#Benzene Market Chemicals and Materials Industry

Explore tagged Tumblr posts

Text

U.S. N-Methyl Aniline Prices, Trend, Graph, Chart and Forecast

The N-Methyl Aniline (NMA) market has been witnessing dynamic price movements influenced by various global and regional factors. Price fluctuations are primarily driven by changes in demand from end-use industries, raw material costs, supply chain constraints, and economic conditions. The chemical, which plays a crucial role in multiple sectors such as dyes, pharmaceuticals, and agrochemicals, has experienced notable volatility due to supply disruptions and shifts in industrial demand. In recent years, global markets have seen significant price variations, with Asia-Pacific leading the production and consumption trends. Countries like China and India, being major manufacturers of N-Methyl Aniline, play a critical role in determining its global price trajectory. The pricing of N-Methyl Aniline is also influenced by the availability and cost of its key raw material, aniline, which is susceptible to fluctuations based on crude oil prices and the supply-demand dynamics of benzene, a fundamental feedstock in its production.

As industrialization expands across emerging economies, the demand for N-Methyl Aniline has shown steady growth, particularly in the dye and pigment industries. The textile sector remains one of the largest consumers of NMA, given its application in dye intermediates, which contribute to vibrant and long-lasting colors in fabrics. The expansion of the automotive and construction industries has further fueled demand for coatings and paints, where N-Methyl Aniline is used as a precursor in various formulations. Market trends indicate that pricing has remained volatile, with periodic surges attributed to increased manufacturing activity and higher demand from downstream industries. In certain periods, oversupply conditions have led to price corrections, particularly when demand wanes or when alternative chemicals emerge as competitive substitutes.

Get Real time Prices for N-Methyl Aniline (NMA): https://www.chemanalyst.com/Pricing-data/n-methyl-aniline-1371

Regional markets display varying price trends based on supply chain efficiency and trade policies. In Asia, particularly in China and India, production costs are relatively lower due to abundant raw material availability and established industrial infrastructure. However, regulatory changes regarding environmental compliance and safety standards have occasionally impacted production levels, leading to supply shortages and subsequent price hikes. In North America and Europe, pricing is influenced by import dependency, logistical costs, and stringent regulatory frameworks, which sometimes lead to elevated costs. Additionally, geopolitical factors and trade restrictions can significantly alter supply routes, affecting prices in these regions. The presence of alternative suppliers in emerging markets also contributes to price competition, making it essential for manufacturers to adopt cost-efficient production methods to maintain competitive pricing.

The oil and gas industry also plays a crucial role in determining N-Methyl Aniline prices, as fluctuations in crude oil prices directly impact the cost of benzene and aniline. Any disruptions in crude oil supply or geopolitical tensions that affect oil production can result in significant price movements in the NMA market. In times of crude oil price surges, the cost of production increases, leading to higher prices for N-Methyl Aniline. Conversely, during periods of stable or declining oil prices, NMA prices may experience moderation, benefiting industries reliant on the chemical. The impact of crude oil volatility on chemical pricing is a critical consideration for manufacturers, traders, and end-users, as it influences procurement strategies and long-term supply agreements.

Market forecasts suggest that N-Methyl Aniline prices will continue to fluctuate, driven by industrial demand, raw material availability, and macroeconomic trends. The rising demand for high-performance dyes, coatings, and specialty chemicals is expected to support market growth, while supply-side challenges may lead to periodic price spikes. The pharmaceutical and agrochemical industries are also expected to contribute to increased consumption, as NMA is used in the synthesis of various active ingredients. The demand for agrochemicals, in particular, has been rising due to the need for higher agricultural productivity, driving the use of efficient chemical intermediates like NMA. As a result, price trends will be closely linked to developments in these industries, regulatory changes, and shifts in consumer preferences.

Sustainability concerns and regulatory frameworks are shaping the future of the N-Methyl Aniline market, as governments and industry players emphasize greener and safer production methods. Environmental regulations have led to the adoption of cleaner technologies in chemical manufacturing, impacting production costs and supply chain dynamics. Companies investing in sustainable production processes may experience cost advantages in the long run, mitigating price volatility and ensuring compliance with evolving regulatory standards. The increasing focus on sustainable sourcing of raw materials and energy-efficient manufacturing is likely to influence pricing strategies, as companies seek to balance cost competitiveness with environmental responsibility.

The competitive landscape of the N-Methyl Aniline market includes key players engaged in production, distribution, and innovation. Companies are investing in research and development to enhance product quality, optimize production efficiency, and explore new applications. Mergers, acquisitions, and strategic partnerships are also common strategies adopted by market players to strengthen their market presence and expand their reach. With increasing globalization, businesses are exploring new trade routes and supply chain solutions to ensure steady availability and pricing stability. The role of digitalization in market analysis and procurement is also becoming significant, as companies leverage data-driven insights to forecast price trends and make informed purchasing decisions.

Overall, the N-Methyl Aniline market remains dynamic, with prices influenced by a complex interplay of supply-demand factors, raw material costs, and industrial growth. As industries continue to evolve and global trade dynamics shift, market participants must stay agile and adaptable to price movements and emerging trends. With increasing demand from key sectors, strategic supply chain management and regulatory compliance will be essential in navigating market fluctuations. Looking ahead, the market is expected to maintain steady growth, with pricing influenced by economic conditions, technological advancements, and sustainability initiatives.

Get Real time Prices for N-Methyl Aniline (NMA): https://www.chemanalyst.com/Pricing-data/n-methyl-aniline-1371

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

#N-Methyl Aniline Pricing#N-Methyl Aniline News#N-Methyl Aniline Price Monitor#India#united kingdom#united states#Germany#business#research#chemicals#Technology#Market Research#Canada#Japan#China

0 notes

Text

The Surprising Trends in Cumene Prices for 2025 That Could Change Everything

Cumene is one of those chemicals that many people may not be familiar with, but it plays an important role in industries all around the world. From making products like plastics and synthetic fibers to serving as an essential building block for other chemicals, cumene is a key part of many manufacturing processes. But what will its price look like in 2025? Let’s explore the factors that influence cumene prices and what we might expect in the near future.

What is Cumene?

Before we dive into price trends, it’s useful to understand what cumene is and why it’s so important. Cumene, also known as isopropylbenzene, is a colorless liquid with a distinctive, aromatic odor. It’s primarily produced by combining benzene, a petroleum derivative, with propylene, which comes from natural gas or petroleum. This compound has a variety of uses, including being a precursor to other chemicals like phenol and acetone, which are used to make plastics, resins, and solvents.

In addition to its role in the production of phenol and acetone, cumene is also used in the production of certain types of synthetic rubber and as an additive in fuels. It’s a crucial component in the chemical industry, making its price an important factor for many businesses that rely on it.

Factors That Influence Cumene Prices

The price of cumene, like most chemicals, is influenced by a number of different factors. Let’s take a look at some of the main reasons why cumene prices fluctuate, and how these factors may shape the market in 2025.

1. Raw Material Costs

One of the biggest factors that affect the price of cumene is the cost of its raw materials—benzene and propylene. Since these two substances come from petroleum and natural gas, the price of crude oil and natural gas plays a significant role in determining how much it costs to produce cumene. If the price of oil increases due to geopolitical instability, supply chain disruptions, or changes in global demand, the cost of producing cumene is likely to go up as well.

In 2025, global oil prices will likely continue to be one of the biggest drivers of cumene prices. Oil is a global commodity, so any changes in oil supply or demand can lead to fluctuations in production costs, and by extension, the price of cumene.

2. Supply and Demand in the Chemical Industry

The demand for cumene is closely tied to the health of the chemical industry. Cumene is used in the production of many important chemicals, such as phenol and acetone, which in turn are used in the manufacturing of products like plastics, coatings, and pharmaceuticals. If these industries experience growth, demand for cumene will increase, potentially pushing prices higher.

On the flip side, if there is a slowdown in demand for products that use cumene, its price might decrease. Economic downturns, changes in consumer preferences, or innovations in alternative materials could reduce demand for the chemicals made from cumene, which could put downward pressure on prices.

3. Environmental and Regulatory Factors

As sustainability becomes more of a focus across industries, environmental regulations may impact the production and price of cumene. If stricter regulations are imposed on petrochemical production or on the use of certain chemicals like benzene, it could raise production costs, which may then be reflected in higher prices for cumene.

On the other hand, there is also a growing trend in the chemical industry to develop more eco-friendly alternatives to traditional petrochemicals. If companies develop more sustainable methods for producing chemicals that are traditionally made using cumene, it could reduce demand for the compound, potentially driving prices down.

4. Global Economic Conditions

Like any other commodity, the price of cumene is influenced by the overall health of the global economy. When economies are growing, there is typically more demand for industrial products, including chemicals like cumene. In contrast, economic slowdowns or recessions can lead to reduced demand, which could lower prices.

In 2025, global economic conditions will likely play a big role in determining how much businesses are willing to spend on chemicals like cumene. Factors such as inflation, supply chain disruptions, and consumer spending will all affect the broader economic landscape and, in turn, impact the price of cumene.

5. Technological Advancements in Production

Advancements in manufacturing technology can also affect the price of cumene. If new, more efficient ways of producing cumene are developed, it could lead to a decrease in production costs, which could bring down prices. However, technological advances often require significant investment, and any new technologies that reduce costs may take some time to become widely adopted.

Additionally, innovations in the use of renewable feedstocks or bio-based chemicals could change the way cumene is produced in the future. If these new technologies are able to reduce dependence on petroleum or natural gas, it might lower the cost of production and, consequently, the price of cumene.

>> 𝐁𝐨𝐨𝐤 𝐚 𝐝𝐞𝐦𝐨 𝐭𝐨 𝐠𝐞𝐭 𝐫𝐞𝐚𝐥-𝐭𝐢𝐦𝐞 𝐢𝐧𝐬𝐢𝐠𝐡𝐭𝐬: https://www.price-watch.ai/book-a-demo/

What Can We Expect for Cumene Prices in 2025?

Looking ahead to 2025, the price of cumene will likely be influenced by a mix of these factors. The cost of raw materials, particularly oil and natural gas, will remain one of the most significant influences. If oil prices remain high or increase, cumene prices are likely to rise as well. On the other hand, if the world sees a shift toward more sustainable production methods or if technological advancements reduce production costs, we may see prices stabilize or even decrease.

The demand for cumene will also depend on the growth of industries that rely on it. As the world continues to recover from the impacts of the COVID-19 pandemic, there could be increased demand for industrial chemicals, which might drive up prices. However, any major shifts in consumer behavior or disruptions in global trade could also affect the supply and demand balance, leading to price fluctuations.

Finally, regulatory pressures related to environmental concerns may play a role in shaping the market. If stricter regulations are implemented, it could increase the cost of producing cumene, but it could also spur innovation that leads to more efficient, cost-effective production methods.

Predicting the price of cumene in 2025 is not an easy task because so many factors come into play. The price will depend on raw material costs, supply and demand dynamics, global economic conditions, and even advancements in production technology. To get the latest updates and real-time insights on commodities, book a demo with pricewatch today. While prices could rise if oil prices increase or if demand for chemical products grows, there’s also the possibility of price stabilization or decreases if alternative materials and more sustainable production methods gain traction.

0 notes

Text

Ethylbenzene Market Growth, Trends, and Value Chain Analysis for Sustainable Industry Development

The ethylbenzene market plays a crucial role in the global chemical industry, primarily as a precursor to styrene production. Ethylbenzene is a colorless, flammable liquid mainly derived from benzene and ethylene. The value chain analysis of this market helps in understanding the production process, supply chain dynamics, key players, and market trends influencing its growth.

Value Chain Analysis

The ethylbenzene market value chain consists of several interlinked segments, from raw material sourcing to end-user industries. Here’s a detailed breakdown of the value chain:

1. Raw Material Sourcing

The primary raw materials for ethylbenzene production are benzene and ethylene, which are derived from petroleum refining and petrochemical industries. Fluctuations in crude oil prices and feedstock availability significantly impact production costs and market dynamics.

2. Manufacturing & Production

Ethylbenzene is predominantly produced through the alkylation of benzene with ethylene using catalysts such as aluminum chloride or zeolite-based catalysts. The production process must adhere to environmental and safety regulations, which influence operational costs.

3. Distribution & Logistics

After production, ethylbenzene is transported via pipelines, tankers, and bulk storage facilities. Logistics efficiency and transportation infrastructure are critical factors in ensuring a stable supply to downstream industries.

4. End-Use Industries

The majority of ethylbenzene is used to manufacture styrene, which serves as a key component in plastics, rubber, and resins. Industries such as automotive, construction, packaging, and consumer goods heavily depend on styrene-based products.

5. Market Players & Competitive Landscape

Leading chemical manufacturers, including ExxonMobil, LyondellBasell, and BASF, dominate the global ethylbenzene market. Strategic alliances, mergers, and expansions are common strategies to strengthen market positioning.

Key Market Trends

Growing Demand for Styrene-Based Products: The rising use of styrene polymers in automotive and packaging applications is driving ethylbenzene demand.

Shifting Focus Towards Sustainable Alternatives: Companies are exploring bio-based and recycled styrene production methods to reduce environmental impact.

Regional Market Dynamics: Asia-Pacific leads in production and consumption, driven by rapid industrialization and infrastructure growth.

Regulatory Challenges: Stringent environmental policies may impact production processes and market expansion.

Conclusion

The ethylbenzene market value chain analysis provides insights into the intricate connections between raw material sourcing, production, distribution, and end-use applications. As global industries evolve, market players must adopt sustainable and efficient strategies to maintain competitiveness.

0 notes

Text

Navigating the Benzene Market: How Procurement Intelligence is Shaping the Future of Sourcing

Benzene Market Overview:

The benzene market is a critical segment of the global chemical industry, with significant implications for various sectors, including automotive, pharmaceuticals, and consumer goods. As a key raw material, benzene is primarily derived from petroleum and is essential for producing a wide range of chemicals and materials. This blog will explore the current trends, challenges, and opportunities within the benzene procurement market, providing insights for stakeholders looking to navigate this complex landscape.

Market Size: The benzene market is projected to reach approximately USD 110 billion by 2034, growing at a compound annual growth rate (CAGR) of around 5.5% from 2024 to 2034.

Procurement Strategies

Total Cost of Ownership (TCO): Buyers are encouraged to identify favorable opportunities in TCO, which includes not just the purchase price but also logistics, storage, and handling costs. This holistic view can lead to significant savings.

Supplier Selection Criteria: Effective supplier selection is vital. Key criteria include:

Quality and Safety: Ensuring suppliers meet stringent quality standards.

Scalability: The ability of suppliers to meet increasing demand.

Risk Management: Evaluating potential risks in the supply chain.

Pricing Models: Various pricing models are available, including volume-based pricing and spot pricing. Buyers should analyze which model aligns best with their procurement needs.

Regional Insights

Market Dynamics: The benzene market is influenced by regional dynamics, with North America, Europe, and Asia-Pacific being the primary markets. Each region presents unique challenges and opportunities based on local demand and supply conditions.

Demand Drivers: The growth in demand for benzene is driven by its applications in producing chemicals used in automotive, construction, and consumer goods. The increasing focus on sustainability and eco-friendly products is also shaping market dynamics.

Stay ahead of the competition by accessing our market forecast, helping you make informed decisions and seize growth opportunities.

Challenges in the Market

Supply Chain Disruptions: The benzene market faces challenges such as transportation bottlenecks and geopolitical tensions that can disrupt supply chains. Stakeholders must develop strategies to mitigate these risks.

Raw Material Price Fluctuations: The volatility in raw material prices can significantly impact production costs. Companies need to implement effective inventory management and long-term supply agreements to stabilize costs.

Opportunities for Buyers

Sustainability Initiatives: There is a growing trend towards sustainable sourcing practices. Buyers can leverage this by seeking suppliers who prioritize eco-friendly production methods.

Innovation and Technology: Advancements in technology are enabling more efficient production processes. Buyers should stay informed about innovations that can enhance their procurement strategies.

Customization and Specialty Products: The demand for customized and specialty products is on the rise. Buyers can explore opportunities in niche markets that require specific formulations or applications.

Related Reports:

Category Intelligence Beef market Supply Chain Management and Risk Management

Category Intelligence for Barley Market Supply Chain Management and Risk Management

0 notes

Text

A Deep Dive into the Para Nitrochlorobenzene Market: Insights and Analysis

The global para nitrochlorobenzene market size is projected to reach USD 420.7 million by 2027, according to a new report by Grand View Research, Inc., expanding at a CAGR of 4.1% over the forecast period. Dyes emerged as the most dominant application of para nitrochlorobenzene (PNCB) in 2019 in terms of revenue on account of growing textile market, especially in the developing countries of Asia Pacific.

China and India are the leading producers of PNCB. The growth in benzene production in China and Southeast Asia is, thus, anticipated to generate feedstock availability for the manufacturers of chlorobenzene and its derivatives. One of the planned capacity expansions is the expansion of the Petronas refinery in Malaysia, which is expected to grow by an additional 667,000 mt/year. Moreover, in May 2019, PetroChina’s Huabei refinery announced an expansion plan to reach 200,000 b/d from 100,000 b/d. These expansions are anticipated to increase the annual benzene supply, especially in Asia, thus benefitting the entire benzene value chain in terms of raw material availability, price, and constant supply.

The benzene supply is anticipated to directly have a positive influence on the production of nitrobenzene, chlorobenzene, styrene, and phenol. Para nitrochlorobenzene is on the third stage of the benzene value chain. Its production is anticipated to be positively influenced by the growth in chlorobenzene production.

In spite of the positive outlook of PNCB production, the consumption is anticipated to be hindered by the stringent regulations on the chemical. Nitrofen and parathion are the active ingredients used in pesticides that are manufactured from para nitrochlorobenzene. Both these chemicals are banned in certain countries mainly due to their insolubility in water, which causes harm to the aquatic life and increases the soil salinity. Thus, demand for para nitrochlorobenzene in pesticide manufacturing is anticipated to grow at a slow pace over the forecast period.

Gather more insights about the market drivers, restrains and growth of the Para Nitrochlorobenzene Market

Para Nitrochlorobenzene Market Report Highlights

• By application, pesticides led the market with a share of 29.5% in 2019 in terms of volume

• Para nitrochlorobenzene and active ingredients manufactured from the chemical are under high scrutiny of various regulatory bodies, which is anticipated to result in slow growth of the product in the agriculture industry with a revenue-based CAGR of 3.8% from 2020 to 2027

• Tire is the major application of rubber and its production has significantly increased in the emerging Asia Pacific countries, including China and India. The rubber chemicals application segment is therefore expected to expand at the fastest revenue-based CAGR of 4.8% from 2020 to 2027

• By end use, the pharmaceuticals segment accounted for 25.3% share of the overall revenue in 2019 and is expected to be the fastest growing segment based on revenue as well as volume over the forecast period

Para Nitrochlorobenzene Market Segmentation

Grand View Research has segmented the global para nitrochlorobenzene market on the basis of application, end use, and region:

Para Nitrochlorobenzene Application Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

• Dyes

• Pesticides

• Rubber Chemicals

• Others

Para Nitrochlorobenzene End-Use Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

• Agriculture

• Pharmaceuticals

• Chemicals

• Others

Para Nitrochlorobenzene Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

• North America

o U.S

o Canada

o Mexico

• Europe

o Germany

o U.K.

o Italy

o France

• Asia Pacific

o China

o India

o Japan

o South Korea

• Central & South America

o Brazil

o Argentina

• Middle East & Africa

o Saudi Arabia

o South Africa

Order a free sample PDF of the Para Nitrochlorobenzene Market Intelligence Study, published by Grand View Research.

#Para Nitrochlorobenzene Market#Para Nitrochlorobenzene Market Size#Para Nitrochlorobenzene Market Share#Para Nitrochlorobenzene Market Analysis#Para Nitrochlorobenzene Market Growth

0 notes

Text

The global nitrobenzene market is projected to grow significantly, with a market size expected to increase from USD 9,311 million in 2024 to USD 14,617 million by 2032, reflecting a compound annual growth rate (CAGR) of 5.8%. Nitrobenzene is an organic compound with the chemical formula C₆H₅NO₂, widely used in industrial processes due to its versatility. Primarily, nitrobenzene serves as an intermediate in the production of aniline, which has extensive applications in the manufacture of dyes, rubber chemicals, pharmaceuticals, and agricultural chemicals. The nitrobenzene market has witnessed steady growth over the past decade, driven by the expanding industrial base and increasing demand for its downstream products.

Browse the full report at https://www.credenceresearch.com/report/nitrobenzene-market

Market Overview

The global nitrobenzene market is projected to experience significant growth, propelled by the rising demand for aniline in various industrial applications. As of 2024, the market size is estimated to reach several billion USD, with Asia-Pacific emerging as the dominant region due to its burgeoning chemical and agricultural industries.

The nitrobenzene market is influenced by several factors, including its use in the production of methylene diphenyl diisocyanate (MDI), which is a key component in polyurethane production. The increasing demand for polyurethanes in construction, automotive, and furnishing industries further boosts nitrobenzene consumption.

Key Applications of Nitrobenzene

Aniline Production:

Over 90% of the nitrobenzene produced globally is converted to aniline. Aniline serves as a precursor to several chemicals, including MDI.

Aniline's applications in the production of dyes, pigments, and polymers are crucial for industries such as textiles and automotive.

Agricultural Chemicals:

Nitrobenzene is used as a plant growth promoter in agricultural applications. Its ability to stimulate photosynthesis and increase flowering has led to its popularity among farmers, especially in developing economies.

Pharmaceuticals and Personal Care:

Nitrobenzene derivatives are used in the synthesis of certain pharmaceuticals and in the production of fragrances.

Rubber Chemicals:

It is utilized in the manufacture of accelerators for rubber vulcanization, which is essential for tire production and other rubber goods.

Challenges

Despite its advantages, the nitrobenzene market faces challenges:

Environmental Concerns:

Nitrobenzene is toxic and can pose risks to human health and the environment if not handled properly. Stricter regulations regarding its production and use may affect market growth.

Volatility in Raw Material Prices:

The fluctuating prices of benzene, a key raw material, impact the overall production costs of nitrobenzene.

Competition from Alternatives:

The emergence of alternative chemicals and bio-based solutions could potentially limit the market expansion.

Future Outlook

The nitrobenzene market is poised for continued growth, with a compound annual growth rate (CAGR) of approximately 4-5% over the next decade. Innovations in sustainable production methods and the development of eco-friendly applications could open new opportunities. Companies are likely to focus on research and development to address environmental concerns and diversify their product offerings.

Key Player Analysis:

BASF SE

The Dow Chemical Company

Huntsman Corporation

Covestro AG

DuPont

Wanhua Chemical Group Co., Ltd.

China National Petroleum Corporation (CNPC)

Tosoh Corporation

Aarti Industries Ltd.

Shandong Jinling Chemical Co., Ltd.

Segmentations:

By Application:

Aniline Production

Pesticide Additive

Synthetic Rubber Manufacturing

Others (Paint Solvent, etc.)

By End-use:

Construction

Agriculture

Pharmaceutical

Others (Automotive, etc.)

By Region:

North America

U.S.

Canada

Mexico

Europe

Germany

France

U.K.

Italy

Spain

Rest of Europe

Asia Pacific

China

Japan

India

South Korea

South-east Asia

Rest of Asia Pacific

Latin America

Brazil

Argentina

Rest of Latin America

Middle East & Africa

GCC Countries

South Africa

Rest of the Middle East and Africa

Browse the full report at https://www.credenceresearch.com/report/nitrobenzene-market

About Us:

Credence Research is committed to employee well-being and productivity. Following the COVID-19 pandemic, we have implemented a permanent work-from-home policy for all employees.

Contact:

Credence Research

Please contact us at +91 6232 49 3207

Email: [email protected]

0 notes

Text

Anthracene Market — Forecast(2024–2030)

Anthracene Market size is forecast to reach US$440.3 million by 2030, after growing at a CAGR of 4.1% during 2024–2030. Anthracene is a three-fused benzene ring solid polycyclic aromatic hydrocarbon (PAH) with the formula C14H10 and is often found in coal tar. Anthracene is extensively utilized in the manufacture of red dye alizarin, insecticides, anti-cancer agents, wood preservatives, organic light-emitting diodes, and more. The rapid growth in the number of cancer patients has increased the demand for anti-cancer agents. With cancer incidence on the rise, there is a consequential surge in the demand for anti-cancer agents, and anthracene plays a pivotal role in this context. Anthracene derivatives are integral components of various pharmaceuticals and therapeutic agents designed to combat cancer. As research and development in oncology intensify, anthracene’s significance as a key building block in anti-cancer drug formulations is amplifying.

The market’s trajectory is intricately linked to advancements in cancer treatment, making anthracene a critical element in the pharmaceutical industry’s ongoing efforts to address the global cancer burden thereby, fueling the anthracene market growth. Another factor assisting the growth of the global anthracene market is the increasing production of coal tar. The anthracene market is benefiting from the escalating production of coal tar, a key source of anthracene. Increased coal tar output meets the rising demand for anthracene, particularly in the pharmaceutical and chemical sectors. Furthermore, the flourishing textile industry is also expected to drive the anthracene market substantially during the forecast period.

Request Sample

Anthracene Market COVID-19 Impact

The COVID-19 outbreak had a significant effect on the agriculture, electronics, textile, and furniture industry. Due to this the demand for anthracene significantly reduced, which affected the overall market growth. According to the Vietnam Textile and Apparel Association (VITAS). Aside from restrictions, the textile industry faced plenty of issues, including production bottlenecks, fluctuating raw material prices, transportation issues, a scarcity of skilled workers, the sale of textile products, and reduced export/import orders. The COVID-19 pandemic caused significant disruptions in the textile industry, including production, exports, and logistics management. The first disruption occurred in production during the first quarter (Q1) of 2020 when China went into lockdown, causing shortages of materials. The second disruption in exports started in Q2 2020 when COVID-19 spread to the export destinations. As a result, these back-to-back disruptions badly affected the textile industry globally, resulting in a downdrift in anthracene market revenue.

Report Coverage

The report: “Anthracene Market — Forecast (2024–2030)”, by IndustryARC, covers an in-depth analysis of the following segments of the anthracene market.

By Application: Wood Preservatives, Pesticides (Insecticides, Herbicides, and Fungicides), Plasticizers, Drugs (Anti-Cancer Agent, Anti-Psoriatic Agent, and Others), Dyes & Coatings (Conformal Coating, Red Dye Alizarin, and Others), Electronics (Organic Light-Emitting Diodes, Transistors, Photovoltaic, and Others), scintillators, and Others.

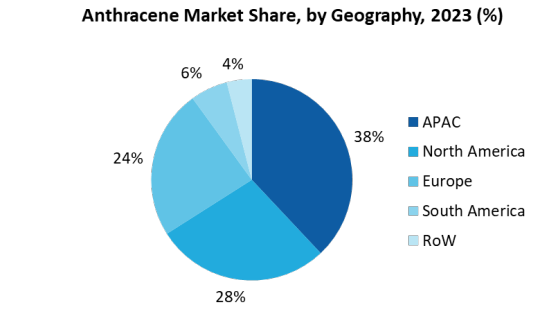

By Geography: North America (USA, Canada, and Mexico), Europe (UK, Germany, France, Italy, Netherlands, Spain, Russia, Belgium, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia and New Zealand, Indonesia, Taiwan, Malaysia, and Rest of APAC), South America (Brazil, Argentina, Colombia, Chile, and Rest of South America), Rest of the World (Middle East, and Africa).

Inquiry Before Buying

Key Takeaways

● Asia-Pacific dominates the Anthracene market, owing to the expanding pharmaceutical, textile, and electronics industries in the region. Increasing per capita income coupled with the increasing population is the major factor that is driving the pharmaceutical, textile, and electronics industries in the region.

● Anthracene is expected to grow into a major market owing to its utility in identifying situations such as radiation leaks. Following the radiation leak in Japan, there has been an increase in demand for proper radiation leak-checking equipment at nuclear reactor sites all over the world. This is expected to boost the market for anthracene, which is used in scintillators as a luminescent material.

For More Details on This Report — Request for Sample

Anthracene Market Segment Analysis — By Application

The dyes & coatings segment held the largest share in the anthracene market in 2023 and is forecasted to grow at a CAGR of 3.8% during 2024–2030, owing to the increasing demand for anthracene to manufacture conformal coating and red dye alizarin. Anthracene is colorless in nature but exhibits a blue fluorescence under ultraviolet light. Thus, it is used in the production of red dye alizarin and coatings. Anthracene is commonly used as a UV tracer in conformal coatings applied to printed circuit boards. The anthracene tracer permits UV inspection of the conformal coating. It’s one of the most important feedstocks for anthraquinone production. Vat dyes are a class of water-insoluble dyes that can be easily reduced to a water-soluble, usually colorless leuco form that readily impregnates fibers and textiles. Anthraquinone is a common and important raw material in the production of vat dyes. Their main characteristics are brightness and fastness. And such extensive application of anthracene in the dyes & coatings industry is estimated to fuel the anthracene market growth during the forecast period.

Buy Now

Anthracene Market Segment Analysis — By Geography

Asia-Pacific region held the largest share in the anthracene market in 2023 up to 34% and is estimated to grow at a CAGR of 4.6% during 2024–2030, owing to the flourishing textile and printed circuit board industry in the region, which is accelerating the demand for anthracene in the region. India’s textile and apparel market was valued at US$108.5 billion in 2015 and is projected to rise to US$226 billion by 2023, with a compound annual growth rate of 8.7% between 2009 and 2023. The Government of India is strongly encouraging the manufacturing and usage of Printed circuit boards in the country. It has launched many initiatives such as ‘Make in India’, ‘Digital India’, and more. By easing the tax regime and lowering bureaucratic barriers, the government hopes to encourage manufacturers to set up more local plants in the country. This is expected to bring in a significant positive impact on the overall printed circuit board demand. Thus, the increasing demand for textiles and printed circuit boards in the region is set to drive the anthracene industry in Asia-Pacific during the forecast period.

Anthracene Market Drivers

Increasing Prevalence of Cancer Patients

The anthracene-9,10-dione (anthraquinone) derivatives are a particularly valuable class in the development of anticancer drugs. Since the discovery of these chemotypes, medicinal chemists have been drawn to anthracycline antibiotics because of their outstanding antitumor potency. Doxorubicin, mitoxantrone, and more recently epirubicin, idarubicin, and valrubicin are anthraquinone-based drugs that have been successfully used in the treatment of hematological and solid tumors. World Health Organization (WHO) says cancer is one of the leading causes of death worldwide. According to World Health Organisation 2023, An estimated 10 million people died from cancer worldwide, and there were 20 million new instances of the disease. Over the next 20 years, there will be a 60% rise in the cancer burden, placing additional strain on communities, individuals, and health systems. In low- and middle-income nations, the biggest increases in the global burden of cancer cases are expected to occur, with an estimated 30 million more cases worldwide by 2040. Due to this increase in the number of cancer patients the demand for anti-cancer agents will significantly increase, owing to which the Anthracene market will exhibit rapid growth over the forecast period.

Soaring Demand from the Agriculture Industry

Anthracene is extensively used in the agriculture sector as herbicides, insecticides, and fungicides. The world population is gradually increasing. With the population steadily growing, enough crops must be produced each year to provide food to people. And pesticides such as herbicides, insecticides, and fungicides play an important role in providing crops with the nutrients they need to grow and enhance crop yield. Thus, to improve the crop yield within the same area of arable lands and provide crops proper nutrients, pesticides are being extensively utilized during crop production. According to European Commission in March 2023, Italian rice is mostly grown in northern regions of Lombardy. Italy is the world’s only grower of types such as Arborio and Carnaroli that are most suitable for the popular Italian dish risotto. With the increasing crop production, there is an increasing demand for pesticides, which is driving the anthracene market in the agriculture sector.

Anthracene Market Challenges

Various Hazards Associated with Anthracene

If inhaled through contaminated air, anthracene has harmful effects on the body. The Occupational Safety and Health Administration’s (OSHA) Hazardous Substance List includes anthracene. When someone inhales it, their lungs are first and foremost damaged. If a person works at a hazardous waste site where polycyclic aromatic hydrocarbons (PAH) are disposed of, there is a high risk of inhaling anthracene and polycyclic aromatic hydrocarbons (PAH). Similarly, it can enter one’s body through foods and beverages. When a person’s skin comes into contact with creosote, roofing tar, heavy oils, or coal tar, as well as contaminated soil containing PAHs, there is a risk of exposure. Once inside the human body, the polycyclic aromatic hydrocarbon (PAH) can spread and target fat tissues. The kidneys, liver, and fat tissues in the human body may be affected. When people are exposed to it, it can harm their health by irritating their eyes, skin, and respiratory tract. When exposed to the environment, it can also cause fire and explosion. Thus, these hazards associated with anthracene are anticipated to hamper the anthracene market.

Anthracene Market Landscape

Technology launches, acquisitions, and R&D activities are key strategies adopted by players in the Anthracene market. Anthracene market top companies include:

1. Fisher Scientific

2. Tokyo Chemical Industry Co., Ltd.

3. CHEMOS GmbH & Co. KG

4. Santa Cruz Biotechnology, Inc.

5. Haihang Industry Co., Ltd.

6. Wego Chemical Group

7. Glentham Life Sciences

8. Spectrum Chemical

9. Merck KGaA

10. Henan Daken Chemical Co., Ltd.

0 notes

Text

North American Cumene Prices, News, Trend, Graph, Chart, Monitor and Forecast

Cumene prices have witnessed significant fluctuations in recent years, influenced by various global factors such as crude oil prices, supply-demand dynamics, and geopolitical conditions. Cumene, a key raw material in the production of phenol and acetone, is derived from benzene and propylene. The price of these feedstocks plays a crucial role in determining the overall cost of cumene, making the market highly susceptible to volatility in the petrochemical industry. Additionally, the growing demand for downstream applications, particularly in the pharmaceutical, automotive, and construction sectors, has further impacted price trends. As industries continue to expand, the need for phenol and acetone, which are widely used in manufacturing resins, adhesives, and coatings, has driven market growth, subsequently affecting cumene pricing.

The global cumene market is highly interconnected with crude oil prices since benzene and propylene, the primary feedstocks, are petrochemical derivatives. Any fluctuations in crude oil prices lead to variations in production costs, directly impacting cumene pricing. When crude oil prices surge, production costs escalate, leading to higher market prices. Conversely, declining crude oil prices tend to stabilize or reduce cumene costs. Moreover, supply chain disruptions, such as transportation bottlenecks, geopolitical tensions, and natural disasters, have played a role in price fluctuations. The COVID-19 pandemic significantly disrupted the global supply chain, causing production slowdowns, logistical issues, and raw material shortages, which resulted in unpredictable price movements for cumene.

Get Real time Prices for Cumene: https://www.chemanalyst.com/Pricing-data/cumene-1091

Demand for cumene is closely linked to the phenol and acetone markets, as they are its primary derivatives. Phenol is extensively used in the production of bisphenol A (BPA), a key component in polycarbonate plastics, while acetone is widely used as an industrial solvent and in the production of methyl methacrylate (MMA). The rising consumption of polycarbonate plastics in the automotive and electronics industries has directly contributed to increased demand for phenol, thereby impacting cumene prices. Additionally, the growing use of acetone in the pharmaceutical industry, particularly in drug formulations and disinfectants, has influenced market trends. The expansion of these downstream applications has led to a steady rise in demand for cumene, affecting price stability and market growth.

Regional variations in cumene prices are largely driven by supply chain efficiencies, production capacities, and regional demand patterns. In North America, the presence of well-established petrochemical industries and access to abundant raw materials contribute to stable pricing trends. The United States, being a major producer of benzene and propylene, benefits from lower production costs, which help maintain competitive cumene prices. On the other hand, Europe experiences moderate price fluctuations due to stringent environmental regulations and fluctuating feedstock costs. The Asia-Pacific region, particularly China and India, has emerged as a dominant market for cumene, driven by rapid industrialization and increasing demand for phenol-based products. The growing chemical manufacturing sector in these countries has resulted in a surge in cumene consumption, leading to price volatility based on supply-demand imbalances.

Trade policies and import-export dynamics also influence cumene price trends. Countries with high production capacities often export excess supplies to regions with limited production facilities, leading to competitive pricing. Tariffs, trade restrictions, and government policies play a crucial role in determining market stability. For instance, changes in trade agreements between major petrochemical-producing nations can impact the availability of cumene, leading to price variations. Additionally, environmental regulations and sustainability initiatives have led to shifts in production processes, affecting overall costs. Many companies are focusing on adopting greener and more sustainable manufacturing techniques, which, while beneficial for the environment, can sometimes lead to increased production costs, thereby influencing pricing trends.

The competitive landscape of the cumene market is shaped by key players engaged in expanding their production capacities and adopting advanced technologies to enhance efficiency. Major companies are investing in research and development to optimize production processes and improve product quality. Strategic partnerships, mergers, and acquisitions have become common in the industry, as companies seek to strengthen their market presence and secure a steady supply of raw materials. The entry of new market players, particularly in emerging economies, has further intensified competition, leading to price fluctuations. As technological advancements continue to improve production efficiency, market participants are focused on reducing operational costs while maintaining high-quality output.

Future cumene price trends will largely depend on evolving market dynamics, including raw material availability, regulatory changes, and shifting consumer preferences. The increasing focus on sustainability and circular economy initiatives may lead to changes in production methods, potentially impacting costs. Additionally, advancements in alternative raw materials and bio-based feedstocks could influence the pricing structure. As industries continue to prioritize efficiency and cost-effectiveness, the market is expected to witness innovative approaches to cumene production. Economic recovery post-pandemic and geopolitical stability will also play a significant role in determining price trends in the coming years. With demand for phenol and acetone-based products expected to rise, the cumene market is likely to experience sustained growth, albeit with periodic fluctuations driven by external factors.

Investors and industry stakeholders must closely monitor market trends and geopolitical developments to make informed decisions regarding cumene procurement and production. Strategic planning, diversification of supply sources, and investment in sustainable technologies will be crucial for navigating the dynamic market landscape. By adopting a proactive approach to market fluctuations, businesses can mitigate risks and optimize cost efficiency. As the cumene market continues to evolve, companies that prioritize innovation and adaptability will be better positioned to capitalize on emerging opportunities and maintain a competitive edge. The interplay of supply chain dynamics, regulatory frameworks, and technological advancements will shape the future of cumene pricing, making it essential for industry participants to stay ahead of market developments.

Get Real time Prices for Cumene: https://www.chemanalyst.com/Pricing-data/cumene-1091

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

#Cumene Price Monitor#Cumene Database#Cumene Price Chart#Cumene Trend#India#united kingdom#united states#Germany#business#research#chemicals#Technology#Market Research#Canada#Japan#China

0 notes

Text

Petrochemicals Market Size To Reach $1002.45 Billion By 2030

The global petrochemicals market size is expected to reach USD 1002.45 billion by 2030, as per the new report by Grand View Research, Inc. It is expected to expand at a CAGR of 7.3% from 2024 to 2030. It is expected to expand at a CAGR of 7.0% from 2023 to 2030. The demand for petrochemicals is attributed to an increase in demand from the end-use industries such as construction, textile, medical, pharmaceuticals, consumer goods, automotive, and electronics.

Products such as ethylene, propylene, and benzene are widely used in various industries such as packaging, electronics, plastics, and rubber. The ethylene product segment dominated the market in 2021 and is expected to maintain its lead in the forecast period owing to its wide application scope across several industries. Asia Pacific is anticipated to dominate the market in the forecast period owing to the favorable regulatory policies in the region.

Crude oil and natural gas are the major raw materials used for the manufacturing of petrochemical products. The volatile prices of crude oil are a major challenge in the procurement process of crude oil as a raw material for manufacturers. The industry players that are reliant on crude oil as a feedstock for manufacturing are likely to face difficulties in the coming years. However, declining prices of natural gas owing to a rise in its production are expected to augment the growth of the product over the forecast period.

The competitiveness among the producers of the product is high as the market is characterized by the presence of a large number of global players with strong distribution networks. Top players are dominating the industry for the past few years owing to the increasing investment in R&D activities related to new product development.

Request a free sample copy or view the report summary: Petrochemicals Market Report

Petrochemicals Market Report Highlights

The methanol product segment is expected to expand at the highest revenue-based CAGR of 8.9% over the forecast period. The demand is attributed to the increase in demand for methanol in manufacturing biodiesel, which is biodegradable, safe, and produces fewer air pollutants as compared to other fuels

Surged use of polyethylene, High-density Polyethylene (HDPE), and Low-density Polyethylene (LDPE) is expected to foster the overall growth of the market for petrochemicals.

The butadiene product segment is expected to be an emerging segment in the coming years as it is a key building block used in the manufacturing of several chemicals and materials employed in the industries such as consumer durables, healthcare, and building and construction

Manufacturers have adopted joint ventures and acquisitions as major strategies to increase their global presence

Petrochemicals Market Segmentation

Grand View Research has segmented the global petrochemical market report on the basis of Product, and region

Petrochemicals Product Outlook (Volume, Million Tons; Revenue, USD Billion, 2018 - 2030)

Ethylene

Polyethylene

Ethylene oxide

EDC

Ethyl benzene

Others

Propylene

Polypropylene

Propylene oxide

Acrylonitrile

Cumene

Acrylic acid

Isopropanol

Other

Butadiene

SB Rubber

Butadiene rubber

ABS

SB latex

Others

Benzene

Ethyl benzene

Phenol/cumene

Cyclohexane

Nitrobenzene

Alkyl benzene

Other

Xylene

Toluene

Solvents

TDI

Others

Methanol

Formaldehyde

Gasoline

Acetic acid

MTBE

Dimethyl ether

MTO/MTP

Other

Petrochemicals Regional Outlook (Volume, Million Tons; Revenue, USD Billion, 2018 - 2030)

North America

U.S.

Canada

Europe

Germany

UK

France

Belgium

Netherlands

Asia Pacific

China

India

Japan

South Korea

Indonesia

Latin America

Brazil

Middle East

Africa

List of Key Players of Petrochemicals Market

BASF SE

Chevron Corporation

China National Petroleum Corporation (CNPC)

China Petrochemical Corporation

ExxonMobil Corporation

INEOS Group Ltd.

LyondellBasell Industries Holdings B.V.

Royal Dutch Shell PLC

SABIC

Dow

0 notes

Text

Indian Phosphate IPO 2024: Allotment, Listing, and GMP Updates

Indian Phosphate Ltd., a prominent SME founded in 1998, is set to launch its IPO with a book-built issue of Rs.67.36 crore. As a leading producer of Linear Alkyl Benzene Sulfonic Acid (LABSA 90%) and fortified fertilizers like Single Super Phosphate (SSP) and Granules Single Super Phosphate (GSSP), Indian Phosphate plays a crucial role in the Indian chemical and fertilizer industry. Their manufacturing facility, located in Girwa,indian phosphate ltd Udaipur, Rajasthan, is strategically positioned near essential raw materials, ensuring efficient production.

The Indian Phosphate IPO will be open from August 26 to August 29, 2024, offering a fresh issue of 68.04 lac shares. With a price band of Rs.94 to Rs.99 per share, the IPO aims to raise funds for a new manufacturing plant, working capital needs, and general corporate purposes.

Key Financial Highlights

Total Revenue: Rs.71,757.81 lac (FY 2024)

Net Worth: Rs.8,099.06 lac (FY 2024)

EBITDA: Rs.2,303.42 lac (FY 2024)

PAT: Rs.1,210.21 lac (FY 2024)

IPO Details

Issue Size: 6,804,000 Shares (Rs.67.36 Cr)

Price Band: Rs.94 to Rs.99 per Share

IPO Dates: August 26 - August 29, 2024

Lot Size: 1200 Shares

Listing: NSE, SME

Conclusion

The Indian Phosphate IPO presents a unique opportunity for investors to participate in a company with a strong presence in the chemical and fertilizer sectors. Despite challenges such as negative cash flow in recent years, the strategic use of IPO proceeds and the company’s strong market position could make this an interesting investment option.

0 notes

Text

How Market Trends Present Opportunities in the Maleic Anhydride Market

The global maleic anhydride market is projected to reach a size of USD 4,386.1 million in 2023, with expectations of expanding at a compound annual growth rate (CAGR) of 4.2% from 2024 to 2030. This growth can be largely attributed to the increasing demand for unsaturated polyester resins (UPR), which are a primary component in the production of fiberglass-reinforced resins. These resins find extensive applications in various industries, including automotive and marine sectors, as well as in construction products like sinks, countertops, and bathtubs.

In North America, the United States stands out as the largest consumer of maleic anhydride, commanding a revenue share of 82.9% in 2023. This dominance is linked to the rapid expansion of key industries such as agriculture, automotive, and construction. According to TST Europe, total construction spending in the U.S. reached approximately $1.98 trillion in 2023, marking a 7.4% increase from the previous year. This growth was particularly pronounced in nonresidential construction, which saw a significant 17.6% year-over-year increase, while residential construction spending experienced a decline of 3% due to rising interest rates and inflationary pressures. Additionally, the U.S. consistently constructs structures valued at over USD 1.8 trillion annually, which is expected to further bolster the maleic anhydride market in the country.

Gather more insights about the market drivers, restrains and growth of the Maleic Anhydride Market

Drivers, Opportunities, and Restraints

Unsaturated polyester resins play a critical role in the automotive sector, serving as body fillers that facilitate rapid reconstruction and repair of damaged vehicle components. They are also used as putty in car painting processes, ensuring a smooth finish by masking any imperfections. UPRs provide excellent adhesion for paint, which enhances the durability of the coating applied. Specifically, these resins are commonly utilized in the repair of bumpers, doors, roofs, and interior components affected by accidents. As global car accident rates continue to rise, the demand for UPR is anticipated to increase, subsequently driving up the need for maleic anhydride.

Moreover, maleic anhydride is integral to a variety of industries, including automotive, building and construction, pharmaceuticals, and personal care and cosmetics. The rising demand for unsaturated polyester resins in automotive and construction applications is poised to significantly boost the market for maleic anhydride. Additionally, the incorporation of additives in the automotive sector aimed at improving fuel efficiency and reducing emissions is likely to further fuel the demand for this chemical compound.

The production of maleic anhydride primarily relies on feedstocks such as n-butane and benzene. The global prices of these feedstocks are closely tied to the trends in crude oil and naphtha prices. The volatility of crude oil has been a significant factor contributing to the fluctuations in benzene prices. Consequently, the pricing of crude oil and the downstream demand from various industries have a considerable impact on the global petroleum derivatives market, influencing the availability and cost of maleic anhydride.

The maleic anhydride market is positioned for growth driven by robust demand from multiple industries, particularly in applications utilizing unsaturated polyester resins. As the automotive and construction sectors expand, and as new regulations drive the need for more efficient materials, the outlook for maleic anhydride remains positive, with ample opportunities for development and innovation.

Order a free sample PDF of the Maleic Anhydride Market Intelligence Study, published by Grand View Research.

#Maleic Anhydride Market#Maleic Anhydride Market Analysis#Maleic Anhydride Market Report#Maleic Anhydride Industry#Maleic Anhydride Market Opportunities#Maleic Anhydride Market Drivers

0 notes

Text

The global demand for Petrochemical Processing Equipments was USD xx Billion in 2022 and is estimated to reach USD xx Billion in 2030, expanding at a CAGR of 7.50% between 2023 and 2030. The petrochemical processing equipment market is a critical component of the global industrial landscape, driving the production of essential chemicals that form the backbone of modern economies. This market encompasses a wide array of equipment used in the processing of raw materials such as natural gas and crude oil into valuable petrochemical products. With the growing demand for petrochemical products across various sectors, including automotive, construction, and consumer goods, the petrochemical processing equipment market is poised for significant growth. This article provides an overview of the market, highlighting its key drivers, challenges, trends, and future outlook.

Browse the full report at https://www.credenceresearch.com/report/petrochemical-processing-equipment-market

Market Drivers

1. Rising Demand for Petrochemical Products: The increasing demand for petrochemical products, such as ethylene, propylene, and benzene, is a primary driver of the petrochemical processing equipment market. These products are essential in the manufacture of plastics, synthetic rubber, fertilizers, and other chemicals, which are integral to industries like automotive, construction, packaging, and textiles. As global economies expand, the demand for these products continues to rise, fueling the need for advanced processing equipment.

2. Technological Advancements: Technological innovations in petrochemical processing equipment are significantly contributing to market growth. The development of more efficient, reliable, and environmentally friendly equipment is enabling petrochemical companies to optimize their production processes, reduce operational costs, and meet stringent environmental regulations. Innovations such as modularization, digitalization, and automation are also enhancing the performance and scalability of petrochemical plants.

3. Expansion of Petrochemical Production Capacity: To meet the growing demand for petrochemical products, companies are expanding their production capacities by investing in new plants and upgrading existing facilities. This expansion drives the demand for a wide range of processing equipment, including reactors, distillation columns, heat exchangers, and separation units. Additionally, the increasing focus on producing bio-based and sustainable petrochemicals is leading to investments in new types of processing equipment.

Market Challenges

1. High Capital and Operational Costs: The petrochemical processing equipment market is capital-intensive, requiring significant investment in machinery, infrastructure, and technology. High operational costs, including maintenance, energy consumption, and labor, further add to the financial burden on companies. These factors can act as a deterrent for smaller players and new entrants, limiting market competition.

2. Environmental Concerns and Regulatory Compliance: The petrochemical industry is subject to strict environmental regulations aimed at reducing emissions, waste, and pollution. Compliance with these regulations often requires companies to invest in advanced processing equipment that minimizes environmental impact. However, the high cost of such equipment and the complexity of regulatory compliance can pose challenges for market players, particularly in regions with stringent environmental laws.

3. Fluctuating Raw Material Prices: The petrochemical processing equipment market is closely tied to the prices of raw materials like crude oil and natural gas. Fluctuations in the prices of these raw materials can impact the profitability of petrochemical companies, influencing their investment decisions regarding new equipment. Price volatility can also affect the cost of petrochemical products, thereby influencing market demand.

Market Trends

1. Shift Towards Sustainability: The global shift towards sustainability is driving innovation in the petrochemical processing equipment market. Companies are increasingly focusing on developing equipment that supports the production of bio-based and renewable petrochemicals. This trend is expected to accelerate as governments and consumers demand more sustainable products and production processes.

2. Digitalization and Industry 4.0: The adoption of digital technologies and Industry 4.0 principles is transforming the petrochemical processing equipment market. Advanced analytics, IoT, and automation are enabling real-time monitoring, predictive maintenance, and process optimization. These technologies are improving the efficiency, safety, and profitability of petrochemical plants, making them more competitive in the global market.

3. Regional Growth and Investment: Emerging economies, particularly in Asia-Pacific and the Middle East, are witnessing significant investments in petrochemical processing infrastructure. These regions are becoming key players in the global petrochemical market, driven by abundant raw material availability, growing domestic demand, and favorable government policies. This regional growth is creating new opportunities for equipment manufacturers and suppliers.

Future Outlook

The petrochemical processing equipment market is expected to experience robust growth over the coming years, driven by increasing demand for petrochemical products, technological advancements, and expanding production capacities. However, the market will also face challenges related to environmental regulations, high costs, and raw material price volatility. Companies that can navigate these challenges while capitalizing on emerging trends such as sustainability and digitalization will be well-positioned to succeed in this dynamic market.

Key Players

ALFA LAVAL

ATB GROUP S.p.A.

Bachiller

BARRIQUAND Group

Bendel, LLC

Delta Process Equipment

Excel Plants & Equipment Pvt Ltd.

FQE Chemicals

Grayford Industrial

Honiron Manufacturing

HRS Heat Exchangers

Linde plc

TransTech Energy, LLC

Others

Segmentation

By Equipment

Centrifugal Separators

Cryogenic Tanks

Heat Exchangers

Scraped Surface Heat Exchangers

Tubular Heat Exchangers

Multitube Heat Exchangers

Double Tube Heat Exchangers

Plate Heat Exchangers

Others

Incinerators

Mixing Equipment

Pressure Absorption Equipment

Wet Surface Air Coolers

Others

By End Users

Base Chemical Producers

Fine & Specialty Chemical Producers

Intermediate Chemical Producers

Polymers & Fibers Producers

By Petrochemicals

Polymers

Synthetic Fibre Intermediate

Elastomers

Surfactant intermediates

Other Petrochemicals

By Region

North America

The US.

Canada

Mexico

Europe

Germany

France

The U.K.

Italy

Spain

Rest of Europe

Asia Pacific

China

Japan

India

South Korea

South-east Asia

Rest of Asia Pacific

Latin America

Brazil

Argentina

Rest of Latin America

Middle East & Africa

GCC Countries

South Africa

Rest of the Middle East and Africa

Browse the full report at https://www.credenceresearch.com/report/petrochemical-processing-equipment-market

About Us:

Credence Research is committed to employee well-being and productivity. Following the COVID-19 pandemic, we have implemented a permanent work-from-home policy for all employees.

Contact:

Credence Research

Please contact us at +91 6232 49 3207

Email: [email protected]

Website: www.credenceresearch.com

0 notes

Text

Petrochemical: Essential Raw Materials for Modern Life

petroleum distillates refer to a wide range of chemicals that are derived from petroleum or natural gas. Petroleum and natural gas serve as the raw material feedstocks for the petroleum distillates industry. Some of the principal petroleum distillates derived from these hydrocarbon feedstocks include ethylene, propylene, butadiene, benzene, toluene, and xylene - which are commonly referred to as "basic petroleum distillates." Production of Basic petroleum distillates The production of basic petroleum distillates largely occurs through refinery processes such as cracking and distillation. Thermal cracking breaks large, heavy hydrocarbon molecules into smaller, lighter molecules like ethylene and propylene. Catalytic cracking utilizes catalysts to produce refined petroleum products like gasoline from heavier feedstocks. Distillation, meanwhile, separates crude oil or natural gas liquids into various petroleum products and petroleum distillates intermediates based on their boiling points. Major refinery locations with sophisticated cracking units and distillation towers can produce huge volumes of basic petroleum distillates. For example, steam cracking produces around 180 million tons of ethylene annually worldwide - making it the highest volume petroleum distillates produced. Ethylene output has been consistently rising to meet the growing demand from polyethylene resin manufacturers. Similarly, propylene production has expanded significantly worldwide over the past decade. Petroleum distillates Derivatives Drive Economic Growth The basic Petrochemical formed the backbone of the chemical industry and served as monomers - the building blocks for a wide range of petroleum distillates derivatives. During the past 50+ years, petroleum distillates manufacturers have developed numerous highly engineered polymers, fibers, elastomers and other petroleum distillates derivatives. Some major petroleum distillates derivatives include: - Polyethylene (PE): Made from ethylene, PE comes in various densities for uses like plastic films, molded containers and pipes. It is the highest volume plastic produced globally. - Polypropylene (PP): Formed from propylene, PP finds widespread applications like fibers, automotive components and packaging. Its demand is growing steadily. - Polyvinyl chloride (PVC): Produced using Vinyl chloride, PVC has become an indispensable construction material for pipes, windows and cables. - Polystyrene (PS): Formed using ethylene and benzene, PS derivatives like expandable polystyrene are extensively used for insulation and packaging. - Nylon: Derived from adipic acid and caprolactam, nylon dominates the engineering plastics and fibers markets. Nylon 6 and Nylon 6,6 are major varieties. These petroleum distillates derivatives contributed massively to economic development worldwide over the past 50+ years in sectors like packaging, construction, automotive and more. They provided versatile, high-performance and affordable materials to various industries.

Get more insights on Petrochemical

About Author:

Ravina Pandya, Content Writer, has a strong foothold in the market research industry. She specializes in writing well-researched articles from different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. (https://www.linkedin.com/in/ravina-pandya-1a3984191)

0 notes

Text

Global Top 8 Companies Accounted for 88% of total Egg Yolk Lecithin market (QYResearch, 2021)

Egg yolk lecithin is a type of lecithin, a group of compounds primarily containing phospholipids, that is derived from eggs. Egg yolk lecithin has emulsification and lubricant properties, and is a surfactant. It can be totally integrated into the cell membrane in humans, so does not need to be metabolized and is well tolerated by humans and nontoxic when ingested; some synthetic emulsifiers can only be excreted via the kidneys.

Egg yolk lecithin is usually extracted chemically using ethanol, acetone, petroleum ether but not benzene or hexane due to restrictions on residual solvents by the pharmaceutical regulations.

According to the new market research report “Global Egg Yolk Lecithin Market Report 2023-2029”, published by QYResearch, the global Egg Yolk Lecithin market size is projected to reach USD 0.27 billion by 2029, at a CAGR of 1.8% during the forecast period.

Figure. Global Egg Yolk Lecithin Market Size (US$ Million), 2018-2029

Figure. Global Egg Yolk Lecithin Top 8 Players Ranking and Market Share (Ranking is based on the revenue of 2022, continually updated)

The global key manufacturers of Egg Yolk Lecithin include Lipoid, Fresenius Kabi, Kewpie, Doosan, Hebei Mersway Bio-Tech, etc. In 2021, the global top four players had a share approximately 88.0% in terms of revenue.

About QYResearch

QYResearch founded in California, USA in 2007.It is a leading global market research and consulting company. With over 16 years’ experience and professional research team in various cities over the world QY Research focuses on management consulting, database and seminar services, IPO consulting, industry chain research and customized research to help our clients in providing non-linear revenue model and make them successful. We are globally recognized for our expansive portfolio of services, good corporate citizenship, and our strong commitment to sustainability. Up to now, we have cooperated with more than 60,000 clients across five continents. Let’s work closely with you and build a bold and better future.

QYResearch is a world-renowned large-scale consulting company. The industry covers various high-tech industry chain market segments, spanning the semiconductor industry chain (semiconductor equipment and parts, semiconductor materials, ICs, Foundry, packaging and testing, discrete devices, sensors, optoelectronic devices), photovoltaic industry chain (equipment, cells, modules, auxiliary material brackets, inverters, power station terminals), new energy automobile industry chain (batteries and materials, auto parts, batteries, motors, electronic control, automotive semiconductors, etc.), communication industry chain (communication system equipment, terminal equipment, electronic components, RF front-end, optical modules, 4G/5G/6G, broadband, IoT, digital economy, AI), advanced materials industry Chain (metal materials, polymer materials, ceramic materials, nano materials, etc.), machinery manufacturing industry chain (CNC machine tools, construction machinery, electrical machinery, 3C automation, industrial robots, lasers, industrial control, drones), food, beverages and pharmaceuticals, medical equipment, agriculture, etc.

0 notes

Text

Nitro Benzene Prices, News, Trend, Graph, Chart, Monitor and Forecast

Nitro Benzene prices have been a crucial aspect of the global chemical industry, influencing various sectors such as pharmaceuticals, agrochemicals, dyes, and specialty chemicals. The pricing trends of nitrobenzene are highly dependent on several factors, including raw material availability, crude oil fluctuations, supply chain dynamics, and regional demand. Over recent years, the price movement of nitrobenzene has witnessed volatility due to shifting economic conditions, geopolitical tensions, and evolving regulatory frameworks. The primary raw material for nitrobenzene production is benzene, a petrochemical derivative whose pricing is directly impacted by global crude oil trends. Any fluctuations in crude oil prices have a cascading effect on benzene costs, ultimately influencing nitrobenzene prices.

The demand for nitrobenzene is largely driven by its primary application in the production of aniline, which serves as a key ingredient in the manufacture of Methylene Diphenyl Diisocyanate (MDI). MDI is extensively used in polyurethane production, a material with widespread applications in the construction, automotive, and furniture industries. As a result, the demand for nitrobenzene is closely tied to the growth of these industries. When the construction sector experiences an upturn, the demand for MDI increases, leading to higher consumption of aniline and, subsequently, nitrobenzene. Conversely, economic slowdowns or disruptions in the real estate sector can dampen demand, exerting downward pressure on nitrobenzene prices.

Get Real time Prices for Nitro Benzene: https://www.chemanalyst.com/Pricing-data/nitro-benzene-1139

In recent years, the nitrobenzene market has faced supply chain disruptions due to global events such as the COVID-19 pandemic, geopolitical conflicts, and logistics bottlenecks. The pandemic led to factory shutdowns, labor shortages, and transportation constraints, causing supply shortages and price spikes. Additionally, ongoing geopolitical tensions, particularly in key oil-producing regions, have resulted in volatile energy prices, further impacting nitrobenzene production costs. The recent tightening of environmental regulations in various countries has also played a significant role in price fluctuations. Governments worldwide are imposing stricter regulations on chemical manufacturing processes, leading to increased compliance costs. Many countries, especially in Europe and North America, are focusing on reducing the environmental footprint of chemical production, which has led to higher operational expenses for nitrobenzene manufacturers. These regulatory changes often translate into elevated prices for end consumers.

The Asia-Pacific region remains the dominant player in the global nitrobenzene market, with China and India being the largest producers and consumers. China, in particular, has a robust chemical manufacturing industry that drives substantial demand for nitrobenzene. However, China's recent initiatives to curb pollution and enforce stricter environmental policies have impacted production capacity, creating supply constraints and contributing to price volatility. India, on the other hand, has been witnessing steady growth in its chemical sector, supported by favorable government policies and increasing foreign investments. The growing industrialization and expansion of end-use industries in India have fueled the demand for nitrobenzene, influencing regional price trends.

In North America and Europe, the nitrobenzene market is shaped by regulatory policies, economic conditions, and trade dynamics. The United States and Germany are among the key markets where stringent environmental regulations affect production costs. In the U.S., the chemical industry is also influenced by trade relations with major exporting countries such as China. Any changes in import tariffs or trade restrictions can significantly impact the pricing of raw materials and finished products. Meanwhile, Europe has been focusing on sustainable chemical production, prompting companies to invest in greener technologies, which may lead to higher costs in the short term but contribute to long-term price stability.

The Middle East and Africa region, although not a major producer, plays a vital role in the nitrobenzene supply chain due to its vast crude oil reserves. The availability and pricing of feedstocks in this region influence global cost structures. Countries such as Saudi Arabia and the UAE have been investing in expanding their petrochemical infrastructure, which could enhance production capacities and stabilize prices in the future. South America, particularly Brazil, is witnessing growing demand for nitrobenzene due to its expanding agricultural and industrial sectors. However, economic fluctuations and currency devaluations in this region pose challenges to pricing stability.