#Bharti Airtel share price

Explore tagged Tumblr posts

Text

Stock Market Trends for 2025: Companies to Watch for Huge Profits in New Year

Investing in the stock market is a meticulous process and, therefore, must be planned and analyzed. So far, until January 2, 2025, the following companies seem to have impressive potential for providing investors with hefty returns. Let's discuss four such companies: Voltas Limited, Mahindra & Mahindra, Bharti Airtel Limited, and NCC Limited.

Voltas Limited

Voltas Limited, a major player in the Indian air conditioning and engineering services industry, has been performing well of late. The company's shares rose more than 3% in the last trading sessions as the stock hit an intraday high of Rs.1,597.65 against the previous close of Rs.1,535.15.

Recent Performance and Growth Drivers

Voltas has capitalized on the increased demand for cooling solutions in India due to increased disposable income and a shift in climatic conditions. Strong distribution networks along with brand recognition have strengthened its position in the market.

Investment Report

Voltas is an attractive investment candidate due to its consistent performance and favorable market dynamics. There is a need to track the company's quarterly performance and market share performance to understand the situation better and make informed decisions.

Mahindra & Mahindra

Mahindra & Mahindra (M&M) is an integrated conglomerate with considerable presence in the automotive and farm equipment space. Focus on electric vehicles and sustainable farming solutions has its strategic advantage in this dynamic market landscape.

Strategic Initiatives and Market Position

M&M's investments in EV technology and its commitment to expanding its EV portfolio align with global trends toward sustainable mobility. In addition, the company's stronghold in the agricultural sector through its farm equipment division ensures a steady revenue stream.

Investment Outlook

With its diversified business model and strategic focus on future technologies, M&M offers a balanced investment option. Investors should keep an eye on the company's EV developments and agricultural sector performance.

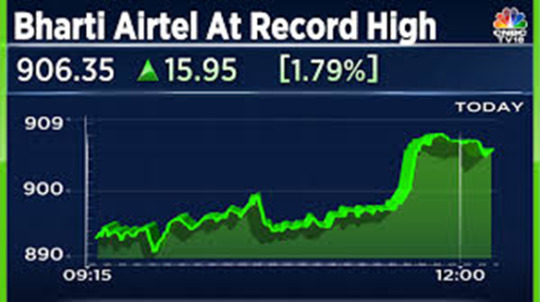

Bharti Airtel Limited

Bharti Airtel is a giant Indian telecommunications firm, which has also been withstanding the stiff market competition. Bharti Airtel stock has also shown some volatile moves, but of late, in the trading sessions, there has been an appreciation and decline as well. On Wednesday, the stock of Bharti Airtel gained 0.50% to Rs.1,596.05, and on Tuesday, Bharti Airtel shares lost 0.03% at Rs.1,588.15.

Financial Performance and Market Dynamics

During the second quarter, Bharti Airtel managed to post net profit that surged by more than double to Rs.35.93 billion. Growth in revenue also saw a healthy 12 percent rise to Rs.414.73 billion, partly mitigating a one-time loss to currency devaluation. Average revenue per user went up 10 percent from the last tariff hike, after a gap of more than two years, at Rs.233.

Bharti Airtel's strategic tariff revisions and emphasis on high-quality subscribers would help sustain the revenue growth trajectory. Analysts expect further improvement in EBITDA margins of the company through price increases in the near term.

NCC Limited

NCC Limited is an Indian major in construction and infrastructure development. Recent domestic orders for it include one to the tune of Rs.3,389.49 crore that the company would have to deliver over 72 months.

Project Portfolio and Growth Prospects

The diversified portfolio at NCC would include projects relating to residences, commercial units and industrial ventures. The order indicates the significant standing of the group in the market coupled with effective project execution skills

Investment Outlook

With a strong order book and a positive outlook for the construction sector in India, NCC Limited is an investment opportunity that is promising. Investors should consider the company's project execution track record and financial health when making investment decisions.

Conclusion

The companies chosen for investment-Voltas Limited, Mahindra & Mahindra, Bharti Airtel Limited, and NCC Limited-as have a strong market position and good growth prospectivity therefore potential for huge returns. Investors should study carefully and consider the volatility of the market before investing. In today's scenario, diversification of your portfolio with constant industry trend information is very essential for a good investor.

Stay tuned for more interesting news about financial market visit Share Market: Invest in These 5 Stocks Today for Huge Gains, Expert Advice.

0 notes

Text

Bharti Airtel Share Price Target 2025

Discover insights on Bharti Airtel Share Price Target 2025, exploring market trends, growth potential, and expert forecasts to help you make informed investment decisions in the telecom sector.

0 notes

Text

Viscose Staple Fiber Market is Estimated to Witness High Growth Owing to Increasing Demand for Clothing and Textiles Market

Viscose staple fiber is a cellulosic fiber made from plant sources like wood pulp or cotton linters. It has the appearance and feel of natural fibers like silk, wool or cotton. Viscose staple fiber is used in clothing, linens, towels, napkins, handkerchiefs and filtration products. It offers advantages like soft handfeel, moisture absorption, comfort and an affordable price point. The growing textile industry and rising demand for affordable apparel drive the need for viscose staple fiber.

The Global viscose staple fiber market is estimated to be valued at US$ 14.83 Bn in 2024 and is expected to exhibit a CAGR of 78.% over the forecast period 2024 To 2031.

Key Takeaways Key players operating in the viscose staple fiber market are AT&T Inc., Huawei Technologies Co. Ltd., Verizon Wireless, Nokia Solutions and Networks B.V., Sprint Corporation, Alcatel-Lucent, T-Mobile US Inc., LM Ericsson, China Mobile Ltd., and Bharti Airtel Ltd. The growing textile industry in Asia Pacific offers significant opportunities for viscose staple fiber manufacturers and suppliers. The market is also witnessing expansion in regions like North America and Europe owing to growing demand for eco-friendly fabrics.

Market Drivers Rising population and higher disposable incomes in developing regions are Viscose Staple Fiber Market Demand caters to this demand due to its silk-like texture and lower price point compared to natural fibers. Strict regulations around use of plastics and non-biodegradable materials are favoring growth of viscose staple fiber as it is plant-based and biodegradable.

PEST Analysis

Political: The viscose staple fiber market is influenced by government policies and regulations around environment protection. Stringent regulations around wastewater treatment and emissions can impact market players.

Economic: A slowing global economy can negatively impact the viscose staple fiber market as demand reduces from end-use industries like textiles and clothing. However, rising disposable incomes in developing nations support market growth.

Social: Changing lifestyle and fashion trends influence demand for viscose fabrics. A rise in health consciousness and preference for natural and sustainable fabrics works in favor of the market.

Technological: Advances in Viscose Staple Fiber market Size And Trends technology help manufacturers increase efficiency and output. New spinning technologies allow production of novel fiber blends and high-performance viscose fibers. Focus on resource efficiency and reducing environmental footprint also drives technological innovation.

Geographical regions of concentration Asia Pacific accounts for a major share of the global viscose staple fiber market in terms of value. Countries like China, India and Vietnam are leading producers and consumers due to a well-established textile industry. Europe is another prominent regional market fueled by stringent regulations around sustainable fibers.

The viscose staple fiber market is witnessing fastest growth in South American countries like Brazil. A thriving textile sector, policy support for fiber exports and growing domestic demand from end-use industries are supporting market expansion in the region. Developing economies offer sizable opportunities for viscose staple fiber producers to increase market share. Get More Insights On, Viscose Staple Fiber Market About Author: Ravina Pandya, Content Writer, has a strong foothold in the market research industry. She specializes in writing well-researched articles from different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. (https://www.linkedin.com/in/ravina-pandya-1a3984191)

#Viscose Staple Fiber Market Demand#Viscose Staple Fiber Market Size#Viscose Staple Fiber Market Trends#Viscose Staple Fiber#Viscose Staple Fiber Market

0 notes

Text

Nifty, Sensex End Higher For Fourth Day Led By ICICI Bank, Kotak Bank: Market Wrap

India's benchmark stock indices ended higher for the fourth session on Wednesday, led by gains in Kotak Mahindra Bank Ltd., ICICI Bank Ltd., and Larsen & Toubro Ltd. The NSE Nifty 50 ended 34.40 points or 0.15% higher at 22,402.40, and the S&P BSE Sensex gained 114.48 points or 0.16% to close at 73,852.94. Intraday, the NSE Nifty 50 rose 0.48% to 22,476.45, and the S&P BSE rose 0.52%. "Late selling at higher levels erased the majority of the Nifty 50 gains to settle at 22,402.40, with gains of 34.40 points," said Aditya Gaggar, director, Progressive Shares. "Nothing has changed in Nifty50, and we continue to stick to our view, i.e., we need to fill the 22,430–22,500 gap zone to extend its uptrend, while a level of 22,200 (50DMA) will continue to act as support." "Indian markets lagged the Asian peers as Q4 earnings remained largely subdued, with weak results from IT and a few index heavyweights also disappointed. However, buoyed by strong manufacturing and service sectors, the Indian composite PMI hit a multi-year high, reflecting domestic resilience and bringing some buoyancy to the broad market. Globally, investor sentiment improved with easing tensions in the Middle East and declining oil prices," said Vinod Nair, head of research at Geojit Financial Services. Kotak Mahindra Bank Ltd., ICICI Bank Ltd., Larsen & Toubro Ltd., Tata Steel Ltd., and HDFC Bank Ltd. contributed to the index. Reliance Industries Ltd., Tata Consultancy Services Ltd., Bharti Airtel Ltd., and Infosys Ltd. limited gains in the index. On NSE, eight sectors advanced and four declined. The NSE Nifty Metal index was the top gainer, while the NSE Nifty IT index was the top loser

0 notes

Text

Vodafone Idea Secures Rs 5,400 Crore from Anchor Investors Ahead of FPO

As Vodafone Idea (VIL) prepares for its much-anticipated Follow-On Public Offering (FPO), the telecom giant has successfully closed its anchor book allocation, raising a substantial Rs 5,400 crore from both global and domestic investors. This significant investment marks a pivotal moment for the company, positioning it strategically as it gears up for the next phase of growth.

The anchor book allocation, comprising 490.9 crore shares allotted to 74 funds, saw enthusiastic participation from esteemed investors at Rs 11 per share, reflecting confidence in VIL’s potential. Among the notable investors are GQG Partners Emerging Markets Equity Fund, Fidelity, UBS Fund Management, Abu Dhabi Investment Authority, and others, alongside domestic heavyweights like Motilal Oswal Mutual Fund, HDFC Mutual Fund, and SBI General Insurance.

This achievement places Vodafone Idea’s anchor book as the third-largest in history, following the footsteps of One 97 Communications and Life Insurance Corporation (LIC), which raised Rs 8,235 crore and Rs 5,627 crore, respectively, in their anchor rounds. Such substantial support underscores the confidence investors have in VIL’s future prospects.

The forthcoming FPO, scheduled to open for public subscription on April 18 and conclude on April 22, is poised to be the country’s largest, with a price band set between Rs 10 and Rs 11 per share. This monumental fundraising endeavor is expected to inject fresh capital into VIL, empowering the company to bolster its position in the fiercely competitive Indian telecom market.

With industry giants like Reliance Jio and Bharti Airtel dominating the landscape, Vodafone Idea aims to leverage these funds to fortify its presence, accelerate the much-awaited 5G rollout, enhance 4G services, and address pending vendor dues. Additionally, the infusion of capital will enable VIL to execute its ambitious plans of matching its competitors’ offerings and stemming the tide of subscriber attrition.

The road ahead hasn’t been easy for Vodafone Idea, grappling with a daunting debt burden of Rs 2.1 lakh crore and consecutive quarterly losses. Despite these challenges, the company remains resolute in its commitment to rejuvenate its operations and emerge stronger in the ever-evolving telecom sector.

As the telecom landscape continues to evolve, Vodafone Idea’s strategic moves and robust investor support signal a new chapter in its journey towards revitalization and sustainable growth. With the stage set for its transformative FPO, all eyes are on VIL as it navigates through the dynamic telecom terrain, poised for a resurgence in the days to come.

0 notes

Text

Bharti Hexacom Makes a Strong Market Debut with 32% Premium

Exciting news shook the market as shares of Bharti Hexacom Ltd, a subsidiary of Bharti Airtel, hit the trading floor with a remarkable 32% premium against the issue price of Rs 570. The stock kicked off the trade at Rs 755.20 on the BSE, marking a gain of 32.49% from its issue price, and later surged to Rs 824.70, a climb of 44.68%.

Over on the NSE, the stock debuted at Rs 755, reflecting a 32.45% rise. With this successful entry into the market, Bharti Hexacom's market valuation soared to Rs 40,637.50 crore.

The overwhelming response to Bharti Hexacom's initial public offering was evident, with a subscription rate of 29.88 times on the last day of bidding, which closed on April 5. This marked the first public issue of the financial year 2024-25.

The IPO, totaling Rs 4,275 crore, was open for public subscription from April 3-5, featuring a price band of Rs 542-570 per share for the Initial Public Offer. Notably, the IPO comprised entirely of an Offer For Sale (OFS) of 7.5 crore equity shares, representing a 15% stake divested by Telecommunications Consultants India Ltd, without any fresh issue component.

Bharti Hexacom is a leading provider of telecommunication services in Rajasthan and the Northeast region, contributing to the Bharti Group's diverse portfolio. This momentous market debut follows the group's previous IPO of Bharti Infratel, now known as Indus Towers, back in 2012.

With Bharti Hexacom's stellar performance on its market debut, all eyes are on its future trajectory as it navigates the dynamic landscape of the telecommunications industry.

0 notes

Text

This happened right after the Supreme Court dismissed allegations of Adani Group controversies. The shares of Bharti Airtel Limited were trading at INR 1054.0, up 0.55% from its previous day’s close price of INR 1049.05.

0 notes

Text

The Role of Technology and Innovation in Shaping Bharti Airtel's Share Price Trajectory

In the ever-evolving landscape of the telecommunications industry, Bharti Airtel has proven itself as a dynamic and innovative player that has harnessed technology to shape its share price trajectory. The company's commitment to staying at the forefront of technological advancements has played a pivotal role in its market positioning and growth.

Bharti Airtel's share price journey has been closely intertwined with its focus on adopting cutting-edge technologies and fostering innovation. The telecom giant has consistently invested in upgrading its network infrastructure, enhancing data services, and exploring emerging technologies like 5G. These initiatives have not only expanded its customer base but have also bolstered investor confidence, positively impacting Bharti Airtel's share price performance.

Furthermore, the company's foray into the digital services space has been instrumental in diversifying its revenue streams. Bharti Airtel has ventured into sectors such as digital payments, content streaming, and e-commerce, aligning with the growing digital trends in India. These strategic moves have not only broadened the company's market reach but have also reflected positively in its share price growth.

In a competitive and rapidly evolving sector, Bharti Airtel's emphasis on providing innovative solutions to meet the evolving demands of consumers has enabled it to carve a niche for itself. As technology continues to be a driving force in the telecom industry, Bharti Airtel's relentless pursuit of technological excellence remains central to its share price trajectory, ensuring its relevance and competitiveness in the market.

1 note

·

View note

Text

Bharti Airtel Share Price: A Good Investment for the Long Term?

Bharti Airtel is the largest telecom operator in India, with over 350 million subscribers. The company's share price has been on a steady rise in recent years, and it is currently trading at around ₹950 per share.

There are a number of factors that are driving the performance of Bharti Airtel's share price.

Strong demand for telecom services: The demand for telecom services in India is expected to grow at a CAGR of 7-8% over the next 5 years. This is due to a number of factors, including the growing smartphone penetration rate and the increasing use of data services.

Market leadership: Bharti Airtel is the market leader in the Indian telecom industry. The company has a strong brand presence and a wide distribution network.

5G rollout: Bharti Airtel is one of the leading players in the 5G rollout in India. The company has already launched 5G services in over 100 cities across the country.

Financial strength: Bharti Airtel has a strong financial position. The company has a healthy balance sheet and a low debt-to-equity ratio.

However, there are also some challenges that Bharti Airtel is facing.

Competition: The Indian telecom industry is highly competitive, with a number of players vying for market share. This can put downward pressure on prices and margins.

Regulatory risks: The Indian telecom industry is subject to a number of regulations, which can change from time to time. This can create uncertainty for the industry and impact the profitability of telecom companies.

Overall, Bharti Airtel is a well-managed company with a strong track record of growth. The company is well-positioned to benefit from the growing demand for telecom services in India. However, investors should be aware of the challenges that the company is facing before investing.

Analysts' views on Bharti Airtel's share price

Most analysts have a positive view on Bharti Airtel's share price. They believe that the company is well-positioned to benefit from the growing demand for telecom services in India.

For example, analysts at ICICI Securities have a "buy" rating on Bharti Airtel's stock. They believe that the company's share price has the potential to reach ₹1,100 in the next 12-18 months.

Analysts at HDFC Securities also have a "buy" rating on Bharti Airtel's stock. They believe that the company's share price has the potential to reach ₹1,050 in the next 12-18 months.

Conclusion

Bharti Airtel is a good investment for the long term. The company is well-positioned to benefit from the growing demand for telecom services in India. However, investors should be aware of the challenges that the company is facing before investing.

0 notes

Text

Stock Market Closing: Market Declines Due to Weak Global Cues, Sensex and Nifty Drop by 1 Percent

The stock market concluded the fourth day of the trading week in the red. Both stock exchanges recorded a decline of nearly 1 percent. Meanwhile, the Indian Rupee saw a slight increase of 2 paise against the US Dollar. It's worth noting that crude oil prices continue to fluctuate.

Amidst significant negative trends in global markets, continuous foreign fund outflows, equity benchmark indices Sensex and Nifty witnessed a decline of approximately 1 percent on Thursday. Traders also pointed out that heavy selling pressure in major companies like Reliance Industries, Infosys, and TCS had an impact on the market sentiment. Read more : Petrol and Diesel Prices Today: Updated Fuel Rates in These Cities, Find Out Today's Prices Today, the BSE Sensex closed at 65,508.32, down 610.37 points or 0.92 percent. During the day, it slipped to 65,423.39 after falling by 695.3 points or 1.05 percent. The Nifty ended at 19,523.55, down 192.90 points or 0.98 percent. Top Gainers and Losers Tech Mahindra saw the most significant decline in the Sensex pack today, dropping by 4.59 percent. It was followed by Asian Paints, Vipro, Kotak Mahindra Bank, Bajaj Finserv, Infosys, TCS, Mahindra and Mahindra, Hindustan Unilever, IndusInd Bank, Reliance Industries, and JSW Steel, all witnessing substantial losses. On the flip side, Larsen and Toubro, Bharti Airtel, Power Grid, and Axis Bank's shares were among the top gainers. Global Market Overview In Asian markets, the Shanghai Composite closed in the red, while Tokyo and Hong Kong ended lower. South Korea had a holiday, leading to a halt in trading. European markets were trading with a negative bias. On Wednesday, the US markets closed mixed. Global crude oil benchmark Brent Crude slipped by 0.38 percent to $96.18 per barrel. According to exchange data, Foreign Institutional Investors (FIIs) sold equities worth ₹354.35 crore on Wednesday. Vinod Nair, Chief Research Officer at Geojit Financial Services, commented that the selling was broad-based as investors remained cautious due to the fluctuations in oil prices. If crude oil continues to stay above $90 per barrel, it poses a risk to inflation and reduces operating margins. Currently, high interest rates and the tapering of the US bond yields are affecting FIIs' staying in sell mode. Market Recap from Yesterday In the previous session on Wednesday, the BSE benchmark index gained 173.22 points or 0.26 percent to close at 66,118.69. Meanwhile, the Nifty increased by 51.75 points or 0.26 percent to end at 19,716.45. Rupee Strengthens The Indian Rupee closed at ₹83.20 (last) against the US Dollar on Thursday, marking a 2 paise increase due to rising crude oil prices and improvements in greenback. It opened at ₹83.22 against the US Dollar and traded in the range of ₹83.25 to ₹83.13 during the day's trading. Today, the Rupee closed at ₹83.20 against the US Dollar, which is 2 paise higher than the previous close of ₹83.22. On Wednesday, after sluggish trading, the Rupee had closed at ₹83.22 against the US Dollar." Read the full article

0 notes

Link

#AxisBank#BhartiAirtel#BSESensex#FederalReserve#Indianequityindices#JamnagarUtilities#Japan#JioFinancial#Nifty#Nifty50#NiftyBank#NSE#NTPC#PowerGrid#RelianceIndustries#rupee#Sensex#TataSteel#TechMahindra#USmacrodata

0 notes

Text

Tips and Calls Make On a Daily Basis Heyday in Stock Market

Tips and Calls Make On a Daily Basis Heyday in Stock Market

The stock market is an extremely enticing front to make quick cash. But added caution should be absorbed order to discontinue from wrecking your hard earned money. The stock market is an area where supplies and also shares of numerous excellent companies are dealt. When you buy a share you are virtually being a partial partner in a firm. They do not give you the right to have a say in their daily working but most definitely entitles you to get part of earnings. There are a range of stocks offered out there and also basing upon needs the stocks need to be purchased with great caution and also vigilance. Some shares allow you to be entitled to regular dividends while some have wonderful potential keeping future leads in mind. The type of supply you purchase need to be appropriate to your economic condition as well as care need to be taken not to over delight in the marketplace trading. The stock exchange is a very fascinating area when costs of supplies and shares falls or increase, people are seen clambering about like nuts. The volatility of stock exchange is very high and it fluctuates significantly within short spans of time. Supplies are traded via stock market like BSE (Bombay Stock Exchange) or NSE (National Stock Exchange). In India BSE holds the leading setting as it has the largest number (thirty) of blue chip companies provided in it. These consist of business like BHEL, Bharti Airtel, HDFC, ICICI, L&T, ITC, NTPC, Mahindra & Mahindra, reliance, TCS, Wipro etc. They represent about one fifth of the capitalization of the Indian exchange and also are thus provided the should have interest. The way in which various capitalists operate depends upon the knowledge of the inside working of the share market. Some like to take their personal choices while others favor availing services of a professional stock broker company which specializes in providing handy clever tips, cool calls, intraday calls, intraday pointers, as well as option pointers and so on various on the internet stock broker firms provide value added services like suggestions with 99.99% precision which will help high end people take crucial choices at the nick of the moment. There goes a lot of study and also analysis right into providing pointers as well as calls. The companies do a lot of study on business profile, firm history and various other current market fads to predict future surge or fall in prices of shares. The Indian securities market is very strong which can be proved by the truth that it was not impacted by the global economic crisis which struck most of the world. Hence obtaining knowledge through trading continuously will lead you to additional elevation. Individuals will gradually be able to comprehend the fundamental nature of the market as well as will slowly but regularly develop a sense of risk measuring qualities as time flows. Thus taking computed threats is the lineup. And also one must always keep in mind not to succumb to false pretensions of small time center males, false rumors or rip-offs that typically emerge out of nowhere. Write-up Source: http://EzineArticles.com/3882131

DISCLAIMER : Investments in securities market are subject to market risks, read all the related documents carefully before investing.

Start Trading With Gill Broking

Our Links Below

Homepage || Commodities || Equity || Mutual Funds

#stock investments india#best stock trading app in india#trade in indian stocks#stock market trading india#stock markets india

0 notes

Link

#Nifty#niftychart#niftylive#NiftyLiveChart#niftyprediction#niftytechnicalanalysis#niftytomorrow#niftytradesetup#nifty50

0 notes

Text

Nifty, Sensex End Little Changed Amid Volatility; Midcap Hits Record High: Market Wrap

India's benchmark indices ended little changed amid volatility on Wednesday, ahead of the Fed Chair's speech at the Macroeconomics and Monetary Policy Conference. However, the Nifty Midcap 150 hit a fresh lifetime high during the day and settled higher for the eighth day in a row. The Nifty Smallcap 250 closed with gains for the ninth day in a row. The NSE Nifty settled 18.65 points, or 0.083%, , lower at 22,434.65, and the S&P BSE Sensex declined 27.09 points, or 0.037%, to end at 73,876.82. Market participants will closely monitor Powell's comments to get fresh cues about the U.S. central bank's policy outlook in the backdrop of robust economic data and high inflation weighing on rate cut expectations. The Nifty 50 fell to an intraday low of 22,346 and the Sensex touched a low of 73,540.27 on Wednesday. "Weak Asian and U.S. market cues coupled with caution ahead of the RBI's monetary policy announcement on Friday saw domestic equities end flattish with a negative bias. Surging crude oil prices and an uptick in US bond yields are making investors nervous, with FIIs offloading local shares further dampening the sentiment,” Prashanth Tapse, senior vice president research, Mehta Equities Ltd. Reliance Industries Ltd., Kotak Mahindra Bank Ltd., Larsen & Toubro Ltd., Nestle India Ltd., and ICICI Bank Ltd. contributed to the gains in Nifty. Tata Consultancy Services Ltd., Bharti Airtel Ltd., Axis Bank Ltd., NTPC Ltd., and Bajaj Finance Ltd. weighed on the index. On NSE, five sectors advanced, three remained flat, and four declined. The NSE Nifty Realty fell the most among peers, while the NSE Nifty PSU Bank became the top performing sector. check this out www.optionperks.com

0 notes

Text

Government Approves BSNL's $11 Billion Revival Plan to Support the Deployment of 4G and 5G

BSNL stands for Bharat Sanchar Nigam Limited. It is a state-owned telecommunications company in India. It was incorporated on September 15, 2000, and took over the business of providing telecom services and network management from the erstwhile Central Government Departments of Telecom Services (DTS) and Telecom Operations (DTO). India's government has granted an Rs. 89,000 crore ($10.79 billion) bailout package to Bharat Sanchar Nigam Ltd (BSNL), a state-run telecom company struggling to compete with private players in the market. The package aims to assist BSNL in deploying 4G and 5G services and extend connectivity to remote areas of the country. The cabinet commented that the support will make BSNL a reliable telecom service provider. Recently, the company partnered with Tata Consultancy Services, a top software firm, to expand its 4G network nationwide while bigger competitors were establishing fifth-generation 5G infrastructure. BSNL, burdened by debt and inadequate infrastructure, has recorded losses for 12 consecutive years. In the fiscal year ending March 2022, its losses decreased to Rs. 69.82 billion from Rs. 74.41 billion in the previous year. Competing against Reliance Jio Infocomm, Bharti Airtel, and Vodafone Idea, the company has faced difficulty in attracting customers due to fierce price competition. The introduction of Reliance Jio Infocomm in 2016, which provided free calls and discounted data plans, disrupted the Indian telecom market, resulting in decreased profits and revenue for competitors, and ultimately leading to market consolidation. Following the announcement of a revival package for BSNL, Mahanagar Telephone Nigam Ltd's shares saw a notable increase of 14.3 percent. Also Read: Vodafone To Lay Off Thousands Of Employees In 2023, What Are The Reasons? Read the full article

0 notes