#Crypto Market Making Bot Development

Explore tagged Tumblr posts

Note

I'm interested in your thoughts about Large Language Models. I'm much more opposed to them than text to image generators for similar reasons I'm opposed to crypto. The use cases seem so vastly over exaggerated, and I'm particularly concerned by unmonitored uses. Like I have good reason to believe it's a very dangerous technology and my efforts to oppose dangerous uses of it in the charity I work for have consisted of opposing all uses because they've been dangerous for obvious reasons. Some developers put together a chat bot to give out cancer advice.

i think you're basically right about this but i think that as with AI art the problem isnt the technology itself but the societal and material conditions around it -- in this case disastrously irresponsible and deceptive marketing fueled by uncritical stenographic reporting. like, by far imo the biggest danger of something like chatGPT is people trusting a machine that is basically good at authoritativbely lying to give them advice and help make decisions. like the lawyers who used chatGPT to help submit their court filing and it just fucking made up a bunch of citations -- the idea of this beocming a pervasive problem across multiple fields is like, terrifying. but again that's not because like, the idea of a program that can dynamically produce text is ontologically evil or without legimate application -- it's because of the multimillion dollar marketing push of GPT & similar models as 'AI assistants' that you can 'talk to' rather than 'a way to generate a bunch of text with no particular relation to reality'.

120 notes

·

View notes

Text

Revolutionizing DeFi Development: How STON.fi API & SDK Simplify Token Swaps

The decentralized finance (DeFi) landscape is evolving rapidly, and developers are constantly seeking efficient ways to integrate token swap functionalities into their platforms. However, building seamless and optimized swap mechanisms from scratch can be complex, time-consuming, and risky.

This is where STON.fi API & SDK come into play. They provide developers with a ready-to-use, optimized solution that simplifies the process of enabling fast, secure, and cost-effective swaps.

In this article, we’ll take an in-depth look at why developers need efficient swap solutions, how the STON.fi API & SDK work, and how they can be integrated into various DeFi applications.

Why Developers Need a Robust Swap Integration

One of the core functions of any DeFi application is token swapping—the ability to exchange one cryptocurrency for another instantly and at the best possible rate.

But integrating swaps manually is not a straightforward task. Developers face several challenges:

Complex Smart Contract Logic – Handling liquidity pools, slippage, and price calculations requires expertise and rigorous testing.

Security Vulnerabilities – Improperly coded swaps can expose user funds to attacks.

Performance Issues – Slow execution or high gas fees can frustrate users and hurt adoption.

A poorly integrated swap feature can turn users away from a DeFi application, affecting engagement and liquidity. That’s why an efficient, battle-tested API and SDK can make a significant difference.

STON.fi API & SDK: What Makes Them a Game-Changer?

STON.fi has built an optimized API and SDK designed to handle the complexities of token swaps while giving developers an easy-to-use toolkit. Here’s why they stand out:

1. Seamless Swap Execution

Instead of manually routing transactions through liquidity pools, the STON.fi API automates the process, ensuring users always get the best swap rates.

2. Developer-Friendly SDK

For those who prefer working with structured development tools, the STON.fi SDK comes with pre-built functions that remove the need for extensive custom coding. Whether you’re integrating swaps into a mobile wallet, trading platform, or decentralized app, the SDK simplifies the process.

3. High-Speed Performance & Low Costs

STON.fi’s infrastructure is optimized for fast transaction execution, reducing delays and minimizing slippage. Users benefit from lower costs, while developers get a plug-and-play solution that ensures a smooth experience.

4. Secure & Scalable

Security is a major concern in DeFi, and STON.fi’s API is built with strong security measures, protecting transactions from vulnerabilities and ensuring reliability even under heavy traffic.

Practical Use Cases for Developers

1. Building Decentralized Exchanges (DEXs)

STON.fi API enables developers to integrate swap functionalities directly into their DEX platforms without having to build custom liquidity management solutions.

2. Enhancing Web3 Wallets

Crypto wallets can integrate STON.fi’s swap functionality, allowing users to exchange tokens without leaving the wallet interface.

3. Automating Trading Strategies

The API can be used to build automated trading bots that execute swaps based on real-time market conditions, improving efficiency for traders.

4. Scaling DeFi Platforms

For DeFi applications handling high transaction volumes, STON.fi API ensures fast and cost-effective execution, improving user retention.

Why Developers Should Consider STON.fi API & SDK

For developers aiming to create efficient, user-friendly, and scalable DeFi applications, STON.fi offers a robust solution that eliminates the complexities of manual integrations.

Saves Development Time – Reduces the need for custom swap coding.

Improves Security – Pre-tested smart contracts minimize vulnerabilities.

Enhances User Experience – Faster swaps create a smoother, more reliable platform.

Optimizes Performance – Low latency and cost-efficient execution ensure better outcomes.

Whether you’re working on a new DeFi project or improving an existing platform, STON.fi’s API & SDK provide a solid foundation to enhance functionality and scalability.

By leveraging STON.fi’s tools, developers can focus on building innovative features, rather than getting caught up in the technical challenges of token swaps.

3 notes

·

View notes

Text

Tobi and STON.fi: A Game-Changer for Crypto Trading on Telegram

The way we trade crypto is evolving. We’ve seen decentralized exchanges (DEXs) transform how we swap assets, and we’ve seen AI-driven tools make complex processes simpler. But what happens when you combine the efficiency of AI with the power of a top-tier DEX?

That’s exactly what’s happening with Tobi, an AI-powered trading bot on Telegram, and STON.fi, a leading DEX on the TON blockchain. This integration brings a seamless, user-friendly, and fully decentralized trading experience—all within Telegram.

What Makes Tobi Unique

Tobi isn’t just another trading bot. It’s built to simplify crypto trading, making it accessible to both beginners and experienced traders. Here’s what users can do with Tobi:

Swap assets across multiple networks with minimal effort.

Store assets securely with its built-in non-custodial wallet.

Access real-time market data and asset insights without leaving Telegram.

By integrating with STON.fi, Tobi now expands its reach to the TON blockchain, enabling smooth token swaps on one of the fastest-growing networks.

Why Does This Matter

Crypto trading often comes with challenges—high fees, complex interfaces, and multiple steps just to execute a simple swap. For many, trading on DEXs can feel overwhelming. But with this new integration, users can now trade directly in Telegram without navigating through different platforms.

What this means for traders:

No more switching between apps—all trades happen within the chat.

Lower fees and faster transactions thanks to TON’s scalability.

Complete ownership of assets since everything remains decentralized.

This integration streamlines the process, removing unnecessary barriers and making DeFi trading more accessible.

STON.fi’s Expanding Influence

The STON.fi SDK has already been adopted by several major projects, including Tonkeeper, Wallet, Punk City, Tap Fantasy, and TapSwap. These platforms are leveraging STON.fi’s technology to provide users with better DeFi experiences, proving that its impact extends far beyond just one integration.

For developers and crypto projects, this SDK offers a straightforward way to incorporate decentralized swaps into their products, enabling more platforms to provide frictionless DeFi services.

The Future of AI in Crypto Trading

The integration of AI-powered tools with DeFi solutions is a major step toward fully automated and intelligent trading systems. As AI continues to evolve, we’ll likely see even more innovations in:

Automated trading strategies that analyze market trends in real time.

Risk management tools that help users make better financial decisions.

More intuitive trading experiences that eliminate complexities for users.

With Tobi and STON.fi working together, this marks the beginning of a new era where AI and DeFi create smarter, faster, and more accessible trading experiences.

Final Thoughts

Crypto trading shouldn’t be complicated. By merging AI automation with decentralized finance, we are moving toward a future where anyone can trade easily, securely, and with full control of their assets. The Tobi-STON.fi integration is proof that innovation in DeFi is far from slowing down.

This is just the beginning. The future of crypto trading is smarter, faster, and fully decentralized.

4 notes

·

View notes

Text

Crypto Exchange API Integration: Simplifying and Enhancing Trading Efficiency

The cryptocurrency trading landscape is fast-paced, requiring seamless processes and real-time data access to ensure traders stay ahead of market movements. To meet these demands, Crypto Exchange APIs (Application Programming Interfaces) have emerged as indispensable tools for developers and businesses, streamlining trading processes and improving user experience.

APIs bridge the gap between users, trading platforms, and blockchain networks, enabling efficient operations like order execution, wallet integration, and market data retrieval. This blog dives into the importance of crypto exchange API integration, its benefits, and how businesses can leverage it to create feature-rich trading platforms.

What is a Crypto Exchange API?

A Crypto Exchange API is a software interface that enables seamless communication between cryptocurrency trading platforms and external applications. It provides developers with access to various functionalities, such as real-time price tracking, trade execution, and account management, allowing them to integrate these features into their platforms.

Types of Crypto Exchange APIs:

REST APIs: Used for simple, one-time data requests (e.g., fetching market data or placing a trade).

WebSocket APIs: Provide real-time data streaming for high-frequency trading and live updates.

FIX APIs (Financial Information Exchange): Designed for institutional-grade trading with high-speed data transfers.

Key Benefits of Crypto Exchange API Integration

1. Real-Time Market Data Access

APIs provide up-to-the-second updates on cryptocurrency prices, trading volumes, and order book depth, empowering traders to make informed decisions.

Use Case:

Developers can build dashboards that display live market trends and price movements.

2. Automated Trading

APIs enable algorithmic trading by allowing users to execute buy and sell orders based on predefined conditions.

Use Case:

A trading bot can automatically place orders when specific market criteria are met, eliminating the need for manual intervention.

3. Multi-Exchange Connectivity

Crypto APIs allow platforms to connect with multiple exchanges, aggregating liquidity and providing users with the best trading options.

Use Case:

Traders can access a broader range of cryptocurrencies and trading pairs without switching between platforms.

4. Enhanced User Experience

By integrating APIs, businesses can offer features like secure wallet connections, fast transaction processing, and detailed analytics, improving the overall user experience.

Use Case:

Users can track their portfolio performance in real-time and manage assets directly through the platform.

5. Increased Scalability

API integration allows trading platforms to handle a higher volume of users and transactions efficiently, ensuring smooth operations during peak trading hours.

Use Case:

Exchanges can scale seamlessly to accommodate growth in user demand.

Essential Features of Crypto Exchange API Integration

1. Trading Functionality

APIs must support core trading actions, such as placing market and limit orders, canceling trades, and retrieving order statuses.

2. Wallet Integration

Securely connect wallets for seamless deposits, withdrawals, and balance tracking.

3. Market Data Access

Provide real-time updates on cryptocurrency prices, trading volumes, and historical data for analysis.

4. Account Management

Allow users to manage their accounts, view transaction history, and set preferences through the API.

5. Security Features

Integrate encryption, two-factor authentication (2FA), and API keys to safeguard user data and funds.

Steps to Integrate Crypto Exchange APIs

1. Define Your Requirements

Determine the functionalities you need, such as trading, wallet integration, or market data retrieval.

2. Choose the Right API Provider

Select a provider that aligns with your platform’s requirements. Popular providers include:

Binance API: Known for real-time data and extensive trading options.

Coinbase API: Ideal for wallet integration and payment processing.

Kraken API: Offers advanced trading tools for institutional users.

3. Implement API Integration

Use REST APIs for basic functionalities like fetching market data.

Implement WebSocket APIs for real-time updates and faster trading processes.

4. Test and Optimize

Conduct thorough testing to ensure the API integration performs seamlessly under different scenarios, including high traffic.

5. Launch and Monitor

Deploy the integrated platform and monitor its performance to address any issues promptly.

Challenges in Crypto Exchange API Integration

1. Security Risks

APIs are vulnerable to breaches if not properly secured. Implement robust encryption, authentication, and monitoring tools to mitigate risks.

2. Latency Issues

High latency can disrupt real-time trading. Opt for APIs with low latency to ensure a smooth user experience.

3. Regulatory Compliance

Ensure the integration adheres to KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations.

The Role of Crypto Exchange Platform Development Services

Partnering with a professional crypto exchange platform development service ensures your platform leverages the full potential of API integration.

What Development Services Offer:

Custom API Solutions: Tailored to your platform’s specific needs.

Enhanced Security: Implementing advanced security measures like API key management and encryption.

Real-Time Capabilities: Optimizing APIs for high-speed data transfers and trading.

Regulatory Compliance: Ensuring the platform meets global legal standards.

Scalability: Building infrastructure that grows with your user base and transaction volume.

Real-World Examples of Successful API Integration

1. Binance

Features: Offers REST and WebSocket APIs for real-time market data and trading.

Impact: Enables developers to build high-performance trading bots and analytics tools.

2. Coinbase

Features: Provides secure wallet management APIs and payment processing tools.

Impact: Streamlines crypto payments and wallet integration for businesses.

3. Kraken

Features: Advanced trading APIs for institutional and professional traders.

Impact: Supports multi-currency trading with low-latency data feeds.

Conclusion

Crypto exchange API integration is a game-changer for businesses looking to streamline trading processes and enhance user experience. From enabling real-time data access to automating trades and managing wallets, APIs unlock endless possibilities for innovation in cryptocurrency trading platforms.

By partnering with expert crypto exchange platform development services, you can ensure secure, scalable, and efficient API integration tailored to your platform’s needs. In the ever-evolving world of cryptocurrency, seamless API integration is not just an advantage—it’s a necessity for staying ahead of the competition.

Are you ready to take your crypto exchange platform to the next level?

#cryptocurrencyexchange#crypto exchange platform development company#crypto exchange development company#white label crypto exchange development#cryptocurrency exchange development service#cryptoexchange

2 notes

·

View notes

Text

Trade Smarter! Not Harder!! Rule the Market with Smart Crypto Bots!!!

Crypto Trading Bots are intelligent tools that automate the buying and selling of digital assets using real-time market data and predefined strategies. They execute trades with speed and clarity. Free from emotion or human error. Whether you're a beginner or a seasoned trader, crypto bots make smart, hands-free trading a reality.

Smarter Trading with Automation:

BlockchainAppsDeveloper crypto trading bots are built to turn strategy into opportunity, 24/7. We have intelligent systems that automate proven techniques like arbitrage, grid trading, and scalping. By analyzing real-time market data and executing trades at lightning speed, our bots help users earn tokens, grow digital assets, and optimize their portfolios.

Trending Crypto Trading Bots in 2025 BlockchainAppsDeveloper specializes in developing advanced crypto trading bots inspired by leading platforms such as 3Commas, Coinrule, Altrady, and Cryptohopper to maximize trading efficiency and profitability. Its customization and automation are tailored to modern trading needs.

Bots For Crypto Trading: Cryptohopper 3commas Coinrule altrady

Cryptohopper: Cryptohopper Bot is an automated cryptocurrency trading bot provided by the Cryptohopper platform. Arbitrage, Market-making, Custom Strategies, Social Trading. 16 Exchanges supported.

3Commas: It is a powerful cryptocurrency trading automation tool that helps users execute trades more efficiently across multiple exchanges. It has DCA, Grid, Options, Custom Signals. 15 Exchanges Supported.

Coinrule: Coinrule is a user-friendly crypto trading bot platform designed to help traders automate their strategies without requiring any coding skills. It is Rule-based strategies, Custom conditions trading Strategies. It supported 4 Exchanges.

Altraday: Altrady Bot is an advanced crypto trading automation tool integrated within the Altrady platform, designed to assist traders in executing strategies efficiently across multiple exchanges.

Why Choose BlockchainAppsDeveloper For Crypto Bot Development:

As a premier Crypto Trading Bot Development Company, BlockchainAppsDeveloper is an expert in blockchain, AI, and machine learning, and powers highly efficient bots tailored to your trading goals With BlockchainAppsDeveloper, you gain a dedicated partner who understands the Future of Markets and trading with our Bot. With seamless automation and robust risk management, our solutions Authorise traders to thrive in volatile crypto markets.

Automate Your Trades & Maximize Profits – Create Your Crypto Trading Bot!!

#crypto trading bot development company#trading bot development#crypto trading bot development services#crypto arbitrage bot#build a crypto currency trading bot#trading bot development services#Build your own crypto trading bot#Automated Crypto Trading Bot Development#Automated Crypto Trading Bot#Top 10 Best Crypto Trading Bot

1 note

·

View note

Text

Top Tools and Technologies for Custom Crypto Market Making Bot Development

Introduction

In the world of cryptocurrency trading, automated market making has become a key strategy for liquidity provision and price stability. Market making bots play a crucial role in ensuring that liquidity is available for traders, helping exchanges function efficiently. In this blog, we will explore the essential tools, technologies, and strategies for developing high-performance crypto market making bots. Whether you're a developer or a crypto exchange operator, understanding the best tools and technologies can help you design effective bots for market making and trading.

What is Crypto Market Making Bot Development?

Crypto market making bot development refers to the creation of automated trading bots designed to provide liquidity on exchanges. These bots place buy and sell orders within a market, ensuring that there are always available orders for traders. Market making bots typically work by maintaining an optimal bid-ask spread to capture profits while simultaneously ensuring smooth market operations. Developing such bots involves creating complex algorithms and systems that can adapt to market conditions in real-time.

What is Crypto Market Making Bot and How Does It Work?

A crypto market making bot is a software application that automatically buys and sells cryptocurrencies at specified prices to maintain liquidity on exchanges. These bots work by continuously placing buy orders at lower prices and sell orders at higher prices, ensuring there is enough liquidity for traders.

The bots use specific algorithms that react to market trends and fluctuations, adjusting prices based on real-time data. The goal is to create a continuous cycle of buying and selling that enables traders to execute trades smoothly while generating profits for the bot's operator.

Why is Crypto Market Making Bot Important?

Crypto market making bots are essential for several reasons:

Liquidity Provision: These bots help maintain liquidity in the market, making it easier for traders to buy or sell assets without significant slippage.

Price Stability: By automatically placing buy and sell orders, market making bots help stabilize price movements, preventing excessive volatility.

Efficiency: Automation allows for faster execution of trades and more efficient price discovery, which is especially crucial in high-frequency trading environments.

Profit Generation: Bots can generate consistent profits by taking advantage of the bid-ask spread.

Key Components for Automated Crypto Market Making Strategies

Decision Engines, Pricing Logic, and Order Book Handling

A key component of any market making bot is its decision engine, which uses algorithms to place orders based on real-time market data. Pricing logic determines the buy and sell prices of assets, while order book handling ensures that orders are placed in the right position to provide liquidity. These components must work in harmony to ensure that the bot can respond quickly to market changes and maintain optimal pricing.

Signal Input and Execution Layer for Real-Time Action

The signal input layer collects real-time market data such as order book depth, price fluctuations, and trading volume. This data is processed by the execution layer, which places orders in the market based on the collected signals. The execution layer must be optimized for speed and reliability to handle the high-frequency nature of crypto trading.

Programming Frameworks and Toolkits for Fast Bot Deployment

To build a successful market-making bot, it is crucial to select the right programming framework. The choice of language and tools can significantly impact the bot’s performance, especially when dealing with low-latency trading environments.

Development Tools for Low-Latency Trading Bot for Exchanges

For low-latency trading, it is essential to use programming languages and frameworks that are optimized for speed. Tools like Rust and Go are often used due to their ability to execute high-speed operations with minimal delays. These languages ensure that the bot can react to market changes in real-time, which is critical for high-frequency trading.

Framework Comparison: Rust, Go, and Python in Bot Logic

Rust: Offers superior performance and memory management, making it ideal for latency-sensitive applications.

Go: Known for its simplicity and speed, it’s often used in high-frequency trading environments where reliability and quick execution are key.

Python: While Python is not as fast as Rust or Go, it’s widely used for bot development due to its extensive libraries and ease of use for algorithm testing and backtesting.

Infrastructure Setup for AI-Powered Crypto Market Making Bot

To handle real-time data and ensure high performance, crypto market making bots require a robust infrastructure. AI models play a critical role in real-time quote adjustments and spread sensitivity.

Hosting Architecture, Cloud Selection, and Local Environments

When setting up infrastructure for a crypto market making bot, developers must decide between cloud hosting or on-premise solutions. Cloud hosting services like AWS, Google Cloud, and Microsoft Azure offer scalability and flexibility for deploying bots. Alternatively, on-premise setups may offer more control and security but can require more maintenance.

AI Models in Live Quote Adjustments and Spread Sensitivity

AI models are increasingly integrated into market making bots to help adjust quotes dynamically based on real-time market data. These models use machine learning to predict market trends and optimize the bot’s pricing strategy.

How to Build a Crypto Market Maker Bot with Custom APIs

Custom APIs are crucial for integrating the bot with various exchanges, ensuring that it can place orders, retrieve market data, and execute trades seamlessly.

SDKs, RESTful Calls, and WebSocket Connection Layers

To facilitate communication between the bot and exchanges, developers use SDKs (Software Development Kits), RESTful APIs, and WebSocket connections. RESTful APIs allow the bot to make HTTP requests for market data, while WebSocket connections enable real-time data streaming for faster response times.

Simulated Testing and Dry-Run Environments

Before deploying a market making bot, it is important to simulate its behavior using historical data or in a dry-run environment. This helps in understanding how the bot will perform under various market conditions and ensures that it does not engage in risky behavior.

Best Algorithmic Trading Bot Configurations for Liquidity Provision

For successful market making, bots must be configured with the right algorithms to ensure that they provide adequate liquidity while minimizing risk.

Volume Thresholds, Order Placement Logic, and Risk Controls

Setting volume thresholds ensures that the bot only places orders when the market is liquid enough to support them. Order placement logic is based on various strategies such as mean reversion or arbitrage. Risk controls ensure that the bot does not expose the trader to significant losses.

Pair-Specific Adjustments for Thin and Thick Order Books

Market conditions vary across different trading pairs. A well-configured market making bot adjusts its strategies based on the thickness of the order book. For pairs with a thin order book, the bot might place tighter spreads to ensure liquidity, while for pairs with thicker books, it may use wider spreads to optimize profit.

Market Making Bot for DEX and CEX: Tool Differences

Crypto market making bots for DEX (decentralized exchanges) and CEX (centralized exchanges) operate differently due to their varying architectures and protocols.

Node Connectivity, Smart Contracts, and AMM Considerations

For DEXs, bots interact with smart contracts and Automated Market Makers (AMMs), which require special configurations. Centralized exchanges, on the other hand, provide access through APIs, which can sometimes be subject to throttling limits.

Centralized Exchange API Behavior and Throttling Limits

Centralized exchanges often impose API rate limits to prevent abuse and ensure fair usage. Bots need to be designed to handle these limits and prevent errors during heavy traffic periods.

Monitoring, Scaling, and System Health Tools

Once deployed, crypto market making bots need constant monitoring to ensure their performance is optimal.

Real-Time Dashboards, Logging, and Alerts

Real-time dashboards are essential for tracking bot performance and monitoring for any anomalies. Logging tools and alert systems help developers keep track of system health and make necessary adjustments.

Latency Tracking and Throughput Benchmarks

Latency tracking ensures that the bot is performing at the desired speed, while throughput benchmarks help determine how many orders the bot can process per second.

Final Thoughts

Building a custom crypto market making bot requires a deep understanding of trading strategies, technology tools, and infrastructure. By selecting the right programming languages, frameworks, and APIs, developers can create efficient, high-performance bots capable of navigating complex markets. Start Your Custom Crypto Market Making Bot Today and gain a competitive edge. In this competitive space, it's crucial to stay ahead of the game, and companies like Malgo are leading the way in developing reliable and sophisticated crypto market making bots. Their expertise in the field allows them to deliver cutting-edge solutions that meet the demands of traders and exchanges alike. The development cost depends on factors such as feature complexity, technology stack, customization requirements, and deployment preferences.

1 note

·

View note

Text

How to a WazirX Crypto Exchange Clone and Dominate the Market

1. Introduction

Cryptocurrency trading has transformed from a niche investment vehicle to a mainstream financial phenomenon. With millions of users flocking to digital assets, crypto exchanges have become the backbone of this revolution. Among these, WazirX has carved out a dominant position, offering a seamless trading experience coupled with high liquidity and security.

For entrepreneurs and blockchain enthusiasts, launching a WazirX crypto exchange clone presents an unparalleled opportunity. By leveraging proven business models and technology, a well-executed crypto trading platform can become a formidable player in the market.

2. Understanding the Market Landscape

Before venturing into the crypto exchange business, a deep understanding of the industry’s intricacies is crucial. Cryptocurrency trading is a fiercely competitive sector where only the most secure, user-friendly, and scalable exchanges thrive.

Key Success Factors

Success hinges on multiple factors, including robust security measures, intuitive UI/UX, deep liquidity pools, and compliance with regulatory frameworks. A failure in any of these areas could lead to significant setbacks.

Regulatory & Security Challenges

Each jurisdiction has different compliance requirements regarding KYC (Know Your Customer) and AML (Anti-Money Laundering) policies. Ignoring these could result in legal repercussions, making it imperative to align with the latest regulatory mandates while ensuring user protection through multi-layer security protocols.

3. Essential Features of a WazirX Crypto Exchange Clone

To replicate WazirX’s success, integrating core functionalities is non-negotiable. Below are the must-have features of an advanced crypto exchange:

1. Trading Engine & Order Matching

A high-frequency trading engine is the heart of any crypto exchange. It should process buy and sell orders instantaneously, ensuring users experience minimal slippage and optimal trade execution.

2. Multi-Layer Security Architecture

The rise of cyber threats in the crypto space necessitates the use of multi-layered security protocols. Two-factor authentication (2FA), cold wallet storage, and encryption standards fortify user funds against breaches.

3. KYC & AML Compliance

A robust identity verification system ensures adherence to global compliance standards. AI-powered verification processes streamline user onboarding while reducing fraudulent activity.

4. Multi-Currency Wallet Integration

Users demand seamless access to multiple digital assets. A reliable crypto wallet with support for major cryptocurrencies enhances trading convenience while ensuring secure transactions.

5. Liquidity Management & API Integration

An exchange’s success depends on its liquidity. By integrating with global liquidity providers and utilizing market-making strategies, new platforms can ensure smooth order execution and prevent price volatility issues.

6. Scalability & Performance Optimization

As user demand surges, the exchange should effortlessly scale. Cloud-based infrastructure and microservices architecture enable seamless scaling while maintaining peak performance.

4. Choosing the Right Crypto Exchange Clone Software

Selecting the ideal crypto exchange clone software is a decisive step in your venture. Entrepreneurs must weigh various aspects before finalizing their tech stack.

White-Label vs. Custom Development

While white-label solutions offer a fast-track approach, custom-built exchanges allow for greater flexibility and brand differentiation. A hybrid approach, incorporating both pre-built modules and custom enhancements, often proves optimal.

Key Functionalities to Look For

The software should offer advanced trading charts, multi-order types, API access, and AI-driven analytics to enhance the trading experience. Additionally, it must support high-frequency trading and automated bot integration.

5. Strategic Marketing & User Acquisition

A high-functioning exchange is only valuable if users actively trade on it. Strategic marketing initiatives are essential for onboarding traders and maintaining long-term engagement.

1. Establishing Trust & Credibility

Trust is paramount in the crypto space. Publishing security audits, obtaining regulatory licenses, and engaging in transparent communication help instill confidence in potential users.

2. Referral & Affiliate Programs

Referral-based incentives fuel organic growth. A well-structured affiliate program encourages existing users to invite others in exchange for rewards, expediting market penetration.

3. Social Media & Community Engagement

The crypto audience is highly active on social media platforms like Twitter, Telegram, and Discord. Hosting AMAs, sharing educational content, and collaborating with influencers bolster brand awareness.

4. Seamless User Onboarding

Simplifying the registration and verification process encourages user adoption. Offering fiat on-ramps further eliminates barriers to entry, ensuring even non-tech-savvy users can begin trading effortlessly.

6. Scaling & Future-Proofing Your Crypto Exchange

Beyond initial launch success, long-term sustainability hinges on innovation and adaptability.

1. Integrating DeFi & Staking Features

Decentralized finance (DeFi) is reshaping the financial landscape. By incorporating staking, yield farming, and decentralized lending, exchanges can cater to a broader audience.

2. Global Expansion & Multi-Lingual Support

The crypto market knows no boundaries. To tap into international users, exchanges must support multiple languages and comply with global regulations.

3. AI-Driven Trading Insights

Artificial intelligence is revolutionizing trading strategies. AI-driven analytics, automated risk assessments, and predictive market insights enhance traders’ decision-making capabilities.

4. Regulatory Adaptation & Compliance

Regulatory landscapes evolve rapidly. Proactively adhering to new legal frameworks ensures longevity, protecting the platform from potential shutdowns or penalties.

Conclusion

Building a WazirX crypto exchange clone is an ambitious yet rewarding endeavor. By integrating essential features, selecting the right crypto exchange clone software, and executing strategic marketing initiatives, entrepreneurs can carve out a strong presence in the booming crypto trading ecosystem.

With the right blend of security, innovation, and user-centric strategies, your exchange can dominate the market and become a strong force in the digital asset space.

#technology#wazirx clone app#wazirx clone script#wazirx clone software#bitcoin#crypto exchange clone development#crypto#crypto trading

1 note

·

View note

Text

Notcoin – How to Earn Crypto in Telegram

Let's face it: trends have a habit of fizzling out quickly. We've seen this play out time and time again. If we're being honest, probably 95% of Telegram games are just riding the hype train, offering little to no real value.

But Notcoin? That's a whole different ball game. NOT isn't just a game; it's a philosophy. The developers realized that a simple clicker game wouldn't cut it long-term. So they used that viral mechanic merely as a way to distribute coins. The real challenge was to offer users something more substantial, something truly valuable.

No sooner had the clicker craze cooled off than Notcoin launched the next big thing: Explore-to-Earn. This is uncharted territory in the crypto world. After a successful beta run, they finally dropped the full release on July 11th.

Let's dive deep into what this project looks like today, who might benefit from it, and most importantly - how to make some money.

Getting Started with Explore-to-Earn

Jumping in couldn't be easier. All you need to do is hop into the Telegram bot.

Next up - and we can't stress this enough - link your crypto wallet to the app. Don't sweat it; it's completely safe. Notcoin can't touch your funds without your say-so. It's just requesting info. Any non-custodial wallet will do the trick. The crowd favorites? TON Space and TON Keeper.

And that's it!

The Essence of Explore-to-Earn: A Triple Win

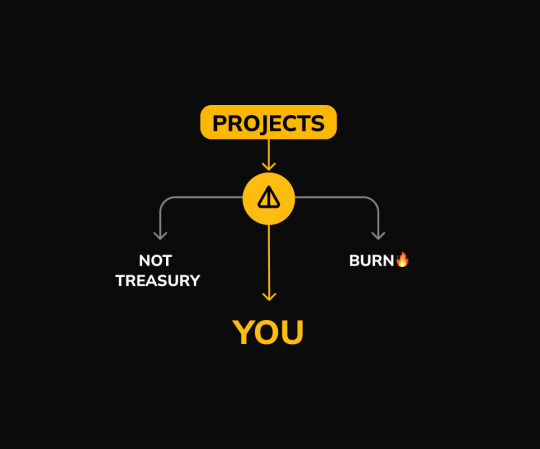

In the crypto world, you'll often hear the phrase "win-win" - a situation where both parties come out on top. But Notcoin? They've upped the ante with a "win-win-win" system. Let's break down how this clever setup works.

The Notcoin ecosystem brings together three key players: Notcoin itself, other Web 3.0 developers, and you, the users. Notcoin's user base has already blown past an eye-popping 40 million. Let's be real - what project wouldn't jump at the chance to showcase their product to such a massive audience?

Here's how the mechanism works in practice:

A crypto project buys a chunk of NOT tokens from the market (usually around 1 million coins). Think of this as their advertising budget.

You, as a user, go through an onboarding process - getting to know their product, following their channels and social media, and completing various tasks. For your efforts, you pocket the lion's share of these tokens.

A smaller portion goes to the Notcoin team. This is how they monetize the project and fund further development of the app.

The third, also small, portion gets burned. This reduces the total supply of coins, potentially driving up the value of NOT tokens.

In the end, everyone comes out ahead:

You pocket tokens for checking out new projects.

Crypto projects tap into a massive audience.

Notcoin turns a profit from their platform.

NOT holders benefit from the token's rising value.

Simple, yet brilliant...

Let's dive deeper into how this mechanism ticks.

Pools

When a new project drops into Notcoin, they kick off what's called a "pool". Think of it as a reservoir of NOT tokens, with two key features:

Pool Size: This is the total number of NOT tokens up for grabs, waiting to be divvied up among users.

Campaign: This is your to-do list - a series of tasks you need to knock out to get your slice of the pool.

Here's how the process of participating unfolds:

You spot a new pool and decide to jump in.

You work your way through the campaign tasks. This could involve following the project's channels, getting acquainted with their product, performing specific actions on their platform, and so on.

Once you've successfully completed all the tasks, you become a full-fledged pool participant.

Now, here's where it gets exciting: As a pool participant, you start "draining" NOT tokens from it. This happens automatically, every hour. You and other participants gradually claim tokens until the pool is completely emptied.

Levels

Your farming speed in the pool depends on your level. There are three levels: Bronze, Gold, and Platinum. During the beta, your level was determined by how many NOT tokens you staked. Now, things have changed.

Those who staked their NOT tokens early (before May 16th) and haven't withdrawn them yet have been granted a permanent level (as long as they keep their coins staked).

For everyone else, it's now subscription-based. You can pay through Telegram Stars, or use your NOT tokens already in the app.

Will the subscription pay off? That's the million-dollar question. For example, over 2 months of farming at the Platinum level, we managed to mine about 10,000 NOTs. Currently, a 3-month subscription costs 9,990. It's a decision you'll have to weigh carefully.

The Evolution of Notcoin

We envision Notcoin evolving into something akin to Steam - a platform connecting products with end-users. This is the unique value Notcoin offers, setting it apart from most of its clones and imitators.

Looking Ahead:

Temper Expectations: While the potential is there, it's clear that initial promises haven't fully materialized yet. Be patient and realistic.

Stay Active: With future airdrops planned, maintaining activity in the ecosystem could pay off.

Watch the Tokenomics: The limited supply and burn mechanism could lead to price appreciation over time, but it's not guaranteed.

Keep an Eye on New Features: The trading bot and NFTs could add new dimensions to the platform's utility and value.

Platform Potential: If Notcoin successfully positions itself as a go-to platform for crypto projects to reach users, it could become a significant player in the space.

Diversify: While Notcoin shows promise, remember it's just one project in a vast crypto ecosystem. Don't put all your eggs in one basket.

The team's focus on creating a unique value proposition - being the bridge between crypto projects and users - is a smart move. If executed well, this could indeed make Notcoin a "Steam for crypto", providing lasting value beyond the initial hype.

As always in crypto, there are no guarantees. The project shows promise, but also faces challenges and competition. Stay informed, engage wisely, and as they say, DYOR (Do Your Own Research).

Good luck!

2 notes

·

View notes

Text

How To Develop A Profitable Crypto Market Making Bot?

Introduction

Cryptocurrency trading! If you are interested in investing in cryptocurrencies, you come across the term "crypto market-making bot development company" and wonder what it means. In this blog post, we will explore the concept of a crypto market-making bot development company and how it can help you navigate the volatile world of crypto trading.

What is a crypto market-making bot?

What is a crypto market-making bot? A crypto market-making bot is a software program designed to automatically create buyer and seller orders to provide liquidity to the market. The bot constantly analyzes the market conditions and adjusts its orders accordingly to ensure the consistent flow of trading activity. It helps to stabilize the market and narrow the bid-ask spread, making it easier for traders to execute their orders at desired prices.

Why do companies need crypto market-making bots?

Why do companies need crypto market-making bots? With the increasing popularity and volatility of the cryptocurrency market, it has become crucial for companies to have efficient and effective trading strategies. Market-making bots can provide significant advantages in this regard.

Benefits of Using Crypto Market-Making Bots

Benefits of Using Crypto Market-Making Bots:

Increased Liquidity

Efficient Execution

Risk Management

24/7 Trading

Backtesting and Optimization

1. Increased Liquidity: One of the primary advantages of using a market-making bot is the ability to increase liquidity in the cryptocurrency market. These bots constantly place buy and sell orders at different price levels, ensuring that there is always a ready market for traders to execute their orders. This increased liquidity benefits the traders and helps stabilize the market and reduce price volatility.

2. Efficient Execution: Market-making bots designed to execute trades quickly and efficiently. They can analyze market data and execute trades in a matter of milliseconds, ensuring that traders can take advantage of even the minimum price movements. This speed and efficiency can be especially beneficial for high-frequency traders who rely on quick and accurate execution to make profits.

3. Risk Management: Another key benefit of using market-making bots is the ability to manage risk effectively. These bots can be programmed to implement risk management strategies such as stop-loss orders, position sizing, and portfolio diversification. By automating these risk management techniques, traders can minimize losses and protect their capital.

4. 24/7 Trading: Unlike human traders who need to sleep, eat, and take breaks, market-making bots can operate 24/7 without interruption. This ensures that the bot can capitalize on market fluctuations and not overlook any trading chances even if the trader is not actively keeping an eye on the market. This round-the-clock trading capability can be especially beneficial in the volatile cryptocurrency market, where prices can change rapidly at any time.

5. Backtesting and Optimization: Market-making bots often have built-in backtesting and optimization tools. These tools allow traders to test their strategies using historical market data and identify the most profitable settings for their bots. By backtesting and optimizing their strategies, traders can improve the performance of their bots and increase their chances of making consistent profits in the long run.

Navigating the Dynamic Landscape of Digital Assets

Traders and investors face a puzzling mission when it comes to maneuvering through the ever-shifting realm of digital assets. With the ever-changing market conditions and the constant influx of new cryptocurrencies, it is crucial to have a reliable partner that can help you stay ahead of the curve. That is where Beleaf Technologies comes in.

Understanding the challenges of the crypto market

In addition to the volatility, liquidity is another challenge in the crypto market. Some digital assets have lower trading volumes, making it difficult for traders to execute large orders without impacting the price. This lack of liquidity can lead to slippage and increased trading costs.

Market-making bots play a vital role in addressing these challenges. By continuously placing bids and asks on the order book, these bots provide liquidity to the market. They help narrow the bid-ask spread, making it easier for traders to buy and sell assets at desired prices. Additionally, market-making bots can identify and exploit arbitrage opportunities, where prices differ across different exchanges, to generate profits.

However, developing an effective market-making bot requires in-depth knowledge of the crypto market, as well as expertise in algorithmic trading. Factors such as order book dynamics, market microstructure, and risk management need to be carefully considered during the development process. Moreover, the bot should possess sufficient flexibility to conform to varying market circumstances and revise its trading strategies correspondingly.

By collaborating with a respected crypto market-making bot development firm such as Beleaf Technologies, you can reap the rewards of their know-how and proficiency. They will work closely with you to understand your specific trading goals and develop a bot that aligns with your requirements. Their team of skilled professionals will guarantee that the bot is fortified, productive, and capable of navigating the intricate crypto market proficiently.

Beleaf Technologies as a strategic partner

Beleaf Technologies is not just a market-making bot development company but also a strategic partner for navigating the dynamic landscape of digital assets. With their profound expertise in cryptocurrency markets and pioneering solutions, they provide a distinct advantage to clients seeking to optimize their trading strategies and augment liquidity.

Conclusion

In conclusion, if you are looking to navigate the complex and volatile world of cryptocurrency trading, a crypto market-making bot development company can be a valuable partner. With their expertise in algorithmic trading and deep understanding of the crypto market, these companies can help you develop a customized bot that is suited to your trading strategy and goals.

Reach us:

Website:https://beleaftechnologies.com/centralized-cryptocurrency-exchange-developent

WhatsApp: +91 80567 86622

Skype: live:.cid.62ff8496d3390349

Telegram: https://t.me/BeleafTech

Mail:[email protected]

3 notes

·

View notes

Text

Top Aviator Game Development Companies Selling Readymade Source Code

The emergence of crash games like Aviator has drastically changed the online gaming landscape — fast, addictive and built on relatively uncomplicated mechanics that produce a thrilling experience. For developers, entrepreneurs and operators wanting to enter this lucrative gaming market, one significant shortcut is aviator source code — Aviator Readymade Source Code to be precise.

In this guide, we will highlight the value of this type of source code, the features it should possess, and why companies such as Buyfullcode are becoming the go-to partner for the rapid, cost-effective launch of Aviator games.

Why Choose Aviator Source Code?

Creating a game from scratch, including coding, testing, bug fixing, and optimization can take months of work and once you consider the full duration of a project, it could take years to complete once everything is added up. With the Aviator Source Code, you won’t have to deal with all of this.

Here is why that is a good idea: 1. Fast to Market: The main features and functions are already built so you can go live in day or weeks instead of months.

2. Development Cost: Bringing a team together to build a functional Aviator game from scratch will costs thousands of dollars and take months to develop. Buying a well-structured source code will save you thousands.

3. Customize Away: Most readymade solutions will also allow you to customize for branding, design and rules to make yours different from everyone else.

4. Tested: Most of the readymade code will be tested in the battle field with real users, that will Minimize bugs and security issues.

Key Features of Aviator Readymade Source Code

Prior to your purchase, verify that the source code includes necessary elements, such as:

Crash Multiplier Engine: The central component of Aviator. The algorithm is responsible for two things: how the multiplier grows, and when the game crashes.

Real-Time Bets & Auto-Cashout: Players need to be able to place bets, auto-cashout, or manually tap out — this all must be done in real time.

User-friendly UI/UX: Both mobile and desktop versions of the game should be easily accessible, animations should smoothly transition between frames, and load times prolonged or interrupted.

Admin Dashboard: Users can be managed, profits can be tracked, the behavior of the game/machine can be controlled (bots, crash range), and reports can be generated.

Security Features: Proven fair system, anti-cheating features, and encryption of data.

Monetization: Affiliate, commission, track referrals, set higher “house edge” through custom odds.

Top Company Offering Readymade Aviator Source Code

Buyfullcode is a reputable source of fully editable Aviator game source code. Their package includes a straightforward UI, bot and real users, crash control (manual or algorithm), and a strong admin dashboard. It includes crypto and fiat payment systems, as well, to fit different markets.

With solid customer support, an open price list, and demo access, Buyfullcode is a great option for new ventures and gaming sites who want to launch quickly without additional backend hassles.

How to Choose the Right Aviator Game Development Partner

Here are five key points to consider:

Technology Stack — Whether the game is built using the tech stacks of pre-established frameworks as Node.js, Laravel, React, and even Unity if adopting 3D technology.

Fairness in Gaming — Keep an eye out for provably fair mechanisms or a certified random number generator.

Support & Updates — An acceptable vendor will provide update support, bug fix support, and installation support.

Customization Availability — Are you allowed to modify the logo, theme, payout, and chat capabilities?

Pricing — Some have a one-off price, others utilize licensing or splits or revenue. Understand their pricing model.

Case Study: Buyfullcode’s Aviator Game Platform

What really distinguishes Buyfullcode is how truly “plug-and-play” their solution is.

Their Aviator Readymade Source Code includes real-time betting, provably fair algorithms, and a backend admin panel that is actually user-friendly. You do not need to be a heavy coder; you can set your payout percentages, manage users, turn on bots, and see your earnings all from the dashboard.

Customization is fast, and their team provides white-label options, allowing you to add your brand to the game in days. Buyfullcode’s flexibility in developing a real money aviator is perfect whether you want to launch on web, mobile, or as part of an existing casino system.

Conclusion: Build Faster with Readymade Aviator Source Code

If you are serious about starting a crash style Aviator game, using Aviator Source Code will save you development time, budget and allow you to focus on branding, marketing and user acquisition.

Simply put, Buyfullcode has the most features, the most affordable price, and the best support — Buyfullcode checks all the boxes and is the best of the aviator readymade source code.

🚀 Ready to start your Aviator game ASAP? Check out Buyfullcode and ask for demo today. The sky is not the limit, it is merely the beginning.

#top aviator game development company#aviator readymade source code#buyfullcode#game development company#aviator game source code

0 notes

Text

Unlock More Power on Discord: Buy Aged Discord Accounts and Server Boosts

Discord has rapidly evolved from a gaming chat platform to a powerful communication tool used by communities, influencers, businesses, and developers alike. Whether you are managing a growing server or building a new brand, owning a reliable and aged discord account buy can make a huge difference. Similarly, server boosts are essential for unlocking advanced features that enhance user experience. If you’re looking to buy Discord accounts or buy Discord server boosts, here’s why it’s becoming a popular strategy—and how it benefits your online presence.

Why Buy Aged Discord Accounts?

When you buy aged Discord accounts, you're getting accounts that have been active for months or even years. These accounts are less likely to be flagged as spam and often have a better trust score with Discord’s moderation systems.

Advantages of aged Discord accounts include:

Higher Trust and Lower Ban Risk: Older accounts are seen as more trustworthy. Whether you’re joining multiple servers or creating one, aged accounts are less likely to be flagged or restricted.

Smooth Server Management: If you're running multiple communities or managing bots, aged accounts help you avoid frequent verification hurdles.

Instant Setup: Instead of waiting to build a new account’s credibility, buying an aged Discord account gives you immediate access to all standard features.

Buy Discord Accounts for Business and Marketing

Discord isn’t just for gamers. It’s a hub for creators, crypto communities, NFT projects, education platforms, and businesses. Buying Discord accounts helps marketers and business owners test, engage, and moderate without delays.

Use cases include:

Promoting services or products

Managing multiple community servers

Running promotional campaigns with ease

Launching Discord-based support systems

Boost Your Server with Purchased Server Boosts

Discord Server Boosting is a feature that allows community members to improve a server's quality. More boosts mean better audio quality, higher upload limits, and customizable server features.

When you buy discord server boosts, you can immediately upgrade your server to higher tiers without waiting for members to contribute. This enhances:

Server Audio & Video Quality – Perfect for events or streaming.

Custom Server Banner & Vanity URL – Boosts branding.

Increased Emoji & File Upload Limits – Offers users a richer experience.

Better Visibility and Member Retention – Higher-tier servers look more professional and attract more members.

Things to Consider Before Purchasing

While buying aged Discord accounts and server boosts is beneficial, ensure you do so from a reputable provider. Look for:

Verified sellers with positive reviews

Accounts with original emails and full ownership

Secure payment gateways

Transparency about terms of use and Discord policies

It’s also vital toavoid spammy practices. Use purchased accounts ethically to build genuine communities and interactions.

Final Thoughts

In the competitive world of online communities, speed and efficiency are key. By opting to buy Discord accounts aged or purchase server boosts, you’re investing in credibility, performance, and user satisfaction. Whether you're a brand, developer, or digital marketer, this strategy can provide the momentum you need to build a thriving Discord presence—quickly and effectively.

0 notes

Text

Meta Quora: The Foundation of Crypto Achievement

Reach New Crypto Milestones with Meta Quora

In an era where digital currencies are reshaping the global financial landscape, Meta Quora stands out as the ultimate platform to help traders reach new crypto milestones. This timely announcement introduces a dynamic, user-centric solution that brings the latest in AI and blockchain technology to every trader’s fingertips.

From day one, Meta Quora has been committed to democratizing access to powerful trading tools, advanced analytics, and a vibrant learning community. Whether you are a beginner eager to make your first investment or a seasoned trader aiming to optimize your portfolio, Meta Quora offers the infrastructure and support needed to elevate your journey.

Unlocking New Levels of Success

“Crypto trading can be overwhelming, but with the right tools and insights, anyone can achieve significant milestones,” stated the CEO of Meta Quora. “Our platform is built to guide users step-by-step, transforming obstacles into opportunities for growth.”

With features such as real-time data feeds, customizable dashboards, and AI-driven trading signals, Meta Quora empowers users to make informed decisions and seize profitable moments in the ever-changing market. The platform’s commitment to security, accuracy, and accessibility ensures that every user can trade confidently.

Innovative Tools for Modern Traders

What sets Meta Quora apart is its relentless pursuit of innovation. The platform integrates cutting-edge algorithms that sift through vast amounts of data to identify trends, risks, and opportunities. Users receive timely alerts and personalized recommendations, enabling them to respond swiftly to market developments.

Additionally, Meta Quora’s automated trading bots are designed to execute strategies with precision, reducing human error and emotional bias. This technology is backed by robust risk management features, including stop-loss triggers, portfolio diversification suggestions, and real-time performance tracking.

Empowering the Crypto Community

Central to the Meta Quora experience is a thriving community of traders, investors, and analysts. Through interactive forums, live webinars, and a wealth of educational resources, Meta Quora fosters collaboration and shared learning. This environment accelerates personal growth, allowing users to learn from experts and peers alike.

“Our community is our strength,” the CEO emphasized. “At Meta Quora, we believe that the best way to achieve new milestones is by learning and growing together.”

Key Benefits of Meta Quora

AI-Powered Insights: Real-time analytics and predictive modeling for smarter trades.

Flexible Portfolio Management: Build and adjust portfolios to align with evolving goals.

Secure Trading Environment: State-of-the-art encryption and transparent operations.

Continuous Learning: Access to tutorials, expert commentary, and strategy workshops.

Join the Revolution—Achieve Your Next Milestone

The launch of Meta Quora signals a new era in crypto trading. Traders are encouraged to explore the platform, utilize its innovative features, and connect with a community dedicated to mutual success. By joining Meta Quora, users position themselves at the forefront of the digital currency revolution.

Begin Your Journey to Success with Meta Quora

Ready to reach new crypto milestones? Experience the future of trading by joining Meta Quora today. Unlock exclusive tools, insightful analytics, and a supportive network—all designed to help you achieve your financial goals in the crypto market.

0 notes

Text

Sector-Based Crypto Investing: Inside Token Metrics’ DeFi and AI Indices

In the rapidly evolving world of cryptocurrency, investing based solely on market cap or hype is no longer sufficient. The market is fragmenting into sectors — just like traditional finance — with each vertical (e.g., DeFi, AI, RWAs, crypto trading Gaming) developing its own narratives, innovations, and growth cycles.

In 2025, sector-based crypto investing is proving to be the most effective way to gain targeted exposure to the next wave of wealth creation. At the forefront of this strategy is Token Metrics, which offers AI-powered crypto indices that specialize in sectoral momentum — especially in DeFi and AI tokens, two of the highest-performing narratives this year.

This blog dives into how sector-based investing works, why it’s better than general indexing, and how Token Metrics makes it smarter with AI.

Why Sector-Based Investing Matters in Crypto

Traditional stock investors have long used sector rotation strategies — allocating capital to outperforming industries like tech, healthcare, or energy at different times. In crypto, sector investing is gaining momentum because:

Narratives drive price action (e.g., AI, RWAs, Meme Coins)

Different sectors respond to macroeconomic and regulatory shifts

Innovation cycles are sector-specific

Influencers and institutions often back certain verticals heavily

By targeting specific sectors, investors can capitalize on early narratives, enter during growth phases, and exit before saturation.

Overview of Token Metrics Sector Indices

Token Metrics has launched specialized indices designed to track and rotate into:

AI Tokens

DeFi Tokens

Real World Assets (RWAs)

Decentralized Infrastructure (DePIN)

Gaming and Metaverse tokens

Moonshots across sectors

Each index uses real-time data, AI scoring, and trend detection to curate the most promising projects in each vertical.

Let’s focus on two high-conviction sectors in 2025: AI and DeFi.

Inside the Token Metrics AI Token Index

🔹 What It Is

A dynamically updated index of the top-performing tokens in the artificial intelligence and machine learning space within crypto.

🔹 Why It Matters

AI is the biggest global trend of the decade — and crypto-native projects are integrating AI into:

On-chain data processing

Trading bots and agents

Decentralized AI compute

Predictive analytics

🔹 Top Tokens in the Index (Example 2025)

FET (Fetch.ai) – Agent-based infrastructure

AGIX (SingularityNET) – AI marketplace

GRT (The Graph) – Indexing protocol for data feeds

NUM (Numbers Protocol) – AI data integrity

TAO (Bittensor) – Decentralized machine learning

🔹 How It’s Built

AI grades each token based on volume, momentum, community growth, GitHub commits, and market sentiment

Rebalances weekly based on score shifts

Detects new entrants from social buzz, GitHub activity, and DEX listings

🔹 2025 Performance Snapshot

+126% YTD — outperforming BTC and ETH by 2–3x

Inside the Token Metrics DeFi Token Index

🔸 What It Is

A carefully curated portfolio of leading decentralized finance protocols across L1 and L2 chains.

🔸 Why It Matters

DeFi is seeing a 2025 resurgence due to:

On-chain yield farming

Institutional stablecoin adoption

Layer 2 liquidity incentives

Real-world asset tokenization (RWAs)

🔸 Top Tokens in the Index (Example 2025)

AAVE – Lending protocol

GMX – Perpetual DEX

LQTY – Interest-free stablecoin system

SNX – Synthetic assets

RPL – Liquid staking on Rocket Pool

🔸 Index Highlights

Tracks TVL, protocol fees, governance votes, and usage metrics

Uses on-chain data and social sentiment to rotate allocations

Adjusts for chain-specific performance (e.g., Arbitrum vs. Ethereum)

🔸 2025 Performance Snapshot

+91% YTD — fueled by rising ETH staking and institutional DeFi flows

How AI Makes These Indices Smarter

Unlike traditional sector indices based on market cap, Token Metrics applies:

Trader Grade – Short-term momentum and volatility

Investor Grade – Long-term strength and adoption

On-Chain Grade – TVL, wallet count, protocol activity

Sentiment Grade – Social media, Telegram, Reddit, and YouTube trends

Technical Grade – Breakouts, support levels, volume surges

This creates a multidimensional view of each project — ensuring only the strongest performers stay in the index.

Sector Investing vs. General Market Exposure

Who Should Use Sector Indices?

✅ Narrative Traders – Rotate into narratives early and exit before hype fades ✅ DeFi Maxis or AI Believers – Focused exposure to your favorite vertical ✅ Diversified Investors – Combine sectors for non-overlapping bets ✅ Long-Term Builders – Invest in themes likely to last for 5–10 years

Token Metrics Makes It Simple

Using the Token Metrics platform, investors can:

Explore live sector index pages

See each token’s grade, allocation, and trend score

Receive alerts when the index updates

Recreate the index on any CEX or self-custodial wallet

No coding, no spreadsheets — just clear, actionable intelligence.

Final Thoughts: Invest in the Future, Not the Past

In 2025, crypto investing isn’t about picking one coin. It’s about aligning with sectors that matter — AI, DeFi, infrastructure, and tokenized assets.

With Token Metrics’ AI crypto indices:

You gain focused exposure

Eliminate emotional trading

Ride emerging themes early

Avoid getting stuck in laggards

If you want to build serious wealth in the next cycle, you need more than just conviction. You need sector strategy, powered by data and AI — and Token Metrics is the best crypto trading platform to deliver it.

0 notes

Text

Top Crypto Trends in 2025: What Every Investor Should Know

If you’ve been following the latest crypto news online, you already know 2025 is shaping up to be a groundbreaking year for the cryptocurrency market. From the rise of AI-integrated trading bots to regulatory clarity and the growing dominance of decentralized finance (DeFi), the industry is evolving faster than ever.

Whether you’re a seasoned investor or a curious newcomer, this in-depth guide will help you understand the top crypto trends in 2025 that are redefining the digital asset space—and show you how to stay ahead of the curve.

1. Institutional Investment Is Skyrocketing

One of the biggest shifts in 2025 is the sheer volume of institutional capital flowing into the crypto space. Big players like BlackRock, JPMorgan, and Goldman Sachs are no longer sitting on the sidelines. They’re investing in crypto ETFs, tokenized assets, and blockchain infrastructure.

According to the latest crypto news online, institutional ownership of Bitcoin and Ethereum has doubled in the past year alone. This influx of money not only legitimizes crypto in the eyes of mainstream investors but also adds stability and long-term growth potential.

Investor Tip:

Keep an eye on institutional movements. Follow portfolios, ETF approvals, and public fund disclosures to ride the same wave.

2. AI + Blockchain = Smart Crypto Ecosystems

Artificial Intelligence is no longer just a buzzword in tech—it’s revolutionizing blockchain too. AI-based crypto trading bots are making smarter trades with minimal human input. AI is also being used for blockchain auditing, fraud detection, smart contract optimization, and DeFi risk assessment.

According to recent updates from the latest crypto news online, several projects like Fetch.ai, SingularityNET, and Ocean Protocol are leading the AI-blockchain fusion trend.

Investor Tip:

Look into hybrid tokens and ecosystems where AI is used to enhance scalability, security, and user experience.

3. Real-World Asset (RWA) Tokenization

Real estate, gold, bonds, and even art are now being tokenized and traded on blockchain platforms. This trend is gaining massive popularity in 2025, giving everyday investors access to previously illiquid or high-barrier assets.

Read Also: Ethereum’s Role Defended: Bitwise Exec Compares It to Microsoft Amid Criticism

Platforms like Ondo Finance and Polymesh are getting attention in the latest crypto news online due to their innovations in making RWAs easy to buy and sell.

Investor Tip:

Start by researching platforms that are legally compliant and have partnerships with traditional asset managers.

4. Layer 2 Networks Are Going Mainstream

Ethereum’s high gas fees and network congestion created demand for faster, cheaper Layer 2 solutions. In 2025, networks like Arbitrum, Optimism, and zkSync have become go-to platforms for developers and investors alike.

The latest crypto news online highlights how these networks are helping scale DeFi, NFTs, and gaming applications without compromising on security.

Investor Tip:

Investing in Layer 2 tokens or dApps built on them could bring high ROI as user adoption increases.

5. DeFi 2.0 Is Here

The first wave of DeFi was about lending, borrowing, and staking. DeFi 2.0 is smarter, safer, and more user-centric. Features like impermanent loss protection, undercollateralized loans, and automated risk management tools are drawing more users.

Projects like Aave, Curve, and Uniswap are rolling out upgraded protocols. As per the latest crypto news online, newer DeFi 2.0 platforms are focusing on long-term sustainability rather than short-term hype.

Investor Tip:

Review DeFi projects with strong tokenomics, solid audits, and transparent roadmaps before investing.

6. Bitcoin’s Role Is Evolving

Bitcoin remains the king of crypto, but its role is shifting in 2025. It’s no longer just a store of value or digital gold. With the implementation of Bitcoin Layer 2 networks like Lightning and RSK, it’s being used for smart contracts, DeFi, and instant payments.

As reported in the latest crypto news online, countries like El Salvador and some African nations are expanding their Bitcoin infrastructure to support everything from remittances to public services.

Read Also: Solo Bitcoin Miner Strikes Gold, Earns 3.125 BTC for Block Validation

Investor Tip:

Diversify by holding Bitcoin not just as an asset, but as a platform token with evolving use cases.

7. Regulatory Clarity Is Accelerating Growth

2025 is witnessing global governments finally getting serious about crypto regulations. While this scared off some retail investors in the past, the current trend is encouraging.

The latest crypto news online reports that the U.S., EU, and several Asian countries have rolled out clear frameworks for stablecoins, token classification, and exchange licensing. This is bringing more legitimacy and fewer legal grey areas.

Investor Tip:

Stay informed about laws in your jurisdiction. Invest in compliant projects that are more likely to succeed long term.

8. Green Crypto and Sustainable Mining

The days of energy-hungry crypto mining are fading. With the rise of proof-of-stake (PoS) and eco-friendly blockchain initiatives, green crypto is in the spotlight.

Ethereum’s full transition to PoS has inspired many newer blockchains to prioritize sustainability. According to the latest crypto news online, clean energy crypto mining and carbon-neutral blockchain projects are gaining investor interest.

Investor Tip:

Support eco-conscious projects that align with global ESG (Environmental, Social, Governance) goals. This also appeals to institutional investors.

9. NFTs Are Maturing Beyond Art

Forget overpriced JPEGs. In 2025, NFTs are being used for ticketing, identity verification, insurance policies, and even academic credentials.

New use-cases are making headlines in the latest crypto news online, including NFT-based music royalties and intellectual property rights tracking. Utility-driven NFTs are shaping the next phase of the non-fungible revolution.

Investor Tip:

Look for NFTs backed by real-world utility, partnerships, and active user bases.

10. Crypto Gaming and Metaverse Integration

Crypto-powered gaming is going big in 2025. Games like Illuvium, Star Atlas, and Big Time are pushing the boundaries of blockchain in gaming and metaverse economies.

Read Also: India Trains 3,000 Police Officials in Crypto Investigations During 2022–2023

With players earning tokens, owning in-game assets, and trading NFTs in open marketplaces, the gaming sector is exploding. The latest crypto news online reports that venture capital funding in this space has hit all-time highs.

Investor Tip:

Explore gaming tokens and metaverse real estate with active user engagement and developer support.

11. Interoperability Is No Longer Optional

Blockchain islands are a thing of the past. In 2025, cross-chain bridges and interoperability protocols are critical. Cosmos, Polkadot, and Chainlink CCIP are helping different blockchains talk to each other seamlessly.

The latest crypto news online emphasizes that interoperability is key to future scalability, especially in DeFi, NFTs, and Web3 infrastructure.

Investor Tip:

Favor tokens and ecosystems that enable seamless cross-chain operations. These will dominate the multi-chain future.

Final Thoughts: Stay Informed or Stay Behind

The crypto landscape in 2025 is dynamic, promising, and full of new opportunities. But as exciting as it is, it’s equally risky. Staying informed through the latest crypto news online is your best weapon.

From institutional adoption and regulatory clarity to AI integration and DeFi upgrades, investors must remain agile and well-researched. Crypto is no longer the Wild West—it’s entering its industrial revolution, and those who prepare will thrive.

FAQs

Q: How can I stay updated with the latest crypto news online? A: Follow top crypto news platforms like CoinTelegraph, Decrypt, The Block, and Twitter handles of top analysts and projects.

Q: What’s the best crypto investment strategy for 2025? A: Diversify across Bitcoin, Ethereum, Layer 2s, DeFi 2.0 projects, and real-world tokenized assets. Stay informed and focus on long-term value.

Q: Is it too late to invest in crypto in 2025? A: Not at all! We’re still early in crypto’s global adoption. The key is to invest smartly, backed by research and news insights.

0 notes

Text

Crypto Trading Bot Development for Smart Automation

Leverage the power of automation to trade smarter with high-performance crypto trading bots built to suit your strategies. From real-time market tracking to automated decision-making, our bots are optimized for speed, precision, and scalability. Touch Crypto offers tailored bot development with support for multiple exchanges and trading styles like arbitrage, grid, and AI-based strategies. Whether you're an individual trader or an enterprise, our solutions help minimize risk and maximize efficiency. Stay ahead of the market with intelligent automation designed for results.

Explore more - https://www.touchcrypto.org/crypto-trading-bot-development

Contact no - +91 8148541753

Mail us - [email protected]

#CryptoTradingBots#AutomatedCryptoTrading#TradingBotDevelopment#CryptoAutomation#AlgoTrading#CryptoTech#CryptoBotDevelopment#TouchCrypto#BlockchainExperts#FintechSolutions

1 note

·

View note

Text

How Non-Repainting Indicators Ensure Reliable Trading Signals Over Time

How Non-Repainting Indicators Ensure Reliable Trading Signals Over Time

Introduction