#250 Crore support

Explore tagged Tumblr posts

Text

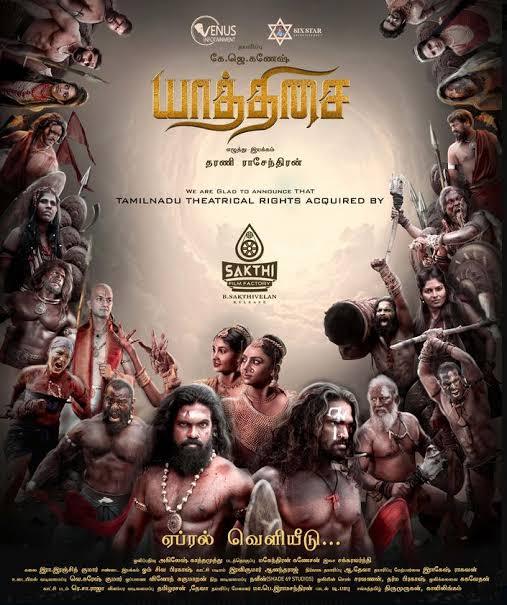

If you liked Ponniyin Selvan and want to watch something like that, I have the exact thing for you - Yaathisai (2023)

Non-spolier review

The film is set in the 7th century (around 270-250 years before Ponniyin Selvan) and tells the fictional story of a small tribe (Einar) that fought against the famous Pandiyan king Ranadheera Pandiyan aka Kochchadaiyan. Remember Rajinikanth's old film? The protagonist is named after this historical King.

The film was written and directed by debutant director Dharani Rajendran. The film's dialogues are in Old Tamil, which are subtitled for viewers in modern Tamil and English. The cast and crew, comprising mostly of debutants, deserve high praise for making such a good film on a shoestring budget (7-10 crores, according to various online sources).

Revolving around the theme of the hunger for power and the thirst for authority, Yaathisai doesn't sing the glories of the emperors or the goodness of their heart. It is a raw, visceral, gripping tale about the corrupting influence of power and the people who are caught up in it.

Newcomers Shakthi Mithran, Seyon Rajalakshmi, Samar and Vaidhegi Amarnat play the main roles and they are amply supported by actors like Guru Somasundaram (the only name I could recognise), Chandrakumar, Semmalar Annam, Subathra and Vijay Seyon.

Cons of the film would be shoddy CGI in some parts and the lack of budget which is reflected in the technical side of the film. That doesn't mean that the film is bad or unwatchable. There are some glitches in some parts, that's it.

If you loved Ponniyin Selvan and wants to watch something like that, this is a very interesting choice. On the surface level, it is a historical fiction, period movie set in a similar period. On the deeper level, it questions and scrutinises everything monarchist narratives like Ponniyin Selvan stands for.

7/10

The movie is available for streaming online and you can watch it on Amazon Prime Video.

#Yaathisai#tamilculture#tamilnadu#ponniyin selvan#ponniyin selvan 2#PS1#PS2#kollywood#kollycinema#tamilcinema

20 notes

·

View notes

Photo

Badhaai Do

2022 ‧ Comedy/Romance ‧ 2h 27m

Badhaai Do (transl. Give Congratulations) is a 2022 Indian Hindi-language socialcomedy-drama film directed by Harshavardhan Kulkarni. Produced by Junglee Pictures, it is a spiritual sequel to Badhaai Ho (2018). Depicting a couple in a lavender marriage, it stars Rajkummar Rao and Bhumi Pednekar with Gulshan Devaiah, Chum Darang, Sheeba Chaddha and Seema Pahwa in supporting roles

Shardul, a gay guy, and Suman, a lesbian woman, enter into holy matrimony to appease their families. However, when Suman's girlfriend moves in with them, their lives become more complex.

Release date: February 11, 2022 (France)

Director: Harshavardhan Kulkarni

Budget: 250 million INR

Distributed by: Zee Studios

Box office: est. ₹28.33 crore

Cinematography: Swapnil S. Sonawane

Starring

Rajkummar Rao

Bhumi Pednekar

Sheeba Chaddha

Chum Darang

Gulshan Devaiah

Badhaai Do - Wikipedia

Badhaai Do (2022)

Bhumi Pednekar as Suman Singh and Chum Darang as Rimjhim Jongkey

Requested by @rainbowskittle :3

1K notes

·

View notes

Text

Understanding Udyog Aadhaar: Empowering Small Businesses in India

Udyog Aadhaar is a vital initiative by the Indian government to support the growth and formalization of the Micro, Small, and Medium Enterprises (MSME) sector. Introduced in 2015 under the Ministry of Micro, Small, and Medium Enterprises, Udyog Aadhaar enables entrepreneurs to register their businesses easily, gaining access to various benefits and schemes aimed at boosting the sector. This article explores the essentials of Udyog Aadhaar, its benefits, and how to register for it.

What is Udyog Aadhaar?

Udyog Aadhaar, now replaced by Udyam Registration as of 2020, was initially introduced as a 12-digit unique identification number for MSMEs. The primary objective behind its implementation was to streamline the registration process and make it accessible to small and medium-sized business owners. Registration under Udyog Aadhaar provides an official recognition for businesses, enabling them to avail a variety of government schemes, subsidies, and benefits designed specifically for the MSME sector.

Why Was Udyog Aadhaar Introduced?

The MSME sector is crucial to the Indian economy, contributing significantly to GDP and providing employment to millions. However, a major challenge has been the formalization of this sector, as many MSMEs operate informally and do not benefit from government schemes due to lack of registration. Udyog Aadhaar addressed these challenges by making the registration process simple, paperless, and free of cost.

Key Benefits of Udyog Aadhaar for MSMEs

Easy Access to Government Subsidies: Registered businesses are eligible for a range of subsidies provided by the government. These may include subsidies on power tariffs, tax exemptions, and lower interest rates on loans.

Credit and Financing Support: MSMEs registered under Udyog Aadhaar can access government-sponsored credit schemes, which aim to provide financial support at low-interest rates, ensuring that businesses have sufficient working capital.

Participation in Government Tenders: Udyog Aadhaar allows MSMEs to participate in government tenders without requiring the Earnest Money Deposit (EMD), which reduces the initial financial burden on small businesses.

Access to Skill Development Programs: Registered businesses can benefit from various skill development and training programs offered by the government, helping entrepreneurs and employees upgrade their skills for better efficiency.

Easier Collateral-Free Loans: MSMEs registered under Udyog Aadhaar have better access to collateral-free loans through schemes such as the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE).

Who is Eligible for Udyog Aadhaar?

The Udyog Aadhaar registration is open to micro, small, and medium enterprises involved in manufacturing, processing, or service activities. The classification for MSMEs is as follows:

Micro Enterprises: Investment up to ₹1 crore and turnover up to ₹5 crore.

Small Enterprises: Investment up to ₹10 crore and turnover up to ₹50 crore.

Medium Enterprises: Investment up to ₹50 crore and turnover up to ₹250 crore.

How to Register for Udyog Aadhaar?

The registration process for Udyog Aadhaar is simple and online. Here is a step-by-step guide:

Visit the Udyog Aadhaar Portal: Go to the official Udyog Aadhaar (now Udyam Registration) website to start the registration process.

Enter Aadhaar Details: The applicant needs to provide their Aadhaar number, which acts as an identification proof. Only the owner, proprietor, or authorized partner can register.

Fill in Business Details: Provide essential business details such as name, type of organization, address, bank account information, and other relevant data.

Classification of Enterprise: Choose the appropriate classification as a micro, small, or medium enterprise based on the business's investment and turnover.

Submission: After completing the form, submit it online. Once verified, a unique Udyam Registration Number is issued, confirming the business's registration.

Transition from Udyog Aadhaar to Udyam Registration

In July 2020, the Ministry of MSME revamped the registration process by introducing Udyam Registration, which replaced Udyog Aadhaar. The transition simplified the process even further, using PAN and GSTIN integration for verification. For those with Udyog Aadhaar, the government allows migration to Udyam Registration without any additional cost, maintaining their access to benefits.

Final Thoughts

Udyog Aadhaar and, more recently, Udyam Registration have been transformative steps in formalizing the MSME sector, helping businesses access financing, government schemes, and a host of other benefits. For Indian entrepreneurs, registering their MSME under Udyog Aadhaar or Udyam Registration is an essential step towards growth and stability in a competitive market.

Whether you are a budding entrepreneur or an established small business owner, Udyog Aadhaar can be a significant advantage, offering the recognition, support, and opportunities needed to thrive in today’s economy.

0 notes

Text

Udyam Registration Online: A Comprehensive Guide

Udyam re- Registration is a significant initiative by the Government of India aimed at promoting and supporting micro, small, and medium enterprises (MSMEs). This digital registration process not only simplifies the procedure for entrepreneurs but also opens doors to various benefits. In this article, we’ll explore the Udyam registration process, its benefits, eligibility criteria, and the importance of MSMEs in the Indian economy.

Understanding Udyam Registration

Udyam Registration is a self-declaration process that allows businesses to register as MSMEs through an online platform. This initiative was introduced to replace the earlier MSME registration processes, making it more efficient and user-friendly. The Udyam portal provides a streamlined way for businesses to register and avail themselves of various government schemes and financial support.

Importance of MSMEs in India

MSMEs play a crucial role in India’s economic development. They contribute significantly to the country’s GDP, employment generation, and exports. Here are a few reasons why MSMEs are vital:

Employment Generation: MSMEs create a vast number of jobs, absorbing a significant portion of the workforce, particularly in rural and semi-urban areas.

Economic Contribution: They contribute around 30% to India’s GDP and account for nearly 50% of total exports.

Innovation and Competitiveness: MSMEs foster innovation and competition by introducing new products and services, driving growth in various sectors.

Balanced Regional Development: By promoting entrepreneurship in rural and less-developed areas, MSMEs contribute to balanced regional development.

Eligibility Criteria for Udyam Registration

To be eligible for Udyam registration, businesses must meet specific criteria based on their investment and turnover. The classification is as follows:

Micro Enterprises: Investment up to ₹1 crore and turnover up to ₹5 crore.

Small Enterprises: Investment up to ₹10 crore and turnover up to ₹50 crore.

Medium Enterprises: Investment up to ₹50 crore and turnover up to ₹250 crore.

It’s important to note that Udyam registration is applicable to both manufacturing and service sectors.

Benefits of Udyam Registration

Registering under Udyam comes with a plethora of advantages:

Access to Government Schemes: Registered MSMEs can avail themselves of various government schemes, subsidies, and incentives designed to support small businesses.

Financial Assistance: Udyam-registered businesses have better access to loans and credit facilities from banks and financial institutions, often at lower interest rates.

Market Development: MSMEs can participate in exhibitions, trade fairs, and buyer-seller meets organized by the government, enhancing their market reach.

Tax Benefits: Udyam registration can facilitate tax concessions and exemptions, reducing the financial burden on small enterprises.

Ease of Doing Business: The online registration process simplifies documentation and reduces bureaucratic hurdles, making it easier for entrepreneurs to start and run their businesses.

Protection Against Delayed Payments: Registered MSMEs can benefit from protections under the MSME Development Act, ensuring timely payments from buyers.

How to Register for Udyam Online

The process of Udyam registration is straightforward and can be completed online in a few simple steps:

Visit the Udyam Registration Portal: Go to the official Udyam registration website (udyamregistration.gov.in).

Start Registration: Click on the ‘Register’ button on the homepage.

Enter Your Aadhar Number: Provide your 12-digit Aadhar number. Ensure that the Aadhar is linked to your mobile number for verification.

Business Details: Fill in the necessary details about your business, such as name, type, address, and bank account information.

Investment and Turnover Details: Enter the required investment and turnover figures to classify your business as micro, small, or medium.

Self-Declaration: Review all the information entered and submit the registration form. There’s no need to upload any documents, as it’s a self-declaration process.

Registration Confirmation: After submission, you will receive a confirmation message, and your Udyam Registration Number will be generated. You can download the certificate from the portal.

Common FAQs About Udyam Registration

1. Is Udyam registration mandatory?

While Udyam registration is not mandatory for all businesses, it is highly beneficial for MSMEs to avail themselves of various government benefits.

2. How long does it take to get registered?

The online registration process is quick and typically completed within a few hours, although you may receive your registration certificate immediately.

3. Do I need to renew my Udyam registration?

No, Udyam registration is a one-time process and does not require renewal. However, businesses must update their registration in case of changes in their status or details.

4. Is there any fee for Udyam registration?

There is no fee for registering under Udyam; the process is completely free of cost.

5. Can I register more than one business under Udyam?

Yes, entrepreneurs can register multiple businesses under Udyam, provided each business meets the eligibility criteria.

Conclusion

Update Udyam Registration is a pivotal step towards empowering small businesses in India. By streamlining the registration process and providing various benefits, the government aims to create a conducive environment for MSMEs to thrive. Whether you are an aspiring entrepreneur or an established business owner, registering under Udyam can significantly enhance your growth prospects and enable you to tap into numerous government resources. Embrace this opportunity and take your business to the next level with Udyam registration!

#udyam registration#udyam registration online#print udyam certificate#apply udyam registartion#udyam registartion portal

0 notes

Text

75 years of powering India: Hitachi Energy announces investments to support the country’s energy transition journey

Press ReleaseZurich, Switzerland 07-10-2024 N Venu, Managing Director and CEO, Hitachi Energy India & South Asia, Amitabh Kant, India’s G20 Sherpa and Andreas Schierenbeck, Global CEO, Hitachi Energy at the inauguration of Energy & Digital World 75 event in India. The company plans to invest around $250 million USD (INR 2,000 crore) in expanding capacity, portfolio, and talent base to support…

0 notes

Text

MSME Registration in Chandigarh: A Complete Guide by Fin Matters

Micro, Small and Medium Enterprise (MSMEs) are an important source of employment generation and economic development in India. The presence of various MSMEs in the business environment of Chandigarh makes proper registration for them more imperative than ever. At Fin Matters, we realize far better than anyone the need to be accurately guided when it comes to the registration of MSMEs in Chandigarh. As you move through the stages of creating a new business or legitimizing an informal business entity this guide will help you understand all that you need to know about registering your MSME in Chandigarh and Mohali.

Why is MSME Registration Important?

The MSME registration is essential for companies that would like to grow and access many government programmes and incentives. These incentives are part and parcel facilitative in growth, innovation and overall easier allows small enterprises to survive competition. He noted further that registering your business as an MSME means that your business falls under a high-risk, high-reward category because you’ll be eligible for subsidies, tax exemptions, and favourable credit terms.

At Fin Matters, we assist various companies based in Chandigarh and Mohali regarding the complex procedure of MSME registration. Thus, with our help you would not face any difficulties and get all the opportunities that are provided to the companies with the status of an MSME.

What is MSME Registration?

MSME registration is a government-propelled program which offers authorization to the businesses in micro, small and medium enterprises category. After registration, there are many schemes and incentives which can be claimed by the businesses from the government.

Registration of MSMEs on both Chandigarh and Mohali is not complicated once you know how to do it but it demands comprehensive preparation and support from a professional. Fin Matters offers business registration services in this area and we guarantee you a smooth process freeing up your time to concentrate on business expansion.

MSME Categories: A Quick Overview

As one embarks on the process of registration of his/her MSME there is need to understand the classification of the sector known as the MSME. Businesses are classified based on their investment in equipment and turnover:

1. Micro Enterprises:

Investment in Plant & Machinery or Equipment: Less than ₹1 crore

Turnover: Less than ₹5 crore

2. Small Enterprises:

Investment in Plant & Machinery or Equipment: From one crore to ten crore rupees

Turnover: Less than ₹50 crore

3. Medium Enterprises:

Investment in Plant & Machinery or Equipment: For the duration of 26-50 quarters or between ₹10 crore and ₹50 crore

Turnover: Less than ₹250 crore

Familiarizing oneself with where your business fitting within these categories is paramount in the process of finalizing the MSME registration in Chandigarh or even Mohali.

Benefits of MSME Registration in Chandigarh

The details of registering your business signifies MSME are stated below, it is very beneficial to register business such as the following. Being an industrialized state, the union territory of Chandigarh is replete with numerous opportunities for establishment of MSMEs. Here's a breakdown of the key benefits you can access through MSME registration:

1. Access to Loans and Credit

The MSME registration ensures that the small businesses access so many credit schemes formulated for their operations. Such loans bear relatively lower interest charges and there are some which do not require the borrowers to put up their securities. Whether you are operating your business in Chandigarh or Mohali you should know that only registered MSMEs stand a better chance of getting any financial support which is always a plus for the growth of business.

2. Government Subsidies

Once your MSME is registered you are able to access several government subsidies which come in handy in the running of your business. Such costs may include capital investment subsidies, subsidies for power bills and subsidies for technology upgradation. Fin Matters will assist you to determine the taxes that you will have to pay as well as the subsidies that will benefit your business at maximum.

3. Tax Exemptions

Those small and medium enterprises that registered under the MSME scheme are privileged to enjoy several tax concessions. The government has formulated peculiar tax relief measures aimed at reducing the tax pressure on small firms and enable them expand. This makes MSME registration in Chandigarh a good move for minimizing overall taxes that could be paid by any business entity.

4. Easier Access to Tenders

Chandigarh and Mohali base MSMEs can avail many privileges such as bidding on government tenders. To add on this, many government projects will set special provisions where tenders will only be open for registered MSMEs meaning you stand a better chance against larger and unregistered players. Let Fin Matters help you avoid the pitfalls of applying for tenders to allow you to get your share of the pie.

5. Protection Against Delayed Payments

Another benefit of MSME registration is that it gives the businessmen legal/rights on delayed payments. The MSME Act provides for prompt payments to be made to business in order to enhance cash flow. You can charge your clients an interest rate which they will be able to pay once they delay to make the payments.

6. Technology and Skill Development Programs

SMEs that have registered can avail government sponsored skill development and technology up gradation schemes. These activities make it possible for companies to effectively compete for markets that require the use of up to date technologies as well as inventiveness of the workforce.

Step-by-Step Guide to MSME Registration in Chandigarh and Mohali

Now that you know the benefits of the registration, let mention a few words about the process of its completion. It may sound like a lot but FinMatters is here to help and break it down for you.

Step 1: Prepare the Necessary Documents

Collect all the papers that are required for admission as some universities / colleges may say that special documents are not needed while on the candidate’s list they will mention that this / that document is missing, for example.

The registration process also requires the collection of documents which must be provided before you begin the registration. Here’s a list of essential documents for MSME registration in Chandigarh and Mohali:

• Aadhar Card of the Business Owner: This is required for registration only.

• PAN Card: The business owner’s and the company PAN cards are required.

• Business Address Proof: This could be rent bill, utilities paid bills or receipts showing payment of property taxes among others.

• Bank Account Details: This also entails something known as the account number and or the IFSC code.

• Business Incorporation Details: One is to show the registration or incorporation certificate of the business.

Step 2: Fill in the Online Application Form

In the current world, registration of MSMEs is carried out fully online. You can register through the Udyam portal an online entrance you fill some form and submit a adh bears affidavit. The online application form involves entering the fundamentals about your business such as category, address and turnover information. Fin Matters would assist first time registrants to complete the form properly so that the right information is filled.

Step 3: Submit the Application

The application form must be filled completely; after the process is complete, recheck it thoroughly. After you have entered information you are comfortable with providing, go ahead and submit the form. After a successful submission the candidate will be given a reference number. You can use this number to check its status regarding your application.

Step 4: Receive Your Udyam Registration Certificate

After your application is successfully verified, you get the Udyam Registration Certificate. This certificate is the legal document that guarantees your MSME and it is the only way through which you can unlock the privileges.

MSME Registration in Mohali, Chandigarh: Key Differences

The registration of msme registration in mohali Chandigarh is similar to the one mentioned above in terms of process, the benefit and incentives offered by the locals are slightly different. Both cities are focusing towards the development of MSMEs, however, Mohali is in a position of a satellite city thus offering necessary requisites like reasonable prices related to lands and concrete schemes for IT based MSMEs.

While helping you get registered with the essential platforms, Fin Matters also makes you know more about the various opportunities existing closer to either Chandigarh or Mohali.

Why Choose Fin Matters for MSME Registration?

MSME registration can be quite tricky and any missteps made will lead to a lengthy period of time before your application is approved. When you get Fin Matters, you’ll be sure that all the fine prints will be handled by professionals. Here’s why businesses in Chandigarh and Mohali trust us:

1. Expertise in Local Policies: It has helped us to determine the initial requirements and major incentives available to the MSMEs in the Chandigarh and Mohali. The team makes sure we are up to date on all the changes that occur with government schemes always keeping you informed.

2. End-to-End Support: First of all, we help in collecting your documents, then we assist at each step of filling of the online application. This has made Fin Matters take the stress of registering any MSME real and easy.

3. Quick Turnaround: Haste is expensive, and so is lost time, they are well aware of that. However, our team is dedicated to making the MSME registration process as fast as possible so that you can begin to take advantage of them.

4. Tailored Solutions: Being the unique and individual enterprises, all of them have own requirements, and we offer right services. Regardless you are a little start up or a growing mid sized business we present solution perfect for you.

Conclusion

This is a guide on MSME registration in Chandigarh and Mohali, including the benefits that can change your business for the better. This entails getting loan access, government promotions, tax exclusions and legal defense, such a move will go along way to reinventing the company for the long-term future of those msme’s who choose to register their operations.

However, at Fin Matters, we are committed to supporting Chandigarh and Mohali based businesses in this process. At our end, with our team’s knowledge and experience, we take care to make the MSME registration process easy for you and ensure that you are able to avail as much as possible of the benefits offered under each government scheme.

Fin Matters can help register your business or answer any questions you may have if you are prepared for this process. We invite you to take the first step towards a better and a richer future for your MSME in Chandigarh.

0 notes

Text

BCL Industries Announces Strategic Acquisition of Goyal Distillery and Expansion of Ethanol Production

On October 3, 2024, BCL Industries Ltd. made an exciting announcement regarding its latest strategic move to strengthen its position in India's ethanol manufacturing sector. The Board of Directors approved the acquisition of Goyal Distillery Private Ltd., marking a pivotal step in the company’s long-term growth plan.

Goyal Distillery, based in Fatehabad, Haryana, will now become a wholly owned subsidiary of BCL Industries. The acquisition comes as part of BCL's efforts to enhance its production capacity and expand its footprint in the ethanol sector, which has become increasingly vital to India’s energy landscape. BCL Industries, already a leader in the grain-based ethanol manufacturing industry, will now be better equipped to meet the growing demand for sustainable energy solutions.

The acquisition holds particular significance for BCL, as Goyal Distillery already possesses the necessary land and regulatory clearances to set up a 250 KLPD (Kilo Liters Per Day) grain-based ethanol unit. This ready-to-go infrastructure means the distillery can be operational in a much shorter timeframe than typical plant setups, giving BCL a significant advantage in terms of speed and efficiency. This rapid commission timeline is particularly critical as the global ethanol market continues to expand.

Once the plant is up and running, BCL Industries’ total distillery capacity will increase from its current level of 700 KLPD to 1100 KLPD. This expansion includes an additional 150 KLPD at BCL’s existing Bathinda unit and the newly added 250 KLPD capacity at the Fatehabad unit. This scale of growth is set to place BCL Industries among the top ethanol producers in India.

Beyond the sheer production increase, the acquisition highlights BCL Industries’ commitment to sustainability. The new plant will include a power generation facility that uses paddy straw as its primary fuel source, making it a prime example of the company’s green energy initiatives. By utilizing this agricultural byproduct, BCL is taking a significant step towards promoting renewable energy sources while supporting the local agricultural economy.

BCL Industries is also making strides in the biogas sector. As part of its expansion plan, the company intends to establish a biogas plant on a 9-acre plot adjacent to the distillery in Fatehabad. The plant will have the capacity to process approximately 250 metric tons of paddy straw daily, converting it into around 20 metric tons of biogas. This initiative not only supports BCL’s green energy ambitions but also addresses environmental concerns associated with the disposal of paddy straw, a common agricultural waste product.

The estimated capital expenditure (Capex) for the combined distillery and biogas projects is projected to be around ₹350 crore. The timeline for the construction and commissioning of these facilities is expected to be around 20 months from the groundbreaking date, making 2026 a pivotal year for BCL Industries’ ethanol and renewable energy operations.

With this acquisition, BCL Industries continues to strengthen its position as an industry leader. By increasing its production capacity and integrating renewable energy solutions into its operations, BCL is setting itself up for sustained growth and success in the ethanol market.

The Board of Directors' meeting, held on October 3, 2024, commenced at 3 PM and concluded at 3:30 PM. Following the meeting, the company expressed confidence in the new acquisition’s ability to contribute significantly to both its financial performance and its sustainability goals.

This acquisition is yet another step in BCL Industries’ ongoing journey towards creating a greener, more energy-efficient future. The move also aligns with the broader national and global trends towards renewable energy, putting the company in an excellent position to capitalize on the growing demand for eco-friendly energy solutions.

For BCL Industries, this is not just an acquisition; it’s a commitment to innovation, growth, and sustainability. The company’s leadership in ethanol production, combined with its focus on renewable energy initiatives, continues to set the standard for the future of energy in India.

0 notes

Text

Your Guide to Udyam Registration: A Simple Step-by-Step Approach

Introduction

For small and medium enterprises (SMEs) in India, securing Udyam Registration is a pivotal step that can open doors to a multitude of benefits and opportunities. This registration process, overseen by the Ministry of Micro, Small, and Medium Enterprises (MSME), is designed to streamline and simplify the formalization of your business. In this blog, we’ll walk you through a straightforward roadmap to Udyam Registration , highlighting each step to ensure a smooth and efficient process.

Grasping Udyam Registration: An Overview for Businesses

Udyam Registration is an official process that provides a unique identification number to small and medium enterprises. It allows businesses to access a range of government benefits, including financial support, subsidies, and incentives tailored for SMEs. The registration not only aids in business growth but also helps in complying with regulatory requirements.

Step 1: Assess Your Business’s Eligibility

Before diving into the registration process, it’s essential to determine whether your business qualifies as a micro, small, or medium enterprise. The classification is based on two main criteria:

Expenditure on Machinery, Equipment, or Plant

Yearly Revenue

Here’s a summary of the classifications:

Micro Enterprises: Expenditure on Machinery, Equipment, or Plant is up to ₹1 crore, and Yearly Revenue is less than ₹5 crore.

Small Enterprises: Investment ranges from ₹1 crore to ₹10 crore, and Yearly Revenue is between ₹5 crore and ₹50 crore.

Medium Enterprises: Investment ranges from ₹10 crore to ₹50 crore, and Yearly Revenue is between ₹50 crore and ₹250 crore.

Evaluating where your business fits within these criteria will help you understand the benefits and support you’re eligible for.

Step 2: Compile Essential Information and Documentation

To begin the Udyam Registration process, ensure you have the following information and documents ready:

Aadhaar ID: The Aadhaar ID of the business owner or an authorized representative.This functions as the main form of identification.

Business Details: Information about your business, including the name, type, and PAN (Permanent Account Number).

Contact Information: The business address and phone number.

Investment Details: Records of investments made in machinery or equipment.

Bank Account Information: Details of your business’s bank account for verification purposes.

Having these documents and details organized before starting the registration process will help streamline your application.

Step 3: Navigate to the Udyam Registration Portal

The Udyam Registration process is conducted online via the official portal. To start, visit the Udyam Registration website at [Udyamregister.org]. The portal is designed to be user friendly, guiding you through the registration process with ease.

Step 4: Complete the Online Registration Form

Once on the portal, you’ll need to fill out the online registration form. This form requires comprehensive details about your business, including:

Business Name and Address

Type of Business

Investment and Turnover Details

Owner’s Aadhaar ID

Ensure that every field is completed accurately. Providing correct information is crucial to avoid delays or complications in the registration process.

Step 5: Make the Required Payment

After completing the form, you may be required to make a nominal payment.This fee is used to handle the processing of your registration. Payments can typically be made online through various available methods on the portal. Ensure that the payment is completed as per the instructions to proceed with your application.

Step 6: Upload Necessary Documents

With the form filled out and payment made, the next step is to upload the required documents. Make sure to upload clear and legible copies of all documents, such as:

PAN Card

Aadhaar ID

Proof of Business Details

Investment Records

Properly scanned and accurately uploaded documents will help prevent processing delays.

Step 7: Verification Process

After submitting your application and documents, a verification process will take place. A representative from the certification body will review your application and may conduct a verification call. During this call, you will need to confirm the details provided and authenticate the information using an Aadhaar OTP (OneTime Password).

Ensure that your contact information is accurate and that your mobile network is functioning well to receive the OTP. This step is crucial for validating your registration.

Step 8: Receive Your Udyam Certificate

Upon successful verification, your Udyam certificate will be processed. The certificate will be sent to your registered email address within 3 to 4 business days. This certificate is an essential document that provides formal recognition of your business and its registration status.

Benefits of Udyam Registration

Once registered, your business can enjoy several advantages:

Access to Government Schemes: Udyam Registration opens doors to various government schemes, including subsidies, grants, and support programs designed to foster SME growth.

Financial Support: Registered businesses can access financial aids such as low interest loans, credit guarantees, and investment subsidies.

Regulatory Ease: The registration simplifies compliance with regulatory requirements, making it easier to obtain licenses and permits.

Enhanced Credit Access: With Udyam Registration, businesses are better positioned to secure loans and credit facilities from financial institutions.

Overcoming Common Challenges

While Udyam Registration is designed to be straightforward, businesses may encounter some common challenges:

Technical Issues: If you face technical problems on the portal, ensure that you are using a compatible browser and clear your browser’s cache. Contact the portal’s helpdesk if issues persist.

Document Discrepancies: Ensure all documents are accurate and uptodate. Discrepancies can delay processing, so double check all information before submission.

OTP Problems: If you do not receive the OTP, check your mobile network connection or request a new OTP. If the problem continues, contact support for assistance.

Note: Cancel Udyam Registration easily with Udyam Portal .

Conclusion

Navigating the Udyam Registration process is a key step for small and medium enterprises looking to formalize their operations and access valuable government benefits. By following these simple steps—assessing eligibility, gathering documents, completing the online form, and addressing common challenges—you can efficiently register your business and unlock opportunities for growth. Udyam Registration not only facilitates access to financial support and government schemes but also enhances your business’s credibility and operational efficiency. Start your registration today to take advantage of these benefits and set your business on the path to success.

0 notes

Text

Eligibility Criteria for Udyam Registration

Udyam Registration has emerged as a vital step for micro, small, and medium enterprises (MSMEs) to gain formal recognition in India. Introduced by the Ministry of Micro, Small, and Medium Enterprises, this registration system is designed to simplify the process for MSMEs to avail themselves of various government schemes, benefits, and incentives. Udyam Registration replaces the previous process known as Udyog Aadhaar and serves as an online, paperless, and fully automated system for business registration.

To successfully apply for Udyam Registration, businesses must meet specific eligibility criteria based on various factors, including investment in plant and machinery, annual turnover, and business category. This article explores the detailed eligibility criteria for Udyam Registration and why it is essential for MSMEs across different sectors.

Understanding Udyam Registration

Before diving into the eligibility criteria, it is essential to understand what Udyam Registration is and why it matters. Udyam Registration provides formal recognition to MSMEs in India, allowing them to take advantage of a host of government incentives, subsidies, and schemes aimed at promoting growth and sustainability.

Once registered, businesses receive a unique Udyam Registration Number (URN), which can be used to access benefits like priority sector lending, reduced interest rates on loans, credit-linked capital subsidy schemes, and other advantages. The registration process has been streamlined to ensure that businesses can complete it online without any paperwork, further simplifying the procedure for entrepreneurs.

Categories of MSMEs

The eligibility for Udyam Registration is based on the classification of the business into one of three categories:

Micro Enterprises

Small Enterprises

Medium Enterprises

The government sets different criteria for each category in terms of investment in plant and machinery or equipment and turnover. These categories ensure that businesses of varying sizes receive benefits tailored to their specific needs.

Key Eligibility Criteria for Udyam Registration

To qualify for Udyam Registration, businesses must meet specific investment and turnover criteria, as outlined by the government. These criteria differ depending on whether the business falls under the micro, small, or medium category.

1. Micro Enterprises

Micro-enterprises are the smallest category of MSMEs. To be classified as a micro-enterprise for Udyam Registration, the following conditions must be met:

Investment in Plant and Machinery or Equipment: The investment must not exceed ₹1 crore.

Annual Turnover: The turnover of the business should not exceed ₹5 crore.

Micro-enterprises often include small manufacturers, service providers, and artisans operating on a smaller scale but significantly contributing to the local economy. These businesses benefit greatly from Udyam Registration by gaining access to financial support and subsidies.

2. Small Enterprises

Small enterprises represent the next tier of MSMEs. The eligibility criteria for this category are:

Investment in Plant and Machinery or Equipment: The investment should be more than ₹1 crore but not exceed ₹10 crore.

Annual Turnover: The annual turnover must be more than ₹5 crore but should not exceed ₹50 crore.

Small enterprises include various businesses engaged in manufacturing, retail, and service sectors. Udyam Registration for small enterprises opens doors to a wider range of benefits, including government tenders, tax exemptions, and easier access to credit.

3. Medium Enterprises

Medium enterprises are the largest category under MSMEs. They are vital contributors to industrial and economic growth. The eligibility criteria for medium enterprises are:

Investment in Plant and Machinery or Equipment: The investment must exceed ₹10 crore but should not be more than ₹50 crore.

Annual Turnover: The turnover should be above ₹50 crore but not exceed ₹250 crore.

Medium enterprises are eligible for significant benefits through Udyam Registration, such as subsidies, protection against delayed payments, and various incentives for technological upgrades and innovation.

Additional Criteria and Considerations

Apart from the primary eligibility criteria based on investment and turnover, businesses must also comply with certain other requirements to qualify for Udyam Registration:

1. Form of Business

Udyam Registration is available for businesses operating under various forms, including:

Proprietorships

Partnerships

Limited Liability Partnerships (LLPs)

Private Limited Companies

Public Limited Companies

Hindu Undivided Families (HUFs)

Co-operative Societies

Trusts

There is no restriction based on the legal structure of the business, which means MSMEs from various sectors can apply for Udyam Registration, provided they meet the financial criteria.

2. Adherence to the Revised MSME Definition

The MSME classification based on investment and turnover was revised in 2020. Previously, the classification was solely based on investment, but now turnover is also considered to ensure a more comprehensive evaluation of the business’s scale.

The turnover calculation excludes revenue from exports, ensuring that businesses focused on international markets are not penalized for their success abroad.

3. Single Udyam Registration for Multiple Activities

Businesses involved in multiple activities (manufacturing and services) are required to file a single Udyam Registration. They must declare all their activities during the registration process, but they do not need to register separately for each type of business activity. This provision simplifies the registration process and reduces the administrative burden on entrepreneurs.

4. GST and PAN Requirement

The government has made it mandatory for businesses applying for Udyam Registration to provide their PAN and GSTIN. However, in some cases, businesses not yet registered under GST may still apply for Udyam Registration, but they will need to update their information later.

Advantages of Meeting Udyam Registration Eligibility Criteria

Once an MSME meets the eligibility criteria for Udyam Registration, it can enjoy a multitude of benefits:

Access to Government Schemes: Registered businesses can apply for various MSME-focused government schemes, including financial assistance, subsidies, and grants.

Priority Sector Lending: Udyam-registered businesses are given priority in the disbursement of loans under government-supported lending programs.

Subsidized Rates on Loans: MSMEs can avail themselves of loans at lower interest rates, improving their financial stability.

Tax Benefits: Udyam Registration makes businesses eligible for several tax exemptions and benefits, reducing their overall tax liability.

Protection Against Delayed Payments: The MSME Act provides protection to registered businesses, ensuring timely payments from buyers. In case of delayed payments, the buyer is liable to pay compound interest.

Note: Apply for Print Udyam Certificate through the official portal.

Conclusion

Udyam Registration is a crucial step for micro, small, and medium enterprises to unlock a world of opportunities and government incentives. By meeting the eligibility criteria for Udyam Registration, MSMEs can access financial benefits, priority lending, and a range of subsidies that promote their growth and sustainability. Understanding the investment and turnover thresholds and ensuring compliance with the revised MSME definition are essential for businesses aspiring to register under the Udyam platform.

0 notes

Text

Udyam Registration in India

In a bid to formalize and bolster the growth of small-scale industries, the Indian government launched the Udyam Registration process in 2020. It replaced the earlier Udyog Aadhaar system and simplified the procedure for Micro, Small, and Medium Enterprises (MSMEs) to register themselves. This new system aims to provide MSMEs with the recognition and support they need to thrive in a competitive economy. Udyam Registration allows businesses to access government benefits, financial schemes, and other support systems more efficiently.

This article will explore the purpose, benefits, and steps involved in Udyam Registration in India.

Purpose of Udyam Registration:

India’s MSME sector is often described as the backbone of the economy, employing millions of people and contributing significantly to the country’s GDP. However, many of these enterprises have remained in the informal sector for a long time, missing out on vital support and opportunities offered by the government. The Udyam Registration system was introduced to address this gap.

The primary objectives of Udyam Registration include:

Formalizing MSMEs: Bringing more enterprises under a formalized structure helps the government track growth, provide targeted benefits, and offer better financial and legal assistance.

Access to Government Schemes: Registered MSMEs can benefit from a range of government schemes, including financial aid, subsidies, and tax incentives designed to promote their growth.

Data-driven Policy Making: Having a robust database of MSMEs enables the government to craft policies and schemes that address the actual needs and challenges faced by the sector.

Who is Eligible for Udyam Registration?

To register under the Udyam system, a business must fall within the MSME category, which is based on the business's investment in plant and machinery or equipment and its annual turnover. The classification of enterprises is as follows:

Micro Enterprises: Investment up to ₹1 crore and turnover up to ₹5 crore.

Small Enterprises: Investment up to ₹10 crore and turnover up to ₹50 crore.

Medium Enterprises: Investment up to ₹50 crore and turnover up to ₹250 crore.

If a business fits within any of these categories, it is eligible for Udyam Registration.

Steps for Udyam Registration

The Udyam Registration process is straightforward and entirely online, which eliminates the need for paperwork and long waits. Below are the key steps to complete the registration process:

Step 1: Visit the Official Udyam Portal

The Udyam Registration process can be initiated by visiting the official website https://udyamregistration.gov.in. This is the only government-authorized platform for registering MSMEs in India.

Step 2: Aadhaar Details

Aadhaar is mandatory for registration. The registration form asks for the Aadhaar number of the business owner in the case of a proprietorship, or the Aadhaar of the managing partner or director in the case of partnership firms and companies.

Step 3: Fill in Business Details

After the Aadhaar details are verified through an OTP sent to the registered mobile number, business owners need to fill out specific details regarding their enterprise. This includes:

Business name

Type of organization (proprietorship, partnership, LLP, etc.)

PAN number (mandatory for businesses that are classified as small or medium)

Address and contact information

Bank account details

Step 4: Submit the Application

Once all the required fields are filled out and double-checked, the application can be submitted online. Upon successful registration, a Udyam Registration Number will be generated, and the business owner will receive a digital certificate as proof of their registration.

Benefits of Udyam Registration

Udyam Registration opens the door to several benefits and opportunities for MSMEs, such as:

1. Access to Government Schemes

MSMEs with Udyam Registration are eligible for a wide range of government schemes like the Credit Guarantee Scheme, Credit Linked Capital Subsidy Scheme, and the Public Procurement Policy, which reserves a certain percentage of government purchases for MSMEs.

2. Easy Access to Bank Loans

Registered MSMEs are viewed as more credible by banks and financial institutions, making it easier for them to secure loans. Many banks offer collateral-free loans to Udyam-registered businesses under the Credit Guarantee Fund Scheme for Micro and Small Enterprises (CGTMSE).

3. Protection Against Delayed Payments

The MSME Development Act provides registered MSMEs with protection against delayed payments. Buyers who fail to pay within the agreed time frame must pay compounded interest on the amount owed.

4. Tax and Subsidy Benefits

Businesses registered under Udyam can access various tax exemptions and subsidies, such as those related to electricity bills, patent fees, and bar code registration.

5. Easier Access to Markets

Udyam-registered MSMEs can benefit from easier access to both domestic and international markets through government-backed initiatives. They can also participate in tenders and procurements reserved for MSMEs.

6. Technology and Skill Development Support

MSMEs can access government-run programs designed to enhance technology use, innovation, and skill development, helping them stay competitive and efficient.

Conclusion

Udyam Registration is a game-changer for MSMEs in India. By bringing more businesses into the formal sector, it offers a pathway to growth and long-term sustainability. The benefits of registering, such as access to government schemes, financial aid, and legal protections, can help MSMEs overcome many of the traditional challenges they face.

With the registration process being entirely online and free of cost, any eligible business should consider completing its Udyam Registration as an essential step toward securing a more stable and prosperous future.

#udyam aadhar registration#udyam registration#udyam download#udyam registration number#udyam certificate download

0 notes

Text

Obesity: A Growing Health Problem, Leading to Many Illnesses

Obesity and overweight are significant global health concerns. The World Health Organization (WHO) defines them as excessive fat accumulation that may harm health. In 2022, approximately 250 crore adults were overweight, with 89 crore suffering from obesity, worldwide. The prevalence of obesity was nearly half of all adults, with 16% classified as obese. Children were also affected, with 3.7 crore under the age of 5 being overweight and over 39 crore children and adolescents aged 5–19 overweight, including 16 crore living with obesity. This situation demands immediate attention.

The Multifaceted Causes of Obesity

Understanding obesity requires recognizing its complex nature, including genetic factors, lifestyle choices and medication impacts. Three major contributors to obesity are as follows:

1. Genetic predisposition influences obesity, with certain DNA profiles making individuals more prone to weight gain. 2. Unhealthy lifestyles and consuming high-calorie diets significantly contribute to the obesity crisis. 3. Some medications, like steroids and certain psychiatric drugs, can lead to weight gain as a side effect.

Health Consequences of Excess Weight

The impact of obesity on health is extensive, spanning across various metabolic and cardiovascular conditions, as well as affecting cancer risk, reproductive health, and bone density. Recognizing these consequences underscores the urgency of implementing effective management strategies. 1. Obesity significantly increases the risk of metabolic disorders such as type 2 diabetes, which can lead to serious complications if not properly managed. 2. Cardiovascular diseases, including heart disease and stroke, are more prevalent among individuals with obesity due to factors like high blood pressure and cholesterol levels. 3. Obesity is associated with a higher likelihood of developing certain types of cancer, including breast, colon, and pancreatic cancer, highlighting the importance of weight management in cancer prevention. 4. Reproductive health can be adversely affected by obesity, leading to issues such as infertility, irregular menstrual cycles, and complications during pregnancy. 5. Bone density may be compromised in obese individuals, increasing the risk of conditions like osteoarthritis and fractures, necessitating comprehensive management strategies to address these health concerns. 6.Other common issues due to obesity include joint pain, high blood pressure, sleep apnea, decreased mobility, depression, fatty liver, skin issues, etc.

Strategies for Managing Weight

Effectively managing weight involves implementing a multifaceted approach that incorporates lifestyle modifications. By integrating strategies such as regular physical activity, balanced nutrition, and stress management techniques, individuals can achieve sustainable weight management goals. 1. Engage in regular physical activity, aiming for at least 30-45 minutes of moderate exercise per day to promote calorie expenditure and improve overall health. 2. Incorporate stress management techniques such as meditation, yoga, or deep breathing exercises to reduce emotional eating and promote healthier coping mechanisms. 3. Monitor portion sizes and practice mindful eating to avoid overconsumption and promote better control over calorie intake. 4. Prioritize adequate sleep, aiming for 7-8 hours per night, as insufficient sleep can disrupt hormones involved in appetite regulation and contribute to weight gain. 5. Adopt dietary changes that emphasize whole grains, fruits, vegetables, lean proteins, and healthy fats, while minimizing intake of sugars and unhealthy fats to support weight loss and maintenance.

Remember, these tips aren't medical advice. If you can't follow them, consider weight management supplements available in markets that help in weight management. Consult a healthcare professional for obesity related concerns.

Conclusion and Call to Action

Addressing the obesity epidemic requires a global response that integrates public health initiatives, awarenss about proper weight management, and individual lifestyle changes. This is essential for improving health and quality of life.

0 notes

Text

How Udyam Registration Can Enhance Your Business’s Market Value

Introduction

In today's rapidly evolving business environment, small and medium-sized enterprises (SMEs) are pivotal in driving innovation and economic growth. However, they often face challenges in establishing market credibility and competing with larger corporations. Udyam Registration, a government initiative in India, offers a strategic solution to these challenges by providing formal recognition and a range of benefits tailored for SMEs. Beyond the immediate perks like access to government schemes and financial support, Udyam Registration significantly boosts a business's market value.

Understanding Udyam Registration

Udyam Registration is a simplified and updated version of the erstwhile Udyog Aadhaar Memorandum (UAM). Launched by the Ministry of Micro, Small, and Medium Enterprises (MSME) in July 2020, Udyam Registration aims to streamline the registration process for MSMEs and offer them a unique identification number that serves as a recognition of their status.

Eligibility for Udyam Registration

To qualify for Udyam Registration, a business must fall within the defined criteria for micro, small, or medium enterprises:

Micro Enterprises: Investment in plant and machinery or other equipment does not exceed INR 1 crore, and revenue does not exceed INR 5 crores.

Small Enterprises: Investment in plant and machinery or other equipment does not exceed INR 10 crores, and revenue does not exceed INR 50 crores.

Medium Enterprises: Investment in plant and machinery or other equipment does not exceed INR 50 crores, and revenue does not exceed INR 250 crores.

Enhancing Market Value Through Udyam Registration

Building Credibility and Trust

Credibility is the cornerstone of any successful business. In a crowded market, customers and partners are more likely to engage with businesses that demonstrate legitimacy and reliability. Udyam Registration serves as a government-backed validation of a business's existence and its adherence to statutory norms. This formal recognition enhances the credibility of the business in the eyes of potential clients, suppliers, and financial institutions.

Government Recognition

Being registered under Udyam, an enterprise gains recognition from the Indian government, which is a powerful endorsement. This recognition assures stakeholders that the business is compliant with regulatory requirements and is operating within the legal framework. Such an endorsement can significantly enhance the business's reputation, making it more attractive to customers who prioritize dealing with legitimate and recognized entities.

Trust Amongst Customers and Partners

Udyam Registration can act as a trust signal for customers and business partners. In a market where businesses of varying scales and legitimacy operate, having Udyam Registration can set a business apart from unregistered or informal enterprises. Customers are more likely to trust and do business with companies that are formally recognized and endorsed by the government.

Access to Financial Resources

One of the most significant challenges faced by MSMEs is access to finance. Udyam Registration can open doors to various financial resources, including loans, credit, and subsidies, that are crucial for business expansion and growth. By improving a business's financial standing, Udyam Registration can directly contribute to enhancing its market value.

Eligibility for Government Schemes and Subsidies

Udyam Registration makes businesses eligible for a variety of government schemes and subsidies aimed at supporting MSMEs. These include:

Priority Sector Lending (PSL): Banks are mandated to allocate a certain percentage of their lending to MSMEs under the PSL scheme. Registered businesses can benefit from easier access to loans at competitive interest rates.

Credit Guarantee Fund Scheme for Micro and Small Enterprises (CGTMSE): This scheme offers collateral-free loans to MSMEs, reducing the risk for lenders and making it easier for businesses to secure financing.

Interest Subvention Schemes: Registered MSMEs can avail of interest subsidies on loans, reducing the cost of borrowing and improving cash flow.

Enhanced Creditworthiness

Financial institutions view Udyam-registered businesses as more credible and lower-risk borrowers. This enhanced creditworthiness can lead to easier access to loans, credit lines, and other financial products. With better access to finance, a business can invest in expansion, innovation, and marketing, all of which contribute to increasing its market value.

Attracting Investors

Investors are more likely to invest in businesses that demonstrate formal recognition and compliance with government regulations. Udyam Registration can make a business more attractive to potential investors by showcasing its commitment to growth and adherence to statutory requirements. An influx of investment can be a game-changer for businesses looking to scale, enter new markets, or develop new products.

Market Expansion Opportunities

Market expansion is a critical factor in enhancing a business's market value. Udyam Registration can facilitate market expansion by providing businesses with opportunities to participate in government tenders, access new markets, and build strategic partnerships.

Participation in Government Tenders

Government contracts and tenders can be highly lucrative for MSMEs. However, to participate in these tenders, businesses often need to meet specific eligibility criteria, one of which is Udyam Registration. By registering under Udyam, businesses can access a broader range of tender opportunities, allowing them to secure contracts that can significantly boost their revenue and market presence.

Access to Export Markets

Udyam Registration can also help businesses tap into international markets. Many government schemes support MSMEs in exploring export opportunities, such as the Export Promotion Capital Goods (EPCG) scheme and the Market Access Initiative (MAI). By leveraging these schemes, Udyam-registered businesses can expand their market reach beyond domestic borders, increasing their global footprint and market value.

Strategic Partnerships and Collaborations

Udyam Registration can make a business more attractive to potential partners and collaborators. Other businesses, particularly larger corporations, often prefer to partner with registered MSMEs for supply chain collaborations, joint ventures, and other strategic alliances. These partnerships can lead to new business opportunities, increased revenue, and enhanced market value.

Competitive Advantage and Market Differentiation

Differentiation is essential in a competitive market to stand out and draw clients. Udyam Registration can provide businesses with a competitive advantage by enabling them to access resources, incentives, and opportunities that unregistered businesses cannot.

Access to Specialized Training and Development Programs

The government offers various training and development programs exclusively for Udyam-registered businesses. These programs cover areas such as digital marketing, financial management, quality control, and more. By participating in these programs, businesses can enhance their skills, improve their operations, and offer better products and services, giving them an edge over competitors.

Better Branding and Marketing Opportunities

Udyam Registration can also enhance a business's branding and marketing efforts. Registered businesses can use the Udyam logo and other government endorsements in their marketing materials, which can help build trust and credibility with customers. Additionally, Udyam-registered businesses may receive priority in government-promoted trade shows, exhibitions, and other marketing platforms, providing them with greater visibility.

Leveraging Government Incentives for R&D and Innovation

Innovation is a key driver of competitive advantage. Udyam Registration can make businesses eligible for government incentives and grants for research and development (R&D). By investing in R&D, businesses can develop new products, improve existing ones, and stay ahead of the competition, all of which contribute to increasing their market value.

Long-Term Business Sustainability

Sustainability is increasingly becoming a critical factor in determining a business's market value. Udyam Registration can contribute to long-term business sustainability by providing access to resources, support, and opportunities that help businesses thrive in the long run.

Access to Environmental Compliance Support

With growing awareness of environmental issues, businesses are under increasing pressure to comply with environmental regulations and adopt sustainable practices. Udyam-registered businesses can access government support and incentives for adopting green technologies, energy-efficient practices, and other sustainability initiatives. By enhancing their environmental credentials, businesses can appeal to a broader customer base and improve their market value.

Improved Risk Management and Resilience

Udyam Registration can also help businesses improve their risk management and resilience. Registered businesses are more likely to receive support during economic downturns, natural disasters, and other crises. This support can include financial assistance, tax relief, and other measures that help businesses weather difficult times and emerge stronger, thus ensuring their long-term sustainability and market value.

Compliance with Corporate Social Responsibility (CSR) Norms

As businesses grow, they may be required to comply with corporate social responsibility (CSR) norms, particularly if they cross certain revenue thresholds. Udyam Registration can provide businesses with guidance and support in fulfilling their CSR obligations, ensuring compliance, and enhancing their reputation as socially responsible enterprises. A strong CSR record can significantly enhance a business's market value, as customers and investors increasingly prioritize ethical and responsible businesses.

Legal and Regulatory Compliance

Compliance with legal and regulatory requirements is essential for maintaining a business's market value. Non-compliance can result in penalties, legal issues, and reputational damage, all of which can negatively impact a business's market standing. Udyam Registration helps businesses stay compliant with relevant laws and regulations, thereby safeguarding their market value.

Simplified Compliance with Taxation Laws

Udyam Registration simplifies compliance with various taxation laws, including the Goods and Services Tax (GST) and Income Tax. Registered businesses can avail of tax benefits, exemptions, and simplified filing procedures, reducing their tax burden and improving their financial health. Compliance with taxation laws also helps businesses avoid legal issues and penalties, which can protect and enhance their market value.

Protection of Intellectual Property Rights

For any firm, intellectual property (IP) is a vital resource. Udyam Registration can help businesses protect their IP rights by providing access to government schemes and support for IP registration, enforcement, and management. By safeguarding their IP, businesses can prevent unauthorized use of their innovations and maintain their competitive edge, which contributes to enhancing their market value.

Legal Protection and Dispute Resolution

Udyam-registered businesses can access government support for legal protection and dispute resolution. This support includes access to legal counsel, mediation services, and other resources that can help businesses resolve disputes efficiently and avoid costly legal battles. By minimizing legal risks, businesses can protect their reputation and market value.

Note: You can also Print Udyam Registration Certificate.

Conclusion

Udyam Registration is more than just a formal recognition of an MSME; it is a powerful tool that can enhance a business's market value in multiple ways. From building credibility and accessing financial resources to facilitating market expansion and ensuring long-term sustainability, the benefits of Udyam Registration are far-reaching. MSMEs looking to thrive in a competitive market, Udyam Registration offers a pathway to growth, innovation, and success. By leveraging the opportunities provided by this registration, businesses can enhance their market value, secure their future, and contribute to the broader economic development of the country.

0 notes

Text

How to Apply for the Telangana Indiramma Housing Scheme 2024: Step-by-Step Process

Introduction:

The Telangana state government has launched the Indiramma Housing Scheme 2024, aimed at providing housing for all homeless citizens in the state. With a budget allocation of INR 22,000 crore for the current financial year, this scheme offers financial assistance and benefits to help individuals build permanent homes. Eligible applicants can apply through the official website to take advantage of this initiative.

Key Highlights of the First Phase

In the initial phase, the Telangana government plans to construct 4.5 lakh houses for the homeless, each featuring a minimum of 400 sq. ft. with essential amenities like an RCC roof, kitchen, and toilet. The chosen candidates would each receive INR 5 lakh in funding to construct these dwellings.

Objectives of the Indiramma Housing Scheme

The primary objective is to significantly reduce homelessness in Telangana by providing land and financial assistance to citizens who cannot afford permanent housing. The scheme aims to support all citizens, particularly those living in rented accommodations or without a home, to build a permanent residence.

Also Read: Rythu Runa Mafi Telangana 2024 2nd Phase: A complete Guide

Scheme Overview

Section

Details

Scheme Name

Indiramma Housing Scheme

Introduced By

Telangana State Government

Objective

Provide financial assistance for housing

Beneficiaries

Citizens of Telangana

Budget

INR 22,000 crore

Target

Build 4.5 lakh houses

Application

Available on the official website

Eligibility Criteria

Eligibility Criteria

Details

Residency

Permanent resident of Telangana

Economic Status

Belong to the lower or middle-class category

Other Programs

Not enrolled in any other Telangana housing program

Home Ownership

Not own a permanent house

Required Documents

Required Documents

Details

Aadhaar Card

Yes

Mobile Number

Yes

Electricity Bill

Yes

Address Proof

Yes

PAN Card

Yes

Ration Card

Yes

Benefits of the Indiramma Housing Scheme

Participants will enjoy several benefits:

Permanent housing provided by the Telangana government

Land and financial assistance to construct a house

Financial assistance of INR 6 lakh for citizens of the SC/ST category and INR 5 lakh for general applicants

Significant reduction in homelessness across the state

Application Process

Follow these steps to apply:

Visit the official Telangana Housing Portal.

Click on “Apply Online” on the homepage.

Fill out the application form with the requested information, then attach the appropriate files.

Review the information and submit the form.

Also Read: Telangana New Bhumata Portal: A Strategic Replacement for the Dharani System

Checking the Beneficiary List

Registered applicants can check the beneficiary list on the official website by following these steps:

Navigate to the homepage and select "Beneficiary Search."

Enter the address information, including the village, Mandal, and district, or the BEN ID.

Review and submit the details to view the status.

Flat Allotment Process

Only applicants without a home in Telangana's urban regions will receive plots according to the scheme. The Telangana Housing Board's prescribed income restrictions for the applicant's category must be met.

Comprehensive Solution

The Indiramma House Details Scheme addresses the housing needs of landless and homeless citizens, including Telangana movement activists and fighters. It guarantees a safe and long-term housing solution by offering free land for building homes as well as financial support.

key details of the Indiramma Housing Scheme:

Key Details

Information

Scheme Name

Indiramma Housing Scheme (Indiramma Indlu Scheme)

State

Telangana

Launched By

Telangana Government

Application Process

Offline

Beneficiaries

Citizens of Telangana

Benefits

- Free land or site for homeless families

- INR 5 lakh loan for building a house

- 250 square meters of land for activists or soldiers in the Telangana movement

Starting Date

March 11, 2024

Also Read: New Ration Card In Telangana 2024 Guidelines

Objectives and Benefits

The scheme aims to provide eligible applicants with a 250-square-yard plot of land and financial assistance of INR 5 lakh to facilitate home construction. Major benefits include:

Free land or site for home construction

Financial aid for constructing houses

Housing land for Telangana movement fighters or activists

3,500 dwellings are allotted to each Telangana constituency.

Supervision by District Collectors for construction

Eligibility Criteria

To be eligible:

Applicant must be a resident of Telangana

The applicant's family should be from a lower-class (Dalit, tribal, minority, and underprivileged sections) background.

The applicant's family cannot possess property in India.

The applicant’s family should have participated in the Telangana movement for the 250 square meter land

How to Apply

Applicants can apply by:

going to the office of the Gram Sabha, Gram Panchayat, or Municipal Corporation.

obtaining the application through the Praja Palana website or downloading it.

Fill out the form and attach the required details.

Submitting the form to the respective office.

Required Documents

Aadhaar Card

Latest passport-size photographs

Residence Proof

Caste Certificate

Income Certificate

Ration Card

The TG Indiramma Housing Scheme 2024 with its provisions for land and financial aid, is set to bring transformative change to the housing scenario in Telangana. The state government is committed to effectively implementing this prestigious program, ensuring that the benefits reach the most deserving citizens.

Conclusion:

The Telangana Indiramma Housing Scheme 2024 represents a major step forward in addressing the housing needs of the state's homeless population. By providing both land and substantial financial aid, the scheme aims to significantly reduce homelessness and offer a secure, permanent housing solution to eligible citizens. With a budget of INR 22,000 crore and plans to build 4.5 lakh houses, the initiative reflects the Telangana government's commitment to improving the living conditions of its residents. As the application process is streamlined through the official portal, it offers an accessible route for eligible individuals to benefit from this transformative scheme.

Frequently Asked Questions:

Q1. What is the Indiramma Housing Scheme 2024?

The Indiramma Housing Scheme 2024 is a government initiative to provide financial assistance and land for constructing houses for the homeless in Telangana.

Q2. Who is eligible to apply for this scheme?

Applicants must be permanent residents of Telangana, belong to the lower or middle-class category, not own a house, and not be registered under any other housing scheme in Telangana.

Q3. What are the benefits of the scheme?

The scheme provides financial aid of INR 5 lakh for house construction, and additional support for SC/ST category citizens. It also offers land to eligible individuals.

Q4. How can I apply for the Indiramma Housing Scheme?

Apply online through the official Telangana Housing Portal by filling out the application form, uploading the required documents, and submitting the form.

Q5. What documents are required for the application?

Required documents include Aadhaar Card, mobile number, electricity bill, address proof, PAN Card, and ration card.

Suggested Articles

Rythu Runa Mafi Telangana 2024 2nd Phase: A complete Guide

Telangana New Bhumata Portal: A Strategic Replacement for the Dharani System

New Ration Card In Telangana 2024 Guidelines

1 note

·

View note

Text

How to Get Subsidies with Udyam Registration

Do you know that our Indian economy is nothing without the support of MSMEs? Fortunately, the Government of India too recognized their value and implemented a range of schemes for their growth.

However, Udyam Registration is one of the key initiatives that was successful in formalising the existence of MSMEs. So, we are here to aid you in getting subsidies from Udyam registration.

Eligibility Criteria for Udyam Registration

You can enjoy subsidies with Udyam Registration, but make sure you're eligible for it. Go and check whether your business falls under MSME as per the criteria mentioned below:

Micro Enterprise: As a microenterprise, your investment should be up to ₹1 crore and turnover more than ₹5 crores.

Small Enterprise: As a small enterprise, your investment should be up to ₹10 crores and turnover more than ₹50 crores.

Medium Enterprise: As a medium enterprise, your investment should be up to ₹50 crores and turnover more than ₹250 crores.

Steps to Obtain Udyam Registration

Are you done with the eligibility criteria? If yes, then it's time to get registered for your business under Udyam. We've mentioned steps to aid in registering:

Step 1: Visit the Udyam Registration Portal