#Credit Repair Miami

Explore tagged Tumblr posts

Text

Need Fast Cash in Miami? Here’s How Same-Day Car Title Loans Can Help | Full Finance

Life can be unpredictable, and financial emergencies often come when you least expect them. Whether it’s a medical bill, home repair, or other urgent expense, sometimes you need cash quickly. That’s where same-day car title loans come in. If you're in Miami and looking for fast car title loans, this guide is for you.

What Are Same-Day Car Title Loans?

A car title loan is a secured loan where your vehicle's title is used as collateral. With same-day car title loans, you can get quick cash—often within a few hours of applying—to address your financial needs. These loans are ideal for those who need money fast and own a car outright or have significant equity.

How Do They Work?

Apply Online or In-Person: You can start by applying online for fast car title loans or visit a local lender in Miami for instant approval.

Provide Your Car Title: The lender will use your car title as collateral.

Get Approved Quickly: With Quick Car Title Loan Approval processes, most lenders will assess your application within minutes.

Receive Your Cash: Once approved, you’ll receive your money on the same day, either through direct deposit or in cash.

Fast Car Title Loans: Pros, Cons, and What to Expect

Pros

Quick Access to Cash: Same-day approval ensures you get the money when you need it most.

No Credit Check Required: Since your car title secures the loan, lenders typically do not require a credit check.

Keep Driving Your Car: Even after taking the loan, you can continue using your vehicle as usual.

Easy Application Process: Most fast car title loans online have a straightforward application process that takes only a few minutes.

Cons

High-Interest Rates: Car title loans often come with higher interest rates compared to other types of loans.

Risk of Losing Your Vehicle: If you fail to repay the loan, the lender may repossess your car.

Short Repayment Periods: These loans usually have a short repayment timeline, which can be challenging if you're not financially prepared.

Fees and Penalties: Late payments may lead to additional fees, making the loan more expensive.

What to Expect

When applying for a same-day car title loan, ensure you have the following documents ready:

Government-issued ID

Car title (clear or with significant equity)

Proof of income

Proof of residency

Finding Fast Car Title Loans Online or Near You in Miami

If you’re in Miami, you’re in luck! Many lenders are offering instant car title loans near you. Here’s how to find the best options:

Search Online: Use terms like "fast car title loans online" or "instant car title loans near me" to find reliable lenders in Miami.

Visit Local Lenders: Many brick-and-mortar lenders in Miami offer same-day car title loans with quick approval processes.

Check Reviews: Before choosing a lender, read online reviews to ensure they are trustworthy and transparent.

Compare Rates: Always compare interest rates and repayment terms from multiple lenders to find the best deal.

Tips for Managing a Car Title Loan

Borrow Only What You Need: Avoid overborrowing to keep your repayments manageable.

Read the Fine Print: Understand all the terms and conditions before signing any agreement.

Plan Your Repayments: Create a budget to ensure you can pay back the loan on time.

Communicate with Your Lender: If you’re struggling to make payments, reach out to your lender to discuss options.

Why Choose Full Finance?

At full finance, we specialize in providing fast car title loans tailored to your needs. Whether you’re looking for quick car title loan approval or need guidance, our team is here to help. Based in Miami, we understand the urgency of your financial needs and aim to provide same-day car title loans with competitive rates.

Final Thoughts

Same-day car title loans can be a lifesaver in times of financial distress. However, the pros and cons carefully before committing to a loan. By choosing a reputable lender like Full Finance and planning your repayments, you can navigate your financial emergency with ease.

If you're in Miami and need cash fast, don’t wait. Explore fast car title loans online or visit Full Finance to get started today.

Visit Our Website: www.fullfinance.com

Publication Date: 23 January 2025 Author Name: Thomas

#can i get a loan for a salvage title car#bad credit loans in baton rouge#cash and title loans#easy title loans

0 notes

Text

Why Assured Contracting Should Be the Best Decision in Your Hurricane Impact Doors and Windows

Nothing can tell a safe business or home from erratic hurricanes except the right contractor. However, Assured Contracting happens to be South Florida's leading hurricane-impact door and window provider. This company's solid approach to quality, service, and customer satisfaction is the reason they lead homeowners and business owners. Below are key reasons why you ought to consider Assured Contracting as your one-stop shop for hurricane-impact solutions.

1. Quality of Products

Assured Contracting hurricane-impact windows and doors have up-to-date materials used: high-grade vinyl and aluminum. They provide resistance against stormy weather as well as any other extreme circumstances. They are made up of advanced noise-reducing, UV-blocking, and energy-saving features so they are durable and earth-friendly for your residential and commercial places, respectively.

It also teams with a few leading manufacturers like PGT and Custom Windows to ensure that its products are given strict safety standards as well as aesthetic requirements. In fact, all of their products have a 100% warranty. Therefore, you can have a clear conscience when it comes to investing.

2. Full Range of Services

Assured Contracting offers a complete line of sales and installation to repair and maintain hurricane-impact doors and windows. They can service both residential and commercial buildings with customized solutions that suit varying architectural styles and requisites. Whether retrofitting your home for additional protection or equipping a new commercial building, Assured Contracting has you covered.

3. Expert Installation and Craftsmanship

Installation, in most ways, effectively matters in hurricane-impact doors and windows. Assured Contracting has fully qualified professionals, ensuring good installation as per industry practice to guarantee quality performance and durability. This will allow better service of the property for a long time, sheltering your structure from storms and also trespassers.

4. Obsession with Safety

Assured Contracting always puts safety first. Extreme testing is undergone by its hurricane-impact windows and doors before they can be certified to withstand hurricane-level winds and flying debris, thus ensuring your home's safety during a hurricane. Advanced security also features on their products by adding an anti-break-in resistance to give you peace of mind beyond storm season.

5. Attractive Financing Options

Assured Contracting offers flexible financing plans so more customers can afford hurricane-impact solutions. Options include $99 monthly payments and special financing programs through Renovate America and Ygrene, among others, so you can upgrade your property without draining your wallet. Such plans aren't credit-dependent, so more homeowners get to benefit from improved storm protection.

6. Local Expertise in South Florida

Assured Contracting, based in Fort Lauderdale, would have a realistic understanding of the adversities that face South Florida due to its hurricane season. Its staff is fully conversant with local building codes and vagaries of the weather; thus, their products and services are tailored to suit that area. They service major cities such as Miami, Boca Raton, Coral Springs, and Palm Beach, an indicator of their commitment to localized service.

7. Attractive Designs

Beauty does not have to be compromised for functionality. Hurricane impact doors and windows designed by Assured Contracting are engineered to enhance the look of your property. From a variety of different styles and finishes with numerous options for customization, choose from designs that really make a home or business look its best while providing strong storm protection.

8. Excellent Customer Reviews

Assured Contracting boasts a sparkling reputation for customer satisfaction. Online reviews characterize it as professional, transparent, and timely in delivering services. They look forward to the company's extra efforts with high quality products to fulfill their demands. This perfect record stamps its position as a partner for hurricane impact solutions.

9. Licensed and Insured Professionals

Being a licensed and insured general contractor, Assured Contracting ensures that every project is completed with utmost professionalism and adherence to safety standards. This certification provides additional assurance that your property is in good hands, minimizing risk throughout the installation process.

10. Free Estimates and Consultations

To know that the process of home improvement can be a tiring and overwhelming task, Assured Contracting offers free quotations and consultations. Their skillful experts will guide you through every step of the selection of products, cost estimation, and plan of installation of an entirely hassle-free, stress-free process from start to finish.

11. Eco-Friendly Solutions

As more individuals are becoming conscious of energy preservation in homes, Assured Contracting is a hurricane-impact solution to this growing requirement. Their products aid in energy preservation and reflect sunlight for minimal UV rays.

12. Special Promotions/Offer Availability

There are special promotions time and again assuredly provided by Assured Contracting that makes the services even cheaper. Special products or services with low prices help the customers in gaining maximum value while being surrounded by an environment that promotes safety and aesthetics for their property.

Choosing Assured Contracting for your hurricane impact doors and windows ensures you receive a winning combination of quality, service and value. Their commitment to safety, aesthetic appeal, and customer satisfaction has made them leaders in South Florida among the contractors. It is with such expert installation, attractive financing, and a strong commitment to community well-being that Assured Contracting can be considered as the best choice for protection of your home or business during hurricane season and beyond.

#roof services#metal roofing#roof repair#agatha all along#aesthetic#metal roofing florida#florida metal roofing services

0 notes

Text

Roofing Cost Estimator in Miami-Dade County

When it comes to using a roofing cost estimator in Miami-Dade County, understanding the cost factors and planning your budget effectively is crucial. The unique climate and strict building codes in the area mean that roofing costs can vary significantly depending on the materials, design, and other variables. Let’s explore the key factors and provide you with an accurate roofing cost estimator.

Key Factors Influencing Roofing Costs in Miami-Dade County

Roof Size and Complexity The size of your roof is one of the most significant factors influencing costs. Larger roofs require more materials and labor, while complex designs with multiple slopes, dormers, or intricate details add to the overall expense.

Material Selection The choice of roofing material has a substantial impact on costs. Here are some common materials:

Asphalt Shingles: Affordable and versatile, ideal for many homes in Miami-Dade.

Metal Roofing: Durable and energy-efficient, perfect for handling Miami's intense heat and rain.

Tile Roofing: A popular choice for aesthetics and durability but requires more significant investment upfront.

TPO Roofing: Often used for flat roofs, offering a cost-effective and weather-resistant solution.

Labor and Installation Costs Labor costs in Miami-Dade County depend on the complexity of the roof design and the expertise of the contractor. Simple roofs may cost less, but intricate designs with steep slopes or custom features require more skilled labor and higher costs.

Permits and Building Codes Due to Miami-Dade's hurricane-prone environment, strict building codes apply. Permit fees and compliance with local regulations can add $300 to $600 or more to your project. These requirements help ensure the roof can withstand extreme weather conditions.

Additional Features Adding features like hurricane straps, roof insulation, or specialized coatings can increase costs but offer long-term benefits in durability and energy efficiency.

Roofing Cost Overview for Miami-Dade County

The average cost of a roofing project in Miami-Dade County depends on various factors. For example:

Asphalt Shingles: These typically range from $5,000 to $10,000 for an average-sized roof.

Metal Roofing: Costs can vary between $10,000 and $25,000, depending on roof size and material type.

Tile Roofing: Expect to pay $15,000 to $30,000 for these premium options.

Flat Roofing Systems: TPO or similar materials generally range between $8,000 and $15,000.

Keep in mind that these are average figures, and the final cost depends on your specific needs and preferences.

Tips for Reducing Roofing Costs in Miami-Dade County

Plan Ahead: Avoid the hurricane season when contractors are busiest, and material costs may be higher.

Choose Durable Materials: Investing in high-quality, weather-resistant materials reduces repair costs in the long run.

Work With Experts: Selecting reputable contractors ensures quality work, reducing potential issues that can incur additional costs.

How Estimate Florida Consulting Can Help

At Estimate Florida Consulting, we specialize in providing accurate and detailed roofing cost estimates tailored to Miami-Dade County’s unique requirements. Our expertise ensures you stay within budget while meeting all building codes and standards. Contact us today at 561-530-2845 to get started on your roofing project.

Frequently Asked Questions (FAQs)

Q: What is the average cost to replace a roof in Miami-Dade County? A: The cost typically ranges between $10,000 and $20,000 for a standard asphalt shingle roof on a 2,000 sq. ft. home.

Q: Are there any tax benefits for installing energy-efficient roofing? A: Yes, some energy-efficient roofing systems may qualify for federal tax credits or local incentives.

Q: How long does a typical roofing project take in Miami? A: Depending on the roof size and type, most projects take 3 to 7 days to complete.

0 notes

Text

A Comprehensive Guide to Replacing Your Windows and Sliding Doors

Why Replace Windows and Sliding Doors?

Improved Energy Efficiency: Older windows and sliding doors often have single-pane glass, which lacks insulation. Modern replacements come with double or even triple-pane options that significantly reduce heat transfer, helping to keep your home warm in the winter and cool in the summer. Energy-efficient windows can reduce your heating and cooling bills, making this investment financially beneficial in the long run.

Enhanced Curb Appeal: Replacing outdated or damaged windows and sliding doors can instantly boost the appearance of your home. window and sliding door replacement Modern designs are sleek, stylish, and available in a variety of finishes to complement your home’s aesthetic. Whether you're looking to give your home a fresh look or increase its resale value, new windows and doors can make a significant difference.

Increased Security: Old windows and sliding doors may have weaker locks or frames, making your home more vulnerable to break-ins. Modern replacements often come with advanced locking systems, reinforced frames, and impact-resistant glass that can improve your home’s security and give you peace of mind.

Better Functionality: Over time, windows and sliding doors can become difficult to open and close due to wear and tear. New windows and doors glide smoothly and are easier to operate, making daily use much more convenient.

The Replacement Process

Assessing Your Current Windows and Doors: Before starting, inspect your windows and sliding doors to determine if they need replacement. Look for signs like drafts, condensation between the panes, cracks in the glass, or difficulty in operation. If you notice these issues, it’s time to consider upgrading.

Choosing the Right Materials: There are several material options available when replacing windows and sliding doors. Vinyl, wood, and aluminum are popular choices. Vinyl is cost-effective and requires little maintenance, while wood offers a classic look with excellent insulation properties. Aluminum is lightweight and durable, making it ideal for larger sliding doors. Choose the material that best suits your budget and design preferences.

Selecting Glass Options: When it comes to glass, you’ll have options for single, double, or triple-pane windows. Double and triple-pane glass provide better insulation and soundproofing. Additionally, you can opt for low-E (low-emissivity) coatings that reduce UV rays, protect your furniture from fading, and enhance energy efficiency.

Professional Installation: While DIY installation might seem tempting, hiring a professional ensures that your new windows and sliding doors are properly installed. A certified installer will measure accurately, seal the windows effectively, and make sure that everything is level and secure. Proper installation is crucial for achieving optimal performance and longevity.

Key Considerations

Cost: Replacing windows and sliding doors is a substantial investment. Prices can vary based on materials, size, and labor costs. Be sure to get multiple quotes from contractors to ensure you’re getting a fair price. Keep in mind that energy-efficient models may qualify for tax credits or rebates, which can help offset the initial cost.

Style and Design: There are various styles to choose from, including casement, double-hung, sliding, and more. Consider the architectural style of your home when selecting your new windows and doors to ensure a cohesive look.

Maintenance: Some materials require more upkeep than others. Sliding Glass Door Repair Miami For instance, wood windows need to be painted or stained regularly to maintain their appearance, while vinyl and aluminum options are virtually maintenance-free.

0 notes

Text

Tips for Getting the Best Price on Auto Body Work in Miami

Getting the best price on auto body work requires a bit of research and strategy. Here are some practical tips to help you find a good deal without compromising on quality:

1. Get Multiple Estimates

Tip: Contact several Miami Paint and Body Shop to get multiple estimates for the same repair work. This will give you a range of prices and help you understand the average cost for the job.

How to Do It: Provide each shop with detailed information about the damage and ask for a written estimate. Be sure to compare the estimates based on the scope of work, materials used, and labor costs.

2. Research Shop Reputation

Tip: Choose a shop with a strong reputation for quality work. Sometimes paying a bit more for a reputable shop can save you money in the long run by avoiding poor workmanship and additional repairs.

How to Do It: Check online reviews, ask for recommendations from friends or family, and look for certifications from industry organizations. A reputable shop will have positive feedback and a history of satisfied customers.

3. Ask About Discounts and Promotions

Tip: Inquire about any available discounts or promotions that the shop may offer. Some shops have seasonal promotions, referral discounts, or special rates for new customers.

How to Do It: Contact the shop directly or check their website for any current promotions. Be sure to ask if there are any discounts available when you request your estimate.

4. Consider Paying in Cash

Tip: Paying in cash may sometimes lead to a discount since it avoids credit card fees or processing costs for the Miami Paint and Body Shop.

How to Do It: Ask the shop if they offer a discount for cash payments. Be sure to get a receipt and verify that the cash payment does not impact the warranty or quality of the work.

5. Negotiate the Price

Tip: Don’t hesitate to negotiate the price of the repair work. Many shops are willing to adjust their pricing or offer a better deal, especially if you’re a returning customer.

How to Do It: After receiving an estimate, discuss the cost with the shop and see if they can offer any adjustments. Mention that you’re comparing prices with other shops and see if they can provide a better deal.

6. Check Insurance Coverage

Tip: If the damage is covered by insurance, work with your insurance company to ensure you get the best price. The insurance company may have preferred shops or discounts available.

How to Do It: Contact your insurance provider and discuss the repair options. They can provide recommendations and may handle the payment process directly with the shop.

7. Understand the Scope of Work

Tip: Ensure that the estimate includes a detailed breakdown of the work to be done, including labor, parts, and materials. Understanding the scope of work helps you compare estimates accurately and avoid hidden costs.

How to Do It: Ask the shop to provide an itemized estimate and explain any items that you don’t understand. This will help you make an informed decision and avoid unexpected charges.

8. Evaluate the Quality of Materials

Tip: Higher-quality materials often result in better and longer-lasting repairs. Ensure that the shop uses high-quality paint and parts, which may affect the overall cost but provide better results.

How to Do It: Inquire about the types of materials and paint the shop uses. Ask if they offer different options at varying price points and consider investing in quality materials for a better finish.

9. Review the Warranty

Tip: Check if the shop offers a warranty on their work. A warranty can provide peace of mind and protect you from additional costs if issues arise after the repair.

How to Do It: Ask the shop about their warranty policy and what it covers. Make sure you receive a written warranty and understand the terms and conditions before committing to the repair.

10. Consider Off-Peak Times

Tip: Scheduling your repair during off-peak times may result in lower prices or faster turnaround. Shops may offer better deals when they are less busy.

How to Do It: Ask the shop if there are times of the year or days of the week when they offer lower rates or have more flexibility with scheduling.

11. Explore DIY Options for Minor Repairs

Tip: For minor cosmetic issues like small scratches or chips, consider DIY repair kits. These can be a cost-effective way to handle small repairs yourself.

How to Do It: Purchase a reputable DIY repair kit and follow the instructions carefully. For more extensive damage, consult with a professional to avoid worsening the issue.

Conclusion

Getting the best price on auto body work in Miami involves researching, comparing, and negotiating. By following these tips, you can ensure that you receive high-quality repairs at a fair price. Always prioritize the quality of work and materials to avoid additional costs in the future. With careful planning and informed decisions, you can find a reputable shop that meets your budget and repair needs.

0 notes

Text

Your credit score plays an important role in your life. It influences your ability to secure loans, obtain favorable interest rates, and even rent an apartment or land a job. When your credit score is less than stellar, it can limit your opportunities and cause undue stress. That's where credit repair companies come in. They guide or provide best Tips to Improve Credit Score. These organizations specialize in identifying and resolving inaccuracies on credit reports, negotiating with creditors on your behalf, and implementing strategies to improve your creditworthiness.

0 notes

Text

When to Use a Car Title Loan for an Emergency | fullfinance

Introduction

Crises are unpredictable, and financial security might be thrown off control during critical circumstances. A car title loan could be a good way to get the money you need fast in these situations. Car title loans for emergencies can assist in filling up your financial gaps, whether related to urgent medical bills, house repairs, or additional costs. However, it is crucial to understand when to use this loan and, if required, look into other options.

What is a Car Title Loan?

You will use the vehicle as an asset to borrow money with an auto title loan. You are still able to use your automobile during this time, but the lender will keep the title until you pay back the loan. Since many lenders do not demand a credit check, it is a quick fix for people in need of money right away, especially those with bad credit.

Common Uses:

Emergency car title loan options are popular for medical bills, home repairs, or other urgent expenses that cannot wait.

When to Use a Car Title Loan for an Emergency

1. Urgent Medical Bills

If you have unexpected medical expenses and no other quick sources of funds, a car title loan for emergencies can help you get immediate relief. For those who don't qualify for other types of loans, such as personal loans or credit cards, car title loans offer fast access to cash.

2. Home Repairs

Major home repairs, such as fixing a roof or plumbing, can’t be delayed. In such cases, using car title loans for urgent expenses like home maintenance can prevent further damage and higher costs down the road.

3. Vehicle Repairs

If your car breaks down and you need immediate repairs to get to work or manage other responsibilities, emergency funding with car title loans can provide the quick cash you need to fix the vehicle.

4. Urgent Travel or Relocation

Sometimes, personal emergencies like family matters or urgent relocations require you to travel quickly. Fast car title loans for urgent needs offer quick funding for emergencies like these when other loan options are not available.

How to Get a Car Title Loan for Emergencies

Step-by-Step Guide

Find a Lender: Start by finding a reputable lender that offers online Texas title loan service if you're in Texas, or local services in your area such as Miami.

Submit Your Application: Most lenders offer an easy title loan online quote that lets you know how much you can borrow.

Get a Quote: After your application, you’ll receive a title loan quote online based on your vehicle’s value.

Provide Required Documents: You'll need your car title, proof of income (if required), and identification documents.

Get Your Funds: Once approved, you can get the funds as soon as the same day, depending on the lender.

Tip: You can also apply for title loans that don’t require the car in some states, meaning you keep possession of your vehicle even while the lender holds the title.

What You Need for a Car Title Loan

To get a car title loan, you typically need:

Vehicle title: The lender will hold this as collateral.

Proof of income: Some lenders offer car title loans with no income verification near me, but others may require proof.

Proof of residency: A utility bill or similar document to verify your address.

Valid ID: A government-issued ID like a driver’s license.

Other Considerations:

If your car is not paid off, some lenders still offer title loans on cars not paid off, but it depends on the loan amount and vehicle’s value.

Alternatives to Car Title Loans for Emergencies

While car title loans offer quick cash, they often come with higher interest rates and short repayment periods. It's important to explore alternatives to car title loans for emergencies before committing.

1. Personal Loans

Personal loans from banks or online lenders may offer lower interest rates and longer repayment terms. If you have bad credit, bad credit loans in Baton Rouge or your local area may be worth considering.

2. Credit Cards

If you have available credit, using a credit card may be a better option for urgent expenses since it often comes with lower interest rates compared to a car title loan.

3. Home Equity Loans

If you own a home, tapping into your home’s equity could provide more substantial funding at a lower interest rate. However, this takes longer to process compared to car title loans.

4. Refinancing a Car Loan

If you're wondering, "Can I get a title loan with a financed car?" the answer is often yes, but refinancing your current auto loan may also be an option to free up funds.

How Fast Can You Get a Car Title Loan?

The fast process of approval is one of the main reasons individuals choose auto title loans in times of need. Online title loans are an attractive option for those in need of money right away since they may be approved and funded on the same day.

Visit Our Website: www.fullfinance.com

Publication Date: 22 October 2024 Author Name: Donald

#easy title loans#car loans for rebuilt titles#car title loans no credit check#car title loan texas#online title loans for bad credit#approved title loans texas

0 notes

Text

Yellow Card Properties

Discover the Best Real Estate Solutions with Yellow Card Properties

When it comes to navigating the complexities of real estate, finding a trustworthy and reliable partner is essential. At Yellow Card Properties, we understand the challenges homeowners face, whether it's dealing with foreclosure, struggling to sell a property, or needing to sell quickly for other reasons. As a family-owned business in Florida, we are dedicated to providing personalized real estate solutions that cater to your unique needs.

Why Choose Yellow Card Properties?

Yellow Card Properties stands out in the real estate market for several reasons. Our commitment to delivering top-notch service and innovative solutions sets us apart from the competition. Here’s why we are the best choice for your real estate needs:

Comprehensive Real Estate Solutions

Whether you're facing foreclosure, unable to sell your property, or simply need to offload a house quickly, Yellow Card Properties offers a range of solutions tailored to your situation. Our team has the expertise to handle properties in any condition, ensuring a hassle-free experience for you.

Family-Owned and Operated

As a family-owned business, we prioritize your needs and work diligently to provide personalized service. We treat every client with respect and understanding, recognizing that each situation is unique. Our family values drive us to go above and beyond to help you find the best solution.

Fast and Efficient Service

Time is often of the essence in real estate transactions. At Yellow Card Properties, we streamline the process to ensure a quick and efficient sale. We offer fast cash offers and work around your schedule to make the process as smooth as possible.

Expertise in Florida Real Estate

With extensive knowledge of the Florida real estate market, Yellow Card Properties is well-equipped to handle various scenarios. Whether you’re in Miami, Orlando, Tampa, or any other Florida city, our local expertise ensures that you receive the most accurate and relevant advice.

No Repairs Needed

One of the major advantages of working with Yellow Card Properties is that you don’t need to worry about making repairs or renovations. We buy houses in any condition, saving you time and money. Simply let us know about your property, and we’ll handle the rest.

Services We Offer

At Yellow Card Properties, we provide a range of services designed to address different real estate challenges:

Foreclosure Solutions: If you’re facing foreclosure, we offer solutions to help you avoid the negative impact on your credit and financial stability.

Quick Property Sales: Need to sell your house quickly? Our fast cash offers ensure you get a fair price without the delays of traditional selling methods.

As-Is Property Purchases: We buy houses in any condition, so you can sell without worrying about repairs or renovations.

Personalized Consultations: Our team provides one-on-one consultations to understand your needs and offer tailored solutions.

Why We’re the Best Choice

Choosing Yellow Card Properties means choosing a company that values your time, understands your needs, and provides effective solutions. Our family-owned approach ensures that you receive personalized service and attention to detail. We pride ourselves on our integrity, transparency, and commitment to helping homeowners find the best solutions for their real estate challenges.

Ready to find out how Yellow Card Properties can help you? Visit our website at Yellow Card Properties to learn more about our services and get started today. Whether you’re dealing with foreclosure, need to sell quickly, or just want to explore your options, we’re here to assist you every step of the way.

0 notes

Text

Essential Tips for Managing Florida Investment Properties Effectively

Managing Florida investment properties effectively requires a strategic approach. Start by understanding the local market trends and regulations to ensure compliance and maximize rental income. Screen tenants thoroughly to find reliable renters and maintain open communication to address any issues promptly. Regular property maintenance and timely repairs are crucial to preserving property value and ensuring tenant satisfaction. Implementing efficient financial tracking and budgeting practices will help manage expenses and optimize profitability.

Understanding the Market for Florida Investment Properties

To successfully invest in Florida investment properties, it's crucial to have a deep understanding of the local market. Research trends such as property values, rental rates, and neighborhood growth. Florida's diverse real estate market varies significantly between urban areas like Miami and Orlando and more rural regions. Analyzing local economic indicators and demographic data can help you identify high-potential areas for investment. By staying informed about market conditions, you can make strategic decisions that enhance the profitability of your Florida investment properties.

Key Factors to Consider When Buying Florida Investment Properties

When purchasing Florida investment properties, several factors should be top of mind. First, evaluate the location's potential for rental income and property appreciation. Proximity to amenities, schools, and transportation can impact demand and rental rates. Additionally, assess the condition of the property and any potential repair or renovation costs. It's also important to understand local zoning laws and property management regulations. Thorough due diligence will help you select the right Florida investment properties that align with your investment goals.

Financing Options for Florida Investment Properties

Securing financing is a critical step in acquiring Florida investment properties. Explore various options, including conventional mortgages, private lenders, and real estate investment trusts (REITs). Consider factors such as interest rates, down payment requirements, and loan terms. It's also beneficial to have a solid credit score and financial history to improve your chances of obtaining favorable loan conditions. Understanding your financing options can help you manage cash flow and maximize returns on your Florida investment properties.

Effective Property Management for Florida Investment Properties

Effective property management is key to the success of Florida investment properties. This involves handling tenant relations, maintaining the property, and managing finances. Establish clear lease agreements and conduct regular property inspections to ensure tenant compliance and property upkeep. Implementing a robust system for rent collection and maintenance requests can streamline operations and enhance tenant satisfaction. For those who prefer a hands-off approach, hiring a local property management company can provide expertise and efficiency in managing your Florida investment properties.

Legal Considerations for Florida Investment Properties

Navigating the legal landscape is essential when dealing with Florida investment properties. Familiarize yourself with Florida's landlord-tenant laws, which cover aspects like security deposits, eviction processes, and lease agreements. Compliance with local ordinances and state regulations is crucial to avoid legal disputes and fines. Additionally, consider consulting with a real estate attorney to ensure that all contracts and transactions are legally sound. Understanding your legal obligations and rights will help protect your investment and ensure smooth management of your Florida investment properties.

Tax Implications of Florida Investment Properties

Investing in Florida investment properties comes with various tax implications. Familiarize yourself with federal and state tax laws related to rental income, property depreciation, and potential deductions. Florida does not have a state income tax, which can be advantageous for investors. However, it's important to understand how property taxes and other local taxes might impact your overall profitability. Consulting with a tax professional can help you optimize your tax strategy and ensure compliance with tax regulations related to your Florida investment properties.

Future Trends in Florida Investment Properties

Keeping an eye on future trends can give you a competitive edge in Florida investment properties. Emerging trends such as remote work, sustainable living, and technological advancements are shaping the real estate market. For instance, properties with smart home features or those located in desirable lifestyle communities may attract higher demand. Staying informed about these trends can help you make proactive investment decisions and adapt your strategy to capitalize on new opportunities in the Florida real estate market.

conclusion

Effectively managing Florida investment properties involves a combination of market knowledge, proactive maintenance, and sound financial practices. By understanding local market trends and tenant needs, you can make informed decisions that boost profitability. Regular property upkeep and efficient communication with tenants are key to maintaining high occupancy rates and satisfaction. Additionally, implementing robust financial management and considering professional property management services can streamline operations. By following these essential tips, you can maximize the success of your Florida investment properties and achieve your investment goals with confidence.

0 notes

Text

Car Buyer Miami Hialeah: Your Ultimate Guide to Selling Your Car!

Welcome to Miami Auto Buyers! If you're looking to sell your car in Miami Hialeah, you've come to the right place. We're here to make your car-selling experience smooth, profitable, and exciting! Get ready to discover why Miami Auto Buyers is the top choice for car sellers in the area.

Why Choose Miami Auto Buyers?

Miami Auto Buyers is renowned for providing top-notch service and unbeatable prices. Our team of experts ensures you get the best value for your car. We're not just buyers; we're your partners in the car-selling Car buyer Miami Hialeah journey!

Quick and Easy Process

Selling your car has never been this easy! At Miami Auto Buyers, we streamline the process to ensure you get cash for your car without any hassle. From valuation to payment, it's quick and efficient.

Free Car Valuation

Get an accurate and free valuation for your car with Miami Auto Buyers. Our experts assess your vehicle's condition and market value to provide you with a fair and competitive offer. No hidden fees or surprises!

Instant Cash Offers

Need cash fast? Miami Auto Buyers offers instant cash for your car. Once you accept our offer, you get paid immediately. No waiting, no delays – just cash in your hands!

We Buy Cars of All Conditions

Whether your car is old, damaged, or no longer running, we buy cars in all conditions. Don't worry about repairs or cleaning – we take care of everything. Your car is valuable to us, no matter its state.

Hassle-Free Paperwork

Say goodbye to complicated paperwork! Miami Auto Buyers handles all the necessary documentation for you. We ensure a smooth and legal transaction, giving you peace of mind.

Convenient Locations

Located in Miami Hialeah, we're easily accessible and ready to assist you. Drop by our office or schedule an appointment – we're here to accommodate your needs.

Friendly and Professional Staff

Our team is dedicated to providing exceptional customer service. We treat you with respect and professionalism, ensuring a positive and friendly experience throughout the selling process.

Competitive Prices

Miami Auto Buyers offers the best prices for your car. We stay updated with the market trends to provide you with the most competitive and fair offers. Get the most value out of your vehicle with us!

Customer Testimonials

Don't just take our word for it – hear from our satisfied customers! Read our testimonials to see how Miami Auto Buyers has helped countless car sellers get the best deals.

No Obligations

Not sure about selling yet? No problem! Get a free valuation and take your time to decide. There's no pressure or obligation to sell. We're here to provide information and assist you whenever you're ready.

Sell Any Make or Model

We buy all makes and models! Whether you have a luxury car, a family sedan, or a vintage vehicle, Miami Auto Buyers is interested. We appreciate Car buyer Miami Hialeah the value of every car, regardless of its brand or age.

Safe and Secure Transactions

Your safety is our priority. Miami Auto Buyers ensures all transactions are secure and transparent. We follow strict guidelines to protect your personal information and ensure a trustworthy process.

Eco-Friendly Disposal

Concerned about the environment? We are too! Miami Auto Buyers follows eco-friendly practices for disposing of non-functional vehicles. We recycle parts and materials to minimize our environmental footprint.

Fast and Reliable Service

Time is money, and we value yours. Our efficient process ensures you get a quick response and reliable service. From valuation to payment, expect a smooth and speedy experience.

Trade-In Options

Looking to upgrade your car? Miami Auto Buyers offers trade-in options. Sell your old car and get credit towards purchasing a new one. It's a win-win situation!

Online Appraisal

Can't visit us in person? No worries! Use our online appraisal tool to get an estimate for your car. It's easy, convenient, and gives you an idea of what to expect.

Flexible Scheduling

We understand your busy schedule. That's why Miami Auto Buyers offers flexible appointment times. Whether it's a weekend or after hours, we're here to accommodate your availability.

Transparent Offers

No lowballing here! Miami Auto Buyers provides transparent and honest offers. We explain how we determine your car's value and ensure you understand every detail of the offer.

Community Focused

Miami Auto Buyers is proud to be a part of the Miami Hialeah community. We support local initiatives and contribute to the community's growth. Selling your car with us means supporting a local business that cares.

Satisfaction Guaranteed

Your satisfaction is our goal. Miami Auto Buyers goes above and beyond to ensure you're happy with the sale. From the first contact to the final payment, we strive to exceed your expectations.

Contact Us Today!

Ready to sell your car? Contact Miami Auto Buyers today! Our team is eager to assist you and make your car-selling experience Car buyer Miami Hialeah exciting and profitable. Don't wait – get cash for your car now!

Miami Auto Buyers is your trusted partner in Miami Hialeah for selling your car. With our expert team, competitive offers, and hassle-free process, you're in for an amazing experience. Sell your car with confidence and excitement – choose Miami Auto Buyers!

0 notes

Text

Great American Credit Repair offers professional credit repair services to help individuals in Pittsburgh, PA, and beyond regain financial freedom. With a focus on improving credit scores, our team works to remove negative items from credit reports and help clients rebuild their financial reputation. Most clients begin seeing results in as little as 45 days, with significant improvements often achieved in 90 days. Whether you're in Pittsburgh, Charlotte, NC, Miami, FL, or anywhere in Florida, we are committed to helping you achieve a brighter financial future. Visit us at 322 N Shore Dr Suite 200 - #103, Pittsburgh, PA 15212, United States, to start your journey to better credit today.

Great American Credit Repair

322 N Shore Dr Suite 200 - #103, Pittsburgh, PA 15212, United States

223-895-3525

.website: https://gacr.pro/

0 notes

Text

Prime Locations for Investment Property for Sale

Prime locations for investment property for sale offer unparalleled opportunities for significant returns and long-term value. Urban centers with strong job markets, such as New York, Los Angeles, and Miami, attract a steady stream of tenants, ensuring high occupancy rates. Coastal cities and tourist hotspots like Orlando and Las Vegas provide lucrative vacation rental prospects. Emerging markets with rapid economic growth, such as Austin and Nashville, promise substantial property appreciation. Additionally, areas with top-rated schools and amenities appeal to families, guaranteeing stable rental demand. Identifying these prime locations allows investors to capitalize on favorable market conditions, ensuring a profitable and secure investment in real estate.

Identifying the Best Markets for Investment Property for Sale

When seeking investment property for sale, it's crucial to identify markets with strong growth potential. Look for cities with robust job markets, population growth, and economic stability. Places like Austin, Texas, and Raleigh, North Carolina, have shown consistent demand for housing, making them excellent choices for property investment. These markets often offer favorable rental yields and potential for appreciation, ensuring a solid return on investment.

Evaluating the Condition of Investment Property for Sale

Before purchasing investment property for sale, thoroughly evaluate its condition. Inspect the property for structural integrity, necessary repairs, and overall maintenance. Properties in good condition require less upfront investment in renovations and can generate rental income more quickly. Additionally, well-maintained properties are more attractive to tenants, ensuring higher occupancy rates and consistent cash flow.

Financing Options for Investment Property for Sale

Securing financing for investment property for sale can be different from financing a primary residence. Investors have various options, including conventional loans, hard money loans, and private financing. Understanding the pros and cons of each financing method helps in selecting the best option to maximize return on investment. It’s also beneficial to have a strong credit score and a substantial down payment to secure favorable loan terms.

Analyzing the Rental Income Potential of Investment Property for Sale

A key factor in choosing investment property for sale is its rental income potential. Analyze the local rental market, average rental rates, and vacancy rates to estimate potential income. Consider properties in high-demand areas with low vacancy rates and stable rental prices. Additionally, look at the property's features, such as number of bedrooms, amenities, and proximity to schools or business districts, which can influence rental demand and income.

Understanding the Legal Aspects of Investment Property for Sale

Investing in property involves understanding various legal aspects. This includes zoning laws, property taxes, landlord-tenant laws, and building codes. It’s essential to conduct due diligence to ensure the investment property for sale complies with all local regulations. Consulting with a real estate attorney or a professional familiar with local real estate laws can prevent legal issues and protect your investment.

Leveraging Property Management for Investment Property for Sale

Effective property management is vital for the success of any investment property for sale. Consider whether you will manage the property yourself or hire a professional property management company. Professional managers can handle tenant screening, rent collection, maintenance, and legal compliance, freeing up your time and ensuring the property is well-maintained. This can lead to higher tenant satisfaction, reduced vacancy rates, and consistent rental income.

Forecasting Long-Term Appreciation of Investment Property for Sale

When evaluating investment property for sale, consider its long-term appreciation potential. Research historical property value trends in the area and future development plans that could impact property values. Locations with planned infrastructure improvements, new business developments, and community enhancements are likely to see property value increases. Investing in such areas can lead to substantial appreciation over time, adding to the overall profitability of your investment.

Conclusion

Identifying prime locations for investment property for sale is crucial for maximizing returns and ensuring long-term value. Urban centers with robust job markets, coastal cities with high tourist traffic, and emerging markets with rapid growth present excellent opportunities. Additionally, areas with top-rated schools and desirable amenities attract stable, long-term tenants. Thoroughly researching these prime locations and understanding local market dynamics can lead to lucrative investment decisions. By focusing on areas with strong demand, favorable economic conditions, and potential for property appreciation, investors can secure profitable and sustainable real estate investments, ultimately achieving their financial goals and building a successful property portfolio.

0 notes

Text

Sell Your House Fast in Miami: Your Ultimate Guide

If you're looking to sell your house fast in Miami, you've come to the right place. Miami's vibrant real estate market offers numerous opportunities for homeowners to sell their properties quickly and efficiently. Whether you're facing foreclosure, moving for a job, or simply need to liquidate your assets, we can help you navigate the process smoothly and get the best deal for your home.

Why Choose Miami?

Miami is not just a city; it's a lifestyle. Known for its beautiful beaches, diverse culture, and bustling nightlife, Miami attracts buyers from all over the world. This means there's always a high demand for properties, making it easier for you to sell your house quickly.

Steps to Sell Your House Fast

Prepare Your Home for Sale: First impressions matter. Make sure your home is clean, decluttered, and well-maintained. Consider minor repairs and touch-ups to increase its appeal.

Set the Right Price: Pricing your home competitively is crucial. Conduct a market analysis or hire a professional appraiser to determine the best price for your property.

Market Your Property: Utilize various marketing channels to reach potential buyers. Online listings, social media, and local advertisements can significantly boost your property's visibility.

Work with Professionals: Consider working with real estate agents or companies that specialize in quick home sales. They have the expertise and resources to expedite the process.

Benefits of Selling Your House Fast

Quick Cash: If you need immediate funds, selling your house fast can provide you with the necessary cash flow.

Avoid Foreclosure: If you're at risk of foreclosure, a quick sale can help you avoid damaging your credit score.

Move On: Whether you're relocating for work or starting a new chapter in your life, selling your house quickly allows you to move on without lingering stress.

Ready to Sell Your House Fast in Miami?

If you're ready to take the next step, we are here to help. Sell your house fast in Miami with our expert guidance and support. Contact us today to get started and take advantage of Miami's thriving real estate market.

For more information on how to sell your house fast in Miami, visit our website.

Trueway Sell My House Fast Miami Ltd 8330-8505 Mills Dr, Miami, FL 33183 (786) 733-3624

0 notes

Text

Your credit score is a crucial factor that lenders consider when deciding whether to approve your loan application and what interest rate to offer you. A higher credit score generally means you are a lower risk, which can lead to more favorable loan terms and lower interest rates. One factor that contributes to your credit score is your credit mix, which refers to the different types of credit accounts you have. In this article, we will explore how your credit mix affects your credit score and provide tips for maintaining a healthy credit profile.

0 notes

Text

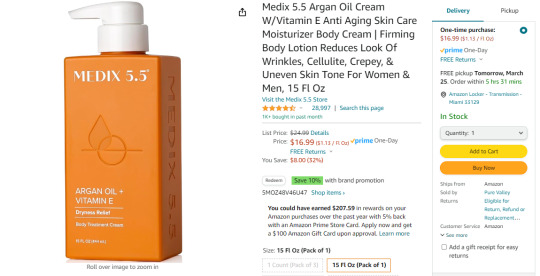

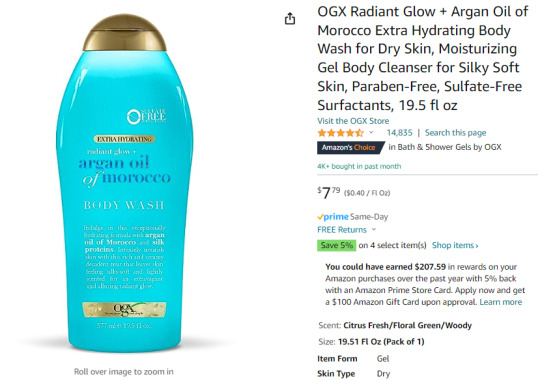

15 FL OZ - IS - BULK - SIZE

LARGE - LOVE - THIS - THE

SCENT - SPECTACULAR

LOTION - MY SCENT - NOW

ARGAN OIL - ANTI - AGING

THIS - WORKS - 4 - ME

CHECKING - MY - BUDGET

FIFTH THIRD - REVERSED

CREDIT - $119.07

LA FITNESS - HAS - MIAMI

RIGHTS - CAN - BODILY FL

REMOVED - U - AS - NAKED

FRONT - F - GLASS - DOOR

2ND - FLOOR - CAN - PUT U

THERE - NAKED - AND WET

15 MIN - B 4 - CLOSING

LA FITNESS - LOS ANGELES

FRANCHISE - NON-VIRGINS

IMMORAL - HUMANS

MIAMI - WORST - THEY'RE

NOT BRIGHT NON-VIRGINS

HOMOS - LESBIANS

LEGALLY - WED - AT

BRICKELL - LA FITNESS

IMMORAL LIKE - 53 . com

FIFTH - THIRD - BANK

LOW - TECHNOLOGY

LOVE - BAKER - ACT

DECLARED - ME

MENTALLY - ILL

PHILIPINES - GOLD - MEDAL

WOMEN - HEAVY - WEIGHTS

OVER - 400 LBS

MISS UNIVERSE - 2018 - 2015

4 TIMES - WON - PILIPINAS 2

WHY - MENTALLY - ILL

FEMALES BORN THERE

FLORIDA - HAITI - BLK

MEN - WOMEN - NEW

PAID - SERVITUDE

LOST SLAVES - SOUTH AFRICA

3.5 MILLION

AGE 80 - AGE 70 - AGE - 10 - 12

NOW BLKS - ILLEGALLY ARMED

PAID - SERVITUDE OF - FLORIDA

BLK - MEN - WOMEN - OF - HAITI

CHRISTIAN - VUDU - AND - VUDU

HAITI CATHOLIC BIBLE OFFICIAL

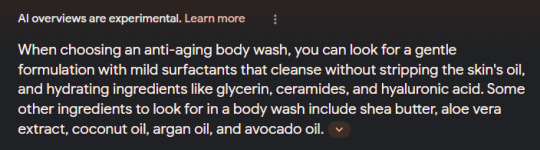

ANTI - AGING - BODY - WASH

MINE - $10.50 - NOT A - MILD

SURFACTANT - STRIPS SKIN's

OIL - HYDRATING - LIKE

GLYCERIN - AND - WHAT - IS

THERE - HYALURONIC - ACID

I - FELT - DIDN'T - LIKE - ACID

PERSUADED - BY GIANT KELP

APPLE - AVOCADO - SCENT

BUT - ITS - FIGHTING ABOVE

LOTION - PUMP - ARGAN OIL

NOT - KNOWING - DID - USE

GLYCERIN - ALSO

GOT - ANOTHER - CHEAPER

PARIS - FRANCE - WILL - LEARN

WHAT - 2 - TAKE - WHAT - NOT 2

TAKE - I'M - CREATING - SKIN - 2

CARE - WOULD - LIKE - 2 - TRULY

SPECIALIZE - IN - KIDS - BABY

SKIN - ACNE - REMOVAL WITH

BABY - CARE - AND - ANTI - YES

AGE - CREATING MY PRODUCTS

TOKYO - MALE - SCIENTISTS

THEIR - INPUT - MAJOR ALSO

JAPAN - OVER - 25 MILLION YRS

KOREA - OVER 1 MILLION YEARS

PARIS - OVER - 2,000 - YEARS

EUROPE - VS - ASIA

TURNING AGE 60 - APRIL 2O24

ARGAN - OIL - MY - RESCUE - 2

ARGAN - OIL - ALL - SKIN - TYPES

SAFE - 4 - ACNE - PRONE - SKIN 2

IMPROVES - SKIN - ELASTICITY

REDUCES - APPEARANCE - OF

FINE LINES - WRINKLES

TREATS -DRY SKIN - MAINTAINS

SKIN's - MOISTURE

ARGAN - OIL - LEAVE - IN - YES

CONDITIONER - REPAIRS

SPLIT - ENDS

TAMES - FRIZZ

PROTECTS HAIR - FR - HEAT

BLOW - DRYERS - THE - SUN

COCONUT OIL - NOT 4 OILY

SKIN - OR - ACNE - PRONE

MY - FACE - CAN - B - OILY

CAN'T USE - AS - MAKE - UP

REMOVER DIDN'T - WORK 4

MY - DRY - LIPS - ACTUALLY

AGE 60 - APRIL - 2024 - MY - NEED

IS - ARGAN OIL - LIGHTWEIGHT OIL

INDEED - RICH - IN - ANTIOXIDANTS

10 MIN - 2 - ORDER - GET - TODAY

2P - 6P - FREE - AT - HUB LOCKER

SCENT - WOODY - WORKS 4 ME

CITRUS - FRESH - LOVE - THIS 2

FLORAL - GREEN - ALSO GEL

4 - DRY - SKIN - BODY - WASH

ARGAN - OIL - OF - MOROCCO

GEL - BODY - CLEANSER

MOISTURIZING - SILKY - SOFT

SKIN - CHEAPER - $7.79 - TRUE

1 note

·

View note

Text

🌴 Miami Debt Relief: Your Path to Financial Freedom! 🌴

Struggling with credit card debt in Miami? You're not alone! With over 2 million Floridians burdened by credit card debt averaging over $5,000, it's time to break free. Discover the key to financial freedom with "Miami Credit Card Debt Relief."

🔑 Key Solutions for Credit Card Debt in Miami 🔑

Miami Credit Card Debt Relief offers a range of tailored solutions to help you regain control of your finances:

Debt Consolidation in Miami: Our Miami debt consolidation service simplifies your finances by merging multiple credit card debts into a single, manageable monthly payment. Plus, it could lead to lower interest rates, saving you money over time.

Credit Counseling in Miami: Our certified credit counselors work closely with you, providing personalized advice to navigate your financial situation and regain financial stability.

Bankruptcy in Miami: If your credit card debts seem insurmountable, our Miami bankruptcy attorneys can guide you through the process, helping you make the best decision for your situation.

Credit Repair in Miami: A good credit score is essential for financial stability. Our Miami credit repair experts will work diligently to fix errors in your credit report and boost your score, granting access to better loans and lower interest rates in the future.

🤝 Why Choose Us for Credit Card Debt Relief in Miami? 🤝

At "Miami Credit Card Debt Relief," we understand that every financial situation is unique. We take pride in offering customized solutions that align with your individual needs and financial goals. Our approach is rooted in trust, transparency, and exceptional customer service.

🏙️ Serving All of Florida 🏙️

Whether you reside in Miami Beach, Coral Gables, Kendall, or anywhere else in Florida, we're here to help you overcome financial challenges and achieve your goals. Credit card debt knows no boundaries, but with our assistance, you can break free.

📞 Call Today and Take Control of Your Financial Future! 📞

We know that taking the first step to tackle credit card debt can be daunting, but we're here to support you every step of the way. No matter how overwhelming your financial situation may seem, there's always a solution. Call us today at (877) 870-0717 to schedule a free consultation and embark on a journey toward credit card debt relief. Reclaim control over your finances and build a debt-free future!

🚀 Don't Wait, Act Today! Your Brighter Financial Future Awaits. 🚀

#MiamiCreditCardDebtRelief #FinancialFreedom #DebtConsolidation #CreditCounseling #Bankruptcy #CreditRepair #Miami #Florida 🌞💳🌴

#AlivioDeDeudaDeTarjetasDeCrédito #Miami #FinanzasPersonales #LibertadFinanciera #ConsolidaciónDeDeudas #ConsejeríaDeCrédito #Bancarrota #ReparaciónDeCrédito 🌴💰

#AlivioDeDeudaDeTarjetasDeCrédito#Miami#FinanzasPersonales#LibertadFinanciera#ConsolidaciónDeDeudas#ConsejeríaDeCrédito#Bancarrota#ReparaciónDeCrédito 🌴💰

0 notes