#Flight Simulator Market size

Explore tagged Tumblr posts

Text

New SpaceTime out Friday

SpaceTime 20250606 Series 28 Episode 68

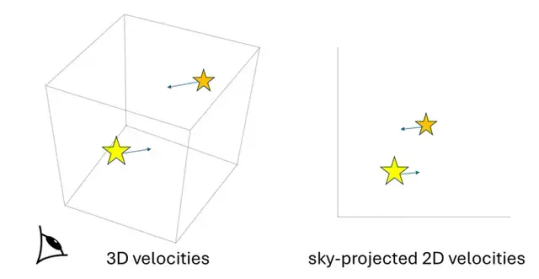

Confirmation of Modified Newtonian Dynamics as a possible alternative to dark matter

A new study has provided more evidence that the hypothesis of Modified Newtonian Dynamics or MOND could provide a possible alternative to dark matter.

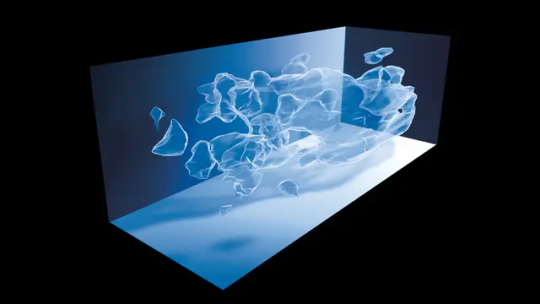

Earth's core contains vast hidden gold reserves

A new study has found that Earth's largest gold reserves are not kept inside Fort Knox but lie buried deep under 3,000 kilometres of solid rock.

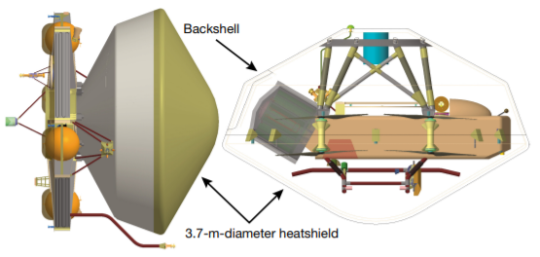

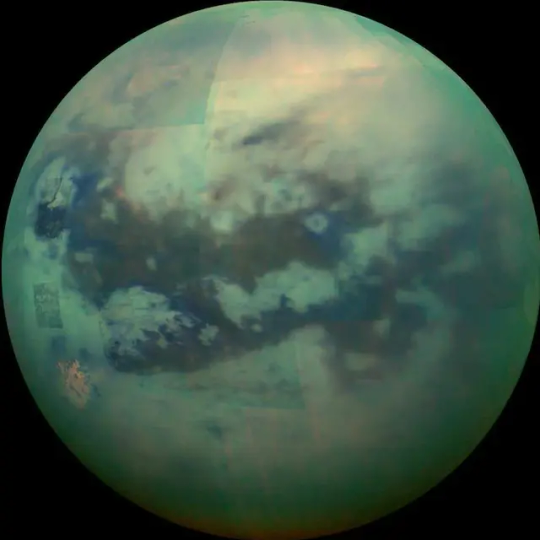

Looking for the chemistry of life on Titan

NASA’s Dragonfly car-sized rotorcraft set to launch in 2028 to explore the frigid Saturnian moon of Titan to potentially answer one of science's biggest questions: How did life begin?

The Science Report

Study claims humans may have been making tools from whale bones up to 20,000 years ago.

Quantum computer used to simulate the chemical dynamics of real compounds for the first time.

A new study has found that biodiversity in Antarctic soils might be much greater than previously thought.

Skeptics guide to Winston Churchill and Britain's last witch.

SpaceTime covers the latest news in astronomy & space sciences.

The show is available every Monday, Wednesday and Friday through your favourite podcast download provider or from www.spacetimewithstuartgary.com

SpaceTime is also broadcast through the National Science Foundation on Science Zone Radio and on both i-heart Radio and Tune-In Radio.

SpaceTime daily news blog: http://spacetimewithstuartgary.tumblr.com/

SpaceTime facebook: www.facebook.com/spacetimewithstuartgary

SpaceTime Instagram @spacetimewithstuartgary

SpaceTime twitter feed @stuartgary

SpaceTime YouTube: @SpaceTimewithStuartGary

SpaceTime -- A brief history

SpaceTime is Australia’s most popular and respected astronomy and space science news program – averaging over two million downloads every year. We’re also number five in the United States. The show reports on the latest stories and discoveries making news in astronomy, space flight, and science. SpaceTime features weekly interviews with leading Australian scientists about their research. The show began life in 1995 as ‘StarStuff’ on the Australian Broadcasting Corporation’s (ABC) NewsRadio network. Award winning investigative reporter Stuart Gary created the program during more than fifteen years as NewsRadio’s evening anchor and Science Editor. Gary’s always loved science. He was the dorky school kid who spent his weekends at the Australian Museum. Gary studied astronomy at university and was invited to undertake a PHD in astrophysics, but instead focused on a career in journalism and radio broadcasting. His radio career stretches back some 34 years including 26 at the ABC. Gary’s first gigs were spent as an announcer and music DJ in commercial radio, before becoming a journalist, and eventually joining ABC News and Current Affairs. He was part of the team that set up ABC NewsRadio and became one of its first on air presenters. When asked to put his science background to use, Gary was appointed Science Editor and quickly developed the StarStuff Astronomy shgw, which he wrote, produced, and hosted. The program proved extremely popular, consistently achieving 9 per cent of the national Australian radio audience -- based on the ABC’s Nielsen ratings survey figures for the five major Australian metro markets: Sydney, Melbourne, Brisbane, Adelaide, and Perth. That compares to the ABC’s overall radio listenership of 5.6 per cent. The StarStuff podcast was published on line by ABC Science -- achieving over 1.3 million downloads annually. However, after some 20 years, the show finally wrapped up in December 2015 following ABC funding cuts, and a redirection of available finances to increase sports and horse racing coverage. Rather than continue with the ABC, Gary resigned so that he could keep the show going independently. StarStuff was rebranded as “SpaceTime”, with the first episode broadcast in February 2016. Over the years, SpaceTime has grown, more than doubling its former ABC audience numbers and expanding to include new segments such as the Science Report -- which provides a wrap of general science news, weekly skeptical science features, special reports looking at the latest computer and technology news, and Skywatch – which provides a monthly guide to the night skies. The show is published three times a week (every Monday, Wednesday and Friday) and it’s available from the United States National Science Foundation on Science Zone Radio, and through both i-heart Radio and Tune-In Radio.

#science#space#astronomy#physics#news#nasa#astrophysics#esa#spacetimewithstuartgary#starstuff#spacetime#hubble telescope#hubble#hubble space telescope

9 notes

·

View notes

Text

AR/VR Technology: Types, Uses, and Future with Karyahub Studios

Introduction to AR/VR: The Future Is Now

Welcome to the future of immersive technology! Augmented Reality (AR)and Virtual Reality (VR)are no longer science fiction ideas — they're technologies reshaping the way we live, learn, shop, and work.

At Karyahub Studios, we're experts at providing best-in-class AR/VR development services specifically designed for businesses looking to go digital. If you're just starting out in this domain or interested in understanding how AR/VR can help grow your business, this blog covers everything you need to know.

What is AR/VR?

Augmented Reality (AR) adds digital overlays to your real world — imagine interactive product demonstrations or live navigation.

Virtual Reality (VR) completely engulfs users in a virtual 3D environment through headsets such as Oculus Quest or HTC Vive.

AR and VR, together, are an effective toolset for creating next-generation experiences across sectors.

Types of AR Technology

1. Marker-Based AR

Detects special patterns (such as QR codes) to show AR content.

Example: Scannable animations on product packaging.

2. Markerless AR

Deploys GPS, gyroscopes, and accelerometers to activate AR without pre-defined markers.

Example: AR navigation apps.

3. Projection-Based AR

Projects light and images onto surfaces — best for presenting holograms.

Example: Museum exhibits.

4. Superimposition-Based AR

Replaces the actual view with a digital substitute.

Example: AR in surgery or industrial maintenance.

Types of VR Technology

1. Non-Immersive VR

Provides virtual interaction using standard screens.

Example: Simulators or 3D tours.

2. Semi-Immersive VR

Mixes a virtual scene with real-world components.

Example: Flight simulators.

3. Fully Immersive VR

Provides a 360° experience with the use of VR headsets and motion sensors.

Example: VR games, architectural walkthroughs.

Top Applications of AR/VR in 2025

1. AR/VR in Education

Virtual classrooms

3D science models

Immersion in languages

2. AR/VR in Healthcare

Surgical training simulators

AR for vein visualisation

VR for therapy of mental illnesses

3. AR/VR in Retail

Virtual try-on functionality

AR experiences in stores

Customized product visualizations

4. AR/VR in Real Estate

VR property tours

AR interior previews

Virtual staging software

5. AR/VR in Marketing

Interactive product launches

Branded AR filters on social media

Immersive storytelling campaigns

Chief Applications of AR/VR Technology

Improving customer experience

Professional training & simulation

Product visualization prior to buying

Remote collaboration in immersive spaces

Data visualization in 3D for more effective decision-making

Here at Karyahub Studios, we apply AR/VR to address real business challenges — from product training to customer interaction — with tailored, scalable solutions.

Why Karyahub Studios for AR/VR Development?

✅ Personalized immersive experiences

✅ Cross-platform development (Unity, Unreal Engine, WebAR)

✅ Experienced team of 3D artists, developers & storytellers

✅ Success track record across sectors

We turn your concepts into reality with the latest tools and interactive storytelling — be it a VR training module or an AR product demo.

Frequently Asked Questions (FAQs)

1. Which industries gain the most from AR/VR?

Those industries that gain the most include education, healthcare, property, online shopping, gaming, and training industries.

2. Do I require a special device to access AR/VR?

AR: Mostly through smartphones or tablets.

VR: Headsets such as Oculus, HTC Vive, or the like are needed.

3. Is AR/VR costly to apply?

The cost depends on the complexity. We provide “flexible pricing” at Karyahub Studios that accommodates companies of any size.

4. Can AR/VR grow customer interaction?

Yes. Brands that employ AR/VR see their engagement levels increase by 30–50% above the level of traditional media.

5. How much time does it take to create an AR/VR experience?

Development times can vary from several weeks up to several months, depending on the complexity of the project and the features included.

Conclusion: The AR/VR Revolution Begins with You

AR/VR is not tomorrow — it's today. As industries keep transforming, immersive technologies present unparalleled engagement, efficiency, and innovation.

Whether you're launching an interactive product or a virtual training solution, Karyahub Studios can assist you in making it a reality.

Let's Build the Future, Together

Visit us: https://karyahubstudios.com

Get in touch: Phone us today to arrange a complimentary consultation and discover how AR/VR can transform your brand.

0 notes

Text

0 notes

Text

Flight Simulator Market Size, Share & Trends Analysis growing at a CAGR of 5.1% from 2025 to 2033

The global flight simulator market size was valued at USD 5.62 billion in 2024 and is projected to reach USD 8.70 billion by 2033, growing at a CAGR of 5.1% from 2025 to 2033. The market is witnessing steady growth, driven by the increasing demand for smart warehousing, autonomous delivery, and last-mile logistics full flight simulator (FFS). Key Market Trends & Insights Europe held 31.6%…

0 notes

Text

Failure Analysis Market Size Unlocking Reliability Through Advanced Diagnostics

The global Failure Analysis Market Size is witnessing robust expansion, driven by the increasing complexity of semiconductor devices, the rising need for product reliability, and growing demand for quality assurance across industries. Failure analysis enables organizations to investigate the root cause of faults in materials, electronics, and systems—ultimately enhancing design, manufacturing, and product lifecycle decisions. According to Market Size Research Future, the market is projected to reach USD 10.4 billion by 2030, growing at a CAGR of 8.3% from USD 5.2 billion in 2023.

Market Size Overview

Failure analysis involves a range of techniques such as microscopy, spectroscopy, and simulation to diagnose issues in failed components, identify root causes, and propose corrective actions. It plays a pivotal role across sectors such as semiconductors, aerospace, automotive, energy, and consumer electronics. The growing miniaturization of devices and adoption of advanced materials have increased the criticality of failure analysis to ensure performance, safety, and compliance.

As modern manufacturing pushes boundaries of design complexity and cost efficiency, failure analysis becomes a strategic imperative for minimizing downtime, reducing product recalls, and enhancing overall reliability.

Market Size Segmentation

The Failure Analysis Market Size is segmented as follows:

By Equipment:

Scanning Electron Microscope (SEM)

Transmission Electron Microscope (TEM)

Focused Ion Beam (FIB)

Secondary Ion Mass Spectrometry (SIMS)

Dual Beam System

Others

By Technology:

Energy Dispersive X-ray Spectroscopy (EDX)

Time-of-Flight Secondary Ion Mass Spectrometry (TOF-SIMS)

Broad Ion Milling (BIM)

Others

By Application:

Semiconductors

Industrial & Manufacturing

Automotive

Aerospace & Defense

Telecommunications

Medical Devices

Others

By Region:

North America

Europe

Asia-Pacific

Rest of the World

Emerging Trends

1. Shift Toward 3D Failure Analysis

The integration of 3D imaging technologies into electron microscopy is offering deeper insights into microstructures and internal defects. This is especially beneficial in analyzing advanced semiconductor packages and 3D ICs.

2. Rise in Semiconductor Complexity

With transistor sizes shrinking and node geometries reaching below 5nm, the failure points in integrated circuits are becoming harder to detect. This trend is prompting increased investment in advanced failure analysis tools.

3. AI-Powered Diagnostics

Artificial intelligence and machine learning algorithms are being embedded into analysis tools to automate defect detection, pattern recognition, and classification, improving accuracy and speed.

4. Environmental and Mechanical Failure Investigation

Beyond electronic failures, environmental and mechanical factors such as corrosion, fatigue, and thermal shock are being scrutinized through advanced simulation and modeling.

5. Increased Use in Medical and Automotive Devices

Stringent safety regulations in healthcare and automotive sectors are prompting the use of failure analysis to ensure component reliability under harsh operating conditions.

Segment Insights

By Equipment Insight:

SEM and TEM remain the dominant equipment types due to their ability to deliver high-resolution imaging. However, FIB systems are increasingly preferred for their dual functionality in imaging and precise material removal for cross-sectional analysis.

By Application Insight:

The semiconductor segment leads the market, accounting for the majority share. The growing demand for chip performance, yield optimization, and zero-defect manufacturing makes failure analysis critical to chip fabrication and packaging.

By Technology Insight:

Energy Dispersive X-ray Spectroscopy (EDX) is widely used in conjunction with SEMs to analyze elemental compositions of materials at failure sites. Techniques like TOF-SIMS are gaining traction for high-resolution chemical analysis.

End-User Insights

Semiconductor Manufacturers:

Fabrication labs and chip designers rely on failure analysis to reduce yield loss, investigate wafer defects, and validate device reliability during R&D and mass production.

Aerospace & Automotive Industries:

These industries demand high durability and safety compliance. Failure analysis is vital for understanding stress points in critical components such as turbine blades, engine parts, and onboard electronics.

Medical Device Manufacturers:

In medical implants and diagnostics, failure analysis ensures biocompatibility and product functionality—helping companies avoid costly product recalls and maintain regulatory approvals.

Industrial Manufacturing:

OEMs and component suppliers use failure analysis to improve product life, reduce maintenance costs, and ensure that materials can withstand harsh operational conditions.

Key Players

Leading players in the Failure Analysis Market Size are investing in high-resolution imaging, AI integration, and multi-functional instruments to cater to diverse industries:

Carl Zeiss AG – Renowned for advanced electron microscopy and imaging systems.

Thermo Fisher Scientific Inc. – Offers comprehensive solutions including SEM, TEM, and dual beam systems.

Hitachi High-Technologies Corporation – Provides precision equipment for electronics and material failure analysis.

A&D Company Ltd. – Specializes in analytical instrumentation and reliability testing tools.

JEOL Ltd. – Known for electron microscopes and spectroscopy instruments.

Eurofins Scientific – Offers failure analysis as part of its broader materials and electronics testing services.

Future Outlook

The Failure Analysis Market Size is expected to witness continued innovation with the integration of automated analysis, real-time data feedback, and cloud-enabled diagnostics. As industries advance toward smart manufacturing, the ability to proactively detect and address potential failures will become indispensable.

With increasing regulatory scrutiny and product complexity, failure analysis will transition from being a reactive tool to a proactive component in design and quality engineering strategies. Equipment miniaturization, AI integration, and cost-effective services will further broaden its adoption across small and mid-sized enterprises.

Conclusion

The Failure Analysis Market Size is emerging as a cornerstone of modern engineering and manufacturing. It supports innovation, ensures reliability, and safeguards reputations across industries. As technologies advance and product expectations rise, failure analysis will remain a critical enabler of operational excellence and customer trust.

Trending Report Highlights

Explore related emerging markets with high-growth potential:

Beam Bender Market Size

Depletion Mode Junction Field Effect Transistor Market Size

Logic Semiconductors Market Size

Semiconductor Wafer Transfer Robots Market Size

US Warehouse Robotics Market Size

Single Multi Stage Semiconductor Coolers Market Size

Gas Concentration Sensor Market Size

Thermal Management in Consumer Electronics System Market Size

Underfill Dispensers Market Size

Wet Chemicals Market Size

Taiwan Robotics Market Size

0 notes

Text

Global Flight Simulator Market

The Global Flight Simulator Market size was valued at USD 7.8 billion in 2023. It is likely to grow up to USD 13.6 billion by 2030 at a CAGR of 7.1 % during the forecast period, ranging between 2025 and 2030.

Explore more- https://www.vynzresearch.com/automotive-transportation/global-flight-simulator-market/request-sample

Key Drivers

Surging air travel & pilot shortage

Safety & cost-efficiency

Advancements in simulation tech

Key Players

CAE Inc., Boeing, Airbus, L3Harris, FlightSafety International, TRU Simulation, Thales, Lockheed Martin, Leonardo, etc

Source

VynZ Research

9960288381

0 notes

Text

0 notes

Text

0 notes

Text

0 notes

Text

0 notes

Text

0 notes

Text

Simulators Market Size, Share, Forecast, & Trends Analysis

Meticulous Research®—a leading global market research company, published a research report titled 'Simulators Market—Global Opportunity Analysis and Industry Forecast (2025-2032)’. According to this latest publication from Meticulous Research®, the simulators market is expected to reach $30.3 billion by 2032, at a CAGR of 5.6% from 2025 to 2032.

The growth of the simulators market is primarily driven by the growing demand for risk-free, simulator-based training environments and the increasing adoption of simulators in the military and aviation sectors. However, the high initial investments and operational costs associated with these simulators restrain the growth of this market.

Additionally, the integration of virtual reality (VR) and augmented reality (AR) into simulators, the development of simulators for unmanned aerial systems (UAS), and advancements in simulation technology are expected to create growth opportunities for players operating in this market. However, data security concerns pose a major challenge to the market’s growth.

The simulators market is segmented by product type, technology, application, and end-use industry. The report evaluates industry competitors and analyzes the market at the regional and country levels.

Based on product type, in 2025, the flight simulators segment is anticipated to dominate the simulators market. Factors contributing to the segment’s dominant position in the simulators market include the increasing acceptance of virtual pilot training, rising demand for effective training methods, and strict regulatory requirements that mandate simulator training. Flight simulators provide a cost-effective alternative to actual flight time, reducing fuel and maintenance costs. Additionally, their customizability allows for targeted training tailored to specific aircraft models.

Based on technology, the virtual reality simulators segment is anticipated to dominate the simulators market. Factors contributing to the segment’s dominant position in the simulators market include advancements in VR technology, a growing demand for immersive learning experiences, and the increasing use of virtual reality simulators in the aerospace & defense sector.

Based on application, the training and education segment is anticipated to dominate the simulators market. Factors contributing to the segment’s dominant position in the simulators market include the increasing demand for risk-free training environments, the growing need for simulator-based training across various industries, and the rising focus on experiential learning, which encourages educational institutions to adopt simulators to provide practical, real-world scenarios for students.

Based on end-use industry, the aerospace and defense segment is anticipated to dominate the simulators market. Factors contributing to the segment’s dominant position in the simulators market include rapid advancements in simulator technology, the development of simulators for unmanned aerial systems (UAS), and the rising demand for simulator-based training in the defense sector.

Based on geography, in 2025, North America dominates the simulators market. The presence of major simulator companies, including CAE Inc. (Canada), L3Harris Technologies, Inc. (U.S.), FAAC Incorporated (U.S.), and TRU Simulation + Training Inc. (U.S.), contribute to the region's high revenue share. Additionally, the rising demand for simulator-based training solutions, substantial R&D investments promoting the development of advanced simulation technologies, and high defense budgets in the U.S. driving investments in military training simulators are factors contributing to the region’s dominant position in the simulators market.

Key Players:

The key players operating in the simulators market are CAE Inc. (Canada), L3Harris Technologies, Inc. (U.S.), FlightSafety International Inc. (U.S.), FAAC Incorporated. (U.S.), Elbit Systems Ltd. (Israel), HAVELSAN Inc. (Turkey), AMST-Aviation GmbH (Austria), TRC Simulators b.v. (Netherlands), Vesaro (U.K.), TRU Simulation + Training Inc. (U.S.), CKAS Mechatronics Pty Ltd. (Australia), Pulseworks, LLC. (U.S.), ECA Group (France), and Thales Group (France).

Download Sample Report Here @ https://www.meticulousresearch.com/download-sample-report/cp_id=6051

Key Questions Answered in the Report-

What is the revenue generated from the sales of simulators?

At what rate is the global demand for simulators projected to grow for the next five to seven years?

What is the historical market size and growth rate for the simulators market?

What are the major factors impacting the growth of this market at the global and regional levels?

What are the major opportunities for existing players and new entrants in the market?

Which product type, technology, application, and end-use industry segments create major traction in this market?

What are the key geographical trends in this market? Which regions/countries are expected to offer significant growth opportunities for the manufacturers operating in the simulators market?

Who are the major players in the simulators market? What are their specific product offerings in this market?

What are the recent developments in the simulators market? What are the impacts of these strategic developments on the market?

Contact Us: Meticulous Research® Email- [email protected] Contact Sales- +1-646-781-8004 Connect with us on LinkedIn- https://www.linkedin.com/company/meticulous-research

#simulators Market#Simulators#Flight Simulators#Driving Simulators#Medical Simulators#Military Simulators#Marine Simulators#Virtual Reality Simulators#Augmented Reality

0 notes

Text

How to Choose the Right Aviation Academy for Pilots: A Complete Guide

Pursuing a career as a pilot is more than a dream—it’s a commitment to rigorous training, discipline, and dedication. One of the most critical steps on this journey is selecting the right aviation academy. With numerous institutes across India offering flight training, it's essential to choose one that not only meets industry standards but also aligns with your career goals.

Whether you're just out of school or switching careers, this complete guide will help you understand what to look for when choosing the right aviation academy for pilots.

1. Define Your Aviation Career Path

Before comparing academies, take a moment to define your aviation goal. Are you aiming to become a commercial pilot, a private jet pilot, or work in aviation management? Your career path will determine the type of training and certification you need.

Most aspiring pilots begin with a Commercial Pilot License (CPL), which includes flight training, simulator hours, and theoretical instruction. Your chosen academy should specialize in the kind of pilot license that fits your goals.

2. Verify DGCA Approval and Industry Accreditation

In India, the Directorate General of Civil Aviation (DGCA) is the regulatory authority for civil aviation. Any aviation academy you consider must be approved by the DGCA to ensure it meets the official standards for training and safety.

A reputable aviation institute in Lucknow, for instance, typically displays its DGCA credentials clearly and follows a syllabus approved by national aviation authorities.

3. Assess the Quality of Instructors and Aircraft

Aviation training is only as good as the people and equipment behind it. Check whether the flight instructors are experienced and hold the appropriate licenses. It's also helpful to ask about the instructor-to-student ratio—smaller class sizes usually mean more personalized instruction.

Evaluate the fleet size and aircraft condition. A modern, well-maintained fleet with models like the Cessna 152 or 172 is a good sign of a well-run program.

4. Examine the Course Structure and Syllabus

An academy’s curriculum should provide a strong foundation in both practical and theoretical aspects of flying. A comprehensive training program will include subjects like:

Air Navigation

Aviation Meteorology

Aircraft Systems

Human Factors in Aviation

Air Law and Regulations

Make sure the program includes simulator training and real-time flying experience. For example, a well-equipped flying school in Lucknow offers a detailed syllabus aligned with DGCA requirements and prepares students for both exams and real-world flying.

5. Look Into Flight Hour Guarantees and Scheduling

One of the main requirements to obtain a CPL is completing at least 200 hours of flying. Ensure that the academy guarantees these hours within the course timeline and has the capacity to provide consistent training without delays.

Also, inquire about how weather and maintenance are handled. Frequent delays due to aircraft issues or scheduling problems can extend your training time significantly.

6. Investigate Past Performance and Alumni Success

Success stories speak louder than promises. Research how previous students have performed—have they successfully obtained their licenses? Are they now working with reputed airlines?

A good academy will often share alumni testimonials and placement records. These can give you insight into the quality of training and job support you can expect after completing the program.

7. Evaluate Additional Facilities and Support

Some aviation academies offer more than just flying lessons—they also provide support services like:

DGCA exam preparation

English language training for aviation

Accommodation and food services

Personality development classes

Internship or placement assistance

These extras can enhance your training experience and better prepare you for a competitive aviation job market.

An established aeronautical training institute Lucknow, for example, typically combines flight education with soft skills development and post-training support to ensure holistic preparation.

8. Consider the Training Location and Weather Conditions

Weather plays a major role in flight training. Locations with stable climates allow for more flying days, helping you complete your course on time. Lucknow, with its moderate weather and good visibility for most of the year, is often chosen for this very reason.

Also, think about convenience and cost of living. Training closer to home or in a reasonably priced city can reduce overall expenses.

9. Compare Fees and Financing Options

Pilot training is an investment. Depending on the program, the cost of obtaining a CPL in India ranges from ₹25 to ₹45 lakhs. It’s crucial to get a detailed breakdown of what the fees include—such as uniforms, study materials, simulator hours, DGCA exams, and flying time.

Some academies offer EMI options, scholarships, or tie-ups with banks for education loans. Be sure to ask about financial assistance before enrolling.

10. Visit the Academy (If Possible)

Lastly, if feasible, visit the campus in person. A physical tour lets you observe the condition of the aircraft, classrooms, and facilities firsthand. You’ll also get a feel for the learning environment and be able to speak directly with instructors and current students.

This real-world check can confirm whether the promises made on paper match reality.

Conclusion

Choosing the right aviation academy is a major milestone on your journey to the cockpit. From checking DGCA approval to evaluating instructor quality and understanding the financial investment, every step matters. A strong foundation in the right environment will not only help you earn your pilot license but also build confidence, competence, and a clear path toward a successful career.

Take the time to research, compare, and consult before making your decision. With the right training partner, your dream of flying professionally can soon become your reality.

0 notes

Text

0 notes

Text

Golf Launch Monitor Market Size | Share and Forecast by 2025-2033

The Reports and Insights, a leading market research company, has recently releases report titled “Golf Launch Monitor Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033.” The study provides a detailed analysis of the industry, including the global Golf Launch Monitor Market share, size, trends, and growth forecasts. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Report Highlights:

How big is the Golf Launch Monitor Market?

The global golf launch monitor market was valued at US$ 230.5 Million in 2024 and is expected to register a CAGR of 5.5% over the forecast period and reach US$ 373.2 Million in 2033.

What are Golf Launch Monitor?

A golf launch monitor is a tool utilized to monitor and analyze different aspects of a golfer's swing and the trajectory of the ball. These monitors employ radar, cameras, or other sensors to measure variables such as clubhead speed, ball speed, launch angle, spin rate, and carry distance. By providing golfers, instructors, and club fitters with valuable data, these devices aid in enhancing performance by offering insights into swing mechanics and equipment effectiveness. They are commonly used in both professional and amateur golf to help players improve their skills.

Request for a sample copy with detail analysis: https://www.reportsandinsights.com/sample-request/1782

What are the growth prospects and trends in the Golf Launch Monitor industry?

The golf launch monitor market growth is driven by various factors. The market for golf launch monitors is rapidly expanding due to a growing need for cutting-edge technology to enhance golf performance. These monitors are gaining popularity among professional golfers, coaches, and enthusiasts, offering valuable insights into swing mechanics and ball flight characteristics. Technological advancements, such as enhanced sensor accuracy and improved data analysis capabilities, are further driving market growth by improving user experiences. With increasing interest in golf and a trend towards data-driven improvement, the golf launch monitor market is poised for continued growth in the foreseeable future. Hence, all these factors contribute to golf launch monitor market growth.

What is included in market segmentation?

The report has segmented the market into the following categories:

Type of Launch Monitor:

Doppler-based Launch Monitors

Camera-based Launch Monitors

Infrared-based Launch Monitors

Radar-based Launch Monitors

Application:

Training and Practice

Indoor Simulator

Club Fitting

Entertainment and Gamin

End-User:

Professional Golfers

Golf Training Institutes and Academies

Golf Clubs and Facilities

Individual Consumers

Connectivity:

Wired

Wireless

Distribution Channel:

Online Retail

Offline Retail

Features and Technology:

Swing Analysis

Ball Flight Tracking

Club Data Measurement

Shot Dispersion Analysis

Launch Angle and Spin Measurement

Integration with Other Technologies:

Virtual Reality (VR) Integration

Augmented Reality (AR) Integration

Mobile Application Integration

Cloud-based Data Storage

Segmentation By Region:

North America:

United States

Canada

Europe:

Germany

United Kingdom

France

Italy

Spain

Russia

Poland

BENELUX

NORDIC

Rest of Europe

Asia Pacific:

China

Japan

India

South Korea

ASEAN

Australia & New Zealand

Rest of Asia Pacific

Latin America:

Brazil

Mexico

Argentina

Rest of Latin America

Middle East & Africa

Saudi Arabia

South Africa

United Arab Emirates

Israel

Rest of MEA

Who are the key players operating in the industry?

The report covers the major market players including:

TrackMan A/S

Foresight Sports

FlightScope

Ernest Sports

Rapsodo

SkyTrak

GCQuad by Foresight Sports

Voice Caddie

OptiShot Golf

Zepp Golf

Swing Caddie by Voice Caddie

Garmin

P3ProSwing

Sports Sensors

Uneekor

View Full Report: https://www.reportsandinsights.com/report/Golf Launch Monitor-market

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

Reports and Insights consistently mееt international benchmarks in the market research industry and maintain a kееn focus on providing only the highest quality of reports and analysis outlooks across markets, industries, domains, sectors, and verticals. We have bееn catering to varying market nееds and do not compromise on quality and research efforts in our objective to deliver only the very best to our clients globally.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

Contact Us:

Reports and Insights Business Research Pvt. Ltd. 1820 Avenue M, Brooklyn, NY, 11230, United States Contact No: +1-(347)-748-1518 Email: [email protected] Website: https://www.reportsandinsights.com/ Follow us on LinkedIn: https://www.linkedin.com/company/report-and-insights/ Follow us on twitter: https://twitter.com/ReportsandInsi1

0 notes