#trader funding uk

Explore tagged Tumblr posts

Video

tumblr

Every trader started somewhere. And for a lot of us, getting into the market before the 2000’s was more about finding people IRL (in real life) that did trade, or knew someone who did. They would then make in-person contact, ask questions, and build their own knowledge base.

Learn more about funded trading here: https://traderfundingprogram.com/

Learn more about funded trading here in USA: https://traderfundingprogram.com/usa-new-york

Learn more about funded trading here in UK: https://traderfundingprogram.com/uk-london

Learn more about funded trading here in Canada : https://traderfundingprogram.com/canada-toronto

Learn more about funded trading in Australia here: https://traderfundingprogram.com/australia-sydney

Learn more about funded trading in India here: https://traderfundingprogram.com/india-mumbai

#trader funding usa#trader funding new york#trader funding uk#trader funding london#trader funding australia#trader funding sydney#trader funding canada#trader funding toronto#trader funding india#trader funding mumbai

0 notes

Text

Conquer the US forex market! Bespoke Funding Program helps you choose the right forex trading platform. Explore benefits, key considerations & popular platforms in the USA.

#forex funding program#forex trading platforms usa#forex trading usa#prop trading firms in usa#prop firm accounts#forex trader in uk#prop firms uk

0 notes

Text

Unlock Advanced Trading Potential with Stock Professional Funding Account Package

Our Stock Professional Funding Account Package is tailored for seasoned traders with years of experience in equities trading, whether on a retail or institutional level. If you possess an in-depth understanding of macro/microeconomic influences and a track record of proven successful strategies, this package is designed to elevate your trading to the next level.

#Stock Professional Funding Account Package#Funded Trader#funded trading accounts uk#fully funded trader#trading stock and forex#stock and forex trading business

1 note

·

View note

Text

Market Volatility Alert: US Banks' Take on Credit Squeeze

Wayne Cole provides a brief insight into the upcoming trading day in the European and global markets. Despite the new week, Asia seems to be off to a slow start, which is not unusual, as the market gears up for the release of US consumer prices data, set to be a major test of the market's confidence in the Fed's decision to halt rate hikes. Futures currently show a 90% likelihood of steady rates in June and a 38% chance of a cut as early as July, leaving the market exposed to an upside surprise on the CPI.

While the median forecasts predict a rise of 0.4%, the range is 0.2% to 0.6%, and any unexpected figure could have a significant impact on the market.

#USBanks#creditsqueeze#interestrates#loan demand#profitability#Brexit#UK#nodeal#pound#investors#earningsreports#Fed#borrowingcosts#futurechallenges#Europe.#FTG#Funded Traders Global

0 notes

Text

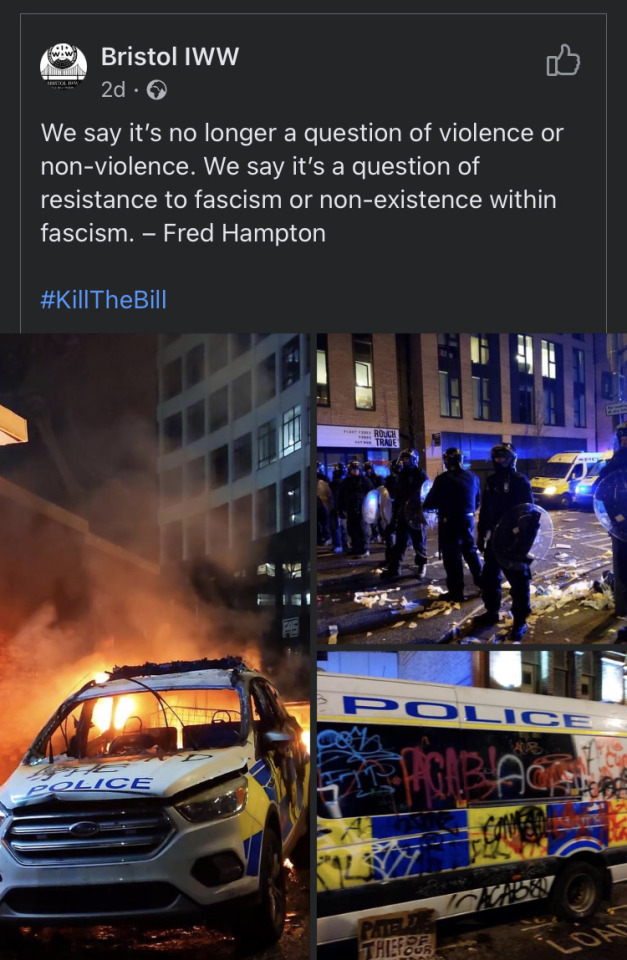

From the Bristol, UK, IWW Chapter:

“Uprisings in Bristol UK have been continuing since Sunday against the new Police and Crime Bill which would restrict peoples right to peacefully protest and would give 10 yeah prison sentences for people causing damage to statues (the usual sentence for rape in the UK is only 5 years).

The bill also includes many restrictions on traveler communities in the UK who throughout the covid lockdown have faced violence and illegal evictions. This Bill would institutionalise this violence and illegalise the lifestyle of a marginalised and regularly persecuted minority group.

This comes in a time when people are still mourning the death of Sarah Everard who was attacked and murdered by an off duty Met police officer while walking home. Women held vigils around the country for Sarah and some of these were broken up by the police and attendees arrested (by male police colleagues of the officer charged with the murder).

Here in Bristol the Black Lives Matter movement is also very strong and many people feel that the Police and Crime Bill is a response to the people of Bristol pulling down of a statue to Edward Colston, a slave trader who funded many of the cities major institutions.

Locally these struggles have intersected in the #KillTheBill movement and peaceful protests have repeatedly been attacked by the police, causing a revolt on Sunday where Bristolians lay siege to the police station and set several cop vehicles on fire.

Last night, an explicitly peaceful protest was again attacked by police and a number of people arrested and beaten with shield and batons, charged with horses and dogs. Travelers had come to hold space in a public park where they could make their voices heard but they were attacked in the night by the cops, arrested, beaten and their dwellings and property destroyed without consideration that some had nowhere else to go. Several protestors were hospitalised and many more suffered minor injuries.

When young people lay down in the streets shouting that it was a 'peaceful demonstration' the cops charged in, again beating people and arresting anyone who wasn't able to flee. This took place in the middle of a residential area where many of these folks actually live.

For several nights the streets of Bristol have become a physical and metaphorical battleground that may determine the rights and freedoms for all people living in the UK.

Kill The Bill has no official organisers and actions have been mostly autonomous and spontaneous, this includes a march of 5,000 people in support of the protests on Sunday.

Members of Bristol IWW have continually done what we can to support these protests, including providing first aid for protestors who have been injured by the police. While we know some on the British left may question why we have offered our support to this autonomous street movement rather than appealing to the parliamentary system and its antiquated processes. Some even question why we would take part in events that have seen the destruction of police equipotent and self defense used against the cops. We be believe our position to be clear and consistent as members of a revolutionary working class union.

"There can be no peace so long as hunger and want are found among millions of the working people and the few, who make up the employing class, have all the good things of life.

Between these two classes a struggle must go on until the workers of the world organise as a class, take possession of the means of production, abolish the wage system, and live in harmony with the Earth.””

359 notes

·

View notes

Text

It all started under a duvet held up by an oar

Not so long ago I emailed Chris Tester, the voice of Heinrix van Calox in Owlcat’s recently released CRPG Rogue Trader, and asked if he would like to sit for an interview with me. Having some experience in interviewing people I like, most famously Oscar winner and all-around sweetheart Eddie Redmayne, this was not a completely nerve-wracking endeavour. And within a day of sending my email, Chris said yes. And what a pleasure it was interviewing him: Chris was so generous with his time, that the agreed upon 30 minutes turned into 50 minutes as we brushed upon many topics from his start as a theatre actor to his first voice-over role in a video game to his recently discovered hobby of playing D&D. Of course, we also spoke about all things Warhammer 40k, his new found fame brought on by voicing Heinrix and the insights he could share about the character.

I will publish this interview in three parts over the next week in text form and with the accompanying audio file (the audio quality is not spectacular but tumblr limits uploads to 10MB). If you quote or reshare, please quote me as the original source.

Part 2 of the interview

Part 3 of the interview

Fran: Thank you very much for taking your time.

Chris Tester: That's no problem. No problem at all.

F: So then let's start. You graduated in 2008.

CT: I did. Yes.

F: You started out as a stage actor. Did you always want to become a stage actor or an actor in general? Tell us a bit about your career.

CT: I always wanted to be a stage actor. Yes, as soon as I knew that I wanted to be an actor, which probably wasn't until I was a teenager. But yeah, my first passion was always the stage, and that was kind of borne out in my career. I would have been open to TV and film of course, if it had come along, I'm a huge fan of TV and film as well, but I never got an audition for any TV or film work.

I think I literally did about three short films in my 10, 12 years of actually professionally acting, and it is one of those industries where the more you do of one thing, the more you seem to find yourself doing the same thing to a degree. So yes, watching Shakespeare from an early age was one of my first passions.

And that was what first planted the seed of wanting to do it myself. The whole aspect of live performance is still something that I'm very passionate about. Up until 2020, when the world changed, I was trying to do two or three theatre shows a year, but since 2020, I haven't been near a stage and I doubt right now, especially with the way that the UK theatre scene is going, that I'm going to be back on stage anytime soon. I am resigned to that, but at some point in my career, I know I will be on stage again, because I can't live without it, but only for the right thing, both financially, but more importantly, creatively.

F: Your production company is currently on hiatus?

CT: I was the producer of a theatre company, which was run and was the baby of the director of the company, a guy called Ross Armstrong, who's one of the most talented writers and directors that I've ever worked with. I was helping out with a lot of the administration stuff so that he could still put me in plays. Instead of creating my own work because I'm not a very good writer or the best writer in the world, I support those people who will write me good parts. So yes, it is currently on hiatus, but never say never, we would always be looking to get back. It's difficult right now. It's difficult for all of us, because arts council subsidy, that way of being able to fund stuff, is drying up. We were doing a national tour of the UK when we were doing that [with the support of a subsidy]. There's even less money, there's even more people. I won't bore you with anything more than that, but it's kind of tough. We'd like to come back, but in the right way, and that's tricky to negotiate.

F: It's always hard as a stage actor to earn a living.

CT: Well, I've been spoiled by voice-over as well, and whereas when I was in my 20s and 30s then you're all about your art. And of course, I'm still all about my art, but I'm also about my wife and my cat and the mortgage and the bills and wanting to have nicer things to a degree as well. I've come to terms with that and voice-over does facilitate that as well as it opens you up to different roles and working with different people. So, I can't complain.

F: It's quite similar with making a living as a writer, because with a steady income you get used to a certain standard of living and once you have obligations and bills to pay, I think the stress on your mental health being creative and having all the stresses of regular life thrust upon you brings with it a challenge.

CT: It's a cliche we can very easily fall into: if I'm suffering, then it means I'm an artist. And that's not necessarily very true. It very often means that the art that we create only reflects one aspect of our lives, and it's usually a very tortured one. I am also about having wider experiences and broadening myself out. Whereas I think when I was in my twenties, I was thinking a bit more like: Oh, I'll experience the world and life through my art and just purely through my art. Whereas now necessarily I need to have a life outside of it as well, and then I can justify like I have the life so that I can feed my art or not, whatever. You know, I'll be a better artist by having a bit of a life outside of it. Maybe.

F: But that's what your twenties are for.

CT: Yeah, indeed.

F: Doing the crazy stuff, doing the band stuff

CT: Yeah, yeah, exactly. So, there was certainly an aspect of that in my twenties.

F: So, what brought you to voice acting or voice-over work initially?

CT: Money. Video game stuff is kind of sexy and cool, and I'm a gamer, so that's important. Before I was a video gamer, I was a board gamer and off the back of that, I was a voracious video gamer, partly because I wasn't very good at team sports at school. I was always the person who was picked last in the football team. So that becomes part of your identity for better or worse. But video games, I was pretty good at, not amazing, but I was pretty good at, and I enjoyed it. And it gave me a different form of escapism as well, and off the back of that I always had an interest in them.

So, the very first voiceover job was a video game: Dark Souls, which is quite a big franchise. At that time, I was your very typically jobbing actor. My acting agent came in and said: I got something for you. And so, I went in with that. But it was only in 2016, 2017 that I realised it was something that you could actually do yourself. People had recording studios at home and they were contacting people directly, not just going through agents. Because I'd basically written to the same 20 voice agents in the UK, mainly in London for like eight years in a row and not received anything. So, you keep knocking on those doors hoping.

Before I'd even graduated from drama school, I'd burnt a CD and made these cases with my headshot on it and sent them all off at what at the time felt like great personal expense and didn't get anything for eight years in a row. So, I was a bit like, I'm obviously doing something wrong, but I don't really know what, because I'm doing these workshops and getting good feedback. Then I found out through a couple of online courses, that there were ways and means of doing it myself, and that was a bit of a game changer for me, and within six months of having started, I was earning more through voice work than the bar job and the box office job that I was doing combined. Within six months, I was kind of like: “I gotta quit because I'm actually holding myself back from things.” So that was quite a big shift.

F: Somewhere you said, you started out under a duvet and with an oar.

CT: Yeah. On my website, I do have an image of it. [Dear reader, I could not locate this elusive photo] I literally had to take the duvet off my bed and put it into the living room, which was the quietest space in my then shared flat. I also had to wait until after one flat mate had watched TV and another one had used the table that had their washing on it. One of my flat mates had stolen an oar from some night out and that was perfect in order to be able to erect it over my head and the duvet as a frame.

I did probably the first four or five months of voice recording like that. Probably about 10, 15 voiceover jobs that I actually got paid for, I was using that because it worked well enough. Since then, I've gone through various different iterations of a setup in the bedroom, to a setup in the hallway, to my current setup. In 2020 we moved to our first house, and this is the spare bedroom which I've had converted into a studio, which means my cat can be here asleep on me or near me getting fur everywhere, but it's fine. I can thrash around and I've got natural light to work in at the same time, which I find quite important. [Pictured below Chris' current setup.]

F: Very pretty. That's good. Guide us through a typical day of yours, if you like.

CT: Oh, sure. I mean, there is no typical day. And yet, and yet, and yet. A typical day for me is, because I am spending the vast majority of the day sitting in this room or somewhere close to this room, because I may need to record at short notice, because the vast majority of jobs are quite short notice. My priority is exercise for mental health more than anything. I've got some weights at the bottom of the garden, and I will get up first thing, and I will go there and I will do that after breakfast. And that's my minimal routine of physical activity done.

And then I'll come back, and this is so rock and roll. Now what I do is, I spend like an hour on LinkedIn. And that's what you dreamed of as a creative person. Isn't it as an actor? I spend time on LinkedIn regularly every day, because it's a really good networking place for a lot of my types of work, and first thing in the morning, I'm a bit mentally sharper. So that's when I come up with a quick post that may be inspired by a bit of content that I've made elsewhere. That probably takes about 20 minutes and then I spend another 45 minutes to an hour engaging with people and saying hi and introducing myself and asking questions, whether that's with video producers or game developers or documentary makers or pretty much anything and everything. There are a lot of people who are active at that time. And so I do it.

And then after that, if I already have some recording lined up, then I'll prioritise mid-morning, because I've warmed up physically a bit more then, and I'm focused. So, you're going through the scripts, annotating the scripts, recording the scripts, editing the scripts. But then there could be live sessions at any time within that as well. I try to keep hours from nine till six. But occasionally, like with Rogue Trader, that was recorded at various different times of the day because we had people in New York, we had people in mainland Europe, and we had people in the UK. So all different time zones, so that can happen at any time.

And then I try to do other kinds of bits and pieces of marketing whenever I've got free time to. I do use really exciting productivity hacks, like time blocking. Again, not something that as a creative individual, I was like: Oh God, this gets me so excited, because it doesn't, but it works. It's finding a system that works for you, but still has a certain kind of flexibility and fluidity. I'm trying to make sure that I get outside of the house, and that kind of stuff.

Recently, over the last year, I’ve started doing audiobooks as well. That long form type of thing is quite nice to be able to dip into because sometimes you don't record for two, three days. You don't get the work. Nothing’s coming in. So, you’re marketing, but it kind of connects you back to the performance side of things to go: I can do a few chapters and you know, that kind of thing. So that's probably it. I try to formalise it, but you know, every voice actor’s day is radically different. There are people, some of the biggest names, going into different studios every week or every day. I very rarely, despite being based in London, I very rarely go into external studios. Like I would say 99 percent of the work I just do from home.

F: So how do you find the right voice for the specific type of voiceover work you do, maybe start with how did you find Heinrix's voice?

CT: Thankfully, Owlcat sent through quite a detailed casting breakdown. So, you get a picture, and that's pretty crucial, as well as a short bio, in terms of the background of the character, but not too much, because you have to sign an NDA, a non-disclosure agreement. But even if you do sign an NDA, I think developers are always slightly hesitant of giving you too much info about the game because things could still be changed. But I think I did get a picture of Heinrix, if not in the first audition, then certainly on the second one. From that you immediately think about the physicality and what might affect the voice, and there was also some direction in terms of what they were looking for. Anybody who has heard the character and me, they do not sound radically dissimilar. There's not a transformative process that I needed to go through, other than his sense of authority and the space that he takes up and the sureness that he has in that he has a kind of divine right from the emperor, so that level of confidence being brought through.

The other part of the audition was about the void ship [the Black Ship] that he'd been raised in and the horrors that he'd seen. And you as the actor have to do the detective work to go like this is showing another side, the more vulnerable side, the side that underpins all of his life choices up to this point. It's essentially playing the opposite to a degree. So it was kind of knowing when to let those elements bleed through a little bit. I think I had probably about a page worth of scripts, quite a lot of script actually to audition with.

But I don't like to listen back to it a lot, because I think you get into your head. My biggest thing is stage work where it's ephemeral. You say it once and it could be different the next night. The whole point is that there's no one definitive way of doing things. Not quite the same with voice acting, where it's being recorded and you've got to get used to hearing it back. But I try not to overthink it. Just like record it two or three times with different impulses and then review and go like, those two seem pretty contrasting. I'll send those along and hope and then never hear anything back unless I do.

110 notes

·

View notes

Text

Why It’s Important to Learn from Top Forex Brokers Review for Choosing the Right Broker

In the vast world of Forex trading, selecting the right broker is a critical step that can significantly influence your trading success. With numerous brokers available, each with its own unique features, spreads, and platforms, making an informed decision can be daunting. This is where understanding top Forex brokers review becomes essential. In this article, we will explore why these reviews are crucial for your trading journey and how they can help you choose the right broker tailored to your needs.

Understanding the Role of Forex Brokers

Forex brokers serve as intermediaries between traders and the foreign exchange market. They facilitate currency trades, provide access to trading platforms, offer market insights, and assist with account management. A reputable broker ensures the safety of your funds, compliance with regulatory standards, and access to high-quality trading tools.

The Importance of Learning from Top Forex Brokers Reviews

1. Evaluating Credibility and Trustworthiness

When choosing a Forex broker, trust is paramount. Top Forex brokers review can help you assess a broker’s credibility through:

Regulatory Status: A regulated broker is overseen by financial authorities, ensuring adherence to strict guidelines. Reviews typically highlight whether brokers are regulated by entities such as the FCA (UK), ASIC (Australia), or NFA (U.S.). This oversight provides a level of safety for your funds.

User Feedback: Authentic experiences from other traders offer insights into a broker’s reliability. Positive reviews affirm a broker’s trustworthiness, while negative feedback can serve as a warning signal.

2. Understanding Trading Conditions

Different brokers offer varying trading conditions, which can greatly impact your profitability. By consulting top Forex brokers review, you can gather critical information about:

Spreads and Commissions: The costs associated with trading can vary widely. Reviews often provide comparisons of spreads and commissions, allowing you to identify brokers with competitive pricing.

Leverage Options: While leverage can amplify your trading potential, it also increases risk. Reviews clarify the leverage ratios different brokers offer, enabling you to choose one that aligns with your risk tolerance.

3. Assessing Customer Support

Having access to responsive customer support is vital in Forex trading. Issues can arise unexpectedly, and prompt assistance can make a difference. Reviews often cover:

Availability: Knowing whether a broker offers 24/5 or 24/7 customer support can help you select one that fits your trading schedule.

Quality of Service: Insights from user experiences can shed light on how quickly and effectively a broker resolves issues. Look for brokers with positive reviews regarding their customer service.

4. Examining Trading Platforms and Tools

The trading platform is your primary interface for executing trades and analyzing markets. A user-friendly platform can enhance your overall experience. Top Forex brokers review provide insights into:

Platform Usability: Reviews often discuss how intuitive and easy it is to navigate a broker’s platform. A smooth user experience can save you time and frustration.

Tools and Features: Different brokers offer various tools for technical analysis, charting, and automated trading. Understanding what features are available can help you choose a broker that meets your specific needs.

5. Identifying Educational Resources

For beginner traders, education is crucial. Many brokers provide educational resources to help traders develop their skills. Reviews typically highlight:

Quality of Educational Content: Look for brokers that offer comprehensive learning materials, including tutorials, webinars, and market analysis. Reviews can help you identify brokers that excel in educational support.

Access to Market Insights: Some brokers provide regular market updates and insights, which can be beneficial for traders at all levels. Reviews often highlight brokers that offer excellent analytical resources.

6. Understanding User Experience

User experience encompasses all aspects of dealing with a broker, from account setup to withdrawal processes. Reviews can reveal:

Ease of Account Setup: Many reviews detail how straightforward or complicated the account opening process is. A hassle-free setup can enhance your initial experience with a broker.

Withdrawal Processes: Timely and transparent withdrawals are critical. Reviews often highlight the experiences of other users regarding withdrawal times and any associated fees.

7. Avoiding Common Pitfalls

Not all brokers are transparent, and some may have hidden fees or unfavorable terms. Learning from top Forex brokers reviews allows you to:

Spot Red Flags: Frequent complaints about withdrawal issues, hidden charges, or poor customer service can signal potential problems with a broker.

Gain Insights from Others: Understanding the experiences of other traders can help you avoid common pitfalls and make more informed decisions.

How to Find Reliable Forex Broker Reviews

To maximize the benefits of top Forex brokers reviews, it’s essential to find trustworthy sources. Here are some tips:

Seek Established Review Platforms: Reputable financial websites often employ analysts who rigorously evaluate brokers, offering unbiased reviews.

Cross-Reference Information: Don’t rely solely on one review. Compare multiple sources to get a well-rounded view of a broker’s strengths and weaknesses.

Focus on Recent Reviews: The Forex landscape can change rapidly, so look for the most current reviews that reflect recent trading conditions.

The Top 10 Forex Brokers You Should Consider

Selecting the right Forex broker is a pivotal decision for anyone venturing into currency trading. With hundreds of brokers vying for your attention, each offering unique features, fees, and services, making an informed choice can be overwhelming. This comprehensive top Forex brokers review aims to simplify that process by presenting the top 10 Forex brokers, highlighting their strengths, trading conditions, and key features.

Why Choosing the Right Forex Broker Matters

1. Safety of Funds

A reliable broker ensures the safety of your capital. Brokers regulated by reputable authorities provide assurance that they adhere to stringent financial standards, protecting your investments.

2. Cost of Trading

Different brokers have varying spreads and commissions, which can significantly affect your overall profitability. Understanding these costs is vital for effective trading.

3. Access to Tools and Resources

The right broker provides tools, educational resources, and analytical data that can enhance your trading strategy and improve your skills.

4. Quality of Customer Support

When issues arise, having access to responsive customer support can make a significant difference in your trading experience.

Key Criteria for Evaluating Forex Brokers

To ensure a comprehensive review, we considered several important factors:

Regulation: Is the broker regulated by a reputable authority?

Trading Costs: What are the spreads, commissions, and other fees?

Trading Platforms: How user-friendly and feature-rich are the platforms offered?

Customer Support: What kind of support is available, and how responsive is it?

Educational Resources: Are there resources available to help traders improve their skills?

The Top 10 Forex Brokers

1. IG Group

Overview: IG Group is one of the oldest and most respected Forex brokers in the world, known for its robust trading platform and extensive market offerings.

Regulation: Regulated by FCA (UK) and ASIC (Australia).

Trading Costs: Spreads from 0.6 pips on major pairs.

Platform: Proprietary platform and MetaTrader 4.

Customer Support: 24/5 support via phone, email, and live chat.

Educational Resources: Offers webinars, trading guides, and market analysis.

2. Forex.com

Overview: Forex.com, a subsidiary of GAIN Capital, is well-known for its user-friendly platform and comprehensive trading services.

Regulation: Regulated by NFA and CFTC (U.S.).

Trading Costs: Spreads start from 0.2 pips.

Platform: Proprietary platform and MetaTrader 4.

Customer Support: 24/5 support through multiple channels.

Educational Resources: Extensive educational content, including videos and articles.

3. OANDA

Overview: OANDA is recognized for its transparent pricing and high-quality trading data, appealing to both beginners and experienced traders.

Regulation: Regulated by CFTC (U.S.) and FCA (UK).

Trading Costs: Spreads start at 1 pip, with no commission on standard accounts.

Platform: Proprietary platform and MetaTrader 4.

Customer Support: 24/5 customer support via phone and email.

Educational Resources: Offers a variety of educational materials and market insights.

4. eToro

Overview: eToro is a pioneer in social trading, allowing users to copy the trades of successful traders and engage with a vibrant community.

Regulation: Regulated by FCA (UK) and CySEC (Cyprus).

Trading Costs: Spread-based fees with no commissions on stock trading.

Platform: Unique social trading platform and mobile app.

Customer Support: 24/5 customer support.

Educational Resources: Provides trading guides, webinars, and community features.

5. XM Group

Overview: XM is known for its flexible trading conditions and a variety of account types tailored to different trading strategies.

Regulation: Regulated by ASIC (Australia) and CySEC (Cyprus).

Trading Costs: Spreads from 0.0 pips on certain accounts.

Platform: Supports MetaTrader 4 and 5.

Customer Support: Available 24/5 in multiple languages.

Educational Resources: Offers webinars, trading articles, and various tools for traders.

6. Pepperstone

Overview: Pepperstone is favored for its low-cost trading environment and exceptional customer service.

Regulation: Regulated by ASIC (Australia) and FCA (UK).

Trading Costs: Spreads as low as 0.0 pips on Razor accounts.

Platform: MetaTrader 4, MetaTrader 5, and cTrader.

Customer Support: 24/5 support via live chat, phone, and email.

Educational Resources: Extensive educational materials including articles and tutorials.

7. Saxo Bank

Overview: Saxo Bank caters to professional traders with its premium trading tools and a wide range of assets.

Regulation: Regulated by FCA (UK) and FSA (Denmark).

Trading Costs: Competitive pricing with low spreads for premium accounts.

Platform: SaxoTraderGO and SaxoTraderPRO.

Customer Support: 24/5 customer support via multiple channels.

Educational Resources: Provides in-depth market analysis and educational content.

8. FXTM (ForexTime)

Overview: FXTM is known for its flexible trading options and extensive educational resources for traders.

Regulation: Regulated by FCA (UK) and CySEC (Cyprus).

Trading Costs: Spreads from 0.1 pips on ECN accounts.

Platform: Supports MetaTrader 4 and 5.

Customer Support: Available 24/5 via phone and email.

Educational Resources: Offers webinars, seminars, and market analysis.

9. IC Markets

Overview: IC Markets is preferred by high-frequency traders for its low-cost trading environment and excellent liquidity.

Regulation: Regulated by ASIC (Australia).

Trading Costs: Spreads as low as 0.0 pips.

Platform: MetaTrader 4, MetaTrader 5, and cTrader.

Customer Support: 24/7 customer support available.

Educational Resources: A range of tutorials and market insights are provided.

10. Admiral Markets

Overview: Admiral Markets offers diverse account types and a wide range of trading instruments, catering to both beginners and experienced traders.

Regulation: Regulated by FCA (UK) and ASIC (Australia).

Trading Costs: Competitive spreads starting from 0.0 pips.

Platform: MetaTrader 4 and 5.

Customer Support: 24/5 support via live chat, phone, and email.

Educational Resources: Extensive educational materials and market analysis available.

In the competitive landscape of Forex trading, choosing the right broker is essential for your trading success. This top Forex brokers review highlights some of the best options available, each with unique features that cater to different trading styles and needs.

When making your choice, consider your trading goals, risk tolerance, and the specific features that are most important to you. Whether you prioritize low trading costs, advanced platforms, or robust educational resources, the brokers listed above provide excellent starting points for your trading journey.

Conclusion

In the fast-paced world of Forex trading, selecting the right broker is vital for your success. By utilizing top Forex brokers review, you can gain valuable insights into broker credibility, trading conditions, customer support, and overall user experience. This informed approach not only increases your chances of finding a suitable broker but also enhances your overall trading experience.

Investing time in researching and comparing brokers through reviews is a wise step that can lead to better trading outcomes and greater confidence in your trading decisions. By being well-informed, you can navigate the Forex market more effectively and work towards achieving your trading goals. Happy trading!

2 notes

·

View notes

Note

Did you say you lived in Botswana? Botswana always ranks pretty high on HDI, corruption, quality of life measurements, especially for the region. Is that accurate to your experience, compared to SA?

My dad was moved there by his employer so I went to a private school and thus knew a lot of expat kids from like, India and the UK and the USA, not locals, so I can't give you a great read on that, also I moved back to ZA when I was twelve. The Batswana kids I knew growing up were still mostly the children of ministers or executives or successful entrepreneurs.

From talking to my parents, inequality seemed better in Gaborone than in many cities in South Africa, and there's much less obvious segregation because they didn't get apartheid. Gini index is still pretty bad and you can see it, there's a very wealthy trader, professional, and merchant class in Gaborone, like, The Dentist is also The Family That Owns The Movie Theater And Half The Pharmacies.

Gaborone is only 10% of the population, very sparsely populated country, lots of small to medium towns, I have no idea what life is like in the more far flung towns.

It's a weird one, the entire country only has two million and change people, the interior is largely the Kalahari desert.

Botswana has a lot of mineral wealth and a lot of it is captured effectively by the state, so that funds a pretty robust and reliable government that is harder for outside forces to influence, and the state seems very willing to exert its influence when it thinks it needs to.

#ask#anonymous#my inscrutable changeable accent can probably be attributed to my largely british schoolteachers#botswana

17 notes

·

View notes

Text

Mysteel UK Limited

Mysteel UK Limited - your reliable Forex partner

Mysteel UK Limited is a reputable forex broker that offers a wide range of services for traders in the currency market (Forex). The broker stands out for its reliability, professionalism and cutting-edge technology in order to provide customers with optimal conditions for successful trading in the financial markets.

Regulation and reliability: Is a licensed and regulated forex broker, which ensures the safety and security of client funds. The broker adheres to high standards of regulation and investor protection, which makes clients feel confident when working with the company.

Trading conditions: Offers competitive trading conditions that meet the needs of various traders. The broker provides access to a wide range of currency pairs and instruments, allowing clients to choose the most suitable assets to trade. In addition, Mysteel UK Limited offers low spreads, fast order execution and flexible leverage support.

Trading platforms: Offers advanced trading platforms that provide convenience and functionality for traders. These include popular platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which offer extensive market analysis, automated strategies and instant order execution.

Educational resources: The company values the education of its clients and provides extensive educational resources. The broker offers webinars, trainings, video tutorials and analytical materials that help traders expand their knowledge of the Forex market, develop trading skills and make more informed decisions.

Customer support: The broker has a responsive customer support team that is ready to help clients with any trading and technical issues. The support team is available 24/7 and can be reached through a variety of communication channels including phone, email and online chat.

Conclusion: Mysteel UK Limited is a reliable forex broker that offers clients a safe and profitable trading environment in the Forex market. With regulation, competitive trading conditions, advanced platforms, educational resources and professional customer support.

3 notes

·

View notes

Text

What is binance and types of trading & how to make money from it

Homecryptocurrency

What is binance and types of trading & how to make money from it

bywebcallon-March 09, 2023

0

what is binance

Binance is a global cryptocurrency exchange that was founded in 2017 by Changpeng Zhao, a former software developer at Bloomberg Tradebook. It has quickly become one of the most popular exchanges in the world due to its wide range of features and user-friendly interface. Binance is headquartered in Malta and has offices in various countries around the world.

One of the key features of Binance is its vast selection of cryptocurrencies. It currently supports over 500 different coins and tokens, making it one of the most comprehensive exchanges in the market. This allows users to access a wide range of investment opportunities and diversify their portfolio across different cryptocurrencies.

Binance also offers a variety of trading options, including spot trading, margin trading, and futures trading. Spot trading involves buying and selling cryptocurrencies for immediate delivery, while margin trading allows users to trade with borrowed funds, giving them the opportunity to increase their profits or losses. Futures trading involves trading contracts that allow traders to speculate on the price of a cryptocurrency at a future date.

In addition to trading, Binance offers a range of other services, including staking, savings, and lending. Staking involves holding cryptocurrencies in a wallet to support the network and earn rewards. Savings allows users to earn interest on their cryptocurrency holdings, while lending allows them to earn interest by lending their cryptocurrency to other users.

Binance also has its own cryptocurrency, Binance Coin (BNB), which can be used to pay for trading fees on the platform. BNB has become one of the most popular cryptocurrencies in the market, with a market capitalization of over $40 billion.

One of the key strengths of Binance is its security measures. The platform uses a variety of security features to protect user funds, including two-factor authentication, SSL encryption, and cold storage. Binance also has a Secure Asset Fund for Users (SAFU) that provides an extra layer of protection in case of security breaches or other unexpected events.

Another advantage of Binance is its user-friendly interface. The platform is designed to be easy to use, even for beginners, and offers a range of educational resources to help users learn about cryptocurrencies and trading. Binance also has a mobile app that allows users to trade and manage their portfolio on the go.

Despite its many strengths, Binance has faced some challenges in recent years. In 2019, the platform suffered a security breach that resulted in the theft of over $40 million worth of cryptocurrency. Binance responded quickly to the breach and was able to recover the stolen funds, but it highlighted the need for strong security measures in the cryptocurrency industry.

Binance has also faced regulatory scrutiny in some countries, including the United States and Japan. In 2021, the Financial Conduct Authority (FCA) in the UK banned Binance from operating in the country, citing concerns about its compliance with anti-money laundering (AML) regulations. Binance has since made efforts to improve its AML policies and has been working to address regulatory concerns in other countries.

In conclusion, Binance is a comprehensive and user-friendly cryptocurrency exchange that offers a wide range of trading options and services. Its vast selection of cryptocurrencies, security measures, and educational resources make it an attractive choice for both beginner and experienced traders. However, like any cryptocurrency exchange, it also faces challenges and risks, including security breaches and regulatory scrutiny. As with any investment, it is important for users to do their own research and carefully consider the risks before investing in cryptocurrencies.

Binance has grown rapidly since its launch in 2017 and has become one of the largest cryptocurrency exchanges in the world. According to CoinMarketCap, Binance is currently ranked as the 4th largest exchange by trading volume, with a 24-hour trading volume of over $12 billion at the time of writing.

Binance has also expanded its offerings beyond just cryptocurrency trading. In 2020, the exchange launched Binance Card, a debit card that allows users to spend their cryptocurrency holdings at merchants that accept Visa. Binance has also launched its own blockchain, Binance Chain, which is designed to facilitate the issuance and trading of digital assets.

Binance has also been active in the cryptocurrency industry through its various initiatives and investments. In 2019, the exchange launched Binance Labs, a blockchain incubator that invests in early-stage blockchain projects. Binance has also invested in other blockchain companies and projects, including Polkadot, Terra, and Oasis Labs.

Another notable feature of Binance is its customer support. The platform offers 24/7 customer support via live chat, email, and social media, which has earned it a reputation for being responsive and helpful. Binance also has a large community of users and supporters, with over 3 million followers on Twitter and over 2 million members in its official Telegram group.

In terms of fees, Binance is known for having some of the lowest trading fees in the industry. The platform charges a flat fee of 0.1% for spot trading and 0.04% for futures trading, with further discounts available for users who hold BNB. Binance also has a referral program that allows users to earn commission by referring new users to the platform.

Overall, Binance is a popular and well-established cryptocurrency exchange that offers a wide range of features and services for traders and investors. While it faces some challenges and risks, it has demonstrated a commitment to security, innovation, and customer support that has earned it a loyal following in the cryptocurrency community.

Binance has a strong focus on innovation and has been at the forefront of developing new products and features in the cryptocurrency space. In 2020, the exchange launched Binance Smart Chain, a blockchain platform that enables the creation of decentralized applications (dApps) and the execution of smart contracts. Binance Smart Chain has gained significant traction in the decentralized finance (DeFi) space, with a growing number of dApps being built on the platform.

Binance has also been active in the crypto lending space. In 2019, the exchange launched Binance Lending, a platform that allows users to lend their cryptocurrency holdings to other users and earn interest. Binance Lending has since expanded to offer a range of lending products, including flexible and fixed-term loans.

In addition to its lending platform, Binance has also launched a peer-to-peer (P2P) trading platform. P2P trading allows users to buy and sell cryptocurrencies directly with each other, without the need for a centralized exchange. This can be particularly useful in countries where cryptocurrency exchanges are restricted or banned.

Binance has also been actively involved in promoting cryptocurrency adoption and education. The exchange has launched a range of educational resources, including articles, videos, and webinars, to help users learn about cryptocurrencies and blockchain technology. Binance has also launched several initiatives aimed at promoting cryptocurrency adoption, such as the Binance Charity Foundation, which uses blockchain technology to facilitate charitable donations.

One area where Binance has faced criticism is in its listing process for new cryptocurrencies. Some critics have accused the exchange of prioritizing profit over due diligence, leading to the listing of some questionable cryptocurrencies. Binance has responded by implementing stricter listing requirements and conducting more thorough due diligence on new listings.

Overall, Binance is a dynamic and innovative cryptocurrency exchange that has become a major player in the industry. While it faces some challenges and criticisms, it has demonstrated a commitment to security, innovation, and customer support that has helped it attract a large and loyal user base.

Binance has a user-friendly interface that is easy to navigate, making it an attractive option for both novice and experienced traders. The platform also offers a range of advanced trading tools, such as advanced charting, technical analysis, and trading indicators. These tools allow traders to conduct detailed analysis and make informed trading decisions.

Binance also offers a range of order types, including limit orders, market orders, stop-limit orders, and trailing stop orders. These order types allow traders to execute their trades with greater precision and control.

Another feature of Binance is its margin trading platform. Margin trading allows users to trade with borrowed funds, enabling them to increase their potential profits (as well as their potential losses). Binance offers up to 125x leverage on select cryptocurrencies, which can be particularly attractive to experienced traders.

Binance also offers a range of security features to protect its users' funds and personal information. These include two-factor authentication (2FA), anti-phishing measures, and SSL encryption. Binance also has a Secure Asset Fund for Users (SAFU) that acts as an emergency insurance fund in the event of a security breach or hack.

Finally, Binance has a wide range of supported cryptocurrencies, including many of the most popular cryptocurrencies such as Bitcoin, Ethereum, and Litecoin, as well as a range of smaller and emerging cryptocurrencies. This makes it a one-stop-shop for users who want to trade a variety of cryptocurrencies on a single platform.

Overall, Binance offers a wide range of features and services that make it a popular and well-regarded cryptocurrency exchange. While it is not without its challenges and criticisms, it has demonstrated a commitment to innovation, security, and customer support that has helped it become a major player in the industry.

Types of trading in binance

Binance offers several types of trading for its users, including:

Spot Trading: This is the most common type of trading on Binance. In spot trading, users buy and sell cryptocurrencies at the current market price. The user's order is matched with an existing order on the exchange's order book.

Margin Trading: Binance offers margin trading, which allows users to trade with borrowed funds. This means users can increase their profits (as well as their losses) by trading with leverage. Binance offers up to 125x leverage on select cryptocurrencies.

Futures Trading: Binance also offers futures trading, which allows users to trade cryptocurrencies at a predetermined price at a future date. This type of trading is typically used by more experienced traders who want to hedge against price fluctuations.

Options Trading: Binance also offers options trading, which allows users to buy and sell options contracts based on the price of an underlying cryptocurrency. Options trading can be used for hedging, speculation, or generating income.

OTC Trading: Binance also offers over-the-counter (OTC) trading for large volume trades. This type of trading is typically used by institutional investors or high-net-worth individuals who want to avoid affecting the market price of a cryptocurrency.

Leveraged Tokens: Binance offers leveraged tokens that allow users to gain exposure to the price movements of cryptocurrencies without having to manage their own leveraged positions. Leveraged tokens can be bought and sold on Binance like any other cryptocurrency.

Staking: Binance offers staking services for select cryptocurrencies. Staking involves holding a certain cryptocurrency in a wallet for a certain period of time to earn rewards. Binance offers staking rewards to users who hold certain cryptocurrencies on the exchange.

Binance Launchpad: Binance Launchpad is a platform that allows users to participate in initial coin offerings (ICOs) and other token sales. Binance Launchpad offers users the opportunity to invest in promising new blockchain projects before they are available on other exchanges.

Binance Savings: Binance Savings allows users to earn interest on their cryptocurrency holdings. Users can deposit their cryptocurrencies into Binance Savings and earn interest on a daily, weekly, or monthly basis.

Binance Pool: Binance Pool is a mining pool that allows users to mine cryptocurrencies and earn rewards. Binance Pool supports several cryptocurrencies, including Bitcoin and Ethereum.

Overall, Binance offers a wide range of trading options and services that cater to the needs of different users. Whether you're interested in spot trading, margin trading, futures trading, options trading, or staking, you can find a trading type that suits your needs on Binance.

how to make money from binance

There are several ways to make money from Binance. Here are some strategies that you can consider:

Trading: Trading cryptocurrencies on Binance can be a profitable way to make money. You can buy low and sell high to make a profit. Binance offers a wide range of trading types, including spot trading, margin trading, and futures trading, which can help you maximize your profits.

read more

#btc latest newsmake#crypto#crypto latest news#bitcoin#cryptocurrencies#ethereum#make money tips#make money for free#make money today

3 notes

·

View notes

Text

Funded Trading Accounts UK refers to trading accounts provided by proprietary trading firms in the United Kingdom, offering access to capital for traders to engage in financial markets. These accounts empower traders with the ability to trade with the firm's capital rather than their own, potentially amplifying trading opportunities and financial gains. Explore the benefits of funded trading accounts in the UK with #BespokeFundingProgram.

#Funded Trading Accounts Uk#Funded Trading Account#Forex Funding#Forex Funding Program#Forex Trader Funding#Funded Trader Programs#Forex Funded Account Uk

0 notes

Text

The Underrated Power of GBP/CAD and High-Frequency Trading Ah, the good old British Pound (GBP) and Canadian Dollar (CAD). One's known for its history, culture, and royalty. The other? Maple syrup, hockey, and an economy that knows how to pump oil. When they get together, sparks fly—financially speaking, of course. Today, we're taking a closer look at this dynamic duo in the world of Forex trading, specifically through the exhilarating (and sometimes terrifying) lens of high-frequency trading (HFT). Grab your favorite hot beverage, because we're about to reveal the hidden techniques, advanced strategies, and insider tips that can make your GBP/CAD trades as exciting as a plot twist in your favorite TV drama. The GBP/CAD Pair: A Hidden Gem in the Forex Market If you've been spending most of your time trading USD/EUR, let me stop you right there. It's like only ordering vanilla when the entire ice cream shop is in front of you. Sure, vanilla is nice, but why not explore the fascinating, often unpredictable world of GBP/CAD? The GBP/CAD currency pair offers volatility, potential for profit, and a depth that few traders truly understand. We're talking rollercoaster price action that's thrilling for those in the know. By leveraging high-frequency trading techniques, the opportunities for profit with this pair are nothing short of exhilarating. But before we dive too deep, let's set the stage by explaining what makes this pair such a high-stakes, high-reward playground for traders. A Quick Fact Check: GBP/CAD is known for its inherent volatility—largely due to the fact that both currencies are heavily influenced by geopolitical and economic events. Think Brexit, think oil price swings—trading GBP/CAD can sometimes feel like you're trying to predict a cat's next move. And you know how cats are—adorable, but slightly psychotic. High-Frequency Trading 101: The Invisible Hand of the Market Okay, so let's talk about high-frequency trading, or HFT, and how it connects with the GBP/CAD currency pair. HFT is like speed dating but with trades—quick, automated, and prone to unexpected outcomes if you're not careful. Algorithms are designed to take advantage of tiny price discrepancies that occur over milliseconds. This isn't your average "sit back and wait for a trend to form" approach. No, HFT is for those who want to move at lightning speed—those who have the chops to make hundreds or even thousands of trades in a day. Insider Tip: High-frequency trading in GBP/CAD is like finding a golden egg in a goose nest that most people walk right past. Because this pair is often underappreciated compared to its flashier cousins, it presents unique opportunities that HFT can uniquely capitalize on. But here's the rub—you're not alone. Hedge funds and big banks are also eyeing these trades, and they have deep pockets. The trick to standing out? Find the patterns they overlook. The Hidden Patterns That Drive the GBP/CAD Market HFT in the GBP/CAD market involves recognizing patterns most traders can't see because, let's be real, they're often too busy chasing the major pairs like everyone else. The GBP/CAD pair tends to spike when oil prices shift, or when a major political event hits the UK. The smart HFT trader knows how to use this. But here's where things get really interesting: the Bank of Canada and the Bank of England often make announcements that send waves through the market. The algorithms used in HFT can pick up on these movements in fractions of a second and execute trades accordingly. It's like having a friend who’s a master at reading people’s expressions and can tell exactly when someone is bluffing at poker. Proven Technique #1: Sentiment Analysis for GBP/CAD It's not all about the tech, though. If you're really going to play with the big boys, you need to understand how to incorporate sentiment analysis into your HFT strategy. Basically, you want to program your trading algorithm to recognize market sentiment based on news releases. For instance, news about unexpected growth in the UK economy can give the GBP a nice little boost. By programming your HFT system to identify keywords from news releases—you can execute trades at a faster rate than your average trader could even blink. Myth-Busting Moment: Some traders think high-frequency trading is reserved for hedge funds. The reality? With the right broker, tech stack, and a sound strategy, even retail traders can take advantage of HFT. Sure, you might not have the high-tech infrastructure of Goldman Sachs, but there's still enough room for the "little guy" to profit if you know what you're doing. Underground Trends in GBP/CAD High-Frequency Trading Here's a trend that’s flying under the radar: cross-pair arbitrage. While everyone is busy looking at EUR/USD or USD/JPY, savvy traders are capitalizing on price differences between GBP/CAD, EUR/CAD, and other cross pairs. The more eyeballs are glued to EUR/USD, the fewer are watching our trusty GBP/CAD. And fewer eyeballs? That's a win for those of us who like to stay hidden. Advanced Technique #2: Latency Arbitrage Latency arbitrage is an HFT strategy that relies on price feeds from different brokers. This one's not for the faint of heart (or those with slow internet speeds), but when done right, it's like hitting the "fast-forward" button on your profit potential. Essentially, you're exploiting price differences that arise due to latency between broker feeds—entering and exiting trades in milliseconds. And with the GBP/CAD's frequent volatility spikes, latency arbitrage can be your secret weapon. Why Most Traders Get GBP/CAD Wrong (And How You Can Avoid It) You may have heard the saying, "If everyone is doing it, it’s probably wrong." Most traders are drawn to popular pairs. They think they understand GBP/CAD, but they end up trading it like it's EUR/USD—a big mistake. The truth is, the GBP/CAD pair has a mind of its own, and the best way to tackle it is to understand how it reacts to external forces—such as commodities like oil or global market sentiment regarding UK economic strength. Game-Changing Idea: Trade when everyone else is cautious. During big market-moving events (like Brexit votes or Canadian interest rate announcements), HFT traders can capitalize on the chaos while everyone else is holding their breath. Elite Tactics for Mastering GBP/CAD High-Frequency Trading - Set Tight Stops and Take Profits: The volatility in GBP/CAD is no joke. It can move fast in your favor, but it can also leave you hanging—kind of like asking someone for a high-five and being left hanging in public. Always use tight stop losses and have a clear take profit strategy. No one likes to be that person waving their hand in the air. - Utilize Volatility Breakout Strategies: Breakout trading is a perfect match for high-frequency systems. With GBP/CAD, look for times when volatility is spiking—often during major UK or Canadian economic reports. The trick is to let your system capture these breakouts faster than anyone else. - Monitor Key Economic Indicators: The British economy isn’t shy about letting the world know what’s happening. Take advantage of PMI reports, unemployment data, and retail sales numbers—all of which tend to cause wild swings. For CAD? It’s all about oil. Keep one eye on the crude market and the other on your GBP/CAD charts. - Hidden Formula: Correlation Exploitation - GBP/CAD can have a surprising correlation with oil prices and other currency pairs like EUR/GBP. Understanding these correlations can help you better predict price movements and automate your trades accordingly. For example, a sudden dip in oil prices might spell a weakening CAD, while the GBP might be less affected, resulting in a predictable move in the GBP/CAD pair. - Join the Community: High-frequency trading is tough to go at alone. I recommend joining a group like the StarseedFX community where traders share tips, insider analysis, and real-time insights. It’s always more fun when you’ve got a few friends along for the ride (https://www.starseedfx.com/community). Embrace the Chaos GBP/CAD might not be the most popular kid at the Forex school dance, but it knows how to bust a move. Whether you're diving into HFT or just looking for a pair with some real action, there's nothing quite like GBP/CAD. High-frequency trading is no walk in the park—it's more like sprinting through an amusement park full of twists, turns, and unexpected drops. But the thrills? Oh, they're worth every second. Remember, the key to winning with GBP/CAD and high-frequency trading is to understand the nuances—the correlations, the external forces, and the hidden opportunities. If you take the time to learn these, you'll have a fighting chance to be one of the few who truly gets it right. And if you want to go even deeper? Check out the latest Forex education courses, sign up for exclusive analysis, or grab your free trading journal from StarseedFX. Because, at the end of the day, the best traders are those who never stop learning. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

GRAINS-Chicago wheat set for 6% weekly rise on Black Sea supply worries BEIJING, Nov 22 (Reuters) - Chicago wheat firmed on Friday, poised for a more than 6% weekly gain, as Russia launched a hypersonic missile at a Ukrainian city, raising concerns over potential disruptions to exports from the breadbasket region. The most-active wheat contract on the Chicago Board of Trade (CBOT) Wv1 was up 0.09% at $5.70-4/8 a bushel, as of 0355 GMT. Soybean futures Sv1 were up 0.18% at $9.80 a bushel, but outlook for rising global supplies set them on course for a 1.9% weekly decline. Corn Cv1 gained 0.11% to $4.37 a bushel. "(Wheat) supplies held by major exporters Russia and France are much smaller than the world has gotten used to the last several years, and the two major exporters in the Black Sea growing area, Russia and Ukraine, remain at war with tensions escalating again," Bergman Grains Research said in a note. In a further escalation of the 33-month-old war, Russia fired a hypersonic intermediate-range ballistic missile at Dnipro on Thursday in response to the U.S. and the UK allowing Kyiv to strike Russian territory with advanced Western weapons, and warned that more could follow. The International Grains Council has trimmed its forecast for 2024/25 global wheat production by 2 million metric tons to 796 million tons, driven partly by a diminished outlook for the European Union. The UK wheat area for the 2025 harvest is forecast to rise by 5%, while rapeseed sowings are seen falling by 17% to a 42-year low, the Agriculture and Horticulture Development Board said in provisional results of its early bird survey. The U.S. Department of Agriculture confirmed private sales of 198,000 tons of U.S. soybeans to China and another 135,000 metric tons to unknown destinations, all for delivery in the 2024/25 marketing year. Argentina's 2024/25 soybean planting progressed by 16 percentage points in the past week, reaching 35.8% of the 18.6 million hectares projected for the season, according to the Buenos Aires Grain Exchange. China granted Brazil permission to export sorghum, fresh grapes, sesame and fish products to Chinese buyers, the Latin American country's agriculture ministry said on Wednesday. Commodity funds were net sellers of Chicago Board of Trade soybean, soymeal, soyoil, corn and wheat futures contracts, traders said.

0 notes

Text

How to Withdraw Money from Coinbase Wallet?

Are you wondering how to withdraw money from Coinbase Wallet? Coinbase, a popular cryptocurrency wallet and exchange, provides many features. One such advantage of using this service, if you reside in the US, is being able to transfer digital assets back into bank accounts easily. Simply transfer cryptocurrency from Coinbase Wallet into your bank account linked with Coinbase before exchanging this fiat currency back for cryptocurrency. This method works across a range of countries, including Australia and the UK. Coinbase's withdrawal process is easy and uses its wallet interface.

After signing into your Coinbase account, go to Wallet Dashboard/Overview and identify which cryptocurrency you would like to withdraw. Select it, and follow the on-screen instructions. Once your withdrawal request is approved, funds should arrive in your account within a few business days (depending on factors such as bank processing speed). As part of its effort to protect your accounts and avoid unauthorized transactions, additional documentation, and verification information such as photo ID or address proof may be requested from you as evidence of authenticity and protect your account further.

What Are the Cash-Out Options on Coinbase?

Coinbase provides a hosted crypto wallet service at no additional charge, giving users complete control of their private keys while being subject to custodial model restrictions. In addition, multiple withdrawal methods allow users to choose one that meets their individual needs - with these being some of your primary cash-out choices:

Bank Transfer: Bank Transfer is the go-to solution, enabling you to send fiat currencies like USD and EUR directly into your bank account. PayPal: If a digital wallet is more your style, then try PayPal instead - an excellent digital wallet alternative!

Crypto-to-Crypto transfers: When necessary, convert cryptocurrency to another currency before withdrawing it.

DebitCard Cash Out: Certain regions allow customers to withdraw directly from their debit cards.

How to Withdraw Money from Coinbase Wallet to Bank Account?

To withdraw money from Coinbase Wallet and deposit it directly into your bank account, follow these simple steps:

Transfer Funds Between Coinbase Wallet and Account:

Open the Coinbase wallet app, make sure your Coinbase Account is linked

Select the cryptocurrency of your choice to send, enter the recipient's address (your Coinbase Account address), and complete the transfer.

Once your cryptocurrency is in your Coinbase Account, click the "Buy/Sell section."

Select which cryptocurrency you would like to sell and enter its amount; once done, confirm its conversion into fiat currency.

Withdraw Fiat from Your Bank Account:

From the "Portfolio tab," choose your fiat wallet. Then, select your bank account by clicking "Withdraw."

Finally, please enter the amount to withdraw and confirm it before finalizing the transaction.

How to Withdraw Funds from Coinbase Pro?

Coinbase Pro provides experienced traders with an advanced trading platform with lower fees and larger limits. It also offers lower withdrawal fees and higher limits. To withdraw money from Coinbase Pro, follow these steps.

Coinbase Pro Login: Sign in to Coinbase Pro with your credentials.

Use "Deposit Option" to move funds over from Coinbase, and use its trading interface to transform cryptocurrency into fiat money.

Click "Withdraw" in the Portfolio tab, and select your fiat wallet by clicking it.

After choosing your withdrawal method (bank transfer or PayPal, for example), confirm all details by clicking "Confirm Details."

How Long Does It Take to Cash Out from Coinbase?

Cashing out from Coinbase varies based on your withdrawal method of choice and local banking systems; PayPal transfers typically occur within minutes, while cash-out times depend on how you select to withdraw your funds from Coinbase.

For instance, the bank transfers typically take 1-5 working days to complete. And instant transfer allows funds to be available quickly, but fees may be higher; please check processing time in your area since this can depend on both bank and country-specific factors.

How to Transfer Crypto from Coinbase?

To transfer Crypto from Coinbase, you need to take the steps mentioned below:

First, log into your Coinbase account using either mobile apps or websites.

Then select which cryptocurrency you would like to transfer by selecting it and providing its wallet address.

Review transaction details before finalizing them and confirm them before continuing with transactions.

Make sure to remember that network fees may apply depending on which blockchain is chosen.

What Is the Difference Between Coinbase and Coinbase Wallet?

Both Coinbase and Coinbase Wallet are custodial crypto exchanges and wallets; Coinbase will hold onto your private keys in exchange for quick digital currency purchases; this makes sense if you value security over speed, though its use might compromise control and ownership of your crypto. In contrast, Coinbase Wallet does not take custody of its crypto. Coinbase Wallet offers superior security and controls but requires assets to be transferred directly into their system before fiat withdrawals can take place.

Furthermore, its compatibility includes Web3, DeFi protocol, and NFT markets (dApps/DEFi protocols/NFT Markets/etc.), making this distinction even more apparent than between its namesake counterparts.

Coinbase: For cryptocurrency trading and investment, Coinbase serves as your custodial wallet, storing all your funds safely.

Coinbase Wallet: For non-custodial wallets, the control of private keys is crucial when dealing with cryptocurrency and decentralized applications. Incorporating such technology can provide access to decentralized applications with greater ease than using standard crypto storage options like Bitcoin.

FAQ

Can I withdraw directly from Coinbase Wallet to my bank account?

No. To do this, first transfer funds between Coinbase Wallet and Coinbase Account accounts.

Does Coinbase Have a Daily Withdrawal Limit?

Your daily withdrawal limit on Coinbase is $100,000 per day.

How secure is Coinbase Wallet when it comes to storing funds?

Its Coinbase Wallet provides high levels of security as a non-custodial service where you control the private key and recovery phase.

Why is my Coinbase withdrawal taking longer than expected?

There could be delays in Coinbase withdrawals due to bank processing times, restrictions in certain regions, or pending confirmations.

0 notes

Text

Avoiding and Recovering from Trading Scams: Tips for Safe Trading

Unfortunately, the exponential growth of online trading platform sites has also equipped fraudsters, which have affected novice and seasoned traders alike. Trading scams result in financial losses, psychological trauma, and the wasting of hours trying to recover lost money. This article aims to provide you with some valuable tips on how you can identify trading scams and how you can put a stop to it. Plus, ways you can get your money back if you are or fall victim of any of these scam activities.

1. Be Aware of the Common Trading Scams

Understanding the various common types of trading scams is an important portion in self-protection.

Ponzi schemes involve a simulation of return through the return of money from new investors to those who have previously invested; they inevitably fail once there are not enough new investments. Pump-and-dump scams involve the fraudsters creating false information about something in order to raise the price of an asset, sell their portion of the asset, and drastically drop the price, thus leaving victims with worthless assets.

Fraudulent trading sites: these are the fake sites that appear to be a credible trading app and website, but after investment, they make it hard to return the money or just vanish.

Scams of signal sellers: They promise to provide inside trading tips for which obviously they need the money. Many of those promises give very little or no return and were all lies.

This is because the scammer impersonates a genuine trading company to gain access to personal and financial information for theft, either by identity access or directly drawing funds from accounts.

2. Identifying Red Flags in Trading Platforms

By knowing what to look for, you can spot potential scams before they happen. Here are some warning signs:

Promises of Guaranteed Returns: Since trading is always risky, legitimate trading platforms and professionals never make such claims.

High-Pressure Sales Techniques: Con artists frequently use pressure to move fast, suggesting that you might pass up a profitable opportunity. Making snap decisions is not necessary for legitimate investing prospects.

Platforms without licenses: Verify if the platform has a license and is subject to financial authorities' regulations. For instance, reputable platforms in the US should be registered with FINRA or the SEC, whereas UK-based brokers are governed by the FCA.

Inadequate or absent Internet Reviews: reviews of other users' research. Take it as a warning sign if there are few or a lot of unfavorable reviews. Fake testimonials are common on scam websites, bUnfortunately, the exponential growth of online trading platform sites has also equipped fraudsters, which have affected novice and seasoned traders alike. Trading scamUnfortunately, the exponential growth of online trading platform sites has also equipped fraudsters, which have affected novice and seasoned traders alike. Trading scams result in financial losses, psychological trauma, and the wasting of hours trying to recover lost money. This article aims to provide you with some valuable tips on how you can identify trading scams and how you can put a stop to it. Plus, ways you can get your money back if you are or fall victim of any of these scam activities.

2. Identifying Red Flags in Trading Platforms

Most times, you can avoid getting scammed if you know what to look out for. Following are some possible warnings that may trigger a potential scam alert:

Guaranteed Returns: No trading platform or professional will promise returns from trading for this reason, as it always involves some risk.

High-Pressure Sales: Scammers often use urgency for you to act quickly, or else you can lose an opportunity of a lifetime. Real investment opportunities never force you to make decisions right on the spot.

Unlicensed Platforms: Miscreants are usually operating unlicensed and unregulated platforms. For instance, genuine platforms in the US should be listed under FINRA or SEC, while all online brokers in the UK come under FCA.

Sparse or no Internet Reviews at all: other customers' experiences with the researcher. This acts as a bad alarm in instances where the reviews are scanty or where negative reviews abound. Many scamming websites are riddled with fake testimonials, yet what is lacking are actual consumer reviews.

Requesting Unusual Payment Methods: A platform accepting only cryptocurrency or wire transfers, which may be hard to track down, could be a ploy for eluding detection.

3. How to Avoid Trading Scams

Prevention is always the best approach. Here are some ways to stay safe:

Conduct Thorough Research: Before investing, research the platform, its founders, and its history. A reputable platform should have transparent information available.

Verify Platform Credentials: Check whether the platform is registered with regulatory bodies. Many regions have searchable databases of licensed trading firms.

Look for Secure Website Features: A legitimate trading platform should have HTTPS encryption and other security measures, such as two-factor authentication.

Avoid Unknown Signal Sellers: Unless you are familiar with the signal seller's reputation, avoid paying for trading signals. Many of these sellers operate scams or provide unreliable information.

Stay Informed: Scam tactics evolve, so staying updated on the latest fraud schemes in the trading world can help you avoid becoming a victim.

4. Steps to Take if You Fall Victim to a Trading Scam

If you suspect you've fallen victim to a trading scam, quick action is crucial to recover your funds. Here’s a step-by-step guide to help you:

1. Document Everything

Start by collecting evidence, including screenshots, emails, and transaction records. Documentation is critical for any investigations by law enforcement or recovery agents.

2. Contact Your Financial Institution

If you used a credit card or bank transfer, notify your bank or credit card provider. They may be able to block the transaction, or if you act fast, reverse it. For wire transfers or other non-reversible methods, the chances of recovery are lower but still worth pursuing.

3. Report to Regulatory Authorities

File a complaint with your country’s financial regulatory agency. In the U.S., this would be the Securities and Exchange Commission (SEC) or Federal Trade Commission (FTC). Other countries have equivalent bodies that manage consumer complaints and may help track fraudulent platforms.

4. Report to Consumer Protection Organizations

Organizations like Better Business Bureau (BBB), Trustpilot, or the Financial Conduct Authority (FCA) (in the UK) track and report on scams. Reporting your experience can alert other users and support larger investigations.

5. Consider Hiring a Recovery Service