#201(b) copyright act

Explore tagged Tumblr posts

Photo

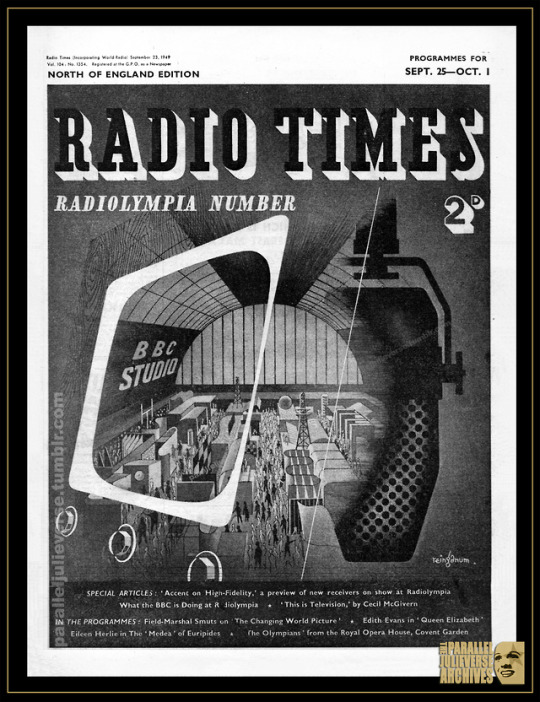

This Week in Julie-history: Julie Andrews makes her solo television debut on 8 October 1949

Seventy years ago, the young Julie Andrews realised another major milestone in her budding career when she made her first solo television appearance in a special live broadcast of Radiolympia Showtime on October 8, 1949.*

At the time, British television was still in its infancy and Radiolympia –– an annual trade show held at the sprawling Olympia exhibition centre in London –– was a major showcase for the new medium (Law, p. 49ff). The 1936 Radiolympia was where the BBC first launched its TV services to the British public and, by 1938, “television was the main feature of the show” (Briggs 1975, p. 537). The outbreak of war in 1939 saw Radiolympia -- as, indeed, the rollout of television -- put on hold for almost a decade. When the show returned in 1947 it “broke all attendance records” with over 450,000 admissions as the postwar British public clamoured for the sense of promissory modernity represented by television and the entertainment broadcast media (Briggs 1979, p. 201).

By the time of the 1949 Radiolympia, an estimated 200,000 British households had a television set with new licenses selling at the rate of 1,000 units per day––an impressive uptake given TV service was still limited to the greater London area (Hilmes, 31). The country was, however, poised to get its first regional relay transmitter near Birmingham in December of that year, bringing TV to a potential new market of 8.5 million viewers across the populous Midlands (Pawley, 366). Consequently, the 1949 Radiolympia shaped up as “[b]iggest drive ever to sell TV to the public” with "every known trick ...employed to glamorize this new entertainment medium” (“British Launching”, 17).

A key attraction provided by the BBC at the 1949 trade fair was a massive television studio –– the biggest in the word, reportedly (Allister, 334) –– overlooked by a glass encased gallery where audiences could “watch rehearsals as well as transmitted performances” (“British Launching”, 17). Dubbed “television’s big shop window”, the BBC studio at Radiolymia hosted an enticing cavalcade of entertainment across the 12 days of the show with everything from fashion parades and cooking shows to dramatic teleplays, ice revues, and even a grand ballet (”The Scanner”, 21) . Inevitably, ‘variety shows’ formed a key element of the line-up with nightly tentpole specials scheduled for the all-important 8:00p.m. slot. These variety programmes showcased a range of acts drawn from across British and even European entertainment, including many performers who loomed large in Julie’s early career such as Pat Kirkwood, Richard Hearne, Peter Brough and Archie Andrews.

The biggest and best variety special was earmarked for the exhibition’s closing night on Saturday 8 October. Titled Radiolympia Showtime, it was all-out star-studded spectacular, hosted by popular radio personality, Wilfred Pickles, and featuring top talent names of the era such as wartime singing sweetheart, Vera Lynn, comedians Leslie Henson and Reg Varney, jazz trumpeter Kenny Baker, beloved music hall comic–– and Julie’s future stage 'Dad’––Stanley Holloway...and, making her solo TV debut, Britain’s ‘prima donna in pigtails’, Julie Andrews.*

Backed by the BBC orchestra under the direction of conductor, Eric Robinson, Julie sang two songs: her juvenile signature aria, the ‘Polonaise’ from Mignon and “I Heard a Robin Singing”, a number she had performed in the earlier Christmas panto, Humpty Dumpty at the London Casino. Given the embryonic status of TV at the time, there wasn't yet an established culture of TV reviews and most press coverage of the show, as of all the broadcasts from Radiolympia, focussed largely on technology and production aspects rather than broadcast content (Madden 1949). The Sketch called Radiolympia Showtime “a large scale spectacle on music hall lines” (Allister, 334), while the Daily Mail noted that “the baby of the show, Julie Andrews, treated audiences to some beautiful singing” (“Last Night”, 4).

It is not known if any record of Julie’s performance in Radiolympia Showtime exists. As a live emission, the broadcast wouldn’t have been recorded as a matter of course but, given its historical significance, it very well may have been filmed either “on set” or as a kinescope. The Library of Congress in Washington, D.C. has a catalogue entry in its film holdings for Radiolympia Showtime (1949) which seems to feature "segments” from the show ––Kenny Baker is listed, for example –– but, whether or not, Julie’s performance is included is unclear. We can but live in hope...

Notes:

* While Radiolympia Showtime was certainly a major step up the career ladder for Julie and helped launch what would become a long association with television, it wasn’t in fact her very first appearance on the small screen. A year earlier, Julie performed on an another BBC variety special, Rooftop Rendezvous on 27 November 1948 (“Rooftop”, 27). For that performance, Julie was billed alongside parents, Ted and Barbara Andrews, so Showtime marked her solo TV debut.

Sources:

Allister, Ray. “Television.” The Sketch. 12 October 1949: 334-35.

Briggs, Asa. The History of Broadcasting in the United Kingdom: Volume II: The Golden Age of Wireless. Oxford: Oxford University Press, 1975.

__________. The History of Broadcasting in the United Kingdom: Volume IV: Sound and Vision. Oxford: Oxford University Press, 1979.

“British Launching Drive to Sell TV to Public Via Olympic Exhibit.” Variety. 14 September 1949: 17.

“Highlights at Radiolympia.” Radio Times. 2-8 October, 1949: 40.

Hilmes, Michele. The Television History Book. London: BFI, 2003.

“Last Night.” Daily Mail. 9 October 1949: 4.

Law, Michael J. 1938: Modern Britain: Social Change and Visions of the Future. London: Bloomsbury Academic, 2018.

Madden, Cecil. “Television Close-Up.” The Sketch. 12 October 1949: 336-37.

Pawley, Edward. BBC Engineering 1922 - 1972, London: BBC, 1972.

“Radiolympia Showtime.” Programme Listing. Radio Times. 2-8 October, 1949: 43.

“Rooftop Rendezvous.” Programme Listing. Radio Times. 21-27 November, 1948: 21.

“The Scanner: Radiolympia is Television’s ‘Big Shop Window’”, Radio Times. 25 September-1 October, 1949: 44-45.

Copyright © Brett Farmer 2019

#julie andrews#television#debut#1949#70th Anniversary#bbc#showtime#radiolympia#london#united kingdom#star

11 notes

·

View notes

Text

The new horror comedy Boo takes place on Halloween night in 1984, when a killer in a bed sheet ghost costume targets a group of teens, and while it pays homage to some of our favorite classics, it also marks the arrival of an exciting new voice to the genre in the film’s writer, producer, director, and star Dana Melanie, who’s ready to scare you and excited to get bloody.

Boo is Melanie’s first feature-length project as both writer and director, but she is no stranger to acting, having starred as a kidnapping survivor in the 2014 thriller Treehouse, a murderous outcast in the 2016 short film Lissy Borton Had an Axe, and most recently as legendary author Emily Dickinson in this year’s Wild Nights with Emily, which had its world premiere at the prestigious South by Southwest (SXSW) Film Festival.

In each role, she is unafraid to completely commit to transforming her physicality to fit each part, convincingly embracing a southern drawl for the tough heroine of Treehouse and a tragic lisp and braces as the title character in Lissy Borton. In the short comedy Waiting to Die in Bayside, Queens, she fully embodies a native New York teenager in 1976 talking to her diary about all the ways she is likely about to die.

Having written and directed a few smaller projects before, Boo will be Melanie’s feature film directorial debut, and when we talked a few weeks ago, I couldn’t wait to find out how she landed on Halloween in 1984.

In our pleasantly candid conversation, we discussed recreating the innocence of the ’80s, finding the right balance between Mean Girls and Halloween, and the timely importance of a woman calling the shots in the #MeToo era.

Read on for our exclusive interview with filmmaker Dana Melanie, on creating a killer in the gray area between comedy and horror.

Dana Melanie

What are some of your Halloween memories from when you were growing up? Did you celebrate Halloween a lot as a kid?

Yeah, I remember in my elementary school, we had a Halloween Day parade. We’d all dress up in our costumes and just parade around our track, which was not a big track. It was elementary school sized, but in my mind it was gigantic.

I remember my mom used to make my Halloween costumes. I was a gypsy one year, and it was freezing and raining. I was probably 7, and it was a midriff, so I was like, ‘But I want to show it, because you made it’. I had to wear a jacket because I was freezing and the rain was ice cold, but I was determined. My mom had spent all the time making it. She had the pattern and everything.

The homemade costumes are the best.

Very true.

How did you get into acting? Did you grow up in Los Angeles?

Yes, I’m from Los Angeles, born and raised. My whole family is from New York, so I spend a lot of time back and forth.

I have been acting and writing for several years now, basically my whole life. My mom is also a writer and she used to act a little when she was younger, so I don’t know, I just fell into it. It was always what I wanted to do and what I’m meant to do.

I’ve been writing a lot recently, and Boo is the script that I decided to take the leap with first, because I think audiences will respond to it. I have another film that I wrote, but it’s a little more dramatic and heavier. With Boo, I thought it would be a good starting point.

This is a first step for you as far as writing and directing a feature, but you’re certainly not new to acting. I love your work in Treehouse and Lissy Borton Had an Axe. Can you talk a little bit about those projects? Treehouse seemed like a pretty demanding role.

Treehouse was amazing. That was basically my first real project as an actress, my first big role. We shot it in rural Missouri for about a month. It was a fantastic experience. I met some of my best friends on that film. Actually our first A.D. on Treehouse is the director who directed me in Lissy. I learned so much. I got a taste of the horror/thriller side of the industry. It was a very good jumping off point for me. I’m so happy that I got the opportunity.

And then Lissy, I’m just obsessed with. It kind of takes the horror and has a little bit of comedy in it also. I love those films.

Dana Melanie directing a short teaser for ‘WS16’, which she also wrote.

Let’s talk about Boo. Where did this idea come from, and why did you decide to set the film in 1984?

I just love the ‘80s. I love films that are set in the ‘80s. That’s sort of how I came about wanting to write Boo. I just think that there’s this realness to them and a simplicity, but it’s also so entertaining, which I think is what movies are about.

I wanted explore what it would be like to have a scream queen that you kind of wanted to die, because she’s so mean. I started toying with that concept, and I was coming up with one liners and ideas. I thought, ‘Well, if you throw it back to back in the day on Halloween, costumes were kind of quirky and funny, and they weren’t necessarily like what we have today.’ So you had little kids in sheets with black eyes running around, and it was so simplistic and endearing and cute, but it could also still be terrifying if you saw that in the middle of the road in the middle of the night staring at you. It’s unsettling.

Then adding in the ‘80s itself, I mean, I thought it was a no-brainer because there’s so much to work with. The ‘80s just was an explosion of film and art and politics, so I just love it. Plus jazzercise, I mean, you can’t go wrong with jazzercise. (laughs)

So it was honestly because I love watching films that are from or are set back in the ‘80s. And you’re seeing it more and more in TV right now too.

Between things like Stranger Things and Glow on Netflix, the ‘80s are definitely all over the pop culture landscape right now.

I think it’s because there are so many different layers to it. So much happened in that time, and there are so many avenues to explore with it.

That’s what I thought was such a great thing about the ‘80s, was just how pure and just entertaining the films were, so that’s what we hope to bring back with this.

Obviously Halloween was different in 1984 than it is now, so I imagine you’ll be playing with that quite a bit in the film. I’ve seen where you’ve described Boo as sort of Mean Girls meets Halloween with a dash of Scream and Clueless thrown in, which sounds great. How will you be using those influences?

Again, I love stylized films, with wardrobe especially, which is how the ‘80s is really going to play a big part. That’s where like the Mean Girls and the Clueless comes in. And then you have Halloween, which is the actual gut of it.

We have our three main girls, Blair, Betty, and Becca, the three B’s. They’re the ones that you love to hate, who are the popular girls, naturally. So playing with all of that is really what we’re planning on doing, and just going with the whole concept of how back in the ‘80s you had all those Pretty in Pink, where it’s a popular girl and a not popular girl and how they’re clashing with each other. So we play a lot with that, and just getting back to those old movies and how the vibe was in high school.

It’s really about these high school kids and how they’re dealing with this psychopath who decided to show up and start killing people.

Would you say the tone is going to be more comedic or more horror, or will it walk the line?

It’s going to walk the line. The comedy of it may read a little slapstick, but it’s not going to be that, because it will be performed very real. It’s like real life, you know, you have these tragedy moments, but then there could be something funny that happens, and you’re like, ‘Oh my god, I’m not supposed to laugh, but I’m going to laugh because it was funny.’

Nothing is black and white. Real life is all about the gray area, so we’re going to be toying around a lot with the gray area.

Scream is one of my favorites, and it’s very funny throughout the movie, but when the horror comes, it’s serious horror. Would you say that when the horror does come into play in Boo that it will be similar to that?

Yeah, it definitely will. I think Scream makes fun of the whole concept of horror films a little bit more than we are going to, but when it gets down to the horror, I mean, it’s definitely going to be a murderer after these kids, and that’s scary.

‘Boo’ promo image

How did you decide on the look of your killer, using just a simple ghost sheet?

You know, I think it goes back to what I said before, being back in the day and having these simple costumes. I was thinking, ‘How could I make a monster that people wouldn’t necessarily find scary, but then make it scary?’ I think a sheet that you have on your bed, everybody’s got one, is a great way to play with that, and be like, ‘Well, you don’t think ghosts are scary, but wait until you see our film. You might change your mind.’

And it’s such an iconic old school, classic costume idea too.

Exactly, (we can) kind of bring it back.

You mentioned that a lot of what’s going to bring the ‘80s feel is in the costumes. Are you doing things like trying to find vintage Halloween décor of the time to incorporate?

It’s great because the location where we’re shooting is a school that’s actually been abandoned for a few years. We just location scouted for it the other day, and it looks like it was locked in that time. So the location itself is going to be so incredible and really add to the aesthetic of it.

And the language, some of the lines that we have are going to cater to the slang that was used back then. And yeah, of course the decorations also, and the ghost himself in the sheet.

It all sounds great. You’re running a crowd funding campaign now, but the film is definitely going into production, regardless if the Indiegogo goal is met or not, is that right?

Yes. We’re talking to investors right now, so that’s where the majority (of our budget) is coming from. But we wanted to start our Indiegogo because we wanted to start hype and we wanted to engage with our audience as soon as possible, and allow them to give us feedback of what they’re responding to, and allow them to be involved. It’s a great way to engage with an audience, and it’s not just giving us money, you’re buying a perk that’s going to give you a download of the film the day it premieres.

So we thought it was just a great opportunity for everybody to learn and engage, and to see what’s working and maybe what’s not working.

The more money we raise, the more blood we can have, the bigger name actors we can have, the more extensive our stunts can be. Every bit helps, especially when it’s on an indie film like ours.

What are some of your other influences as far as filmmakers?

I’ve been heavily inspired lately by the directors that I’ve recently worked with. I’ve done a lot of independent films, and each one is a completely new experience.

You know, indie films, they’re hard. You’re working against the elements to make this art, and hope that people respond to it and see it, so all of these directors and writers that I’ve worked with really inspired me to push forward and create my own stuff, and especially now. As a woman writer, my voice I think is important in its own unique way, so I want to be heard.

I’ve just been learning by watching. I love being on set. I don’t hide away in my room or trailer, I like to be there (on set) asking questions and learning, and figuring out as much as I can. Honestly that’s where I’ve been really heavily inspired, by all the directors that I’ve been working with recently and in the past.

Dana Melanie at the premiere of ‘Waiting to Die in Bayside, Queens’ in 2017.

Can you talk a little bit about the significance of the fact that you are a female writer, director, producer, and star of your own feature film in the current #MeToo era?

I just got back from South by Southwest, because my film Wild Nights with Emily premiered there. Our director, Madeleine Olnek, wrote and directed it, and she did an outstanding job. It’s a really artistic piece of work. I was inspired by her. And there was another film there that had a male who wrote, directed, and starred in his film, and I thought, ‘I can do that. Why don’t I just do that?’

It’s terrifying. I’ve never done this before. I’ve written before and I’ve directed a little short before for a script I did. I think I’m starting to gain enough experience. And because I’m so terrified, I think that means that I absolutely have to do this. I think what scares you is something that is – you need to take that leap. Otherwise, what’s worth it in the end? It’s the things that scare you which have the biggest rewards.

And then being a woman. Blair, the main character, I didn’t want her to be just your typical scream queen. In my opinion, she’s deeper than that. She’s got layers. She’s a force to be reckoned with. She’s an alpha woman girl who’s figuring all this out on her own. I think as a woman writing a female lead in a horror character, I think it’s important, and I’m excited to see how audiences respond to her and to the whole film itself.

So when do you begin shooting Boo?

Filming is going to take place this October.

So you’ll be filming right during Halloween season and getting those real October vibes, which is awesome.

Exactly.

And you’re filming in Minnesota, right?

Yes, Kiester, Minnesota.

How did you pick that location?

Actually, our producer, Mike, is from Kiester, Minnesota. It’s this extremely small town. Hardly anybody’s heard of it. Their claim to fame is a Preparation H commercial was filmed there I think last year. So we’re bringing Hollywood to Kiester. (laughs)

We originally assumed it was going to be filmed here in Los Angeles, because that’s where we’re all based, and our producer, Mike, was just telling us stories one day about his childhood in this small town. And I went on Google Earth and was just going through the streets and everything, and I thought, ‘Hey, this would be a great location for Boo to be filmed.’ The script wasn’t even finished yet. It was just kind of sitting there, because I was working on other things.

When I saw the town, it sort of just put everything into full gear, and I finished it and decided we’re going to do this now.

We’re shooting for 12 days in October. Then we’ll go into post production. And hopefully we can make a deal and get this out for October 2019.

I can’t wait to show it to everybody. I’m so excited.

‘Boo’ writer/director/producer/actor Dana Melanie

What else can you tell us about Boo?

Let’s see. I’m trying to think of how many people die. There’s a lot, actually. (laughs) I want to say that there’s going to be seven deaths.

Are you excited about shooting those scenes?

I’m so excited. I can’t wait to start killing people and get that blood gushing everywhere. Yeah, it will be really fun. And we’re playing with it. We’re going to get a little Hitchcock with it, where you don’t necessarily see things, but you will.

I assure you, there will be blood and guts. (laughs)

_

Boo is currently raising a portion of its budget through an Indiegogo campaign running until July 11, which you can contribute to in exchange for some sweet perks here.

Keep watching Halloween Daily News, as we are excited to cover the development of this fun new Halloween film.

Dana Melanie

For more Halloween news, follow @HalloweenDaily.

'Boo' Writer/Director Dana Melanie [Interview] The new horror comedy Boo takes place on Halloween night in 1984, when a killer in a bed sheet ghost costume targets a group of teens, and while it pays homage to some of our favorite classics, it also marks the arrival of an exciting new voice to the genre in the film's writer, producer, director, and star Dana Melanie, who's ready to scare you and excited to get bloody.

0 notes

Text

FIR registered against ShareChat for alleged copyright violation

New Post has been published on https://apzweb.com/fir-registered-against-sharechat-for-alleged-copyright-violation/

FIR registered against ShareChat for alleged copyright violation

BENGALURU: The Yeshwantpur Police in Bengaluru have registered an FIR against social media platform ShareChat for alleged copyrights violation based on a complaint from Lahari Recording Company.

The music company, in its complaint, said it owns the audio rights of many movies, but Mohalla Tech, which owns ShareChat, has facilitated users to download its copyrighted musical content without its consent. This has caused monetary loss to the company, the complainant said.

A police team visited the ShareChat office in Koramangala on Tuesday evening, and conducted a mahajar. When contacted, the police said they have booked the startup under Section 64 of Indian Copyrights Act, 1957 along with Section 201 of Indian Trademarks Act, 1999.

ShareChat had not responded to an email seeking its comments, as of presstime.

if(geolocation && geolocation != 5 && (typeof skip == 'undefined' || typeof skip.fbevents == 'undefined')) !function(f,b,e,v,n,t,s) if(f.fbq)return;n=f.fbq=function()n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments); if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)(window, document,'script', 'https://connect.facebook.net/en_US/fbevents.js'); fbq('init', '338698809636220'); fbq('track', 'PageView');

Source link

0 notes

Text

McCalla, Christine Ann’s Attempt At Leveraging Equities In The Doctoral College’s Environment Columbia Southern University: Thwarting Murder, by McCalla, Christine Ann

To: Interpol and variations thereof

From: McCalla, Christine Ann and all variations thereof

Re: Brandmeir’s inability to understand and appreciate how crimes of an unnecessary are committed

Date: February 19, 2018

In regards to my report filed earlier this morning, it appears to Brandmeir that his encouragement and facilitation of criminal activities does not go unnoticed or unperceived by the matured student and one at the doctoral level.

It appears Brandmeir’s email has been duplicated in which duplicate copies are being forwarded to numerous persons. He refers to a DL-Blackholes and I am unware of that person being that I merely responded all to his email. I do not know this person but it is an indication that unauthorized persons have access to student’s correspondence and files violating privacy regulation, antitrust and monopolization statutes, and the oath of the government official. Since Brandmeir is unaware of the calibre of his conduct, I believe it is best that he sees my way of thinking via statutes and those violated.

Also attached is his response including that of BL-Blackholes.

STATUTE VIOLATED -

-20 U.S. Code Chapter 15 - STUDIES AND RESEARCH ON PROBLEMS IN EDUCATION

-The de facto officer doctrine - acts performed by a person acting under the color of official title even though it is later discovered that the legality of that person's appointment or election to office is deficient

-6 USCS § 133 § 133. Protection of voluntarily shared critical infrastructure information (iii) be used other than for the purpose of protecting critical infrastructure or protected systems, or in furtherance of an investigation or the prosecution of a criminal act;

-15 USCS § 6a § 6a. Conduct involving trade or commerce with foreign nations This Act [15 USCS §§ 1 et seq.] shall not apply to conduct involving trade or commerce (other than import trade or import commerce) with foreign nations unless-- (1) such conduct has a direct, substantial, and reasonably foreseeable effect-- (A) on trade or commerce which is not trade or commerce with foreign nations, or on import trade or import commerce with foreign nations; or (B) on export trade or export commerce with foreign nations, of a person engaged in such trade or commerce in the United States; and (2) such effect gives rise to a claim under the provisions of this Act [15 USCS §§ 1 et seq.], other than this section.

-42 USCS § 1981 (b) "Make and enforce contracts" defined. For purposes of this section, the term "make and enforce contracts" includes the making, performance, modification, and termination of contracts, and the enjoyment of all benefits, privileges, terms, and conditions of the contractual relationship. (c) Protection against impairment. The rights protected by this section are protected against impairment by nongovernmental discrimination and impairment under color of State law.

-4 USCS § 102 § 102. Same; by whom administered Such oath may be administered by any person who, by the law of the State, is authorized to administer the oath of office; and the person so administering such oath shall cause a record or certificate thereof to be made in the same manner, as by the law of the State, he is directed to record or certify the oath of office.

-20 USCS § 3401 § 3401. Congressional findings (4) in our Federal system, the primary public responsibility for education is reserved respectively to the States and the local school systems and other instrumentalities of the States; (7) there is a need for improvement in the management and coordination of Federal education programs to support more effectively State, local, and private institutions, students, and parents in carrying out their educational responsibilities;

-USCS Const. Art. II, § 4 Sec. 4. Removal from office. The President, Vice President and all civil Officers of the United States, shall be removed from Office on Impeachment for, and Conviction of, Treason, Bribery, or other high Crimes and Misdemeanors.

-8 USCS § 1772 § 1772. International cooperation

-8 USCS § 1778 § 1778. Vulnerability and threat assessment

-12 USCS § 582 § 582. Receipt of United States or bank notes as collateral

-12 USCS § 630 § 630. Offenses by officers of corporation; punishment

-15 U.S. Code § 1 - Trusts, etc., in restraint of trade illegal; penalty

-15 U.S. Code § 1052 - Trademarks registrable on principal register; concurrent registration

-15 USCS § 2 § 2. Monopolization; penalty

-15 USCS § 6a § 6a. Conduct involving trade or commerce with foreign nations

-15 USCS § 15 § 15. Suits by persons injured

-15 USCS § 15c § 15c. Actions by State attorneys general

-15 USCS § 45a § 45a. Labels on products

-15 USCS § 78c-1 § 78c-1. Swap agreements

-15 USCS § 1513 § 1513. Duties and powers vested in Department

-17 USCS § 101 § 101. Definitions

-17 USCS § 201 § 201. Ownership of copyright

-17 USCS § 202 § 202. Ownership of copyright as distinct from ownership of material object

-17 USCS § 202 § 202. Ownership of copyright as distinct from ownership of material object

-17 USCS § 204 § 204. Execution of transfers of copyright ownership

-17 USCS § 1201 § 1201. Circumvention of copyright protection systems

-17 USCS § 1301 § 1301. Designs protected

-17 USCS § 1309 § 1309. Infringement protected designs

-17 USCS § 1309 § 1309. Infringement

-18 U.S. Code § 521 - Criminal street gangs

-18 USCS § 201 § 201. Bribery of public officials and witnesses

-18 USCS § 215 § 215. Receipt of commissions or gifts for procuring loans

-18 USCS § 521 § 521. Criminal street gangs

-18 USCS § 894 § 894. Collection of extensions of credit by extortionate means

-18 USCS § 1961 § 1961. Definitions

-18 USCS § 1962 § 1962. Prohibited activities

-18 USCS § 2101 § 2101. Riots

-18 USCS § 2102 § 2102. Definitions

-18 USCS § 2441 § 2441. War crimes

-20 U.S. Code § 3401 - Congressional findings

-22 USCS § 501 § 501. Utilization of services of Government agencies to promote inter-American relations

-22 USCS § 504 § 504. Transfer of hemisphere territory from one non-American power to another; recognition; consultation with American Republics

-22 USCS § 611 § 611. Definitions

-22 USCS § 618 § 618. Enforcement and penalties

-22 USCS § 5353 § 5353. Fair trade in financial services

-23 USCS § 313 § 313. Buy America

-28 USCS § 631 § 631. Appointment and tenure

-28 USCS § 1407 § 1407. Multidistrict litigation

-28 USCS § 1410 § 1410. Venue of cases ancillary to foreign proceedings

-28 USCS § 1654 § 1654. Appearance personally or by counsel

-28 USCS § 1733 § 1733. Government records and papers; copies

-29 CFR 18.87 § 18.87 Standards of conduct.

-42 USCS § 1981 § 1981. Equal rights under the law

-42 USCS § 2000a-3 § 2000a-3. Civil actions for preventive relief

-42 USCS § 2000a-5 § 2000a-5. Civil actions by the Attorney General

-48 USCS § 1489 § 1489. Loss of title of United States to lands in territories through adverse possession or prescription forbidden

-49 USCS § 50102 § 50102. Restricting contract awards because of discrimination against United States goods or services

-49 USCS § 50104 § 50104. Restriction on airport projects using products or services of foreign countries denying fair market opportunities

-49 USCS § 50105 § 50105. Fraudulent use of "Made in America" label

-50 U.S. Code § 98a - Congressional findings and declaration of purpose

-50 U.S. Code § 3231 - Applicability to United States intelligence activities of Federal laws implementing international treaties and agreements

-50 U.S. Code § 4502 - Declaration of policy

-50 USCS § 23 § 23. Jurisdiction of United States courts and judges

-50 USCS § 23 § 23. Jurisdiction of United States courts and judges

-50 USCS § 24 § 24. Duties of marshals

-50 USCS § 82 § 82. Procurement of ships and material during war

-50 USCS § 3093 § 3093. Presidential approval and reporting of covert actions

-Civil Forfeiture doctrine

-50 U.S. Code Chapter 4 - ESPIONAGE

-ARTICLE IV THE STATES, STATES’ RELATIONS

Section 1. Full Faith and Credit shall be given in each State to the public Acts, Records, and judicial Proceedings of every other State. And the Congress may by general Laws prescribe the Manner in which such Acts, Records, and Proceedings shall be proved, and the Effect thereof.

-Convention on the Service Abroad of Judicial and Extrajudicial Documents in Civil or Commercial Matters

-International Covenant on Civil and Political Rights

-Respondeat superior doctrine and with strict liability

-Rules for Judicial-Conduct and Judicial-Disability Proceedings Article II. Initiation of Complaint, USCS Jud. Con. And Disab. Proc. 5 Review Court Orders which may amend this Rule

-United Nations Convention on Contracts for the International Sale of Goods

My comments from my earlier correspondence are as follows with the relevant statute violations as I have now officially submitted notice to CSU’s registrar regarding withdrawal.

Correct me if I am wrong as I seem unable to identify the deficiencies I have in Doctoral Orientation. My discussion presented an in-depth discussion on the dissertation process in my post to the professor's posting/discussion including the, (1) analysis of ProQuest’s Database in which a doctoral dissertation written by Nowlin’s (2018) Incorporating stakeholder input into financial decision making in california school districts was presented; (2) given with the provision of Nowlin reference, the doctoral dissertation requested was provided. My representation was present and was not validated means I am free to initiate plagiarism and infringements as I see fit. This is a failure of Department of Education to provide me with the quality of education required at the Doctoral level - an infringement;

STATUTE VIOLATED -

(3) Nowlin's dissertation was retrieved from ProQuest's dissertation database and not the traditional database. In that my obligation and burden towards Columbia Southern University have been met as required and instructed; (4) It is inappropriate for my doctoral professor at my university to direct me to infringe upon other elements as vital Department of Education's resources and suggest identity theft as it is the only way to access additional dissertation databases not provided my university library. I am a legitimate student at Columbia Southern. I expect to be provided with any and all resources necessary from them and not some other illegitimate resources resulting in civil and criminal penalties. In other words, Columbia Southern University does not tell me to seek references from universities other than its own; (5) Your reference of deterrence in participation in a cooperative learning activity is quite discouraging. The act of conference participation is a peer learning activity. To this you specified, "No need to analyze or comment on others or event the dissertation, just yes or no but could be useful." Again, another Department of Education failure/deficiency. (6) Your feedback of, "Accusations are not appropriate in discussion boards." It is clear to see how this comment came in with. (a) my Al Khatib to Khatib fraudulent infringement resulting in academic violation; grader's response . Grader response Delete: “Al Khatib, A. S. (2014). Time management and its relation to students' stress, gender and academic a…” Grader response Add: “Khatib, A. S. (2014). Time management and its relation to students' stress, gender and academic achi…” (2) the comments regarding my grammar, citation formatting, and presentation of personality including those of a nonsensical manner, the lack of representation and presentation of faculty at a doctoral level including, lack of introduction being it is way too long and needs to be concise; Which means what? Look up sesquipedalian. It is alleged sesuipedalian, applied to the phrase in my paper discernment of the DBA program, is a term reserved for Department of Education and not for students which you fail to appreciate. Furthermore, according to dictionary.com, the definition of sesuipedalian is, (1) given to using long words, 2. (of a word) containing many syllables. noun 3. a sesquipedalian word. How discernment becomes using long words and containing many syllables as defined by dictionary.com is a reflection of Department of Education. Hopefully with time, they will see the err. The representation in my paper, "This reflection paper demands discernment of the DBA program including the objectives of the program, the expectation by the school and society, characteristics / attributes of success in the program, areas of development and growth, and the consequences of time management application within the DBA students personal life. The desire to be conferred upon as a DBA must reflect the diligence, commitment, and discipline required to achieve said accolade." is met with the comment This sentence is useless, the paper does not demand (anthropomorphism perhaps). Not sure where you found this list but just make no sense. Dictionary.com defines anthromorphism as an anthropomorphic conception or representation, as of a deity. Anthropomorphic, dictionary.com, means ascribing human form or attributes to a being or thing not human, especially to a deity. 2. resembling or made to resemble a human form... As for my week 1 rewrite, I was met with the comment of This paper is supposed to be a personal reflection and it is not – not sure why you insist on all the extra materials instead of your own thinking. If you spent the time writing the paper correctly, and a little less on compiling references that are not needed, you could resolve some of the writing issues. The references are nice for a doctoral level effort, but in this case, overdone. Overdone and yet my grade for week 1 was 70.5%. American Psychological Association (2010) appreciates the benefits on reliances on prior studies to advance theories. American Psychological Association (2010) argues successfully, 1.03 Theoretical Articles In theoretical articles, authors draw on existing research literature to advance theory. Literature reviews and theoretical articles are often similar in structure, but theoretical articles present empirical information only when it advances a theoretical issue. Authors of theoretical articles trace the development of theory to expand and refine theoretical constructs or present a new theory or analyze existing theory, pointing out flaws or demonstrating the advantage of one theory over another. For a doctoral feedback to be contesting the focus on the reliance on prior studies including appropriate citation management in favor of unsupported originality creates a substantial problem for me. There were also comments such as Transfer or incorporate – pedagogical concepts on prior learning do not seem to apply here, Do you mean the ability to strategize, You don’t understand copyrighting so not sure why you are putting this in here, Requires mentoring?, The department of education has nothing to do with this – what are you writing about here., Students don’t exerts so what are you saying?, Do not have consequences to attributes – so what are you saying... A DBA degree is considered a practitioner's degree with encouragements to reliance on prior knowledge and skills, but since this doctoral orientation and I overdo with references none will be provided here.

0 notes

Text

SEC Charges Pastor with Defrauding Retirees

The Securities and Exchange Commission announced fraud charges and an emergency asset freeze obtained against a Michigan-based pastor accused of exploiting church members, retirees, and laid-off auto workers who were misled to believe they were investing in a successful real estate business.

The SEC alleges that Larry Holley, the pastor of Abundant Life Ministries in Flint, Mich., cloaked his solicitations in faith-based rhetoric, replete with references to scripture and biblical figures. Holley allegedly told prospective investors that as a person who “prayed for your children,” he was more trustworthy than a “banker” with their money. According to the SEC’s complaint, Holley held financial presentations masked as “Blessed Life Conferences” at churches nationwide during which he asked congregants to fill out cards detailing their financial holdings, and he promised to pray over the cards and invited attendees to have one-on-one consultations with his team. He allegedly called his investors “millionaires in the making.”

According to the SEC’s complaint, which also charges Holley’s company Treasure Enterprise LLC and his business associate Patricia Enright Gray, approximately $6.7 million was raised from more than 80 investors who were guaranteed high returns and told they were investing in a profitable real estate company with hundreds of residential and commercial properties.

youtube

According to the complaint, Gray advertised on a religious radio station based in Flint and singled out recently laid-off auto workers with severance packages to consult her for a “financial increase.” Gray allegedly promised to roll over investors’ retirement funds into tax-advantaged Individual Retirement Accounts (IRA) and invest them in Treasure Enterprise. The SEC alleges that no investor funds were deposited into IRAs, and Treasure Enterprise struggled to generate enough revenue from its real estate investments to support the business and make payments owed to investors. Treasure Enterprise owes investors an estimated $1.9 million in past due payments, according to the SEC’s complaint.

“As alleged in our complaint, Holley and Gray targeted the retirement savings of churchgoers, building a bond of trust purportedly based on faith but actually based on false promises,” said David Glockner.

According to the SEC’s complaint, Holley, Gray, and Treasure Enterprise were not registered to sell investments. The SEC encourages investors to check the background of anyone offering to sell them investments by doing a quick search on the SEC’s investor website.

The SEC has obtained a temporary restraining order in U.S. District Court for the Eastern District of Utah that freezes the assets of Holley, Gray, and Treasure Enterprise. The court’s order also appoints a receiver and imposes other emergency relief.

The SEC’s complaint alleges violations of Sections 5(a), 5(c), and 17(a) of the Securities Act of 1933 and Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 and Rule 10b-5. The complaint seeks disgorgement of ill-gotten gains plus interest, penalties, and permanent injunctions.

youtube

The SEC’s investigation, which is continuing, is being conducted by Ana P. Doncic, Delia L. Helpingstine, and Sruthi Koneru of the Utah office. The case is being supervised by Steven L. Klawans, and the litigation is being led by Jonathan S. Polish.

SEC ADOPTS JOBS ACT AMENDMENTS TO HELP ENTREPRENEURS AND INVESTORS

The Securities and Exchange Commission today announced that it has adopted amendments to increase the amount of money companies can raise through crowdfunding to adjust for inflation. It also approved amendments that adjust for inflation a threshold used to determine eligibility for benefits offered to “emerging growth companies” (EGCs) under the Jumpstart Our Business Startups (JOBS) Act.

“Regular updates to the JOBS Act, as prescribed by Congress, ensure that the entrepreneurs and investors who benefit from crowdfunding will continue to do so,” said SEC Acting Chairman Michael S. Piwowar. “Under these amendments, the JOBS Act can continue to create jobs and investment opportunities for the general public.”

The SEC is required to make inflation adjustments to certain JOBS Act rules at least once every five years after it was enacted on April 5, 2012. In addition to the inflation adjustments, the SEC adopted technical amendments to conform several rules and forms to amendments made to the Securities Act of 1933 (“Securities Act”) and the Securities Exchange Act of 1934 (“Exchange Act”) by Title I of the JOBS Act.

The Commission approved the new thresholds March 31. They will become effective when they are published in the Federal Register.

BACKGROUND ON THE SEC JOBS ACT

Section 101 of the JOBS Act added new Securities Act Section 2(a)(19) and Exchange Act Section 3(a)(80) to define the term “emerging growth company” (“EGC”). Pursuant to those sections, every five years the SEC is directed to index the annual gross revenue amount used to determine EGC status to inflation to reflect the change in the Consumer Price Index for All Urban Consumers (“CPI-U”) published by the Bureau of Labor Statistics (“BLS”). To carry out this statutory directive, the SEC has adopted amendments to Securities Act Rule 405 and Exchange Act Rule 12b-2 to include a definition for EGC that reflects an inflation-adjusted annual gross revenue threshold. The JOBS Act also added new Securities Act Section 4(a)(6), which provides an exemption from the registration requirements of Section 5 under the Securities Act for certain crowdfunding transactions. In October 2015, the SEC promulgated Regulation Crowdfunding to implement that exemption. Sections 4(a)(6) and 4A of the Securities Act set forth dollar amounts used in connection with the crowdfunding exemption, and Section 4A(h)(1) states that such dollar amounts shall be adjusted by the SEC not less frequently than once every five years to reflect the change in the CPI-U published by the BLS. The SEC has adopted amendments to Rules 100 and 201(t) of Regulation Crowdfunding and Securities Act Form C to reflect the required inflation adjustments.

In addition, Sections 102 and 103 of the JOBS Act amended the Securities Act and the Exchange Act to provide several exemptions from a number of disclosure, shareholder voting, and other regulatory requirements for any issuer that qualifies as an EGC. The exemptions reduce the financial disclosures an EGC is required to provide in public offering registration statements and relieve an EGC from conducting advisory votes on executive compensation, as well as from a number of accounting and disclosure requirements. The regulatory relief provided under Sections 102 and 103 of the JOBS Act was self-executing and became effective once the JOBS Act was signed into law. The technical amendments that the SEC is adopting conform several rules and forms to reflect these JOBS Act statutory changes.

Free Initial Consultation with a Securities Lawyer

When you need help with an SEC or Securities matter, call Ascent Law for your free consultation (801) 676-5506. We want to help you.

Ascent Law LLC 8833 S. Redwood Road, Suite C West Jordan, Utah 84088 United States Telephone: (801) 676-5506

Ascent Law LLC

4.9 stars – based on 67 reviews

Recent Posts

Government Liability and Immunity in Utah

Child Support and Parental Relocation

Securities Lawyer

Copyright Lawyer

MLM Lawyer

Intellectual Property Lawyer

From http://www.ascentlawfirm.com/sec-charges-pastor-with-defrauding-retirees/

source https://familylawattorneyut.wordpress.com/2018/03/16/sec-charges-pastor-with-defrauding-retirees/

from Divorce Lawyer Tooele Utah http://divorcelawyertooeleutah.blogspot.com/2018/03/sec-charges-pastor-with-defrauding.html

0 notes

Text

SEC Charges Pastor with Defrauding Retirees

The Securities and Exchange Commission announced fraud charges and an emergency asset freeze obtained against a Michigan-based pastor accused of exploiting church members, retirees, and laid-off auto workers who were misled to believe they were investing in a successful real estate business.

The SEC alleges that Larry Holley, the pastor of Abundant Life Ministries in Flint, Mich., cloaked his solicitations in faith-based rhetoric, replete with references to scripture and biblical figures. Holley allegedly told prospective investors that as a person who “prayed for your children,” he was more trustworthy than a “banker” with their money. According to the SEC’s complaint, Holley held financial presentations masked as “Blessed Life Conferences” at churches nationwide during which he asked congregants to fill out cards detailing their financial holdings, and he promised to pray over the cards and invited attendees to have one-on-one consultations with his team. He allegedly called his investors “millionaires in the making.”

According to the SEC’s complaint, which also charges Holley’s company Treasure Enterprise LLC and his business associate Patricia Enright Gray, approximately $6.7 million was raised from more than 80 investors who were guaranteed high returns and told they were investing in a profitable real estate company with hundreds of residential and commercial properties.

youtube

According to the complaint, Gray advertised on a religious radio station based in Flint and singled out recently laid-off auto workers with severance packages to consult her for a “financial increase.” Gray allegedly promised to roll over investors’ retirement funds into tax-advantaged Individual Retirement Accounts (IRA) and invest them in Treasure Enterprise. The SEC alleges that no investor funds were deposited into IRAs, and Treasure Enterprise struggled to generate enough revenue from its real estate investments to support the business and make payments owed to investors. Treasure Enterprise owes investors an estimated $1.9 million in past due payments, according to the SEC’s complaint.

“As alleged in our complaint, Holley and Gray targeted the retirement savings of churchgoers, building a bond of trust purportedly based on faith but actually based on false promises,” said David Glockner.

According to the SEC’s complaint, Holley, Gray, and Treasure Enterprise were not registered to sell investments. The SEC encourages investors to check the background of anyone offering to sell them investments by doing a quick search on the SEC’s investor website.

The SEC has obtained a temporary restraining order in U.S. District Court for the Eastern District of Utah that freezes the assets of Holley, Gray, and Treasure Enterprise. The court’s order also appoints a receiver and imposes other emergency relief.

The SEC’s complaint alleges violations of Sections 5(a), 5(c), and 17(a) of the Securities Act of 1933 and Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 and Rule 10b-5. The complaint seeks disgorgement of ill-gotten gains plus interest, penalties, and permanent injunctions.

youtube

The SEC’s investigation, which is continuing, is being conducted by Ana P. Doncic, Delia L. Helpingstine, and Sruthi Koneru of the Utah office. The case is being supervised by Steven L. Klawans, and the litigation is being led by Jonathan S. Polish.

SEC ADOPTS JOBS ACT AMENDMENTS TO HELP ENTREPRENEURS AND INVESTORS

The Securities and Exchange Commission today announced that it has adopted amendments to increase the amount of money companies can raise through crowdfunding to adjust for inflation. It also approved amendments that adjust for inflation a threshold used to determine eligibility for benefits offered to “emerging growth companies” (EGCs) under the Jumpstart Our Business Startups (JOBS) Act.

“Regular updates to the JOBS Act, as prescribed by Congress, ensure that the entrepreneurs and investors who benefit from crowdfunding will continue to do so,” said SEC Acting Chairman Michael S. Piwowar. “Under these amendments, the JOBS Act can continue to create jobs and investment opportunities for the general public.”

The SEC is required to make inflation adjustments to certain JOBS Act rules at least once every five years after it was enacted on April 5, 2012. In addition to the inflation adjustments, the SEC adopted technical amendments to conform several rules and forms to amendments made to the Securities Act of 1933 (“Securities Act”) and the Securities Exchange Act of 1934 (“Exchange Act”) by Title I of the JOBS Act.

The Commission approved the new thresholds March 31. They will become effective when they are published in the Federal Register.

BACKGROUND ON THE SEC JOBS ACT

Section 101 of the JOBS Act added new Securities Act Section 2(a)(19) and Exchange Act Section 3(a)(80) to define the term “emerging growth company” (“EGC”). Pursuant to those sections, every five years the SEC is directed to index the annual gross revenue amount used to determine EGC status to inflation to reflect the change in the Consumer Price Index for All Urban Consumers (“CPI-U”) published by the Bureau of Labor Statistics (“BLS”). To carry out this statutory directive, the SEC has adopted amendments to Securities Act Rule 405 and Exchange Act Rule 12b-2 to include a definition for EGC that reflects an inflation-adjusted annual gross revenue threshold. The JOBS Act also added new Securities Act Section 4(a)(6), which provides an exemption from the registration requirements of Section 5 under the Securities Act for certain crowdfunding transactions. In October 2015, the SEC promulgated Regulation Crowdfunding to implement that exemption. Sections 4(a)(6) and 4A of the Securities Act set forth dollar amounts used in connection with the crowdfunding exemption, and Section 4A(h)(1) states that such dollar amounts shall be adjusted by the SEC not less frequently than once every five years to reflect the change in the CPI-U published by the BLS. The SEC has adopted amendments to Rules 100 and 201(t) of Regulation Crowdfunding and Securities Act Form C to reflect the required inflation adjustments.

In addition, Sections 102 and 103 of the JOBS Act amended the Securities Act and the Exchange Act to provide several exemptions from a number of disclosure, shareholder voting, and other regulatory requirements for any issuer that qualifies as an EGC. The exemptions reduce the financial disclosures an EGC is required to provide in public offering registration statements and relieve an EGC from conducting advisory votes on executive compensation, as well as from a number of accounting and disclosure requirements. The regulatory relief provided under Sections 102 and 103 of the JOBS Act was self-executing and became effective once the JOBS Act was signed into law. The technical amendments that the SEC is adopting conform several rules and forms to reflect these JOBS Act statutory changes.

Free Initial Consultation with a Securities Lawyer

When you need help with an SEC or Securities matter, call Ascent Law for your free consultation (801) 676-5506. We want to help you.

Ascent Law LLC 8833 S. Redwood Road, Suite C West Jordan, Utah 84088 United States Telephone: (801) 676-5506

Ascent Law LLC

4.9 stars – based on 67 reviews

Recent Posts

Government Liability and Immunity in Utah

Child Support and Parental Relocation

Securities Lawyer

Copyright Lawyer

MLM Lawyer

Intellectual Property Lawyer

From http://www.ascentlawfirm.com/sec-charges-pastor-with-defrauding-retirees/

0 notes

Text

SEC Charges Pastor with Defrauding Retirees

The Securities and Exchange Commission announced fraud charges and an emergency asset freeze obtained against a Michigan-based pastor accused of exploiting church members, retirees, and laid-off auto workers who were misled to believe they were investing in a successful real estate business.

The SEC alleges that Larry Holley, the pastor of Abundant Life Ministries in Flint, Mich., cloaked his solicitations in faith-based rhetoric, replete with references to scripture and biblical figures. Holley allegedly told prospective investors that as a person who “prayed for your children,” he was more trustworthy than a “banker” with their money. According to the SEC’s complaint, Holley held financial presentations masked as “Blessed Life Conferences” at churches nationwide during which he asked congregants to fill out cards detailing their financial holdings, and he promised to pray over the cards and invited attendees to have one-on-one consultations with his team. He allegedly called his investors “millionaires in the making.”

According to the SEC’s complaint, which also charges Holley’s company Treasure Enterprise LLC and his business associate Patricia Enright Gray, approximately $6.7 million was raised from more than 80 investors who were guaranteed high returns and told they were investing in a profitable real estate company with hundreds of residential and commercial properties.

youtube

According to the complaint, Gray advertised on a religious radio station based in Flint and singled out recently laid-off auto workers with severance packages to consult her for a “financial increase.” Gray allegedly promised to roll over investors’ retirement funds into tax-advantaged Individual Retirement Accounts (IRA) and invest them in Treasure Enterprise. The SEC alleges that no investor funds were deposited into IRAs, and Treasure Enterprise struggled to generate enough revenue from its real estate investments to support the business and make payments owed to investors. Treasure Enterprise owes investors an estimated $1.9 million in past due payments, according to the SEC’s complaint.

“As alleged in our complaint, Holley and Gray targeted the retirement savings of churchgoers, building a bond of trust purportedly based on faith but actually based on false promises,” said David Glockner.

According to the SEC’s complaint, Holley, Gray, and Treasure Enterprise were not registered to sell investments. The SEC encourages investors to check the background of anyone offering to sell them investments by doing a quick search on the SEC’s investor website.

The SEC has obtained a temporary restraining order in U.S. District Court for the Eastern District of Utah that freezes the assets of Holley, Gray, and Treasure Enterprise. The court’s order also appoints a receiver and imposes other emergency relief.

The SEC’s complaint alleges violations of Sections 5(a), 5(c), and 17(a) of the Securities Act of 1933 and Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 and Rule 10b-5. The complaint seeks disgorgement of ill-gotten gains plus interest, penalties, and permanent injunctions.

youtube

The SEC’s investigation, which is continuing, is being conducted by Ana P. Doncic, Delia L. Helpingstine, and Sruthi Koneru of the Utah office. The case is being supervised by Steven L. Klawans, and the litigation is being led by Jonathan S. Polish.

SEC ADOPTS JOBS ACT AMENDMENTS TO HELP ENTREPRENEURS AND INVESTORS

The Securities and Exchange Commission today announced that it has adopted amendments to increase the amount of money companies can raise through crowdfunding to adjust for inflation. It also approved amendments that adjust for inflation a threshold used to determine eligibility for benefits offered to “emerging growth companies” (EGCs) under the Jumpstart Our Business Startups (JOBS) Act.

“Regular updates to the JOBS Act, as prescribed by Congress, ensure that the entrepreneurs and investors who benefit from crowdfunding will continue to do so,” said SEC Acting Chairman Michael S. Piwowar. “Under these amendments, the JOBS Act can continue to create jobs and investment opportunities for the general public.”

The SEC is required to make inflation adjustments to certain JOBS Act rules at least once every five years after it was enacted on April 5, 2012. In addition to the inflation adjustments, the SEC adopted technical amendments to conform several rules and forms to amendments made to the Securities Act of 1933 (“Securities Act”) and the Securities Exchange Act of 1934 (“Exchange Act”) by Title I of the JOBS Act.

The Commission approved the new thresholds March 31. They will become effective when they are published in the Federal Register.

BACKGROUND ON THE SEC JOBS ACT

Section 101 of the JOBS Act added new Securities Act Section 2(a)(19) and Exchange Act Section 3(a)(80) to define the term “emerging growth company” (“EGC”). Pursuant to those sections, every five years the SEC is directed to index the annual gross revenue amount used to determine EGC status to inflation to reflect the change in the Consumer Price Index for All Urban Consumers (“CPI-U”) published by the Bureau of Labor Statistics (“BLS”). To carry out this statutory directive, the SEC has adopted amendments to Securities Act Rule 405 and Exchange Act Rule 12b-2 to include a definition for EGC that reflects an inflation-adjusted annual gross revenue threshold. The JOBS Act also added new Securities Act Section 4(a)(6), which provides an exemption from the registration requirements of Section 5 under the Securities Act for certain crowdfunding transactions. In October 2015, the SEC promulgated Regulation Crowdfunding to implement that exemption. Sections 4(a)(6) and 4A of the Securities Act set forth dollar amounts used in connection with the crowdfunding exemption, and Section 4A(h)(1) states that such dollar amounts shall be adjusted by the SEC not less frequently than once every five years to reflect the change in the CPI-U published by the BLS. The SEC has adopted amendments to Rules 100 and 201(t) of Regulation Crowdfunding and Securities Act Form C to reflect the required inflation adjustments.

In addition, Sections 102 and 103 of the JOBS Act amended the Securities Act and the Exchange Act to provide several exemptions from a number of disclosure, shareholder voting, and other regulatory requirements for any issuer that qualifies as an EGC. The exemptions reduce the financial disclosures an EGC is required to provide in public offering registration statements and relieve an EGC from conducting advisory votes on executive compensation, as well as from a number of accounting and disclosure requirements. The regulatory relief provided under Sections 102 and 103 of the JOBS Act was self-executing and became effective once the JOBS Act was signed into law. The technical amendments that the SEC is adopting conform several rules and forms to reflect these JOBS Act statutory changes.

Free Initial Consultation with a Securities Lawyer

When you need help with an SEC or Securities matter, call Ascent Law for your free consultation (801) 676-5506. We want to help you.

Ascent Law LLC 8833 S. Redwood Road, Suite C West Jordan, Utah 84088 United States Telephone: (801) 676-5506

Ascent Law LLC

4.9 stars – based on 67 reviews

Recent Posts

Government Liability and Immunity in Utah

Child Support and Parental Relocation

Securities Lawyer

Copyright Lawyer

MLM Lawyer

Intellectual Property Lawyer

Source: http://www.ascentlawfirm.com/sec-charges-pastor-with-defrauding-retirees/

from Divorce Lawyer Pepperwood Sandy Utah http://divorcelawyerpepperwoodsandyut.blogspot.com/2018/03/sec-charges-pastor-with-defrauding.html

0 notes

Text

SEC Charges Pastor with Defrauding Retirees

The Securities and Exchange Commission announced fraud charges and an emergency asset freeze obtained against a Michigan-based pastor accused of exploiting church members, retirees, and laid-off auto workers who were misled to believe they were investing in a successful real estate business.

The SEC alleges that Larry Holley, the pastor of Abundant Life Ministries in Flint, Mich., cloaked his solicitations in faith-based rhetoric, replete with references to scripture and biblical figures. Holley allegedly told prospective investors that as a person who “prayed for your children,” he was more trustworthy than a “banker” with their money. According to the SEC’s complaint, Holley held financial presentations masked as “Blessed Life Conferences” at churches nationwide during which he asked congregants to fill out cards detailing their financial holdings, and he promised to pray over the cards and invited attendees to have one-on-one consultations with his team. He allegedly called his investors “millionaires in the making.”

According to the SEC’s complaint, which also charges Holley’s company Treasure Enterprise LLC and his business associate Patricia Enright Gray, approximately $6.7 million was raised from more than 80 investors who were guaranteed high returns and told they were investing in a profitable real estate company with hundreds of residential and commercial properties.

youtube

According to the complaint, Gray advertised on a religious radio station based in Flint and singled out recently laid-off auto workers with severance packages to consult her for a “financial increase.” Gray allegedly promised to roll over investors’ retirement funds into tax-advantaged Individual Retirement Accounts (IRA) and invest them in Treasure Enterprise. The SEC alleges that no investor funds were deposited into IRAs, and Treasure Enterprise struggled to generate enough revenue from its real estate investments to support the business and make payments owed to investors. Treasure Enterprise owes investors an estimated $1.9 million in past due payments, according to the SEC’s complaint.

“As alleged in our complaint, Holley and Gray targeted the retirement savings of churchgoers, building a bond of trust purportedly based on faith but actually based on false promises,” said David Glockner.

According to the SEC’s complaint, Holley, Gray, and Treasure Enterprise were not registered to sell investments. The SEC encourages investors to check the background of anyone offering to sell them investments by doing a quick search on the SEC’s investor website.

The SEC has obtained a temporary restraining order in U.S. District Court for the Eastern District of Utah that freezes the assets of Holley, Gray, and Treasure Enterprise. The court’s order also appoints a receiver and imposes other emergency relief.

The SEC’s complaint alleges violations of Sections 5(a), 5(c), and 17(a) of the Securities Act of 1933 and Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 and Rule 10b-5. The complaint seeks disgorgement of ill-gotten gains plus interest, penalties, and permanent injunctions.

youtube

The SEC’s investigation, which is continuing, is being conducted by Ana P. Doncic, Delia L. Helpingstine, and Sruthi Koneru of the Utah office. The case is being supervised by Steven L. Klawans, and the litigation is being led by Jonathan S. Polish.

SEC ADOPTS JOBS ACT AMENDMENTS TO HELP ENTREPRENEURS AND INVESTORS

The Securities and Exchange Commission today announced that it has adopted amendments to increase the amount of money companies can raise through crowdfunding to adjust for inflation. It also approved amendments that adjust for inflation a threshold used to determine eligibility for benefits offered to “emerging growth companies” (EGCs) under the Jumpstart Our Business Startups (JOBS) Act.

“Regular updates to the JOBS Act, as prescribed by Congress, ensure that the entrepreneurs and investors who benefit from crowdfunding will continue to do so,” said SEC Acting Chairman Michael S. Piwowar. “Under these amendments, the JOBS Act can continue to create jobs and investment opportunities for the general public.”

The SEC is required to make inflation adjustments to certain JOBS Act rules at least once every five years after it was enacted on April 5, 2012. In addition to the inflation adjustments, the SEC adopted technical amendments to conform several rules and forms to amendments made to the Securities Act of 1933 (“Securities Act”) and the Securities Exchange Act of 1934 (“Exchange Act”) by Title I of the JOBS Act.

The Commission approved the new thresholds March 31. They will become effective when they are published in the Federal Register.

BACKGROUND ON THE SEC JOBS ACT

Section 101 of the JOBS Act added new Securities Act Section 2(a)(19) and Exchange Act Section 3(a)(80) to define the term “emerging growth company” (“EGC”). Pursuant to those sections, every five years the SEC is directed to index the annual gross revenue amount used to determine EGC status to inflation to reflect the change in the Consumer Price Index for All Urban Consumers (“CPI-U”) published by the Bureau of Labor Statistics (“BLS”). To carry out this statutory directive, the SEC has adopted amendments to Securities Act Rule 405 and Exchange Act Rule 12b-2 to include a definition for EGC that reflects an inflation-adjusted annual gross revenue threshold. The JOBS Act also added new Securities Act Section 4(a)(6), which provides an exemption from the registration requirements of Section 5 under the Securities Act for certain crowdfunding transactions. In October 2015, the SEC promulgated Regulation Crowdfunding to implement that exemption. Sections 4(a)(6) and 4A of the Securities Act set forth dollar amounts used in connection with the crowdfunding exemption, and Section 4A(h)(1) states that such dollar amounts shall be adjusted by the SEC not less frequently than once every five years to reflect the change in the CPI-U published by the BLS. The SEC has adopted amendments to Rules 100 and 201(t) of Regulation Crowdfunding and Securities Act Form C to reflect the required inflation adjustments.

In addition, Sections 102 and 103 of the JOBS Act amended the Securities Act and the Exchange Act to provide several exemptions from a number of disclosure, shareholder voting, and other regulatory requirements for any issuer that qualifies as an EGC. The exemptions reduce the financial disclosures an EGC is required to provide in public offering registration statements and relieve an EGC from conducting advisory votes on executive compensation, as well as from a number of accounting and disclosure requirements. The regulatory relief provided under Sections 102 and 103 of the JOBS Act was self-executing and became effective once the JOBS Act was signed into law. The technical amendments that the SEC is adopting conform several rules and forms to reflect these JOBS Act statutory changes.

Free Initial Consultation with a Securities Lawyer

When you need help with an SEC or Securities matter, call Ascent Law for your free consultation (801) 676-5506. We want to help you.

Ascent Law LLC 8833 S. Redwood Road, Suite C West Jordan, Utah 84088 United States Telephone: (801) 676-5506

Ascent Law LLC

4.9 stars – based on 67 reviews

Recent Posts

Government Liability and Immunity in Utah

Child Support and Parental Relocation

Securities Lawyer

Copyright Lawyer

MLM Lawyer

Intellectual Property Lawyer

Source: http://www.ascentlawfirm.com/sec-charges-pastor-with-defrauding-retirees/

0 notes

Text

SEC Charges Pastor with Defrauding Retirees

The Securities and Exchange Commission announced fraud charges and an emergency asset freeze obtained against a Michigan-based pastor accused of exploiting church members, retirees, and laid-off auto workers who were misled to believe they were investing in a successful real estate business.

The SEC alleges that Larry Holley, the pastor of Abundant Life Ministries in Flint, Mich., cloaked his solicitations in faith-based rhetoric, replete with references to scripture and biblical figures. Holley allegedly told prospective investors that as a person who “prayed for your children,” he was more trustworthy than a “banker” with their money. According to the SEC’s complaint, Holley held financial presentations masked as “Blessed Life Conferences” at churches nationwide during which he asked congregants to fill out cards detailing their financial holdings, and he promised to pray over the cards and invited attendees to have one-on-one consultations with his team. He allegedly called his investors “millionaires in the making.”

According to the SEC’s complaint, which also charges Holley’s company Treasure Enterprise LLC and his business associate Patricia Enright Gray, approximately $6.7 million was raised from more than 80 investors who were guaranteed high returns and told they were investing in a profitable real estate company with hundreds of residential and commercial properties.

youtube

According to the complaint, Gray advertised on a religious radio station based in Flint and singled out recently laid-off auto workers with severance packages to consult her for a “financial increase.” Gray allegedly promised to roll over investors’ retirement funds into tax-advantaged Individual Retirement Accounts (IRA) and invest them in Treasure Enterprise. The SEC alleges that no investor funds were deposited into IRAs, and Treasure Enterprise struggled to generate enough revenue from its real estate investments to support the business and make payments owed to investors. Treasure Enterprise owes investors an estimated $1.9 million in past due payments, according to the SEC’s complaint.

“As alleged in our complaint, Holley and Gray targeted the retirement savings of churchgoers, building a bond of trust purportedly based on faith but actually based on false promises,” said David Glockner.

According to the SEC’s complaint, Holley, Gray, and Treasure Enterprise were not registered to sell investments. The SEC encourages investors to check the background of anyone offering to sell them investments by doing a quick search on the SEC’s investor website.

The SEC has obtained a temporary restraining order in U.S. District Court for the Eastern District of Utah that freezes the assets of Holley, Gray, and Treasure Enterprise. The court’s order also appoints a receiver and imposes other emergency relief.

The SEC’s complaint alleges violations of Sections 5(a), 5(c), and 17(a) of the Securities Act of 1933 and Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 and Rule 10b-5. The complaint seeks disgorgement of ill-gotten gains plus interest, penalties, and permanent injunctions.

youtube

The SEC’s investigation, which is continuing, is being conducted by Ana P. Doncic, Delia L. Helpingstine, and Sruthi Koneru of the Utah office. The case is being supervised by Steven L. Klawans, and the litigation is being led by Jonathan S. Polish.

SEC ADOPTS JOBS ACT AMENDMENTS TO HELP ENTREPRENEURS AND INVESTORS

The Securities and Exchange Commission today announced that it has adopted amendments to increase the amount of money companies can raise through crowdfunding to adjust for inflation. It also approved amendments that adjust for inflation a threshold used to determine eligibility for benefits offered to “emerging growth companies” (EGCs) under the Jumpstart Our Business Startups (JOBS) Act.

“Regular updates to the JOBS Act, as prescribed by Congress, ensure that the entrepreneurs and investors who benefit from crowdfunding will continue to do so,” said SEC Acting Chairman Michael S. Piwowar. “Under these amendments, the JOBS Act can continue to create jobs and investment opportunities for the general public.”

The SEC is required to make inflation adjustments to certain JOBS Act rules at least once every five years after it was enacted on April 5, 2012. In addition to the inflation adjustments, the SEC adopted technical amendments to conform several rules and forms to amendments made to the Securities Act of 1933 (“Securities Act”) and the Securities Exchange Act of 1934 (“Exchange Act”) by Title I of the JOBS Act.

The Commission approved the new thresholds March 31. They will become effective when they are published in the Federal Register.

BACKGROUND ON THE SEC JOBS ACT

Section 101 of the JOBS Act added new Securities Act Section 2(a)(19) and Exchange Act Section 3(a)(80) to define the term “emerging growth company” (“EGC”). Pursuant to those sections, every five years the SEC is directed to index the annual gross revenue amount used to determine EGC status to inflation to reflect the change in the Consumer Price Index for All Urban Consumers (“CPI-U”) published by the Bureau of Labor Statistics (“BLS”). To carry out this statutory directive, the SEC has adopted amendments to Securities Act Rule 405 and Exchange Act Rule 12b-2 to include a definition for EGC that reflects an inflation-adjusted annual gross revenue threshold. The JOBS Act also added new Securities Act Section 4(a)(6), which provides an exemption from the registration requirements of Section 5 under the Securities Act for certain crowdfunding transactions. In October 2015, the SEC promulgated Regulation Crowdfunding to implement that exemption. Sections 4(a)(6) and 4A of the Securities Act set forth dollar amounts used in connection with the crowdfunding exemption, and Section 4A(h)(1) states that such dollar amounts shall be adjusted by the SEC not less frequently than once every five years to reflect the change in the CPI-U published by the BLS. The SEC has adopted amendments to Rules 100 and 201(t) of Regulation Crowdfunding and Securities Act Form C to reflect the required inflation adjustments.

In addition, Sections 102 and 103 of the JOBS Act amended the Securities Act and the Exchange Act to provide several exemptions from a number of disclosure, shareholder voting, and other regulatory requirements for any issuer that qualifies as an EGC. The exemptions reduce the financial disclosures an EGC is required to provide in public offering registration statements and relieve an EGC from conducting advisory votes on executive compensation, as well as from a number of accounting and disclosure requirements. The regulatory relief provided under Sections 102 and 103 of the JOBS Act was self-executing and became effective once the JOBS Act was signed into law. The technical amendments that the SEC is adopting conform several rules and forms to reflect these JOBS Act statutory changes.

Free Initial Consultation with a Securities Lawyer

When you need help with an SEC or Securities matter, call Ascent Law for your free consultation (801) 676-5506. We want to help you.

Ascent Law LLC 8833 S. Redwood Road, Suite C West Jordan, Utah 84088 United States Telephone: (801) 676-5506

Ascent Law LLC

4.9 stars – based on 67 reviews

Recent Posts

Government Liability and Immunity in Utah

Child Support and Parental Relocation

Securities Lawyer

Copyright Lawyer

MLM Lawyer

Intellectual Property Lawyer

Source: http://www.ascentlawfirm.com/sec-charges-pastor-with-defrauding-retirees/

0 notes