#CA IPCC

Explore tagged Tumblr posts

Text

CA IPCC / Intermediate Qualified + ACCA | Advance Your Accounting Career

Elevate your accounting career with our specialized program for CA IPCC / Intermediate qualified candidates who want to pursue ACCA. Our expert team provides comprehensive coaching and support to help you excel in the ACCA exams and advance in the field of accountancy. By integrating CA IPCC / Intermediate knowledge with ACCA qualifications, you'll enhance your expertise and position yourself for leadership roles, including CFO. Join us to gain the skills and credentials needed to thrive in the competitive world of accountancy.

#CA IPCC qualified ACCA coaching#Intermediate CA ACCA program#IPCC to ACCA pathway#Advanced accounting career coaching#CA IPCC ACCA preparation

0 notes

Text

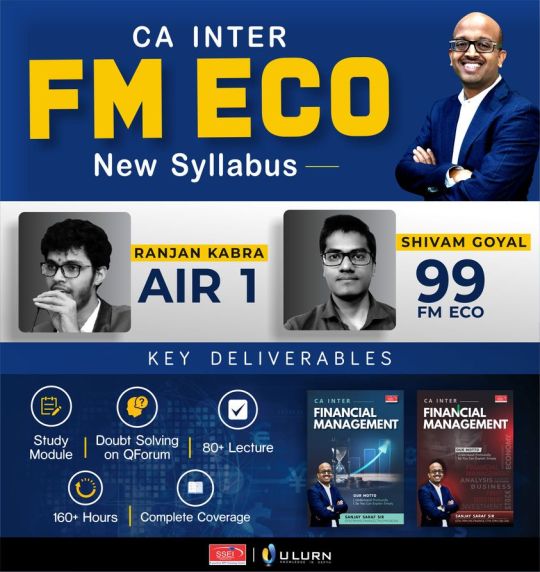

clear your exam with CA Final Intermediate New Syllabus online courses, study materials & video lectures for your CA Intermediate Exam exclusively at ULURN.

#CA Inter#CA Intermediate#best faculty for ca inter fm eco#ca inter fm eco#CA Intermediate Pendrive Classes#best pen drive classes for ca ipcc

0 notes

Text

CA Intermediate is second level exam in the Chartered Accountancy Course in India. The students after clearing the Common Proficiency Test or CA Foundation becomes eligible to register for the CA Intermediate.

#CA Inter#CA Intermediate#ca inter pendrive classes#best pendrive classes for ca ipcc#CA Intermediate Pendrive Classes#CA Inter EFF & FM Pendrive#best faculty for ca inter fm eco

0 notes

Text

PREPRight is a premier coaching institution providing high-quality education and courses to its students. We provide training to students from the preparation of professional courses like CA | CS | CMA | ACCA & more.

Teaching is not just our profession but our biggest passion. Here we endeavor to teach in a very innovative manner, making learning really interesting and fun for our students.

0 notes

Text

The Best Accounting Software for Small Businesses in 2023:

Introduction:

There are several accounting software options available for small businesses, including QuickBooks, Xero, FreshBooks, and Wave. These software programs can help small business owners manage their financial transactions, create invoices and track expenses, and generate financial reports. Some key factors to consider when choosing accounting software for a small business include the cost, ease of use, and the specific features and integrations that are important for the business's needs.

VNC is another term for perfection we are India's leading financial accounting and bookkeeping outsourcing Accounting Experts in India.

Accounting Expert in India:

An accounting expert is a professional with extensive knowledge and experience in the field of accounting. They may hold certifications such as a Certified Public Accountant (CPA) or Chartered Accountant (CA) and have a deep understanding of accounting principles, regulations, and financial reporting. They can assist with financial statement preparation, tax compliance, financial forecasting, budgeting, and other financial matters. It's important to note that accounting experts can specialize in different areas such as audit, tax, and management accounting.

What does an accountant do?

An accountant is a professional who performs financial tasks such as recording, classifying, and summarizing financial transactions to provide information that is useful in making business and economic decisions. Some of the specific responsibilities of an accountant include:

Recording and maintaining financial records, including those related to income, expenses, and assets.

Preparing financial statements such as balance sheets, income statements, and cash flow statements.

Analyzing financial information to identify and recommend ways to reduce costs and increase revenues.

Assisting with budgeting and forecasting.

Ensuring compliance with tax laws and regulations.

Providing advice on financial matters, such as raising capital or investing funds.

Auditing financial records to ensure accuracy and compliance with laws and regulations.

There are different types of accountants, such as public accountants, management accountants, and government accountants, each with its own specific responsibilities and focus areas.

Chartered Accountants in India:

Chartered Accountants (CA) in India are professionals who have completed a rigorous education and training process and have passed a series of exams in order to be recognized as a CA by the Institute of Chartered Accountants of India (ICAI). They are considered experts in the field of accounting, auditing, and tax.

VNC is another term for perfection we are India's leading financial accounting and bookkeeping outsourcing Accounting Experts in India.

The process to become a Chartered Accountant in India includes:

Completing an undergraduate program in commerce or a related field.

Registering as a student member of the ICAI.

Completing three levels of theoretical and practical education, including the Common Proficiency Test (CPT), the Integrated Professional Competence Course (IPCC), and the final exam.

Completing a certain period of practical training under a practicing CA.

Clearing an Ethics and Professionalism assessment.

Chartered Accountants in India are authorized to perform various roles such as auditing financial statements, filing tax returns, advising clients on tax planning and compliance, providing business and financial consulting services, and conducting internal audits for companies.

In addition, CAs are also authorized to provide services to the public, including certification of financial statements, providing opinions on financial matters, and carrying out due diligence exercises.

VNC is another term for perfection we are India's leading financial accounting and bookkeeping outsourcing Accounting Automation experts in Australia.

3 notes

·

View notes

Text

Documents Required for CMA Inter Registration 2025

The CMA Intermediate Registration 2025 is an essential milestone for candidates aiming to achieve the prestigious CMA certification. This stage plays a crucial role in advancing your career in cost accounting. By understanding the process, including the documents required for CMA Inter registration, eligibility criteria, and key deadlines, you can efficiently navigate through the registration steps and focus on exam preparation.

This article offers a detailed guide to help aspiring cost accountants register seamlessly for the CMA Intermediate level and prepare thoroughly for their exams.

Overview of CMA Intermediate Registration 2025

The CMA Intermediate Registration 2025 is conducted by the Institute of Cost Accountants of India (ICMAI). Successfully completing this level is mandatory to move forward to the CMA Final stage. The process involves meeting specific eligibility criteria, submitting required documents, and paying the applicable fees.

Registering early not only ensures eligibility but also provides candidates ample time to organize their study plans. With early preparation, you can enhance your understanding of the course material and increase your chances of success in the exams.

Documents Required for CMA Inter Registration

Preparing the documents required for CMA Inter registration is a critical step in ensuring a smooth application process. Submitting complete and correctly attested documents helps avoid delays and rejections. Below is a list of essential documents:

Matriculation Certificate:

An attested copy of your matriculation certificate is mandatory to verify your date of birth and identity.

10+2 Certificate or Marks Statement:

Include an attested copy of your higher secondary certificate or marks statement to confirm your educational qualifications.

Degree Certificate (if applicable):

Candidates who are graduates must provide an attested copy of their degree certificate.

Passport-Sized Photographs:

Three passport-sized photographs are required:

One photograph to paste on the application form.

One for the identity card.

An extra photograph to attach with the application form.

Attestation Authority:

Ensure all documents are attested by one of the following authorized individuals:

A member of ICMAI, ICAI, or ICSI.

A Gazetted Officer.

A Member of Parliament or State Legislative Assembly.

A college principal.

By preparing the documents required for CMA Inter registration in advance, candidates can avoid last-minute stress and ensure their application is processed without delays.

Eligibility Criteria for CMA Intermediate Registration

Before proceeding, candidates must ensure they meet the eligibility criteria for CMA Intermediate Registration 2025:

Citizenship:

Indian citizens are eligible to apply. Residents of select international locations like Dubai, Muscat, and Bahrain may also apply.

Educational Requirements:

Graduates or postgraduates from recognized universities.

Completion of the CMA Foundation course.

Candidates with equivalent qualifications such as CA IPCC Inter or CS Foundation.

Provisional Registration:

Students in the 4th semester or 2nd year of their undergraduate program can register provisionally. Their eligibility will be confirmed upon graduation.

Steps to Complete CMA Intermediate Registration

Follow these steps to complete your CMA Intermediate Registration:

Choose Your Registration Method:

Online registration: Visit the ICMAI website, upload scanned documents, and pay the fees online.

Offline registration: Submit physical documents and fees to the designated regional councils or chapters.

Submit Required Documents:

Ensure all documents required for CMA Inter registration are properly attested and submitted.

Pay the Registration Fee:

Fees can be paid online through the official ICMAI portal or via demand draft for postal registration.

Confirm Your Registration:

After completing the process, confirm your registration details to avoid discrepancies.

Why Early Registration is Important

Completing your registration early provides several advantages. It allows candidates to start preparing sooner, creating a structured study plan and increasing their focus on exam preparation. Early registration also ensures timely updates on important announcements from ICMAI, keeping you well-informed throughout your CMA journey.

Conclusion

The CMA Intermediate Registration 2025 is a critical step for aspiring cost accountants. By ensuring you meet the eligibility criteria and preparing the documents required for CMA Inter registration, you can confidently complete the registration process and focus on exam readiness. Early preparation is key to success, so take the first step toward achieving your CMA goals today.

0 notes

Text

CA Success Starts with the Right Institute in Hyderabad

INTRODUCTION

Becoming a Chartered Accountant (CA) is a highly rewarding career choice, not just in India but globally. The role of a CA goes beyond just balancing books; it’s about financial strategy, decision-making, tax planning, auditing, and ensuring financial transparency. However, the journey to becoming a successful CA begins with choosing the right institute. In Hyderabad, one name that stands out in guiding aspirants toward CA success is CMS for CA College. If you’re looking for the CA institutes in Hyderabad look no further than CMS FOR CA.

Why is Choosing the Right Institute Crucial for CA Success?

The Chartered Accountancy course is one of the most challenging academic pathways. It requires a strong foundation in accounting principles, taxation laws, auditing standards, financial management, and much more. A successful CA must not only be knowledgeable but also possess practical skills and a thorough understanding of real-world financial scenarios.

However, acquiring such knowledge and skillsets requires quality education, mentorship, and resources. That’s where choosing the right institute becomes paramount. The right institute doesn’t just teach theory; it equips students with the right tools, strategies, and confidence to succeed in the rigorous CA exams and excel in their professional careers.

CMS for CA College: Shaping Future CAs in Hyderabad

CMS for CA College in Hyderabad has established itself as a leading institution for aspiring CAs. With a comprehensive curriculum, experienced faculty, and a track record of producing successful CAs, CMS is the ideal place for students looking to build a strong career in the field of accounting and finance.

Experienced Faculty for Quality Education

At CMS for CA College, the first step toward success is provided by a team of highly qualified and experienced faculty members. Faculty at CMS are not only experienced in teaching but also have substantial professional experience in the field. Their expertise allows them to provide students with insights that go beyond the textbook, preparing them for real-life challenges. Whether it's clearing doubts, offering guidance on complex topics, or sharing industry insights, the faculty members are always accessible to students.

Comprehensive Curriculum

The Chartered Accountancy course is divided into three stages: CPT (Common Proficiency Test), IPCC (Integrated Professional Competence Course), and CA Finals. Each stage demands a thorough understanding of its syllabus, but more importantly, students need to develop a practical understanding of each subject to apply them effectively in the real world.

CMS for CA College offers a well-structured, in-depth curriculum for all three levels of the CA course. The curriculum not only aligns with the guidelines set by the Institute of Chartered Accountants of India (ICAI) but also includes practical exposure to ensure students are prepared for every aspect of the CA profession. This structured approach is crucial for CA aspirants to move forward step by step toward their goal.

Focused Approach to Exams

The CA exams are known for their rigor and challenge. With high competition and the complexity of the subjects, passing the exams requires hard work, dedication, and strategic preparation. CMS for CA College understands the importance of focused exam preparation and provides students with the right tools to succeed.

The college offers mock exams, test series, and regular assessments to keep track of progress. These mock exams mimic the real exam environment and help students identify their strengths and weaknesses. This constant practice and evaluation improve performance and ensure that students are exam-ready.

Personalized Mentorship and Guidance

Each student is unique, and their learning requirements may differ. CMS for CA College recognizes this and ensures that every student receives personalized attention. The college offers one-on-one mentorship, where students can discuss their challenges, seek advice on overcoming difficulties, and get customized solutions to excel in their exams and careers.

This mentorship is not limited to academic assistance. CMS faculty members also provide career guidance, helping students understand the various job opportunities available post-qualification, preparing them for interviews, and ensuring they are equipped for the corporate world.

State-of-the-Art Infrastructure

CMS for CA College understands that the learning environment plays a significant role in a student’s academic success. The college is equipped with modern infrastructure, including well-lit classrooms, comfortable seating arrangements, and advanced teaching tools. The college also provides a library with a vast collection of textbooks, reference materials, and case studies that aid students in their preparation.

Additionally, the college offers digital resources like online lectures, study materials, and access to e-books, which allow students to learn from anywhere and at any time. This flexibility ensures that students can pace their learning according to their schedules. If you’re looking for the CA institutes in Hyderabad look no further than CMS FOR CA.

Interactive Learning Environment

Gone are the days when learning was just about lectures and note-taking. Today, CA students need to engage with the subject matter actively to ensure better retention and application of knowledge. CMS for CA College focuses on creating an interactive learning environment where students can participate in discussions, debates, and case study analyses.

By actively engaging with the course material, students are able to gain deeper insights into various concepts and how they are applied in real-world scenarios. The interactive teaching methods enhance student involvement and foster a deeper understanding of complex topics.

Proven Track Record of Success

CMS for CA College has a remarkable track record of producing successful CAs who have gone on to achieve excellence in their careers. The college’s alumni network is vast, with graduates holding prestigious positions in leading companies, financial institutions, and government bodies. This strong alumni network plays a crucial role in providing students with networking opportunities and career prospects.

The college’s consistent success in producing top-performing students in the CA exams is a testament to its dedication and commitment to quality education.

Placement Assistance and Career Support

The journey to becoming a CA doesn’t end with passing exams. CMS for CA College goes the extra mile in ensuring its students are well-prepared for the professional world. The college offers placement assistance, helping students secure jobs in top organizations across various sectors. Whether it's tax consulting, auditing, corporate finance, or financial planning, CMS students are equipped with the knowledge and skills to excel in their careers. If you’re looking for the CA institutes in Hyderabad look no further than CMS FOR CA.

In addition to job placement, CMS for CA College also offers guidance on starting your own practice as a CA. The college prepares students for entrepreneurship and provides them with the tools and strategies needed to succeed as self-employed professionals.

Conclusion

Success in the Chartered Accountancy exam and career doesn’t come easy. It requires the right blend of education, mentorship, resources, and strategic preparation. CMS for CA College in Hyderabad stands out as one of the best institutions for aspiring Chartered Accountants, offering a comprehensive, student-focused approach that caters to all aspects of CA education and career development.If you're looking to start your journey toward becoming a successful CA, CMS for CA College in Hyderabad should be your top choice. With expert faculty, a well-structured curriculum, personalized mentorship, and a track record of excellence, CMS for CA College is the perfect partner in your CA success story.

0 notes

Text

Best CA Academy in Hyderabad

Achieving your dream of becoming a Chartered Accountant (CA) is no small feat, but with the right guidance, success is well within reach. Hyderabad has emerged as a hotspot for some of the premier CA coaching centers, renowned for its expert faculty, structured study plans, and exceptional student success rates. In addition to the quality of teaching, many coaching institutes in Hyderabad are now harnessing the power of CMS to offer a more dynamic and efficient learning experience. In this post, we’ll explore how these top CA coaching centers are using CMS to elevate student performance and help aspirants realize their CA goals.

Why CA Coaching in Hyderabad Stands Out

Hyderabad’s coaching centres are well-known for producing CA professionals who excel in their careers. Institutes such as CMS for CA Coaching Academy and popular among students for their intensive preparation programs. These programs cover all levels of the CA examination—CPT, IPCC, and Final—with specialized training modules that prepare students for each stage. If you’re looking for the Best CA Academy in Hyderabad then look no further than CMS FOR CA. However, what truly sets these institutes apart is their ability to blend traditional classroom teaching with cutting-edge technology, specifically through the use of CMS platforms.

How CMS Enhances the Learning Experience for CA Aspirants

Content Management Systems have revolutionized the education sector, and CA coaching is no exception. The implementation of CMS in coaching institutes has made it possible to create more organized, accessible, and interactive learning environments. Here’s how CMS adds value to CA coaching centres:

1. Streamlined Access to Study Material

With CMS, students have 24/7 access to all their learning resources, whether it’s study materials, recorded lectures, or practice exams. Instead of relying solely on physical textbooks or attending in-person classes, students can engage with digital content anytime, allowing them to study at their own pace.

2. Enhanced Communication Between Teachers and Students

A CMS platform facilitates smooth communication by integrating discussion boards, chat systems, and announcements. Students can reach out to their instructors to clear doubts, submit assignments, and receive feedback promptly. This seamless communication ensures that students stay connected with their mentors throughout the learning process. If you’re looking for the CA Academy in Hyderabad then look no further than CMS FOR CA.

3. Personalized Learning Paths

Every CA aspirant is unique, with varying strengths and areas of improvement. CMS enables coaching centres to create personalized learning paths for students, tailoring lessons to suit individual needs. With features like progress tracking and performance analytics, students can focus on areas where they need more practice, optimizing their preparation for exams.

4. Efficient Assessment and Mock Exams

Mock tests and regular assessments are crucial for CA preparation. CMS platforms provide an easy way to administer, grade, and analyze these tests. Students receive instant results, along with detailed feedback on their performance. This helps them track their improvement and make necessary adjustments to their study strategies.

5. Remote Learning Opportunities

In today’s fast-paced world, not all students can attend classes in person. CMS allows institutes to offer hybrid or fully online courses, enabling students to attend live lectures, participate in discussions, and complete assignments remotely. This flexibility is particularly beneficial for working professionals or students living in remote areas who want to pursue CA without compromising on quality coaching.

The Future of CA Coaching: A Blend of Tradition and Technology

The integration of CMS in CA coaching centers is more than just a trend—it represents the future of education. By blending traditional face-to-face teaching with innovative digital tools, Hyderabad’s premier coaching institutes are giving students the best of both worlds. CMS ensures that students are not only well-prepared academically but also equipped with the skills to navigate an increasingly digital professional landscape. If you’re looking for the Best CA Academy in Hyderabad then look no further than CMS FOR CA.

0 notes

Text

Best Ca Classes in Banglore

Looking for the best CA classes in Bangalore? Whether you're just starting your journey toward becoming a Chartered Accountant or are preparing for advanced levels of the CA exam, Bangalore offers a range of top-quality coaching centers to help you succeed.

The best CA classes in Bangalore provide a comprehensive curriculum that covers all aspects of the Chartered Accountancy course, from CPT (Common Proficiency Test) to IPCC (Integrated Professional Competence Course) and CA Final. These classes are taught by experienced faculty members who are experts in accounting, taxation, auditing, and law, ensuring that you receive a strong theoretical foundation combined with practical knowledge.

Many of these institutions also offer personalized coaching, doubt-solving sessions, and mock exams to help students assess their progress. They use modern teaching methods, including online learning resources, which is especially beneficial for students balancing their studies with work or other commitments.

In addition to excellent academic coaching, these CA classes in Bangalore also provide guidance on time management, exam strategies, and stress management, giving you a holistic approach to cracking the CA exams. With a track record of producing top ranks, these coaching centers are an ideal choice for those aspiring to excel in the CA exams and build a successful career in accounting and finance.

0 notes

Text

CA Final Registration for May 2025 : Full Details

The CA Final registration is available year-round, but students have to finish it before the deadline. To apply, see the CA Final Registration deadlines for the May and November sessions here.

The deadline for CA Final Registration for May 2025 is January 1, 2025. To register for the CA Final course online, go to the SSP site and enter your registration ID and password. Next, select the student cycle, fill out the registration form, sign the required documents, and pay. Furthermore, the expenses will also be paid online.

CA Final Registration May 2025: To be able to participate in the CA Final course, students must complete both the CA Inter groups and two and a half years of articleship instruction. ICAI administers the CA Final Exam twice a year. Scroll down to find out more about the CA Final course’s eligibility requirements, deadline, necessary documents, price, validity, and other specifics.

ICAI CA Final Registration May 2025

Candidates who want to register for the CA Final course should be aware of the deadlines, as the ICAI CA Final Registration deadline for the May 2025 exams is January 1, 2025.

Check the table below to know the essential dates:ParticularsDetailsLast Date for ICAI CA Final Registration May 2025January 1, 2025Exam Form AvailabilityIn February 2025Exam DatesNot Announced Yet

Students must also apply online for the CA Final Registration using the BOS Portal on the official icai.org website. Students who passed both CA Inter groups are eligible to take the CA Final exams prior to beginning their articleship. They will save time because they won’t have to wait six months after completing the articleship.

However, students who successfully completed the CA Intermediate groups on their own need to register for the CA Final exams before the deadline.

One-Month Strategy for Effective CA Final Preparation

Eligibility Criteria for the CA Final Registration 2025

Applicants must confirm that they fulfill all of the eligibility requirements established by ICAI before to submitting the registration form. To find out if you qualify for CA Final May 2025.

Should have passed the CA Intermediate/CA IPCC Examination with a minimum of 50% aggregate percentage and 40% marks for each subject.

Have completed at least 2.5 years of articleship training.

Step-by-Step Guide to Register for CA Final Exam 2025

The process to register for the CA Final Course online through the SSP portal is as follows:

Visit the ICAI’s official website and go to the SSP portal.

Enter the previous registration ID and password.

Afterwards, choose “Student Cycle” and then CA Final Course.

Now, you’ll see the registration form page where the basic details (of Intermediate) are mentioned. Check all the details and submit the required documents.

Students then need to pay the CA Final Registration Fee of Rs. 22,000 via Debit Card, Credit Card, or Net Banking.

Enter the Re-captcha to confirm the payment for the registration.

You then need to download the PDF containing your registration number and other necessary data. Students who make mistakes or try to change the language, the testing site, or the elective paper must wait for the first free corrective window to open.

Students will get their CA Final study materials at their current address via the Centralized Dispatch System (CDS).

Documents Required for CA Final Registration 2025

When submitting the registration form, students need to provide specific papers. Therefore, review the paperwork needed to sign up for the CA Final course and make sure you have scanned copies on hand.

Signature of the student.

Passport Size Photo

CA IPCC/Intermediate examination result, attested copy.

CA Foundation/CPT examination attested copy.

Nationality Certificate of the student.

A copy of the special category certificate

Important Details Required for ICAI Final Registration 2025

Students and their Parents Name.

Scanned mark sheet of CA Inter

Mobile Number and Address

DOB and Gender

Nationality

Email Address of the applicant

Roll Number and Marks of CA Inter/IPCC

Social Category of the Student

Preparation Strategy For CA Final Group 1 Nov 24

ICAI CA Final Registration Fees for Both Groups 2025

The table below mentions the ICAI CA Final course fees for single and both groups.Total Fees for CA Course: CA FinalParticularsSingle GroupBoth GroupsIndian StudentsForeign Students (US$)Indian StudentsForeign Students (US$)Registration fee––₹22,000$1100Total––₹22,000$1100Practical Training Fees––₹14,500Examination Fees₹1,800$325₹33,00$550Total₹18,00$325₹39,800$1650

ICAI CA Final Registration Fees 2025

The CA Final registration fee for both groups is Rs. 22,000. The overseas students have to pay registration fees of US $1000.NationalityCA Final Registration FeesIndian StudentsRs. 22000Overseas Students$ 1100

Next Steps After Registering for the CA Final Course - May 2025

Once you’ve registered for the CA Final Course for May 2025, it’s crucial to map out a clear plan to maximize your preparation. Here’s a step-by-step guide to help you stay organized and focused:

Design a Study Schedule Allocate dedicated study hours to each subject, emphasizing both conceptual understanding and rigorous practice. Create a study timetable that allows you to complete the syllabus by March 2025, reserving April for focused revision.

Collect Essential Study Material Gather all necessary materials, including ICAI modules, practice manuals, and relevant reference books. Use mock test papers and previous years’ question papers to familiarize yourself with the exam format.

Consider Enrolling in Coaching for Support If there are subjects you find particularly challenging, enrolling in a coaching program could offer structured guidance and provide clarity on complex concepts.

Develop a Revision Strategy Plan for at least two thorough rounds of revision before the exams. Give extra attention to high-weightage subjects and challenging topics to ensure you’re well-prepared.

Prioritize Practical Training Continue with your Articleship, aiming to gain exposure in areas related to the CA Final syllabus. Hands-on experience will deepen your understanding of the subject matter.

Stay Informed and Motivated Keep up with ICAI updates, participate in study groups, and maintain a balanced lifestyle to stay energized and focused.

By following this roadmap, you’ll be well-equipped to complete the syllabus effectively and confidently face the May 2025 CA Final exams.

designed to cover every aspect of the syllabus. Their expert faculty and proven teaching methodologies can provide you with the support and clarity needed to tackle challenging subjects, making your path to CA success smoother and more focused.

Procedure to Check CA Final Regsitration Status

Go to the SSP site and view the student’s dashboard.

Sign up as an already-enrolled student.

Complete the online revalidation form and submit it.

The revalidation fee is Rs 500.

Once you have been revalidated, you can sit for the upcoming CA Final exams. The revalidation date must be included in the CA Final Exam application.

CA Final Registration Validity

The CA Final Registration has a five-year validity period. You can try up to ten times in those five years. During these five years, if you fail the exam, you have to reapply for the registration form.

The changes to the CA course have been communicated to us by ICAI. The CA New method allows for a ten-year enrollment period for the CA Final course.

Conclusion

Completing the CA Final registration process is just the beginning of your journey toward becoming a Chartered Accountant. With the right preparation strategy and dedication, you can approach the May 2025 exams confidently. For students seeking structured guidance, Lakshya Edu in Hyderabad offers comprehensive CA coaching

0 notes

Text

CA Final Registration for May 2025: Last Date, Fees and Eligibility

The CA Final Registration May 2025 registration deadline is January 1, 2025. Enter your registration ID and password to access the SSP portal and register for the CA Final course online. After that, choose the student cycle, complete the registration form, certify the necessary paperwork, and make the payment. Additionally, the costs will be paid online as well.

CA Final Registration May 2025: Students must finish both CA Inter groups and 2.5 years of articleship training in order to be eligible to enroll in the CA Final course. The CA Final Exam is administered by ICAI twice a year. Learn about the CA Final course’s eligibility requirements, deadline, required documents, costs, validity, and other details by scrolling down.

ICAI CA Final Registration May 2025

The ICAI CA Final Registration deadline for the May 2025 tests is January 1, 2025, thus candidates who wish to register for the CA Final course must be aware of the deadlines.

Check the table below to know the essential dates:CA Final Important Dates May 2025ParticularsDetailsLast Date for ICAI CA Final Registration May 2025January 1, 2025Exam Form AvailabilityIn February 2025Exam DatesNot Announced Yet

Additionally, students must apply online using the BOS Portal on the official icai.org website for the CA Final Registration. Before starting their articleship, students who passed both groups of the CA Inter can apply for the CA Final exams. They won’t have to wait six months after finishing the articleship, which will save them time.

Students who passed the CA Intermediate groups independently, however, must sign up for the CA Final exams prior to the deadline.

CA Final Preparation Strategy for the Last One Month

Eligibility Criteria for the CA Final Registration

Applicants must confirm that they fulfill all of the eligibility requirements established by ICAI before to submitting the registration form. To find out if you qualify for CA Final May 2025.

● Should have passed the CA Intermediate/CA IPCC Examination with a minimum of 50% aggregate percentage and 40% marks for each subject. ● Have completed at least 2.5 years of articleship training.

Step-by-Step Guide to Register for CA Final Exam

The process to register for the CA Final Course online through the SSP portal is as follows:

1. Visit the ICAI’s official website and go to the SSP portal. 2. Enter the previous registration ID and password. 3. Afterwards, choose “Student Cycle” and then CA Final Course. 4. Now, you’ll see the registration form page where the basic details (of Intermediate) are mentioned. Check all the details and submit the required documents. 5. Students then need to pay the CA Final Registration Fee of Rs. 22,000 via Debit Card, Credit Card, or Net Banking. 6. Enter the Re-captcha to confirm the payment for the registration.

After that, you must download the PDF with your registration number and essential information. Students must wait for the free correction window 1 to open if they make a mistake or attempt to alter the language, the testing location, or the elective paper.

The Centralized Dispatch System (CDS) will be used to distribute the CA Final study materials to the student’s current address.

Documents Required for CA Final Registration

Students must submit certain documents when filing the registration form. So, check out the documents required to register for the CA Final course and keep the scanned copies with you.

● Signature of the student. ● Passport Size Photo ● CA IPCC/Intermediate examination result, attested copy. ● CA Foundation/CPT examination attested copy. ● Nationality Certificate of the student. ● A copy of the special category certificate

Important Details Required for ICAI Final Registration

● Students and their Parents Name. ● Scanned mark sheet of CA Inter ● Mobile Number and Address ● DOB and Gender ● Nationality ● Email Address of the applicant ● Roll Number and Marks of CA Inter/IPCC ● Social Category of the Student

CA Final Course Nov 2024

ICAI CA Final Registration Fees for Both Groups

The table below mentions the ICAI CA Final course fees for single and both groups.

td style=”border: 1px solid black; padding: 10px;”>3. Linear Inequalities with Objective Functions and Optimization20%-30%Total Fees for CA Course: CA FinalParticularsSingle GroupBoth GroupsIndian StudentsForeign Students (US$)Indian StudentsForeign Students (US$)Registration fee––₹22,000$1100Total––₹22,000$1100Practical Training Fees––₹14,500–Examination Fees₹1,800$325₹3,300$550Total₹1,800$325₹39,800$1650

ICAI CA Final Registration Fees

The CA Final registration fee for both groups is Rs. 22,000. The overseas students have to pay registration fees of US $1000.CA Final Registration FeesNationalityCA Final Registration FeesIndian StudentsRs. 22000Overseas Students$ 1100

Things to do After Registering for CA Final Course May 2025

After registering for the CA Final Course for May 2025, here’s a roadmap to keep your preparation on track:

1. Plan a Study Schedule: Divide your time wisely among all subjects, focusing on concepts and practice. Create a timetable covering the entire syllabus by March 2025, leaving April for revision. 2. Gather Study Material: Get ICAI modules, practice manuals, and recommended reference books. Use mock test papers and past year question papers to understand the exam pattern. 3. Enroll in Coaching if Needed: Consider enrolling in coaching for challenging subjects. This can provide structured guidance and help clarify doubts. 4. Set Up a Revision Strategy: Plan at least two rounds of revision before the exams. Allocate extra time to subjects with high weightage and complex topics. 5. Focus on Practical Training: Continue your Articleship and try to gain exposure to areas relevant to the CA Final syllabus. Real-life applications will strengthen your understanding. 6. Stay Updated and Motivated: Follow ICAI announcements, stay connected with study groups, and maintain a balanced routine for optimal performance.

This approach will ensure you cover the syllabus effectively, boosting confidence for the May 2025 CA Final exam.

CA Final Registration Validity

The validity of the CA Final Registration is five years. You may make up to ten attempts within that five years. You must reapply for the registration form if you are unable to pass the exam within these five years.

We have been informed by ICAI of the modifications to the CA course. The CA Final course registration is valid for ten years under the CA New system.

Procedure to Check CA Final Regsitration Status?

1. Visit the student’s dashboard in the SSP portal. 2. Register as an existing student. 3. Fill out and submit the revalidation form online. 4. Pay Rs 500 for the revalidation fee.

You can take the forthcoming CA Final examinations after revalidation. In the application for the CA Final Exam, you must provide the revalidation date.

Conclusion

In conclusion, preparing for the CA Final exam requires diligent planning, dedication, and timely action. By keeping track of the registration dates, fees, and eligibility criteria, you can ensure a smooth journey toward your CA qualification. Registering for the May 2025 attempt well in advance is key to avoiding last-minute stress and focusing fully on your preparation.

For those seeking structured guidance, enrolling in a reputable coaching institute can make a significant difference. Agrawal Classes, recognized as one of the best CA coaching institutes in Pune, provides comprehensive support and tailored strategies to help students excel in their CA journey.

0 notes

Text

Maximize Your CA Final & IPCC/Inter Prep with CS Executive Past Papers for Aspiring CAs

Achieving success in CA Final and IPCC/Inter exams requires knowledge, practice, and effective resources. Our CS Executive Past Papers are the perfect tool for candidates looking to master their exam preparation. By practicing real exam questions, you familiarize yourself with the format and gain confidence. Analyzing trends in question types and topics helps you prioritize your study efforts. Each paper is accompanied by solutions, offering instant feedback and tracking your progress. Our extensive collection is designed for both CA Final and IPCC/Inter candidates, ensuring you have the materials best suited to your study needs. Integrating these past papers into your study routine will equip you with the knowledge and confidence to excel.

0 notes

Text

clear your exam with CA Final Intermediate New Syllabus online courses, study materials & video lectures for your CA Intermediate Exam exclusively at ULURN.

#CA Inter#CA Intermediate#ca inter fm eco#best faculty for ca inter fm eco#CA Intermediate Pendrive Classes#ca inter pendrive classes#best pen drive classes for ca ipcc

0 notes

Text

#1 Best CA Coaching Institute in Jaipur | Best CA Coaching Institute | CA Coaching Institute in India | VSI Jaipur

VSI Jaipur is the best CA Coaching Institute in India, offering classes for all the levels of the CA course. By providing quality teaching, personalized guidance and conducting regular mock tests, VSI became the only CA Coaching in India whose students got the ever-highest marks in IPCC, Intermediate & Final.

VSI Jaipur has built a reputation as the best CA Coaching Institute in India, known for consistently producing top rankers in all levels of the Chartered Accountancy (CA) exams—Foundation, Intermediate (formerly IPCC), and Final. The institute follows a results-driven approach that emphasizes the following key features:

Experienced Faculty VSI Jaipur boasts a team of highly experienced and qualified faculty members who are experts in their respective subjects. They employ a teaching methodology that simplifies complex concepts, ensuring students grasp even the most challenging topics.

Personalized Guidance One of the standout features of VSI is its personalized approach to student guidance. Faculty members and mentors offer one-on-one counseling to address each student's individual needs, weaknesses, and strengths. This personal attention ensures that students stay on the right path toward success.

Comprehensive Study Material The study material provided by VSI is meticulously crafted to align with the latest CA syllabus. It includes detailed explanations, practical examples, and a large variety of practice questions, which help students build a strong foundation in each subject.

Regular Mock Tests and Assessments Regular mock test series are a hallmark of VSI Jaipur's coaching program. These tests are conducted in an exam-like environment, helping students practice time management and exam strategy. VSI evaluates these tests thoroughly and provides detailed feedback to help students identify and improve on their weaknesses.

Unparalleled Results VSI is the only CA institute in India whose students have consistently achieved the highest marks in the IPCC, Intermediate, and Final CA exams. Notably, VSI Jaipur produced AIR 1 in CA Final May 2018 and CA Intermediate May 2022, among other top-ranking students over the years. These results speak volumes about the effectiveness of its teaching methodology.

Updated Curriculum The curriculum at VSI Jaipur is updated regularly in line with the latest changes in ICAI's guidelines and exam patterns. This ensures that students are always well-prepared for the current exam standards.

Small Batch Size VSI Jaipur maintains small batch sizes to ensure that each student receives personalized attention. This allows the faculty to engage more closely with each student, answer questions more effectively, and ensure thorough understanding.

Doubt Clearing Sessions Frequent doubt-clearing sessions are conducted where students can interact directly with the faculty to clarify any questions they might have. This ensures that no student is left behind, and all doubts are addressed timely.

Focus on Conceptual Clarity Rather than encouraging rote learning, VSI Jaipur emphasizes a deep understanding of fundamental concepts. This approach not only helps students score well in exams but also equips them with the analytical skills required for a successful career as a Chartered Accountant.

Online and Offline Coaching VSI offers both online and offline classes, allowing students from all across India to access their quality education. The online classes are designed to provide the same level of interaction and engagement as traditional classroom settings, making it convenient for students to study from anywhere.

Proven Track Record VSI Jaipur’s proven track record over the years has made it the most trusted name in CA coaching. The institute continues to deliver top results, making it the go-to choice for CA aspirants.

1 note

·

View note

Text

CA or ACCA -Which is better option?

When deciding between ACCA (Association of Chartered Certified Accountants) and CA (Chartered Accountant) as a career path, it’s important to understand the key differences, advantages, and focus areas of both certifications. Here's a more detailed breakdown:

ACCA (Association of Chartered Certified Accountants)

1. Global Recognition: One of ACCA’s biggest advantages is its global reach. It is recognized in over 180 countries, including key financial hubs such as the UK, UAE, Singapore, and parts of Europe. This makes ACCA an excellent choice for professionals aiming for an international career or planning to work in multinational corporations. The global focus of ACCA prepares candidates to work with diverse financial regulations and international standards.

2. Flexibility in Completion: The ACCA course can be completed in a relatively short time, typically within 2 to 3 years, depending on the candidate's dedication and pace of study. This flexibility makes it suitable for professionals who want to complete their certification quickly and enter the workforce. Additionally, ACCA offers flexible study options, allowing students to study part-time while working.

3. Exemptions for Relevant Qualifications: Candidates with prior relevant qualifications such as degrees in accounting, finance, or even certain business management fields may be eligible for exemptions from some of ACCA’s 14 exams. This feature speeds up the process for candidates with advanced qualifications, reducing the time needed to become fully certified.

4. Course Structure: ACCA is divided into two key levels:

Fundamentals: This level includes knowledge-based exams that cover essential topics like Financial Accounting, Management Accounting, and Business and Technology.

Professional: This level focuses on advanced topics such as Corporate Reporting, Strategic Business Leadership, and Advanced Financial Management. This blend ensures that ACCA graduates are well-rounded in both the theoretical and practical aspects of finance and accounting.

5. Career Path: With ACCA, graduates can pursue various roles, including accounting, finance, auditing, management consulting, and even corporate finance positions in multinational organizations. The certification is highly valued for finance roles that require an understanding of global markets, regulatory compliance, and international financial reporting standards (IFRS).

CA (Chartered Accountant - India)

1. Local Recognition and Prestige: In India, the CA certification carries significant prestige. The Institute of Chartered Accountants of India (ICAI) is the regulating body, and its qualifications are highly respected. CA is the most recognized qualification for accounting, auditing, and taxation professions within India. Employers, particularly in accounting firms, banks, corporate houses, and government agencies, often prefer CA-certified professionals due to their in-depth knowledge of Indian tax laws and accounting standards.

2. Duration and Rigor: Becoming a CA typically takes longer—around 4 to 5 years—owing to the structure and requirements of the course. The course is known for its rigorous exams, with a low pass percentage, which adds to its prestige. The path to becoming a CA includes completing the Foundation Course (formerly CPT), followed by Intermediate (IPCC) and Final exams, along with a mandatory 3-year articleship (practical training) under a practicing Chartered Accountant.

3. Eligibility: Students can start preparing for CA after completing their 12th grade through the CA Foundation Course. Graduates can also directly enter the CA Intermediate level, which gives some flexibility in starting the CA course at different points in their education.

4. Course Structure: The CA program consists of three key stages:

Foundation: Basics of accounting, law, and economics.

Intermediate: More detailed subjects like financial management, taxation, auditing, and advanced accounting.

Final: The final level covers advanced topics in auditing, corporate laws, financial reporting, and strategic financial management.

5. Career Path: In India, CA-certified professionals often secure top roles in accounting, auditing, taxation, and financial management. CAs are also sought after for roles in internal and statutory audits, tax advisory, risk management, corporate governance, and consultancy. They can also open their own practices or join firms that specialize in tax, accounting, and auditing services.

Comparison and Key Differences

Recognition: ACCA has a more global recognition, making it ideal for those who want international exposure. CA, on the other hand, is more regionally focused on India and is the top qualification for accounting professionals in the country.

Time and Flexibility: ACCA is faster to complete (2-3 years) with flexible exam timings, while CA takes longer (4-5 years) and requires a mandatory articleship for practical experience.

Course Structure and Specialization: ACCA’s course is divided into international accounting standards and offers flexibility in electives. CA is highly focused on Indian laws, tax policies, and accounting standards, making it ideal for those who wish to specialize in Indian markets.

Career Opportunities: ACCA graduates are likely to work with multinational companies, often in financial hubs globally, or pursue roles in international financial reporting. CA professionals are more likely to work in the Indian corporate, financial, and government sectors. However, a CA can also pursue opportunities abroad by clearing local certifications or additional qualifications like ACCA or CPA.

Which One Should You Choose?

The decision between ACCA and CA depends largely on your career goals and where you want to work:

For a global career or working in multinational companies, ACCA is a better fit. It equips you with skills and knowledge recognized worldwide and gives you flexibility in terms of specialization.

If you plan to work in India, particularly in fields like auditing, taxation, or setting up your own practice, CA has the upper hand. It’s more prestigious and widely accepted in Indian firms.

ACCA’s Flexibility vs. CA’s Rigor: ACCA offers a structured but more flexible pathway to become a globally certified accountant, while CA is more rigorous with its longer duration and mandatory practical training. If you prefer a faster certification and a career that might take you abroad, ACCA is the better option. But if you're interested in long-term stability within India, CA offers immense value.

Ultimately, the choice between ACCA and CA should reflect your aspirations, whether you aim to work in India or internation

0 notes

Text

Leseprobe von meiner Homepage

August 2024: (Etwas schwitzend niedergeschrieben, daher nur kurz). Könnte man auch als Grusel dich mal, Teil 3 bezeichnen....

Am Horizont taucht es auf: das Gespenst "Klassentreffen", und noch dazu ein Jubiläum nächstes Jahr (welches, verrate ich hier nicht :). Erste Anzeichen: das Rundschreiben eines (ehemals eher schüchternen) Schülers, an ca. 30 Leute gerichtet, mit der Bitte um Aktualisierung der email-Adressen (und vermutlich auf reges Interesse hoffend). Ich weiß ja nicht, ob einige an seine neue Adresse zurück geschrieben haben, jedenfalls gingen auf das allgemeine Rundschreiben nur drei Antworten ein. ("Ihr Lieben!") Soviel zum allgemeinen Interesse. Wie sagte Walken so schön? "Ich falle am besten auf, wenn ich nicht anwesend bin". Oder so ähnlich.

Es ist heiß. Und das seit Tagen. Natürlich, wir haben Hochsommer, das Heu trocknet wunderbar, dafür versinken die Menschen in Schweißbädern. Von Motten-, Gelsen- und Mückenschwärmen habe ich ja schon berichtet, aber nun steht auch die Wespenzeit vor der Tür, wenn die Zwetschken/Pflaumen am Baum reifen. Fliegen die (Wespen) eigentlich in offene Münder?

Schlimm, wenn man ein Rezept oder auf die Schnelle einen Zahnarzt braucht, es ist ja schließlich Urlaubszeit. Krabbeliger Nachtrag: Gelsen stechen ja am liebsten des Nachts. Woher sie trotz Gelsenstecker kommen, ist mir ein Rätsel.

Im Auto bin ich nur unterwegs, wenn es nicht anders möglich ist. Und, der unausgesprochene Zwist: Klimaanlage- ja oder nein? Wenn ich sie mal dringend brauche, (da nimmt man sogar den Luftzug und drohende Nackensteife in Kauf), kann man den Tropenurlaub getrost nach Österreich verlegen. Ich hoffe, Pferdekutschen haben Hitzeferien und Hunde und Kinder werden nicht im Auto vergessen. btw: Kaninchen sind sehr hitzeempfindlich! Bitte den Fellnasen einen kühlen Rückzugsort bieten....bitteee!

Ferragosto: 90.000 Italiener in Tirol!In Italien ist Ferragosto. Man sieht es an den Kolonnen von Reisebussen und der vorherrschenden Innsbrucker Stadt-Sprache. Kein Einheimischer würde sich in den Mittagsstunden auf die brühend heißen Straßen wagen. Aber 35 Grad im Schatten zaubern dem Südländer ein seliges Lächeln ins gebräunte Gesicht, denn auch an italienischen Stränden herrscht dieser Tage Hochbetrieb. Ein Grillhähnchen neben dem anderen und ein paar Brathühner dazwischen. Ich verfolge regelmäßig die Kurier-Kolumne über einen italienischen Spatzi-Doktor (sprich Urologen), und der taut laut seiner Wiener Angetrauten bei diesen Temperaturen erst richtig auf.

Bei uns nur das Gletschereis oder solches im Stanitzel.Mittlerweile werden Hitzewarnungen bereits in Deutschland ausgerufen. So gerne ich (gemäßigte) Gewitter mit Abkühlung habe, Unwetter mit Hagelstürmen sind eher gefürchtet (nicht nur bei der Hagelversicherung). Heult irgendwo die Sirene, wird es bereits kritisch. An dieser Stelle: ein Riesen-Dankeschön an all die wackeren Feuerwehrmänner! Fällt dann noch das Satellitenfernsehen mit meinem geliebten Raumschiff Enterprise aus, werde ich leicht stinkig.

Früher hatten wir nach Wolkenbrüchen Wasser im Keller, heute gottseidank nicht mehr dank eines speziellen Ventils, allerdings drückt der kurzzeitig durch Hagel verstopfte Kanal äußerst unangenehme Gerüche retour in den Keller, und das Klo samt Inhalt sprudelt im schlimmsten Fall über. Auf gut Deutsch: es stinkt nach Gülle im kühlen Geschoß, und das große Geschäft sollte man lieber nach Beendigung des Gewitters verrichten.

Wetterextreme & Klimakrise (orf.at)Zwar lassen sich einzelne Extremereignisse nicht direkt auf eine bestimmte Ursache zurückführen, klar ist laut dem aktuellen IPCC-Bericht aber: Durch die Klimakrise werden Extremwetterereignisse wie Überschwemmungen, Stürme und Hitze häufiger und intensiver. Das heißt: Niederschläge und Stürme werden stärker, Hitzewellen heißer und Dürren trockener.

Der "Blue Moon" verursacht (mir) wilde Träume:Der Vollmond im August hat es in sich : Er ist Erntemond, Supermond und blauer Mond in einem. Zu sehen ist er in diesem Monat am 19. August und erreicht seinen Höhepunkt um 20.26 Uhr. Als Supermond erscheint er zudem größer als andere Vollmonde. Das liegt daran, dass der Abstand zwischen Mond und Erde sich verändert. Ein Supermond kann bis zu sieben Prozent größer sein und leuchtet sogar etwas heller als andere Monde. /Quelle

So, ich geh jetzt Wasser schlürfen, solange wir noch eins haben. (Wieso wir das kostbare Nass am Klo verschwenden und nicht wirklich etwas dagegen unternehmen, ist mir ein Rätsel, auch meiner Fußpflegerin). Fast vergessen: vorgestern hatte ich eine Pediküre; trage jetzt dunkelvioletten Nagellack und darf somit in (schicken schwarzen) Zehentrennern aus dem Haus :-)

by Lady Aislinn

1 note

·

View note