#Cryptocurrency Exchange For Bitcoin

Text

Crypto Currencies

Are you looking for best crypto exchanges available today? If yes, Trade cryptocurrencies on Hotcoin is the best way to make money through a centralized Crypto Currencies exchange.

0 notes

Text

I think I might’ve teared my tutor a new one…

#oh let me tell you I let all out#like crying snot falling screeching#I questioned everything and let me tell you I was not surprised when I asked if they had actually researched anythinh about the topic#and she said no#that out job is to do the research so they can ’’learn’’ and use it as a material for future lessons#and I’m like sure.. I can do research no problem#but have you considered the ethical AND ecologial side of this?#and she literally goes ’’tbh no.. I have not even thought about that’’#jesus take the wheel (actually take the whole fucking car)#plus she had no idea why I’m the only one in a group of just exchange students#and don’t get me wrong they’re very sweet people#but I’m not a project manager nor a babysitter#one of them has studied english for ONE YEAR#and she’s strugggglingggg#so we got to the point where instead of fucking around with fucking crypto wallets and NTF’s we could study the rise fall and darkside of#metaverse cryptocurrencies etc#and don’t ask me what the innovation is because the tutor had no idea either but…#I rather write a thesis about this than fuck around with blockchains bitcoins and whatever the shit#thank FUCK I’m seeing Kuumaa and Käärijä this weekend#might’ve actually done something really stupid if I didn’t have something else to think about#irl shenanigans

17 notes

·

View notes

Text

Caw Crypto Price Prediction: Unveiling Future Market Trends

#Cryptocurrency#Blockchain#Crypto Trading#Crypto News#Crypto Analysis#Bitcoin#Ethereum#Altcoins#DeFi (Decentralized Finance)#Crypto Investing#Crypto Education#Crypto Market Updates#Crypto Wallets#Crypto Security#ICO (Initial Coin Offering)#NFTs (Non-Fungible Tokens)#Crypto Regulations#Crypto Mining#Crypto Trends#Crypto Exchange Reviews

7 notes

·

View notes

Text

BITCOIN KING OF CURRENCY

Bitcoin, the revolutionary digital currency, has been making waves in the financial world since its inception in 2009. With its decentralized nature and secure transactions, it has gained popularity among investors and tech enthusiasts alike. In this article, we will delve into the world of Bitcoin, exploring its features, benefits, and the future it holds.

What is Bitcoin?

Bitcoin is a decentralized digital currency that allows for peer-to-peer transactions without the need for intermediaries such as banks. It was invented by an anonymous person or group of people using the pseudonym Satoshi Nakamoto. Operating on a technology called blockchain, Bitcoin ensures secure and transparent transactions through a network of computers known as nodes.

How Does Bitcoin Work?

Bitcoin works on the principle of blockchain technology, a distributed ledger that records all transactions made using the indo3388 cryptocurrency. When someone initiates a Bitcoin transaction, it is broadcasted to the network of nodes. These nodes validate the transaction by solving info slot complex mathematical problems. Once verified, the transaction is added as a block to the blockchain.

Benefits of Bitcoin

Decentralization: Bitcoin operates on a decentralized network, meaning that no central authority controls or governs it. This provides individuals with more control over their finances and reduces the risk of government interference or manipulation.

Security: Bitcoin transactions are highly secure due to the use of cryptographic algorithms. Each transaction is digitally signed to ensure authenticity and integrity, making it nearly impossible to counterfeit or manipulate.

Anonymity: While Bitcoin transactions are public, users have the option to remain anonymous. Instead of using personal information, Bitcoin addresses are used, providing a certain degree of privacy.

Low Transaction Fees: Traditional financial institutions often charge hefty fees for international or large-scale transactions. Bitcoin eliminates the need for intermediaries, resulting in lower transaction fees, especially for cross-border transfers.

Global Accessibility: Bitcoin can be accessed by anyone with an internet connection, regardless of their geographic location. This allows for seamless international transactions and financial inclusion for the unbanked population.

The Future of Bitcoin

The future of Bitcoin looks promising, with its growing acceptance and adoption in various industries. Here are some slot gacor key factors shaping its future:

Increased Institutional Adoption: With companies like Tesla and Square investing in Bitcoin, institutional adoption is on the rise. This not only adds credibility to the cryptocurrency but also paves the way for more mainstream acceptance.

Technological Advancements: As technology evolves, so does Bitcoin. Innovations such as the Lightning Network aim to improve scalability and transaction speeds, addressing some of the current limitations of the network.

Central Bank Digital Currencies (CBDCs): Governments around the world are exploring the concept of CBDCs, digital currencies issued and regulated by central banks. This could potentially lead to a greater acceptance and integration of Bitcoin into the traditional financial system.

Store of Value: Bitcoin is often referred to as "slot online" due to its limited supply and scarcity. As a store of value, Bitcoin can act as a hedge against inflation and economic uncertainty, making it an attractive asset for long-term investment.

In conclusion, Bitcoin has emerged as a revolutionary form of digital currency, offering benefits such as decentralization, security, and low transaction fees. Its future looks promising, with increasing institutional adoption and technological advancements. Whether Bitcoin will become the currency of the future remains to be seen, but its impact on the indo3388 financial landscape is undeniable. So, are you ready to embrace the world of Bitcoin and explore the possibilities it holds?

#bitcoin#crypto#cryptocurrency#blockchain#defi#ethereum#bitcoin mining#coinbase#binance#crypto exchange

15 notes

·

View notes

Text

2 notes

·

View notes

Text

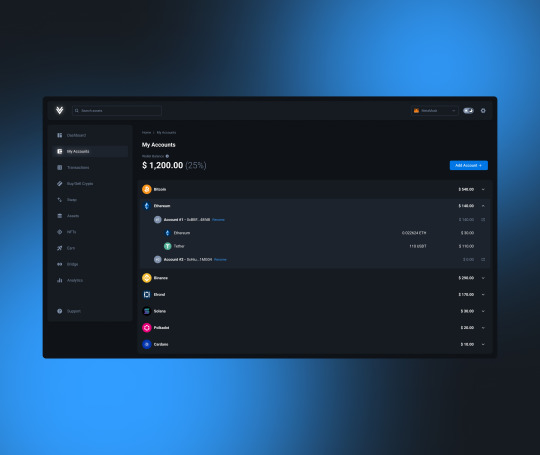

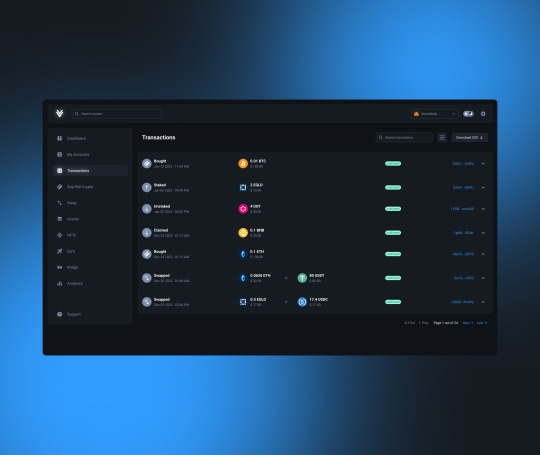

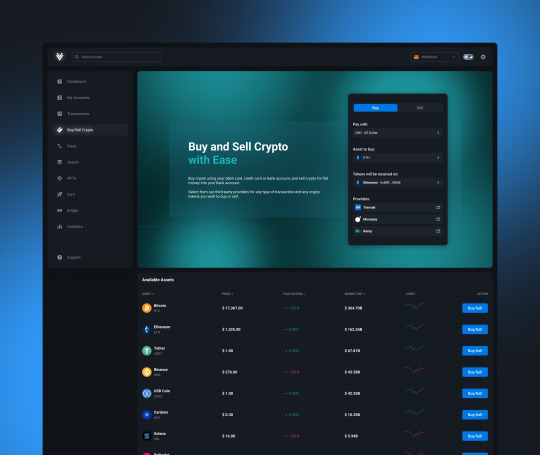

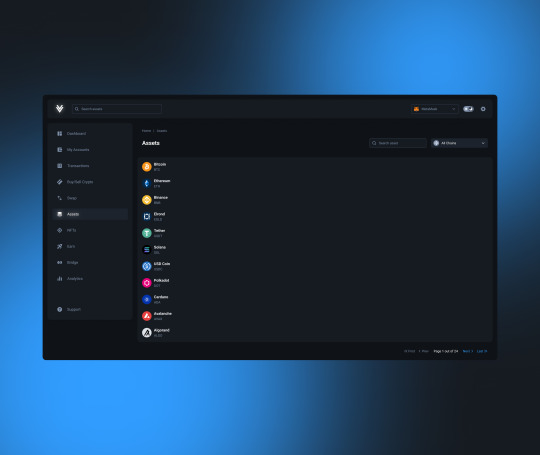

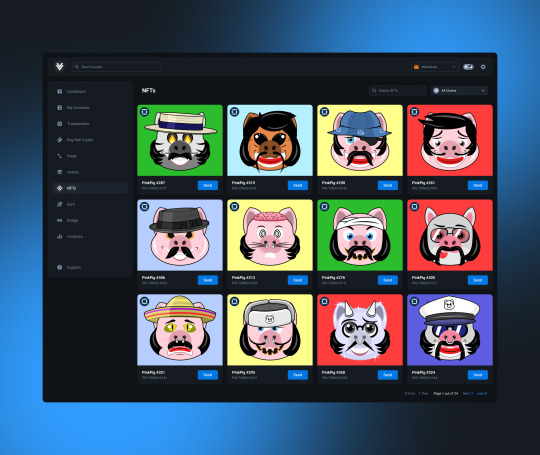

Vector Crypto DeFi Exchange - A Complete Figma UI Kit

Introducing the ultimate crypto DeFi exchange UI kit! This UI kit is a must-have for any designer looking to create a sleek and modern crypto exchange platform.

Download:

#figma#figmadesign#crypto#cryptocurrency#wallet#cryptowallet#defi#exchange#bitcoin#ethereum#solana#memecoin#framer#ux#ui#uikit#uiux#uxdesign#uidesign#nft#cryptocoin#binance#swap#not#notcoin

3 notes

·

View notes

Text

Cryptocurrency Regulation and Its Impact on Forex Trading

Cryptocurrency regulation has become a hot topic in recent years as governments worldwide grapple with the rapid rise of digital currencies. Understanding how these regulations affect the broader financial markets, including forex trading, is crucial for traders and investors.

What is Cryptocurrency Regulation?

Cryptocurrency regulation involves the implementation of laws and guidelines that…

#Bitcoin#Crypto#Crypto Market#Crypto Trading#Cryptocurrency#Currency Exchange#Currency Trading#Ethereum#Financial Markets#Forex#Forex Brokers#Forex Market#Forex Traders#Forex Trading#Market Stability#Trading Strategies#Transparency#Volatility

2 notes

·

View notes

Text

Cryptocurrency forecast

What are the most promising cryptocurrencies in 2023? Many financial analysts call Tezos - XTZ , ALGO , SOL ( Solana ), and Cardano.Classic of the genre - bitcoin is also not going anywhere)

Popular Cryptocurrency Exchanges :

Huobi-link here

Bybit-link here

Yobit-link

#bitcoin#ALGO#SOL#solana#cardano#Cryptocurrency Exchanges#crypto#cryptocurrencies#BTC#cryptocurrency news latest#bitcoin news#yobit#binance#bybit#huobi#huobi global#Cryptocurrency forecast#crypto predictions#crypto forecast#Crypto 2023

12 notes

·

View notes

Text

#UNDRGRND PURCHASE: THE ART EXHIBITION by John Talley

UNDRGRND PURCHASES WORK FROM ARTISTS FEATURED IN UNDRGRND DIGS. THESE PIECES WILL GO ON TO BE FEATURED IN THE UNDRGRND GALLERY.

#nftart#nftcollectors#nftpurchase#objktcom#tezos#tezosnft

#tezos (xtz)#nftcommunity#nft#cryptoart#tezos#nftcollection#nftmagazine#undrgrnd#crypto#nft crypto#dogecoin#crypto exchange#altcoins#bitcoin#cryptocurrency#binance

2 notes

·

View notes

Text

Bitcoin Investment Strategies For Beginners In Four Easy Steps

Bitcoin Investment Strategies For Beginners In Four Easy Steps

You don’t need to be rich to invest in cryptocurrency, but you should exercise caution and be realistic about potential returns. Here’s our guide that will tell you how to make a cryptocurrency wallet and buy Bitcoin. Are you finally prepared to delve into the world of cryptocurrencies? Well, it might appear complex at first, but with a little research, anyone can quickly buy and sell Bitcoin in no time.

#crypto#Bitcoin Investment Strategies#best crypto exchange platform#how to make money with cryptocurrency#sell bitcoin in Dubai

7 notes

·

View notes

Text

Storing And Securing Your Bitcoins: The Role of Wallets

Bitcoin wallets, also known as cryptocurrency wallets, are digital wallets that store your private and public keys, which are used to access your Bitcoins. As a decentralized digital currency, Bitcoin operates on a peer-to-peer network and transactions are made directly between users. A Bitcoin wallet is an essential tool for buying, selling, and storing Bitcoins. In this article, we will explore the basics of Bitcoin wallets and the different types available.

Read More...

#bitcoin#bitcoin exchange#bitcoin wallet#crypto wallets#virtual currency vs cryptocurrency#crypto currency#cryptography#crypto#cryptid#crypto exchanges

7 notes

·

View notes

Text

Welcome to our groundbreaking Trading Platform For Bitcoin! This innovative platform offers seamless trading opportunities for both newcomers and experienced traders in the world of cryptocurrency. With our user-friendly interface and advanced tools, you can easily buy, sell, and exchange Bitcoin with just a few clicks. Join the future of trading with Trading Platform For Bitcoin and watch your investments grow like never before. Say goodbye to complicated platforms and hello to simplicity with our Trading Platform For Bitcoin. Start trading today and unlock the potential of the cryptocurrency market! For More Details :- https://www.hotcoin.com/

Contact US :-

Email:- [email protected]

0 notes

Text

New Crypto Coins: Exploring the Latest Digital Investments

#Cryptocurrency#Blockchain#Crypto Trading#Crypto News#Crypto Analysis#Bitcoin#Ethereum#Altcoins#DeFi (Decentralized Finance)#Crypto Investing#Crypto Education#Crypto Market Updates#Crypto Wallets#Crypto Security#ICO (Initial Coin Offering)#NFTs (Non-Fungible Tokens)#Crypto Regulations#Crypto Mining#Crypto Trends#Crypto Exchange Reviews

5 notes

·

View notes

Text

From Bitcoin to Beyond: Exploring the Evolving Landscape of Cryptocurrencies

Over the past decade, cryptocurrencies have emerged as a disruptive force in the world of finance and technology, with Bitcoin leading the way as the pioneering digital currency. The concept of a decentralized, borderless, and secure form of money challenged the traditional financial system, opening the door to a myriad of new possibilities. As the blockchain technology behind cryptocurrencies continues to evolve, the landscape of digital finance is undergoing a transformation that reaches far beyond the realms of Bitcoin.

The Genesis: Bitcoin's Impact and Legacy

Bitcoin, created by the pseudonymous Satoshi Nakamoto in 2009, was the first successful implementation of a peer-to-peer electronic cash system that operates without the need for intermediaries like banks. Its underlying technology, blockchain, introduced a distributed and immutable ledger, ensuring transparency and security in financial transactions.

Bitcoin's rise in popularity sparked interest among tech enthusiasts, libertarians, and investors seeking an alternative to the traditional financial system. Its decentralized nature and limited supply, capped at 21 million coins, instilled confidence in its ability to act as a store of value akin to digital gold.

The Altcoin Era: Diverse Cryptocurrencies Emerge

Following the success of Bitcoin, a wave of new cryptocurrencies, often referred to as "altcoins," flooded the market. These altcoins sought to address perceived limitations in Bitcoin's design or aimed to serve specific use cases.

Ethereum, launched in 2015 by Vitalik Buterin, revolutionized the crypto landscape by introducing smart contracts. These self-executing contracts enabled developers to create decentralized applications (dApps) on top of the Ethereum blockchain. This innovation laid the foundation for the explosive growth of the decentralized finance (DeFi) ecosystem, enabling peer-to-peer lending, decentralized exchanges, and other financial services without intermediaries.

Other notable cryptocurrencies, such as Ripple (XRP), Litecoin (LTC), and Cardano (ADA), each brought their unique features and use cases to the table. Ripple, for instance, targeted faster and cheaper cross-border payments, while Litecoin aimed to be a more efficient and lighter version of Bitcoin for everyday transactions.

The Rise of Stablecoins: Stability in a Volatile Market

Cryptocurrencies have a reputation for extreme price volatility, which has limited their adoption for everyday transactions. To address this issue, stablecoins were introduced. These digital assets are pegged to stable assets like fiat currencies (USD, EUR, etc.) or commodities, reducing price fluctuations and making them more suitable for day-to-day use.

Tether (USDT), the first stablecoin, was launched in 2014, and it quickly became the most widely used stablecoin in the market. As regulatory scrutiny increased, more transparent and regulated stablecoins like USD Coin (USDC) and DAI emerged, further solidifying the role of stablecoins in the cryptocurrency ecosystem.

Institutional Adoption: A Paradigm Shift

In the early days, cryptocurrencies were primarily embraced by individual investors and tech enthusiasts. However, as the market matured and regulatory frameworks became clearer, institutional players started to take notice.

Major financial institutions, asset management firms, and even governments began to explore cryptocurrencies as potential investment vehicles and digital store of value. The entry of institutional investors, like Tesla and MicroStrategy, into the market signaled a shift towards wider acceptance and recognition of cryptocurrencies as legitimate assets.

Beyond Currency: NFTs and the Metaverse

Cryptocurrencies are not limited to being just a form of money. Non-Fungible Tokens (NFTs) have emerged as a revolutionary use case within the crypto space. NFTs represent unique digital assets and have found applications in art, collectibles, virtual real estate, and more.

The concept of the metaverse, a virtual world where users can interact, socialize, and conduct business, has gained traction with the help of blockchain technology. Virtual real estate within these metaverses is being bought and sold using cryptocurrencies and NFTs, opening up entirely new economic opportunities in the digital realm.

To know more click here -

Despite the progress and success of cryptocurrencies, several challenges remain. Regulatory uncertainty, scalability issues, energy consumption concerns (particularly for proof-of-work blockchains like Bitcoin), and security vulnerabilities need to be addressed to ensure the long-term sustainability and widespread adoption of cryptocurrencies.

2 notes

·

View notes

Text

Coinbase Referral Link / Sign Up Bonus Instructions - Earn $10 in BTC

2 notes

·

View notes

Text

The MtGox Hack: How the World’s Largest Bitcoin Exchange was Hacked

Cryptocurrencies were once seen as a game-changing innovation that would make financial transactions more secure and fraud-proof. However, with the occurrence of various high-profile hacks and scandals, people's faith in the safety of cryptocurrencies has dwindled. One of the most infamous cases of cryptocurrency hacking is the MtGox hack, which resulted in the breach of the largest Bitcoin exchange in the world.

MtGox was started by Jed McCaleb in 2010 as a website for trading Magic the Gathering cards, but he soon saw the potential of Bitcoin. A French software programmer named Mark Karpeles assumed control of the exchange in March 2011 and turned it into a Bitcoin trading hub. MtGox expanded quickly under Karpeles' direction, handling more than 80% of all Bitcoin transactions at its height and processing over $100 million in transactions per month. However, MtGox unexpectedly stopped all trading in February 2014 due to a fault that allowed for price manipulation of Bitcoin on its site by hackers.

Hackers had stolen 850,000 Bitcoins worth about $450 million at the time from the exchange. After the hack, MtGox filed for bankruptcy, and the company was forced to shut down. Although several attempts were made to recover the stolen funds, a significant amount of the Bitcoins remain missing to this day. While authorities conducted an investigation into the incident, the identity of the hackers and the exact details of the hack are still unknown.

The MtGox hack's aftermath resulted in the company's bankruptcy and a subsequent decrease in Bitcoin's value, leading many investors to lose faith in the cryptocurrency industry.

To read more about this infamous hack and the ongoing repayment process for creditors, visit the official website Coinpedia.

3 notes

·

View notes