#Automotive Exhaust Gas Recirculation System

Explore tagged Tumblr posts

Text

Thermal Management Breakthroughs: How Smart Valves in Automotive for Thermal Management Market Are Changing the Auto Industry

Introduction

The global valves in automotive for thermal management market is experiencing significant growth, driven by advancements in vehicle technology and the increasing emphasis on energy efficiency and emission control. As of 2023, the valves in automotive for thermal management market was valued at approximately USD 5,125.6 million and is projected to reach USD 6,496.2 million by 2031, reflecting a compound annual growth rate (CAGR) of 10.02% during the forecast period from 2024 to 2031.

Request Sample Report PDF (including TOC, Graphs & Tables): https://www.statsandresearch.com/request-sample/40579-global-valves-in-automotive-for-thermal-management-market

Valves in Automotive for Thermal Management Market Dynamics:

Surge in Electric and Hybrid Vehicle Adoption

The escalating demand for electric and hybrid vehicles is a primary catalyst for the expansion of the automotive thermal management valves market. Governments worldwide are implementing stringent emission regulations and offering incentives to promote the adoption of environmentally friendly vehicles. This regulatory landscape compels automakers to invest in electric and hybrid technologies, necessitating advanced thermal management systems to ensure optimal performance and longevity of these vehicles.

Integration of Advanced Driver Assistance Systems (ADAS)

The proliferation of Advanced Driver Assistance Systems (ADAS) in modern vehicles significantly influences the market. ADAS features, including adaptive cruise control, lane-keeping assist, and automatic emergency braking, rely on sophisticated sensors and electronic components that require effective thermal management to function reliably. The increasing consumer demand for enhanced vehicle safety and the subsequent rise in ADAS adoption underscore the need for efficient thermal management solutions.

Get up to 30%-40% Discount: https://www.statsandresearch.com/check-discount/40579-global-valves-in-automotive-for-thermal-management-market

Valves in Automotive for Thermal Management Market Segmental Analysis:

By Valve Type

The valves in automotive for thermal management market is segmented based on valve types, including:

Thermostat Valves

Coolant Control Valves

Heater Control Valves

Exhaust Gas Recirculation (EGR) Valves

Bypass Valves

Pressure Relief Valves

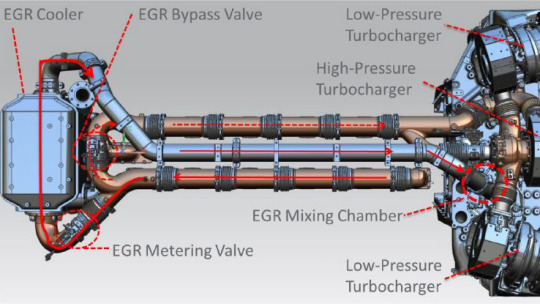

Among these, EGR valves are anticipated to dominate, holding a market share of 27.5% in 2023. Their prominence is attributed to their crucial role in reducing nitrogen oxide (NOx) emissions and enhancing fuel efficiency by recirculating a portion of exhaust gas back into the engine's combustion chamber, thereby lowering combustion temperatures.

By Vehicle Type

The vehicle type segmentation comprises:

Passenger Cars

Light Commercial Vehicles (LCVs)

Heavy Commercial Vehicles (HCVs)

Off-Road Vehicles

Passenger cars lead this segment, accounting for 59% of the valves in automotive for thermal management market share in 2023. This dominance is driven by the substantial demand for efficient temperature control systems to ensure optimal engine performance and passenger comfort in passenger vehicles.

By Application

Applications of thermal management valves include:

Engine Cooling

HVAC Systems

Emission Control

Transmission Cooling

The HVAC systems segment is projected to witness the highest growth rate of 3.7% during the forecast period. This growth is due to the essential role HVAC systems play in regulating cabin temperature and ensuring passenger comfort, necessitating advanced thermal management solutions.

Valves in Automotive for Thermal Management Market Regional Insights:

The Asia-Pacific region stands out as the dominant market, generating 39.0% of worldwide revenue in 2023. This leadership is primarily due to the region's extensive automotive manufacturing base in countries such as China, Japan, South Korea, and India. The burgeoning demand for electric vehicles in these nations further accelerates the need for effective thermal management solutions to address battery cooling and energy efficiency challenges.

Competitive Landscape

The global valves in automotive for thermal management market is moderately consolidated, with the top three players contributing to over 55% of the industry's share. Key players include:

BorgWarner Inc.

Continental Automotive Technologies GmbH

AISAN INDUSTRY CO., LTD.

DENSO CORPORATION

MAHLE GmbH

HELLA GmbH & Co. (FORVIA Faurecia)

Rheinmetall AG

Eberspächer

These companies are actively engaging in strategic initiatives such as product launches and partnerships to strengthen their market positions. For instance, in March 2022, DENSO invested in developing advanced thermal management solutions for electric vehicles, focusing on enhancing battery system efficiency and safety through precise temperature control. citeturn0search0 Similarly, in November 2021, BorgWarner acquired Rhombus Energy Solutions, specializing in EV charging and thermal management technologies, bolstering BorgWarner's capabilities in providing integrated thermal management systems for electric and hybrid vehicles.

Purchase Exclusive Report: https://www.statsandresearch.com/enquire-before/40579-global-valves-in-automotive-for-thermal-management-market

Future Outlook

The automotive thermal management valves market is poised for substantial growth, driven by the increasing adoption of electric and hybrid vehicles, integration of ADAS, and stringent emission regulations. Technological advancements, such as electronically controlled valves and smart thermal systems, are expected to further propel market expansion. Manufacturers focusing on innovation and strategic collaborations are well-positioned to capitalize on emerging opportunities in this dynamic landscape.

Our Services:

On-Demand Reports: https://www.statsandresearch.com/on-demand-reports

Subscription Plans: https://www.statsandresearch.com/subscription-plans

Consulting Services: https://www.statsandresearch.com/consulting-services

ESG Solutions: https://www.statsandresearch.com/esg-solutions

Contact Us:

Stats and Research

Email: [email protected]

Phone: +91 8530698844

Website: https://www.statsandresearch.com

#Valves#Automotive#Thermal Management#Market#Industry#Trends#Growth#Analysis#Forecast#Cooling System#Engine Efficiency#HVAC#Electric Vehicles#Combustion Engines#Fluid Control#Smart Valves#Actuators#Suppliers#Manufacturers#Innovation#Technology#Regulation#Sustainability

1 note

·

View note

Text

Discover Expert Vehicle Care with Hydro Flush

At Hydro Flush, we believe your vehicle deserves to perform at its very best. As a leading name in automotive care, we specialise in the DPF cleaning process, car suspension and steering repair, gearbox replacement, and cleaning egr valve. Whether you drive a family car, a commercial van, or a performance vehicle, our skilled technicians are here to restore and maintain your vehicle’s efficiency and optimal performance.

Professional DPF Cleaning Process for Better Engine Performance

One of our primary services at Hydro Flush is our state-of-the-art DPF cleaning process. The Diesel Particulate Filter (DPF) plays a vital role in lowering emissions and helping your diesel vehicle run efficiently. Over time, soot and ash can clog the filter, reducing performance, increasing fuel consumption, and even causing engine damage.

At Hydro Flush, we use advanced cleaning methods to thoroughly clear the DPF, removing all obstructions without damaging the filter. Our process improves airflow, restores fuel economy, and extends the lifespan of your DPF system.

We strongly recommend regular DPF cleaning to avoid costly repairs and maintain compliance with emissions regulations. If your vehicle is losing power or producing excessive smoke, it’s time to have Hydro Flush inspect and clean your DPF professionally.

Car Suspension and Steering Services to Keep You Safe on the Road

Your vehicle’s car suspension and steering system are crucial for both safety and driving comfort. A faulty suspension or misaligned steering can lead to uneven tyre wear, poor handling, and increased braking distances.

At Hydro Flush, our fully qualified technicians provide comprehensive inspections and repairs for all types of car suspension and steering systems. Whether it’s shock absorber replacement, wheel alignment, or steering component diagnostics, we ensure your vehicle operates smoothly and securely.

We use advanced diagnostic equipment to measure suspension performance and steering precision, ensuring every component functions according to manufacturer specifications. Trust Hydro Flush to restore your vehicle’s ride quality and keep your journeys safe and comfortable.

Professional Gearbox Replacement for Smooth Driving

If your vehicle is having trouble shifting gears, producing strange noises, or leaking transmission fluid, you may need a gearbox replacement. The gearbox is one of the most complex and essential parts of any vehicle. At Hydro Flush, we specialise in both manual and automatic gearbox replacement services.

Our expert technicians assess the condition of your gearbox using diagnostic software and hands-on mechanical testing. Whether the problem stems from wear, internal failure, or fluid contamination, we offer a complete replacement using high-quality OEM or reconditioned parts.

We understand just how important a reliable transmission is for smooth performance, which is why we only use trusted components and proven techniques. With Hydro Flush, you’ll leave with peace of mind, knowing your gearbox is functioning as it should.

EGR Valve Cleaning to Maximise Engine Efficiency

The EGR valve (Exhaust Gas Recirculation valve) plays a key role in reducing emissions by recirculating a portion of exhaust gases back into the combustion process. However, carbon build-up over time can cause the EGR valve to stick or malfunction, affecting both performance and fuel efficiency.

At Hydro Flush, we provide professional cleaning egr valve services to remove stubborn carbon deposits without needing to replace the entire valve system. Our thorough cleaning process improves emissions, restores engine performance, and helps prevent common issues such as engine knocking, loss of power, and dashboard warning lights.

For modern engines, especially diesel vehicles, routine cleaning egr valve is a smart way to protect your investment and maintain efficiency.

Why Choose Hydro Flush?

Partnering with Hydro Flush means choosing a team committed to quality, integrity, and precision. Here’s what sets us apart:

✅ Experienced technicians with hands-on expertise ✅ Industry-leading diagnostic and cleaning equipment ✅ OEM-grade components and manufacturer-approved techniques ✅ Transparent pricing with no hidden charges ✅ Fast turnaround times to keep you moving

Whether it’s a complex gearbox replacement, a thorough DPF cleaning process, or precise car suspension and steering work, Hydro Flush delivers trusted, long-lasting solutions that save you time, money, and hassle.

Book Your Appointment Today

At Hydro Flush, your vehicle’s health is our highest priority. Regular maintenance and prompt repairs can help prevent breakdowns, improve driving safety, and boost performance. If you’ve noticed signs like poor fuel economy, strange engine noises, or handling issues, don’t delay—get in touch with us today for a professional assessment.

0 notes

Text

High Temperature Thermistor Market 2025-2032

MARKET INSIGHTS

The global High Temperature Thermistor Market size was valued at US$ 627.4 million in 2024 and is projected to reach US$ 1,010 million by 2032, at a CAGR of 7.1% during the forecast period 2025-2032.

High temperature thermistors are thermally sensitive resistors that exhibit significant resistance changes at elevated temperatures, typically above 150°C. These components are categorized into Negative Temperature Coefficient (NTC) and Positive Temperature Coefficient (PTC) types, with NTC thermistors dominating the market due to their superior sensitivity and response characteristics in high-heat environments.

The market growth is driven by increasing demand from automotive applications, particularly in exhaust gas recirculation systems and battery thermal management for electric vehicles. Furthermore, expanding industrial automation and the need for precise temperature monitoring in harsh environments are creating new opportunities. Key players like Thermik Corporation and Minco are investing in advanced materials to improve temperature range and stability, with recent developments focusing on lead-free compositions to meet environmental regulations.

Access Your Free Sample Report Now-https://semiconductorinsight.com/download-sample-report/?product_id=98051

Key Industry Players

Innovation and Market Expansion Drive Competition in High Temperature Thermistor Industry

The global High Temperature Thermistor market exhibits a moderately competitive landscape with a mix of established leaders and emerging niche players. The market is projected to grow from $XXX million in 2024 to $XXX million by 2032, with North America and Asia-Pacific showing particularly strong demand growth in automotive and industrial electronics applications.

Thermik Corporation maintains a dominant position with approximately XX% market share in 2024, attributed to its comprehensive product portfolio spanning both NTC and PTC thermistor technologies. The company’s strong technical expertise in high-temperature sensor solutions has secured its leadership across multiple end-use sectors.

Meanwhile, Microtherm Inc. and Thermalogic Corp. have significantly increased their footprint through strategic acquisitions and technology partnerships. These companies are focusing on developing ultra-precision thermistors capable of operating in extreme environments up to 300°C, responding to growing demand from aerospace and energy sectors.

Emerging players like Veritas Sensors and Quality Thermistor are adopting innovative strategies, including customized sensor solutions and fast delivery models, to capture niche market segments. This has intensified competition in specialized applications such as medical devices and EV charging systems.

Recent industry trends show established manufacturers increasing R&D expenditure by an estimated XX% year-over-year to develop IoT-enabled smart thermistors with wireless capabilities. Market leaders are also expanding production capacities in Asia to meet growing regional demand while maintaining technological superiority through continuous product innovation.

List of Key High Temperature Thermistor Manufacturers

Thermik Corporation (Germany)

Thermalogic Corp. (U.S.)

Minco (U.S.)

Microtherm Inc. (U.S.)

Thermistors Unlimited, Inc. (U.S.)

Sensor Scientific, Inc. (U.S.)

Quality Thermistor, Inc. (Japan)

AdSem, Inc. (U.S.)

ThermoWorks (U.S.)

Veritas Sensors, LLC (U.S.)

Segment Analysis:

By Type

NTC Thermistor Segment Leads Due to High Sensitivity in Temperature Monitoring Applications

The market is segmented based on type into:

NTC Thermistor

Subtypes: Bead type, Disc type, Chip type, and others

PTC Thermistor

Subtypes: Ceramic PTC, Polymer PTC, and others

By Application

Automotive Systems Segment Drives Demand for High Reliability in Extreme Conditions

The market is segmented based on application into:

Telecommunications and Networking

Automotive System

Industrial Electronics

Others

By Temperature Range

High Temperature Segment (Above 150°C) Gains Traction in Industrial Applications

The market is segmented based on temperature range into:

Low Temperature (Below 0°C)

Medium Temperature (0°C to 150°C)

High Temperature (Above 150°C)

By Configuration

Surface Mount Configurations Dominate Due to Miniaturization Trends

The market is segmented based on configuration into:

Surface Mount

Through Hole

Wire Lead

Download Your Complimentary Sample Report-https://semiconductorinsight.com/download-sample-report/?product_id=98051

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global High Temperature Thermistor Market?

-> High Temperature Thermistor Market size was valued at US$ 627.4 million in 2024 and is projected to reach US$ 1,010 million by 2032, at a CAGR of 7.1% during the forecast period 2025-2032.

Which key companies operate in Global High Temperature Thermistor Market?

-> Key players include Thermik Corporation, Thermalogic Corp., Minco, Microtherm Inc., Thermistors Unlimited, Inc., Sensor Scientific, Inc., and Quality Thermistor, Inc., among others.

What are the key growth drivers?

-> Key growth drivers include increasing adoption in automotive applications, growing industrial automation, and demand for reliable high-temperature sensing solutions.

Which region dominates the market?

-> North America currently leads the market, while Asia-Pacific is projected to grow at the highest CAGR of 7.8% during 2024-2032.

What are the emerging trends?

-> Emerging trends include development of ultra-high temperature thermistors, miniaturization of components, and integration with IoT platforms.

About Semiconductor Insight

Established in 2016, Semiconductor Insight specializes in providing comprehensive semiconductor industry research and analysis to support businesses in making well-informed decisions within this dynamic and fast-paced sector. From the beginning, we have been committed to delivering in-depth semiconductor market research, identifying key trends, opportunities, and challenges shaping the global semiconductor industry.

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014

[+91 8087992013]

0 notes

Text

Gas Sensor for Automotive Market to reach US$ 1.34 billion by 2032, at a CAGR of 6.9%

Global Gas Sensor for Automotive Market size was valued at US$ 789.4 million in 2024 and is projected to reach US$ 1.34 billion by 2032, at a CAGR of 6.9% during the forecast period 2025-2032.

Gas sensors for automotive are critical components that detect and measure the concentration of gases in vehicle environments. These sensors convert gas-related data into electrical signals for processing by the vehicle’s electronic control units (ECUs). They play a vital role in monitoring emissions, optimizing combustion efficiency, and ensuring passenger safety by detecting hazardous gases like carbon monoxide.

The market growth is primarily driven by stringent global emission regulations such as Euro 7 and China 6 standards, which mandate sophisticated emission control systems. Furthermore, the rising adoption of advanced driver-assistance systems (ADAS) and electric vehicles creates new opportunities for sensor integration. Key industry players including Bosch, Continental, and DENSO are investing heavily in developing more accurate and durable sensor technologies to meet these evolving demands.

Get Full Report : https://semiconductorinsight.com/report/gas-sensor-for-automotive-market/

MARKET DYNAMICS

MARKET DRIVERS

Stringent Emission Regulations Accelerating Adoption of Gas Sensors

The global automotive industry is witnessing unprecedented regulatory pressure to reduce emissions, with governments implementing progressively stricter standards. The Euro 7 norms scheduled for 2025 aim to reduce NOx emissions by 35% compared to current limits, compelling automakers to incorporate more sophisticated exhaust monitoring systems. Similarly, China’s China 6b standards and the U.S. EPA’s Tier 3 regulations are creating mandatory demand for high-precision gas sensors. This regulatory push isn’t limited to exhaust systems – evaporative emission control systems in fuel tanks now require vapor detection sensors meeting 0.02g/hr sensitivity thresholds, expanding the addressable market further.

Electrification Wave Creating New Sensing Requirements

While battery electric vehicles eliminate tailpipe emissions, they introduce new gas sensing challenges that are driving innovation. Lithium-ion battery thermal runaway events can produce hazardous gases including hydrogen fluoride (HF) at concentrations as low as 30ppm. Advanced cabin air quality systems now integrate multiple gas sensors to detect CO2 buildup from occupant breathing (typically above 1000ppm triggers ventilation) and volatile organic compounds. Emerging solid-state battery technologies are creating demand for novel hydrogen sulfide (H2S) sensors capable of detecting concentrations below 1ppm to monitor cell degradation.

ADAS Integration Expanding Sensor Functionality

Advanced driver assistance systems are evolving to incorporate environmental sensing capabilities that go beyond traditional collision avoidance. Modern implementations now integrate gas sensors with predictive algorithms – detecting rising CO levels in tunnels can trigger cabin air recirculation before oxygen depletion becomes dangerous. Some premium vehicles now feature methane detection systems that alert drivers to gas leaks when parked in residential garages, with sensitivity thresholds below 10% of the lower explosive limit (LEL). This sensor fusion approach is creating opportunities for multi-gas detection modules that interface directly with vehicle ECUs.

MARKET RESTRAINTS

Thermal and Chemical Stability Challenges in Harsh Environments

Automotive gas sensors face extreme operating conditions that push material science boundaries. Under-hood applications require sensors to maintain accuracy across a -40°C to 125°C temperature range while exposed to vibration loads exceeding 20G. Electrochemical sensors particularly struggle with electrolyte evaporation at high temperatures, leading to calibration drift. Recent field studies show particulate contamination can reduce nitrogen oxide sensor lifespan by up to 40% in diesel applications. While new alumina-based protective coatings show promise, they add approximately 15-20% to unit costs, creating adoption barriers in price-sensitive segments.

Complex Validation Requirements Increasing Time-to-Market

The automotive industry’s rigorous qualification processes create significant bottlenecks for new sensor technologies. A typical OEM approval cycle now spans 18-24 months, requiring validation across 50+ environmental and durability tests. Redundant sensor architectures needed for ASIL-D compliance in safety-critical applications can increase system costs by 30-35%. Recent changes in ISO 26262 functional safety standards have mandated additional failure mode documentation, with some Tier 1 suppliers reporting 40% longer development cycles for new sensor integrations.

MARKET OPPORTUNITIES

AI-Enabled Predictive Maintenance Creating Value-Added Services

Vehicle connectivity is enabling innovative business models around gas sensor data monetization. Cloud-based analytics platforms now correlate sensor outputs with drive cycle data to predict emission system failures with 85-90% accuracy 3,000-5,000 miles before they occur. Some fleet operators have reduced NOx-related warranty claims by 60% using these predictive models. Emerging applications include real-time fuel quality monitoring through hydrocarbon pattern recognition, helping detect adulterated fuels that can cause aftertreatment system damage.

Material Science Breakthroughs Enabling New Sensing Modalities

Recent advances in nanomaterials are overcoming traditional limitations of gas sensors. Graphene-based FET sensors demonstrate parts-per-billion sensitivity to NO2 at room temperature, eliminating traditional heater power requirements. Metal-organic framework (MOF) materials show exceptional selectivity for oxygenates like ethanol and formaldehyde, enabling new cabin air quality applications. These innovations are particularly significant for hydrogen fuel cell vehicles, where current sensors struggle with cross-sensitivity between hydrogen and other reducing gases.

MARKET CHALLENGES

Supply Chain Vulnerabilities Impacting Sensor Availability

The gas sensor industry faces critical material dependencies that create supply risks. Over 75% of global platinum group metal production – essential for electrochemical sensors – comes from just three countries, making pricing volatile. Recent geopolitical tensions have caused rhodium prices to fluctuate by ±40% in 12-month periods, directly impacting sensor manufacturing costs. Silicon carbide shortages for MEMS-based sensors have extended lead times to 52+ weeks, forcing redesigns of next-generation products.

Standardization Gaps Hindering Technology Adoption

The lack of unified protocols for sensor data communication creates integration challenges. While SAE J1939 dominates heavy-duty applications, passenger vehicles use at least six competing protocols including SENT, PSI5, and LIN. This fragmentation increases development costs by requiring multiple interface ASICs. Emerging challenges include cybersecurity requirements for connected sensors, with recent UNECE WP.29 regulations mandating secure boot and encrypted communications for all safety-related components.

GAS SENSOR FOR AUTOMOTIVE MARKET TRENDS

Stringent Emission Regulations Driving Adoption of Advanced Gas Sensors

The global gas sensor for automotive market is experiencing accelerated growth due to tightening emission standards across major automotive markets. With Europe’s Euro 7 norms and China’s China 6 standards imposing stricter limits on nitrogen oxides (NOx) and particulate matter, automakers are being compelled to integrate more sophisticated gas sensing technologies. Recent data indicates that emission-related gas sensors now account for over 65% of the total automotive sensor market. This regulatory push is further amplified by real-time monitoring requirements in modern vehicles, creating sustained demand for high-accuracy sensors that can operate in harsh automotive environments while maintaining long-term reliability.

Other Trends

Electrification and Hybrid Vehicle Integration

While battery electric vehicles (BEVs) eliminate tailpipe emissions, they still require precise thermal runaway detection sensors for battery safety. The rapid growth of hybrid vehicles—projected to represent 30% of global car sales by 2030—is creating demand for dual-purpose sensors that monitor both combustion emissions and cabin air quality. These systems are becoming increasingly integrated with vehicle telematics, enabling predictive maintenance alerts based on gas sensor data patterns.

Advancements in Solid-State and MEMS Sensor Technologies

The shift towards MEMS (Micro-Electro-Mechanical Systems) based gas sensors is transforming the market landscape. These miniature sensors offer faster response times (<1 second for CO detection) and consume 60% less power than traditional electrochemical sensors—critical for electric vehicle applications. Furthermore, NDIR (Non-Dispersive Infrared) sensors are gaining adoption for their superior accuracy in measuring CO2 levels, with some advanced models achieving ±20ppm precision. Recent collaborations between semiconductor companies and automotive OEMs are accelerating the development of multi-gas detection chips that combine up to 5 sensing technologies in a single package.

COMPETITIVE LANDSCAPE

Key Industry Players

Innovation and Strategic Expansion Drive Market Leadership

The global gas sensor for automotive market features a dynamic and evolving competitive landscape, characterized by a mix of established players and emerging innovators. Robert Bosch and Continental dominate the market, collectively holding a significant share due to their extensive R&D investments and strong global supply chains. These companies benefit from robust partnerships with automotive OEMs, enabling them to integrate advanced sensors into next-generation vehicles.

DENSO Corporation and Sensata Technologies have also solidified their positions as key market players, particularly in exhaust and intake gas sensor segments. Their growth is propelled by the increasing demand for emission control solutions, especially in regions with stringent environmental regulations such as Europe and North America.

While the market is competitive, smaller players like Cubic Sensor and Instrument and Zhengzhou Weisheng Electronic are gaining traction by focusing on cost-effective solutions tailored for emerging markets. These companies leverage localized manufacturing and agile innovation to capture niche opportunities in Asia-Pacific and Latin America.

In response to rising demand for electric and hybrid vehicles, key players are intensifying their efforts to develop sensors compatible with alternative fuel systems. For instance, Infineon Technologies recently launched a new line of hydrogen sensors targeted at fuel-cell vehicles, reflecting the industry’s shift toward sustainable mobility solutions.

List of Key Gas Sensor for Automotive Companies Profiled

Robert Bosch (Germany)

Continental AG (Germany)

DENSO Corporation (Japan)

Sensata Technologies (U.S.)

Delphi Technologies (U.K.)

Infineon Technologies (Germany)

Valeo (France)

Hitachi Automotive Systems (Japan)

Autoliv (Sweden)

ZF Friedrichshafen (Germany)

Bourns, Inc. (U.S.)

Cubic Sensor and Instrument (China)

Zhengzhou Weisheng Electronic (China)

Hanwei Electronics Group (China)

Luftmy Intelligence Technology (China)

Segment Analysis:

By Type

Exhaust Gas Sensor Segment Dominates Due to Stringent Emission Regulations

The market is segmented based on type into:

Exhaust Gas Sensor

Subtypes: Oxygen (O2) sensors, NOx sensors, Particulate Matter sensors, and others

Intake Gas Sensor

Subtypes: Mass airflow sensors, Manifold absolute pressure sensors, and others

Cabin Air Quality Sensors

Battery Gas Sensors (for EV applications)

By Application

Passenger Vehicle Segment Leads Due to Increased Vehicle Production and Consumer Demand

The market is segmented based on application into:

Passenger Vehicles

Commercial Vehicles

Electric Vehicles

Hybrid Vehicles

By Technology

Electrochemical Sensors Remain Prevalent Due to Cost-Effectiveness

The market is segmented based on technology into:

Electrochemical Sensors

Infrared Sensors

Semiconductor Sensors

Catalytic Sensors

By Vehicle Type

Internal Combustion Vehicles Hold Majority Share Due to Existing Fleet

The market is segmented based on vehicle type into:

Gasoline Vehicles

Diesel Vehicles

Electric Vehicles

Regional Analysis: Gas Sensor for Automotive Market

North America The North American market is leading in technological adoption and regulatory compliance, driven by stringent EPA and CARB emission standards. The U.S. holds the largest share, with OEMs integrating advanced exhaust and intake gas sensors to meet Tier 3 and LEV IV norms. The shift toward electrification is reshaping demand, with hybrid vehicles requiring dual-purpose sensors for both combustion and battery safety monitoring. Collaboration between Robert Bosch and Sensata Technologies has accelerated innovations in MEMS-based gas sensing solutions for improved accuracy.

Europe Europe’s market thrives under the Euro 7 emission standards, pushing automakers to adopt NOx and particulate sensors at scale. Germany and France dominate production, with Continental and Infineon developing low-power, high-durability sensors for luxury and commercial vehicles. The EU’s 2025 carbon neutrality targets have spurred R&D investments in hydrogen fuel cell sensors, particularly for heavy-duty transport. However, high costs and complex integration with legacy vehicle architectures remain hurdles for widespread adoption in Eastern Europe.

Asia-Pacific As the largest and fastest-growing market, Asia-Pacific is fueled by China’s China 6 norms and India’s BS-VI regulations, creating a $420M annual demand for gas sensors. Japanese suppliers like DENSO lead in compact sensor designs, while local players such as Zhengzhou Weisheng cater to cost-sensitive segments. The region’s EV boom is driving innovation in battery thermal runaway detection sensors. However, inconsistent enforcement of emission laws in Southeast Asia limits growth potential outside major automotive hubs.

South America Market progress is uneven, with Brazil accounting for 60% of regional demand due to its Proconve L7 emission standards. Economic instability has delayed sensor upgrades in Argentina and Colombia, though aftermarket demand for O2 sensors is rising. The lack of localized production forces reliance on imports, inflating costs by ~20% compared to other regions. Recent trade agreements with Asian manufacturers could improve accessibility to affordable sensor solutions.

Middle East & Africa The GCC countries are prioritizing vehicle safety standards, creating niche opportunities for cabin air quality sensors in premium vehicles. Saudi Arabia and the UAE are investing in sensor-equipped smart city fleets, but adoption lags in Africa due to minimal emission regulations. South Africa remains the only significant market, with Autoliv and ZF supplying sensors to European OEMs’ local plants. The region’s harsh climate conditions drive demand for dust- and corrosion-resistant sensor designs.

Get A Detailed Sample Report : https://semiconductorinsight.com/download-sample-report/?product_id=97965

Report Scope

This market research report provides a comprehensive analysis of the Global and regional Gas Sensor for Automotive markets, covering the forecast period 2025–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The market was valued at USD 907 million in 2024 and is projected to reach USD 2147 million by 2032 at a CAGR of 13.4%.

Segmentation Analysis: Detailed breakdown by product type (Exhaust Gas Sensor, Intake Gas Sensor), application (Passenger Vehicle, Commercial Vehicle), and technology to identify high-growth segments.

Regional Outlook: Insights into market performance across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, including country-level analysis.

Competitive Landscape: Profiles of leading market participants including Robert Bosch, Continental, DENSO, Sensata Technologies, and Delphi, covering their product portfolios, market share, and strategic developments.

Technology Trends & Innovation: Assessment of emerging sensor technologies, integration with ADAS/autonomous systems, and advancements in emission control solutions.

Market Drivers & Restraints: Analysis of stringent emission regulations, fuel efficiency demands, technological challenges, and cost factors impacting market growth.

Stakeholder Analysis: Strategic insights for automotive OEMs, sensor manufacturers, component suppliers, and investors regarding market opportunities and challenges.

The research employs both primary and secondary methodologies, including interviews with industry experts and analysis of verified market data to ensure accuracy and reliability.

Customization of the Report

In case of any queries or customization requirements, please connect with our sales team, who will ensure that your requirements are met.

Related Reports :

Contact us:

+91 8087992013

0 notes

Text

The Evolution of Cummins Engines – From Diesel Pioneers to Clean Energy Leaders

Cummins Inc. has been a global leader in diesel and alternative fuel engine technology for over a century. Founded in 1919, the company revolutionized the transportation and industrial sectors with its reliable, high-performance engines. Today, Cummins continues to innovate, transitioning from traditional diesel engines to advanced clean energy solutions. This blog explores the evolution of Cummins engines, highlighting key technological advancements and their impact on industries worldwide.

Early Innovations in Diesel Technology

Cummins’ first major breakthrough came in the 1930s with the introduction of the Model H engine, a powerful and efficient diesel motor that set new standards for heavy-duty applications. Unlike gasoline engines of the time, Cummins’ diesel engines offered superior fuel efficiency and durability, making them ideal for trucks, buses, and industrial equipment.

By the 1950s, Cummins had expanded its reach into the automotive and marine sectors, with engines like the NH Series gaining popularity for their reliability. The company also pioneered turbocharging technology, enhancing engine performance while reducing emissions—a critical step toward sustainability.

The Shift Toward Emission Compliance

With growing environmental concerns in the late 20th century, Cummins led the charge in developing engines that met stringent emission standards. The EPA Clean Air Act in the 1990s pushed manufacturers to reduce nitrogen oxides (NOx) and particulate matter (PM). Cummins responded with innovations like:

Exhaust Gas Recirculation (EGR) – Lowered NOx emissions by recirculating exhaust gases back into the combustion chamber.

Selective Catalytic Reduction (SCR) – Used diesel exhaust fluid (DEF) to break down harmful emissions.

Advanced Fuel Injection Systems – Improved combustion efficiency, reducing fuel consumption and pollution.

These technologies ensured Cummins engines complied with EPA Tier 4 and Euro VI standards, making them some of the cleanest diesel engines in the world.

The Future: Electrification and Alternative Fuels

Cummins is no longer just a diesel engine company—it’s a leader in zero-emission solutions. Key developments include:

Electric Powertrains – Cummins’ AEOS electric truck concept and PowerDrive systems showcase its commitment to electrification.

Hydrogen Engines – The X15H, a hydrogen internal combustion engine, offers a carbon-neutral alternative for heavy-duty transport.

Hybrid Solutions – Cummins’ hybrid diesel-electric systems provide a bridge between traditional and fully electric power.

Conclusion

From its early diesel innovations to cutting-edge clean energy solutions, Cummins has consistently pushed the boundaries of engine technology. As industries shift toward sustainability, Cummins remains at the forefront, proving that power and environmental responsibility can go hand in hand.

0 notes

Link

0 notes

Text

Diesel vs. Spark‑Ignited Engines: Which Is Best for Your Application?

When you're selecting the right engine, especially for industrial, agricultural, marine, or generator applications, the choice between diesel (compression‑ignition) and spark‑ignited (typically gasoline/petrol) engines is pivotal. Engines, Inc. — via their Engines Power brand — offers top-quality diesel and spark‑ignited engines tailored for critical power needs across multiple sectors. Let’s break down the key aspects to determine which engine type is best suited for your specific needs.

1. Fundamentals of Combustion

Diesel Engines (Compression‑Ignition, CI)

Invented by Rudolf Diesel in the late 19th century, diesel engines rely on compression ignition—only air is compressed at high ratios (typically 15:1 to 23:1), producing sufficient temperature to ignite injected fuel. This leads to several advantages:

High thermal efficiency: Diesel engines convert a greater percentage of fuel into useful work—up to 43% in automotive, 45% in heavy trucks, and even 55% in low-speed marine engines.

Torque performance: Diesel engines generate substantial low-end torque, ideal for heavy loads.

Lean‑burn operation: The lean-air-fuel mixture improves efficiency and reduces fuel waste.

Spark‑Ignited Engines (SI)

These engines rely on spark plugs to ignite a premixed air-fuel blend. Typical compression ratios are lower—9:1 to 12:1 . While they don’t reach the efficiency of diesels, spark‑ignited engines offer benefits in:

Simplicity and cost: Generally cheaper to build and maintain.

Flexibility of fuel types: Run on gasoline, ethanol, LPG, CNG, and even hydrogen

Quieter operation: Less noise and vibration compared to the diesel “clatter.”

2. Efficiency & Fuel Economy

Diesel’s Edge

Diesel’s high compression ratios yield superior thermodynamic efficiency. For instance, the largest marine diesels reach around 55% efficiency, while typical passenger-car diesels hit about 43% . EnginesPower highlights diesel’s suitability in applications demanding long runtimes, high load, and fuel economy, such as:

Generators (prime & standby)

Marine propulsion

Industrial and agricultural machinery

Spark‑Ignited Tradeoffs

Spark‑ignited engines suffer from two key losses:

Thermal limits: Lower compression ratios translate to slower burn and more energy wasted as heat.

Pumping losses: Throttled air intake reduces volumetric efficiency .

However, advancements like direct injection, turbocharging, and variable valve timing (VVT) have significantly improved gasoline engine efficiency in recent years.

3. Torque & Power Delivery

Diesel Strength

Diesel engines shine in torque output:

High torque at low RPMs is common, making them ideal for heavy-duty tasks like hauling, plowing, or powering industrial equipment.

Air throttling is unnecessary; engine power is controlled by adjusting fuel injection, ensuring efficient torque management en.wikipedia.org+4en.wikipedia.org+4enginespower.com+4.

Spark‑Ignited Dynamics

SI engines offer:

Higher peak power per liter due to higher RPM limits.

Faster throttle response, suitable for applications requiring quick speed changes.

Lower torque compared to diesel at low RPMs, often compensated by turbocharging.

4. Durability & Maintenance

Diesel Durability

Built to withstand high compression, diesel engines are robust and ideal where longevity is critical. Yet they require:

Precision fuel injection systems

Periodic maintenance of systems like turbochargers, EGR, and DPF modules due to soot buildup

SI Simplicity

Gasoline engines are:

Simpler to maintain

Cheaper parts and services

Less complex emissions control systems, making them ideal for smaller applications where ease of maintenance is key.

5. Emissions & Environmental Compliance

Diesel Challenges & Solutions

Diesel engines emit NOₓ and particulate matter, but modern systems mitigate this with:

Exhaust Gas Recirculation (EGR) to lower combustion temperatures

Diesel Particulate Filters (DPFs)

Selective Catalytic Reduction (SCR) using urea

Spark‑Ignited Control

SI engines also produce pollutants but:

Catalytic converters and oxygen sensors help manage CO, HC, and NOₓ

EGR use reduces NOₓ and enhances efficiency

6. Cost & Total Cost of Ownership (TCO)

Diesel: Higher Initial, Lower Cycle

Upside: Strong fuel economy, long engine life, lower fuel consumption.

Downside: Higher upfront cost and more expensive repairs.

Spark‑Ignited: Economical Entry

Upside: Lower purchase cost, less complex maintenance.

Downside: Higher fuel consumption and shorter lifespan under heavy use.

7. Typical Applications

Engine Type -Diesel

Heavy‑duty trucks, industrial generators, agricultural/marine equipment

Engine Type - Spark‑Ignited

Light-duty vehicles, portable generators, small machinery, residential use

Engines Power offers both:

Diesel for prime/standby generators, marine propulsion, drivetrain components, repower solutions

Spark‑Ignited for lighter OEM, industrial, and agricultural applications seeking simpler, less emission-intensive engines .

8. Emerging Technologies

HCCI and Advanced Combustion

Homogeneous Charge Compression Ignition (HCCI) combines diesel’s compression ignition with gasoline-like premixed charge for cleaner combustion . Though not commercially mainstream, it's a promising hybrid approach that could reshape future engine choices.

Variable Valve Timing & Advanced Fuel

VVT and direct injection in gasoline engines improve fuel efficiency and emissions.

Diesel also benefits from common-rail injection and variable geometry turbochargers to boost performance .

9. Final Decision: Diesel or Spark‑Ignited?

Here’s a practical selection guide:

Choose Diesel if you need:

Long runtime and heavy-load capability

Exceptional fuel economy

Robustness and longevity

Applications in remote, off-grid, marine, or industrial settings

Choose Spark‑Ignited if you need:

Low upfront costs and easier maintenance

Light to medium-duty use

Less stringent emissions requirements

Versatility in fuel type for residential or small commercial use

10. Why EnginesPower?

Engines, Inc. (EnginesPower) offers:

Specialist diesel and spark‑ignited power units, tailored for OEM, marine, agricultural, and industrial sectors

Services such as customization, testing, dynamometer validation, and service support for both engine types

Global supply, including Tier-compliant diesel for export .

Service infrastructure: 24-hour support, nationwide dealer network, engine rebuilding, and prototyping enginespower.com.

In Summary

Diesel engines: High efficiency, torque, and endurance—ideal for heavy-duty, long-run operations.

Spark‑ignited engines: Lower cost, simpler maintenance—fit for smaller scale, flexible use.

Your ideal engine depends on workload, fuel economics, emission regulations, and budget. EnginesPower’s comprehensive diesel and spark-ignited engine offerings, backed by robust service and engineering support, ensure you get the right solution for your needs enginespower.com

#diesel engine solutions#diesel engine services in odessa#diesel parts#diesel engine solution#diesel engine#kohler engine#baton rouge#san antonio tx#new orleans#diesel engine odessa#diesel engine service#diesel engine repair#Diesel Engine

0 notes

Text

Automotive Actuator Market Poised for Growth with Rising Demand for Fuel Efficiency and Vehicle Electrification

The automotive actuator market is undergoing a significant transformation, fueled by the increasing emphasis on fuel efficiency, stringent emission regulations, and the rapid shift toward vehicle electrification. As automakers worldwide strive to meet evolving environmental standards and consumer expectations, actuators have become pivotal in optimizing vehicle performance, improving energy efficiency, and enabling automation. These components, responsible for converting electrical signals into mechanical movement, play a critical role in modern vehicles—whether in controlling engine valves, power windows, or advanced driver-assistance systems (ADAS).

What Are Automotive Actuators?

Automotive actuators are electromechanical or electrohydraulic devices used to control various vehicle functions. They are key to achieving seamless and efficient operations across a vehicle’s powertrain, braking systems, HVAC units, and body control mechanisms. With their capability to enhance precision and automation, actuators are essential for modern vehicle technologies including automatic transmission systems, turbochargers, electronic throttle control, and electric seat adjustments.

The most common types of automotive actuators include:

Electrical actuators – Widely used due to their precision, reliability, and energy efficiency.

Hydraulic actuators – Typically used in high-force applications such as braking and suspension.

Pneumatic actuators – Employed in systems requiring quick, linear movement and relatively low power.

As vehicle systems become more complex and interconnected, the role of actuators continues to expand.

Market Dynamics Driving Growth

1. Rising Demand for Fuel Efficiency

One of the foremost drivers of the automotive actuator market is the rising global demand for improved fuel efficiency. Governments around the world have implemented regulations to reduce vehicle emissions and encourage the production of low-emission vehicles. For example, the Corporate Average Fuel Economy (CAFE) standards in the U.S. and the Euro 6 norms in Europe have compelled automakers to adopt advanced technologies that optimize engine performance and reduce fuel consumption.

Automotive actuators are crucial in implementing these technologies. For instance, actuators used in variable valve timing (VVT) systems or turbochargers help optimize combustion efficiency, leading to better fuel economy. Furthermore, throttle actuators and EGR (Exhaust Gas Recirculation) valve actuators contribute to reducing emissions while maintaining power output.

2. Acceleration of Vehicle Electrification

The global automotive industry is experiencing a shift toward electrification, spurred by climate change concerns, favorable government incentives, and consumer interest in sustainable mobility. This trend encompasses both battery electric vehicles (BEVs) and hybrid electric vehicles (HEVs), both of which rely heavily on advanced actuator systems for optimal functioning.

In electric vehicles, actuators are used in various applications such as thermal management systems, regenerative braking systems, and electric power steering. The integration of smart actuators into electric drivetrains allows for better energy management and enhances overall vehicle efficiency.

As the EV market continues to expand, so will the demand for specialized actuators that cater to the unique requirements of electric propulsion systems.

3. Advancements in Automotive Technology

The automotive sector is witnessing rapid advancements in automation and intelligent systems, including ADAS and autonomous driving technologies. These innovations rely heavily on actuators for real-time, responsive control of systems like braking, steering, adaptive cruise control, and lane-keeping assistance.

Additionally, consumer expectations for comfort and convenience features such as automated seats, power tailgates, and climate control systems are rising. Actuators form the backbone of these systems, enabling vehicle manufacturers to deliver a seamless and luxurious driving experience.

Market Segmentation and Regional Insights

The automotive actuator market can be segmented by:

Product Type: Linear actuators, rotary actuators, and electric actuators.

Application: Powertrain, body & exterior, interior, and chassis systems.

Vehicle Type: Passenger cars, light commercial vehicles (LCVs), and heavy commercial vehicles (HCVs).

Sales Channel: OEM (original equipment manufacturer) and aftermarket.

Asia-Pacific dominates the market, with major automotive manufacturing hubs in China, Japan, South Korea, and India. The region's strong presence of OEMs and rapid adoption of electric vehicles contribute significantly to actuator demand. Europe and North America follow closely, driven by stringent environmental regulations and technological innovation.

Key Players and Competitive Landscape

The automotive actuator market is characterized by the presence of several global players focusing on product innovation, strategic partnerships, and expansion into emerging markets. Key companies include:

Robert Bosch GmbH

Denso Corporation

Continental AG

HELLA GmbH & Co. KGaA

Johnson Electric Holdings Limited

BorgWarner Inc.

These players are investing heavily in research and development to produce compact, lightweight, and energy-efficient actuators that align with evolving automotive trends.

Challenges and Opportunities

While the market outlook is promising, certain challenges persist:

High cost of advanced actuators may limit adoption in cost-sensitive markets.

Complex integration into existing vehicle architectures can pose engineering challenges.

Reliability and durability remain concerns in harsh operational environments.

However, these challenges are outweighed by the growing opportunities:

The rising trend of software-defined vehicles is creating a demand for intelligent, programmable actuators.

3D printing and lightweight materials are enabling cost-effective actuator production.

Aftermarket growth offers additional revenue streams as vehicle owners seek replacements or upgrades.

Conclusion

The automotive actuator market is poised for robust growth in the coming years, driven by global efforts to enhance fuel efficiency, the surging popularity of electric vehicles, and the continuous evolution of automotive technology. With manufacturers investing in innovation and regulatory frameworks supporting sustainability, actuators are set to become even more integral to the future of mobility. As vehicles become smarter, more efficient, and environmentally friendly, the demand for sophisticated actuator solutions will only intensify—presenting vast opportunities across the automotive ecosystem.

0 notes

Text

The Heart of Emission Control: Different Types of Exhaust Gas Recirculation Valves Explained – Pneumatic vs. Electronic

In today's automotive landscape, where emissions regulations are becoming increasingly stringent, the exhaust gas recirculation (EGR) valve plays a crucial role in reducing harmful nitrogen oxides (NOx) emitted by internal combustion engines. This seemingly small component diverts a portion of the exhaust gases back into the engine's intake manifold, lowering combustion temperatures and thereby inhibiting NOx formation. But not all EGR valves are created equal. Let's delve into the two primary types you'll encounter: pneumatic and electronic.

What is an Exhaust Gas Recirculation Valve (EGR Valve) and Why Do We Need It?

Before we dive into the different types, let's quickly recap the fundamental purpose of an exhaust gas recirculation valve. During combustion, high temperatures in the engine cylinders cause nitrogen and oxygen in the air to react, forming nitrogen oxides (NOx). These are major air pollutants contributing to smog and acid rain. By recirculating a controlled amount of inert exhaust gas back into the combustion chambers, the peak combustion temperature is reduced. This temperature reduction is key to minimizing NOx production without significantly impacting engine performance or fuel economy.

Type 1: Pneumatic EGR Valves – The Traditional Workhorse

Pneumatic EGR valves are the older, more traditional design. They rely on vacuum pressure from the engine's intake manifold to operate.

How they work: A diaphragm inside the pneumatic EGR valve is connected to a vacuum source. When the engine's control unit (ECU) determines that EGR is needed, it opens a vacuum solenoid, allowing manifold vacuum to pull on the diaphragm. This movement opens the valve, allowing exhaust gases to flow into the intake. A spring then closes the valve when the vacuum is released.

Key Characteristics:

Simplicity: Generally simpler in design and often more mechanically robust.

Cost-effective: Typically less expensive to manufacture and replace.

Less precise control: The amount of exhaust gas recirculated is primarily dependent on manifold vacuum, which can fluctuate. This offers less precise control compared to electronic systems.

Vulnerability to vacuum leaks: Performance can be significantly affected by vacuum leaks in the system.

Common Applications: Often found in older vehicles and some commercial vehicles where cost and robustness are primary concerns.

Type 2: Electronic EGR Valves – The Modern Standard

Electronic EGR valves represent a significant leap forward in precision and control. They are the prevalent type in modern vehicles.

How they work: Instead of vacuum, electronic EGR valves use an electric motor (often a stepper motor or a DC motor) to directly open and close the valve. The engine's ECU sends precise electrical signals to the motor, dictating the exact position of the valve.

Key Characteristics:

Precision Control: The biggest advantage is the highly precise control over the amount of exhaust gas being recirculated. The ECU can rapidly and accurately adjust the valve's opening based on a multitude of sensor inputs (engine speed, load, temperature, etc.).

Faster Response: Electronic operation allows for quicker opening and closing times, leading to more responsive emission control.

Self-diagnosis: Electronic EGR valves often have position sensors that allow the ECU to monitor their operation and detect faults, triggering diagnostic trouble codes (DTCs).

Integration with engine management: Seamlessly integrated into the overall engine management system, contributing to optimized performance and emissions.

Higher Cost: Generally more expensive to manufacture and replace due to their complex electronic components.

Common Applications: Found in almost all modern passenger vehicles, SUVs, and light trucks, where sophisticated emission control and fuel efficiency are paramount.

Which is Better?

From a performance and emissions standpoint, electronic EGR valves are definitively superior due to their precision and responsiveness. They allow for much finer control over the combustion process, leading to better emission reduction and often improved drivability.

However, pneumatic EGR valves still have their place, especially in applications where simplicity, cost-effectiveness, and a certain degree of robustness are prioritized over absolute precision.

Maintaining Your EGR Valve

Regardless of the type, keeping your exhaust gas recirculation valve in good working order is essential for both your vehicle's performance and the environment. Symptoms of a faulty EGR valve can include:

Rough idle

Engine hesitation or stumbling

Reduced fuel economy

Increased emissions (leading to failed emission tests)

Check Engine Light illumination

Regular maintenance, such as cleaning carbon deposits, can extend the life of your EGR valve. If you suspect an issue, it's always best to consult with a qualified mechanic.

By understanding the differences between pneumatic and electronic exhaust gas recirculation valves, you gain a deeper appreciation for the intricate technologies working behind the scenes to keep our air cleaner.

#pv clean mobility technologies#electric vehicle component manufacturers in india#bldc pump manufacturer in india#fuel level sensor#auto parts manufacturer#automobile component manufacturer

0 notes

Text

Heavy-duty Automotive Aftermarket Industry: Innovations in Diagnostic Tools

Heavy-duty Automotive Aftermarket Industry Overview

The global Heavy-Duty Automotive Aftermarket Industry was valued at an estimated USD 137.68 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 3.79% from 2023 to 2030. This growth is anticipated to be significantly driven by ongoing technological advancements. Innovations such as the development of connected and autonomous trucks, alongside progress in diagnostic tools, data analytics, and telematics, are becoming increasingly crucial in the heavy-duty automotive aftermarket. These advancements enable superior vehicle monitoring, facilitate predictive maintenance, and lead to more cost-effective repairs, all of which are expected to bolster demand throughout the forecast period.

Furthermore, the growing adoption of electric and hybrid heavy-duty vehicles is carving out a distinct new segment within the aftermarket. Given that electric and hybrid vehicles feature different powertrains and components compared to conventional internal combustion engine (ICE) vehicles, this technological shift generates demand for a new array of aftermarket products. These include essential components such as batteries, electric motors, inverters, and charging infrastructure. The expansion of electric vehicles (EVs) also necessitates the establishment of robust charging infrastructure, encompassing charging stations, cables, and connectors. The aftermarket is playing a vital role in supplying these products and facilitating the installation of charging stations for both commercial and fleet customers.

Detailed Segmentation:

Replacement Parts Insights

The turbochargers segment is expected to grow at a CAGR of 7.37% from 2023 to 2030. Turbochargers enable engine downsizing, where a smaller-displacement engine is equipped with a turbocharger to deliver the power output of a larger engine. This reduces fuel consumption and emissions while maintaining performance. Furthermore, the segment is crucial for enhancing the fuel efficiency of heavy-duty vehicles. As fuel costs remain a significant operational expense for fleet operators, there's a growing focus on adopting turbochargers to reduce fuel consumption.

Vehicle Type Insights

The class 7 to class 8 segment dominated the market with a revenue share of 64.3% in 2022. Stricter emissions regulations are driving the demand for aftermarket emissions control technologies in class 7 to class 8 vehicles. This includes diesel particulate filters (DPFs), selective catalytic reduction (SCR) systems, and exhaust gas recirculation (EGR) components. Moreover, the integration of telematics and fleet management systems is growing in this segment. Fleet operators are using these technologies for vehicle tracking, maintenance scheduling, and route optimization, leading to increased demand for related aftermarket products and services.

Service Channel Insights

The DiFM segment dominated the market with a revenue share of 69.4% in 2022. The "Do it For Me" (DiFM) segment in the heavy-duty automotive aftermarket is characterized by services and maintenance performed by professional technicians or service providers on behalf of vehicle owners or fleet operators. This segment is essential for those who prefer to outsource vehicle maintenance and repairs rather than doing it themselves. DiFM providers often offer fleet management services that include maintenance scheduling, cost tracking, and compliance management. These services help fleet operators optimize vehicle performance and reduce operational costs.

Regional Insights

South America is expected to grow at the fastest CAGR of 12.1% from 2023 to 2030.Economic conditions play a significant role in the heavy-duty automotive aftermarket in South America. Economic stability and growth can lead to increased demand for transportation services, which, in turn, drives the demand for heavy-duty vehicles and their aftermarket parts and services. Furthermore, the need for infrastructure development and maintenance in South America, including road construction and improvements, has historically driven the demand for heavy-duty vehicles and their aftermarket components, such as tires, suspension systems, and engine parts.

Gather more insights about the market drivers, restraints, and growth of the Heavy-duty Automotive Aftermarket Market

Key Companies & Market Share Insights

The market is characterized by strong competition, with a few major worldwide competitors owning a significant market share. The major focus is developing new products and collaborating among the key players. In January 2023, Dorian Drake International, Inc. and maximatecc announced a strategic alliance to manage and develop sales of specialty gauges for the aftermarkets in Mexico and South Africa. The alliance will focus on the Stewart-Warner and Datcon brands of maximatecc. Some prominent players in the global heavy-duty automotive aftermarket industry include:

3M Company

ATC Technology Corp

Continental AG

Denso Corporation

Detroit Diesel Corporation

Dorian Drake International Inc.

Dorman Products

Federal-Mogul LLC

Instrument Sales & Service, Inc.

Remy International Inc.

UCI International Inc.

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

0 notes

Text

The Automotive Exhaust System Market: A Quiet Giant in the Auto Industry (2018–2032)

The stringent vehicle emission regulations are enforcing automotive manufacturers to introduce technologies to lower emissions from the conventional fuel vehicles.

📊 Market Forecast Snapshot

Market size in 2018: USD 11.35 billion

Projected market size in 2032: USD 14.7 billion

CAGR (2018–2032): 2.0%

Europe’s Market Share in 2018: 42.47%

At a glance, this may not look like explosive growth, but there's more under the hood here.

🌍 Why Is the Automotive Exhaust System Market Still Relevant?

Internal Combustion Engines Aren’t Dead Yet Despite the EV surge, ICE vehicles will still dominate many regions well into the 2030s. That means demand for efficient, emissions-compliant exhaust systems isn’t going away anytime soon.

Stricter Emissions Regulations Governments (especially in Europe) are tightening CO₂ and NOx emissions standards, pushing automakers to invest in advanced catalytic converters, particulate filters, and other exhaust tech.

Diesel Down, Hybrids Up While diesel is declining, hybrid vehicles (which still rely on combustion engines) are on the rise. These also need high-efficiency exhaust systems to stay compliant.

OEM + Aftermarket Demand It’s not just about new cars. Millions of aging vehicles on the road still need replacement parts, boosting aftermarket demand for mufflers, pipes, and sensors.

🌐 Regional Highlight: Europe Leads the Pack

Back in 2018, Europe held a dominant 42.47% of the global market, largely due to:

Stringent EU emissions regulations (Euro 6, Euro 7)

High diesel vehicle penetration

Strong automotive manufacturing base in Germany, France, and Italy

That said, Asia-Pacific is catching up fast, especially with increasing car production in China, India, and Japan.

🔮 What's the Future Look Like?

Slow but steady growth is expected through 2032.

Innovations in exhaust gas recirculation, lightweight materials, and integration with onboard diagnostics will help manufacturers meet stricter standards.

Long-term, as EV adoption ramps up post-2030, this market may plateau—but it’s far from irrelevant right now.

0 notes

Text

Automotive Exhaust Gas Recirculation Cooler Market Size, Analyzing Trends and Projected Outlook for 2025-2032

Fortune Business Insights released the Global Automotive Exhaust Gas Recirculation Cooler Market Trends Study, a comprehensive analysis of the market that spans more than 150+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

The Automotive Exhaust Gas Recirculation Cooler Market is experiencing robust growth driven by the expanding globally. The Automotive Exhaust Gas Recirculation Cooler Market is poised for substantial growth as manufacturers across various industries embrace automation to enhance productivity, quality, and agility in their production processes. Automotive Exhaust Gas Recirculation Cooler Market leverage robotics, machine vision, and advanced control technologies to streamline assembly tasks, reduce labor costs, and minimize errors. With increasing demand for customized products, shorter product lifecycles, and labor shortages, there is a growing need for flexible and scalable automation solutions. As technology advances and automation becomes more accessible, the adoption of automated assembly systems is expected to accelerate, driving market growth and innovation in manufacturing. Automotive Exhaust Gas Recirculation (EGR) Cooler Market Size, Share & Industry Analysis, By Cooler Type (Finned EGR Cooler, Tube EGR Cooler), By Fuel Type (Gasoline, Diesel), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles) and Regional Forecast 2021-2028

Get Sample PDF Report: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/103624

Dominating Region:

North America

Fastest-Growing Region:

Asia-Pacific

Major Automotive Exhaust Gas Recirculation Cooler Market Manufacturers covered in the market report include:

Major players operating in the global automotive EGR cooler market include Senior Flexonics, Delphi Automotive LLP, Denso Corporation, Bosal Automotive Division, Korens Inc., Mahle Group, Friedrich Boysen Gmbh & Co KG, and FUTABA INDUSTRIAL CO., LTD among others.

Moreover, the stringent norms imposed by the government on the automotive industry to curb the fuel emission is compelling the automotive manufacturers to integrate EGR system in their vehicles which controls the emission of gases and the EGR coolers helps lower the temperature of gases. Furthermore, the increasing volume of sales and production of automobiles is ultimately propelling the growth of the exhaust gas recirculation cooler market.

Geographically, the detailed analysis of consumption, revenue, market share, and growth rate of the following regions:

The Middle East and Africa (South Africa, Saudi Arabia, UAE, Israel, Egypt, etc.)

North America (United States, Mexico & Canada)

South America (Brazil, Venezuela, Argentina, Ecuador, Peru, Colombia, etc.)

Europe (Turkey, Spain, Turkey, Netherlands Denmark, Belgium, Switzerland, Germany, Russia UK, Italy, France, etc.)

Asia-Pacific (Taiwan, Hong Kong, Singapore, Vietnam, China, Malaysia, Japan, Philippines, Korea, Thailand, India, Indonesia, and Australia).

Automotive Exhaust Gas Recirculation Cooler Market Research Objectives:

- Focuses on the key manufacturers, to define, pronounce and examine the value, sales volume, market share, market competition landscape, SWOT analysis, and development plans in the next few years.

- To share comprehensive information about the key factors influencing the growth of the market (opportunities, drivers, growth potential, industry-specific challenges and risks).

- To analyze the with respect to individual future prospects, growth trends and their involvement to the total market.

- To analyze reasonable developments such as agreements, expansions new product launches, and acquisitions in the market.

- To deliberately profile the key players and systematically examine their growth strategies.

Frequently Asked Questions (FAQs):

► What is the current market scenario?

► What was the historical demand scenario, and forecast outlook from 2025 to 2032?

► What are the key market dynamics influencing growth in the Global Automotive Exhaust Gas Recirculation Cooler Market?

► Who are the prominent players in the Global Automotive Exhaust Gas Recirculation Cooler Market?

► What is the consumer perspective in the Global Automotive Exhaust Gas Recirculation Cooler Market?

► What are the key demand-side and supply-side trends in the Global Automotive Exhaust Gas Recirculation Cooler Market?

► What are the largest and the fastest-growing geographies?

► Which segment dominated and which segment is expected to grow fastest?

► What was the COVID-19 impact on the Global Automotive Exhaust Gas Recirculation Cooler Market?

FIVE FORCES & PESTLE ANALYSIS:

In order to better understand market conditions five forces analysis is conducted that includes the Bargaining power of buyers, Bargaining power of suppliers, Threat of new entrants, Threat of substitutes, and Threat of rivalry.

Political (Political policy and stability as well as trade, fiscal, and taxation policies)

Economical (Interest rates, employment or unemployment rates, raw material costs, and foreign exchange rates)

Social (Changing family demographics, education levels, cultural trends, attitude changes, and changes in lifestyles)

Technological (Changes in digital or mobile technology, automation, research, and development)

Legal (Employment legislation, consumer law, health, and safety, international as well as trade regulation and restrictions)

Environmental (Climate, recycling procedures, carbon footprint, waste disposal, and sustainability)

Points Covered in Table of Content of Global Automotive Exhaust Gas Recirculation Cooler Market:

Chapter 01 - Automotive Exhaust Gas Recirculation Cooler Market for Automotive Executive Summary

Chapter 02 - Market Overview

Chapter 03 - Key Success Factors

Chapter 04 - Global Automotive Exhaust Gas Recirculation Cooler Market - Pricing Analysis

Chapter 05 - Global Automotive Exhaust Gas Recirculation Cooler Market Background or History

Chapter 06 - Global Automotive Exhaust Gas Recirculation Cooler Market Segmentation (e.g. Type, Application)

Chapter 07 - Key and Emerging Countries Analysis Worldwide Automotive Exhaust Gas Recirculation Cooler Market.

Chapter 08 - Global Automotive Exhaust Gas Recirculation Cooler Market Structure & worth Analysis

Chapter 09 - Global Automotive Exhaust Gas Recirculation Cooler Market Competitive Analysis & Challenges

Chapter 10 - Assumptions and Acronyms

Chapter 11 - Automotive Exhaust Gas Recirculation Cooler Market Research Methodology

About Us:

Fortune Business Insights™ delivers accurate data and innovative corporate analysis, helping organizations of all sizes make appropriate decisions. We tailor novel solutions for our clients, assisting them to address various challenges distinct to their businesses. Our aim is to empower them with holistic market intelligence, providing a granular overview of the market they are operating in.

Contact Us:

Fortune Business Insights™ Pvt. Ltd.

US:+18339092966

UK: +448085020280

APAC: +91 744 740 1245

0 notes

Text

Automotive Exhaust Systems Market :Driven by Emission Norms, Vehicle Sales, and Technological Advancements

The automotive exhaust systems market is undergoing significant changes due to shifting industry trends, stricter environmental regulations, technological advancements, and evolving consumer preferences. Exhaust systems are critical for directing combustion gases away from engines, minimizing emissions, and improving fuel efficiency. Below are the main drivers currently shaping the global market for automotive exhaust systems:

1. Stringent Emission Regulations

One of the primary drivers for the growth of the automotive exhaust systems market is the increasing enforcement of emission regulations worldwide. Governments and environmental agencies across regions such as North America, Europe, and Asia-Pacific have introduced rigorous standards aimed at reducing harmful pollutants like nitrogen oxides (NOx), carbon monoxide (CO), hydrocarbons (HC), and particulate matter (PM).

Regulatory frameworks such as Euro 6, China 6, and the Corporate Average Fuel Economy (CAFE) standards are pushing automakers to adopt advanced exhaust systems. Components like catalytic converters, diesel particulate filters (DPFs), and selective catalytic reduction (SCR) systems have become essential to comply with these norms. The push toward lower emissions continues to drive innovation and demand for high-efficiency exhaust technologies.

2. Growth in Vehicle Production and Sales

The overall growth in automotive production and sales, especially in emerging economies like India, China, Brazil, and Southeast Asia, is fueling demand for exhaust systems. As more passenger cars and commercial vehicles hit the roads, the need for reliable and compliant exhaust solutions rises in parallel. Increased urbanization, rising disposable incomes, and improving road infrastructure in developing countries further boost vehicle ownership, directly impacting the market.

Moreover, with the expansion of the middle-class population in these regions, the demand for personal mobility and transportation of goods has surged, thereby increasing the volume of vehicles and, subsequently, the demand for their exhaust systems.

3. Technological Advancements

Advancements in automotive technologies, particularly in exhaust system design and materials, are driving growth. Modern exhaust systems are being developed with lightweight materials such as stainless steel, titanium, and ceramics, which help reduce vehicle weight and improve fuel economy. In addition, integration of smart sensors and electronic control units (ECUs) in exhaust systems helps monitor emissions in real-time, enhancing performance and regulatory compliance.

Innovations like active exhaust systems that modify sound and performance, and the use of variable valve timing (VVT) technologies, are also pushing the envelope. Automakers are increasingly investing in R&D to create more efficient and compact exhaust systems that can be integrated easily into smaller engine compartments without sacrificing performance.

4. Rise in Diesel and Gasoline Engine Efficiency Demands

Despite the global push for electric vehicles (EVs), diesel and gasoline internal combustion engines (ICEs) still dominate the automotive landscape, particularly in heavy-duty vehicles and in regions with limited EV infrastructure. The need to improve fuel efficiency and engine performance is leading to the development of more sophisticated exhaust after-treatment technologies.