#Aviation Lubricants Market

Explore tagged Tumblr posts

Text

The volume of package delivery drones is projected to grow from 32,456 (In units) in 2024 to 275,703 (In units) by 2030. The Drone Package Delivery Market is projected to grow from USD 693 Million in 2024 to USD 4,666 Million by 2030, at a CAGR of 37.4%. There is rise in deployment of drones for quick and same day package delivery. Government approvals, cost-effectiveness delivery, reducing carbon emissions and instant package delivery are main reasons for the Drone Package Delivery Industry growth.

#Aviation Lubricant#Aviation Lubricant Market#Aviation Lubricant Industry#Global Aviation Lubricant Market

0 notes

Text

The Aviation Lubricants Market is estimated at USD 804 Million in 2022 and is projected to reach USD 1,082 Million by 2027, at a CAGR of 6.1% from 2022 to 2027.

#Aviation Lubricant#Aviation Lubricant Market#Aviation Lubricant Industry#Aviation Lubricant Market Trends#Aviation Lubricant Market Report#Aviation Lubricant Market Value#Aviation Lubricant Market Forecast#Aviation Lubricant Market Growth

0 notes

Photo

Illustration Photo: Sugarcane is one of the most efficient producers of biomass of all plant species and can be used as a renewable fuel. The new variety Ho 06-9002 has a high fiber content, excellent regrowth ability over 4 to 5 years, is cold-tolerant, has a high stalk population, and produces excellent biomass yields. (credits: USDA Media by Lance Cheung / Public domain)

Repsol Entrepreneurs Fund for Startups in the Energy Transition

At the Repsol Foundation, we have been supporting entrepreneurship and entrepreneurs for more than 10 years through Fondo de Emprendedores, our accelerator for start-ups that provide technological solutions to meet the challenges of the Energy Transition. This is a perfect program for start-ups in the testing phase with real customers, or that will reach this phase in 1–2 years.

This program aims to accelerate startups working in any of the following:

SCOPE 1: LOW-CARBON ENERGY TECHNOLOGIES AND CIRCULAR ECONOMY 1. Recycling and treatment technologies: conversion of biomass, new processes for converting waste into chemical products 2. Biogas production, upgrading, transport and end use technologies 3. Low environmental impact H2 renewable solutions for production, blending, transport and storage 4. Advanced biofuel production and conversion technologies (liquefaction or de novo, gasification) and synthetic fuels for road, maritime and aviation transport 5. Processing of chemicals and other organic materials for circular economy 6. Low-carbon lubricants for industrial and automotive applications 7. CO2 Capture, Use and/or Storage Technologies. CO2 Direct Air Capture: new absorbent materials and efficient process design 8. COX, H2 conversion processes to Hydrocarbons 9. Low carbon technologies for Oil & Gas operations, including energy efficiency, GHG direct emissions (scopes 1 and 2), Methane emissions, CCS or Geothermal. 10. Other technologies related to this scope’s heading

SCOPE 2: BIOTECHNOLOGY AND NANOTECHNOLOGY FOR SUSTAINABLE SOLUTIONS 1. Bio conversion of organic material to chemicals. Biorefinery, biofactory 2. Protein engineering, development of biocatalysts and enzymes 3. Gene editing technologies and applications in energy and materials 4. Plastic biodegradation technologies 5. Biosensors design, production and end use. 6. Anti-corrosive, anti-bacterial, thermal nanocoating for pipelines and infrastructures 7. Organic and inorganic membrane technologies, including new materials 8. Improvement of the properties of fuels, lubricants and chemicals 9. Other technologies related to this scope’s heading

SCOPE 3: PRODUCTS AND SERVICES BASED ON ENERGY MANAGEMENT AND RENEWABLES 1. Intelligent energy management systems 2. New batteries and fuel cells technologies 3. Distributed energy solutions 4. Energy conversion and storage systems 5. Advanced mobility solutions 6. Renewable energy generation, maintenance and control and commercialization. 7. Other technologies related to this scope’s heading

SCOPE 4: DIGITAL TECHNOLOGIES FOR THE ENERGY SECTOR 1. Artificial intelligence applied to process optimization and energy efficiency. 2. Digital twins and intelligent interfaces for process control 3. Digital technologies for predictive and prescriptive maintenance 4. Smart trading for the energy marketplace 5. Computational chemistry tools for energy applications 6. Remote sensing, IoT and robotic solutions for industrial assets and environment 7. Quantum computing applications in energy sector 8. Other technologies related to this scope’s heading SCOPE 5: NATURAL SOLUTIONS FOR CARBON FOOTPRINT REDUCTION 1. Reforestation and afforestation technologies for resilient CO2 absorption sinks 2. Advanced monitoring, reporting and verification technologies in CO2 absorption 3. Digital technologies applied to carbon markets value chain 4. Technologies for ESG (Environmental, Social and Governance) project certification 5. Other technologies related to this scope’s heading

Startups admitted to the Program will receive during the acceleration period a contribution of FIVE THOUSAND EUROS (€ 5,000) per month as ordinary funds. Additionally, admitted Startups may request up to a maximum of FORTY THOUSAND EUROS (€ 40,000) per year as extraordinary funds for strategic expenses to achieve the milestones of the Work Plan (as defined in section 4.4), mainly to complete the pilot test. The disbursement of this additional contribution will be subject to the exclusive decision of Fundación Repsol.

Application Deadline: March 10, 2023

Check more https://adalidda.com/posts/c4qmPwNwToZAAbf2L/repsol-entrepreneurs-fund-for-startups-in-the-energy/call

2 notes

·

View notes

Text

airsLLide No. 8028: HI-602CA, Curtiss C-46D Commando, Antillas Air Cargo, Santo Domingo-Las Americas, November 9, 1992.

In November 1992, the airport of the capital of the Dominican Republic was the incarnation of a propliner paradise with several active operators of rare vintage transports, ranging from Curtiss C-46s, Douglas Super DC-3s and DC-7s to Lockheed Super Constellations and Convair 340s. But doom and demise was just around the corner: After the crash of a Dominican-registered Douglas DC-7 outside of Miami on February 18, 1993, the Federal Aviation Authority was quick to ban all Dominican aircraft from US airspace, including Puerto Rico.

This cut-off all the local operators from their most important and lucrative markets, as flights to Miami and Puerto Rico were the base of their business plan. Unaware of the inevitable fate lying before her, Antillas Air Cargo's sole aircraft, a Curtiss Commando manufactured in 1945, basks in Santo Domingos afternoon sun, on an apron thickly stained with decades-worth of lubricant oil that dripped from these radial engines.

1 note

·

View note

Text

Aviation Lubricant Market — Forecast(2024–2030)

Aviation Lubricant Market Overview

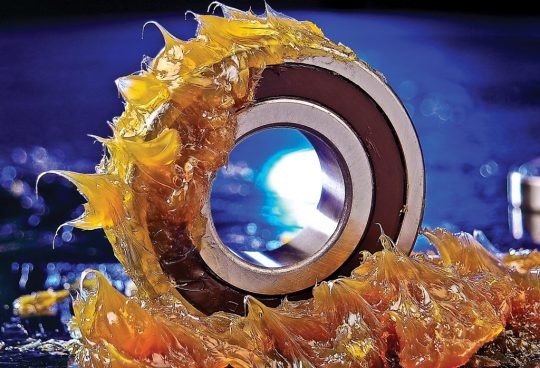

Aviation Lubricants are the chemical compounds that provide a fluid barrier between various parts of an aircraft and are used as engine oil, hydraulic fluid, piston engine oil and grease, etc. in aircraft. Hence, these lubricants are either mineral-based which is derived from crude oil, or synthetic-based derived from petroleum, but the most common lubricants used in aircraft are calcium sulfonate and perfluoropolyether which are both synthetic based. Hence drivers for the aviation lubricant market include an increase in the volume of air passenger traffic, an increase in the number of air fleets by airlines, increase in usage of effective aircraft engines such as turbofans engine. However, the major challenge in the aviation lubricant market is that, as the aviation lubricants are derived from crude oil, hence the fluctuating price of crude oil disrupts the manufacturing of lubricants. Hence such disruptions caused by price fluctuation have hampered the growth of the aviation lubricant industry.

As sustainability gains prominence, the aviation lubricant market is witnessing a notable shift towards bio-based lubricants. Manufacturers are increasingly investing in research and development to formulate lubricants derived from renewable resources, reducing environmental impact and meeting stringent regulatory requirements. The aviation lubricant market is experiencing a surge in demand for advanced synthetic lubricants. These high-performance formulations offer superior stability, thermal resistance, and extended service intervals, contributing to enhanced aircraft efficiency and reduced maintenance costs.

COVID-19 Impact

COVID-19 pandemic had negatively impacted the aviation lubricant market on a global level, as the restrictions and lockdown imposed by governments all across the globe caused a shortage of labor, decrease in the supply of spare parts due to import-exports restriction, and shutdown of various production plants. Hence all this hampered the productivity of the aerospace sector and reduced the demand for new aircraft. For instance, as per the 2021 report of the General Aviation Manufacturers Association, the Global business jet deliveries declined 20.4% to 644 aircraft in 2020 due to the COVID-19 pandemic. As per the 2021 finance report of Boeing, the company saw 40% less funding towards new aircraft deliveries in 2020 compared to 2019, and also the company reduced production of aircrafts 787s & 777s while halting production of 737max. Reduction in the demand and production of new aircraft and halting of maintenance work due to labor shortage reduced the demand for lubricants like grease, engine oil, hydraulic fluids that are used in such aircraft. Hence such reductions in demand negatively impacted the growth of the aviation lubricant industry. However, the industry slowly recovered from the pandemic through government support, debt sales, and cost reduction actions.

Request Sample

Report Coverage

The report: “Aviation Lubricant Market — Forecast (2024–2030)”, by IndustryARC, covers an in-depth analysis of the following segments of the Aviation Lubricant Industry.

By Product Type — Grease, Hydraulic fluid, Engine Oil, Turbine Oil, Cum Pressure Oil, Special Lubricant & Additives, Others

By Lubricant Type — Synthetic, Mineral based

By Aviation Type — Commercial, Military, General, Helicopter, Others

By Application Type — Hydraulic system, Engine, Landing gear, Airframe, others

By End User — Original Equipment Manufacturer (Engine cases, Combustor Components, Bearing Housing, Vanes, Manifold, Shaft nuts & gears, Others), Maintenance Repair Overhaul (Rotating components, Stationary seals, Frame & Casings)

By Geography — North America (USA, Canada, Mexico), Europe (UK, Germany, France, Italy, Netherlands, Spain, Russia, Belgium, Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, Australia, and New Zealand, Indonesia, Taiwan, Malaysia, Rest of APAC), South America (Brazil, Argentina, Colombia, Chile, Rest of South America), Rest of the World (Middle East, Africa).

Key Takeaways

• Investments in new-generation aircraft especially in the commercial aircraft segment are continuously growing especially in developing markets such as India. Hence with such an increase in investments in aircraft, the demand for lubricants to be used in them will also increase.

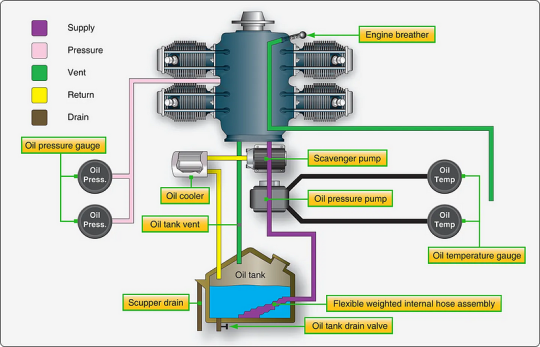

• Liquid lubricant is pumped throughout the engine to the parts that require lubrication and reduction of friction during engine performance increase the potential power output. Hence due to reason lubricants have high applicability in aircraft engines.

• North America dominates the aviation lubricant market as the region has U.S and Canada is one of the major aircraft manufacturing countries showing a significant increase in their air commute, new orders for aircraft and components.

Aviation Lubricant Market Segment — By Product

Engine oil held the largest share in the aviation lubricant market in 2023, with a share of over 40%. This owns to factors like high consumption of engine oil during the flight hours as they can be circulated readily and when engine parts are in constant friction the engine oil lubricates them and prevents wear & tear of parts. The increasing usage of advanced engines like turbofan engines in aircraft has positively impacted the demand for engine oil in them. For instance, in July 2023, the deal for LEAP engines, which will power Air India’s future fleet of 210 Airbus A320/A321neos and 190 Boeing 737 MAX family aircraft, has been finalized by Air India and CFM International. A multi-year services agreement covering the airline’s whole fleet of LEAP engines was also signed by both businesses. Hence with the usage of such advanced engines, the demand for efficient engine oil like synthetic-based oil that would enable these engines to function well at high temperatures will also increase. Such an increase in engine oil usage will create more demand for aviation lubricants, thereby positively impacting the growth of the aviation lubricant industry.

Inquiry Before Buying

Aviation Lubricant Market Segment — By Lubricant Type

Synthetic lubricant held the largest share in the aviation lubricant market in 2023, with a share of over 35%. This owns to factors like synthetic lubricants like perfluoropolyether and calcium sulfonate provides good thermal-oxidative stability, good deposit control capability and due to low volatility provides superior performance. Hence synthetic lubricants enable jet engines to operate at high temperatures. With the airline companies increasing their aircraft strength to meet the increasing traveling scale of air passengers, hence the necessary amount of lubrication would be required to keep such aircraft in working condition. For instance, in February 2023, the most anticipated airplane of the upcoming years is without a doubt the Airbus A321XLR. With an early 2024 aim for entering service, the European behemoth is presently awaiting certification for the narrowbody. With over 550 orders placed by 26 clients, the XLR is still very popular even though the pandemic threatens to slow things down. Hence with such an increase in the demand for aircraft from major airline companies the demand for high-performance synthetic lubricants like perfluoropolyether will also increase.

Aviation Lubricant Market Segment — By Aviation Type

Commercial aviation held the largest share in the aviation lubricant market in 2023, with a share of over 45%. This owns to factors like increase in the production rate of heavy aircraft commercial airliners in major aircraft manufacturers like Airbus, Raytheon Technologies, United Aircraft Corporation, Boeing, etc. owing to an increase in domestic and international traveling volume, especially in emerging economies like India. For instance, in January 2023, Airbus SE recorded 1,078 gross new orders in 2022 and delivered 661 commercial aircraft to 84 customers. By December 2022, Airbus had 7,239 aircraft on backorder. Hence with the increase in the demand for a commercial airliner, the demand for effective lubricants like calcium sulfonate which is used in engine oil, transmission fluids, gear oil, etc. will also increase. thereby showing a positive impact on the aviation lubricant market.

Aviation Lubricant Market Segment — By Application

The engine held the largest share in the aviation lubricant market in 2023, with a share of over 35%. With commercial air transport rapidly developing in various emerging markets like China, India, etc. the demand for new and efficient aircraft models has increased. Hence this has raised the demand for an efficient engine like turbo engines that would be used in these aircraft. For instance, in July 2023, Air India recently finalized orders with the engine manufacturer for over 800 LEAP engines to power its new fleet of 210 Airbus A320neo/A321neo and 190 Boeing 737 MAX family jetliners, strengthening CFM International’s market position in India. Hence as the usage of advanced LEAP engines increases, the demand for lubricants like engine oil and grease will also increase, thereby increasing the demand for the aviation lubricant market in this segment of the application.

Aviation Lubricant Market Segment — By End User

Maintenance repair overhaul held the largest share in the aviation lubricant market in 2023, with a share of over 40%. The maintenance work consists of base maintenance, line maintenance, and different level checks which an aircraft goes through during its lifetime. To ensure that the aircraft flies efficiently without facing any issues, maintenance work is considered a necessary step. Hence this has led to the creation of agreements between aircraft companies and manufacturers. For instance, in October 2023, Cyprus Airways has chosen Airbus’ Flight Hour Services (FHS) to support their A220 Family aircraft, making Airbus the third European FHS customer for an A220 fleet and the sixth FHS contract for an A220 globally, the company revealed. Hence as the maintenance contract of such major aircraft manufacturers increases, this would lead to an increase in usage of lubricants used during the maintenance work. Hence such an increase in usage will positively impact demand for aviation lubricants in such aircraft manufacturers.

Aviation Lubricant Market Segment — By Geography

North America held the largest share in the aviation lubricant market in 2023, with a share of over 30%. This owns to factor like the region being a hub for major aircraft manufacturing companies like Boeing, Embraer in U.S and Bombardier in Canada, and also the region consists one of the largest shares of the world domestics passengers. For instance, in September 2023. As per Airports Council International, It is projected that the North American region will have 2.0 billion passengers by the end of 2023, or 99.8% of the 2019 level, which is close to the 2019 level. Despite the fact that domestic travel drove the region’s robust rebound in 2021 and 2022. Hence with a growing number of airline passengers, the demand for more aircraft especially commercial aircraft has increased which has positively impacted the demand for aviation lubricants in the U.S and Canadian aviation market.

Aviation Lubricant Market Drivers

Increase in volume of aircraft production

Hence with the increase in demand for defense & commercial aircraft and their components in regions like Europe & North America has led to an increase in the production volume of major aircraft manufacturers like Airbus & Boeing. For instance, in February 2023, the ramp-up trajectory for the A320 Family program has been modified in collaboration with suppliers. Moreover, the company is currently working toward producing 65 aircraft per month by the end of 2024 and 75 aircraft per month by the end of 2026. As anticipated, the monthly manufacturing rate of A330 reached about 3 by the end of 2022, and the company is now aiming for rate 4 by 2024. There are currently six airplanes every month for the A350. After a feasibility analysis with the supply chain and in order to fulfill the increasing demand for widebody aircraft as international air travel recovers, the company is now aiming for a monthly production rate of nine A350s by the end of 2025. Hence with such an increase in the production of major aircraft manufacturers, the aviation lubricant like perfluoropolyether to be used in them would also increase thereby positively impacting the aviation lubricant industry in terms of lubricant demands.

Increase in usage of turbofan engines

Modern engines in terms of reliability and efficiency depend directly on the effectiveness of the lubricating system. lubrication is responsible for cooling internal parts of the engine which are acting relative to each other creating friction and heat which results in overheating. The introduction of advanced turbofans engines by major aircraft engine manufacturers like CFM International, Pratt & Whitney, Rolls Royce, etc. has increased their demand by airline companies for their aircraft. For instance, in September 2022, Williams’ turbofan engine fleet, which includes about 7,000 FJ44 and FJ33 engines, has accumulated more than 18 million flying hours. The engines are installed on a range of airframes, including the Cessna CJ series, Beechcraft Premier, Cirrus SF50, and Nextant reconditioned light jets. Hence the increase in demand for such advanced turbofan engines has positively impacted the demand for aviation lubricants such as calcium sulfonate which would be used as grease, hydraulic fluids in such engines.

Buy Now

Aviation Lubricant Market Challenges

The fluctuating price of crude oil

Lubricant oil is extracted from crude oil after going through a series of processes like sedimentation, fractioning, hence the lube oil collected after these processes is mixed with additives to create base oil which is used in the manufacturing of aviation lubricants like engine oil, piston oil, etc. Hence the price of crude oil keeps fluctuating due to geopolitical, whether or supply chain mishap reasons which disrupt the flow of crude oil to markets. Such disruption leads to irregular production of lubricants thereby causing a misbalance between demand and supply of lubricants. As per the U.S. Energy Information Administration, In 2023, the average price of Brent crude oil was $83 per barrel (b), a $19/b difference after rounding. In 2022, the price was $101/b. With Russia’s crude oil finding homes outside of the EU, global markets adjusted to the new trade dynamics, and demand for crude oil fell short of projections worldwide. Such a decrease in crude oil demand reduced the lubricant output for aircraft thereby negatively impacting the aviation lubricant market.

Aviation Lubricant Industry Outlook

The companies to develop a strong regional presence and strengthen their market position, continuously engage in mergers and acquisitions. Aviation Lubricant’s top 10 companies include:

1. Total Group

2. Exxon Mobil Corporation

3. Royal Dutch Shell Plc.

4. Eastman Chemical Company

5. The Chemours Company

6. The Phillips 66 Company

7. NYCO

8. Lukoil

9. Aerospace Lubricant Inc

10. Nye Lubricants

0 notes

Text

Aerospace Engine Oil Cooler Market Review and Future Growth Strategies 2024 - 2032

The aerospace engine oil cooler market is a vital segment within the aerospace industry, playing a crucial role in maintaining the performance and longevity of aircraft engines. Engine oil coolers are essential components that regulate oil temperature, ensuring optimal engine performance and reliability. This article provides a comprehensive overview of the aerospace engine oil cooler market, including current trends, key drivers, challenges, and future outlook.

Introduction to Aerospace Engine Oil Coolers

The aerospace engine oil cooler market is poised for steady growth, driven by increasing air travel demand, advancements in technology, and a focus on fuel efficiency.

What is an Aerospace Engine Oil Cooler?

An aerospace engine oil cooler is a heat exchanger designed to remove excess heat from the engine oil in aircraft engines. By maintaining the oil at optimal temperatures, these coolers help enhance engine efficiency, reduce wear and tear, and prevent overheating. They are typically designed to withstand the demanding conditions of flight, including high altitudes and varying temperatures.

Importance of Oil Cooling in Aerospace

Effective oil cooling is critical in aerospace applications, as it directly affects engine performance and safety. Properly cooled oil ensures efficient lubrication, minimizes friction, and enhances the overall lifespan of engine components. Given the stringent safety standards in the aerospace industry, reliable oil cooling solutions are paramount.

Market Overview

Current Market Trends

The aerospace engine oil cooler market is experiencing significant growth due to several key trends:

Increased Aircraft Production: The global rise in air travel and the expansion of the aerospace sector are driving demand for new aircraft, subsequently increasing the need for efficient engine oil coolers.

Technological Advancements: Innovations in materials and designs are leading to the development of more efficient and lightweight oil coolers, which improve overall engine performance.

Focus on Fuel Efficiency: As airlines and manufacturers strive to enhance fuel efficiency and reduce emissions, efficient engine oil cooling solutions are becoming increasingly important.

Market Segmentation

The aerospace engine oil cooler market can be segmented based on type, application, and region.

By Type

Air-Cooled Oil Coolers

Liquid-Cooled Oil Coolers

Others

By Application

Commercial Aviation

Military Aviation

General Aviation

Spacecraft

Others

By Region

North America

Europe

Asia-Pacific

Latin America

Middle East and Africa

Key Drivers of Market Growth

1. Growing Demand for Air Travel

The increasing global demand for air travel is a primary driver for the aerospace engine oil cooler market. With more airlines expanding their fleets and adding new routes, the need for advanced engine cooling solutions is rising.

2. Rising Focus on Aircraft Maintenance

As aircraft operators prioritize maintenance and operational efficiency, the demand for reliable engine components, including oil coolers, is growing. Properly functioning oil coolers are essential for extending engine life and ensuring safety.

3. Technological Innovations

Advancements in engineering and materials science are leading to the development of more efficient and lightweight oil coolers. These innovations enhance the performance of aircraft engines and align with the industry's focus on sustainability.

Challenges Facing the Market

1. High Initial Costs

The development and production of aerospace engine oil coolers can be costly, leading to higher initial investment requirements. This can pose challenges, particularly for smaller manufacturers or operators.

2. Stringent Regulatory Standards

The aerospace industry is subject to strict regulatory standards and certifications. Meeting these requirements can be a lengthy and costly process, posing challenges for manufacturers entering the market.

3. Competition from Alternative Cooling Technologies

The aerospace engine oil cooler market faces competition from alternative cooling technologies, such as advanced cooling systems that may provide better efficiency or reduced weight. Manufacturers must continually innovate to stay competitive.

Future Trends in the Market

1. Development of Lightweight Materials

The trend toward lightweight materials in aerospace engineering is expected to continue. The use of advanced composites and lightweight alloys in the design of engine oil coolers will enhance fuel efficiency and performance.

2. Integration of Smart Technologies

The integration of smart technologies, such as IoT sensors and predictive maintenance systems, is likely to gain traction in the aerospace engine oil cooler market. These technologies can provide real-time monitoring and enhance the overall efficiency of oil cooling systems.

3. Expansion in Emerging Markets

Emerging markets, particularly in Asia-Pacific and Latin America, are expected to see significant growth in air travel and aircraft production. This expansion presents opportunities for manufacturers of aerospace engine oil coolers to tap into new markets.

Conclusion

The aerospace engine oil cooler market is poised for steady growth, driven by increasing air travel demand, advancements in technology, and a focus on fuel efficiency. While challenges such as high initial costs and stringent regulatory standards exist, the future looks promising with trends toward lightweight materials and smart technologies. Stakeholders in this market must navigate these dynamics to capitalize on emerging opportunities and ensure long-term success.

#Aerospace Engine Oil Cooler Market Size#Aerospace Engine Oil Cooler Market Trend#Aerospace Engine Oil Cooler Market Growth

0 notes

Text

0 notes

Text

0 notes

Text

Turbine Drip Oil Market Anticipated to Witness High Growth Owing to Increasing Military Spending

The turbine drip oil market includes oils that are used for lubrication inside gas turbine engines. Turbine drip oil provides essential lubrication to critical engine components such as bearings, gears and seals. It protects vital engine parts from damage due to friction and wear. The demand for turbine drip oil is driven by rising aviation activities and increasing military budgets across countries.

Global Turbine Drip Oil Market is estimated to be valued at USD 2.21 Bn in 2024 and is expected to reach USD 3.31 Bn by 2031, exhibiting a compound annual growth rate (CAGR) of 5.1% from 2024 to 2031.

Key Takeaways Key players operating in the turbine drip oil market are Chevron, Royal Manufacturing, Cenex, Archer Lubricants, Mystik Lubricants, United Lubricants, Magnum Manufacturing, Texas Refinery Corp, Apar Industries Ltd, Behran Oil Co., BP Plc, Castrol Ltd., CHS Inc., CITGO Petroleum Corp, Exxon Mobil Corporation, Shell India, Penrite Oil Company, Paras Lubricants. These players are focusing on new product development and global expansion strategies to gain competitive advantage. The key opportunities in the Turbine Drip Oils Market Growth include growing demand for lightweight and high-performance aircraft turbines as well as increasing MRO activities. The global turbine drip oil market is expanding rapidly as major players seek to tap opportunities in emerging economies such as China, India and Brazil through joint ventures, partnerships and acquisitions. Market Drivers and Restrain The primary driver for the turbine drip oil market is the rising global defense budgets. Many countries are increasing their defense spending to modernize their militaries with new aircraft, helicopters, warships and other equipment requiring turbine engines. For instance, the US defense budget stood at $778 billion in 2022, creating strong demand for turbine oils. However, stringent environmental regulations pose a challenge for the Turbine Drip Oil Market Size and Trends. Regulators are enforcing stricter norms on emission levels from aircraft and turbine engines to control air pollution. This is increasing the pressure on oil manufacturers to develop bio-based and environmentally acceptable lubricant solutions. Continuous innovation is needed to meet the dual objectives of performance and sustainability.

Segment Analysis The turbine drip oil market is dominated by the industrial segment, as turbine drip oil is widely used in manufacturing industries for lubricating machinery. Turbine drip oil finds major applications in various industries like power generation, oil & gas, chemicals, and others where large turbines and other heavy machinery are used. Within industrial segment, power generation sub-segment holds the largest share as continuous operations of turbines in power plants requires effective lubrication and cooling provided by turbine drip oil. Global Analysis North America region holds the largest share in the global turbine drip oil market currently. The region has presence of developed industrial sector with numerous power plants and oil & gas installations where turbine drip oil is highly consumed. Asia Pacific is projected to be the fastest growing market during the forecast period owing to rapid industrialization and growing energy demands in emerging economies of China and India. Countries like China, Japan and India are witnessing rise in power generation through coal based plants, thus driving the adoption of turbine drip oil.

Get more insights on Turbine Drip Oil Market

Priya Pandey is a dynamic and passionate editor with over three years of expertise in content editing and proofreading. Holding a bachelor's degree in biotechnology, Priya has a knack for making the content engaging. Her diverse portfolio includes editing documents across different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. Priya's meticulous attention to detail and commitment to excellence make her an invaluable asset in the world of content creation and refinement.

(LinkedIn- https://www.linkedin.com/in/priya-pandey-8417a8173/)

#Coherent Market Insights#Turbine Drip Oil Market#Turbine Drip Oil#Steam Turbines#Gas Turbines#Hydro Turbines#Synthetic Turbine Drip Oil#Turbine Drip Oil Market Forecast#Turbine Drip Oil Market Demand

0 notes

Text

Lubricants Market: Current Landscape, Trends, Key Players, Challenges, and Future Outlook

The global lubricants market is a crucial component of various industries, including automotive, manufacturing, marine, and aviation. As industrialization and urbanization continue to surge, the demand for high-quality lubricants grows in tandem. These essential fluids reduce friction, wear, and tear between mechanical components, ensuring the smooth operation of machinery and extending the lifespan of equipment.

In this blog, we will delve into the intricacies of the lubricants market, providing a comprehensive analysis of its current size, share, and growth. We will also explore emerging trends, key market players, challenges, and offer a forward-looking conclusion.

Market Size, Share, and Growth

The global lubricants market was valued at approximately USD 158 billion in 2023, and it is projected to grow at a compound annual growth rate (CAGR) of around 3.5% from 2024 to 2030. This growth is driven by several factors, including increased automotive production, the expansion of the industrial sector, and the rising demand for high-performance lubricants.

Market Segmentation by Product Type:

Mineral-based Lubricants: These traditional lubricants hold the largest share of the market due to their cost-effectiveness and wide availability. However, their market share is gradually declining as synthetic and bio-based lubricants gain popularity.

Synthetic Lubricants: Known for superior performance, especially in extreme conditions, synthetic lubricants are witnessing a steady increase in demand. This segment is expected to grow at the fastest rate during the forecast period.

Bio-based Lubricants: With growing environmental concerns, the market for bio-based lubricants is expanding. Although they currently represent a smaller share of the market, their adoption is expected to rise significantly due to regulatory pressures and increasing consumer awareness.

Market Segmentation by End-use Industry:

Automotive: The automotive sector remains the largest consumer of lubricants, accounting for over 50% of the market share. The demand is driven by the need for engine oils, transmission fluids, and greases.

Industrial: The industrial sector, including manufacturing, mining, and construction, is the second-largest consumer. The demand for lubricants in this sector is fueled by the need to maintain heavy machinery and equipment.

Marine and Aviation: These sectors, though smaller in terms of volume, require specialized lubricants for engines and other critical components, contributing to the market's overall growth.

Market Trends

Shift Towards Synthetic and Bio-based Lubricants: As mentioned earlier, there is a significant shift from traditional mineral-based lubricants to synthetic and bio-based alternatives. This trend is driven by the superior performance of synthetic lubricants, especially in extreme temperatures, and the eco-friendly nature of bio-based lubricants.

Increased Focus on Sustainability: Environmental regulations are becoming stricter worldwide, pushing manufacturers to develop lubricants with lower carbon footprints. The growing awareness among consumers and industries about the environmental impact of lubricants is also fueling this trend.

Advancements in Additive Technology: Additives play a crucial role in enhancing the performance of lubricants. Recent advancements in additive technology are leading to the development of lubricants that offer better protection against wear, oxidation, and corrosion, thereby extending the lifespan of machinery.

Digitalization and Smart Lubricants: The integration of IoT (Internet of Things) and AI (Artificial Intelligence) in the lubricants industry is paving the way for smart lubricants. These advanced products can monitor and report the condition of the machinery in real-time, enabling predictive maintenance and reducing downtime.

Rising Demand in Emerging Markets: Emerging economies in Asia-Pacific, Latin America, and Africa are witnessing rapid industrialization and urbanization. This is leading to an increased demand for lubricants, especially in the automotive and industrial sectors.

Key Market Players

The global lubricants market is highly competitive, with several key players dominating the landscape. These companies are continually innovating and expanding their product portfolios to maintain their market positions.

Royal Dutch Shell Plc: Shell is a global leader in the lubricants market, with a market share of around 12%. The company offers a wide range of lubricants, including synthetic and bio-based options, catering to various industries.

ExxonMobil Corporation: ExxonMobil holds a significant market share of approximately 10%. The company is known for its high-performance lubricants, including the well-known Mobil brand, which is widely used in the automotive and industrial sectors.

BP Plc (Castrol): Castrol, a subsidiary of BP, is another major player with a market share of about 9%. The brand is particularly strong in the automotive sector, offering a wide range of engine oils and transmission fluids.

Chevron Corporation: Chevron holds a market share of around 7%. The company is known for its premium lubricants, including the Havoline and Delo brands, which are popular in the automotive and industrial markets.

TotalEnergies SE: TotalEnergies has a market share of approximately 6%. The company offers a diverse range of lubricants, with a strong presence in both the automotive and industrial sectors.

Fuchs Petrolub SE: Fuchs is a leading independent manufacturer with a market share of around 5%. The company specializes in industrial lubricants and has a strong focus on innovation and sustainability.

Market Challenges

Despite the positive growth trajectory, the lubricants market faces several challenges:

Environmental Regulations: As governments worldwide tighten environmental regulations, lubricant manufacturers are under pressure to reduce the environmental impact of their products. This includes reducing emissions, minimizing waste, and using sustainable raw materials. Compliance with these regulations can be costly and complex, especially for smaller manufacturers.

Fluctuating Raw Material Prices: The lubricants market is heavily dependent on crude oil, which is the primary raw material for mineral-based lubricants. Fluctuations in crude oil prices can lead to volatility in lubricant prices, impacting profit margins for manufacturers.

Intense Competition: The market is highly competitive, with numerous global and regional players vying for market share. This intense competition can lead to price wars, putting pressure on margins and making it difficult for companies to maintain profitability.

Technological Advancements in Machinery: As machinery becomes more advanced, the demand for specialized lubricants increases. While this presents an opportunity, it also poses a challenge for manufacturers to continuously innovate and develop products that meet the evolving needs of the market.

Economic Slowdowns: Economic downturns can lead to reduced industrial activity and lower vehicle sales, directly impacting the demand for lubricants. Manufacturers must be prepared to navigate these cyclical challenges and adjust their strategies accordingly.

Conclusion

The global lubricants market is poised for steady growth, driven by increasing demand from various industries, especially in emerging markets. The shift towards synthetic and bio-based lubricants, coupled with advancements in additive technology and digitalization, is reshaping the market landscape. However, the industry must navigate several challenges, including stringent environmental regulations, fluctuating raw material prices, and intense competition. Key players in the market, such as Shell, ExxonMobil, and BP, are well-positioned to capitalize on these trends, but they must continue to innovate and adapt to maintain their market leadership.

0 notes

Text

Base Oil Prices | Pricing | Price | News | Database | Chart | Forecast

Base oil prices play a critical role in the global economy, influencing a wide range of industries and products. Base oils are the primary ingredients in lubricants, which are essential for the smooth operation of machinery and engines in various sectors, including automotive, industrial, marine, and aviation. Understanding the dynamics of base oil prices requires a comprehensive look at several key factors, including crude oil prices, supply and demand balances, production processes, and geopolitical influences.

The price of crude oil is a fundamental driver of base oil prices. Crude oil is the raw material from which base oils are derived, and its cost significantly impacts the overall production expenses. When crude oil prices rise, the cost of producing base oils typically follows suit. Conversely, a decline in crude oil prices can lead to lower base oil costs. However, the relationship between crude oil and base oil prices is not always straightforward. Other factors, such as refining capacity, technological advancements, and environmental regulations, also play vital roles.

Supply and demand dynamics are another crucial aspect of base oil pricing. The balance between the availability of base oils and the demand from various industries determines market prices. For instance, during periods of economic growth, the demand for lubricants increases, leading to higher base oil prices. On the other hand, during economic downturns, demand may decrease, resulting in lower prices. Additionally, the global supply of base oils can be affected by production disruptions, natural disasters, and changes in production levels by key suppliers.

Get Real Time Prices for Base oil: https://www.chemanalyst.com/Pricing-data/base-oil-63

Production processes and refining capacity are significant determinants of base oil prices. The complexity and efficiency of the refining process can influence the cost of base oil production. Modern refineries with advanced technologies are capable of producing higher quality base oils at lower costs. In contrast, older and less efficient refineries may have higher production costs, which can be reflected in the prices of their base oils. Moreover, the availability of refining capacity can affect the supply of base oils in the market. If there is limited refining capacity, it can lead to supply constraints and higher prices.

Geopolitical factors also have a profound impact on base oil prices. Political instability in oil-producing regions, trade disputes, and sanctions can disrupt the supply chain and lead to price volatility. For example, conflicts in the Middle East, a major oil-producing region, can cause uncertainty and lead to spikes in crude oil and base oil prices. Additionally, international trade policies and agreements can influence the flow of base oils between countries, affecting their availability and cost.

Environmental regulations are increasingly influencing base oil prices. Governments around the world are implementing stricter environmental standards to reduce pollution and carbon emissions. These regulations can affect the production and formulation of base oils. Refineries may need to invest in cleaner technologies and processes to comply with environmental standards, potentially increasing production costs. Additionally, the shift towards more environmentally friendly lubricants, such as synthetic and bio-based oils, can impact the demand and pricing of traditional mineral-based base oils.

Technological advancements are playing a pivotal role in shaping the base oil market. Innovations in refining processes and the development of new base oil formulations are contributing to changes in pricing dynamics. For instance, the production of Group III and Group IV base oils, which offer superior performance characteristics, requires advanced technologies and investments. These higher-quality base oils often command premium prices compared to Group I base oils, which are produced using older technologies. As the demand for high-performance lubricants grows, the pricing structure of base oils is likely to evolve accordingly.

The global economic landscape and market sentiment also influence base oil prices. Economic indicators, such as GDP growth, industrial production, and consumer spending, can affect the demand for base oils. Positive economic trends usually correlate with higher demand and prices, while economic downturns can lead to reduced demand and lower prices. Additionally, market sentiment, driven by factors such as investor confidence and speculative activities, can contribute to short-term price fluctuations.

Base oil prices are also impacted by transportation and logistics costs. The cost of transporting base oils from refineries to end-users can vary depending on factors such as distance, transportation modes, and fuel prices. For instance, higher fuel costs can increase shipping expenses, which can be passed on to consumers in the form of higher base oil prices. Additionally, logistical challenges, such as port congestion and supply chain disruptions, can affect the timely delivery of base oils and influence their market prices.

In conclusion, base oil prices are influenced by a complex interplay of factors, including crude oil prices, supply and demand dynamics, production processes, geopolitical influences, environmental regulations, technological advancements, economic conditions, and transportation costs. Understanding these factors is essential for stakeholders in the lubricant industry to make informed decisions and navigate the market effectively. As the global economy and technological landscape continue to evolve, the base oil market is likely to experience ongoing changes, presenting both challenges and opportunities for industry participants.

Get Real Time Prices for Base oil: https://www.chemanalyst.com/Pricing-data/base-oil-63

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

#Base Oil#Base Oil Price#Base Oil Prices#Base Oil Pricing#Base Oil News#Base Oil Price Monitor#Base Oil Database#Base Oil Price Chart

0 notes

Text

Introduction to Aviation Jet Fuel Suppliers

Aviation jet fuel suppliers are vital to the aviation industry, providing the essential fuel that powers aircraft around the globe. The quality and reliability of jet fuel are crucial for safe and efficient flight operations. This article explores the various aspects of aviation jet fuel supply, including types of fuel, production processes, and how to choose a reliable supplier.

Types of Aviation Jet Fuel

Jet A and Jet A-1

Jet A and Jet A-1 are the most common types of jet fuel used in commercial aviation. Jet A is primarily used in the United States, while Jet A-1 is used internationally. Both types are kerosene-based, with Jet A-1 having a lower freezing point, making it suitable for international flights.

Jet B and TS-1

Jet B is a naphtha-kerosene blend used in extremely cold climates due to its low freezing point. TS-1 is similar to Jet A-1 but is used mainly in Russia and the Commonwealth of Independent States (CIS).

Sustainable Aviation Fuel (SAF)

Sustainable Aviation Fuel (SAF) is an emerging alternative to traditional jet fuel. Produced from renewable sources, SAF offers a significant reduction in carbon emissions, making it a critical component in the industry's efforts to achieve sustainability goals.

Key Processes in Jet Fuel Production

Refining Crude Oil

The production of jet fuel begins with refining crude oil. This involves distillation, where crude oil is heated and separated into various fractions, with jet fuel being one of the middle distillates.

Quality Control Measures

Quality control is paramount in jet fuel production. Rigorous testing ensures that the fuel meets stringent specifications for properties such as flash point, freezing point, and energy content.

Blending for Performance

Blending is used to achieve the desired performance characteristics of jet fuel. Additives may be included to enhance properties like thermal stability and lubricity.

Choosing an Aviation Jet Fuel Supplier

Key Factors to Consider

When selecting a jet fuel supplier, consider:

Reliability: Can the supplier guarantee a steady supply of high-quality fuel?

Quality: Does the fuel meet or exceed industry standards?

Pricing: Are the prices competitive and transparent?

Service: What kind of support and additional services does the supplier offer?

Evaluating Supplier Reliability

To evaluate a supplier's reliability, review their history of performance, customer feedback, and logistical capabilities. Assess their ability to manage supply chain disruptions and maintain consistent delivery schedules.

Benefits of Reliable Jet Fuel Suppliers

Consistent Supply

A reliable jet fuel supplier ensures a consistent supply, which is crucial for uninterrupted flight operations and schedule adherence.

Quality Assurance

High-quality jet fuel is essential for optimal engine performance and safety. Reliable suppliers adhere to stringent quality standards, providing fuel that meets all necessary specifications.

Cost Efficiency

A dependable supplier offers cost efficiencies through competitive pricing, bulk purchasing options, and strategic partnerships that can reduce overall fuel expenses.

Challenges in the Jet Fuel Supply Chain

Market Volatility

Jet fuel prices are subject to significant volatility due to fluctuations in crude oil prices, geopolitical events, and changes in global demand.

Regulatory Compliance

Compliance with international, national, and local regulations is complex and costly. Suppliers must navigate environmental laws, safety standards, and trade regulations.

Environmental Concerns

The environmental impact of jet fuel production and consumption is a major concern. Suppliers must invest in sustainable practices and technologies to mitigate their environmental footprint.

Quality Standards in Jet Fuel

Industry Benchmarks

Industry benchmarks for jet fuel include specifications for purity, performance, and safety. Adhering to these standards ensures reliable and safe flight operations.

Importance of High-Quality Fuel

High-quality jet fuel is vital for engine efficiency, reducing maintenance costs, and ensuring safety. Quality issues can lead to operational inefficiencies, increased costs, and safety risks.

Environmental Impact of Jet Fuel

Emissions and Pollution

Jet fuel combustion contributes to air pollution and greenhouse gas emissions. Efforts are being made to develop cleaner fuels and improve fuel efficiency to reduce environmental impact.

Sustainable Practices

Sustainable practices in the jet fuel industry include the development and use of SAF, which significantly reduces carbon emissions and reliance on fossil fuels.

Innovations in Jet Fuel Production

Technological Advances

Technological advances such as process optimization, automation, and the use of advanced materials are transforming jet fuel production, improving efficiency and reducing environmental impact.

Sustainable Aviation Fuel (SAF)

SAF is a game-changer in the aviation industry, offering a sustainable alternative to conventional jet fuel. Produced from renewable sources, SAF can reduce lifecycle carbon emissions by up to 80%.

Cost Considerations

Pricing Structures

Jet fuel pricing structures can include fixed pricing, floating rates tied to market indices, and long-term contracts. Understanding these structures helps airlines manage fuel costs effectively.

Factors Influencing Jet Fuel Prices

Several factors influence jet fuel prices, including crude oil costs, global demand, geopolitical events, and refining capacity. Staying informed about these factors is crucial for effective financial planning.

Logistics and Distribution

Supply Chain Management

Effective supply chain management ensures that jet fuel is delivered on time and in the right quantities. This involves coordinating transportation, storage, and distribution networks.

Delivery Mechanisms

Jet fuel is transported via pipelines, tankers, rail, and trucks. The choice of delivery mechanism depends on factors like distance, volume, and infrastructure availability.

Safety and Compliance

Safety Protocols

Safety in jet fuel operations is paramount. This includes adhering to protocols for production, transportation, storage, and handling to prevent accidents and ensure fuel integrity.

Regulatory Requirements

Compliance with regulatory requirements is mandatory. Jet fuel suppliers must stay updated on international, national, and local regulations related to environmental protection, safety standards, and trade practices.

Customer Support and Service

Importance of Excellent Customer Service

Excellent customer service is a key differentiator for jet fuel suppliers. Providing prompt, efficient, and knowledgeable support can enhance customer satisfaction and loyalty.

Support Options Available

Top suppliers offer various support options, including 24/7 customer service, technical assistance, and customized supply solutions. These services help customers optimize their operations and manage their fuel supply effectively.

Future Trends in the Jet Fuel Industry

Emerging Technologies

Emerging technologies such as digitalization, automation, and blockchain for supply chain transparency are set to revolutionize the jet fuel industry, improving efficiency and reducing costs.

Market Projections

Market projections indicate that the jet fuel industry will continue to evolve, driven by demand for cleaner fuels and advancements in production technologies. Adapting to this evolving landscape will be key for suppliers.

How to Switch Jet Fuel Suppliers

Step-by-Step Guide

Switching suppliers involves several steps:

Assess Current Supplier: Evaluate the performance and cost-effectiveness of your current supplier.

Research Alternatives: Look for suppliers that meet your needs and have strong reputations.

Request Quotes: Obtain detailed quotes from potential suppliers.

Check References: Speak with other customers to gauge their satisfaction.

Negotiate Terms: Discuss pricing, delivery schedules, and support services.

Finalize Agreement: Ensure all terms are clearly documented in the contract.

Key Considerations

Considerations when switching suppliers include ensuring a smooth transition, minimizing disruptions, and maintaining or improving supply quality and service levels.

Conclusion

Choosing the right aviation jet fuel supplier is crucial for the success of any airline or aviation operation. By considering factors such as reliability, quality, pricing, and customer service, businesses can ensure a steady and efficient supply. As the industry evolves, innovations and emerging trends will continue to shape the future of jet fuel production, offering new opportunities and challenges.

1 note

·

View note

Text

#Aviation Lubricant#Aviation Lubricant Market#Aviation Lubricant Industry#Aviation Lubricant Market Trends#Aviation Lubricant Market Report#Aviation Lubricant Market Value#Aviation Lubricant Market Forecast#Aviation Lubricant Market Growth

0 notes

Text

New Innovations in Aviation Consumables: What to Expect for the Future

In the dynamic world of aviation, innovation is a constant driving force that pushes the boundaries of safety, efficiency, and performance. The field of aviation consumables, encompassing lubricants, adhesives, sealants, and cleaning agents, is no exception. As technology advances, new innovations in aviation consumables are set to revolutionize aircraft maintenance and operations. Team Aviation, a leading aviation consumables provider, is at the forefront of these developments. This article explores the latest innovations in aviation consumables and what to expect for the future.

The Importance of Aviation Consumables

Aviation consumables play a critical role in ensuring the smooth operation and maintenance of aircraft. They are essential for:

1. Lubrication: Reducing friction and wear in moving parts.

2. Protection: Shielding components from corrosion and environmental damage.

3. Bonding and Sealing: Ensuring structural integrity and preventing leaks.

4. Cleaning: Maintaining cleanliness and hygiene within and outside the aircraft.

Current Trends in Aviation Consumables

Before delving into future innovations, it is essential to understand the current trends shaping the aviation consumables market:

1. High-Performance Lubricants: The demand for lubricants that can withstand extreme temperatures and pressures is increasing. High-performance lubricants enhance engine efficiency and longevity.

2. Eco-Friendly Products: There is a growing emphasis on environmentally friendly consumables that reduce the carbon footprint without compromising performance.

3. Advanced Sealants and Adhesives: Innovations in materials science have led to the development of advanced sealants and adhesives that offer superior bonding strength and durability.

4. Specialized Cleaning Agents: Tailored cleaning agents that effectively remove specific contaminants without damaging aircraft surfaces are becoming more prevalent.

Future Innovations in Aviation Consumables

1. Nanotechnology in Lubricants

Nanotechnology is poised to revolutionize aviation lubricants by enhancing their properties at the molecular level. Nanolubricants incorporate nanoparticles that provide superior lubrication, reduce friction, and enhance wear resistance. These lubricants can operate effectively under extreme conditions, extending the lifespan of engine components and improving fuel efficiency.

Benefits of Nanolubricants:

- Reduced friction and wear.

- Enhanced thermal stability.

- Improved fuel efficiency.

- Extended maintenance intervals.

2. Bio-Based and Sustainable Consumables

The aviation industry is increasingly focusing on sustainability, and bio-based consumables are at the forefront of this movement. Bio-based lubricants, adhesives, and cleaning agents are derived from renewable resources, reducing environmental impact. These products are designed to meet performance standards while offering eco-friendly alternatives to traditional petrochemical-based consumables.

Advantages of Bio-Based Consumables:

- Reduced carbon footprint.

- Biodegradability.

- Sustainable sourcing.

- Compliance with environmental regulations.

3. Smart Lubricants and Self-Healing Materials

Smart lubricants and self-healing materials represent a significant leap forward in aviation consumables. Smart lubricants are formulated with additives that respond to changes in operating conditions, providing optimal lubrication when and where it is needed. Self-healing materials, used in adhesives and sealants, can automatically repair minor damages, enhancing durability and reducing maintenance needs.

Features of Smart Lubricants and Self-Healing Materials:

- Adaptive lubrication.

- Enhanced durability and longevity.

- Reduced maintenance requirements.

- Improved safety and reliability.

4. Antimicrobial Coatings and Cleaning Agents

The COVID-19 pandemic has highlighted the importance of hygiene in aviation. Antimicrobial coatings and cleaning agents are designed to kill or inhibit the growth of microorganisms on aircraft surfaces. These products help maintain a sanitary environment, protecting passengers and crew from potential infections.

Benefits of Antimicrobial Products:

- Long-lasting microbial protection.

- Enhanced passenger and crew safety.

- Compliance with health regulations.

- Reduced need for frequent cleaning.

The Role of Aviation Consumables Providers

Aviation consumables providers, such as Team Aviation, play a crucial role in bringing these innovations to the market. By partnering with leading manufacturers and investing in research and development, providers ensure that their clients have access to the latest and most effective consumables.

Team Aviation’s Commitment to Innovation

As a leading aviation consumables provider in India, Delhi, and Asia, Team Aviation is dedicated to staying at the forefront of industry advancements. Our commitment to innovation ensures that we offer our clients the best products available, supporting their operations with cutting-edge solutions.

Adopting New Innovations

Adopting new innovations in aviation consumables requires a strategic approach:

1. Evaluation and Testing: Thoroughly evaluate and test new products to ensure they meet performance and safety standards.

2. Training and Education: Provide training for maintenance teams on the proper use and benefits of new consumables.

3. Collaboration with Providers: Work closely with aviation consumables providers to stay informed about the latest developments and innovations.

4. Regulatory Compliance: Ensure that all new consumables comply with industry regulations and certifications.

The Future of Aviation Consumables

The future of aviation consumables is bright, with numerous innovations set to enhance the efficiency, safety, and sustainability of aircraft maintenance and operations. As technology continues to evolve, the aviation industry can expect even more advanced solutions that push the boundaries of what is possible.

About Team Aviation

Team Aviation is a leading aviation consumables provider, specializing in supplying high-quality aviation products and consumables. With a focus on safety, reliability, and performance, we serve clients across India, Delhi, and Asia, ensuring they have the best materials for their aviation needs. Our extensive range of products includes lubricants, greases, adhesives, sealants, cleaning agents, and more, all sourced from reputable manufacturers and rigorously tested for quality. Contact us today to learn more about our products and how we can support your aviation operations.

Why Choose Team Aviation?

1. Expertise: With years of experience in the aviation industry, we understand the unique challenges and requirements of aviation maintenance. Our team is knowledgeable and well-equipped to provide expert advice and support.

2. Quality Assurance: We are committed to delivering products that meet the highest quality standards. Our rigorous testing and quality control processes ensure that our clients receive only the best.

3. Comprehensive Range: We offer a wide range of aviation consumables, from lubricants and greases to cleaning agents and adhesives. This comprehensive selection ensures that our clients can find everything they need in one place.

4. Customer Focus: Our clients are at the heart of everything we do. We strive to provide exceptional customer service and build long-term relationships based on trust and mutual success.

Conclusion

New innovations in aviation consumables are set to revolutionize the industry, offering enhanced performance, safety, and sustainability. By staying informed and adopting these advancements, aviation professionals can ensure their operations remain at the cutting edge. Team Aviation is dedicated to supporting the aviation industry with the latest consumables, helping clients achieve the highest standards of safety and efficiency.

For more information on how Team Aviation can support your aviation operations with innovative consumables, contact us today. Let us help you stay ahead in the ever-evolving world of aviation.

#Aviation consumables provider in India#Aviation consumables provider in Delhi#Aviation consumables provider in Asia#Aircraft consumables distributors in India#Aircraft consumables distributors in Delhi#Aircraft consumables distributors in Asia

0 notes

Text

Aerospace Materials Market Share, and SWOT Analysis Report 2024-2031

The Aerospace Materials Market Size was valued at USD 45.74 billion in 2023 and is expected to reach USD 89.15 billion by 2031 and grow at a CAGR of 8.7% over the forecast period 2024-2031. The aerospace materials market is in the midst of a transformative phase, buoyed by a confluence of factors including advancements in material science, increasing demand for fuel-efficient aircraft, and the burgeoning space exploration industry. Aerospace materials, encompassing a diverse range of metals, composites, ceramics, and alloys, are fundamental to the design and manufacturing of aircraft, spacecraft, satellites, and drones. In the pursuit of lightweighting and improved performance, aerospace manufacturers are increasingly turning to advanced materials such as carbon fiber composites, titanium alloys, and lightweight metals like aluminum and magnesium. These materials offer exceptional strength-to-weight ratios, corrosion resistance, and thermal stability, making them ideal for critical aerospace applications.

Market Scope & Overview

The Aerospace Materials Market report offers a detailed exploration into the world of lubricant enhancement compounds, providing a thorough analysis of their uses, compositions, and market dynamics. It covers a wide range of additives and examines how they improve the performance of lubricants in various sectors like automotive, industrial machinery, and aerospace. Focusing on innovation and sustainability, the report highlights emerging trends in additive technology and introduces new formulations that promise to enhance lubricant effectiveness while minimizing environmental impact. Through careful market segmentation and trend analysis, the report not only predicts the future direction of the Aerospace Materials Market but also offers valuable insights for industry players navigating this rapidly evolving field of lubrication science and engineering.

Get Sample Report of Aerospace Materials Market@ https://www.snsinsider.com/sample-request/2334

Major Key Players in the Aerospace Materials Market

Constellium SE, Alcoa Corporation, Toray Industries, Inc., Allegheny Technologies Incorporated, Solvay S.A., Teijin Limited, Kobe Steel, Ltd., NOVELIS, AMG N.V., Hexcel, DuPont de Nemours, Inc., and other players.

Market Segmentation Analysis

This Aerospace Materials Market report isn't just about data; it's about your competitive advantage. By understanding your market on a deeper level, you're not just surviving – you're thriving. It's a roadmap to sustainable growth, a tool to stay ahead in the game. So, whether you're a seasoned entrepreneur, a curious investor, or someone just dipping their toes into the business world, this report is your guide

By Type

Aluminum Alloys

Steel Alloys

Composites

Titanium Alloys

Super Alloys

Others

By Aircraft Type

Commercial Aircraft

Military Aircraft

Business & General Aviation

Helicopters

Others

By Application

Interior

Passenger Seating

Panels, Galley

Others

Propulsion Systems

Airframe

Windows & Windshields

Tail & Fin

COVID-19 Impact Analysis

What this report offers is more than just information – it's a guide for making smart decisions. In times of uncertainty, like those brought about by the pandemic, having the right information is crucial. It's not just about making decisions; it's about making the right decisions. By going through these pages, you gain access to a wealth of data and Aerospace Materials Market analysis that can help you make informed choices, minimizing risks and maximizing opportunities.

Impact of Ukraine-Russia War

Businesses need a flexible approach to navigate uncertainties and seize new opportunities while building overall resilience. Our Aerospace Materials Market research report provides valuable perspectives for individuals and entities in the business world, including industry stakeholders, investors, and companies. It guides them toward lasting success in the global market, offering insights to help them navigate the changing landscape.

Check Discount on Aerospace Materials Market Report@ https://www.snsinsider.com/discount/2334

Impact of Global Recession

The market report on Aerospace Materials Market outlines practical strategies for strengthening your organization's resilience – diversification, cost management, and risk reduction. Through real-life examples and industry best practices, we explore how companies have weathered economic challenges. Investors and stakeholders can find valuable information about new investment opportunities, growing sectors, innovative technologies, and potential collaborations for a post-recession recovery.

Regional Outlook

Tailored to meet the specific needs of those involved in the industry, our document provides the knowledge needed to succeed in a highly competitive environment. The Aerospace Materials Market report takes a thorough look at trends, opportunities, and risks, acting as a guiding tool for shaping business strategies. We offer detailed analyses of key market players, their approaches, and how they position themselves in the market.

Competitive Analysis

Understanding where your industry stands today is important, but what's even more crucial is anticipating what's coming next. Our report is like a crystal ball for the Aerospace Materials Market, giving you a peek into potential future developments. This forward-thinking approach helps you prepare for upcoming trends, ensuring you stay ahead in the competition. Armed with this insight, everyone in the industry, from individuals to big companies, can create smart plans based on real information.

Key Reasons to Purchase the Aerospace Materials Market Report

We've put together this report using the latest data and advanced analytical tools. It's like having a comprehensive guidebook that gives you a clear picture of where your industry is right now and where it could go.

With our report in hand, you can make decisions with confidence. It's your go-to resource for creating innovative strategies that keep you at the forefront of your industry.

Conclusion

In conclusion, this market analysis report is more than just a document. It's a strategic asset for anyone involved in the industry – be it participants, investors, or companies. It equips organizations with the essential information needed to make wise decisions, minimize risks, and grab opportunities. Inside these pages, you'll discover a wealth of data, analysis, and recommendations that can give you a leg up in the competition and foster sustainable growth.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

0 notes

Text

In-Depth Analysis of Market Share in the Aircraft Sensors Sector

Market Overview

The Aircraft Sensors Market was valued at USD 4.7 Billion in 2022 and is projected to grow from USD 5.17 Billion in 2023 to USD 7.0 Billion by 2027, at a Compound Annual Growth Rate (CAGR) of 8.3% during the forecast period. This significant growth is driven by the increasing need for advanced sensing solutions to ensure efficient operations and the safety of aircraft systems.

Market Size and Growth

Current Market Size

As of 2022, the global Aircraft Sensors Market stands at USD 4.7 billion. The market's size highlights its critical role in the aviation industry, which relies on sophisticated sensors to monitor various parameters essential for safe and efficient aircraft operations.

Projected Market Size

The market is anticipated to grow to USD 7.0 billion by 2027, with a robust CAGR of 8.3%. This growth trajectory underscores the expanding adoption of advanced sensor technologies in both commercial and military aviation sectors.

Market Drivers

Increased Usage of Sensors for Data Sensing and Measurement

Sensors play a crucial role in providing feedback on various flight conditions and the state of aircraft systems. For example, flow sensors detect the amount of lubricating oil, liquid coolant, and fluid movement in fuel transfer and bleed air systems. Liquid level sensors monitor oil, fuel, coolant, and fluid levels in hydraulic reservoirs and waste water tanks. Pressure sensors are essential in hydraulic systems used for braking, control surfaces, and landing gear operations. Position sensors, such as rotary variable differential transformers (RVDTs) and linear variable differential transformers (LVDTs), measure the displacement of aircraft parts like thrust reversers. Additionally, sensors monitor force, vibration, and temperature in critical systems.

Technological Advancements in Military Applications

The criticality of modern military airborne missions has led to the development of highly advanced navigational and surveillance systems. These systems enable long-range target detection in low-light conditions and include missile indication and deterrence systems capable of operating in radar-denied zones. The increasing number of sensors on military aircraft enhances situational awareness, driving demand in this sector.

Get a Deeper Understanding of the Industry by Visiting: https://www.marketsandmarkets.com/Market-Reports/aircraft-sensors-market-53630527.html

Market Restraints

Frequent Calibration and Maintenance Requirements

Aircraft sensors require regular calibration and maintenance to ensure accurate and reliable performance. For instance, airspeed sensors need frequent calibration to maintain proper auto-throttle modes and effective automatic landing operations. Pre-flight checks and periodic calibrations, often every 500 flight hours, are necessary. Sensors exposed to harsh environments, such as those on aerostructures and engines, are particularly susceptible to contamination and require more frequent calibration.

Market Opportunities

Increasing Adoption of Internet of Things (IoT) in Aviation

The rapid development of IoT and sensor networks presents significant opportunities for the Aircraft Sensors Market. IoT-enabled sensor networks are being widely adopted across various sectors, including aviation, to enhance operational efficiency and passenger experience. For example, temperature sensors in aircraft cabins facilitate automated temperature control systems, ensuring passenger comfort. IoT systems also monitor the condition of aircraft components, providing real-time data to pilots and ground crews, which improves maintenance efficiency and reduces runway downtime.

Enhancing Passenger Experience

IoT applications in aviation extend beyond operational efficiency to improving the passenger experience. Sensors that monitor cabin temperature, air quality, and lighting conditions contribute to a more comfortable journey. Additionally, sensors that track seat occupancy and in-flight entertainment preferences enable personalized services, enhancing overall passenger satisfaction.

Market Challenges

Cybersecurity Risks

The increasing digitalization and integration of systems in the aviation sector pose significant cybersecurity risks. The open and networked nature of modern aviation ecosystems makes them vulnerable to cyberattacks. For instance, the F-35's autonomic logistics information system (ALIS) uses sensors to detect aircraft performance and predict maintenance needs, communicating this data to ground crews. However, such systems are susceptible to cybersecurity threats, necessitating robust security measures to protect sensitive data and ensure the integrity of aircraft operations.

Market Segmentation

This Research Report Categorizes the Aircraft Sensors Market Into Sensor Type, Application, Aircraft Type, End Use, Connectivity, and Region:

By End Use:

OEM

Aftermarket

By Sensor Type:

Pressure Sensors

Temperature Sensors

Force Sensors

Torque Sensors

Speed Sensors

Position & Displacement Sensors

Level Sensors

Proximity Sensors

Flow Sensors

Optical Sensors

Motion Sensors

Radar Sensors

Smoke Detection Sensors

GPS Sensors

Others

By Aircraft Type:

Fixed-Wing

Rotary-Wing

Unmanned Aerial Vehicles

Advanced Air Mobility

By Application:

Fuel, Hydraulic, and Pneumatic Systems

Engine/Propulsion

Cabin & Cargo Environmental Controls

Aerostructures & Flight Control

Flight Decks

Landing Gear Systems

Weapon Systems

Others

By Connectivity:

Wired Sensors

Wireless Sensors

By Regions:

North America

Europe

Asia Pacific

Middle East

Latin America

Africa

By End Use

OEM Segment