#Enhancing resource efficiency with disruptive green technologies

Explore tagged Tumblr posts

Text

The Ultimate Guide to ESG Investing: Strategies and Benefits

Socio-economic and environmental challenges can disrupt ecological, social, legal, and financial balance. Consequently, investors are increasingly adopting ESG investing strategies to enhance portfolio management and stock selection with a focus on sustainability. This guide delves into the key ESG investing strategies and their advantages for stakeholders.

What is ESG Investing?

ESG investing involves evaluating a company's environmental, social, and governance practices as part of due diligence. This approach helps investors gauge a company's alignment with humanitarian and sustainable development goals. Given the complex nature of various regional frameworks, enterprises and investors rely on ESG data and solutions to facilitate compliance auditing through advanced, scalable technologies.

Detailed ESG reports empower fund managers, financial advisors, government officials, institutions, and business leaders to benchmark and enhance a company's sustainability performance. Frameworks like the Global Reporting Initiative (GRI) utilize globally recognized criteria for this purpose.

However, ESG scoring methods, statistical techniques, and reporting formats vary significantly across consultants. Some use interactive graphical interfaces for company screening, while others produce detailed reports compatible with various data analysis and visualization tools.

ESG Investing and Compliance Strategies for Stakeholders

ESG Strategies for Investors

Investors should leverage the best tools and compliance monitoring systems to identify potentially unethical or socially harmful corporate activities. They can develop customized reporting views to avoid problematic companies and prioritize those that excel in ESG investing.

High-net-worth individuals (HNWIs) often invest in sustainability-focused exchange-traded funds that exclude sectors like weapon manufacturing, petroleum, and controversial industries. Others may perform peer analysis and benchmarking to compare businesses and verify their ESG ratings.

Today, investors fund initiatives in renewable energy, inclusive education, circular economy practices, and low-carbon businesses. With the rise of ESG databases and compliance auditing methods, optimizing ESG investing strategies has become more manageable.

Business Improvement Strategies

Companies aiming to attract ESG-centric investment should adopt strategies that enhance their sustainability compliance. Tracking ESG ratings with various technologies, participating in corporate social responsibility campaigns, and improving social impact through local development projects are vital steps.

Additional strategies include reducing resource consumption, using recyclable packaging, fostering a diverse workplace, and implementing robust cybersecurity measures to protect consumer data.

Encouraging ESG Adoption through Government Actions

Governments play a crucial role in educating investors and businesses about sustainability compliance based on international ESG frameworks. Balancing regional needs with long-term sustainability goals is essential for addressing multi-stakeholder interests.

For instance, while agriculture is vital for trade and food security, it can contribute to greenhouse gas emissions and resource consumption. Governments should promote green technologies to mitigate carbon risks and ensure efficient resource use.

Regulators can use ESG data and insights to offer tax incentives to compliant businesses and address discrepancies between sustainable development frameworks and regulations. These strategies can help attract foreign investments by highlighting the advantages of ESG-compliant companies.

Benefits of ESG Investing Strategies

Enhancing Supply Chain Resilience

The lack of standardization and governance can expose supply chains to various risks. ESG strategies help businesses and investors identify and address these challenges. Governance metrics in ESG audits can reveal unethical practices or high emissions among suppliers.

By utilizing ESG reports, organizations can choose more responsible suppliers, thereby enhancing supply chain resilience and finding sustainable companies with strong compliance records.

Increasing Stakeholder Trust in the Brand

Consumers and impact investors prefer companies that prioritize eco-friendly practices and inclusivity. Aligning operational standards with these expectations can boost brand awareness and trust.

Investors should guide companies in developing ESG-focused business intelligence and using valid sustainability metrics in marketing materials. This approach simplifies ESG reporting and ensures compliance with regulatory standards.

Optimizing Operations and Resource Planning

Unsafe or discriminatory workplaces can deter talented professionals. A company's social metrics are crucial for ESG investing enthusiasts who value a responsible work environment.

Integrating green technologies and maintaining strong governance practices improve operational efficiency, resource management, and overall profitability.

Conclusion

Global brands face increased scrutiny due to unethical practices, poor workplace conditions, and negative environmental impacts. However, investors can steer companies towards appreciating the benefits of ESG principles, strategies, and sustainability audits to future-proof their operations.

As the global focus shifts towards responsible consumption, production, and growth, ESG investing will continue to gain traction and drive positive change.

5 notes

·

View notes

Text

Cloud Computing Market: Unlocking Business Transformation in the Digital Age

The Cloud Computing Market is rapidly evolving into a foundational force driving enterprise transformation, empowering organizations to streamline operations, foster agility, and unlock new business value. As companies prioritize digital innovation, cloud infrastructure has become essential in delivering scalable, secure, and intelligent services across industries.

Reimagining Business Models with Cloud

Modern businesses are no longer bound by traditional IT limitations. Cloud-native platforms have enabled a shift toward service-oriented architectures, allowing companies to innovate at speed. Whether through Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), or Software-as-a-Service (SaaS), organizations now enjoy unprecedented control over resource allocation and deployment flexibility.

One of the most transformative aspects of the Cloud Computing Market is its ability to facilitate real-time collaboration and remote workforce enablement. Post-pandemic work models heavily rely on cloud environments to sustain productivity, ensuring secure access to tools, platforms, and data regardless of geography.

Seamless Integration of Advanced Technologies

The synergy between cloud platforms and next-generation technologies is reshaping how businesses approach innovation. Artificial Intelligence (AI), Machine Learning (ML), and big data analytics are thriving in cloud ecosystems due to the vast computing power and storage capabilities available on-demand.

Additionally, edge computing, in combination with 5G, is enhancing latency-sensitive applications across industries such as autonomous vehicles, telemedicine, and smart manufacturing. These technologies rely on distributed cloud frameworks to deliver localized processing without compromising performance.

Sector-Specific Disruption and Benefits

The financial sector has embraced cloud computing to enhance cybersecurity, reduce infrastructure costs, and develop customer-centric digital banking solutions. Healthcare providers are leveraging cloud technologies to enable telehealth platforms, streamline electronic medical records (EMR), and deploy predictive diagnostics powered by AI.

Retail businesses, on the other hand, are using cloud services to personalize consumer experiences, manage complex supply chains, and optimize inventory in real time. This sector-specific adoption is broadening the impact and scope of the Cloud Computing Market, proving that cloud services are not a one-size-fits-all solution but rather adaptable frameworks that drive value across domains.

Scalability and Sustainability as Core Pillars

Scalability remains one of the most compelling features of cloud computing. Organizations can seamlessly scale their operations up or down in response to market demand without investing in expensive physical infrastructure. This agility reduces operational risk and enhances cost-efficiency.

From a sustainability perspective, cloud providers are increasingly adopting green data centers and energy-efficient technologies. As environmental concerns become more pressing, the Cloud Computing Market is aligning with global sustainability goals by minimizing energy consumption and promoting responsible resource use.

Challenges and Evolving Regulatory Landscapes

Despite its benefits, cloud computing comes with a unique set of challenges. Data security, privacy, and compliance remain top concerns, especially as data volumes surge. Governments around the world are tightening regulations to safeguard consumer data, making compliance a priority for cloud service providers and users alike.

Latency, service outages, and vendor lock-in also pose risks. However, with continuous advancements in encryption, multi-cloud strategies, and disaster recovery solutions, the Cloud Computing Market is actively addressing these concerns to ensure robust and reliable services.

The Road Ahead

As cloud adoption continues to rise, the next decade will likely see deeper integration between cloud platforms and AI-driven automation, blockchain, and quantum computing. The emphasis will be on intelligent, interconnected, and secure digital ecosystems that fuel real-time decision-making and agile business strategies.

The Cloud Computing Market is no longer just a back-end infrastructure solution—it is a catalyst for business reinvention in the digital age. With the continuous expansion of services and capabilities, organizations that strategically invest in cloud technologies will be best positioned to thrive in an increasingly complex and competitive global environment.

0 notes

Text

Shifting Media aims to improve project efficiency and outcomes

Shifting Media is a Melbourne-based company specializing in 3D construction staging and 4D construction scheduling. Their services are designed to enhance project planning and visualization, providing clients with detailed staging plans and advanced scheduling solutions. By leveraging these technologies, Shifting Media aims to improve project efficiency and outcomes.

In today’s fast-paced world, the construction industry faces increasing pressure to deliver projects on time, within budget, and with high-quality standards. To meet these demands, construction companies are embracing innovative solutions that optimize workflows, reduce inefficiencies, and enhance communication across all stakeholders. One such innovation is Digital Construction Planning, a process that leverages modern technology to streamline every phase of a construction project, from pre-construction planning to post-project completion.

What is Digital Construction Planning?

Digital construction planning refers to the integration of advanced digital technologies into the planning, design, and execution stages of construction projects. By incorporating tools such as Building Information Modeling (BIM), project management software, augmented reality (AR), and artificial intelligence (AI), construction teams can better visualize, plan, and monitor the entire lifecycle of a project. The goal is to enhance efficiency, reduce risks, and ultimately create more accurate and cost-effective projects.

Key Benefits of Digital Construction Planning

Improved Accuracy and Precision: One of the primary advantages of digital construction planning is the improved accuracy it offers. Traditional construction planning methods often rely on manual measurements, which can lead to mistakes and delays. With digital tools, all data is stored and processed electronically, ensuring that information is up-to-date and precise. BIM, for example, allows for 3D modeling of a building, which ensures that architects, engineers, and contractors are working from the same set of accurate and updated information.

Better Collaboration and Communication: Effective communication is crucial in construction projects, where multiple teams and stakeholders must work together. Digital Construction Planning tools provide centralized platforms for sharing documents, designs, schedules, and other critical information. This fosters real-time collaboration, allowing for faster decision-making and reducing the potential for misunderstandings or delays.

Cost and Time Savings: Through digital planning, construction companies can identify potential issues before they become major problems. Using predictive analytics and simulations, teams can forecast delays or budget overruns and take corrective actions in advance. This helps to avoid costly rework and reduces project timelines, ultimately delivering cost savings.

Enhanced Risk Management: The construction industry is fraught with risks, including safety hazards, supply chain disruptions, and unforeseen design flaws. Digital tools allow teams to simulate various scenarios and identify potential risks before they occur. By planning for contingencies and addressing issues proactively, construction projects can be carried out with a greater level of confidence and reduced risk.

Sustainability and Environmental Impact: Digital Construction Planning can also contribute to sustainability goals by improving energy efficiency and reducing waste. Through detailed simulations, construction teams can optimize the use of materials, minimizing excess and ensuring that resources are used efficiently. Additionally, digital tools can help monitor energy consumption during construction, ensuring that the project adheres to green building standards.

Key Technologies in Digital Construction Planning

Building Information Modeling (BIM): BIM is a foundational technology for digital construction planning. It is a digital representation of the physical and functional characteristics of a building. Through BIM, all project stakeholders can access real-time updates on the design, construction process, and maintenance schedules, ensuring better coordination and reducing errors during construction.

Project Management Software: Digital tools like Procore, Buildertrend, and Autodesk Construction Cloud offer comprehensive project management solutions. These platforms provide everything from task management and scheduling to budgeting and document control. By streamlining project management, these tools ensure that construction projects stay on track and within budget.

Augmented Reality (AR) and Virtual Reality (VR): AR and VR are transforming the way construction projects are visualized and planned. With AR, construction teams can overlay digital designs onto real-world environments, helping them to spot design flaws and make adjustments before physical construction begins. VR, on the other hand, allows stakeholders to walk through a virtual version of the project, providing a better understanding of the final product.

Drones and 3D Scanning: Drones equipped with cameras and LiDAR sensors are being increasingly used for surveying and mapping construction sites. They can capture high-resolution images and data, allowing project managers to monitor progress, check for discrepancies, and assess potential risks. 3D scanning technology also helps create accurate as-built models that can be compared against the original design to ensure the project is being executed as planned.

Artificial Intelligence (AI) and Machine Learning: AI and machine learning algorithms are used to analyze vast amounts of data generated throughout the construction process. These technologies can predict potential delays, optimize schedules, and recommend solutions based on historical data. AI can also improve safety by monitoring construction sites for hazardous conditions or behaviors, reducing the likelihood of accidents.

Challenges and Considerations in Implementing Digital Construction Planning

While the benefits of digital construction planning are clear, implementing these technologies can be challenging. Here are some considerations for construction companies:

Initial Investment: Digital construction tools often come with a hefty price tag, especially for small to medium-sized businesses. The initial cost of software, hardware, and training can be a barrier to entry. However, the long-term cost savings often outweigh the upfront investment.

Training and Skill Development: The successful implementation of digital construction planning requires skilled professionals who are well-versed in using advanced tools and technologies. Construction companies must invest in training their workforce to ensure that digital tools are used effectively.

Integration with Legacy Systems: Many construction companies still rely on traditional paper-based methods or outdated software systems. Transitioning to a digital workflow requires careful integration with existing systems, which can be time-consuming and complicated.

Data Security: As construction projects generate large amounts of sensitive data, ensuring the security of this information is paramount. Construction companies must implement robust cybersecurity measures to protect against data breaches and ensure compliance with regulations.

The Future of Digital Construction Planning

The future of digital construction planning is promising, with emerging technologies like AI, blockchain, and IoT (Internet of Things) poised to further enhance the planning and execution of construction projects. As these technologies continue to evolve, we can expect even more automation, real-time collaboration, and data-driven decision-making in the construction industry.

In conclusion, Digital Construction Planning is transforming the way construction projects are managed, offering numerous benefits, from enhanced accuracy and efficiency to better risk management and cost savings. As the construction industry continues to embrace digital technologies, it will become more streamlined, sustainable, and capable of delivering projects on time and within budget. The future of construction is digital, and those who adapt to these new tools and processes will be well-positioned to thrive in an increasingly competitive market.

0 notes

Text

Kostas Paschos Gains Recognition in The CIO World as The Most Successful Chief Growth Officer You Should Know

cio leaders magazine is proud to spotlight one of the most visionary and impactful leaders redefining business success through sustainability and innovation. Enhancing Sustainability: Kostas Paschos Gains Recognition in The CIO World as The Most Successful Chief Growth Officer You Should Know — this statement echoes across boardrooms and industry forums, validating the unique contribution Paschos continues to make in a rapidly evolving corporate world.

Championing a Sustainable Business Vision

Enhancing Sustainability: Kostas Paschos Gains Recognition in The CIO World as The Most Successful Chief Growth Officer You Should Know is not just a headline; it reflects a deep-rooted mission that Paschos has carried throughout his career. As businesses face increasing pressure to align their operations with environmental, social, and governance (ESG) goals, Paschos has positioned himself at the forefront of sustainable leadership. His focus has consistently been on building strategies that fuel both long-term growth and planetary well-being.

As highlighted in cio leaders magazine, Paschos’ work goes beyond theory — his measurable success lies in implementing green business models, reducing carbon footprints, and aligning product innovations with ecological goals. His commitment to environmental stewardship has earned him not only awards but also trust across stakeholders and communities.

Innovating Growth with Sustainability

In a world where growth is often viewed through the lens of scale and revenue, Paschos offers a refreshing perspective — growth through responsibility. Under his leadership, companies are integrating renewable resources, digitizing supply chains to minimize waste, and prioritizing long-term sustainability over short-term gains.

Enhancing Sustainability: Kostas Paschos Gains Recognition in The CIO World as The Most Successful Chief Growth Officer You Should Know is a fitting accolade for a professional who believes that innovation and environmental consciousness are not mutually exclusive. His data-driven approach and willingness to disrupt traditional models have helped organizations leap ahead in competitive, yet ethical, ways.

Leadership That Transforms Culture

True sustainability begins from within. Paschos has worked tirelessly to foster a culture of awareness, responsibility, and innovation. cio leaders magazine reports that under his leadership, companies have embedded sustainable values into daily operations — from employee engagement programs to community outreach and supplier accountability initiatives.

The title Enhancing Sustainability: Kostas Paschos Gains Recognition in The CIO World as The Most Successful Chief Growth Officer You Should Know encapsulates a broader impact: he’s not just leading; he’s cultivating new leaders who are equipped to tackle tomorrow’s ecological and economic challenges.

Adapting to the Future

In today’s volatile economic landscape, resilience and adaptability are key. Paschos has shown that integrating sustainability into corporate strategy is one of the best ways to future-proof an organization. By promoting energy efficiency, circular economy principles, and low-emission technologies, he has helped enterprises stay ahead of regulations and consumer expectations alike.

According to cio leaders magazine, Paschos has also invested in digital transformation tools that track and optimize sustainability metrics — providing transparency and trust at every level of the business.

Enhancing Sustainability: Kostas Paschos Gains Recognition in The CIO World as The Most Successful Chief Growth Officer You Should Know is not just a celebration of past achievements; it’s a forecast of what’s next for corporate growth in the modern era.

Collaboration and Global Impact

Paschos understands that sustainability is a shared mission. He has been instrumental in forging partnerships across industries, NGOs, and governments. These collaborations have accelerated the implementation of sustainable technologies and influenced policy changes, setting new global standards.

cio leaders magazine emphasizes that Paschos does not view corporate responsibility as an obligation, but as an opportunity — an opportunity to innovate, to inspire, and to make a lasting impact. His influence reaches beyond his organization, affecting how industries view profitability, ethics, and purpose.

His leadership, as stated again in Enhancing Sustainability: Kostas Paschos Gains Recognition in The CIO World as The Most Successful Chief Growth Officer You Should Know, is a blueprint for aspiring executives seeking to lead with vision and integrity.

Setting the Bar for Future Leaders

As more organizations begin to recognize the tangible benefits of sustainable practices, the need for leaders like Kostas Paschos becomes even more apparent. He represents a new generation of executives who understand that long-term success is rooted in responsibility and resilience.

cio leaders magazine encourages rising leaders to study Paschos’s career not just for inspiration but for practical insights into leading with purpose. From climate-conscious investments to ethical stakeholder engagement, he is proving that growth and good governance go hand in hand.

The mantra Enhancing Sustainability: Kostas Paschos Gains Recognition in The CIO World as The Most Successful Chief Growth Officer You Should Know is not simply a headline; it’s a declaration of a movement he’s helped launch — one where business is a force for good.

0 notes

Text

The Impact of Mobile Construction Management Apps on UAE's Building Sector

The construction industry in the UAE is known for its ambitious projects, rapid growth, and cutting-edge technologies. As cities like Dubai and Abu Dhabi continue to evolve into global hubs, construction companies are under constant pressure to deliver high-quality projects faster and more efficiently. One major game-changer in this transformation has been the rise of mobile construction management apps.

Let’s dive into how these apps are revolutionizing the UAE's building sector.

1. Real-Time Communication and Collaboration

In the fast-paced UAE construction environment, delays in communication can cost millions. Mobile apps allow project managers, engineers, and on-site teams to communicate instantly. Whether it's sharing project updates, photos, or important documents, everything happens in real-time — minimizing misunderstandings and ensuring everyone is on the same page.

This is especially crucial for large-scale projects like Expo City Dubai or Masdar City, where coordination among multiple teams is essential.

2. Improved Project Tracking and Transparency

Mobile construction apps offer features like live dashboards, progress tracking, and automated reporting. Project managers can monitor every stage of the construction lifecycle through their phones or tablets, whether they're at the site or the office.

This level of transparency has led to better accountability and more predictable project outcomes in the UAE, where clients demand both speed and quality.

3. Enhanced Document Management

Gone are the days of lugging around piles of blueprints and paperwork. With mobile apps, workers and managers can access drawings, plans, contracts, and specifications instantly from the cloud. This not only saves time but also reduces costly errors caused by outdated information.

For UAE companies handling multiple mega-projects simultaneously, this feature is a major productivity booster.

4. Faster Decision Making

In the UAE, where project deadlines are often tight and competition is fierce, the ability to make quick, informed decisions is key. Mobile apps provide immediate access to project data, allowing decision-makers to spot issues early and act before they escalate.

Whether it’s approving design changes or ordering new materials, mobile solutions speed up every part of the decision-making process.

5. Boosted On-Site Productivity

Construction sites across the UAE are becoming increasingly digital. Mobile apps allow workers to log their hours, report issues, track equipment usage, and even perform safety inspections directly from their smartphones.

This shift has led to fewer disruptions, increased productivity, and better quality control — all of which are critical for maintaining the UAE's reputation for iconic, high-standard construction.

6. Stronger Safety Compliance

Health and safety are top priorities in the UAE's building sector. Mobile apps are helping companies comply with stringent safety regulations by streamlining inspections, reporting hazards in real-time, and providing easy access to safety guidelines.

This not only protects workers but also helps companies avoid costly legal penalties and project delays.

7. Supporting Sustainability Goals

The UAE is pushing hard for greener, more sustainable development. Mobile construction management tools support these goals by optimizing resource usage, minimizing waste, and tracking sustainability metrics throughout the project lifecycle.

Apps that monitor material usage and energy consumption, for example, are helping construction firms align with UAE’s Green Building Regulations and Net Zero 2050 targets.

Final Thoughts

The impact of mobile Best Construction Management Software UAE 's building sector is undeniable. From enhanced communication and real-time tracking to increased safety and sustainability support, these tools are reshaping how construction projects are planned, executed, and delivered.

As the UAE continues to lead in innovation and urban development, the adoption of mobile technology in construction is not just a trend — it's a necessity for companies aiming to stay competitive and deliver world-class projects.

Looking to implement mobile construction management solutions for your business? Now is the perfect time to embrace the future of construction in the UAE.

0 notes

Text

Offshore Wind Energy Market Drivers Include Policies, Innovation, Cost Reduction, and Rising Global Energy Demand Trends

The offshore wind energy sector has gained remarkable momentum over the past decade, emerging as one of the most promising renewable energy sources. As nations strive to meet their climate commitments, reduce carbon emissions, and transition to sustainable energy systems, offshore wind has become a key focus. Its potential to provide large-scale, reliable, and clean energy makes it an attractive investment for governments and private enterprises alike.

1. Government Policies and Incentives

Supportive regulatory frameworks and incentives are among the strongest drivers of offshore wind energy market. Many governments have established ambitious renewable energy targets and long-term decarbonization goals aligned with the Paris Agreement. In Europe, the United Kingdom, Germany, and the Netherlands have committed to scaling offshore wind capacity substantially by 2030 and beyond. Similarly, the United States is ramping up its offshore initiatives, especially along the East Coast.

Policies such as feed-in tariffs, power purchase agreements (PPAs), tax incentives, and auction-based mechanisms have created favorable conditions for investors. These policy tools reduce financial risk, enhance project bankability, and stimulate continuous innovation and competition in the sector.

2. Technological Advancements

Advancements in turbine design, foundation engineering, and grid integration technologies are significantly enhancing the feasibility and efficiency of offshore wind projects. Modern turbines have become larger and more efficient, with some models exceeding 15 MW in capacity. These high-capacity turbines lower the levelized cost of energy (LCOE), making offshore wind increasingly competitive with traditional power sources.

Additionally, floating wind technology has opened up new possibilities by enabling the deployment of turbines in deeper waters previously deemed unsuitable. This has expanded the geographic scope of offshore wind, allowing access to regions with stronger and more consistent wind resources.

3. Rising Demand for Clean and Reliable Energy

Global electricity demand is rising, particularly in rapidly developing nations. Simultaneously, there is growing pressure to decarbonize power generation. Offshore wind presents an opportunity to address both challenges: it can deliver large volumes of clean power, often located close to high-demand urban areas, reducing transmission losses and infrastructure costs.

As industries and consumers become more environmentally conscious, there is an increasing push for green energy procurement. Corporations are entering into long-term power purchase agreements with offshore wind farms to meet their sustainability goals and hedge against energy price volatility.

4. Declining Costs and Economies of Scale

One of the most significant market drivers has been the rapid decline in offshore wind costs. Innovations in construction, project management, and supply chain optimization have brought down capital expenditure (CAPEX) and operational expenditure (OPEX). Larger projects and increased competition among suppliers have also driven down prices.

According to various market reports, offshore wind energy is now competitive with fossil fuels in several regions. This cost parity is expected to improve further with continued innovation and scale, unlocking investment opportunities and accelerating deployment.

5. Energy Security and Diversification

Geopolitical tensions, fossil fuel market volatility, and the need for energy independence have pushed many countries to reconsider their energy strategies. Offshore wind, as a domestic and renewable resource, provides an opportunity to reduce reliance on imported fuels and enhance national energy security.

By diversifying the energy mix, offshore wind reduces exposure to global energy market disruptions and price spikes. This is especially relevant in light of recent geopolitical developments that have disrupted global gas and oil supply chains.

6. Environmental and Social Benefits

Offshore wind projects typically have a lower land footprint compared to onshore alternatives, making them less disruptive to human settlements and ecosystems. Moreover, the offshore wind industry creates thousands of high-skilled jobs in engineering, construction, operations, and maintenance, contributing to economic growth and workforce development.

As public awareness and support for renewable energy grows, social acceptance of offshore wind projects continues to increase, further encouraging policymakers and developers.

Conclusion

Offshore wind energy stands at the intersection of environmental necessity, economic opportunity, and technological progress. Driven by supportive policies, technological innovation, cost competitiveness, and global climate commitments, the offshore wind energy market is set to expand rapidly over the coming decades. Continued collaboration between governments, investors, and developers will be crucial in harnessing the full potential of this transformative energy source.

0 notes

Text

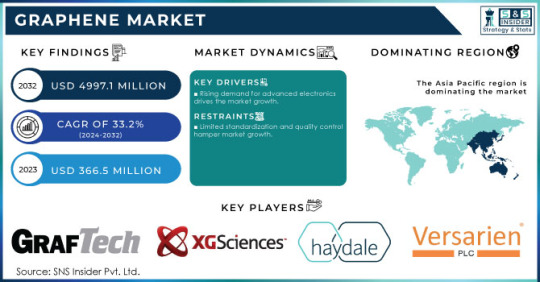

Graphene Market Booms with Demand from Electronics and Energy Storage

Expanding Applications in Electronics, Energy Storage, and Composites Drive Growth in the Graphene Market.

The Graphene Market Size was valued at USD 366.5 Million in 2023. It is expected to grow to USD 4997.1 Million by 2032 and grow at a CAGR of 33.2% over the forecast period of 2024-2032.

The Graphene Market is driven by the material's exceptional mechanical strength, electrical conductivity, and thermal properties. Known as the "wonder material," graphene is a one-atom-thick sheet of carbon atoms arranged in a hexagonal lattice, offering 100 times the strength of steel while remaining incredibly lightweight and flexible. Its versatility has attracted applications in electronics, energy storage, composites, coatings, biomedical devices, and more.

Key Players:

GrafTech International

Graphene NanoChem Plc

XG Sciences, Inc.

Applied Graphene Materials plc

Haydale Graphene Industries Plc

Versarien Plc

Talga Resources Ltd

First Graphene Ltd

G6 Materials Corp.

Thomas Swan & Co. Ltd.

Future Scope & Emerging Trends:

The graphene market is rapidly evolving as global R&D efforts continue to uncover new use cases across various industries. In electronics, graphene is enabling the development of flexible displays, faster transistors, and advanced sensors. The energy sector is exploring graphene for high-performance batteries and supercapacitors, pushing toward more efficient energy storage solutions. Biomedical applications like targeted drug delivery, bio-imaging, and antimicrobial coatings are gaining traction. Additionally, the aerospace and automotive industries are incorporating graphene into composites for lightweight, high-strength components. With ongoing government and private investments in nano-innovation and green technology, graphene is poised to become a cornerstone of next-gen materials.

Key Points:

Graphene is stronger than steel, yet incredibly thin and lightweight.

Key applications include electronics, energy storage, composites, coatings, and biomedical devices.

Surge in demand for flexible electronics and high-capacity batteries fuels market growth.

Increasing use of graphene-enhanced materials in automotive and aerospace.

Significant R&D and commercialization efforts in Asia-Pacific, North America, and Europe.

Governments and companies are investing in scalable production and cost-reduction technologies.

Conclusion:

The Graphene Market is on a transformative path, reshaping industries with its unmatched performance characteristics and disruptive potential. As commercialization accelerates and costs decline, graphene is expected to become a key enabler of innovation in the clean energy, healthcare, electronics, and advanced materials sectors. With its promise of revolutionizing the way we power, build, and connect the world, graphene is truly paving the way for a smarter and more sustainable future.

Read Full Report: https://www.snsinsider.com/reports/graphene-market-4733

Contact Us:

Jagney Dave — Vice President of Client Engagement

Phone: +1–315 636 4242 (US) | +44- 20 3290 5010 (UK)

#Graphene Market#Graphene Market Size#Graphene Market Share#Graphene Market Report#Graphene Market Forecast

0 notes

Text

Center Enamel Provides Anaerobic Digester Tanks For United Kingdom Wastewater Treatment Project

The United Kingdom is at the forefront of climate action, circular economy integration, and environmental protection. With growing demands for decarbonisation, increased population density, and ageing water infrastructure, the UK faces mounting pressure to modernise wastewater treatment systems. One solution gaining prominence is anaerobic digestion (AD), which enables energy recovery, greenhouse gas reduction, and enhanced sludge treatment.

Shijiazhuang Zhengzhong Technology Co., Ltd (Center Enamel), a global leader in advanced storage tank solutions, proudly supports this transition. With over 30 years of engineering excellence and an extensive international project portfolio, Center Enamel offers world-class anaerobic digester tanks tailored for the UK’s complex regulatory and environmental landscape.

UK Wastewater and Sludge Management Needs Innovative Solutions

The UK generates over 1.4 billion tonnes of wastewater per year, processed by more than 9,000 treatment plants across England, Scotland, Wales, and Northern Ireland. Anaerobic digestion plays a crucial role in these systems by converting sludge and organic waste into biogas, which can be used to produce heat and electricity, or upgraded to biomethane for injection into the national gas grid.

Increasing pressure to reduce landfill and incineration reliance

Anaerobic digestion enables cost savings, resource recovery, and compliance with government mandates. Center Enamel's tanks deliver scalable, reliable, and durable infrastructure to meet these national objectives.

Why Center Enamel Anaerobic Digester Tanks Stand Out

Center Enamel specializes in the manufacture of Glass-Fused-to-Steel (GFS) anaerobic digester tanks. This advanced technology combines the strength of steel with the corrosion resistance of glass, creating a long-lasting, high-performance containment solution for aggressive environments like those in AD plants.

Our anaerobic digester tanks are widely used in:

Municipal wastewater treatment plants

Agricultural and food waste AD facilities

Industrial effluent treatment systems

Combined heat and power (CHP) operations

Green gas grid injection schemes

Core Advantages of Our GFS Anaerobic Digester Tanks

Superior Corrosion Resistance

Acid and alkali resistant (pH range 1–14)

Impervious to hydrogen sulphide, ammonia, and other aggressive gases/liquids

Proven Durability and Longevity

Over 30-year design life

Hardness of 6.0 on the Mohs scale

Tight Sealing for Biogas Retention

Airtight bolted connections and gas-tight membranes

Gas domes and double-membrane roofs optional

Rapid and Safe Installation

Pre-fabricated panels assembled on-site using jacks

Minimal disruption and high installation efficiency

Cost Efficiency Over Lifecycle

Reduced downtime, maintenance, and refurbishment costs

Lower overall capital expenditure compared to concrete or epoxy tanks

Modular and Expandable Design

Future-proofed infrastructure with scalable tank capacities (20 m³ to 60,000+ m³)

Glass-Fused-to-Steel Tank Specifications

Coating Thickness: 0.25–0.45mm

Coating Colours: Forest Green, Black Blue, Grey Olive, Desert Tan, etc.

Adhesion Strength: ≥3450 N/cm²

Service Life: ≥30 years

Standards: AWWA D103, ISO28765, EN1090, WRAS, CE, NSF61

Applications: Biogas storage, primary and secondary digesters, gas holders, mixing tanks, post-digesters

Certifications and Compliance with UK Standards

Center Enamel’s tanks are manufactured under rigorous quality systems and meet international and British standards, including:

ISO 9001 (Quality Management)

ISO 45001 (Health and Safety Management)

ISO 28765 (Glass-Fused-to-Steel Tanks Design)

EN1090 (CE Marking for Structural Steel)

NSF/ANSI 61, WRAS (Water Safety Regulations)

FM, LFGB (Fire and Food Safety, respectively)

Applications Across the UK Wastewater and Energy Sectors

Our anaerobic digestion tanks can serve numerous sectors across the UK, including:

Water Companies (e.g., Thames Water, Severn Trent, Scottish Water)

Local Authorities (Councils seeking circular waste strategies)

Food and Beverage Industry (Effluent treatment)

Agricultural Cooperatives (Farm waste-to-energy systems)

Green Gas/Biomethane Producers

Environmental Engineering Contractors and EPC firms

Relevant Global Case Studies for the UK Market

Costa Rica Drinking Water Project

Malaysia POME Biogas Plant

Saudi Arabia Treated Sewage Facility

SINOPEC Industrial Effluent Project (China)

These international projects reflect our ability to deliver robust and customized solutions to various clients under diverse conditions—expertise that is highly transferrable to the UK.

Full Lifecycle Support from Concept to Commissioning

Center Enamel offers comprehensive support for AD tank projects, including:

Site-specific design consultation

Detailed 2D/3D tank design and simulation

Manufacturing and QA/QC protocols

On-site assembly and project supervision

Commissioning support and operational training

Post-installation inspection and spare part supply

We work closely with UK-based EPC firms, consultants, utilities, and private developers to ensure smooth, regulation-compliant implementation.

Environmentally Responsible and Socially Aligned

Center Enamel embraces sustainability in every aspect of manufacturing and project execution. From eco-friendly coatings to efficient logistics, we reduce the environmental footprint of our tanks. Our operations align with UN Sustainable Development Goals (SDGs) and ESG frameworks—values that matter to British stakeholders.

Supporting UK’s Net-Zero and Bioeconomy Goals

Anaerobic digestion contributes to:

Decarbonising wastewater treatment

Reducing landfill methane emissions

Boosting renewable energy production

Generating bio-fertilizers and closing nutrient loops

Center Enamel’s anaerobic digester tanks are more than infrastructure—they are essential tools for reaching Net Zero by 2050, fulfilling the UK government’s climate commitments and energy security agenda.

Why Center Enamel is the Trusted Partner for UK AD Projects

Decades of global experience across 100+ countries

Proven quality with repeat clients and global partners

Local adaptation of tank designs and regulations

Multilingual documentation (English-ready)

Responsive support from planning to maintenance

Let’s Build the UK’s Greener Future Together

As the United Kingdom continues investing in low-carbon infrastructure and sustainable waste solutions, Center Enamel stands ready to deliver reliable, cost-effective, and scalable anaerobic digester tanks that empower local communities, protect natural resources, and fuel clean energy systems.

Let’s create a smarter, cleaner, and more circular future for the UK—one digester tank at a time.

Center Enamel: Global Strength, Local Impact.

0 notes

Text

Harnessing Technology for a Smarter, Sustainable Future

Technology has become the cornerstone of progress in the modern world. From revolutionizing healthcare and education to enhancing industries and communication, it continues to redefine how we live, work, and interact. As we move further into the 21st century, understanding and embracing the transformative power of technology is essential—not only for innovation but for creating a more sustainable, equitable future.

The Expanding Influence of Artificial Intelligence

Artificial Intelligence (AI) is no longer a distant concept—it's a central force driving decision-making and automation across countless sectors. In healthcare, AI assists with early disease detection, diagnostics, and personalized treatments, reducing human error and increasing efficiency. In business, AI analyzes massive datasets to uncover trends, improve customer service, and streamline operations.

Education is another sector reaping the benefits. AI-driven platforms can assess individual learning patterns and offer tailored content, enabling students to learn independently. As AI systems become more intuitive, they will play a more significant role in solving complex problems, delivering predictive analytics, and automating routine tasks across industries.

Bridging Gaps Through Digital Connectivity

The advancement of digital technologies has made global communication faster and more accessible than ever. The expansion of 5G networks, cloud computing, and the Internet of Things (IoT) has created a world where data and devices are interconnected, improving convenience and productivity.

These developments are particularly beneficial for remote work and education, providing tools that ensure continuity even during disruptions like pandemics or natural disasters. Businesses increasingly adopt cloud-based infrastructures, allowing teams to collaborate seamlessly across borders. For individuals in rural or underserved areas, digital connectivity offers access to information, healthcare, and job opportunities—narrowing the digital divide.

Sustainable Technology and Environmental Impact

One of the most important aspects of modern technology is its potential to combat environmental challenges. Innovations in renewable energy—such as solar panels, wind turbines, and energy storage solutions—are making sustainable power sources more efficient and affordable.

Innovative grid technologies optimize energy consumption, while electric vehicles and green manufacturing processes reduce carbon emissions.

Environmental monitoring technologies, including satellites and sensors, help scientists track climate change, monitor pollution, and manage natural resources more responsibly. Sustainable tech is not just about innovation; it's a necessary shift toward preserving the planet for future generations.

Cybersecurity in a Digitized World

With increasing digitalization comes a growing need for cybersecurity. As businesses and governments shift to online platforms, protecting sensitive data has become more critical than ever. Cyberattacks can disrupt economies, compromise personal information, and threaten national security.

Organizations are investing in advanced encryption methods, AI-powered security protocols, and real-time threat detection systems to address these concerns. Education and awareness also play vital roles in cybersecurity, ensuring users practice safe online behaviors. A robust cybersecurity strategy is no longer optional—it's fundamental to maintaining trust and stability in a connected world.

The Role of Robotics and Automation in Industry

Robotics and automation are reshaping industries by improving efficiency and reducing labor-intensive tasks. Robots assemble products with high precision and speed in manufacturing, reducing waste and production costs. In agriculture, automated machines perform tasks like planting, harvesting, and monitoring crop health, boosting productivity while conserving resources.

Logistics and transportation also benefit from automation through autonomous vehicles, drones, and warehouse robots that optimize supply chain management. As these technologies evolve, the workforce must adapt, emphasizing the importance of re-skilling and education in a technology-driven economy.

Technology and Healthcare: A New Era of Medicine

Healthcare has witnessed some of the most profound technological advancements. Telemedicine enables patients to consult with doctors remotely, reducing barriers to care. Wearable devices track vital signs and fitness data, providing early warnings of health issues and encouraging proactive wellness.

Breakthroughs in biotechnology, genomics, and nanotechnology lead to more personalized treatments and even potential cures for previously incurable diseases. Robotic-assisted surgeries offer greater precision and shorter recovery times, while AI-driven diagnostics can analyze medical images and patient data faster and more accurately than traditional methods.

These innovations enhance the quality of life, expand access to care, and lay the groundwork for more integrated, patient-centered healthcare systems.

Ethical Considerations and Human Responsibility

As we embrace technological advancement, addressing the ethical implications is crucial. Data privacy, surveillance, job displacement, and the digital divide must be contemplated. Who controls emerging technologies? How are decisions made about their deployment? And how can we ensure they benefit all of society—not just a privileged few?

Creating inclusive policies, encouraging public dialogue, and enforcing responsible development practices are essential for maintaining ethical standards. Technology should empower and uplift, not exploit or divide. Fostering a culture of ethical innovation ensures that humanity remains at the heart of progress.

Preparing for a Tech-Driven Future

Individuals, organizations, and governments must commit to continuous learning and adaptation to fully harness the benefits of emerging technologies. Educational institutions should integrate STEM (science, technology, engineering, and mathematics) into curricula, preparing students for future careers. Meanwhile, workplaces must encourage lifelong learning and provide training in digital skills.

Collaboration across sectors—private industry, academia, and government—will be key to driving innovation that meets economic and societal needs. Innovation should not be isolated; it thrives when diverse minds and perspectives come together to solve shared challenges.

Building a Resilient and Innovative Society

Technology is not a magic solution to all problems but an essential tool in building a more resilient and equitable world. By investing in sustainable innovations, prioritizing digital literacy, and ensuring ethical governance, we can create systems that are not only more efficient but more inclusive and just.

As we navigate the challenges and opportunities of the digital age, embracing a thoughtful, forward-looking approach to technology will be critical. Innovation should always aim to elevate the human experience—making life safer, healthier, and more meaningful.

0 notes

Text

Sustainable MEP Design & Environmental Solutions: Shaping Green Buildings and Metro Infrastructure

In today's rapidly evolving urban landscapes, the need for sustainable practices in construction and infrastructure development has become more pressing than ever. Varun Hydro Tech is at the forefront of this movement, focusing on creating innovative Sustainable MEP Mechanical, Electrical, and Plumbing Design and advanced environmental solutions. With a commitment to shaping green buildings and efficient metro infrastructure, we are dedicated to reducing environmental impact while enhancing the quality of urban life.

The Importance of Green Building MEP Design

As cities grow and populations rise, the demand for energy-efficient and environmentally friendly buildings has surged. Green Building MEP Design is a crucial component of this trend, integrating sustainable energy solutions and resource management into the design and operation of buildings. By focusing on energy-efficient systems, water conservation, and sustainable material usage, we can significantly reduce a building's carbon footprint. Varun Hydro Tech employs state-of-the-art technology and best practices to ensure that our MEP design not only meets current regulations but exceeds them, paving the way for a more sustainable future.

Energy Optimization

One of the primary goals of Green Building MEP Design is to optimize energy consumption. Our team at Varun Hydro Tech specializes in utilizing renewable energy sources, such as solar power and geothermal heating, to minimize reliance on non-renewable resources. Moreover, we implement advanced building management systems that monitor and control energy usage in real-time, helping our clients achieve significant cost savings and reduce their overall environmental impact.

Water Conservation

Water is an invaluable resource, and its conservation is essential in the pursuit of sustainable development. Our approach to Green Building MEP Design involves designing efficient plumbing systems that minimize water waste. By incorporating rainwater harvesting systems and greywater recycling techniques, we help buildings achieve self-sufficiency, thereby reducing strain on municipal water supplies.

Impact Assessment on MEP in Metro Projects

As urban transit systems expand, the integration of sustainable practices in metro projects becomes paramount. Conducting a thorough Impact Assessment on MEP in metro projects helps identify potential environmental effects and implement strategies to mitigate them. Varun Hydro Tech emphasizes the importance of evaluating how MEP systems will interact with the environment and surrounding communities.

Sustainable Materials and Technologies

In our metro infrastructure projects, we advocate for the use of sustainable materials and cutting-edge technologies that contribute to minimizing ecological disruption. For instance, we prioritize the use of recyclable materials in construction and MEP installations. Additionally, our focus on adaptive reuse of existing structures reduces the need for new materials, which not only lessens waste but also preserves historical and cultural integrity.

Community Engagement

Engaging with the community is a vital aspect of any infrastructure project. By conducting public consultations and involving local stakeholders early in the planning process, we help ensure that the impacts of MEP systems are understood and addressed while fostering a sense of ownership and pride in the project.

MEP Environmental Solutions: A Holistic Approach

At Varun Hydro Tech, we believe in providing comprehensive MEP Environmental Solutions that encompass all aspects of sustainable building design and infrastructure development. Our solutions go beyond mere compliance; they aim to create spaces that are resilient, efficient, and harmonious with their environments.

Smart Technology Integration

Utilizing smart technologies allows us to enhance the performance of MEP systems in real time. Through Internet of Things IoT devices and smart sensors, we enable buildings and metro systems to adapt their operations automatically based on usage patterns, minimizing waste and maximizing efficiency.

Life Cycle Analysis

We conduct life cycle analyses for our projects, assessing the environmental impacts associated with all stages of a building's life—from material extraction to demolition. This holistic perspective ensures our designs are not only sustainable during construction but also maintain their environmental integrity throughout their lifespan.

Conclusion

Varun Hydro Tech is at the forefront of Sustainable MEP Design and environmental solutions, ensuring that green buildings and metro infrastructure contribute positively to our planet. With a focus on energy efficiency, water conservation, and community engagement, we are committed to reshaping urban environments for a sustainable future. Join us on this journey to create a greener world through innovative MEP solutions.

#Green Building MEP Design#Impact Assessment on MEP in metro Project#MEP Environmental Solution#MEP Design#MEP Design Consultancy

0 notes

Text

Market Analysis of Oleochemicals by Product Type: Global Size, Regional Insights, Leading Company Profiles, Competitive Overview, and Projections for 2025–2035.

Industry Outlook

The Oleochemicals Market was valued at USD 38.5 Billion in 2024 and is projected to reach USD 85.3 Billion by 2035, experiencing a CAGR of approximately 7.5% between 2025 and 2035. The growing demand for oleochemicals is driven by their increasing applications in industries such as personal care, food & beverages, and detergents. These bio-based and sustainable chemicals are gradually replacing petroleum-derived products due to their biodegradable nature.

Consumer preferences are shifting towards environmentally friendly and non-toxic products, particularly in the Asia-Pacific region. However, challenges such as supply chain disruptions, raw material fluctuations, and regulatory barriers may pose potential limitations to market growth. Key market players, including BASF, Cargill, and Wilmar International, are continuously investing in research and development, particularly in fatty acids, glycerin, and fatty alcohols, to drive market expansion.

Get free sample Research Report - https://www.metatechinsights.com/request-sample/2147

Market Dynamics

Rising Demand for Biodegradable and Sustainable Chemicals

The global shift toward eco-friendly and sustainable chemicals is transforming industries. Consumers are increasingly seeking products with minimal environmental impact, prompting companies to adopt bio-based alternatives. Major industries utilizing bio-based oleochemicals include personal care, detergents, pharmaceuticals, and food production.

Governments worldwide are implementing regulations to limit the use of synthetic chemicals, further accelerating market growth. Additionally, manufacturers are focusing on cost-effective strategies to reduce CO₂ emissions and comply with international environmental standards.

The rising adoption of biofuels and green packaging solutions has significantly contributed to the expansion of the oleochemicals market, particularly in the Asia-Pacific region, which benefits from abundant natural resources and rapid industrialization. Large corporations are heavily investing in R&D to develop innovative biodegradable oleochemicals, fostering strategic collaborations to enhance the sustainability of the chemical industry.

Advancements in Oleochemical Processing Technologies

Technological advancements in oleochemical processing are improving production efficiency and product applications. Innovations in enzymes, catalysis, and biorefining biotechnologies are enhancing yields while minimizing waste. These developments enable the large-scale production of high-quality oleochemicals for applications in personal care, pharmaceuticals, and lubricants.

Modern extraction methods are reducing waste generation and emissions, contributing to sustainability. Additionally, the integration of artificial intelligence and automation in manufacturing is optimizing process control, reducing energy consumption, and lowering operational costs.

The development of new oleochemical applications, such as bioplastics and emulsifiers, is expanding their use across various industries. The shift towards bio-based feedstocks is accelerating, particularly in Asia-Pacific, where technological integration is advancing manufacturing efficiency.

Raw Material Price Volatility Impacting Production Costs

Fluctuations in raw material prices pose a challenge for oleochemical manufacturers, affecting production costs and profit margins. Variability in the costs of key raw materials such as palm oil, soybean oil, and animal fats leads to inconsistent manufacturing expenses.

Supply chain disruptions, geopolitical factors, and environmental policies also influence raw material availability and pricing. Additionally, regulatory restrictions on deforestation and the push for sustainable sourcing add to production costs.

High demand for bio-based products exerts pressure on raw material suppliers, further driving prices upward. Inflation and currency fluctuations impact procurement strategies, making long-term contracts and supplier diversification essential for maintaining cost stability.

Increasing Demand for Biodegradable Products Due to Eco-Friendly Regulations

Stringent environmental policies and sustainability initiatives are fueling demand for biodegradable products. Governments and environmental agencies are encouraging industries to transition to bio-based and non-toxic chemicals, reducing reliance on petroleum-derived substances.

Consumers are increasingly opting for biodegradable alternatives in personal care, packaging, and cleaning products due to their lower environmental impact. Oleochemicals, including plant-derived fatty acids, glycerin, and alcohols, are replacing synthetic counterparts across various industries, including food, pharmaceuticals, and cosmetics.

The adoption of biodegradable plastics and surfactants derived from oleochemicals is gaining momentum as businesses strive to lower carbon emissions. Regions such as Asia-Pacific and Europe are at the forefront of promoting sustainable chemical manufacturing through policies and funding. Advancements in green chemistry and biotechnology are further enhancing the use of biodegradable materials, driving long-term market growth.

Development of Specialty Oleochemicals Expanding Industrial Applications

The growing demand for specialty oleochemicals is fostering advancements in adhesives, coatings, and industrial chemicals. These biochemicals offer enhanced performance, improved sustainability, and superior biodegradability compared to petroleum-based counterparts.

Manufacturers are incorporating oleochemical-based resins into adhesives to enhance bonding properties while reducing volatile organic compound (VOC) emissions. In coatings, alkyd resins derived from oleochemicals improve durability, flexibility, and water resistance.

Biodegradable lubricants and corrosion inhibitors made from fatty acids and esters are gaining traction across industrial applications. Increasing awareness of green chemistry is driving R&D investments in specialty oleochemicals, with Asia-Pacific and Europe emerging as key production hubs due to supportive environmental regulations.

Industry Experts' Perspective

"One of the hallmarks of P&G Chemicals is our steadfast dedication to delivering on our commitments. Even in the face of global challenges, we remain committed to upholding the high standards that define us."

Tom Nelson, Vice President, Global Sales at P&G Chemicals

Read Full Research Report https://www.metatechinsights.com/industry-insights/oleochemicals-market-2147

Segment Analysis

Product Type Segmentation

The oleochemicals market is segmented into fatty acids, fatty alcohols, fatty esters, glycerol, and other specialty chemicals such as amines and amides.

Fatty Acids: Dominating the market, fatty acids are widely used in soaps, detergents, lubricants, and the food industry.

Fatty Alcohols: Extensively utilized in personal care and cosmetics as surfactants and emulsifiers.

Fatty Esters: Found in lubricants, food additives, and pharmaceuticals, contributing to the increasing demand for bio-based products.

Glycerol: A key byproduct used in biodiesel production, personal care, pharmaceuticals, and food products.

Specialty Oleochemicals (Amines & Amides): Gaining traction in industrial and agricultural applications.

Application Segmentation

Soaps & Detergents: The largest segment, driven by the rising demand for biodegradable and eco-friendly cleaning products.

Personal Care & Cosmetics: Growing adoption of natural ingredients in skincare and beauty products.

Food & Beverages: Oleochemicals used as emulsifiers and food additives.

Pharmaceuticals: Essential in drug formulations due to their bio-compatible properties.

Industrial Applications: Utilized in lubricants and specialty chemicals as sustainable alternatives to petroleum-derived substances.

Regional Analysis

North America

The North American oleochemicals market is driven by strong demand from personal care, pharmaceutical, and food industries. The United States leads the market, supported by advanced industrial infrastructure and stringent environmental regulations promoting green chemistry. The growing biodiesel industry further fuels demand. However, challenges such as raw material price volatility and high production costs persist.

Asia-Pacific

Asia-Pacific is the fastest-growing oleochemicals market, driven by increasing consumer demand for sustainable and bio-based products. Rapid industrialization in China, India, and Indonesia, coupled with abundant palm oil production, supports market expansion. Government policies promoting renewable chemicals and sustainable practices further boost growth.

Competitive Landscape

The oleochemicals market is highly competitive, with key players expanding production capabilities through innovation and strategic partnerships. Sustainability initiatives are a key focus, with companies investing in bio-based solutions to reduce dependence on petrochemicals.

Compliance with environmental regulations significantly influences market strategies. Fluctuating raw material costs drive companies to optimize operations and enhance efficiency. Mergers and acquisitions are common as businesses strengthen market positioning. The emphasis on biodegradable products and green chemistry is shaping competition.

Buy Now https://www.metatechinsights.com/checkout/2147

Recent Developments

May 2024: Corbion partnered with IMCD to expand its specialty food ingredient distribution in Thailand.

April 2024: Vantage Specialty Chemicals increased its METAUPON* NMT production capacity to meet demand in personal care, industrial, and household sectors.

January 2024: Godrej Industries signed an MoU with the Gujarat government to invest USD 71.8 million in oleochemical production expansion over the next four years.

0 notes

Text

Industry’s Eco-Crossroads

Rising temperatures, erratic weather patterns, and a vanishing ecosystem struggling to adapt. Global warming isn’t just a distant threat. From extreme heatwaves to disrupted agriculture, the consequences paint a stark picture of global warming’s impact. Across sectors, there is a growing realization that economic growth cannot come at the cost of the planet. A new wave of innovation is emerging, with companies leading the way toward sustainability by adopting groundbreaking methods like zero waste mining and advanced eco-friendly practices to combat environmental degradation.

Heatwaves are intensifying, and rainfall patterns are shifting, threatening biodiversity. Industrial operations have long contributed to carbon emissions and environmental degradation. However, a shift in perspective is taking place. Companies are beginning to recognize that sustainable business models are an ethical choice. By adopting cutting-edge technologies, green tech companies in India are proving that industrial growth and environmental care can go hand in hand.

The vision behind zero waste mining is a groundbreaking approach that minimises environmental damage while maximising efficiency. Every byproduct is repurposed, recycled, or reused, and nothing is wasted. Instead of dumping waste, companies now recover valuable materials from mining residues, reducing the need for fresh raw materials and lowering the overall carbon footprint. The challenge lies in developing solutions that balance economic growth with ecological preservation, and that’s where innovative green tech companies in India are making a difference.

As these companies continue to push boundaries, sustainable industrial practices will become the norm rather than the exception. Companies can significantly reduce land degradation and water pollution by implementing zero waste mining. This shift benefits the environment and enhances efficiency, making mining operations more sustainable in the long run. The goal is to create a system where resource extraction does not come at the cost of the planet’s well-being.

The transition to greener industries is about redefining success in a way that values both people and the planet. Green tech companies in India are proving that industry and environment do not have to be at odds. The choices made today will determine the world we leave behind for future generations. With ongoing innovation and a commitment to sustainability, achieving zero waste mining and other eco-conscious industrial advancements is within reach. The question now is: Will we support this shift? Because the future isn’t just something that happens to us—it is something we create.

0 notes

Text

Capital Projects and Infrastructure Market Future Demand and Evolving Business Strategies to 2033

Introduction

The capital projects and infrastructure (CP&I) market is a critical component of global economic development. It encompasses large-scale investments in public and private infrastructure, including transportation, energy, water, and telecommunications. As urbanization accelerates, populations grow, and digital transformation reshapes industries, the demand for infrastructure investment continues to rise. This article explores key industry trends, drivers, challenges, and forecasts for the CP&I market leading up to 2032.

Market Overview

The CP&I market is witnessing unprecedented growth driven by urbanization, population expansion, and technological advancements. Governments and private entities are investing in smart cities, renewable energy, and sustainable infrastructure to meet future needs. The market is expected to grow at a compound annual growth rate (CAGR) of approximately 5%-7% over the next decade.

Download a Free Sample Report:- https://tinyurl.com/yd6w74vt

Key Industry Trends

1. Sustainable and Green Infrastructure

Sustainability is at the forefront of capital projects. Governments and corporations are increasingly focusing on reducing carbon footprints by investing in green energy, sustainable transportation, and environmentally friendly construction materials. Green building certifications, such as LEED and BREEAM, are becoming standard practices in infrastructure development.

2. Digital Transformation and Smart Infrastructure

The adoption of digital technologies such as Building Information Modeling (BIM), Artificial Intelligence (AI), and the Internet of Things (IoT) is revolutionizing infrastructure development. Smart cities integrate these technologies to optimize energy use, traffic management, and resource allocation.

3. Public-Private Partnerships (PPPs)

Governments worldwide are leveraging PPPs to finance large-scale infrastructure projects. These partnerships help mitigate financial risks and enhance efficiency in project execution. The private sector's involvement brings in expertise and innovation, contributing to cost-effective and timely completion of projects.

4. Resilient Infrastructure and Climate Adaptation

With increasing climate-related risks such as floods, hurricanes, and wildfires, the need for resilient infrastructure is more pressing than ever. Investments are being directed toward climate-resilient roads, water management systems, and energy-efficient buildings.

5. Renewable Energy and Decarbonization Initiatives

Renewable energy projects, particularly in solar, wind, and hydropower, are experiencing substantial investments. Governments and corporations are setting ambitious targets for carbon neutrality, driving significant shifts in energy infrastructure planning.

6. Increased Government Spending on Infrastructure

Many nations are increasing their infrastructure budgets to stimulate economic growth. The United States' Infrastructure Investment and Jobs Act and China's Belt and Road Initiative (BRI) are prime examples of substantial government-backed infrastructure investments.

Market Challenges

1. Funding Constraints

Despite high demand, infrastructure projects often face funding shortages. Governments, particularly in developing countries, struggle to finance large-scale projects without external investments or loans.

2. Regulatory and Bureaucratic Hurdles

Lengthy approval processes, stringent regulations, and bureaucratic inefficiencies can delay infrastructure projects. Streamlining regulatory procedures is essential for efficient project execution.

3. Supply Chain Disruptions

Global supply chain disruptions, exacerbated by the COVID-19 pandemic and geopolitical tensions, have led to delays and cost overruns in infrastructure projects. The industry is now focusing on localizing supply chains and diversifying sources.

4. Skilled Workforce Shortage

There is a growing shortage of skilled labor in engineering, construction, and project management. The industry must invest in workforce development programs to address this challenge.

5. Technological and Cybersecurity Risks

The increasing reliance on digital technologies exposes infrastructure projects to cybersecurity threats. Ensuring robust cybersecurity measures is crucial to protect critical infrastructure from cyberattacks.

Market Forecast (2024-2032)

The CP&I market is projected to witness steady growth, driven by technological advancements and increased government spending. Key forecasts for the sector include:

Global Infrastructure Spending: Expected to reach $94 trillion by 2040, with a significant share allocated to sustainable projects.

Smart City Investments: Projected to exceed $2.5 trillion by 2032, as cities integrate AI, IoT, and automation.

Renewable Energy Growth: Solar and wind energy projects will account for over 50% of new energy investments.

Regional Growth Trends:

North America: Strong investments in transportation, energy, and digital infrastructure.

Europe: Focus on green infrastructure and smart city development.

Asia-Pacific: Rapid urbanization driving large-scale infrastructure projects, particularly in China and India.

Middle East & Africa: Increasing investments in renewable energy and water management infrastructure.

Conclusion

The capital projects and infrastructure market is set for significant transformation over the next decade. Sustainability, digitalization, and resilience will be key drivers of growth, while funding constraints, regulatory challenges, and supply chain disruptions pose notable risks. By embracing innovation and strategic investments, governments and private sector stakeholders can build a more sustainable and resilient infrastructure ecosystem by 2032.Read Full Report:-https://www.uniprismmarketresearch.com/verticals/banking-financial-services-insurance/capital-projects-and-infrastructure.html

0 notes

Text

Smart Offices: How Tech is Changing Commercial Workspaces in India

The way businesses operate is undergoing a massive transformation, and smart offices are at the forefront of this change. With advancements in AI, IoT, 5G, and sustainable infrastructure, companies are adopting tech-driven office spaces that enhance efficiency, reduce operational costs, and improve employee productivity.As businesses shift towards smart commercial workspaces, the demand for office space for rent in Delhi NCR, Aerocity, and Gurgaon is increasing. Organizations are prioritizing flexibility, automation, and sustainability in their workspace choices. This article explores how technology is shaping the future of offices in India and why companies should consider upgrading to smart commercial spaces.

1. The Role of AI and Automation in Modern Offices

Artificial Intelligence (AI) is revolutionizing how businesses manage office operations, enhance security, and improve employee experience. AI-powered offices streamline workflows, optimize energy consumption, and create highly productive environments.

Key AI Applications in Smart Offices:

✔ AI-Powered Virtual Assistants – Smart offices integrate AI-based virtual assistants for meeting scheduling, workflow automation, and task management. ✔ Predictive Maintenance – AI sensors detect maintenance issues in HVAC, lighting, and security systems before they cause disruptions. ✔ Automated Climate & Lighting Control – AI adjusts temperature, humidity, and lighting based on occupancy, reducing energy wastage. ✔ Enhanced Cybersecurity – AI detects unauthorized access attempts and prevents cyber threats in digital workspaces.

Why Are Businesses Adopting AI-Driven Workspaces?

Higher operational efficiency with automation.

Energy savings through AI-controlled smart devices.

Seamless employee collaboration with AI-powered communication tools.

Businesses looking for smart office spaces in Delhi NCR and Gurgaon should prioritize buildings that offer AI-powered automation for maximum efficiency.

2. How IoT is Improving Workplace Efficiency