#Event coverage service in UAE

Explore tagged Tumblr posts

Text

There is much concern that Elon Musk’s Starlink intends to provide satellite internet coverage to the United States following the failure of its Red Sea “Operation Prosperity Guardian” alliance to curb Yemen’s pro-Palestinian front.

This conversation has gained traction since the company’s announcement on 18 September that it would launch services in Yemen after months of informal contracts with the Saudi-backed government in Aden. The timing of this announcement raised eyebrows, especially as it coincided with Israel’s terrorist attacks in Lebanon, involving exploding pagers and walkie-talkies.

[...]

The announcement that Yemen would be the first country in West Asia to have full access to its services surprised many – particularly because the US embassy in Yemen was quick to praise the move as an “achievement” that could unlock new opportunities.

[...]

The rival Sanaa government, under which most of Yemen’s population lives, was quick to warn that the Starlink project may threaten Yemen and its national security. Mohammed al-Bukhaiti, a member of Ansarallah’s political bureau, criticized the US embassy’s stance, which he says:

"Confirms the relationship between the launch of Starlink and the war launched by America on Yemen, which threatens to expand the conflict to the orbits of outer space for the first time in history."

[...]

In March, the Financial Times reported that the US and UK faced intelligence shortfalls in their Red Sea campaign, particularly around the capabilities of the Ansarallah-aligned forces’ arsenal. This intelligence gap underlined the west’s need for a reliable spy network, and Starlink’s role in this context raises serious questions.

A Reuters report revealed that SpaceX had signed secret contracts with the US Department of Defense aimed at developing a spy satellite system capable of detecting global threats in real-time.

[...]

Another concerning aspect is the involvement of Israel. Israel’s spy satellites, OFEK-13 and OFEK-14, are reportedly linked to Starlink’s satellite network. SpaceX, as a third party, may provide critical guidance and intelligence to these satellites, further enhancing Tel Aviv’s surveillance capabilities in the region. This connection between Starlink and Israeli intelligence efforts has heightened fears in Yemen that the satellite network will be used to undermine the country’s security and sovereignty.

Currently, Starlink services are available primarily in Yemeni areas controlled by the Saudi and UAE-led coalition, although roaming packages allow temporary access in other regions. This has prompted concerns about data security, privacy, and the spread of misinformation, as unrestricted satellite internet bypasses local government control.

[...]

Moreover, cybersecurity risks are particularly troubling, as the network might be exploited for dangerous purposes, including facilitating terrorist activities like bombings. The presence of a global satellite internet service that bypasses local regulations raises concerns about its potential to disrupt local internet infrastructure.

Starlink could also introduce unfair competition to local provider Yemen Net, further marginalizing the national telecom provider and hindering local development efforts.

[...]

Dr Youssef al-Hadri, a right-wing political affairs researcher, shared his views with The Cradle on the recent events in Lebanon and the ongoing electronic warfare involving the US and its allies. According to Hadri, intelligence agencies operating in areas under the control of the Sanaa government face challenges in detecting the locations of missiles, drones, and military manufacturing sites.

This shortfall became even more apparent after a major intelligence operation exposed a long-running spy cell in Yemen, with activities spanning across multiple sectors.

From the risk of espionage to the undermining of local telecom providers, the implications of Starlink’s operations extend far beyond providing internet access – they could become a vehicle for foreign influence and control.

[...]

3 Oct 2024

13 notes

·

View notes

Text

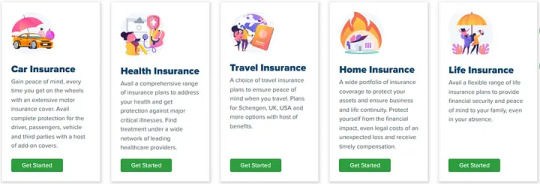

Financial Security: Why You Should Secure Your Life Before Anything Else

Introduction

Insuring yourself is an important step in securing your financial future. Insurance provides the safety net of protection against potential losses, offering peace of mind and security to individuals and families. In the UAE, insurance plays a pivotal role in protecting people from unforeseen risks and ensuring that their loved ones are taken care of financially should something unexpected happen. Understanding what type of coverage you need for different life events can help you make smart decisions about which policy is best for your needs. From health insurance plans to motor vehicle coverage and more, having the right insurance can give you greater financial security both now and into the future.

Benefits of Insuring Yourself in UAE

One of the biggest benefits of insuring yourself in the UAE is protection against financial loss. Having a policy in place will ensure that any unexpected expenses or losses are covered, helping to reduce stress and worry. Insurance policies can provide coverage for both physical and financial risks, allowing you to be better prepared for whatever life throws at you. This type of protection provides peace of mind knowing that your family’s financial future is secure should something happen to you or your loved ones.

Some insurers offer discounts on certain services such as home maintenance if they know you have an active policy with them — this could add up to significant savings over time! Finally, having an insurance policy in place gives people greater security when it comes to their finances since they know there’s a safety net protecting them from potential losses.

How to Compare Insurance Wisely in UAE

When it comes to insurance policies in the UAE, there are a variety of coverage options available. It is important to understand what type of policy you need and how it will protect you from potential losses. Before making any decisions, be sure to research the different types of coverage and compare quotes from multiple insurers. This will help ensure that you get the best deal for your needs and budget.

Another factor when comparing insurance policies is looking for discounts or rewards programs that may be offered by certain providers. Many insurers offer reduced premiums or special benefits if customers have an active policy with them. Additionally, some companies provide loyalty programs which offer additional perks such as free medical check-ups or cash vouchers if customers remain loyal for a certain period of time.

Finally, researching customer reviews can give insight into an insurer’s reliability and services provided — this information could potentially save money in the long run should something unexpected arise later down the line! Taking all these factors into consideration will help ensure that you make an informed decision when choosing insurance in the UAE.

Insurancepolicy.ae as Your Partner for Insurance

Insurancepolicy.ae is a trusted partner for individuals and families looking to purchase insurance in the UAE. The company offers comprehensive services that make it easy for customers to compare quotes, receive secure advice, and complete their policy purchases hassle-free.

When searching for the right insurance policy, insurancepolicy.ae makes it simple to compare quotes from multiple providers quickly and without any pressure or commitment. The website provides an overview of different plans, so customers can easily find what they’re looking for without having to spend time researching each insurer individually. Once a customer has selected their desired plan, they are then able to finalize the details with one of insurance policy’s experienced advisors who will provide tailored advice based on their individual needs — ensuring they get the best possible coverage at a price that fits within their budget!

The process of purchasing an insurance policy through insurancepolicy.ae is straightforward and stress-free thanks to its user-friendly interface which guides customers every step of the way from start to finish. In addition, all customer information is securely stored in accordance with data protection laws — giving customers peace of mind knowing their personal information remains safe throughout the process! For those who need help understanding specific terms or concepts related to policies and coverage options available in the UAE, insurancepolicy.ae also offers support from dedicated customer service representatives, who are ready to answer any questions that may arise during initial research or when completing an application form online.

For anyone looking for reliable insurance solutions in UAE look no further than insurancepolicy.ae — your trusted partner providing quality service and expert guidance every step along the way!

2 notes

·

View notes

Text

Where is California Audio Visual located, and do they offer services outside of the UAE?

California Audio Visual Location & Service Coverage

California Audio Visual is located in the United Arab Emirates (UAE), specifically offering top-notch AV rental and event technology solutions across the region. They specialize in audio visual equipment rental, staging, lighting, LED screens, and full event production services.

Do they operate outside the UAE?

While their primary operations are based in the UAE, California Audio Visual has the capability and resources to support international projects upon request. For specific inquiries about services outside the UAE, it's best to contact them directly through their official website: https://www.california-av.com/

0 notes

Text

Property Insurance

Property insurance in the UAE provides homeowners, tenants, and businesses with financial protection against damage or loss caused by fire, theft, natural disasters, and other unexpected events. Whether you own a villa, apartment, or commercial space, having property insurance ensures your assets are safeguarded. Coverage typically includes building structure, personal belongings, and liability protection in case of accidents within the property. Some policies even offer alternative accommodation support and protection for valuables like jewelry or electronics. Leading insurers in the UAE such as RSA, AXA, and Oman Insurance offer customizable property insurance plans tailored to individual and commercial needs. Many providers now offer online applications, virtual inspections, and flexible premium options for greater convenience. For tenants, contents insurance is a popular choice, while landlords can benefit from building insurance with rental income protection. When choosing a policy, it’s important to assess coverage limits, exclusions, and additional services like home maintenance support. In a region prone to extreme weather and with high-value properties, property insurance is a wise investment. It provides peace of mind, safeguards your financial interests, and ensures a quick recovery in the event of an emergency. Whether for personal use or business, property insurance is an essential layer of protection in today’s unpredictable world.

0 notes

Text

Top Trends in Aerial Footage: A Look at the Dubai Scene

Dubai, a city renowned for its architectural grandeur, stunning skyline, and innovative spirit, has rapidly become a hub for cutting-edge technology. One such technological advancement transforming industries in the UAE is the use of drone services. These high-tech devices have brought a new dimension to the world of aerial footage, providing businesses and filmmakers with unique perspectives that were once impossible to achieve. With its iconic structures and dynamic landscapes, Dubai is an ideal setting for drone companies to showcase their aerial filming capabilities. From the bustling city streets to the tranquil desert, drones are capturing stunning visuals that are reshaping how the world views Dubai.

The Growing Popularity of Drone Services in Dubai

As the demand for high-quality aerial footage continues to rise, drone services are becoming increasingly essential for businesses in Dubai. Whether it's for commercial purposes, real estate, or filmmaking, drones offer an unparalleled ability to capture breathtaking shots that were once reserved for helicopters or expensive equipment. The introduction of drones into the city has allowed industries to enhance their marketing efforts, provide better customer experiences, and create stunning visual content.

Drone companies dubai are now leading the charge, offering advanced services that cater to a wide range of industries, including tourism, advertising, and event filming. These companies provide businesses with the ability to use drones for everything from capturing panoramic shots of Dubai's skyline to filming large-scale events. Thanks to the advanced technology and the vast potential for creative footage, drone services are increasingly becoming a staple for businesses looking to enhance their content and engage their audiences.

Top Trends in Aerial Footage in Dubai

1. Cinematic Aerial Shots

One of the most popular trends in aerial footage is the use of cinematic drone shots.Drone companies dubai are creating breathtaking films, commercials, and documentaries by utilizing drone technology to capture sweeping views of the city's iconic landmarks. From the Burj Khalifa to the Palm Jumeirah, drones offer filmmakers a unique way to showcase Dubai’s impressive architecture and natural landscapes.

The use of drones for cinematic shots provides a level of mobility and flexibility that traditional filming methods can't match. Filmmakers and content creators can now capture dynamic, high-quality shots that move seamlessly through the air, creating immersive visual experiences for their audiences. With drones, Dubai's beauty and grandeur can be showcased in ways that are more dynamic and engaging than ever before.

2. Real Estate Aerial Footage

Another growing trend is the use of drone services for the real estate industry. Dubai’s booming real estate sector has embraced drones as a powerful marketing tool. Real estate companies can now use aerial footage to offer potential buyers a detailed view of properties from multiple angles. From residential villas in the desert to luxury apartments with breathtaking views of the waterfront, drones provide stunning visuals that give clients a unique perspective on the properties they're considering.

With drone services, real estate professionals in Dubai can create immersive virtual tours of properties, helping clients visualize the space and its surroundings. This trend is particularly beneficial in a city like Dubai, where properties can be vast, and buyers may be located far away. Aerial footage allows clients to get an in-depth view of a property’s exterior, landscape, and amenities, increasing the chances of a successful sale.

3. Event Coverage and Documentation

Drones have also revolutionized event coverage in Dubai. Whether it’s a music festival, a sporting event, or a corporate conference, drones are increasingly being used to capture high-quality footage from above. Event organizers and production companies are working with Drone companies dubai to create captivating, large-scale visuals that provide audiences with a bird's-eye view of the event.

The ability to capture aerial shots of crowded spaces, stages, and performances adds a unique element to event documentation. It allows businesses to create stunning promotional videos, live streams, and post-event content that highlight the scale and excitement of their events. With drones, events in Dubai are no longer limited to ground-level shots—now, filmmakers can capture the full scope of the action from above, adding a fresh dimension to event filming.

4. Aerial Surveying and Inspections

While drones are primarily known for their role in filmmaking and marketing, they are also becoming essential tools in industries such as construction, infrastructure, and agriculture. Aerial surveying and inspections have become one of the most practical applications of drones in Dubai. Drone services can be used to inspect hard-to-reach areas like rooftops, tall buildings, and large-scale infrastructure projects, providing real-time data and reducing the risk of accidents.

This trend is particularly useful in Dubai, where large construction projects are constantly underway. Drones provide an efficient way to monitor construction progress, assess the condition of buildings, and detect potential issues early on. By using aerial footage, businesses can gather important data that helps streamline project management, improve safety, and maintain high-quality standards.

5. Tourism and Travel Promotion

Dubai’s tourism sector has also benefited greatly from drone technology. With its world-class attractions and luxury resorts, Dubai is a major global travel destination. Drones are now being used by tourism boards and travel agencies to create compelling promotional content that highlights the city’s most iconic landmarks and destinations.

From capturing aerial views of the Burj Al Arab to flying over the stunning Dubai Marina, drones provide tourists with a unique glimpse into the beauty of the city from the sky. These visually captivating videos and advertisements are perfect for travel campaigns, inspiring travelers to visit and explore Dubai. With the rise of social media and online travel platforms, drone footage has become an essential tool in tourism marketing, helping to create memorable experiences for potential visitors.

Looking Ahead: The Future of Drone Filming in Dubai

As drone technology continues to evolve, the possibilities for aerial footage in Dubai are endless. From advancements in drone flight time and camera quality to the integration of AI for autonomous filming, drone services are poised to become even more sophisticated. These innovations will only further enhance the ability of drone companies Dubai to capture stunning footage that helps businesses stay competitive and creative in a fast-changing landscape.

In the coming years, we can expect drones to be used even more widely across various industries. Whether for capturing incredible footage for films, inspecting infrastructure, or promoting real estate and tourism, drones will continue to play a pivotal role in shaping Dubai’s future.

Conclusion

Dubai is a city where innovation and creativity thrive, and the rise of drone services is one of the most exciting developments in recent years. From cinematic shots to real estate promotions and event coverage, drones are revolutionizing how businesses in Dubai create and capture visual content. With drone companies Dubai offering advanced services and a growing demand for aerial footage, the sky is truly the limit for what drone technology can achieve in this dynamic city. As these trends continue to evolve, Dubai will remain at the forefront of aerial innovation, attracting businesses and content creators from all around the world.

0 notes

Text

Bring Your Brand to Life – Professional Videography Services in UAE

At The Creatives 360, we specialize in videography services in Dubai and Abu Dhabi that tell stories with emotion and clarity. From event coverage to corporate video production in Dubai, our team knows how to create visuals that resonate with your audience.

0 notes

Text

Innovative Add-Ons and Coverage Options: Enhancing Car Insurance in the UAE

The UAE’s car insurance market is evolving rapidly, with insurers introducing innovative add-ons and coverage options to meet the diverse needs of motorists. From replacement vehicle coverage to emergency desert recovery services, these enhancements provide greater convenience, financial protection, and peace of mind. Whether you’re looking for cheap insurance in the UAE or comprehensive protection, understanding these options can help you make an informed decision.

The Rise of Customizable Car Insurance in the UAE

As more drivers seek flexible and affordable car insurance policies, UAE insurers are offering tailored solutions that go beyond standard coverage. Online car insurance in the UAE now includes various add-ons that cater to different driving habits, risk factors, and lifestyle needs. Let’s explore some of the most beneficial and innovative add-ons available today.

1. Replacement Vehicle Coverage

One of the biggest concerns for car owners after an accident or breakdown is being left without a vehicle. With replacement vehicle coverage, policyholders can receive a temporary car while theirs is being repaired. This ensures minimal disruption to daily life and work commitments.

Benefits:

Ensures mobility in case of an accident or mechanical failure

Reduces reliance on public transport or expensive rental cars

Available for a specific number of days based on the policy

2. Emergency Desert Recovery Services

Given the UAE’s vast desert landscapes and off-roading culture, emergency desert recovery services are becoming increasingly popular. If a vehicle gets stuck in the sand, policyholders can call for specialized recovery assistance, which is particularly useful for those who enjoy desert adventures.

Benefits:

Provides quick recovery for stranded vehicles

Ideal for off-roaders and adventure seekers

Offers peace of mind for travelers exploring remote areas

3. Roadside Assistance & Towing Services

Many insurance cars in the UAE now come with roadside assistance add-ons, covering services like battery jump-starts, flat tire changes, fuel delivery, and towing. This add-on ensures that minor inconveniences don’t turn into major problems.

Benefits:

Reduces stress during vehicle breakdowns

Saves money on emergency towing and repair services

Provides 24/7 support across UAE roads

4. Personal Accident Cover for Drivers & Passengers

Accidents can have serious financial and medical consequences. Personal accident cover provides compensation for injuries sustained by the driver and passengers, ensuring financial assistance for medical expenses and lost income.

Benefits:

Covers medical expenses and disability benefits

Provides financial security to the policyholder and family

Available as an add-on to comprehensive insurance plans

5. Natural Disaster Coverage (Flood, Sandstorm, and Fire Protection)

Extreme weather conditions in the UAE, such as floods and sandstorms, can cause significant damage to vehicles. Many insurers now offer natural disaster coverage to protect against such unpredictable events.

Benefits:

Covers repairs for damages caused by floods, storms, and fires

Reduces out-of-pocket expenses for natural disaster-related incidents

Essential for residents in areas prone to extreme weather

6. Zero Depreciation Cover

Standard insurance policies consider depreciation when calculating claim settlements, meaning you might receive a lower amount for car repairs or replacements. With zero depreciation cover, insurers compensate the full cost of repair or part replacement without accounting for depreciation.

Benefits:

Higher claim settlements with full compensation

Ideal for new or high-value cars

Reduces financial burden after an accident

7. Engine Protection Cover

For many policyholders, engine repairs can be costly, especially if damage results from waterlogging or mechanical failure. Engine protection cover ensures that repairs or replacements are covered under the insurance policy.

Benefits:

Covers damages due to oil leaks, hydrostatic lock, and overheating

Prevents high out-of-pocket repair costs

Recommended for areas prone to flooding

8. No-Claims Bonus (NCB) Protection

A No-Claims Bonus is a discount provided for not making any claims in a policy year. However, a single claim can lead to losing the accumulated NCB discount. With NCB protection, you can retain your discount even after making a claim.

Benefits:

Helps maintain premium discounts year after year

Encourages responsible and safe driving

Available as an affordable add-on for long-term savings

9. Key Replacement Cover

Lost or stolen car keys can be an expensive inconvenience. Many insurers now offer key replacement coverage, covering the cost of new keys, locks, and even programming of electronic key fobs.

Benefits:

Covers replacement and reprogramming costs

Ensures quick access to a new set of keys

Essential for high-tech, keyless entry vehicles

10. Off-Road Adventure Cover

For adventure lovers who enjoy off-roading in the UAE’s dunes, standard car insurance often doesn’t cover damages sustained during such activities. Off-road adventure cover ensures protection for 4x4 vehicles during off-road excursions.

Benefits:

Covers damages sustained during off-road driving

Essential for desert explorers and thrill-seekers

Provides peace of mind for adventure trips

Why Choose GIG Gulf for Innovative Car Insurance in the UAE?

At GIG Gulf, we understand the evolving needs of UAE motorists. Our comprehensive and customizable insurance plans offer:

A wide range of add-ons to suit different lifestyles

Affordable and flexible premium options

Quick and hassle-free online car insurance UAE solutions

Reliable customer support and claims assistance

Whether you’re looking for cheap insurance UAE options or comprehensive coverage, GIG Gulf ensures you get the best value for your policy.

Final Thoughts

Innovative add-ons in car insurance provide enhanced protection, convenience, and financial security for UAE drivers. From emergency desert recovery to zero depreciation cover, these options help motorists navigate the unexpected with confidence. By exploring these add-ons and choosing the right policy, you can optimize your insurance plan while keeping costs under control.

If you’re looking for online car insurance UAE solutions that offer maximum benefits, explore GIG Gulf’s offerings today and drive with peace of mind!

0 notes

Text

Choosing the right insurance really a tedious job in a large array of options available. When looking for top insurance for car, health, or home, it's essential to understand your needs and evaluate your options carefully. After understanding of specified need it’s easy to select best insurance plan in the UAE to ensure you get the most value for your money.

Insurance in the UAE

The insurance sector is highly competitive, with both local and international providers offering a wide range of services. No one can predict about future but we should be ready for unforeseen events. Insurance is important in every one’s life. In the Country like UAE accidents and medical expenses can be very high. Everyone should be covered under safety net. For car owners, selecting the best insurance company for car insurance ensures peace of mind.

How to Choose the Best Insurance Company in UAE-

Before selecting best insurance company in UAE one should do research as per his insurance requirements. Are you looking for the top insurance for car, health, life, or property? Knowing what you need helps narrow down the list of providers.

Explore about the Company’s Reputation and market value

Make a list of top rated car insurance companies for their reliability. Check online reviews, ask for recommendations, and explore ratings on local comparison platforms. Great car insurance companies and health insurers will usually have a proven track record of customer satisfaction, financial stability, and transparent services.

Compare Quotes and Coverage using online platforms

Always compare plans using platforms that show the best insurance quote options from multiple providers. Focus on what are the things listed in the policy, such as deductibles, claim limits, and add-on benefits. The best car insurance providers typically offer customizable packages.

Focus on extra services mentioned in the policy

This is the most important part of any insurance which we are thinking to opt.Some of the best insurance companies for auto insurance and other types of policies offer extras like roadside assistance, car replacement, and 24/7 customer service. These benefits can make a significant difference when it comes to convenience and support in emergencies.

Local Expertise advice

Working with Dubai insurance companies or brokers who understand UAE regulations can be an advantage. They are familiar with local requirements, especially for car insurance, which is mandatory in the UAE. Search for motor insurance near me to find nearby agencies with a solid presence and reputation.

Evaluate Customer Support and Claims Process

Good insurers offer clear guidance, fast approvals, and easy documentation procedures. Look for a provider with a streamlined and customer-friendly claims process.

Thus there are many factors which we take in consideration while choosing best insurance plan in UAE.

0 notes

Text

Why Dubai is the New Hotspot for Digital Nomads

Dubai is quickly becoming the New Hotspot for digital nomads seeking a unique blend of work, travel, and luxury living. With its world-class infrastructure, sunny climate, and growing support for remote workers, Dubai offers everything modern nomads seek. From ultra-modern skyscrapers to sandy beaches, it's a place where work and play meet effortlessly. If you're considering a life of remote work in a vibrant city, this guide will walk you through why Dubai is the perfect choice and what you need to know about Dubai remote work visa requirements.

Why Dubai Appeals to Digital Nomads

Dubai has rapidly gained popularity among digital nomads for several key reasons:

High-speed internet: Reliable Wi-Fi is available in homes, cafes, and co-working spaces.

Modern co-working spaces: Plenty of creative, comfortable, and productivity-boosting spaces.

Multicultural vibe: Meet like-minded professionals from across the globe.

Safe and clean: The city maintains top-notch cleanliness and public safety.

Travel hub: Strategic location between Europe, Asia, and Africa with frequent flights.

Add to that the tax-free income and unmatched lifestyle options, and it’s easy to see why Dubai is becoming a top choice for remote workers around the world.

Understanding Dubai Remote Work Visa Requirements

The UAE government introduced a virtual working program to attract remote talent. Here’s what you need to get started:

A passport valid for at least 6 months

Proof of employment with a minimum 1-year contract, or ownership of a company

Monthly income of at least $3,500

Health insurance with UAE coverage

Bank statements from the last 3 months

These visa guidelines are designed to make the transition smooth and legal, allowing remote workers to reside in the city for up to a year.

Affordable Living with Luxury Perks

Dubai offers both luxury and affordability. Whether you're on a budget or want to splurge, the city caters to all:

Accommodation: Choose from budget-friendly shared spaces to fully serviced apartments.

Food: Eat at local cafeterias or indulge in global fine dining.

Transport: Dubai Metro, public buses, and taxis make getting around simple and cheap.

Activities: From visiting the Burj Khalifa to desert adventures, there’s never a dull moment.

This balance of comfort and affordability is another reason it's drawing in a growing number of remote professionals from around the world.

Co-working Spaces and Community

Digital nomads thrive in communities. Dubai understands this well and offers many shared workspaces like:

Astrolabs – A tech hub in Jumeirah Lakes Towers

Let's work – Affordable access to co-working across cafes and hotels

NEST – One of the first co-working hotels in the region

These spaces often host workshops, networking events, and meetups. They help you connect with fellow nomads, entrepreneurs, and professionals, growing your network in meaningful ways.

Why Dubai is the New Hotspot for Digital Nomads

Dubai isn’t just passively welcoming digital nomads – it’s actively building infrastructure and policy to support them:

Dedicated visa for remote work

English-speaking environment

Low crime rates

World-class healthcare

Meeting the Dubai remote work visa requirements means unlocking all of these benefits in one exciting location. The support doesn’t end at the visa—Dubai makes sure remote workers feel at home.

Cultural and Work-Life Balance

Dubai offers a unique blend of modern and traditional experiences. Weekends can be spent exploring heritage villages or enjoying rooftop brunches. With a flexible work schedule, you can:

Visit the beach after work

Try desert safaris on weekends

Join cultural tours in Old Dubai

Attend global expos and conferences

It’s a lifestyle tailored to inspire and energize digital professionals.

Pro Tips: Thriving as a Digital Nomad in Dubai

Start your visa application early: It takes a few weeks to process.

Join expat groups and digital nomad communities: Great for support and networking.

Use budgeting apps: Track living expenses to manage costs effectively.

Explore co-working cafes: Many offer free Wi-Fi and great coffee.

Respect local laws and customs: Be mindful of cultural differences and legal rules.

These tips will help make your Dubai journey smooth, productive, and enjoyable.

FAQs

1. Why is Dubai considered a New Hotspot for Digital Nomads?

Dubai offers everything digital nomads look for—tech-friendly infrastructure, tax benefits, safety, and a global community—making it a top remote work destination.

2. What documents are needed to meet Dubai remote work visa requirements?

You’ll need a valid passport, employment or business proof, health insurance, bank statements, and proof of income above $3,500/month.

3. Can I bring my family with the Dubai remote work visa?

Yes, the virtual working program allows dependents like spouses and children to stay with you.

4. Is the visa renewable after one year?

Yes, if you still meet the necessary conditions, you can apply for renewal.

5. Are there restrictions on the kind of remote work I can do?

As long as your employer or business is based outside the UAE and you meet the visa conditions, you can work remotely in various sectors like IT, marketing, writing, design, and more.

Conclusion

Dubai has become a digital nomad’s dream—tech-savvy, welcoming, and full of life. From high-speed internet to tax-free income and luxury experiences, it checks all the boxes. Thanks to the clear and accessible Dubai remote work visa requirements, remote workers from around the world can now call Dubai their home base.

Whether you're a freelancer, entrepreneur, or remote employee, Dubai gives you the freedom to live the lifestyle you want while staying productive. It's no surprise that more and more people see it as the New Hotspot for Digital Nomads.

0 notes

Text

Affordable & Flexible Car Rental Options in Sharjah: Why Monthly Rentals Make Sense

Whether you're a resident, a long-term visitor, or in Sharjah for work or business, having access to reliable transport is essential. While public transport is an option, it often doesn’t provide the convenience and flexibility that many people need. That’s where car rentals come in—especially long-term rentals. More and more people are choosing to monthly rent a car in Sharjah, and for good reason.

Why Monthly Car Rentals Are Gaining Popularity

Owning a car in the UAE can be expensive, especially when you factor in upfront costs, maintenance, insurance, and depreciation. With a monthly rental, you get the benefits of having a car—freedom, flexibility, and reliability—without the long-term financial commitment.

In recent years, the demand for car rental in Sharjah has seen a steady rise, particularly among professionals, small families, and even tourists who plan to stay for a few weeks or months. Monthly rentals are not only budget-friendly but also come with added benefits such as free servicing, breakdown assistance, and insurance coverage.

Who Should Consider a Monthly Car Rental in Sharjah?

Business travellers who are in the city for extended projects or meetings.

Remote workers and digital nomads who need flexibility in their transportation.

New residents waiting for their own car to arrive or still deciding whether to buy.

Families needing a second car temporarily.

Tourists on an extended stay wanting to explore the UAE at their own pace.

If you fall into any of these categories, opting for a rent a car monthly in Sharjah might be the smartest choice.

The Advantages of Monthly Car Rentals

Cost Efficiency Monthly rental rates are significantly cheaper than daily or weekly rates. Most rental agencies offer discounted packages for long-term rentals, making it a cost-effective option.

No Maintenance Worries Regular car maintenance is not your responsibility. If anything goes wrong, the rental company takes care of it.

Easy Upgrades Need a larger car for a road trip or a business event? Most companies allow you to upgrade or switch vehicles with minimal fuss.

Insurance Included With most car rental Sharjah services, basic insurance is part of the package, saving you time and money.

Freedom to Explore Having your own set of wheels means you can explore not just Sharjah, but the entire UAE at your own pace—from the stunning desert landscapes to the urban buzz of Dubai.

Choosing the Right Rental Company

When looking for a car rental in Sharjah, it’s important to choose a company that offers transparent pricing, a variety of vehicle options, and excellent customer support.

Al Dhile Rent A Car is one such company that ticks all the right boxes. Whether you're looking for a small sedan, a spacious SUV, or even a luxury car, they have a fleet that caters to all needs and budgets. What makes them stand out is their simple, no-hidden-fees policy and commitment to customer satisfaction.

If you're considering to monthly rent a car in Sharjah for the first time, their team is incredibly helpful in walking you through the process—making it hassle-free and straightforward.

Tips for Monthly Car Rentals

Book in advance: Especially during peak seasons, booking early ensures better vehicle availability and rates.

Read the fine print: Understand what’s included in the rental—mileage limits, fuel policy, and what happens in case of an accident.

Inspect the vehicle: Always check the car before driving off to avoid disputes over damages.

Know your routes: While GPS helps, having a basic idea of the routes and traffic rules in Sharjah can save you time and frustration.

Final Thoughts

A monthly rent a car in Sharjah is a smart choice for anyone needing reliable transportation without the burdens of ownership. It's flexible, affordable, and comes with peace of mind—everything you’d want when getting around one of the UAE’s most vibrant emirates.

Whether you're in town for work, transitioning into a new job, or just exploring the culture and beauty of Sharjah, having your own vehicle can truly elevate your experience. And with services like Al Dhile Rent A Car, you’re in good hands.

0 notes

Text

Rent A CADILLAC In Dubai,

Rent A CADILLAC In Dubai,

Dubai is a city of luxury, innovation, and unforgettable experiences. If you're visiting or living in this vibrant city and want to make a statement on the road, renting a Cadillac in Dubai is the perfect choice. Known for its bold design, advanced technology, and unmatched comfort, a Cadillac adds an extra layer of sophistication to your Dubai journey.

Why Rent a Cadillac in Dubai?

Whether you're here for business, leisure, or a special event, a Cadillac makes every ride smooth and stylish. Here’s why a Cadillac rental stands out in Dubai:

1. Iconic American Luxury

Cadillac is one of the most prestigious American car brands, synonymous with luxury and performance. Driving a Cadillac in Dubai instantly elevates your presence, whether you're cruising through Downtown Dubai or heading to a high-end event in Palm Jumeirah.

2. Comfort Meets Performance

From the powerful Cadillac Escalade SUV to the sleek CT5 or XT6, these vehicles offer plush interiors, top-tier sound systems, and cutting-edge driving features — perfect for city drives or long desert adventures.

3. Impress Clients or Guests

Make a lasting impression by arriving in a Cadillac. Whether it's a corporate meeting, airport transfer, or a luxury wedding, these vehicles represent prestige and success.

4. Flexible Rental Plans

Many Dubai car rental companies offer daily, weekly, or monthly Cadillac rentals, allowing you to choose what suits your needs. Chauffeur services are also available if you prefer to relax while being driven.

Popular Cadillac Models for Rent in Dubai

Cadillac Escalade – The ultimate luxury SUV with room for up to 7 passengers, perfect for families or group travel.

Cadillac XT5/XT6 – Midsize SUVs ideal for solo travelers or couples wanting a stylish ride.

Cadillac CT5 – A sleek luxury sedan with responsive performance and modern tech features.

Requirements to Rent a Cadillac in Dubai

To rent a Cadillac in Dubai, you generally need:

A valid driving license (UAE license or international license for tourists)

A passport and visa copy (for tourists)

Minimum age: 21 or 25, depending on the rental agency

A valid credit card for deposit

How Much Does It Cost?

Cadillac rental prices in Dubai can vary depending on the model and duration. Here’s a rough estimate:

Cadillac Escalade: AED 700 – AED 1,200 per day

Cadillac XT5/XT6: AED 400 – AED 700 per day

Monthly rentals come with discounted rates.

Many companies also offer free delivery and pickup to your hotel, airport, or residence in Dubai.

Where to Rent a Cadillac in Dubai?

There are several trusted luxury car rental services in Dubai offering Cadillac models:

OneClickDrive

VIP Rent a Car

Be VIP Rent a Car

Dubai Luxury Cars

Uptown Rent a Car

Be sure to compare rates, check customer reviews, and confirm insurance coverage before booking.

Final Thoughts

Dubai is all about style, and nothing says sophisticated elegance like a Cadillac. Whether you're looking to explore the city in comfort, arrive in style at an event, or just enjoy the thrill of driving a world-class vehicle, renting a Cadillac in Dubai is a luxurious experience worth every dirham.

0 notes

Text

Will My Car Insurance Cover Damage Caused by Natural Disasters Like Floods?

Natural disasters, such as floods, storms, and earthquakes, can cause significant damage to vehicles. If you live in a region prone to extreme weather conditions, it's essential to understand whether your car insurance covers such damages. For those looking to Buy Car Insurance UAE, ensuring adequate protection against natural calamities is crucial. In this article, we will explore different aspects of car insurance coverage concerning natural disasters and help you choose the Best Motor Insurance In UAE for maximum protection.

Understanding Car Insurance Coverage in UAE

When purchasing car insurance in the UAE, you generally have two types of policies to choose from:

1. Third-Party Liability Insurance

This is the most basic and mandatory car insurance in the UAE. It covers damages and injuries caused to third parties but does not cover any damage to your own vehicle. If your car is affected by a natural disaster like a flood, you will not be able to claim any compensation under this policy.

2. Comprehensive Car Insurance

Comprehensive insurance offers broader coverage, including damages to your own vehicle. However, the extent of coverage for natural disasters depends on the specific terms and conditions of the policy. If you want protection against floods and other natural calamities, carefully review the policy before purchasing the Best Motor Insurance In UAE.

Does Car Insurance Cover Flood Damage?

Floods can severely damage vehicles, leading to expensive repairs or total loss. Whether your insurance covers flood damage depends on your policy type and its inclusions.

1. Coverage Under Comprehensive Insurance

Most comprehensive car insurance policies in the UAE cover natural disasters, including floods, storms, and other extreme weather events. However, this is not always an automatic inclusion. Some insurers provide flood coverage as an optional add-on, so you must confirm with your provider when you Buy Car Insurance UAE.

2. Exclusions to Be Aware Of

While comprehensive policies generally cover flood damage, there are some exclusions, such as:

Negligence: If you deliberately drive through a flooded area, your claim may be denied.

Mechanical Failure: Water damage causing mechanical breakdowns may not always be covered.

Expired Policy: If your insurance has lapsed, you will not receive any coverage.

How to Claim Insurance for Flood Damage?

If your car has suffered flood damage, follow these steps to file an insurance claim:

1. Inform Your Insurance Provider

Immediately notify your insurer about the incident. Provide details such as the time, location, and extent of damage.

2. Take Photographic Evidence

Capture clear images and videos of the damage to support your claim.

3. File a Police Report

In the UAE, a police report is mandatory for filing an insurance claim. Visit the nearest police station or use online services to obtain a report.

4. Submit Required Documents

Provide all necessary documents, including your policy details, police report, and photographs of the damage.

5. Vehicle Inspection

Your insurer may require an inspection to assess the extent of the damage before approving the claim.

6. Claim Approval and Repairs

Once approved, your insurer will arrange repairs at an authorized service center.

Tips for Choosing the Best Motor Insurance in UAE

When looking to Buy Car Insurance UAE, consider these factors to ensure comprehensive protection against natural disasters:

1. Check for Natural Disaster Coverage

Make sure the policy explicitly covers natural calamities, including floods.

2. Compare Policies

Different insurers offer varying levels of coverage. Compare multiple plans to find the Best Motor Insurance In UAE.

3. Look for Additional Benefits

Some policies offer added benefits like roadside assistance, emergency towing, and rental car coverage during repairs.

4. Understand the Deductible

A higher deductible can lower your premium but may increase out-of-pocket expenses when making a claim.

5. Read Policy Terms Carefully

Always read the fine print to understand the inclusions, exclusions, and claim process.

Preventive Measures to Protect Your Car from Flood Damage

Even with insurance coverage, taking preventive measures can minimize risks and damages:

Avoid driving in flooded areas to prevent engine and electrical damage.

Park in elevated locations during heavy rains to reduce exposure to water.

Seal windows and doors properly to prevent water from entering the vehicle.

Regularly check the weather forecast and move your car to a safer location if needed.

Conclusion

Natural disasters like floods can cause extensive damage to vehicles, leading to costly repairs. If you want financial protection, opting for a comprehensive insurance policy that includes flood coverage is essential. When you Buy Car Insurance UAE, carefully review policy details to ensure it covers natural calamities. By choosing the Best Motor Insurance In UAE, you can safeguard your vehicle and avoid unexpected expenses during emergencies.

Always stay informed, compare policies, and take preventive measures to minimize damage. Having the right insurance coverage provides peace of mind and ensures that your vehicle is well-protected against unforeseen events.

#Best Car Insurance In UAE#Best Car Insurance In Dubai#Car Insurance Sharjah#Buy Car Insurance UAE#Best Car Insurance In Abu Dhabi#Motor Insurance Dubai#Motor Insurance UAE#Best Motor Insurance In UAE#Online Motor Insurance Dubai#Motor Insurance Company Abu Dhabi

0 notes

Text

Protect Your Ride: The Best Vehicle Insurance Options in UAE

Being a vehicle owner in the UAE is a need and a desire, but the assurance that the car is being insured should come first. It is not merely a regulation – it's an essential safeguard for unforeseen accidents, damages, and liabilities.

The numerous insurance companies and coverage options make buying the finest UAE vehicle insurance hard to choose.

This article will guide you through the finest car insurance plans available in the market, why one needs to get the correct policy, and advice on getting the best deal without compromising on protection.

Why Car Insurance is Important in the UAE

a. Legal Requirement

The UAE government mandates that every vehicle on the road should be at least covered by third-party liability insurance. Driving without an insurance cover will incur very expensive fines, black points on your driving license, and even your vehicle being confiscated.

b. Financial Protection

Repairing your vehicle can be costly, especially when involved in accidents, theft, or natural disasters. Having proper insurance cover ensures that you are not hit with the cost shock.

c. Personal and Third-Party Liability Coverage

Accidents cause injuries or damages to third parties. You are compensated under comprehensive insurance for medical, property, and third-party liability, evading court and financial fights.

d. Peace of Mind

For the daily commute as well as lengthy journeys, the sufficient insurance coverage puts you at ease and secure in case.

Best Vehicle Insurance Coverages in the UAE

There are two broad types of car insurance in the UAE:

a. Third-Party Liability Insurance

Compulsory for every vehicle in the UAE.Covers third-party damages and injuries in case of an accident.Less costly but does not cover your own vehicle.Suitable for old vehicles or budget-friendly drivers.

b. Comprehensive Car Insurance

Provides full protection for your vehicle and third-party damages. Covers accidents, theft, fire, and natural disasters.Also includes personal accident cover and road assistance.A suitable option for new or high-value vehicles.

c. Add-On Coverages

Most insurance companies also offer other optional coverages to extend your policy:

Roadside Assistance – Towing and on-the-spot repair in the event of an emergency.Off-Road Coverage – A necessity for 4x4 owners in the UAE.Personal Injury Protection – Covers medical expenses for you and passengers.Agency Repair – Having repairs done at the manufacturer's workshop.

Tips on How to Get the Best Motor Vehicle Insurance in the UAE

a. Compare Several Providers

Don't take the first offer—compare insurance quotes from different companies on websites like:

ShoryPolicybazaar UAEYallacompareInsuranceMarket.ae

These websites allow you to get the best quotes and tailor policies according to your needs.

b. Choose Suitable Coverage According to Your Needs

If you travel frequently or have a new car, opt for comprehensive coverage.If your vehicle is old, third-party liability cover may be enough.Avoid add-ons based on frequency of driving and risk factors.

c. Find Discounts and Deals

Various insurance companies offer discounts for:

No-claims history (lower premiums if there are no accidents).Policy bundles (motor, house, or health).Low mileage motorist (fewer miles driven, lower premiums you could be charged). d. Pay Annual and Not Monthly

Paying on an annual basis will often work out cheaper than paying on a monthly basis because companies offer an incentive to pay upfront. e. Review Consumer Comments and Claims Process

Investigate the customer service ratings of the insurance company. Make sure the claim process is efficient, transparent, and hassle-free. Check online reviews or seek referrals from friends and family.

Top Car Insurance Companies in the UAE

Some of the best car insurance companies in the UAE are:

AXA Gulf – Known for extensive coverage and excellent customer service.RSA Insurance – Offers extensive road-side assistance and off-road coverage.Orient Insurance – Offers affordable third-party and comprehensive policies.ADNIC (Abu Dhabi National Insurance Company) – Reliable with prompt claims settlement.Oman Insurance – Popular for flexible policies and low premiums.Trulife Insurance – Known for trustworthy coverage and prompt claims settlement.

Conclusion

Choosing the best Vehicle insurance in the UAE is key to your economic stability and tranquility. Through comparison of policies, selection of the right coverage, and utilization of discounts, you can insure your car without spending a fortune.

Whether it is third-party liability or a comprehensive cover policy, ensure that it fits your needs and budget. Invest time in conducting research on suppliers, reading consumer reviews, and understanding the claims process to make an informed purchase.

Compare today and drive with peace of mind knowing that your car is fully insured!

0 notes

Text

The Rising Demand for Arabic-English Translators in the UAE’s Global Economy

As the UAE continues to strengthen its role in global trade, tourism, and technology, the need for Arabic-English translators in Dubai has never been greater. With businesses operating across multiple languages, UAE localization specialists play a critical role in ensuring smooth cross-cultural communication. From legal contracts to real-time interpretation, bilingual workforce solutions are essential to maintaining the UAE’s international business appeal.

Why the UAE Needs More Arabic-English Translators

1. Expanding Global Trade and Business Partnerships

With the UAE’s increasing involvement in global trade partnerships, accurate technical translation services UAE are needed to facilitate international negotiations, compliance documentation, and business agreements. Industry-specific translators for sectors like finance, logistics, and oil and gas ensure clarity and legal accuracy.

2. Growth of the Tourism and Hospitality Industry

As one of the world’s leading travel destinations, the UAE welcomes millions of visitors annually. Real-time interpretation services and multilingual workforce solutions are vital for hotels, airports, and tourism operators to cater to Arabic and English-speaking guests.

3. Advancing Technology and Innovation

Dubai is a rising tech hub, attracting global IT firms and startups. Businesses require technical translation services UAE for software localization, cybersecurity compliance, and IT documentation. While AI translation tools vs. human translators remains a hot topic, human expertise is still essential for accuracy and contextual relevance.

4. Specialized Translation Needs in Healthcare

With the UAE's growing healthcare sector, industry-specific translators are needed to accurately translate medical reports, prescriptions, and pharmaceutical regulations. Misinterpretation in the medical field can have serious consequences, making human translators indispensable.

5. Dubai Expo 2030 and International Events

As Dubai prepares to host Expo 2030, the demand for language services for Dubai Expo 2030 will rise significantly. Whether for government delegations, corporate presentations, or media coverage, Arabic-English translators Dubai will be essential for smooth communication.

The Role of AI in Translation: Can It Replace Human Experts?

The rise of AI translation tools vs. human translators has transformed the industry, but machine translation often lacks cultural nuance, technical accuracy, and industry-specific expertise. UAE localization specialists ensure that translations are:

Legally compliant for contracts and business agreements.

Technically precise for medical, engineering, and IT documentation.

Culturally appropriate for marketing and branding materials.

Accurate in real-time scenarios, such as conferences and business negotiations.

Conclusion

The growing demand for Arabic-English translators in UAE’s global economy highlights the critical role of professional language experts. While AI translation tools provide assistance, human translators remain irreplaceable in key industries like trade, tourism, healthcare, and technology. As the UAE gears up for Dubai Expo 2030 and strengthens global trade partnerships, businesses must invest in professional language services to stay competitive and ensure seamless communication in a multilingual market.

0 notes

Text

Your Ultimate Sea and Air Freight Partner in UAE

In terms of dependable logistics services, GTZ Shipping is one of the leading sea and air freight companies in UAE. It offers efficient and affordable freight solutions. Whether you need international shipping via sea freight or domestic cargo transport, GTZ Shipping provides reliable, on-time delivery with high-quality services.

Being one of the best cargo logistics companies in Dubai, GTZ Shipping provides sea and air freight services for business entities in different areas, including Corniche Deira, Al Baraha, Al Rigga, and Abu Hail. With their proficiency in handling international sea freight shipping rates, they offer competitive prices, which are the best option for businesses wanting to simplify cargo movement.

For businesses looking for a sea freight company in Dubai, GTZ Shipping provides customized solutions to address the specific needs of global trade. Their wide coverage includes major places such as Al Muraqqabat and Corniche Deira, to facilitate smooth logistics operations. While having a clear emphasis on dependability, GTZ Shipping is also known to offer the most reliable exhibition courier services, ensuring that businesses ship event materials easily.

As a trusted sea and air freight company in UAE, GTZ Shipping promises convenient shipping services and premium logistics assistance. Regardless of whether you are seeking sea freight firms in Al Rigga or want help with international sea freight shipping, their professional expertise ensures smooth border crossing.

Trust GTZ Shipping for the best logistics solutions in UAE. We are your global business partner for borderless trade and cargo movement.

For all your shipping needs, GTZ Shipping is here to assist you with seamless sea and air freight services in UAE. You can visit their official website at https://gtzshipping.ae/ to explore their services or get in touch with their team for personalized solutions. For direct inquiries, feel free to contact their customer support via phone at +971-56-274-3284 or email [email protected], ensuring a smooth and efficient freight experience.

0 notes

Text

VIP Protection Services in Dubai: Ensuring Elite Security and Safety

Dubai is a global hub for luxury, business, and international events, attracting high-profile individuals, celebrities, executives, and diplomats. With its growing prominence, the need for VIP protection services in Dubai has become essential. Professional security teams offer customized protection solutions to ensure safety, privacy, and peace of mind for VIPs in various settings, including business meetings, public events, and private travels.

Why Are VIP Protection Services Important in Dubai?

While Dubai is known for its strict laws and high security, VIPs often face risks such as unauthorized access, excessive media attention, and personal threats. VIP protection services in Dubai provide a layer of security that prevents disruptions and ensures smooth day-to-day activities without compromising personal safety.

Key Benefits of VIP Protection Services

24/7 Security Coverage – Continuous monitoring and protection against potential risks.

Discreet and Professional – Highly trained personnel ensure security without interfering with the client’s privacy.

Crowd Control and Threat Prevention – Bodyguards and security teams manage large crowds and prevent unauthorized access.

Secure Transportation – Safe travel arrangements, including airport escorts and armored vehicles.

Emergency Response – Immediate action in case of medical emergencies, security threats, or evacuation needs.

Types of VIP Protection Services in Dubai

1. Executive Protection

Business executives and corporate leaders require security while attending meetings, conferences, and corporate events. Trained security professionals ensure safety and maintain confidentiality in all settings.

2. Celebrity Security

Celebrities and public figures attract large crowds and media attention, increasing the risk of security breaches. VIP security teams provide protection during public appearances, red carpet events, and personal outings.

3. Diplomatic and Government Protection

Government officials and diplomats require high-level security due to their positions. Specially trained security teams provide discreet and professional protection for official visits, meetings, and personal engagements.

4. High-Net-Worth Individual Protection

Wealthy individuals and business magnates often require close protection due to financial risks and potential threats. Personalized security services ensure a secure environment at home, offices, and during international travel.

5. Event Security for VIPs

Large-scale events such as business summits, award functions, and private parties require enhanced security to manage access control, prevent unauthorized entry, and ensure a secure environment for VIP guests.

Qualities of a Professional VIP Protection Team

A top-tier VIP protection services in Dubai team possesses the following attributes:

Expert Training: Skilled in risk assessment, combat, surveillance, and first aid.

Discretion and Confidentiality: Ensures that security measures do not interfere with personal or professional matters.

Physical and Mental Agility: Capable of handling high-pressure situations with quick decision-making.

Multilingual Skills: Effective communication with clients from diverse backgrounds.

Legal Compliance: Adheres to Dubai’s strict security regulations and ethical practices.

How to Hire VIP Protection Services in Dubai?

To hire VIP protection services in Dubai, it is crucial to choose a reputable security firm with licensed and experienced professionals. Look for agencies with strong client reviews, customized security solutions, and compliance with UAE security laws. Many agencies provide tailored protection plans based on the client’s specific needs.

Conclusion

VIPs in Dubai require specialized protection to navigate their personal and professional lives securely. Whether for executives, celebrities, diplomats, or high-net-worth individuals, VIP protection services in Dubai ensure a safe and seamless experience. With professional security teams offering discreet and efficient solutions, VIPs can enjoy Dubai’s dynamic environment without compromising their safety.

0 notes