#Automatic Stock Trader

Text

Advanced Automated Trading Services | Robotrade

Robotrade offers modern automatic trading services that transform the way individuals and businesses engage in the financial markets. Our algorithmic trading system leverages advanced artificial intelligence and machine learning technologies to quickly analyze vast amounts of market data, identifying profitable trading opportunities with accuracy and speed. Visit Robotrade to get started trading with us.

#auto trading software india#robot trading platform india#automatic stock trader#automatic trading#automated online trading#algo trading provider#Automatic Trading Services

0 notes

Text

orange colored sky (older!modern!eddie)

older!modern!eddie - setlist

inspired by the fact that i fall in love with someone new every time i got to trader joe's and @loveshotzz new older!steve series. manip by my fave @eddiemunsons-missingnipple

tw: nothing really, very much a meet cute at a grocery store. eddie is in his early 40s, reader is late-late 20s/early 30s.

lemme know if you guys want this to be a whole thing.

the automatic doors rush cool air into your face, a sweet reprieve from the sticky heat of this summer. a much muggier july than you remember having as a kid. but then again, you don't remember that much about being a kid these days. trader joe's is a little busier than usual, which makes sense with the holiday weekend coming up -- but you hate when it's busy. there's already too many sounds -- some summer 90s playlist and the squeaks of the carts, people in their hawaiian shirts milling around with boxes and box cutters. you just want some snap peas for god sakes.

you grab a basket and adjust your canvas bags on your shoulder, tossing your headphones in them for later. you feel 'running errands ugly' but everyone seeing you in the bike shorts you threw on this morning doesn't think that view is ugly at all. your music drowned it out on the train ride over here. you're already sort of annoyed. people just don't know how to do anything anymore -- why are we just standing in front of produce. get what you need and go! you think hastily. but you wait for people to stop gawking at the produce and make their selection before you grab the romaine, snap peas, and shredded brussel sprouts you need. when you turn you almost walk entirely into someone's cart, eyes flitting up briefly and muttering a 'sorry, s'cuse me'.

can everyone just get off my fucking ass? you huff to yourself internally. you maneurver over to fruits, a few stands in a row -- citrus, apples, berries. all separated by category in large cargo looking boxes. you snag a big box of cherries, the three pound one, knowing you'll go through the small ones too fast. you frown over the lack of watermelon, continuing along while someone turns the corner into your aisle. you look up for a moment, just to scan your surroundings, to see who it is.

you've never seen him before, but you've never seen anyone here before. it's not like there's regulars at the grocery store in a city like this. his hands hang over the handle to his cart by the wrists, knuckles tattooed in shapes you can't make out. you follow the leather banded watch up to a full sleeve of ink, only obscured by the start of a cuffed t-shirt sleeve, a crisp white that blinds against the black of the elvira pin up tattoo on his tricep. horror icons blending into each other seamlessly. you can see more black and color peeking out from the collar of his shirt --vintage judas priest, mint condition, tucked comfortably under a well perserved denim vest covered in patches of bands you've never heard of. you're surprised by the black chino shorts on his bottom half, not expecting someone who was clearly still stuck in their grunge phase to wear those over cut off jeans. the busted up reebok's on his feet make up for it though -- pairing nicely with the tattoos on his calves and thighs, not quite sleeves, but enough to make a statement.

you grab a box of strawberries and pop them into your basket, surveying the mangos on the top shelf at your eye level while he maneuvers behind you. you think he's cute but you don't take too much stock in it -- it's so like you to have a 'train boyfriend' or 'trader joe's boyfriend' for a brief moment in time. someone cute that you spot outside and never speak to. it's one of those days.

he has brown eyes and thick lashes, hair dark wrapped in a bun on the top of his head with streaks of silver poking through, bangs in his face. some curls stick to the heated skin by his neck and jaw. not that you're looking. the scruff on his face is littered with salt and pepper -- maybe that part of him aging more than the rest. he grabs a heap of bananas to his nearly empty cart. he also has a big box of cherries in there. he wears a cologne with spice and suede in the notes, it's familiar, a little smoky. maybe an old boyfriend used to wear it. you shrug it off, grabbing a mango or two and popping it in a produce bag before hocking it in. more veggies for a greek salad. an onion. some pre-packaged turkey slices.

you turn into the first frozen food section, weaving through more people who just stand there and you grit your teeth. you snag some frozen broccoli, the coolness bringing you a moment of calm so that you don't lose your mind inside the store. more like traitor joe's. you grab a few more things, a veggie medley for a tofu scramble, some scallion pancakes that you’ll use as meal replacement because no matter how many times you think you’ll food prep you never do. you see him at the end of the aisle, rifling through bags of frozen shrimp to find one he likes. you notice he has a ring on but it’s on his pointer finger, two more rings on the hand that holds his cart by his hip – a silver chain dangles from what you assume is his wallet in his back pocket. his keys jingle from a carabiner by his front belt loop. slut, you think to yourself. you grab a bag of small frozen salmon filets, not paying much mind to your grocery store boyfriend of the week when you turn the corner to the next frozen food aisle. he’s there not soon after you, grabbing frozen fruit medleys and a few bars of chocolate on the non-frozen shelving above. you aren’t sure if he sees you, but you see him. you can smell the suede and spice of his cologne as his moves past you to the other end.

bread is on the back wall of the store, you want to get sourdough but you know you’ll just eat it plain and not make sandwiches so you opt for the tuscan loaf instead. you snag a bag of mini bagels, forgoing the small baguettes this time. you can’t afford the good burrata this week for any special girl dinner you come up with, so it’s best to not have it around if you can’t pair it with anything pretty. further down the back wall you get to snacks and don’t ignore the bag of yogurt covered pretzels – a basket must. seaweed snacks for salmon rice bowls. plantain chips. Your basket feels a little heavy but at least this errand is almost over.

you turn down the pasta, beans, and rice aisle and there he is turning down the other end. you both catch each other this time, because this time feels like it’s not a coincidence. you both break eye contact as quickly as you make it, both of you looking down and smiling to yourselves. you feel the heat on your cheeks but you don’t see his blush, both of you too preoccupied with whatever you have to pick up to pay attention to the other. you smell the suede and smoke even after you lose him to the next couple of aisles.

pre-packaged tortellini, lox, shredded cheese. chicken thighs. a six pack of some pretty sounding beer you’ve never tried. your basket overflows but it’s fine. the errand is over, at least here, before you need to run into target which for some reason is far less overstimulating. he’s a few people ahead of you on the opposite line, still leaning over the edge of his cart with his hands hanging, one thumbing a text to someone before he stands up fully to push the cart ahead. he looks over his shoulder and your eyes briefly meet for a moment – heat on your cheeks – before he moves ahead to turn down the long row of cashiers to pay. you don’t see him when it’s your turn and by the time you’re done paying you’ve already forgotten about him, lost in a flirty conversation with the guy ringing you up.

target only has half of what you need and that’s fine because nothing else will fit in the big canvas bags you brought with you for your groceries and it’s at least an eight minute walk back to the train. you groan when you get back out into the heat, the boiler room of the subway cooking you as you make it down to the platform. a pleasant sigh passes your lips when you see it’s at least only a four minute wait until your train makes it to you – only a few more minutes of suffering before you’re on your way back to your air conditioned studio apartment.

you look across the platform where some old lady’s push cart rattles as it makes it down the stairs on the other side. her little body walking ahead, a voice saying ‘i got it, ma’am don’t worry,’ echos down into the chamber of the subway.

there he is. a canvas bag on each arm filled to the brim and the push cart lifted in front of him. while you can’t see from this distance, you have a feeling you’d like how his arms looked at full capacity like this. the cart’s metallic jingle continues when he places it on the concrete ground, pushing it over to the woman who now sits pleasantly on the bench. you watch their conversation while they say quiet ‘thank yous’ and ‘your welcomes’ to each other and he checks his phone while he finds a spot to stand, waiting for his train on the opposite side.

you check your phone just the same and look up again as he puts his phone in the pocket of his vest. his attention catches on you from across the way.

he gives you a small wave and smiles. he has a nice smile, infectious.

“hi.”

you wave back with two fingers, a small salute, “hey.”

“i’m eddie,” he starts as the red glow of the light on your train starts to pull in.

the chug, chug, chug starting to drown him out. he raises his voice with a boyish grin, you hear him just before the train obscures him from view – whooshing past you as it pulls into the station.

“i normally go to trader’s on wednesdays!”

you get on the train when the doors open, seeing him still on the platform, searching for you in the windows. you put your hand up again in an awkward wave and he grins when he finds you.

‘stand clear of the closing doors, please!’

he puts a hand back up with two fingers, mouthing out a message.

‘wednesdays around two.’

you give him the okay symbol with your fingers and nod at him, chuckling at the ridiculousness of the situation, he chuckles too. his smile is pretty, lips are full. his two fingers point to his eyes and then at you – ‘see you then’.

the train pulls away before you get a chance to reply.

next

#eddie munson#eddie munson fluff#eddie munson x you#eddie munson x reader#older!eddie munson#old!eddie munson#eddie munson fanfic#eddie munson fan fiction#stranger things#stranger things fan fiction

1K notes

·

View notes

Text

Mission Gone Wrong

☆.。.:*・°☆.。.:*・°☆.。.:*・°☆.。.:*・°☆ .。.:*

A/N; Coming back to retry this one after I abandoned the idea months ago :’) got some random motivation!! Also gonna preface this by saying I did in fact make up the first planet <3

Art credit to @/KasiopeaArt

Summary; Your mission for the resistance goes south, so you and Ben have to find a way to escape the First Order.

Content; Jedi/resistance AU, Ben Solo never turned AU, Jedi reader, Jedi Ben, running from the space cops, reader gets injured, Ben patches you up, saving two kids, Ben has the Solo Sass™️, piloting the Falcon :), Jedi rules be damned I’m gonna make them kiss, Ben’s family dynamic, Ben’s a mama’s boy, his parents love you, fun shenanigans, fluff

Wc; 7k

☆.。.:*・°☆.。.:*・°☆.。.:*・°☆.。.:*・°☆ .。.:*

“Stop! In the name of the First Order!”

The sun blazes above you, the sky a perfect blue with no clouds in sight—a contrast to the chaos happening below. The pound of your boots against cobblestone and the rapid beating of your heart fills your ears. Your breath comes in short, quick pants, your lungs burning as you try to suck in air while you run. The crowded streets of the Sandura trader outpost don’t make it easy. You dodge and weave between civilians, shouting excuse me’s and sorry’s every other second; you know that more than a few of them cuss you out in native tongues you don’t quite understand.

You spare a glance to your right, making sure that Ben is still keeping up. You’ve always been faster than him, more agile and lithe, so you have to be mindful that you don’t leave him behind. But you have no reason to worry because he’s right there with you, running just as quick from your pursuers. You can hear the heavy, plastic clanks of the Stormtrooper armor that slows them down as they chase after you. They’re too close for it to be comfortable but luckily the streets have too many civilians packed in them that they aren’t stupid enough to open fire.

Or so you’d think. With all of the commotion, people naturally move out of the way. They tuck into corners, squeeze under shop awnings, innocently clearing the path so they don’t get trampled. In doing so, they make you an easy target. You yelp as the first blaster shot is fired, wizzing right past your head and finding purchase in the corner of a building you run past.

“This is not how this was supposed to go!” Ben shouts, sweat trailing down the side of his face. His Jedi robes flutter behind him with his movements, both of your cloaks that were meant to conceal you long lost and forgotten.

“You think?!” You yell back, teeth gritting together from your annoyance. This mission was supposed to be simple. It was supposed to be easy. You were just going to set up a fuel trade with one of the bosses stationed in the outpost, pick up some extra ship parts on the way since stocks are running low. You have those at least, they slam into your side with every step you take as the bag you carry jostles about. The fuel tanks on the other hand…

The boss you had been meeting with, Kaijat, turned out to be a slimy two-facer who sold you out to the ones who offered him more credits. That naturally happened to be the First Order, their desire to eradicate the Jedi and the Resistance knowing no bounds. You and Ben had barely escaped from Kaijat’s facility before Stormtroopers circled the whole place, trying to trap you inside and imprison you. Your lightsabers had come in handy. You cursed yourself over and over for not being able to tell Kaijat’s true intentions, for not being able to see how he was going to betray you. You’d made deals with him before, you thought it would be fine. You should’ve known better—nobody can be trusted for very long anymore, if at all.

You’re ripped from your thoughts by searing pain in your left arm, a choked and startled yell coming from your throat as your running falters. A blaster shot went clean through, cutting about an inch into your shoulder. The outer layers are automatically cauterized but the deeper layers begin to bleed generously, crimson running down your skin and staining the whites of your robes. There’s a feeling of worry that blossoms at the forefront of your mind, and you know that it’s Ben with the way he shouts your name. Your bond connects you in a way that allows you to feel what the other feels, see what the other sees. You reassure him through that bond that you’re fine. You’ve had worse.

You channel your pain to your fingertips, calling the Force to you as you abruptly stop and turn. You use the Force like a second set of hands, digging its fingers into the cobblestone and cement below you, ripping it up and curving it into a sort of wall to create an obstacle that’ll buy you more time. You’ve always been more attuned to the physical aspects of the Force, using the objects and earth around you to your advantage. Ben is much better with the psychological aspects, easily being able to see into the thoughts and feelings of anyone he desires. That’s why you make such a great pair.

You both keep running, not wasting a second of the time that distraction has given you. Though you don’t look back, you know the Stormtroopers are already squeezing around the wall you made. You can tell by the way their blasters keep firing.

“This way!” You say, grabbing Ben and making a sharp left. You skid against the ground from your speed, accidentally banging your injured shoulder into the wall and leaving a smear of blood. You try to ignore the wave of nausea.

The new path seems promising, perhaps even having a way out of the outpost. Until you see the wall ahead begin to close in and you curse more than a few times. “No, no, no! Shit!” You snap. You and Ben slow your pace, coming upon a dead end. A death sentence. You beat a fist against the brick like that’ll do anything while Ben runs his hands along it like there’s a secret button you’re missing that’ll magically open it up. There’s nobody else around, nowhere to hide. Nowhere to go. You look up, trying to calculate how difficult it’d be to just scale the damn thing. There’s barely any footholds so you’d most likely just slip and bust your ass. Your hand begins to reach towards your lightsaber as the sounds of the Stormtroopers get nearer.

“Hey! Jedi! Over here!” A voice whisper shouts to you. You whirl around, searching for it. Ben does the same. “Look down!”

You do what it says and see a manhole cover lifted up by tiny hands, an equally tiny face poking out from between the gap. It’s a child, a young girl. “Follow me! They won’t find you down here!” She urges. The shouts and footsteps are getting closer. “Come on!”

You don’t give yourself a second to hesitate, forcing Ben along with you. You’re already in deep shit, you don’t think this’ll make it any worse. You both jump down into the manhole, the kid then dragging the cover back to its original resting spot so that anyone above ground is none the wiser. Just in time too, because you hear the Stormtroopers just above you, entering into that alley you were trapped in seconds before.

Looking around, you’re surprised by what you see. Somebody’s made a comfy living space of underground tunnels, outfitted with mismatching furniture like couches and chairs and tables, scraps of rugs and carpet covering the stone floors, pieces of drapes and paper clippings glued to the walls. There’s cozy lights strung along the seams of the curved ceiling, bathing the tunnels in a warm glow.

“What is this?” Ben mutters, eyes going every which way just like yours.

“Welcome to the tunnels of Sandura! Or home, as we like to call it.” The little girl from before is in front of you now, a big smile on her face. She looks to be eight. Her brown hair is messy and sticks up in all different directions, her face has smears of soot on it that hides her freckles, and her abnormally green eyes shimmer with childlike mischief. Her clothes are torn at their edges, like they’ve been worn generously or found in a trash heap.

You lift a brow. “We?”

The girl turns to shout down the tunnels. “Shamar!” There’s a pause and then the sound of little footsteps before a boy appears, looking to be only a year or two younger than the girl. You can see in their faces how they’re related, same round cheeks and pointed ears and sloped eyes. Their differences lie in the boy’s black hair, though it’s just as messy as his sister’s, and in his blue eyes.

“This is Shamar, my younger brother. I’m Almae. We’ve been living in these tunnels for years.” She says it proudly. You can tell the boy is the more nervous one of the pair as he looks you and Ben over with scrutiny. He hangs farther back, letting his sister lead the charge.

“Where’s your parents?” You can’t help but ask. You don’t sense any other life forms within the tunnels save for some rats maybe, but no people.

“They’ve been gone for a while. It’s just us now.” Shamar says it like it’s the simplest thing in the world.

Ben’s eyes narrow. He’s always so skeptical, you can feel his suspicion through your bond like it’s your own. “Why’d you save us?”

“We don’t like the First Order none, either. We know you Jedi folk, you go around the galaxy helping people and such.” Almae says, nodding to herself. “So we wanted to ask you to help us. We’ll take you through the tunnels and get you out of the city as long as you promise to take us back with ya.”

You’ll admit that’s not exactly what you expected. What you did expect was for them to ask for credits or ship parts they could resell, it’s what everybody’s after these days. That’s why you don’t like going on missions very much, you have a bad habit of coming back with empty pockets. At least when Ben joins you, he keeps that from happening.

“How do we know you’re not going to sell us out?” Ben demands, immediately going on the defensive from already being double-crossed once today.

You tug on his sleeve, pulling him to the side. “Ben, relax. They’re children.” You whisper.

“Children can still be convinced with the right amount of credits.” He retorts. “I’m trying to not get us captured.”

You roll your eyes. “I appreciate it, but read the two of them. Do they seem malicious to you?”

He hesitates, looking back at the siblings. You feel how his Force reaches out, roaming over their minds in a way that’ll leave them none the wiser. Through your bond, you’re able to get what he’s sensing. There’s no secret motive, no evil desire. It’s just hope, anticipation, and a desire for freedom, for something more than this. They just want out, they want to get away from the back-breaking jobs they had to take to scrape by, from the adults who yell at them for doing something wrong. They want to get away from always having to steal their next meal and living in the dark of the tunnels where they can’t see the sky. You feel a strong pang of sympathy in your chest, and you know Ben experiences the same.

You turn towards the kids, you crouch down to their level. Shamar shies away behind his sister, still eyeing you suspiciously. Good instincts on him. You hold out your pinky. “You pinky promise you’ll get us out of here?”

Almae grins, interlocking her little pinky with yours. “Pinky promise!”

“Alright,” you smile, “lead the way.”

Almae squeals. “Shamar! Go get your bag!” She tells her brother, shoving him towards one of the offshoot tunnels. Their bedroom, if you had to guess.

“I hope we don’t regret this.” Ben mutters once they’re gone, arms crossed over his chest.

“C’mon, they’re so cute.” You tease, nudging him. “How could we say no?” There’s a quirk of a smile from him and you know you’ve won. You always do.

Shamar and Almae come hurrying back a minute later, each with a heavy satchel slung over their shoulders. They’re full of any belongings they feel they can’t leave behind, like mementos from their parents, books, little trinkets and toys, and a few pairs of clothes. Everything else will stay behind in the tunnels, waiting for the next person to discover.

“Let’s go!” Almae says excitedly. You give her a nod, telling her to go ahead. She grabs her brothers hand and begins to walk, you and Ben following dutifully behind.

The further you get from the main living space, the darker it becomes. There’s the occasional overhead light or cracks in the foundation above luckily making your path more visible. The kids seem to know exactly where they’re going, probably traveling these tunnels hundreds of times over and using them to escape from the authorities trying to capture them for stealing. You admire their resourcefulness, even though kids shouldn’t have to live this way.

“How’s your arm?” Ben mutters to you after a while of walking in silence.

The pain had dulled, instead becoming a constant throbbing you could ignore. You’d basically forgotten about it. “I’m fine. I’ll patch it up when we get back to the Falcon.”

“Are you sure?” He presses. “I don’t want you passing out on me again.”

You groan. “That was only one time!” You laugh at the memory, even though it definitely wasn’t funny for Ben. You can tell by the way he scowls. It’d been an exploratory mission, scoping out a new planet and seeing what the resistance could make of it. You’d gotten yourself injured by one of the creatures inhabiting it and you’d brushed off your wounds until you’d passed out from blood loss. Ben had nearly had a heart attack, then having to drag your body over rough terrain and back to the ship. You’d done his chores back at Luke’s academy for a month to apologize. Besides that, he’s always been so concerned about you, acting like a mother hen with the way he frets. You certainly don’t do him any favors by constantly diving headfirst into danger. “I’m fine, I promise. You’ll be the first to know if I start feeling lightheaded.”

The siblings take a final left before Almae is shouting back at you because you’d fallen a bit behind. “We’re here! Come on, slow pokes!”

You hurry along, coming to a ladder that leads all the way up to another manhole cover. Almae climbs first with Ben right behind in case there’s danger above ground. Shamar follows, and you bring up the rear. The cover is shoved aside by Almae, the thing screeching in protest, and you have to squint your eyes as unfiltered sunlight pours in to the dark tunnels. The others climb out and you don’t hear any shouts of Stormtroopers or blasters going off so you assume it’s safe. Ben gives you a hand to help you and you gladly take it to relieve your bad arm of the strain.

Coming out of the tunnels, you immediately look around to get your bearings. It seems the path you followed brought you right to the outer border of the outpost, the wall of it standing tall directly behind you. In front of you stretches the lush jungle forest that makes Sandura what it is. The trees stretch to the skies, covered in moss and lichen, animals of all kinds roaming freely amongst the leaves above and underbrush below. Within that forest is where the Millennium Falcon waits for you, and that’s where you now head.

You and Ben take the lead this time, keeping the two kids between you to both protect them and keep an eye on them. You follow the invisible string of the Force that connects you to the Falcon, helping you find it within the massive jungle. You’d parked the ship far, far from the outpost, away from any sensors or prying eyes. It was common practice for people like you, to trek practically halfway across a planet because you couldn’t risk your ship being spotted. Especially something like Han Solo’s Falcon, just about everyone in the galaxy knew about that thing. The only reason Ben’s father had allowed you to use it today was the premise of getting in and out fast, something his ship was an expert in. Ben had sat through a multitude of rules and threats from Han, something that happened any time he was allowed to use his father’s ship. Ben swore up and down that Han loved the Falcon more than him, and sometimes you couldn’t help but think he’s right.

Honestly, you can’t blame Han either as you come upon the ship tucked into the forest. It really is a gorgeous piece of work; it looks at home between the vibrant greens of the bushes and trees. It’s huge, and the dappled sunlight reflects beautifully off its shiny silver exterior. Han takes such good care of it nowadays, showing it more attention as both of them have climbed in age. There’s not a scratch or dent on it, not a wire or panel out of place. You can’t recall how many conversations you’ve had with Han about the Millennium Falcon, how many hours you’ve spent talking and talking about all the intricacies of the ship—even when Ben would beg you to stop so he wouldn’t have to listen to his father drone on anymore. You’ve loved flight crafts ever since you were a child, there’s always something new to learn and they feel so powerful under your hands. You take to tinkering with your X-wing whenever you have free time, seeing what you can possibly improve and fix. You and Ben are some of the best pilots to come out of the Jedi academy, even rivaling Poe who’s more than happy to challenge either of you.

It seems Almae and Shamar share in your awe of the Falcon, both of their heads tilting all the way back to try and take in the whole thing. It’s impossible, you know that because you did the same when you were a kid seeing it for the first time. Even now in your late twenties, you’re still finding out new things about the ship.

“I didn’t know they were this big!” Almae exclaims, immediately running beneath the kickstands holding up the ship, twisting her body every which way in an attempt to look at it all with wide eyes.

“You’ll see much bigger ones when we get back to base.” Ben tells them, hitting the button to lower to ramp. “Come on.”

The siblings don’t hesitate to rush past him into the ship and you laugh as pure fear crosses over his face. “Don’t touch anything!” He shouts after them, hurrying the rest of the way inside. You follow behind, doing him a favor and shutting the ramp since he’s busy corralling two kids as they try to run this way and that. More laughter bubbles out of you and tears prick your eyes while you watch him, your poor, dear Ben so frazzled by a pair of children.

He finally gets them to sit down on the main couch that’s curved against the wall, then tightly securing the seatbelts over them so they can’t escape. Almae and Shamar pout. “That’s not going to work on me.” Ben tells them sternly. “I’m not risking my dad tearing me a new one because you two want to go exploring. Now just sit there and… I don’t know, play dejarik or something.” He clicks on the table in front of the couch, the holographic board game coming to life.

“You think they’ll know anything about that game? I can’t even understand it.” You mutter to him as you head towards the cockpit. The kids seem fascinated enough by the moving creatures at least.

“I know, it makes it very easy for me to beat you.” He says with a knowing smirk. You punch his shoulder.

There’s a familiar beeping and the sound of rolling metal as your droid, BB-3, comes from around the corner. You had left him behind in the ship both to avoid obvious suspicion and so that he could keep a robotic eye on it. “Hey buddy, you miss me?” You say affectionately, crouching down to run a hand along the top of his head. You love your droid, he’s been with you for years after you’d found him stuck in a garbage chute on some nowhere planet where he was going to be scrapped for parts. You cleaned him up and he’s never left your side since.

He notices the injury on your arm, one of his compartments opening to reveal the spare medical supplies you keep inside him in case of an emergency. You smile. “Aw, thanks bud but I’ll patch myself up in a bit. We need to get out of here first.” He beeps at you, rolling back and forth once.

He follows you to the cockpit where Ben’s already waiting, flipping switches and pressing buttons that have the Falcon roaring to life. You hear the kids shouts of excitement as everything powers on. “They’re fun.” You say with a laugh as you sink into the copilot’s chair.

“Uh huh.” Ben mutters. He grips the controls in his big hands, steadying the ship as it lifts off the ground. He keeps it low until you’re even farther from the outpost, not wanting to risk anything after you’d already been chased by Stormtroopers. They’ll be looking for you, for the Falcon. Once he thinks it’s safe, he brings the ship up, up, up into the atmosphere while you prepare the hyperdrive without him even having to ask. You’ve flown together enough times to know the sequence. You’ll jump to hyperspace in order to get away from Sandura, and then travel normally the rest of the way back to D’Qar in order to not blow all the fuel reserves.

You grip the chair under you as space around the viewport begins to blur, turning different shades of blue and white. You both get pushed back into your seats when the ship successfully makes the jump, speeding across the galaxy.

“What’s all that?”

You and Ben startle at the sound of the voice, turning to see Shamar peering at the control panel from between your chairs. “How did you- where’s your sister?” Ben demands, struggling to look at the kid and also keep his focus on controlling the Falcon.

Shamar shrugs. “I dunno, looking at some turret type thing.”

You and Ben both look at each other with wide, fearful eyes. The laser cannons. You’re out of your seat immediately, running across the ship and into the sectioned off compartment that houses the guns. Almae is indeed in there, about to touch the controls before you lift her by the armpits and yank her out of the chair. She yells in protest, thrashing her arms about. She manages to wheel back a fist that smacks your open wound, making you hiss and nearly drop her from the wave of nausea and pain you get. You set her roughly on the ground, your free hand coming up to clasp your injury as you wince. You feel fresh blood on your palm.

Almae instantly stops, body language changing as guilt sweeps over her. “I’m.. I’m sorry, I didn’t mean to. You- you just startled me is all. I just wanted to look around.” Her eyes are so big, so scared. “Please don’t take us back! I didn’t mean to hit ya, I swear!”

You can practically taste her fear on your tongue from how much it swells, how obvious it is across the Force. She truly thinks you’d take her and her brother back to Sandura and turn them in, leave them to sit in a jail all over again. You sigh, using your breathing to get past the pain. You guide her back to the main room where Sharma is waiting, sitting her down on the couch. She’s crying, small body shuttering as she sniffles.

“Hey, hey, listen to me.” You say softly, trying to get that strong girl you saw before to come back. She seems to calm a bit when she realizes you’re not angry, finally meeting your gaze. “It’s okay. But we told you not to move from these seats, that was for your own safety and ours. If you messed with something you shouldn’t have, it could’ve gotten us detected by the First Order or messed with the ship. We brought you both here to help you so we expect you to respect us and follow the rules we give you, alright?” You’re honest with her, but not cruel. You know that’s what children need to be able to understand, and Almae seems to get it. She nods, wiping stubbornly at her tears with a fist.

“M’sorry.” She mumbles. “I really didn’t mean it.”

“I know you didn’t. It’s okay, Almae. You’re not in trouble. We’re not going to take you back.” You say, putting a comforting hand on her head. Besides, doing that would only get your own selves arrested. “You’ll get a tour of the Falcon sometime later, I promise.” She perks up at the sound of that, nodding. You buckle her and her brother in a second time and they seem like they won’t be making any moves to escape again.

BB-3 beeps at you when you turn around, concerned by the new blood on your arm. “Yeah, yeah, I got it.” You mutter, going to plop yourself onto one of the bunks built into the wall, a heavy sigh leaving you. It’s time to finally patch yourself up, you suppose. The Falcon shudders as it comes out of hyperspace and you feel some tension release from your muscles. You’re grateful nothing decided to chase after you from Sandura.

You take one of the med kits and settle it next to you, popping it open and grabbing what you’ll need. Wipes, anti-bacterial, gauze. From BB-3 you take your small canister of bacta, something you keep hidden because of how precious it is. You begin to try and clean yourself of your blood, finding it a little difficult because of the angle. You run through more than a few wipes, leaving them stained red and scattered around you.

You’re about to try and apply the anti-bacterial before a large, warm hand encompasses yours. You look up to see Ben leaning over you, your eyes meeting. “Let me do it.” He says softly. Your faces are so close you can’t help but reach forward and kiss the corner of his mouth, making him smile. You always love his smile, the way his dimples show.

“I can handle it, Ben.” You say with a good-natured huff. “Don’t you have to go pilot?”

“It’s on auto. You’ve always sucked at bandaging injuries, just let me.” He insists. You roll your eyes, slapping the anti-bacterial into his waiting, open palm. Amusement twinkles in his eyes because he knows you always end up giving in. It’s true, you do suck at bandaging injuries because your hands aren’t careful enough for it, nor are you meticulous enough. You only are when it comes to a ship, something you can’t kill. Ben has always been more of the medic between the two of you—he has to be with the way you are—always taking such care when it comes to you.

He sits next to you on the bunk, making you scoot over to accommodate his huge frame. When cleaning your wound, he becomes so concentrated, his brows furrowing in the way you like with a slight crease to the side of his mouth. You wince as the anti-bacterial stings and he mutters out an apology, too focused for anything else. You know he’ll give you plenty of kisses for it later though, he always does. Ben coats the strips of gauze in bacta and then wraps them around your arm, not too tight and not too loose. Perfect, just like his dressings always are.

As you suspected, he takes you into his arms and kisses you plenty once he’s done. Your cheeks, your nose, your lips. He’s generous in his attention and love, the happy and gentle emotions filtering through your bond to match. It has you smiling like an idiot. When he’s satisfied, he lays back in the bunk, sitting against the wall with you between his legs. That’s when it hits you both, how tired you are. All the fighting and running, all the stress and anger, and now bringing along two kids. You look over and find the siblings asleep in their seats, heads lolling to the side. You want to follow them, want to just fall asleep in Ben’s lap. He’s so warm, and his robes are so comfortable. Easy to wrap yourself in and ignore the outside world.

But you know you can’t, you have to stay alert in case something happens, and Ben will have to get back to piloting soon. So you settle for sitting there and enjoying the way he holds you, because that’s always been more than enough.

» ☆ «

You must’ve dozed off despite your efforts because when your eyes are opening again, Ben is gone and you can feel that the Falcon is being lowered to the ground with the way it shakes and the sounds of it powering down. You sit up with a small grumble, wiping sleep from your eyes. Your legs ache in protest when you stand, exhaustion still weighing heavy on your body.

Almae and Shamar are up now too, shaking in their seats from excitement. Ben appears from the cockpit, having successfully parked and turned off the ship. He comes over to you, brushing some of your tussled hair from your forehead. “Did you sleep well?” He teases. You have half the mind to punch him again.

You settle for sticking your tongue out instead, then brushing past him to release the kids. You unbuckle their seatbelts and they immediately jump off the couch, clutching their bags against themselves. “I want you two to stick close to me, okay? There’s going to be a lot of new people and things to see. I don’t want you to get lost.” You say, holding your hands out so the kids take them. You’re glad when they oblige you, their tiny hands fitting snugly into yours.

Ben leads the way, once again pressing that button to release the ramp hatch. As it lowers, bright sunlight filters in and the fresh, damp air of D’Qar fills your nostrils.

There’s a crowd of people waiting when you exit the ship—resistance pilots welcoming you back, engineers already inspecting for repairs, captains and generals waiting for reports. It’s nothing unusual, it’s something that happens just about every time you two make a return. The rebellion hold the Jedi in such high regard that they always have to get some sort of glimpse of you, to see what you’ve been able to accomplish. You were right in taking Almae and Shamar’s hands because you can feel the way they startle and tense, too many sights and sounds coming at them. They shy away from the crowd, instead trying to hide behind you and BB-3 where it’s safe.

People begin to disperse within the minute, most having seen what they needed to see—that the two Jedi made it back alive. The rest of them part when the general comes through, her familiar gold-plated companion right behind her. Ben’s attention immediately shifts, and you smile knowingly.

“Welcome home, son.” Leia says fondly, having to reach up to cup Ben’s cheek in a weathered hand even after he tries to lean down for her. She tucks a strand of his black hair behind his big ears out of habit, even though he hates it. He’s always been self conscious about his ears despite how much you love them.

He huffs. “Thanks, mom.”

She chuckles, looking around him to greet you as well. You dip your head towards her with respect. “So, how did things go?” She asks.

You wince. “Well…”

“Kaijat betrayed us. He sold us out to the First Order, we almost got captured.” Ben’s words are blunt, his expression stony. He always gets that way when giving a mission report; he learned from his mother.

Leia curses under her breath. She seems troubled for only a moment before it disappears, a sigh leaving her. She’s always so put together, something you’ve admired about her ever since you were a kid. “There goes that, then. Did you manage to get anything? Were either of you hurt? Were you followed?”

“I got some of the ship repair parts you were wanting.” You say, motioning to the satchel you have slung over your shoulder. “I got shot in the arm, but it’s nothing too bad. Ben patched me up, of course.” Leia nods along with that, a twinkle in her eye, knowing exactly how her son takes care of you.

“And no, we weren’t followed. It’s all thanks to these two that we were able to escape.” You pull the siblings out from behind you, then holding them against you so they don’t scamper off. “It’s okay, guys. This is Leia, Ben’s mom and the leader of the resistance. She’s a powerful lady.”

Leia smiles, immediately softening. “And who are you?” She asks, trying to meet their eye level as best she can.

The kids are clearly too stunned to speak, making you laugh. It’s a big difference from how they were when you first met them. “C’mon, it’s alright. Introduce yourselves.” You whisper.

“I- I’m Almae and… and this is Shamar, my little brother.” Almae says, swallowing down her fear.

“It’s lovely to meet you, Almae.” Leia says, holding out a hand for her to shake. Almae hesitates for just a second before breaking into a smile and taking the hand. Leia does the same for her brother. “And Shamar. Now tell me, how’d you save these two delinquents of mine?” Ben rolls his eyes.

“We lived in the tunnels at Sandura, ya see, and the First Order had been there for a while. We don’t like them none, they’re all hoity toity and mean. They almost got us a few times when we were trying to get food.” Almae says, more than happy to launch into a story. She becomes much more open and expressive as she talks. “So we hear all this commotion above us one mornin’, all this shoutin’ and stompin’. I go to try and see what it is and it’s a pair of Jedi! They were running from the Order so I figured I’d help ‘em escape when they got stuck. We went through the tunnels and those stupid Troopers had no idea. Then the nice lady let us on the big ship. The big guy was kinda mean though.”

Ben glowers. “Why you-“

You smack a hand against his chest and he grumbles, crossing his arms. Leia laughs. “Well, aren’t you two brave? I have to thank you for saving the both of them. I don’t know what I’d do if anything happened to them.” She says earnestly. There’s a warm feeling that builds in your chest from her words, and you know Ben experiences the same. “I think you’ll fit right in here.”

“Really? We get to stay?” Sharma says, big eyes hopeful.

“Of course you do. We have a place for children just like you where it’s safe. C-3PO, give them a little tour of the place, will you? I’ll come find you in a bit.” Leia says, turning to the droid who’d been happily engaging in some type of conversation with BB-3.

“Oh, certainly general.” He teeters forward on his stiff legs, waving his arms at the kids. Almae looks overjoyed. You can already tell she has the heart of a mechanic in her, just like you. “Pleasure to meet you, I am C-3PO, human-cyborg relations. Please, follow me this way.”

The kids seem hesitant, instinctively looking back at you. You smile. “Go on. It’s safe here, everyone’s a friend. Just make sure to stay with the droid so you don’t get lost, okay?” You lean in to whisper, “and ask him stupid questions. He loves those.” The siblings grin impishly at you.

“You’ll come visit us, won’t you?” Shamar asks, tugging on the hem of your robes.

“Yeah, of course we will. Once you get all settled.” You promise, patting him on the back. You watch as they hurry to catch up to C-3PO; it wasn’t too hard, he doesn’t move all that fast.

“They’ll have to be transferred to one of our more remote civilization bases. This one is too dangerous and open to have children on it.” Leia says once they’re gone, both hands resting on her cane.

You sigh. “I figured. I just didn’t have the heart to tell them.” Ben’s hand finds yours, a small comfort.

“There you are!”

All three of you jolt at the sound of Han’s voice as he comes up to you with long strides, Chewie right behind him. “I was wondering when you’d come back with her.” He says to Ben, meaning the Millennium Falcon. “No issues with her, right?”

Ben sighs, automatically knowing what his father would say to him. “No, dad. Nothing happened to your precious ship.”

Han nods. “Good. Chewie and I are gonna head out for a bit. We’ll keep in touch.”

“Sure you will.” Leia mutters.

Han is about to walk up the ramp past you when he stops. “Hey, kid.”

“Hey, Han.”

“How ya been?”

You shrug. “I’ve been alright. Doing the usual.”

He nods again. “Good to hear. I’ll see ya later.” He points at Ben. “Keep that boy out of trouble.”

You can’t help the small smile on your face. Ben’s parents accepted the fact that you two were inseparable a long time ago, and they know you don’t really go anywhere without the other. Not if you can help it, at least. “I will, Han.”

When Chewie walks by, he ruffles both you and Ben’s hair with a big, furry paw—his own way of saying hello. You laugh while Ben groans, immediately trying to fix the mess. Then Chewie and Han are gone, disappearing into the Falcon and getting it powered up. That’s typically how your interactions with Ben’s father and his companion go, always short and sweet because Han is always on his way to do something, to go annoy someone in some part of the galaxy.

Leia just shakes her head. When she moves past you, she puts a gentle hand against your bandaged wound. “I want you to go see the medic when you can, dear.”

“I will, Mrs. Organa, don’t worry.” You reassure her. “Ben won’t leave me alone until I do.” She seems satisfied with that.

“Oh, and Luke wants you two to contact him within the next few days. He may ask for your return to Ossus. I believe he has some things to discuss, but it didn’t seem like there was a big rush.” She says. You and Ben share a look, wondering what your Master would have to say. You’re both too exhausted to care about it right now though. “I’ll leave you both to it. But do stop by tomorrow morning to give a full report, hm?”

“Sure, mom. We’ll see you then.” Ben says, generously leaning down again so Leia could give him a little peck on the cheek and hold him close.

She takes a few extra seconds than necessary, Ben beginning to squirm in her grasp. She sighs after finally letting him go. “I’m glad you both made it back safely. I didn’t realize how dangerous things have become. We may have to rethink how we go about negotiations so this doesn’t happen again.”

“We’ll figure it out, we always do.” You try to reassure her, even though you’re feeling doubtful yourself. The First Order is expanding, taking more planets, spreading their control.

Leia hums in agreement, trying to keep up some semblance of optimism. “I’ll have to speak to Luke, he needs to make his move. That means you both will need to be on alert.” She says, tone heavy. She waves a hand suddenly, shaking her head. “We’ll worry about it tomorrow, you two don’t need to listen to me trying to figure out a war right now. Go rest up. I need to make sure C-3PO and those kids didn’t get into any trouble.”

“Good idea.” Ben mutters, knowing those kids are probably trying to get into all kinds of mischief.

With a final goodbye, you two and Leia are going your separate ways. You stretch your arms above your head, enjoying the feeling of the sun on your skin. “Now let’s go get something to eat, please, my stomach is digesting itself. I hope they still have some of those sandwiches I like.” You say, practically drooling at the thought of those tasty sandwiches they serve in the cafeteria.

Ben scoffs. “This late in the afternoon? You’re dreaming.”

“Don’t ruin it for me.” You groan.

Even without the sandwiches, as long as you get some type of decent food, you’ll be okay. As long as Ben is with you, you’ll be okay. You know that you’ll both grab a meal together, you’ll sit side by side, never seperated. You know that when you’re done, you’ll both find somewhere quiet, preferably bathed in sunlight, you’ll curl up together looking like two puzzle pieces, and you’ll sleep for as long as you want. Because it’s what you always do, and because you earned it.

#I’m sorry there’s too many planets I’ll just make up one respectfully#idk how this ended up being so long lmao???#ben solo come back to me!!!!!#ben solo#ben solo x reader#ben solo fanfic#ben solo x you#star wars#star wars fanfic#star wars x reader#kylo ren x reader#kylo ren fanfic#kylo x reader#kylo ren#kylo fanfic#kylo x you#kylo

54 notes

·

View notes

Text

What is a Stock Ticker? Definition, How it Works, and Origins

A stock ticker is a tool that shows the price of certain stocks, updated continuously during the trading day by stock market exchanges.

A “tick” is any change in the stock’s price, whether it goes up or down. A stock ticker automatically shows these changes, along with other useful information like how much of the stock is being traded. This helps investors and traders keep up with the market and see how popular a particular stock is.

Key Points

A stock ticker updates the transaction and price data for a stock throughout the day.

It usually shows the most active or newsworthy stocks.

The ticker shows the stock symbol, price change, percentage change from the last session, and trading volume.

Information is often color-coded: green for price increases, red for decreases, and gray or tan for no change.

2 notes

·

View notes

Text

Kenma Kozume: Hogwarts AU

Kenma Kozume is a Half-Blood wizard that was born on the 16th of October 1972 and started attending Hogwarts on the 1st of September 1984, being sorted into Ravenclaw House.

He has a Willow wand with a Unicorn Hair Core.

His Patronus is a Ragdoll Cat.

His favorite subject is Muggle Studies and his least favorite subject is Defense Against the Dark Arts.

He was one of Ravenclaw's Chasers from his fifth year onward.

Kenma usually has a quiet, composed and analytical personality. He rarely loses his temper, and usually does not get too excited or fired-up about most things, with a few exceptions being video games, Hinata, Lev, and Yamamoto during their first year at Hogwarts.

Because of his reserved nature, Kenma does not often voice his opinions since he is afraid of what others might think of him and does not like standing out or being noticed in any way. His shy tendencies also prevent him from being very approachable and because of this, he has a difficult time making friends, with Kuroo being stated to have been the only friend he's made since he was a kid. He is also not fond of the authority that comes with being an upperclassman and doesn't expect his junior's to automatically respect him, often reminding Lev that he does not need to be so formal with him.

Kenma rarely tends to show many emotions which usually causes him to look like he is giving a cold impression to others. However, it is shown that he does care about his friends and notices small upsets in their behavior. An example is when they were younger, Kuroo's favorite Quidditch team had badly lost a match and was feeling down. Kenma noticed this feeling and, despite not caring for Quidditch, asked if Kuroo would like to practice and "level up" to which he agreed eagerly. Another can be seen later when he admits that he tries hard to win for his friends.

Despite his modest personality, Kenma is quite skilled at Quidditch with his extraordinary game sense, technique, and strong strategic abilities. Although he seems somewhat apathetic about it, Kenma is the type of person to only do things he enjoys and would therefore quit Quidditch if he didn't enjoy it somewhat, which according to him was the aspect of improving his skills in the same sense as a video game. However, despite having a tough time admitting his feelings, the real motivation behind his continuation of Quidditch is his friends. Kenma is also shown to be quite competitive.

After graduating from Hogwarts, Kenma can be described as having a good head on his shoulders. Even after being a successful stock trader & the CEO of his own company, he doesn't spend his money lavishly except for video games and sponsoring Hinata during his time in Brazil.

4 notes

·

View notes

Text

Navigating the Markets: Unveiling the Diverse Landscape of Types of Traders in the Stock Market

The stock market is a dynamic arena where various players engage in buying and selling securities, aiming to capitalize on market movements and generate profits. Understanding the diverse Types of Traders in Stock Market operating in this financial landscape is crucial for both novice investors and seasoned professionals alike. In this article, we will delve into the intricacies of the stock market and explore the distinct roles played by different types of traders.

Day Traders:

Day traders are individuals who execute multiple trades within a single day, taking advantage of short-term price fluctuations. Their primary goal is to capitalize on intraday price movements and avoid overnight exposure to market risks. Day trading requires quick decision-making, technical analysis skills, and a deep understanding of market trends. ᅠ ᅠ ᅠ ᅠ ᅠ ᅠ ᅠ ᅠ ᅠ ᅠ

Swing Traders:

Swing traders aim to capture price "swings" or short to medium-term trends within a specific stock or market. Unlike day traders, swing traders may hold positions for several days or even weeks. They rely on both technical and fundamental analysis to identify potential entry and exit points, attempting to profit from market momentum.

Position Traders:

Position traders take a longer-term approach, holding positions for weeks, months, or even years. They base their decisions on fundamental analysis, macroeconomic trends, and company performance. Position trading requires a patient mindset and the ability to weather short-term market fluctuations while keeping an eye on the broader market landscape.

Scalpers:

Scalpers are ultra-short-term traders who focus on making small profits from very quick trades, often holding positions for just seconds to a few minutes. Their strategy involves taking advantage of small price changes and relying on high-frequency trading systems. Scalping requires precision and the ability to execute trades swiftly.

Algorithmic Traders:

Algorithmic or algo traders utilize computer algorithms to execute trades automatically based on predefined criteria. These traders employ complex mathematical models and statistical analysis to identify trading opportunities and execute orders at optimal times. Algorithmic trading has become increasingly prevalent in modern financial markets.

Trend Followers:

Trend followers identify and capitalize on existing market trends, either upward or downward. They use technical analysis to spot patterns and indicators that suggest the continuation of a trend. Trend-following strategies aim to ride the momentum of a trend until signs of a reversal appear.

Click here for more information :-

Upcoming Dividend Dates Nse

Bank Nifty Chart Pattern

2 notes

·

View notes

Text

Understanding the Working Model of Forex Prop Trading Firms

Most of the passionate people in trading know prop businesses but may need to learn exactly what they do. Property trading firms, or prop firms for short, are niche businesses that invite experienced traders to use their trading abilities on behalf of the company. Prop trading is distinguished from traditional trading by this special structure, which gives traders several benefits and chances in the financial sector.

Essentially, a prop trading company is a financial marketplace that provides funds to knowledgeable traders to trade stocks, commodities, and currencies, among other financial instruments. Through this extract, we intend to clear up the mystery surrounding prop trading and offer a thorough grasp of how it operates within the dynamic context of financial markets.

Business Model of Forex Prop Trading Firms

Capital Allocation and Proprietary Trading Desk:

Forex Prop Trading Companies differentiate themselves from one another based on the capital they offer their dealers. Capital allocation, which allows traders to profit from huge amounts of money above their own capital, is the cornerstone of their business plan. The best forex prop trading firms thoroughly assess risk before disbursing cash to traders.

These assessments consider the trader's approach, prior performance, and additional variables. Based on this evaluation, the company determines how much cash to provide each trader, ensuring that the strategy remains balanced and risk-controlled. Prop trading firms use the profit-sharing model in return for the provided funds. Traders do this by contributing a percentage of their profits to the business.

Trading Strategies and Risk Management:

Exclusive Trading in Forex Businesses uses a wide variety of trading techniques to take advantage of the existing market opportunities and turn it into a profit. Some of the most important trading tactics and risk management techniques these organizations use are statistical arbitrage, high-frequency trading, algorithmic trading, and quantitative strategies. Using sophisticated algorithms and fast data feeds, high-frequency trading allows for the execution of several deals in a matter of milliseconds. Using predefined algorithms to carry out trading strategies is known as algorithmic trading.

These algorithms can examine market data, spot trends, and automatically execute trades by preset parameters. Statistical analysis and mathematical frameworks are used to find trading opportunities in the quantitative trading process. Finding and taking advantage of arithmetic correlations between various financial instruments is the process of statistical arbitrage. By employing this tactic, traders hope to profit from transient disparities in price or mispricing among connected assets. You can control your earnings and losses more with a very successful risk management strategy.

Technology and Tools:

The capacity of Forex Prop Trading Organizations to utilize advanced technologies and apply skillful instruments to maneuver through the intricacies of the financial markets is critical to their success. Discover in this article how these companies' operations rely heavily on technology such as data analytics, trading algorithms, direct market access (DMA), etc. Large volumes of market data are processed in real-time by these companies using sophisticated analytics techniques.

Traders can obtain important insights that guide their trading methods by looking at past data and detecting patterns. Prop businesses use several trading tactics, one of which is algorithmic trading. These systems automate the execution of trades based on predefined conditions using intricate algorithms. A "direct market access" technique enables traders to communicate with financial markets directly and eliminates the need for middlemen. Forex Prop Trading Firms use DMA to provide quick and effective order execution by executing transactions with the least delay.

Regulatory Framework:

Similar to other financial operations, prop trading is subject to several laws and rules that are designed to maintain market stability, equitable treatment, and transparency. Prop trading rules differ from nation to nation, but they are always intended to balance encouraging financial innovation with discouraging actions that would endanger the system. For instance, the US Dodd-Frank Act has placed several limitations on prop trading, especially for commercial banks. The purpose of these restrictions is to restrict trading activity that carries a high risk of destabilizing the financial system.

The minimum capital requirements for forex prop trading firms are frequently outlined in regulations. Regulators seek to improve the overall stability of the financial system and lower the danger of insolvency by setting minimum capital limits. Regulations also require prop trading companies to use effective risk management techniques, such as defining profit goals and using complex techniques like volatility/merger arbitrage to reduce risk. The execution of trading methods by forex proprietary trading firms is mostly dependent on prop traders. It is essential for a prop trader to be be clear about the legal and regulatory landscape in which they operate.

Success Factors and Challenges

The best Forex prop firms rely on a number of variables to be successful, including personnel management, technology, technological adaptation, good risk management, and strategic alliances. Prop businesses must address the difficulties of market saturation, liquidity constraints, technology risks, market volatility, talent retention, and regulatory compliance to succeed in the competitive and constantly changing world of forex trading.

The reason being that forex markets are dynamic, there is a chance that prices would observe fluctuations quickly and unexpectedly. In order to overcome increased volatility, best prop firms for forex need to have strong risk management methods. Businesses that rely heavily on technology run the risk of experiencing cybersecurity attacks and system malfunctions. Strong cybersecurity safeguards, regular monitoring, and upgrades are necessary to mitigate these dangers.

Conclusion

Navigating the intricacies of financial markets requires a thorough understanding of the Forex Proprietary Trading Firms operating model. It involves more than just making profitable trades; it also involves understanding the bigger picture, including subtle regulatory differences, new technological developments, and risk management techniques.

Prop traders need to be aware of the legal and regulatory landscape, the value of utilizing technology, and the crucial role they play in the success of their companies, regardless of their level of experience. The robustness and success of the larger financial ecosystem are strengthened by ongoing education and interaction with the complex components of Forex Proprietary Trading Firms.

2 notes

·

View notes

Text

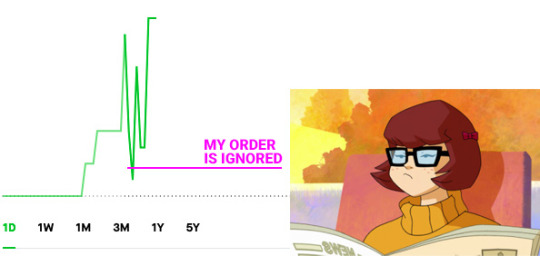

Puts become Shorts

If you can't afford to exercise a call option, it's self explanatory. Can't afford to. Sell the option back to the bank.

But what about Puts? If you don't have the stock to sell, what happens?

That my friend is *probably* how traders broke the market in a way that allowed too many shorts to begin with. It has to do with an oversight in *somebody's* trading algorithm, that allowed too many put options to be exercised simultaneously.

When you execute a *put* option without owning the stock, now you own a hundred short positions, *AND* however much money your strike price was. Which means, you now have to make sure to buy the stock back before the price bounces back up.

Unfortunately, and I have no evidence for this, this *might* be what happened in the individual investor world. A bunch of small traders on the other side of the bet didn't realize they needed to buy their shorts back.

Well... It was probably a bunch of hedge funds too. So, you know... Max Pain or whatever.

I would say this is a combination of algorithmic trading oversight *and* financial democratization apps. An individual investor not versed in "Puts become Shorts" could make that mistake.

But if they're doing similar trades as Wallstreet, or other finance bros, and they are *also* making those mistakes. Then it's not a skill issue, it's an accountability issue.

Imagine if a put automatically executed the short sell AND buyback, and the algorithmic pricing caused volatility that bounced the price to an extreme high causing you to owe much more than you made at the initial sell...

Not an Accusation.

4 notes

·

View notes

Text

Empowering Investments with an Automated Stock Trading Bot

Robotrade is a cutting-edge, sophisticated automated stock trading bot designed to revolutionize the investment landscape. Powered by advanced algorithms and artificial intelligence, Robotrade seamlessly combines real-time market data analysis with intelligent decision-making capabilities. With its comprehensive range of features, including trend identification, risk assessment, and portfolio optimization, Robotrade empowers investors to navigate the complex world of stock trading with unparalleled efficiency and accuracy. Sign up today and trade with us now!

#algo trading provider#robot trading platform#automated online trading#auto trading software india#automatic stock trader

0 notes

Text

Following the bankruptcy of one of the world’s largest cryptocurrency exchanges, FTX, the price of bitcoin (BTC) has tumbled again. It is now about $16,500 – a far cry from the all-time high of $66,000 just a year ago.

Why such a large drop in value? It’s because of the highly toxic combination of an exchange (an electronic platform for buying and selling) called Binance, a stablecoin (a crypto whose price is pegged 1:1 to the US dollar or another “fiat” currency) called tether, and the skilled professional traders running high-frequency algorithms.

Unlike stocks, bitcoin can be traded on many different exchanges, but Binance has more than 50% of the entire crypto market, and as a result it sets the price of bitcoin and other cryptocurrencies. In order to buy cryptocurrencies, traders must convert fiat money, into a stablecoin like tether. Bitcoin-tether has by far the largest volume of all products on Binance, and because one dollar usually equals one tether, trading on bitcoin-tether sets the dollar price of bitcoin. But when bitcoin crashes, so does the entire crypto ecosystem.

The issue is that Binance is only self-regulated, meaning it is completely unregulated by traditional market regulators such as the Securities Exchange Commission in the US or the Financial Conduct Authority in the UK. This is a great attraction for professional traders because they can deploy high-frequency price-manipulation algorithms on Binance, which are against the law in regulated markets. These algorithms can cause rapid price movements up and down, making bitcoin extremely volatile.

Binance does its own clearing and settlements of trades, the same as all other self-regulated crypto exchanges. This means that losing counterparties – those on the other side of profitable trades – often have their positions wiped out automatically without notice.

Unlike normal exchanges, self-regulated crypto exchanges aren’t required to raise the alarm when a trade has lost so much money that the collateral in the account needs topping up. Instead, traders are solely responsible for funding their accounts by continually monitoring something called the liquidation price. This is done automatically by the algorithms run by professional traders, but it is exhausting for ordinary players like you and me, who need to remain highly vigilant whenever manipulation is being used to create the volatility that professional traders use to increase their profits.

When professionals trade against each other it is called toxic flow, because the chance of profit is more like 50-50 if their algorithms are equally fast and effective. Professional traders much prefer their counterparty to be an ordinary investor.

This is worrying because Binance has been hugely successful at attracting ordinary investors. The fees it earns from this kind of investor have funded its very rapid expansion; it is now branching out with its own stablecoin, blockchain and NFT marketplace. Binance is consolidating its role as the Amazon of crypto, following a very effective business model.

In some ways one can liken the current circumstances in crypto markets to the burst of the dotcom bubble in 2001-2. The venture capital that had poured into internet startups in 1999-2000 suddenly dried up, as many companies went bankrupt. This year, Three Arrows Capital, one of the largest crypto hedge funds, defaulted on its loans, and major crypto-lending companies Celsius and Voyager filed for bankruptcy as the price of bitcoin collapsed, following some unexpected and shocking attacks on a new type of stablecoin called Terra. Following the bankruptcy of FTX, several other exchanges such as Gemini, and lending platforms (shadow banks) including Genesis are preventing customers from withdrawing their funds.

We shall see a lot more of this contagion, precipitating widespread bankruptcies among startups now that venture capital has dried up in the crypto sector. More exchanges and lending platforms, as well as blockchains, NFT marketplaces, data aggregators and analytics companies, will all bite the dust.

Binance could emerge from this chaos with a monopoly. But right now, this non-domiciled and self-regulated company still needs fee revenue from ordinary investors, and it needs market makers (professional traders akin to unfriendly stall holders on the exchange) to conduct its business.

The danger is that everyone is very scared now, so the only way to draw in ordinary investors is to pump up the price of bitcoin again. This would tempt people back into the crypto game, only to have their savings wiped out as the cycle of volatility continues.

13 notes

·

View notes

Text

Financial Lesson I learnt in 2022

In the year 2022 I've learnt a lot of this some good, some bad and some have absolutely no purpose whatsoever but here are some financial lessons I learnt in 2022 that have made my life all the better.

1. Every penny you save will one day save you: In the middle of the year I got a job that paid about 7x my previous job and hoped my life would automatically become worthwhile and I wouldn't have to the way I did previously and would have more money in my account but to my greatest surprise, this wasn't the case as I seemed to save less money than when I was at my previous job. This became very evident when my younger brother's school called for resumption suddenly, I realized that I had no money to support him and had to resort to borrowing. If I had saved as I was supposed to I wouldn't have had to beg for money to support my brother's education. So it is important that we save a little money for emergencies; no matter the level of income that you are at currently, try to keep at least 1/10 of your monthly income for emergencies because while we do not pray for them eventualities will always arise: you could lose your job, a family member or yourself can get sick, you can make a bad investment, etc and then in your days of trouble, your savings will save you!

2. If it sounds too good to be true, it most usually is: In Nigeria, it is very common to hear: invest 20,000 and get 100,000. Simple mathematics shows that this kind of investment is trying to 500% returns on your investment and there is currently no business on God's green earth that can do this even for stock traders that invest wisely and safely make around 8-12% returns on their investment. Your average business man doesn't make that much profit, neither does your international business man or even your most experienced crypto trader (which by the way I would advise against if you want your money to be safe). So any business that promises you an absurd amount of returns be it online or physical, is usually a Ponzi scheme that will leave a lot of so-called investors in tears!

3. If you can't afford to pay in cash don't buy it: With the advent of things like Easy Buy, buy now and pay later offers; more and more people are tempted to buy things they cannot afford and sometimes things that they do not need. While this is not something I practice, I have a colleague let's call him Bob that bought a phone using one of these services and it would surprise you that the resulting debt accrued by Bob could not be paid in six months for a phone that just cost around 60000! He was knee deep in debt that he had to take loans to pay the phones cost and this spiralled out of control as he was borrowing from one loan app to pay the other and all this started because he bought a phone he could not pay for in cash!

4. Stay Broke: While this might sound like a terrible advice, hear me out. If for example you're like myself that was making a particular amount and you were living comfortably then you 7x your income and immediately raise your standard of living, spending on frivolities, etc; your account balance and assets will most definitely not reflex your new income. Instead of doing what I did, if you instead try to maintain your standard of living or maybe just raise it a bit and avoid non essential things as much as you possibly can: then you have more money to save, more money to invest in things that will serve your future. So while it might sound counter intuitive, staying broke is one of the things I learnt in the year 2022

5. Don't forget to have fun: In my quest to do better with my finances, I found myself at a place where I completely avoided things that I used to do for fun as I said to myself that they were just excuses to spend money that I should be saving; this mentality change when I cracked and went on a spending spree as I had been starving myself of fun things I used to do. If you don't have fun every once in a while, the day you finally break, you would incure the worst expenses ever. So, keep some money aside for fun things, doesn't have to be too much but just enough to keep the "fun monster" satiated!

6. Make efforts to learn about money and how you can make more of it: Growing up in a religious family we rarely talked about money and living in a country where it is very possible to make money from fraudulent and/or mystic way having too much money is usually regarded as a bad thing but one truth I've learnt about money is that money buys you time for example if you had sufficient money you wouldn't have to work extra hours to make more money. Those hours could be spend with friends and family or used to pursue a hobby rather than bursting your butt on a job you don't really like. So while some people might view money in a bad light I've learnt that money obtained legally and genuinely while it might not buy you happiness as we have always been told, will buy you the time you need to find happiness. So learning about your finances and how to make more money is one of the most important things I learnt in 2022.

8 notes

·

View notes

Text

Best Stock Market Comprehensive guide for beginner to advance #stockmarkettrading

Stock Market Trading Strategies: A Comprehensive Guide

## Introduction

In the dynamic world of finance, stock market trading strategies play a pivotal role in navigating the complex web of markets. A trading strategy acts as a roadmap, providing traders with a structured approach to making high-quality trading decisions. By defining specific rules and parameters, these strategies offer a systematic and disciplined approach to capitalizing on market opportunities. In this comprehensive guide, we will explore six different types of trading strategies and techniques that every trader should know. So, let's dive in and unravel the secrets of successful stock market trading.

Understanding Trading Strategies

At its core, a trading strategy is a set of rules that guide traders in executing profitable trades. These rules can encompass various aspects, including chart patterns, price action, technical indicators, and fundamental analysis. The primary objective of a trading strategy is to streamline the process of analyzing market information and provide traders with a structured methodology for decision-making. By offering structure, focus, and consistency, these strategies empower traders to navigate the market with confidence.

The Top Six Types of Trading Strategies

Day Trading: Day trading is a popular strategy that involves buying and selling financial instruments within the same trading day. Day traders aim to capitalize on short-term price fluctuations and take advantage of intraday volatility. With a focus on quick profits, day traders employ various techniques such as scalping and momentum trading to identify lucrative opportunities.

Swing Trading: Swing trading is a strategy that capitalizes on medium-term price movements. Unlike day trading, swing traders hold positions for several days to weeks, aiming to capture substantial price swings. Technical analysis plays a crucial role in swing trading, helping traders identify entry and exit points based on trends and patterns.