#Depending on income they only have to pay 10-30% and there's a monthly threshold where anything over that is waived/reimbursed

Explore tagged Tumblr posts

Text

A kind of funny trend I've noticed is that many fanfic writers who write for fandoms that take place in Japan often aren't aware of the fact that Japan has universal health care. I've seen quite a few fics set in Japan with whump/hurt comfort plots that mention large medical bills as if it's taking place in America lol.

#Random#fanfiction#For reference#It's not free but it's very cheap#Depending on income they only have to pay 10-30% and there's a monthly threshold where anything over that is waived/reimbursed#Also the bills are generally cheaper to begin with even before the insurance coverage#Age also affects how much is covered#So medical care is very inexpensive in Japan for the average citizen#And fees would generally be waived for anyone too poor to afford it

4 notes

·

View notes

Text

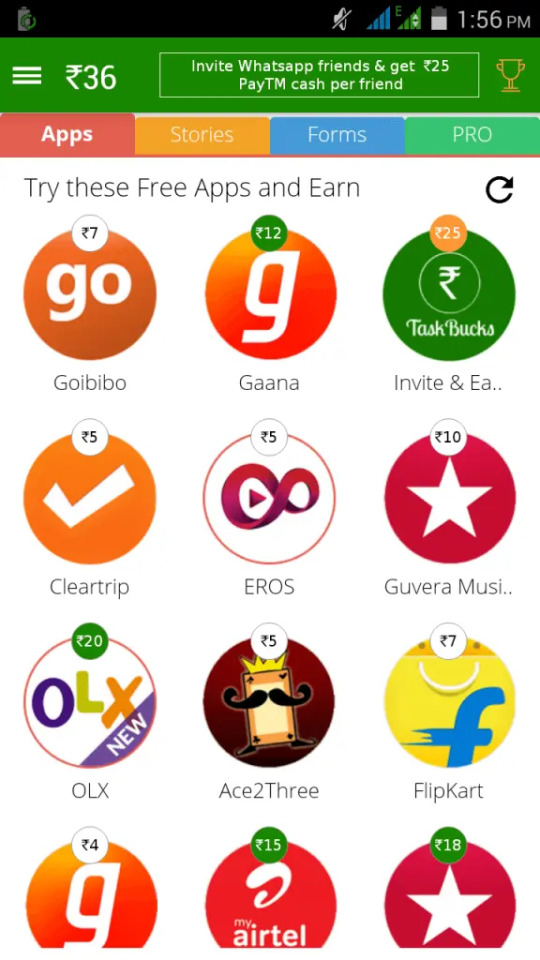

8 Mobile Recharge Apps To Get Maximum Real Money Cash

Free Mobile Recharge apps for Android are the best way to pay you Real Money Cash. Lots of people search the internet for the best free Android apps to Earn Extra Money.

Refer and earn apps are similar to them too. Nobody wants to spend a lot of money every day to recharge their Prepaid Mobile SIM card. So in this situation, we thought we could find something that allows you to charge for free.

It is always good to have some money at the end of each month. If you are looking for some extra money, you have come to the right place. Many survey apps pay you just by filling out survey forms online.

While they won't make you rich, there are plenty of apps that will reward you for completing simple recharge tasks on your phone. Some of these apps pay real money to the people who use them. There are dozens of these apps available, and yes, many of them are sketchy or scam. But there are some that are not only legitimate, but also worth checking out.

That’s why we decided to share some of the best paying Real money Cash Online Recharge apps for Android phone, which gives you unlimited recharge by downloading some apps or Make online recharge with these apps

Looking for the Best Mobile Recharge Apps for Android to Earn Extra Money? If yes then this article is very helpful for you. I’m going to share some of the best referral and earning apps that can earn you a lot of top-ups (depending on the number of referrals).

If you are really interested in Earn Real Money with online prepaid Mobile Recharge , try the top paying free recharing apps from the list below. Trying to search the internet will bring up a large list of applications that provide free charging services. But not all of them are good enough.

Why? Because most of them don’t pay their users a cent. Don’t worry, we only have proven and real apps on our list.

There are many ways to make money online, but getting free top-ups is a bit crazy. You can earn everything you want with the best free Recharge apps for Android that we are going to share in the next section.

This article lists the latest popular apps today. Even you can say them too, Best Refer & Earn Apps as the most important part to load up is referral program for these applications. We also recently shared the best 3D games for Android, we hope you like them.

We can earn a lot of free recharges with these free recharge apps that pay more money. While some people think that all these apps in play store are fake. But they are actually wrong. Some apps are well in the market for the best free Recharge apps for Android, which really send your free talk time by filling up a few offers or using a referral program.

Android is the best gadget nowadays, everyone has Android phone. But what if you get a great fit to get a free balance on your SIM? Yes, it is possible to use the best applications to earn free credit. What you need is simple, install these applications on your mobile and start earning free credits. Check out the funny biographies on Instagram.

1. Empire ReEarn

Empire ReEarn, With just a few clicks and all the required information, you can successfully online recharge and pay your bills. As a 100% secure payment option, it ensures complete security of shared information. The various service provider networks covered by Prepaid mobile recharge include Airtel, Jio, Vodafone, Tata, BSNL and Tata Docomo etc.Empire ReEarn Provides Cashback Offer On every prepaid recharge. Along With that Empire ReEarn provides tree income to grow your business with no investment.

Prepaid users, there are many plans and their information that you can use to make informed choices before performing a top-up transaction. For uninterrupted DTH services, you can connect your Airtel DTH, Big TV, Dish TV, Sun TV, Tata Sky and VideoconD2H to live instant charging, without missing your favourite shows to capture all live sports. with great mobile recharge cashback.

2. Khatriji

Khatriji also includes a cashback policy, according to which the user receives cashback on every recharge whether it is for mobile and DTH or data card. Skyomie can expand the tree by handing over to his friends and family and in that case if any of them buys Khatriji’s product, Skyomie benefits more than the referral income.

Thus, Khatriji’s Skyomie is capable of earning money from home. Skyomie can also set up his own business and increase his income through Khatriji in this way. Therefore, Khatriji can be considered a digital platform for start-ups.

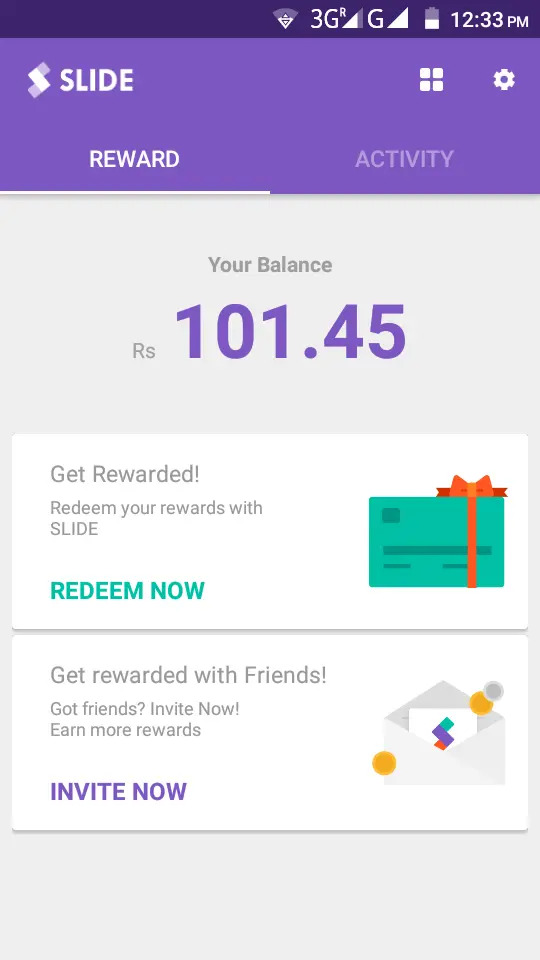

3. Slide – Free Paytm Cash Earning App

A Slide is the best free Paytm cash earning app for Android phones. It gives you a sign-up bonus of Rs. 5, which will be credited to your account immediately after registration and verification of your account via OTP.

You will then receive 10 rupees for each successful referral. You can exchange your winnings as a free top-up or Paytm Cash, it is your wish! If you think it is fake or if you did not pay your money, you can check the reviews of its users in the Play Store, it is one of the trusted applications according to the comments of its users.

Exchange your winnings as long as you reach a minimum threshold of Rs 50. I have personally tried this app and found it very useful. the slide app from play store. click Here

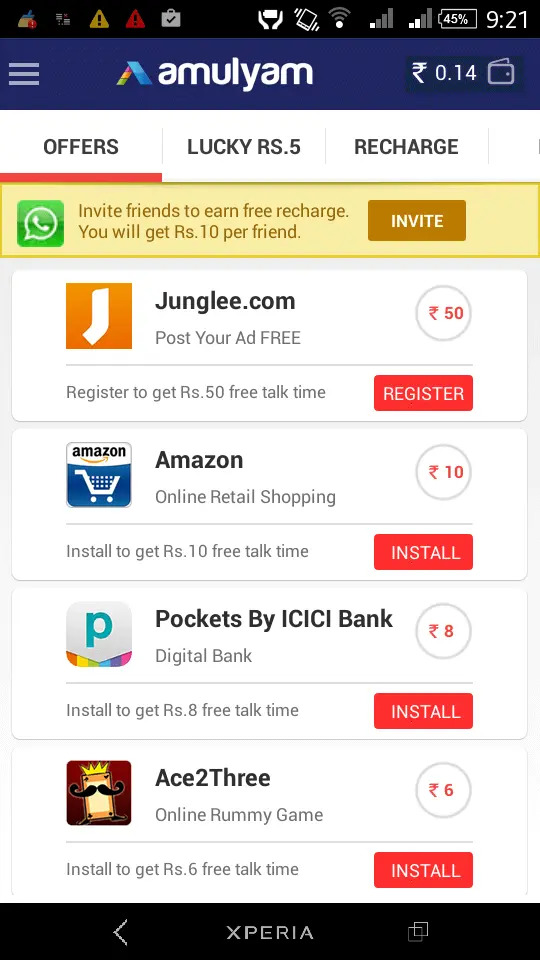

4. Amulyam – the highest paying free Recharge app

Amulyam is a very old application that receives updates in a very short time. Initially Amulyam will pay Rs. 10-30 for referrals but now they have expanded their database and loopholes users installed this app on their android mobile.

You can make a lot of money by downloading other apps from there or you can go to the Refer & Earn program where you get Rs. 1 receive instantly when your invited friends sign up for this app and then Rs. 10 if they take Rs. 1 on the same registration day and the last Rs.100 if they earn Rs.50 on the same registration day.

So isn’t it the cool and top paying free Recharge app? Download today and earn unlimited free talk time. click here

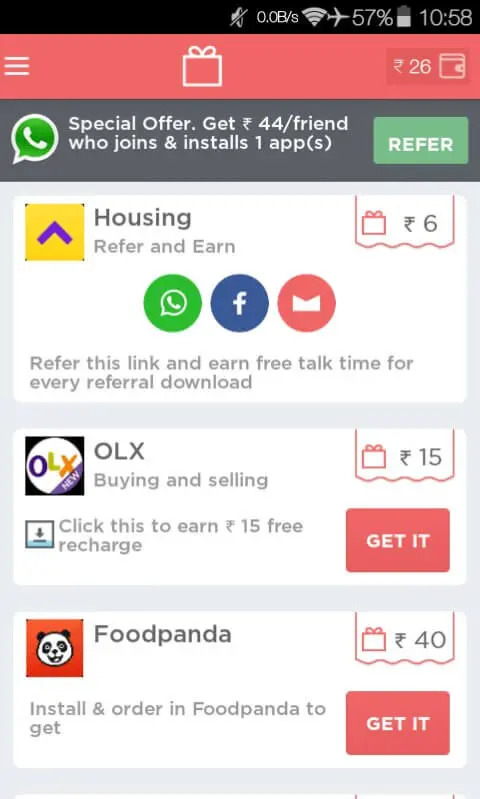

5. mCent – the best free Recharge app ever

mCent is one of the best and oldest free Recharge apps for Android of the year. We have received over 10,000 (Rs. 10,000) with referrals. You can get free refills by downloading an app included with mCent. Per app offers something Rs. 2-10. In addition, it provides a referral system. Once mCent Rs. 700 per referral and after that it lowered its referral amount and now offers Rs. 40 / per referral.

It means you will spend Rs. 40 per download via your link or referral code. All you need to do is register in the mCent application. Click the Recommend & Earn tab, copy your referral link (code) and share it with your friends and family. As long as they download the mCent app and sign up with their referral code. Your account will be automatically credited with Rs. 40.

6. Task Bucks – Free Paytm Cash

Task Bucks is one of the best applications to earn free reloads. One of the main features of Task Bucks is that you can also exchange your earnings as Paytm Cash. Yes, it directly means you can earn free Paytm money with this app. In addition, you can exchange your points for top-ups.

It is a new free Recharge app that offers Rs. 25 Paytm cash per referral. You need to register there and share your referral code with friends. For each successful referral, your account will receive a credit of 25 rupees.

It also shows you a lot of apps on your homepage, by downloading them you will make more money without referrals. You can withdraw your earnings as Top-Up or Paytm Cash.

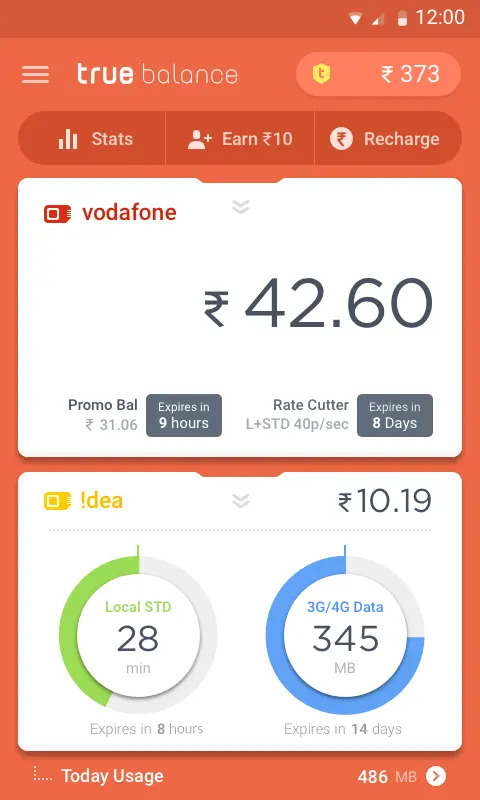

7. True Balance – Trusted Free Recharge App

True Balance app It is also a newcomer to the Play Store application developed by the developers of Balance Hero. You can also charge your phone for free when downloading applications and references.

The main feature we love is that it shows your SIM card balance in the notification bar. Yes, you do not need to enter the USSD code to check the remaining balance. You can view the main balance of both Sim cards directly from your Android’s notification bar.

8. Ladooo – The best application to earn free balance

Ladooo is also the best and oldest free Recharge app for Android users. We have already won many reloads with him. It offers free recharge by downloading an application and by referrals.

If you don’t want to send a link to friends or family, you can also earn directly by downloading function apps from Ladooo App. Each app offers Rs. 5-10. You can exchange your earnings for mobile recharge.

There can be thousands of ways you can make money. Of the ways you will find online, many may be legitimate while many options don’t necessarily help you make money. With the advent of smartphones, people have found many ways to profit from them. These apps don’t make you a millionaire overnight, but they help you meet your daily needs and save money. The money earned from these apps will help you with your monthly bills.

Source : 8 Mobile Recharge Apps That Pay You Real Money Cash

#8apps#amulyam#appsthatpayyou#bestearningapp#earningapp#EmpireReEarn#khatriji#makemoneyfast#makemoneyonline#makemoremoney#mcent#onlineearning#onlinerecharge#Refer&earn#taskbucks#Truebalance#waystoearnmoney

0 notes

Text

How To Control Your Finances

Do you ever seem to find yourself without enough money? Do you find that money slips from your hand as fast as a bar of soap? Do you find it easier to stick your head in the sand rather than face your bills or review your bank statements?

If this sounds like you, you’re certainly not alone. Being good with money is not a natural practice for most of us.

This post is designed to help you get control of your finances by equipping you with the knowledge and skills you need to make informed choices about money. So, what are you waiting for? It’s time to get learning, start saving and look forward to a calmer, more secure future.

You can land a cheaper mortgage by saving for a larger deposit and reining in your expenses.

Let’s begin by addressing one of the most cumbersome financial problems of our era – and what is most likely your largest expense – housing.

Over the last few decades, house prices across Western countries have escalated rapidly. This has made the prospect of home-ownership nothing but a pipe dream for a whole generation of young people.

A report by the Institute for Fiscal Studies estimates that average house prices across the UK have risen to at least ten times the average salary of 25 to 34 year-olds, and in London, it’s as much as 16 times.

Given that you’re unlikely to be able to borrow more than four or five times your salary with a mortgage, you can see why there’s an affordability problem – the numbers just don’t add up.

Unfortunately, for those wanting to get on the housing ladder, there are no quick solutions. But there are things you can do to appear less risky to lenders, and that will help you borrow more and secure a cheaper mortgage.

Whether you can afford to buy a house really depends on two things: can you raise enough for the deposit, and can you convince the bank to let you borrow the rest?

Regarding deposits, the general rule is that the more you can put toward a deposit, the less you have to borrow, and the lower your interest rate is likely to be. Most first-time buyers will only be able to afford a deposit equivalent to 5 percent of the value of their house. But, here’s some advice: if you can scrape together at least a 10 percent deposit, you should – because this is the threshold for substantially cheaper interest rates.

Whether the bank will let you borrow the rest depends chiefly on your income, which you probably can’t do much to change. But one thing you can do is team up with another salaried person, which will effectively double how much you can borrow.

Your outgoings are also important. You’ll have to show at least three months of bank statements – or two to three years of bank statements if you’re self-employed – so it’s vital that you don’t default on any bills or make excessive purchases within this period.

This deep dive into your finances might seem excessive, but it should also make you think about whether you can actually afford to make the monthly repayments on a mortgage for the better part of your life. Or if you even want to.

Improving your credit score can get you better deals on loans and mortgages.

Another crucial factor that banks look at when evaluating you for a mortgage or any loan, for that matter, is your credit score.

Your credit score is a number created by credit reference agencies. These agencies keep track of your interactions with financial institutions like banks and energy suppliers. The idea of a credit score is to evaluate your past borrowing behavior so that lenders have some indication of how likely you will be to repay a loan in the future.

Credit scores are important for everything from applying for a credit card to being accepted as a tenant. But, most importantly, they’re essential for getting cheaper mortgages. Any blemish on your credit score, due to, say, defaulting on a bill for several years, could get you turned down for a cheaper mortgage, costing you thousands in extra interest.

Another quirk of the credit-score system that has long perplexed borrowers is that having no credit history is often worse than having a negative credit history. But just think, if a stranger asked you for money and you didn’t know a single thing about their history of repaying loans, you’d probably be reluctant to hand them money too. Lenders need something to go on.

This can be a problem for first-time buyers who haven’t yet had the chance to build a credit score. The easiest way to remedy this is to start borrowing small amounts. You could, for example, take out a credit card and start using it for daily expenses but make sure you pay it off in full each month!

There are plenty of things you can do to improve your credit score. For one, you can pay all your bills on time. Defaults will stay on your credit report for six years! Also, avoid applying for too many financial products within too short a space of time – things like savings accounts, loans, and credit cards – as this doesn’t go down well with a lot of lenders. And remember, even if your application is turned down, it’ll still affect your credit score.

It can be extremely frustrating knowing that these mysterious credit agencies have such a frightening amount of control over your life. It’s important to remember that you do have certain rights. If there’s anything on your credit report you think is unfair, contact the agency to have the issue investigated and, hopefully, struck off.

No matter how much debt you have, it’s not unmanageable.

Unaffordable housing is one problem that defines this generation – another is debt. Whether it’s life-time mortgages, astronomical student loans, or spiraling credit-card debt, we’re up to our eyeballs in the stuff.

The debt charity StepChange estimates that, in the UK alone, there are 21 million people struggling to pay their bills on time, and 3.3 million people suffering from severe problem debt.

So, if you’re struggling with debt, you’re certainly not alone. But you need to stay on top of it. Understanding how to manage your debt will save you a lot of pain and money in the future.

This might seem obvious, but the general rule of thumb when borrowing money is to borrow as little as possible and pay it back as quickly as possible. That way, you minimize the amount of interest you have to pay on top of what you borrowed.

So, let’s imagine you’re £3,000 in debt on your credit card, and you have to pay 19 percent interest. If you only pay the minimum required payment each month – say £74 – it would take you 27 years to pay off your debt in full and would cost you £7,192 in total. That’s more than double what you borrowed. If, instead, you pushed yourself to pay £108 a month, you’d pay it all off after only three years, and it would only cost you £3,879 overall.

It simply doesn’t pay to bury your head in the sand and pretend your debts don’t exist. You’ll only magnify the grief you have to face down the line.

If you’re really struggling with your debt repayments, you should contact your creditor to arrange a more manageable repayment plan. If you explain your situation, many creditors will also offer you some interest-free breathing space of at least 30 days.

Failing that, you do have other options. Debt really shouldn’t be something to lose sleep over. Remember, no debt is completely insurmountable. Even bankruptcy isn’t all that difficult to bounce back from should you decide to wipe the slate clean and start again.

If you're in a substantial amount of problem debt and you’re finding it overwhelming to pay off, then get help. There are a lot of institutions out there dedicated to helping people in your position. If you’re in the UK, check out StepChange’s online debt calculator and free advice service.

You can budget effectively without lowering your standard of living.

Unfortunately, with housing costs and debt to pay off, most of us exist in a constant state of needing more money. If we can’t earn more, there’s really only one option left – budgeting.

Yet, budgeting doesn’t always come naturally to us. It often feels easier to flash our plastic than to rein in our temptations.

Perhaps the problem is that we often engage in retail therapy to make ourselves feel better. So, when we hear the word budgeting, it invokes a sense of puritan-like restraint and a life as plain as breadsticks.

But budgeting really doesn’t need to imply a reduced quality of life. We all know that a lot of what we buy doesn’t make us any happier. So, budgeting isn’t about cutting back on life’s pleasures; it’s about cutting back on needless spending. And to do this, we need to be a little less unthinking with our debit cards and a little more mindful.

This is where the Japanese concept of Kakeibo can really help us. The word literally translates to a kind of household ledger in which you keep track of your day-to-day expenses. But it also refers to the philosophy and art of personal money management.

The principle goal of Kakeibo is to imbue a sense of mindfulness into your everyday spending. Honestly, just being aware of your spending is sometimes all it takes to rein yourself in. If you knew that the £4 tray of prawn gyoza you buy for lunch every day costs you over £1,000 a year, you’d probably make your own lunch more often.

The first step in the Kakeibo method is to do some basic accounting. Write down your total income for the month and then subtract all the necessary expenses from this figure, such as rent and bills. Next, decide on a savings target – maybe 20 percent of your income – and subtract this from the total as well. Then divide what’s left into four, and you have your spending money for the week.

The next step is to divide your money into pots. Let’s face it, if there’s money in your current account, in your eyes, it’s probably going to be fair game for spending. So separate that money into different accounts as soon as your salary comes in each month: one for savings, one for essentials, and another for everyday spending.

The Kakeibo method makes it easy to save with minimal effort. Since you do all the calculations in advance, you don’t need to struggle with the mental math while your card’s already poised.

Investing your money in a fund is a safe way to grow your savings.

Since the 2008 financial crash, interest rates have fallen to record lows, even lower than inflation. That means your savings are growing more slowly than the currency is decreasing in value. In other words, you’re losing money.

For this reason, you’re arguably better off taking your money out of your savings account and putting it into an investment fund instead, as these usually have better returns.

But wait a second. Investing? Don’t you have to be rolling in cash to invest?

Well, not really, not unless you intend to go full Wolf of Wall Street. As a matter of fact, investing your money isn’t any more complicated than opening a savings account – all you need is a spare evening after work.

But granted, maybe you don’t know the first thing about investing. Where do you begin?

You’ll most likely invest in a fund via an online platform known as a fund supermarket. These are companies that administer your investments on your behalf for a fee, and in exchange, they offer various tools, advice, and graphics to help you manage your portfolio.

Unless you really want to get involved, you don’t actually need to make any decisions about which shares or assets to invest in. The only decision you need to make is which investment funds you want to jump on board.

Investment funds are like a big pot in which a bunch of separate investors have pooled their money. Only the fund manager – someone who knows what they’re doing – makes the difficult decisions about where and what to invest in.

This is all great, but isn’t investing risky?In theory, yes, there is an element of risk involved in investing. But, in practice, if you’re only investing in funds, you’re highly unlikely to end up with less money than you started. That’s because the whole point of an investment fund is to minimize risk.

It does this by giving everybody in the fund a percentage stake in a much larger and more diverse spread of assets than any individual could afford by themselves. The more diverse the spread of assets, the less vulnerable investors are to fluctuations in the value of any one type of asset.

This practice is called diversifying – otherwise known as not putting all your eggs in one basket – and it’s one of the pillars of safe investing.

Ultimately, the experience of investing your money in a fund is much the same as keeping it in a savings account, so definitely consider it as a legitimate option for growing your money.

The earlier you set up a pension plan, the better.

Pensions are the least sexy of all personal finance topics – and that’s saying something.

Saving for a future that may never happen, in accounts that you can’t touch for decades, is the least fun kind of saving. At least saving for a house or a holiday gives you something tangible to look forward to.

Nevertheless, it’s important to save for your future. You might not want to hear it, but someday you’ll be old. And, with average life-expectancy creeping ever upward, you probably won’t want to still be serving coffees when you’re pushing 100.

The hard truth is, it’s better to start contributing toward a pension when you’re young. The sooner you start, the more time you’ll have to make contributions and grow your pot thanks to the miracle of compound interest.

But why do you even need a pension? Why can’t you just keep your money in a savings account?

Well, governments are keen for their citizens to save up for retirement while they’re young and still able to earn. So, to encourage you to save, they offer pretty generous tax reliefs on money you put into a pension pot.

At its simplest, a pension is really nothing more than a savings account or an investment fund that’s been wrapped in a tax break.

That’s why a pension is a more lucrative way to save than merely tossing money into a current account of stashing it under the bed until you’re 70. The downside, of course, is that you have to lock that money away until you retire.

So, how much should you be saving? Brace yourself, because it’s probably much more than you imagined. Most experts say that, in order to maintain the same quality of life you have now, you’ll need about two-thirds of your current salary for every year of retirement, which you should assume will be at least 20 years.

Therefore, if your current salary is about £30,000, then to have a yearly payout of £20,000 over 20 years of retirement, you’ll need to save £400,000. To save that amount, you’d realistically have to save about £750 a month in your pension fund.

This might not match up with your situation exactly, but it should light a fire under you. The easiest way to figure out how much you need to save is to use an online pension calculator.

Discussing finances regularly and openly can improve your relationship.

It’s up to each couple to hash out an arrangement that works for them. But, of course, couples aren’t always going to agree, so they should be prepared for some awkward conversations around the dinner table.

It shouldn’t come as a surprise that money is the most common source of conflict between couples in relationship counseling.

Part of the problem is that partners often have very different expectations about the social value of money and how it should be spent. For example, one partner might interpret lavish spending on clothes as an expression of success, while the other thinks it’s just plain wasteful.

For this reason, couples counselors recommend open and regular communication about financial expectations – especially if you have joint finances.

Any resentments around money need to be aired and talked about with your partner. While these often feel petty and not worth talking about, they can easily get out of hand and cause more destructive conflicts.

A technique employed in couples’ counseling to help restore trust around finances is contracting. You can try it at home too. The idea with contracting is that you work together to set out a series of financial guidelines that you both sign off on. You might, for example, contract that the other is not allowed to comment on any purchases you make with your personal account. Or you might decide how much each person must contribute to rent and bills given your different salaries.

Remember, fairness in relationships doesn’t always mean that each partner must contribute the same amount of money. It’s rare to find a couple who both earn the same income when they meet and continue to earn the same income for the duration of their life together.

Managing your money also requires managing your emotional relationship with money.

Money might not be able to buy you happiness, but constantly feeling as though you don’t have enough of it can have a detrimental effect on your mental health and quality of life.

Unfortunately, financial strain and mental health problems tend to compound one another, creating a vicious cycle. Money affects our mental health when, for example, we are stretched too thin to meet the bills we have to pay, or we feel overwhelmed by our debt obligations.

The mental health charity Mind estimates that people in unmanageable debt are 33 percent more likely to suffer depression and anxiety than the general population.

And, on the flip side, when we feel depressed and overwhelmed, we might not be able to face opening the bills and debt letters that arrive unwanted in our letterbox. Or we spend to make ourselves feel better.

The connection between our finances and our state of mind is the bedrock of financial therapy, which has recently taken off in the United States. Financial therapy mixes practical financial advice with more traditional emotional and psychological therapy.

What this practice demonstrates is that tackling money problems involves more than doing some accounting and calculating budget plans. Managing your money ultimately means managing your relationship with money – that is, how money makes you feel and behave.

Let’s consider some practical advice that should help you feel a bit better about your finances.

First, be realistic about your budgeting. Holding yourself to an unrealistic budget can make you feel terrible when you inevitably overspend. You might then give up budgeting altogether. Always budget some money for fun, pleasurable experiences too.

Next, consider getting yourself a folder and use it to store all your financial paperwork, such as bills, receipts, and statements, in one place. If you haven’t done this already, it’s a truly cathartic ritual that works wonders to cure scatter-brain syndrome.

And, finally, consider incorporating a mood diary into your household ledger. That means that alongside your day-to-day expenses, you can also keep a record of how you felt when you spent money. You might, for example, notice that you only do online shopping when you’re exhausted in the evening. So you could introduce a rule where you’re only allowed to make purchases in the morning – at which point, you probably won’t want it anymore.

Ethical funds are a safer and more lucrative option for your money.

Do you support the National Rifle Association? What about oil companies like Shell or Exxon?

You might not be a vocal supporter of gun rights or fossil fuels, but there is the chance that you may be propping up these industries without realizing it.

If you’ve ever been enrolled in a workplace pension, there’s a good chance that one or more of the investment funds chosen by your pension provider includes shares in companies you believe to be socially and environmentally irresponsible.

So what can you do about it? You don’t have any say in who your pension provider invests in, right?

Fortunately, it’s getting easier for people who care about the ethical impact of their money to do something about it.

Most workplace pension schemes should offer you the option of changing your default fund to what’s called an ethical fund. This is an investment fund that excludes companies deemed to be socially or environmentally detrimental, from gun manufacturers to gambling websites.

You might even have the option of investing in a positive impact fund that goes one step further. These take a more proactive stance to investing by only selecting companies deemed to have a positive impact on society. For example, Dame Helena Morrissey introduced the world’s first “girl fund,” which only invests in companies with a good track record for gender equality and diversity.

In the past, the objection to investing in ethical funds was that they weren’t as lucrative. Of course, if you’re investing money, it’s probably because you want that money to grow. This means you might be tempted to put your personal interest before the public good.

Fortunately, the view that taking an ethical stance means sacrificing financial return is outdated. Actually, experts are increasingly voicing the opposite opinion. Ethical investments might be safer and more lucrative in the long run.

This is due to society's changing values. The younger generation is far more socially and environmentally conscious than their baby-boomer parents, whose wealth they’ll soon be inheriting. As a result, while companies like gun manufacturers and fossil fuel providers were once safe bets, they’re increasingly seen as risky due to mounting pressure on governments to regulate these industries.

It’s important to remember that what you do with your money has an impact on the real world, so use it wisely.

Getting on top of your finances means tackling both the practical side of money – learning how financial products work and using them to your advantage – and the personal side of money – learning to control the way money makes you feel and behave.

Action plan: Try the 50/20/30 technique.

To budget effectively with minimum effort, it helps to put your income into separate pots when it comes in every month. The 50/20/30 technique gives you a good estimate of how you should divide your money. Put 50 percent of your income into an essentials account – that means rent, bills, and commuting costs. The next 20 percent goes toward paying off debt, or if you’ve paid off all your debt, you can put it into a savings account. The last 30 percent goes into your current account, and that constitutes the absolute limit you can spend on cocktails for the month.

0 notes

Text

11 Best High Paying Affiliate Programs you need to Join in 2020(updated)

Are you serious in making online money? Then there is the chance which lets you earn more online revenue with the help of the high paying affiliate programs. The affiliate programs that pay not only benefits the bloggers but also the people who do a good CPA marketing. There are many affiliate marketing websites which helps you to earn revenue with the affiliate programs. They provide huge and attractive offers and also commissions for the promoting through the affiliate products with the links.

List of High Paying Affiliate Programs you need to Join in 2020:

The best paying affiliate programs for the year 2020 which earns a surplus revenue. 1.Bidvertiser is high paying affiliate program

The bidvertiser is the best paying affiliate program where you can earn through affiliate programs. By promoting the affiliate link you can earn some income. You need to sign up with 50$ and run the campaigns by promoting the bidvertiser affiliate links. If any user sign up using your affiliate link and deposits the 50$ in the bidvertiser account, then you will get 25$ as the commission for joining them. You can promote your bidvertiser affiliate link with the help of the social channels such as facebook, twitter etc. By creating the youtube video you can earn more referral joins because a majority of the traffic can be from this youtube source. Be alert and make every moment to enjoy the surplus revenue from the bidvertiser. Join now to grab the attractive bidvertiser offers exclusively on the eknowledgetree website and Naya video channel. For more information, you can go through the below channel, Naya youtube channel. 2.Amazon Associates Affiliate Programs:

Amazon Associates Affiliate programs serve the users to gain a substantial revenue by promoting the Amazon products. The easyazon plugin is the ultimate option for the bloggers to promote the products using the Amazon associates. Do Not waste your precious time and simply use the easyazon plugin to get high commissions. With the easy amazon affiliate link, you can easily create high commissions rate products and earn a huge revenue from this amazon associates. First you need to create the amazon associate account and start promoting the products which are on the list. Be careful that some products are excluded from the commission and some are rated with fewer commissions i.e 1% only. Some products are listed for getting the higher commissions also. Before promoting the associate link you need to check which product carries higher commissions. If you are website owner it's very easy to promote the Amazon affiliate links. The affiliate programs that pay the genuine revenue is the amazon associates. You can check all your commissions and sales you made in the reports section. Forgetting a dynamic and growing income you need to just join now here. 3. 365 Luxury Car Hire Affiliate Program:

Affiliate programs are the very common nowadays because of the widespread of the technology and promoting their brands or services they are offering. The affiliate programs help the bloggers to gain a good revenue from their websites. What the affiliates need to do? They need to generate traffic and sales in order to generate commissions for the activity they are doing... How long does this affiliate programs benefit the affiliates? Depending on the traffic source they are promoting their links, creating attractive sales promoting links in their websites with some attractive discount offers. The 365 luxury car hire is high paying affiliate program is a good income source if you are getting a good traffic from the European based countries as this affiliate program rents a car in that region. The CPA marketing is a good technique to market their services based on the customers or visitors engagement with the particular websites. Its very easy and free to sign up for the 365 luxury car hire affiliate program. Once you joined this affiliate program you can get the bonus of 50 euros. When the visitors hire the car by clicking your link you can earn commissions too. You can withdraw your balance once it had reached 100 euros. In this affiliate program, you can get all the super luxury and branded cars for hire. Sign up here to earn attractive income from this affiliate program of the 365 luxury car hire. 4.Mango Tools Affiliate Program:

Mango tools affiliate program is the free signup program which benefits mostly the bloggers to maintain their website with good SERP results and attractive keywords, competitive keywords too. You can analyze the website's accuracy with this affiliate program. You can get 30% of the commission if anyone used your link to sign up for this program. It had three plan one is basic which is 29$, a premium is 39$ and the agency for 79$ per month. For the free account with mango tools you can get 3 keywords for every 24 hours and 50 related keywords depending on your search. In general, no website is paying such type of services. As an overall the mango tools affiliate program is the one of the best affiliate paying program for the website owners because it helps to generate or reach their web content to a huge traffic. Simply sign up here to enjoy the good keywords density for your websites. 5 Adbuff Affiliate Program:

Adbuff affiliate program is an Adsense network where you can earn a substantial revenue by joining as the publisher. But to get approved for the adbuff affiliate program your website must qualify the terms and conditions of the adbuff. Once it had approved, for having the adbuff AdSense on your website for a period of 60 days you will get 25$ and for referral any of the publisher you can earn 5% as the commission too. For the publisher account to be approved your website must have 2000 unique visitors per day. Your website should contain a good content, not the illegal or any other external links which opens malware files. Your website must contain a good functional design layout. It helps the publishers to double their revenue by attracting the other publishers to join your affiliate program. 6.Payoneer high paying affiliate program:

For online international payments you mostly use the PayPal, but the Payoneer stands before you to earn through its affiliate program for using this service.The Payoneer transactions are very highly secure and trustable. By promoting the simple word of the Payoneer payment services you can earn money. It's very easy and free to sign up. If you sign up and do the transactions of the 100$ you can get 25$ as the benefit. If you promote this affiliate link, for each and every referral who joins with that link and had done 100 $ transactions, you can get 35$ as the commission for his referral and the other one get 25$ as the benefit. If also benefits by giving 25$ free for completing the 1000$ transactions successfully. Join for free to grab the 25$ instantly. 7.Macphun affiliate program: Macphun is an affiliate program which mainly focuses on the photo editing software. You can promote the affiliate links of the different types of the photo editing software on your website. It's very free to join and easy to set up. This is the top paying affiliate program which pays you to 50% for every sale you made through the links. You can refer for a period of 150 days to promote your affiliate link and earn 20% for every sale and .35$ for every download. In order to get the affiliate link to promote simply enter the landing page and copy the link to paste in your website browser. You can give your bank details and can withdraw when it reached the threshold of INR 3200. The macphun CPA marketing helps to draw a maximum revenue with the sales and number of downloads. 8.SE ranking affiliate program:

The SE ranking affiliate program is an all in one SEO platform for building a project with the accurate budget. It provides the competitive SEO tools with special features. This affiliate program helps in finding the competitor keywords, backlinks monitoring, and keyword grouper. This SE ranking program follows the 100% ranking, website audit, and marketing planning for getting the dynamic results for the websites. It had a great SEO potential for monetizing and budgeting. It also provides and tracks the white label and page changes monitoring too. You can outrace the competitors and get top in the SERPs results using the competitors' research module. It provides a wide range of offers for the people. The basic plan i.e personal 7$ per month with 50 keywords, website audit for 5000 pages and backlink monitoring for 1000 links. OPtimum plan for 35 $ per month for 10 websites. They provide 250 keywords, website audit for 25000 pages and backlink monitoring for 5000. The plus plan for the 89$ per month, 1000 keywords per month, website audit for 150000 pages and backlink monitoring for 25000 links. The enterprise plan for 189$ per month with 2500 keywords, website audit for 250000 pages and backlink monitoring for 75000 links. You can get 30% commission for every sale you made. 9.Wealthy Affiliate Program:

Wealthy affiliate program is one of the CPA marketing based online program for earning a good revenue by just referring the friends. You can also know more knowledge about how to increase the website revenue with good SEO tips and do the effective affiliate marketing. You can also get awareness about many functionalities while using this wealthy affiliate program . Its very easy to join and free. The first-month discount offer for 19$ where you can get the commission of 8$ per the first month and thereafter 23.50$ next month, yearly 172$ and for premium signup, you can earn 100$. For doing simply joins you can earn 4$ per referrals and 11.8$ monthly and 87.50$ yearly commissions. 10.Adsterra Affiliate Program:

Adsterra affiliate program is nothing but Adsense network where you can simply earn with the referrals also. Its very easy to join this affiliate program, send your website for approval, choose the ad formats and get the ad code once your website had approved. You can earn dollars with the referrals. Simply promote your affiliate link and when the referral joins and uses this adsense, you can start your earning. Your earnings will increase if the referral uses the adsterra network daily for promoting. Slowly you can increase your revenue share by multiplying the number of referrals. I had earned a few, so start earning by joining here. 11. 3dcart Affiliate Program

Here is another great affiliate program that you can use to refer to anyone looking to create a website or start an online business. 3dcart is a complete website builder that makes it easy for anyone to sell products online. 3dcart’s affiliate program pays a 300% commission, which is over $600 per sale. They also have a 120-days cookie duration which extends the tracking time of any referrals, and they also offer second tier affiliate commissions, which can add up quickly if any of your referrals also become an affiliate. Read the full article

0 notes

Text

Forget These Common Credit Myths That Prevent You From Acting Now

Often we are stopped from the actions that we need to do to solve our problems by some myths or rumors about unpleasant consequences. To get financial support from creditors, you just need to choose the most suitable type of credit and the best offer among others, corresponding to your needs. However, common credit myths is holding back many from filing an application, raising concerns about the undesirable outcome. The good news is that not everything that you could hear about loans has a solid foundation and is true. For example, you may have heard that the average credit rating in different states may affect your creditworthiness and the likelihood that you will receive approval from the creditor. In fact, this does not determine the probability for you personally, because each lender will study your particular circumstances when considering your loan application. There are quite a few such common credit myths, but most often they have nothing to do with the real situation. You may be frightened by bad aftermath, or vice versa, promise a quick improvement in the status of your credit, but before you make a decision, find out which common credit myths really should not be taken into account. Such a reasonable approach will allow you to avoid wrong decisions that can affect your finances badly. In some cases, you will not receive the necessary financial assistance, and in others you will get into unwanted debts, from which it will be very difficult to get out. Further you will learn about the most common credit myths that are not worth listening to if you want to improve your credit.

One late payment will not lower your rating

Life sometimes brings us surprises, both pleasant and not so pleasant, so it may become difficult for everyone at some point to make timely credit payments. If you were a responsible and punctual borrower before, then you might think that a lender might ignore one such case and forgive you. The meanness of this from common credit myths is that even a single overdue payment on a loan or credit card will immediately badly affect your rating and lower your credit score. You must remember that no one owes you anything and you sholdn’t count on lender leniency. Yes, now some lenders give their customers the opportunity to make a monthly payment a few days or weeks later without having to inform the credit bureaus about this. In some cases, you may be able to make a payment even after a month, but not later. It is worth remembering that in the near future you will have to pay the next monthly payment. Therefore, do not abuse this opportunity and try to make a payment as quickly as possible. If you exceed at least once the period that you are given to make a payment, then this will immediately damage your creditworthiness and lower the rating.

One-late-payment-will-not-lower-your-rating

Checking your credit reduces your credit score

You have probably heard about hard credit checks and how they badly affect your credit score. The truth is that this is right only when such tough checks are carried out by lenders, when you are trying to get a loan. This effect is especially negative when for a short period several creditors carried out a hard check of your credit report. In this case, your credit score may decrease by 1/10 of the total score. As for your personal checks of your credit rating, the decrease in the score in this case applies to common credit myths, which have no basis. On the contrary, it is recommended to regularly monitor your credit in order to track changes and to be able to take timely necessary measures to improve it. You have every right to check the status of your credit as often as you see fit, without negatively affecting it, unlike what common credit myths tells. The only thing you should keep in mind is that at each of the American credit bureaus you can request your credit report for free every year. On the other hand, now many companies offer free information on the status of your credit every month or even more often and all this without bad consequences for it.

A new credit card harms your account

This statement can only be partially true, since this reducing is temporary. It largely depends on how you will use the newly opened credit card in the future. The best option for your rating is to use a new credit card with a lower interest to transfer the balance from your other cards, where the APR is higher. Many lenders offer this service to new customers on attractive initial terms. At the entrance you can even get a zero interest rate for several months, while the promotional period lasts. So you get a great opportunity to pay off your old debt during the grace period at 0% and thereby greatly improve the condition of the credit. A small temporary decrease in the score will result in a significant increase further. Of course, at the same time, you must responsibly use your new credit card, paying for her purchases and timely making all that you owe. At the same time, remember that several new cards will immediately lower the status of the credit, so you should not get carried away with opening new accounts in a short time. It is better to gradually pay off your debts, carefully controlling your expenses. One of the best ways you can use your new credit card to improve your credit rating is the balance transfer. Getting a credit card with a lower interest rate and then transferring your balance from another card will help you pay off your debt faster, ultimately raising your rating.

For a good credit you need to have a very high income

One of common credit myths tells us that you must have a high income so that you can have good credit. This is a fallacy that many take for granted and therefore do not take the necessary steps to gradually increase their credit rating. You should not postpone the improvement of your credit status until later, when the best times may come. You can begin to move in this direction now and thereby bring closer the best times. Start managing your personal finances and distributing your income more efficiently. So you will find more abilities to pay off your debts, as well as be able to pay a long time in a timely manner. Not your income level but stable timely payments affect your credit score best. Of course, if you have a lot of money, then it will be easier for you to find opportunities for paying off debts, but this says almost nothing about how responsible as a borrower you are. You may be a millionaire, but not pay your bills on time and your credit status will be bad, regardless of what common credit myths tells us about.

Credit rating depends on the amount of your debt.

Your credit status is undoubtedly affected by the amount of your total debt, but not independently and not directly. The amount of debt determines your credit in relation to other indicators. In credit cards, we call this a balance, which is determined by how much you use the credit limit opened to you. Your use of a credit tells lenders how much you need money, which means risks you carry for them. The threshold for lowering your credit score is 30%. This means that if a credit line of $ 10,000 is opened for you, then when using more than $ 3,000 of credit funds, your score will begin to decrease.

For a high credit rating, there must be a balance

Many credit card holders believe that in order to maintain their credit score at a good level, they must have a balance on their credit cards. This one of common credit myths is periodically supported by some companies, saying that it will be regarded as an active and skillful use of credit and then will increase credit score. In a way, they are right when it comes to one credit card, but this does not mean that there must be a balance on all your cards. In fact, less commitment on you means less risk to lenders. The lower your ratio of total open credit to total balance, the more reliable you are for creditors. You do not need to close all credit cards, since still the ability to manage different types of credit positively characterizes you as a borrower, but one or two cards with a balance will be quite enough. It’s better to leave in use those cards that you have the longest, the most expensive for you and have a good history of use without late payments.

Credit-rating-depends-on-the-amount-of-your-debt

Does your debt-to-income ratio affect your credit status?

Unfortunately, not all users of loans and credit cards understand financial glossary well. Often this causes confusion in terms and from there come common credit myths and a misunderstanding of what affects the credit score. The rating of any borrower is affected by the ratio of debt to credit, and not debt to income. Your income will be deliberated directly by the lenders during the consideration of your application for a new loan to determine the amount of the monthly payment that you could afford to pay. At the same time, credit bureaus calculate the credit score, each according to its own method with slight differences, and your income is not taken into account. They determine the level of risk for creditors, which depends on your responsibility and solvency.

Need to close old credit cards

common credit myths also tells us that old and unused credit cards need to be closed so that your rating does not decrease. This is a misconception, as the length of your credit history significantly affects your borrower rating. Closing an old credit card, you interrupt your history and your score decreases. Of course, also reckon how much the cost of a particular credit card costs you, is there an annual fee or a high interest rate. Perhaps in some cases it makes sense to sacrifice a few points if your old card costs you too much. Choose the oldest of the inexpensive to maintain and the cheapest of the old credit cards to leave it open.

Credit is combined upon marriage

Your credit will be changed in conjunction with your spouse's credit only from the moment you start making joint purchases on credit, but this does not apply to the credit rating that you had before marriage. The view that when you marry you can combine your old credit obligations with your spouse’s credit is no more than one of common credit myths. Some expect this to improve their low credit rating by combining it with a spouse's credit. Your old debt will remain your old debt. Only joint loans in the future will affect your credit rating together.

Paying debts to collection companies will improve your credit

Paying past due debt that has been transferred to collectors will not improve your damaged credit rating due to unpaid debts. This one from common credit myths has no basis. But this does not mean that these debts do not need to be paid at all, because you will be subject to legal and psychological pressure from companies collecting debts. However, you should not rely on the fact that when paying a debt, information about non-payment will disappear from your credit history and your credit score will immediately increases.

Do not be guided by common credit myths that mislead you

Here we looked at some of the most common credit myths that have become most widespread, which cause erroneous financial decisions. There are other loans misconceptions that should be avoided when making decisions. You can use our financial blog to learn from it about loans and managing your personal finances. All that is necessary for a true understanding of how loans work. Also find out how you can improve your credit status. Read the full article

0 notes

Text

Is It Worth Having A High Deductible Health Plan To Be Eligible For A Health Savings Account?

Everywhere I go, I hear the benefits of the Health Savings Account, or HSA for short. People say it’s one of the best ways to save for retirement and pay for inevitable medical expenses given the tax benefits.

Not wanting to miss out on an obvious financial benefit, I did what most lazy husbands do and asked my wife about it. She is, after all, the CFO and COO of our online business. As such, she is also in charge of our healthcare plan.

She told me we aren’t eligible for Health Savings Accounts because we don’t have a High Deductible Health Plan. Hmrph. Well that doesn’t seem right. Based on what I heard, everybody is eligible, otherwise, that would be discrimination!

But then I realized the government consistently discriminates against some of us all the time. For example, if you make over a certain income threshold, you cannot contribute to a traditional IRA or Roth IRA. What’s up with that? We should all be allowed to save for our financial future.

In the past, if you made over $75,000 as a single filer or $110,000 as a joint filer, you couldn’t receive a child tax credit. Children are already expensive and stressful enough. Why was the government incentivizing lower-income households to have more children and disincentivizing higher income households to have fewer children?

Maybe they were looking to increase the divorce rate due to powerful lobbyists in the legal community.

Luckily, the child tax credit income threshold is now a more reasonable and logical $200,000 for single filers and $400,000 for joint filers. Why the government thought 1+1=1.5 in the past made no sense. Same thing with the marriage penalty tax that has since been abolished with the passage of the Tax Cut And Jobs Act.

Slowly, we are heading towards equal treatment of all American citizens. But not yet when it comes to healthcare.

Things To Know About The HSA Plan

People who say the Health Savings Plan is the best thing ever and is available to everyone really need to stop being so insensitive. There are real people out there who do not qualify, whether by choice or by circumstance.

In order to qualify for an HSA, you must be covered by a High Deductible Health Plan (HDHP). An HDHP generally costs less than what traditional healthcare coverage costs, so the money that you save on insurance, can therefore, be put into the Health Savings Account.

To qualify to contribute to an HSA in 2019, you must have a health insurance policy with a deductible of at least $1,350 for single coverage or $2,700 for family coverage. Some feel uncomfortable paying such a high deductible each year.

If you happen to have a rockstar Gold or Platinum healthcare plan with a lower deductible or no deductible, you are not eligible.

If you are eligible you can contribute up to $3,500 pre-tax to an HSA if you have single coverage or up to $7,000 pre-tax for family coverage in 2019. If you’re 55 or older anytime in 2019, you’ll continue to be able to contribute an extra $1,000.

HSA funds can pay for any “qualified medical expense,” even if the expense is not covered by your HDHP. If the money from the HSA is used for qualified medical expenses, including dental and vision, then the money spent is tax-free.

If the money is used for other than qualified medical expenses, the expenditure will be taxed and, for individuals who are not disabled or over age 65, subject to a 10% tax penalty.

The unused balance in a Health Savings Account automatically rolls over year after year. You won’t lose your money if you don’t spend it within the year. Further, the money in your HSA can be invested and earn compound gains tax-free.

When Is It Worth Getting A High Deductible Health Plan?

Healthcare might be the biggest ripoff in America. Most people get little-to-no medical usage while still having to pay on average $20,000 a year in healthcare premiums.

The reason why there isn’t a bigger uproar is because most of an employee’s healthcare costs are subsidized by the employer. The same goes for paying higher taxes.

Once you become a business owner, you feel the pain of paying all the various taxes much more acutely. Therefore, you tend to stop voting incessantly to raise more taxes to pay for more wasteful government spending.

The only reasons I can think of for people to get a High Deductible Health Plan are:

You rarely get sick or injured. Folks in their 20s and 30s may be prime targets.

You can afford to pay your deductible without having to go into debt.

You’re willing to pay your deductible to get medical treatment.

You have enough money to fund an HSA each month.

You don’t have little ones or sick dependents.

You want another financial way to support your retirement.

The Out Of Pocket Maximum is affordable.

The conundrum is, if you are getting an HDHP because you can’t comfortably afford higher monthly premiums, how is it then possible for you to make significant contributions to an HSA each month?

Such logic seems contradictory.

Who Should Get A Low Or No-Deductible Health Plan

In general, low-deductible or no-deductible plans have higher premiums. Despite the higher premiums, however, it makes healthcare expenses easier to estimate.

A low- or no-deductible plan might be right for you if:

You are pregnant, planning to become pregnant, or have small children.

You have a chronic condition or need to see a doctor frequently.

You’re considering or anticipating a big surgery.

You take several expensive prescription medications.

You or your children like to partake in high-risk activities such as mountain climbing, scuba diving, sky diving, skiing/snowboarding, and the like.

You’re not a good budgeter and like more certainty.

You put a premium on peace of mind and want to minimize the stress of dealing with health insurance providers who may refuse payments.

Before our son was born we decided to get a no-deductible platinum healthcare plan. The cost of giving birth sometimes runs in the tens of thousands of dollars. Further, we were unsure about our baby’s health. You really don’t know how healthy your little one will be until s/he is around 10 years old or so.

With a no-deductible healthcare plan, we made our healthcare costs predictable so we could focus our time being first-time parents. Focus is one of the main reasons why we sold our SF rental house right after he was born as well.

Health Insurance Horror Stories

Some insurance companies always seem to find a way not to pay out a claim, despite years of receiving premiums. I’ve heard so many stories about patients getting screwed by the insurance company or their health provider because of a low-quality health plan or some type of mix up.

Here are some headlines from Vox, which has done a great job uncovering individual health insurance horror stories here in SF.

A $20,243 Bike Crash: Zuckerberg Hospital’s Aggressive Tactics Leave Patients With Big Bills

Hit by a city bus — and hit with a $27,660 city hospital bill

She tried to go to an in-network emergency room. She ended up with a $28,254 bill anyway.

As new parents, we don’t have time to deal with this BS, nor did we want to risk the potential extra stress of dealing with difficult insurance providers or health providers.

I have friends who are doctors and they tell me straight up the worst part about their job is dealing with insurance companies followed by increasing bureaucracy.

A couple of doctors have admitted to me that if their patient has a “more difficult” health insurance plan, they are more reluctant to return calls or e-mails or fit them into their schedules.

Doctors, too, are economically motivated, particularly given the amount of time and money required to become a doctor. If they can join a healthcare network whose patients have higher quality health plans, they will.

It’s not hard to believe more money attracts better doctors.

And yes, one would hope that just because one has a high deductible doesn’t mean once the deductible is reached, the quality of care is any less. But some people just aren’t willing to take that chance.

Note: There is a poll embedded within this post, please visit the site to participate in this post's poll.

Income Threshold Consideration For A Health Plan

In terms of deciding what type of healthcare plan to get based on income, an easy rule of thumb is to go with the high deductible health plan if you earn less than $100,000 a year and are relatively healthy.

Once you earn over $100,000 per person in your household, you might as well pay up for the highest quality health plan possible. Again, having young children is a big X factor in terms of how much healthcare your family will need.

You may initially feel like you’re missing out on the HSA party, but you won’t feel bad for long because your income is high enough to where you can comfortably max out your 401(k) and still save additional after-tax money for retirement.

Further, you might receive more healthcare benefits that could save you money in the future. You will be logically more inclined to proactively seek medical treatment since your costs are more fixed.

The next time you hear someone say an HSA is the best retirement savings vehicle on Earth, you now know what they’re sacrificing. There is no free lunch.

The good thing about a HDHP or a low or no-deductible health plan is that so long as we have one, we are insured from disaster. Make sure you know what your maximum out of pocket expense is for each plan. Once you’ve run some calculations with various scenarios, choose the plan that’s right for you.

Note: There is a poll embedded within this post, please visit the site to participate in this post's poll.

Related:

Why I Never Contributed To A Roth IRA But Why You Probably Should

The Health Affordability Ratio For Financial Freedom

The post Is It Worth Having A High Deductible Health Plan To Be Eligible For A Health Savings Account? appeared first on Financial Samurai.

from Finance https://www.financialsamurai.com/is-it-worth-having-a-high-deductible-health-plan-to-be-eligible-for-a-health-savings-account/ via http://www.rssmix.com/

0 notes

Text

Is It Worth Having A High Deductible Health Plan To Be Eligible For A Health Savings Account?

Everywhere I go, I hear the benefits of the Health Savings Account, or HSA for short. People say it’s one of the best ways to save for retirement and pay for inevitable medical expenses given the tax benefits.

Not wanting to miss out on an obvious financial benefit, I did what most lazy husbands do and asked my wife about it. She is, after all, the CFO and COO of our online business. As such, she is also in charge of our healthcare plan.

She told me we aren’t eligible for Health Savings Accounts because we don’t have a High Deductible Health Plan. Hmrph. Well that doesn’t seem right. Based on what I heard, everybody is eligible, otherwise, that would be discrimination!

But then I realized the government consistently discriminates against some of us all the time. For example, if you make over a certain income threshold, you cannot contribute to a traditional IRA or Roth IRA. What’s up with that? We should all be allowed to save for our financial future.

In the past, if you made over $75,000 as a single filer or $110,000 as a joint filer, you couldn’t receive a child tax credit. Children are already expensive and stressful enough. Why was the government incentivizing lower-income households to have more children and disincentivizing higher income households to have fewer children?

Maybe they were looking to increase the divorce rate due to powerful lobbyists in the legal community.

Luckily, the child tax credit income threshold is now a more reasonable and logical $200,000 for single filers and $400,000 for joint filers. Why the government thought 1+1=1.5 in the past made no sense. Same thing with the marriage penalty tax that has since been abolished with the passage of the Tax Cut And Jobs Act.

Things To Know About The HSA Plan

People who say the Health Savings Plan is the best thing ever and is available to everyone really need to stop being so insensitive. There are real people out there who do not qualify, whether by choice or by circumstance.

In order to qualify for an HSA, you must be covered by a High Deductible Health Plan (HDHP). An HDHP generally costs less than what traditional healthcare coverage costs, so the money that you save on insurance, can therefore, be put into the Health Savings Account.

To qualify to contribute to an HSA in 2019, you must have a health insurance policy with a deductible of at least $1,350 for single coverage or $2,700 for family coverage. Some feel uncomfortable paying such a high deductible each year.

If you happen to have a rockstar Gold or Platinum healthcare plan with a lower deductible or no deductible, you are not eligible.

If you are eligible you can contribute up to $3,500 pre-tax to an HSA if you have single coverage or up to $7,000 pre-tax for family coverage in 2019. If you’re 55 or older anytime in 2019, you’ll continue to be able to contribute an extra $1,000.

HSA funds can pay for any “qualified medical expense,” even if the expense is not covered by your HDHP. If the money from the HSA is used for qualified medical expenses, including dental and vision, then the money spent is tax-free.

If the money is used for other than qualified medical expenses, the expenditure will be taxed and, for individuals who are not disabled or over age 65, subject to a 10% tax penalty.

The unused balance in a Health Savings Account automatically rolls over year after year. You won’t lose your money if you don’t spend it within the year. Further, the money in your HSA can be invested and earn compound gains tax-free.

When Is It Worth Getting A High Deductible Health Plan?

Healthcare might be the biggest ripoff in America. Most people get little-to-no medical usage while still having to pay on average $20,000 a year in healthcare premiums.

The reason why there isn’t a bigger uproar is because most of an employee’s healthcare costs are subsidized by the employer. The same goes for paying higher taxes.

Once you become a business owner, you feel the pain of paying all the various taxes much more acutely. Therefore, you tend to stop voting incessantly to raise more taxes to pay for more wasteful government spending.

The only reasons I can think of for people to get a High Deductible Health Plan are:

You’re healthy and rarely get sick or injured. Folks in their 20s and 30s may be prime targets.

You can afford to pay your deductible without having to go into debt.

You have enough money to fund an HSA each month.

You don’t have little ones or sick dependents.

You want another financial way to support your retirement.

The conundrum is, if you are getting an HDHP because you can’t comfortably afford higher monthly premiums, how is it then possible for you to make significant contributions to an HSA each month?

Such logic seems contradictory.

Who Should Get A Low Or No-Deductible Health Plan

In general, low-deductible or no-deductible plans have higher premiums. Despite the higher premiums, however, it makes healthcare expenses easier to estimate.

A low- or no-deductible plan might be right for you if:

You are pregnant, planning to become pregnant, or have small children.

You have a chronic condition or need to see a doctor frequently.

You’re considering or anticipating a big surgery.

You take several expensive prescription medications.

You or your children like to partake in high-risk activities such as mountain climbing, scuba diving, sky diving, skiing/snowboarding, and the like.

Before our son was born we decided to get a no-deductible Platinum healthcare plan. The cost of giving birth sometimes runs in the tens of thousands of dollars. Further, we were unsure about our baby’s health. You really don’t know how healthy your little one will be until s/he is around 10 years old or so.

With a no-deductible healthcare plan, we made our healthcare costs predictable so we could focus our time being first-time parents. Focus is one of the main reasons why we sold our SF rental house right after he was born as well.

Health Insurance Horror Stories

Some insurance companies always seem to find a way not to pay out a claim, despite years of receiving premiums. I’ve heard so many stories about patients getting screwed by the insurance company or their health provider because of a low-quality health plan or some type of mix up.

Here are some headlines from Vox, which has done a great job uncovering individual health insurance horror stories here in SF.

A $20,243 Bike Crash: Zuckerberg Hospital’s Aggressive Tactics Leave Patients With Big Bills

Hit by a city bus — and hit with a $27,660 city hospital bill

She tried to go to an in-network emergency room. She ended up with a $28,254 bill anyway.

As new parents, we don’t have time to deal with this BS, nor did we want to risk the potential extra stress of dealing with difficult insurance providers or health providers.

I have friends who are doctors and they tell me straight up the worst part about their job is dealing with insurance companies.

A couple of doctors have admitted to me that if their patient has a “more difficult” health insurance plan, they are more reluctant to return calls or e-mails or fit them into their schedules.

Doctors, too, are economically motivated, particularly given the amount of education required to become a doctor. If they can join a healthcare network whose patients have higher quality health plans, they will.

And yes, one would hope that just because one has a high deductible doesn’t mean once the deductible is reached, the quality of care is any less. But some people just aren’t willing to take that chance.

Note: There is a poll embedded within this post, please visit the site to participate in this post's poll.

Income Threshold Consideration For A Health Plan

In terms of deciding what type of healthcare plan to get based on income, I think a good rule of thumb is to go with the high deductible health plan if you earn less than $100,000 a year and are relatively healthy.

Once you earn over $100,000 a year or $200,000 as a couple, you might as well pay up for the highest quality health plan possible. Again, having young children is a big X factor in terms of how much healthcare your family will need.

You may initially feel like you’re missing out on the HSA party, but you won’t feel bad for long because your income is high enough to where you can comfortably max out your 401(k) and still save additional after-tax money for retirement.

Further, you might receive more healthcare benefits because you will be more inclined to proactively seek medical treatment since your costs are more fixed.

The next time you hear someone say an HSA is the best retirement savings vehicle on Earth, you now know what they’re sacrificing. When it comes to healthcare, it’s not worth messing around if you can afford the best. It’s not just the better care you might receive, there’s also less red tape.

Note: There is a poll embedded within this post, please visit the site to participate in this post's poll.

Related:

Why I Never Contributed To A Roth IRA But Why You Probably Should

The Health Affordability Ratio For Financial Freedom

The post Is It Worth Having A High Deductible Health Plan To Be Eligible For A Health Savings Account? appeared first on Financial Samurai.

from https://www.financialsamurai.com/is-it-worth-having-a-high-deductible-health-plan-to-be-eligible-for-a-health-savings-account/

0 notes

Text

Best Affiliate Programs – And the Highest Paying

As a website owner, writer, blogger or social media influencer you work hard creating quality content. Chances are you dream of finding the best ways to make money from your efforts — and that includes the best affiliate programs.

Savvy content creators look for the highest earning opportunities that are relevant to their audience. That way they can earn cash at the same time as they serve their readers, by highlighting products and services they’ve taken the time to investigate and carefully select.

The great news is that even people with small social followings or the owners of small blogs can make money from their content. With affiliate marketing you can literally earn while you sleep — waking up to see a nice juicy commission in your dashboard. Wouldn’t that be wonderful?

The only problem is, there are thousands of affiliate earning opportunities. How do you find the top affiliate programs? That’s where this article can be your guide. We help you focus on choosing the best programs and networks for your needs.

What is an Affiliate Program?

An affiliate program is a program set up by a merchant to pay other parties for each new lead or sale they bring in. The party bringing in the lead or sale is usually a website publisher, content creator or blogger, called an “affiliate.” From the merchant’s standpoint, the model is attractive because the merchant only pays if a defined action occurs leading to increased sales.

Marketing affiliates like this business model because they make money by serving their readers with great suggestions for products and services. And they don’t have to create their own products to sell — they simply insert affiliate links in their content. Creators can focus on content and maintaining good relations with their audience — while the merchant handles sales, invoicing, delivery and customer support process.

Finding the Best Affiliate Programs

With so many programs to choose from, it’s daunting to select a handful to promote. So we’ve curated a list of what we consider the best affiliate programs for entrepreneurs, small business owners, creators and bloggers. We further broke down the list by popular categories that may be attractive to you.

Not every category will be relevant to your audience. Focus on finding the best programs covering offerings your audience cares about. Likewise, you should have a passion for the offerings you are going to promote. If you are not interested in them, then skip over them — because your lack of interest will be obvious.

Last but certainly not least, choose from among the affiliate programs that will pay you more. After all, you’re going to work hard on your content to serve your audience. So you should be paid well.

Best Recurring Commission Affiliate Program