principle explained above. Hosting providers like Data Base Mart offer various VPS plans with different resource allocations. You choose a plan that aligns with your needs and budget. The provider then sets up your virtual server on their physical infrastructure, granting you root access for complete control and customization.

Powering Forex Trading with VPS

Foreign exchange (Forex) trading thrives on speed and reliability. A VPS ensures uninterrupted access to the market, even during peak trading hours. With a VPS, you can run trading bots and automated strategies 24/7 without worrying about downtime caused by shared hosting issues.

Choosing the Right VPS

Selecting the ideal VPS hinges on your specific needs. Here's a breakdown of key factors to consider:

Resource Requirements: Evaluate your CPU, memory, and storage needs based on the website or application you'll be running.

Operating System: Choose a provider offering the operating system you're comfortable with, such as Linux or Windows.

Managed vs. Unmanaged: Managed VPS plans include maintenance and support, while unmanaged plans require you to handle server administration.

Scalability: If you anticipate future growth, choose a provider that allows easy scaling of your VPS resources.

How to Use VPS with Remote Desktop Protocol (RDP)

Many VPS providers offer remote access via RDP, a graphical interface that lets you manage your server from a remote computer. This is particularly useful for installing software, configuring settings, and troubleshooting issues.

Creating a VPS Account

The signup process for a VPS account is straightforward. Head to your chosen provider's website, select a plan, and follow the on-screen instructions. They'll typically guide you through the account creation and server setup process.

VPS Pricing

VPS plans are generally more expensive than shared hosting but significantly cheaper than dedicated servers. Pricing varies based on resource allocation and features. Providers like Data Base Mart offer competitive rates for reliable VPS solutions.

VPS Terminology Explained

VPS Stands For: Virtual Private Server

VPS Airport (doesn't exist): VPS is not an airport code.

VPS in Basketball (doesn't exist): VPS has no meaning specific to basketball.

VPS Hosting: As explained earlier, refers to a hosting service that provides virtual private servers.

VPS in Business: In a business context, VPS can refer to a virtual private server used for web hosting, application deployment, or other IT needs.

VPS in School (uncommon): While uncommon, schools might use VPS for specific applications requiring a dedicated server environment.

Final Thoughts

VPS offers a compelling middle ground between shared hosting and dedicated servers. It provides the power and control of a dedicated server at a fraction of the cost. By understanding how VPS works and choosing the right plan, you can unlock a secure and reliable platform for your website, application, or even Forex trading needs.

#How Do Vps Work#How Does Vps Work#How Does Vps Work In Forex Trading#How Does Vps Hosting Work#How Are Vps Chosen#How To Vps Rdp#How To Vps Account#How To Vps Price#What Does Vps Stand For#What Does Vps Airport Stand For#What Does Vps Mean In Basketball#What Does Vps Hosting Mean#What Does Vps Stand For In Business#What Does Vps Stand For In School#How Much Does Vps Cost

2 notes

·

View notes

Text

Advantages and Applications for Brokerage Technology Solutions.

Start: Every brokerage services provider looks at growth and expansion in the shortest time possible. And the use of automation, AI, and other emerging technologies is a very clear indicator of that trend. Brokerage Technology Solutions today helps many brokerages scale or push forward their aspirations on several levels. Let’s look at the real advantages and applications.

Where a Forex CRM Is Great for Forex Brokerage Business.

- Better Business Accessibility and Scalability.

Every brokerage service provider wants solutions that grow as the business scales new heights of success and transformation. This includes having end-to-end systems and forex back office software that delivers front office, back office, accounting, and messaging solutions. Besides, incorporating abilities like equity, forex, commodities, and derivatives into the entire forex trade life cycle (pre and post trade) empowers brokerages to operate at optimum efficiency, delivering maximum value and returns.

- Automate and Streamline Customer Data.

There are advantages in streamlining customer data as that allow faster access, enhances safety, improves service delivery and above all impacts your business engagement and performance. Automation has become key in several regions and geographies to ensure better and more standard service access at all times.

When brokerage businesses can automate and streamline customer data, information, or documentation, they are able to reach and serve a wider and more diverse target audience or clientele in a short time. Besides, an automated Forex Crm Solution has built-in options like automated trade orders and peer-to-peer messaging. They empower brokerages to save time and improve accuracy and compliance.

- Track Sales Progress and Enhance Departmental Collaboration.

No one is an island so goes a famous saying or rather you cannot be the all dominant and consuming knowledge of everything. Sometimes, partnerships and collaborations are crucial and vital. Tracking sales progress on a real-time basis drives several growth and transformational factors, which is good for the business.

- Real Time Third Party Integration.

The best advantage of a brokerage business is the ease of integration. It's vital to have secure and faster client management, seamless integration with your back office, multiple communication channel options, and much more. That makes your Forex Crm For Brokers more robust and integrated with both your business and other third-party platforms.

- Reliable Trading Platforms, Payment Gateways and Safe Marketing Channels.

Every forex brokerage business wants secure deals as much as their clients do. It pays to keep all plans and execute them without a drop of standards or exposure to unwarranted risks. That’s where a forex CRM is a lifesaver and guarantor of secure deals and trading platforms.

- User-Friendly, Better Customer Service and Higher Productivity.

These are truly solid company or brokerage firm goals that can take it far with great outcomes. It’s good to have a platform for trading forex or a forex web trading platform that offers all these and more advantages. It pushes business plans and their execution from afar.

End: Are you in the forex brokerage business looking for agile solutions to power your smart brokerage? Well, you just hit the jackpot with the best CRM for forex brokers having new brokerage affiliate software. Standout with your brokerage staying competitive, adaptive, and successful with the custom Forex Crm Solution. A forex CRM for a modern brokerage business is an engine for change and progress.

Blog Source URL:

#Brokerage Technology Solutions#Forex Back Office Software#Crm For Forex Brokers#Crm Forex#Custom Forex Crm#Forex Crm For Brokers#Forex Crm Provider#Forex Crm Software#Forex Crm Solution#Forex Crm System#Brokerage Affiliate Software#Forex Web Design

0 notes

Text

Improving Client Relationships Using CRM in Forex Brokerage

The key to success in the cutthroat world of Forex trading is building and maintaining customer connections. The tools and technologies that enable effective client management change along with the industry. Customer Relationship Management (CRM) software is one such product that has grown to be essential for Forex brokerages.

A Good CRM system is the cornerstone of every profitable Forex brokerage, serving as the primary interface for managing customer relations and optimizing corporate operations as a whole. Choosing the Best CRM solution is essential due to the growing need for efficient operations and tailored services.

Forex brokerages need CRM systems that are not only reasonably priced but also have special features designed to meet their requirements. Presenting ForexCRM, the best CRM solution in the business, which gives brokerages access to cutting-edge features at a reasonable price.

Thanks to ForexCRM and other affordable CRM solutions, brokerages may now affordably manage client interactions with the resources they need. Brokerages of all sizes can make use of CRM's scalable features and features to maximize customer engagement and retention.

ForexCRM's extensive feature set, created especially for Forex brokerages, is what makes it unique. With features like integrated trading platforms, Contest Management, smooth onboarding procedures, sophisticated analytics, Social Trading, and Liquidity Feeds, ForexCRM provides a comprehensive answer to satisfy the many demands of contemporary brokerages.

Brokerages may automate tedious operations, optimize communication channels, and obtain insightful data about customer behavior and preferences by utilizing ForexCRM. Brokerages may expand their company, provide individualized services, and cultivate enduring loyalty by centralizing client data and interactions.

ForexCRM provides customized solutions to simplify complex processes, making it an asset for New brokerage Formation, licensing, and regulatory compliance initiatives. With features like compliance checklists and customizable onboarding workflows, ForexCRM streamlines the registration and licensing process and guarantees prompt approvals.

Brokerages may effortlessly manage regulatory compliance while reducing risk thanks to specialized modules for KYC and AML compliance. Furthermore, ForexCRM makes regulatory reporting system connection easier, allowing for accurate submissions and providing transparency to authorities. All things considered, ForexCRM gives brokerages the confidence they need to successfully negotiate regulatory difficulties, which helps them succeed in the cutthroat Forex business.

In summary, CRM is essential to improving client connections in the Forex brokerage sector. Brokerages can stay ahead of the curve by offering great customer experiences and retaining a competitive edge in the industry with feature-rich and reasonably priced systems like ForexCRM. Unlock the full potential of client relationship management for your Forex brokerage by selecting the finest CRM available.

3 notes

·

View notes

Text

Download US30 EA

Elevate your forex trading game with the Download US30 EA, a cutting-edge Expert Advisor designed to enhance your trading experience on the MetaTrader platform. This powerful tool brings precision, adaptability, and innovation to the forefront, promising traders a dynamic solution for navigating the complexities of the financial markets.

Key Features:

Precision Trading: The US30 EA is equipped with a sophisticated algorithm that ensures precise market analysis. This empowers traders to make informed decisions based on accurate data, allowing them to navigate the ever-changing dynamics of the forex market with confidence and strategic precision.

Adaptability: Market conditions can be unpredictable, but the US30 EA excels in adaptability. Whether facing volatile price movements or evolving trends, this Expert Advisor dynamically adjusts its strategies in real-time, providing traders with the flexibility to optimize performance across various market scenarios.

Innovation: Staying ahead in the fast-paced world of forex trading is crucial. The US30 EA incorporates innovative features and strategies, ensuring traders have access to the latest advancements in trading technology. This commitment to innovation positions users strategically in the competitive landscape of forex trading.

Membership Benefits:

Join a vibrant community of traders who have harnessed the power of the US30 EA. As a member, you'll enjoy exclusive benefits, including:

Regular Updates: Stay ahead of market changes with continuous updates and enhancements to the US30 EA. Our team is dedicated to refining the software to ensure it remains at the forefront of performance.

Educational Resources: Access a wealth of educational materials designed to deepen your understanding of automated trading strategies. This empowers you to maximize the potential of the US30 EA and refine your overall trading approach.

Community Support: Connect with like-minded traders, share insights, and benefit from a supportive community committed to achieving success in forex trading.

Getting Started:

Take control of your trading journey by downloading the US30 EA today. Click the link below to access a tool that combines precision, adaptability, and innovation for unparalleled results on the MetaTrader platform

#ForexTrading#ExpertAdvisor#MetaTrader#US30EA#TradingTools#AlgorithmicTrading#TradingPrecision#InnovationInTrading#TradeSmart

2 notes

·

View notes

Text

Understanding the Working Model of Forex Prop Trading Firms

Most of the passionate people in trading know prop businesses but may need to learn exactly what they do. Property trading firms, or prop firms for short, are niche businesses that invite experienced traders to use their trading abilities on behalf of the company. Prop trading is distinguished from traditional trading by this special structure, which gives traders several benefits and chances in the financial sector.

Essentially, a prop trading company is a financial marketplace that provides funds to knowledgeable traders to trade stocks, commodities, and currencies, among other financial instruments. Through this extract, we intend to clear up the mystery surrounding prop trading and offer a thorough grasp of how it operates within the dynamic context of financial markets.

Business Model of Forex Prop Trading Firms

Capital Allocation and Proprietary Trading Desk:

Forex Prop Trading Companies differentiate themselves from one another based on the capital they offer their dealers. Capital allocation, which allows traders to profit from huge amounts of money above their own capital, is the cornerstone of their business plan. The best forex prop trading firms thoroughly assess risk before disbursing cash to traders.

These assessments consider the trader's approach, prior performance, and additional variables. Based on this evaluation, the company determines how much cash to provide each trader, ensuring that the strategy remains balanced and risk-controlled. Prop trading firms use the profit-sharing model in return for the provided funds. Traders do this by contributing a percentage of their profits to the business.

Trading Strategies and Risk Management:

Exclusive Trading in Forex Businesses uses a wide variety of trading techniques to take advantage of the existing market opportunities and turn it into a profit. Some of the most important trading tactics and risk management techniques these organizations use are statistical arbitrage, high-frequency trading, algorithmic trading, and quantitative strategies. Using sophisticated algorithms and fast data feeds, high-frequency trading allows for the execution of several deals in a matter of milliseconds. Using predefined algorithms to carry out trading strategies is known as algorithmic trading.

These algorithms can examine market data, spot trends, and automatically execute trades by preset parameters. Statistical analysis and mathematical frameworks are used to find trading opportunities in the quantitative trading process. Finding and taking advantage of arithmetic correlations between various financial instruments is the process of statistical arbitrage. By employing this tactic, traders hope to profit from transient disparities in price or mispricing among connected assets. You can control your earnings and losses more with a very successful risk management strategy.

Technology and Tools:

The capacity of Forex Prop Trading Organizations to utilize advanced technologies and apply skillful instruments to maneuver through the intricacies of the financial markets is critical to their success. Discover in this article how these companies' operations rely heavily on technology such as data analytics, trading algorithms, direct market access (DMA), etc. Large volumes of market data are processed in real-time by these companies using sophisticated analytics techniques.

Traders can obtain important insights that guide their trading methods by looking at past data and detecting patterns. Prop businesses use several trading tactics, one of which is algorithmic trading. These systems automate the execution of trades based on predefined conditions using intricate algorithms. A "direct market access" technique enables traders to communicate with financial markets directly and eliminates the need for middlemen. Forex Prop Trading Firms use DMA to provide quick and effective order execution by executing transactions with the least delay.

Regulatory Framework:

Similar to other financial operations, prop trading is subject to several laws and rules that are designed to maintain market stability, equitable treatment, and transparency. Prop trading rules differ from nation to nation, but they are always intended to balance encouraging financial innovation with discouraging actions that would endanger the system. For instance, the US Dodd-Frank Act has placed several limitations on prop trading, especially for commercial banks. The purpose of these restrictions is to restrict trading activity that carries a high risk of destabilizing the financial system.

The minimum capital requirements for forex prop trading firms are frequently outlined in regulations. Regulators seek to improve the overall stability of the financial system and lower the danger of insolvency by setting minimum capital limits. Regulations also require prop trading companies to use effective risk management techniques, such as defining profit goals and using complex techniques like volatility/merger arbitrage to reduce risk. The execution of trading methods by forex proprietary trading firms is mostly dependent on prop traders. It is essential for a prop trader to be be clear about the legal and regulatory landscape in which they operate.

Success Factors and Challenges

The best Forex prop firms rely on a number of variables to be successful, including personnel management, technology, technological adaptation, good risk management, and strategic alliances. Prop businesses must address the difficulties of market saturation, liquidity constraints, technology risks, market volatility, talent retention, and regulatory compliance to succeed in the competitive and constantly changing world of forex trading.

The reason being that forex markets are dynamic, there is a chance that prices would observe fluctuations quickly and unexpectedly. In order to overcome increased volatility, best prop firms for forex need to have strong risk management methods. Businesses that rely heavily on technology run the risk of experiencing cybersecurity attacks and system malfunctions. Strong cybersecurity safeguards, regular monitoring, and upgrades are necessary to mitigate these dangers.

Conclusion

Navigating the intricacies of financial markets requires a thorough understanding of the Forex Proprietary Trading Firms operating model. It involves more than just making profitable trades; it also involves understanding the bigger picture, including subtle regulatory differences, new technological developments, and risk management techniques.

Prop traders need to be aware of the legal and regulatory landscape, the value of utilizing technology, and the crucial role they play in the success of their companies, regardless of their level of experience. The robustness and success of the larger financial ecosystem are strengthened by ongoing education and interaction with the complex components of Forex Proprietary Trading Firms.

2 notes

·

View notes

Video

youtube

primexalgo USDJPY 21 Consecutive Successes! "PrimeXAlgo: 27 Consecutive Successes! AI-Based Real-Time Trading Signal Technology"Description:Introducing PrimeXAlgo's innovative AI trading signal technology. Boasting impressive results with 27, 17, 18, and 20 consecutive successes.Key features:• No repainting on real-time charts (Gold, BTC, Nasdaq, etc.)• 100% legal and ethical signal technology• AI applied to a dataset of 2,500 comprehensive indicators• Real-time trading signals provided (no delay)• Works across all markets and time zones• BTP and STP signals for closing positions• AI predictions displayed (Buy, Sell, Neutral)Experience PrimeXAlgo's performance, verified across various markets including gold, Bitcoin, and Nasdaq!Tags:#PrimeXAlgo,#AITrading,#RealTimeSignals,#TradingTechnology,#GoldInvestment,#BitcoinTrading,#AIPrediction,#TradingSuccessStories,#FX,#FOREX,#GOLD,#Chart,#TradingChart,#Stock,#Finance,#Investment,primexalgo,primex,treader,#primexalgo,Consecutive Successes,No repainting on,real-time charts

2 notes

·

View notes

Text

youtube

At Gambit, we believe that financial success starts with a trusted partner. Our team of seasoned professionals provides customized solutions for forex trading, wealth management, and financial planning. With cutting-edge technology and a deep understanding of market trends, we are committed to helping you achieve your financial goals. Whether you're a beginner or an experienced trader, trust Gambit to deliver a personalized approach to success. Join us today and discover the power of finance. #forextrading #financialservices #wealthmanagement #Gambit

4 notes

·

View notes