#Emergent Connext

Explore tagged Tumblr posts

Text

Global Timber Connectors Market Key Drivers, Challenges by 2025-2032

Global Timber Connectors Market is experiencing steady growth, valued at USD 453 million in 2024 and projected to reach USD 654 million by 2032, expanding at a CAGR of 4.70% during the forecast period (2025-2032). This upward trajectory is driven by rising demand in construction sectors, particularly in residential and commercial building applications, along with infrastructure development projects worldwide.

Timber connectors are critical components in modern timber construction, providing structural stability and enhancing load-bearing capacity. Their adoption is accelerating due to the growing preference for sustainable and cost-effective wood-based construction solutions. Governments and industry bodies are increasingly promoting timber as a renewable building material, further stimulating market growth.

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/293180/global-timber-connectors-market-2025-2032-824

Market Overview & Regional Analysis

North America leads the timber connectors market, accounting for over 35% of global consumption, supported by well-established construction industries and stringent building codes requiring reliable timber framing systems. The region's focus on sustainable construction practices and the rehabilitation of aging infrastructure creates consistent demand.

Europe follows closely, with Germany and Scandinavia being key markets due to their advanced timber construction technologies and environmental regulations favoring wood-based building materials. Meanwhile, Asia-Pacific is emerging as the fastest-growing region, propelled by rapid urbanization and increasing investments in residential construction across China, Japan, and Southeast Asia.

Key Market Drivers and Opportunities

The market is primarily driven by the global construction industry's expansion, particularly the growing popularity of timber frame construction in both residential and commercial sectors. Lightweight wood structures are gaining preference over traditional materials because they offer faster construction times, better seismic performance, and lower carbon footprints.

Significant opportunities exist in the development of innovative connector designs that enhance installation efficiency and structural performance. The increasing adoption of engineered wood products like cross-laminated timber (CLT) and glue-laminated timber (glulam) presents new avenues for specialized connector systems. Additionally, post-pandemic infrastructure stimulus packages in various countries are expected to boost demand for timber construction components.

Challenges & Restraints

The timber connectors market faces several challenges, including competition from alternative building materials such as steel and concrete, which remain dominant in certain construction applications. Fluctuations in lumber prices and supply chain disruptions can impact market stability, while skilled labor shortages in timber construction may hinder adoption rates.

Regulatory hurdles and varying building codes across regions pose additional challenges for manufacturers. Furthermore, concerns about long-term durability in high-moisture environments and the need for proper installation techniques present technical barriers that the industry must address.

Market Segmentation by Type

3-way Connectors

4-way Connectors

Other

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/293180/global-timber-connectors-market-2025-2032-824

Market Segmentation by Application

Residential Building

Commercial Building

Infrastructure

Market Segmentation and Key Players

Pryda

Simpson Strong Tie

MiTek

Timberplates

Connext Post and Beam

Knapp GmbH

Report Scope

This comprehensive report analyzes the global timber connectors market from 2024 to 2032, providing detailed insights into:

Market size and growth projections

Detailed segmentation by type, application, and region

Competitive landscape and market share analysis

The report also includes in-depth profiles of major industry players, covering:

Company overview and product portfolios

Production capabilities and market strategies

Financial performance and recent developments

Our research methodology combines primary interviews with industry experts, market surveys, and thorough analysis of industry trends to provide accurate and actionable insights.

Get Full Report Here: https://www.24chemicalresearch.com/reports/293180/global-timber-connectors-market-2025-2032-824

About 24chemicalresearch

Founded in 2015, 24chemicalresearch has rapidly established itself as a leader in chemical market intelligence, serving clients including over 30 Fortune 500 companies. We provide data-driven insights through rigorous research methodologies, addressing key industry factors such as government policy, emerging technologies, and competitive landscapes.

Plant-level capacity tracking

Real-time price monitoring

Techno-economic feasibility studies

With a dedicated team of researchers possessing over a decade of experience, we focus on delivering actionable, timely, and high-quality reports to help clients achieve their strategic goals. Our mission is to be the most trusted resource for market insights in the chemical and materials industries.

International: +1(332) 2424 294 | Asia: +91 9169162030

Website: https://www.24chemicalresearch.com/

Follow us on LinkedIn: https://www.linkedin.com/company/24chemicalresearch

0 notes

Text

I enter the cafe. I am wearing the most pretentious scarf you have ever seen and a backpack.

I sit down and place my backpack on the floor. I unzip the backpack and pull out a laptop. I carefully place the computer on the table, rotating it slightly to ensure it is set parallel to the edge of the table. I open the lid but do not sign in. I reach in to the backpack's other pocket and extract a large power bank, which I set on the floor next to the table. From my pocket I extract my phone, nearly dropping my wallet in the process. I place the phone face down on the table next to the laptop, adjusting once more to ensure it is aligned with the computer and the edge of the table. I reach into another pocket of the bag to remove a pair of wireless headphones, which I place next to the phone. The headphones do not have straight edges, so there is no point trying to align them with the table or the other items on it. I reach into the bag again and come up with a large power cable. I connect the cable to a nearby power cable, then connect the other end to the large power bank. I reach into the bag again and remove a thin but long cable. One end of the cable goes into the power bank, and the other goes to the laptop. In plugging in the cable, the computer is accidentally moved. It is now crooked compared to the other objects. I carefully but quickly readjust. Another cable emerges from my bag, connecting my laptop to my phone. Another connects the laptop to my headphones. With the cables all connected, the headphones go onto my head and I pick up my phone.

Suddenly, I glance at my watch. My movements quickened, I set down my phone. My laptop is closed and put back into the backpack. The cables connected to it extend outside the bag. Next I put the power bank into the bag. The plug cord still extends to the outlet, and the other cable emerges from the backpack only to enter into the laptop's pocket. I put the pack onto my back. One cable extends from the power bank's pocket to the outlet. One cable loops from the power bank's pocket to the laptop's. Another cable extends from the laptop pocket to my headphones. A final cable connexts the laptop pocket to my phone, which is deposited into my pants pocket. I begin to powerwalk away, glancing at my watch again. I stumble when the power cord runs out of slack, but the tension on the cable pulls the plug from the outlet. The loose cable trails behind me like a tail as I leave the cafe.

8 notes

·

View notes

Text

Tips for getting ready for Chemo

The insight about cancer can be breaking and can lead the patient and their loved ones into inner strife. It is one of the hardest times for individuals who are experiencing cancer, and time might accelerate or dial back for them. Physical checkups are made, medical procedures are planned, and the course of therapy is talked about by Cancer consultants. It is normal to get overpowered and feel like you are besieged with lots of feelings during the interaction. You might want to explore the street ahead, be that as it may, with trust and a positive mentality, wrecking cancer and emerging as a winner is conceivable.

Chemotherapy and Radiotherapy are two fundamental systems that are utilized to uncover cancer. The two cycles work in cooperative energy with one another, and if one falls flat, the other one is utilized. At Cancer Connext, gives all-encompassing, coordinated care by combining perspectives on specialists in Careful Oncology, Clinical Oncology, and Radiation Oncology. At cancer connext, we have confidence in treating cancer with a mix of Chemotherapy, Radiation Treatment, Medical procedures, and Designated Treatment.

If you are going through Chemotherapy, this is the way you can get past it and have a blissful and solid existence -

Wear Open to Attire

Chemotherapy is tedious and can require anyplace from two or three hours to eight hours and might include short-term visits to the emergency clinic. Remembering this, wearing an open dress will facilitate the interaction and your visit to the clinic. Pack free garments, since, in such a case your strategy requires a chemo port (which is a little gadget associated with your chest and makes chemotherapy conveyance agreeable for the patient), then free dress will be of tremendous assistance.

Hydrate

Drink as much liquid as possible in the evening and the morning before imbuement. It will be more straightforward for the specialists to find a vein for IV and will help in flushing out the chemo. Make sure to drink a lot of liquids like water, juices, and then some. A glass of juice won’t cut it for chemo, and you want more than that for a fruitful and simple flush out. Drinking something like 10–12 glasses of water day to day will set up your body for the drying-out impacts of the treatment.

Hostile to Sickness Things

Chemotherapy will prompt queasiness in a patient because of the high restorative substance. Attempt an assortment of hostile to-sickness things like -

· Pranayam in the outdoors

· Fragrance based treatment

· Paying attention to delicate music

· Peppermints

· Great oral Cleanliness propensities

Nonetheless, during the implantation cycle, specialists will likewise add a decent portion of hostile to queasiness prescriptions, contingent upon the chemotherapy.

Interruptions

It is important to divert yourself previously, during, and after the chemotherapy. Ensure you have an adequate number of interruptions during the mixture interaction. Bring your cell phone, music, books, earphones, and so forth to keep yourself occupied; it will maneuver down agony and assist you with relaxing all the more productively.

Clarify some things

It is typical to be apprehensive and restless while going through chemotherapy, and it is an exceptional encounter for everybody. Assuming you are befuddled or ignorant about something, ensure you get some information about it. It is dependably an effective method for writing down questions you want to ask as that makes inquiries more unambiguous and you wind up requesting all from them. It is great to peruse, however many times you probably won’t find a proper solution from Dr. Google, and besides the response probably won’t accommodate what is happening. Request an extensive response, and attempt to stay informed consistently. Assuming you are worried about the amount you can move during imbuement, or the number of breaks you that can take to the washroom, make a point to ask the medical caretaker to start with.

Stay away from Contamination

Chemotherapy will debilitate your invulnerable framework, and it can prompt cancers if you don’t watch out. Keeping away from swarmed places and guarding yourself against infection is ideal. Likewise, attempt and use hand sanitizer, and try not to contact surfaces that might be messy.

Lay out an Encouraging group of people

The fresh insight about cancer can be obliterating for the patient and individuals near them. During and after the course of chemotherapy, it very well may be particularly challenging to adapt to its eventual outcomes to cancer control. Setting up an organization of loved ones will assist you with adapting during testing times, and they can give you the necessary basic reassurance. Having somebody with you during the interaction can additionally reassure you.

There are a few roads for help during chemotherapy, and it tends to be gainful to add the focuses referenced previously. Ensure you are counseling the best cancer medical clinic in India to work on your possibilities of effective therapy further.

A Healthy Community

At the point when you pick us, you join a local area. We work with you and get the physiotherapy at home Bangalore as well as with different individuals from our local area to construct an organization of individuals cooperating for a better world.

0 notes

Link

1 note

·

View note

Text

Email Marketing: Emerging Trends to Survive 2019 and Beyond [Infographic]

Email Marketing: Emerging Trends to Survive 2019 and Beyond [Infographic]

Email is still one of the most important assets of digital marketers and is expected to grow bigger and better. In fact, the return on investment (ROI) of email marketing has reached an all-time high of 3,800%, and email users will grow to 4.3 billion by 2022. Connext Digital has released the following infographics, which contain some quick facts. Can help you optimize your digital marketing…

View On WordPress

1 note

·

View note

Text

Second extinction account

SECOND EXTINCTION ACCOUNT UPGRADE

SECOND EXTINCTION ACCOUNT PC

SECOND EXTINCTION ACCOUNT DOWNLOAD

For example, if the velocity during the first hour be double of what it. So what are you waiting for? The fight to reclaim earth starts here. are to be taken in a contrary order, till the extinction of the motion. Every piece of feedback and every mission you play matters. You’re joining us on a journey as we shape the experience. Let the threat level get out of control and you can expect an especially tough Emergence Event to be waiting for you.īy playing Second Extinction you’re not just picking up another co-op shooter. Get access to this game and play with cloud gaming (where available) with an Xbox Game Pass Ultimate subscription (sold separately). It will presumably act in a sentry role, alerting other Dinosaurs to the players position. What we know so far: The Watcher is capable of summoning other enemies. Game requires Xbox Live Gold to play on Xbox (subscription sold separately). The Watcher is one of the mutated Dinosaur enemies in the Second Extinction video game. But the dinosaurs aren’t resting either, and they’ll focus their efforts where you aren’t.Įach week the community will see the fruits of their labours or feel the consequence of their incompetence. Second Extinction is an online FPS with a bite. This threat level can be lowered if enough of our players are successful in their missions and activities. Nowhere is this more true than our War Effort feature.Įach region of our big map has a unique threat level. Our mantra is that players win battles, communities win wars.

SECOND EXTINCTION ACCOUNT UPGRADE

We want to hear your feedback loud and clear, and we intend for our community to be a vital part of the development process.Įven so, there’s plenty to get your teeth (and claws) into from day one: 4 heroes,ġ0 weapons (with 5 upgrade tiers each) and 6 missions - plus some special side quests - across multiple regions of our big map. Doing this will place you on island 5 and add a Relic of the titans to your inventory. Pass through the rift to island 3 and move the boulder on the far East side onto the symbol on the ground. The goal of Game Preview is also simple: Work with our community to make the best game possible. Take the rift to island 2 and grab the Telekinetic soul remnant, then return to island 1. Solo players beware: Second Extinction is designed with squads in mind. In Second Extinction you take on hordes of mutated dinosaurs with up to two friends. Second Extinction is an intense 3 player co-op shooter, where your goal is to reclaim Earth by wiping out the mutated dinosaurs that have taken over the. Purchase only if you are comfortable with the current state of the unfinished game.Ī NEW BREED OF BIG MAP MULTIPLAYER SHOOTER Gear up with your friends to ReclaimEarth from the mutated Dinosaur invasion This is a community-run page with some dev support. It may or may not change over time or release as a final product. The official place to discuss anything related to Second Extinction an intense big-map 3-player online co-op FPS, by Systemic Reaction. Players can keep up with Second Extinction’s ongoing development roadmap at For other news, follow on Twitter and join the community on Discord.This game is a work in progress. You can find it on Steam Early Access, as well.

SECOND EXTINCTION ACCOUNT PC

Second Extinction is also available on Xbox Series X|S, Xbox One, the Microsoft Store for PC, and Xbox Game Pass for consoles and PC via Xbox Game Preview. To get the drops you need to connect your twitch account to your Apex Connext account. Equip a range of uniquely powerful weapons and abilities and fight on your own or with friends against monstrous dinosaurs long thought extinct - now mutated and deadlier than ever! The War Effort is Second Extinction’s community-driven global metagame: by completing missions and activities, you’ll directly impact the threat level and challenges players around the world face. Khlydo It will ask you to log in when you start the game for the first time. Second Extinction pits teams of up to three players against swarms of bloodthirsty dinos in fast-paced battles across Earth’s post-apocalyptic wastelands. These groups will be used throughout this account in describing the diversity of bat. Team up with friends and battle mutated dinosaurs in a devastated world filled with seasonal contracts and rewards from the recently debuted Pre-Season 7 update. Bats are the second-most speciose group of mammals, after rodents.

SECOND EXTINCTION ACCOUNT DOWNLOAD

Second Extinction, the action-packed co-op dinosaur shooter from Systemic Reaction, is free to download and keep on the Epic Games Store now through December 22 at 11 a.m. Split Second Extinction by Human Cull, released 15 March 2012 1.

0 notes

Text

APAC GAS LEAK DETECTORS MARKET ANALYSIS

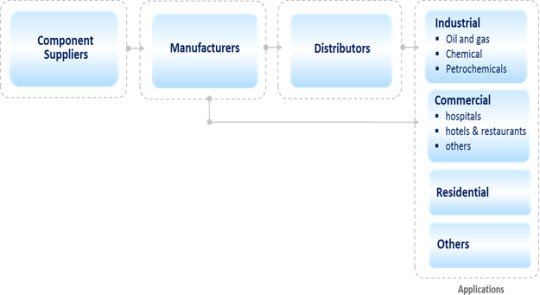

APAC Gas Leak Detectors Market, By Technology (Electrochemical, Infrared, Semiconductor, Catalytic and Others), By Application (Industrial (Oil and gas, Chemical, Petrochemicals), Commercial (hospitals, hotels & restaurants, others), Residential and Others), By Product Type (Fixed and Portable), and by Country (China, India, Japan, ANZ, South Korea, Rest of APAC) - Size, Share, Outlook, and Opportunity Analysis, 2019 - 2027

Market Insight- APAC Gas Leak Detectors Market

Market Overview

A gas detector is an equipment that detects the presence of gases in an area. Generally, it is used as part a of safety system to detect gas leak or other emissions. These gas detectors are, generally, linked to control systems so that appropriate actions can be taken to ensure safety. There are different types of gas leak detectors available in the market including electrochemical, photoionization, infrared point, ultrasonic, semiconductor, etc. Gas leak detectors are used in various industrial and commercial enterprises. The major use of gas leak detectors is in oil & gas industries, chemical and power industries, while in commercial segment, it finds applications in restaurants, hotels, and hospitals. Furthermore, gas leak detectors find applications in municipal water, wastewater treatment, automotive manufacturing, mining, and iron & steel industries.

The global gas leak detector market was valued for US$ 1,242.7 Mn in 2019 is expected to exhibit a CAGR of 5.9 % during the forecast period.

Market Dynamics- Drivers

Growing application in oil & gas industry to ensure safety of workers is expected to drive growth of the APAC gas leak detectors market during the forecast period

Gas leak detectors are one of the many must-have devices in oil & gas industry that are necessary for protection of personnel and property hazards such as deadly, toxic, and combustible gases. Furthermore, gas detectors offer high reliability and high responsive methods to monitor toxicity, oxygen levels, and flammability. Development of gas infrastructure pipelines, warehouses, and gas stations is expected to increase, owing to growing demand for gas in the region. According to Coherent Market Insights’ analysis, natural gas liquefaction capacity in the region is expected to exhibit growth of around 66% between 2014 and 2020. Moreover, expansion of capabilities and establishments of new facilities is expected to boost the demand for gas leak detectors and thereby drive growth of the APAC gas leak detectors market in the near future.

Strict regulatory policies and safety norms regarding gas leaks in numerous industries are expected to propel the APAC gas leak detectors market growth over the forecast period

Stringent regulatory policies, laws, and safety norms are being implemented in various industries including chemical, pharmaceuticals, energy, petrochemicals, etc. Gas leak detectors are used in these aforementioned industries to detect toxic and flammable gas leaks from process containers and chambers. For instance, hazardous CO2 gas is produced during the brewing process, which needs to be safely disposed of. There are number of strict regulatory policies, safety norms, operational safety rules, and management procedures for environmental accountability that are being enforced to ensure safety operational environment for personnel and property. For instance, according to the Australia/New Zealand standard AS/NZS60079.29.2:2008, it is mandatory to install a gas detector as per work regulations, to detect flammable gases and oxygen. Thus, these factors are expected to support the market growth over the forecast period.

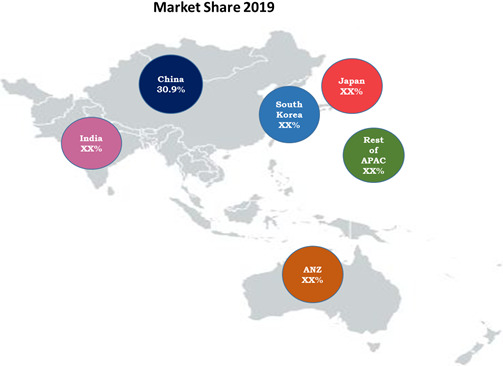

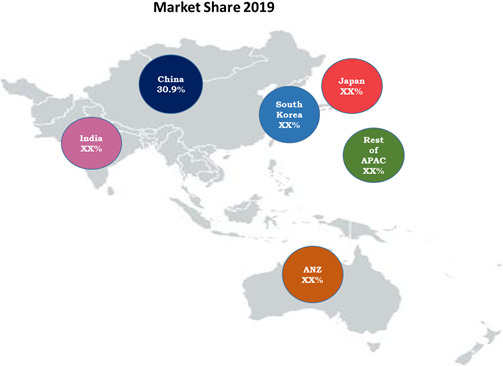

The market in China dominated the APAC gas leak detectors market 30.9 % in 2019 followed by Japan and South Korea, respectively

Source: Coherent Market Insights

Market Dynamics- Restraints

Low profit margins due to strong competition in the region are expected to hinder growth of the APAC gas leak detectors market during the forecast period

The APAC gas leak detectors market is highly fragmented and competitive with presence of small regional players and very few large international enterprises. Such intense competition between SMEs and large organizations has resulted in low profit margins from products. This, in turn, is expected to hinder the APAC gas leak detectors market growth over the forecast period.

Lack of highly skilled workers is expected to restrain growth of the APAC gas leak detectors market growth over the forecast period

Training associated with specific application of gas leak detectors is essential, typically for personnel using portable gas leak detectors apart from guidelines from the manufacturer’s side such as quick-start guides and electronic simulators. Gas leak detectors are designed to alarm people in the form of light, sound, or vibrate when some gas is detected, but in case of critical situations, it is very important to understand technical limitations and environmental influences to avoid misinterpretations, major accidents, or personnel panic. Relative operational complexities and costs associated with advanced technology based systems hampers their wide-scale adoption especially among relatively smaller scale end users. Hence, these factors are expected to hinder the market growth during the forecast period.

Market Opportunities

Increasing development of infrastructure in Asia Pacific is expected to present lucrative growth opportunity

In commercial and residential applications, gas leak detectors are primarily used for detection of propane gas leak from appliances, gas pipe fittings, and propane tank. Increasing development of commercial infrastructure combined with various large-scale projects such as malls, company headquarters, airports, and hospitals in the region are expected to offer lucrative growth opportunities in the near future. These opportunities are majorly available in emerging economies such as India and China due to increasing demand for safety and security features in residential projects.

Rising use of industrial gases is expected to provide major growth opportunities in the near future

Growing consumption of industrial gases such as helium, nitrogen, and argon across different manufacturing industries is expected to provide significant growth opportunities for major vendors to capitalize on the market. Moreover, the use of gases in refrigeration and HVAC processes in automotive application is expected to provide excellent growth for market players over the forecast period.

Source: Coherent Market Insights

Market Trends

Integration of advanced technology in gas leak detectors

Many manufacturers are focused on development of gas detectors incorporated with advanced features and novel technologies such as artificial neutral network (ANN) and Internet of Things (IoT), in order to make gas detectors highly efficient. For instance, Honeywell partnered with Houston-based Accudata Systems to develop ConneXt Pro, the first-of-its-kind wireless gas detection system based in the IoT technology. Moreover, General Monitor – a U.S.-based manufacturer of gas leak detectors – developed Observer-i, an ultra-sonic multiple gas leak detector, based on ANN technology platform, which can distinguish between real gas leaks and false alarms.

Advent of portable gas detectors is another major trend in the market

Various manufacturers in the industry are involved in incorporation advanced technologies including data logging, recording, streamline compliance, wireless connectivity, etc. into gas leak detectors. Furthermore, advanced portable gas detectors are focused on increasing applications as personal protective devices in different industries and also for mobile testing of widespread manufacturing plants. This is owing to the capability of these detectors to detect multiple gases and store data for analysis.

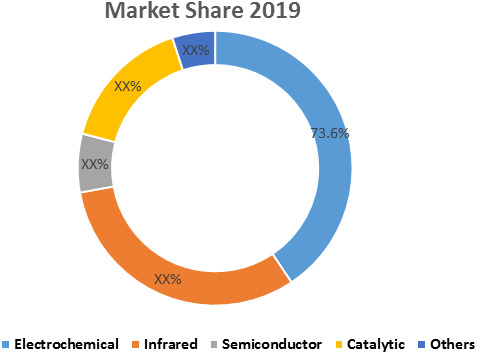

Segment information:

In APAC gas leak detectors market, by technology segment, electrochemical sub-segment dominated the APAC market in 2019, accounting for 73.6% share in terms of value.

Source: Coherent Market Insights

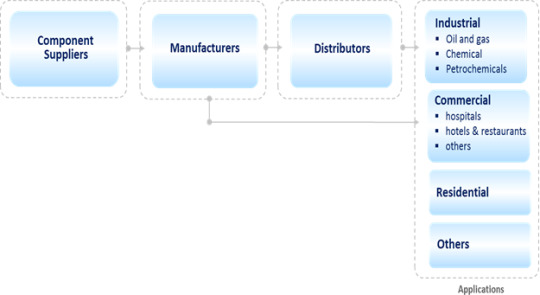

Value Chain Analysis

Competitive Section

Key players operating in the APAC gas leak detectors market are Honeywell International, Inc., MSA, New Cosmos Electric Co. Ltd, Emerson Electric Co., Industrial Scientific, Thermo Fisher Scientific Inc., Tyco International plc, Drägerwerk AG & Co. KgaA, United Technologies Corporation, and General Electric.

Key Developments

Key companies in the market are focused on mergers and acquisitions, in order to gain competitive edge in the market. For instance, in December 2019, Honeywell International Inc. acquired Rebellion Photonics, a U.S.-based provider of intelligent, visual gas monitoring solutions.

Major market players are involved in collaborations and partnerships, in order to enhance their market presence. For instance, in June 2018, New Cosmos Electric Co. Ltd, a supplier of gas detection equipment, collaborated with Itron Inc. to improve gas safety for utilities with methane detectors.

About Us:

Coherent Market Insights is a global market intelligence and consulting organization focused on assisting our plethora of clients achieve transformational growth by helping them make critical business decisions.

What we provide:

Customized Market Research Services

Industry Analysis Services

Business Consulting Services

Market Intelligence Services

Long term Engagement Model

Country Specific Analysis

Contact Us:

Mr. Shah

Coherent Market Insights Pvt. Ltd.

Address: 1001 4th ave, #3200 Seattle, WA 98154, U.S.

Phone: +1-206-701-6702

Email: [email protected]

Press Release/Source

Request Sample

Download PDF

0 notes

Text

APAC Gas Leak Detectors Market Drivers , Trends, Top Players, Industrial Analysis and Forecast till 2027

Summary:

A gas detector is an equipment that detects the presence of gases in an area. Generally, it is used as part a of safety system to detect gas leak or other emissions. These gas detectors are, generally, linked to control systems so that appropriate actions can be taken to ensure safety.

The global gas leak detector market was valued for US$ 1,242.7 Mn in 2019 is expected to exhibit a CAGR of 5.9 % during the forecast period

Statistics:

The market in China dominated the APAC Gas Leak Detectors Market 30.9 % in 2019 followed by Japan and South Korea, respectively.

Market Drivers

Gas leak detectors are one of the many must-have devices in oil & gas industry that are necessary for protection of personnel and property hazards such as deadly, toxic, and combustible gases. Furthermore, gas detectors offer high reliability and high responsive methods to monitor toxicity, oxygen levels, and flammability. Development of gas infrastructure pipelines, warehouses, and gas stations is expected to increase, owing to growing demand for gas in the region.

According to Coherent Market Insights’ analysis, natural gas liquefaction capacity in the region is expected to exhibit growth of around 66% between 2014 and 2020.

Moreover, expansion of capabilities and establishments of new facilities is expected to boost the demand for gas leak detectors and thereby drive growth of the APAC gas leak detectors market in the near future.

Stringent regulatory policies, laws, and safety norms are being implemented in various industries including chemical, pharmaceuticals, energy, petrochemicals, etc. Gas leak detectors are used in these aforementioned industries to detect toxic and flammable gas leaks from process containers and chambers. For instance, according to the Australia/New Zealand standard AS/NZS60079.29.2:2008, it is mandatory to install a gas detector as per work regulations, to detect flammable gases and oxygen. Thus, these factors are expected to support the market growth over the forecast period.

Request for the Sample copy @ https://www.coherentmarketinsights.com/insight/request-sample/3516

Market Opportunities

In commercial and residential applications, gas leak detectors are primarily used for detection of propane gas leak from appliances, gas pipe fittings, and propane tank. Increasing development of commercial infrastructure combined with various large-scale projects such as malls, company headquarters, airports, and hospitals in the region are expected to offer lucrative growth opportunities in the near future. These opportunities are majorly available in emerging economies such as India and China due to increasing demand for safety and security features in residential projects.

Growing consumption of industrial gases such as helium, nitrogen, and argon across different manufacturing industries is expected to provide significant growth opportunities for major vendors to capitalize on the market.

Moreover, the use of gases in refrigeration and HVAC processes in automotive application is expected to provide excellent growth for market players over the forecast period.

Request for the PDF Brochure @ https://www.coherentmarketinsights.com/insight/request-pdf/3516

Market Trends

Many manufacturers are focused on development of gas detectors incorporated with advanced features and novel technologies such as artificial neutral network (ANN) and Internet of Things (IoT), in order to make gas detectors highly efficient. For instance, Honeywell partnered with Houston-based Accudata Systems to develop ConneXt Pro, the first-of-its-kind wireless gas detection system based in the IoT technology.

Moreover, General Monitor – a U.S.-based manufacturer of gas leak detectors – developed Observer-i, an ultra-sonic multiple gas leak detector, based on ANN technology platform, which can distinguish between real gas leaks and false alarms.

Various manufacturers in the industry are involved in incorporation advanced technologies including data logging, recording, streamline compliance, wireless connectivity, etc. into gas leak detectors.

Furthermore, advanced portable gas detectors are focused on increasing applications as personal protective devices in different industries and also for mobile testing of widespread manufacturing plants..

Value Chain Analysis

Key players operating in the APAC Gas Leak Detectors Market are:

Honeywell International, Inc., MSA, New Cosmos Electric Co. Ltd, Emerson Electric Co., Industrial Scientific, Thermo Fisher Scientific Inc., Tyco International plc, Drägerwerk AG & Co. KgaA, United Technologies Corporation, and General Electric.

Key Developments

Key companies in the market are focused on mergers and acquisitions, in order to gain competitive edge in the market. For instance, in December 2019, Honeywell International Inc. acquired Rebellion Photonics, a U.S.-based provider of intelligent, visual gas monitoring solutions.

Major market players are involved in collaborations and partnerships, in order to enhance their market presence. For instance, in June 2018, New Cosmos Electric Co. Ltd, a supplier of gas detection equipment, collaborated with Itron Inc. to improve gas safety for utilities with methane detectors.

About Us

Coherent Market Insights is a global market intelligence and consulting organization focused on assisting our plethora of clients achieve transformational growth by helping them make critical business decisions.

What we provide:

Customized Market Research Services

Industry Analysis Services

Business Consulting Services

Market Intelligence Services

Long term Engagement Model

Country Specific Analysis

Contact Us:

Mr. Shah

Coherent Market Insights Pvt.Ltd.

Address: 1001 4th Ave, #3200 Seattle, WA 98154, U.S.

Phone: +1–206–701–6702

Email: [email protected]

#APAC Gas Leak Detectors Market#coherent market insights#market analysis#market research#business consulting

0 notes

Text

@connexted-by-hearts | x

Pit watched as this happened. He was in a safe place inside the temple and watched Roxas’s anger emerged from him. The pure angel watches nervously through the fountain. Going down was too risky for him. But if this still continues, Roxas could possibly hurt thousands of people. This would be a disaster if he doesn’t do anything.

Right when Pit had that thought, Dark Pit entered in the room. The brunette looks over at his twin. “Pittoo! Thank goodness your here! It’s Roxas! He’s going on a rampage!” Pit warned out. The ebony blinked and walk over to get a closer look at what’s going on.

But seeing Roxas starting to destroy everything he sees - well, mostly enemies - wasn’t like him at all. The black angel flexed his wings as he continued to watch. “You have to go down there and stop him, Pittoo!” Pit cried out.

“What?! Why me?!” Dark Pit looks over at the brunette. That only made Pit twiddle his fingers, “R-Roxas looks really scary.. b-besides.. I’m sure he’ll calm down if he sees you.. since you hang out with him more then I do..”

Pit did have a kind of valid reason for the. However, the ebony just rolled his eyes are beginning to head out through the hallway full of doors. Eventually, he found the one that was a shortcut to the city.

-

Dark Pit flew across pass skyscrapers and the buildings below. Taking on the city lights and streets. Watching the traffic and the constant honking at each other’s cars. The ebony never really loved the city. Sure, it’s modern. But humans are so noisy nowadays that he can’t even think properly. How annoying.

Eventually, he found out where Roxas was at.. when a building crumbled to the ground. Black wings flapped harder and he flew as fast as he can to eventually get to Roxas’s location. Wings flutter down on top of an unharmed building to watch Roxas battle it out all alone. Of course, he would be here all alone. Should have known.

He jumps off the edge and flies down to Roxas. Swooping in to grab him by the back of his jacket. “Roxas! Chill out! Your making a fucking mess!”

0 notes

Text

Emergent Connext Collaborates with Microsoft to Expand Rural IoT Network in California

Key Takeaways Emergent Connext has partnered with Microsoft’s Airband initiative and ISP Cal.net to extend rural IoT connectivity across unconnected farmland in California. The collaboration will provide broadband access to support precision agriculture and sustainable farming practices. Initial education and training programs for farmers will launch in California’s Central Valley in summer…

0 notes

Text

Don’t Believe the FUD: Ethereum Can Scale

Hunter Hillman is the head of growth at Connext. Steven McKie is a co-founder of Amentum Capital. Eric Olszewski is an ethereum developer.

Over the past few months, we have noticed a significant number of articles proclaiming the imminent failure and collapse of the ethereum platform due to its inability to scale and its overall lack of user traction. This is hardly a surprise; with many new emerging technologies, we see a similar hype cycle. In Gartner’s famous model, the “Peak of Inflated Expectations” is followed rapidly by the “Trough of Disillusionment.”

In the case of ethereum, we have passed the former and are well on our way through the latter.

The concerns raised in these articles are legitimate, but generally ignore the staggering progress being made daily in regards to scalability. No, ethereum cannot scale to become a world computer in its current state. The throughput is low and the cost is exorbitant. However, these issues were anticipated and have been well understood, since before the launch of ethereum as a blockchain. In this article, we will discuss the various solutions which have been created the past few years to address these limitations.

In the midst of the ICO bubble, high transaction volumes crowded the network and raised the price of gas, the small amount of ether required to power transactions. This brought scaling challenges, which ethereum developers were well aware of and had already begun addressing, though to the media’s attention would make you think otherwise.

While ethereum scaling may be a brave new world for some, the options for addressing throughput have been on developers’ radars for years:

Scale ethereum itself to be able to handle the increased transaction load (e.g., through the upgrades known as Serenity and Casper).

Reduce the load on the main chain by moving the bulk of transactions to a second layer an only using the base layer during transaction settlement (e.g., Payment Channels, State Channels, Plasma, and Sidechains)

“Layer One” solutions like sharding and Casper have been on the ethereum roadmap for a few years, but have been plagued by multiple setbacks that have prevented significant progress on the implementation and development front. Even after these improvements, there will still be a need for “Layer Two” scaling mechanisms which provide even higher throughput, private transactions, and lower transaction fees.

Before diving into the various Layer Two solutions, we ask that you think of ethereum as a global settlement layer rather than a holistic world computer. This means that ethereum serves to settle any and all transactions which have been conducted off the main chain and enforce value transfers accordingly. It is this use case of the blockchain serving as an unbiased third party for arbitration on which all second layer solutions operate.

At a high level, any layer two solution follows this formula, or some variation of it:

Two or more parties agree to a set of rules by which they will be to join and exit a Layer Two solution.

These parties then encode those rules into a smart contract which requires that each party put down a security deposit.

After putting down their security deposits, all parties can operate between each other off-chain while submitting intermittent updates to the on-chain smart contract.

When one or more parties wished to exit the layer two solution, they will typically provide some cryptographic proof that is an accurate representation of each parties’ remaining security deposit.

There is a challenge period where the proof can be disputed and thrown away. If the challenge period elapses, then the related parties will exit the layer two solution with their updated balances

Layer Two innovations like Plasma and Payment Channels/State Channels, some of which are already processing real payments in production, will facilitate the bulk of ethereum transactions. Scaling a public blockchain (particularly one with such a robust consensus mechanism) is difficult, to be sure. But it is by no means impossible; in fact, smart contract support and the ethereum virtual machine (EVM) allow for novel scaling solutions and greater extensibility than other chains attempting to scale via a second layer with scripts based strictly on unspent transaction outputs (UTXOs), which aren’t as extendable, by design (a different set of trade-offs and benefits, like everything in computer science).

The struggles of distributed applications (dapps) to retain users are well publicized. But years of scaling research and implementation are enabling the user experience and low latency necessary to support dapps with high numbers of monthly active users (MAU).

In short, ethereum’s Layer Two solutions are nearly ready for prime time – with firms like Cent and Spankchain (warning: NSFW), and others, already serving users on the live blockchain – and are poised to upend the narrative that ethereum can’t scale. The following sections discuss limitations of highly-touted traditional scaling methods and make the case for ethereum’s suite of robust, generalizable solutions.

Traditional scaling methods

Most traditional scaling methods boil down to the observation that many interactions don’t require rigorous consensus to be considered final by the parties involved. For example, if a retailer and a customer agree that a service was rendered satisfactorily in exchange for a specified payment, there’s no reason for third-, fourth-, and fifth-party confirmation to occur.

What matters are two factors: (i) certainty that the payer will fulfill their side of the bargain, and (ii) that neither payer nor payee has to trust that a third party will faithfully execute the transaction on their behalves.

This framework allows us to consider off-chain scaling, wherein transactions are conducted off the main blockchain and later settled on the chain. To comply with (i), payers must cryptographically and irrevocably commit to transfer funds; to comply with (ii), those funds must be transferred in a trustless manner and the transaction must be enforceable on-chain if need be.

These criteria underpin bitcoin’s lightning network, which has (rightly) been the subject of widespread media coverage. Think of it like a bar tab: participants agree to pay small amounts over the course of an evening but only settle up at the end of the night. This is an oversimplification of lightning network of course; a more detailed explanation can be found here.

Lightning is undeniably good for bitcoin and holds great potential for Layer Two bitcoin scaling. Due in part to extensive media coverage, lightning is often viewed as a panacea for bitcoin’s scaling issues. Meanwhile, there’s been a slew of articles hailing “Ethereum-killer blockchains” and opining that ethereum is incapable of scaling. In a few words, this is wrong.

First, ethereum is more than capable of scaling payment volume in a very similar manner to lightining. Hashed time-lock contract (HTLC)-based payment channels are just as feasible on ethereum as they are on bitcoin, and in fact, ethereum enables more innovative and user-friendly multi-hop strategies than bBitcoin can, and they can be deployed far more easily.

Because bitcoin uses a UTXO model, funds must actually be passed utilizing traditional cryptographic messaging methods to conduct transactions (even those off-chain). In contrast, ethereum’s account balance system allows for simpler and less costly off-chain balance updates.

For example, Connext’s implementation of payment channels (which has been processing payments in production for Spankchain for nearly a few months) uses “threads,” a multi-hop implementation that allows parties to directly pass balance updates amongst themselves rather than relying on hash-locked payment routing. This is a computationally cheaper, equally fast, and equally secure approach that’s likely better suited to many transaction patterns than lightning.

Moreover, complex contract interactions are a bit more overhead intensive to deploy, as bitcoin scripting is somewhat limiting. The UTXO model, though an excellent method for sending and receiving signed transactions to be verified on a blockchain-based network, means you have to augment your scripts for more novel use cases (i.e. escrows).

With the generalizability of ethereum, and the capability to create tokens, registries, non-fungible assets (like CryptoKitties, or digital identifiers for luxury goods) and other community-accepted smart contract standards, building modular and interoperable contracts that target the EVM is simply more seamless.

Generalized state channels

Smart contract and EVM support on ethereum enables a wide variety of applications that are not currently feasible on non-Turing-complete platforms like bitcoin, due to its architecture and design decisions – which lower its overall attack surface, which in turn puts greater focus on its permissionless peer-to-peer payments use case as its most touted feature.

Because Turing-complete scripts are more complicated to execute than simple transactions, however, these capabilities increase the overall congestion on ethereum (and causes the size of the state to grow at a much faster pace).

We’ve already discussed how payment channels can cut fees and latency for peer-to-peer payments, but ethereum supports much more complex transaction logic that payment channels don’t address.

Generalized State Channels, however, propose one solution to scaling issues associated with complex contract interactions. Right now, stateful contract interactions that enable the use cases that ethereum is known for must be executed on the blockchain. The thinking of many ethereum bears is that as more and more contracts are deployed, function calls will slowly overwhelm the network and drive gas prices through the roof.

Layer One scaling, which has received the vast majority of media coverage, asks how we can accommodate more of these complex interactions on the live blockchain, or mainnet; Layer Two solutions like Generalized State Channels and Plasma (more on this later) ask how we can move more of these functions off-chain, while retaining the security and integrity we’re provided by the mainnet (given certain trade-offs).

The security of payment channels relies on the ability of each party to “go on-chain” and use a smart contract to adjudicate and rectify disputes. That is, payment channels let two parties behave as though they are transacting on-chain even though they aren’t.

Because they have the ability to go on-chain at any time (as the balance updates that they send back and forth carry the weight of on-chain transactions) in a dispute the contract simply decides whose balance update is more recent by polling the mainnet chain. On-chain dispute resolution is costly, though, in terms of time and gas, so rational actors would avoid this scenario. And, if most state channels are using secure and audited standards, we can create interoperable systems with fast finality that are bound by the same cryptographic assurances as mainnet interactions, with drastically reduced, almost zero gas cost.

Counterfactual instantiation

This approach raises the question: if we can incentivize parties to behave as though a simple contract exists on-chain, can we do the same for more complex logic? One strategy is known as counterfactual instantiation.

There are a few different implementations, but they revolve around the same principle: state is passed into the generalized framework once at the onset and can be manipulated according to a contract specified (but not deployed) when the channel is opened. Dispute cases are adjudicated by the contract as well. Because participants have the ability to go on-chain and invoke the contract, though, all are incentivized to behave as though it exists.

The effects of production-ready Generalized State Channels that leverage counterfactual instantiation will be two-fold:

Operations involving contracts that can now be counterfactually instantiated will all occur off-chain; the sheer volume of deployed contracts will decrease relative to the status quo. This will reduce network congestion, benefitting contracts that must be deployed on-chain.

Operations that occur off-chain in Generalized State Channels don’t incur confirmation times or gas fees; this will radically improve user experience and allow ethereum (as a whole) to accommodate orders-of-magnitude-larger transaction volume.

Connext, Counterfactual, Perun, and others are actively working towards Generalized State Channel frameworks which will directly address the network congestion, user experience, and cost issues that many cite as ethereum’s Achilles’ heels. These solutions are enabled by smart contract functionality, are significantly more extensible than UTXO-based scaling solutions, retain the security of the underlying blockchain, and have the potential to unlock the new markets and business opportunities promised by ethereum. We believe that Generalized State Channels have the potential to be as transformative for ethereum as Serenity; whether due to poor information accessibility or inadequate publicity efforts, they have not gotten their due attention.

Lightning

Lightning was the starting ground for UTXO-based payment channels, atomic swaps, and more. The work that has done by the Olaoluwa Osuntokun, Joseph Poon, and the entire ecosystem lightning researchers and engineers is impressive.

There are a few working implementations of the lightning protocol and specification, including the LND project (by Lightning Labs, headed by its chief scientist, Olaoluwa and written in the Go programming language), and the C-lightning project (written in C).

On top of exciting additions like “Watchtowers” (services that watch your payment channels for fraud, and remain online so your node does not have to be – in return for a fee), the Neutrino wallet (Lightning Labs’ experimental light client, also written in Go), there are a slew of other improvements in the pipeline as the lightning specification and developer community matures and grows.

Some of the hard research is currently focused on: Splicing (partial deposit/withdraw and parallel channel deployment); Wumbo (removal of the channel capacity limit); Multi-Path Payments (breaking a payment into several, allowing for it to be routed over multiple routes – think sharding); Hidden Destinations (public routes for payments to private channels) and more hard work is being done repeatedly at conferences and by independent teams all over the world.

The work by the lightning team and scaling UTXO-based chains – utilizing some bleeding-edge implementations of crypto – is no small feat, and cannot be downplayed. Often, the problem is that people seek to directly compare lightning and ethereum’s Layer Two scaling measures using similar methodologies that don’t consider the trade-offs and unique capabilities the two varying solutions offer, due to the unique architecture of the underlying root chain (i.e. UTXO model versus the account model in ethereum).

Plasma

Generalized state channels are far from the only option for scaling ethereum. Plasma is a second-layer scaling solution that, in tandem with state channels, seeks to provide additional throughput, and finality, but with some additional trade-offs.

Think of Plasma as a sort of “proto-chain,” one that seeks to mimic as much of the root chain’s integrity and security as possible, just with a varying cost component, which is typically higher than when compared to state channels (due to replicating more of the main chain’s functionality onto a new substrate above it).

Plasma takes the entirety of the off-chain state, and maintains a full state of it, hashed to the root mainnet chain (which has its own set of risk trade-offs, though that’s constantly being improved through additional research).

Though throughput can be greater than the main chain’s, unlike state channels where there is no formal consensus algorithm, Plasma chains can bring their own unique consensus algorithm, complete with its custom block times, too (which possess their own series of trade-offs). Although throughput and finality are not as fast, they are far more accessible when compared to state channels, as anyone can access the root chain’s state that’s been broadcasted and join – whereas state channels are only available to their agreed upon counterparties (in most current implementations). And, state channels are no longer available after a channel closes, making them economic machines with finite lifespans, as they are purposely built to be more semi-permanent.

However, in Plasma, since you have to save every state interaction into the root chain, from your child chain, these costs are higher depending on which version of Plasma you opt to implement. With breakthroughs in how to best implement Plasma happening regularly at many teams spread globally, we’re sure a common standard will arise with a sensible set of trade-offs that can be applied to a wide array of use cases.

Power of interoperable standards

Non-custodial liquidity – and how to most efficiently and securely transmit it in a number of different scenarios involving multiple participants – is an ongoing discovery that continues to expand on the emerging science of crypto-economics and how various mechanisms operate in adversarial conditions.

Standards like ERC-20 (for tokens) and ERC-721 (for non-fungible assets) make ethereum Layer Two scalability tech and dapps more socially secure, given that there are community accepted norms and best practices around which standards to implement for certain use cases. This is especially important when these various standards – which eventually seek to interact with one another fluidly to enable “decentralized finance” – can talk and communicate interoperably, with minimal friction and cost.

Those frictionless interactions and economies that spring up from the novel interoperability between tokens, non-fungible assets, and Layer 2 scalability create further security for the greater ethereum network, because all participants are now intertwined in complex economic activity on the additional layers above it; all being built on secure standards, that were audited and accepted by the greater technical community.

The importance of non-custodial architecture, combined with the path of least resistance to the most extendable and generalizable functionality, cannot be understated. These are crucial components and primitives to bringing new and novel economic machines to life, that thanks to expense, regulation, and computational limitation, were once thought impossible to implement into the real world.

Time for a new narrative

Scaling blockchains is difficult, and ethereum is no exception. But lionizing “ethereum-killer” blockchains, or its pre-existing alternatives, all because ethereum supposedly can’t scale, minimizes the remarkable work that the ethereum community is doing on Layer Two technology. Layer One solutions are in the works and will likely prove transformative for the network down the road, but Layer Two solutions are hitting the market now.

The narrative that ethereum can’t scale and the idea that Layer One solutions are the only plans to scale the network are tiresome and are being actively disproven in production environments on a daily basis. Today, ethereum is a slow and unstoppable platform for programmable money; the potential of such a system is self-evident. An entirely novel financial system could be built on top of ethereum, and Layer Two solutions will pave the way for radical new markets that leverage this decentralized financial stack.

Value transfer, governance, new kinds of markets and incentive structures, community coordination, and even proper implementation of tax policy are possible on ethereum. Ethereum developers see this future and are building the dapps to make it happen. Other Ethereum developers are building the protocols to make the network usable at a large enough scale to usher in that future.

This article is not intended as a knock on alternative blockchain implementations, many of which are pushing forward the bleeding edge of cryptographic research as stated above. Nor is it a case for ICOs, shilling, and misguided hype.

Rather, it is a case for ethereum scalability, for a decentralized economic future that uses the ethereum blockchain as a settlement layer and facilitates the bulk of transactions with Layer Two technologies.

It is a case for the ethereum that we see, and that we hope will get its due in the public eye, and see the light of day.

Ethereum image via CoinDesk archives.

This news post is collected from CoinDesk

Recommended Read

Editor choice

BinBot Pro – Safest & Highly Recommended Binary Options Auto Trading Robot

Do you live in a country like USA or Canada where using automated trading systems is a problem? If you do then now we ...

9.5

Demo & Pro Version Try It Now

Read full review

The post Don’t Believe the FUD: Ethereum Can Scale appeared first on Click 2 Watch.

More Details Here → https://click2.watch/dont-believe-the-fud-ethereum-can-scale-3

0 notes

Text

Cal.net and Emergent Connext Launch IoT Network for AgTech

Key Takeaways Cal.net and Emergent Connext have launched an IoT network solution for AgTech in California’s Central Valley. The partnership aims to improve connectivity in agricultural fields and rural communities. Initial deployment at Terranova Ranch aims to enhance water conservation and operational efficiency. The network will connect numerous IoT devices to benefit agriculture and rural…

View On WordPress

0 notes

Text

Don’t Believe the FUD: Ethereum Can Scale

Hunter Hillman is the head of growth at Connext. Steven McKie is a co-founder of Amentum Capital. Eric Olszewski is an ethereum developer.

Over the past few months, we have noticed a significant number of articles proclaiming the imminent failure and collapse of the ethereum platform due to its inability to scale and its overall lack of user traction. This is hardly a surprise; with many new emerging technologies, we see a similar hype cycle. In Gartner’s famous model, the “Peak of Inflated Expectations” is followed rapidly by the “Trough of Disillusionment.”

In the case of ethereum, we have passed the former and are well on our way through the latter.

The concerns raised in these articles are legitimate, but generally ignore the staggering progress being made daily in regards to scalability. No, ethereum cannot scale to become a world computer in its current state. The throughput is low and the cost is exorbitant. However, these issues were anticipated and have been well understood, since before the launch of ethereum as a blockchain. In this article, we will discuss the various solutions which have been created the past few years to address these limitations.

In the midst of the ICO bubble, high transaction volumes crowded the network and raised the price of gas, the small amount of ether required to power transactions. This brought scaling challenges, which ethereum developers were well aware of and had already begun addressing, though to the media’s attention would make you think otherwise.

While ethereum scaling may be a brave new world for some, the options for addressing throughput have been on developers’ radars for years:

Scale ethereum itself to be able to handle the increased transaction load (e.g., through the upgrades known as Serenity and Casper).

Reduce the load on the main chain by moving the bulk of transactions to a second layer an only using the base layer during transaction settlement (e.g., Payment Channels, State Channels, Plasma, and Sidechains)

“Layer One” solutions like sharding and Casper have been on the ethereum roadmap for a few years, but have been plagued by multiple setbacks that have prevented significant progress on the implementation and development front. Even after these improvements, there will still be a need for “Layer Two” scaling mechanisms which provide even higher throughput, private transactions, and lower transaction fees.

Before diving into the various Layer Two solutions, we ask that you think of ethereum as a global settlement layer rather than a holistic world computer. This means that ethereum serves to settle any and all transactions which have been conducted off the main chain and enforce value transfers accordingly. It is this use case of the blockchain serving as an unbiased third party for arbitration on which all second layer solutions operate.

At a high level, any layer two solution follows this formula, or some variation of it:

Two or more parties agree to a set of rules by which they will be to join and exit a Layer Two solution.

These parties then encode those rules into a smart contract which requires that each party put down a security deposit.

After putting down their security deposits, all parties can operate between each other off-chain while submitting intermittent updates to the on-chain smart contract.

When one or more parties wished to exit the layer two solution, they will typically provide some cryptographic proof that is an accurate representation of each parties’ remaining security deposit.

There is a challenge period where the proof can be disputed and thrown away. If the challenge period elapses, then the related parties will exit the layer two solution with their updated balances

Layer Two innovations like Plasma and Payment Channels/State Channels, some of which are already processing real payments in production, will facilitate the bulk of ethereum transactions. Scaling a public blockchain (particularly one with such a robust consensus mechanism) is difficult, to be sure. But it is by no means impossible; in fact, smart contract support and the ethereum virtual machine (EVM) allow for novel scaling solutions and greater extensibility than other chains attempting to scale via a second layer with scripts based strictly on unspent transaction outputs (UTXOs), which aren’t as extendable, by design (a different set of trade-offs and benefits, like everything in computer science).

The struggles of distributed applications (dapps) to retain users are well publicized. But years of scaling research and implementation are enabling the user experience and low latency necessary to support dapps with high numbers of monthly active users (MAU).

In short, ethereum’s Layer Two solutions are nearly ready for prime time – with firms like Cent and Spankchain (warning: NSFW), and others, already serving users on the live blockchain – and are poised to upend the narrative that ethereum can’t scale. The following sections discuss limitations of highly-touted traditional scaling methods and make the case for ethereum’s suite of robust, generalizable solutions.

Traditional scaling methods

Most traditional scaling methods boil down to the observation that many interactions don’t require rigorous consensus to be considered final by the parties involved. For example, if a retailer and a customer agree that a service was rendered satisfactorily in exchange for a specified payment, there’s no reason for third-, fourth-, and fifth-party confirmation to occur.

What matters are two factors: (i) certainty that the payer will fulfill their side of the bargain, and (ii) that neither payer nor payee has to trust that a third party will faithfully execute the transaction on their behalves.

This framework allows us to consider off-chain scaling, wherein transactions are conducted off the main blockchain and later settled on the chain. To comply with (i), payers must cryptographically and irrevocably commit to transfer funds; to comply with (ii), those funds must be transferred in a trustless manner and the transaction must be enforceable on-chain if need be.

These criteria underpin bitcoin’s lightning network, which has (rightly) been the subject of widespread media coverage. Think of it like a bar tab: participants agree to pay small amounts over the course of an evening but only settle up at the end of the night. This is an oversimplification of lightning network of course; a more detailed explanation can be found here.

Lightning is undeniably good for bitcoin and holds great potential for Layer Two bitcoin scaling. Due in part to extensive media coverage, lightning is often viewed as a panacea for bitcoin’s scaling issues. Meanwhile, there’s been a slew of articles hailing “Ethereum-killer blockchains” and opining that ethereum is incapable of scaling. In a few words, this is wrong.

First, ethereum is more than capable of scaling payment volume in a very similar manner to lightining. Hashed time-lock contract (HTLC)-based payment channels are just as feasible on ethereum as they are on bitcoin, and in fact, ethereum enables more innovative and user-friendly multi-hop strategies than bBitcoin can, and they can be deployed far more easily.

Because bitcoin uses a UTXO model, funds must actually be passed utilizing traditional cryptographic messaging methods to conduct transactions (even those off-chain). In contrast, ethereum’s account balance system allows for simpler and less costly off-chain balance updates.

For example, Connext’s implementation of payment channels (which has been processing payments in production for Spankchain for nearly a few months) uses “threads,” a multi-hop implementation that allows parties to directly pass balance updates amongst themselves rather than relying on hash-locked payment routing. This is a computationally cheaper, equally fast, and equally secure approach that’s likely better suited to many transaction patterns than lightning.

Moreover, complex contract interactions are a bit more overhead intensive to deploy, as bitcoin scripting is somewhat limiting. The UTXO model, though an excellent method for sending and receiving signed transactions to be verified on a blockchain-based network, means you have to augment your scripts for more novel use cases (i.e. escrows).

With the generalizability of ethereum, and the capability to create tokens, registries, non-fungible assets (like CryptoKitties, or digital identifiers for luxury goods) and other community-accepted smart contract standards, building modular and interoperable contracts that target the EVM is simply more seamless.

Generalized state channels

Smart contract and EVM support on ethereum enables a wide variety of applications that are not currently feasible on non-Turing-complete platforms like bitcoin, due to its architecture and design decisions – which lower its overall attack surface, which in turn puts greater focus on its permissionless peer-to-peer payments use case as its most touted feature.

Because Turing-complete scripts are more complicated to execute than simple transactions, however, these capabilities increase the overall congestion on ethereum (and causes the size of the state to grow at a much faster pace).

We’ve already discussed how payment channels can cut fees and latency for peer-to-peer payments, but ethereum supports much more complex transaction logic that payment channels don’t address.

Generalized State Channels, however, propose one solution to scaling issues associated with complex contract interactions. Right now, stateful contract interactions that enable the use cases that ethereum is known for must be executed on the blockchain. The thinking of many ethereum bears is that as more and more contracts are deployed, function calls will slowly overwhelm the network and drive gas prices through the roof.

Layer One scaling, which has received the vast majority of media coverage, asks how we can accommodate more of these complex interactions on the live blockchain, or mainnet; Layer Two solutions like Generalized State Channels and Plasma (more on this later) ask how we can move more of these functions off-chain, while retaining the security and integrity we’re provided by the mainnet (given certain trade-offs).

The security of payment channels relies on the ability of each party to “go on-chain” and use a smart contract to adjudicate and rectify disputes. That is, payment channels let two parties behave as though they are transacting on-chain even though they aren’t.

Because they have the ability to go on-chain at any time (as the balance updates that they send back and forth carry the weight of on-chain transactions) in a dispute the contract simply decides whose balance update is more recent by polling the mainnet chain. On-chain dispute resolution is costly, though, in terms of time and gas, so rational actors would avoid this scenario. And, if most state channels are using secure and audited standards, we can create interoperable systems with fast finality that are bound by the same cryptographic assurances as mainnet interactions, with drastically reduced, almost zero gas cost.

Counterfactual instantiation

This approach raises the question: if we can incentivize parties to behave as though a simple contract exists on-chain, can we do the same for more complex logic? One strategy is known as counterfactual instantiation.

There are a few different implementations, but they revolve around the same principle: state is passed into the generalized framework once at the onset and can be manipulated according to a contract specified (but not deployed) when the channel is opened. Dispute cases are adjudicated by the contract as well. Because participants have the ability to go on-chain and invoke the contract, though, all are incentivized to behave as though it exists.

The effects of production-ready Generalized State Channels that leverage counterfactual instantiation will be two-fold:

Operations involving contracts that can now be counterfactually instantiated will all occur off-chain; the sheer volume of deployed contracts will decrease relative to the status quo. This will reduce network congestion, benefitting contracts that must be deployed on-chain.

Operations that occur off-chain in Generalized State Channels don’t incur confirmation times or gas fees; this will radically improve user experience and allow ethereum (as a whole) to accommodate orders-of-magnitude-larger transaction volume.

Connext, Counterfactual, Perun, and others are actively working towards Generalized State Channel frameworks which will directly address the network congestion, user experience, and cost issues that many cite as ethereum’s Achilles’ heels. These solutions are enabled by smart contract functionality, are significantly more extensible than UTXO-based scaling solutions, retain the security of the underlying blockchain, and have the potential to unlock the new markets and business opportunities promised by ethereum. We believe that Generalized State Channels have the potential to be as transformative for ethereum as Serenity; whether due to poor information accessibility or inadequate publicity efforts, they have not gotten their due attention.

Lightning

Lightning was the starting ground for UTXO-based payment channels, atomic swaps, and more. The work that has done by the Olaoluwa Osuntokun, Joseph Poon, and the entire ecosystem lightning researchers and engineers is impressive.

There are a few working implementations of the lightning protocol and specification, including the LND project (by Lightning Labs, headed by its chief scientist, Olaoluwa and written in the Go programming language), and the C-lightning project (written in C).

On top of exciting additions like “Watchtowers” (services that watch your payment channels for fraud, and remain online so your node does not have to be – in return for a fee), the Neutrino wallet (Lightning Labs’ experimental light client, also written in Go), there are a slew of other improvements in the pipeline as the lightning specification and developer community matures and grows.

Some of the hard research is currently focused on: Splicing (partial deposit/withdraw and parallel channel deployment); Wumbo (removal of the channel capacity limit); Multi-Path Payments (breaking a payment into several, allowing for it to be routed over multiple routes – think sharding); Hidden Destinations (public routes for payments to private channels) and more hard work is being done repeatedly at conferences and by independent teams all over the world.

The work by the lightning team and scaling UTXO-based chains – utilizing some bleeding-edge implementations of crypto – is no small feat, and cannot be downplayed. Often, the problem is that people seek to directly compare lightning and ethereum’s Layer Two scaling measures using similar methodologies that don’t consider the trade-offs and unique capabilities the two varying solutions offer, due to the unique architecture of the underlying root chain (i.e. UTXO model versus the account model in ethereum).

Plasma

Generalized state channels are far from the only option for scaling ethereum. Plasma is a second-layer scaling solution that, in tandem with state channels, seeks to provide additional throughput, and finality, but with some additional trade-offs.

Think of Plasma as a sort of “proto-chain,” one that seeks to mimic as much of the root chain’s integrity and security as possible, just with a varying cost component, which is typically higher than when compared to state channels (due to replicating more of the main chain’s functionality onto a new substrate above it).

Plasma takes the entirety of the off-chain state, and maintains a full state of it, hashed to the root mainnet chain (which has its own set of risk trade-offs, though that’s constantly being improved through additional research).

Though throughput can be greater than the main chain’s, unlike state channels where there is no formal consensus algorithm, Plasma chains can bring their own unique consensus algorithm, complete with its custom block times, too (which possess their own series of trade-offs). Although throughput and finality are not as fast, they are far more accessible when compared to state channels, as anyone can access the root chain’s state that’s been broadcasted and join – whereas state channels are only available to their agreed upon counterparties (in most current implementations). And, state channels are no longer available after a channel closes, making them economic machines with finite lifespans, as they are purposely built to be more semi-permanent.

However, in Plasma, since you have to save every state interaction into the root chain, from your child chain, these costs are higher depending on which version of Plasma you opt to implement. With breakthroughs in how to best implement Plasma happening regularly at many teams spread globally, we’re sure a common standard will arise with a sensible set of trade-offs that can be applied to a wide array of use cases.

Power of interoperable standards

Non-custodial liquidity – and how to most efficiently and securely transmit it in a number of different scenarios involving multiple participants – is an ongoing discovery that continues to expand on the emerging science of crypto-economics and how various mechanisms operate in adversarial conditions.

Standards like ERC-20 (for tokens) and ERC-721 (for non-fungible assets) make ethereum Layer Two scalability tech and dapps more socially secure, given that there are community accepted norms and best practices around which standards to implement for certain use cases. This is especially important when these various standards – which eventually seek to interact with one another fluidly to enable “decentralized finance” – can talk and communicate interoperably, with minimal friction and cost.

Those frictionless interactions and economies that spring up from the novel interoperability between tokens, non-fungible assets, and Layer 2 scalability create further security for the greater ethereum network, because all participants are now intertwined in complex economic activity on the additional layers above it; all being built on secure standards, that were audited and accepted by the greater technical community.

The importance of non-custodial architecture, combined with the path of least resistance to the most extendable and generalizable functionality, cannot be understated. These are crucial components and primitives to bringing new and novel economic machines to life, that thanks to expense, regulation, and computational limitation, were once thought impossible to implement into the real world.

Time for a new narrative